UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23124

Franklin Templeton ETF Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur

One Franklin Parkway

San Mateo, CA 94403-1096

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650-312-2000

Date of fiscal year end: March 31, 2024

Date of reporting period: September 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

| a) | The following is a copy of the report transmitted to shareholders pursuant to Rule30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1.) |

| b) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not applicable.

The Semi-Annual Report to Stockholders is filed herewith.

| | |

Franklin Emerging Market Core Dividend Tilt Index ETF | |

DIEM | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Emerging Market Core Dividend Tilt Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin Emerging Market Core Dividend Tilt Index ETF | $10 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $14,308,945 |

Total Number of Portfolio Holdings* | 578 |

Portfolio Turnover Rate | 28.82% |

| * | Does not include derivatives, except purchased options, if any. |

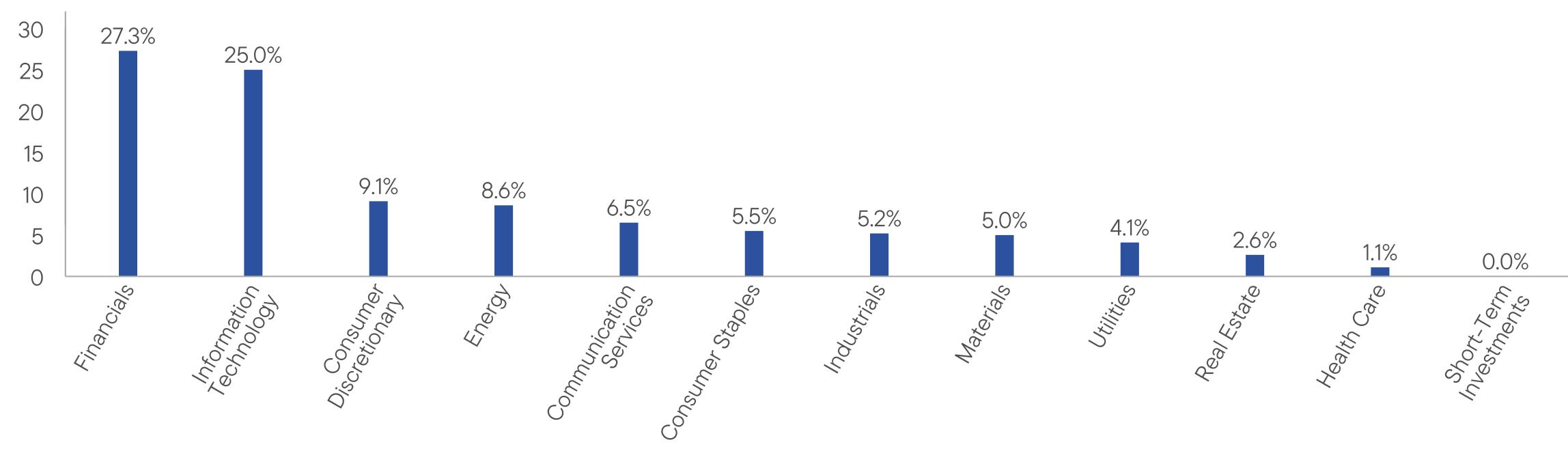

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Emerging Market Core Dividend Tilt Index ETF | PAGE 1 | DIEM-STSR-1124 |

27.325.09.18.66.55.55.25.04.12.61.10.0

| | |

Franklin International Core Dividend Tilt Index ETF | |

DIVI | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin International Core Dividend Tilt Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin International Core Dividend Tilt Index ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $1,001,483,104 |

Total Number of Portfolio Holdings* | 467 |

Portfolio Turnover Rate | 14.78% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Portfolio Composition* | % of Total Investments |

Financials | 23.6% |

Industrials | 12.9% |

Health Care | 11.8% |

Consumer Discretionary | 11.3% |

Information Technology | 9.6% |

Materials | 7.2% |

Consumer Staples | 7.0% |

Utilities | 5.0% |

Communication Services | 4.7% |

Energy | 3.8% |

Real Estate | 3.0% |

Short-Term Investments | 0.1% |

| |

Geographic Composition* | % of Total Investments |

Europe | 60.2% |

Asia | 27.5% |

Australia & New Zealand | 11.0% |

North America | 0.7% |

Middle East & Africa | 0.5% |

Short-Term Investments | 0.1% |

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Core Dividend Tilt Index ETF | PAGE 1 | DIVI-STSR-1124 |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin International Core Dividend Tilt Index ETF | PAGE 2 | DIVI-STSR-1124 |

| | |

Franklin U.S. Core Dividend Tilt Index ETF | |

UDIV | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Core Dividend Tilt Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Core Dividend Tilt Index ETF | $3 | 0.06% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $35,702,668 |

Total Number of Portfolio Holdings* | 283 |

Portfolio Turnover Rate | 7.75% |

| * | Does not include derivatives, except purchased options, if any. |

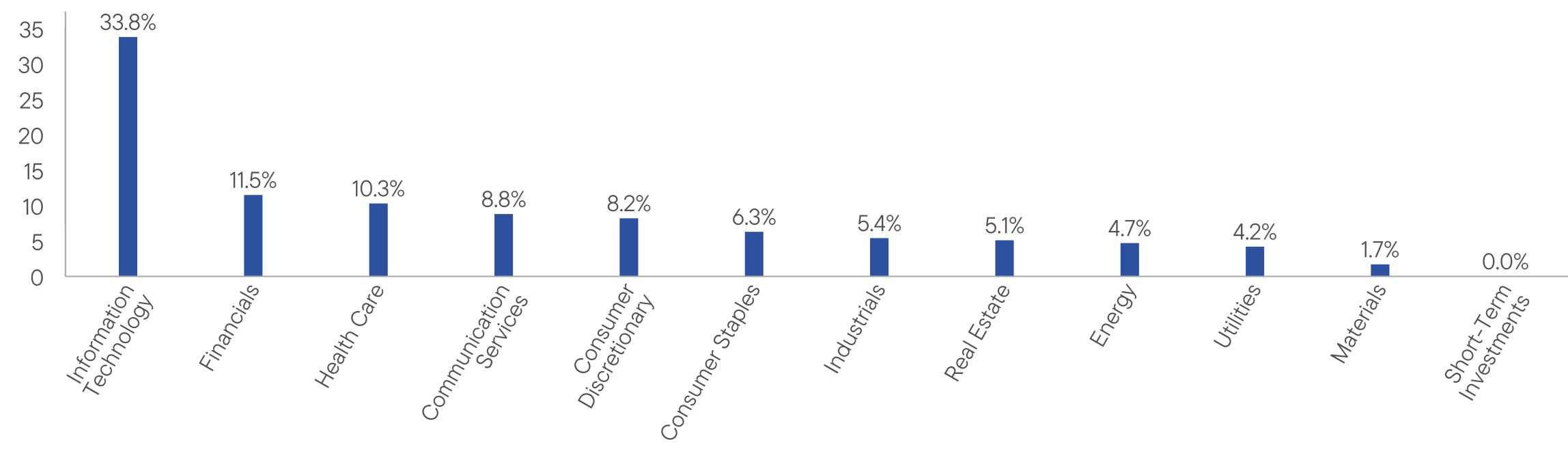

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Core Dividend Tilt Index ETF | PAGE 1 | UDIV-STSR-1124 |

33.811.510.38.88.26.35.45.14.74.21.70.0

| | |

Franklin U.S. Large Cap Multifactor Index ETF | |

FLQL | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Large Cap Multifactor Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Large Cap Multifactor Index ETF | $8 | 0.15% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $1,358,514,639 |

Total Number of Portfolio Holdings* | 215 |

Portfolio Turnover Rate | 27.63% |

| * | Does not include derivatives, except purchased options, if any. |

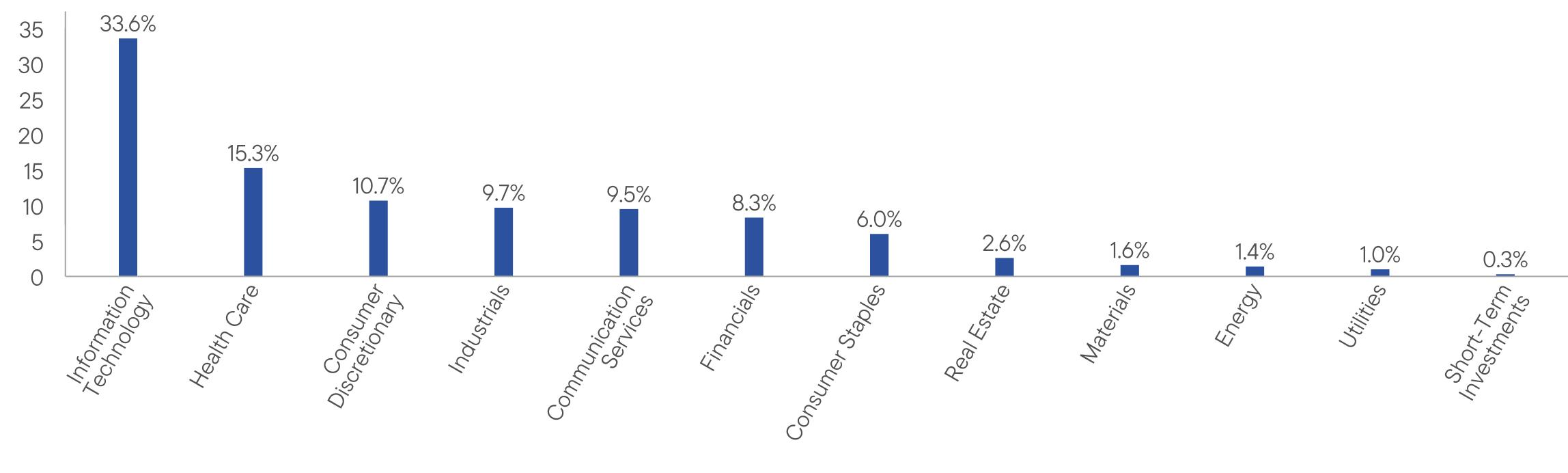

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Large Cap Multifactor Index ETF | PAGE 1 | FLQL-STSR-1124 |

33.615.310.79.79.58.36.02.61.61.41.00.3

| | |

Franklin U.S. Mid Cap Multifactor Index ETF | |

FLQM | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Mid Cap Multifactor Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Mid Cap Multifactor Index ETF | $15 | 0.30% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $1,037,146,231 |

Total Number of Portfolio Holdings* | 206 |

Portfolio Turnover Rate | 12.12% |

| * | Does not include derivatives, except purchased options, if any. |

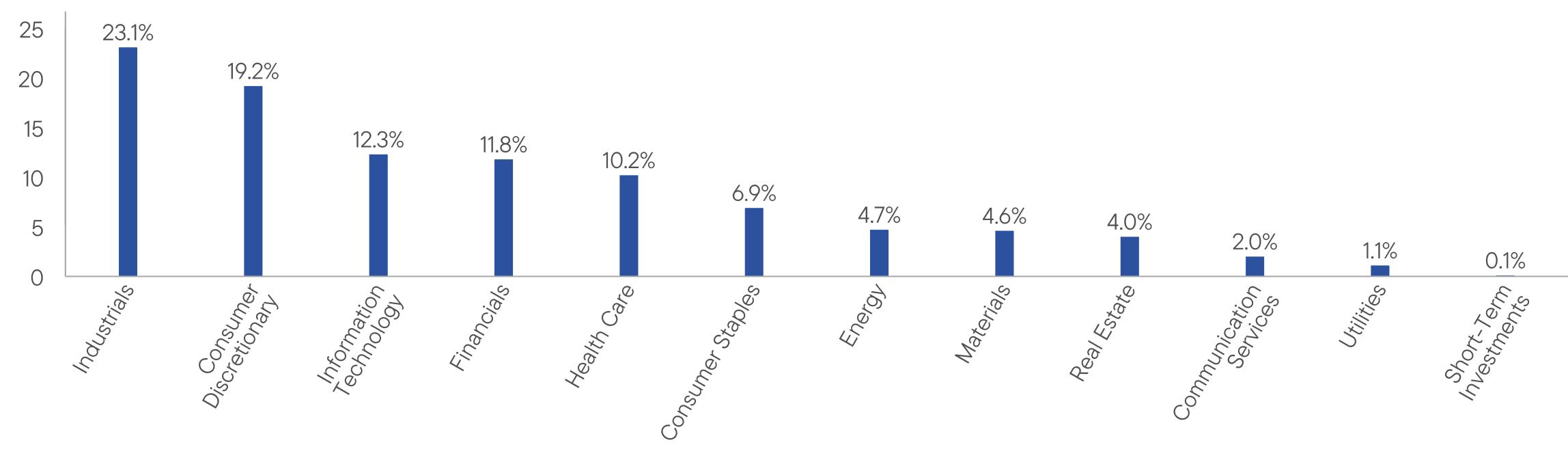

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Mid Cap Multifactor Index ETF | PAGE 1 | FLQM-STSR-1124 |

23.119.212.311.810.26.94.74.64.02.01.10.1

| | |

Franklin U.S. Small Cap Multifactor Index ETF | |

FLQS | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Small Cap Multifactor Index ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Small Cap Multifactor Index ETF | $18 | 0.35% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $42,328,976 |

