QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

Brookfield Business Partners L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS OF

BROOKFIELD BUSINESS PARTNERS L.P.

As at March 31, 2017 and December 31, 2016 and for the three months

ended March 31, 2017 and 2016

1

INDEX TO THE UNAUDITED INTERIM CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS OF BROOKFIELD BUSINESS PARTNERS L.P.

| | | | |

Unaudited Interim Condensed Consolidated Statements of Financial Position | | | 3 | |

Unaudited Interim Condensed Consolidated Statements of Operating Results | | | 4 | |

Unaudited Interim Condensed Consolidated Statements of Comprehensive Income | | | 5 | |

Unaudited Interim Condensed Consolidated Statements of Changes in Equity | | | 6 | |

Unaudited Interim Condensed Consolidated Statements of Cash Flow | | | 7 | |

Notes to Unaudited Interim Condensed Consolidated Financial Statements | | | 8 | |

2

BROOKFIELD BUSINESS PARTNERS L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS

OF FINANCIAL POSITION

| | | | | | | | | | |

(US$ MILLIONS) | | Notes | | March 31,2017 | | December 31,2016 | |

|---|

Assets | | | | | | | | | | |

Cash and cash equivalents | | | 3 | | $ | 1,205 | | $ | 1,050 | |

Financial assets | | | 4 | | | 270 | | | 433 | |

Accounts and other receivable, net | | | | | | 1,784 | | | 1,703 | |

Inventory, net | | | | | | 236 | | | 229 | |

Assets held for sale | | | 6 | | | 76 | | | 264 | |

Other assets | | | 5 | | | 401 | | | 397 | |

| | | | | | | | | |

Current assets | | | | | | 3,972 | | | 4,076 | |

Financial assets | | | 4 | | | 105 | | | 106 | |

Accounts and other receivable, net | | | | | | 106 | | | 94 | |

Other assets | | | 5 | | | 21 | | | 21 | |

Property, plant and equipment | | | 7 | | | 2,095 | | | 2,096 | |

Deferred income tax assets | | | | | | 121 | | | 111 | |

Intangible assets | | | | | | 361 | | | 371 | |

Equity accounted investments | | | 8 | | | 147 | | | 166 | |

Goodwill | | | | | | 1,191 | | | 1,152 | |

| | | | | | | | | |

Total assets | | | 17 | | $ | 8,119 | | $ | 8,193 | |

| | | | | | | | | |

Liabilities and equity | | | | | | | | | | |

Liabilities | | | | | | | | | | |

Accounts payable and other | | | 9 | | $ | 2,183 | | $ | 2,079 | |

Liabilities associated with assets held for sale | | | 6 | | | 21 | | | 66 | |

Borrowings | | | 11 | | | 674 | | | 411 | |

| | | | | | | | | |

Current liabilities | | | | | | 2,878 | | | 2,556 | |

Accounts payable and other | | | 9 | | | 383 | | | 378 | |

Borrowings | | | 11 | | | 743 | | | 1,140 | |

Deferred income tax liabilities | | | | | | 94 | | | 81 | |

| | | | | | | | | |

Total liabilities | | | | | $ | 4,098 | | $ | 4,155 | |

| | | | | | | | | |

Equity | | | | | | | | | | |

Limited partners | | | 14 | | $ | 1,240 | | $ | 1,206 | |

Non-controlling interests attributable to: | | | | | | | | | | |

Redemption-Exchange Units, Preferred Shares and Special Limited Partnership Units held by Brookfield Asset Management Inc. | | | 14 | | | 1,331 | | | 1,295 | |

Interest of others in operating subsidiaries | | | 14 | | | 1,450 | | | 1,537 | |

| | | | | | | | | |

Total equity | | | | | | 4,021 | | | 4,038 | |

| | | | | | | | | |

Total liabilities and equity | | | | | $ | 8,119 | | $ | 8,193 | |

| | | | | | | | | |

The accompanying notes are an integral part of the unaudited interim condensed consolidated

financial statements.

3

BROOKFIELD BUSINESS PARTNERS L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS

OF OPERATING RESULTS

| | | | | | | | | | |

| |

| | Three months ended

March 31, | |

|---|

(US$ MILLIONS, except per unit amounts) | | Notes | | 2017 | | 2016 | |

|---|

Revenues | | | 17 | | $ | 1,934 | | $ | 1,677 | |

Direct operating costs | | | 16 | | | (1,874 | ) | | (1,569 | ) |

General and administrative expenses | | | 17 | | | (62 | ) | | (62 | ) |

Depreciation and amortization expense | | | 17 | | | (65 | ) | | (72 | ) |

Interest expense | | | 17 | | | (19 | ) | | (24 | ) |

Equity accounted income, net | | | | | | 10 | | | 27 | |

Impairment expense, net | | | | | | (7 | ) | | — | |

Gain on acquisitions/dispositions, net | | | 4,6 | | | 272 | | | — | |

Other income (expenses), net | | | | | | 14 | | | (10 | ) |

| | | | | | | | | |

Income (loss) before income tax | | | | | | 203 | | | (33 | ) |

Income tax (expense) recovery | | | | | | | | | | |

Current | | | | | | 4 | | | (3 | ) |

Deferred | | | | | | (4 | ) | | 7 | |

| | | | | | | | | |

Net income (loss) | | | | | $ | 203 | | $ | (29 | ) |

| | | | | | | | | |

Attributable to: | | | | | | | | | | |

Limited partners(1) | | | | | $ | 32 | | $ | — | |

Brookfield Asset Management Inc.(2) | | | | | | — | | | (5 | ) |

Non-controlling interests attributable to: | | | | | | | | | | |

Redemption-Exchange Units held by Brookfield Asset Management Inc.(1). | | | | | | 34 | | | — | |

Interest of others in operating subsidiaries | | | | | | 137 | | | (24 | ) |

| | | | | | | | | |

| | | | | $ | 203 | | $ | (29 | ) |

| | | | | | | | | |

Basic and diluted earnings per limited partner unit | | | 14 | | $ | 0.61 | | | | |

| | | | | | | | | | |

- (1)

- For the periods subsequent to June 20, 2016.

- (2)

- For the periods prior to June 20, 2016.

The accompanying notes are an integral part of the unaudited interim condensed consolidated

financial statements.

4

BROOKFIELD BUSINESS PARTNERS L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

| | | | | | | | | | |

| |

| | Three months

ended

March 31, | |

|---|

(US$ MILLIONS) | | Notes | | 2017 | | 2016 | |

|---|

Net income (loss) | | | | | $ | 203 | | $ | (29 | ) |

| | | | | | | | | |

Other comprehensive income (loss): | | | | | | | | | | |

Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | |

Foreign currency translation | | | | | $ | 52 | | $ | 131 | |

Available-for-sale securities | | | | | | (27 | ) | | 12 | |

Net investment and cash flow hedges | | | | | | (14 | ) | | (25 | ) |

Equity accounted investment | | | | | | — | | | (10 | ) |

Taxes on the above items | | | | | | 3 | | | 5 | |

| | | | | | | | | |

Total other comprehensive income (loss) | | | | | | 14 | | | 113 | |

| | | | | | | | | |

Comprehensive income (loss) | | | | | $ | 217 | | $ | 84 | |

| | | | | | | | | |

Attributable to: | | | | | | | | | | |

Limited partners(1) | | | | | $ | 39 | | $ | — | |

Brookfield Asset Management Inc.(2) | | | | | | — | | | 50 | |

Non-controlling interests attributable to: | | | | | | | | | | |

Redemption-Exchange Units held by Brookfield Asset Management Inc.(1). | | | | | | 42 | | | — | |

Interest of others in operating subsidiaries | | | | | | 136 | | | 34 | |

| | | | | | | | | |

| | | | | $ | 217 | | $ | 84 | |

| | | | | | | | | |

- (1)

- For the periods subsequent to June 20, 2016.

- (2)

- For the periods prior to June 20, 2016.

The accompanying notes are an integral part of the unaudited interim condensed consolidated

financial statements.

