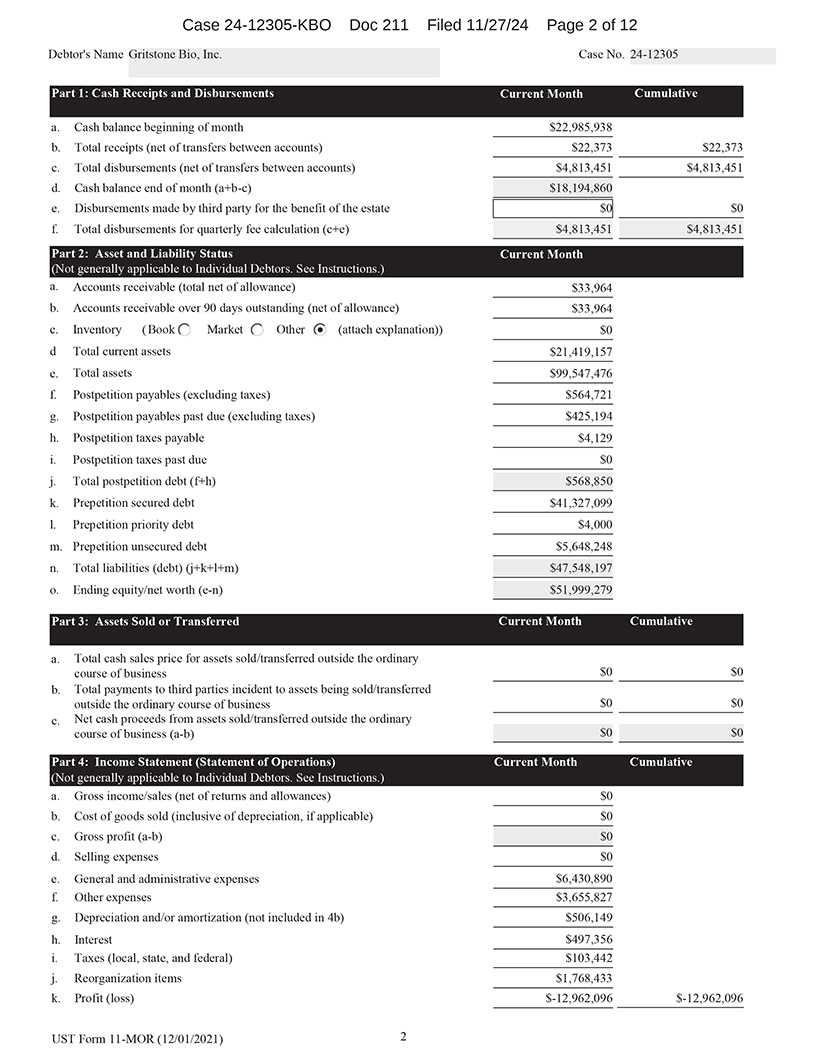

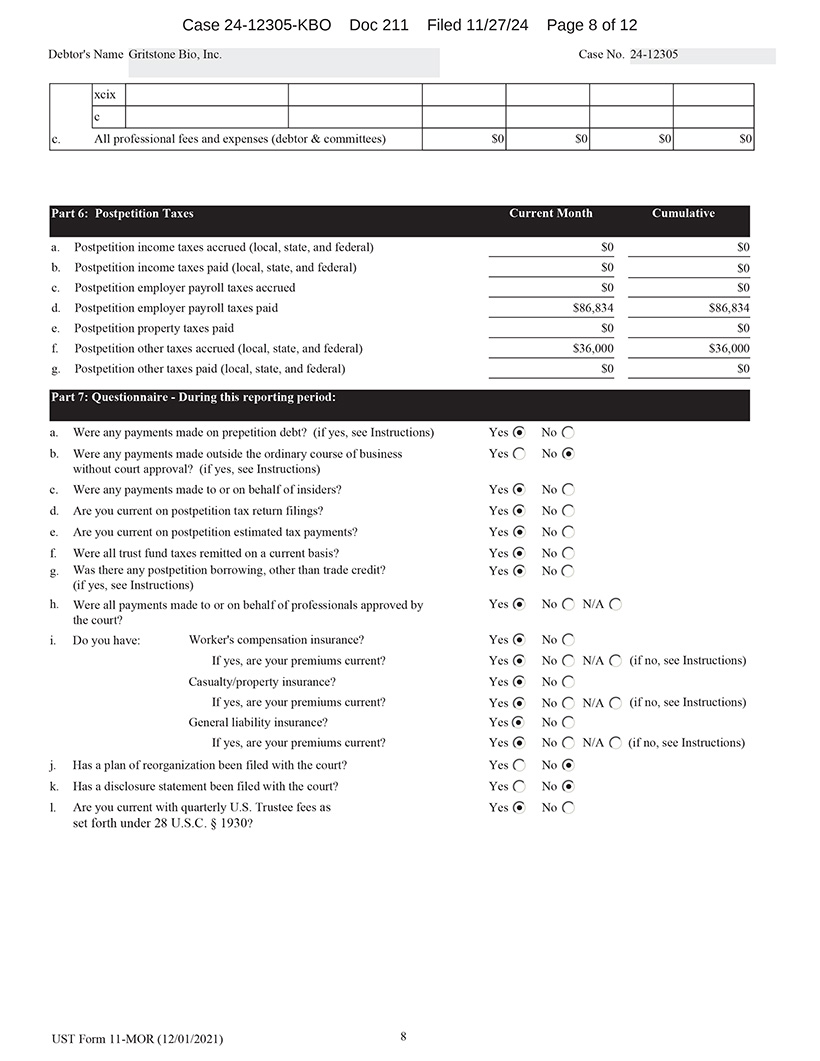

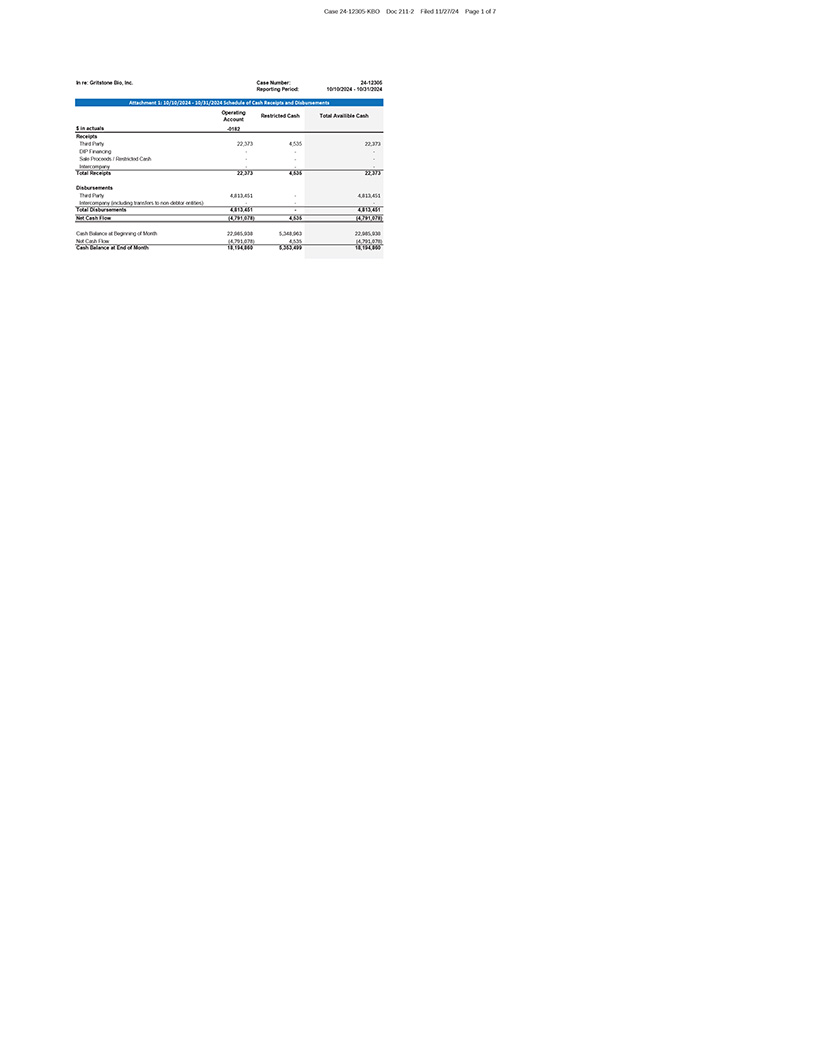

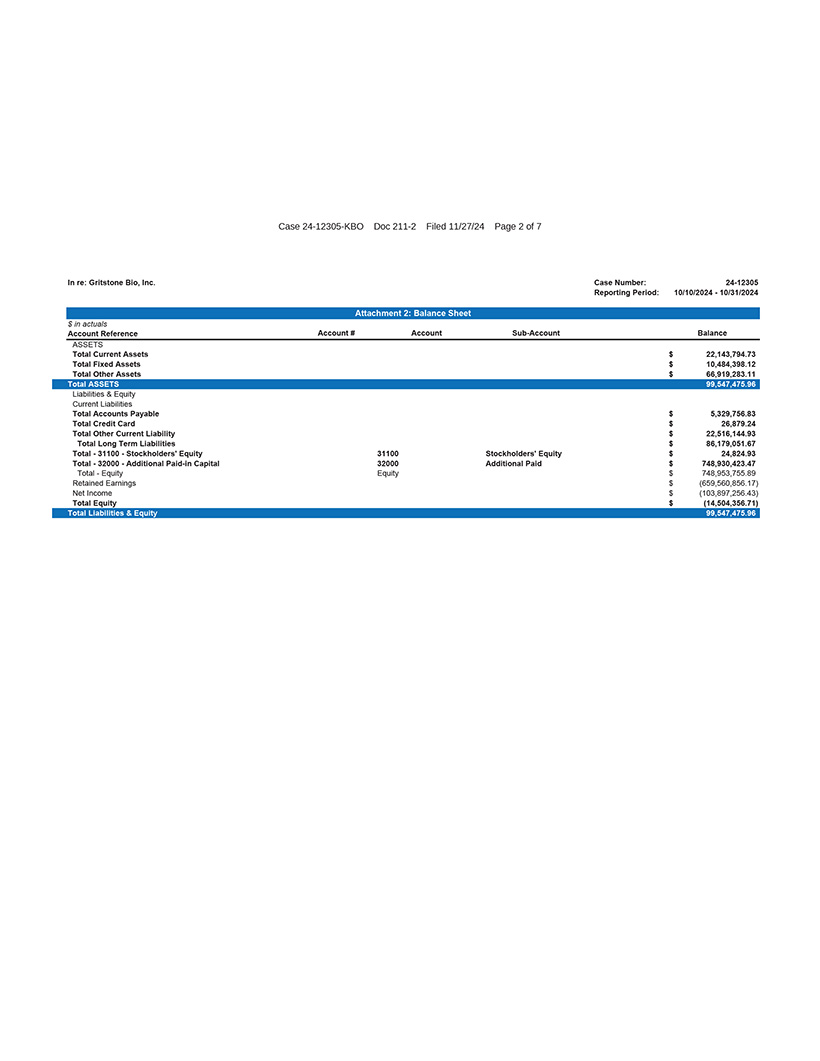

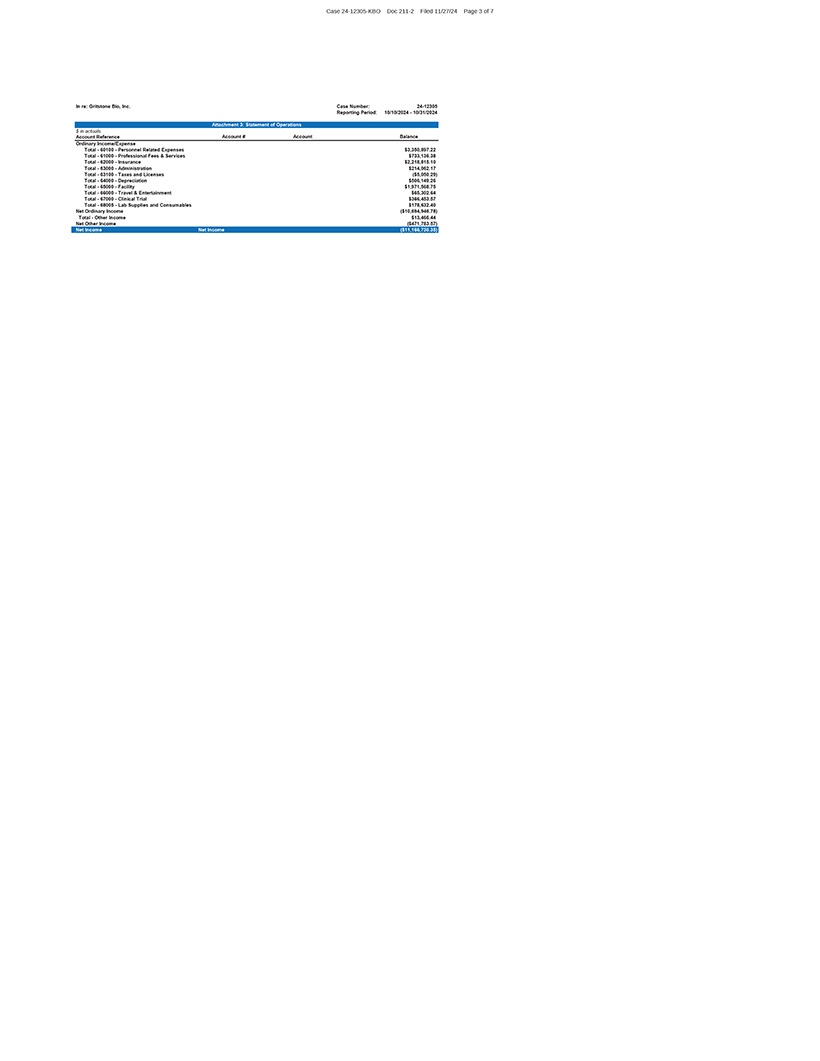

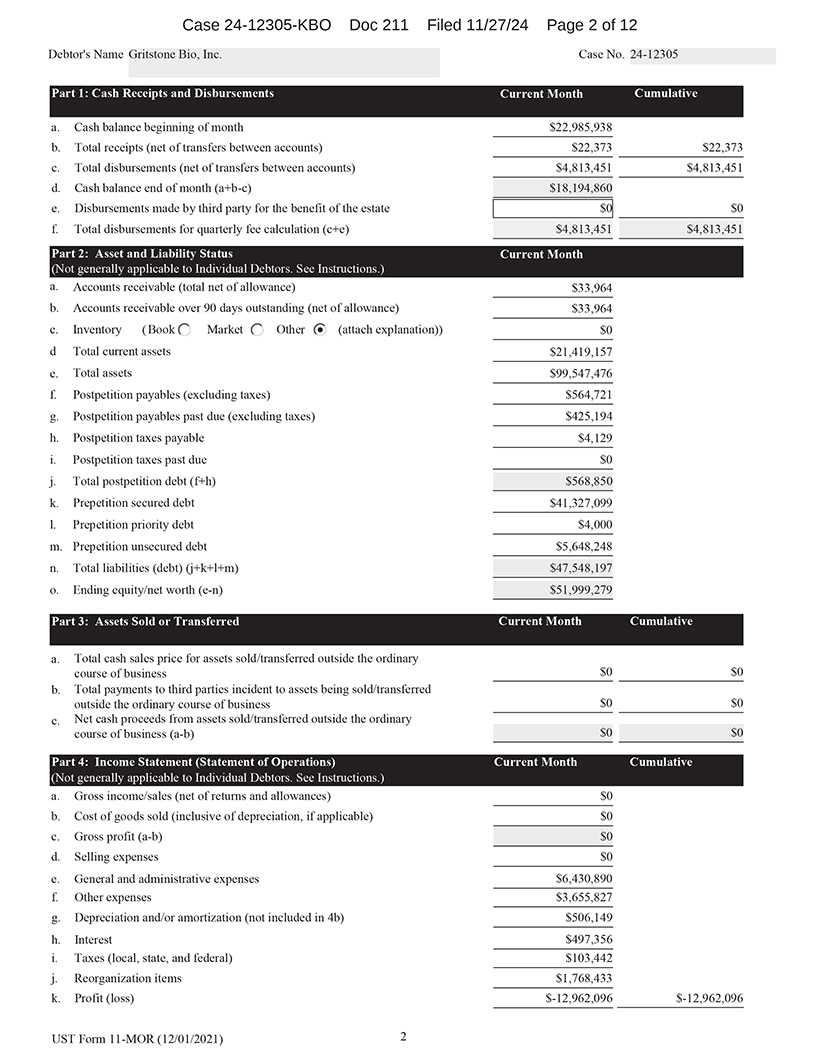

Case 24-12305-KBO Doc 211 Filed 11/27/24 Page 2 of 12 Debtor’s Name Gritstone Bio, Inc. Case No. 24-12305 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $22,985,938 b. Total receipts (net of transfers between