| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-227081-04 | ||

November 12, 2019 Credit Suisse Société Générale UBS Securities LLC Co-Lead Managers and Joint Bookrunners Academy Securities Co-Manager CIBC World Markets Co-Manager CSAIL 2019-C18 Commercial Mortgage Trust Free Writing Prospectus Structural and Collateral Term Sheet Credit Suisse Commercial Mortgage Securities Corp. as Depositor Commercial Mortgage Pass-Through Certificates Series 2019-C18 Column Financial, Inc. UBS AG Rialto Real Estate Fund III – Debt, LP CIBC Inc. Societe Generale Financial Corporation as Sponsors and Mortgage Loan Sellers THE DEPOSITOR HAS FILED A REGISTRATION STATEMENT (INCLUDING A PROSPECTUS) WITH THE SEC (SEC FILE NO. 333-227081) FOR THE OFFERING TO WHICH THIS COMMUNICATION RELATES. BEFORE YOU INVEST, YOU SHOULD READ THE PROSPECTUS IN THAT REGISTRATION STATEMENT AND OTHER DOCUMENTS THE ISSUER HAS FILED WITH THE SEC FOR MORE COMPLETE INFORMATION ABOUT THE ISSUER AND THIS OFFERING. YOU MAY GET THESE DOCUMENTS FOR FREE BY VISITING EDGAR ON THE SEC WEB SITE AT WWW.SEC.GOV. ALTERNATIVELY, CREDIT SUISSE WILL ARRANGE TO SEND YOU THE PROSPECTUS IF YOU REQUEST IT BY CALLING TOLL FREE 1-800-221-1037.

STATEMENT REGARDING ASSUMPTIONS AS TO

SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

This material is for your information, and neither Credit Suisse Securities (USA) LLC nor any other underwriter (collectively, the “Underwriters”) is soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

Neither this document nor anything contained herein shall form the basis for any contract or commitment whatsoever. The information contained herein is preliminary as of the date hereof. These materials are subject to change, completion or amendment from time to time. The information contained herein will be superseded by similar information delivered to you prior to the time of sale, including as part of the Prospectus referred to herein relating to the CSAIL 2019-C18 Commercial Mortgage Trust, Commercial Mortgage Pass-Through Certificates (the “Offering Document”). The information supersedes any such information previously delivered. The information should be reviewed only in conjunction with the entire Offering Document. All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document in its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Free Writing Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the appropriateness of the assumptions used in preparing the Computational Materials, or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters nor any of their respective affiliates makes any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities.

This document contains forward-looking statements. Those statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth herein. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, the depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the issuer’s view only as of the date hereof.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Free Writing Prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

Indicative Capital Structure

Publicly Offered Certificates

| Class | Expected Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial Certificate Principal Balance or Notional Amount(2)(3) | Approximate Initial Available Certificate Principal Balance or Notional Amount(2)(3) | Approximate Initial Credit Support(4) | Expected Weighted Avg. Life (years)(5) | Expected Principal Window(5) | Certificate Principal to Value Ratio(6) | Underwritten NOI Debt Yield(7) |

| A-1 | AAAsf/AAA(sf)/AAA(sf) | $25,306,000 | $24,263,000 | 30.000% | 2.81 | 1 - 58 | 44.8% | 15.1% |

| A-2 | AAAsf/AAA(sf)/AAA(sf) | $65,479,000 | $62,781,000 | 30.000% | 4.90 | 58 - 59 | 44.8% | 15.1% |

| A-3(2) | AAAsf/AAA(sf)/AAA(sf) | $170,000,000 | $162,996,000 | 30.000% | 9.80 | 115 - 118 | 44.8% | 15.1% |

| A-4(2) | AAAsf/AAA(sf)/AAA(sf) | $185,034,000 | $177,410,000 | 30.000% | 9.92 | 118 - 119 | 44.8% | 15.1% |

| A-SB | AAAsf/AAA(sf)/AAA(sf) | $36,487,000 | $34,983,000 | 30.000% | 7.38 | 59 - 115 | 44.8% | 15.1% |

| X-A(8) | AAAsf/AAA(sf)/AA+(sf) | $534,843,000 | $512,805,000 | N/A | N/A | N/A | N/A | N/A |

| X-B(8) | A-sf/AAA(sf)/A-(sf) | $64,594,000 | $61,932,000 | N/A | N/A | N/A | N/A | N/A |

| A-S | AAAsf/AAA(sf)/AA+(sf) | $52,537,000 | $50,372,000 | 22.375% | 9.93 | 119 - 119 | 49.6% | 13.6% |

| B | AA-sf/AA+(sf)/AA-(sf) | $32,728,000 | $31,379,000 | 17.625% | 9.93 | 119 - 119 | 52.7% | 12.8% |

| C | A-sf/A+(sf)/A-(sf) | $31,866,000 | $30,553,000 | 13.000% | 9.93 | 119 - 119 | 55.6% | 12.2% |

Privately Offered Certificates(9)

| Class | Expected Ratings (Fitch/KBRA/S&P)(1) | Approximate Initial Certificate Principal Balance or Notional Amount(2)(3) | Approximate Initial Available Certificate Principal Balance or Notional Amount(2)(3) | Approximate Initial Credit Support(4) | Expected Weighted Avg. Life (years)(5) | Expected Principal Window(5) | Certificate Principal to Value Ratio(6) | Underwritten NOI Debt Yield() |

| X-D(8) | BBB-sf/BBB(sf)/NR | $37,896,000 | $36,334,000 | N/A | N/A | N/A | N/A | N/A |

| X-F(8) | BB-sf/BB(sf)/NR | $17,225,000 | $16,515,000 | N/A | N/A | N/A | N/A | N/A |

| X-G(8) | B-sf/B+(sf)/NR | $6,890,000 | $6,606,000 | N/A | N/A | N/A | N/A | N/A |

| D | BBBsf/A-(sf)/NR | $20,671,000 | $19,819,000 | 10.000% | 9.93 | 119 - 119 | 57.5% | 11.8% |

| E | BBB-sf/BBB(sf)/NR | $17,225,000 | $16,515,000 | 7.500% | 9.93 | 119 - 119 | 59.1% | 11.4% |

| F | BB-sf/BB(sf)/NR | $17,225,000 | $16,515,000 | 5.000% | 9.96 | 119 - 120 | 60.7% | 11.1% |

| G | B-sf/B+(sf)/NR | $6,890,000 | $6,606,000 | 4.000% | 10.01 | 120 - 120 | 61.4% | 11.0% |

| NR-RR | NR/NR/NR | $27,561,002 | $26,425,000 | 0.000% | 10.01 | 120 - 120 | 63.9% | 10.6% |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and S&P Global Ratings (“S&P”), which the depositor hired to rate the offered certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. The ratings of each class of offered certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A, X-B, X-D, X-F and X-G Certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the preliminary prospectus, expected to be dated November 12, 2019 to be filed in connection with the offering of the Publicly Offered Certificates (the “Prospectus”). Fitch, KBRA and S&P have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The exact initial certificate balances of the Class A-3 and Class A-4 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective approximate initial certificate balances, assumed final distribution dates, weighted average lives and expected principal windows of the Class A-3 and Class A-4 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-3 and Class A-4 certificates is expected to be approximately $355,034,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of | Expected Range of Assumed | Expected Range of Weighted Average Life (Years) | Expected Range of Principal Window (Months) |

| Class A-3 | $75,000,000 - $170,000,000 | October 2029 / October 2029 | 9.75 / 9.80 | 115 - 118 / 115 - 118 |

| Class A-4 | $185,034,000 - $280,034,000 | November 2029 / November 2029 | 9.89 / 9.92 | 118 - 119 / 118 - 119 |

| (3) | Approximate, subject to a variance of plus or minus 5% (including in connection with any variation in the portion of the certificate balances or notional amounts of the classes comprising the VRR Interest following the calculation of the actual fair value of the certificates (other than the Class R certificates) issued by the issuing entity) and further subject to footnote 2. In addition, the notional amount of each class of Class X Certificates may vary depending upon the final pricing of the classes of certificates whose certificate balances comprise such notional amount and, if as a result of such pricing the pass-through rate of such class of Class X Certificates would be equal to zero, such Class X Certificates may not be issued on the closing date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| (4) | The approximate initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates, are represented in the aggregate. |

