Priority Technology Holdings, Inc. (Nasdaq: PRTH) Supplemental Slides: 3Q 2024 Earnings Call November 2024

prioritycommerce.com 2 Disclaimer Important Notice Regarding Forward-Looking Statements and Non-GAAP Measures This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services, and other statements identified by words such as “may,” “will,” “should,” “anticipates,” “believes,” “expects,” “plans,” “future,” “intends,” “could,” “estimate,” “predict,” “projects,” “targeting,” “potential” or “contingent,” “guidance,” “anticipates,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, Priority Technology Holdings, Inc.’s (“Priority”, “we”, “our” or “us”) 2024 outlook and statements regarding our market and growth opportunities. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive risks, trends and uncertainties that could cause actual results to differ materially from those projected, expressed, or implied by such forward-looking statements. Our actual results could differ materially, and potentially adversely, from those discussed or implied herein. We caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. All forward- looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in our Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 10-K filed with the SEC on March 12, 2024. These filings are available online at www.sec.gov or www.prioritycommerce.com. We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences we anticipate or affect us or our operations in the way we expect. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. This presentation includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non- GAAP financial measures used by other companies. Priority believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends of the Company. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. See the footnotes on the slides where these measures are discussed and the slides at the end of this presentation for a reconciliation of such non-GAAP financial measures to the most comparable GAAP numbers. Additionally, we present guidance for Adjusted EBITDA and Adjusted EBITDA as percentage of revenue, non-GAAP measures without reconciliation due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. See more information in Priority’s earnings press release. Adjusted Gross profit referred throughout this presentation is a non-GAAP measure calculated by subtracting Cost of services (excluding depreciation and amortization) from Revenue. Adjusted Gross profit margin referred throughout this presentation is a non-GAAP measure calculated by dividing Adjusted Gross Profit discussed above by Revenue. Adjusted EBITDA referred to throughout this presentation is a non-GAAP measure calculated as net income prior to interest expense, tax expense, depreciation and amortization expense, adjusted to add back certain non-cash charges and / or non-recurring charges deemed to not be part of normal operating expenses. Adjusted EBITDA margin referred throughout this presentation is a non-GAAP measure calculated by dividing Adjusted EBITDA discussed above by Revenue. See Appendix 1 – 2 of this presentation for a reconciliation of Adjusted Gross Profit to Gross Profit as per GAAP, a reconciliation of Adj. EBITDA to GAAP Income (loss) before Taxes and Priority’s earnings press release for more details.

prioritycommerce.com $153 $96 $140 $168 $47 $4 2021 2022 2023 2024 $653 $515 $664 $756 $222 $8 2021 2022 2023 2024 3 Key 3rd Quarter 2024 Highlights Q3 2024 RESULTS CONTINUED STRONG MOMENTUM Q3 2024 KEY METRICS TOTAL REVENUE (In Millions) ADJUSTED EBITDA1 (In Millions) $875 - $883 $200 - $204 Guidance Range Guidance Range YTD Actual YTD Actual NET REVENUE +20% ADJ GROSS PROFIT1 +19% ADJ EBITDA1 +22% OPERATING INCOME +62% >$1.1B Account Balances >1.1M Total Accounts ~$127B LTM Total Volume 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details

