0001657201 ietsift:C000237721Member ietsift:OtherAssetsLessLiabilitiesMember 2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

Invesco Exchange-Traded Self-Indexed Fund Trust

(Exact name of registrant as specified in charter)

3500 Lacey Road Downers Grove, IL 60515

(Address of principal executive offices) (Zip code)

Brian Hartigan, President

3500 Lacey Road

Downers Grove, IL 60515

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Reports to Stockholders

(a) The Registrant's annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the "Act") is as follows:

Invesco Bloomberg Pricing Power ETF

POWA | NYSE Arca, Inc.

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco Bloomberg Pricing Power ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

This report describes changes to the Fund that occurred during the reporting period.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco Bloomberg Pricing Power ETF | $48 | 0.43% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, U.S. large- and mid-cap equities benefited from investment themes levered to artificial intelligence technology and investor anticipation that slowing inflation would cause the Federal Reserve to ease monetary policy. Despite primarily investing in U.S. large- and mid-cap equities, the Fund underperformed the broader market primarily due to its significant underweight allocation to information technology, the strongest performing sector.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Bloomberg Pricing Power Index (the “Index”). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 22.90%, differed from the return of the Index, 23.41%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Sector Allocations | Industrials sector, followed by the health care and consumer discretionary sectors, respectively.

Positions | Costco Wholesale Corp., a consumer staples company, and Trane Technologies PLC, an industrials company (no longer held at fiscal year-end).

What detracted from performance?

Sector Allocations | No sectors detracted from the Fund's performance during the period.

Positions | Paycom Software, Inc., an industrials company (no longer held at fiscal year-end), and Humana Inc., a health care company (no longer held at fiscal year-end).

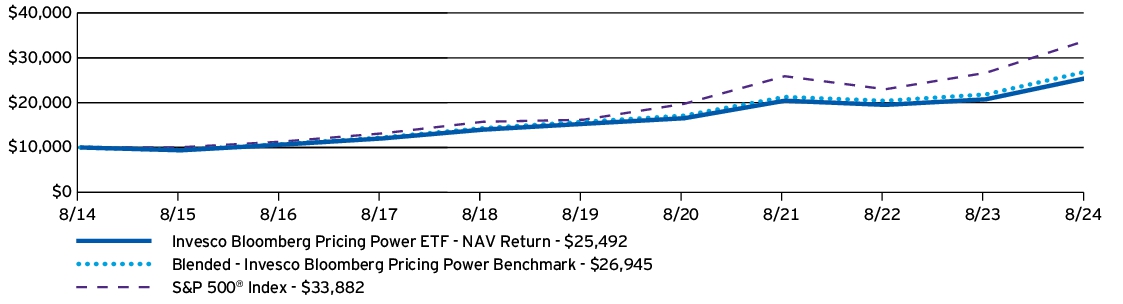

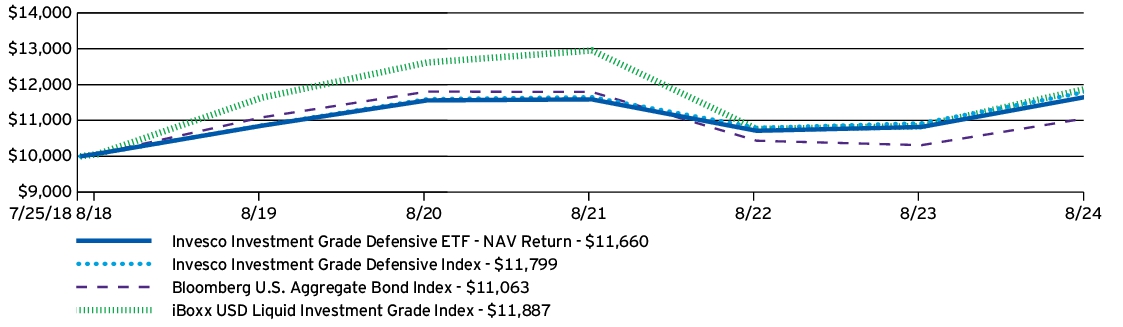

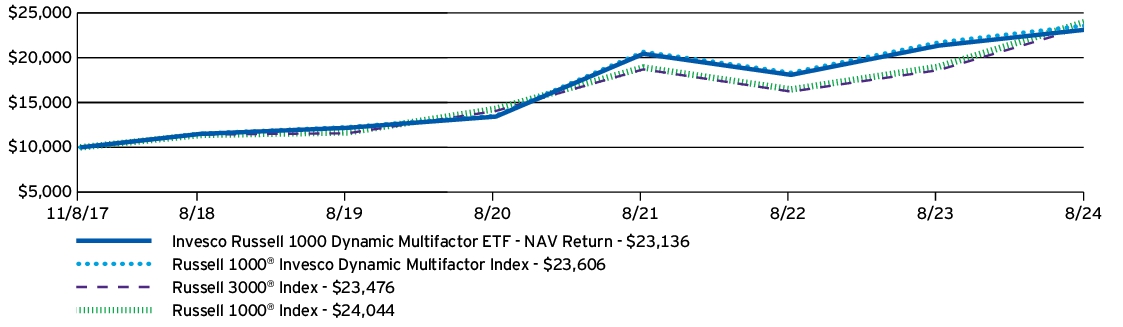

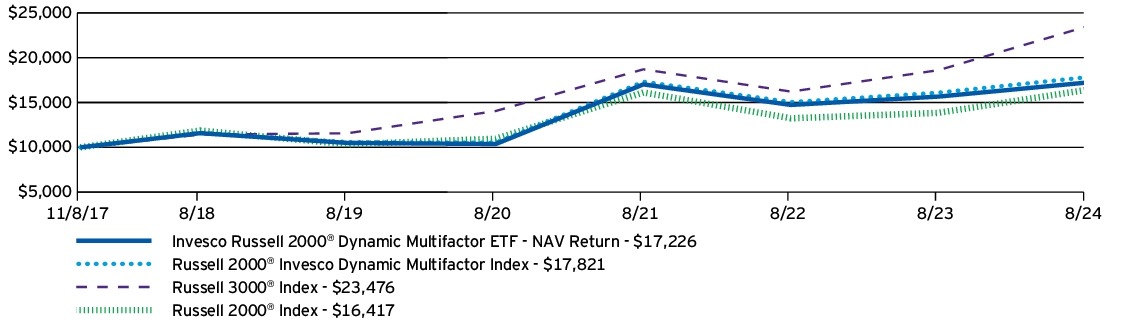

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years |

10 Years |

| Invesco Bloomberg Pricing Power ETF — NAV Return | 22.90% | 10.79% | 9.81% |

| Invesco Bloomberg Pricing Power ETF — Market Price Return | 22.85% | 10.78% | 9.80% |

| Blended - Invesco Bloomberg Pricing Power Benchmark | 23.41% | 11.38% | 10.42% |

| S&P 500® Index | 27.14% | 15.92% | 12.98% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective after the close of business on April 06, 2018, Guggenheim Defensive Equity ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim Defensive Equity ETF and the Fund.

- The Blended - Invesco Bloomberg Pricing Power Benchmark performance is comprised of the performance of the Sabrient Defensive Equity Index, a former underlying index, through October 24, 2016, followed by the performance of the Invesco Defensive Equity Index, the previous underlying index, from October 25, 2016 through August 25, 2023, followed by the performance of the Index from August 26, 2023 through August 31, 2024.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $195,428,106 |

| Total number of portfolio holdings | 53 |

| Total advisory fees paid | $784,274 |

| Portfolio turnover rate | 96% |

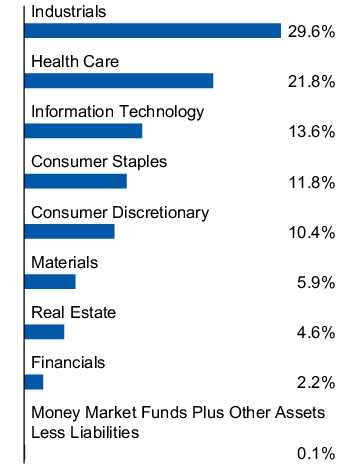

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| Best Buy Co., Inc. | 2.68% |