| (5) | Assumes 0% CPR / 0% CDR and a December 12, 2019 closing date. Based on “Modeling Assumptions” as described in the Prospectus. Capitalized terms used but not defined herein have the meanings ascribed to them in the Prospectus. |

| (6) | The “Certificate Principal to Value Ratio” for any class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial certificate principal balance of such class of certificates and all classes of principal balance certificates senior to such class of certificates and the denominator of which is the total initial certificate principal balance of all of the principal balance certificates. The Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for those classes as if they were a single class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (7) | The “Underwritten NOI Debt Yield” for any class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial certificate principal balance of all of the classes of principal balance certificates divided by the total initial certificate principal balance for such class and all classes of principal balance certificates senior to such class of certificates. The Underwritten NOI Debt Yield for each class of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates is calculated in the aggregate for those classes as if they were a single class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (8) | The notional amounts of the Class X-A, Class X-B, Class X-D, Class X-F and Class X-G certificates (collectively, the “Class X Certificates”) are described in the Prospectus. In addition, the notional amount of each class of Class X Certificates may vary depending upon the final pricing of the classes of certificates whose certificate balances comprise such notional amount and, if as a result of such pricing the pass-through rate of such class of Class X Certificates would be equal to zero, such Class X Certificates may not be issued on the closing date. |

| (9) | The Class Z and Class R certificates are not shown above. |

Class A-2(1)

| No. | Loan Name | Cut-off Date Balance | % of IPB | Maturity Balance | % of Certificate Class | Original Loan Term | Remaining Loan Term | UW NCF DSCR(2) | UW NOI Debt Yield(2) | Cut-off Date LTV(2) | Maturity Date LTV(2) |

| 2 | Palm Beach Estates | $42,319,198 | 6.1% | $38,781,100 | 59.2% | 60 | 59 | 1.78x | 11.4% | 63.9% | 58.6% |

| 8 | United Healthcare Office | 20,000,000 | 2.9 | 19,111,929 | 29.2 | 60 | 58 | 1.56x | 10.2% | 66.7% | 63.7% |

| 35 | Bassett Furniture - King of Prussia | 7,000,000 | 1.0 | 7,000,000 | 10.7 | 60 | 59 | 2.10x | 9.5% | 58.8% | 58.8% |

| Total / Wtd. Avg.: | $69,319,198 | 10.1% | $64,893,029 | 99.1% | 60 | 59 | 1.75x | 10.9% | 64.2% | 60.1% | |

| (1) | The tables above presents the mortgage loans whose balloon payments would be applied to pay down the majority of the principal balance of the Class A-2 certificates, as applicable, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to the maturity date, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of certificates, including the Class A-2 certificates, as applicable, evidences undivided ownership interests in the entire pool of mortgage loans. DSCR, debt yield and LTV information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of the mortgage loan. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the LTV, DSCR and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) or mezzanine loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

Summary of Transaction Terms

| Securities: | $689,009,002 monthly pay, multi-class, commercial mortgage REMIC pass-through certificates. |

| Managers and Bookrunners: | Credit Suisse Securities (USA) LLC, SG Americas Securities, LLC and UBS Securities LLC, as Co-Lead Managers and Joint Bookrunners and CIBC World Markets Corp. and Academy Securities, Inc., as Co-Managers. |

| Mortgage Loan Sellers: | Column Financial, Inc. (“Column”) (31.3%), UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (26.1%), Rialto Real Estate Fund III – Debt, LP (“RREF”) (15.2%), CIBC Inc. (“CIBC”) (14.1%) and Societe Generale Financial Corporation (“SGFC”) (13.3%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association (“Midland Loan Services”). |

| Special Servicer: | Rialto Capital Advisors, LLC (“Rialto”). |

| Directing Certificateholder: | RREF III-D CSAIL 2019-C18 MOA-HRR, LLC. |

| Trustee & Certificate Administrator: | Wells Fargo Bank, National Association (“Wells Fargo”). |

| Operating Advisor & Asset Representations Reviewer: | Pentalpha Surveillance LLC (“Pentalpha”). |

| U.S. Credit Risk Retention: | RREF, as the retaining sponsor, intends to cause its majority-owned affiliate to satisfy the U.S. credit risk retention requirement through the purchase by one or more of its “majority-owned affiliate” (as defined in the credit risk retention rules), from the underwriters and initial purchasers, on the Closing Date, of (i) an “eligible horizontal residual interest” comprised of the Class NR-RR certificates that are not part of the VRR Interest and (ii) an “eligible vertical interest” comprised of a certain percentage of the certificate balance, notional amount or percentage interest in each class of certificates (other than the Class R certificates) in a manner that satisfies the credit risk retention rules (the “VRR Interest”). The aggregate estimated fair value of the “eligible horizontal residual interest” will equal approximately 0.91% of the estimated fair value of all of the certificates (other than the Class R certificates) issued by the issuing entity and the VRR Interest will consist of the portion of each class of certificates (other than the Class R certificates) necessary to satisfy the credit risk retention rules. See “Credit Risk Retention” in the Prospectus. |

| EU Credit Risk Retention: | None of the sponsors, the depositor, the issuing entity, the underwriters or any other person is required or intends to retain a material net economic interest in the securitization constituted by the issue of the offered certificates, or to take any other action in respect of such securitization, in a manner prescribed or contemplated by the European Union’s Securitization Regulation (Regulation (EU) 2017/2402). |

| Closing Date: | On or about December 12, 2019. |

| Cut-off Date: | With respect to each mortgage loan, the respective due date for the monthly debt service payment that is due in December 2019 (or, in the case of any mortgage loan that has its first due date after December 2019, the date that would have been its due date in December 2019 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month). |

| Distribution Date: | The 4thbusiness day following each Determination Date, commencing in January 2020. |

| Determination Date: | 11thday of each month, or if the 11th day is not a business day, then the business day immediately following such 11th day, commencing in January 2020. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC regular interests for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C certificates will be offered publicly (the “Publicly Offered Certificates”). The Class X-D, Class X-F, Class X-G, Class D, Class E, Class F, Class G, Class NR-RR and Class R certificates (the “Privately Offered Certificates”) and the Class Z certificates will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The certificates willnot constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | 1% clean-up call. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | Expected to be available on Bloomberg Financial Markets, L.P., CMBS.com, Inc., Thomson Reuters Corporation, Trepp, LLC, Intex Solutions, Inc., Moody’s Analytics, RealINSIGHT and BlackRock Financial Management, Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

Collateral Characteristics

| Loan Pool | |

| Initial Pool Balance (“IPB”)(1): | $689,009,003 |

| Number of Mortgage Loans: | 55 |

| Number of Mortgaged Properties: | 80 |

| Average Cut-off Date Balance per Mortgage Loan: | $12,527,436 |

| Weighted Average Current Mortgage Rate: | 3.9731% |

| 10 Largest Mortgage Loans as % of IPB: | 44.7% |

| Weighted Average Remaining Term to Maturity/ARD(2): | 113 |

| Weighted Average Seasoning: | 1 |

| Credit Statistics | |

| Weighted Average UW NCF DSCR(3)(4): | 2.16x |

| Weighted Average UW NOI Debt Yield(3): | 10.6% |

| Weighted Average Cut-off Date LTV(3): | 63.9% |

| Weighted Average Maturity Date LTV(2)(3): | 57.5% |

| Other Statistics | |

| % of Credit Assessment Mortgage Loans(5): | 8.1% |

| % of Mortgage Loans with Additional Debt: | 10.1% |

| % of Mortgaged Properties with Single Tenants: | 23.9% |

| Amortization | |

| Weighted Average Original Amortization Term(6): | 357 |

| Weighted Average Remaining Amortization Term(6): | 357 |

| % of Mortgage Loans with Interest-Only: | 37.3% |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 32.6% |

| % of Mortgage Loans with Amortizing Balloon: | 28.9% |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon, ARD: | 1.2% |

