UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23109

NorthStar Real Estate Capital Income Fund

(Exact name of registrant as specified in charter)

| 399 Park Avenue, 18th Floor | |

| New York, New York | 10022 |

| (Address of principal executive offices) | (Zip code) |

Daniel R. Gilbert

Chief Executive Officer and President

NorthStar Real Estate Capital Income Fund

399 Park Avenue, 18th Floor

New York, New York 10022

(Name and address of agent for service)

Copy to:

Sandra Matrick Forman, Esq.

Colony NorthStar, Inc.

399 Park Avenue, 18th Floor

New York, New York 10022

Registrant’s telephone number, including area code: (212) 547-2600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders.

The annual report (the “Annual Report”) of NorthStar Real Estate Capital Income Fund (the “RE Capital Fund”) for the period from May 6, 2016 (commencement of operations) through December 31, 2016 transmitted to shareholders pursuant to Rule 30e-1 promulgated under the Investment Company Act of 1940, as amended (the “1940 Act”), is as follows:

Table of Contents

NorthStar Real Estate Capital Income Fund

Annual Report for the period from May 6, 2016 (commencement of operations) through December 31, 2016:

NorthStar Real Estate Capital Income Master Fund

Annual Report for the period from May 6, 2016 (commencement of operations) through December 31, 2016:

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of NorthStar Real Estate Capital Income Fund

In our opinion, the accompanying statement of assets and liabilities, and the related statements of operations and of changes in net assets present fairly, in all material respects, the financial position of the NorthStar Real Estate Capital Income Fund (the "RE Capital Fund") as of December 31, 2016, the results of its operations, and the changes in its net assets for the period from May 6, 2016 (commencement of operations) through December 31, 2016, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the RE Capital Fund's management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

New York, NY

February 28, 2017

NorthStar Real Estate Capital Income Fund

Statement of Assets and Liabilities

| | | December 31, 2016 | |

| Assets | | | | |

| Cash | | $ | 110,276 | |

| Receivable for common shares issued | | | 5,085 | |

| Total assets | | | 115,361 | |

| | | | | |

| Liabilities | | | | |

| Professional fees payable | | | 3,030 | |

| Printing fees payable | | | 2,887 | |

| Administrative services expense payable | | | 2,790 | |

| Custodian fees payable | | | 1,667 | |

| Accrued expense and other liabilities | | | 104 | |

| Total liabilities | | | 10,478 | |

| Net assets | | $ | 104,883 | |

| | | | | |

| Commitments and contingencies (Note 7) | | | | |

| | | | | |

| Composition of net assets | | | | |

| Class A shares, $0.001 par value per share, 300,000,000 shares authorized,11,560 shares issued and outstanding | | $ | 12 | |

| Capital in excess of par value | | | 118,252 | |

| Net investment loss | | | (13,381 | ) |

| Net assets | | $ | 104,883 | |

| | | | | |

| Net asset value per Class A share, at period end | | $ | 9.07 | |

Refer to accompanying notes to financial statements.

NorthStar Real Estate Capital Income Fund

Statement of Operations

| | | For the period from | |

| | | May 6, 2016* through | |

| | | December 31, 2016 | |

| Investment Income | | | | |

| Interest income | | $ | 12 | |

| Total investment income | | | 12 | |

| | | | | |

| Expenses | | | | |

| Professional fees | | | 3,849 | |

| Custodian fees | | | 3,763 | |

| Printing fees | | | 2,887 | |

| Administrative services expense | | | 2,790 | |

| Other expenses | | | 104 | |

| Total expenses | | | 13,393 | |

| Net investment loss | | | (13,381 | ) |

| Net decrease in net assets resulting from operations | | $ | (13,381 | ) |

* Commencement of operations

Refer to accompanying notes to financial statements.

NorthStar Real Estate Capital Income Fund

Statement of Changes in Net Assets

| | | For the period from | |

| | | May 6, 2016* through | |

| | | December 31, 2016 | |

| Decrease in net assets resulting from operations: | | | | |

| Net investment loss | | $ | (13,381 | ) |

| Net decrease in net assets resulting from operations | | | (13,381 | ) |

| | | | | |

| Capital Transactions | | | | |

| Issuance of Class A shares (11,560 shares) (Note 3) | | | 105,085 | |

| Contributions from affiliate (Note 4) | | | 13,179 | |

| Net increase in net assets resulting from capital transactions | | | 118,264 | |

| | | | | |

| Total increase in net assets | | | 104,883 | |

| Net assets at beginning of period | | | - | |

| Net assets at end of period | | $ | 104,883 | |

| Net investment loss | | $ | (13,381 | ) |

* Commencement of operations

Refer to accompanying notes to financial statements.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS

| 1. | Business and Organization |

NorthStar Real Estate Capital Income Fund (the “RE Capital Fund”) was organized as a Delaware statutory trust on October 2, 2015. The RE Capital Fund’s primary investment objectives are to generate attractive and consistent income through cash distributions and preserve and protect shareholders’ capital, with a secondary objective of capital appreciation. The RE Capital Fund has multiple share classes and intends to invest substantially all of its net assets in NorthStar Real Estate Capital Income Master Fund (the “Master Fund”). The Master Fund’s investment objective and strategies are substantially the same as the RE Capital Fund’s. The RE Capital Fund’s financial statements should be read in conjunction with the attached financial statements for the Master Fund.

The RE Capital Fund commenced operations on May 6, 2016 when, together with NorthStar Real Estate Capital Income Fund-T, which is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and whose principal investment strategy is to invest substantially all of its assets in the Master Fund, the RE Capital Fund’s registration statement was declared effective by the Securities and Exchange Commission (the “SEC”).

The RE Capital Fund and the Master Fund are externally managed by NSAM B-RECF Ltd., a Bermuda exempt company, (the “Advisor”) and NSAM US-RECF LLC, a Delaware limited liability company (the “Co-Advisor” and collectively, the “Advisors”) which are registered investment advisors under the Investment Advisors Act of 1940, as amended, (the “Advisors Act”). Pursuant to a separate advisory agreement with each of the RE Capital Fund and Master Fund, the Advisor oversees the management of the RE Capital Fund’s and the Master Fund’s activities, respectively, including investment strategies, investment goals, asset allocation, leverage limitations, reporting requirements and other guidelines in addition to the general monitoring of the RE Capital Fund’s and the Master Fund’s portfolios. The Advisor also provides asset management and other administrative services. Pursuant to an agreement with the Advisor and the RE Capital Fund (the “Co-Advisory Agreement”), the Co-Advisor assists the Advisor with the day-to-day activities and the sourcing, management and monitoring of investments for the RE Capital Fund’s and the Master Fund’s portfolios, subject to the oversight of the Advisor. The Co-Advisor also furnishes the RE Capital Fund and the Master Fund with office facilities and equipment, and assists the Advisor with the provisions of clerical and other administrative services, including marketing, investor relations and certain accounting services and maintenance of certain books and records on behalf of the RE Capital Fund and the Master Fund. In addition, the Co-Advisor performs the calculation and publication of the RE Capital Fund and the Master Fund’s net asset value. The Advisor and Co-Advisor are affiliates of NorthStar Asset Management Group Inc. (“NorthStar”), which sponsors other public companies that raise capital through the retail market.

On January 10, 2017, pursuant to a merger agreement between NorthStar, NorthStar Realty Finance Corp. (“NorthStar Realty”), and Colony Capital Inc. (“Colony”), dated as of June 2, 2016 (as amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), NorthStar, NorthStar Realty and Colony merged into Colony NorthStar, Inc. (NYSE: CLNS or “Colony NorthStar”) through a series of merger transactions (the “Mergers”). As a result of the Mergers, Colony NorthStar is a diversified equity REIT with an embedded institutional and retail investment management business. In addition, following the Mergers, the Advisor is a subsidiary of Colony NorthStar.

On January 31, 2017, the Advisor was re-domiciled as a Delaware limited liability company and renamed CNI RCEF Advisors, LLC. On February 23, 2017, the Co-Advisory Agreement was terminated, effective immediately, and the Advisor is now responsible for all the advisory and administrative duties formerly performed by the Co-Advisor.

The RE Capital Fund is registered under the 1940 Act, as a non-diversified, closed-end management investment company that intends to elect to be treated for federal income tax purposes as a C-corporation for the period ended December 31, 2016.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

The RE Capital Find intends to qualify annually thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Refer to Note 2 and Note 5 for further details.