| Iron Mountain, Inc. | 2.63% |

| Lockheed Martin Corp. | 2.27% |

| HEICO Corp. | 2.24% |

| Walmart, Inc. | 2.22% |

| Autodesk, Inc. | 2.21% |

| Cardinal Health, Inc. | 2.20% |

| MSCI, Inc. | 2.17% |

| CRH PLC | 2.13% |

| Lowe's Cos., Inc. | 2.11% |

| * Excluding money market fund holdings, if any. | |

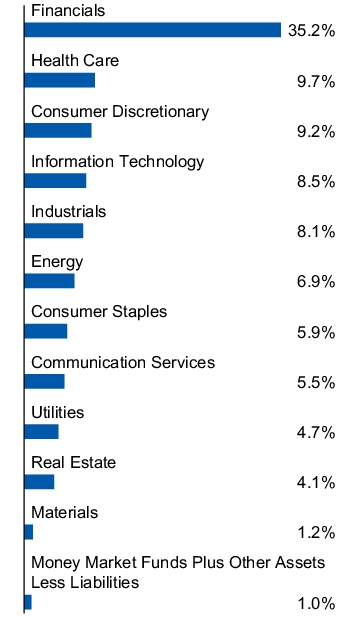

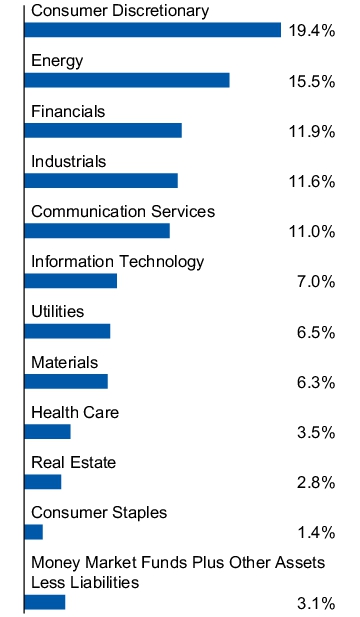

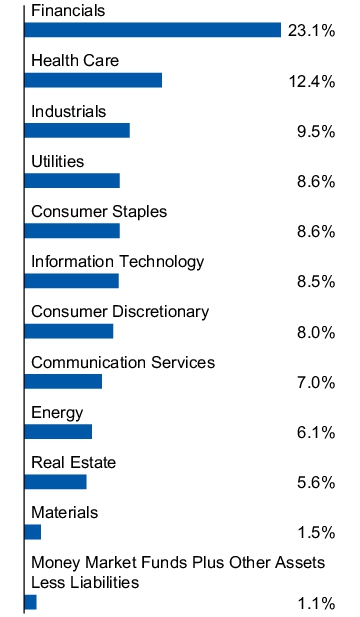

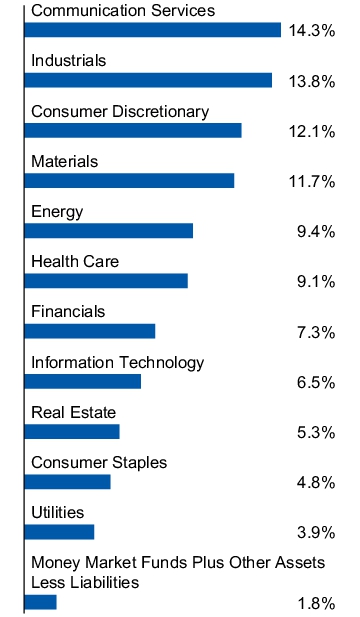

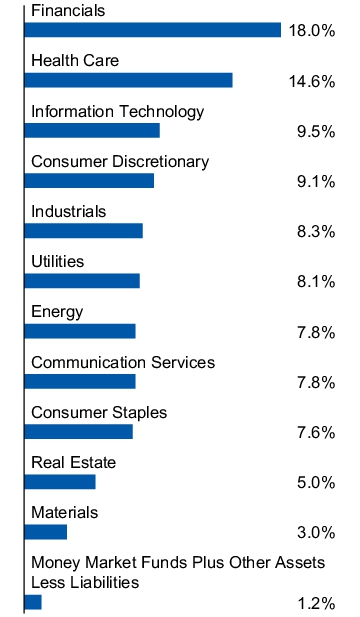

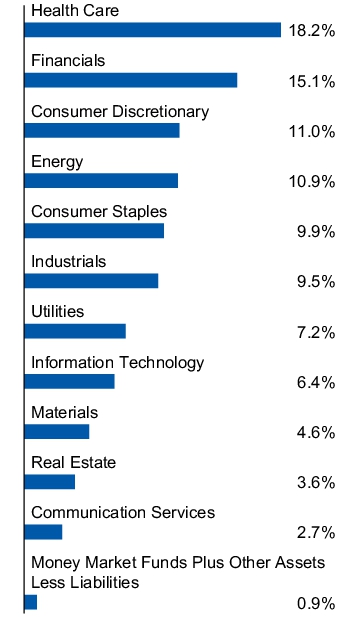

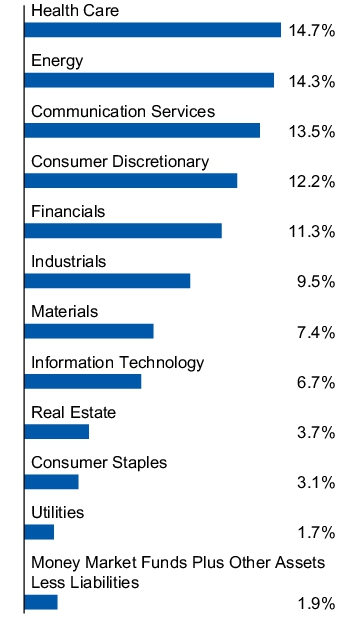

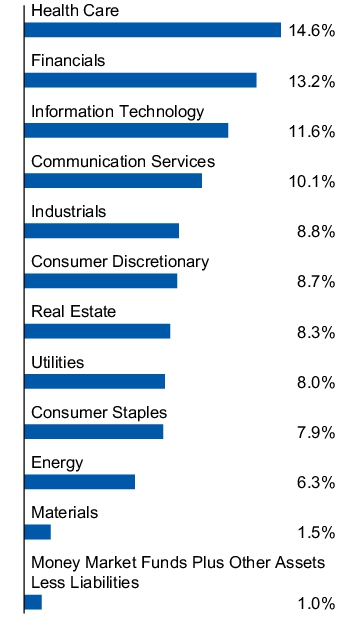

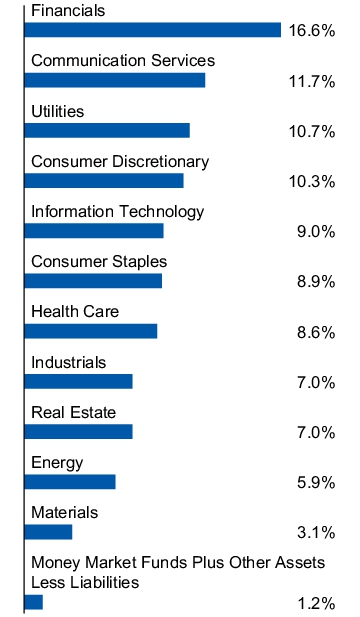

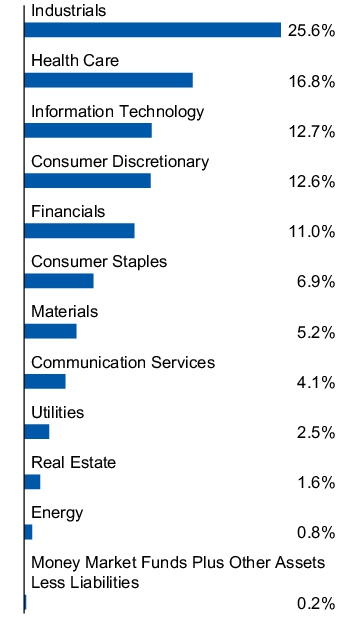

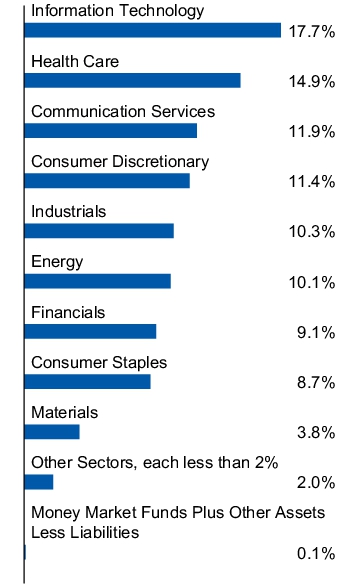

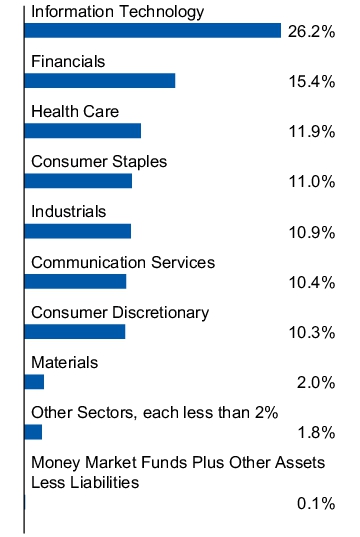

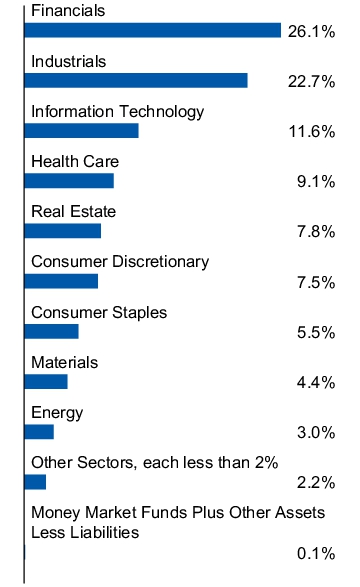

Sector allocation

(% of net assets)

How Has The Fund Changed Over The Past Year?

This is a summary of certain changes to the Fund since August 31, 2023. For more complete information, you may review the Fund's prospectus, which is available at invesco.com/reports or upon request at (800) 983-0903.

The Fund's net expense ratio decreased from the prior fiscal year end as a result of a change in the Fund's investment advisory agreement which became effective on August 28, 2023.

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2024 Corporate Bond ETF

BSCO | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2024 Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2024 Corporate Bond ETF | $10 | 0.10% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the investment grade corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in investment grade corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD Corporate Bond 2024 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 5.77%, differed from the return of the Index, 5.86%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Banks industry, followed by the consumer finance and capital markets industries, respectively.

Positions | AbbVie, Inc., 2.60% coupon, due 11/21/2024, a biotechnology company, followed by Credit Suisse AG, 3.63% coupon, due 9/9/2024, a capital markets company (no longer held at fiscal year-end).

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | No positions detracted from the Fund's performance during the period.

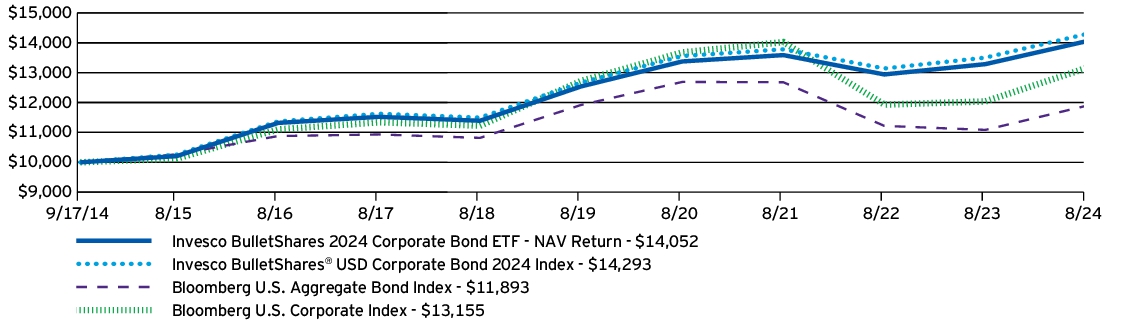

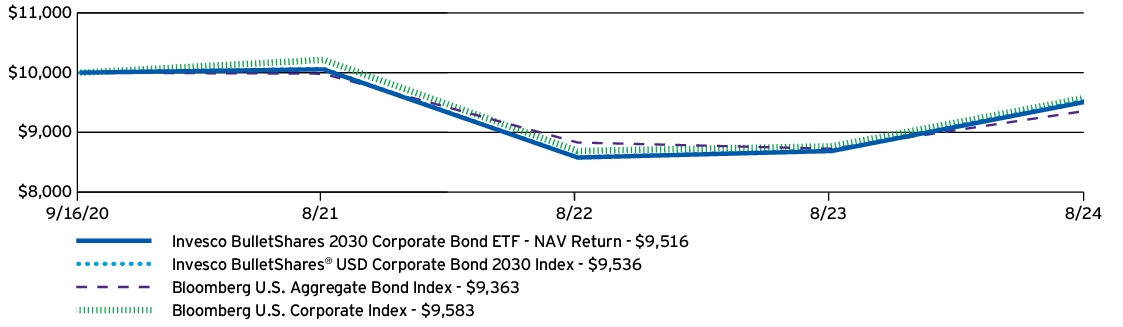

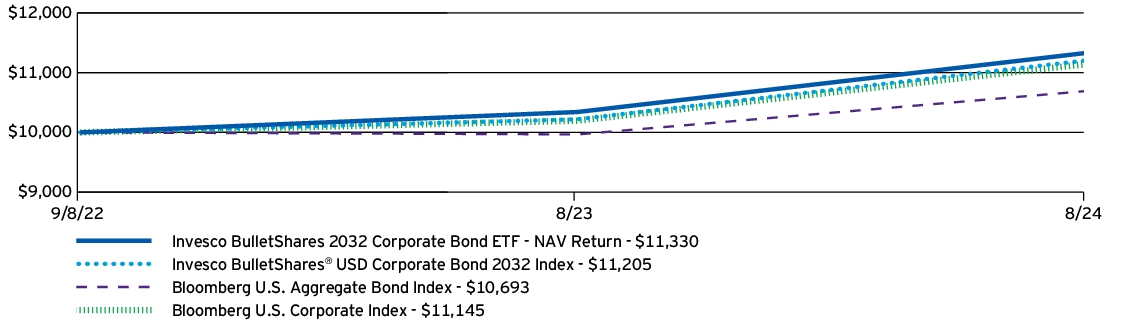

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/17/14) |

| Invesco BulletShares 2024 Corporate Bond ETF — NAV Return | 5.77% | 2.30% | 3.48% |

| Invesco BulletShares 2024 Corporate Bond ETF — Market Price Return | 5.72% | 2.26% | 3.47% |

| Invesco BulletShares® USD Corporate Bond 2024 Index | 5.86% | 2.45% | 3.65% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.76% |

| Bloomberg U.S. Corporate Index | 9.29% | 0.67% | 2.79% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on April 06, 2018, Guggenheim BulletShares 2024 Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2024 Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $2,844,552,687 |

| Total number of portfolio holdings | 119 |

| Total advisory fees paid | $3,453,570 |

| Portfolio turnover rate | 1% |

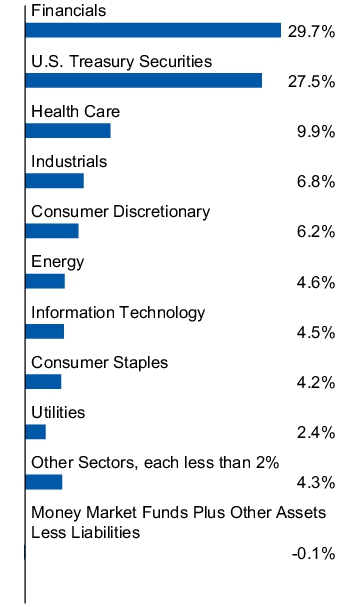

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| U.S. Treasury Bills, 5.12%-5.20%, 10/17/2024 | 12.23% |

| U.S. Treasury Bills, 5.26%-5.27%, 09/19/2024 | 9.01% |

| U.S. Treasury Bills, 5.05%-5.06%, 11/21/2024 | 6.26% |

| AbbVie, Inc., 2.60%, 11/21/2024 | 2.50% |

| Morgan Stanley, 3.70%, 10/23/2024 | 2.05% |

| JPMorgan Chase & Co., 3.88%, 09/10/2024 | 1.99% |

| UBS AG, 3.63%, 09/09/2024 | 1.87% |

| Thermo Fisher Scientific, Inc., 1.22%, 10/18/2024 | 1.67% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 1.65%, 10/29/2024 | 1.51% |

| Wells Fargo & Co., 3.30%, 09/09/2024 | 1.50% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2024 High Yield Corporate Bond ETF

BSJO | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2024 High Yield Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2024 High Yield Corporate Bond ETF | $44 | 0.42% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the high yield corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in high yield corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD High Yield Corporate Bond 2024 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 7.17%, differed from the return of the Index, 7.68%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Media industry, followed by the broadline retail and industrial conglomerates industries, respectively.