Total Number of Portfolio Holdings* | 494 |

Portfolio Turnover Rate | 11.53% |

| * | Does not include derivatives, except purchased options, if any. |

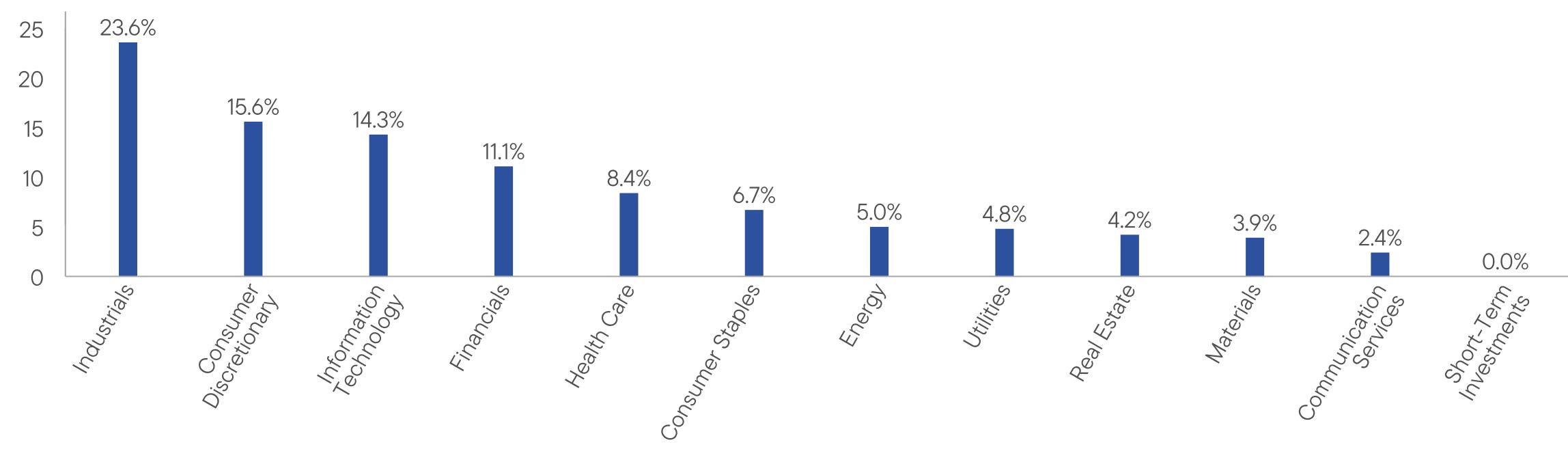

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Small Cap Multifactor Index ETF | PAGE 1 | FLQS-STSR-1124 |

23.615.614.311.18.46.75.04.84.23.92.40.0

| | |

Franklin Disruptive Commerce ETF | |

BUYZ | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Disruptive Commerce ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Disruptive Commerce ETF | $26 | 0.50% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $10,309,728 |

Total Number of Portfolio Holdings* | 47 |

Portfolio Turnover Rate | 1.79% |

| * | Does not include derivatives, except purchased options, if any. |

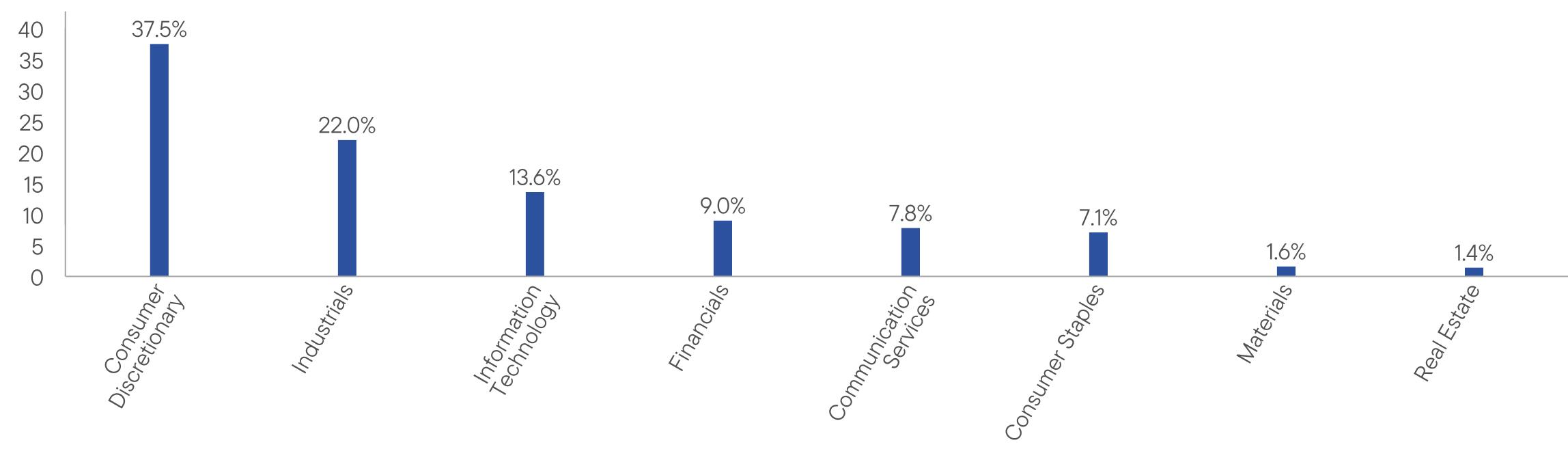

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Disruptive Commerce ETF | PAGE 1 | BUYZ-STSR-1124 |

37.522.013.69.07.87.11.61.4

| | |

Franklin Dynamic Municipal Bond ETF | |

FLMI | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Dynamic Municipal Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Dynamic Municipal Bond ETF | $15 | 0.30% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $323,020,276 |

Total Number of Portfolio Holdings* | 604 |

Portfolio Turnover Rate | 29.29% |

| * | Does not include derivatives, except purchased options, if any. |

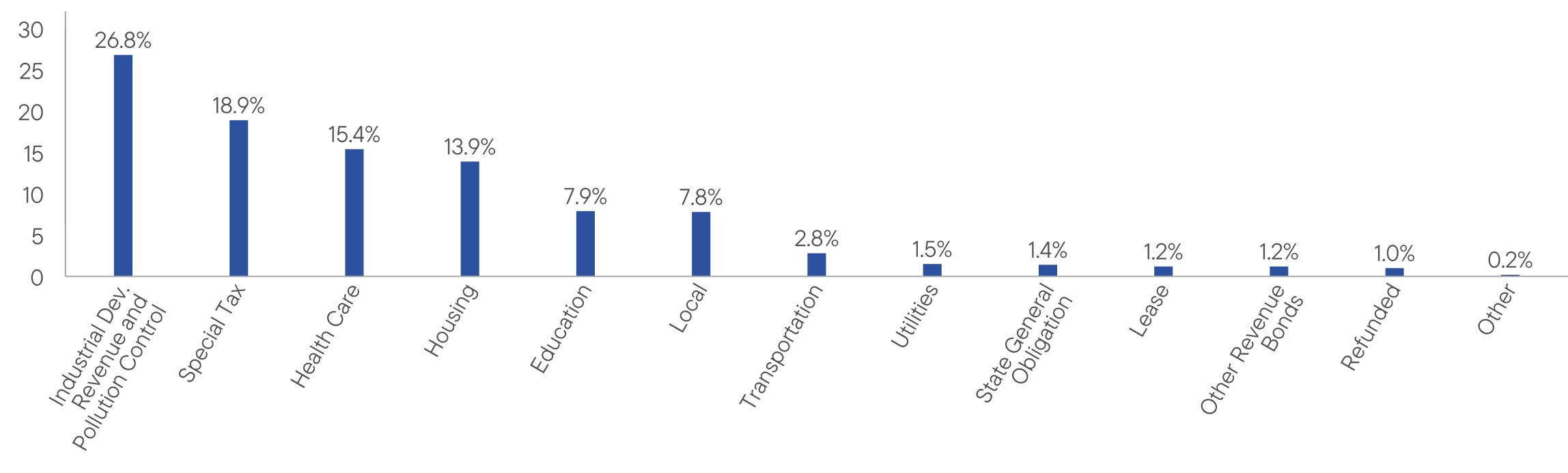

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Dynamic Municipal Bond ETF | PAGE 1 | FLMI-STSR-1124 |

26.818.915.413.97.97.82.81.51.41.21.21.00.2

| | |

Franklin Exponential Data ETF | |

XDAT | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Exponential Data ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin Exponential Data ETF | $25 | 0.49% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $5,935,700 |

Total Number of Portfolio Holdings* | 42 |

Portfolio Turnover Rate | 2.95% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Exponential Data ETF | PAGE 1 | XDAT-STSR-1124 |

67.216.56.66.11.52.1

| | |

Franklin Focused Growth ETF | |

FFOG | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Focused Growth ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin Focused Growth ETF | $29 | 0.55% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $124,869,552 |

Total Number of Portfolio Holdings* | 28 |

Portfolio Turnover Rate | 5.96% |

| * | Does not include derivatives, except purchased options, if any. |

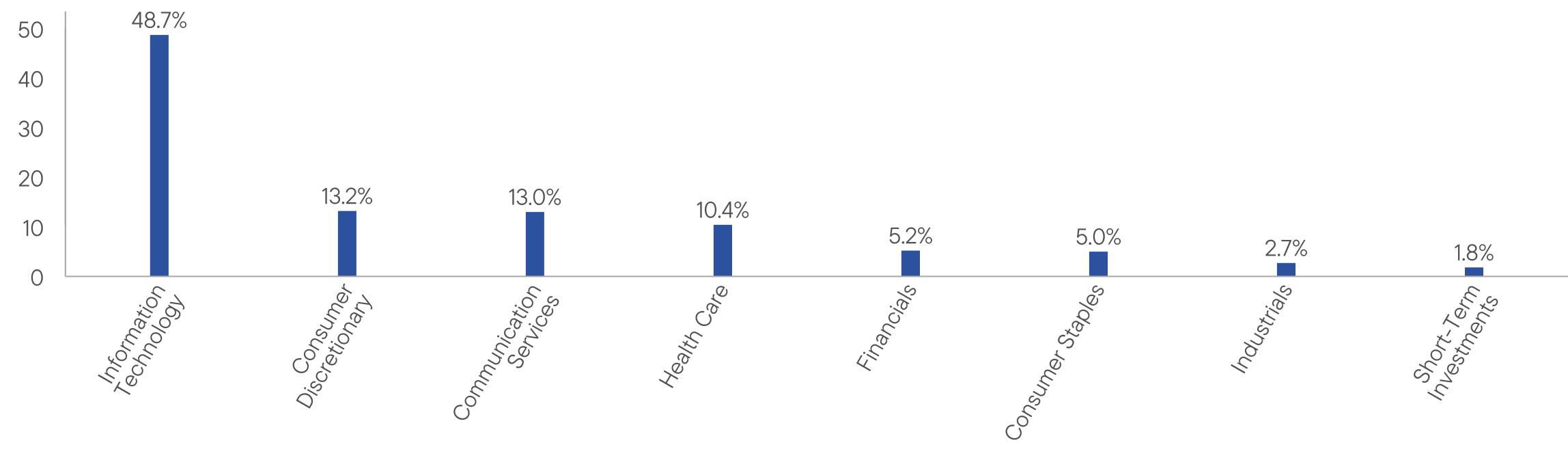

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Focused Growth ETF | PAGE 1 | FFOG-STSR-1124 |

48.713.213.010.45.25.02.71.8

| | |

Franklin Genomic Advancements ETF | |

HELX | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Genomic Advancements ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Genomic Advancements ETF | $25 | 0.50% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $9,720,388 |

Total Number of Portfolio Holdings* | 60 |

Portfolio Turnover Rate | 5.37% |

| * | Does not include derivatives, except purchased options, if any. |

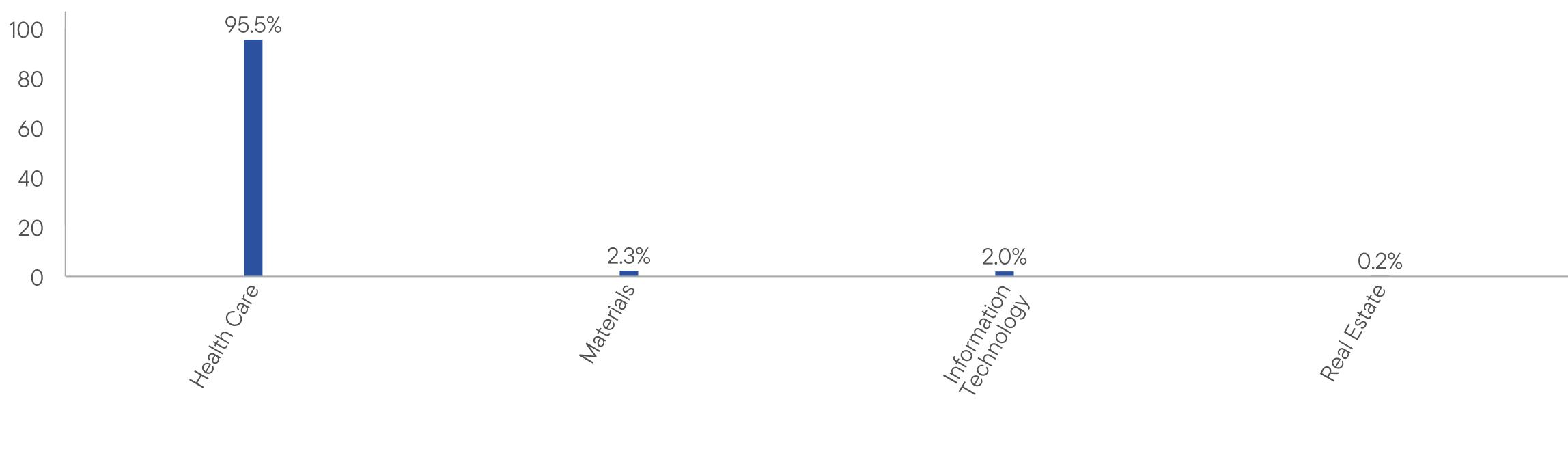

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Genomic Advancements ETF | PAGE 1 | HELX-STSR-1124 |

95.52.32.00.2

| | |

Franklin High Yield Corporate ETF | |

FLHY | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin High Yield Corporate ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin High Yield Corporate ETF | $21 | 0.40% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $573,901,475 |

Total Number of Portfolio Holdings* | 250 |

Portfolio Turnover Rate | 13.05% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