| Cash Management(7) | |

| % of Mortgage Loans with In-Place, Hard Lockboxes: | 35.2% |

| % of Mortgage Loans with Springing Lockbox: | 44.4% |

| % of Mortgage Loans with In-Place, Soft Lockboxes: | 20.4% |

| % of Mortgage Loans with No Lockbox: | 0.0% |

| Reserves | |

| % of Mortgage Loans Requiring Upfront or Ongoing Tax Reserves: | 61.0% |

| % of Mortgage Loans Requiring Upfront or Ongoing Insurance Reserves: | 60.8% |

| % of Mortgage Loans Requiring Upfront or Ongoing CapEx Reserves(8): | 67.6% |

| % of Mortgage Loans Requiring Upfront or Ongoing TI/LC Reserves(9): | 64.5% |

| (1) | Subject to a permitted variance of plus or minus 5%. |

| (2) | In the case of Loan No. 32, which has an anticipated repayment date (an “ARD Loan”), unless otherwise indicated, references herein to the applicable maturity date, original term or remaining term refer to the anticipated repayment date with respect to such ARD Loan, and such anticipated repayment date is treated as its maturity date for all purposes. |

| (3) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary below and Annex A-1 to the Prospectus. |

| (4) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the initial principal and interest payment during the term of the mortgage loan once amortization has commenced. |

| (5) | Includes loans that at least one of Fitch and KBRA have indicated, in the context of its inclusion in the Initial Pool Balance, are expected to have credit characteristics consistent with an investment grade obligation. S&P does not provide credit assessments on underlying loans. |

| (6) | Excludes mortgage loans that are interest-only for the entire term. |

| (7) | For a detailed description of cash management, refer to“Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts—Lockbox Accounts” in the Prospectus. |

| (8) | CapEx Reserves include FF&E reserves for hotel properties. |

| (9) | Calculated only with respect to the Cut-off Date Balance of Loan No. 15 and mortgage loans secured by industrial, office, other, mixed use, retail and various type properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

Collateral Characteristics

| Loan Seller | Number of Mortgage Loans | Number of Mortgaged Properties | Aggregate Cut-off Date Balance | % of IPB | |

| Column(1) | 11 | 14 | $215,668,745 | 31.3% | |

| UBS AG(2) | 15 | 33 | 179,603,555 | 26.1 | |

| RREF(3) | 13 | 14 | 104,884,027 | 15.2 | |

| CIBC | 10 | 13 | 97,099,294 | 14.1 | |

| SGFC | 6 | 6 | 91,753,381 | 13.3 | |

| Total: | 55 | 80 | $689,009,003 | 100.0% | |

| (1) | Loan Nos. 7, 27, 44, 48 and 55 were originated by Bayview Commercial Mortgage Finance, LLC and subsequently acquired by Column. Loan No. 24 was originated by Regions Bank and subsequently acquired by Column. |

| (2) | Loan No. 5 is part of a whole loan that was co-originated by Morgan Stanley Bank, N.A., UBS AG and Bank of America, N.A. Loan No. 40 was originated by an unrelated third party, Greystone Servicing Company LLC and subsequently acquired by UBS AG. |

| (3) | RREF acquired each of the mortgage loans it is selling to the depositor from BSPRT CMBS Finance, LLC. |

Ten Largest Mortgage Loans

| # | Loan Name | Loan Seller | No. of Properties | Cut-off Date Balance | % of IPB | Property Type | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) |

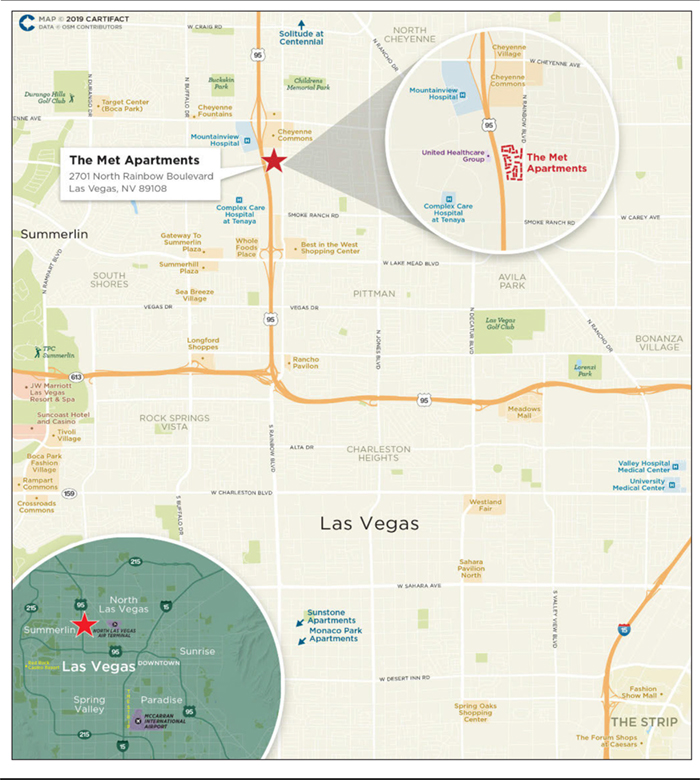

| 1 | The Met Apartments | Column | 1 | $51,900,000 | 7.5% | Multifamily | 2.25x | 8.0% | 66.7% | 66.7% |

| 2 | Palm Beach Estates | SGFC | 1 | 42,319,198 | 6.1 | Multifamily | 1.78x | 11.4% | 63.9% | 58.6% |

| 3 | Towne Center East | Column | 1 | 38,550,000 | 5.6 | Retail | 2.80x | 9.4% | 63.2% | 63.2% |

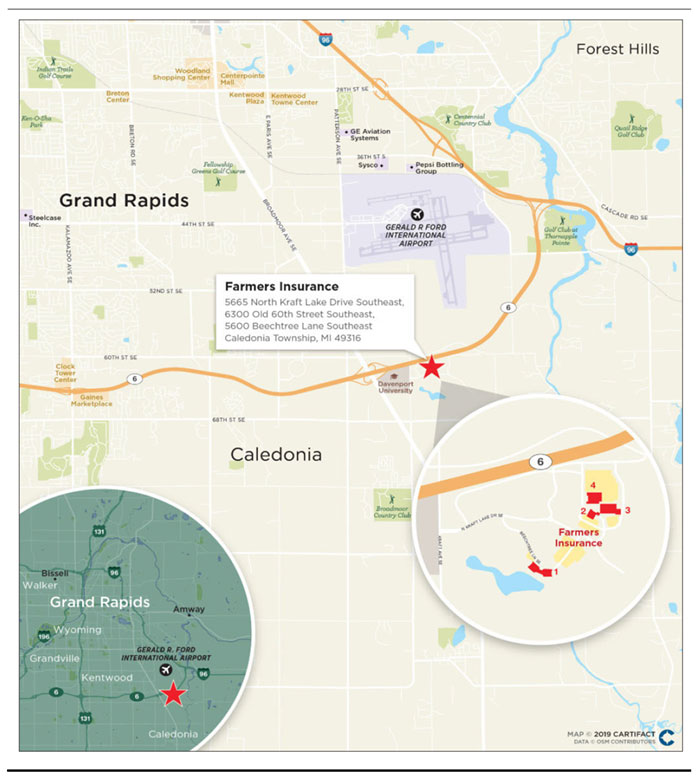

| 4 | Farmers Insurance | Column | 1 | 36,450,000 | 5.3 | Office | 1.82x | 10.0% | 63.8% | 57.4% |

| 5 | ILPT Industrial Portfolio | UBS AG | 11 | 34,320,000 | 5.0 | Industrial | 5.05x | 14.8% | 39.2% | 39.2% |