Positions | DISH DBS Corp., 5.88% coupon, due 11/15/2024, a media company, followed by U.S. Treasury Bill, due 8/15/2024 (no longer held at fiscal year-end).

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | Ford Motor Credit Co. LLC, 4.06% coupon, due 11/1/2024, an automobiles company (no longer held at fiscal year-end), followed by Taylor Morrison Communities, Inc., 5.63% coupon, due 3/1/2024, a household durables company (no longer held at fiscal year-end).

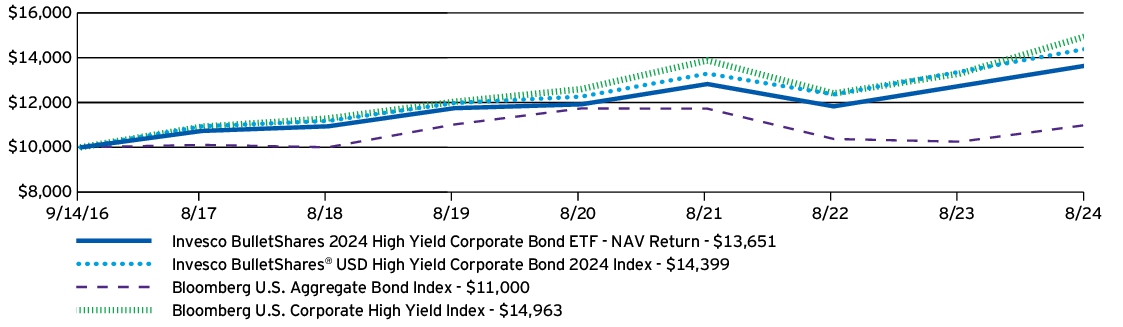

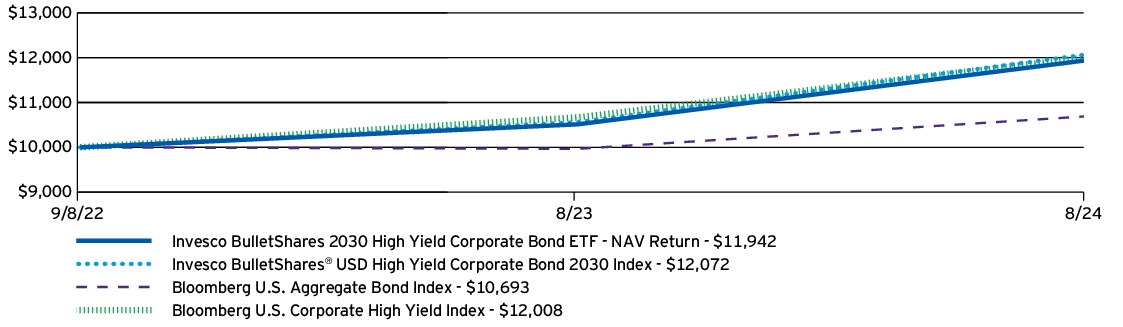

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/14/16) |

| Invesco BulletShares 2024 High Yield Corporate Bond ETF — NAV Return | 7.17% | 3.05% | 3.99% |

| Invesco BulletShares 2024 High Yield Corporate Bond ETF — Market Price Return | 6.93% | 3.02% | 3.97% |

| Invesco BulletShares® USD High Yield Corporate Bond 2024 Index | 7.68% | 3.75% | 4.69% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.20% |

| Bloomberg U.S. Corporate High Yield Index | 12.55% | 4.46% | 5.19% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate High Yield Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on April 06, 2018, Guggenheim BulletShares 2024 High Yield Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2024 High Yield Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $543,412,031 |

| Total number of portfolio holdings | 13 |

| Total advisory fees paid | $2,819,377 |

| Portfolio turnover rate | 59% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| U.S. Treasury Bills, 5.14%-5.20%, 10/17/2024 | 61.08% |

| U.S. Treasury Bills, 5.25%-5.26%, 09/19/2024 | 15.79% |

| DISH DBS Corp., 5.88%, 11/15/2024 | 5.68% |

| Vericast Corp., Term Loan, 13.03%, 06/16/2026 | 5.54% |

| Perrigo Finance Unlimited Co., 3.90%, 12/15/2024 | 3.48% |

| Live Nation Entertainment, Inc., 4.88%, 11/01/2024 | 3.07% |

| Navient Corp., 5.88%, 10/25/2024 | 2.67% |

| Owens & Minor, Inc., 4.38%, 12/15/2024 | 1.01% |

| Starwood Property Trust, Inc., 3.75%, 12/31/2024 | 0.73% |

| Rakuten Group, Inc., 10.25%, 11/30/2024 | 0.60% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2024 Municipal Bond ETF

BSMO | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2024 Municipal Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2024 Municipal Bond ETF | $18 | 0.18% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the municipal bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in municipal bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® Municipal Bond 2024 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 3.36%, differed from the return of the Index, 3.63%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

State Allocations | New York bonds, followed by California bonds.

Positions | Pennsylvania (Commonwealth of) Economic Development Financing Authority, 4.00% coupon, due 2/1/2040, followed by California (State of) Department of Water Resources, 5.00% coupon, due 12/1/2028.

What detracted from performance?

State Allocations | No states detracted from the Fund's performance during the period.

Positions | California (State of), 5.00% coupon, due 10/1/2032 (no longer held at fiscal year-end), followed by Santa Clara (County of), CA, Series 2014 AS, RB, 3.00% coupon, due 8/1/2031 (no longer held at fiscal year-end).

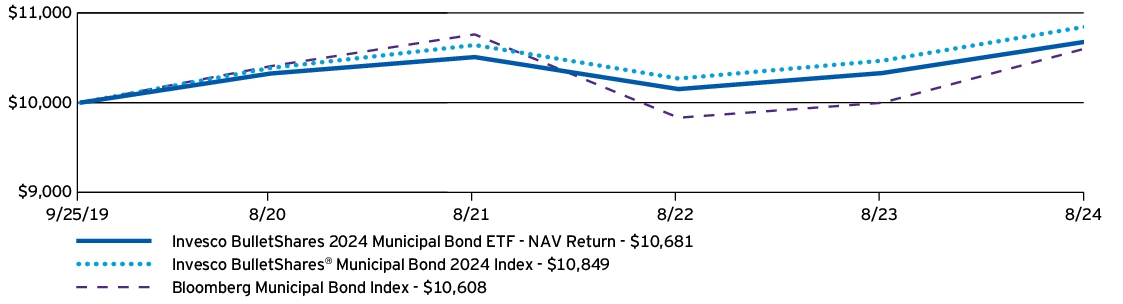

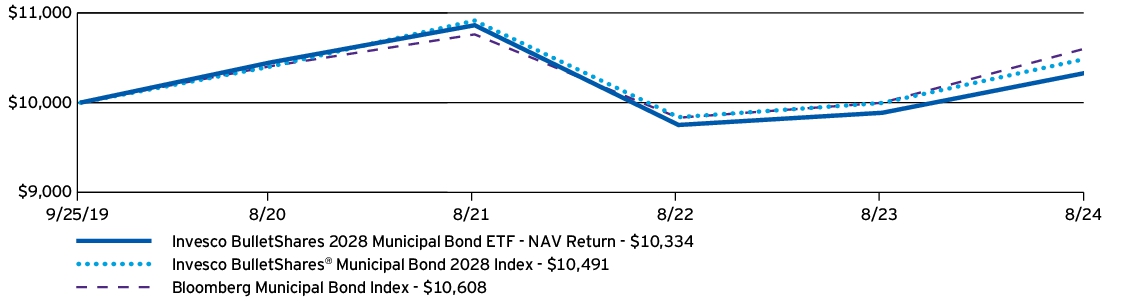

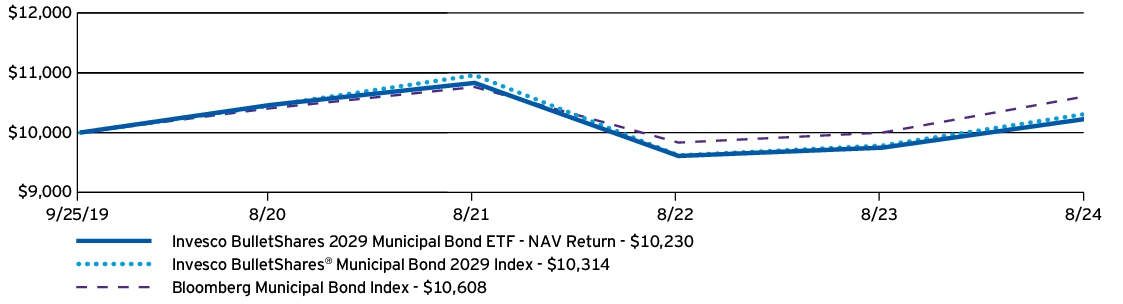

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(09/25/19) |

| Invesco BulletShares 2024 Municipal Bond ETF — NAV Return | 3.36% | 1.35% |

| Invesco BulletShares 2024 Municipal Bond ETF — Market Price Return | 2.99% | 1.30% |

| Invesco BulletShares® Municipal Bond 2024 Index | 3.63% | 1.67% |

| Bloomberg Municipal Bond Index | 6.09% | 1.20% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $189,266,440 |

| Total number of portfolio holdings | 386 |

| Total advisory fees paid | $369,399 |

| Portfolio turnover rate | 52% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings

(% of net assets)

| California (State of) Department of Water Resources (Central Valley), Series 2014 AS, RB, 5.00%, 12/01/2024 | 1.06% |

| Colorado Springs (City of), CO, Series 2014 A-2, RB, 5.00%, 11/15/2024 | 1.06% |

| California State University, Series 2014, Ref. RB, 5.00%, 11/01/2024 | 1.06% |

| District of Columbia, Series 1998 A, RB, 2.85%, 08/15/2038 | 1.06% |

| Halifax Hospital Medical Center, Series 2008, Ref. VRD RB, 2.80%, 06/01/2048 | 1.06% |

| Massachusetts (Commonwealth of) Health & Educational Facilities Authority (Boston College), Series 1997 P-1, VRD RB, 2.15%, 07/01/2027 | 1.06% |

| Louisiana (State of) Public Facilities Authority (CHRISTUS Health), Series 2009 B-2, Ref. VRD RB, 3.02%, 07/01/2047 | 1.06% |

| Philadelphia (City of), PA, Eighth Series 2009 D, Ref. VRD RB, 2.83%, 08/01/2031 | 1.06% |

| Fairfax (County of), VA Economic Development Authority (Smithsonian Institution), Series 2003 A, VRD RB, 2.80%, 12/01/2033 | 1.06% |

| Tarrant County Cultural Education Facilities Finance Corp. (Christus Health), Series 2008 C1, Ref. VRD RB, 2.50%, 07/01/2047 | 1.06% |