5

BROOKFIELD BUSINESS PARTNERS L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| | Non-controlling interests | |

| |

|---|

| | Brookfield Asset Management Inc. | | Limited Partners | | Redemption-Exchange Units held by

Brookfield Asset Management Inc. | |

| |

| |

| |

|---|

(US$ MILLIONS) | | Equity | | Accumulated

other

comprehensive

income

(loss)(1) | | Brookfield

Asset

Management

Inc. | | Capital | | Ownership

Change(2) | | Retained

earnings | | Accumulated

other

comprehensive

income

(loss)(1) | | Limited

Partners | | Capital | | Ownership

Change(2) | | Retained

earnings | | Accumulated

other

comprehensive

income

(loss)(1) | | Redemption-

Exchange

Units | | Preferred

shareholder's

capital | | Interest of

others in

operating

subsidiaries | | Total

Equity | |

|---|

Balance as at January 1, 2017 | | $ | — | | $ | — | | $ | — | | $ | 1,345 | | $ | — | | $ | 2 | | $ | (141 | ) | $ | 1,206 | | $ | 1,474 | | $ | — | | $ | 3 | | $ | (197 | ) | $ | 1,280 | | $ | 15 | | $ | 1,537 | | $ | 4,038 | |

Net income (loss) | | | — | | | — | | | — | | | — | | | — | | | 32 | | | — | | | 32 | | | — | | | — | | | 34 | | | — | | | 34 | | | — | | | 137 | | | 203 | |

Other comprehensive income (loss) | | | — | | | — | | | — | | | — | | | — | | | — | | | 7 | | | 7 | | | — | | | — | | | — | | | 8 | | | 8 | | | — | | | (1 | ) | | 14 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income (loss) | | | — | | | — | | | — | | | — | | | — | | | 32 | | | 7 | | | 39 | | | — | | | — | | | 34 | | | 8 | | | 42 | | | — | | | 136 | | | 217 | |

Contributions | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Distributions(3) | | | — | | | — | | | — | | | — | | | — | | | (3 | ) | | — | | | (3 | ) | | — | | | — | | | (4 | ) | | — | | | (4 | ) | | — | | | (223 | ) | | (230 | ) |

Other | | | — | | | — | | | — | | | — | | | — | | | (2 | ) | | — | | | (2 | ) | | — | | | — | | | (2 | ) | | — | | | (2 | ) | | — | | | — | | | (4 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at March 31, 2017 | | $ | — | | $ | — | | $ | — | | $ | 1,345 | | $ | — | | $ | 29 | | $ | (134 | ) | $ | 1,240 | | $ | 1,474 | | $ | — | | $ | 31 | | $ | (189 | ) | $ | 1,316 | | $ | 15 | | $ | 1,450 | | $ | 4,021 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at January 1, 2016 | | $ | 2,147 | | $ | (360 | ) | $ | 1,787 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 1,297 | | $ | 3,084 | |

Net income (loss) | | | (5 | ) | | — | | | (5 | ) | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (24 | ) | | (29 | ) |

Other comprehensive income (loss) | | | — | | | 55 | | | 55 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 58 | | | 113 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income (loss) | | | (5 | ) | | 55 | | | 50 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 34 | | | 84 | |

Contributions | | | 46 | | | — | | | 46 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 95 | | | 141 | |

Distributions | | | (8 | ) | | — | | | (8 | ) | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (20 | ) | | (28 | ) |

Net increase (decrease) in Brookfield Asset Management Inc. investment | | | (29 | ) | | (2 | ) | | (31 | ) | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 50 | | | 19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at March 31, 2016 | | $ | 2,151 | | $ | (307 | ) | $ | 1,844 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | $ | 1,456 | | $ | 3,300 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- (1)

- See Note 15 for additional information.

- (2)

- Includes gains or losses on changes in ownership interests of consolidated subsidiaries.

- (3)

- See Note 14 for additional information on distribution as it relates to interest of others in operating subsidiaries.

The accompanying notes are an integral part of the unaudited interim condensed consolidated financial statements.

6

BROOKFIELD BUSINESS PARTNERS L.P.

UNAUDITED INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

| | | | | | | | | | |

| |

| | Three months

ended

March 31, | |

|---|

(US$ MILLIONS) | | Notes | | 2017 | | 2016 | |

|---|

Operating Activities | | | | | | | | | | |

Net income (loss) | | | | | $ | 203 | | $ | (29 | ) |

Adjusted for the following items: | | | | | | | | | | |

Equity accounted income, net | | | | | | (10 | ) | | (27 | ) |

Impairment expense, net | | | | | | 7 | | | — | |

Depreciation and amortization expense | | | | | | 65 | | | 72 | |

Gain on acquisitions/dispositions, net | | | | | | (272 | ) | | — | |

Provisions and other items | | | | | | (24 | ) | | 13 | |

Deferred income tax expense (recovery) | | | | | | 4 | | | (7 | ) |

Changes in non-cash working capital, net | | | 18 | | | 75 | | | 17 | |

| | | | | | | | | |

Cash from operating activities | | | | | | 48 | | | 39 | |

| | | | | | | | | |

Financing Activities | | | | | | | | | | |

Proceeds from borrowings | | | | | | 97 | | | 276 | |

Repayment of borrowings | | | | | | (245 | ) | | (163 | ) |

Capital provided by others who have interests in operating subsidiaries | | | | | | — | | | 99 | |

Capital provided by Brookfield Asset Management Inc. | | | | | | — | | | 46 | |

Distributions to limited partners and Redemption-Exchange Unitholders | | | | | | (7 | ) | | — | |

Distributions to others who have interests in operating subsidiaries | | | | | | (223 | ) | | (21 | ) |

Distributions to Brookfield Asset Management Inc. | | | | | | — | | | (8 | ) |

| | | | | | | | | |

Cash from (used in) financing activities | | | | | | (378 | ) | | 229 | |

| | | | | | | | | |

Investing Activities | | | | | | | | | | |

Acquisitions | | | | | | | | | | |

Property, plant and equipment and intangible assets | | | | | | (37 | ) | | (36 | ) |

Intangible assets | | | | | | (3 | ) | | (1 | ) |

Financial assets | | | | | | (13 | ) | | (307 | ) |

Dispositions and distributions | | | | | | | | | | |

Subsidiaries, net of cash disposed | | | | | | 357 | | | — | |

Property, plant and equipment | | | | | | — | | | 4 | |

Equity accounted investments | | | | | | 6 | | | 2 | |

Financial assets | | | | | | 158 | | | 2 | |

Net settlement of foreign exchange hedges | | | | | | (5 | ) | | 19 | |

Restricted cash and deposits | | | | | | 16 | | | — | |

| | | | | | | | | |

Cash from (used in) investing activities | | | | | | 479 | | | (317 | ) |

| | | | | | | | | |

Cash | | | | | | | | | | |

Change during the period | | | | | | 149 | | | (49 | ) |

Impact of foreign exchange on cash | | | | | | 6 | | | 11 | |

Balance, beginning of year | | | | | | 1,050 | | | 354 | |

| | | | | | | | | |

Balance, end of period | | | | | $ | 1,205 | | $ | 316 | |

| | | | | | | | | |

Supplemental cash flow information is presented in Note 18 | | | | | | | | | | |

The accompanying notes are an integral part of the unaudited interim condensed consolidated

financial statements.

7

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 1. NATURE AND DESCRIPTION OF THE PARTNERSHIP

Brookfield Business Partners L.P. and its subsidiaries, (collectively, "the partnership") own and operate business services and industrial operations ("the Business") on a global basis. Brookfield Business Partners L.P. was registered as a limited partnership established under the laws of Bermuda, and organized pursuant to a limited partnership agreement as amended on May 31, 2016, and as further amended on June 17, 2016. Brookfield Business Partners L.P. is a subsidiary of Brookfield Asset Management Inc. ("Brookfield Asset Management" or "Brookfield" or the "parent company"). Brookfield Business Partners L.P.'s limited partnership units are listed on the New York Stock Exchange and the Toronto Stock Exchange under the symbols "BBU" and "BBU.UN", respectively. The registered head office of Brookfield Business Partners L.P. is 73 Front Street, 5th Floor, Hamilton HM 12, Bermuda.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

These unaudited interim condensed consolidated financial statements of the partnership have been prepared in accordance with International Accounting Standard 34,Interim Financial Reporting, or IAS 34, as issued by the International Accounting Standards Board, or the IASB, and using the accounting policies the partnership applied in its annual consolidated financial statements as at and for the year ended December 31, 2016, except for the impact of the adoption of the accounting standard described below. The accounting policies the partnership applied in its annual consolidated financial statements as at and for the year ended December 31, 2016 are disclosed in Note 2 of such consolidated financial statements, with which reference should be made in reading these unaudited interim condensed consolidated financial statements. All defined terms are also described in the annual consolidated financial statements. The unaudited interim condensed consolidated financial statements are prepared on a going concern basis and have been presented in U.S. dollars rounded to the nearest million unless otherwise indicated. Certain comparative figures have been reclassified to conform to the current period's presentation.