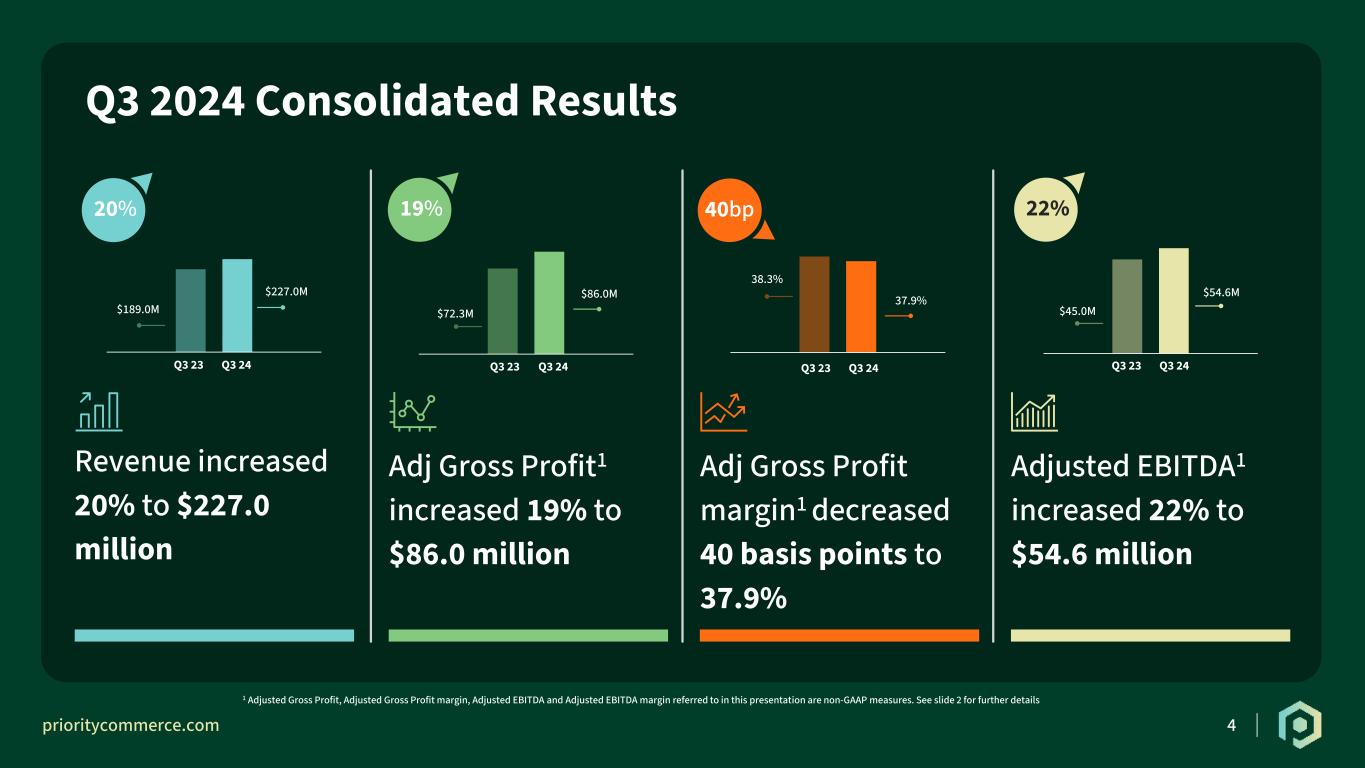

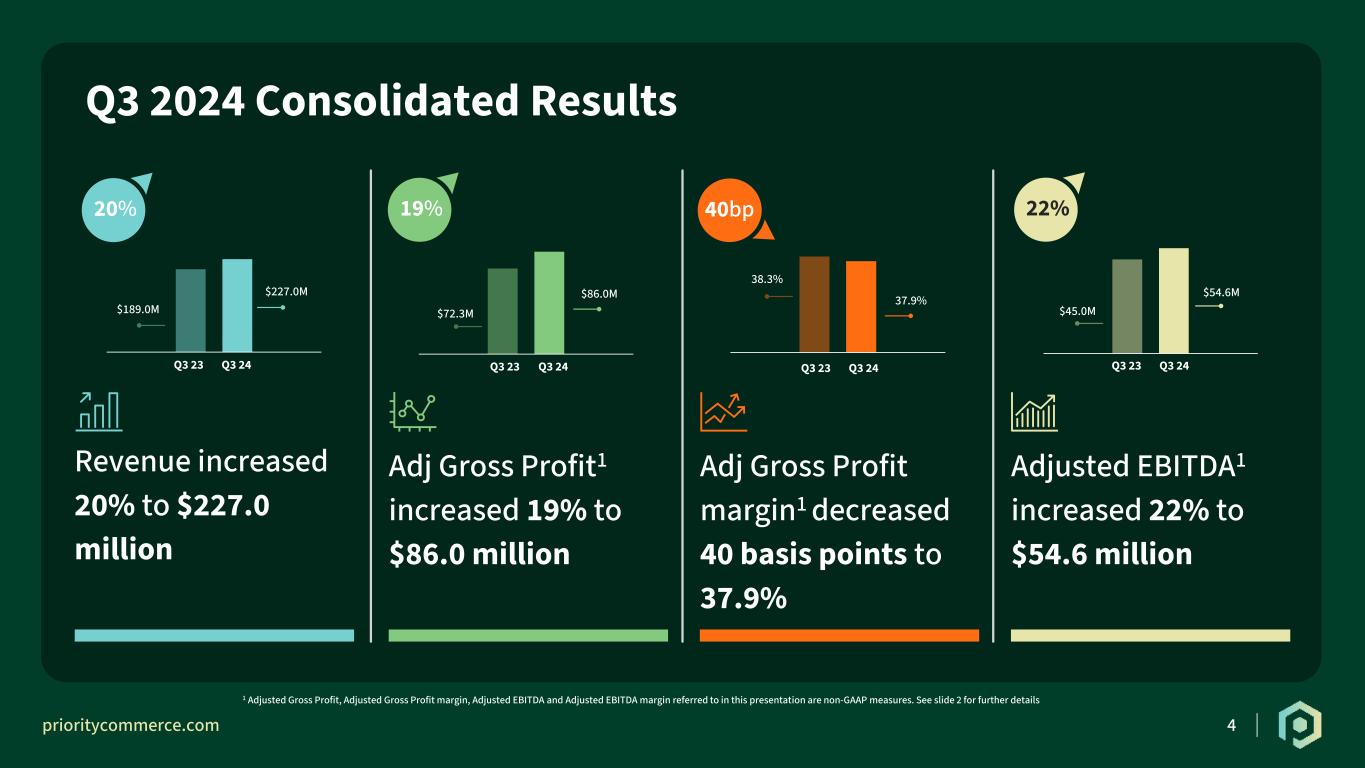

prioritycommerce.com 4 Q3 2024 Consolidated Results $72.3M $86.0M 38.3% 37.9% $45.0M $54.6M $189.0M $227.0M Q3 23 Q3 24 Q3 23 Q3 24 Q3 23 Q3 24Q3 23 Q3 24 20% 19% 40bp 22% Adjusted EBITDA1 increased 22% to $54.6 million Adj Gross Profit margin1 decreased 40 basis points to 37.9% Adj Gross Profit1 increased 19% to $86.0 million Revenue increased 20% to $227.0 million 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details

prioritycommerce.com 5 YTD Q3 2024 Consolidated Results $202.4M $244.1M 36.4% 37.4% $123.7M $152.5M $556.3M $652.6M Q3 23 Q3 24 Q3 23 Q3 24 Q3 23 Q3 24Q3 23 Q3 24 17% 21% 100bp 23% Adjusted EBITDA1 increased 23% to $152.5 million Adj Gross Profit1 increased 21% to $244.1 million Revenue increased 17% to $652.6 million 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details Adj Gross Profit margin1 increased 100 basis points to 37.4%

prioritycommerce.com 6 Acquiring Banking & Treasury Payables Risk & Compliance Insights The Priority Commerce Engine (PCE) is an innovative tech platform that seamlessly embeds acquiring, banking, and payables solutions into your existing applications. With our modern API and complimentary, ready-built product suites, PCE is designed to help your business launch quickly, scale with confidence, and drive value and growth through every money movement. Priority Commerce: One Connection is all You Need PCE Overview