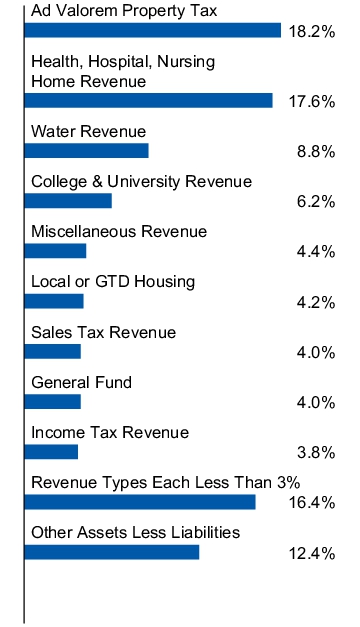

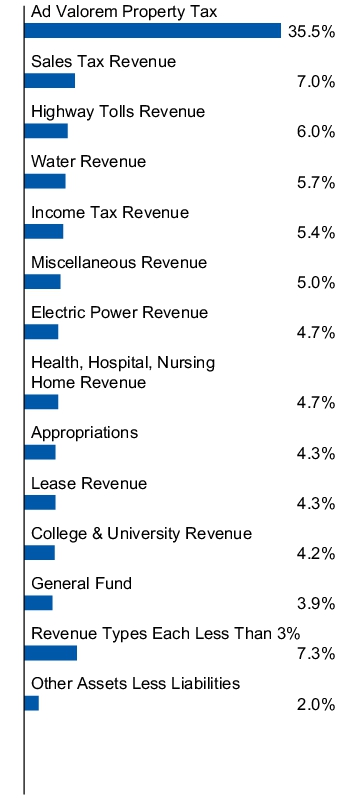

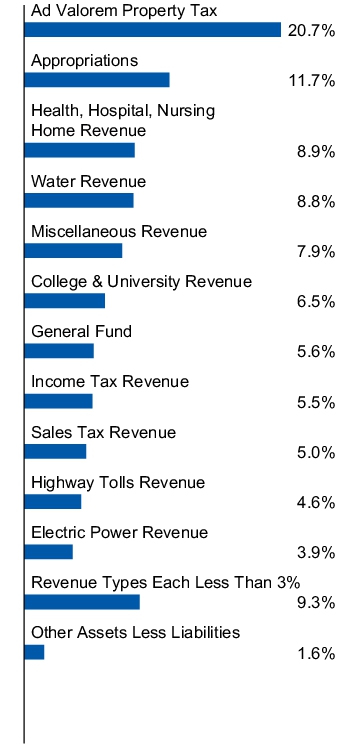

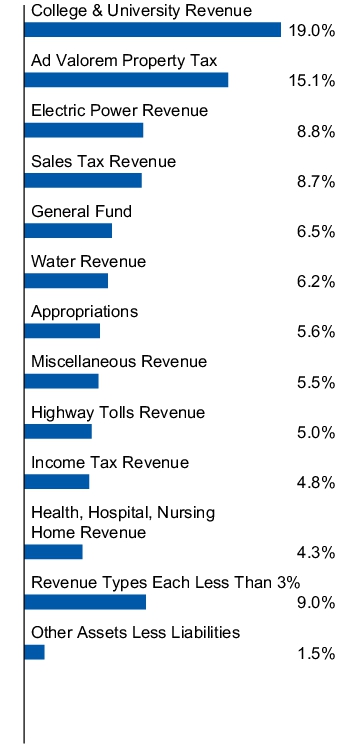

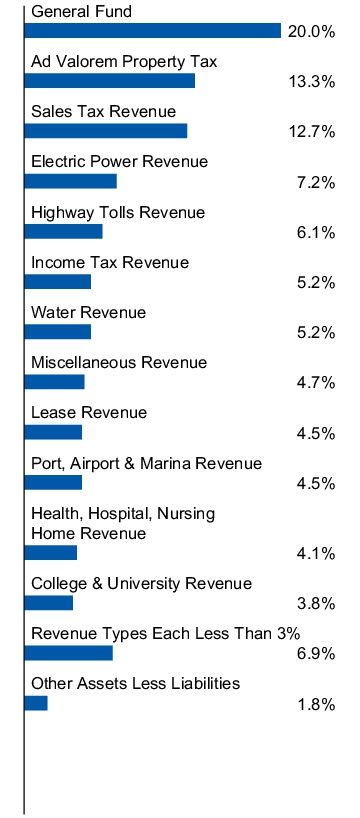

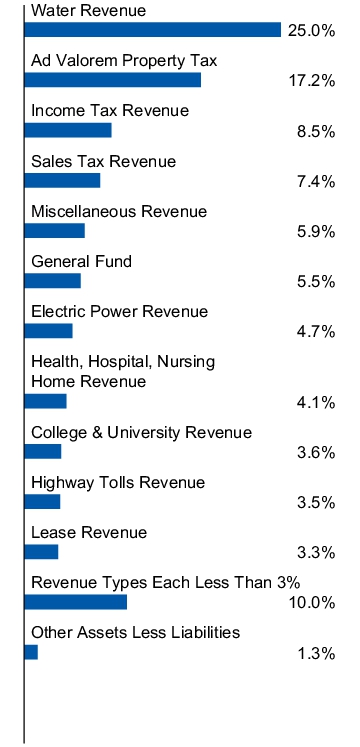

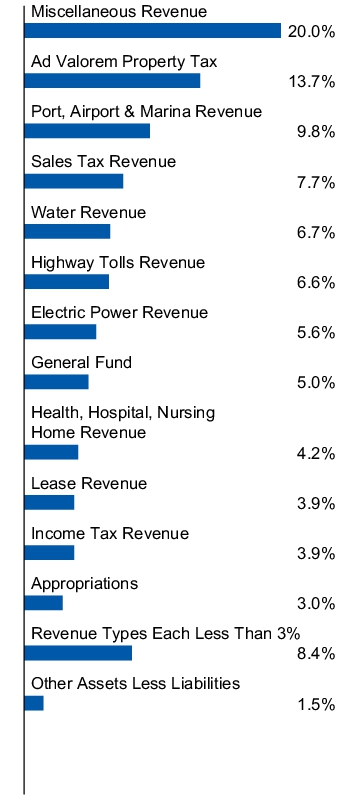

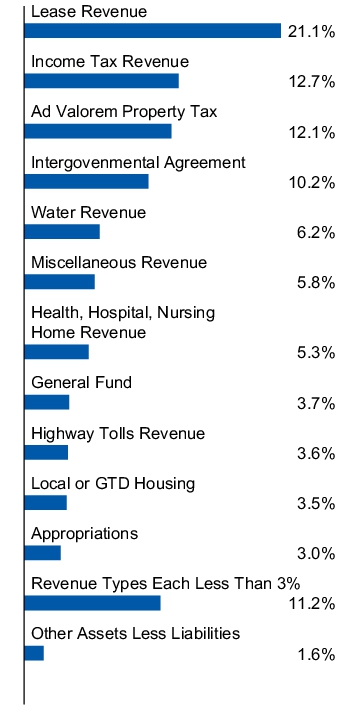

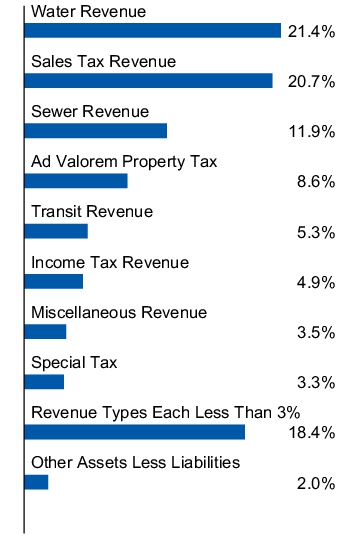

Revenue type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2025 Corporate Bond ETF

BSCP | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2025 Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2025 Corporate Bond ETF | $10 | 0.10% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the investment grade corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in investment grade corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD Corporate Bond 2025 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 6.10%, differed from the return of the Index, 6.20%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Banks industry, followed by the consumer finance and capital markets industries, respectively.

Positions | Charter Communications Operating LLC/Charter Communications Operating Capital Corp., 4.91% coupon, due 7/23/2025, a media company, followed by Visa, Inc., 3.15% coupon, due 12/14/2025, a financial services company.

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | No positions detracted from the Fund's performance during the period.

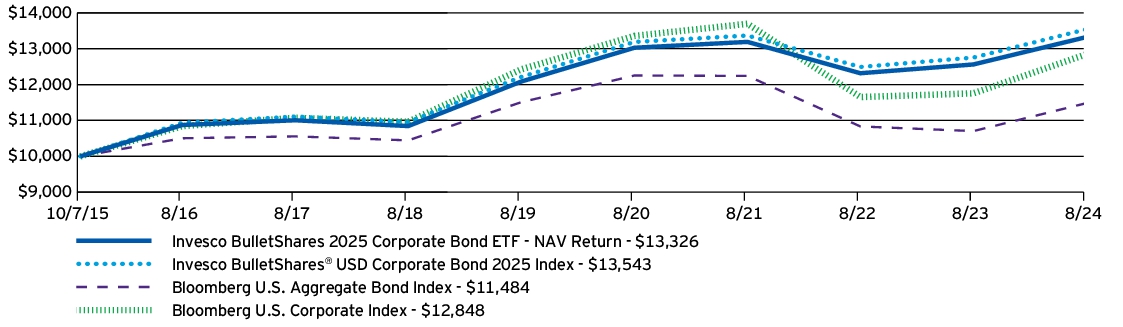

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(10/07/15) |

| Invesco BulletShares 2025 Corporate Bond ETF — NAV Return | 6.10% | 1.98% | 3.28% |

| Invesco BulletShares 2025 Corporate Bond ETF — Market Price Return | 6.10% | 1.97% | 3.28% |

| Invesco BulletShares® USD Corporate Bond 2025 Index | 6.20% | 2.09% | 3.47% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.57% |

| Bloomberg U.S. Corporate Index | 9.29% | 0.67% | 2.86% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on April 06, 2018, Guggenheim BulletShares 2025 Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2025 Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $4,074,369,572 |

| Total number of portfolio holdings | 452 |

| Total advisory fees paid | $3,541,341 |

| Portfolio turnover rate | 2% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| Visa, Inc., 3.15%, 12/14/2025 | 0.85% |

| AbbVie, Inc., 3.60%, 05/14/2025 | 0.81% |

| Boeing Co. (The), 4.88%, 05/01/2025 | 0.76% |

| Goldman Sachs Group, Inc. (The), 3.50%, 04/01/2025 | 0.75% |

| Oracle Corp., 2.50%, 04/01/2025 | 0.75% |

| Morgan Stanley, 4.00%, 07/23/2025 | 0.65% |

| Microsoft Corp., 3.13%, 11/03/2025 | 0.64% |

| CVS Health Corp., 3.88%, 07/20/2025 | 0.61% |

| Exxon Mobil Corp., 2.99%, 03/19/2025 | 0.59% |

| Shell International Finance B.V., 3.25%, 05/11/2025 | 0.59% |

| * Excluding money market fund holdings, if any. | |

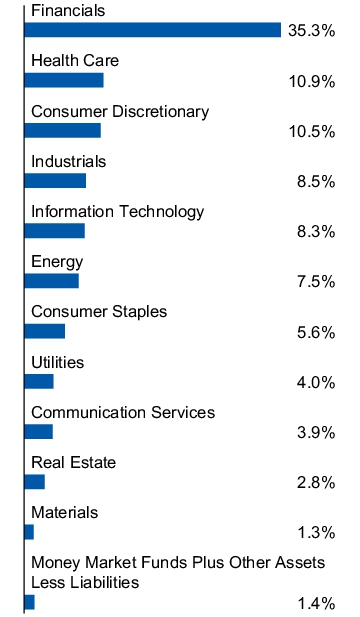

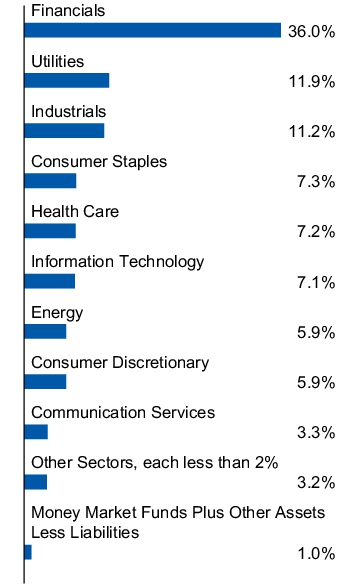

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2025 High Yield Corporate Bond ETF

BSJP | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2025 High Yield Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2025 High Yield Corporate Bond ETF | $44 | 0.42% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the high yield corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in high yield corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD High Yield Corporate Bond 2025 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 9.28%, differed from the return of the Index, 10.01%, primarily due to fees and expenses that the Fund incurred during the period, as well as costs associated with portfolio rebalancing and sampling.

What contributed to performance?

Industry Allocations | Hotels, restaurants & leisure industry, followed by the oil, gas & consumable fuels and health care providers & services industries, respectively.

Positions | Veritas US Inc./Veritas Bermuda Ltd., 7.50% coupon, due 9/1/2025, a software company, followed by RP Escrow Issuer LLC, 5.25% coupon, due 12/15/2025, a health care providers & services company (no longer held at fiscal year-end).

What detracted from performance?