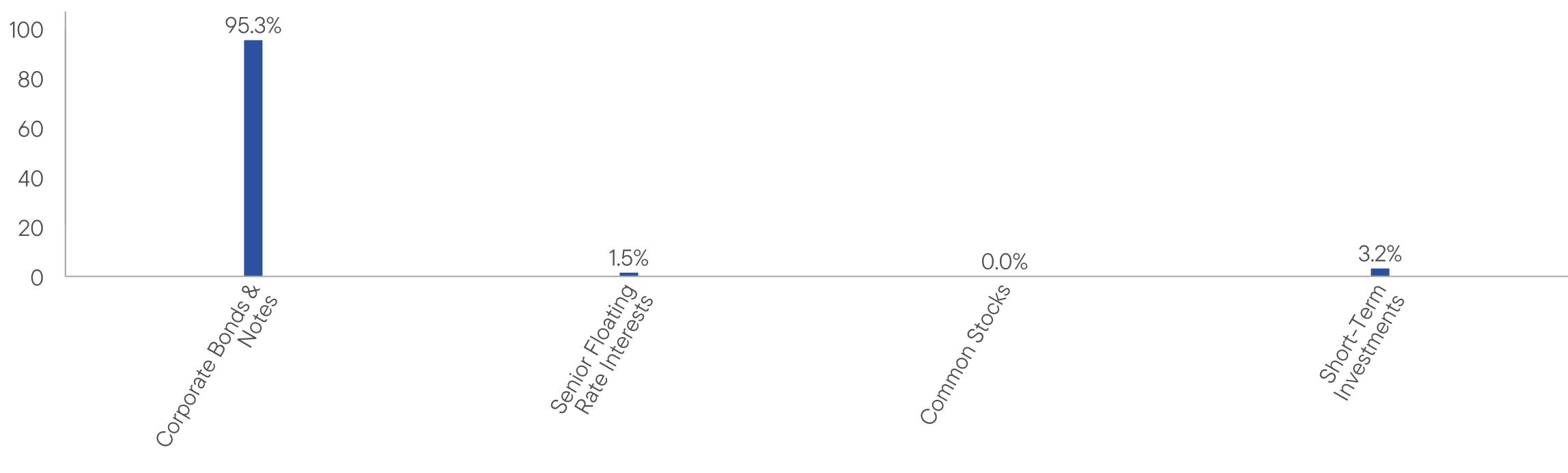

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin High Yield Corporate ETF | PAGE 1 | FLHY-STSR-1124 |

95.31.50.03.2

| | |

Franklin Income Equity Focus ETF | |

INCE | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Income Equity Focus ETF (previously known as Franklin U.S. Low Volatility ETF) for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Income Equity Focus ETF | $15 | 0.29% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $96,117,012 |

Total Number of Portfolio Holdings* | 73 |

Portfolio Turnover Rate | 5.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

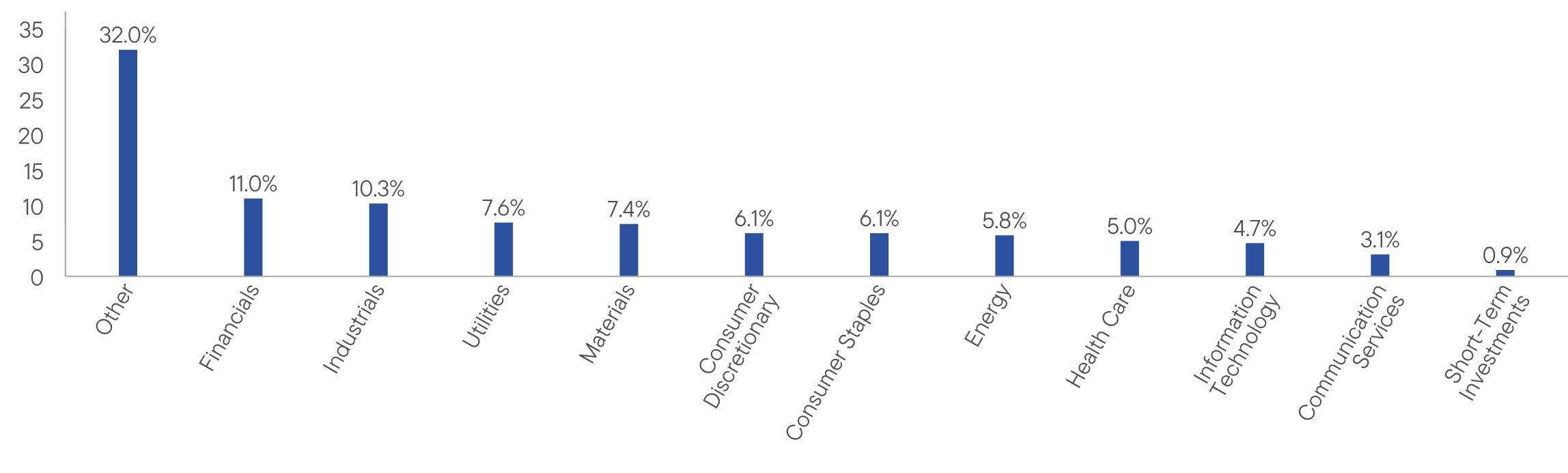

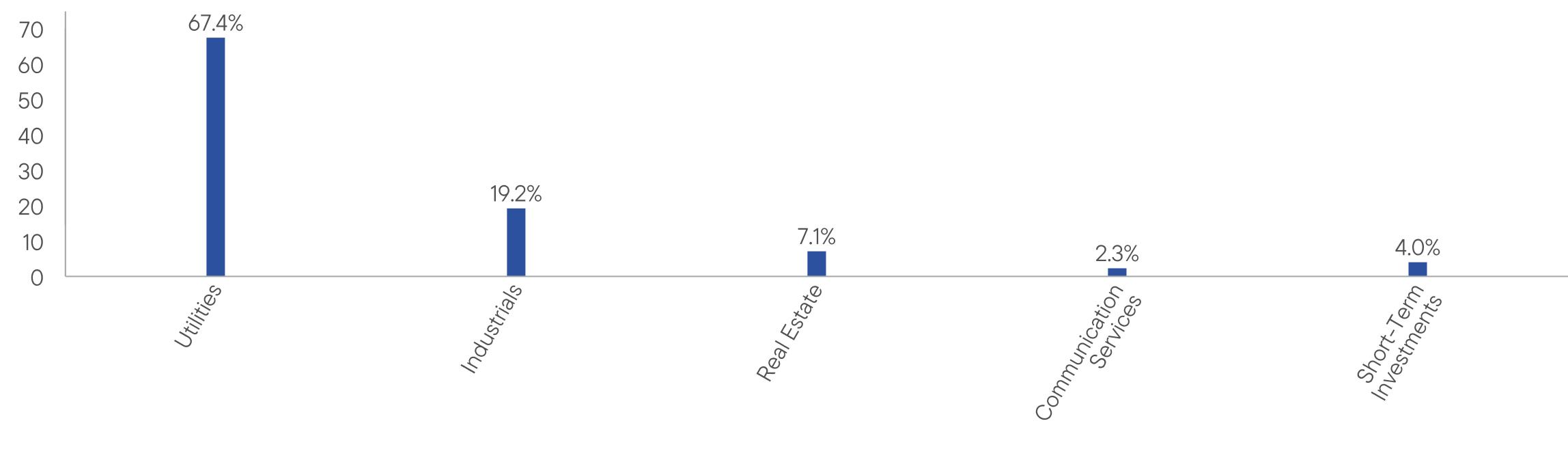

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Income Equity Focus ETF | PAGE 1 | INCE-STSR-1124 |

32.011.010.37.67.46.16.15.85.04.73.10.9

| | |

Franklin Income Focus ETF | |

INCM | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Income Focus ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Income Focus ETF | $20 | 0.38% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $331,089,654 |

Total Number of Portfolio Holdings* | 225 |

Portfolio Turnover Rate | 14.56% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

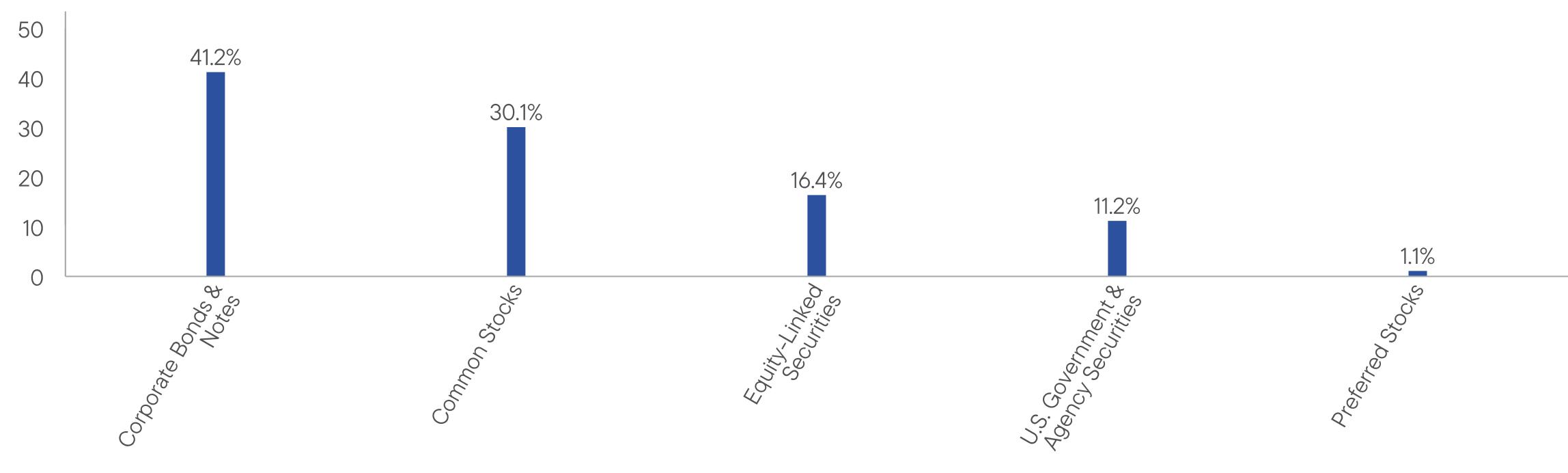

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Income Focus ETF | PAGE 1 | INCM-STSR-1124 |

41.230.116.411.21.1

| | |

Franklin Intelligent Machines ETF | |

IQM | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Intelligent Machines ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Intelligent Machines ETF | $26 | 0.50% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $25,309,849 |

Total Number of Portfolio Holdings* | 56 |

Portfolio Turnover Rate | 5.23% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

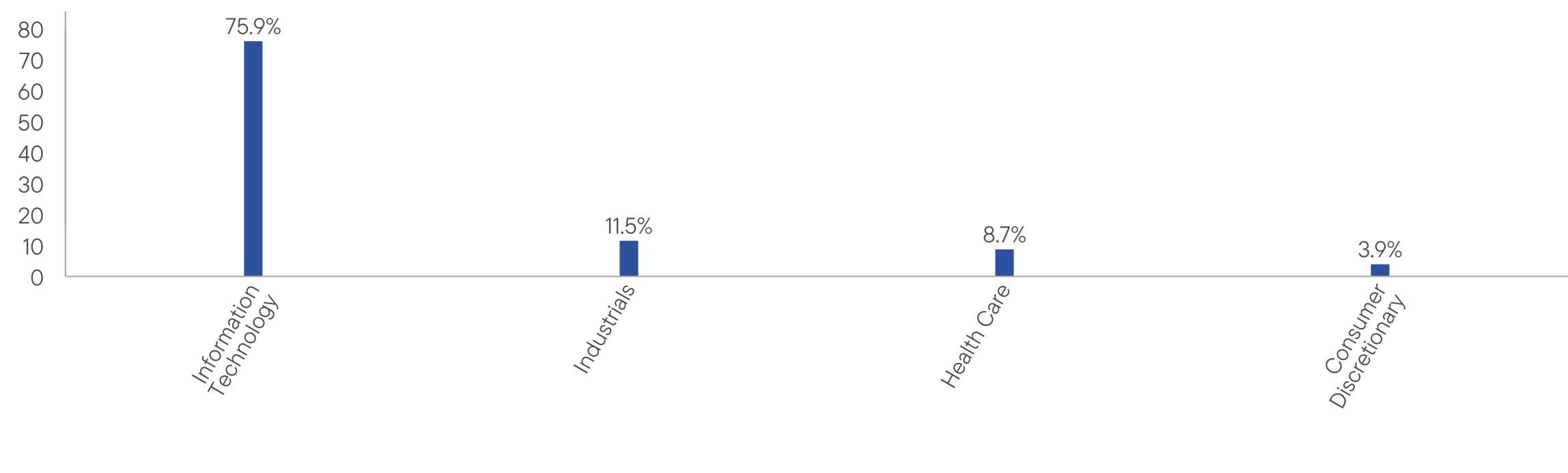

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Intelligent Machines ETF | PAGE 1 | IQM-STSR-1124 |

75.911.58.73.9

| | |

Franklin International Aggregate Bond ETF | |

FLIA | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin International Aggregate Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin International Aggregate Bond ETF | $13 | 0.25% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $583,559,826 |

Total Number of Portfolio Holdings* | 84 |

Portfolio Turnover Rate | 11.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Portfolio Composition* | % of Total Investments |

Foreign Government and Agency Securities | 97.0% |

Corporate Bonds & Notes | 2.7% |

Short-Term Investments | 0.3% |

| |

Geographic Composition* | % of Total Investments |

Europe | 46.3% |

Asia | 37.2% |

Supranationals | 6.0% |

North America | 5.2% |

Australia & New Zealand | 3.0% |

Latin America & Caribbean | 1.1% |

Middle East & Africa | 0.9% |

Short-Term Investments | 0.3% |

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin International Aggregate Bond ETF | PAGE 1 | FLIA-STSR-1124 |

| | |

Franklin Investment Grade Corporate ETF | |

FLCO | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Investment Grade Corporate ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Investment Grade Corporate ETF | $18 | 0.35% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $579,919,649 |

Total Number of Portfolio Holdings* | 192 |

Portfolio Turnover Rate | 17.70% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