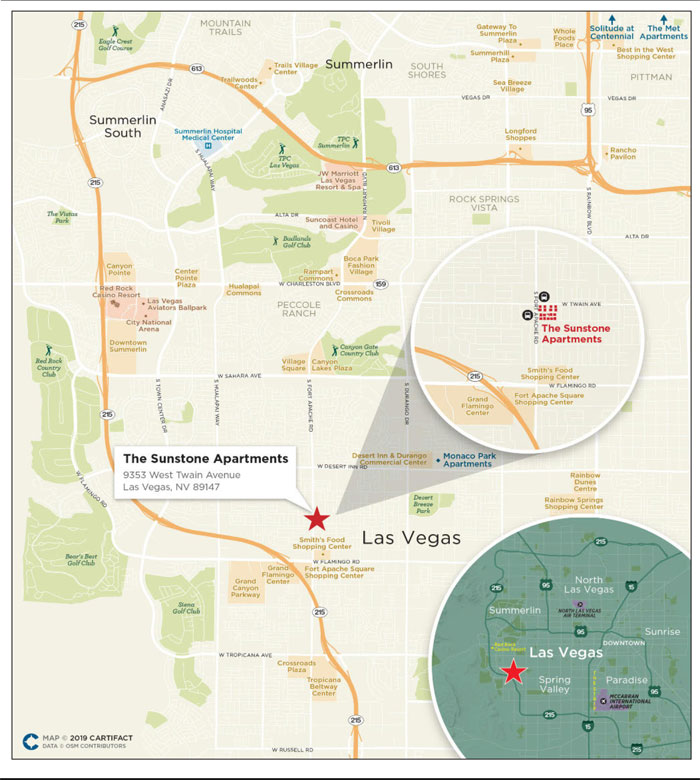

| 6 | The Sunstone Apartments | Column | 1 | 23,500,000 | 3.4 | Multifamily | 2.14x | 7.6% | 63.5% | 63.5% |

| 7 | Duane Reade - Columbia University | Column | 1 | 21,000,000 | 3.0 | Retail | 1.58x | 6.8% | 67.7% | 67.7% |

| 8 | United Healthcare Office | UBS AG | 1 | 20,000,000 | 2.9 | Office | 1.56x | 10.2% | 66.7% | 63.7% |

| 9 | Patriots Crossing Apartments | UBS AG | 1 | 20,000,000 | 2.9 | Multifamily | 1.61x | 9.8% | 72.5% | 62.8% |

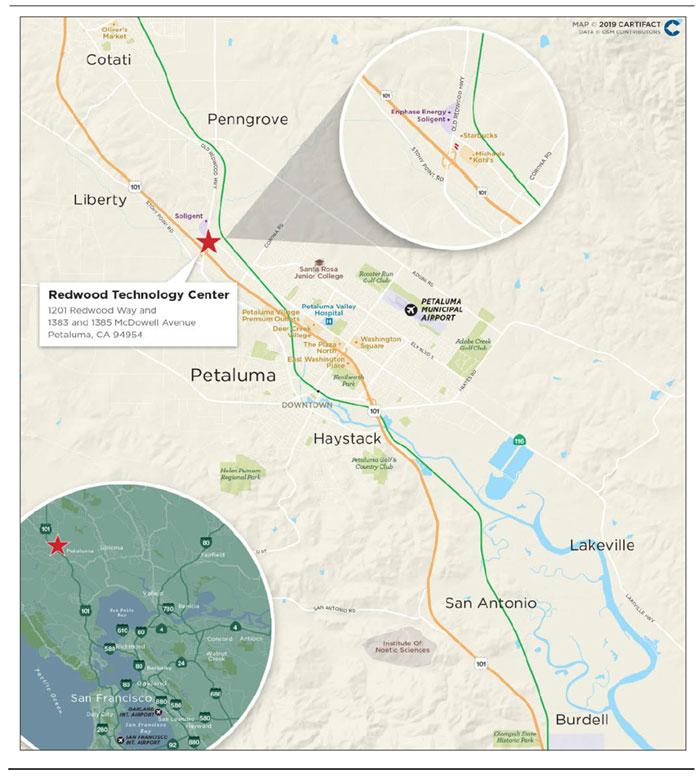

| 10 | Redwood Technology Center | UBS AG | 1 | 20,000,000 | 2.9 | Mixed Use | 1.55x | 9.7% | 71.6% | 65.5% |

| Top 3 Total/Weighted Average: | 3 | $132,769,198 | 19.3% | 2.26x | 9.5% | 64.8% | 63.1% | |||

| Top 5 Total/Weighted Average: | 15 | $203,539,198 | 29.5% | 2.65x | 10.5% | 60.3% | 58.1% | |||

| Top 10 Total/Weighted Average: | 20 | $308,039,198 | 44.7% | 2.33x | 9.9% | 63.0% | 60.3% | |||

| (1) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary below and Annex A-1 to the Prospectus. |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

Pari Passu Loan Summary

| # | Loan Seller | Loan Name | Trust Cut-off Date Balance | Aggregate Pari Passu Companion Loan Cut-off Date Balance | Combined Cut-off Date Balance | Lead Servicing Agreement | Master Servicer Under Lead Securitization | Special Servicer Under Lead Securitization |

| 4 | Column | Farmers Insurance | $36,450,000 | $60,000,000 | $96,450,000 | CSAIL 2019-C17 | Midland | Midland |

| 5 | UBS AG | ILPT Industrial Portfolio | $34,320,000 | $180,080,000 | $214,400,000 | MSC 2019-L3(1) | Wells Fargo | Situs Holdings, LLC(2) |

| 8 | UBS AG | United Healthcare Office | $20,000,000 | $26,800,000 | $46,800,000 | (3) | (3) | (3) |

| 10 | UBS AG | Redwood Technology Center | $20,000,000 | $16,500,000 | $36,500,000 | (3) | (3) | (3) |

| 14 | UBS AG | Crimson Retail Portfolio | $16,556,250 | $16,556,250 | $33,112,500 | CSAIL 2019-C18 | Midland | Midland |

| 15 | SGFC | Presidential City | $15,000,000 | $102,000,000 | $117,000,000 | SGCMS 2019-PREZ | Keybank | AEGON |

| 23 | RREF | Gatlin Retail Portfolio | $9,971,924 | $13,736,326 | $23,708,250 | UBS 2019-C17 | Wells Fargo | Rialto |

| 31 | UBS AG | Phoenix Industrial Portfolio II | $8,000,000 | $60,000,000 | $68,000,000 | UBS 2019-C17 | Wells Fargo | Rialto |

| 38 | RREF | Del Mar Terrace Apartments | $6,700,000 | $9,500,000 | $16,200,000 | WFCM 2019-C52 | Wells Fargo | LNR Partners, LLC |

| 46 | RREF | Courtyard by Marriott Secaucus | $4,981,802 | $9,963,604 | $14,945,406 | UBS 2019-C17 | Wells Fargo | Rialto |

| (1) | The initial directing holder is the holder of the related Note B until the occurrence of a control appraisal event under the related intercreditor agreement, at which time the directing holder will be the directing certificateholder (or other designated party) under the related lead servicing agreement. See “Description of the Mortgage Pool—The Whole Loans” in the Prospectus. |

| (2) | LNR Partners, LLC is the special servicer for the MSC 2019-L3 transaction; however, Situs Holdings, LLC is the special servicer solely with respect to the ILPT Industrial Portfolio Whole Loan. |

| (3) | The United Healthcare Office Whole Loan and the Redwood Technology Center Whole Loan are expected to be initially serviced under the CSAIL 2019-C18 pooling and servicing agreement until the securitization of the related Note A-1, after which the United Healthcare Office Whole Loan and the Redwood Technology Center Whole Loan Whole Loan will be serviced under the pooling and servicing agreement related to the securitization of related Note A-1. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

Mortgaged Properties by Type(1)

| Weighted Average | |||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Balance | % of IPB | Occupancy | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2) | Cut-off Date LTV(2) | Maturity Date LTV(2) |

| Multifamily | |||||||||

| Garden | 14 | $204,461,031 | 29.7% | 95.1% | 2.14x | 10.0% | 65.5% | 59.9% | |

| High Rise | 1 | 15,000,000 | 2.2 | 94.5% | 4.30x | 15.5% | 30.8% | 30.8% | |

| Multifamily Total | 15 | $219,461,031 | 31.9% | 95.1% | 2.29x | 10.4% | 63.1% | 57.9% | |

| Retail | |||||||||

| Anchored | 11 | $128,162,768 | 18.6% | 96.7% | 2.05x | 9.9% | 67.5% | 60.0% | |

| Single Tenant | 7 | 49,398,911 | 7.2 | 100.0% | 1.73x | 8.4% | 64.4% | 62.1% | |

| Unanchored | 3 | 15,750,049 | 2.3 | 95.4% | 1.75x | 10.8% | 60.6% | 52.6% | |

| Shadow Anchored | 1 | 6,305,000 | 0.9 | 62.0% | 2.19x | 10.1% | 65.0% | 65.0% | |

| Retail Total | 22 | $199,616,728 | 29.0% | 96.3% | 1.95x | 9.6% | 66.1% | 60.1% | |

| Industrial | |||||||||

| Warehouse/Distribution | 11 | $34,320,000 | 5.0% | 100.0% | 5.05x | 14.8% | 39.2% | 39.2% | |