On January 9, 2017, the Master Fund, the RE Capital Fund and NorthStar Real Estate Capital Fund-T entered into an administration agreement (the “Administration Agreement”) with ALPS Fund Services, Inc. (“ALPS” or the “Administrator”). ALPS, and/or its affiliates are responsible for, but not limited to, (i) maintaining financial books and records of the Master Fund and the RE Capital Fund, (ii) providing administration services, and (iii) performing other accounting and clerical services as necessary in connection with the administration of the Master Fund and the RE Capital Fund.

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying audited financial statements of the RE Capital Fund have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The RE Capital Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Investment in the Master Fund

The RE Capital Fund’s investment in the Master Fund will be recorded at fair value and will be based upon the RE Capital Fund’s percentage ownership of the common shares of the Master Fund. The performance of the RE Capital Fund will be directly affected by the performance of the Master Fund. As of December 31, 2016, the RE Capital Fund has not made any investment in the Master Fund. On January 17, 2017, the RE Capital Fund purchased 14,375 shares of the Master Fund for a total of $105,085.

Use of Estimates

The preparation of the RE Capital Fund’s audited financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the financial statements and the accompanying notes. Actual results may differ from those estimates.

Cash and cash equivalents

Cash as of December 31, 2016 represents cash held in custody at MUFG Union Bank, N.A. in a bank deposit account that, at times, may exceed federally insured limits.

Valuation of Portfolio Investments

The RE Capital Fund intends to invest substantially all of its net assets in the Master Fund. As such, the RE Capital Fund determines the net asset value (“NAV”) of its common shares of beneficial interest daily during the offering period and quarterly thereafter, based on the value of its interest in the Master Fund (as provided by the Master Fund). The RE Capital Fund calculates NAV per common share by subtracting total liabilities (including accrued expenses or distributions) from the total assets of the RE Capital Fund (the value of its interest in the Master Fund, plus cash or other assets, including interest and distributions accrued but not yet received) and dividing the result by the total number of outstanding common shares of the RE Capital Fund. Refer to Note 2 to the financial statements of the Master Fund for information on the Master Fund’s policies regarding the valuation of its portfolio investments.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Revenue Recognition

Realized gains and losses from Fund transactions will be calculated on the specific identification basis. Fund transactions are recorded on the effective date of the subscription in or the redemption from the Master Fund. Distributions received from the Master Fund will be recorded on ex-dividend date.

Organization and Offering Costs

Organization costs include, among other things, the cost of formation, including the cost of legal services and other fees pertaining to the RE Capital Fund’s organization. Offering costs include, among other things, legal, accounting, printing and other costs pertaining to the preparation of the RE Capital Fund’s Registration Statement on Form N-2 related to the public offering of its common shares.

The Advisor and its affiliates are entitled to receive reimbursement for costs each has paid on behalf of the RE Capital Fund in connection with the offering. The RE Capital Fund will be obligated to reimburse the Advisor and its affiliates, as applicable, for organization and offering costs (“O&O Costs”) to a limit of 1.0% of the aggregate proceeds from the offering, after the payment of selling commissions and dealer manager fees. The RE Capital Fund estimates that it will incur approximately $27.3 million of O&O Costs if the maximum number of shares is sold. The RE Capital Fund records O&O Costs each period based upon an allocation determined by the expectation of total O&O Costs to be reimbursed. In addition, the RE Capital Fund indirectly bears its pro rata portion of O&O Costs incurred by the Master Fund based on its ownership of the Master Fund shares. The offering costs incurred directly by the RE Capital Fund are accounted for as a deferred charge and are amortized over 12 months on a straight-line basis. Organization costs incurred directly by the RE Capital Fund are expensed as incurred. As of December 31, 2016, the Advisor and its affiliates incurred approximately $1.7 million of O&O Costs on behalf of the RE Capital Fund. For the period from May 6, 2016 (commencement of operations) through December 31, 2016, there were no proceeds raised from the offering and no O&O Costs were allocated to the RE Capital Fund.

Income Taxes

The RE Capital Fund intends to elect to be treated for federal income tax purposes as a RIC under Subchapter M of the Code. To maintain qualification as a RIC, the RE Capital Fund must, among other things, meet certain source-of-income and asset diversification requirements and distribute to their respective shareholders, for each taxable year, at least 90% of its “investment company taxable income” and its net tax-exempt interest income. In general, a RIC’s “investment company taxable income” for any taxable year is its taxable income, determined without regard to net capital gains and with certain other adjustments. As a RIC, the RE Capital Fund will not have to pay corporate-level federal income taxes on any income that it distributes to its shareholders. The RE Capital Fund intends to distribute all or substantially all of their “investment company taxable income,” net tax-exempt interest income (if any) and net capital gains (if any) on an annual basis in order to maintain their RIC status each year and to avoid any federal income taxes on income. The RE Capital Fund will also be subject to nondeductible federal excise taxes if it does not distribute at least 98.0% of net ordinary income (if any) and 98.2% of any capital gain net income (if any).

For the taxable period May 6, 2016 (commencement of operations) through December 31, 2016, the RE Capital Fund is qualified to elect RIC status on its federal income tax return, however, it will file as a C corporation. If applicable, the RE Capital Fund will record any applicable income tax expense or benefit on its statement of operations or deferred tax assets and liabilities on its statement of assets and liabilities. Refer to Note 5 for further information regarding income taxes.

Uncertainty in Income Taxes

The RE Capital Fund evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

expected to be taken for the purposes of measuring and recognizing tax benefits or liabilities in the financial statements. Recognition of a tax benefit or liability with respect to an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The RE Capital Fund recognizes interest and penalties, if any, related to unrecognized tax liabilities as income tax expense in the Statement of Operations. During the period from May 6, 2016 (commencement of operations) through December 31, 2016, the RE Capital Fund did not incur any interest or penalties.

Class Accounting

Investment income, common expenses and realized/unrealized gain or loss on investments in the Master Fund will be allocated to various classes of the RE Capital Fund on the basis of net assets of each class.

Distributions

Distributions to the RE Capital Fund’s shareholders are recorded as of the record date. Subject to the discretion of the RE Capital Fund’s board of trustees (the “Board”) and applicable legal restrictions, the RE Capital Fund intends to authorize and declare ordinary cash distributions on quarterly basis and pay such distributions on a monthly basis beginning no later than the first month after shares are first sold to the public. Such ordinary cash distributions are expected to be paid using ordinary cash distributions received from the Master Fund, net of any Trust operating expenses. From time to time, the RE Capital Fund intends to authorize and declare special cash distributions of net long-term capital gains, if any, and any other income, gains and dividends and other distributions not previously distributed. Such special cash distributions are expected to be paid using special cash distributions received from the Master Fund. During the period from May 6, 2016 (commencement of operations) through December 31, 2016, distributions were neither declared nor paid.

Distribution Reinvestment Plan (“DRP”)

The RE Capital Fund has adopted an “opt in” DRP pursuant to which shareholders may elect to have the full amount of their cash distributions reinvested in additional shares. Participants in the DRP are free to elect to participate or terminate participation in the DRP within a reasonable time as specified in the DRP. If a shareholder does not elect to participate in the DRP, the shareholder will automatically receive any distributions the RE Capital Fund declares in cash. The RE Capital Fund expects to issue shares pursuant to the DRP at the monthly distribution payment date at a price equal to the NAV per share that is used to determine the offering price of the shares on the date of such monthly distribution payment date. Shares issued pursuant to the DRP will have the same voting rights as shares offered pursuant to the prospectus.

New Accounting Standards

In October 2016, the SEC adopted new rules and amended existing rules (together, “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Compliance with the requirements of these final rules, as they relate to Form N-CEN must occur by June 1, 2018, with the compliance date for Form N-PORT being June 1, 2018 or June 1, 2019, depending on the net assets of the fund family. Management is currently assessing the impact of this rule to the RE Capital Fund’s financial statements and other filings.

Securities Offered

The RE Capital Fund is offering on a continuing basis up to 300,000,000 shares at the offering price disclosed in the RE Capital Fund’s prospectus. The classes of shares (A, D, and I) differ only with respect to

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

the sales load investors must pay.

Pursuant to the Trustee Share Purchase and Participation Program with the Board of Trustees of the Master Fund, board members can allocate a portion of their trustee fees to investments in the RE Capital Fund. On December 30, 2016, subscriptions of $5,085 were made at an estimated NAV per share of $9.09, resulting in the issuance of 559 Class A shares. The related dealer manager fees and selling commissions were waived.

Since commencing its continuous public offering on May 6, 2016 through December 31, 2016, the RE Capital Fund has not sold any shares to the public.

Capital Contribution by NSAM FV Holdings, LLC (“NSAM”)

Prior to commencement of operations, NSAM, an affiliate of NorthStar, contributed $100,000 to purchase 11,001 common shares of Class A shares of the RE Capital Fund at a price of $9.09 per share. The related dealer manager fees and selling commissions were waived.

