UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

SKYLINE BANKSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11. |

EXPLANATORY NOTE: This notice, proxy statement and form of proxy (the "Proxy Materials") in connection with the registrant's 2023 annual meeting of shareholders are being furnished to the Securities and Exchange Commission (the "Commission") pursuant to the requirements of Form 10-K under "Supplemental Information to be Furnished with Reports Filed Pursuant to Section 15(d) of the Act by Registrants Which Have Not Registered Securities Pursuant to Section 12 of the Act." The Proxy Materials shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, except as expressly set forth by specific reference in such filing. The Proxy Materials are being submitted to the Commission in electronic format on Form DEF 14A pursuant to Commission Release Nos. 33-7427; 34-38798 and Rule 101(a)(1)(iii) of Regulation S-T.

SKYLINE BANKSHARES, INC.

Dear Shareholder:

You are cordially invited to attend the 2023 Annual Meeting of Shareholders of Skyline Bankshares, Inc. to be held on Tuesday, May 16, 2023 at 1:00 p.m. at the Community Room, 203 E. Oxford Street, Floyd, Virginia 24091.

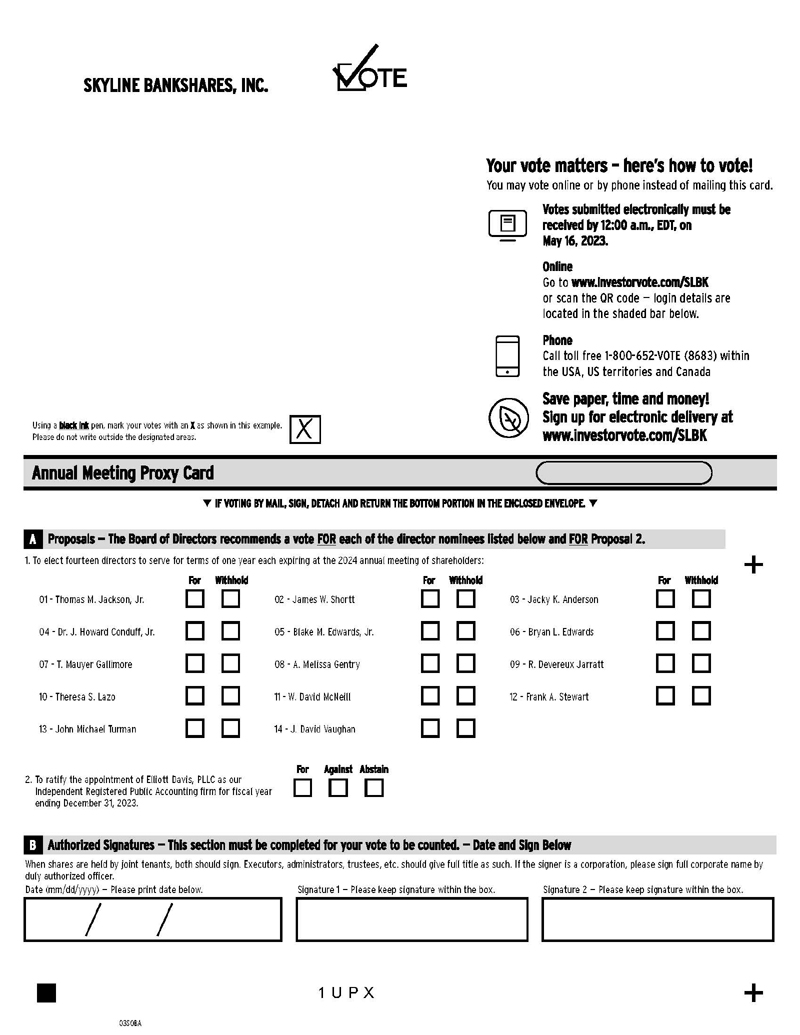

At the Annual Meeting, you will be asked to elect fourteen directors for terms of one year each and to ratify the appointment of our independent registered public accounting firm for the year ending December 31, 2023. Enclosed with this letter is a formal notice of the Annual Meeting, a Proxy Statement and a form of proxy.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted. Please complete, sign, date and return the enclosed proxy promptly using the enclosed postage-paid envelope. The enclosed proxy, when returned properly executed, will be voted in the manner directed in the proxy. You may also vote by internet or telephone by following the instructions on the enclosed proxy.