These unaudited interim condensed consolidated financial statements were approved by the partnership's Board of Directors and authorized for issue on May 5, 2017.

- (b)

- Continuity of interests

Brookfield Business Partners L.P. was established on January 18, 2016 by Brookfield and on June 20, 2016 Brookfield completed the spin-off of the Business to holders of Brookfield's Class A and B limited voting shares. Brookfield directly and indirectly controlled the Business prior to the spin-off and continues to control the partnership subsequent to the spin-off through its interests in the partnership. As a result of this continuing common control, there is insufficient substance to justify a change in the measurement of the Business. In accordance with the partnership's and Brookfield's accounting policy, the partnership has reflected the Business in its financial position and results of operations using Brookfield's carrying values, prior to the spin-off.

To reflect this continuity of interests these unaudited interim condensed consolidated financial statements provide comparative information of the Business for the periods prior to the spin-off, as previously reported by Brookfield. The economic and accounting impact of contractual relationships created or modified in conjunction with the spin-off have been reflected prospectively from the date of the spin-off and have not been reflected in the results of operations or financial position of the partnership prior to June 20, 2016, as such items were in fact not created or modified prior thereto. Accordingly, the financial information for the periods prior to June 20, 2016 is presented based on the historical financial information for the Business as previously reported by Brookfield. For the period after completion of the spin-off, the results are based on the actual results of the partnership, including the adjustments associated with the spin-off and the execution of several new and amended agreements including management service and relationship agreements. Therefore, net income (loss) and comprehensive income (loss) not attributable to interests of others in operating subsidiaries has been allocated to Brookfield prior to June 20, 2016 and allocated to the limited partners, the general partner and redemption-exchange unitholders on and after June 20, 2016.

Prior to June 20, 2016, intercompany transactions between the partnership and Brookfield have been included in these unaudited interim consolidated financial statements and are considered to be forgiven at the time the transaction, are recorded and reflected as a "Net increase/(decrease) in Brookfield Asset Management Inc. investment". "Net increase/(decrease) in Brookfield Asset Management Inc. investment" as shown in the unaudited interim condensed consolidated statements of changes in equity represents the parent company's historical investment in the partnership, accumulated net income and the net effect of the transactions and allocations from the parent company. The total net effect of transactions with the parent company is reflected in the unaudited interim condensed consolidated statements of cash flow as a financing activity and in the unaudited interim condensed consolidated statements of financial position as "Equity attributable to Brookfield Asset Management Inc."

8

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES (Continued)

- (c)

- Future Changes in Accounting Policies

- (i)

- Revenue from Contracts with Customers

IFRS 15,Revenue from Contracts with Customers ("IFRS 15") specifies how and when revenue should be recognized as well as requiring more informative and relevant disclosures. IFRS 15 also requires additional disclosures about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts. IFRS 15 supersedes IAS 18, Revenue, IAS 11, Construction Contracts and a number of revenue-related interpretations. IFRS 15 applies to nearly all contracts with customers: the main exceptions are leases, financial instruments and insurance contracts. IFRS 15 must be applied for periods beginning on or after January 1, 2018 with early application permitted. An entity may adopt IFRS 15 on a fully retrospective basis or on a modified retrospective basis. The partnership has developed a detailed transition plan to implement IFRS 15. The partnership is at the assessment and evaluation phase of its plan.

- (ii)

- Financial Instruments

In July 2014, the IASB issued the final publication of IFRS 9,Financial Instruments ("IFRS 9") superseding the current IAS 39,Financial Instruments: Recognition and Measurement. IFRS 9 establishes principles for the financial reporting of financial assets and financial liabilities that will present relevant and useful information to users of financial statements for their assessment of the amounts, timing and uncertainty of an entity's future cash flows. This new standard also includes a new general hedge accounting standard which will align hedge accounting more closely with an entity's risk management activities. It does not fully change the types of hedging relationships or the requirement to measure and recognize ineffectiveness, however, it will provide more hedging strategies that are used for risk management to qualify for hedge accounting and introduce greater judgment to assess the effectiveness of a hedging relationship. IFRS 9 has a mandatory effective date for annual periods beginning on or after January 1, 2018 with early adoption permitted. The partnership has developed a detailed transition plan to implement IFRS 9. The partnership is at the assessment phase and has compiled an inventory of all of its financial instruments.

- (iii)

- Leases

IFRS 16,Leases, ("IFRS 16") provides a single lessee accounting model, requiring recognition of assets and liabilities for all leases, unless the lease term is shorter than 12 months or the underlying asset has a low value. IFRS 16 supersedes IAS 17,Leases, and its related interpretative guidance. IFRS 16 must be applied for periods beginning on or after January 1, 2019 with early adoption permitted if IFRS 15 has also been adopted. The partnership is currently evaluating the impact of IFRS 16 on its consolidated financial statements.

- (d)

- New Accounting Policies adopted

- (i)

- Income taxes

In January 2016, the IASB issued certain amendments to IAS 12,Income Taxes, to clarify the accounting for deferred tax assets for unrealized losses on debt instruments measured at fair value. A deductible temporary difference arises when the carrying amount of the debt instrument measured at fair value is less than the cost for tax purposes, irrespective of whether the debt instrument is held for sale or held to maturity. The recognition of the deferred tax asset that arises from this deductible temporary difference is considered in combination with other deferred taxes applying local tax law restrictions where applicable. In addition, when estimating future taxable profits, consideration can be given to recovering more than the asset's carrying amount where probable. These amendments are effective for periods beginning on or after January 1, 2017 with early application permitted. These amendments did not have a significant impact on the unaudited interim condensed consolidated financial statements.

- (ii)

- Disclosures — Statement of cash flows

In January 2016, the IASB issued the amendments to IAS 7,Statement of Cash Flows, effective for annual periods beginning January 1, 2017. The IASB requires that the following changes in liabilities arising from financing activities are disclosed (to the extent necessary): (i) changes from financing cash flows; (ii) changes arising from obtaining or losing control of subsidiaries or other businesses; (iii) the effect of changes in foreign exchange rates; (iv) changes in fair values; and (v) other changes. These amendments will be applied to the annual consolidated financial statements with no comparatives required.

NOTE 3. FAIR VALUE OF FINANCIAL INSTRUMENTS

The fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair values are determined by reference to quoted bid or ask prices, as appropriate. Where bid and ask prices are unavailable, the closing price of the most recent transaction of that instrument is used. In

9

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 3. FAIR VALUE OF FINANCIAL INSTRUMENTS (Continued)

the absence of an active market, fair values are determined based on prevailing market rates such as bid and ask prices, as appropriate for instruments with similar characteristics and risk profiles or internal or external valuation models, such as option pricing models and discounted cash flow analyses, using observable market inputs.

Fair values determined using valuation models require the use of assumptions concerning the amount and timing of estimated future cash flows and discount rates. In determining those assumptions, the partnership looks primarily to external readily observable market inputs such as interest rate yield curves, currency rates, and price and rate volatilities as applicable. Financial instruments classified as fair value through profit or loss are carried at fair value on the unaudited interim condensed consolidated statements of financial position and changes in fair values are recognized in profit or loss.

The following table provides the details of financial instruments and their associated financial instrument classifications as at March 31, 2017:

| | | | | | | | | | | | | | |

| | (US$ MILLIONS) | | FVTPL | | Available for

sale securities | | Loans and

Receivables/

Other Liabilities | | Total | |

|---|

| |

| | (Fair Value)

| | (Fair Value

through OCI)

| | (Amortized

Cost)

| |

| |

|---|

| | MEASUREMENT BASIS | | | | | | | | | | | | | |

| | Financial assets | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | — | | $ | — | | $ | 1,205 | | $ | 1,205 | |

| | Accounts receivable, net (current and non-current)(1) | | | 40 | | | — | | | 1,850 | | | 1,890 | |

| | Other assets (current and non-current)(2) | | | — | | | — | | | 315 | | | 315 | |

| | Financial assets (current and non-current)(4) | | | 27 | | | 282 | | | 66 | | | 375 | |

| | | | | | | | | | | |

| | Total | | $ | 67 | | $ | 282 | | $ | 3,436 | | $ | 3,785 | |

| | | | | | | | | | | |

| | Financial liabilities | | | | | | | | | | | | | |

| | Accounts payable and other(3) | | $ | 13 | | | — | | $ | 2,337 | | $ | 2,350 | |

| | Borrowings (current and non-current) | | | — | | | — | | | 1,417 | | | 1,417 | |

| | | | | | | | | | | |

| | Total | | $ | 13 | | $ | — | | $ | 3,754 | | $ | 3,767 | |

| | | | | | | | | | | |

- (1)

- Accounts receivable recognized at fair value relates to our mining business.