Share Repurchase Program

To provide shareholders with limited liquidity, the RE Capital Fund intends to conduct quarterly repurchases of shares. Each repurchase offer will generally be conducted in parallel with similar repurchase offers made by the Master Fund with respect to the Master Fund shares. The first offer to repurchase shares from shareholders is expected to occur in the first full calendar quarter after shares are first sold to the public. In months in which the RE Capital Fund repurchases shares, the RE Capital Fund will conduct repurchases on the same date that the RE Capital Fund holds its first bi-monthly closing for the sale of shares in its offering. Any offer to repurchase shares will be conducted solely through written tender offer materials mailed to each shareholder (and not through this prospectus) in accordance with the requirements under Rule 13e-4 of the Securities Exchange Act of 1934 (the “Exchange Act”).

The RE Capital Fund’s quarterly repurchases will be conducted on such terms as may be determined by the Board in its complete and absolute discretion unless, in the judgment of the independent trustees, such repurchases would not be in the best interests of shareholders or would violate applicable law. The Board also will consider the following factors, among others, in making its determination regarding whether to cause the RE Capital Fund’s to offer to repurchase shares and under what terms:

| · | the effect of such repurchases on the RE Capital Fund’s and/or the Master Fund’s qualification as a RIC (including the consequences of any necessary asset sales); |

| · | the liquidity of the RE Capital Fund’s assets (including fees and costs associated with disposing of assets); |

| · | the Master Fund’s investment plans; |

| · | the RE Capital Fund’s and the Master Fund’s working capital requirements; |

| · | the RE Capital Fund’s history in repurchasing shares or portions thereof; |

| · | the condition of the securities markets. |

The RE Capital Fund currently intends to limit the number of shares to be repurchased on each date of repurchase to the number of shares the RE Capital Fund can repurchase with, in the Board’s sole discretion, (i) the aggregate proceeds it has received from the issuance of shares pursuant to its DRP for the previous calendar quarter, and/or (ii) the aggregate proceeds it has received from the sale of shares other than such shares issued pursuant to the DRP for the previous calendar month, immediately prior to the date upon which the notification to repurchase shares was provided to shareholders. The Board may, in its sole discretion, determine to limit the number of shares to be repurchased to an amount that is greater than or less than the amounts described above. The RE Capital Fund will further limit the number of shares to be repurchased in any calendar quarter to 5.0% of the weighted average number of shares

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

outstanding in the previous full calendar quarter prior to the date upon which the notification to repurchase shares was provided to shareholders. In addition, beginning with the RE Capital Fund’s second calendar year of operations, the RE Capital Fund will limit the number of shares to be repurchased in any calendar year to 20.0% of the weighted average number of shares outstanding in the prior calendar year. The RE Capital Fund will offer to repurchase such shares at a price equal to the NAV per share in effect on each date of repurchase.

The RE Capital Fund’s assets are intended to consist primarily of an interest in the Master Fund shares. Therefore, in order to finance the repurchase of its common shares pursuant to the repurchase offers, the RE Capital Fund may find it necessary to liquidate all or a portion of its interest in Fund shares. As a result, the RE Capital Fund will not conduct a repurchase offer for common shares unless the Master Fund simultaneously conducts a repurchase offer for the Mater Fund shares. The members of the Board also serve on the Master Fund’s Board, and the Master Fund’s Board expects that the Master Fund will conduct repurchase offers for Fund shares as necessary to permit the RE Capital Fund to meet its intentions under its share repurchase program. However, there can be no assurance that the Master Fund’s Board will, in fact, decide to undertake any repurchase offers.

During the period from May 6, 2016 (commencement of operations) through December 31, 2016, there were no repurchases of the RE Capital Fund’s shares.

| 4. | Related Party Transactions |

Management and Incentive Fees

The RE Capital Fund will not incur a separate management fee or incentive fee under the RE Capital Fund’s Advisory Agreement for so long as the RE Capital Fund has a policy to invest all or substantially all of its net assets in the Master Fund, but the RE Capital Fund and shareholders will be indirectly subject to the management fee and incentive fee. Pursuant to the Master Fund’s Advisory Agreement, and in consideration of the advisory services provided by the Advisor to the Master Fund, the Advisor will be entitled to a fee consisting of two components — the management fee (“Management Fee”) and the incentive fee (“Incentive Fee”). The Management Fee will be calculated and payable quarterly in arrears at the annual rate of 2.0% of the Master Fund’s average gross assets, excluding cash and cash equivalents, at the end of the two most recently completed calendar quarters (and, in the case of the Master Fund’s first quarter, the gross assets excluding cash and cash equivalents as of such quarter-end). The Incentive Fee will be calculated and payable quarterly in arrears based upon the Master Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, measured quarterly and expressed as a rate of return on the Master Fund’s “adjusted capital” at the beginning of the most recently completed quarter, equal to 1.75% per quarter (7.00% annualized), subject to a “catch-up” feature. Refer to Note 4 to the financial statements of the Master Fund attached hereto for a detailed description of the incentive fees payable by the Master Fund to the Advisor.

On February 23, 2017, the Board approved an amendment to the Advisory Agreement for the calculation of the Management Fee. The Management Fee is calculated at an annual rate of 1.25% of the Master Fund’s average net assets. The Management Fee is payable quarterly in arrears and is calculated based on the Master Fund’s average net assets at the end of the two most recently complete calendar quarters (and, in the case of the Master Fund’s first quarter, the net assets of such quarter-end).

On February 23, 2017, the Board also approved an amendment to the Advisory Agreement for the calculation of the Incentive Fee. The Incentive Fee is calculated and payable quarterly in arrears based upon the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter. The Incentive Fee will be subject to a quarterly fixed preferred return to investors, expressed as a rate of return on the Master Fund’s adjusted capital, at the beginning of the most recently completed calendar quarter, of 1.50% (6.00% annualized), subject to a “catch-up” feature.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Reimbursement of Operating Expenses

The Advisor and Co-Advisor are to each be reimbursed by the RE Capital Fund, as applicable, for actual costs incurred in connection with providing administrative services to the RE Capital Fund. Allocation of the cost of such services to the RE Capital Fund may be based on objective factors such as total assets, revenues and/or time allocations. For the period from May 6, 2016 (commencement of operations) through December 31, 2016, the amount of administrative services expense incurred and payable was $2,790.

The Co-Advisory Agreement provides that the Co-Advisor will receive a portion of the Management Fee and Incentive Fee payable to the Advisor under the Master Fund’s Advisory Agreement (the “Fund Advisory Agreement”). On an annualized basis, the Advisor will pay to the Co-Advisor a co-advisory fee at a rate up to 50.0% of all fees payable to the Advisor under the Master Fund Advisory Agreement with respect to each year, which fees are payable to the Advisor quarterly in arrears. On February 23, 2017, the Co-Advisory Agreement was terminated, effective immediately, and the Advisor is now responsible for all the advisory and administrative duties formerly performed by the Co-Advisor.

Selling Commissions and Dealer Manager Fees

Pursuant to a dealer manager agreement (the “Dealer Manager Agreement”) between the RE Capital Fund and the NorthStar Securities, LLC (“NorthStar Securities”), an affiliate of the Advisor, an investor will pay NorthStar Securities:

| (i) | selling commissions of up to 6.0% and dealer manager fees of up to 2.0% of the selling price of the Class A shares for which a sale is completed, |

| (ii) | dealer manager fees of up to 2.0% of the selling price of Class D shares for which a sale is completed, but no selling commissions, and |

| (iii) | no selling commissions or dealer manager fees for the purchase of Class I shares. |

No selling commissions or dealer manager fees will be paid on sales of the RE Capital Fund shares under the DRP. The selling commissions and dealer manager fees may be reduced or waived in connection with certain categories of sales, such as sales eligible for a volume discount, sales through investment advisers or banks acting as trustees or fiduciaries, and sales to affiliates. For the period from May 6, 2016 (commencement of operations) through December 31, 2016, no selling commissions and dealer manager fees were paid to NorthStar Securities because there were no shares sold to the public during this period.

Distributor

On January 9, 2017, the Dealer Manager agreement was terminated and the RE Capital Fund entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”), pursuant to which ALPS has agreed to serve as the RE Capital Fund's principal underwriter and act as the distributor of the RE Capital Fund's shares. Pursuant to the Distribution Agreement, an investor will pay to the Distributor the same selling commissions and dealer manager fees as would have been paid to NorthStar Securities under the Dealer Management Agreement.

NorthStar Securities has entered into a wholesale marketing agreement with the Distributor in connection with the marketing of the RE Capital Fund’s shares.

