Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial professional or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

3

Chair’s Letterto Shareholders Dear Shareholders,

The COVID-19 crisis is taking an unprecedented toll on our health, societies, economies and financial markets. Our thoughts are with you during this time of significant disruption caused by the disease and its economic fallout. With many regions of the world suppressing the initial spread of the virus, governments and public health officials face the extraordinary challenge of balancing the resumption of economic activity with public safety, particularly as new clusters of infection have emerged in the U.S. and other countries following their reopening. Markets have turned their focus to the potential for an economic recovery, although the timing and magnitude are highly uncertain. Elevated market volatility is likely to continue, with economic data, coronavirus infection rates and the upcoming U.S. presidential election under scrutiny.

While we do not want to understate the dampening effect on the global economy, it is important to differentiate short-term interruptions from the longer-lasting implications to the economy. Prior to the COVID-19 crisis, some areas of the global economy were showing signs of improvement after trade tensions had weighed on economic activity for much of 2019. More recently, countries that have reopened have seen marked improvement in some near-term economic indicators. Central banks and governments around the world have announced economic stimulus measures and pledged to continue doing what it takes to support their economies. In the U.S., the Federal Reserve has cut its benchmark interest rate to near zero and introduced similar programs that helped revive the U.S. economy after the 2008 financial crisis. The U.S. Government has approved three relief packages, including a $2 trillion-dollar package directly supporting businesses and individuals. The Coronavirus Aid, Relief and Economic Security Act, called the CARES Act, provides direct payments and expanded unemployment benefits to individuals, loans and grants to small businesses, loans and other money to large corporations and funding for hospitals, public health, education and state and local governments.

In the meantime, patience and a long-term perspective are key for investors. When market fluctuations are the leading headlines day after day, it’s tempting to “do something.” However, your long-term goals can’t be met with short-term thinking. We encourage you to talk to your financial professional, who can review your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

July 22, 2020

4

Portfolio Managers’ Comments

Nuveen Municipal 2021 Target Term Fund (NHA)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. Portfolio managers John V. Miller, CFA, and Steven M. Hlavin discuss U.S. economic and market conditions, key investment strategies and the twelve-month performance of NHA. John and Steve have managed NHA since its inception in 2016.

What factors affected the U.S. economy and the national municipal market during the twelve-month reporting period ended May 31, 2020?

The longest economic expansion in U.S. history came to an abrupt halt in early 2020 amid the COVID-19 coronavirus pandemic. To slow the spread of the virus, large portions of the economy were shut down, with companies closing either temporarily or permanently and most of the U.S. population under stay-at-home orders during March and April 2020. A phased reopening began toward the end of May and continued after the close of the reporting period. The disruption has been swift and severe, and has tipped the economy into recession, a several months’ long contraction across the broad economy. (Subsequent to the close of this reporting period, in June 2020, the National Bureau of Economic Research announced that the economic expansion that began in June 2009 officially ended in February 2020, marking the start of a recession.) For the first quarter of 2020, the Bureau of Economic Analysis reported that annualized gross domestic product (GDP) shrank 5.0%, according to its “second” estimate. GDP measures the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. Previously, the economy had been expanding at a moderate clip. GDP grew at an annualized rate of 2.1% in the fourth quarter of 2019 and grew 2.3% in 2019 overall.

Consumer spending, the largest driver of the economy, was well supported earlier in this reporting period by low unemployment, wage gains and tax cuts. However, the COVID-19 crisis containment measures drove a significant drop in consumer spending and a sharp rise in unemployment in March and April 2020. The Bureau of Labor Statistics said the unemployment rate rose to 13.3% in May 2020 from 3.6% in May 2019. Although May 2020 saw a surprise addition of 2.7 million jobs during the month as economies began to reopen, the combined job losses in March and April 2020 exceeded 22 million. The average hourly earnings rate appeared to soar, growing at an annualized rate of 6.5% in May 2020, despite the spike in unemployment. Earnings data were skewed by the concentration of job losses in lower-wage work, which effectively eliminated most of the low data, resulting in an average of mostly higher numbers. The overall trend of inflation weakened considerably, which was attributed to large decreases in gasoline, apparel, air travel

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Fund disclaims any obligation to update publicly or revise any forward-looking statements or views expressed herein.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

and lodging prices offsetting an increase in food prices. The Bureau of Labor Statistics said the Consumer Price Index (CPI) increased 0.1% over the twelve-month reporting period ended May 31, 2020 before seasonal adjustment.

Low mortgage rates and low inventory drove home prices moderately higher in this reporting period, although the most recent data do not fully reflect the shutdown. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 4.7% year-over-year in April 2020 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 3.4% and 4.0%, respectively.

With economic momentum slowing in 2019 from 2018’s stronger pace, the U.S. Federal Reserve (Fed) left rates unchanged throughout the first half of 2019 then cut rates by 0.25% at each of the July 2019, September 2019 and October 2019 policy committee meetings. Markets registered disappointment with the Fed’s explanation that the rate cuts were a “mid-cycle adjustment,” rather than a prolonged easing period, and its signal that there would be no additional rate cuts in 2019. Also in the latter half of 2019, the Fed announced it would stop shrinking its bond portfolio sooner than scheduled, as well as began buying short-term Treasury bills to help money markets operate smoothly and maintain short-term borrowing rates at low levels. Fed Chairman Powell emphasized that the Treasury bill purchases were not a form of quantitative easing. The Fed continued its Treasury bill buying in January 2020, as well as left its benchmark interest rate unchanged, while noting the emerging COVID-19 risks.

As the outbreak spread to the U.S. and significant restrictions on social and economic activity were imposed starting in March 2020, the Fed enacted an array of emergency measures to stabilize the financial system and support the markets, including cutting its main interest rate to near zero, offering lending programs to aid small and large companies and allowing unlimited bond purchases, known as quantitative easing. There were no policy changes at the Fed’s April 2020 meeting, where Chairman Powell reiterated a commitment to keep rates near zero until the economy recovers, and the meeting minutes released during May 2020 underscored the Fed’s concerns about a potentially prolonged economic recovery.

Meanwhile, the U.S. government approved three aid packages, totaling more than $100 billion in funding to health agencies and employers offering paid leave and $2 trillion allocated across direct payments to Americans, an expansion of unemployment insurance, loans to large and small businesses, funding to hospitals and health agencies and support to state and local governments.

While trade and tariff policy drove market sentiment for most of the twelve-month reporting period, the outbreak of the novel coron-avirus and its associated disease COVID-19 rapidly dwarfed all other market concerns starting in late February 2020. Equity and commodity markets sold-off and safe-haven assets rallied in March 2020 as China, other countries and then the United States initiated quarantines, restricted travel and shuttered factories and businesses. The potential economic shock was particularly difficult to assess, which amplified market volatility. An ill-timed oil price war between the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC member Russia, which caused oil prices to plunge in March 2020, exacerbated the market sell-off.

Outside the U.S., many countries implemented lockdowns and restrictions on business activity to reduce infection rates, with a deep impact to their economies. Pandemic responses included central bank monetary easing and quantitative easing, fiscal relief programs, the loosening of fiscal rules and, in the case of emerging markets, emergency financing and debt relief from bilateral creditors and international organizations such as the International Monetary Fund and World Bank. The U.K. formally exited the European Union (EU) at the end of January 2020, triggering the one-year transition period, but Brexit talks were temporarily paused during the virus lockdown. When negotiations resumed, the U.K. continued to indicate it would not seek an extension. Italy’s prime minister unexpectedly resigned in August 2019, and the newly formed coalition government appeared to take a less antagonistic stance towards the EU. To help relieve the coronavirus impact on Italy and other more indebted Southern European countries, the European Commission proposed a €750 billion aid program to be funded by all member states, although it is expected to face a bumpy approval process. In Asia, northern countries were among the first to successfully reduce infection rates and relax coronavirus restrictions, but pockets of

6

the disease re-emerged. The widespread anti-government protests roiling Hong Kong throughout 2019 had dissipated amid the lock-down, but tensions flared in late May 2020 when China unexpectedly announced a national security law perceived as a threat to Hong Kong’s sovereignty. India took stringent lockdown steps in March 2020 but still saw a rapid increase in cases. Latin American countries entered the health crisis in already weakened positions, with high government debt and widespread civil unrest. Venezuela’s economic and political crisis continued to deepen. Argentina surprised the market with the return of a less market-friendly administration but continued to pursue a restructuring of its debt. Brazil’s Bolsonaro administration achieved a legislative win on pension reform but had not fully delivered on reviving economic growth. As the pandemic spread to Latin America, the inconsistent government responses, reduced testing capabilities, weaker health care systems, food shortages and public protests contributed to accelerating infection and death rates, while the Southern Hemisphere winter is set to begin.