We hope you will participate in the Annual Meeting, either in person or by proxy.

| | Sincerely, /s/ Blake M. Edwards, Jr. Blake M. Edwards, Jr. President and Chief Executive Officer |

Independence, Virginia

April 5, 2023

Skyline Bankshares, Inc.

101 Jacksonville Circle

Floyd, Virginia 24091

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The Annual Meeting of Shareholders (the “Annual Meeting”) of Skyline Bankshares, Inc. (the “Company”) will be held on Tuesday, May 16, 2023 at 1:00 p.m. at the Community Room, 203 E. Oxford Street, Floyd, Virginia, for the following purposes:

| | 1. | To elect fourteen directors to serve for terms of one year each expiring at the 2024 annual meeting of shareholders; |

| | 2. | To ratify the appointment of Elliott Davis, PLLC as our independent registered public accounting firm for fiscal year ending December 31, 2023; and |

| | 3. | To act upon such other matters as may properly come before the Annual Meeting. |

Only holders of shares of Common Stock of record at the close of business on March 31, 2023, the record date fixed by the Board of Directors of the Company, are entitled to notice of, and to vote at, the Annual Meeting.

| | By Order of the Board of Directors /s/ Suzanne S. Yearout Suzanne S. Yearout Secretary |

April 5, 2023

Skyline Bankshares, Inc.

101 Jacksonville Circle

Floyd, Virginia 24091

PROXY STATEMENT

GENERAL

This Proxy Statement is furnished to holders of the common stock (“Common Stock”) of Skyline Bankshares, Inc. (the “Company”), in connection with the solicitation of proxies by the Board of Directors of the Company to be used at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, May 16, 2023 at 1:00 p.m. at the Community Room, 203 E. Oxford Street, Floyd, Virginia, and any duly reconvened meeting after adjournment thereof.