Distribution Support Agreement

Pursuant to a distribution support agreement (the “Distribution Support Agreement”) between the Master Fund and NorthStar Realty, a publicly-traded real estate investment trust (“REIT”) managed by an affiliate

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

of the Advisor, NorthStar Realty, or an affiliate has agreed to purchase up to $10.0 million in Fund shares at the current NAV per Fund share, of which $2.0 million was contributed to the Master Fund as seed capital investment. During any calendar month when the Distribution Support Agreement is effective, if the cash distributions exceed the net investment income for such calendar month (“Distribution Shortfall”), NorthStar Realty will purchase shares required in order to cover the Distribution Shortfall up to an amount equal to a 7.0% cumulative, non-compounded annual return on the Master Fund’s shareholders’ invested capital prorated for such month.

Notwithstanding NorthStar Realty’s obligations pursuant to the Distribution Support Agreement, the Master Fund will not be required to pay distributions to the Master Fund shareholders, including the RE Capital Fund. Distributions funded from offering proceeds pursuant to the Distribution Support Agreement may constitute a return of capital. The Distribution Support Agreement expires at the earlier of: a) two years from the date on which the RE Capital Fund commences the offering; or b) the date upon which neither the Advisor nor its affiliate is serving as the Master Fund’s Advisor. For the period from May 6, 2016 (commencement of operations) through December 31, 2016, there was no distribution support provided by NorthStar Realty.

On February 23, 2017, the Distribution Support Agreement was amended to replace NorthStar Realty with an affiliate of Colony NorthStar. The Distribution Support Agreement was also amended such that during any month when the Distribution Support Agreement is effective, if the cash distributions exceed the net investment income for such month (“Distribution Shortfall”), an affiliate of Colony NorthStar will purchase shares required in order to cover the Distribution Shortfall up to an amount equal to a 6.0% cumulative, non-compounded annual return on the Fund’s shareholders’ invested capital prorated for such month.

Notwithstanding an affiliate of Colony NorthStar’s obligations pursuant to the Distribution Support Agreement, the RE Capital Fund will not be required to pay distributions to the RE Capital Fund shareholders, including the Master Fund and NorthStar Real Estate Capital Income Fund-T.

Capital Contribution by NSAM

Prior to commencement of operations, NSAM, an affiliate of NorthStar, contributed $100,000 to purchase 11,001 common shares of Class A shares of the RE Capital Fund at a price of $9.09 per share. The related dealer manager fees and selling commissions were waived.

In December 2016, NSAM voluntarily contributed permanent capital of approximately $13,000 to the RE Capital Fund. The purpose of the contribution was to reimburse the RE Capital Fund for certain of its ordinary operating expenses. NSAM has no obligation to contribute additional funds or pay any future operating expenses.

The components of the deferred tax asset as of December 31, 2016, for the RE Capital Fund as a C-corporation, consist of the following:

| | | December 31, 2016 | |

| Deferred tax asset | | | | |

| Net loss carryforwards | | $ | 5,353 | |

| Total deferred tax asset | | | 5,353 | |

| Less: Valuation allowance | | | (5,353 | ) |

| Net deferred taxes | | $ | - | |

At December 31, 2016, the RE Capital Fund had total net operating and capital loss carry forwards of approximately $0.01 million for federal income tax purposes available to offset future taxable income. The

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

loss carry forwards can be carried forward 20 years and will expire in 2036.

A reconciliation of the federal tax rate to the RE Capital Fund’s effective income tax rate is as follows:

| | | December 31, 2016 | |

| Tax at federal statutory rate | | | 35.0 | % |

| State and local rate | | | 5.0 | % |

| Total | | | 40.0 | % |

| Valuation allowance | | | (40.0 | )% |

| Provision for taxes | | | 0.0 | % |

The following is a schedule of financial highlights for the period from May 6, 2016 (commencement of operations) through December 31, 2016:

| | | For the period from

May 6, 2016

(commencement of

operations) through

December 31, 2016 | |

| | | | |

| Per Share Data: | | | Class A | |

| Net asset value, beginning of period | | $ | 9.09 | |

| | | | | |

| Net investment loss(1) | | | (1.22 | ) |

| Net decrease in net assets resulting from operations | | | (1.22 | ) |

| | | | | |

| Contributions from affiliate(2) | | | 1.20 | |

| Net increase in net assets resulting from capital transactions | | | 1.20 | |

| | | | | |

| Net asset value, end of period | | $ | 9.07 | |

| | | | | |

| Shares outstanding, end of period | | | 11,560 | |

| Total return at net asset value(3)(4) | | | (0.2 | )% |

| | | | | |

| Ratio/Supplemental Data: | | | | |

| Net assets, end of period | | $ | 104,883 | |

| Ratio of net investment loss to average net assets(5) | | | (21.4 | )% |

| Ratio of total expenses to average net assets(5) | | | 21.4 | % |

| Portfolio turnover rate (4) | | | Not applicable | |

| (1) | The per share data was derived by using the average number of common shares outstanding during the period from May 6, 2016 (commencement of operations) through December 31, 2016. |

| (2) | Represents voluntary additional capital contributions from NSAM in December 2016. Refer to Note 4 for further detail. |

| (3) | The total return is historical and is calculated by determining the percentage change in net asset value. Total return without contributions from affiliate would have been (13.4)% for the period from May 6, 2016 (commencement of operations) through December 31, 2016. |

| (5) | Annualized. Average net assets for the period from May 6, 2016 (commencement of operations) through December 31, 2016 are used for this calculation. |

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

| 7. | Commitments and Contingencies |

In the normal course of business, the RE Capital Fund may enter into contracts that contain a variety of representations which provide general indemnifications. The RE Capital Fund’s maximum exposure under the arrangements cannot be known; however, the RE Capital Fund expects any risk of loss to be remote.

On January 17, 2017, the RE Capital Fund purchased 14,375 shares of the Master Fund for a total of $105,085.

The management of the RE Capital Fund has evaluated events and transactions through February 28, 2017, the date on which the financial statements were issued, and has determined that there are no material events that would require adjustments to or disclosure in the RE Capital Fund’s financial statements other than previously discussed in Note 1 and Note 4.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

Supplemental Information (UNAUDITED)