Industry Allocations | Metals & mining industry.

Positions | CommScope Technologies LLC, 6.00% coupon, due 9/15/2025, a communications equipment company (no longer held at fiscal year-end), followed by Sabre GLBL, Inc., 7.38% coupon, due 9/1/2025, a hotels, restaurants & leisure company (no longer held at fiscal year-end).

How Has The Fund Historically Performed?

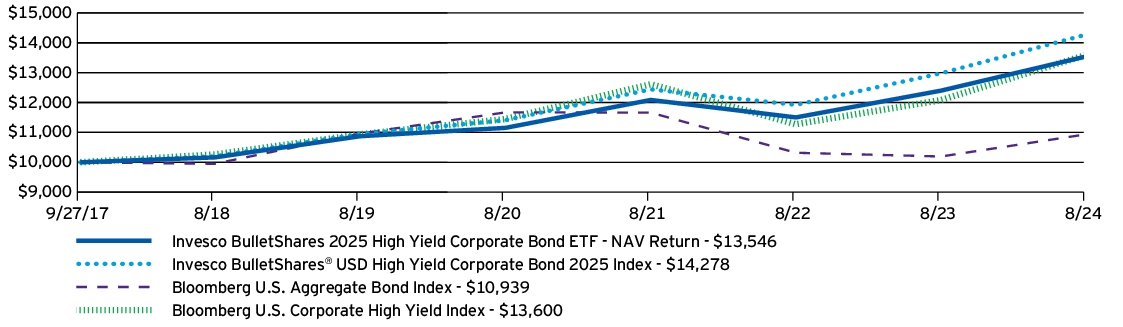

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/27/17) |

| Invesco BulletShares 2025 High Yield Corporate Bond ETF — NAV Return | 9.28% | 4.49% | 4.48% |

| Invesco BulletShares 2025 High Yield Corporate Bond ETF — Market Price Return | 9.12% | 4.47% | 4.49% |

| Invesco BulletShares® USD High Yield Corporate Bond 2025 Index | 10.01% | 5.46% | 5.28% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.30% |

| Bloomberg U.S. Corporate High Yield Index | 12.55% | 4.46% | 4.54% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate High Yield Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on May 18, 2018, Guggenheim BulletShares 2025 High Yield Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2025 High Yield Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $1,025,646,178 |

| Total number of portfolio holdings | 76 |

| Total advisory fees paid | $3,833,790 |

| Portfolio turnover rate | 83% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| Caesars Entertainment, Inc., 8.13%, 07/01/2027 | 3.64% |

| Veritas US, Inc./Veritas Bermuda Ltd., 7.50%, 09/01/2025 | 3.46% |

| Bausch Health Cos., Inc., 5.50%, 11/01/2025 | 3.13% |

| WESCO Distribution, Inc., 7.25%, 06/15/2028 | 3.01% |

| Carnival Corp., 10.50%, 06/01/2030 | 2.67% |

| CITGO Petroleum Corp., 7.00%, 06/15/2025 | 2.40% |

| Spirit AeroSystems, Inc., 9.38%, 11/30/2029 | 2.40% |

| New Fortress Energy, Inc., 6.75%, 09/15/2025 | 2.09% |

| Mallinckrodt International Finance S.A., 14.75%, 11/14/2028 | 1.88% |

| Aethon United BR L.P./Aethon United Finance Corp., 8.25%, 02/15/2026 | 1.86% |

| * Excluding money market fund holdings, if any. | |

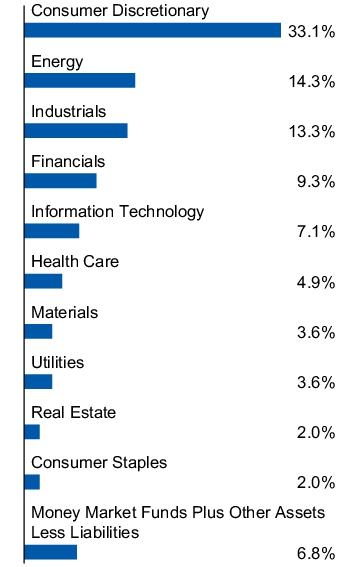

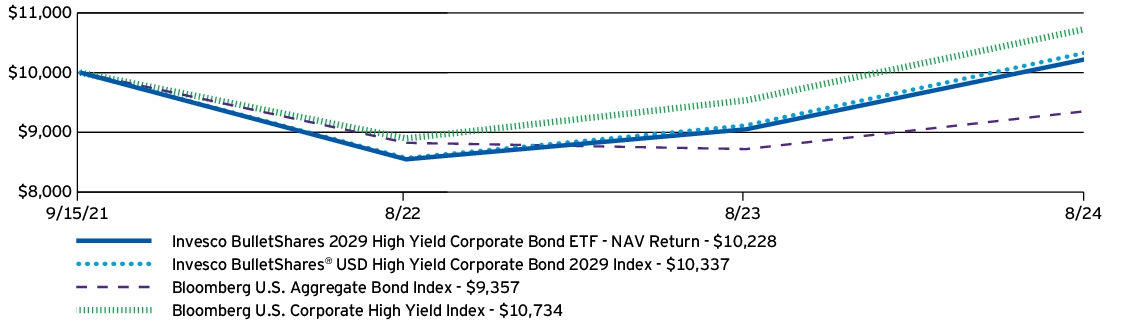

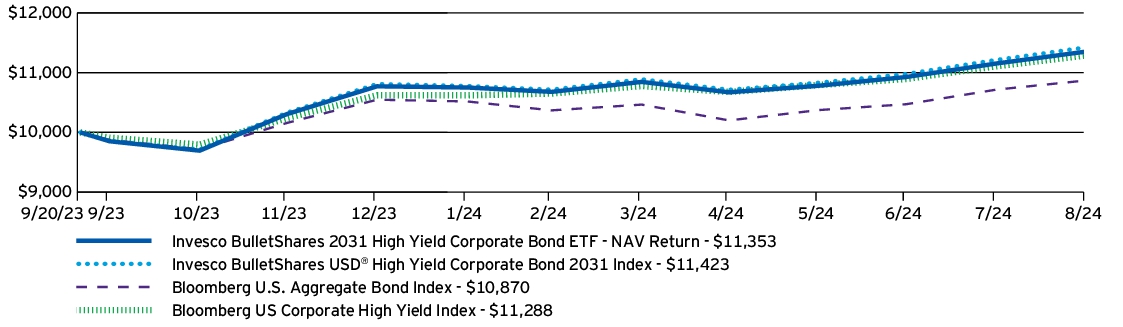

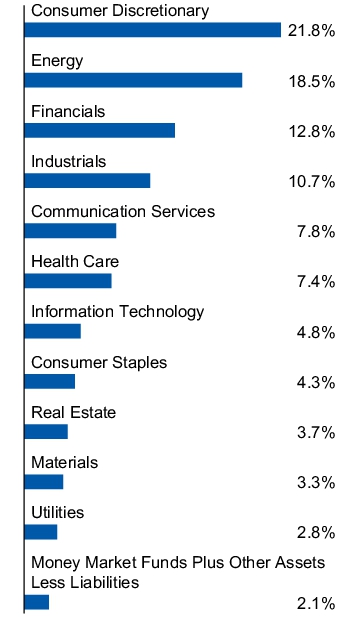

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2025 Municipal Bond ETF

BSMP | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2025 Municipal Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2025 Municipal Bond ETF | $18 | 0.18% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the municipal bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in municipal bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® Municipal Bond 2025 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 3.80%, differed from the return of the Index, 4.00%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

State Allocations | New York bonds, followed by California bonds.

Positions | California (State of), 5.00% coupon, due 8/1/2034, followed by New York (State of) Dormitory Authority, 5.00% coupon, due 2/15/2044.

What detracted from performance?

State Allocations | No states detracted from the Fund's performance during the period.

Positions | Austin (City of), TX, 2.95% coupon, due 9/1/2027 (no longer held at fiscal year-end), followed by California (State of) Public Works Board, 5.00% coupon, due 10/1/2025 (no longer held at fiscal year-end).

How Has The Fund Historically Performed?

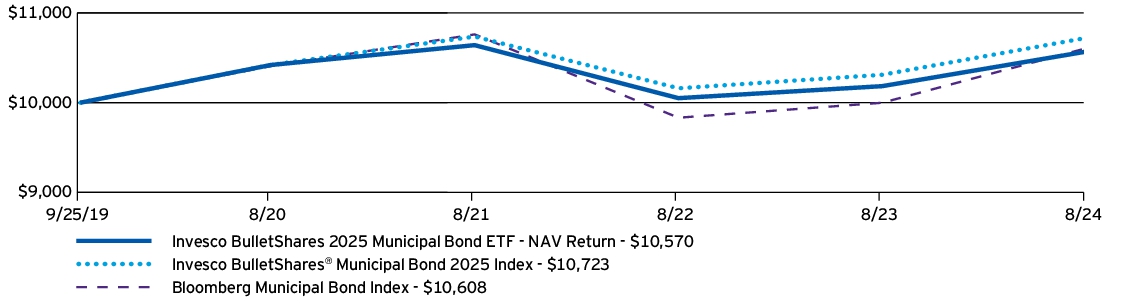

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(09/25/19) |

| Invesco BulletShares 2025 Municipal Bond ETF — NAV Return | 3.80% | 1.13% |

| Invesco BulletShares 2025 Municipal Bond ETF — Market Price Return | 3.63% | 1.15% |

| Invesco BulletShares® Municipal Bond 2025 Index | 4.00% | 1.43% |

| Bloomberg Municipal Bond Index | 6.09% | 1.20% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $227,889,081 |

| Total number of portfolio holdings | 1,001 |

| Total advisory fees paid | $369,331 |

| Portfolio turnover rate | 3% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings

(% of net assets)

| Massachusetts (Commonwealth of), Series 2017 C, Ref. GO Bonds, 5.00%, 10/01/2025 | 1.06% |

| New York (City of), NY Municipal Water Finance Authority, Series 2022 CC-2, RB, 5.00%, 06/15/2027 | 0.91% |

| California (State of), Series 2021, GO Bonds, 4.00%, 10/01/2025 | 0.89% |

| California (State of), Series 2015, Ref. GO Bonds, 5.00%, 08/01/2034 | 0.78% |

| New Jersey (State of), Series 2020 A, GO Bonds, 5.00%, 06/01/2025 | 0.77% |

| New York (State of) Dormitory Authority, Series 2015 B, RB, 5.00%, 02/15/2044 | 0.70% |

| Dallas (City of), TX Area Rapid Transit, Series 2016 A, Ref. RB, 5.00%, 12/01/2025 | 0.68% |

| Indiana (State of) Finance Authority (CWA Authority), Series 2021, Ref. RB, 5.00%, 10/01/2025 | 0.67% |

| Illinois (State of), Series 2021 A, GO Bonds, 5.00%, 03/01/2025 | 0.66% |

| Metropolitan Transportation Authority, Subseries 2015 A-1, RB, 5.00%, 11/15/2040 | 0.63% |

Revenue type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2026 Corporate Bond ETF

BSCQ | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2026 Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2026 Corporate Bond ETF | $10 | 0.10% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the investment grade corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in investment grade corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD Corporate Bond 2026 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 6.92%, differed from the return of the Index, 6.97%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Banks industry, followed by the capital markets and consumer finance industries, respectively.

Positions | Boeing Co. (The), 2.20% coupon, due 2/4/2026, an aerospace & defense company, followed by AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 2.45% coupon, due 10/29/2026, a financial services company.

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | Hughes Satellite Systems Corp., 5.25% coupon, due 8/1/2026, a communications equipment company (no longer held at fiscal year-end), followed by EQM Midstream Partners L.P., 4.13% coupon, due 12/1/2026, an oil, gas & consumable fuels company.

How Has The Fund Historically Performed?

