August 3, 2017

William H. Thompson,

Accounting Branch Chief

Office of Consumer Products

Division of Corporate Finance

United States Securities and Exchange Commission

100 F. Street N.E.

Washington, D.C. 20549

Re: Cotiviti Holdings, Inc.

Form 10-K for the year ended December 31, 2016

Filed February 23, 2017

Form 8-K Filed February 22, 2017

File No. 1-37787

Dear Mr. Thompson:

We refer to your letter dated July 25, 2017 commenting on the disclosures contained in Cotiviti Holdings, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2016 filed with the Securities and Exchange Commission on February 23, 2017 and the Form 8-K filed on February 22, 2017. For your convenience, we have repeated each of the staff’s comments below in italics and have numbered each comment and our response thereto to correspond with the numbers assigned to the comments in your letter.

Form 10-K for the Fiscal Year Ended December 31, 2016

Item 8. Financial Statements and Supplementary Data

Notes to the Financial Statements

Note 17. Segment and Geographic Information, page 114

1. Please disclose segment depreciation and amortization, impairments and transaction-related expenses pursuant to ASC 280-10-50-22.

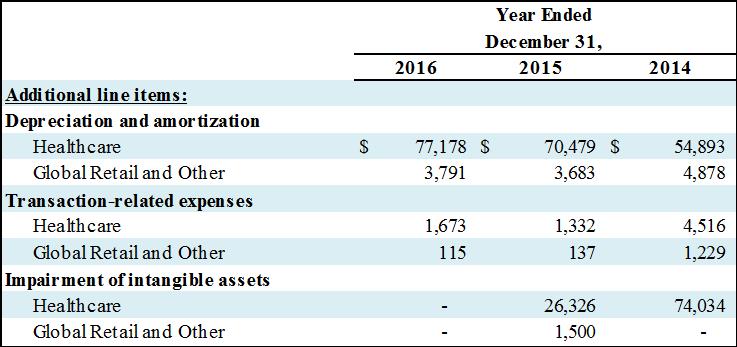

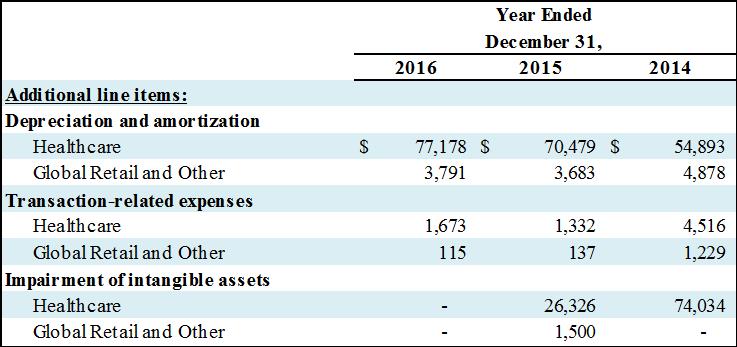

We have considered ASC 280-10-50-22 in preparing our segment disclosures. ASC 280-10-50-22 states that an entity shall report a measure of profit or loss for each reportable segment. It further indicates that an entity shall also disclose additional line items if included in the calculation of the measure of profit of loss. These line items include depreciation and amortization, unusual items and significant noncash items. Our measure of segment profit or loss, as described in Note 17 to our Annual Report on Form 10-K for the year ended December 31, 2016, is operating income. Operating income includes depreciation and amortization, impairments and transaction-related expenses. As such, we will revise our future annual filings beginning with the year ended December 31, 2017 to include these additional disclosures. For the years ended December 31, 2016, 2015 and 2014 the additional disclosures would have been as follows (in thousands):

The South Terraces, 115 Perimeter Center Place, Suite 700, Atlanta, GA 30346 (770) 379-2800 cotiviti.com

Form 8-K Filed February 22, 2017

Exhibit 99.1

2. Reference is made to your disclosure of full-year 2017 Adjusted EBITDA guidance on page 2. Item 10(e)(1)(i)(A) of Regulation S-K requires that when you present a non-GAAP measure you must present the most directly comparable GAAP measure with equal or greater prominence. This requirement applies to non-GAAP measures presented in earnings releases furnished under Item 2.02 of Form 8-K. Refer to Question 102.10 of the Division’s Compliance & Disclosure Interpretations for Non-GAAP Measures. Please revise to present the most directly comparable GAAP measure with equal or greater prominence.

We acknowledge your comment relating to giving equal or greater prominence to the most directly comparable GAAP measures as referenced in Question 102.10 of the Division’s Compliance and Disclosure Interpretations. Accordingly, we have revised our earnings release as filed on August 1, 2017 and will prepare future filings to include net income, the most directly comparable GAAP measure to Adjusted EBITDA, in any annual guidance that we may present in earnings releases.

3. Reference is made to the reconciliation of net income to full-year 2017 Adjusted EBITDA guidance on page 9. Please present a more detailed reconciliation. Refer to Item 10(e)(1)(i)(B) of Regulation S-K.

We have considered the guidance in Item 10(e)(1)(i)(B) of Regulation S-K. Accordingly, we have revised our earnings release as filed on August 1, 2017 and will prepare future filings to include a more detailed reconciliation of net income to any full-year Adjusted EBITDA guidance.

Exhibit 99.2

4. Reference is made to the disclosure of free cash flow on page 8. Please disclose a statement discussing the reasons why you believe that presentation of this non-GAAP financial measure provides useful information to investors and, to the extent material, a statement disclosing the additional purposes, if any, for which your management uses the non-GAAP financial measure. Refer to Item 10(e)(1)(i)(C)-(D) of Regulation S-K.

The South Terraces, 115 Perimeter Center Place, Suite 700, Atlanta, GA 30346 (770) 379-2800 cotiviti.com

We have considered the guidance in Item 10(e)(1)(i)(C)-(D) of Regulation S-K. Accordingly, we have revised our earnings release as filed on August 1, 2017 and will prepare future filings to describe why management believes free cash flow, a non-GAAP financial measure, is useful to management and investors. We believe this additional disclosure included below for reference aligns with the guidance of Regulation S-K.

Free cash flow is a non-GAAP financial measure. Therefore, it should not be considered a substitute for income or cash flow data prepared in accordance with U.S. GAAP and may not be comparable to similarly titled measures used by other companies. The Company defines free cash flow as net cash provided by operating activities less capital expenditures. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures. Management believes free cash flow is meaningful as it is used by management and investors as a measure and indicator of the financial strength of the company and its ability to generate cash.

If you have any questions or comments with respect to the above, please call me at (203) 202-6286.

Respectfully,

/s/JONATHAN OLEFSON

Jonathan Olefson

Senior Vice President, General Counsel

Cotiviti Holdings, Inc.

The South Terraces, 115 Perimeter Center Place, Suite 700, Atlanta, GA 30346 (770) 379-2800 cotiviti.com