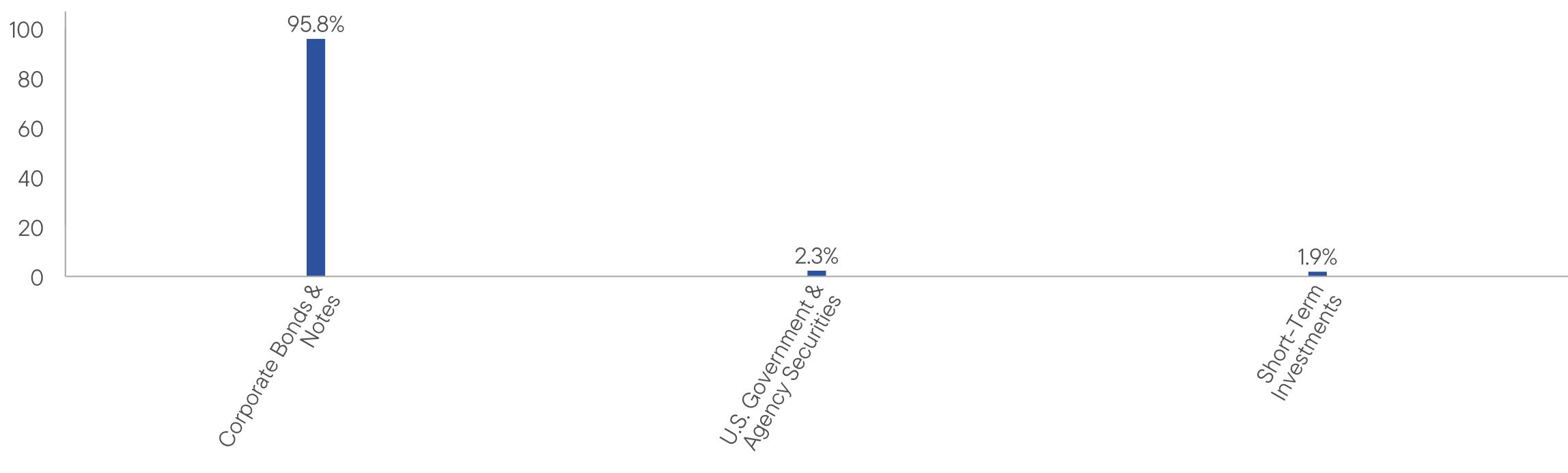

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Investment Grade Corporate ETF | PAGE 1 | FLCO-STSR-1124 |

95.82.31.9

| | |

Franklin Municipal Green Bond ETF | |

FLMB | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Municipal Green Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Municipal Green Bond ETF | $15 | 0.30% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $107,553,147 |

Total Number of Portfolio Holdings* | 133 |

Portfolio Turnover Rate | 14.45% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

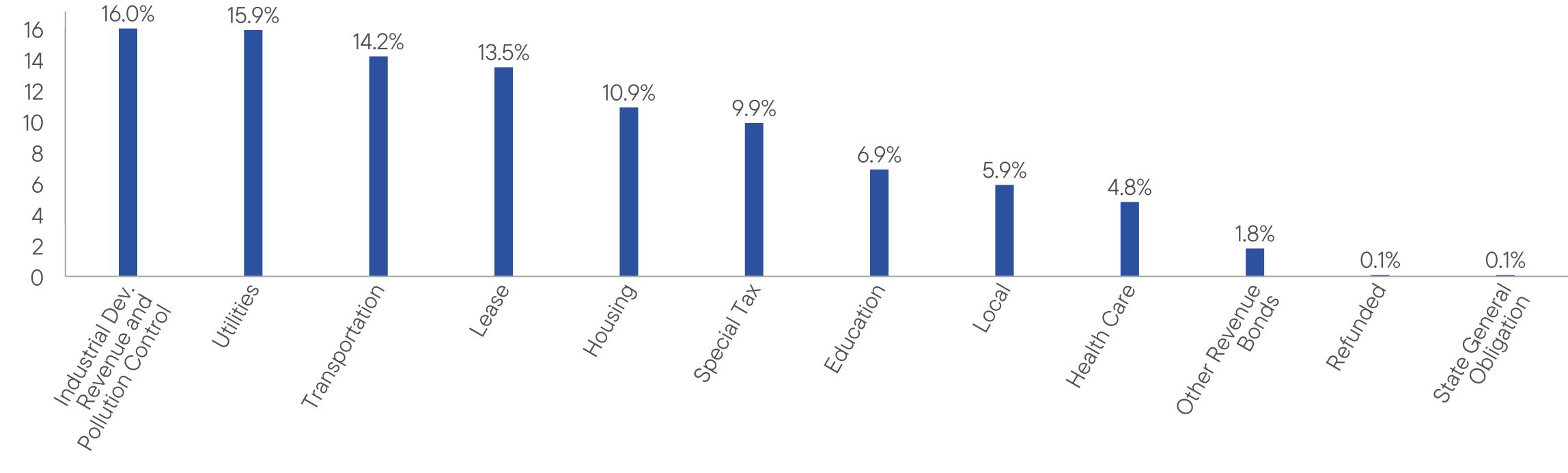

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Municipal Green Bond ETF | PAGE 1 | FLMB-STSR-1124 |

16.015.914.213.510.99.96.95.94.81.80.10.1

| | |

Franklin Senior Loan ETF | |

FLBL | Cboe BZX Exchange, Inc.CboeBZX |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Senior Loan ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Franklin Senior Loan ETF | $23 | 0.45% |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $586,516,720 |

Total Number of Portfolio Holdings* | 271 |

Portfolio Turnover Rate | 7.92% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

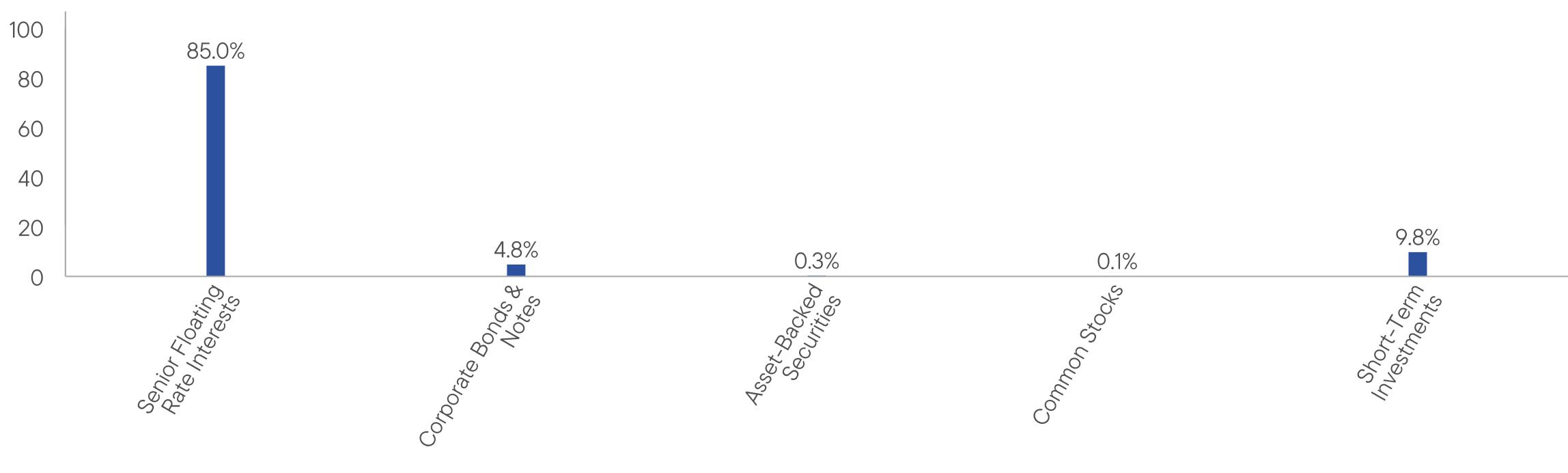

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Senior Loan ETF | PAGE 1 | FLBL-STSR-1124 |

85.04.80.30.19.8

| | |

Franklin Systematic Style Premia ETF | |

FLSP | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Systematic Style Premia ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin Systematic Style Premia ETF | $31 | 0.62% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $205,770,210 |

Total Number of Portfolio Holdings* | 336 |

Portfolio Turnover Rate | 58.20% |

| * | Does not include derivatives, except purchased options, if any. |

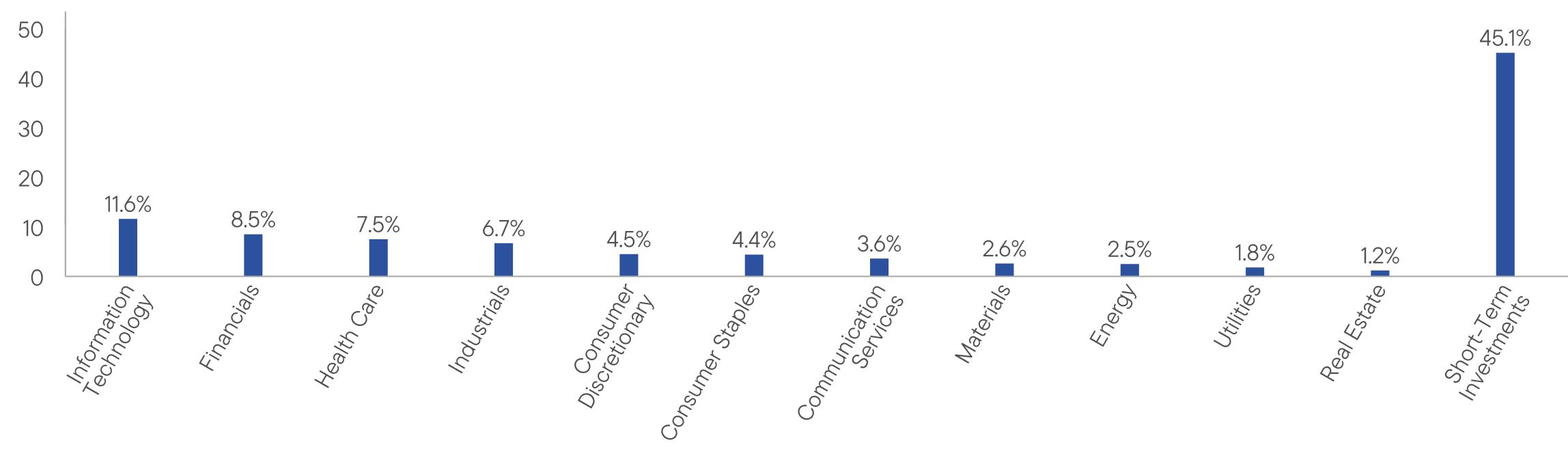

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Systematic Style Premia ETF | PAGE 1 | FLSP-STSR-1124 |

11.68.57.56.74.54.43.62.62.51.81.245.1

| | |

Franklin U.S. Core Bond ETF | |

FLCB | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Core Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Core Bond ETF | $8 | 0.15% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $2,372,441,204 |

Total Number of Portfolio Holdings* | 397 |

Portfolio Turnover Rate | 9.93% |

| * | Does not include derivatives, except purchased options, if any. |

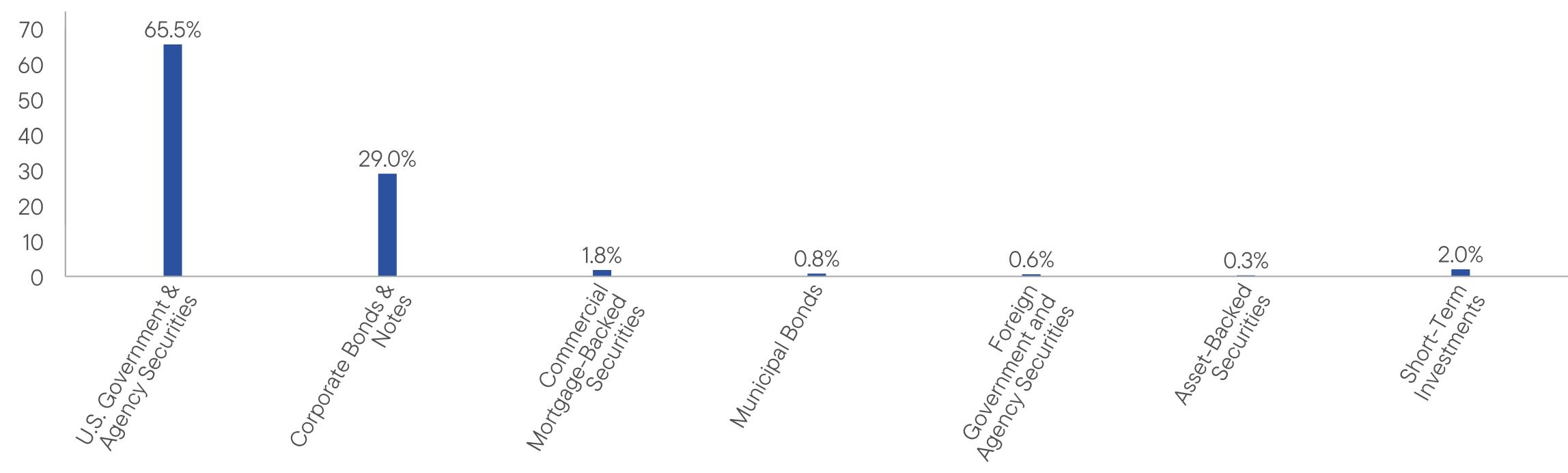

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

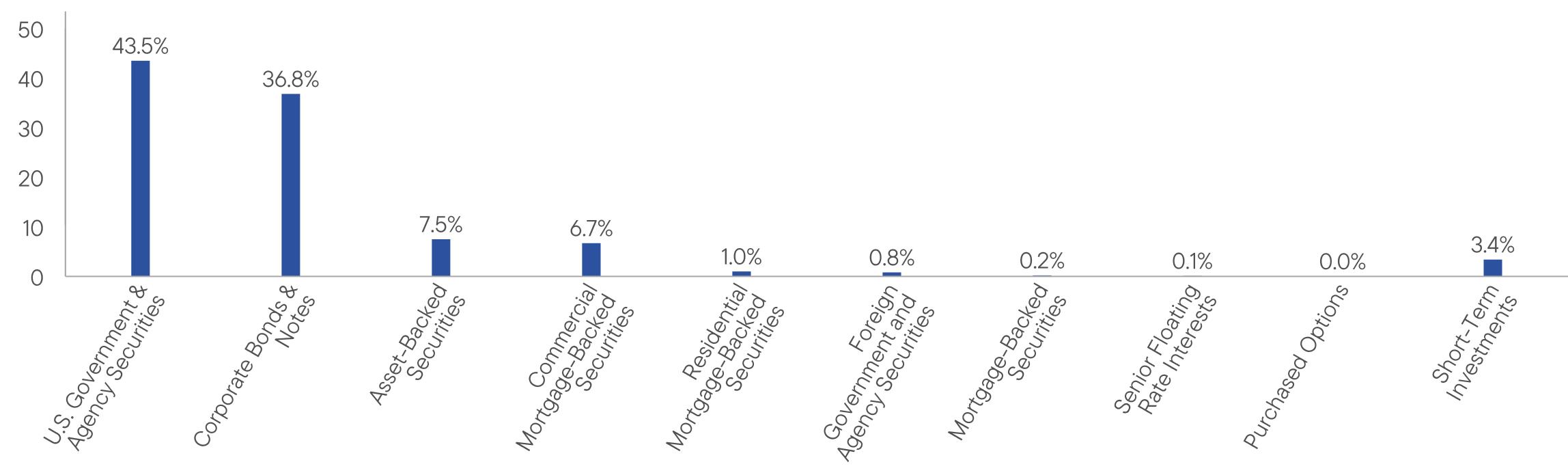

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Core Bond ETF | PAGE 1 | FLCB-STSR-1124 |

