UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-23124

Franklin Templeton ETF Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: 3/31

Date of reporting period: 03/31/17

Item 1. Reports to Stockholders.

| Contents | |

| Annual Report | |

| Economic and Market Overview | 2 |

| Franklin LibertyQ Emerging Markets ETF | 3 |

| Franklin LibertyQ Global Dividend ETF | 11 |

| Franklin LibertyQ Global Equity ETF | 18 |

| Franklin LibertyQ International Equity Hedged ETF | 25 |

| Financial Highlights and Statements of Investments | 32 |

| Financial Statements | 65 |

| Notes to Financial Statements | 68 |

| Report of Independent Registered | |

| Public Accounting Firm | 78 |

| Tax Information | 79 |

| Board Members and Officers | 80 |

| Shareholder Information | 83 |

libertyshares.com

1

ANNUAL REPORT

Economic and Market Overview

The global economy grew moderately during the period since the Funds’ inception on June 1, 2016. In this environment, global developed and emerging market stocks rose, as measured by the MSCI All Country World Index. Global markets were aided by accommodative monetary policies of various global central banks, improved industrial commodity prices, the finalization of Greece’s new debt deal, generally upbeat economic data across regions and investor optimism about U.S. President Donald Trump’s pro-growth policies. A deal by major oil producing countries in December to curb oil production also supported global equity markets.

However, investors expressed concerns about the timing and economic effects of the U.K.’s exit from the European Union (also known as “Brexit”), President Trump’s protectionist policies and his executive order banning entry from some Muslim-majority countries. Other headwinds included uncertainty about the U.S. Federal Reserve’s (Fed’s) timing for raising interest rates; the health of European banks; elections in Europe, particularly in France; and geopolitical tensions in certain regions.

The U.S. economy expanded during the period. The economy strengthened in 2016’s second and third quarter, but moderated in 2016’s fourth quarter and 2017’s first quarter as private inventory investment slowed and government spending declined. The manufacturing sector generally expanded and the services sector continued to grow. The unemployment rate decreased from 5.0% in March 2016 to 4.5% at period-end.1 Monthly retail sales were volatile, but grew during most of the review period. Inflation generally increased during the period, as measured by the Consumer Price Index. After maintaining its target interest rate in the 0.25%–0.50% range for nearly a year, at its December meeting the Fed increased its target range to 0.50%–0.75%, as policymakers noted an improved U.S. labor market and higher inflation. The Fed, at its March meeting, also made the widely anticipated increase in its target rate to 0.75%–1.00%.

In Europe, the U.K.’s economy grew at a faster rate in the fourth quarter of 2016 than in the third quarter, supported by growth in services. Immediate effects of the Brexit vote in June materialized as U.K. stocks declined significantly, the British pound sterling hit a three-decade low amid intensified selling and the U.K.’s credit rating was downgraded. In the eurozone, despite investor concerns about banking sector weakness, low corporate earnings and post-Brexit politics, some regions benefited from rising consumer spending, a cheaper euro that supported exports, low inflation and signs of sustained economic growth. The eurozone’s growth moderated in 2016’s second quarter, edged up in the third quarter, and held steady in the fourth quarter. After declining in the beginning of the review period, the eurozone’s annual inflation rate increased gradually to reach its highest levels in four years in February. However, the inflation rate eased sharply in March, led by slower growth in energy and food prices. In January, the ECB kept its key policy rates unchanged and retained its monthly asset purchases, indicating it could increase the program in size and duration if needed.

In Asia, Japan’s quarterly gross domestic product moderated in 2016’s third quarter, mainly due to decline in private non-residential and public investments, and remained unchanged in the fourth quarter. In July, Japan’s Prime Minister Shinzo Abe announced a higher-than-expected fiscal stimulus to revive the economy, followed by an additional monetary stimulus announcement by the Bank of Japan (BOJ). The BOJ kept its interest rates unchanged toward period-end. However, it overhauled its monetary stimulus program in September to adjust Japanese government bond purchases, with the aim of keeping the 10-year rate for such bonds near 0%.

In emerging markets, Brazil’s economy continued to be in recession, and the country’s central bank cut its benchmark interest rate in October and November 2016 and in January and February 2017 to spur economic growth. Russia’s economy grew for the first time in two years in the fourth quarter compared to the same quarter in 2015 after economic contraction had eased in 2016, following a rebound in oil prices and improved industrial production. The Bank of Russia reduced its key interest rates in June and September 2016 and in March 2017 to try to revive its economy. China’s economy grew at a stable rate in 2016’s second and third quarters. However, growth edged up in the fourth quarter driven by consumer spending and a property market supported by robust bank lending. The People’s Bank of China employed monetary easing measures that included cutting the cash reserve requirement ratio for some banks and devaluing the Chinese currency against the U.S. dollar. India’s GDP in 2016’s fourth quarter slowed compared to the previous quarter, although it exceeded consensus expectations. Overall, emerging market stocks, as measured by the MSCI Emerging Markets (EM) Index, rose during the period.

