Introducing: A Platform for Innovation

As we evolve, our focus remains on streamlining operations, securing predictable cash flows, and insulating our company against economic fluctuations—all while maintaining transparent communication with our investors. Central to our forward strategy will be leveraging single-tenant net lease assets in the tax-advantaged 1031 exchange market, the cornerstone for our growth initiatives. Through this avenue, we aim to bolster shareholder equity and expand our assets under management.

“We will offer a meaningful service to families with direct commercial real estate holdings: a simplified, tax-savvy real estate investment experience.”

It's about offering a product that's intuitive—something that just works for our investors. By transitioning their complex, hands-on real estate assets to our care, they can step back and enjoy simplicity, while we manage the intricacies. It’s not just about investing in properties; it's about investing in peace of mind, and that's the future we're building.

To achieve this, we are developing a platform aimed at attracting equity capital and providing educational resources to our investor community. Through this platform, we aim to navigate investors safely through the planning and execution of tax-advantaged exchanges.

“Guidance and education for the planning, and execution of tax-advantaged exchanges to real estate investors seeking a sanctum of income, safety, reliability, and public market liquidity.”

Summary

At Medalist, we recognize the responsibility of being stewards for the assets entrusted to us. While we acknowledge the costs associated with maintaining our position as a publicly traded REIT, we remain confident shifts in market sentiment will provide us with access to public equity opportunities, ultimately leading to improved outcomes for our shareholders.

Our primary objective is to solidify our reputation as a leader in guiding investors through the complexities of tax-advantaged 1031 exchanges. Our tax-savvy investment approach caters to discerning 1031 exchange investors, while delivering long-term value for our shareholders.

We appreciate your investment and ongoing support. Thank you for your attention.

Warm regards,

Frank Kavanaugh, CEO, Medalist

Brent Winn, CFO, Medalist

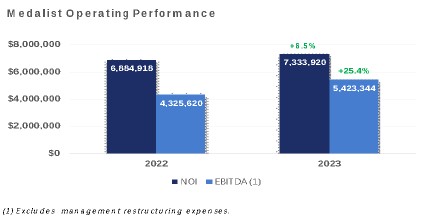

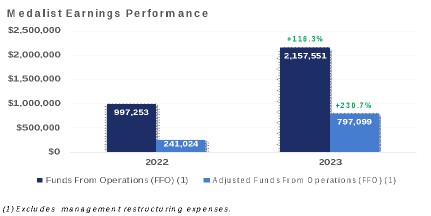

* The attached supplemental financial package will provide you with a detailed analysis of our financial metrics, including net income (loss), EBITDA, NOI, FFO and AFFO. *

Forward-Looking Statements

This shareholder letter contains statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward looking statements are not historical and are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “estimate, “may,” “will,” “should” and “could.” Forward-looking statements are based upon the Company’s present expectations but are not guarantees or assurances as to future developments or results. Factors that may cause actual developments or results to differ from those reflected in forward-looking statements include, without limitation, adverse changes in the pricing of