Prior to the COVID-19 crisis, global markets had become more bullish on the outlook for 2020 as trade policy and Brexit appeared to make progress at the end of 2019. The U.S. and China agreed on a partial trade deal, which included rolling back some tariffs, increasing China’s purchases of U.S. agriculture products and the consideration of intellectual property, technology and financial services rights. The “phase one” deal was signed on January 15, 2020. While much of the focus remained on the U.S.-China relationship, trade spats between the U.S. and Mexico, the EU, Brazil and Argentina also arose throughout the reporting period. In January 2020, the U.S. Congress fully approved the U.S., Mexico and Canada Agreement (USMCA), which replaces the North American Free Trade Agreement. With more clarity on trade deals, the trade-related deterioration in global manufacturing and export data was expected to improve. However, the COVID-19 crisis has since upended those assumptions. Furthermore, tensions between the U.S. and China escalated amid the pandemic, with both sides stoking resentment about the management of the health crisis, Hong Kong’s political protests and trade policy.

Despite the severe sell-off in March 2020, municipal bonds managed positive performance over the twelve-month reporting period. For most of the reporting period, a significant decline in interest rates drove municipal bond prices higher, with positive technical and fundamental conditions also supporting credit spread tightening. Prior to the emergence of the novel coronavirus, interest rates had been pressured lower by signs that the economy’s momentum was slowing, a more dovish central bank policy, geopolitical tensions (especially regarding trade) and bouts of equity market volatility. Then, from late February through March 2020, coronavirus risks permeated the markets, sending U.S. Treasury yields to historic lows. Rate volatility increased sharply in that six-week period. As liquidity became stressed, investors began to liquidate any asset possible, including municipal bonds. Municipal bond prices declined rapidly (and yields spiked higher), amid rampant selling across both the high grade and high yield segments that was exacerbated in some cases by exchange-traded fund and closed-end fund selling. Municipal bond prices became severely dislocated from Treasury prices. Credit spreads widened significantly during the March 2020 sell-off, ending the month above their long-term average. Monetary and fiscal interventions from the Fed and U.S. government helped the market recover in April and May, although spreads remain wider than average as of the end of the reporting period. The municipal yield curve steepened over this reporting period, with a pronounced drop in yields at the short end of the curve spearheading the steepening.

Prior to the market turmoil in March 2020, municipal bond gross issuance nationwide had been robust. The overall low level of interest rates encouraged issuers to continue to actively refund their outstanding debt. In these transactions the issuers are issuing new bonds and taking the bond proceeds and redeeming (calling) old bonds. These refunding transactions have ranged from 30% to 60% of total issuance over the past few years. Thus, the net issuance (all bonds issued less bonds redeemed) is actually much lower than the gross issuance. So, while gross issuance volume has been adequate, the net has not and this was an overall positive technical factor on municipal bond investment performance in recent years. Notably, taxable municipal bond issuance has increased meaningfully since the advent of the Tax Cut and Jobs Act of 2017, which prohibits municipal issuers from issuing new tax-exempt bonds to pre-refund existing tax-exempt bonds. However, municipalities have taken advantage of the low interest rate environment

7

Portfolio Managers’ Comments (continued)

and the strong demand for yield to issue taxable municipal debt, enabling them to save on net interest costs while adding to the scarcity value of tax-exempt issues.

Municipal bond funds saw consistently positive cash flows throughout 2019, but demand has been uneven in 2020 so far. Positive flows continued into early 2020, then municipal bond funds suffered significant outflows in March 2020, particularly from high yield municipal bond funds. After the market stabilized in April 2020, fund flows turned positive again in May 2020. With interest rates in the U.S. and globally remaining near all-time lows, the appetite for yield has continued to drive investors toward higher after-tax yielding assets, including U.S. municipal bonds. Additionally, as tax payers have adjusted to the 2017 tax law, which caps the state and local tax (SALT) deduction for individuals, there has been increased demand for tax-exempt municipal bonds, especially in states with high income taxes and/or property taxes.

What key strategies were used to manage the Fund during the twelve-month reporting period ended May 31, 2020?

The Fund invests in a portfolio of primarily municipal securities, the income from which is exempt from regular U.S. federal income tax. At least 65% of its managed assets are invested in low- to medium-quality municipal securities that, at the time of investment, are rated BBB/Baa or lower or unrated but judged by the portfolio managers to be of comparable quality. The Fund does not invest in securities rated CCC+/Caa1 or lower, or unrated but judged by the portfolio managers to be of comparable quality, nor does it invest in defaulted or distressed securities at the time of investment. No more than 25% will be in any one sector, no more than 5% in any one issuer and no more than 10% in tobacco settlement bonds. Up to 20% may be invested in securities that pay interest that is taxable under the federal alternative minimum tax applicable to individuals (AMT bonds).

The Fund seeks to identify municipal securities across diverse sectors and industries that the managers believe are underrated or undervalued. In seeking to return the original NAV on or about March 1, 2021, the Fund intends to utilize various portfolio and cash-flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest maturity of any holding to no later than September 1, 2021.

As of the end of the reporting period, NHA’s maturity profile was structured with approximately 26% maturing in 2020 and the remainder maturing in 2021. As we continue to seek bonds that may be appropriate for the Fund, to the extent possible, we’ll focus on buying 2021 maturities while looking to sell the earlier maturities first, to continue to reduce the Fund’s interest rate sensitivity as the Fund approaches its term date. The Fund’s credit quality and sector positioning remained in line with Nuveen’s ongoing strategic emphasis on lower rated (including below investment grade) credits and sectors offering higher yields. The Fund’s portfolio turnover was relatively muted in this reporting period as we found opportunities to buy bonds maturing in 2021, to reinvest the small amount of proceeds from maturing and called bonds and sinking fund payments.

We should also note that NHA received Energy Harbor common stock during this reporting period, after FirstEnergy Solutions emerged from bankruptcy and the restructured company was renamed Energy Harbor. The Fund received Energy Harbor stock when its holding of bonds issued by FirstEnergy Solutions was converted into Energy Harbor equity as part of its debt reorganization and emergence from bankruptcy protection, which was completed in February 2020. Due in part to post-emergence price increases, at the end of the reporting period Energy Harbor equity represented 3.7% of the total investments of NHA. Subsequent to the end of the reporting period, the value of Energy Harbor equity fell sharply after federal authorities charged certain Ohio politicians and lobbyists with having accepted large payments from an unnamed company (which was easily identifiable as Energy Harbor’s pre-bankruptcy parent, FirstEnergy Corp.) in what was alleged to be a corrupt scheme to adopt legislation that would benefit that parent company.

8

How did the Fund perform during the twelve-month reporting period ended May 31, 2020?

The table in the Fund’s Performance Overview and Holding Summaries section of this report provides the Fund’s total returns for the one-year and since-inception periods ended May 31, 2020. The Fund’s total returns at common share net asset value (NAV) are compared with the performance of a corresponding market index.

For the twelve months ended May 31, 2020, the total returns at common share NAV for NHA outperformed the return for the S&P Short Duration Municipal Yield Index.

Nearly all of the Fund’s outperformance relative to the benchmark is attributable to the Fund’s significantly shorter duration. As NHA approaches its 2021 target term date, the portfolio’s duration has naturally drifted lower, whereas the benchmark continuously rebalances to maintain its duration target. NHA’s duration has now declined to 3.5 years shorter than the benchmark’s duration, making the Fund less sensitive to the interest rate volatility in this reporting period. The best performing bonds in the portfolio on an absolute basis were the shortest dated bonds. NHA had exposure to some of the same issuers as the benchmark, but the Fund’s preference for the shorter dated bonds of those issuers contributed positively to relative performance. NHA did particularly well in its industrial development revenue (IDR) position, where it held a large exposure to Energy Harbor (formerly FirstEnergy Solutions) and smaller weightings in American Airlines, Inc., United Airlines Inc. and BP Pipelines Inc. As noted above, the strong performance of Energy Harbor has partially reversed itself since the end of the reporting period.

9

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Fund’s distributions is current as of May 31, 2020. The Fund’s distribution levels may vary over time based on its investment activity and portfolio investment value changes.