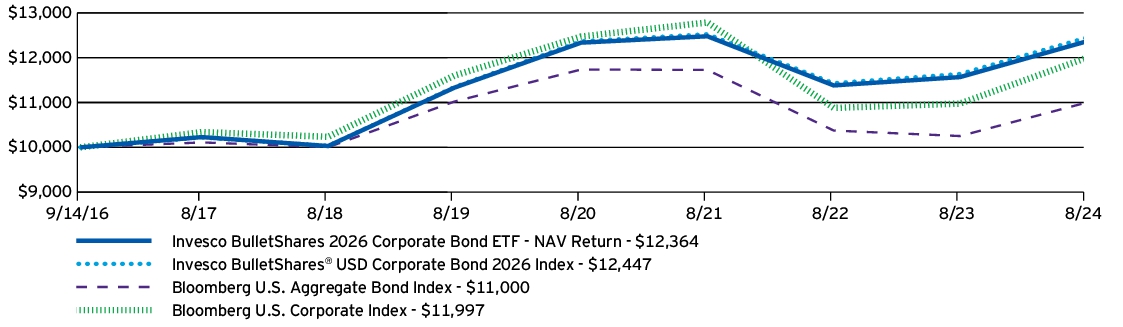

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/14/16) |

| Invesco BulletShares 2026 Corporate Bond ETF — NAV Return | 6.92% | 1.75% | 2.70% |

| Invesco BulletShares 2026 Corporate Bond ETF — Market Price Return | 6.97% | 1.73% | 2.72% |

| Invesco BulletShares® USD Corporate Bond 2026 Index | 6.97% | 1.87% | 2.79% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.20% |

| Bloomberg U.S. Corporate Index | 9.29% | 0.67% | 2.31% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on April 06, 2018, Guggenheim BulletShares 2026 Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2026 Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $3,712,161,924 |

| Total number of portfolio holdings | 467 |

| Total advisory fees paid | $2,724,461 |

| Portfolio turnover rate | 2% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| Boeing Co. (The), 2.20%, 02/04/2026 | 1.08% |

| Microsoft Corp., 2.40%, 08/08/2026 | 0.79% |

| AbbVie, Inc., 2.95%, 11/21/2026 | 0.79% |

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 2.45%, 10/29/2026 | 0.73% |

| Wells Fargo & Co., 3.00%, 04/22/2026 | 0.69% |

| Wells Fargo & Co., 3.00%, 10/23/2026 | 0.69% |

| Apple, Inc., 3.25%, 02/23/2026 | 0.65% |

| Morgan Stanley, 3.88%, 01/27/2026 | 0.61% |

| Morgan Stanley, 3.13%, 07/27/2026 | 0.60% |

| Citigroup, Inc., 3.20%, 10/21/2026 | 0.59% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2026 High Yield Corporate Bond ETF

BSJQ | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2026 High Yield Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2026 High Yield Corporate Bond ETF | $44 | 0.42% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the high yield corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in high yield corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD High Yield Corporate Bond 2026 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 9.13%, differed from the return of the Index, 9.81%, primarily due to fees and expenses that the Fund incurred during the period, as well as costs associated with portfolio rebalancing and sampling.

What contributed to performance?

Industry Allocations | Oil, gas & consumable fuels industry, followed by the commercial services & supplies and hotels, restaurants & leisure industries, respectively.

Positions | Connect Finco S.a.r.l./Connect US Finco LLC, 6.75% coupon, due 10/1/2026, a diversified telecommunication services company, followed by DISH DBS Corp., 5.25% coupon, due 12/1/2026, a media company.

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | Enviva Partners L.P./Enviva Partners Finance Corp., 6.50% coupon, due 1/15/2026, an oil, gas & consumable fuels company (no longer held at fiscal year-end), followed by Hughes Satellite Systems Corp., 5.25% coupon, due 8/1/2026, a communications equipment company.

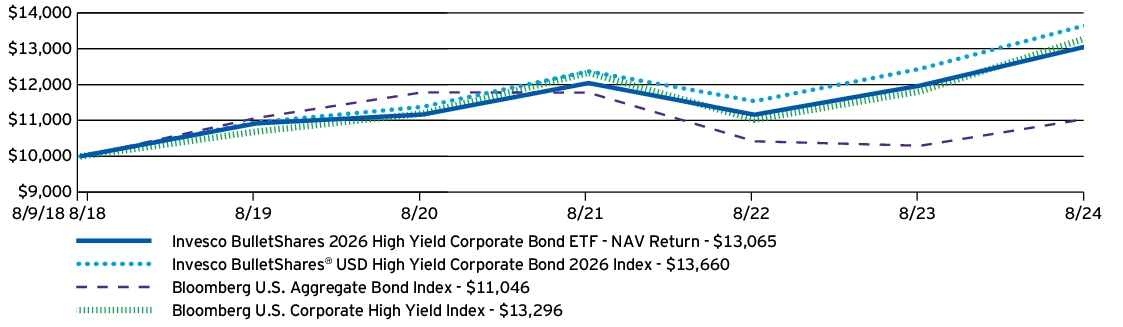

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(08/09/18) |

| Invesco BulletShares 2026 High Yield Corporate Bond ETF — NAV Return | 9.13% | 3.66% | 4.51% |

| Invesco BulletShares 2026 High Yield Corporate Bond ETF — Market Price Return | 8.97% | 3.62% | 4.52% |

| Invesco BulletShares® USD High Yield Corporate Bond 2026 Index | 9.81% | 4.52% | 5.28% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.66% |

| Bloomberg U.S. Corporate High Yield Index | 12.55% | 4.46% | 4.81% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate High Yield Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $641,325,582 |

| Total number of portfolio holdings | 134 |

| Total advisory fees paid | $1,861,957 |

| Portfolio turnover rate | 50% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| DISH DBS Corp., 5.25%, 12/01/2026 | 2.72% |

| Western Digital Corp., 4.75%, 02/15/2026 | 2.67% |

| Newell Brands, Inc., 5.70%, 04/01/2026 | 2.32% |

| Connect Finco S.a.r.l./Connect US Finco LLC, 6.75%, 10/01/2026 | 2.31% |

| United AirLines, Inc., 4.38%, 04/15/2026 | 2.29% |

| OneMain Finance Corp., 7.13%, 03/15/2026 | 1.91% |

| Civitas Resources, Inc., 8.75%, 07/01/2031 | 1.71% |

| Brand Industrial Services, Inc., 10.38%, 08/01/2030 | 1.70% |

| Carnival Corp., 7.63%, 03/01/2026 | 1.60% |

| Spirit AeroSystems, Inc., 9.75%, 11/15/2030 | 1.57% |

| * Excluding money market fund holdings, if any. | |

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2026 Municipal Bond ETF

BSMQ | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2026 Municipal Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2026 Municipal Bond ETF | $18 | 0.18% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the municipal bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in municipal bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® Municipal Bond 2026 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 4.30%, differed from the return of the Index, 4.43%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

State Allocations | California bonds, followed by New York bonds.

Positions | Metropolitan Transportation Authority (Green Bonds), 5.00% coupon, due 11/15/2036, followed by New York (City of), NY, Series 2017 C, 5.00% coupon, due 8/1/2026.

What detracted from performance?

State Allocations | No states detracted from the Fund's performance during the period.

Positions | Metropolitan Water District of Southern California, 5.00% coupon, due 7/1/2031 (no longer held at fiscal year-end), followed by Columbus (City of), OH, 4.00% coupon, due 8/15/2026 (no longer held at fiscal year-end).

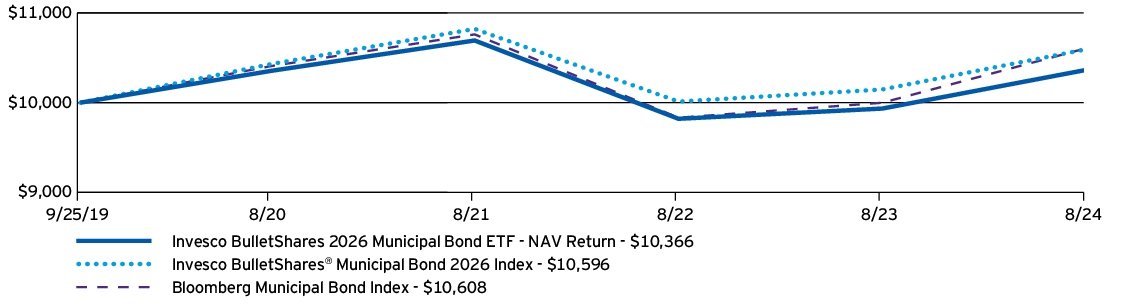

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(09/25/19) |

| Invesco BulletShares 2026 Municipal Bond ETF — NAV Return | 4.30% | 0.73% |

| Invesco BulletShares 2026 Municipal Bond ETF — Market Price Return | 4.11% | 0.82% |

| Invesco BulletShares® Municipal Bond 2026 Index | 4.43% | 1.18% |

| Bloomberg Municipal Bond Index | 6.09% | 1.20% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $215,212,828 |

| Total number of portfolio holdings | 1,479 |

| Total advisory fees paid | $295,323 |

| Portfolio turnover rate | 5% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings

(% of net assets)

| New York (City of), NY, Series 2017 C, Ref. GO Bonds, 5.00%, 08/01/2026 | 0.97% |

| California (State of), Series 2018, GO Bonds, 5.00%, 10/01/2026 | 0.97% |

| Denver City & County School District No. 1, Series 2017, GO Bonds, 5.00%, 12/01/2031 | 0.76% |

| Colorado (State of), Series 2021 A, COP, 5.00%, 12/15/2026 | 0.76% |

| Maryland (State of) Department of Transportation, Series 2019, RB, 5.00%, 10/01/2026 | 0.73% |

| Wisconsin (State of), Series 2016-2, Ref. GO Bonds, 5.00%, 11/01/2029 | 0.72% |

| Massachusetts (Commonwealth of) Development Finance Agency (Dana-Farber Cancer Institute), Series 2016, RB, 5.00%, 12/01/2046 | 0.71% |

| California (State of) Public Works Board, Series 2022 A, Ref. RB, 5.00%, 08/01/2026 | 0.62% |

| California (State of), Series 2018, GO Bonds, 5.00%, 10/01/2026 | 0.62% |

| Minnesota (State of) Public Facilities Authority, Series 2016 A, RB, 5.00%, 03/01/2036 | 0.60% |

Revenue type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2027 Corporate Bond ETF

BSCR | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2027 Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2027 Corporate Bond ETF | $10 | 0.10% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the investment grade corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in investment grade corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD Corporate Bond 2027 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 7.61%, differed from the return of the Index, 7.68%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Banks industry, followed by the consumer finance and capital markets industries, respectively.

Positions | Citigroup, Inc., 4.45% coupon, due 9/29/2027, a banks company, followed by Warnermedia Holdings, Inc., 3.76% coupon, due 3/15/2027, an entertainment company.

What detracted from performance?

Industry Allocations | Construction & engineering industry.

Positions | DTE Energy Co., 4.95% coupon, due 7/1/2027, a multi-utilities company, followed by Quanta Services, Inc. 4.75% coupon, due 8/9/2027, a construction & engineering company.