December 31, 2016

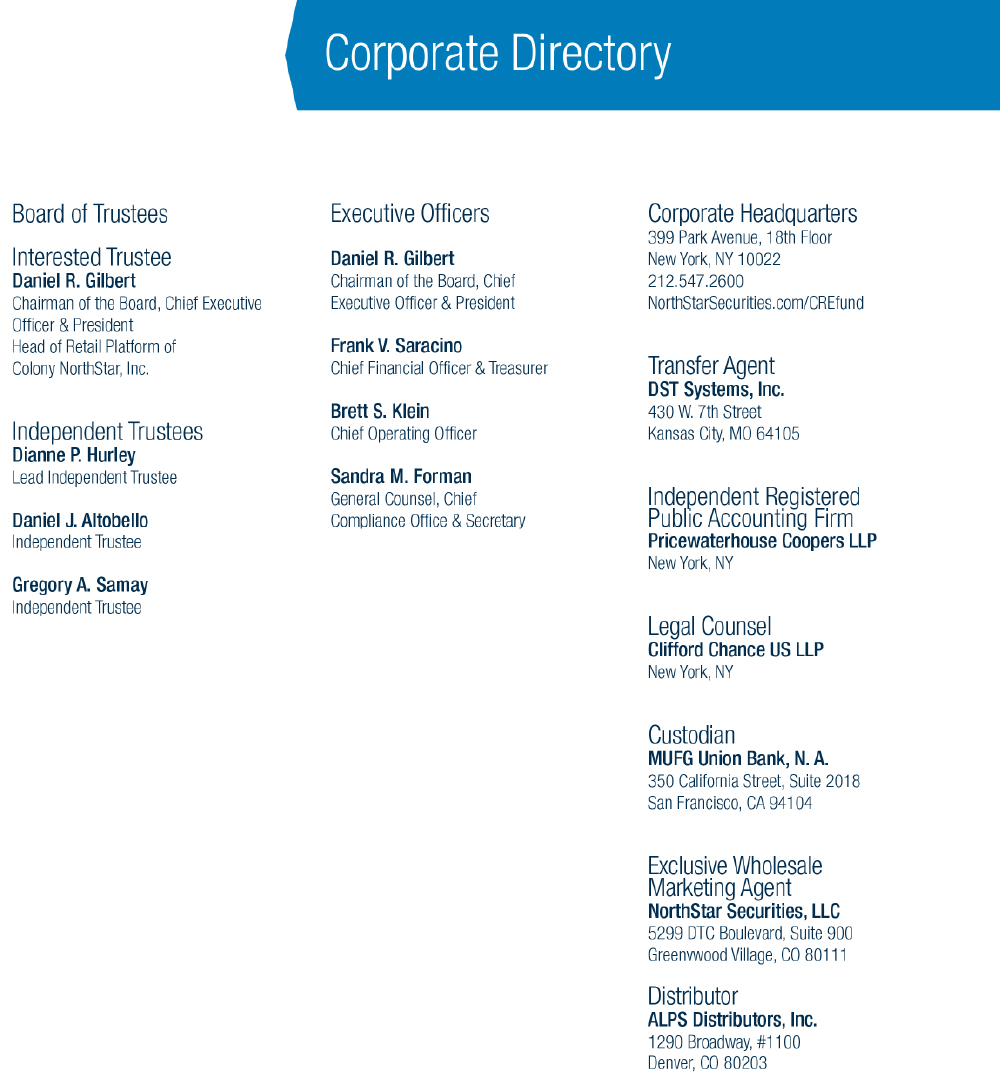

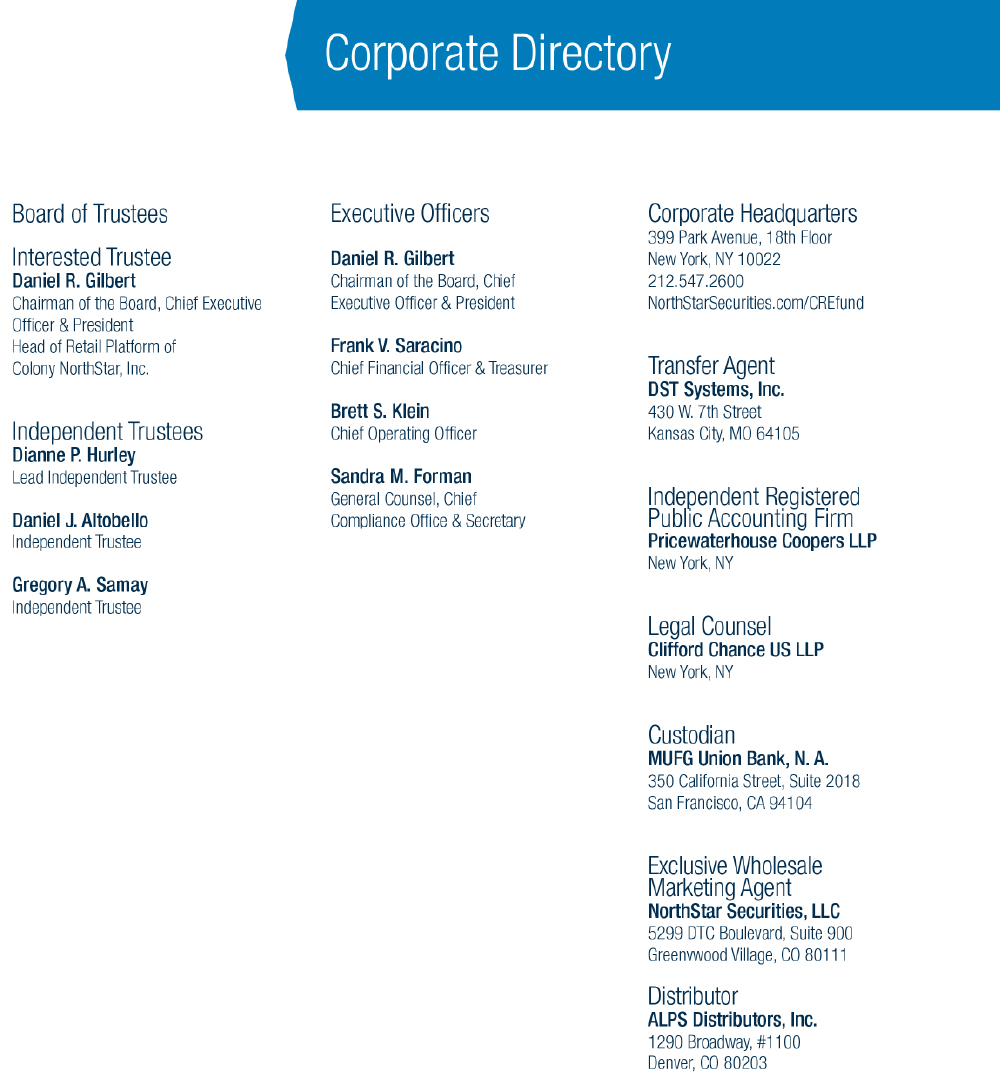

Board of Trustees

Information regarding the members of the Board is set forth below. The trustees have been divided into two groups — Interested Trustees and Independent Trustees. The address for each trustee is c/o NorthStar Real Estate Capital Income Fund, 399 Park Avenue, 18th Floor, New York, New York 10022. As set forth in each of the RE Capital Fund's and Master Fund's declaration of trust and bylaws, a trustee's term of office shall continue until his or her death, resignation or removal.

Name

(Age) | Position Held | Trustee

Since | Principal Occupation Past 5

Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee | Trusteeships Held By Trustees

During Past 5 Years |

| Interested Trustee |

| Daniel R. Gilbert (46) | Chairman of the Board, CEO, and President | 2015 | Head of Retail Platform of Colony NorthStar; Chairman, CEO and President of RE Capital Fund, NorthStar Real Estate Capital Income Fund-T ("RE Capital Fund-T") and NorthStar Real Estate Capital Income Master Fund (“RE Capital Master Fund”) ; Chairman, CEO and President of NorthStar Corporate Income Master Fund (“Corporate Master Fund”), NorthStar Corporate Income Fund (“Corporate Fund”) and NorthStar Corporate Income Fund-T (“Corporate Fund-T”); Co-Chairman, CEO and President of NorthStar/RXR New York Metro Real Estate, Inc. ("NorthStar/RXR"); Chairman, CEO and President of NorthStar Real Estate Income Trust, Inc. ("NorthStar Income") and NorthStar Real Estate Income II, Inc. ("NorthStar Income II"); Sole Director of NorthStar/Townsend Institutional Real Estate Fund Inc. ("NorthStar/Townsend"); Executive Chairman of NorthStar Healthcare Income, Inc. ("NorthStar Healthcare"); Chief Investment and Operating Officer of NorthStar Asset Management Group, Ltd and NorthStar Realty (2013 – 2017). | 6 | Executive Chairman of NorthStar Healthcare; Chief Executive Officer, Chairman of Corporate Master Fund, Corporate Fund and Corporate Fund-T; Chief Executive Officer, Chairman of RE Capital Master Fund, RE Capital Fund and RE Capital Fund-T; Co-Chairman of NorthStar/RXR; and Sole Director of NorthStar/Townsend; Chairman of NorthStar Income and NorthStar Income II. |

| Independent Trustees |

| Daniel J. Altobello (75) | Trustee | 2016 | CEO and President of Caterair International Corporation (1989 – 1995); Executive Vice President of Marriott Corporation (1979 – 1989); President of Marriott Airport Operations Group (1979 – 1989). | 3 | Director of NorthStar Healthcare; Chairman of Altobello Family LP; Director of MamaMancini's Holdings, Inc.; Director of Arlington Asset Investment Corp.; Director of DiamondRock Hospitality Co.; Director of Mesa Air Group, Inc.; Trustee of Loyola Foundation, Inc. |

| | | | | | |

| Dianne P. Hurley (53) | Lead Independent | 2016 | Startup consultant to asset management firms including | 3 | Director of NorthStar/ RXR New York Metro Real Estate, Inc.; |

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

Supplemental Information (UNAUDITED)

December 31, 2016

Name

(Age) | Position Held | Trustee

Since | Principal Occupation Past 5

Years | Number of

Portfolios in Fund

Complex Overseen

by Trustee | Trusteeships Held By Trustees

During Past 5 Years |

| | Trustee | | Stonecourt Capital, Imperial Companies and RedBird Capital Partners; Managing Director of SG Partners (2011-2014); COO, Global Distribution of Credit Suisse Asset Management (2009-2011); Chief Administrative Officer, TPG-Axon (2004-2009). | | Director of Griffin-American Healthcare REIT IV, Inc; Director of NorthStar Realty Europe Corp. ("NorthStar Realty Europe"). |

| | | | | | |

| Gregory A. Samay (57) | Trustee | 2016 | Previously Chief Investment Officer (previously an Investment Officer) of Fairfax County Retirement Systems (2011-2016); Executive Director and Chief Investment Officer of Arlington County Employees' Retirement System (2005-2010). | 3 | Director of NorthStar Healthcare. |

Executive Officers

The following persons serve as the RE Capital Fund's executive officers in the following capacities:

Name | | Age | | Positions Held |

| Daniel R. Gilbert | | 46 | | Chairman of the Board, Chief Executive Officer and President |

| Frank V. Saracino | | 50 | | Chief Financial Officer and Treasurer |

| Brett S. Klein | | 38 | | Chief Operating Officer |

| Sandra M. Forman | | 50 | | Chief Compliance Officer, General Counsel and Secretary |

The address for each executive officer is c/o NorthStar Real Estate Capital Income Fund, 399 Park Avenue, 18th Floor, New York, New York 10022.