prioritycommerce.com 7 Merchant Services Full featured POS & merchant acquiring solutions that accelerate your cash flow to capture revenue opportunities for businesses Payables Optimize your working capital and earn cash back by leveraging our payables & financing solutions while automating reconciliation Banking & Treasury Solutions Passport automates reconciliation, streamlines financial operations & provides full transparency to your liquidity PCE Overview Priority: Your trusted partner Our mission is to deliver a personalized, easy-to-adopt financial toolset to accelerate cash flow and optimize working capital for businesses.

prioritycommerce.com Section 2 8 Third Quarter 2024 Financial Results

prioritycommerce.com 9 Q3 2024 Segment Highlights ➔ Revenue growth of 13% is reflective of organic growth ➔ Bankcard $ Volumes increased 10% to $15.5 billion ➔ New monthly boards averaged 3.4K during quarter Revenue $158.8MM +13% YoY Adj. Gross Profit1 $35.6MM +3% YoY | 22.4% Margin Adj. EBITDA1 $28.6MM +4% YoY | 18.0% Margin SMB Highlights – Q3 2024 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details

prioritycommerce.com 10 Q3 2024 Segment Highlights ➔ $8.2 million of Revenue growth driven primarily by contribution from Plastiq ➔ Adjusted Gross Profit Margin increased 300+ bps sequentially from Q2 2024 due to margin expansion at Plastiq Revenue $22.1MM +58% YoY Adj. Gross Profit1 $6.3MM +24% YoY | 28.5% Margin Adj. EBITDA1 $1.9MM +42% YoY | 8.7% Margin B2B Highlights – Q3 2024 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details