The foregoing information reflects our analysis and opinions as of March 31, 2017. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

2 Annual Report

libertyshares.com

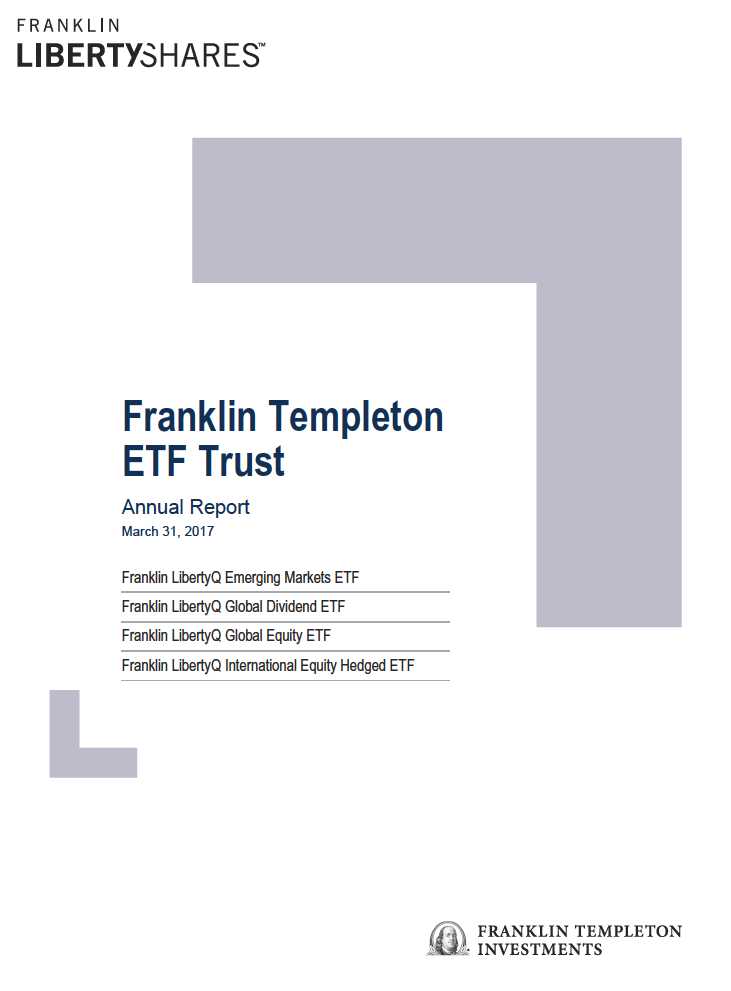

Franklin LibertyQ Emerging Markets ETF

This annual report for Franklin LibertyQ Emerging Markets ETF covers the period since the Fund’s inception on June 1, 2016, through March 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Emerging Markets (EM) Index.1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the index and in depositary receipts representing such securities. The index includes stocks from emerging market countries that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 1% per company weighting. The index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI EM Index over the long term by selecting equity securities from the MSCI EM Index that have exposure to these investment-style factors.

Performance Overview

For the period since inception on June 1, 2016, through March 31, 2017, the Fund posted cumulative total returns of +15.14% based on market price and +14.55% based on net asset value (NAV).2 In comparison, the LibertyQ EM Index delivered a +15.15% total return for the same period, while the MSCI EM Index (Net Returns) produced a +21.13% total return.3 You can find more of the Fund’s performance data in the Performance Summary beginning on page 7.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ EM Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the index of 95% or better. A figure of 100% would indicate perfect correlation. The Fund’s intention is to replicate the component securities of the index as closely as possible. However, under various circumstances, it may not be possible or practicable to purchase all of the component securities in their respective weightings in the index. In these circumstances, the Fund may use a “representative sampling” strategy whereby the Fund would invest in what it believes to be a representative sample of the component securities of the index, but may not track the index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund’s portfolio is reconstituted semiannually following the semiannual reconstitution of the index.

1. The LibertyQ EM Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EM Index using a method-

ology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EM Index is a free float-adjusted market capitalization index

that is designed to measure the equity market performance of emerging markets.

2. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the

NAV of the Fund is used as a proxy for the market price to calculate market returns.

3. Source: Factset.

The index is unmanaged and includes reinvestment of any income or distributions (after the deduction of certain withholding taxes). It does not reflect any fees, expenses or

sales charges. One cannot invest directly in an index.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI

begins on page 33.

libertyshares.com

Annual Report

3

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Manager’s Discussion

During the period since inception on June 1, 2016, through March 31, 2017, the Fund’s underperformance relative to the MSCI EM Index (Net Returns) was largely attributable to the four investment-style factors that the investment strategy targets, namely quality, value, momentum and low volatility. These factors accounted for approximately three-fourths of the Fund’s active risk, when measured on a prospective tracking-error basis, and over time we expect them to drive the bulk of the Fund’s performance. An offsetting contribution to relative returns came from currency exposures that were indirect consequences of our multi-factor investment approach. Security specific positions were a notable drag on performance.

The most significant factor influencing relative performance during the period was the defensive nature of the Fund’s holdings, as the Fund’s overall sensitivity to the direction of broad market moves (i.e., beta) was notably lower than that of the MSCI EM Index (Net Returns). The Fund had on average about nine-tenths the sensitivity to the overall direction of the market and, as a result, lagged the sharp market rally that occurred during the period, as buoyant sentiment indicators drove stock prices higher and funds flowed into emerging markets. This defensive characteristic of the Fund reflected the factor that identifies stocks with lower-than-average volatility, but also the influence of the other elements of our multi-factor approach. The Fund’s low-volatility characteristic dominated performance, weakening with global bonds—an asset class with which this factor shares certain characteristics—as the market focused on higher yields.