Information about Executive Officers

Daniel R. Gilbert. Mr. Gilbert has served as the Head of the Retail Platform of Colony NorthStar since January 10, 2017. Mr. Gilbert has been an Interested Trustee, Chief Executive Officer and President of the RE Capital Fund since October 2, 2015, Chairman since March 3, 2016 and is a member of the Advisor's investment committee. Mr. Gilbert has also been an interested Trustee of RE Capital Master Fund and RE Capital Master Fund’s Chairman, Chief Executive Officer and President since October 5, 2015, Chairman since March 3, 2016. Mr. Gilbert has also been an Interested Trustee, Chief Executive Officer and President of RE Capital Fund-T since December 15, 2015, and Chairman since March 3, 2016. Mr. Gilbert has served as Sole Director of NorthStar/ Townsend since inception. He has been an Interested Trustee, Chief Executive Officer and President of Corporate Fund and Corporate Master Fund since July 2015 and Chairman since January 15, 2016, an Interested Trustee, Chief Executive Officer and President of Corporate Fund-T since November 2015 and Chairman since January 15, 2016. Mr. Gilbert serves as Chairman and Chief Executive Officer and President of NorthStar Income, positions he has held since August 2015, January 2013 and March 2011, respectively and he served as its Chief Investment Officer from January 2009 through January 2013. Mr. Gilbert serves as the Executive Chairman of NorthStar Healthcare, a position he has held since January 2014, and served as its Chief Executive Officer from August 2012 to January 2014 and Chief Investment Officer from October 2010 through February 2012. Mr. Gilbert also serves as Chairman, a position he has held since August 2015, and the Chief Executive

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

Supplemental Information (UNAUDITED)

December 31, 2016

Officer and President, a position he has held since December 2012, of NorthStar Income II. Mr. Gilbert further serves as Co-Chairman, a position he has held since August 2015, the Chief Executive Officer and President, a position he has held since March 2014, of NorthStar/RXR. Mr. Gilbert also served as Chief Investment and Operating Officer of NorthStar Realty from January 2013 to January 2017, a position he maintained as co-employee. Mr. Gilbert has served as Chief Investment and Operating Officer of NorthStar Asset Management Group, Ltd, a wholly owned subsidiary of Colony NorthStar and parent company of the Advisor, from June 2014 to January 2017. Mr. Gilbert served as Co-President of NorthStar Realty from April 2011 until January 2013 and in various other senior management positions since its initial public offering in October 2004. Mr. Gilbert served as an Executive Vice President and Managing Director of Mezzanine Lending of NorthStar Capital Investment Corp., a predecessor company of NorthStar Realty. Prior to that role, Mr. Gilbert was with Merrill Lynch & Co. in its Global Principal Investments and Commercial Real Estate Department and prior to joining Merrill Lynch, held accounting and legal-related positions at Prudential Securities Incorporated. Mr. Gilbert holds a Bachelor of Arts degree from Union College in Schenectady, New York.

Frank V. Saracino. Mr. Saracino joined NorthStar Asset Management Group, Inc. (“NSAM”) in August 2015, and has served as the RE Capital Fund's and RE Capital Master Fund's Chief Financial Officer and Treasurer since inception. Mr. Saracino has also served as the Chief Financial Officer and Treasurer of RE Capital Fund and RE Capital Fund-T since December 2015. Mr. Saracino has served as Chief Financial Officer of NorthStar/Townsend Fund since inception. Mr. Saracino has served as Chief Financial Officer and Treasurer of Corporate Fund and Corporate Master Fund since July 2015 and Chief Financial Officer and Treasurer of Corporate Fund-T since November 2015. In addition, Mr. Saracino has served as Chief Financial Officer and Treasurer of each of NorthStar Income, NorthStar Income II, NorthStar Healthcare and NorthStar/RXR since August 2015. Prior to joining NorthStar, from July 2012 to December 2014, Mr. Saracino was with Prospect Capital Corporation, or Prospect, where he concentrated on portfolio management, strategic and growth initiatives and other management functions. In addition, during his tenure at Prospect, Mr. Saracino served as Chief Financial Officer, Chief Compliance Officer, Treasurer and Secretary of each of Priority Income Fund, Inc. and Pathway Energy Infrastructure Fund, Inc., and their respective investment advisers, and served as a Managing Director of Prospect Administration, LLC. Previously, Mr. Saracino was a Managing Director at Macquarie Group, and Head of Finance from August 2008 to June 2012 for its Americas non-traded businesses which included private equity, asset management, lease financing, private wealth, and investment banking. From 2004 to 2008, he served first as Controller and then as Chief Accounting Officer of eSpeed, Inc. (now BGC Partners, Inc.), a publicly-traded subsidiary of Cantor Fitzgerald. Prior to that, Mr. Saracino worked as an investment banker at Deutsche Bank advising clients in the telecom industry. Mr. Saracino started his career in public accounting at Coopers & Lybrand (now PricewaterhouseCoopers) where he earned a CPA and subsequently worked in internal auditing for The Dun & Bradstreet Corporation. He holds a Bachelor of Science degree from Syracuse University.

Brett S. Klein. Mr. Klein has served as the RE Capital Fund's and RE Capital Master Fund's Chief Operating Officer since inception. In addition, Mr. Klein has served as the Chief Operating Officer of RE Capital Fund and RE Capital Fund-T since December 2015. Mr. Klein has served as Chief Operating Officer of Corporate Fund and Corporate Master Fund since July 2015 and Chief Operating Officer of Corporate Fund-T since November 2015. Mr. Klein has also served as the Chief Operating Officer of NorthStar/RXR, a position he has held since June 2014. Mr. Klein currently serves as a Managing Director of Colony NorthStar, the parent company of the Advisor, a position he has held since January 2017, and heads its Alternative Products Group. Mr. Klein's responsibilities include oversight of the operational elements of Colony NorthStar's retail-focused REITs and alternative retail products as well as coordination of sponsor-related activities of Colony NorthStar's broker-dealer, NorthStar Securities, LLC. Mr. Klein continues to be involved with the investment and portfolio management and servicing businesses and works closely with the accounting and legal departments in connection with the operation of the Managed Companies (defined below). Mr. Klein also served as a Managing Director at NorthStar Asset Management Group Ltd, and headed the Alternative Products Group from June 2014 to January 2017. Mr. Klein previously served as a Managing Director at NorthStar Realty and Head of its Structured and

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

Supplemental Information (UNAUDITED)

December 31, 2016

Alternative Products Group between January 2011 and June 2014. In addition, from 2004 to 2011, Mr. Klein held similar roles at NorthStar Realty and was responsible for capital markets execution of NorthStar Realty and its retail-focused REIT businesses, including credit facility sourcing/structuring and securitization as well as investments and portfolio management. Mr. Klein joined NorthStar Realty in October 2004, prior to its initial public offering. From August 2004 to October 2004, Mr. Klein was an analyst at NorthStar Capital Investment Corp., a predecessor company of NorthStar Realty. From 2000 to 2004, Mr. Klein worked in the CMBS group at Fitch Ratings, Inc., as Associate Director, where he focused on commercial real estate related securitization transactions. Mr. Klein holds a Bachelor of Science in Finance, Investment and Banking in addition to Risk Management and Insurance from the University of Wisconsin in Madison, Wisconsin.

