February 10, 2016

FILED ON EDGAR AS CORRESPONDENCE

United States Securities & Exchange Commission

Division of Corporate Finance

Mara L. Ransom, Assistant Director

100 F Street, NE

Washington, D.C. 20549

Re: PostAds, Inc.

Form S-1 Amendment Number 1

Filed February 10, 2016

File No. 333-208931

Dear Ms. Ransom:

On behalf of PostAds, Inc., a Florida corporation (the “Company”, “PostAds”, “us” or “we”), we submit our responses to the comments of the staff (the “Staff”) of the Securities & Exchange Commission (the “Commission”) dated February 4, 2016, to Amendment Number 1 of the Company’s Registration Statement on Form S-1 (File No. 333-208931) (the “Registration Statement”) filed with the Commission on February 10, 2016, in connection with the registration for resale of up to 5,708,400shares of the Company’s common stock (“Common Stock”). In connection with these responses, as explained below, the Company is filing an Amendment Number 1 to the Registration Statement on Form S-1 (“Amendment Number 1”) via EDGAR seeking to register 940,000 shares of its Common Stock.

GENERAL

Staff Comment 1

1. Please provide us with your analysis as to whether you are a shell company, as defined in Rule 405 under the Securities Act. In this regard, we note that you appear to have nominal operations and assets consisting only of cash and cash equivalents. Please refer to Rule 405 under the Securities Act of 1933, as amended. If you conclude that your company is a shell company, please revise your prospectus to disclose that you are a shell company and disclose the consequences of that status, such as the restrictions on your ability to use registration statements on Form S-8, the limitations on the ability of your security holders to use Rule 144 and the potential reduced liquidity or illiquidity of your securities. Also, please disclose your shell company status on your prospectus cover page and add a related risk factor

Company Response to Staff Comment 1

1. The SEC addressed Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”) in SEC Release No. 33-8587. In the release, the SEC stated, “Weare defining a “shell company” as a registrant with:

| · | no or nominal operations; and |

| · | either no or nominal assets, assets consisting solely of cash and cash equivalents, or assets consisting of any amount of cash and cash equivalents and nominal other assets.” |

We note that this is an “and” test, not an “or” test. Thus, if an issuer has more than no or nominal operations, it is not a shell company, regardless of whether or not it has any assets. We further note that the test is not based upon revenues but upon operations, an important distinction. An issuer that has more than nominal operations but has not generated revenues is not a shell company within this definition.

In the release the SEC stated, “We are not defining the term “nominal,” as we believe that this term embodies the principle that we seek to apply and is not inappropriately vague or ambiguous. [32]”

To demonstrate that the SEC did not think the term “nominal” to be vague or ambiguous, they defined specifically what would be considered nominal.

“[32] We have become aware of a practice in which a promoter of a company and/or affiliates of the promoter appear to place assets or operations within an entity with the intent of causing that entity to fall outside of the definition of “blank check company” in Securities Act Rule 419. The promoter will then seek a business combination transaction for the company, with the assets or operations being returned to the promoter or affiliate upon the completion of that business combination transaction. It is likely that similar schemes will be undertaken with the intention of evading the definition of shell company that we are adopting today. In our view, where promoters (or their affiliates) of a company that would otherwise be a shell company place assets or operations in that company and those assets or operations are returned to the promoter or its affiliates (or an agreement is made to return those assets or operations to the promoter or its affiliates) before, upon completion of, or shortly after a business combination transaction by that company, those assets or operations would be considered “nominal” for purposes of the definition of shell company”

If, then, an issuer has no intention of placing assets or operations in that company and those assets or operations are returned to the promoter or its affiliates (or an agreement is made to return those assets or operations to the promoter or its affiliates) before, upon completion of, or shortly after a business combination transaction by that issuer, according to the SEC, the issuer would not be considered a shell company.

Nonetheless, some confusion arose over the application of shell status under Rule 405 to early stage companies with limited revenues and with legitimate business plans that were taking active steps to implement their business plans as opposed to issuers with phony business plans that did not take and did not intend to take actions to implement their business plan. To clarify that the shell company definition did not apply in the first scenario, early stage companies with limited revenues and with legitimate business plans that were taking active steps to implement their business plans, the SEC in adopting revisions to Rule 144 in Release No. 33-8869 stated:

“Contrary to commenters’ concerns, Rule 144(i)(1)(i) is not intended to capture a “startup company,” or, in other words, a company with a limited operating history, in the definition of a reporting or non-reporting shell company, as we believe that such a company does not meet the condition of having “no or nominal operations.”

Based upon the forgoing, an issuer is not a shell companyif:

| · | The issuer is early stage, pre or early revenue “startup” company with a legitimate business plan that is taking active steps to implement its business plan; and |

| · | The issuer has no intention to place assets or operations in that company and those assets or operations are returned to the promoter or its affiliates (or an agreement is made to return those assets or operations to the promoter or its affiliates) before, upon completion of, or shortly after a business combination transaction by that company. |

We Have More than No or Nominal operations.

We are not a shell company in that it has both significant operating history and have commenced significant operations. Further, we have no intention of transferring any portion of our assets or operations to a stock promoter or its affiliates and there is no agreement to return our assets or operations to a promoter or its affiliates before, upon completion of, or shortly after a business combination transaction.

Even prior to our corporate formation, as a sole proprietorship we engaged in operating activities related to our organization, plan of operations and business plan to develop the PostAds online marketplace.