| Warehouse | 5 | 23,795,802 | 3.5 | 94.2% | 1.72x | 10.8% | 70.8% | 59.1% | |

| Manufacturing | 3 | 16,576,434 | 2.4 | 100.0% | 1.42x | 10.3% | 66.5% | 50.8% | |

| Flex | 1 | 4,850,000 | 0.7 | 100.0% | 1.72x | 10.8% | 69.3% | 56.5% | |

| Industrial Total | 20 | $79,542,235 | 11.5% | 98.3% | 3.09x | 12.4% | 56.2% | 48.6% | |

| Office | |||||||||

| Suburban | 5 | $77,388,650 | 11.2% | 98.1% | 1.70x | 10.1% | 66.8% | 59.4% | |

| Office Total | 5 | $77,388,650 | 11.2% | 98.1% | 1.70x | 10.1% | 66.8% | 59.4% | |

| Hotel | |||||||||

| Extended Stay | 2 | $22,580,781 | 3.3% | 78.8% | 1.94x | 12.7% | 67.6% | 54.4% | |

| Limited Service | 3 | 15,967,090 | 2.3 | 67.2% | 2.07x | 14.7% | 61.4% | 48.2% | |

| Full Service | 1 | 9,000,000 | 1.3 | 72.3% | 4.68x | 22.5% | 43.9% | 43.9% | |

| Hotel Total | 6 | $47,547,871 | 6.9% | 73.7% | 2.50x | 15.2% | 61.0% | 50.3% | |

| Mixed Use | |||||||||

| Office/Retail | 3 | $23,894,401 | 3.5% | 95.1% | 1.53x | 9.7% | 71.3% | 64.1% | |

| Retail/Office | 1 | 3,150,000 | 0.5 | 90.4% | 1.79x | 11.7% | 53.0% | 45.1% | |

| Mixed Use Total | 4 | $27,044,401 | 3.9% | 94.5% | 1.56x | 9.9% | 69.2% | 61.9% | |

| MHC | |||||||||

| MHC | 6 | $26,808,087 | 3.9% | 86.5% | 1.59x | 9.0% | 65.9% | 57.9% | |

| MHC Total | 6 | $26,808,087 | 3.9% | 86.5% | 1.59x | 9.0% | 65.9% | 57.9% | |

| Other | |||||||||

| Leased Fee | 2 | $11,600,000 | 1.7% | 95.5% | 1.52x | 7.7% | 71.6% | 71.6% | |

| Other Total | 2 | $11,600,000 | 1.7% | 95.5% | 1.52x | 7.7% | 71.6% | 71.6% | |

| Total / Wtd. Avg.: | 80 | $689,009,003 | 100.0% | 94.3% | 2.16x | 10.6% | 63.9% | 57.5% | |

| (1) | This table presents information relating to the mortgaged properties and not mortgage loans. The information for mortgage loans secured by more than one mortgaged property is based on the allocated loan amounts set forth in Annex A-1 to the Prospectus. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (3) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

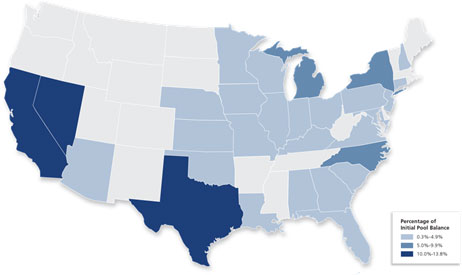

Mortgaged Properties by Location(1)

| State | Number of Properties | Cut-off Date Balance | % of IPB | Weighted Average | ||||

| Occupancy | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2) | Cut-off Date LTV(2) | Maturity Date LTV(2) | ||||

| NV | 3 | $95,400,000 | 13.8% | 94.5% | 2.08x | 8.4% | 65.9% | 65.3% |

| TX | 6 | 87,875,390 | 12.8 | 94.9% | 1.68x | 10.5% | 68.2% | 59.7% |

| CA | 4 | 73,050,000 | 10.6 | 95.9% | 2.22x | 9.5% | 65.2% | 62.2% |

| NY | 7 | 54,495,587 | 7.9 | 96.9% | 1.72x | 8.9% | 61.9% | 59.2% |

| MI | 4 | 48,134,688 | 7.0 | 97.9% | 1.76x | 10.1% | 65.4% | 57.4% |

| NC | 5 | 43,335,006 | 6.3 | 88.6% | 1.73x | 11.4% | 67.5% | 52.8% |

| AZ | 4 | 30,689,183 | 4.5 | 87.5% | 3.88x | 15.0% | 50.1% | 46.0% |

| PA | 5 | 29,161,834 | 4.2 | 97.2% | 3.23x | 12.8% | 46.5% | 43.9% |

| KY | 2 | 22,578,706 | 3.3 | 97.3% | 2.00x | 10.4% | 68.7% | 60.1% |

| LA | 2 | 20,799,423 | 3.0 | 91.3% | 1.44x | 8.8% | 71.6% | 57.5% |

| IL | 1 | 17,750,000 | 2.6 | 92.5% | 1.82x | 11.2% | 69.6% | 57.1% |

| OH | 3 | 16,879,020 | 2.4 | 96.9% | 2.92x | 12.3% | 62.7% | 53.3% |

| NH | 1 | 14,978,465 | 2.2 | 92.8% | 1.75x | 10.8% | 74.2% | 59.0% |

| FL | 3 | 14,668,232 | 2.1 | 93.3% | 1.78x | 10.8% | 67.3% | 58.3% |

| SC | 2 | 14,200,000 | 2.1 | 98.6% | 1.56x | 9.5% | 69.6% | 58.9% |

| VA | 2 | 13,373,133 | 1.9 | 81.3% | 4.80x | 20.0% | 42.4% | 42.4% |

| IN | 4 | 12,385,316 | 1.8 | 100.0% | 5.05x | 14.8% | 39.2% | 39.2% |

| CT | 2 | 12,008,094 | 1.7 | 91.2% | 1.75x | 10.2% | 70.6% | 64.3% |

| WI | 3 | 9,117,503 | 1.3 | 98.5% | 1.56x | 9.7% | 69.5% | 58.4% |

| MO | 2 | 9,026,752 | 1.3 | 94.2% | 3.03x | 10.7% | 57.7% | 57.7% |

| MN | 4 | 8,788,621 | 1.3 | 100.0% | 1.41x | 9.5% | 69.9% | 56.8% |

| OK | 1 | 8,750,000 | 1.3 | 76.0% | 1.96x | 13.3% | 63.9% | 51.8% |

| NE | 1 | 8,250,000 | 1.2 | 100.0% | 1.84x | 8.2% | 67.6% | 67.6% |

| GA | 3 | 6,909,750 | 1.0 | 100.0% | 1.53x | 9.0% | 73.9% | 62.6% |

| NJ | 1 | 4,981,802 | 0.7 | 75.5% | 1.96x | 15.5% | 58.6% | 42.8% |

| AL | 2 | 3,942,433 | 0.6 | 99.0% | 1.45x | 10.2% | 68.1% | 52.3% |

| KS | 1 | 3,590,049 | 0.5 | 100.0% | 1.46x | 8.6% | 66.5% | 53.0% |

| IA | 1 | 2,039,123 | 0.3 | 100.0% | 5.05x | 14.8% | 39.2% | 39.2% |

| MD | 1 | 1,850,896 | 0.3 | 100.0% | 5.05x | 14.8% | 39.2% | 39.2% |

| Total/ Wtd. Avg.: | 80 | $689,009,003 | 100.0% | 94.3% | 2.16x | 10.6% | 63.9% | 57.5% |

| (1) | This table presents information relating to the mortgaged properties and not mortgage loans. The information for mortgage loans secured by more than one mortgaged property is based on the allocated loan amounts set forth in Annex A-1 to the Prospectus. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (3) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