65.529.01.80.80.60.32.0

| | |

Franklin U.S. Treasury Bond ETF | |

FLGV | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin U.S. Treasury Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin U.S. Treasury Bond ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $886,948,865 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 102.49% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Treasury Bond ETF | PAGE 1 | FLGV-STSR-1124 |

99.60.4

| | |

Franklin Ultra Short Bond ETF | |

FLUD | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Ultra Short Bond ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin Ultra Short Bond ETF | $4 | 0.07% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $6,242,950 |

Total Number of Portfolio Holdings* | 36 |

Portfolio Turnover Rate | 74.68% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Ultra Short Bond ETF | PAGE 1 | FLUD-STSR-1124 |

67.432.6

| | |

Franklin FTSE Asia Ex Japan ETF | |

FLAX | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Asia Ex Japan ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Asia Ex Japan ETF | $10 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $30,317,607 |

Total Number of Portfolio Holdings* | 1,567 |

Portfolio Turnover Rate | 2.64% |

| * | Does not include derivatives, except purchased options, if any. |

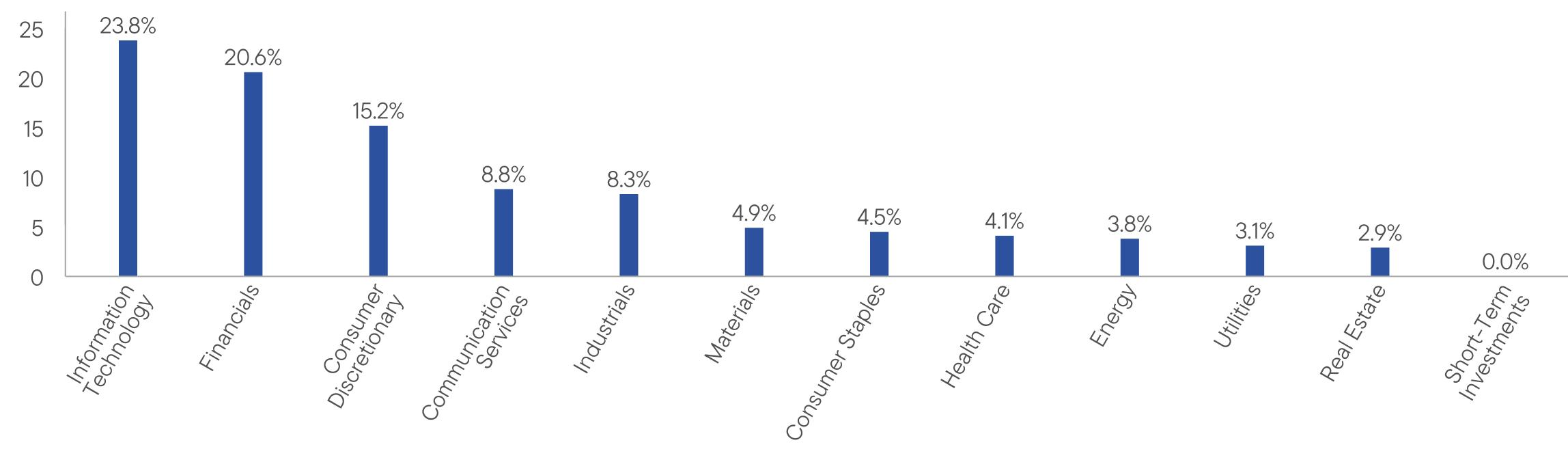

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Asia Ex Japan ETF | PAGE 1 | FLAX-STSR-1124 |

23.820.615.28.88.34.94.54.13.83.12.90.0

| | |

Franklin FTSE Australia ETF | |

FLAU | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Australia ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Australia ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $59,935,602 |

Total Number of Portfolio Holdings* | 106 |

Portfolio Turnover Rate | 2.28% |

| * | Does not include derivatives, except purchased options, if any. |

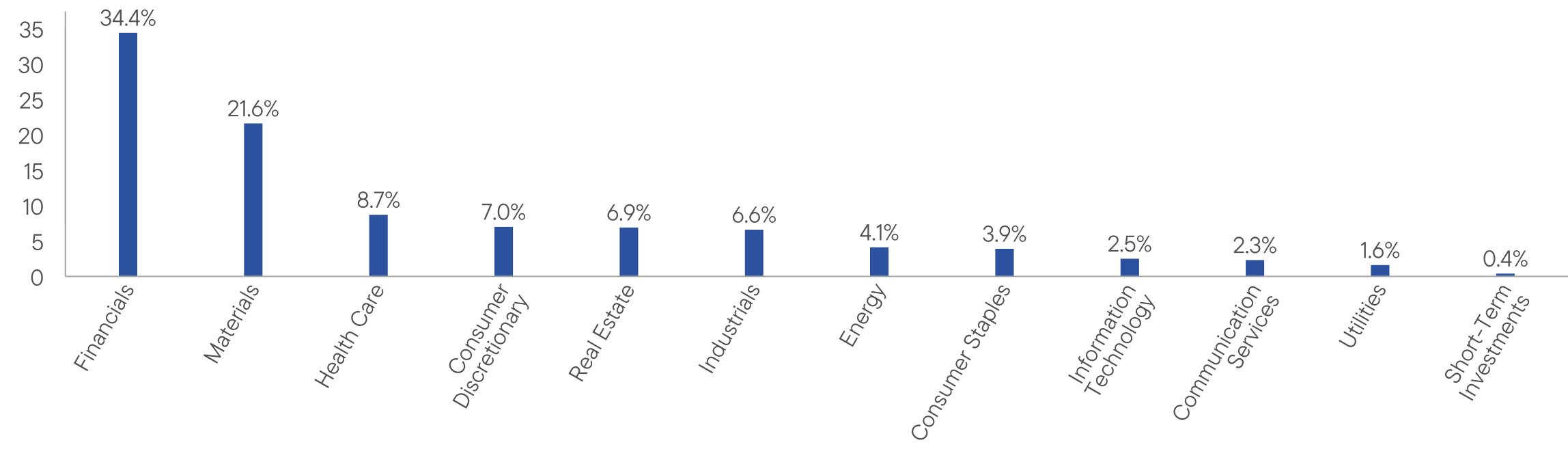

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Australia ETF | PAGE 1 | FLAU-STSR-1124 |

34.421.68.77.06.96.64.13.92.52.31.60.4

| | |

Franklin FTSE Brazil ETF | |

FLBR | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Brazil ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Brazil ETF | $9 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $164,862,294 |

Total Number of Portfolio Holdings* | 84 |

Portfolio Turnover Rate | 9.32% |

| * | Does not include derivatives, except purchased options, if any. |

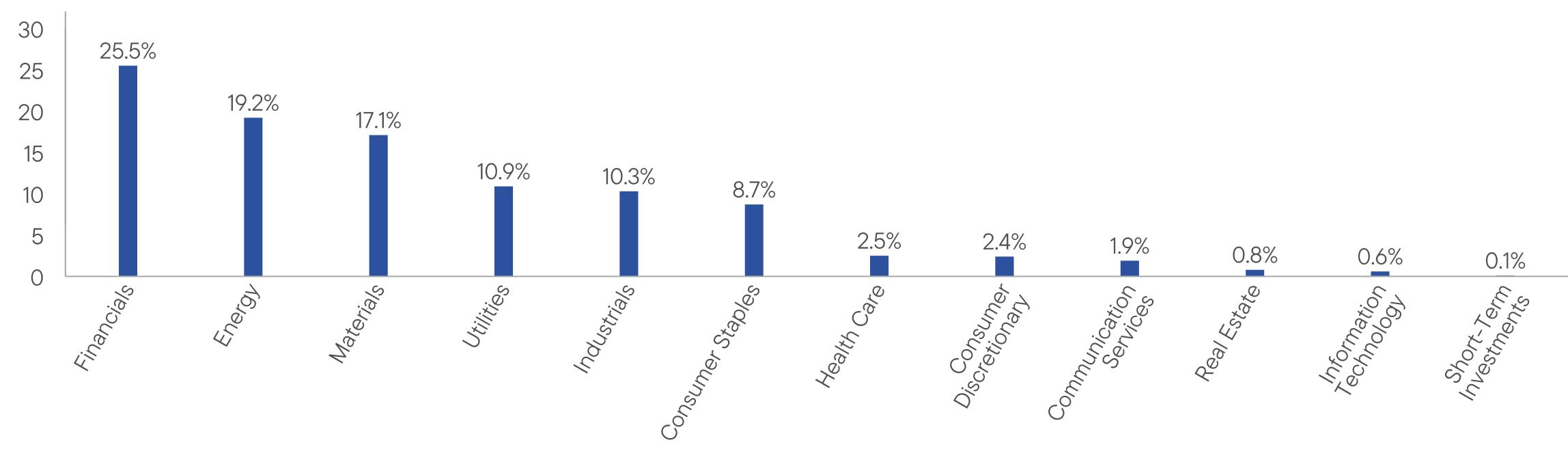

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Brazil ETF | PAGE 1 | FLBR-STSR-1124 |

25.519.217.110.910.38.72.52.41.90.80.60.1

| | |

Franklin FTSE Canada ETF | |

FLCA | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Canada ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Canada ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $412,387,329 |

Total Number of Portfolio Holdings* | 51 |

Portfolio Turnover Rate | 1.88% |

| * | Does not include derivatives, except purchased options, if any. |

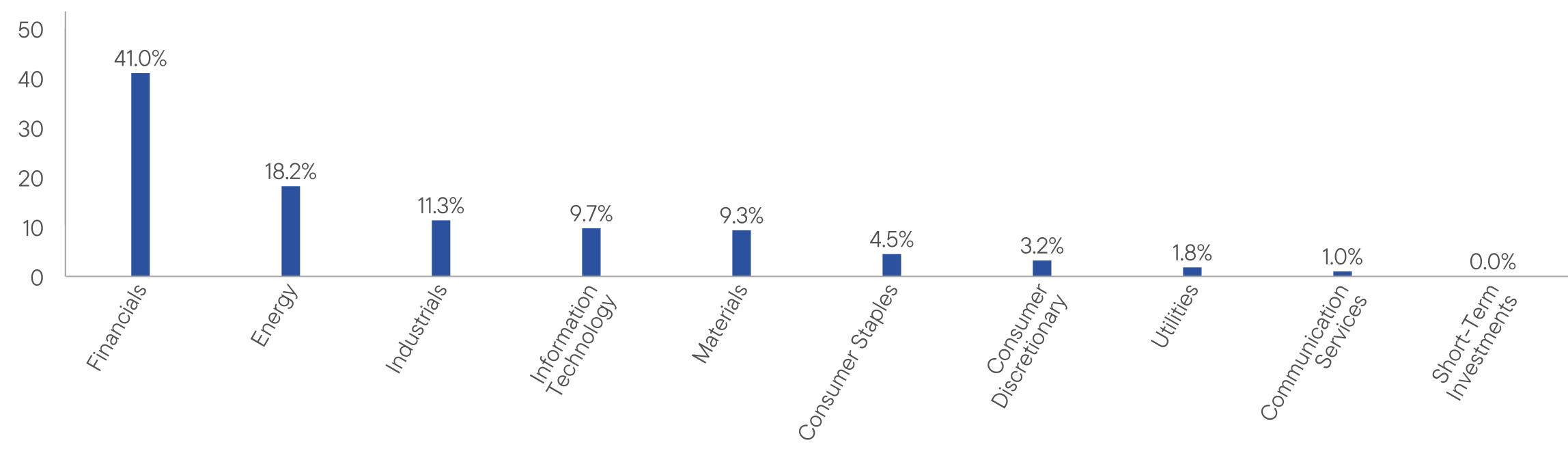

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Canada ETF | PAGE 1 | FLCA-STSR-1124 |

41.018.211.39.79.34.53.21.81.00.0

| | |

Franklin FTSE China ETF | |

FLCH | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE China ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE China ETF | $11 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $139,562,756 |

Total Number of Portfolio Holdings* | 951 |

Portfolio Turnover Rate | 5.63% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE China ETF | PAGE 1 | FLCH-STSR-1124 |