Among other drivers of relative performance, the stocks that the Fund selected with noticeably higher dividend yields than the market boosted returns during the period. This metric is a key element of our value factor. Value includes measures of price-to-earnings ratios and makes up three-tenths of the overall multi-factor score that drives portfolio construction. This factor was one of the prime beneficiaries of the sectoral rotation that occurred following the election of U.S. President Donald Trump, and investors increased confidence in a period of reflationary growth. However, this dynamic market environment led to a greater dispersion of returns, and a change of leadership among sectors and stocks that was less favorable for exposure to stocks that had exhibited positive price momentum. Momentum had minimal impact on relative returns during the review period. The Fund also had

| Top 10 Sectors/Industries | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| Oil, Gas & Consumable Fuels | 8.9 | % |

| Wireless Telecommunication Services | 8.7 | % |

| Banks | 6.2 | % |

| Automobiles | 5.3 | % |

| Technology Hardware, Storage & Peripherals | 5.1 | % |

| Electronic Equipment, Instruments & Components | 4.4 | % |

| Semiconductors & Semiconductor Equipment | 4.2 | % |

| IT Services | 4.2 | % |

| Diversified Financial Services | 4.0 | % |

| Food & Staples Retailing | 3.5 | % |

a pronounced tilt toward stocks with higher return on equity, as part of the quality factor, which accounts for half of the overall multi-factor score. The quality factor was a marginal contributor to relative performance during the period.

The aggregate characteristics of the Fund reflect the four attributes that comprise our multi-factor approach to investing. The Fund is designed to be less volatile than the broader equity market, with modeled risk notably lower than that of the MSCI EM Index (Net Returns). The Fund’s holdings at period-end had a higher dividend yield overall, and they represented companies that have historically generated a greater return on equity than companies in the MSCI EM Index (Net Returns). In addition, the holdings traded at price-to-earnings multiples that were somewhat cheaper than those in the MSCI EM Index (Net Returns).

The Fund’s exposure to sectors and industries reflects the indirect influence of our multi-factor investment approach, rather than any explicit preferences for particular industries. During the reporting period, overall industry exposures detracted from the Fund’s relative results. The Fund held an overweighting in the telecommunication services sector, which detracted from performance, and a larger underweighting in the Internet software and services industry in the technology sector, which was also a drag on returns. Conversely, a smaller underweighting in the health care sector made the largest contribution to sector allocation relative performance. A small underweighted position in the capital markets industry within the financials sector also contributed to relative performance during the period.

4 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

| Top 10 Countries | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| South Korea | 17.3 | % |

| Taiwan | 14.5 | % |

| India | 12.0 | % |

| China | 11.8 | % |

| Russia | 10.2 | % |

| Brazil | 5.8 | % |

| South Africa | 4.7 | % |

| Indonesia | 4.2 | % |

| Malaysia | 3.5 | % |

| Mexico | 3.0 | % |

The Fund’s country exposures also reflect the indirect influence of our multi-factor investment approach, rather than any explicit preferences for particular markets. During the reporting period, overall country exposures modestly detracted from relative performance. The Fund held an overweighting in Russia and a significant underweighting in China, which were the largest detractors from relative performance. Smaller country exposures, including an underweighting in South Africa and an overweighting in India offset these negative effects to some extent. We manage the Fund against an unhedged benchmark and accept the currency exposures that arise from our stock holdings. During the period, currency fluctuations contributed to relative return. The drag on returns from the underweighting in China-based companies and overweighting in Russia-based companies, noted above, was more than offset by positive currency effects.

Certain individual stocks such as Samsung Electronics and Tencent Holdings4 were notable detractors from the Fund’s relative results, in both cases due to a lack of exposure as the stocks performed strongly. In contrast, Largan Precision made the largest contribution to performance, with Banco do Brasil4 making a smaller contribution. In aggregate, individual securities detracted notably from performance, particularly among large-capitalization stocks. However, the overall impact was less severe when viewed in combination with the currency contribution discussed above. The Fund also held an underweighted position in the largest capitalization

| Top 10 Holdings | ||

| 3/31/17 | ||

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| iShares MSCI India ETF | 2.1 | % |

| Diversified Financial Services, India | ||

| Wisdomtree India Earnings ETF | 1.9 | % |

| Diversified Financial Services, India | ||

| Largan Precision Co. Ltd. | 1.2 | % |

| Electronic Equipment, Instruments & Components, | ||

| Taiwan | ||

| Mobile TeleSystems PJSC, ADR | 1.2 | % |

| Wireless Telecommunication Services, Russia | ||

| Catcher Technology Co. Ltd. | 1.2 | % |

| Technology Hardware, Storage & Peripherals, Taiwan | ||

| Rosneft PJSC | 1.1 | % |

| Oil, Gas & Consumable Fuels, Russia | ||

| Advanced Info Service PCL, NVDR | 1.1 | % |

| Wireless Telecommunication Services, Thailand | ||

| SK Hynix Inc. | 1.1 | % |

| Semiconductors & Semiconductor Equipment, | ||

| South Korea | ||

| AAC Technologies Holdings Inc. | 1.1 | % |

| Electronic Equipment, Instruments & Components, | ||

| China | ||

| NetEase Inc., ADR | 1.1 | % |

| Internet Software & Services, China |

segment of the market, which posted the strongest gains during the reporting period, resulting in a notable drag on relative performance.

Thank you for your participation in Franklin LibertyQ Emerging Markets ETF. We look forward to serving your future investment needs.

CFA® is a trademark owned by CFA Institute.

4. No longer held by period-end.

See www.franklintempletondatasources.com for additional data provider information.

libertyshares.com

Annual Report 5

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2017, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

6 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Performance Summary as of March 31, 2017

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

| Performance as of 3/31/171 | ||||||||

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||

| Based on | Based on | Based on | Based on | |||||

| NAV3 | market price4 | NAV3 | market price4 | |||||

| Since Inception (6/1/16) | +14.55 | % | +15.14 | % | +14.55 | % | +15.14 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

See page 9 for Performance Summary footnotes.

libertyshares.com

Annual Report 7

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

See page 9 for Performance Summary footnotes.