Sandra M. Forman. Ms. Forman has served as the RE Capital Fund's, RE Capital Fund-T's and RE Capital Master Fund's Chief Compliance Officer since October 2015 and General Counsel and Secretary since October 2016. Previously, Ms. Forman served as Associate General Counsel and Assistant Secretary of the RE Capital Fund and RE Capital Master Fund from October 2015 to October 2016 and of RE Capital Fund and RE Capital Fund-T from December 2015 to October 2016. Ms. Forman has served as Chief Compliance Officer of Corporate Fund, Corporate Master Fund and Corporate Fund-T since October 2015 and General Counsel and Secretary since January 2017. Previously, Ms. Forman served as Associate General Counsel and Assistant Secretary of Corporate Fund and Corporate Master Fund from October 2015 to January 2017 and Associate General Counsel and Assistant Secretary of Corporate Fund-T from November 2015 to January 2017. Ms. Forman has served as Chief Compliance Officer and Secretary of NorthStar/Townsend Fund since inception. Ms. Forman has also served as Deputy General Counsel at Colony NorthStar since January 2017. Ms. Forman served as Senior Counsel for NorthStar from October 2015 to January 10, 2017. Prior to joining NorthStar, Ms. Forman was Senior Counsel at Proskauer Rose LLP from July 2014 to October 2015, where she represented investment companies, including registered closed-end funds and business development companies, and REITs regarding legal, corporate governance and compliance issues. In addition, from August 2004 to June 2014, she served as General Counsel, Chief Compliance Officer and Director of Human Resources and from January 2009 to June 2014 as Secretary of Harris & Harris Group, Inc., a publicly traded business development company. From January 2012 to June 2014, she served as General Counsel, Chief Compliance Officer and Secretary of H&H Ventures Management, Inc., a wholly owned subsidiary of Harris & Harris Group, Inc. Ms. Forman began her legal career in the Investment Management Group at Skadden, Arps, Slate, Meagher & Flom LLP. She holds a Bachelor of Arts from New York University in New York, New York, and a Juris Doctor from the University of California Los Angeles in Los Angeles, California.

NORTHSTAR REAL ESTATE CAPITAL INCOME FUND

Supplemental Information (UNAUDITED)

December 31, 2016

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

The RE Capital Fund has not had any changes in or disagreements with its independent registered public accounting firm on accounting or financial disclosure matters since its inception.

Form N-Q Filings

The RE Capital Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The RE Capital Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov. The RE Capital Fund’s Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room located at 100 F Street, NE, Washington, DC 20549. Shareholders may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330.

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of NorthStar Real Estate Capital Income Master Fund

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investment, and the related statements of operations, of changes in net assets, and of cash flows present fairly, in all material respects, the financial position of the NorthStar Real Estate Capital Income Master Fund (the "Master Fund") as of December 31, 2016, the results of its operations, the changes in its net assets, and its cash flows for the period from May 6, 2016 (commencement of operations) through December 31, 2016, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Master Fund's management. Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audit, which included confirmation of the security as of December 31, 2016 by correspondence with the custodian, provides a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

New York, NY

February 28, 2017

NorthStar Real Estate Capital Income Master Fund

Schedule of Investment

As of December 31, 2016

Real Estate Investment Trust ("REIT") - 0.0%

| Description | | Shares | | | Cost | | | Fair Value | |

| NS Capital Income Master Fund REIT, Inc. | | | 100 | | | $ | 100 | | | $ | - | |

| Other assets in excess of liabilities - 100.0% | | | | | | | | | | | 1,653,952 | |

| Net assets - 100.0% | | | | | | | | | | $ | 1,653,952 | |

Refer to notes to accompanying financial statements.

NorthStar Real Estate Capital Income Master Fund

Statement of Assets and Liabilities

| | | December 31, 2016 | |

| Assets | | | | |

| Cash | | $ | 1,781,525 | |

| Affiliated investment, at fair value (Cost $100) (Note 6) | | | - | |

| Total assets | | | 1,781,525 | |

| | | | | |

| Liabilities | | | | |

| Professional fee payable | | | 63,614 | |

| Administrative services expense payable | | | 55,798 | |

| Accrued expense and other liabilities | | | 8,161 | |

| Total liabilities | | | 127,573 | |

| Net assets | | $ | 1,653,952 | |

| | | | | |

| Commitments and contingencies (Note 8) | | | | |

| | | | | |

| Composition of net assets | | | | |

| Common shares, $0.001 par value per share, unlimited shares authorized, 222,233 shares issued and outstanding | | $ | 222 | |

| Paid-in-capital in excess of par value | | | 1,999,878 | |

| Net investment loss | | | (346,048 | ) |

| Net unrealized depreciation on investment | | | (100 | ) |

| Net assets | | $ | 1,653,952 | |

| | | | | |

| Net asset value per common share, at period end | | $ | 7.44 | |

Refer to notes to accompanying financial statements.

NorthStar Real Estate Capital Income Master Fund

Statement of Operations

| | | For the period from | |

| | | May 6, 2016* through | |

| | | December 31, 2016 | |

| Investment Income | | | | |

| Interest income | | $ | 259 | |

| Total investment income | | | 259 | |

| | | | | |

| Expenses | | | | |

| Trustees' fees | | | 200,273 | |

| Professional fees | | | 79,977 | |

| Administrative services expense | | | 55,798 | |

| Other expenses | | | 10,259 | |

| Total expenses | | | 346,307 | |

| Net investment loss | | | (346,048 | ) |

| | | | | |

| Realized and Unrealized Loss: | | | | |

| Net change in unrealized depreciation on investment | | | (100 | ) |

| Total net realized and unrealized loss on investment | | | (100 | ) |

| Net decrease in net assets resulting from operations | | $ | (346,148 | ) |

* Commencement of operations

Refer to notes to accompanying financial statements.

NorthStar Real Estate Capital Income Master Fund

Statement of Changes in Net Assets

| | | For the period from | |

| | | May 6, 2016* through | |

| | | December 31, 2016 | |

| Decrease in net assets resulting from operations: | | | | |

| Net investment loss | | $ | (346,048 | ) |

| Net change in unrealized depreciation on investment | | | (100 | ) |

| Net decrease in net assets resulting from operations | | | (346,148 | ) |

| | | | | |

| Capital Transactions | | | | |

| Issuance of common shares (222,233 shares) (Note 4) | | | 2,000,100 | |

| Net increase in net assets resulting from capital transactions | | | 2,000,100 | |

| Total increase in net assets | | | 1,653,952 | |

| | | | | |

| Net assets at beginning of period | | | - | |

| Net assets at end of period | | $ | 1,653,952 | |

| Net investment loss | | $ | (346,048 | ) |

* Commencement of operations

Refer to notes to accompanying financial statements.

NorthStar Real Estate Capital Income Master Fund

Statement of Cash Flows

| | | For the period from | |

| | | May 6, 2016* through | |

| | | December 31, 2016 | |

| Cash flows from operating activities | | | | |

| Net decrease in net assets resulting from operations | | $ | (346,148 | ) |

| | | | | |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment | | | (100 | ) |

| Net change in unrealized depreciation on investment | | | 100 | |

| | | | | |

| Increase in operating assets and liabilities: | | | | |

| Professional fees payable | | | 63,614 | |

| Administrative services expense payable | | | 55,798 | |

| Accrued expense and other liabilities | | | 8,161 | |

| Net cash used in operating activities | | | (218,575 | ) |

| | | | | |

| Cash flows from financing activities | | | | |

| Issuance of common shares (Note 4) | | | 2,000,100 | |

| Net cash provided by financing activities | | | 2,000,100 | |

| Net increase in cash | | | 1,781,525 | |

| Cash, beginning of period | | | - | |

| Cash, end of period | | $ | 1,781,525 | |

* Commencement of operations

Refer to notes to accompanying financial statements.

NORTHSTAR REAL ESTATE CAPITAL INCOME MASTER FUND

NOTES TO FINANCIAL STATEMENTS

| 1. | Business and Organization |

NorthStar Real Estate Capital Income Master Fund (the “Master Fund”) was organized as a Delaware statutory trust on October 2, 2015. The Master Fund’s primary investment objectives are to generate attractive and consistent income through cash distributions and preserve and protect shareholders’ capital, with a secondary objective of capital appreciation.

The Master Fund commenced operations on May 6, 2016, when the registration statements of NorthStar Real Estate Capital Income Fund (the “RE Capital Fund”) and NorthStar Real Estate Capital Income Fund-T (“RE Capital Fund-T”) (collectively, the “Trusts”), whose principal investment strategy is identical to the Master Fund, were declared effective by the Securities and Exchange Commission (the “SEC”).

The Master Fund is externally managed by NSAM B-RECF Ltd., a Bermuda exempt company, (the “Advisor”) and NSAM US-RECF LLC, a Delaware limited liability company (the “Co-Advisor” and collectively, the “Advisors”), which are registered investment advisors under the Investment Advisors Act of 1940, as amended, (the “Advisors Act”). The Advisor oversees the management of the Master Fund’s activities, including investment strategies, investment goals, asset allocation, leverage limitations, reporting requirements and other guidelines in addition to the general monitoring of the Master Fund��s portfolios. The Advisor also provides asset management and other administrative services. The Co-Advisor, pursuant to an agreement with the Advisor (the “Co-Advisory Agreement”), assists the Advisor with the day-to-day activities and the sourcing, management and monitoring of investments for the Master Fund’s portfolios, subject to the oversight of the Advisor. The Co-Advisor also furnishes the Master Fund with office facilities and equipment, and assists the Advisor with the provisions of clerical and other administrative services, including marketing, investor relations and certain accounting services and maintenance of certain books and records on behalf of the Master Fund. In addition, the Co-Advisor performs the calculation and publication of the Master Fund’s net asset value (“NAV”). The Advisor and Co-Advisor are affiliates of NorthStar Asset Management Group Inc. (“NorthStar”), which sponsors other public companies that raise capital through the retail market.