31.519.316.66.05.84.64.63.63.22.52.30.0

| | |

Franklin FTSE Europe ETF | |

FLEE | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Europe ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Europe ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $86,873,740 |

Total Number of Portfolio Holdings* | 521 |

Portfolio Turnover Rate | 3.67% |

| * | Does not include derivatives, except purchased options, if any. |

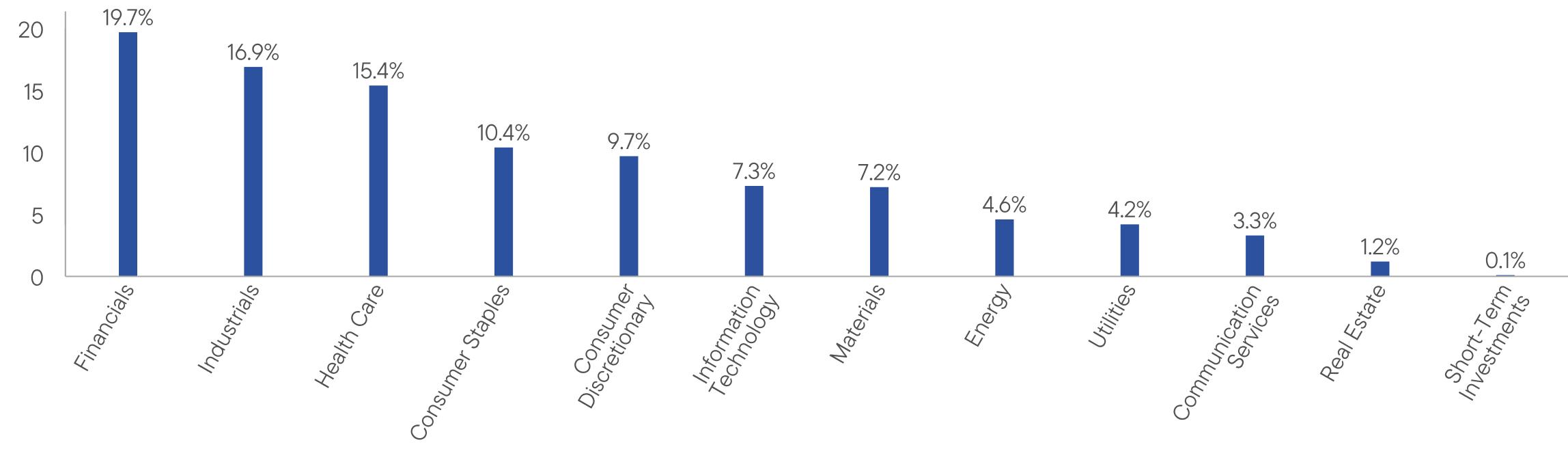

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Europe ETF | PAGE 1 | FLEE-STSR-1124 |

19.716.915.410.49.77.37.24.64.23.31.20.1

| | |

Franklin FTSE Eurozone ETF | |

FLEU | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Eurozone ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Eurozone ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $21,478,090 |

Total Number of Portfolio Holdings* | 270 |

Portfolio Turnover Rate | 2.37% |

| * | Does not include derivatives, except purchased options, if any. |

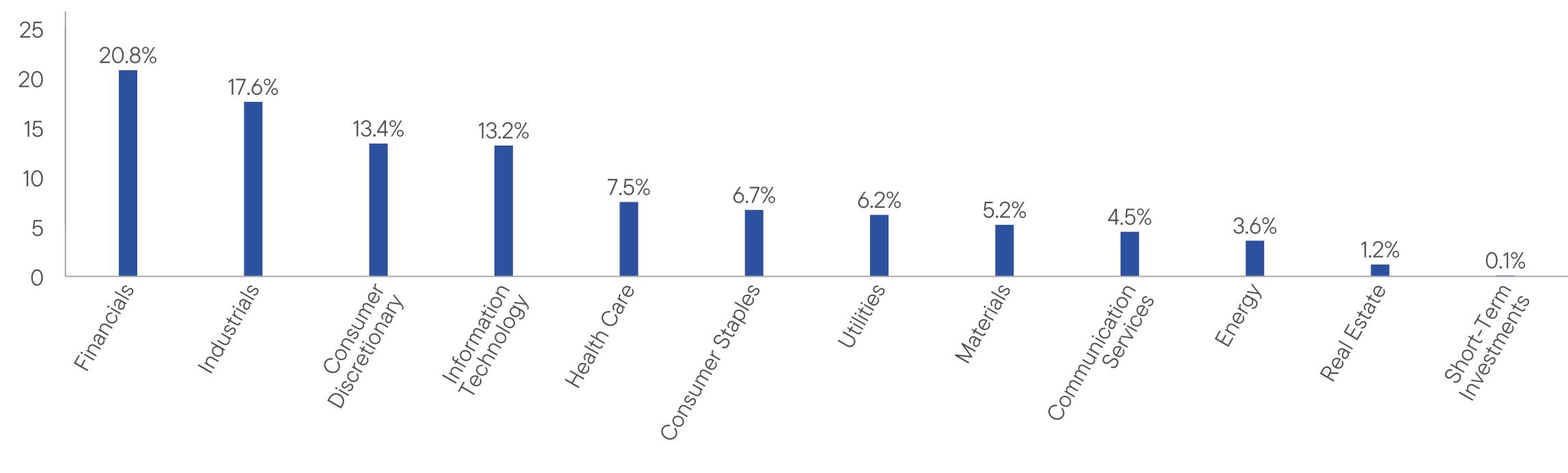

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Eurozone ETF | PAGE 1 | FLEU-STSR-1124 |

20.817.613.413.27.56.76.25.24.53.61.20.1

| | |

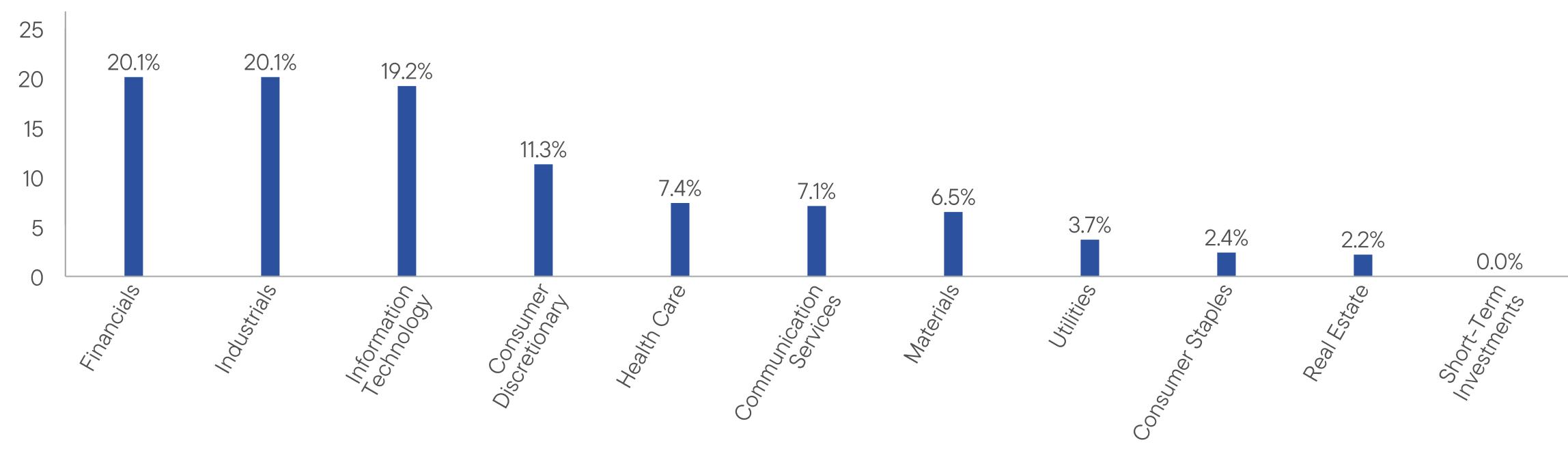

Franklin FTSE Germany ETF | |

FLGR | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Germany ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Germany ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $31,809,006 |

Total Number of Portfolio Holdings* | 69 |

Portfolio Turnover Rate | 2.38% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Germany ETF | PAGE 1 | FLGR-STSR-1124 |

20.120.119.211.37.47.16.53.72.42.20.0

| | |

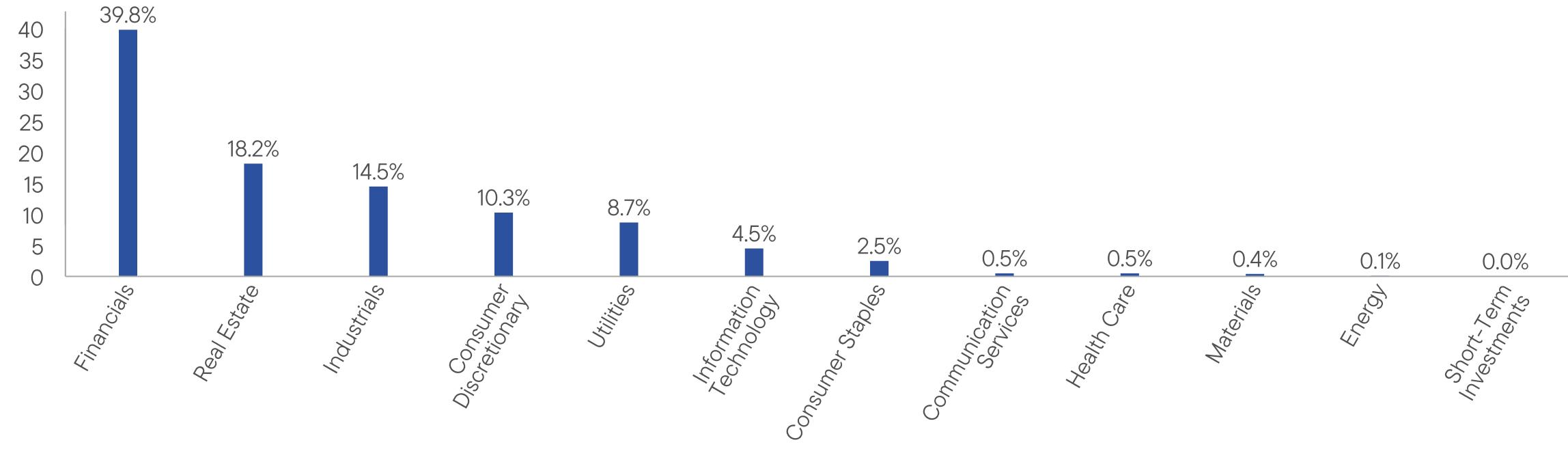

Franklin FTSE Hong Kong ETF | |

FLHK | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Hong Kong ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Hong Kong ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $13,733,981 |

Total Number of Portfolio Holdings* | 72 |

Portfolio Turnover Rate | 3.94% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Hong Kong ETF | PAGE 1 | FLHK-STSR-1124 |

39.818.214.510.38.74.52.50.50.50.40.10.0

| | |

Franklin FTSE India ETF | |

FLIN | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE India ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE India ETF | $10 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $1,812,150,182 |

Total Number of Portfolio Holdings* | 245 |

Portfolio Turnover Rate | 2.83% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE India ETF | PAGE 1 | FLIN-STSR-1124 |

23.212.811.110.09.39.26.95.85.54.01.50.7

| | |

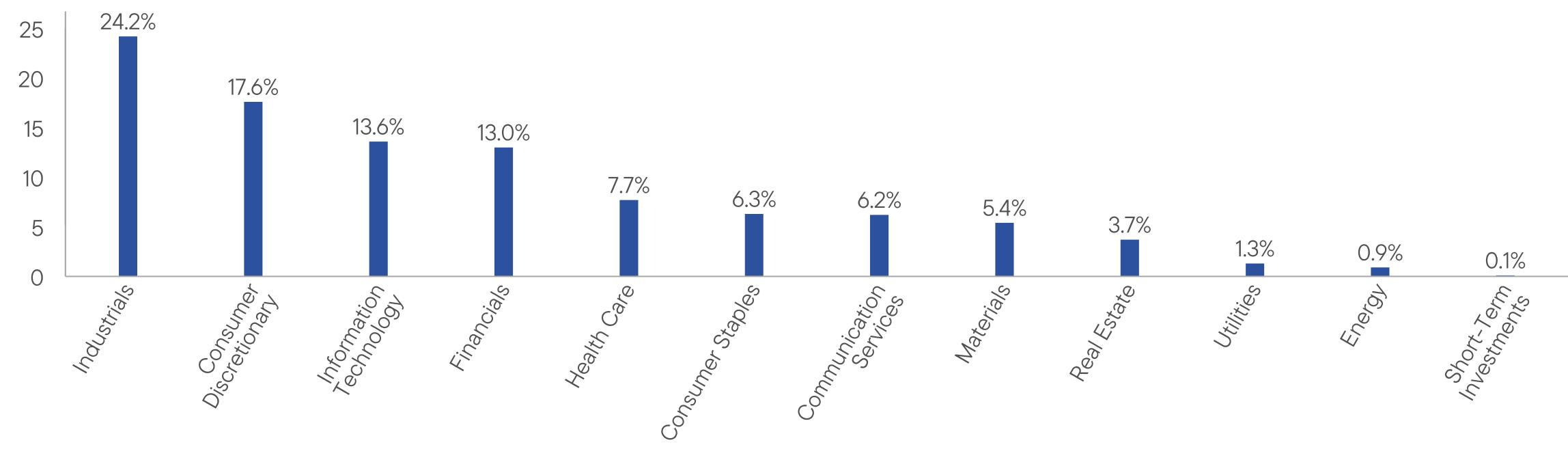

Franklin FTSE Japan ETF | |

FLJP | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Japan ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Japan ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $2,100,944,485 |

Total Number of Portfolio Holdings* | 497 |

Portfolio Turnover Rate | 2.24% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Japan ETF | PAGE 1 | FLJP-STSR-1124 |

