April 18, 2018

Via EDGAR

U.S. Securities and Exchange Commission

Division of Investment Management

Attention: Ms. Ashley Vroman-Lee and Ms. Megan Miller

100 F Street, N.E.

Washington, D.C. 20549

Re: Owl Rock Capital Corporation II

Post-Effective Amendment No. 6 to Registration Statement on Form N-2 (File No. 333-213716)

Dear Ms. Vroman-Lee and Ms. Miller:

On behalf of Owl Rock Capital Corporation II (the “Company”), set forth below are the Company’s responses to the comments provided by the staff of the Division of Investment Management (the “Staff”) of the U.S. Securities and Exchange Commission (the “SEC”) to the Company via telephone on April 2, 2018, regarding the Company’s Post-Effective Amendment No. 6 to the Registration Statement on Form N-2 (File No. 333-213716) (the “Registration Statement”), and the prospectus contained therein (the “Prospectus”) as filed with the SEC on March 23, 2018. The Staff’s comments are set forth below and are followed by the Company’s responses. The revisions to the Prospectus referenced in the below responses are set forth in Post-Effective Amendment No. 7 to the Registration Statement, filed with the SEC concurrently herewith. Defined terms used but not defined herein are intended to have the meaning ascribed to them in the Prospectus.

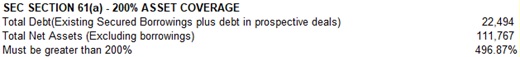

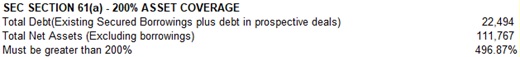

1. Comment: On a supplemental basis, please provide the calculation for asset coverage.

Response: The Company’s calculation for asset coverage, which is being provided to the Staff on a supplemental basis, is:

2. Comment: With respect to note 15 to the schedule of investments in the financial statements, on a going-forward basis please include the total percentage of non-qualifying assets.

Response: The Company undertakes to include the requested information on a going-forward basis.

3. Comment: The notes to the financial statements indicate that management fees are paid quarterly. On a supplemental basis please confirm whether any management fees have been paid to date.

Response: The Company confirms to the Staff, on a supplemental basis, that as of December 31, 2017 $375,000 in management fees had been earned, including $228,000 earned in the fourth

Eversheds Sutherland (US) LLP is part of a global legal practice, operating through various separate and distinct legal entities, under Eversheds Sutherland. For a full description of the structure and a list of offices, please visit www.eversheds-sutherland.com.

1

quarter of 2017. The $375,000 is reflected on the Consolidated Statement of Assets and Liabilities as the Management Fee Payable, and none of that amount has been paid to date.

4. Comment: Please explain why the LIBOR floors were included in the Schedule of Investments in the Company’s most recent 10-Q but not in the Schedule of Investments in the Company’s most recent 10-K?

Response: The Company respectfully advises the Staff that the LIBOR floors were not included in the Schedule of Investments in the Company’s 10-K because as of December 31, 2017, the 1-, 3-, and 6-month LIBOR rates loans exceeded the LIBOR floor (which is typically 1%).

5. Comment: Please confirm on a supplemental basis that the payment-in-kind rates are accurately disclosed in accordance with footnote 4 to Rule 12-12 of Regulation S-X.

Response: The Company confirms to the Staff, on a supplemental basis, that the payment-in-kind rates are accurately disclosed in accordance with footnote 4 to Rule 12-12 of Regulation S-X.

6. Comment: Please confirm on a supplemental basis that the Company has no payment-in-kind loans, and therefore the Company’s payment-in-kind income is properly disclosed in accordance with Rule 6.07.1 of Regulation S-X.

Response: The Company confirms to the Staff, on a supplemental basis, that the Company has no payment-in-kind loans, and therefore the payment-in-kind income is properly disclosed in accordance with Rule 6.07.1 of Regulation S-X.

7. Comment: Please confirm on a supplemental basis that the Company has considered the guidance, effective September 1, 2017, in relation to the hyperlinking of exhibits in certain filings.

Response: The Company has considered the guidance related to hyperlinking its exhibits and confirms that the exhibits are hyperlinked in each of Post-Effective Amendment No. 6 to the Registration Statement and Post-Effective Amendment No. 7 to the Registration Statement.

8. Comment: On a going-forward basis, please add disclosure in the notes to the financial statements indicating that last-out lenders are at a greater risk for increased effective interest rates.

Response: The Company undertakes to include the requested information on a going-forward basis.

9. Comment: With respect to the Company’s “last out” first-lien/unitranche loans (also known as co-lending arrangements) (the “unitranche loans”), please respond to the Staff on a supplemental basis with regard to each of the following points:

a. Please confirm that the Company’s accounting policies apply.

Response: The Company confirms to the Staff that its critical accounting policies, as described in Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in Post-Effective Amendment No. 7 to the Registration Statement, apply to the unitranche loans.

b. Please explain how the valuation takes into account payment priorities and waterfalls.

2

Response: The valuation methodology of the unitranche loans is the same approach as the Company’s other debt investments. The Company typically determines the fair value of its performing Level 3 debt investments utilizing a yield analysis. In a yield analysis, a price is ascribed for each investment based upon an assessment of current and expected market yields for similar investments and risk profiles. Additional consideration is given to the expected life, portfolio company performance since close, and other terms and risks associated with an investment. Among other factors, a determinant of risk is the amount of leverage used by the portfolio company relative to its total enterprise value, and the rights and remedies of the Company’s investment within the portfolio company’s capital structure.

c. Please explain the impact of the unitranche loans on the calculation of interest income under the effective interest method.

Response: Interest income is calculated the same as any of the Company’s other debt investments and is recorded on the accrual basis. The interest rate is determined according to the terms for the last out loan in the executed credit agreement and agreement among lenders.

d. Please confirm whether any of the co-lenders are affiliates of the Company.

Response: None of the co-lenders subject to these investments are affiliates of the Company.

* * *

Do not hesitate to contact me at (202) 383-0218 or Kristin Burns at (212) 287-7023 if you should need further information or clarification.

| Sincerely, |

| |

| /s/ Cynthia M. Krus |

| Cynthia M. Krus |

3