During the current reporting period, the Fund’s distributions to common shareholders were as shown in the accompanying table.

| | Per Common |

| Monthly Distributions (Ex-Dividend Date) | Share Amounts |

June 2019 | $0.0150 |

July | 0.0150 |

August | 0.0150 |

September | 0.0150 |

October | 0.0150 |

November | 0.0150 |

December | 0.0150 |

January | 0.0150 |

February | 0.0150 |

March | 0.0130 |

April | 0.0130 |

May 2020 | 0.0130 |

| Total Distributions from Net Investment Income | $0.1740 |

| Yields | |

Market Yield* | 1.60% |

Taxable-Equivalent Yield* | 2.70% |

* | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 40.8%. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was not exempt from federal income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower. |

The Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit the Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by the Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of the Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for the Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

10

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE REPURCHASES

During August 2019, the Fund’s Board of Trustees reauthorized an open-market share repurchase program, allowing the Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of May 31, 2020, and since the inception of the Fund’s repurchase program, the Fund has cumulatively repurchased and retired its common shares as shown in the accompanying table.

| NHA |

Common shares cumulatively repurchased and retired | — |

Common shares authorized for repurchase | 860,000 |

During the current reporting, the Fund did not repurchase any of its outstanding common shares. | |

OTHER COMMON SHARE INFORMATION

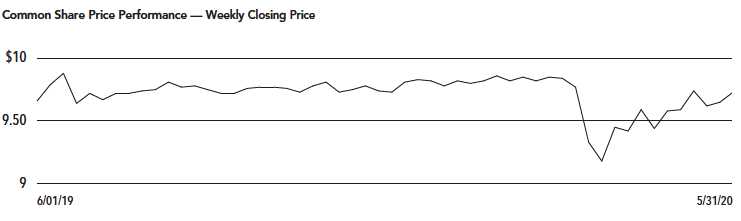

As of May 31, 2020, and during the current reporting period, the Fund’s common share price was trading at a premium/(discount) to its common share NAV as shown in the accompanying table.

| NHA |

Common share NAV | $9.94

|

Common share price | $9.73

|

Premium/(Discount) to NAV | (2.11)% |

12-Month average premium/(discount) to NAV | (1.67)% |

The Fund has an investment objective to return $9.85 (the original net asset value following the Fund’s initial public offering (the “Original NAV”)) to common shareholders on or about the end of the Fund’s term. There can be no assurance that the Fund will be able to return the Original NAV to shareholders, and such return is not backed or otherwise guaranteed by the Fund’s investment adviser, Nuveen Fund Advisors, LLC (the “Adviser”), or any other entity.

The Fund’s ability to return Original NAV to common shareholders on or about the termination date will depend on market conditions and the success of various portfolio and cash flow management techniques. The Fund currently intends to set aside and retain in its net assets a portion of its net investment income and possibly all or a portion of its gains. This will reduce the amounts otherwise available for distribution prior to the liquidation of the Fund, and the Fund may incur taxes on such retained amount, which will reduce the overall amounts that the Fund would have otherwise been able to distribute. Such retained income or gains, net of any taxes, would constitute a portion of the liquidating distribution returned to investors at the end of the Fund’s term. In addition, the Fund’s investment in shorter term and lower yielding securities, especially as the Fund nears the end of its term, may reduce investment income and, therefore, the monthly dividends during the period prior to termination. Investors that purchase common shares in the secondary market (particularly if their purchase price differs meaningfully from the Original NAV) may receive more or less than their original investment.

11

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Municipal 2021 Target Term Fund (NHA)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities, such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Lower credit debt securities may be more likely to fail to make timely interest or principal payments. For these and other risks, including the Fund’s limited term and inverse floater risk, see the Fund’s web page at www.nuveen.com/NHA.

12

| | |

| Nuveen Municipal 2021 Target Term Fund Performance Overview and Holding Summaries as of May 31, 2020 |

| | | |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. | | |

| Average Annual Total Returns as of May 31, 2020 | | |

| Average Annual |

| | Since |

| 1-Year | Inception |

NHA at Common Share NAV | 2.39% | 2.28% |

NHA at Common Share Price | 3.18% | 1.45% |

S&P Short Duration Municipal Yield Index | 0.70% | 3.59% |

Since inception returns are from 1/26/16. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

13

| | |

| NHA | Performance Overview and Holding Summaries as of May 31, 2020 (continued) |

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

The ratings disclosed are the lowest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| Fund Allocation | |

| (% of net assets) | |

Long-Term Municipal Bonds | 89.2% |

Common Stocks | 3.5% |

Other Assets Less Liabilities | 7.3% |

| Net Assets | 100% |

| Portfolio Credit Quality | |

| (% of total investment exposure) | |

U.S. Guaranteed | 2.4% |

AAA | 0.3% |

AA | 15.8% |

A | 23.6% |

BBB | 26.3% |

BB or Lower | 20.4% |

N/R (not rated) | 11.2% |

| Total | 100% |

| Portfolio Composition | |

| (% of total investments) | |

Tax Obligation/Limited | 23.7% |

Tax Obligation/General | 20.5% |

Transportation | 15.3% |

Utilities | 12.3% |

Education and Civic Organizations | 10.1% |

Other | 18.1% |

| Total | 100% |

| States and Territories | |

| (% of total municipal bonds) | |

New Jersey | 13.5% |

Illinois | 12.6% |

New York | 10.2% |

Pennsylvania | 9.9% |

California | 9.1% |

Texas | 7.4% |

Florida | 6.1% |

Wisconsin | 4.2% |

Virginia | 3.6% |

Alaska | 3.1% |

Tennessee | 2.4% |

Other | 17.9% |

| Total | 100% |

14

Shareholder Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on April 22, 2020 for NHA; at this meeting the shareholders were asked to elect Board Members.

| | |

| NHA |

| Common |

| Shares |

| Approval of the Board Members was reached as follows: | |

John K. Nelson | |

| For | 6,733,774 |

| Withhold | 1,314,926 |

| Total | 8,048,700 |

Terence J. Toth | |

| For | 6,731,439 |

| Withhold | 1,317,261 |

| Total | 8,048,700 |

Robert L. Young | |

| For | 6,739,545 |

| Withhold | 1,309,155 |

| Total | 8,048,700 |

15

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Nuveen Municipal 2021 Target Term Fund:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Nuveen Municipal 2021 Target Term Fund (the Fund), including the portfolio of investments, as of May 31, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the four-year period then ended and the period January 26, 2016 (commencement of operations) through May 31, 2016. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of May 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the four-year period then ended and the period from January 26, 2016 through May 31, 2016, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of May 31, 2020, by correspondence with custodians and brokers or other appropriate auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, IL

July 29, 2020

16

| | |

| Nuveen Municipal 2021 Target Term Fund Portfolio of Investments May 31, 2020 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | LONG-TERM INVESTMENTS – 92.7% | | | |

| | MUNICIPAL BONDS – 89.2% | | | |

| | Alabama – 0.2% | | | |

| $ 145 | | The Improvement District of the City of Mobile, Alabama, McGowin Park Project, Sales Tax | No Opt. Call | N/R | $ 144,957 |

| | Revenue Bonds, Series 2016A, 4.000%, 8/01/20 | | | |

| | Alaska – 2.8% | | | |

| 1,000 | | Valdez, Alaska, Marine Terminal Revenue Bonds, BP Pipelines Inc Project, Refunding | No Opt. Call | A1 | 1,018,790 |

| | Series 2003B, 5.000%, 1/01/21 | | | |

| 1,325 | | Valdez, Alaska, Marine Terminal Revenue Bonds, BP Pipelines Inc Project, Refunding | No Opt. Call | A1 | 1,349,897 |

| | Series 2003C, 5.000%, 1/01/21 | | | |

| 2,325 | | Total Alaska | | | 2,368,687 |

| | Arizona – 2.1% | | | |

| 325 | | Goodyear Community Facilities Utilities District 1, Arizona, General Obligation Bonds, | No Opt. Call | A1 | 338,280 |

| | Refunding Series 2016, 4.000%, 7/15/21 | | | |

| 625 | | Pima County Industrial Development Authority, Arizona, Education Facility Revenue Bonds, | No Opt. Call | N/R | 623,362 |

| | American Leadership Academy Project, Series 2019, 4.000%, 6/15/21,144A | | | |

| 795 | | Pima County Industrial Development Authority, Arizona, Education Revenue Bonds, Arizona | No Opt. Call | Ba2 | 802,314 |