8 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

PERFORMANCE SUMMARY

| Distributions (6/1/16–3/31/17) | |

| Net Investment | |

| Income | |

| $ | 0.093195 |

| Total Annual Operating Expenses6 | |||

| With Waiver | Without Waiver | ||

| 0.55 | % | 0.83 | % |

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated

with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. The Fund

is designed for the aggressive portion of a well-diversified portfolio. There can be no assurance that the Fund’s multi-factor stock selection process will enhance

performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. The Fund’s pro-

spectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will

reduce returns.

1. The Fund has an expense reduction contractually guaranteed through 7/31/17. Fund investment results reflect the expense reduction; without this reduction, the results

would have been lower.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has

not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: Factset. The LibertyQ EM Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI EM Index

using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EM Index is a free float-adjusted market capi-

talization index that is designed to measure the equity market performance of emerging markets.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in

this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

libertyshares.com

Annual Report 9

FRANKLIN LIBERTYQ EMERGING MARKETS ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | ||||||||||

| (actual return after expenses) | (5% annual return before expenses) | ||||||||||

| Expenses | Expenses | ||||||||||

| Beginning | Ending | Paid During | Ending | Paid During | |||||||

| Account | Account | Period | Account | Period | Net Annualized | ||||||

| Value 10/1/16 | Value 3/31/17 | 10/1/16–3/31/171,2 | Value 3/31/17 | 10/1/16–3/31/171,2 | Expense Ratio2 | ||||||

| $ | 1,000 | $ | 1,052.20 | $ | 2.81 | $ | 1,022.19 | $ | 2.77 | 0.55 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value

over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

10 Annual Report

libertyshares.com

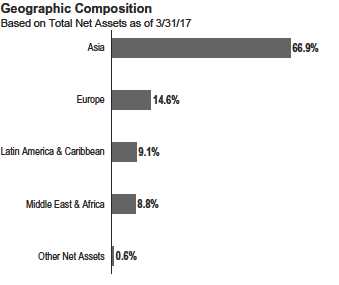

Franklin LibertyQ Global Dividend ETF

This annual report for Franklin LibertyQ Global Dividend ETF covers the period since the Fund’s inception on June 1, 2016, through March 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Dividend Index.1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the index and in depositary receipts representing such securities. The index includes stocks from developed and emerging market countries with high and persistent dividend income that have favorable exposure to a quality investment-style factor, subject to a maximum 2% per company weighting. The index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI All Country (AC) World ex-REITs Index over the long term by applying dividend persistence and yield screens and the quality factor selection process.

Performance Overview

For the period since inception on June 1, 2016, through March 31, 2017, the Fund posted cumulative total returns of +10.39% based on market price and +9.79% based on net asset value (NAV).2 In comparison, the LibertyQ Global Dividend Index delivered a +9.91% total return for the same period, while the MSCI AC World ex-REITs Index (Net Returns) produced a +13.64% total return for the same period.3 You can find more of the Fund’s performance data in the Performance Summary beginning on page 14.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Dividend Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the index of 95% or better. A figure of 100% would indicate perfect correlation. The Fund’s intention is to replicate the component securities of the index as closely as possible. However, under various circumstances, it may not be possible or practicable to purchase all of the component securities in their respective weightings in the index. In these circumstances, the Fund may use a “representative sampling” strategy whereby the Fund would invest in what it believes to be a representative sample of the component securities of the index, but may not track the index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund’s portfolio is reconstituted semiannually following the semian-nual reconstitution of the index.

1. The LibertyQ Global Dividend Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI AC World

ex-REITs Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI AC World ex-REITs Index is a

free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets, excluding REIT securities.

2. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the

NAV of the Fund is used as a proxy for the market price to calculate market returns.

3. Source: Factset.

The index is unmanaged and includes reinvestment of any income or distributions (after the deduction of certain withholding taxes). It does not reflect any fees, expenses or

sales charges. One cannot invest directly in an index.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI

begins on page 40.

libertyshares.com

Annual Report

11

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

Manager’s Discussion

During the period since inception on June 1, 2016, through March 31, 2017, the Fund’s underperformance relative to the MSCI AC World ex-REITs Index (Net Returns) was largely attributable to the investment-style factor that the investment strategy targets, namely quality and dividend income. These attributes also accounted for almost two-thirds of the Fund’s active risk, when measured on a prospective tracking-error basis. The Fund’s relative performance was also adversely impacted by industry exposures resulting from our investment approach. Security specific positions contributed to performance, although the effect was smaller than the elements noted above. The Fund’s investment strategy of tilting toward companies with the traits of high and persistent dividend income along with exposure to the quality style factor were the primary determinants of relative performance during the reporting period.

The defensive nature of the Fund’s holdings was the most significant attribute detracting from relative performance during the period, as the Fund’s overall sensitivity to the direction of broad market moves (i.e., beta) was somewhat lower than that of the MSCI AC World Ex-REITs Index (Net Returns). The Fund’s lower sensitivity to the overall direction of the market meant that it lagged the broad market rally that occurred during the period, as ample liquidity and buoyant sentiment indicators drove stock prices higher.

The Fund’s focus on higher yielding stocks that have exhibited dividend persistence led to the Fund holding a significant exposure to low-volatility equities. This defensive characteristic of the Fund reflected the influence of the other elements of our investment approach. However, the Fund’s low-volatility characteristic dominated performance, weakening with global bonds—an asset class with which this factor shares certain characteristics—as the market focused on higher yields.

Among other drivers of performance, the stocks that the Fund selected with noticeably lower variability of earnings than the broad market supported returns during the period. This metric is a key element of our quality factor. Quality also includes measures of return on equity, return on assets and financial leverage. Overall, exposure to the quality factor detracted from performance, although this effect was small in comparison to other drivers of the Fund’s relative results.