Organizational Matters

Our significant operational activities include:

| · | Prior to incorporation, we operated as a sole proprietorship; |

| · | We changed our structure to a corporation on by incorporating in the State of Nevada; |

| · | We established business plan after research by Kenneth Moore, our Chief Executive Officer; |

| · | We located and set up a corporate office in Deerfield Beach Florida; |

| · | We opened a corporate bank account for Post Ads, Inc. after we incorporated; |

| · | We obtained auction industry research reports from Ibis world and conducted research about online sales of goods and services; |

| · | Purchased the domain name www.postads.com; and |

| · | Set up hosting account for our the PostAds marketplace with godaddy.com. |

Financing Matters

| · | In August of 2015, we engaged our securities attorney to assist us compliance with state and federal securities laws including our private placement offering, Form S-1 Registration Statement filing, and other matters; |

- We engaged the services of an accountant to prepare our financial statements in November 2015;

- In November 2015, we engaged Salberg & Company P.A. as our auditor to audit our financial statements contained in our Form S-1 Registration Statement;

- From November 2015, through February 2016, we secured initial capital of $148,920 from nineteen (19) shareholders in a private placement;

| · | We selected our transfer agent, Island Stock Transfer in December 2015; |

| · | We located our Edgar filer in December 2015; and |

| · | In December 2015, we filed our Form S-1 Registration Statement with the SEC. |

Business Plan Matters

From our inception through July 2015, Mr. Moore donated part time to our business while maintaining full-time employment. During this period, Mr. Moore undertook the following activity on a part time basis in furtherance of our business plan:

| · | consulted with Robert Fratianni a programmer about program and software development for the PostAds online Marketplace; |

| · | researched and evaluated classified and auction software platforms for software security, scalability and features; |

| · | selected Geodesic solutions software; |

| · | created logo and implement custom category images using blufyremedia.com; |

| · | set up our test site and converted the website into Spanish, Brazilian and Portuguese; |

| · | identified the initial features of our site; |

| · | added affiliate software utilizing idev.com; |

| · | created custom category images utilizing Blufyremedia.com; |

| · | researched live auction and classified platforms to ascertain which features sites have in common as well as what one of features they may have to determine what user features we need to implement and the timeline to create the features; |

| · | created the content of our classified ad categories and subcategories; |

| · | created the content of our auction categories and subcategories; and |

| · | created the website content of for our retail and service storefronts and identified the features that each would offer to buyers and sellers. |

In August 2015, Mr. Moore began to devote full time to our business. Shortly thereafter, Mr. Moore and began working with our software developer and programmer Robert Fratianni on a full time basis.

From August through September 2015, we undertook the following activity:

- entered into a Consulting Agreement with Steve Weiss who assisted us in our transition from a sole proprietorship to a corporation and other business related matters;

- entered into an Agreement with Robert Fratianni to serve as our website developer and programmer;

- working with Robert Fratianni, Mr. Moore finalized the features of the PostAds Marketplace website creating apple and android customization and mobile applications of our website so that visitors will be able to use the website features on their cell phone; and

- created PostAds banner management software allowing Sellers to upload their banner for products or services they offer.

During October 2015, we added an image mouse over feature to our website, whereby images enlarge once the mouse icon scrolls over the image.

During October 2015, added Dynamic pop up window controlled by the websites administrator whereby users see dynamic adds as popups when visiting the site.

From November 2015, through January 2016, we continued to work on the site features. During this period, we customized a search engine optimizer for the PostAds market place with:

| · | Meta tags for each category, |

| · | Meta key words for each category, |

| · | Meta descriptions for each category, |

| · | Meta titles for each category, |

| · | Meta keywords for each ad, and |

| · | Meta descriptions for each ad. |

In February 2016, we started the customization of out Bulk uploader software which we expect to complete by April 2016.

In February 2016, we applied for trademark protection of our logo and the PostAds Marketplace name.

Since creating our initial site, we have processed registrations for the 2507 users and responded to user inquiries from time to time.

We expect to test and finalize all features of the PostAds Marketplace so we can launch our site in April 2016, and begin charging fees to Sellers who use our website.

Staff Comment 2

2. Given the nature of the offering, the size of the offering relative to the number of shares outstanding held by non-affiliates, and the identity and nature of the Selling Stockholders, it appears that this offering may be by or on behalf of the registrant. If so, the offering is not eligible to be conducted on a continuous or delayed basis pursuant to Rule 415(a)(1)(i) of Regulation C. Please provide us with a detailed analysis of why this offering is not by or on behalf of the registrant and address all of the factors set forth in Securities Act Rules Compliance and Disclosure Interpretation 612.09. Alternatively, please revise the registration statement to name the Selling Stockholders as underwriters, disclose that such Selling Stockholders must resell their shares at a fixed price throughout the offering, even after you become quoted or listed, and make conforming changes to your prospectus accordingly, including your cover page, summary and plan of distribution sections.

Company Response to Staff Comment 2

2. We do not believe that the Company is engaged in a primary offering of securities based on the Company’s completed private placement (“Private Placement”) and other circumstances relating to the Company.

Please be advised that:

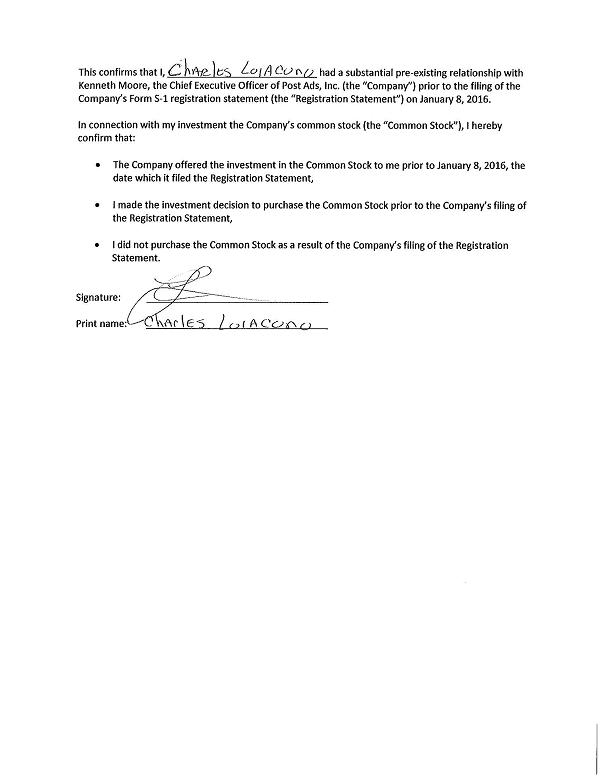

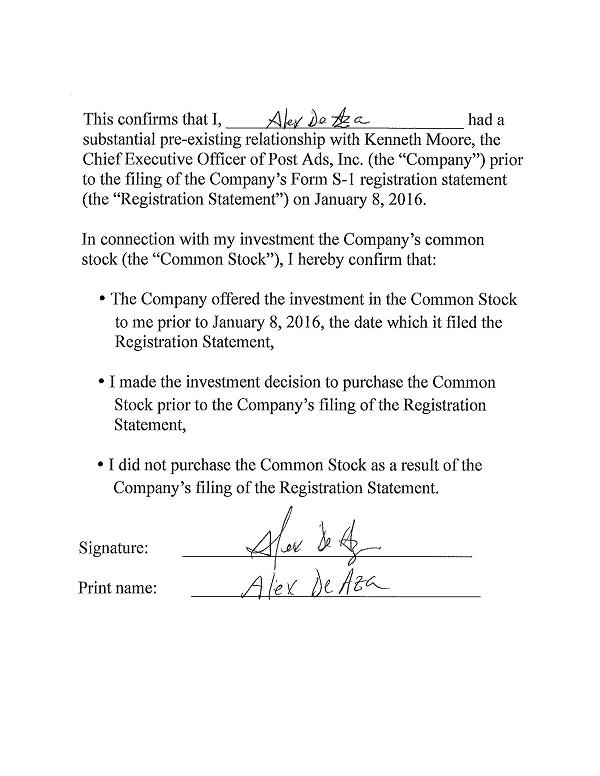

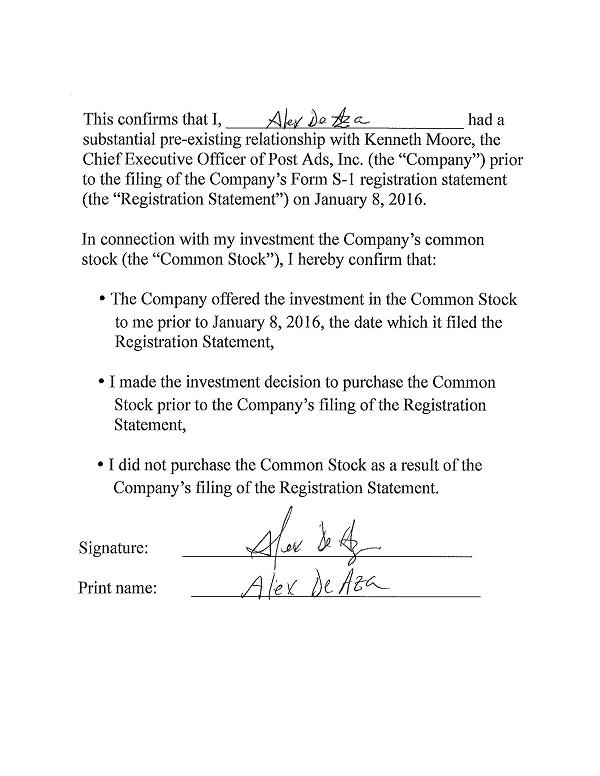

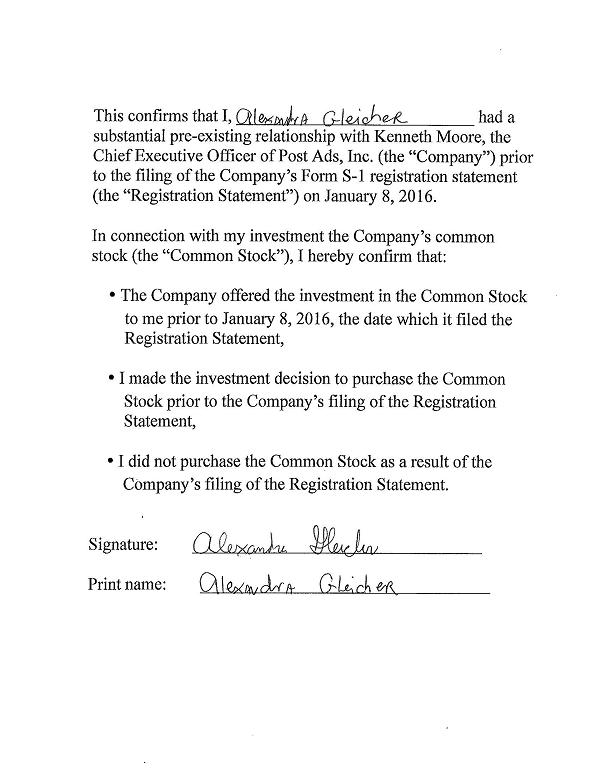

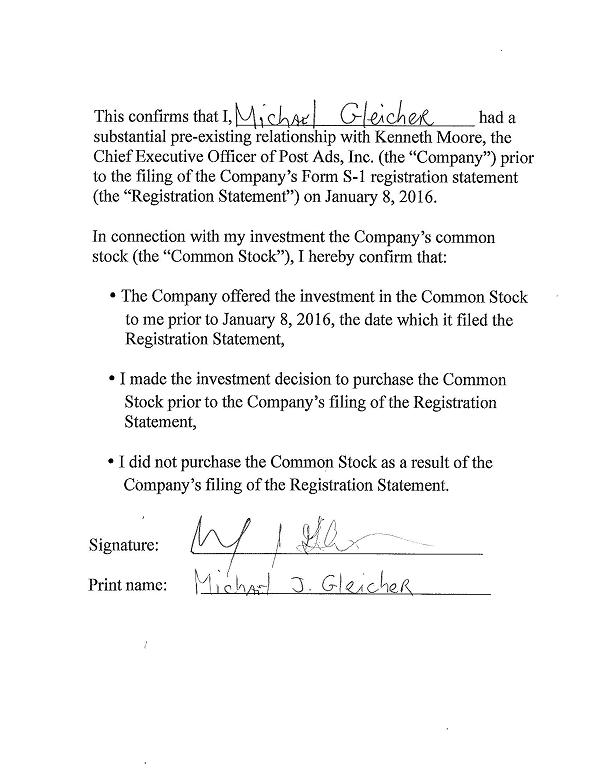

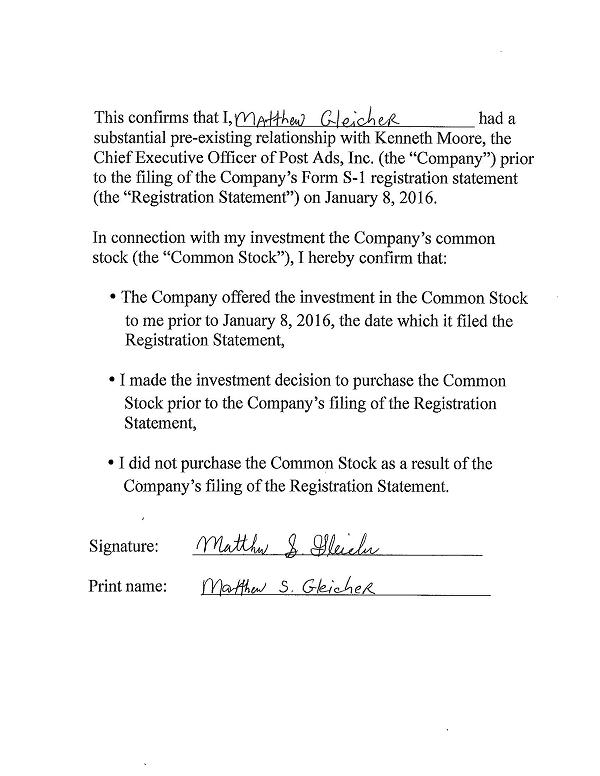

| · | In Amendment Number 1 to the Registration Statement, the Company includes ten (10) additional shareholders who paid cash consideration for their shares who were offered the investment in the Private Placement prior to the filing of the Form S-1, |

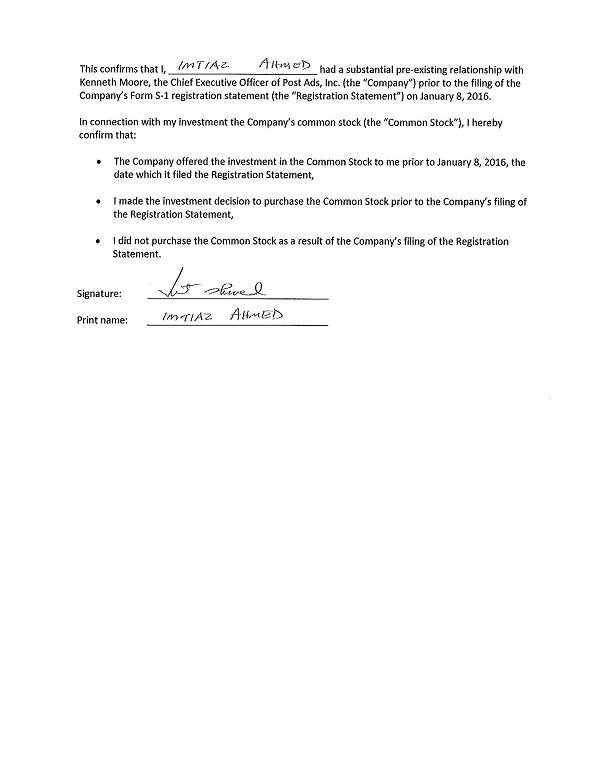

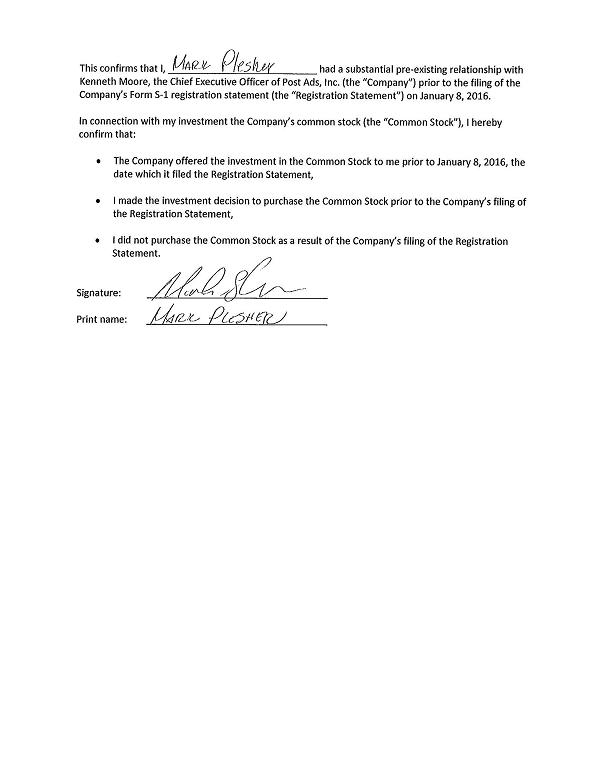

| · | Each shareholder added in Amendment Number 1 represented in writing that: |

(i) he or she had a substantial pre-existing relationship with us,

(ii) made his or her investment decision prior to our filing of this Registration Statement, and

(iii) did not purchase the shares as a result of our filing of this Registration Statement.

These statements are attached as Exhibit A.

| · | We have limited the number of shares being registered on behalf of each stockholder to 50,000 shares to prevent any concentration of ownership of our public float and the reduce the size of the offering relative to the number of shares outstanding held by affiliates, and |

| · | We have removed two (2) individuals as Selling Stockholders who received 2,300,000 shares as a gift from Kenneth T. Moore, the Company’s sole officer and director. |

In Amendment Number 1 we seek to register an aggregate of 940,000 shares on behalf of Selling Stockholders. Additionally, we seek to register no more than 50,000 common shares for each Selling Stockholder. The Selling Stockholders consist of: (i) nineteen (19) non-affiliated investors who purchased an aggregate of 2,938,400 shares of the Company’s common stock from September 2015 through February 2016, at the price of $.05 per share, of which 540,000 shares are being registered and (ii) five (5) stockholders who received an aggregate of 6,796,000 shares for services in August 2015 of which 250,000 shares are being registered.

The Selling Stockholders who paid cash consideration for their shares were offered their shares in the Private Placement from September 4, 2015 through December 15, 2015, prior to the Company’s filing of the Registration Statement on January 8, 2016.

We are not registering shares held by the Company’s sole officer and director, Kenneth T. Moore or his family members. We are not registering shares gifted by Mr. Moore to two (2) stockholders. Additionally, neither the Company nor Mr. Moore will receive the proceeds from shares registered on behalf of the Selling Stockholders.