prioritycommerce.com 11 Q3 2024 Segment Highlights ➔ CFTPay Avg Monthly New Enrollments of 63K increased 12% from 56K in Q3 2023 ➔ CFTPay Avg Number of Billed Clients increased 41% to 832K from 591K in Q3 2023 ➔ Growth in balances offset the impact of the 50 bps Fed rate cut in September Revenue $47.1MM +34% YoY Adj. Gross Profit1 $44.1MM +35% YoY | 93.6% Margin Adj. EBITDA1 $40.9MM +38% YoY | 86.9% Margin Enterprise Highlights – Q3 2024 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details

prioritycommerce.com 12 Q3 2024 Segment Highlights ➔ Higher Salaries and Benefits driven largely by timing of the Plastiq acquisition. On a sequential basis, Salaries and Benefits expense decreased 2% due to continued expense discipline ➔ Increase in SG&A expenses primarily incurred to further support the overall growth of the Company Salaries & Benefits $21.7MM +8% YoY SG&A $12.4MM +9% YoY Depreciation & Amortization $13.7MM (21%) YoY Consolidated Operating Expenses – Q3 2024

prioritycommerce.com 13 Adjusted EBITDA experienced strong growth in Q3 2024 ➔ Q3 2024 Adjusted EBITDA of $54.6 million increased 22% from $45.0 million in Q3 2023 Adjusted EBITDA1 Walk 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details EBITDA Walk (in Millions) 2024 2023 LTM Q3 Q3 Q3 2024 Consolidated net income (loss) (GAAP) 10.6$ (0.1)$ 16.7$ Add: Interest expense 23.2 20.0 86.5 Add: Depreciation and amortization 13.7 17.3 59.3 Add: Income tax expense (benefit) 4.9 4.3 11.9 EBITDA (non-GAAP) 52.5 41.5 174.4 Further adjusted by: Add: Non-cash stock-based compensation 1.4 1.5 6.5 Add: Non-recurring expenses: Debt extinguishment and modification costs 0.0 - 8.7 Legal, professional, accounting and other SG&A 0.7 2.1 7.4 Other Non-recurring expenses - (0.2) 0.3 Adjusted EBITDA (non-GAAP) 54.6$ 45.0$ 197.2$

prioritycommerce.com 14 Total Debt of $832.9 million at end of Q3 2024 decreased from $835.0 million in Q2 2024 ➔ Net Debt of $791.8 million decreased $8.5 million compared to Q2 2024 due to higher cash balances ➔ Revolver Capacity at the end of Q3 2024 was $70.0 million ➔ LTM Adj. EBITDA1 of $197.2 million at end of Q3 2024 Capital Structure & Liquidity Outstanding Debt Balance as of June 30, 2024 $835.0 (+/-) Net Revolver Borrowings -- (+/-) Net Term Loan Borrowings ($2.1) Balance as of September 30, 2024 $832.9 Senior Redeemable Preferred Stock Balance as of June 30, 2024 $105.7 (+/-) Dividend Payable2 ($2.8) (+/-) PIK Dividend $1.9 (+/-) Accretion $0.3 Balance as of September 30, 2024 $105.1 Preferred Stock of $105.1 million, Net of $5.6 million of Unaccreted Discounts and Issuance Costs 1 Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details 2 Represents $2.8MM of outstanding cash dividend at June 30, 2024 | Dividend payable for the three months ended 9/30/2024 was paid on 10/01/2024 3rd Quarter (dollars in Millions) 2024 Dividend: Payment in Kind 1.90$ Cash 2.88 4.79 Accretion 0.34 5.12$