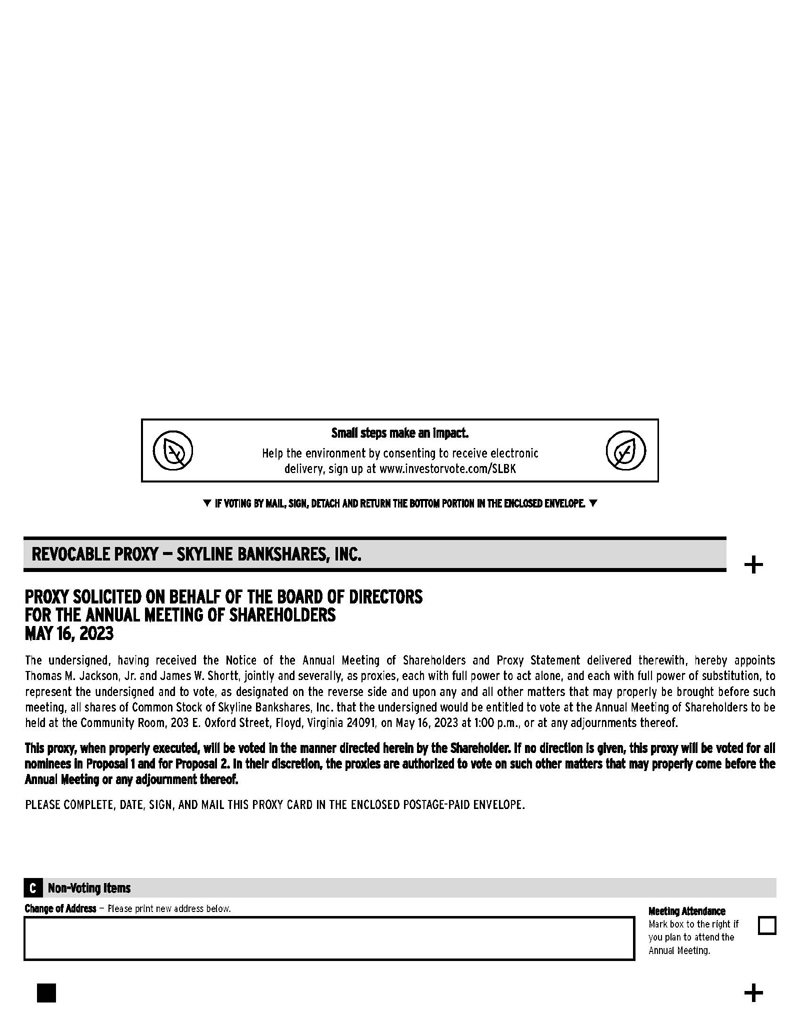

Any shareholder who executes a proxy has the power to revoke it at any time by written notice to the Secretary of the Company, by executing a proxy dated as of a later date or submitting a subsequent vote by internet or telephone, or by voting in person at the Annual Meeting. It is expected that this Proxy Statement and the enclosed proxy card will be mailed on or about April 5, 2023 to all shareholders entitled to vote at the Annual Meeting.

If the enclosed proxy is properly executed in time for voting at the Annual Meeting, the shares represented thereby will be voted according to such instructions. If no instructions are given in an executed proxy, the proxy will be voted FOR each of the nominees for director named herein, FOR Proposal Two, and in the discretion of the proxy holders as to any other matters which may properly come before the meeting.

The cost of soliciting proxies for the Annual Meeting will be borne by the Company. The Company does not intend to solicit proxies otherwise than by use of the mails, but certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies. The Company may also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding proxy materials to the beneficial owners of shares of Common Stock.

On March 31, 2023, the record date for determining those shareholders entitled to notice of and to vote at the Annual Meeting, there were 5,607,416 shares of Common Stock issued and outstanding. Each outstanding share of Common Stock is entitled to one vote on all matters to be acted upon at the Annual Meeting. A majority of the shares of Common Stock entitled to vote, represented in person or by proxy, constitutes a quorum for the transaction of business at the Annual Meeting.

If a quorum is present, the election of each nominee to the Board of Directors will be approved by the affirmative vote of a plurality of the shares represented at the meeting, and the ratification of accountants will be approved if a majority of the votes cast at the meeting vote in favor of the proposal.

A shareholder may abstain or (only with respect to the election of directors) withhold his or her vote (collectively, “Abstentions”) with respect to each item submitted for shareholder approval. Abstentions will be counted for purposes of determining the existence of a quorum. Abstentions will not be counted as voting in favor of, or against the relevant item.

A broker who holds shares in “street name” has the authority to vote on certain items when it has not received instructions from the beneficial owner. Except for certain items for which brokers are prohibited from exercising their discretion, a broker is entitled to vote on matters presented to shareholders without instructions from the beneficial owner. “Broker shares” that are voted on at least one matter will be counted for purposes of determining the existence of a quorum for the transaction of business at the Annual Meeting. Where brokers do not have or do not exercise such discretion, the inability or failure to vote is referred to as a “broker nonvote.” Under the circumstances where the broker is not permitted to, or does not, exercise its discretion, assuming proper disclosure to the Company of such inability to vote, broker nonvotes will not be counted as voting in favor of, or against, the particular matter. A broker is prohibited from voting on the election of directors without instructions from the beneficial owner; therefore, there may be broker nonvotes on Proposal One. A broker may vote on the ratification of the independent registered public accounting firm; therefore, no broker nonvotes are expected to exist in connection with Proposal Two. Because abstentions and broker nonvotes will not count as votes cast in either proposal, abstentions and broker nonvotes will have no effect on the outcome of the voting on these matters at the Annual Meeting.