The Fund is designed to be less volatile than the broader equity market, with modeled risk somewhat below that of the MSCI AC World ex-REITs Index (Net Returns). The Fund’s holdings at period-end had a higher dividend yield overall, and they represented companies that have historically generated a much greater return on equity than the MSCI AC World ex-REITs Index (Net Returns). During the period under

| Top 10 Sectors/Industries | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| Banks | 16.1 | % |

| Pharmaceuticals | 15.6 | % |

| Tobacco | 6.7 | % |

| Food & Staples Retailing | 6.2 | % |

| Household Products | 5.9 | % |

| Diversified Telecommunication Services | 5.4 | % |

| Personal Products | 4.7 | % |

| Semiconductors & Semiconductor Equipment | 3.5 | % |

| Aerospace & Defense | 3.0 | % |

| Professional Services | 2.8 | % |

review, these factors were not the primary driver of performance, as the markets focused on the sectoral rotation that occurred following the election of U.S. President Donald Trump, and investors increased confidence in a period of reflationary growth. This dynamic market environment led to an increased dispersion of returns, and a change of leadership among sectors and stocks.

The Fund’s exposure to sectors and industries reflects the indirect influence of our investment approach, rather than any explicit preferences for particular industries. However, overall industry exposure detracted significantly from the Fund’s relative results during the reporting period. The Fund held an overweighting in the consumer staples sector and an underweighting in the information technology sector, which were the largest detractors from relative performance, and an overweighting in the telecommunication services sector was also a detractor. Conversely, an underweighting in the oil and gas exploration and production industry in the energy sector was the largest contribution to relative performance. Smaller relative allocation exposures, including an overweighting in the banking industry in the financials sector, also contributed to performance during the period.

The Fund’s country exposures also reflect the indirect influence of our investment approach, rather than any explicit preferences for particular markets. During the reporting period, overall country exposures contributed marginally to returns. The Fund held an underweighting in Japan, which boosted performance as this market lagged global markets during the period. A modest overweighted position in Brazil made a meaningful contribution to relative performance, as markets reacted positively to the impeachment of President Dilma Rousseff, which may relieve a period of policy gridlock and help lift Brazil out of its worst recession in a century.

12 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

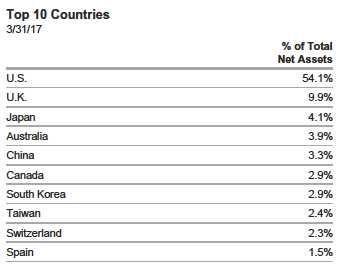

| Top 10 Countries | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| U.S. | 33.0 | % |

| U.K. | 16.9 | % |

| Australia | 12.8 | % |

| Canada | 9.7 | % |

| Brazil | 4.0 | % |

| Switzerland | 3.9 | % |

| Sweden | 3.5 | % |

| Japan | 3.4 | % |

| France | 2.2 | % |

| Germany | 1.9 | % |

Offsetting these positive effects, an underweighted position in U.S. stocks was a drag on performance. We manage the Fund against an unhedged index and accept the currency exposures that arise from our stock holdings. During the period under review, currency fluctuations detracted modestly from the Fund’s relative return. The beneficial impact of an overweighting in U.K. stocks was more than offset by the negative currency effect of the British pound declining following the country’s referendum vote to leave the European Union. Conversely, an overweighting in Australian companies was a notable boost to returns as the Australian dollar appreciated.

Certain individual stocks such as BT Group and Apple4 were notable detractors from the Fund’s relative results, while Itau Banco and BHP Billiton made the largest contributions to performance. In aggregate, individual securities contributed to performance modestly, although stock selection among larger capitalization stocks was particularly weak.

Thank you for your participation in Franklin LibertyQ Global Dividend ETF. We look forward to serving your future investment needs.

| Top 10 Holdings | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| Unilever PLC | 2.3 | % |

| Personal Products, U.K. | ||

| Unilever NV, IDR | 2.3 | % |

| Personal Products, U.K. | ||

| Philip Morris International Inc. | 2.3 | % |

| Tobacco, U.S. | ||

| British American Tobacco PLC | 2.3 | % |

| Tobacco, U.K. | ||

| Westpac Banking Corp. | 2.2 | % |

| Banks, Australia | ||

| Commonwealth Bank of Australia | 2.1 | % |

| Banks, Australia | ||

| Kimberly-Clark Corp. | 2.1 | % |

| Household Products, U.S. | ||

| Altria Group Inc. | 2.1 | % |

| Tobacco, U.S. | ||

| GlaxoSmithKline PLC | 2.1 | % |

| Pharmaceuticals, U.K. | ||

| Ambev SA | 2.1 | % |

| Beverages, Brazil |

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2017, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

4. No longer held by period-end.

See www.franklintempletondatasources.com for additional data provider information.

libertyshares.com Annual Report 13

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

Performance Summary as of March 31, 2017

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

| Performance as of 3/31/171 | |||||||||||||

| Cumulative Total Return2 | Average Annual Total Return2 | ||||||||||||

| Based on | Based on | Based on | Based on | ||||||||||

| NAV3 | market price4 | NAV3 | market price4 | ||||||||||

| Since Inception (6/1/16) | +9.79 | % | +10.39 | % | +9.79 | % | +10.39 | % | |||||

| 30-Day Standardized Yield6 | |||||||||||||

| Distribution Rate5 | (with waiver) | (without waiver) | |||||||||||

| 2.13 | % | 2.81 | % | 2.41 | % | ||||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

See page 16 for Performance Summary footnotes.