prioritycommerce.com Section 3 15 Appendix

prioritycommerce.com SMB B2B Enterprise Eliminations Total SMB B2B Enterprise Eliminations Total Revenues $ 158.8 $ 22.1 $ 47.1 $ (1.0) $ 227.0 $ 140.2 $ 14.0 $ 35.2 $ (0.4) $ 189.0 Cost of revenue (excluding depreciation and amortization) (123.2) (15.8) (3.0) 1.0 (141.1) (105.8) (8.9) (2.4) 0.4 (116.7) Adjusted Gross Profit 35.6 6.3 44.1 (0.0) 86.0 34.5 5.1 32.8 (0.0) 72.3 Adjusted Gross Profit Margin 22.4% 28.5% 93.6% 37.9% 24.6% 36.6% 93.2% 38.3% Depreciation and amortiztion of revenue generating assets (1.9) (0.7) (1.6) -- (4.2) (1.6) (0.4) (1.0) -- (3.0) Gross profit $ 33.7 $ 5.6 $ 42.4 $ (0.0) $ 81.8 $ 32.9 $ 4.7 $ 31.7 $ (0.0) $ 69.3 Gross profit margin 21.2% 25.4% 90.1% 36.0% 23.5% 33.7% 90.2% 36.7% SMB B2B Enterprise Eliminations Total SMB B2B Enterprise Eliminations Total Revenues $ 457.9 $ 65.4 $ 131.8 $ (2.4) $ 652.6 $ 443.1 $ 19.7 $ 93.9 $ (0.5) $ 556.3 Cost of revenue (excluding depreciation and amortization) (354.8) (47.3) (8.8) 2.4 (408.5) (337.9) (10.3) (6.1) 0.4 (353.9) Adjusted Gross Profit 103.1 18.1 123.0 (0.0) 244.1 105.2 9.4 87.8 (0.0) 202.4 Adjusted Gross Profit Margin 22.5% 27.6% 93.3% 37.4% 23.7% 47.6% 93.5% 36.4% Depreciation and amortiztion of revenue generating assets (5.5) (2.2) (4.4) -- (12.0) (5.0) (0.8) (3.2) -- (9.0) Gross profit $ 97.6 $ 15.9 $ 118.5 $ (0.0) $ 232.1 $ 100.2 $ 8.6 $ 84.6 $ (0.0) $ 193.4 Gross profit margin 21.3% 24.3% 90.0% 35.6% 22.6% 43.6% 90.1% 34.8% Nine Months Ended September 30, 2024 Nine Months Ended September 30, 2023 (in Millions) (in Millions) Three Months Ended September 30, 2024 Three Months Ended September 30, 2023 (in Millions) (in Millions) 16 The reconciliation of adjusted gross profit to its most comparable GAAP measure is provided below: Appendix 1 – Adjusted Gross Profit1 Reconciliation Note: Certain dollar amounts may not add mathematically due to rounding 1Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details.