24.217.613.613.07.76.36.25.43.71.30.90.1

| | |

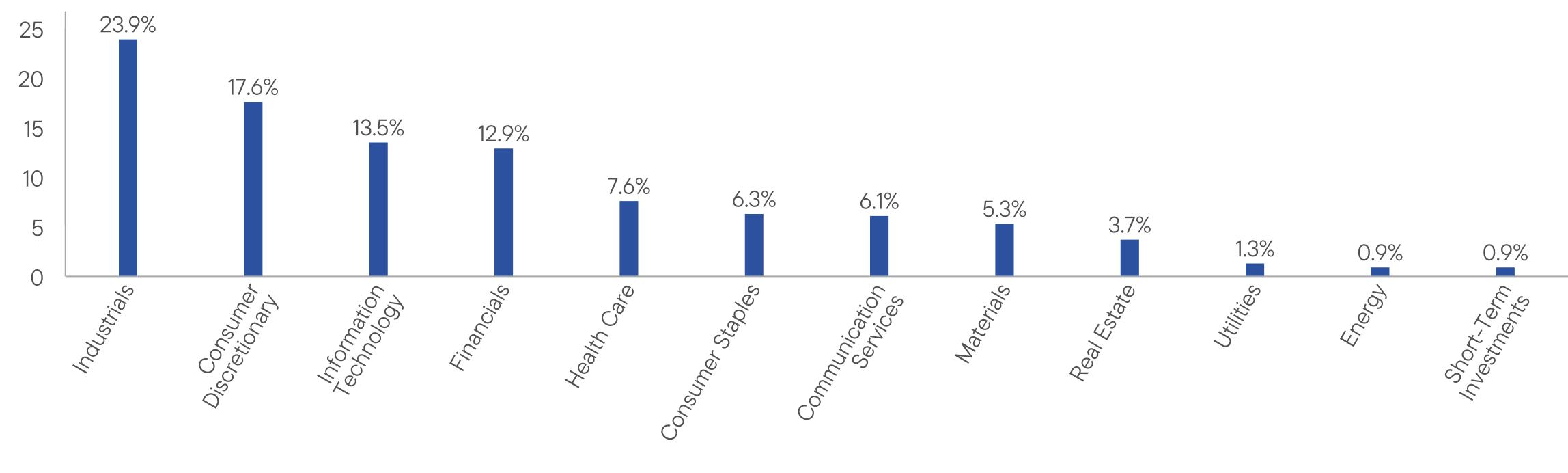

Franklin FTSE Japan Hedged ETF | |

FLJH | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Japan Hedged ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Japan Hedged ETF | $4 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $72,846,338 |

Total Number of Portfolio Holdings* | 487 |

Portfolio Turnover Rate | 8.61% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Japan Hedged ETF | PAGE 1 | FLJH-STSR-1124 |

23.917.613.512.97.66.36.15.33.71.30.90.9

| | |

Franklin FTSE Latin America ETF | |

FLLA | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Latin America ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Latin America ETF | $9 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $52,180,559 |

Total Number of Portfolio Holdings* | 147 |

Portfolio Turnover Rate | 4.45% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Latin America ETF | PAGE 1 | FLLA-STSR-1124 |

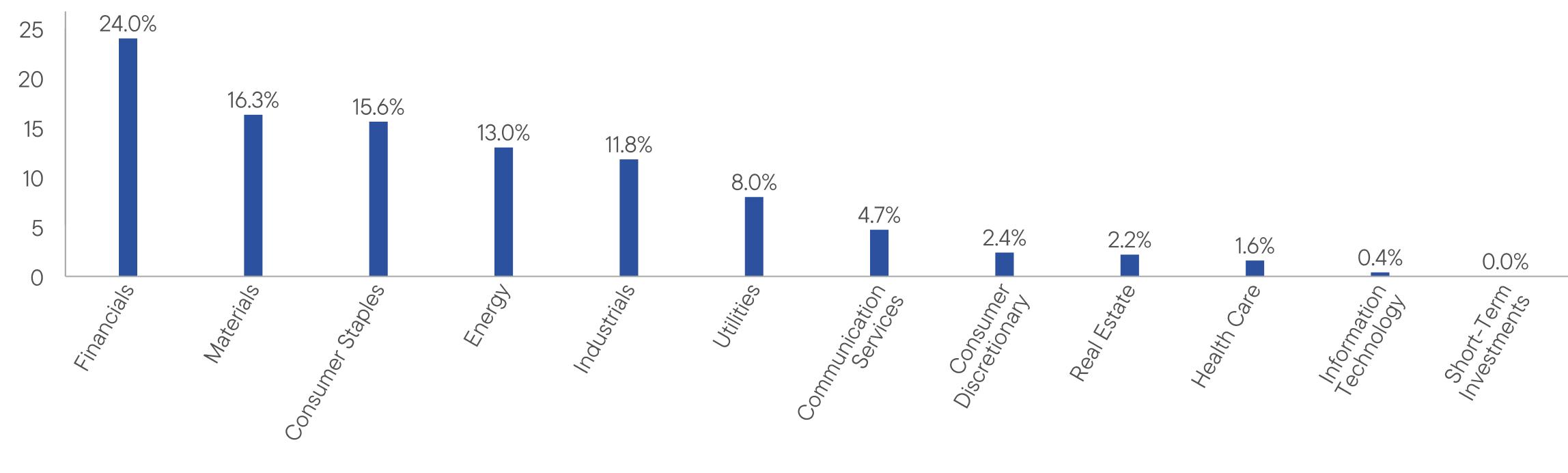

24.016.315.613.011.88.04.72.42.21.60.40.0

| | |

Franklin FTSE Mexico ETF | |

FLMX | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Mexico ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Mexico ETF | $9 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $94,929,551 |

Total Number of Portfolio Holdings* | 40 |

Portfolio Turnover Rate | 4.23% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Mexico ETF | PAGE 1 | FLMX-STSR-1124 |

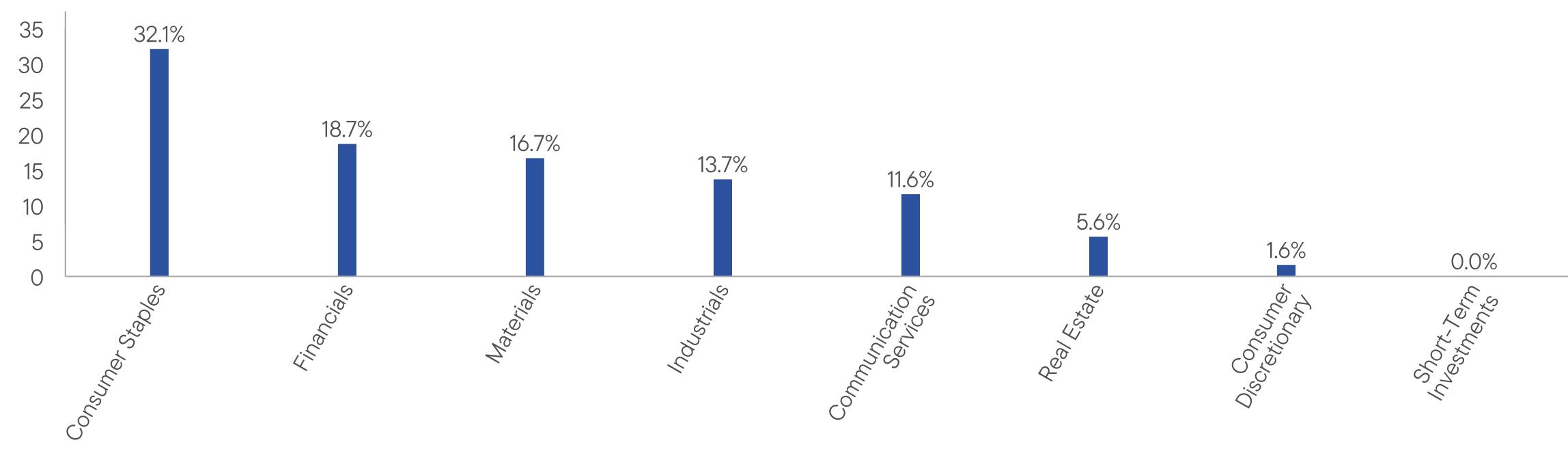

32.118.716.713.711.65.61.60.0

| | |

Franklin FTSE Saudi Arabia ETF | |

FLSA | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Saudi Arabia ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Saudi Arabia ETF | $19 | 0.39% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $18,350,016 |

Total Number of Portfolio Holdings* | 64 |

Portfolio Turnover Rate | 8.88% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Saudi Arabia ETF | PAGE 1 | FLSA-STSR-1124 |

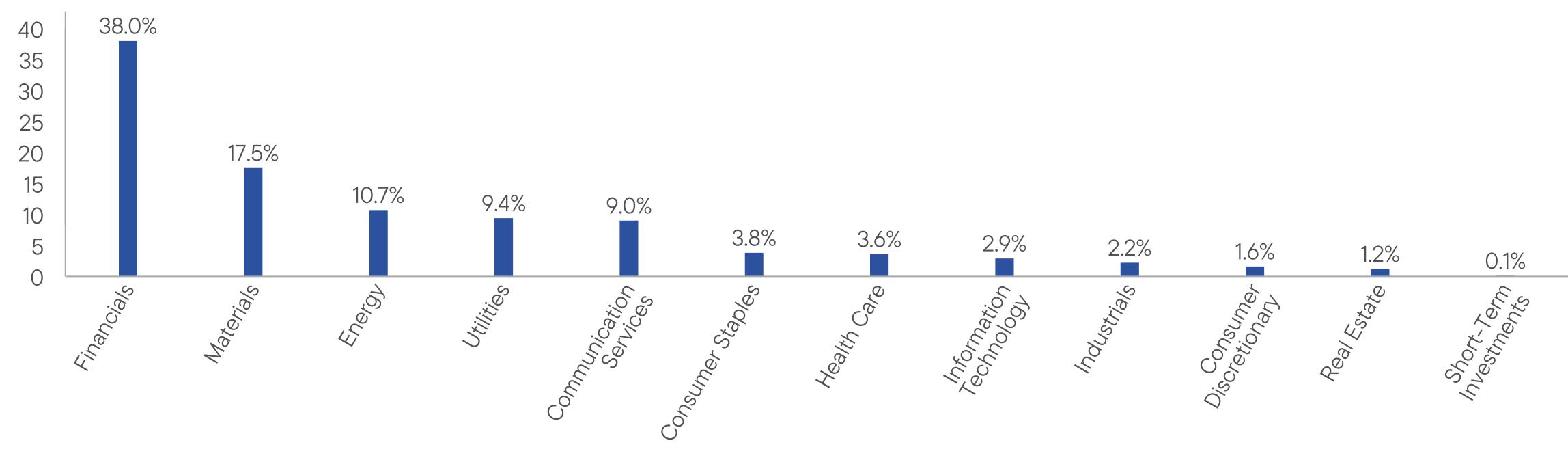

38.017.510.79.49.03.83.62.92.21.61.20.1

| | |

Franklin FTSE South Korea ETF | |

FLKR | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE South Korea ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE South Korea ETF | $4 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $120,538,120 |

Total Number of Portfolio Holdings* | 158 |

Portfolio Turnover Rate | 7.47% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE South Korea ETF | PAGE 1 | FLKR-STSR-1124 |

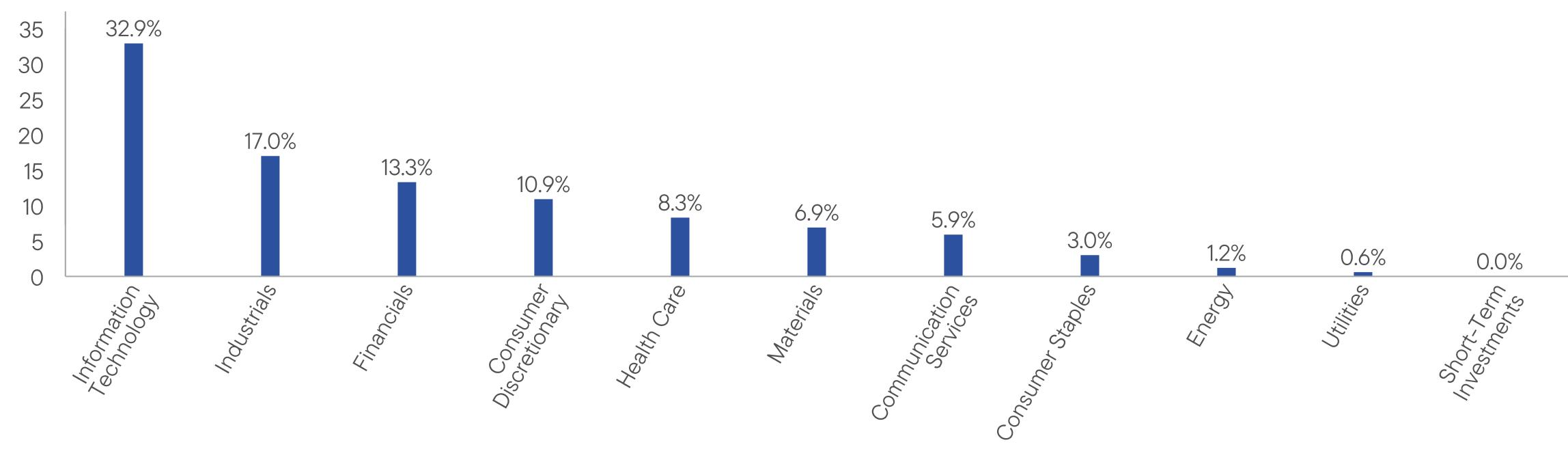

32.917.013.310.98.36.95.93.01.20.60.0

| | |

Franklin FTSE Switzerland ETF | |

FLSW | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Switzerland ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Switzerland ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $57,839,669 |