| | Charter Schools Refunding Project, Series 2016R, 2.875%, 7/01/21 | | | |

| 1,745 | | Total Arizona | | | 1,763,956 |

| | Arkansas – 0.0% | | | |

| 15 | | Arkansas Development Finance Authority, Hospital Revenue Bonds, Washington Regional | No Opt. Call | Baa1 | 15,438 |

| | Medical Center, Refunding Series 2015B, 5.000%, 2/01/21 | | | |

| | California – 8.2% | | | |

| 490 | | Antelope Valley Healthcare District, California, Revenue Bonds, Series 2016A, | No Opt. Call | Ba3 | 503,911 |

| | 5.000%, 3/01/21 | | | |

| 85 | | California Infrastructure and Economic Development Bank, Revenue Bonds, The Walt Disney | No Opt. Call | A+ | 86,608 |

| | Family Museum, Refunding Series 2016, 4.000%, 2/01/21 | | | |

| 1,490 | | California School Finance Authority Charter School Revenue Notes, Inspire Charter | No Opt. Call | N/R | 1,489,523 |

| | Schools, Series 2019B, 3.000%, 7/15/20,144A | | | |

| | California School Finance Authority, California, Charter School Revenue Bonds, Aspire | | | |

| | Public Schools, Refunding Series 2016: | | | |

| 550 | | 5.000%, 8/01/20,144A | No Opt. Call | BBB | 553,971 |

| 500 | | 5.000%, 8/01/21,144A | No Opt. Call | BBB | 524,755 |

| 730 | | California Statewide Communities Development Authority, Revenue Bonds, American Baptist | No Opt. Call | A– | 736,563 |

| | Homes of the West, Refunding Series 2015, 5.000%, 10/01/20 | | | |

| | California Statewide Communities Development Authority, Special Tax Bonds, Community | | | |

| | Facilities District 2015-01, Improvement Area No 1, University District, Series 2016A: | | | |

| 260 | | 2.000%, 9/01/20 | No Opt. Call | N/R | 260,463 |

| 265 | | 2.125%, 9/01/21 | No Opt. Call | N/R | 267,107 |

| 235 | | California Statewide Communities Development Authority, Statewide Community | No Opt. Call | N/R | 235,900 |

| | Infrastructure Program Revenue Bonds, Series 2016A, 3.000%, 9/02/20 | | | |

| 200 | | Cucamonga School District, San Bernardino County, California, Special Tax Bonds, | No Opt. Call | N/R | 204,170 |

| | Community Facilities District 97-1, Series 2016, 3.000%, 9/01/21 | | | |

| 305 | | Fresno, California, Airport Revenue Bonds, Refunding Series 2013B, 5.000%, 7/01/21 – BAM | No Opt. Call | AA | 319,908 |

| | Insured (AMT) | | | |

| 50 | | Poway Unified School District, San Diego County, California, Special Tax Bonds, | No Opt. Call | N/R | 51,672 |

| | Community Facilities District 15 Del Sur East Improvement Area C, Series 2016, 4.000%, 9/01/21 | | | |

| 700 | | Roseville, California, Special Tax Bonds, Community Facilities District 1 Hewlett | No Opt. Call | N/R | 714,560 |

| | Parkard Campus Oaks, Series 2016, 3.250%, 9/01/21 | | | |

17

| | |

| NHA | Nuveen Municipal 2021 Target Term Fund Portfolio of Investments (continued) May 31, 2020 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | California (continued) | | | |

| $ 10 | | South Orange County Public Financing Authority, California, Special Tax Revenue Bonds, | No Opt. Call | AA | $ 10,099 |

| | Ladera Ranch, Refunding Series 2014A, 5.000%, 8/15/20 | | | |

| 995 | | Western Hills Water District, Stanislaus County, California, Special Tax Bonds, Diable | No Opt. Call | N/R | 597,000 |

| | Grande Community Facilities District 1, Refunding Series 2014, 4.000%, 9/01/21 (4) | | | |

| 420 | | Yuba City Redevelopment Agency, California, Tax Allocation Bonds, Redevelopment Project, | No Opt. Call | BBB+ | 427,346 |

| | Refunding Series 2015, 2.000%, 9/01/21 | | | |

| 7,285 | | Total California | | | 6,983,556 |

| | Colorado – 0.4% | | | |

| 230 | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 1997B, 0.000%, | No Opt. Call | A | 228,629 |

| | 9/01/21 – NPFG Insured | | | |

| 116 | | Mountain Shadows Metropolitan District, Colorado, General Obligation Limited Tax Bonds, | No Opt. Call | N/R | 115,841 |

| | Refunding Series 2016, 3.250%, 12/01/20 | | | |

| 346 | | Total Colorado | | | 344,470 |

| | Connecticut – 0.4% | | | |

| 180 | | Stafford, Connecticut, General Obligation Bonds, Series 2018, 5.000%, 8/01/21 – | No Opt. Call | AA | 189,974 |

| | BAM Insured | | | |

| 125 | | University of Connecticut, General Obligation Bonds, Series 2013A, 5.000%, 8/15/21 | No Opt. Call | A+ | 130,946 |

| 305 | | Total Connecticut | | | 320,920 |

| | Florida – 5.4% | | | |

| 150 | | Bellagio Community Development District, Hialeah, Florida, Special Assessment Bonds, | No Opt. Call | BBB | 150,940 |

| | Series 2016, 2.250%, 11/01/20 | | | |

| 135 | | Belmont Community Development District, Florida, Capital Improvement Revenue Bonds, | No Opt. Call | N/R | 135,119 |

| | Series 2016A, 3.625%, 11/01/20 | | | |

| 2,000 | | Broward County, Florida, Airport Facility Revenue Bonds, Learjet Inc, Series 2000, | 6/20 at 100.00 | Caa3 | 2,007,880 |

| | 7.500%, 11/01/20 (AMT) | | | |

| 36 | | Champion’s Reserve Community Development District, Florida, Special Assessment Revenue | No Opt. Call | N/R | 36,058 |

| | Bonds, Series 2016, 3.625%, 11/01/20 | | | |

| 100 | | Creekside at Twin Creeks Community Development District, Florida, Special Assessment | No Opt. Call | N/R | 100,208 |

| | Bonds, Area 1 Project, Series 2016A-1, 3.700%, 11/01/20 | | | |

| 355 | | Grand Bay at Doral Community Development District, Miami-Dade County, Florida, Special | No Opt. Call | N/R | 356,136 |

| | Assessment Bonds, South Parcel Assessment Area Project, Series 2016, 3.500%, 5/01/21 | | | |

| 335 | | Live Oak Community Development District 2, Hillsborough County, Florida, Special | No Opt. Call | A– | 338,099 |

| | Assessment Bonds Refunding Series 2016, 2.000%, 5/01/21 | | | |

| 15 | | Palm Beach County Health Facilities Authority, Florida, Hospital Revenue Bonds, BRCH | No Opt. Call | N/R (5) | 15,359 |

| | Corporation Obligated Group, Refunding Series 2014, 5.000%, 12/01/20 (ETM) | | | |

| 70 | | Palm Beach County Health Facilities Authority, Florida, Revenue Bonds, Lifespace | No Opt. Call | BBB | 70,575 |

| | Community Inc, Series 2015C, 5.000%, 5/15/21 | | | |

| 505 | | Palm Glades Community Development District, Florida, Special Assessment Bonds, Refunding | No Opt. Call | A | 512,393 |

| | Series 2016, 2.250%, 5/01/21 | | | |

| 140 | | Palm Glades Community Development District, Florida, Special Assessment Bonds, Refunding | No Opt. Call | BBB– | 140,675 |

| | Series 2017, 3.500%, 5/01/21 | | | |

| 105 | | Reunion West Community Development District, Florida, Special Assessment Bonds, Area 3 | No Opt. Call | N/R | 105,226 |

| | Project, Series 2016, 3.625%, 11/01/20 | | | |

| 70 | | Rolling Hills Community Development District, Florida, Capital Improvement Revenue | No Opt. Call | N/R | 69,824 |

| | Bonds, Series 2015A-1, 4.600%, 5/01/21 | | | |

| 105 | | Six Mile Creek Community Development District, Florida, Capital Improvement Revenue | No Opt. Call | N/R | 105,175 |

| | Bonds, Assessment Area 2, Series 2016, 3.750%, 11/01/20 | | | |

| 140 | | Tapestry Community Development District, Florida, Special Assessment Revenue Bonds, | No Opt. Call | N/R | 141,033 |

| | Series 2016, 3.625%, 5/01/21 | | | |

18

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | Florida (continued) | | | |