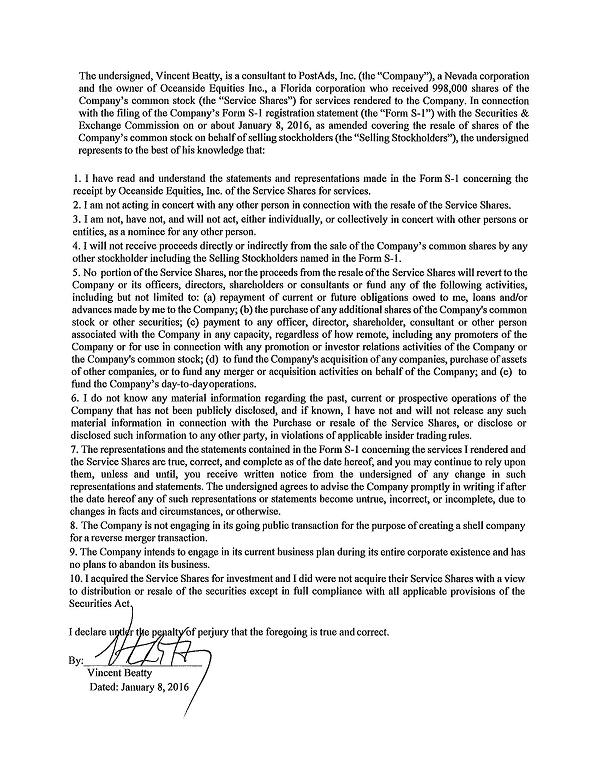

Each consultant who received shares for services (“Service Shares”) provided written representationsattached as Exhibit B stating among other things that“ NoportionoftheService Shares,northeproceedsfromtheresaleofthe Service ShareswillreverttotheCompany or its officers, directors, shareholders or consultants or fund any of the following activities, including but not limited to: (a) repayment of current or future obligations owed to me, loans and/or advances made by me to the Company; (b) the purchase of any additional shares of the Company's common stock or other securities; (c) payment to any officer, director, shareholder, consultant or other person associated with the Company in any capacity, regardless of how remote, including any promoters of the Company or for use in connection with any promotion or investor relations activities of the Company or the Company's common stock;(d)tofundtheCompany'sacquisitionofanycompanies,purchaseofassetsofothercompanies,ortofundany merger or acquisition activities on behalf of the Company; and (e) to fund the Company’s day-to-dayoperations… I acquired the Service Shares for investment and did not acquire their Service Shares with a view to distribution or resale of the securities except in full compliance with all applicable provisions of the Securities Act.”

For the reasons discussed below, we respectfully submit that the offering contemplated by the Registration Statement is a valid secondary offering by or on behalf of the Selling Stockholders (described below) that may be registered for sale on a continuous basis pursuant to Rule 415(a)(1)(i) under the Securities Act of 1933, as amended (the “Securities Act”). The offering is not the type of transaction about which the Staff has historically raised concerns under Rule 415, and a careful consideration of all of the factors articulated in Interpretation 612.09 of the Staff’s Compliance & Disclosure Interpretations (the “C&DIs”) for the Securities Act rules clearly supports a conclusion that the offering does not amount to a distribution by the Selling Shareholder on behalf of the Company.

Rule 415 Analysis

Rule 415(a)(1)(i) provides that securities may be registered for a continuous offering provided that the securities "are to be offered or sold solely by or on behalf of a person or persons other than the registrant, a subsidiary of the registrant or a person of which the registrant is a subsidiary." In Compliance and Disclosure Interpretation 612.09 (“CDI 612.09”) with respect to the rules under the Securities Act, the Staff acknowledged that:

[i]t is important to identify whether a purported secondary offering is really a primary offering, i.e., the selling shareholders are actually underwriters selling on behalf of an issuer. Underwriter status may involve additional disclosure, including an acknowledgment of the seller’s prospectus delivery requirements. In an offering involving Rule 415 or Form S-3, if the offering is deemed to be on behalf of the issuer, the Rule and Form in some cases will be unavailable (e.g., because of the Form S-3 “public float” test for a primary offering, or because Rule 415(a)(1)(i) is available for secondary offerings, but primary offerings must meet the requirements of one of the other subsections of Rule 415). The question of whether an offering styled a secondary one is really on behalf of the issuer is a difficult factual one, not merely a question of who receives the proceeds. Consideration should be given to how long the selling shareholders have held the shares, the circumstances under which they received them, their relationship to the issuer, the amount of shares involved, whether the sellers are in the business of underwriting securities, and finally, whether under all the circumstances it appears that the seller is acting as a conduit for the issuer. (emphasis added)

After consideration of all of the factors listed in CDI 612.09, which are discussed in detail below in the context of the Private Placement, it is the Company’s view that the offering is a valid secondary offering and is eligible to be made under Rule 415(a)(1)(i) under the Securities Act.

The date on which and the circumstances in which each Selling Stockholder received the shares and/or the overlying securities.

We are seeking to register an aggregate of 790,000 shares on behalf of the Selling Stockholders. 790,000 shares were issued to nineteen (19) investors who paid cash consideration for their shares and 250,000 shares were issued for services rendered to us.

In addition to the date on which the securities were acquired, also relevant to the analysis are the circumstances under which the Selling Stockholders received the securities. The issuances were pursuant to valid private placements under Section 4(2) of the Securities Act and Regulation D promulgated thereunder and the Selling Stockholders were offered their shares and made their investment decision prior to the Company’s filing of its Registration Statement.

The Selling Stockholders paying cash consideration for their shares made an aggregate investment of $148,920 in our common stock. With respect to the shares issued for services, we did not have sufficient funds to engage service providers for cash consideration. Each consultant executed a written agreement whereby they agreed to accept shares of our common stock in lieu of cash compensation. We filed these agreements as Exhibits 10.2 through Exhibit 10.5 to our initial Form S-1 Registration Statement, filed with the Commission on January 8, 2016. The Selling Stockholders made an investment in the common stock, they hold the risk of ownership and they paid consideration for the securities which they hold. Even after the Registration Statement is declared effective, the Selling Stockholders will continue to bear the risk of ownership thereafter. The risks being borne by the Selling Stockholders are further evidence that this is not an offering by or on behalf of the Company. The Company has already received the proceeds of the sale of securities under the Private Placement and the consultants were contractually bound to provide services prior to the date of that the Registration Statement was filed.