- (2)

- Excludes prepayments and other assets of $107 million.

- (3)

- Excludes provisions and decommissioning liabilities of $216 million.

- (4)

- Refer to Hedging Activities in note (a).

Included in cash and cash equivalents as at March 31, 2017 is $527 million of cash (December 31, 2016: $519 million) and $678 million of cash equivalents (December 31, 2016: $531 million) which includes $596 million on deposit with Brookfield (December 31, 2016: $519 million), as described in Note 12.

The fair value of all financial assets and liabilities as at March 31, 2017 were consistent with carrying value with the exception of the borrowings at one of our industrial operations, where fair value determined using Level 1 inputs was $202 million (December 31, 2016: $204 million) versus a book value of $224 million (December 31, 2016: $221 million).

10

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 3. FAIR VALUE OF FINANCIAL INSTRUMENTS (Continued)

The following table provides the allocation of financial instruments and their associated financial instrument classifications as at December 31, 2016:

| | | | | | | | | | | | | | |

| | (US$ MILLIONS) | | FVTPL | | Available for

sale securities | | Loans and

Receivables/

Other Liabilities | | Total | |

|---|

| |

| | (Fair Value)

| | (Fair Value

through OCI)

| | (Amortized

Cost)

| |

| |

|---|

| | MEASUREMENT BASIS | | | | | | | | | | | | | |

| | Financial assets | | | | | | | | | | | | | |

| | Cash and cash equivalents | | $ | — | | $ | — | | $ | 1,050 | | $ | 1,050 | |

| | Accounts receivable, net (current and non-current)(1) | | | 42 | | | — | | | 1,755 | | | 1,797 | |

| | Other assets (current and non-current)(2) | | | — | | | — | | | 309 | | | 309 | |

| | Financial assets (current and non-current)(4) | | | 34 | | | 432 | | | 73 | | | 539 | |

| | | | | | | | | | | |

| | Total | | $ | 76 | | $ | 432 | | $ | 3,187 | | $ | 3,695 | |

| | | | | | | | | | | |

| | Financial liabilities | | | | | | | | | | | | | |

| | Accounts payable and other(3) | | $ | 32 | | | — | | $ | 2,222 | | $ | 2,254 | |

| | Borrowings (current and non-current) | | | — | | | — | | | 1,551 | | | 1,551 | |

| | | | | | | | | | | |

| | Total | | $ | 32 | | $ | — | | $ | 3,773 | | $ | 3,805 | |

| | | | | | | | | | | |

- (1)

- Accounts receivable recognized at fair value relates to our mining business.

- (2)

- Excludes prepayments and other assets of $109 million.

- (3)

- Excludes provisions and decommissioning liabilities of $203 million.

- (4)

- Refer to Hedging Activities in note (a).

The partnership uses foreign exchange contracts and foreign currency denominated debt instruments to manage foreign currency exposures arising from net investments in foreign operations. For the three months ended March 31, 2017, unrealized pre-tax net losses of $31 million (March 31, 2016: net loss of $25 million) were recorded in other comprehensive income for the effective portion of hedges of net investments in foreign operations. As at March 31, 2017, there was an unrealized derivative asset balance of $4 million (December 31, 2016: $21 million) and derivative liability balance of $9 million (December 31, 2016: $1 million) relating to derivative contracts designated as net investment hedges.

The partnership uses commodity swap contracts to hedge the sale price of its gas contracts and foreign exchange contracts to hedge highly probable future acquisitions. These contracts are designated as cash flow hedges. For the three months ended March 31, 2017, unrealized pre-tax net gains of $17 million (March 31, 2016: $nil) were recorded in other comprehensive income for the effective portion of cash flow hedges. As at March 31, 2017, there was an unrealized derivative asset balance of $6 million (December 31, 2016: $nil) and derivative liability balance of $1 million (December 31, 2016: $12 million) relating to the derivative contracts designated as cash flow hedges.

Other derivative instruments are measured at fair value, with changes in fair value recognized in the consolidated statements of operating results.

- (b)

- Fair Value Hierarchical Levels — Financial Instruments

Level 3 assets and liabilities measured at fair value on a recurring basis include $102 million (December 31, 2016: $108 million) of financial assets and $nil (December 31, 2016: $nil) of financial liabilities, which are measured at fair value using valuation inputs based on management's best estimates.

11

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 3. FAIR VALUE OF FINANCIAL INSTRUMENTS (Continued)

There were no transfers between levels during the three month period ended March 31, 2017. The following table categorizes financial assets and liabilities, which are carried at fair value, based upon the level of input as at March 31, 2017 and December 31, 2016:

| | | | | | | | | | | | | | | | | | | | |

| |

| | March 31, 2017 | | December 31, 2016 | |

|---|

| | (US$ MILLIONS) | | Level 1 | | Level 2 | | Level 3 | | Level 1 | | Level 2 | | Level 3 | |

|---|

| | Financial assets | | | | | | | | | | | | | | | | | | | |

| | Common shares | | $ | 197 | | $ | — | | $ | — | | $ | 192 | | $ | — | | $ | — | |

| | Corporate bonds | | | | | | — | | | — | | | 143 | | | — | | | — | |

| | Accounts receivable | | | — | | | 40 | | | — | | | — | | | 42 | | | — | |

| | Loans and notes receivable | | | — | | | — | | | 3 | | | — | | | — | | | 8 | |

| | Derivative assets | | | — | | | 10 | | | 14 | | | — | | | 23 | | | 9 | |

| | Other financial assets | | | — | | | — | | | 85 | | | — | | | — | | | 91 | |

| | | | | | | | | | | | | | | |

| | | | $ | 197 | | $ | 50 | | $ | 102 | | $ | 335 | | $ | 65 | | $ | 108 | |

| | | | | | | | | | | | | | | |

| | Financial liabilities | | | | | | | | | | | | | | | | | | | |

| | Derivative liabilities | | $ | — | | $ | 13 | | $ | — | | $ | — | | $ | 32 | | $ | — | |

| | | | | | | | | | | | | | | |

| | | | $ | — | | $ | 13 | | $ | — | | $ | — | | $ | 32 | | $ | — | |

| | | | | | | | | | | | | | | |

- (c)

- Offsetting of Financial Assets and Liabilities

Financial assets and liabilities are offset with the net amount reported in the unaudited interim condensed consolidated statements of financial position where the partnership currently has a legally enforceable right to offset and there is an intention to settle on a net basis or realize the asset and settle the liability simultaneously. As at March 31, 2017, $23 million gross, of financial assets (December 31, 2016: $20 million) and $8 million gross, of financial liabilities (December 31, 2016: $11 million) were offset in the unaudited interim condensed consolidated statements of financial position related to derivative financial instruments.

NOTE 4. FINANCIAL ASSETS

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Current | | | | | | | |

| | Marketable securities(1) | | $ | 197 | | $ | 335 | |

| | Restricted cash | | | 56 | | | 71 | |

| | Derivative contracts | | | 9 | | | 23 | |

| | Loans and notes receivable | | | 8 | | | 4 | |

| | | | | | | |

| | Total current | | $ | 270 | | $ | 433 | |

| | | | | | | |

| | Non-current | | | | | | | |

| | Derivative contracts | | $ | 15 | | $ | 9 | |

| | Loans and notes receivable | | | 5 | | | 6 | |

| | Other financial assets | | | 85 | | | 91 | |

| | | | | | | |

| | Total non-current | | $ | 105 | | $ | 106 | |

| | | | | | | |

- (1)

- During the three month period ended March 31, 2017, the partnership recognized $33 million of net gains on disposition of marketable securities.

12

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 5. OTHER ASSETS

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Current | | | | | | | |

| | Work in progress (Note 10) | | $ | 315 | | $ | 309 | |

| | Prepayments and other assets | | | 86 | | | 88 | |

| | | | | | | |

| | Total current | | $ | 401 | | $ | 397 | |

| | | | | | | |

| | Non-current | | | | | | | |

| | Prepayments and other assets | | $ | 21 | | $ | 21 | |

| | | | | | | |

| | Total non-current | | $ | 21 | | $ | 21 | |

| | | | | | | |

NOTE 6. ASSETS HELD FOR SALE

Industrial Operations — Graphite electrode business

During the three months period ended March 31, 2017, our graphite electrodes business within our industrial operations segment recorded a $7 million charge to align the carrying value of assets to estimated fair value. Management is actively seeking and negotiating with potential buyers and expects to complete the sale of the remaining assets during the year ending December 31, 2017.