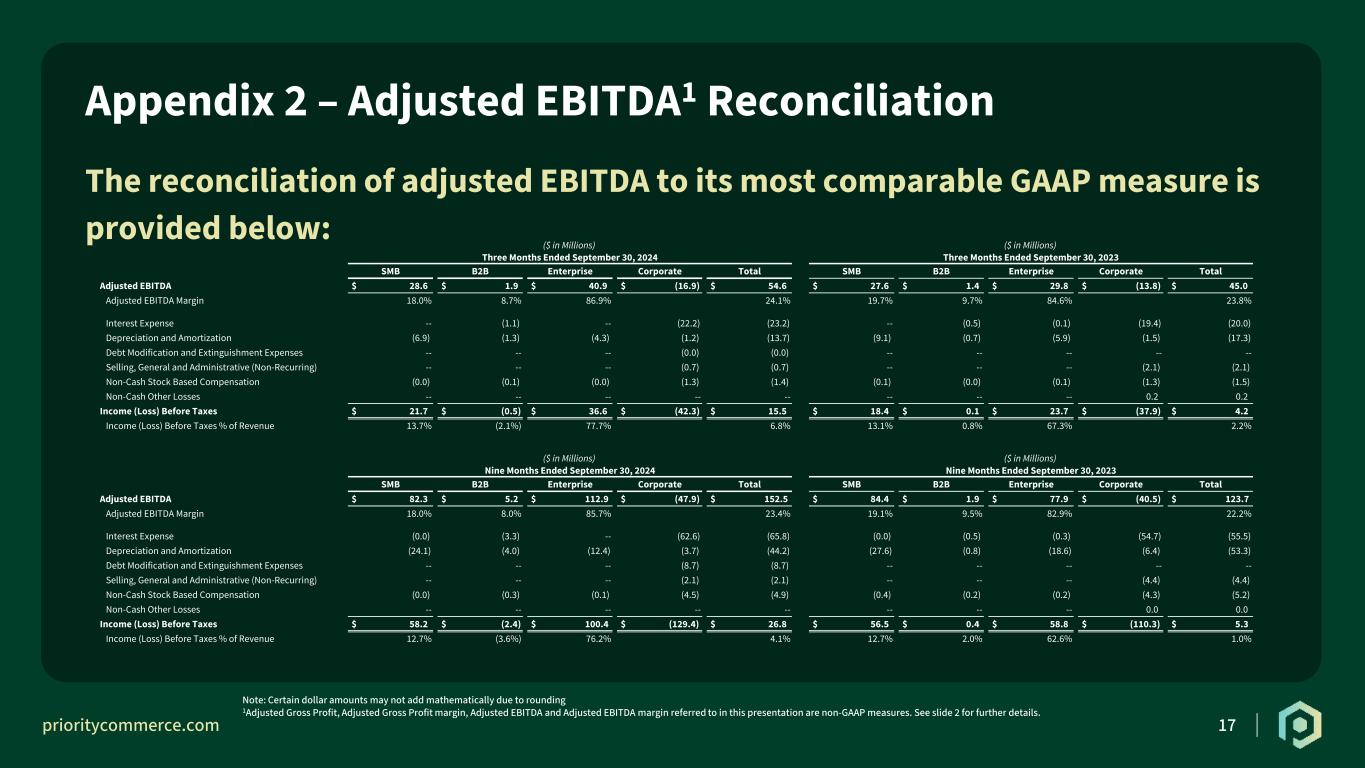

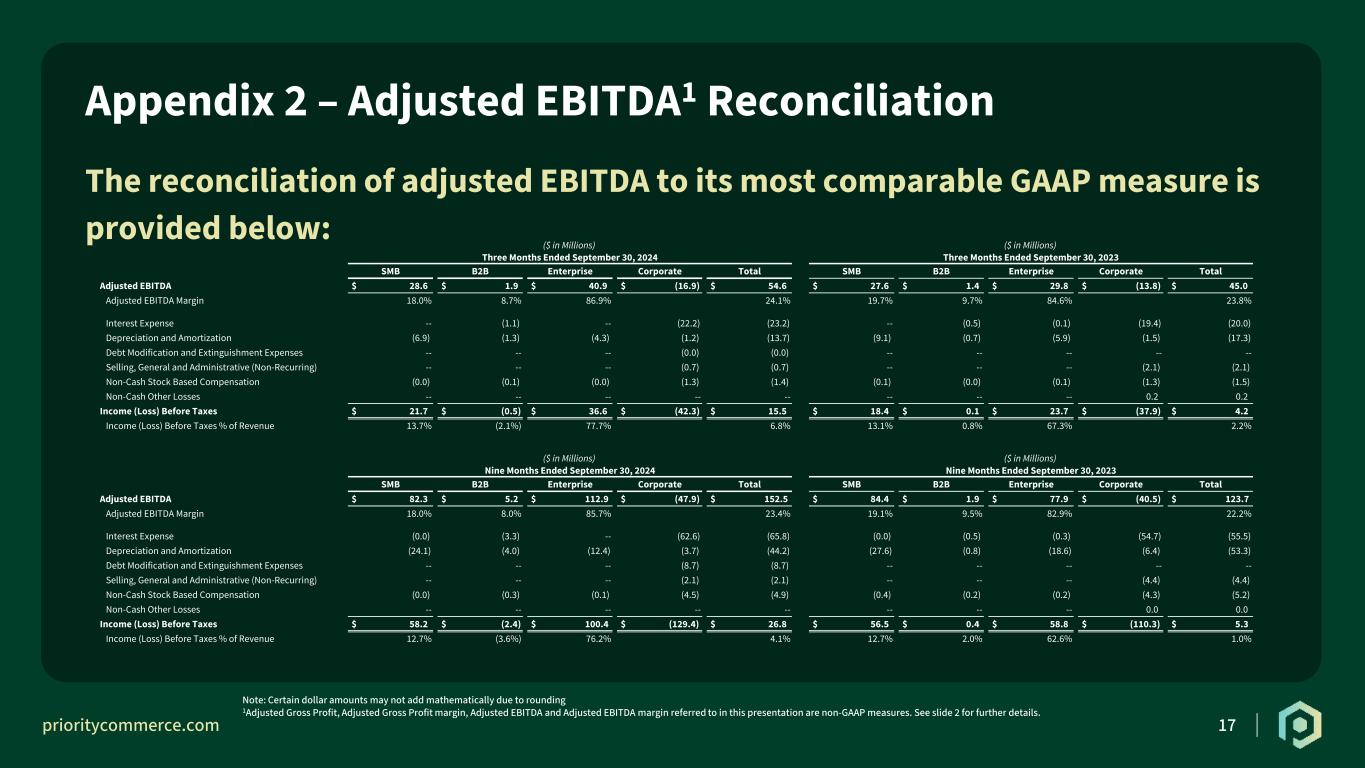

prioritycommerce.com SMB B2B Enterprise Corporate Total SMB B2B Enterprise Corporate Total Adjusted EBITDA $ 28.6 $ 1.9 $ 40.9 $ (16.9) $ 54.6 $ 27.6 $ 1.4 $ 29.8 $ (13.8) $ 45.0 Adjusted EBITDA Margin 18.0% 8.7% 86.9% 24.1% 19.7% 9.7% 84.6% 23.8% Interest Expense -- (1.1) -- (22.2) (23.2) -- (0.5) (0.1) (19.4) (20.0) Depreciation and Amortization (6.9) (1.3) (4.3) (1.2) (13.7) (9.1) (0.7) (5.9) (1.5) (17.3) Debt Modification and Extinguishment Expenses -- -- -- (0.0) (0.0) -- -- -- -- -- Selling, General and Administrative (Non-Recurring) -- -- -- (0.7) (0.7) -- -- -- (2.1) (2.1) Non-Cash Stock Based Compensation (0.0) (0.1) (0.0) (1.3) (1.4) (0.1) (0.0) (0.1) (1.3) (1.5) Non-Cash Other Losses -- -- -- -- -- -- -- -- 0.2 0.2 Income (Loss) Before Taxes $ 21.7 $ (0.5) $ 36.6 $ (42.3) $ 15.5 $ 18.4 $ 0.1 $ 23.7 $ (37.9) $ 4.2 Income (Loss) Before Taxes % of Revenue 13.7% (2.1%) 77.7% 6.8% 13.1% 0.8% 67.3% 2.2% SMB B2B Enterprise Corporate Total SMB B2B Enterprise Corporate Total Adjusted EBITDA $ 82.3 $ 5.2 $ 112.9 $ (47.9) $ 152.5 $ 84.4 $ 1.9 $ 77.9 $ (40.5) $ 123.7 Adjusted EBITDA Margin 18.0% 8.0% 85.7% 23.4% 19.1% 9.5% 82.9% 22.2% Interest Expense (0.0) (3.3) -- (62.6) (65.8) (0.0) (0.5) (0.3) (54.7) (55.5) Depreciation and Amortization (24.1) (4.0) (12.4) (3.7) (44.2) (27.6) (0.8) (18.6) (6.4) (53.3) Debt Modification and Extinguishment Expenses -- -- -- (8.7) (8.7) -- -- -- -- -- Selling, General and Administrative (Non-Recurring) -- -- -- (2.1) (2.1) -- -- -- (4.4) (4.4) Non-Cash Stock Based Compensation (0.0) (0.3) (0.1) (4.5) (4.9) (0.4) (0.2) (0.2) (4.3) (5.2) Non-Cash Other Losses -- -- -- -- -- -- -- -- 0.0 0.0 Income (Loss) Before Taxes $ 58.2 $ (2.4) $ 100.4 $ (129.4) $ 26.8 $ 56.5 $ 0.4 $ 58.8 $ (110.3) $ 5.3 Income (Loss) Before Taxes % of Revenue 12.7% (3.6%) 76.2% 4.1% 12.7% 2.0% 62.6% 1.0% Nine Months Ended September 30, 2024 Nine Months Ended September 30, 2023 ($ in Millions) ($ in Millions) Three Months Ended September 30, 2024 Three Months Ended September 30, 2023 ($ in Millions) ($ in Millions) 17 The reconciliation of adjusted EBITDA to its most comparable GAAP measure is provided below: Appendix 2 – Adjusted EBITDA1 Reconciliation Note: Certain dollar amounts may not add mathematically due to rounding 1Adjusted Gross Profit, Adjusted Gross Profit margin, Adjusted EBITDA and Adjusted EBITDA margin referred to in this presentation are non-GAAP measures. See slide 2 for further details.

23