The Board of Directors is not aware of any matters other than those described in this Proxy Statement that may be presented for action at the Annual Meeting. However, if other matters do properly come before the Annual Meeting, the persons named in the enclosed proxy card possess discretionary authority to vote in accordance with their best judgment with respect to such other matters.

PROPOSAL ONE

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation call for the election of all directors at each annual meeting of the Company’s shareholders. Therefore, at the Annual Meeting, fourteen directors are to be elected to serve for terms of one year each, expiring at the 2024 annual meeting of shareholders.

The election of each nominee for director requires the affirmative vote of the holders of a plurality of the shares of Common Stock cast in the election of directors. If the proxy is executed in such manner as not to withhold authority for the election of any or all of the nominees for directors, then the persons named in the proxy will vote the shares represented by the proxy for the election of the nominees named below. If the proxy indicates that the shareholder wishes to withhold a vote from one or more nominees for director, such instructions will be followed by the persons named in the proxy.

Each nominee has consented to being named in this Proxy Statement and has agreed to serve if elected. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve. If, at the time of the Annual Meeting, any nominee is unable or unwilling to serve as a director, votes will be cast, pursuant to the enclosed proxy, for such substitute nominee as may be nominated by the Board of Directors. There are no current arrangements between any nominee and any other person pursuant to which a nominee was selected. No family relationships exist among any of the directors or between any of the directors and executive officers of the Company.

The following biographical information discloses each director’s age and business experience, and the year that each individual was first elected to the Board of Directors of the Company. Previous service on the boards of Grayson Bankshares, Inc. (“Grayson”), Cardinal Bankshares Corp. (“Cardinal”), or Great State Bank prior to their respective mergers with and into the Company and its wholly owned bank subsidiary, Skyline National Bank, is also disclosed, as are the specific skills or attributes that qualify each director for service on the Board of Directors.

Nominees for Election

Thomas M. Jackson, Jr. (65) – Mr. Jackson has been Chairman of the Board of the Company since its inception in November 2015. Previously he was named a board member for Grayson and Grayson National Bank in 2002 and was elected Chairman in 2012. Mr. Jackson is a practicing attorney and the owner of Jackson Law Group, PLLC, with offices in Hillsville and Wytheville, Virginia. He also has a black angus beef farm at his family home place in Wythe County. He was elected to the Virginia House of Delegates in 1987 and served as a 6th District Representative until 2002. Following his retirement from the General Assembly, he was appointed to the Virginia State Board of Education for a four-year term, serving as Board of Education President the last three years. Mr. Jackson’s knowledge of real estate and contract law assists Skyline National Bank in its real estate and commercial lending activities. Through his service in the legislature and his current legal practice he has gained extensive knowledge of the communities served by the Company and Skyline National Bank.

James W. Shortt (60) – Mr. Shortt has been a director of the Company since its inception in November 2015 and has served as Vice Chairman since June 2016. Mr. Shortt served as a director of Cardinal and the Bank of Floyd from 2012 to 2016, serving as Vice Chairman from 2012 to 2015 and Chairman from 2015 to 2016. He is a partner of Shortt & Murrell, P.C., a general practice law firm with its principal office in Floyd, Virginia. Mr. Shortt is particularly qualified to serve on the Board by virtue of his legal background, especially with regard to his knowledge of real estate law and corporate and business transactions. Mr. Shortt has been practicing law in Virginia since 1988. Mr. Shortt is a graduate of the University of Richmond School of Law and Virginia Tech.