14 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

See page 16 for Performance Summary footnotes.

libertyshares.com

Annual Report

15

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

PERFORMANCE SUMMARY

| Distributions (6/1/16–3/31/17) | |

| Net Investment | |

| Income | |

| $ | 0.580561 |

| Total Annual Operating Expenses8 | |||

| With Waiver | Without Waiver | ||

| 0.45 | % | 0.70 | % |

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on

particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such

areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Companies that have historically paid regular

dividends to shareholders may decrease or eliminate dividend payments in the future. A decrease in dividend payments by an issuer may result in a decrease in

the value of the issuer’s stock and less available income for the Fund. There can be no assurance that the Fund’s multi-factor stock selection process will

enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. The

Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will

reduce returns.

1. The Fund has an expense reduction contractually guaranteed through 7/31/17. Fund investment results reflect the expense reduction; without this reduction, the results

would have been lower.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has

not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Distribution rate is based on the sum of the past four quarterly dividends, if any, and the NAV per share of $27.31 as of 3/31/17.

6. The Fund’s 30-day standardized yield is calculated over a trailing 30-day period using the yield to maturity on bonds and/or the dividends accrued on stocks. It may not

equal the Fund’s actual income distribution rate, which reflects the Fund’s past dividends paid to shareholders.

7. Source: Factset. The LibertyQ Global Dividend Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the

MSCI AC World ex-REITs Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI AC World

ex-REITs Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed and emerging markets, excluding

REIT securities.

8. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in

this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

16 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL DIVIDEND ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | ||||||||||

| (actual return after expenses) | (5% annual return before expenses) | ||||||||||

| Expenses | Expenses | ||||||||||

| Beginning | Ending | Paid During | Ending | Paid During | |||||||

| Account | Account | Period | Account | Period | Net Annualized | ||||||

| Value 10/1/16 | Value 3/31/17 | 10/1/16–3/31/171,2 | Value 3/31/17 | 10/1/16–3/31/171,2 | Expense Ratio2 | ||||||

| $ | 1,000 | $ | 1,062.40 | $ | 2.31 | $ | 1,022.69 | $ | 2.27 | 0.45 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value

over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements.

libertyshares.com

Annual Report

17

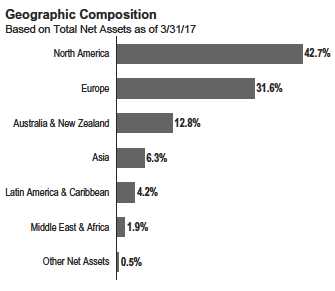

Franklin LibertyQ Global Equity ETF

This annual report for Franklin LibertyQ Global Equity ETF covers the period since the Fund’s inception on June 1, 2016, through March 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Equity Index.1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the index and in depositary receipts representing such securities. The index includes stocks from developed and emerging market countries that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 1% per company weighting. The index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI All Country World Index (ACWI) over the long term by selecting equity securities from the MSCI ACWI Index that have exposure to these investment-style factors.

Performance Overview

For the period since inception on June 1, 2016, through March 31, 2017, the Fund posted cumulative total returns of +10.50% based on market price and +9.95% based on net asset value (NAV).2 In comparison, the LibertyQ Global Equity Index delivered a +9.88% total return for the same period, while the MSCI ACWI (Net Returns) produced a +13.33% total return.3 You can find more of the Fund’s performance data in the Performance Summary beginning on page 21.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ Global Equity Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the index of 95% or better. A figure of 100% would indicate perfect correlation. The Fund’s intention is to replicate the component securities of the index as closely as possible. However, under various circumstances, it may not be possible or practicable to purchase all of the component securities in their respective weightings in the index. In these circumstances, the Fund may use a “representative sampling” strategy whereby the Fund would invest in what it believes to be a representative sample of the component securities of the index, but may not track the index with the same degree of accuracy as would an investment vehicle replicating the entire index. The Fund’s portfolio is reconstituted semiannually following the semian-nual reconstitution of the index.

1. The LibertyQ Global Equity Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI ACWI Index

using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI Index is a free float-adjusted market

capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

2. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the

NAV of the Fund is used as a proxy for the market price to calculate market returns.

3. Source: Factset.

The index is unmanaged and includes reinvestment of any income or distributions (after the deduction of certain withholding taxes). It does not reflect any fees, expenses or

sales charges. One cannot invest directly in an index.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI

begins on page 44.

18 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Manager’s Discussion

During the period since inception on June 1, 2016, through March 31, 2017, the Fund’s underperformance relative to the MSCI ACWI (Net Returns) was largely attributable to the four investment-style factors that the investment strategy targets, namely quality, value, momentum and low volatility. These factors also accounted for more than three-fourths of the Fund’s active risk, when measured on a prospective tracking-error basis. An offsetting contribution to relative returns came from currency exposures that were indirect consequences of our multi-factor investment approach. Security-specific positions were a notable drag on performance.

The most significant factor influencing performance during the period was the defensive nature of the Fund’s holdings, as the Fund’s overall sensitivity to the direction of broad market moves (i.e. beta) was significantly lower than that of the MSCI ACWI (Net Returns). The Fund had on average only eight-tenths the sensitivity to the overall direction of the market and, as a result, lagged the broad market rally that occurred during the period, as ample liquidity and buoyant sentiment indicators drove stock prices higher. This defensive characteristic of the Fund reflected the factor that identifies stocks with lower-than-average volatility, but also the influence of the other elements of our multi-factor approach. The Fund’s low-volatility characteristic dominated performance, weakening with global bonds—an asset class with which this factor shares certain characteristics—as the market focused on higher yields.