| $ 70 | | Union Park Community Development District, Florida, Capital Improvement Revenue Bonds, | No Opt. Call | N/R | $ 70,140 |

| | Series 2016A-1, 3.750%, 11/01/20 | | | |

| 170 | | Village Community Development District 12, Wildwood, Florida, Special Assessment Revenue | No Opt. Call | N/R | 170,600 |

| | Bonds, Series 2016, 2.875%, 5/01/21 | | | |

| 105 | | Windsor at Westside Community Development District, Osceola County, Florida, Special | No Opt. Call | N/R | 105,319 |

| | Assessment Bonds, Area 2 Project, Series 2016, 3.500%, 11/01/20 | | | |

| 4,606 | | Total Florida | | | 4,630,759 |

| | Georgia – 0.3% | | | |

| 275 | | Atlanta, Georgia, Tax Allocation Bonds, Eastside Project, Series 2016, 5.000%, 1/01/21 (ETM) | No Opt. Call | A2 (5) | 282,653 |

| | Guam – 0.8% | | | |

| 475 | | Guam Education Financing Foundation, Certificates of Participation, Guam Public School | No Opt. Call | BB | 477,313 |

| | Facilities Project, Refunding Series 2016A, 5.000%, 10/01/20 | | | |

| 240 | | Guam Government Department of Education, Certificates of Participation, John F Kennedy | No Opt. Call | B+ | 242,155 |

| | High School Project, Series 2010A, 6.000%, 12/01/20 | | | |

| 715 | | Total Guam | | | 719,468 |

| | Illinois – 11.2% | | | |

| 75 | | Cary, Illinois, Special Tax Bonds, Special Service Area 2, Refunding Series 2016, | No Opt. Call | AA | 75,551 |

| | 1.900%, 3/01/21 – BAM Insured | | | |

| 150 | | Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, | No Opt. Call | BB | 151,581 |

| | Refunding Series 2010F, 5.000%, 12/01/20 | | | |

| 1,000 | | Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated | No Opt. Call | Baa2 | 1,023,000 |

| | Tax Revenues, Series 1999A, 5.250%, 12/01/20 – NPFG Insured | | | |

| 800 | | Chicago, Illinois, General Obligation Bonds, Refunding Series 2012C, 5.000%, 1/01/21 (ETM) | No Opt. Call | BBB+ (5) | 821,792 |

| 400 | | Chicago, Illinois, General Obligation Bonds, Refunding Series 2020A, 5.000%, 1/01/21 | No Opt. Call | BBB+ | 402,880 |

| 10 | | Chicago, Illinois, Motor Fuel Tax Revenue Bonds, Refunding Series 2014, 5.000%, 1/01/21 | No Opt. Call | BB+ | 10,049 |

| 630 | | Cook County School District 87, Berkeley, Illinois, General Obligation Bonds, Refunding | No Opt. Call | A1 | 637,623 |

| | School Series 2012A, 3.000%, 12/01/20 | | | |

| 300 | | Cook County, Illinois, General Obligation Bonds, Refunding Series 2012C, 5.000%, 11/15/20 | No Opt. Call | A+ | 303,378 |

| 620 | | Illinois Finance Authority, Revenue Bonds, Ascension Health/fkaPresence Health Network, | No Opt. Call | AA+ | 639,139 |

| | Series 2016C, 5.000%, 2/15/21 | | | |

| 1,000 | | Illinois Finance Authority, Revenue Bonds, Rehabilitation Institute of Chicago, Series | No Opt. Call | A– | 1,037,000 |

| | 2013A, 5.000%, 7/01/21 | | | |

| 270 | | Illinois Finance Authority, Student Housing & Academic Facility Revenue Bonds, | No Opt. Call | BBB– | 272,079 |

| | CHF-Collegiate Housing Foundation – Chicago LLC University of Illinois at Chicago Project, | | | |

| | Series 2017A, 4.000%, 2/15/21 | | | |

| 315 | | Illinois Sports Facility Authority, State Tax Supported Bonds, Series 2001, 0.000%, | No Opt. Call | BBB | 314,654 |

| | 6/15/20 – AMBAC Insured | | | |

| 85 | | Illinois State, General Obligation Bonds, February Series 2014, 5.000%, 2/01/21 | No Opt. Call | BBB– | 85,541 |

| 635 | | Illinois State, General Obligation Bonds, January Series 2016, 5.000%, 1/01/21 | No Opt. Call | BBB– | 638,626 |

| 110 | | Illinois State, General Obligation Bonds, March Series 2012, 5.000%, 3/01/21 | No Opt. Call | BBB– | 110,787 |

| 2,000 | | Illinois State, General Obligation Bonds, May Series 2020, 4.875%, 5/01/21 | No Opt. Call | BBB– | 2,014,760 |

| 105 | | Illinois State, General Obligation Bonds, Refunding Series 2006, 5.000%, 1/01/21 | No Opt. Call | BBB– | 105,600 |

| 1,000 | | Winnebago-Boone Counties School District 205 Rockford, Illinois, General Obligation | No Opt. Call | A+ | 994,580 |

| | Bonds, Series 2013, 0.000%, 2/01/21 | | | |

| 9,505 | | Total Illinois | | | 9,638,620 |

| | Indiana – 1.5% | | | |

| 1,250 | | Indiana Finance Authority, Environmental Facilities Revenue Bonds, Indianapolis Power | No Opt. Call | A2 | 1,290,287 |

| | and Light Company Project, Refunding Series 2011A, 3.875%, 8/01/21 | | | |

19

| | |

| NHA | Nuveen Municipal 2021 Target Term Fund Portfolio of Investments (continued) May 31, 2020 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | Iowa – 0.4% | | | |

| $ 350 | | Iowa Finance Authority, Iowa, Midwestern Disaster Area Revenue Bonds, Iowa Fertilizer | 6/20 at 104.00 | BB– | $ 362,551 |

| | Company Project, Series 2016, 5.875%, 12/01/26,144A | | | |

| | Kentucky – 1.9% | | | |

| 1,535 | | Kentucky Economic Development Finance Authority, Revenue Bonds, Next Generation Kentucky | No Opt. Call | BBB+ | 1,598,196 |

| | Information Highway Project, Senior Series 2015A, 5.000%, 7/01/21 | | | |

| | Louisiana – 0.0% | | | |

| 15 | | Louisiana Public Facilities Authority, Revenue Bonds, Ochsner Clinic Foundation Project, | No Opt. Call | A3 | 15,549 |

| | Series 2015, 5.000%, 5/15/21 | | | |

| | Maine – 0.3% | | | |

| 265 | | Maine Health and Higher Educational Facilities Authority, Revenue Bonds, Maine General | No Opt. Call | BB | 273,830 |

| | Medical Center, Series 2011, 5.250%, 7/01/21 | | | |

| | Massachusetts – 0.1% | | | |

| 50 | | Massachusetts Development Finance Agency, Revenue Bonds, UMass Memorial Health, Series | No Opt. Call | BBB+ | 50,155 |

| | 2011H, 5.000%, 7/01/20 | | | |

| 25 | | Massachusetts Health and Educational Facilities Authority, Revenue Bonds, UMass Memorial | 7/20 at 100.00 | BBB+ | 25,078 |

| | Issue Series 2010G, 5.000%, 7/01/21 | | | |

| 75 | | Total Massachusetts | | | 75,233 |

| | Michigan – 1.5% | | | |

| 500 | | Downtown Development Authority, Michigan, Tax Increment Revenue Bonds, Development | No Opt. Call | AA | 523,655 |

| | Area 1 Projects, Series 2018B, 5.000%, 7/01/21 – AGM Insured | | | |

| 140 | | Detroit Downtown Development Authority, Michigan, Tax Increment Refunding Bonds, | No Opt. Call | BB+ | 132,502 |

| | Development Area 1 Projects, Series 1996C-1, 0.000%, 7/01/21 | | | |

| 155 | | Detroit Local Development Finance Authority, Michigan, Tax Increment Bonds, Senior Lien | 6/20 at 100.00 | B | 155,201 |

| | Series 1997A, 5.375%, 5/01/21 | | | |

| 500 | | Detroit, Michigan, General Obligation Bonds, Series 2018, 5.000%, 4/01/21 | No Opt. Call | BB– | 506,680 |

| 1,295 | | Total Michigan | | | 1,318,038 |

| | Minnesota – 0.5% | | | |

| 105 | | Red Wing, Minnesota Senior Housing Revenue Refunding Bonds, Deer Crest Project, Series | No Opt. Call | N/R | 104,699 |