Cut-off Date Principal Balance

| Weighted Average | ||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| $2,062,500 - $9,999,999 | 33 | $206,167,265 | 29.9 | % | 4.2090% | 117 | 2.14x | 11.6% | 64.7% | 55.6% |

| $10,000,000 - $19,999,999 | 12 | 174,802,539 | 25.4 | 4.1349% | 119 | 1.91x | 10.6% | 64.7% | 54.9% | |

| $20,000,000 - $29,999,999 | 5 | 104,500,000 | 15.2 | 4.2103% | 107 | 1.70x | 8.8% | 68.2% | 64.6% | |

| $30,000,000 - $39,999,999 | 3 | 109,320,000 | 15.9 | 3.1151% | 118 | 3.18x | 11.3% | 55.9% | 53.7% | |

| $40,000,000 - $51,900,000 | 2 | 94,219,198 | 13.7 | 3.8891% | 92 | 2.04x | 9.5% | 65.4% | 63.1% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Mortgage Interest Rates

| Weighted Average | ||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 2.6533% - 3.4999% | 6 | $169,970,000 | 24.7 | % | 3.1695% | 118 | 3.46x | 11.3% | 54.8% | 54.8% |

| 3.5000% - 3.9999% | 8 | 109,937,357 | 16.0 | 3.7893% | 118 | 1.71x | 10.0% | 67.0% | 57.2% | |

| 4.0000% - 4.2499% | 18 | 178,954,472 | 26.0 | 4.1212% | 119 | 1.81x | 10.5% | 69.2% | 58.9% | |

| 4.2500% - 4.4999% | 13 | 93,337,470 | 13.5 | 4.3811% | 114 | 1.73x | 10.4% | 64.1% | 55.6% | |

| 4.5000% - 4.7499% | 7 | 102,315,906 | 14.8 | 4.5241% | 94 | 1.72x | 10.6% | 65.4% | 59.3% | |

| 4.7500% - 4.9999% | 1 | 20,000,000 | 2.9 | 4.9795% | 58 | 1.56x | 10.2% | 66.7% | 63.7% | |

| 5.0000% - 5.2800% | 2 | 14,493,797 | 2.1 | 5.0559% | 119 | 1.59x | 8.8% | 67.8% | 66.1% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Original Term to Maturity in Months

| Weighted Average | ||||||||||

| Original Term to Maturity | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 60 | 3 | $69,319,198 | 10.1 | % | 4.6272% | 59 | 1.75x | 10.9% | 64.2% | 60.1% |

| 120 | 52 | 619,689,804 | 89.9 | 3.8999% | 119 | 2.21x | 10.5% | 63.9% | 57.2% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

Remaining Term to Maturity

| Weighted Average | ||||||||||

| Range of Remaining Term to Maturity | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 58 - 84 | 3 | $69,319,198 | 10.1 | % | 4.6272% | 59 | 1.75x | 10.9% | 64.2% | 60.1% |

| 85 - 119 | 47 | 570,489,804 | 82.8 | 3.8767% | 119 | 2.25x | 10.5% | 63.8% | 57.4% | |

| 120 | 5 | 49,200,000 | 7.1 | 4.1690% | 120 | 1.79x | 11.1% | 64.9% | 55.3% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Original Amortization Term in Months

| Weighted Average | ||||||||||

| Original Amortization Term in Months | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| Interest Only | 14 | $256,925,000 | 37.3 | % | 3.5979% | 117 | 2.98x | 10.8% | 57.5% | 57.5% |

| 300 | 3 | 19,649,401 | 2.9 | 4.3306% | 119 | 1.50x | 11.2% | 65.7% | 48.0% | |

| 360 | 38 | 412,434,601 | 59.9 | 4.1898% | 110 | 1.68x | 10.4% | 67.9% | 57.9% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Remaining Amortization Term in Months

| Weighted Average | ||||||||||

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| Interest Only | 14 | $256,925,000 | 37.3 | % | 3.5979% | 117 | 2.98x | 10.8% | 57.5% | 57.5% |

| 298 - 300 | 3 | 19,649,401 | 2.9 | 4.3306% | 119 | 1.50x | 11.2% | 65.7% | 48.0% | |

| 301 - 359 | 17 | 171,065,851 | 24.8 | 4.2784% | 104 | 1.72x | 10.9% | 68.0% | 56.3% | |

| 360 | 21 | 241,368,750 | 35.0 | 4.1269% | 114 | 1.66x | 10.1% | 67.8% | 59.1% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

Amortization Types

| Weighted Average | ||||||||||

| Amortization Types | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| Interest Only | 14 | $256,925,000 | 37.3 | % | 3.5979% | 117 | 2.98x | 10.8% | 57.5% | 57.5% |

| IO-Balloon | 19 | 224,618,750 | 32.6 | 4.1159% | 113 | 1.64x | 10.0% | 68.4% | 59.7% | |

| Balloon | 21 | 199,465,253 | 28.9 | 4.2977% | 106 | 1.71x | 11.1% | 67.6% | 55.3% | |

| IO-Balloon, ARD | 1 | 8,000,000 | 1.2 | 3.9200% | 120 | 1.75x | 10.4% | 54.8% | 49.7% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Interest Only Periods

| Weighted Average | ||||||||||

| Range of Interest Only Periods | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| None | 21 | $199,465,253 | 28.9 | % | 4.2977% | 106 | 1.71x | 11.1% | 67.6% | 55.3% |

| 12 - 48 | 16 | 159,968,750 | 23.2 | 4.1948% | 111 | 1.60x | 9.9% | 69.4% | 59.7% | |

| 49 - 60 | 5 | 79,650,000 | 11.6 | 3.9617% | 113 | 1.77x | 10.1% | 64.2% | 58.6% | |

| 120 | 13 | 249,925,000 | 36.3 | 3.5757% | 119 | 3.01x | 10.8% | 57.5% | 57.5% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Underwritten Net Cash Flow Debt Service Coverage Ratios

| Weighted Average | ||||||||||

| Range of Underwritten Net Cash Flow DSCRs | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 1.31x - 1.49x | 13 | $107,340,009 | 15.6 | % | 4.1887% | 119 | 1.41x | 8.9% | 71.4% | 58.7% |

| 1.50x - 1.74x | 12 | 130,922,637 | 19.0 | 4.4207% | 109 | 1.57x | 9.1% | 69.3% | 63.2% | |

| 1.75x - 1.99x | 19 | 247,415,111 | 35.9 | 4.1470% | 109 | 1.83x | 11.0% | 65.0% | 56.4% | |

| 2.00x - 2.99x | 7 | 138,311,246 | 20.1 | 3.4851% | 116 | 2.37x | 9.0% | 64.5% | 63.5% | |

| 3.00x - 11.11x | 4 | 65,020,000 | 9.4 | 3.0920% | 118 | 5.45x | 18.0% | 35.5% | 35.5% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

LTV Ratios as of the Cut-off Date

| Weighted Average | ||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 16.2% - 49.9% | 4 | $65,020,000 | 9.4 | % | 3.0920% | 118 | 5.45x | 18.0% | 35.5% | 35.5% |

| 50.0% - 59.9% | 7 | 52,352,379 | 7.6 | 4.2535% | 111 | 1.90x | 11.8% | 55.7% | 47.4% | |

| 60.0% - 64.9% | 10 | 189,124,323 | 27.4 | 3.8779% | 105 | 2.04x | 9.9% | 63.1% | 59.5% | |

| 65.0% - 69.9% | 19 | 210,083,978 | 30.5 | 4.0849% | 113 | 1.81x | 9.4% | 67.8% | 61.1% | |

| 70.0% - 78.6% | 15 | 172,428,323 | 25.0 | 4.1884% | 119 | 1.57x | 9.6% | 73.3% | 62.3% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

LTV Ratios as of the Maturity Date

| Weighted Average | ||||||||||

| Range of Maturity Date LTVs | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| 16.2% - 49.9% | 11 | $113,311,540 | 16.4 | % | 3.5769% | 118 | 3.91x | 15.5% | 44.2% | 39.9% |

| 50.0% - 59.9% | 23 | 245,076,910 | 35.6 | 4.1699% | 107 | 1.72x | 10.6% | 67.0% | 56.6% | |

| 60.0% - 64.9% | 14 | 203,690,553 | 29.6 | 3.9321% | 113 | 1.90x | 9.3% | 68.3% | 62.4% | |

| 65.0% - 71.6% | 7 | 126,930,000 | 18.4 | 4.0127% | 119 | 1.88x | 8.2% | 68.6% | 67.0% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Prepayment Protection

| Weighted Average | ||||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| Defeasance | 43 | $452,694,503 | 65.7 | % | 4.1842% | 115 | 1.82x | 10.3% | 66.1% | 57.7% |

| Defeasance or Yield Maintenance | 4 | 148,270,000 | 21.5 | 3.1485% | 119 | 3.02x | 9.9% | 58.9% | 58.9% | |

| Yield Maintenance | 8 | 88,044,500 | 12.8 | 4.2763% | 90 | 2.49x | 12.9% | 61.3% | 54.2% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