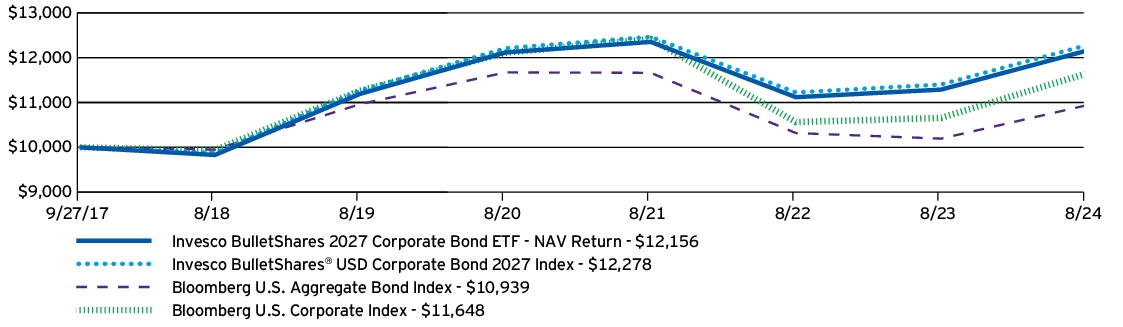

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(09/27/17) |

| Invesco BulletShares 2027 Corporate Bond ETF — NAV Return | 7.61% | 1.65% | 2.86% |

| Invesco BulletShares 2027 Corporate Bond ETF — Market Price Return | 7.65% | 1.61% | 2.87% |

| Invesco BulletShares® USD Corporate Bond 2027 Index | 7.68% | 1.73% | 3.01% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.30% |

| Bloomberg U.S. Corporate Index | 9.29% | 0.67% | 2.23% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

- Effective after the close of business on April 06, 2018, Guggenheim BulletShares 2027 Corporate Bond ETF was reorganized into the Fund. Fund returns shown are blended returns of Guggenheim BulletShares 2027 Corporate Bond ETF and the Fund.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $2,148,252,821 |

| Total number of portfolio holdings | 473 |

| Total advisory fees paid | $1,599,700 |

| Portfolio turnover rate | 0% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| Microsoft Corp., 3.30%, 02/06/2027 | 0.90% |

| Citigroup, Inc., 4.45%, 09/29/2027 | 0.88% |

| Warnermedia Holdings, Inc., 3.76%, 03/15/2027 | 0.88% |

| Amazon.com, Inc., 3.15%, 08/22/2027 | 0.78% |

| Verizon Communications, Inc., 4.13%, 03/16/2027 | 0.74% |

| Goldman Sachs Group, Inc. (The), 3.85%, 01/26/2027 | 0.68% |

| Morgan Stanley, 3.63%, 01/20/2027 | 0.68% |

| Broadcom Corp./Broadcom Cayman Finance Ltd., 3.88%, 01/15/2027 | 0.66% |

| Oracle Corp., 3.25%, 11/15/2027 | 0.61% |

| Meta Platforms, Inc., 3.50%, 08/15/2027 | 0.60% |

| * Excluding money market fund holdings, if any. | |

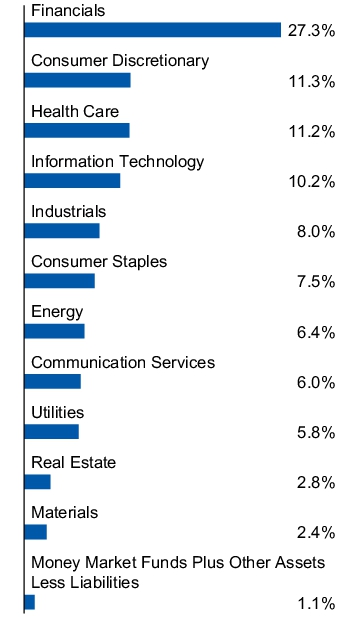

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2027 High Yield Corporate Bond ETF

BSJR | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2027 High Yield Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2027 High Yield Corporate Bond ETF | $44 | 0.42% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the high yield corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in high yield corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD High Yield Corporate Bond 2027 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 10.84%, differed from the return of the Index, 11.33%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Media industry, followed by the hotels, restaurants & leisure and commercial services & supplies industries, respectively.

Positions | Dish Network Corp., 11.75% coupon, due 11/15/2027, a media company, followed by Carnival Corp., 5.75% coupon, due 3/1/2027, a hotels, restaurants & leisure company.

What detracted from performance?

Industry Allocations | Communications equipment industry.

Positions | Ardagh Packaging Finance PLC, 5.25% coupon, due 8/15/2027, a containers & packaging company (no longer held at fiscal year-end), followed by CMG Media Corp., 8.88% coupon, due 12/15/2027, a media company (no longer held at fiscal year-end).

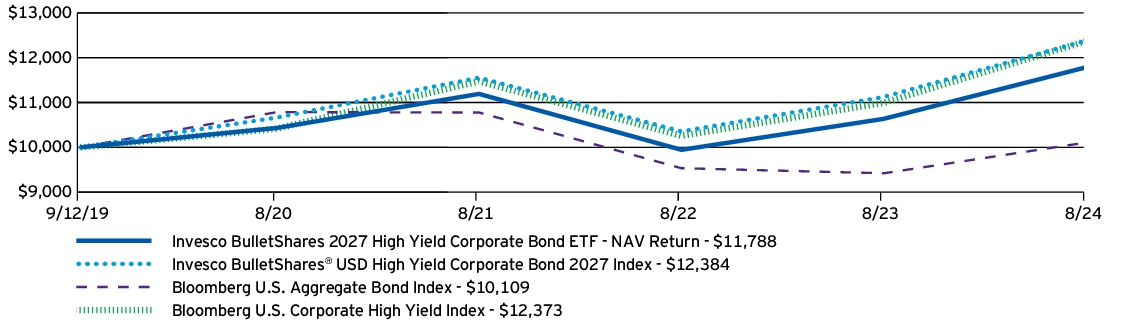

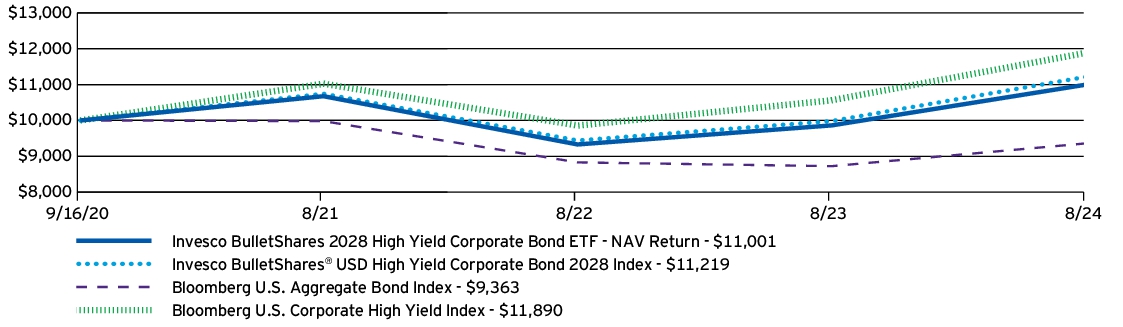

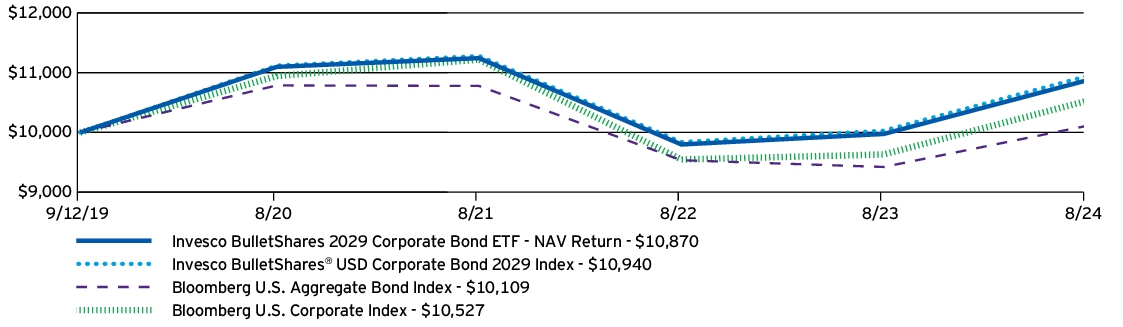

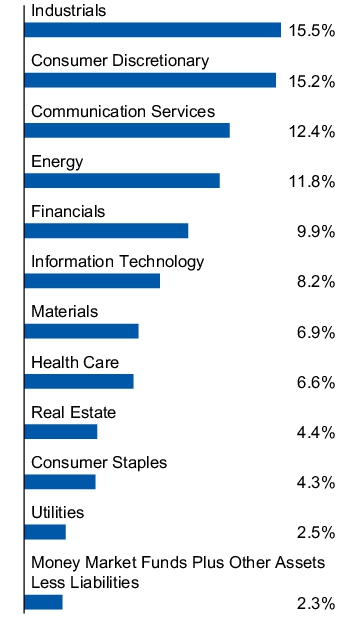

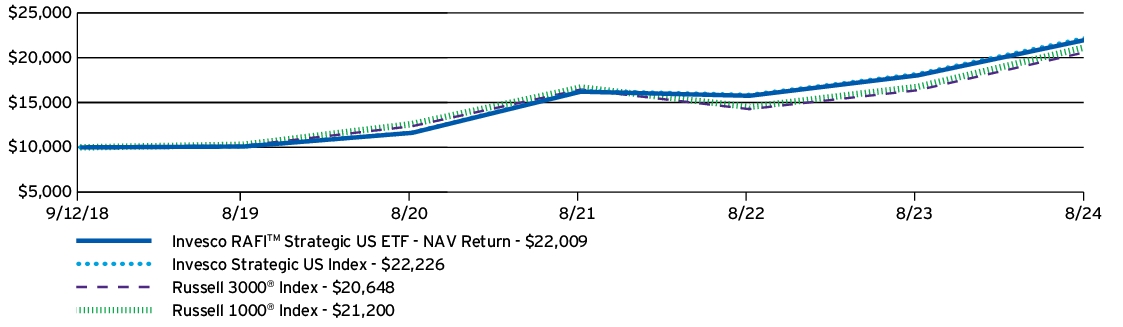

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(09/12/19) |

| Invesco BulletShares 2027 High Yield Corporate Bond ETF — NAV Return | 10.84% | 3.37% |

| Invesco BulletShares 2027 High Yield Corporate Bond ETF — Market Price Return | 10.72% | 3.35% |

| Invesco BulletShares® USD High Yield Corporate Bond 2027 Index | 11.33% | 4.40% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | 0.22% |

| Bloomberg U.S. Corporate High Yield Index | 12.55% | 4.38% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate High Yield Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $287,513,586 |

| Total number of portfolio holdings | 159 |

| Total advisory fees paid | $728,994 |

| Portfolio turnover rate | 16% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings*

(% of net assets)

| DISH Network Corp., 11.75%, 11/15/2027 | 3.01% |

| CCO Holdings LLC/CCO Holdings Capital Corp., 5.13%, 05/01/2027 | 2.80% |

| Mauser Packaging Solutions Holding Co., 7.88%, 04/15/2027 | 2.45% |

| Carnival Corp., 5.75%, 03/01/2027 | 2.41% |

| Venture Global LNG, Inc., 9.88%, 02/01/2032 | 1.96% |

| Rakuten Group, Inc., 11.25%, 02/15/2027 | 1.72% |

| Community Health Systems, Inc., 5.63%, 03/15/2027 | 1.62% |

| Nexstar Media, Inc., 5.63%, 07/15/2027 | 1.48% |

| TK Elevator U.S. Newco, Inc., 5.25%, 07/15/2027 | 1.35% |

| Tenet Healthcare Corp., 6.25%, 02/01/2027 | 1.32% |

| * Excluding money market fund holdings, if any. | |

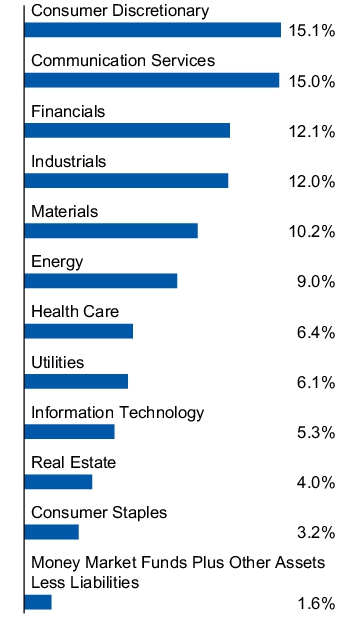

Sector allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2027 Municipal Bond ETF

BSMR | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2027 Municipal Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2027 Municipal Bond ETF | $18 | 0.18% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the municipal bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in municipal bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® Municipal Bond 2027 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 4.40%, differed from the return of the Index, 4.64%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

State Allocations | New York bonds, followed by California bonds.

Positions | New York (City of), NY Transitional Finance Authority, 5.00% coupon, due 2/1/2039, followed by Texas (State of) Water Development Board, 5.00% coupon, due 10/15/2047.

What detracted from performance?

State Allocations | No states detracted from the Fund's performance during the period.

Positions | California (State of) Public Works Board, 5.00% coupon, due 10/1/2029 (no longer held at fiscal year-end), followed by San Francisco (County of), CA Transportation Authority, 3.00% coupon, due 2/1/2030 (no longer held at fiscal year-end).