The resale by the Selling Stockholders of their common shares is not analogous to an offering by the Company. In a Company offering, the Company receives proceeds from the sale of its securities. All of the Selling Stockholders acquired their securities, for investment and specifically represented to the Company that they were not acquiring their securities with a view to distribution or resale of the securities except in full compliance with all applicable provisions of the Securities Act.

The Selling Stockholders’ Relationships to with the Company.

With the exception of Steve Weiss, none of the Selling Stockholders is an affiliate of the Company. Additionally, none of the Selling Stockholders has the ability directly or indirectly to control the actions of the Company either by contract or through management or the exercise of voting rights, and has no special access to material non-public information concerning the Company. Further, none of the Selling Stockholders hold a concentration of shares giving them control of a large number of shares in the Company’s public float.

Additionally, as stated above, each Consultant represented in writing that“ NoportionoftheService Shares,northeproceedsfromtheresaleofthe Service ShareswillreverttotheCompany or its officers, directors, shareholders or consultants or fund any of the following activities, including but not limited to: (a) repayment of current or future obligations owed to me, loans and/or advances made by me to the Company; (b) the purchase of any additional shares of the Company's common stock or other securities; (c) payment to any officer, director, shareholder, consultant or other person associated with the Company in any capacity, regardless of how remote, including any promoters of the Company or for use in connection with any promotion or investor relations activities of the Company or the Company's common stock;(d)tofundtheCompany'sacquisitionofanycompanies,purchaseofassetsofothercompanies,ortofundany merger or acquisition activities on behalf of the Company; and (e) to fund the Company’s day-to-dayoperations… I acquired the Service Shares for investment and did not acquire their Service Shares with a view to distribution or resale of the securities except in full compliance with all applicable provisions of the Securities Act. ”

Whether the Selling Stockholders are in the business of buying and selling securities.

We believe that none of the Selling Stockholders is in the business of buying and selling securities.

The Number of Common Shares Being Registered.

As of the date hereof, we had 21,034,400 shares of common stock issued and outstanding. Based on the number of shares issued and outstanding as of the date hereof, the 940,000 shares being registered represent approximately 4.9% of our issued and outstanding shares of common stock.

We are not registering variable rate or floating securities that pose the potential for significant dilution of current shareholders. However, we respectfully submit that the nature and provisions of the securities being registered, namely that they are not floating rate or variable rate securities are also important factors to consider when making a determination that the transaction is a secondary offering and not a primary offering.

The Selling Stockholders are not acting as a conduit for the Company.

Considering the factors listed in CDI 612.09, (i) the Selling Stockholders made fundamental decisions to invest in the Common Shares, (ii) the Selling Stockholders have represented their investment intent and disclaimed any intent to distribute their securities in violation of any securities laws; and (iii) the shares being registered include no shares issuable upon conversion of notes that would contain toxic or other abusive provisions that have resulted in special concerns by the Commission’s Staff. The facts and analysis provided above demonstrate, the Selling Stockholders are not acting as conduits for the Company. In these circumstances we believe that the offering the Company seeks to register is a valid secondary offering and may proceed consistent with Rule 415.

Staff Comment 3

3. We note statements in your prospectus about your “meaningful revenues” and “minimal revenues.” We also note that your financial statements do not reflect any revenues earned. Please state clearly whether you have generated any revenue to date, and provide additional context about any revenue that you may have earned.

Company Response to Staff Comment 3

3. We have modified our disclosures to clearly reflect that we have not generated revenues.

PROSPECTUS SUMMARY, PAGE 2

Staff Comment 4

4. Please include on page 3 the lack of an independent audit or compensation committee and independent director, and Mr. Moore’s ability to determine the outcome of all matters voted on by security holders by virtue of his ownership of 2,000,000 shares of super voting preferred stock. Please refer to Item 503(a) and the Instruction to paragraph 503(a) of Regulation S-K

Company Response to Staff Comment 4

4. We have modified our disclosures to include the lack of an independent audit or compensation committee and independent director, and Mr. Moore’s ability to determine the outcome of all matters voted on by security holders by virtue of his ownership of 2,000,000 shares of super voting preferred stock.

THE OFFERING, PAGE 4

Staff Comment 5

5. Please disclose the issuance of 2,000,000 preferred shares to Mr. Moore.

Company Response to Staff Comment 5

5. We have disclosed the issuance of 2,000,000 preferred shares to Mr. Moore.

Staff Comment 6

6. We note your disclosure on page 7 that the Selling Stockholders will “offer the shares at prevailing market prices or privately negotiated prices.” Elsewhere you indicate that Selling Stockholders will sell at a fixed price until you are quoted on the OTCQB. Please revise.

Company Response to Staff Comment 6

6. We have revised our disclosures to reflect our Selling Stockholders will offer their shares at the price of $.10 until our shares are quoted by the OTC Markets.

RISKS RELATED TO OUR BUSINESS

IF WE WERE UNABLE TO GENERATE SUFFICIENT REVENUES FOR OUR OPERATING EXPENSES, PAGE 8

Staff Comment 7

7. It appears you may need to obtain additional financing before you begin generating revenue. Please revise this risk factor to discuss that you will need financing to begin generating revenue.

Company Response to Staff Comment 7

7. We have disclosed our risk factors to discuss the possibility that we may need financing to begin generating revenue.

WE ARE DEPENDENT ON THE SALE OF OUR SECURITIES TO FUND OUR OPERATIONS, PAGE 11

Staff Comment 8

8. Please revise this risk factor to discuss how the sale of additional securities could have a dilutive effect on the holdings of existing shareholders.

Company Response to Staff Comment 8

8. We have revised this risk factor to discuss the dilutive effect on our existing shareholders.

OTC MARKETS CONSIDERATIONS, PAGE 23

Staff Comment 9

9. Please tell us the basis for your belief that “market makers will enter ‘piggyback’ quotes and [your] securities will thereafter be quoted by on the OTC Markets” after effectiveness.