Total Number of Portfolio Holdings* | 54 |

Portfolio Turnover Rate | 3.49% |

| * | Does not include derivatives, except purchased options, if any. |

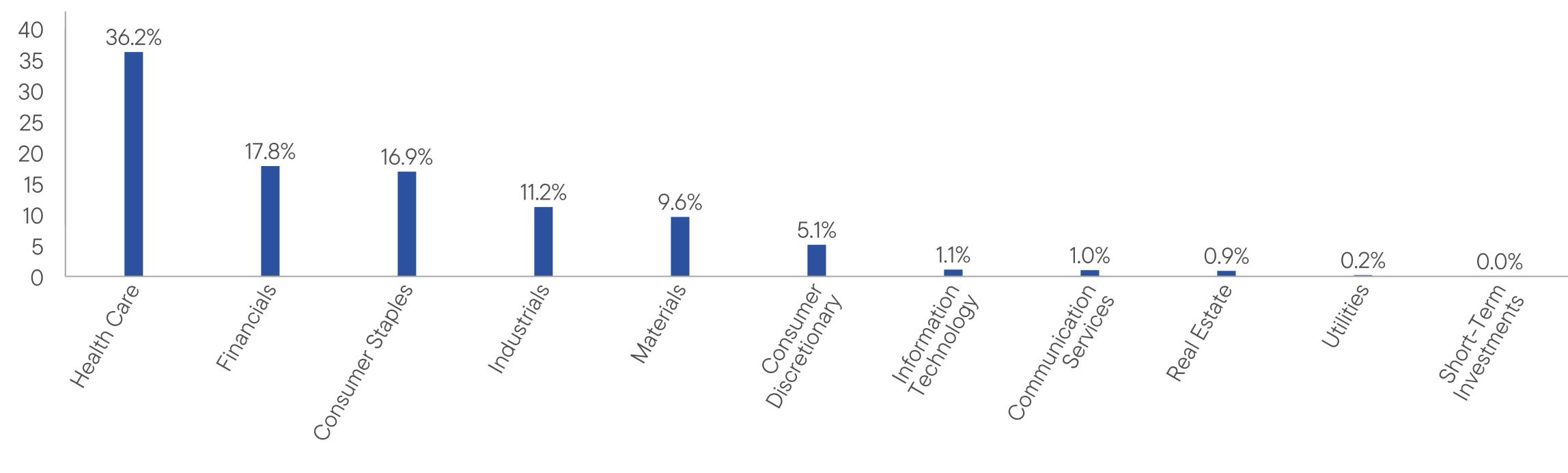

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Switzerland ETF | PAGE 1 | FLSW-STSR-1124 |

36.217.816.911.29.65.11.11.00.90.20.0

| | |

Franklin FTSE Taiwan ETF | |

FLTW | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE Taiwan ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE Taiwan ETF | $10 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $271,358,116 |

Total Number of Portfolio Holdings* | 130 |

Portfolio Turnover Rate | 26.97% |

| * | Does not include derivatives, except purchased options, if any. |

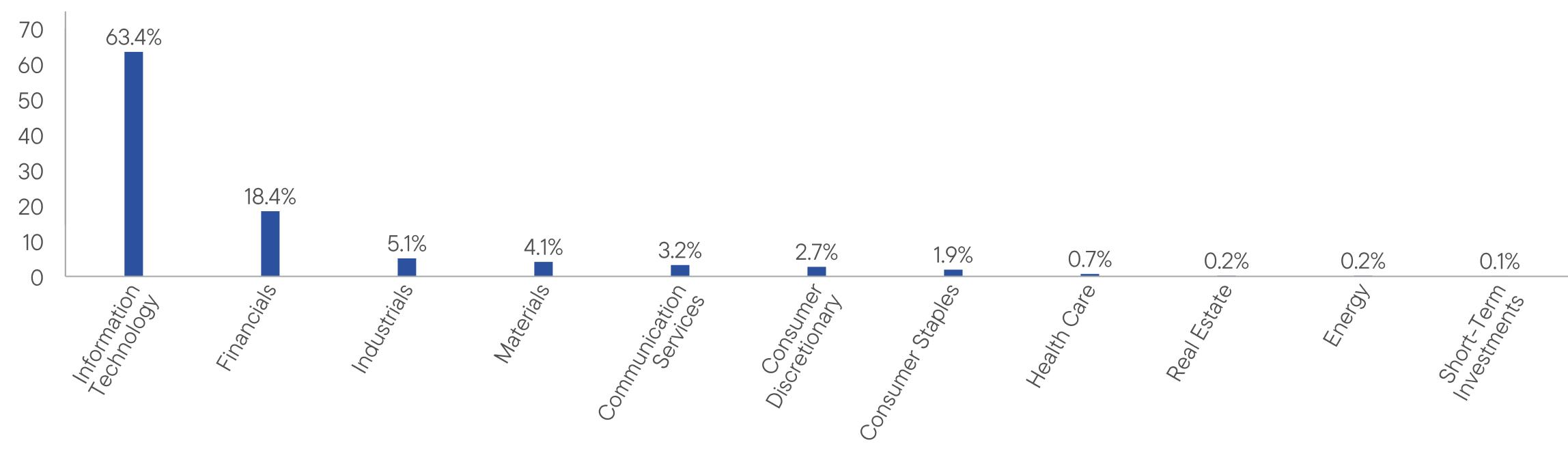

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE Taiwan ETF | PAGE 1 | FLTW-STSR-1124 |

63.418.45.14.13.22.71.90.70.20.20.1

| | |

Franklin FTSE United Kingdom ETF | |

FLGB | NYSE Arca, Inc.NYSEArca |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin FTSE United Kingdom ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Franklin FTSE United Kingdom ETF | $5 | 0.09% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $731,907,856 |

Total Number of Portfolio Holdings* | 104 |

Portfolio Turnover Rate | 4.58% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin FTSE United Kingdom ETF | PAGE 1 | FLGB-STSR-1124 |

19.317.113.811.911.110.37.24.32.81.21.00.0

| | |

BrandywineGLOBAL-Dynamic US Large Cap Value ETF | |

DVAL | The Nasdaq Stock Market LLCNASDAQ |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about BrandywineGLOBAL-Dynamic US Large Cap Value ETF for the period April 1, 2024, to September 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| BrandywineGLOBAL-Dynamic US Large Cap Value ETF | $25 | 0.49% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Total Net Assets | $116,319,447 |

Total Number of Portfolio Holdings* | 116 |

Portfolio Turnover Rate | 33.79% |

| * | Does not include derivatives, except purchased options, if any. |

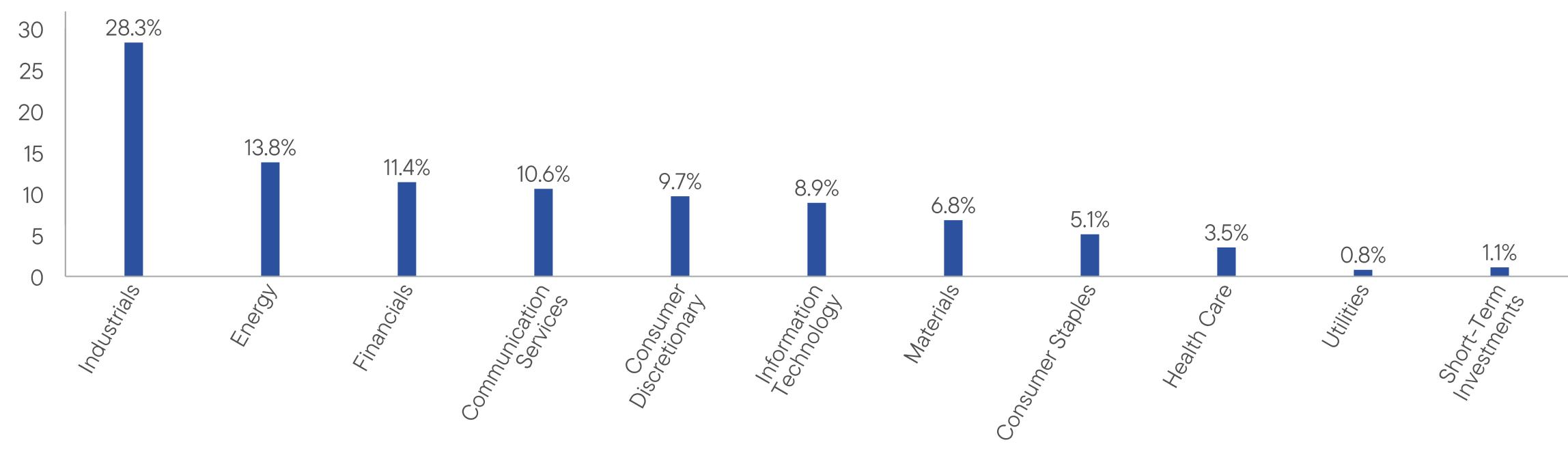

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

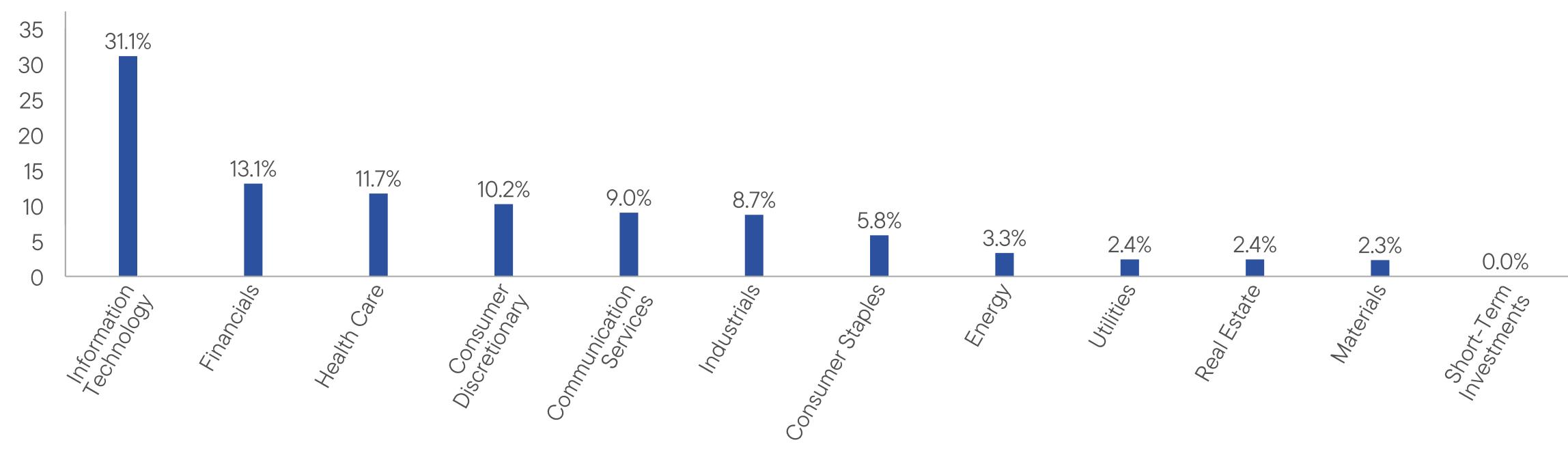

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| BrandywineGLOBAL-Dynamic US Large Cap Value ETF | PAGE 1 | DVAL-STSR-1124 |

28.313.811.410.69.78.96.85.13.50.81.1

| | |

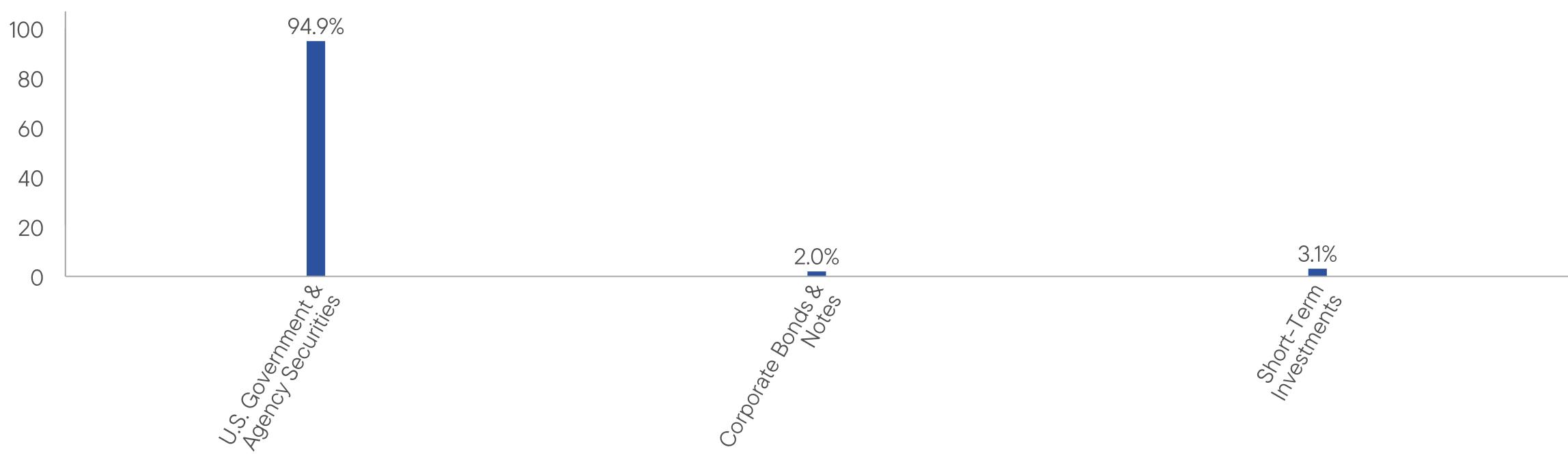

BrandywineGLOBAL - U.S. Fixed Income ETF | |

USFI | The Nasdaq Stock Market LLCNASDAQ |

| Semi-Annual Shareholder Report | September 30, 2024 |

|

This semi-annual shareholder report contains important information about BrandywineGLOBAL - U.S. Fixed Income ETF for the period April 1, 2024, to September 30, 2024.