Among other factors influencing performance, the quality factor was a modest drag on relative returns. The quality factor includes measures of return on equity, return on assets and financial leverage, and quality makes up half of the overall multi-factor score that drives portfolio construction. The Fund’s relative performance was boosted by the value tilt reflected in its holdings. This factor was one of the prime beneficiaries of the sectoral rotation that occurred following the election of U.S. President Donald Trump, and investors increased confidence in a period of reflationary growth. However, this dynamic market environment led to a greater dispersion of returns and a change of leadership among sectors and stocks, which was less favorable for exposure to stocks that had exhibited positive price momentum. As a result, momentum was a modest detractor from relative returns during the review period.

The aggregate characteristics of the Fund reflect the four attributes that comprise our multi-factor approach to investing. The Fund is designed to be less volatile than the broader

| Top 10 Sectors/Industries | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| Pharmaceuticals | 8.1 | % |

| Semiconductors & Semiconductor Equipment | 5.5 | % |

| Banks | 5.1 | % |

| IT Services | 4.7 | % |

| Specialty Retail | 4.6 | % |

| Tobacco | 4.4 | % |

| Diversified Telecommunication Services | 4.3 | % |

| Aerospace & Defense | 3.7 | % |

| Technology Hardware, Storage & Peripherals | 3.6 | % |

| Hotels, Restaurants & Leisure | 3.4 | % |

equity market, with modeled risk about four-fifths that of the MSCI ACWI (Net Returns). The Fund’s holdings at period-end had a higher dividend yield overall, and they represented companies that have historically generated a much greater return on equity than companies in the MSCI ACWI (Net Returns). In addition, they traded at price-to-earnings multiples that were slightly cheaper than those of the MSCI ACWI (Net Returns).

The Fund’s exposure to sectors and industries reflects the indirect influence of our multi-factor investment approach, rather than any explicit preferences for particular industries. During the period, overall sector exposures detracted modestly from returns. The Fund held a notable underweighting in the broad financials sector, which significantly detracted from relative returns, while an overweighting to the consumer staples sector also detracted from performance. Conversely, an underweighting in the energy sector was a contributor to performance, while an overweighting in the information technology sector boosted returns.

The Fund’s country exposures also reflect the indirect influence of our multi-factor investment approach, rather than any explicit preferences for particular markets. During the reporting period, overall country exposures contributed marginally to returns. The Fund held an underweighting in Japan, which boosted performance as this market lagged global markets during the period. Offsetting overweightings in other Asian markets such as South Korea and Taiwan also boosted performance. Offsetting these positive effects, small overweighted positions in Denmark and the U.K. were a drag on performance. We manage the Fund against an unhedged index and accept the currency exposure that arises from our

libertyshares.com

Annual Report

19

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

stock holdings. During the period, currency fluctuations contributed to relative return, with an underweighting in eurozone companies limiting the impact from euro weakness.

Certain individual stocks such as Novo Nordisk and Bank of America4 were notable detractors from the Fund’s relative results, whereas Samsung Electronics made the largest contribution to performance, closely followed by Boeing. In aggregate, individual securities detracted from performance, most notably among large-capitalization stocks.

Thank you for your participation in Franklin LibertyQ Global Equity ETF. We look forward to serving your future investment needs.

| Top 10 Holdings | ||

| 3/31/17 | ||

| % of Total | ||

| Net Assets | ||

| Apple Inc. | 1.2 | % |

| Technology Hardware, Storage & Peripherals, U.S. | ||

| Philip Morris International Inc. | 1.2 | % |

| Tobacco, U.S. | ||

| Samsung Electronics Co. Ltd. | 1.2 | % |

| Technology Hardware, Storage & Peripherals, | ||

| South Korea | ||

| British American Tobacco PLC | 1.1 | % |

| Tobacco, U.K. | ||

| Boeing Co. | 1.1 | % |

| Aerospace & Defense, U.S. | ||

| Visa Inc., A | 1.1 | % |

| IT Services, U.S. | ||

| Altria Group Inc. | 1.1 | % |

| Tobacco, U.S. | ||

| Microsoft Corp. | 1.1 | % |

| Software, U.S. | ||

| Cisco Systems Inc. | 1.0 | % |

| Communications Equipment, U.S. | ||

| Mastercard Inc., A | 1.0 | % |

| IT Services, U.S. |

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2017, the end of the reporting period. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

4. No longer held by period-end.

See www.franklintempletondatasources.com for additional data provider information.

20 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Performance Summary as of March 31, 2017

Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Total returns do not include brokerage commissions that may be payable on secondary market transactions. The performance tables and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares.

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (Market Price) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the NAV of the Fund is used as a proxy for the Market Price to calculate market returns. Market and NAV returns assume that dividends and capital gain distributions have been reinvested at Market Price and NAV.

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses. Capital gain distributions are net profits realized from the sale of portfolio securities.

| Performance as of 3/31/171 | ||||||||

| Cumulative Total Return2 | Average Annual Total Return2 | |||||||

| Based on | Based on | Based on | Based on | |||||

| NAV3 | market price4 | NAV3 | market price4 | |||||

| Since Inception (6/1/16) | +9.95 | % | +10.50 | % | +9.95 | % | +10.50 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

See page 23 for Performance Summary footnotes.

libertyshares.com

Annual Report

21

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return is calculated at net asset value and represents the change in value of an investment over the periods shown. It includes any Fund fees and expenses, and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

See page 23 for Performance Summary footnotes.