Industrial Operations — Infrastructure support manufacturing

During the three months period ended March 31, 2017, a portion of the assets that were classified as held for sale were sold for approximately $11 million. Management is actively negotiating with a buyer and expects to complete the sale of the remaining assets during the year ending December 31, 2017.

Industrial Operations — Bath and shower manufacturing

In January 2017, together with institutional partners, the partnership completed the sale of its bath and shower manufacturing business for proceeds of $357 million after transaction costs and other items with an associated gain of $228 million.

The following table presents the assets and liabilities that are classified as held for sale as at:

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Cash and cash equivalents | | $ | — | | $ | 8 | |

| | Accounts receivable, net | | | 24 | | | 56 | |

| | Inventory | | | 39 | | | 75 | |

| | Property, plant and equipment | | | 13 | | | 58 | |

| | Intangible assets and goodwill | | | — | | | 67 | |

| | | | | | | |

| | Assets held for sale | | $ | 76 | | $ | 264 | |

| | | | | | | |

| | Accounts payable and other | | $ | 21 | | $ | 66 | |

| | | | | | | |

| | Liabilities classified as held for sale | | $ | 21 | | $ | 66 | |

| | | | | | | |

13

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 7. PROPERTY, PLANT AND EQUIPMENT

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Gross Carrying Amount: | | | | | | | |

| | Beginning Balance | | $ | 2,849 | | $ | 2,959 | |

| | Additions | | | 33 | | | 134 | |

| | Disposals | | | (7 | ) | | (113 | ) |

| | Acquisitions through business combinations | | | — | | | — | |

| | Transfers and assets reclassified as held for sale(1) | | | — | | | (197 | ) |

| | Net foreign currency exchange differences | | | 26 | | | 66 | |

| | | | | | | |

| | Ending Balance | | $ | 2,901 | | $ | 2,849 | |

| | | | | | | |

| | Accumulated Depreciation and Impairment | | | | | | | |

| | Beginning Balance | | | (753 | ) | | (595 | ) |

| | Depreciation/depletion/impairment expense | | | (51 | ) | | (216 | ) |

| | Disposals | | | 5 | | | 14 | |

| | Transfers and assets reclassified as held for sale(1) | | | — | | | 59 | |

| | Net foreign currency exchange differences | | | (7 | ) | | (15 | ) |

| | | | | | | |

| | Ending Balance | | $ | (806 | ) | $ | (753 | ) |

| | | | | | | |

| | Net Book Value | | $ | 2,095 | | $ | 2,096 | |

| | | | | | | |

- (1)

- See Note 6 for additional information.

NOTE 8. EQUITY ACCOUNTED INVESTMENT

For the three month period ended March 31, 2017, the partnership recognized a distribution of $25 million from our equity accounted investment within the Energy segment.

NOTE 9. ACCOUNTS PAYABLE AND OTHER

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Current: | | | | | | | |

| | Accounts payable | | $ | 1,308 | | $ | 1,325 | |

| | Accrued and other liabilities(1)(2) | | | 526 | | | 476 | |

| | Work in progress (Note 10) | | | 297 | | | 239 | |

| | Provisions and decommissioning liabilities | | | 52 | | | 39 | |

| | | | | | | |

| | Total current | | $ | 2,183 | | $ | 2,079 | |

| | | | | | | |

| | Non-current: | | | | | | | |

| | Accounts payable | | $ | 93 | | $ | 91 | |

| | Accrued and other liabilities(2) | | | 126 | | | 123 | |

| | Provisions and decommissioning liabilities | | | 164 | | | 164 | |

| | | | | | | |

| | Total non-current | | $ | 383 | | $ | 378 | |

| | | | | | | |

- (1)

- Includes bank overdrafts.

- (2)

- Includes defined benefit pension obligation of $46 million ($1 million current and $45 million non-current) and post-retirement benefits obligation of $27 million ($2 million current and $25 million non-current).

14

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 10. CONTRACTS IN PROGRESS

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Contract costs incurred to date | | $ | 10,649 | | $ | 9,761 | |

| | Profit recognized to date (less recognized losses) | | | 501 | | | 498 | |

| | | | | | | |

| | | | | 11,150 | | | 10,259 | |

| | Less: progress billings | | | (11,132 | ) | | (10,189 | ) |

| | | | | | | |

| | Contract work in progress (liability) | | $ | 18 | | $ | 70 | |

| | | | | | | |

| | Comprising: | | | | | | | |

| | Amounts due from customers — work in progress (current) | | $ | 315 | | | 309 | |

| | Amounts due to customers — creditors (current) | | | (297 | ) | | (239 | ) |

| | | | | | | |

| | Net work in progress | | $ | 18 | | $ | 70 | |

| | | | | | | |

NOTE 11. BORROWINGS

Current and non-current borrowings as at March 31, 2017 were $1,417 million (December 31, 2016: $1,551 million). The decrease of $134 million was primarily due to the repayment of debt balances related to the acquisitions of financial assets in our energy and industrial operations segments, partially offset by an increase in borrowings within our facilities management operations.

Some of the partnership's businesses have credit facilities in which they borrow and repay on a monthly basis. This movement has been shown on a net basis in the partnership's unaudited interim condensed consolidated statements of cash flow.

As described in Note 12, the partnership entered into a credit agreement with Brookfield for two, three-year revolving credit facilities with variable interest rates. One constitutes an operating credit facility that permits borrowings of up to $200 million for working capital purposes and the other constitutes an acquisition facility that permits borrowings of up to $300 million for purposes of funding the acquisitions and investments. As at March 31, 2017, the credit facilities under the Brookfield Credit Agreements remain undrawn.

The partnership has a revolving credit facility for an aggregate of $150 million with a group of US and Canadian banks. The facilities have terms of two years and are available to fund acquisitions and for general corporate purposes. The revolver bears interest at the specified LIBOR or bankers' acceptance rate plus 2.75%, or base rate or prime rate plus 1.75%. As at March 31, 2017, the facilities remain undrawn.

The partnership has credit facilities within its operating businesses with major financial institutions. The credit facilities are primarily composed of revolving term credit facilities and revolving operating facilities with variable interest rates. In certain cases, the facilities may have financial covenants which are generally in the form of interest coverage ratios and leverage ratios. One of the partnership's real estate services businesses within our business services segment has a securitization program under which it transfers an undivided co-ownership interest in eligible receivables on a fully serviced basis, for cash proceeds, at their fair value under the terms of the agreement. While the sale of the co-ownership interest is considered a legal sale, the partnership has determined that the asset derecognition criteria has not been met as substantially all risk and rewards of ownership are not transferred.

NOTE 12. RELATED PARTY TRANSACTIONS

In the normal course of operations, the partnership entered into the transactions below with related parties on exchange value. These transactions have been measured at fair value and are recognized in the unaudited interim condensed consolidated financial statements.

- (a)

- Transactions with the parent company

As at March 31, 2017, $nil was drawn on the credit facilities under the Brookfield Credit Agreement (December 31, 2016: $nil).

The partnership entered into a Deposit Agreement with Brookfield. From time to time, the partnership may place funds on deposit of up to $250 million with Brookfield. The deposit balance is due on demand and earns interest which is on market terms. As at March 31, 2017, the amount of the deposit was $212 million and was included in cash and cash equivalents. Additionally, in December 2016, the partnership entered into a one-time Deposit Agreement with Brookfield to place the proceeds of the December 2016 equity offering on deposit with Brookfield. The deposit balance is due on demand and earns a market rate of interest. As at March 31, 2017, $384 million was on deposit in relation to this agreement. For the three months ended March 31, 2017 the partnership earned interest income of $2 million on these deposits.

15

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 12. RELATED PARTY TRANSACTIONS (Continued)

The partnership pays Brookfield a quarterly base management fee. For purposes of calculating the base management fee, the total capitalization of Brookfield Business Partners L.P. is equal to the quarterly volume-weighted average trading price of a unit on the principal stock exchange for the partnership units (based on trading volumes) multiplied by the number of units outstanding at the end of the quarter (assuming full conversion of the redemption-exchange units into units of Brookfield Business Partners L.P.), plus the value of securities of the other Service Recipients that are not held by the partnership, plus all outstanding third party debt with recourse to a Service Recipient, less all cash held by such entities. The base management fee for the three month period ended March 31, 2017 was $6 million.