| | 2012A, 3.750%, 11/01/20 | | | |

| 70 | | Saint Cloud, Minnesota, Charter School Lease Revenue Bonds, Stride Academy Project, | No Opt. Call | N/R | 47,600 |

| | Series 2016A, 3.000%, 4/01/21 (4) | | | |

| 250 | | Saint Louis Park, Minnesota, Health Care Facilities Revenue Bonds, Mount Olivet Careview | No Opt. Call | N/R | 244,717 |

| | Home Project, Series 2016C, 2.250%, 6/01/21 | | | |

| 425 | | Total Minnesota | | | 397,016 |

| | Mississippi – 0.4% | | | |

| 305 | | Pearl River County School District, Mississippi, General Obligation Bonds, Series 2018, | No Opt. Call | AA | 317,224 |

| | 4.000%, 8/01/21 – BAM Insured | | | |

| | Missouri – 1.7% | | | |

| 100 | | Branson Industrial Development Authority, Missouri, Tax Increment Revenue Bonds, Branson | No Opt. Call | N/R | 99,813 |

| | Shoppes Redevelopment Project, Refunding Series 2017A, 3.000%, 11/01/20 | | | |

| 1,000 | | Kansas City Industrial Development Authority, Missouri, Downtown Redevelopment District | No Opt. Call | AA– | 1,057,940 |

| | Revenue Bonds, Series 2011A, 5.000%, 9/01/21 | | | |

| 325 | | Saint Louis County Industrial Development Authority, Missouri, Health Facilities Revenue | No Opt. Call | N/R | 324,275 |

| | Bonds, Nazareth Living Center, Series 2015A, 4.000%, 8/15/20 | | | |

| 1,425 | | Total Missouri | | | 1,482,028 |

20

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | Nevada – 1.1% | | | |

| $ 815 | | Las Vegas Redevelopment Agency, Nevada, Tax Increment Revenue Bonds, Refunding Series | No Opt. Call | BBB+ | $ 843,574 |

| | 2016, 4.000%, 6/15/21 | | | |

| 125 | | North Las Vegas, Nevada, Local Improvement Bonds, Special Improvement District 64 Valley | No Opt. Call | N/R | 124,756 |

| | Vista, Series 2019, 3.500%, 6/01/21 | | | |

| 940 | | Total Nevada | | | 968,330 |

| | New Jersey – 12.1% | | | |

| 275 | | Bordentown , New Jersey, General Obligation Bonds, Series 2018, 3.000%, 8/01/21 | No Opt. Call | AA | 284,111 |

| 100 | | Delaware River Port Authority, Pennsylvania and New Jersey, Revenue Refunding Bonds, | No Opt. Call | A | 102,676 |

| | Port District Project, Series 2012, 5.000%, 1/01/21 | | | |

| | New Jersey Building Authority, State Building Revenue Bonds, Refunding Series 2016A: | | | |

| 200 | | 4.000%, 6/15/21 (ETM) | No Opt. Call | N/R (5) | 207,756 |

| 300 | | 4.000%, 6/15/21 | No Opt. Call | BBB+ | 301,875 |

| 1,000 | | New Jersey Economic Development Authority, Cigarette Tax Revenue Refunding Bonds, Series | No Opt. Call | BBB+ | 1,037,720 |

| | 2012, 5.000%, 6/15/21 | | | |

| 425 | | New Jersey Economic Development Authority, Private Activity Bonds, The Goethals Bridge | No Opt. Call | A2 | 439,777 |

| | Replacement Project, Series 2013, 5.000%, 7/01/21 (AMT) | | | |

| 1,000 | | New Jersey Economic Development Authority, School Facilities Construction Bonds, | No Opt. Call | BBB+ | 1,016,350 |

| | Refunding Series 2015XX, 5.000%, 6/15/21 | | | |

| 2,000 | | New Jersey Economic Development Authority, School Facilities Construction Financing | 3/21 at 100.00 | BBB+ | 2,023,460 |

| | Program Bonds, Refunding Series 2011GG, 5.000%, 9/01/21 | | | |

| 500 | | New Jersey Economic Development Authority, School Facilities Construction Financing | No Opt. Call | BBB+ (5) | 518,100 |

| | Program Bonds, Refunding Series 2012II, 5.000%, 3/01/21 (ETM) | | | |

| 1,000 | | New Jersey Housing & Mortgage Finance Agency, Multifamily Conduit Revenue Bonds, Garden | No Opt. Call | AA+ | 1,002,190 |

| | Spires Urban Renewal Project, Series 2018A, 2.020%, 8/01/21 (Mandatory Put 8/01/20) | | | |

| 540 | | New Jersey State, General Obligation Bonds, Refunding Series 2009O, 5.250%, 8/01/21 | No Opt. Call | A– | 567,907 |

| 1,000 | | New Jersey State, General Obligation Bonds, Refunding Series 2016T, 5.000%, 6/01/21 | No Opt. Call | A– | 1,041,940 |

| 1,000 | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Refunding | No Opt. Call | BBB+ | 1,010,740 |

| | Series 2006A, 5.250%, 12/15/20 | | | |

| 780 | | New Jersey Transportation Trust Fund Authority, Transportation System Bonds, Series | No Opt. Call | BBB+ | 780,484 |

| | 2011B, 5.000%, 6/15/20 | | | |

| 10,120 | | Total New Jersey | | | 10,335,086 |

| | New York – 9.1% | | | |

| 200 | | Franklin County Solid Waste Management Authority, New York, Solid Waste Revenue Bonds, | No Opt. Call | BBB+ | 208,490 |

| | Series 2015A, 5.000%, 6/01/21 (AMT) | | | |

| 1,000 | | New York City, New York, General Obligation Bonds, Refunding Fiscal 2015 Series A, | No Opt. Call | Aa1 | 1,054,920 |

| | 5.000%, 8/01/21 | | | |

| | New York Transportation Development Corporation, New York, Special Facility Revenue | | | |

| | Bonds, American Airlines, Inc John F Kennedy International Airport Project, Refunding Series 2016: | | | |

| 1,085 | | 5.000%, 8/01/20 (AMT) | No Opt. Call | BB– | 1,079,911 |

| 2,000 | | 5.000%, 8/01/21 (AMT) | No Opt. Call | BB– | 1,984,800 |

| 700 | | New York Transportation Development Corporation, New York, Special Facility Revenue | No Opt. Call | BBB+ | 701,995 |

| | Refunding Bonds, Terminal One Group Association, LP Project, Series 2015, 5.000%, 1/01/21 (AMT) | | | |

| 185 | | Niagara Tobacco Asset Securitization Corporation, New York, Tobacco Settlement | No Opt. Call | N/R | 188,430 |

| | Asset-Backed Bonds, Series 2014, 5.000%, 5/15/21 | | | |

| 1,500 | | Oyster Bay, Nassau County, New York, General Obligation Bonds, Refunding Public | No Opt. Call | AA | 1,585,140 |

| | Improvement Series 2014B, 5.000%, 8/15/21 – BAM Insured | | | |

| 1,000 | | TSASC Inc, New York, Tobacco Settlement Asset-Backed Bonds, Fiscal 2017 Series B, | No Opt. Call | BBB+ | 1,022,650 |

| | 5.000%, 6/01/21 | | | |

| 7,670 | | Total New York | | | 7,826,336 |

21

| | |

| NHA | Nuveen Municipal 2021 Target Term Fund Portfolio of Investments (continued) May 31, 2020 |