22 Annual Report

libertyshares.com

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

PERFORMANCE SUMMARY

| Distributions (6/1/16–3/31/17) | |

| Net Investment | |

| Income | |

| $ | 0.619462 |

| Total Annual Operating Expenses6 | |||

| With Waiver | Without Waiver | ||

| 0.35 | % | 0.60 | % |

All investments involve risks, including possible loss of principal. Special risks are associated with foreign investing, including currency fluctuations, economic

instability and political developments; investments in emerging markets involve heightened risks related to the same factors. To the extent the Fund focuses on

particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such

areas of focus than a fund that invests in a wider variety of countries, regions, industries, sectors or investments. Performance of the Fund may vary significantly

from the performance of an index, as a result of transaction costs, expenses and other factors. There can be no assurance that the Fund’s multi-factor stock

selection process will enhance performance. Exposure to such investment factors may detract from performance in some market environments, perhaps for

extended periods. The Fund’s prospectus also includes a description of the main investment risks.

ETFs trade like stocks, fluctuate in market value and may trade at prices above or below their net asset value. Brokerage commissions and ETF expenses will

reduce returns.

1. The Fund has an expense reduction contractually guaranteed through 7/31/17. Fund investment results reflect the expense reduction; without this reduction, the results

would have been lower.

2. Total return calculations represent the cumulative and average annual changes in value of an investment over the period indicated. Return for less than one year, if any, has

not been annualized.

3. Assumes reinvestment of distributions based on net asset value.

4. Assumes reinvestment of distributions based on market price.

5. Source: Factset. The LibertyQ Global Equity Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI

ACWI Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI ACWI Index is a free float-

adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

6. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in

this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

libertyshares.com

Annual Report

23

FRANKLIN LIBERTYQ GLOBAL EQUITY ETF

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing Fund costs, including management fees and other Fund expenses. All funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual | Hypothetical | ||||||||||

| (actual return after expenses) | (5% annual return before expenses) | ||||||||||

| Expenses | Expenses | ||||||||||

| Beginning | Ending | Paid During | Ending | Paid During | |||||||

| Account | Account | Period | Account | Period | Net Annualized | ||||||

| Value 10/1/16 | Value 3/31/17 | 10/1/16–3/31/171,2 | Value 3/31/17 | 10/1/16–3/31/171,2 | Expense Ratio2 | ||||||

| $ | 1,000 | $ | 1,052.20 | $ | 1.79 | $ | 1,023.19 | $ | 1.77 | 0.35 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value

over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

24 Annual Report

libertyshares.com

Franklin LibertyQ International Equity Hedged ETF

This annual report for Franklin LibertyQ International Equity Hedged ETF covers the period since the Fund’s inception on June 1, 2016, through March 31, 2017.

Your Fund’s Goal and Main Investments

The Fund seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ International Equity Hedged Index.1 Under normal market conditions, the Fund invests at least 80% of its assets in the component securities of the index and in depositary receipts representing such securities. The index includes stocks from developed market countries in Europe, Australasia and the Far East that have favorable exposure to four investment-style factors: quality, value, momentum and low volatility, subject to a maximum 2% per company weighting. The index seeks to achieve a lower level of risk and higher risk-adjusted performance than the MSCI EAFE Index over the long term by selecting equity securities from the MSCI EAFE Index that have exposure to these investment-style factors. The index incorporates a hedge against non-U.S. currency fluctuations by reflecting the impact of rolling monthly currency forward contracts on the currencies represented in the index. In order to replicate the hedge impact incorporated in the calculation of the index, the Fund enters into monthly foreign currency forward contracts designed to offset the Fund’s exposure to the component currencies of the index.

What is a currency forward contract?

A currency forward contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency in exchange for another currency at a specific exchange rate on a future date.

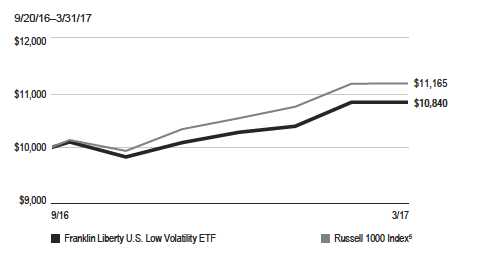

Performance Overview

For the period since inception on June 1, 2016, through March 31, 2017, the Fund posted cumulative total returns of +9.24% based on market price and +8.30% based on net asset value (NAV).2 In comparison, LibertyQ International Equity Hedged Index delivered a +8.92% total return for the

*Figures are stated as a percentage of total and may not equal 100% or may be neg-

ative due to rounding, use of derivatives, unsettled trades or other factors.

same period, while the MSCI EAFE 100% Hedged to USD Index (Net Returns) produced a +16.08% total return.3 You can find more of the Fund’s performance data in the Performance Summary beginning on page 28.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to libertyshares.com or call (800) 342-5236.

Investment Strategy

The Fund, using a passive or indexing investment approach, seeks investment results that closely correspond, before fees and expenses, to the performance of the LibertyQ International Equity Hedged Index. The investment manager seeks to achieve, over time, a correlation between the Fund’s performance, before fees and expenses, and that of the index of 95% or better. A figure of 100% would indicate perfect

1. The LibertyQ International Equity Hedged Index is a systematic, rules-based proprietary index that is owned and calculated by MSCI Inc. (MSCI). It is based on the MSCI

EAFE Index using a methodology developed with Franklin Templeton to reflect Franklin Templeton’s desired investment strategy. The MSCI EAFE Index is a free float-

adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

2. Since shares of the Fund did not trade in the secondary market until after the Fund’s inception, for the period from inception to the first day of secondary trading (6/3/16), the

NAV of the Fund is used as a proxy for the market price to calculate market returns.

3. Source: Factset.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in

an index.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI

begins on page 58.

libertyshares.com

Annual Report

25

FRANKLIN LIBERTYQ INTERNATIONAL EQUITY HEDGED ETF