The partnership entered into a number of hedges of net investments in foreign operations with Brookfield. For the three month period ended March 31, 2017, unrealized losses of $14 million (March 31, 2016: $9 million) and realized losses of $6 million associated with these hedges were recorded in the statement of comprehensive income. The total amount recorded as a financial asset as at March 31, 2017 is $1 million (December 31, 2016: $12 million) and the total amount recorded as a financial liability as at March 31, 2017 is $4 million (December 31, 2016: $nil).

- (b)

- Other

| | | | | | | | |

| |

| | Three Months Ended | |

|---|

| | (US$ MILLIONS) | | March 31, 2017 | | March 31, 2016 | |

|---|

| | Transactions during the period: | | | | | | | |

| | Construction revenues | | $ | 78 | | $ | 65 | |

| | | | | | | |

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Balances at end of period: | | | | | | | |

| | Accounts receivable | | $ | 80 | | $ | 97 | |

| | | | | | | |

| | Accounts payable and other | | $ | 46 | | $ | 47 | |

| | | | | | | |

NOTE 13. DERIVATIVE FINANCIAL INSTRUMENTS

The partnership's activities expose it to a variety of financial risks, including market risk (i.e., currency risk, interest rate risk, commodity risk and other price risk), credit risk and liquidity risk. The partnership and its subsidiaries selectively use derivative financial instruments principally to manage these risks.

The aggregate notional amount of the partnership's derivative positions were as follows as at:

| | | | | | | | | | | |

| | (US$ MILLIONS) | | Note | | March 31, 2017 | | December 31, 2016 | |

|---|

| | Foreign exchange contracts(1) | | | | | $ | 1,014 | | $ | 761 | |

| | Commodity contracts | | | (a | ) | | — | | | — | |

| | | | | | | | | | |

| | | | | | | $ | 1,014 | | $ | 761 | |

| | | | | | | | | | |

- (1)

- Notional amounts are presented on a net basis for those derivative instruments that are offset.

16

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 13. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

| | | | | | | | | | | |

| | (US$ MILLIONS) | | Total Volume | | Weighted average

price range | | Remaining term | | Fair market

value asset (liability) | |

|---|

| | Commodity swap | | 298,578 Mcf/d | | (USD$/Mcf) – $1.90-$2.35 | | April 2017 – Mar 2019 | | $ | 1 | |

| | Commodity swap | | 54,000 Ounces | | (USD$/Oz) – $736-$781 | | April 2017 – July 2017 | | $ | (2 | ) |

| | | | | | | | | | | |

| | | | | | | | | | $ | (1 | ) |

| | | | | | | | | | | |

NOTE 14. EQUITY

For the three month period ended March 31, 2017, the partnership distributed a dividend to LP, GP and REU unitholders of $7 million, or approximately $0.0625 per partnership unit (March 31, 2016: $nil). The partnership also distributed to others who have interests in the operating subsidiaries $217 million primarily related to the sale of the bath and shower manufacturing business.

There was no change in the number of units issued and outstanding during the three month period ended March 31, 2017.

- (a)

- Earnings per limited partner unit

Net income attributable to limited partnership unitholders was $32 million for the three month period ended March 31, 2017. The weighted average number of limited partnership units was 52 million for the three month period ended March 31, 2017.

NOTE 15. ACCUMULATED OTHER COMPREHENSIVE INCOME

- (a)

- Attributable to Limited Partners

| | | | | | | | | | | | | | |

| | (US$ MILLIONS) | | Foreign currency

translation | | Available for sale | | Other(1) | | Accumulated other

comprehensive

income (loss) | |

|---|

| | Balance as at January 1, 2017 | | $ | (148 | ) | $ | 4 | | $ | 3 | | $ | (141 | ) |

| | Other comprehensive income (loss) | | | 17 | | | (3 | ) | | (7 | ) | | 7 | |

| | | | | | | | | | | |

| | Balance as at March 31, 2017 | | $ | (131 | ) | $ | 1 | | $ | (4 | ) | $ | (134 | ) |

| | | | | | | | | | | |

- (1)

- Represents net investment hedges, cash flow hedges and other reserves.

| | | | | | | | | | | | | | |

| | (US$ MILLIONS) | | Foreign currency

translation | | Available for sale | | Other(1) | | Accumulated other

comprehensive

income (loss) | |

|---|

| | Balance as at January 1, 2017 | | $ | (205 | ) | $ | 2 | | $ | 6 | | $ | (197 | ) |

| | Other comprehensive income (loss) | | | 18 | | | (3 | ) | | (7 | ) | | 8 | |

| | | | | | | | | | | |

| | Balance as at March 31, 2017 | | $ | (187 | ) | $ | (1 | ) | $ | (1 | ) | $ | (189 | ) |

| | | | | | | | | | | |

- (1)

- Represents net investment hedges, cash flow hedges and other reserves.

17

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 15. ACCUMULATED OTHER COMPREHENSIVE INCOME (Continued)

- (c)

- Attributable to Brookfield Asset Management Inc.

| | | | | | | | | | | | | | |

| | (US$ MILLIONS) | | Foreign currency

translation | | Available for sale | | Other(1) | | Accumulated other

comprehensive

income (loss) | |

|---|

| | Balance as at January 1, 2016 | | $ | (358 | ) | $ | (35 | ) | $ | 33 | | $ | (360 | ) |

| | Other comprehensive income (loss) | | | 62 | | | 4 | | | (11 | ) | | 55 | |

| | Net increase/decrease in parent company investment | | | 3 | | | — | | | (5 | ) | | (2 | ) |

| | | | | | | | | | | |

| | Balance as at March 31, 2016 | | $ | (293 | ) | $ | (31 | ) | $ | 17 | | $ | (307 | ) |

| | | | | | | | | | | |

- (1)

- Represents net investment hedges, cash flow hedges and other reserves.

NOTE 16. DIRECT OPERATING COSTS

The partnership has no key employees or directors and does not remunerate key management personnel. Key decision makers of the partnership are all employees of the ultimate parent company, which provides management services under the Master Services Agreement.

Direct operating costs include all attributable expenses except interest, depreciation and amortization, impairment expense, other expenses, and taxes and primarily relate to cost of sales and compensation. The following table lists direct operating costs for the three months ended March 31, 2017, and March 31, 2016 by nature:

| | | | | | | | |

| | (US$ MILLIONS) | | March 31, 2017 | | March 31, 2016 | |

|---|

| | Cost of sales | | $ | 1,514 | | $ | 1,242 | |

| | Compensation | | | 354 | | | 325 | |

| | Property taxes, sales taxes and other | | | 6 | | | 2 | |

| | | | | | | |

| | Total | | $ | 1,874 | | $ | 1,569 | |

| | | | | | | |

Inventories recognized as expense during the three month period ended March 31, 2017 amounted to $178 million (March 31, 2016: $237 million).

NOTE 17. SEGMENT INFORMATION

Our operations are organized into five operating segments which are regularly reviewed by our Chief Operating Decision Maker (the "CODM") for the purpose of allocating resources to the segment and to assess its performance. The key measures used by the CODM in assessing performance and in making resource allocation decisions are company funds from operations, or Company FFO and Company EBITDA.

Company FFO is calculated as net income excluding the impact of depreciation and amortization, deferred income taxes, breakage and transaction costs, non-cash valuation gains or losses and other items. When determining Company FFO, we include our proportionate share of Company FFO of equity accounted investment.