Company Response to Staff Comment 9

9. We have removed references to piggy back quotes.

DESCRIPTION OF SECURITIES, PAGE 24

Staff Comment 10

10. Please disclose whether the common stock and preferred stock vote together as a single class.

Company Response to Staff Comment 10

10. We have modified our disclosures to clarify that the holders of our common stock and preferred stock will vote together as a single class.

OUR BUSINESS

REVENUES, PAGE 30

Staff Comment 11

11. Please provide a more specific description of the website features you plan to complete in April 2016. Please discuss how each feature will operate, if and how it will generate revenue, and the costs associated with completion.

Company Response to Staff Comment 11

11. We have modified our disclosures to include a chart with a specific description of the website features we plan to complete in April 2016, how each feature will operate and if and how it will generate revenues as well as the costs to complete the feature.

AUCTIONS, PAGE 31

Staff Comment 12

12. Please enhance your disclosure regarding the “Auction” section of your website. Please discuss how this section operates, the associated costs, and how it generates revenue

Company Response to Staff Comment 12

12. We modified our disclosures to reflect how the Auction section of our website operates, the costs, and how it generates revenues.

Staff Comment 13

13. Please discuss the basis for your belief that your auction services are more advantageous than the “other services” you reference. Please also provide this information in your Competition section on page 34.

Company Response to Staff Comment 13

13. We have modified our disclosures as requested and added this information under Competition on page 34.

MATERIAL AGREEMENTS, PAGE 32

Staff Comment 14

14. According to Exhibit 10.5, a balance of $10,000 for development of the bulk uploader is due in April of 2016. Please revise the last sentence of the first paragraph to state April 2016 instead of April 2015.

Company Response to Staff Comment 14

14. We have modified our disclosures as requested.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION, PAGE 35

Staff Comment 15

15. Please disclose any expected sources of funding for each milestone, and how you intend to meet each of the milestones if you cannot receive funding.

Company Response to Staff Comment 15

15. In order to substantiate that the Company has sufficient capital to meet the listed milestones, we have added the following text below the Milestone Development chart on page 36:

“From September 2015, through February 2016, we sold 2,938,400 shares of common stock to nineteen (19) persons at the price of $.05 per share for aggregate proceeds of approximately $146,920, enabling us to meet the above milestones.”

INTERIM FINANCIAL STATEMENTS

STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY, PAGE F-4

Staff Comment 16

16. Please tell us how you considered SAB Topic 4:B in the above statement for the conversion from a sole proprietorship to a “C” Corporation. In this the regard, undistributed earnings or losses from a non-taxable conduit entity should generally be reclassified to paid-in-capital absent a statutory prohibition. Please advise or revise.

Company Response to Staff Comment 16

16. We considered the guidance provided in SAB Topic 4B and have revised the STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY and BALANCE SHEET to clearly present the reclassification of the $12,242 accumulated deficit as of August 16, 2015 of the sole proprietor business to additional paid-in capital of the Company.

In addition,we modified our disclosures by adding the following text to NOTE 1 - ORGANIZATION, BUSINESS AND OPERATIONS and to NOTE 8 - STOCKHOLDERS EQUITY:

“On August 17, 2015, as part of the re-organization and recapitalization into a ‘C’ corporation, the Company applied paragraph 505-10-S99-3 of the FASB Accounting Standards Codification (formerly Topic 4B of the Staff Accounting Bulletins (“SAB”) (“SAB Topic 4B”) issued by the U.S. Securities and Exchange Commission (the “SEC”)), by reclassifying the accumulated deficit of the sole proprietor businesses of $12,242 to additional paid-in capital.”

ANNUAL FINANCIAL STATEMENTS

NOTE 2 – GOING CONCERN, PAGE F-19

Staff Comment 17

17. Please note that filings containing accountant’s reports that are qualified as a result of questions about the entity’s continued existence must contain appropriate and prominent disclosure of the registrant’s viable plans to overcome these difficulties. Your disclosure here and on page F-7 indicates that the Company intends to fund operations through equity financing arrangements; however, you state on page 38 that you have no external sources of liquidity and your officers and directors have made no commitments with respect to providing a source of liquidity in the form of cash advances, loans and/or financial guarantees. Please revise your disclosure to include more detailed disclosure of your viable plans to overcome your financial difficulties. If you do not have viable plans to overcome such difficulties, then your financial statements should more appropriately be based on the assumption of liquidation. Refer to Section 607.02 of the Financial Reporting Codification

Company Response to Staff Comment 17

17. We modified our disclosures in NOTE 2 – GOING CONCERN on page F-19, NOTE 3 – GOING CONCERN on page F-7, and theLiquidity and Capital Resourcessection of MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION to clearly reflect the Company’s intensions to fund development and initial operations through the placement of its common stock or issuance of debt securities and the ongoing process by which proceeds were received by the Company from the sale of shares of common stock during September of 2015 through January of 2016, enabling the Company to meet milestones, fund development and overcome such financial difficulties.

NOTE 3 – SUMMARY OF SIGNIFIGANT ACCOUNTING POLICIES, PAGE F-19

RECENT ACCOUNTING PRONOUNCEMENTS, PAGE F-21

Staff Comment 18

18. Please disclose whether and when you adopted Accounting Standards Update No. 2014-10 (ASU 2014-10), which eliminates certain financial reporting requirements of development stage entities as defined in ASC 915. If you have not adopted ASU 2014-10, please tell us how you considered the requirements of ASC 915 in your annual financial statements. If you have adopted ASU 2014-10, please explain how you have complied with ASC 275-10-50-2A.

Company Response to Staff Comment 18

18. We modified our disclosures to disclose the Company’s early adoption of Accounting Standards Update No. 2014-10 (ASU 2014-10) by adding a disclosure in the Recent Accounting Pronouncements section of NOTE 4 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES of the Company’s Notes to Financial Statements for the nine months ended September 30, 2015 and in NOTE 3- SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES for the years ended December 30, 2014 and 2013. We also added a disclosure under the basis of presentation in both the September 30, 2015 and December 31, 2014 and 2013 Financial Statements to disclose risks and uncertainties in accordance under ASC 275-10-50-2A.