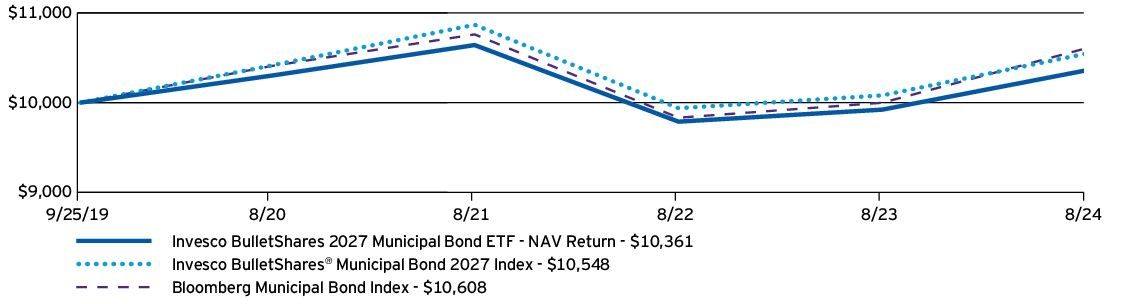

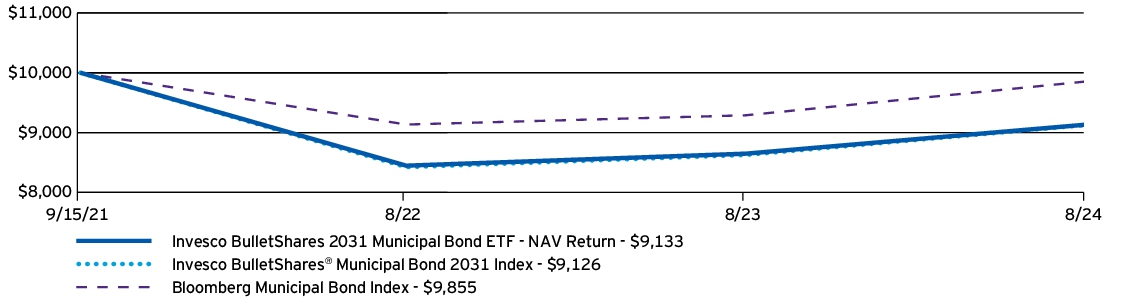

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year | Since

Inception

(09/25/19) |

| Invesco BulletShares 2027 Municipal Bond ETF — NAV Return | 4.40% | 0.72% |

| Invesco BulletShares 2027 Municipal Bond ETF — Market Price Return | 4.22% | 0.75% |

| Invesco BulletShares® Municipal Bond 2027 Index | 4.64% | 1.09% |

| Bloomberg Municipal Bond Index | 6.09% | 1.20% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $168,081,077 |

| Total number of portfolio holdings | 1,288 |

| Total advisory fees paid | $218,134 |

| Portfolio turnover rate | 1% |

What Comprised The Fund's Holdings?

(as of August 31, 2024)

Top ten holdings

(% of net assets)

| Anaheim (City of), CA Housing & Public Improvements Authority, Series 2022, Ref. RB, 5.00%, 10/01/2034 | 0.73% |

| California (State of), Series 2021, Ref. GO Bonds, 5.00%, 12/01/2027 | 0.64% |

| Mississippi (State of), Series 2017 A, Ref. GO Bonds, 5.00%, 10/01/2030 | 0.64% |

| New York (City of), NY Transitional Finance Authority, Series 2017 A-E-1, RB, 5.00%, 02/01/2039 | 0.63% |

| New York (City of), NY Municipal Water Finance Authority, Series 2018 DD-2, Ref. RB, 5.00%, 06/15/2040 | 0.62% |

| Clark (County of), NV, Series 2017, Ref. GO Bonds, 5.00%, 06/01/2030 | 0.62% |

| New York (State of) Utility Debt Securitization Authority, Series 2017, RB, 5.00%, 12/15/2041 | 0.62% |

| New York (State of) Dormitory Authority, Series 2018 A, RB, 5.00%, 10/01/2027 | 0.62% |

| Houston (City of), TX, Series 2017 B, Ref. RB, 5.00%, 11/15/2042 | 0.62% |

| Illinois (State of) Finance Authority, Series 2016 C, Ref. RB, 5.00%, 02/15/2041 | 0.61% |

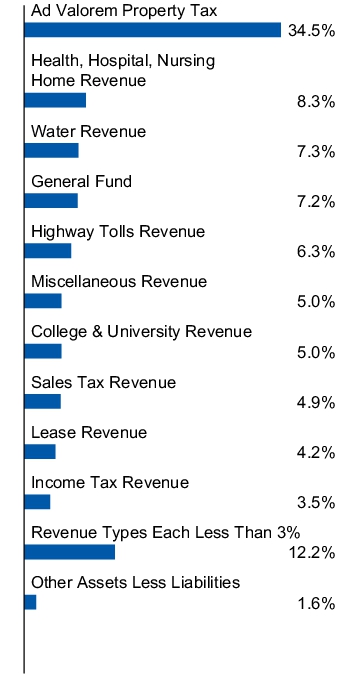

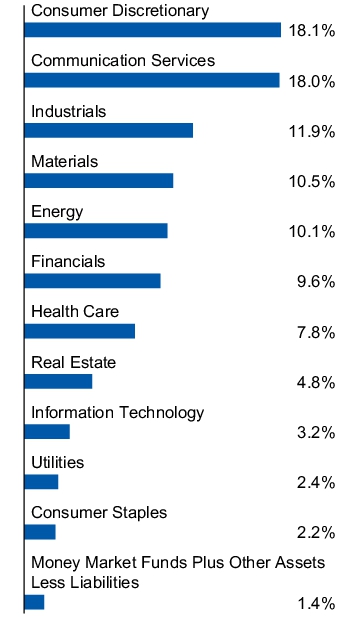

Revenue type allocation

(% of net assets)

Where Can I Find More Information?

You can find more information about the Fund, including the Fund's prospectus, financial information, and holdings at invesco.com/reports. Additionally, the Fund's proxy voting information can be found at invesco.com/proxy-voting.

What Should I Know About Delivery Of Important Regulatory Documents?

Only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact your broker-dealer.

For additional information, please scan the QR code at the left to navigate to additional material at invesco.com/reports.

Invesco BulletShares 2028 Corporate Bond ETF

BSCS | The Nasdaq Stock Market LLC

ANNUAL SHAREHOLDER REPORT | August 31, 2024

This annual shareholder report contains important information about Invesco BulletShares 2028 Corporate Bond ETF (the “Fund”) for the period September 1, 2023 to August 31, 2024. You can find additional information about the Fund at invesco.com/reports. You can also request this information by contacting us at (800) 983-0903.

What Were The Fund Costs For The Last Year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Invesco BulletShares 2028 Corporate Bond ETF | $10 | 0.10% |

How Did The Fund Perform During The Period?

• During the fiscal year ended August 31, 2024, the investment grade corporate bond market benefited from relatively lower longer term interest rates and tightening credit spreads. Because the Fund holds the vast majority of its portfolio in investment grade corporate bonds, it benefited from this broader market environment.

• The Fund is passively managed and seeks to track the investment results (before fees and expenses) of the Invesco BulletShares® USD Corporate Bond 2028 Index (the "Index"). The Fund generally will invest at least 80% of its total assets in securities that comprise the Index.

• For the fiscal year ended August 31, 2024, the Fund's performance, on a net asset value ("NAV") basis, 8.37%, differed from the return of the Index, 8.43%, primarily due to fees and expenses that the Fund incurred during the period.

What contributed to performance?

Industry Allocations | Banks industry, followed by the consumer finance and capital markets industries, respectively.

Positions | AerCap Ireland Capital DAC/AerCap Global Aviation Trust, 3.00% coupon, due 10/29/2028, a financial services company, followed by CVS Health Corp., 4.30% coupon, due 3/25/2028, a health care providers & services company.

What detracted from performance?

Industry Allocations | No industries detracted from the Fund's performance during the period.

Positions | EQM Midstream Partners L.P., 5.50% coupon, due 7/15/2028, an oil, gas & consumable fuels company.

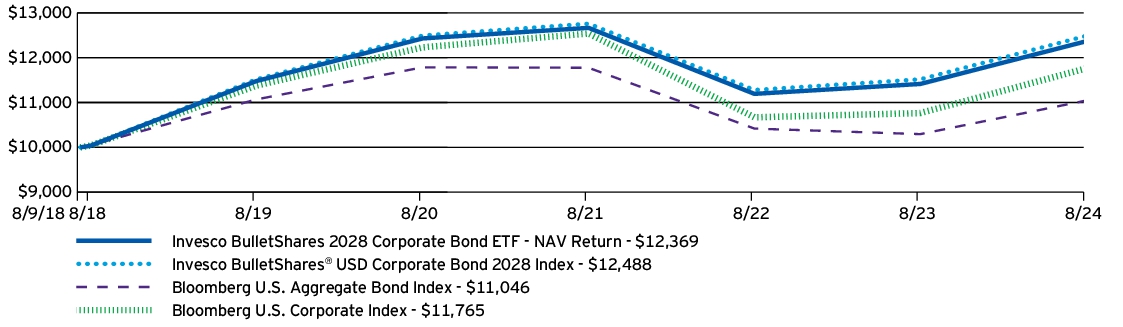

How Has The Fund Historically Performed?

Growth of $10,000 Investment

AVERAGE ANNUAL TOTAL RETURNS |

1 Year |

5 Years | Since

Inception

(08/09/18) |

| Invesco BulletShares 2028 Corporate Bond ETF — NAV Return | 8.37% | 1.51% | 3.57% |

| Invesco BulletShares 2028 Corporate Bond ETF — Market Price Return | 8.47% | 1.49% | 3.57% |

| Invesco BulletShares® USD Corporate Bond 2028 Index | 8.43% | 1.63% | 3.74% |

| Bloomberg U.S. Aggregate Bond Index | 7.30% | (0.04)% | 1.66% |

| Bloomberg U.S. Corporate Index | 9.29% | 0.67% | 2.72% |

The performance data quoted represents past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/ETFs for more recent performance information.

Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

Notes Regarding Indexes and Fund Performance History:

- Effective August 31, 2024, the Fund changed its broad-based securities market benchmark from the Bloomberg U.S. Corporate Index to the Bloomberg U.S. Aggregate Bond Index to reflect that the Bloomberg U.S. Aggregate Bond Index can be considered more broadly representative of the overall applicable securities market.

What Are Key Statistics About The Fund?

(as of August 31, 2024)

| Fund net assets | $1,891,346,207 |

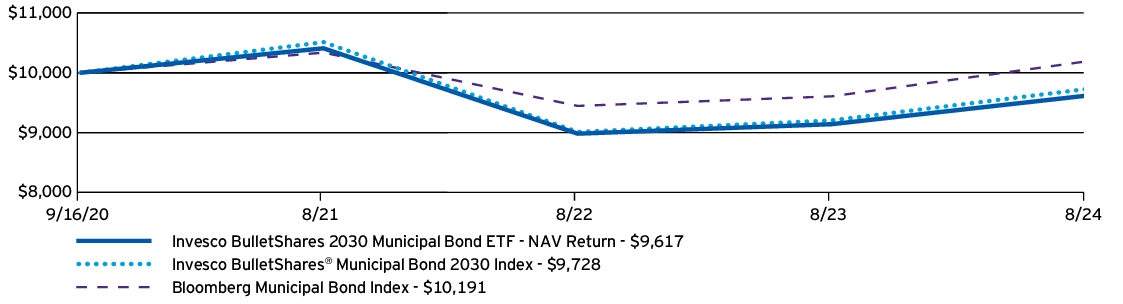

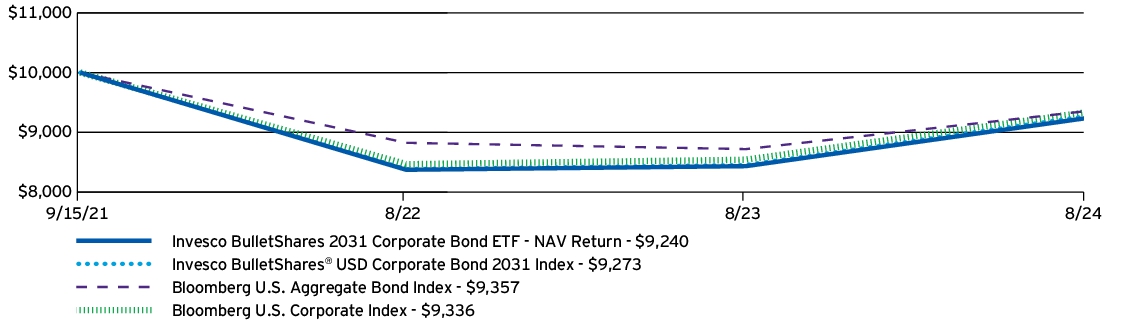

| Total number of portfolio holdings | 371 |