On January 10, 2017, pursuant to a merger agreement between NorthStar, NorthStar Realty Finance Corp. (“NorthStar Realty”) and Colony Capital Inc. (“Colony”), dated as of June 2, 2016 (as amended, supplemented or otherwise modified from time to time, the “Merger Agreement”), NorthStar, NorthStar Realty and Colony merged into Colony NorthStar, Inc. (NYSE: CLNS or “Colony NorthStar”) through a series of merger transactions (the “Mergers”). As a result of the Mergers, Colony NorthStar is a diversified equity REIT with an embedded institutional and retail investment management business. In addition, following the Mergers, the Advisor is a subsidiary of Colony NorthStar.

On January 31, 2017, the Advisor was re-domiciled as a Delaware limited liability company and renamed CNI RCEF Advisors, LLC. On February 23, 2017, the Co-Advisory Agreement was terminated, effective immediately, and the Advisor is now responsible for all the advisory and administrative duties formerly performed by the Co-Advisor.

The Master Fund is registered under the Investment Company Act of 1940, as amended, (the “1940 Act”), as a non-diversified, closed-end management investment company that intends to elect to be treated for federal income tax purposes as a C-corporation for the period ended December 31, 2016. The Master Fund intends to qualify annually thereafter, as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). Refer to Note 2 and Note 5 for further details on income taxes.

On January 9, 2017, the Master Fund and Trusts entered into an administration agreement (the “Administration Agreement”) with ALPS Fund Services, Inc. (“ALPS” or the “Administrator”). ALPS,

NORTHSTAR REAL ESTATE CAPITAL INCOME MASTER FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

and/or its affiliates are responsible for, but not limited to, (i) maintaining financial books and records of the Master Fund and Trusts, (ii) providing administration services, and (iii) performing other accounting and clerical services as necessary in connection with the administration of the Master Fund and Trusts.

| 2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying audited financial statements of the Master Fund have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The Master Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Use of Estimates

The preparation of the Master Fund’s audited financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that could affect the amounts reported in the financial statements and the accompanying notes. Actual results may differ from those estimates.

Cash and cash equivalents

Cash as of December 31, 2016 represent cash held in custody at MUFG Union Bank, N.A. in a bank deposit account that, at times, may exceed federally insured limits.

Valuation of Portfolio Investments

The Master Fund determines the fair value of its investment portfolio as of the close of each regular trading session of the New York Stock Exchange. The Master Fund will calculate the NAV of its common shares of beneficial interest, by subtracting total liabilities (including accrued expenses or distributions) from the total assets of the Master Fund (the value of securities, plus cash or other assets, including interest and distributions accrued but not yet received) and dividing the result by the total number of outstanding common shares of the Master Fund. The Master Fund’s assets and liabilities are valued in accordance with the principles set forth below.

The Master Fund’s board of trustees (the “Board”) has approved the Master Fund’s Valuation Policies and Procedures (the “Valuation Policies and Procedures”) as of October 13, 2016 and the formation of a valuation committee (the “Valuation Committee”) that consists of personnel from the Advisor whose membership on the Valuation Committee was approved by the Board. The Valuation Committee values the Master Fund’s assets in good faith pursuant to the Valuation Policies and Procedures and applies a consistent valuation process, which was developed and approved by the Board. Portfolio securities and other assets for which market quotes are readily available will be valued at market value as provided by an independent pricing source. In circumstances where market quotes are not readily available, the Board has adopted the Valuation Policies and Procedures for determining the fair value of such securities and other assets, and has delegated the responsibility for applying the valuation methods to the Valuation Committee. On a quarterly basis, the audit committee of the Board reviews the valuation determination made with respect to the Master Fund’s investments during the preceding quarter and evaluates whether such determinations were made in a manner consistent with the Master Fund’s Valuation Policies and Procedures. The Board reviews and ratifies such value determinations.

NORTHSTAR REAL ESTATE CAPITAL INCOME MASTER FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosure, (“ASC Topic 820”), issued by the FASB clarifies the definition of fair value and requires companies to expand their disclosure about the use of fair value to measure assets and liabilities in interim and annual periods subsequent to initial recognition. Refer to Note 6 for further discussion on fair value measurement. In accordance with ASC Topic 820, when determining the fair value of an asset or liability, the Valuation Committee seeks to determine the price that would be received from the sale of the asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value determinations are based upon all available inputs that the Valuation Committee deems relevant, which may include indicative dealer quotes, independent third party pricing vendors, values of like securities, recent portfolio company financial statements and forecasts, and valuations prepared by third party valuation services. However, determination of fair value involves subjective judgments and estimates. Accordingly, the notes to the Master Fund’s financial statements refer to the uncertainty with respect to the possible effect of such valuations and any change in such valuations on the Master Fund’s financial statements.

The Master Fund expects that its portfolio will primarily consist of investments that are not actively traded in the market and for which quotation may not be available. For purposes of calculating NAV, the Valuation Committee will use the following valuation methods:

Investments where a market price is readily available:

Generally, the value of any equity interests in public companies for which market quotations are readily available will be based upon the most recent closing public market price. Securities that carry certain restrictions on sale will typically be valued at a discount from the market value of the security. Loans or investments traded over the counter and not listed on an exchange are valued at a price obtained from third-party pricing services, including, where appropriate, multiple broker dealers, as determined by the Valuation Committee.

Investments where a market price is not readily available:

For investments for which no active secondary market exists and, therefore, no bid and ask prices can be readily obtained, the Master Fund will value such investments at fair value as determined in good faith by the Board, with assistance from the Valuation Committee, in accordance with the Master Fund’s Valuation Policies and Procedures.

In making its determination of fair value, the Valuation Committee may retain and rely upon valuations obtained from independent valuation firms; provided that the Valuation Committee shall not be required to determine fair value in accordance with the valuation provided by any single source, and the Valuation Committee shall retain the discretion to use any relevant data, including information obtained from any independent third-party valuation or pricing service, that the Valuation Committee deems to be reliable in determining fair value under the circumstances.

Revenue Recognition

Security transactions will be accounted for on their trade date. For commercial real estate (“CRE”) related debt investments, including first mortgage loans, subordinate mortgage and mezzanine loans, participations in such loans and interest income on such investments is recognized on an accrual basis and any related premium, discount, origination costs and fees are amortized over the life of the investment using the effective interest method. The amortization is reflected as an adjustment to interest income in the statement of operations. For CRE related securities which include commercial mortgage-back securities (“CMBS”), unsecured debt of publicly-traded REITs, interest income on such investments is recognized using the effective interest method with any premium or discount

NORTHSTAR REAL ESTATE CAPITAL INCOME MASTER FUND

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

amortized or accreted through earnings based on expected cash flow through the expected maturity date of the security. Changes to expected cash flow may result in a change to the yield which is then applied retrospectively for high-credit quality securities that cannot be prepaid or otherwise settled in such a way that the holder would not recover substantially all of the investment or prospectively for all other securities to recognize interest income. The Master Fund will record dividend income on the ex-dividend date. The Master Fund will not accrue interest or dividends on loans and securities as a receivable if there is reason to doubt the collectability of such income. Loan origination fees, original issue discount, and market discount (market premium) will be capitalized and such amounts will be accreted (amortized) as interest income (interest expense) over the respective term of the loan or security. Upon the prepayment of a loan or security, any unamortized loan origination fees and original issuance discount will be recorded as interest income. The Master Fund will record prepayment premiums on loans and securities as interest income when it receives such amounts.

Net Realized Gains or Losses and Net Change in Unrealized Appreciation or Depreciation

Gains or losses on the sale of investments will be calculated by using the specific identification method. The Master Fund will measure realized gains or losses by the difference between the net proceeds from the repayment or sale and the amortized cost basis of the investment including any unamortized upfront fees. Net change in unrealized appreciation or depreciation reflects the change in portfolio investment values during the reporting period.

Organization and Offering Costs

Organization costs include, among other things, the cost of formation, including the cost of legal services and other fees pertaining to the Master Fund’s organization. Offering costs include, among other things, legal, accounting, printing and other costs pertaining to the preparation of the Master Fund’s Registration Statement on Form N-2 related to the public offering of its common shares.