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | North Carolina – 0.3% | | | |

| $ 225 | | Goldsboro, North Carolina, General Obligation Bonds, Street Improvement Series 2018, | No Opt. Call | AA | $ 237,739 |

| | 5.000%, 8/01/21 | | | |

| | Ohio – 0.7% | | | |

| 1,000 | | Ohio Air Quality Development Authority, Ohio, Air Quality Development Revenue Bonds, | No Opt. Call | N/R | 5,000 |

| | FirstEnergy Generation Corporation Project, Series 2009A, 5.700%, 8/01/20 (4) | | | |

| 1,400 | | Ohio Air Quality Development Authority, Ohio, Pollution Control Revenue Bonds, | No Opt. Call | N/R | 7,000 |

| | FirstEnergy Nuclear Generation Project, Refunding Series 2008C, 3.950%, 11/01/32 (4) | | | |

| 400 | | Scioto County, Ohio, Hospital Facilities Revenue Bonds, Southern Ohio Medical Center, | No Opt. Call | A3 | 412,492 |

| | Refunding Series 2016, 5.000%, 2/15/21 | | | |

| 205 | | Toledo-Lucas County Port Authority, Ohio, Student Housing Revenue Bonds, CHF-Toledo, | No Opt. Call | BBB– | 209,455 |

| | LLC – The University of Toledo Project, Series 2014A, 5.000%, 7/01/21 | | | |

| 3,005 | | Total Ohio | | | 633,947 |

| | Pennsylvania – 8.8% | | | |

| 800 | | Berks County Municipal Authority, Pennsylvania, Revenue Bonds, Tower Health Project, | No Opt. Call | BBB+ | 813,272 |

| | Series 2020A, 5.000%, 2/01/21 | | | |

| 465 | | Bucks County Industrial Development Authority, Pennsylvania, Revenue Bonds, School Lane | No Opt. Call | BBB– | 471,463 |

| | Charter School Project, Series 2016, 3.125%, 3/15/21 | | | |

| 375 | | Northeastern Pennsylvania Hospital and Education Authority, University Revenue Bonds, | No Opt. Call | BBB | 379,425 |

| | Wilkes University Project, Refunding Series 2016A, 5.000%, 3/01/21 | | | |

| 2,000 | | Pennsylvania Economic Development Financing Authority, Exempt Facilities Revenue | No Opt. Call | CCC+ | 1,989,980 |

| | Refunding Bonds, PPL Energy Supply, LLC Project, Series 2009C, 5.000%, 12/01/37 (Mandatory | | | |

| | Put 9/01/20) | | | |

| 1,250 | | Pennsylvania State, General Obligation Bonds, First Refunding Series 2011-1, 5.000%, 7/01/21 | No Opt. Call | Aa3 | 1,314,175 |

| 2,000 | | Pennsylvania Turnpike Commission, Turnpike Revenue Bonds, Refunding Subordinate Series | No Opt. Call | A3 | 2,074,100 |

| | 2016, 5.000%, 6/01/21 | | | |

| 500 | | Scranton, Lackawanna County, Pennsylvania, General Obligation Bonds, Refunding Series | No Opt. Call | BB+ | 521,415 |

| | 2017, 5.000%, 9/01/21,144A | | | |

| 7,390 | | Total Pennsylvania | | | 7,563,830 |

| | Rhode Island – 0.5% | | | |

| 400 | | Providence Redevelopment Agency, Rhode Island, Revenue Bonds, Public Safety and | No Opt. Call | BBB | 413,432 |

| | Municipal Building Projects, Refunding Series 2015A, 5.000%, 4/01/21 | | | |

| | South Carolina – 0.3% | | | |

| 230 | | South Carolina State, General Obligation State Institution Bonds, University of South | No Opt. Call | Aaa | 238,363 |

| | Carolina, Refunding Series 2011A, 5.000%, 3/01/21 | | | |

| | Tennessee – 2.1% | | | |

| 400 | | Memphis, Tennessee, General Obligation Bonds, Refunding General Improvement Series 2011, | No Opt. Call | AA | 417,560 |

| | 5.000%, 5/01/21 | | | |

| 300 | | Metropolitan Government of Nashville-Davidson County Health and Educational Facilities | No Opt. Call | BBB | 302,829 |

| | Board, Tennessee, Revenue Bonds, Lipscomb University, Refunding & Improvement Series 2016A, | | | |

| | 5.000%, 10/01/20 | | | |

| 710 | | Tennessee Housing Development Agency, Homeownership Program Bonds, Series 2011-1A, | No Opt. Call | AA+ | 724,775 |

| | 4.125%, 1/01/21 (AMT) | | | |

| 260 | | The Tennessee Energy Acquisition Corporation, Gas Revenue Bonds, Series 2006A, | No Opt. Call | A | 270,356 |

| | 5.250%, 9/01/21 | | | |

| 115 | | The Tennessee Energy Acquisition Corporation, Gas Revenue Bonds, Series 2006C, | No Opt. Call | A | 117,438 |

| | 5.000%, 2/01/21 | | | |

| 1,785 | | Total Tennessee | | | 1,832,958 |

22

| | | | | | |

| Principal | | | Optional Call | | |

| Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | Texas – 6.6% | | | |

| $ 135 | | Brazos County, Texas, General Obligation Bonds, Refunding Limited Tax Series 2017, | No Opt. Call | AA | $ 142,980 |

| | 5.000%, 9/01/21 | | | |

| 65 | | Celina, Texas, Special Assessment Revenue Bonds, Glen Crossing Public Improvement | No Opt. Call | N/R | 65,061 |

| | District Phase 1 Project, Series 2016, 3.400%, 9/01/20 | | | |

| | Dallas County Schools, Texas, Public Property Finance Contractual Obligations, Series 2014: | | | |

| 157 | | 4.329%, 6/01/20 (4) | No Opt. Call | B3 | 155,401 |

| 116 | | 5.400%, 6/01/21 (4) | No Opt. Call | B3 | 115,014 |

| 2,000 | | Houston, Texas, Airport System Special Facilities Revenue Bonds, United Airlines Inc | No Opt. Call | BB– | 1,994,900 |

| | Terminal Improvement Project, Refunding Series 2015B-2, 5.000%, 7/15/20 (AMT) | | | |

| 1,250 | | Houston, Texas, Airport System Special Facilities Revenue Bonds, United Airlines Inc | No Opt. Call | BB– | 1,246,812 |

| | Terminal Improvement Project, Refunding Series 2015C, 5.000%, 7/15/20 (AMT) | | | |

| 110 | | La Marque, Galveston County, Texas, Tax and Revenue Certificates of Obligation, Series | No Opt. Call | AA– | 116,445 |

| | 2018, 5.000%, 9/01/21 | | | |

| 500 | | Mesquite Health Facilities Development Corporation, Texas, Retirement Facility Revenue | No Opt. Call | BB– | 495,250 |

| | Bonds, Christian Care Centers Inc, Refunding Series 2016, 5.000%, 2/15/21 | | | |

| 150 | | New Hope Cultural Education Facilities Finance Corporation, Texas, Education Revenue | No Opt. Call | BB | 148,505 |

| | Bonds, Jubilee Academic Center, Series 2016A, 3.375%, 8/15/21,144A | | | |

| 175 | | Polk County, Texas, General Obligation Bonds, Series 2017, 4.000%, 8/15/21 | No Opt. Call | A+ | 182,681 |

| 1,000 | | Texas Public Finance Authority, Revenue Bonds, Texas Southern University Financing | No Opt. Call | AA | 1,015,170 |

| | System, Refunding Series 2013, 5.000%, 11/01/20 – BAM Insured | | | |

| 5,658 | | Total Texas | | | 5,678,219 |

| | Utah – 0.0% | | | |

| 10 | | Utah Charter School Finance Authority, Charter School Revenue Bonds, Paradigm High | No Opt. Call | BB | 10,031 |

| | School, Series 2010A, 5.750%, 7/15/20 | | | |

| | Virgin Islands – 0.3% | | | |

| 285 | | Virgin Islands Water and Power Authority, Electric System Revenue Bonds, Refunding | No Opt. Call | Caa2 | 275,401 |

| | Series 2012A, 4.000%, 7/01/21 | | | |

| | Virginia – 3.2% | | | |

| 1,255 | | Halifax County Industrial Development Authority, Virginia, Recovery Zone Facility | No Opt. Call | BBB+ | 1,255,954 |

| | Revenue Bonds, Virginia Electric & Power Company Project, Series 2010A, 2.150%, 12/01/41 | | | |

| | (Mandatory Put 9/01/20) | | | |

| 1,000 | | Richmond Redevelopment and Housing Authority, Virginia, Multi-Family Housing Revenue | 6/20 at 100.00 | N/R | 1,000,020 |

| | Bonds, American Tobacco Apartments, Series 2017, 3.125%, 7/01/20,144A | | | |

| 500 | | Wise County Industrial Development Authority, Virginia, Solid Waste and Sewage Disposal | No Opt. Call | BBB+ | 500,380 |

| | Revenue Bonds, Virginia Electric and Power Company, Series 2009A, 2.150%, 10/01/40 (Mandatory | | | |

| | Put 9/01/20) | | | |

| 2,755 | | Total Virginia | | | 2,756,354 |

| | Washington – 0.3% | | | |

| 245 | | Washington State Housing Finance Commission, Nonprofit Refunding Revenue Bonds, Wesley | No Opt. Call | N/R | 240,612 |