18

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 17. SEGMENT INFORMATION (Continued)

Company FFO is further adjusted as Company EBITDA to exclude the impact of realized disposition gains (losses), interest expenses, current income taxes, and realized disposition gains, and current income taxes and interest expenses related to equity accounted investments.

| | | | | | | | | | | | | | | | | | | | |

| |

| | Three months ended March 31, 2017 | |

|---|

| |

| | Total attributable to the partnership | |

|---|

| | (US$ MILLIONS) | | Construction

Services | | Business

Services | | Energy | | Industrial

Operations | | Corporate

and Other | | Total | |

|---|

| | Revenues | | $ | 1,016 | | $ | 616 | | $ | 69 | | $ | 231 | | $ | 2 | | $ | 1,934 | |

| | Direct operating costs | | | (1,020 | ) | | (583 | ) | | (51 | ) | | (219 | ) | | (1 | ) | | (1,874 | ) |

| | General and administrative expenses | | | (11 | ) | | (23 | ) | | (4 | ) | | (15 | ) | | (9 | ) | | (62 | ) |

| | Equity accounted Company EBITDA(3) | | | — | | | 4 | | | 14 | | | — | | | — | | | 18 | |

| | Company EBITDA attributable to others(4) | | | 1 | | | (14 | ) | | (12 | ) | | 2 | | | — | | | (23 | ) |

| | | | | | | | | | | | | | | |

| | Company EBITDA | | | (14 | ) | | — | | | 16 | | | (1 | ) | | (8 | ) | | (7 | ) |

| | Realized disposition gain, net | | | 2 | | | 5 | | | 36 | | | 229 | | | — | | | 272 | |

| | Interest expense | | | — | | | (4 | ) | | (6 | ) | | (9 | ) | | — | | | (19 | ) |

| | Realized disposition gain, current income taxes and interest expenses related to equity accounted investments(3) | | | — | | | — | | | (1 | ) | | — | | | — | | | (1 | ) |

| | Current income taxes | | | 10 | | | — | | | (1 | ) | | (8 | ) | | 3 | | | 4 | |

| | Company FFO attributable to others (net of Company EBITDA attributable to others)(4) | | | (1 | ) | | 3 | | | (24 | ) | | (132 | ) | | — | | | (154 | ) |

| | | | | | | | | | | | | | | |

| | Company FFO(1) | | | (3 | ) | | 4 | | | 20 | | | 79 | | | (5 | ) | | 95 | |

| | Depreciation and amortization expense(2) | | | | | | | | | | | | | | | | | | (65 | ) |

| | Impairment expense, net | | | | | | | | | | | | | | | | | | (7 | ) |

| | Deferred income taxes | | | | | | | | | | | | | | | | | | (4 | ) |

| | Other income (expense), net | | | | | | | | | | | | | | | | | | 14 | |

| | Non-cash items attributable to equity accounted investments(3) | | | | | | | | | | | | | | | | | | (7 | ) |

| | Non-cash items attributable to others(4) | | | | | | | | | | | | | | | | | | 40 | |

| | | | | | | | | | | | | | | | | | | | |

| | Net income (loss) attributable to unitholders(1) | | | | | | | | | | | | | | | | | $ | 66 | |

| | | | | | | | | | | | | | | | | | | | |

- (1)

- Company FFO and net income attributable to unitholders include net income and Company FFO attributable to limited partnership unitholders, general partnership unitholders, and redemption-exchange unitholders.

- (2)

- For the three month period ended March 31, 2017, depreciation and amortization by segment is as follows; Construction Services $5 million, Business Services $9 million, Energy $26 million, Industrial Operations $25 million.

- (3)

- The sum of these amounts equate to equity accounted income of $10 million.

- (4)

- Total cash and non-cash items attributable to the interest of others equals net gain of $137 million as per the unaudited interim condensed consolidated statements of operating results.

19

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 17. SEGMENT INFORMATION (Continued)

| | | | | | | | | | | | | | | | | | | | |

| |

| | Three months ended March 31, 2016 | |

|---|

| |

| | Total attributable to the partnership | |

|---|

| | (US$ MILLIONS) | | Construction

Services | | Business

Services | | Energy | | Industrial

Operations | | Corporate

and Other | | Total | |

|---|

| | Revenues | | $ | 888 | | $ | 451 | | $ | 66 | | $ | 272 | | $ | — | | $ | 1,677 | |

| | Direct operating costs | | | (856 | ) | | (418 | ) | | (43 | ) | | (252 | ) | | — | | | (1,569 | ) |

| | General and administrative expenses | | | (10 | ) | | (24 | ) | | (4 | ) | | (24 | ) | | — | | | (62 | ) |

| | Equity accounted Company EBITDA(2) | | | — | | | 3 | | | 59 | | | — | | | — | | | 62 | |

| | Company EBITDA attributable to others(3) | | | — | | | (6 | ) | | (55 | ) | | 4 | | | — | | | (57 | ) |

| | | | | | | | | | | | | | | |

| | Company EBITDA | | | 22 | | | 6 | | | 23 | | | — | | | — | | | 51 | |

| | Realized disposition gain | | | — | | | — | | | — | | | — | | | — | | | — | |

| | Interest expense | | | — | | | (4 | ) | | (8 | ) | | (12 | ) | | — | | | (24 | ) |

| | Realized disposition gain, current income taxes and interest expenses related to equity accounted investments(2) | | | — | | | — | | | (6 | ) | | — | | | — | | | (6 | ) |

| | Current income taxes | | | — | | | (2 | ) | | (1 | ) | | — | | | — | | | (3 | ) |

| | Company FFO attributable to others (net of Company EBITDA attributable to others)(3) | | | — | | | 2 | | | 10 | | | 7 | | | — | | | 19 | |

| | | | | | | | | | | | | | | |

| | Company FFO(4) | | | 22 | | | 2 | | | 18 | | | (5 | ) | | — | | | 37 | |

| | Depreciation and amortization expense(1) | | | | | | | | | | | | | | | | | | (72 | ) |

| | Impairment expense, net | | | | | | | | | | | | | | | | | | — | |

| | Gain on acquisitions | | | | | | | | | | | | | | | | | | — | |

| | Deferred income taxes | | | | | | | | | | | | | | | | | | 7 | |

| | Other income (expense), net | | | | | | | | | | | | | | | | | | (10 | ) |

| | Non-cash items attributable to equity accounted investments(2) | | | | | | | | | | | | | | | | | | (29 | ) |

| | Non-cash items attributable to others(3) | | | | | | | | | | | | | | | | | | 62 | |

| | | | | | | | | | | | | | | | | | | | |

| | Net income (loss) attributable to parent(4) | | | | | | | | | | | | | | | | | $ | (5 | ) |

| | | | | | | | | | | | | | | | | | | | |

- (1)

- For the three month period ended March 31, 2016, depreciation and amortization by segment is as follows; Construction Services $5 million, Business Services $8 million, Energy $31 million, Industrial Operations $28 million.

- (2)

- The sum of these amounts equate to equity accounted income of $27 million.

- (3)

- Total cash and non-cash items attributable to the interest of others equals net loss of $24 million as per the unaudited interim condensed consolidated statements of operating results.

- (4)

- Company FFO and net income attributable to parent includes net income and Company FFO attributable to the parent company prior to the spin-off on June 20, 2016.

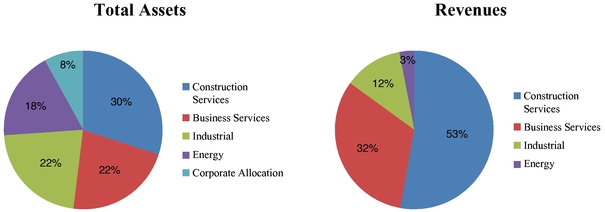

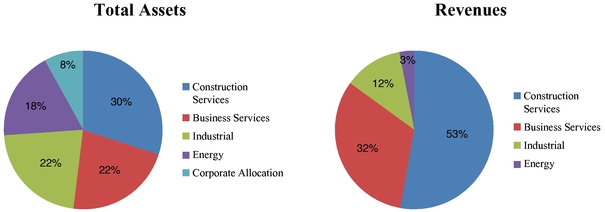

For the purpose of monitoring segment performance and allocating resources between segments, the CODM monitors the assets, including investments accounted for using the equity method, attributable to each segment.

The following is an analysis of the partnership's assets by reportable operating segment as at March 31, 2017 and December 31, 2016:

| | | | | | | | | | | | | | | | | | | | |

| |

| | As at March 31, 2017 | |

|---|

| |

| | Total attributable to the partnership | |

|---|

| | (US$ MILLIONS) | | Construction

Services | | Business

Services | | Energy | | Industrial

Operations | | Corporate

and Other | | Total | |

|---|

| | Total assets | | $ | 2,432 | | $ | 1,738 | | $ | 1,493 | | $ | 1,816 | | $ | 640 | | $ | 8,119 | |

| | | | | | | | | | | | | | | |

20

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 17. SEGMENT INFORMATION (Continued)

| | | | | | | | | | | | | | | | | | | | |

| |

| | As at December 31, 2016 | |

|---|

| |

| | Total attributable to the partnership | |

|---|

| | (US$ MILLIONS) | | Construction

Services | | Business

Services | | Energy | | Industrial

Operations | | Corporate

and Other | | Total | |

|---|

| | Total assets | | $ | 2,275 | | $ | 1,690 | | $ | 1,596 | | $ | 2,047 | | $ | 585 | | $ | 8,193 | |

| | | | | | | | | | | | | | | |

NOTE 18. SUPPLEMENTAL CASH FLOW INFORMATION

| | | | | | | | |

| |

| | Three Months Ended | |

|---|

| | (US$ MILLIONS) | | March 31, 2017 | | March 31, 2016 | |

|---|

| | Interest paid | | $ | 15 | | $ | 13 | |

| | Income taxes received | | $ | 1 | | $ | 3 | |

Amounts paid and received for interest were reflected as operating cash flows in the unaudited interim condensed consolidated statements of cash flow.