accounts) $22,373 $22,373 c. Total disbursements (net of transfers between accounts) $4,813,451 $4,813,451 d. Cash balance end of month (a+b-c) $18,194,860 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $4,813,451 $4,813,451 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $33,964 b. Accounts receivable over 90 days outstanding (net of allowance) $33,964 c. Inventory (Book Market Other (attach explanation)) $0 d Total current assets $21,419,157 e. Total assets $99,547,476 f. Postpetition payables (excluding taxes) $564,721 g. Postpetition payables past due (excluding taxes) $425,194 h. Postpetition taxes payable $4,129 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $568,850 k. Prepetition secured debt $41,327,099 l. Prepetition priority debt $4,000 m. Prepetition unsecured debt $5,648,248 n. Total liabilities (debt) (j+k+l+m) $47,548,197 o. Ending equity/net worth (e-n) $51,999,279 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $0 b. Cost of goods sold (inclusive of depreciation, if applicable) $0 c. Gross profit (a-b) $0 d. Selling expenses $0 e. General and administrative expenses $6,430,890 f. Other expenses $3,655,827 g. Depreciation and/or amortization (not included in 4b) $506,149 h. Interest $497,356 i. Taxes (local, state, and federal) $103,442 j. Reorganization items $1,768,433 k. Profit (loss) $-12,962,096 $-12,962,096 UST Form 11-MOR (12/01/2021) 2