Loan Purpose

| Weighted Average | ||||||||||

| Loan Purpose | Number of Loans | Cut-off Date Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) | |

| Refinance | 34 | $373,080,555 | 54.1 | % | 4.2618% | 108 | 2.00x | 11.0% | 64.2% | 56.5% |

| Acquisition | 19 | 265,052,197 | 38.5 | 3.7493% | 118 | 2.05x | 9.5% | 66.2% | 61.1% | |

| Recapitalization | 1 | 34,320,000 | 5.0 | 2.6533% | 119 | 5.05x | 14.8% | 39.2% | 39.2% | |

| Refinance/Acquisition | 1 | 16,556,250 | 2.4 | 3.7860% | 119 | 1.83x | 10.8% | 72.5% | 61.5% | |

| Total/Wtd. Avg.: | 55 | $689,009,003 | 100.0 | % | 3.9731% | 113 | 2.16x | 10.6% | 63.9% | 57.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, the Cut-off Date LTV, Maturity Date LTV, UW NCF DSCR and UW NOI Debt Yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). See the Pari Passu Loan Summary above and Annex A-1 to the Prospectus. |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

Previous Securitization History(1)

| No. | Loan / Property Name | Location | Property Type | Previous Securitization |

| 1 | The Met Apartments | Las Vegas, NV | Multifamily | FREMF 2018-KF44 |

| 3 | Towne Center East | Signal Hill, CA | Retail | JPMCC 2010-C2 |

| 6 | The Sunstone Apartments | Las Vegas, NV | Multifamily | FREMF 2017-KF35 |

| 8 | United Healthcare Office | Las Vegas, NV | Office | JPMBB 2014-C26 |

| 15 | Presidential City | Philadelphia, PA | Multifamily | NCMS 2018-PREZ |

| 20 | 1447 Enterprise Boulevard | Kinston, NC | Industrial | JPMCC 2007-C1 |

| 38 | Del Mar Terrace Apartments | Phoenix, AZ | Multifamily | MSCR 2016-MDN2 |

| 40 | Alma Elliot Square Shopping Center | Chandler, AZ | Retail | BSCMS 2006-PW11 |

| 46 | Courtyard by Marriott Secaucus | Secaucus, NJ | Hotel | BSPRT 2018-FL3 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan in this securitization paid off a loan in another securitization. |

Additional Subordinate and Mezzanine Debt Summary

| No. | Loan Name | Cut-off Date Balance | % of IPB | Subordinate Debt Cut-off Date Balance | Mezzanine Cut-off Date Balance | Mortgage Loan UW NCF DSCR(1)(2) | Total Debt UW NCF DSCR(2)(3) | Mortgage Loan Cut-off Date LTV(1) | Total Debt Cut-off Date LTV(3) | |

| 5 | ILPT Industrial Portfolio | $34,320,000 | 5.0 | % | $135,600,000 | NAP | 5.05x | 2.47x | 39.2% | 64.0% |

| 8 | United Healthcare Office | 20,000,000 | 2.9 | NAP | $6,000,000 | 1.56x | 1.30x | 66.7% | 75.2% | |

| 15 | Presidential City | 15,000,000 | 2.2 | $100,600,000 | $72,400,000 | 4.30x | 1.41x | 30.8% | 76.3% | |

| Total: | $69,320,000 | 10.1 | % | |||||||

| (1) | Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NCF DSCR calculations include the relatedpari passu companion loan(s) but exclude any related subordinate loan(s) or mezzanine loan(s). |

| (2) | For each partial interest-only mortgage loan, the UW NCF DSCR is calculated using the first principal and interest payment to be made into the trust during the term of the mortgage loan once amortization has commenced. |

| (3) | Total Debt Cut-off Date LTV and Total Debt UW NCF DSCR calculations include the relatedpari passu companion loan(s), any related subordinate loan(s) and/or any mezzanine loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

Structural Overview

Order of Distribution:

| On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust expenses, yield maintenance charges, prepayment premiums and excess interest distributable to the Class Z certificates, will be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds):

First:To interest on the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-D, Class X-F and Class X-G certificates, up to, andpro rata in accordance with, their respective interest entitlements.

Second:To the extent of funds allocated to principal and available for distribution: (i) first,to principal on the Class A-SB certificates, until the certificate balance of the Class A-SB certificates is reduced to the scheduled principal balance for the related distribution date set forth in Annex E to the Prospectus, (ii) second,to principal on the Class A-1 certificates, until the certificate balance of the Class A-1 certificates has been reduced to zero, (iii)third,to principal on the Class A-2 certificates, until the certificate balance of the Class A-2 certificates has been reduced to zero, (iv) fourth,to principal on the Class A-3 certificates, until the certificate balance of the Class A-3 certificates has been reduced to zero, (v)fifth, to principal on the Class A-4 certificates until the certificate balance of the Class A-4 certificates has been reduced to zero and (vi)sixth, to principal on the Class A-SB certificates, until the certificate balance of the Class A-SB certificates has been reduced to zero. If the certificate balance of each and every class of certificates other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates has been reduced to zero as a result of the allocation of mortgage loan losses to those certificates, funds available for distributions of principal will be distributed to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates,pro rata, based on their respective certificate balances, without regard to the distribution priorities described above or the planned principal balance of the Class A-SB certificates.

Third:To reimburse the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates,pro rata, for any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by those classes, together with interest on that amount at the pass-through rate for such class.

Fourth:(i)first, to interest on the Class A-S certificates in the amount of their interest entitlement; (ii) second, to the extent of funds allocated to principal remaining after any distributions in respect of principal to each class of certificates with a higher payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates), to principal on the Class A-S certificates until their certificate balance is reduced to zero; and (iii)third, to reimburse the Class A-S certificates for any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by that class, together with interest at its pass-through rate.

Fifth:(i)first, to interest on the Class B certificates in the amount of their interest entitlement; (ii)second, to the extent of funds allocated to principal remaining after any distributions in respect of principal to each class of certificates with a higher payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S certificates), to principal on the Class B certificates until their certificate balance is reduced to zero; and (iii)third, to reimburse the Class B certificates for any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by that class, together with interest at its pass-through rate.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Order of Distribution (continued): | Sixth:(i)first, to interest on the Class C certificates in the amount of their interest entitlement; (ii)second, to the extent of funds allocated to principal remaining after any distributions in respect of principal to each class of certificates with a higher payment priority (in this case, the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S and Class B certificates), to principal on the Class C certificates until their certificate balance is reduced to zero; and (iii)third, to reimburse the Class C certificates for any previously unreimbursed losses on the mortgage loans allocable to principal that were previously borne by that class, together with interest at its pass-through rate.

Seventh:After the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-D, Class X-F, Class X-G, Class A-S, Class B and Class C certificates are paid all amounts to which they are entitled, the remaining funds available for distribution will be used to pay interest and principal and to reimburse any unreimbursed losses to the Class D, Class E, Class F, Class G and Class NR-RR certificates sequentially in that order in a manner analogous to that described in clausesixthabove with respect to the Class C certificates, until the certificate balance of each such class is reduced to zero.