NOTE 4 – STOCKHOLDERS EQUITY, PAGE F-22

A) COMMON STOCK

Staff Comment 19

19. You state on page 18 that on August 17, 2015, 9,000,000 shares were issued to Kenneth T. Moore for services rendered and were valued at $9,000. In the above-referenced note, you indicate the Company had 9,000,000 to be issued and outstanding shares of common stock to be issued to the Company’s Founder in August 2015. Your disclosure on page F-6 indicates you valued and accounted for the shares retroactively to 2013 treating the nominal value as an expense of 2013. Please explain in detail your basis in GAAP for the retrospective treatment of the stock issuance per Section 805-50 of the Accounting Standards Codification. Please be detailed in your response. Lastly, please reconcile your accounting with your disclosure of Stock-Based Compensation on page F-20 which suggests grant-date accounting.

Company Response to Staff Comment 19

19. During the reorganization process in 2015, management evaluated the accounting for all years being presented in Form S-1 and determined that the sole proprietor Founder performed most of his services through 2013 while the Company was primarily dormant in 2014 and part of 2015. We determined that the $11,000 nominal amount which also equated to the par value of the Founder shares being issued in the reorganization was a reasonable estimate of the value of the services performed through 2013, based on guidance in the AICPA Alert 2000-1, therefore, an expense was recorded in 2013.

The reorganization of the sole proprietorship into a corporation that occurred in August 2015 was treated as a recapitalization in accordance with the concept under SAB Topic 4C as reflected in ASC 505-10-599 and therefore the Founder shares issued are reflected retroactively. In addition, there is no “grant” of Founder shares in 2015, but rather an issuance pursuant to the reorganization and there was no “valuation” of such shares on a valuation date in 2015, but only the share quantity was retroactively applied to the inception date of August, 26, 2013. We note that any accounting under ASC 805-50 would have the same exact accounting effect as above. We have revised the referenced disclosures in the footnotes to clarify.

Staff Comment 20

20. You indicate on page 19 that Kenneth T. Moore gifted 1,900,000 shares to Keith Moore and 400,000 shares to Frank Rocco. Please explain the purpose of the share transfer including whether Mr. Moore or Mr. Rocco provided services to the registrant. If so, please refer to ASC 718-10-15-4. In the event no services were provided, please tell us whether any accounting effect was reflected in the financial statements for such gifted shares.

Company Response to Staff Comment 20

20. Kenneth T. Moore gifted 1,900,000 shares to Keith Moore, his brother, and 400,000 shares to Frank Rocco, a long-time friend, and neither recipient of the shares provided any services to the Company or to Kenneth T. Moore. The disclosure has been clarified as presented below and since no services were rendered for the shares, there has been no accounting effect reflected in the financial statements for such gifted shares. The disclosure is primarily for share ownership presentation and information.

We have modified our disclosures to include the footnote under theCommon Stock Offering chart which summarizes all common shares we have issued since our inception:

| | “(1) | On December 29, 2015, Kenneth T. Moore, our President, Chief Executive Officer and Director gifted 1,900,000 shares to his brother Keith Moore and 400,000 shares to Frank Rocco, a personal friend. We are not registering the common shares held by Keith Moore and Frank Rocco.” |

COMPANY ACKNOWLEDGMENT

The Company acknowledges that:

| · | should the Commission or the staff, acting pursuant to delegated authority, declarethe filing effective, it does not foreclose the Commission from taking any action withrespect to the filing; |

| · | the action of the Commission or the staff, acting pursuant to delegated authority,in declaring the filing effective, does not relieve the Company from its full responsibilityfor the adequacy and accuracy of the disclosure in the filing;and |

| · | the company may not assert staff comments and the declaration of effectiveness asa defense in any proceeding initiated by the Commission or any person under thefederal securities laws of the UnitedStates. |

Sincerely,

/s/ Kenneth T. Moore

Kenneth T. Moore, Chief Executive Officer

Exhibit A

Shareholder Statement - Lawrence Beheshti

Shareholder Statement - Charles Loiacono

Shareholder Statement - Alex De Anza

Shareholder Statement - Alexandra Gleicher

Shareholder Statement - Michael Gleicher

Shareholder Statement - Matthew Gleicher

Shareholder Statement - Jordan Gleicher

Shareholder Statement - Imtiaz Ahmad

Shareholder Statement - Mark Plescher

Shareholder Statement - Gregory Otto

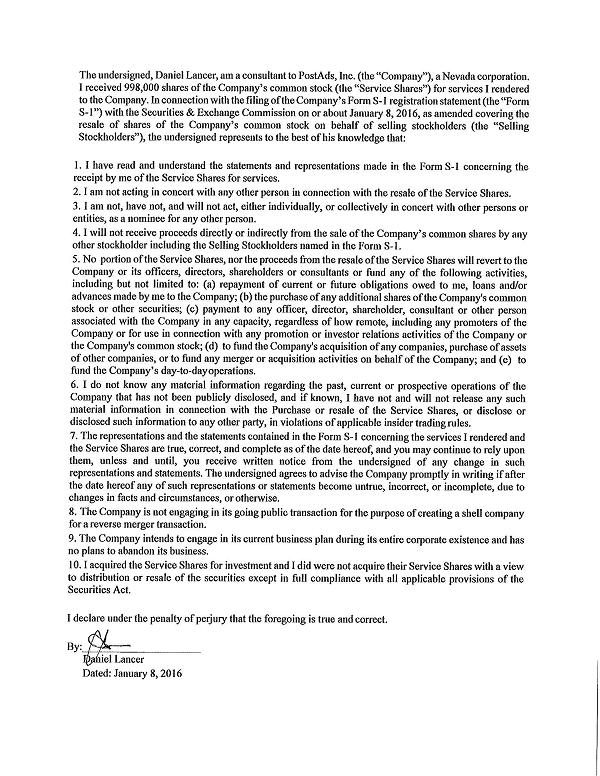

Exhibit B

Shareholder Statement - Oceanside Equities, Inc.

Shareholder Statement - Robert Fratianni

Shareholder Statement - Steve Weiss

Shareholder Statement - Daniel Lancer