| | Homes at Lea Hill Project, Series 2016, 3.200%, 7/01/21,144A | | | |

| | Wisconsin – 3.7% | | | |

| 2,100 | | Glendale Community Development Authority, Wisconsin, Community Development Lease Revenue | 9/20 at 100.00 | A1 | 2,111,970 |

| | Bonds, Tax Increment District 7, Refunding Series 2012, 2.600%, 9/01/21 | | | |

| 1,000 | | Superior, Wisconsin, Limited Obligation Revenue Refunding Bonds, Midwest Energy | No Opt. Call | Aa3 | 1,074,540 |

| | Resources Company, Series 1991E, 6.900%, 8/01/21 – FGIC Insured | | | |

| 3,100 | | Total Wisconsin | | | 3,186,510 |

| $ 78,025 | | Total Municipal Bonds (cost $76,340,533) | | | 76,540,584 |

23

| | |

| NHA | Nuveen Municipal 2021 Target Term Fund Portfolio of Investments (continued) May 31, 2020 |

| | | |

| Shares | Description (1) | Value |

| COMMON STOCKS – 3.5% | |

| Electric Utilities – 3.5% | |

| 77,290 | Energy Harbor Corp, (6), (7), (8) | $ 2,975,665 |

| Total Common Stocks (cost $2,571,437) | 2,975,665 |

| Total Long-Term Investments (cost $78,911,970) | 79,516,249 |

| Other Assets Less Liabilities – 7.3% | 6,222,618 |

| Net Assets Applicable to Common Shares – 100% | $ 85,738,867 |

(1) All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted.

(2) Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm.

(3) The ratings disclosed are the lowest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm.

(4) Defaulted security. A security whose issuer has failed to fully pay principal and/or interest when due, or is under the protection of bankruptcy.

(5) Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest.

(6) Common Stock received as part of the bankruptcy settlements for Ohio Air Quality Development Authority, Ohio, Air Quality Development Revenue Bonds, FirstEnergy Generation Corporation Project, Series 2009A, 5.700%, 8/01/20 and Ohio Air Quality Development Authority, Ohio, Pollution Control Revenue Bonds, FirstEnergy Nuclear Generation Project, Refunding Series 2008C, 3.950%, 11/01/32. Subsequent to the end of the reporting period, the value of this common stock has been adversely impacted as compared to the value reported as of May 31, 2020. See Notes to Financial Statements, Note 9 – Subsequent Events for more information.

(7) Non-income producing; issuer has not declared a dividend within the past twelve months.

(8) For fair value measurement disclosure purposes, investment classified as Level 2. See Notes to Financial Statements, Note 3 – Investment Valuation and Fair Value Measurements for more information.

144A Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers.

AMT Alternative Minimum Tax

ETM Escrowed to maturity

See accompanying notes to financial statements.

24

Statement of Assets and Liabilities

May 31, 2020

| Assets | | | |

Long-term investments, at value (cost $78,911,970) | | $ | 79,516,249 | |

Cash | | | 4,929,055 | |

Receivable for: | | | | |

| Interest | | | 1,109,784 | |

| Investments sold | | | 390,000 | |

| Other assets | | | 3,794 | |

Total assets | | | 85,948,882 | |

| Liabilities | | | | |

Payable for dividends | | | 109,597 | |

Accrued expenses: | | | | |

| Management fees | | | 40,419 | |

| Custodian fees | | | 14,991 | |

| Professional fees | | | 29,214 | |

| Trustees fees | | | 814 | |

| Other | | | 14,980 | |

Total liabilities | | | 210,015 | |

Net assets applicable to common shares | | $ | 85,738,867 | |

Common shares outstanding | | | 8,622,711 | |

Net asset value (“NAV”) per common share outstanding | | $ | 9.94 | |

| Net assets applicable to common shares consist of: | | | | |

Common shares, $0.01 par value per share | | $ | 86,227 | |

Paid-in surplus | | | 84,523,872 | |

Total distributable earnings | | | 1,128,768 | |

Net assets applicable to common shares | | $ | 85,738,867 | |

Authorized shares: | | | | |

| Common | | Unlimited | |

| Preferred | | Unlimited | |

See accompanying notes to financial statements.

25

Year Ended May 31, 2020

| Investment Income | | $ | 2,235,954 | |

| Expenses | | | | |

Management fees | | | 475,136 | |

Custodian fees | | | 28,154 | |

Trustees fees | | | 2,195 | |

Professional fees | | | 33,485 | |

Shareholder reporting expenses | | | 23,273 | |

Shareholder servicing agent fees | | | 7,968 | |

Stock exchange listing fees | | | 6,884 | |

Investor relations expenses | | | 5,492 | |

Other | | | 12,906 | |

Total expenses | | | 595,493 | |

Net investment income (loss) | | | 1,640,461 | |

| Realized and Unrealized Gain (Loss) | | | | |

Net realized gain (loss) from investments | | | (372,332 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 763,272 | |

Net realized and unrealized gain (loss) | | | 390,940 | |

Net increase (decrease) in net assets applicable to common shares from operations | | $ | 2,031,401 | |

See accompanying notes to financial statements.

26

Statement of Changes in Net Assets

| | | | | | | |

| | Year | | | Year | |

| | Ended | | | Ended | |

| | 5/31/20 | | | 5/31/19 | |

| Operations | | | | | | |

Net investment income (loss) | | $ | 1,640,461 | | | $ | 1,973,753 | |

Net realized gain (loss) from investments | | | (372,332 | ) | | | (31,162 | ) |

Change in net unrealized appreciation (depreciation) of investments | | | 763,272 | | | | 1,154,673 | |

Net increase (decrease) in net assets applicable to common shares from operations | | | 2,031,401 | | | | 3,097,264 | |

| Distributions to Common Shareholders | | | | | | | | |

Dividends | | | (1,500,352 | ) | | | (1,590,890 | ) |

Decrease in net assets applicable to common shares from distributions to common shareholders | | | (1,500,352 | ) | | | (1,590,890 | ) |

Net increase (decrease) in net assets applicable to common shares | | | 531,049 | | | | 1,506,374 | |

Net assets applicable to common shares at the beginning of period | | | 85,207,818 | | | | 83,701,444 | |

Net assets applicable to common shares at the end of period | | $ | 85,738,867 | | | $ | 85,207,818 | |

See accompanying notes to financial statements.

27

| | | | | | | | | | | |

| | | | | | |

|

|

|

Selected data for a common share outstanding throughout each period: | | | | |

|

| | | | | | | | | | | | | | Less Distributions to | | | | | | | | | | |

| | | | | Investment Operations | | | Common Shareholders | | | Common Share | |

| | Beginning | | | Net | | | Net | | | | | | From | | | From | | | | | | | | | | | | | |

| | Common | | | Investment | | | Realized/ | | | | | | Net | | | Accumulated | | | | | | | | | | | | Ending | |

| | Share | | | Income | | | Unrealized | | | | | | Investment | | | Net Realized | | | | | | Offering | | | Ending | | | Share | |

| | NAV | | | (Loss) | | | Gain (Loss) | | | Total | | | Income | | | Gains | | | Total | | | Costs | | | NAV | | | Price | |

Year Ended 5/31: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2020 | | $ | 9.88 | | | $ | 0.19 | | | $ | 0.04 | | | $ | 0.23 | | | $ | (0.17 | ) | | $ | — | | | $ | (0.17 | ) | | $ | — | | | $ | 9.94 | | | $ | 9.73 | |

2019 | | | 9.71 | | | | 0.23 | | | | 0.12 | | | | 0.35 | | | | (0.18 | ) | | | — | | | | (0.18 | ) | | | — | | | | 9.88 | | | | 9.60 | |

2018 | | | 9.70 | | | | 0.25 | | | | (0.03 | ) | | | 0.22 | | | | (0.21 | ) | | | — | | | | (0.21 | ) | | | — | | | | 9.71 | | | | 9.45 | |

2017 | | | 9.91 | | | | 0.26 | | | | (0.23 | ) | | | 0.03 | | | | (0.24 | ) | | | — | | | | (0.24 | ) | | | — | | | | 9.70 | | | | 9.76 | |

2016(d) | | | 9.85 | | | | 0.07 | | | | 0.07 | | | | 0.14 | | | | (0.06 | ) | | | — | | | | (0.06 | ) | | | (0.02 | ) | | | 9.91 | | | | 9.95 | |

| | VMTP Shares |

| | at the End of Period |

| Aggregate | | | Asset |

| | Amount | | | Coverage |

| Outstanding

| | | Per $100,000

|