For more detailed information regarding the distributions on the certificates, see “Description of the Certificates—Distributions—Priority of Distributions” in the Prospectus. |

| Realized Losses: | The certificate balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class NR-RR certificates will each be reduced without distribution on any Distribution Date as a write-off to the extent of any loss realized on the mortgage loans allocated to such class of certificates on such Distribution Date. On each Distribution Date, any such write-offs will be applied to such classes of certificates in the following order, in each case until the related certificate balance is reduced to zero:first, to the Class NR-RR certificates;second, to the Class G certificates;third, to the Class F certificates;fourth, to the Class E certificates;fifth, to the Class D certificates;sixth, to the Class C certificates;seventh, to the Class B certificates;eighth, to the Class A-S certificates; and,finally,pro rata, to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB certificates, based on their then-current respective certificate balances. The notional amount of the Class X-A certificates will be reduced to reflect reductions in the certificate balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB and Class A-S certificates resulting from allocations of losses realized on the mortgage loans. The notional amount of the Class X-B certificates will be reduced to reflect reductions in the certificate balances of the Class B and Class C certificates resulting from allocations of losses realized on the mortgage loans. The notional amount of the Class X-D certificates will be reduced to reflect reductions in the certificate balances of the Class D and Class E certificates resulting from allocations of losses realized on the mortgage loans. The notional amount of the Class X-F certificates will be reduced to reflect reductions in the certificate balance of the Class F certificates resulting from allocations of losses realized on the mortgage loans. The notional amount of the Class X-G certificates will be reduced to reflect reductions in the certificate balance of the Class G certificates resulting from allocations of losses realized on the mortgage loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Prepayment Premiums and Yield Maintenance Charges: | On each Distribution Date, yield maintenance charges, if any, collected on the mortgage loans during the one-month period ending on the related Determination Date is required to be distributed to certificateholders (excluding the holders of the Class X-F, Class X-G, Class F, Class G, Class NR-RR, Class Z and Class R certificates) as follows: (1)pro rata, between (x) the group (the “YM Group A”) of Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A and Class A-S certificates, and (y) the group (the “YM Group B” and collectively with the YM Group A, the “YM Groups”) of the Class X-B, Class X-D, Class B, Class C, Class D and Class E certificates, based upon the aggregate amount of principal distributed to the classes of principal balance certificates in each YM Group on such Distribution Date, and (2) as among the respective classes of principal balance certificates in each YM Group in the following manner: (A) on apro rata basis in accordance with their respective entitlements in those yield maintenance charges, to each class of principal balance certificates in such YM Group with a certificate balance in an amount equal to the product of (x) a fraction whose numerator is the amount of principal distributed to such class of principal balance certificates on such Distribution Date and whose denominator is the total amount of principal distributed to all of the certificates in such YM Group with certificate balances on such Distribution Date, (y) the Base Interest Fraction for the related principal prepayment with respect to such class of principal balance certificates, and (z) the aggregate amount of such yield maintenance charge allocated to such YM Group; and (B) the portion of such yield maintenance charge allocated to such YM Group remaining after such distributions to the applicable class(es) of principal balance certificates in such YM Group, in the case of amounts distributable to YM Group A, to the Class X-A certificates and in the case of amounts distributable to YM Group B, on apro ratabasis in accordance with their respective reductions in their notional amounts on such Distribution Date to the Class X-B and Class X-D certificates.

The “Base Interest Fraction” with respect to any principal prepayment on any mortgage loan and with respect to any class of Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D and Class E certificates is a fraction (a) whose numerator is the greater of (x) zero and (y) the difference between (i) the pass-through rate on such class of certificates and (ii) the discount rate used in accordance with the related loan documents in calculating the yield maintenance charge with respect to such principal prepayment and (b) whose denominator is the greater of zero and the difference between (i) the mortgage loan rate on such mortgage loan (or serviced whole loan) and (ii) the discount rate used in accordance with the related loan documents in calculating the yield maintenance charge with respect to such principal prepayment;provided,however, that under no circumstances will the Base Interest Fraction be greater than one or less than zero. If such discount rate is greater than or equal to the lesser of (x) the mortgage loan rate on the related mortgage loan and (y) the pass-through rate described in the preceding sentence, then the Base Interest Fraction will equal zero;provided,however, that if such discount rate is greater than or equal to the mortgage loan rate, but less than the pass-through rate, the fraction will be one.

If a prepayment premium (calculated as a fixed percentage of the amount prepaid) is imposed in connection with a prepayment rather than a yield maintenance charge, then the prepayment premium so collected will be allocated as described above. For this purpose, the discount rate used to calculate the Base Interest Fraction will be the discount rate used to determine the yield maintenance charge for mortgage loans that require payment at the greater of a yield maintenance charge or a minimum amount equal to a fixed percentage of the principal balance of the mortgage loan or, for mortgage loans that only have a prepayment premium based on a fixed percentage of the principal balance of the mortgage loan, such other discount rate as may be specified in the related loan documents. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

| Prepayment Premiums and Yield Maintenance Charges (continued): | No prepayment premiums or yield maintenance charges will be distributed to holders of the Class X-F, Class X-G, Class F, Class G, Class NR-RR, Class Z or Class R certificates. Instead, after the notional amounts of the Class X-A, Class X-B and Class X-D certificates and the certificate balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D and Class E certificates have been reduced to zero, all prepayment premiums and yield maintenance charges with respect to the mortgage loans will be distributed to holders of the Class X-D certificates, regardless of whether the notional amount of the Class X-D certificates has been reduced to zero. For a description of prepayment premiums and yield maintenance charges required on the mortgage loans, see Annex A-1 to the Prospectus. See also“Certain Legal Aspects of the Mortgage Loans—Default Interest and Limitations on Prepayments” in the Prospectus. Prepayment premiums and yield maintenance charges will be distributed on any Distribution Date only to the extent they are received in respect of the mortgage loans as of the related Determination Date. See also“Description of the Certificates—Distributions”in the Prospectus. |

| Advances: | The master servicer and, if the master servicer fails to do so, the trustee, will be obligated to make (i) P&I advances with respect to each mortgage loan in the issuing entity and (ii) with respect to each mortgage loan (other than the non-serviced mortgage loans) and serviced whole loan, servicing advances, including paying delinquent real estate taxes, assessments and hazard insurance premiums, but only to the extent that those advances are not deemed nonrecoverable from collections on the related mortgage loan (or, if applicable, the related serviced whole loan) and, in the case of P&I advances, subject to reduction in connection with any appraisal reduction amounts that may occur. The special servicer will have no obligation to make servicing advances;providedthat with respect to a specially serviced loan, the special servicer will be entitled to make a servicing advance in an urgent or emergency situation, and the master servicer will be required to reimburse the special servicer for such advance, with interest;provided that the advance is not determined by the master servicer to be nonrecoverable. Notwithstanding the foregoing, servicing advances for the non-serviced mortgage loans will be made by the parties to, and pursuant to, the applicable lead servicing agreement. |

| Appraisal Reduction Amounts: | An appraisal reduction amount generally will be created with respect to a required appraisal loan (which is a serviced mortgage loan (or serviced whole loan, if applicable)) as to which certain defaults, modifications or insolvency events have occurred (as further described in the Prospectus) in the amount, if any, by which the principal balance of such required appraisal loan, exceeds 90% of the appraised value of the related mortgaged property (as determined by one or more appraisals obtained by the special servicer) plus certain escrows and reserves (including letters of credit) held with respect to such required appraisal loan (net of other amounts overdue or advanced in connection with such required appraisal loan). In general, subject to the discussion in the succeeding paragraph, any appraisal reduction amount calculated with respect to a whole loan will be allocated to the related mortgage loan and any relatedpari passu companion loan(s) on apro rata basis in accordance with their respective outstanding principal balances. In the case of the non-serviced mortgage loans, any appraisal reduction amounts will be calculated pursuant to, and by a party to, the related lead servicing agreement. As a result of an appraisal reduction amount being calculated for and/or allocated to a given mortgage loan, the interest portion of any P&I advance for such mortgage loan will be reduced, which will have the effect of reducing the amount of interest available for distribution to the most subordinate class(es) of certificates (exclusive of the Class Z and Class R certificates) then outstanding (i.e., first to the Class NR-RR certificates, then to the Class G certificates, then to the Class F certificates, then to the Class E certificates, |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

19

| Appraisal Reduction Amounts (continued): | then to the Class D certificates, then to the Class C certificates, then to the Class B certificates, then to the Class A-S certificates, and then,pro rata based on their respective interest entitlements, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-D, Class X-F and Class X-G certificates). In general, a mortgage loan (or whole loan, if applicable) serviced under the pooling and servicing agreement for this transaction will cease to be a required appraisal loan, and no longer be subject to an appraisal reduction amount, when the same has ceased to be a specially serviced loan (if applicable), has been brought current for at least three consecutive months and no other circumstances exist that would cause such serviced loan to be a required appraisal loan.

Appraisal reduction amounts with respect to the ILPT Industrial Portfolio whole loan will be allocated to notionally reduce the outstanding principal balance of the related subordinate companion loan(s) prior to anypro rata allocation to the related mortgage loan and each relatedpari passu companion loans.