Details of "Changes in non-cash working capital, net" on the unaudited interim condensed consolidated statements of cash flow are as follows:

| | | | | | | | |

| |

| | Three Months Ended | |

|---|

| | (US$ MILLIONS) | | March 31, 2017 | | March 31, 2016 | |

|---|

| | Accounts receivable | | $ | (79 | ) | $ | 16 | |

| | Inventory | | | — | | | 15 | |

| | Prepayments and other | | | 25 | | | 19 | |

| | Accounts payable and other | | | 129 | | | (33 | ) |

| | | | | | | |

| | Changes in non-cash working capital, net | | $ | 75 | | $ | 17 | |

| | | | | | | |

NOTE 19. SUBSEQUENT EVENTS

- (a)

- Distribution

On May 5, 2017, the Board of Directors declared a quarterly distribution in the amount of $0.0625 per unit, payable on June 30, 2017 to unitholders of record as at the close of business on May 31, 2017.

- (b)

- Acquisition of BRK Ambiental

On April 25, 2017, together with institutional partners, the partnership completed the previously announced acquisition of a 70% controlling stake in a water, wastewater and industrial water treatment business in Brazil for a total investment of $908 million. The investment is comprised of a payment of $768 million to the seller and approximately $140 million in additional capital contributed at closing to fund working capital requirements and support expected growth of the business. In addition, the partnership and its institutional partners expect to purchase a direct interest in related assets held through a joint venture for $116 million. A future payment to the seller of up to R$350 million (approximately $115 million at the current exchange rate) may be made if the business achieves certain performance milestones over the three years following closing.

On acquisition, we had a 26% economic interest and a 70% voting interest in this business, providing us the right to direct the relevant activities of the entity, thereby providing the partnership with control. Accordingly, the partnership expects to consolidate the entity effective April 25, 2017.

Due to the recent closing of the acquisition, the complete valuation and initial purchase price accounting for the business combination is not available as at the date of release of these unaudited interim condensed consolidated financial statements. As a result, the partnership has not provided amounts recognized as at the acquisition date for certain major classes of assets acquired and liabilities assumed.

21

NOTES TO UNAUDITED INTERIM CONDENSED

CONSOLIDATED FINANCIAL STATEMENTS (Continued)

As at March 31, 2017 and December 31, 2016 and for the three months ended

March 31, 2017 and 2016

NOTE 19. SUBSEQUENT EVENTS (Continued)

- (c)

- Acquisition of Canadian gas station operation

On April 19, 2017, together with institutional partners, the partnership entered into a definitive agreement to acquire 100% of Loblaw's gas station operations in Canada. The gas station network is one of the largest in Canada and includes 213 retail gas stations and associated convenience kiosks adjacent to Loblaw-owned grocery stores across the country. The transaction provides for a purchase price of approximately C$540 million. Completion of the transaction remains subject to customary closing conditions and is expected to occur in the third quarter of 2017.

22

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

This management's discussion and analysis of our operating results and financial condition, or MD&A, of Brookfield Business Partners L.P. and subsidiaries, (collectively, the partnership, or we, or our), covers the financial position of the partnership as at March 31, 2017 and December 31, 2016, and results of operations for the three month period ended March 31, 2017 and 2016. The information in this MD&A should be read in conjunction with the unaudited interim condensed consolidated financial statements as at March 31, 2017 and December 31, 2016, and for the three month period ended March 31, 2017 and March 31, 2016, or the interim financial statements. This MD&A was prepared as of May 9, 2017. Additional information relating to the partnership can be found at www.sedar.com or www.sec.gov.

In addition to historical information, this MD&A contains forward-looking statements. Readers are cautioned that these forward-looking statements are subject to rules and uncertainties and could cause actual results to differ materially from those reflected in the forward-looking statements.

Forward-Looking Statements

This MD&A contains certain forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Forward-looking statements in this MD&A include statements regarding the quality of our assets, our financial performance, and the partnership's future growth prospects. In some cases, you can identify forward-looking statements by terms such as "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "potential", "should", "will" and "would" or the negative of those terms or other comparable terminology.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us or within our control. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The following factors, among others, could cause our actual results to vary from our forward-looking statements:

- •

- changes in the general economy;

- •

- general economic and business conditions that could impact our ability to access capital markets and credit markets;

- •

- the cyclical nature of most of our operations;

- •

- exploration and development may not result in commercially productive assets;

- •

- actions of competitors;

- •

- foreign currency risk;

- •

- our ability to derive fully anticipated benefits from future or existing acquisitions, joint ventures, investments or dispositions;

- •

- actions or potential actions that could be taken by our co-venturers, partners, fund investors or co-tenants;

- •

- risks commonly associated with a separation of economic interest from control;

- •

- failure to maintain effective internal controls;

- •

- actions or potential actions that could be taken by Brookfield Asset Management Inc., or Brookfield Asset Management, and its subsidiaries (other than the partnership, and, together with Brookfield Asset Management, Brookfield or the parent company);

- •

- the departure of some or all of Brookfield's key professionals;

23

- •

- the threat of litigation;

- •

- changes to legislation and regulations;

- •

- possible environmental liabilities and other possible liabilities;

- •

- our ability to obtain adequate insurance at commercially reasonable rates;

- •

- our financial condition and liquidity;

- •

- volatility in oil and gas prices;

- •

- capital expenditures required in connection with finding, developing or acquiring additional reserves;

- •

- downgrading of credit ratings and adverse conditions in the credit markets;

- •

- changes in financial markets, foreign currency exchange rates, interest rates or political conditions;

- •

- the impact of the potential break-up of political-economic unions (or the departure of a union member);

- •

- the general volatility of the capital markets and the market price of our units; and

- •

- other factors described elsewhere in this document and in our most recent Annual Report on Form 20-F under the heading "Risk Factors".

Statements relating to "reserves" are deemed to be forward-looking statements as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described herein can be profitably produced in the future. We qualify any and all of our forward-looking statements by these cautionary factors.

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements or information, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

These risk factors and others are discussed in detail under the heading "Risk Factors" in our most recent Annual Report on Form 20-F. New risk factors may arise from time to time and it is not possible to predict all of those risk factors or the extent to which any factor or combination of factors may cause actual results, performance or achievements of the partnership to be materially different from those contained in forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results. Although the forward-looking statements contained in this MD&A are based upon what the partnership believes to be reasonable assumptions, the partnership cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this MD&A.

Please refer to our most recent Annual Report on Form 20-F available on SEDAR at www.sedar.com, and EDGAR at www.sec.gov for a more comprehensive list of risks and uncertainties under the heading "Risk Factors".

Continuity of Interests

On June 20, 2016, Brookfield completed the spin-off of the partnership by way of a special dividend of a portion of our limited partnership units to holders of Brookfield's Class A and B limited voting shares (the "spin-off"). On June 1, 2016, we acquired substantially all of the business services and industrial operations, or the Business, and received $250 million in cash from Brookfield. In consideration, Brookfield received (i) approximately 55% of the limited partnership units, or LP Units, and 100% of the general partner units, or GP Units, of Brookfield Business Partners L.P., (ii) special limited partnership units, or Special LP Units, and redemption-exchange units, or Redemption-Exchange Units, of Brookfield Business L.P., or the Holding LP, representing an approximate 52% limited partnership interest in the Holding LP, and (iii) $15 million of preferred shares of certain of our subsidiaries. As at March 31, 2017, Brookfield holds an approximate 75% of the partnership interest on a fully exchanged basis. Holders of the GP Units, LP Units and Redemption-Exchange Units will be collectively referred to throughout this MD&A as "Unitholders". The GP Units, LP Units and Redemption-Exchange Units have the same economic attributes in all respects, except that the

24