Jacky K. Anderson (71) – Mr. Anderson has been a director of the Company since its inception in November 2015. He served as a director of Grayson and Grayson National Bank from 1992 to 2016. Mr. Anderson retired from Grayson and Grayson National Bank in 2013 where he served as President and Chief Executive Officer of Grayson and Grayson National Bank from 2000 to 2013. Mr. Anderson began working for Grayson National Bank in 1971, giving him over 49 years of experience in the banking industry. During his tenure Mr. Anderson gained in-depth knowledge of the laws and regulations applicable to the banking industry and developed extensive customer and community relationships.

Dr. J. Howard Conduff, Jr. (64) – Dr. Conduff has been a director of the Company since its inception in November 2015. He served as a director of Cardinal and the Bank of Floyd for many years, representing a third-generation family member to serve on the Cardinal Board. Dr. Conduff is a private practice dentist in Floyd, Virginia. He is a community leader in the Bank’s market area where he serves on numerous civic boards. Dr. Conduff has substantial banking experience due to the length of his service on the Cardinal Board. He currently serves as Chairman of the Compensation Committee for the Company. Dr. Conduff is a graduate of the Virginia Military Institute and the MCV School of Dentistry.

Blake M. Edwards, Jr. (57) – Mr. Edwards, President and Chief Executive Officer of the Company and Skyline National Bank since January 2019, previously served as the Senior Executive Vice President and Chief Financial Officer of the Company and Skyline National Bank from November 2015 to December 2018. Prior to that he served as the Chief Financial Officer of Grayson and Grayson National Bank since 1999, and as Senior Executive Vice President since 2013. Before joining Grayson, Mr. Edwards worked with a public accounting firm where his primary focus was providing audit and advisory services to community banks. He is a graduate of Radford University and has also attended the AICPA’s School of Banking at the University of Virginia and the Graduate School of Bank Investments and Financial Management at the University of South Carolina. Locally, Mr. Edwards serves as a member of the Joint Governing Board of DLP, Twin County Regional Healthcare, Inc., and as a Director of the Blue Ridge Discovery Center. He also serves as a Director of the Virginia Association of Community Banks and as a member of the Government Relations Committee of the Virginia Bankers Association.

Bryan L. Edwards (72) – Mr. Edwards has been a director of the Company since its inception in November 2015. He served as a director of Grayson and Grayson National Bank from 2005 to 2016. Mr. Edwards served as the manager of the Town of Sparta, North Carolina from 2004 until his retirement in September of 2020. Prior to that he served as Human Resources/Special Projects & Purchasing Director for NAPCO, Inc., a manufacturing company, also in Sparta. He is also a North Carolina licensed real estate broker. His experience allows him to provide working knowledge of local governments and tax authorities as well as insight into local economic and real estate market conditions. Mr. Edwards also serves on the Board of Directors of Blue Ridge Energy, a rural electric cooperative based in Lenoir, North Carolina, since 2007. He is past Chairman of the Virginia-Carolina Water Authority in Independence, Virginia and also past president of the Alleghany County Chamber of Economic Development.

T. Mauyer Gallimore (80) – Mr. Gallimore has been a director of the Company since its inception in November 2015. He served as a director of Cardinal and the Bank of Floyd from 2012 to 2016. Mr. Gallimore is a native of Floyd, Virginia and he has been a small business owner in Floyd County for over 40 years. Mr. Gallimore is the retired owner and founder of Blue Ridge Land and Auction Co., Inc. and has over 30 years of experience as a Certified Real Estate Appraiser. His in-depth knowledge of the real estate market in our primary service areas is a valuable resource for our board and management as the majority of the Bank’s loans are secured by real estate.

A. Melissa Gentry (58) – Ms. Gentry has been a director of the Company since June 2016. She was appointed to the board of Cardinal in April 2016. Ms. Gentry is the Chief Financial Officer of Shelor Motor Mile, Inc., where she oversees all financial, accounting and recordkeeping functions for 31 affiliated entities. These entities include automotive sales and service, consumer finance, insurance sales, real estate investment, construction and development, restaurants, retail stores, hotels, cattle and crop farming representing approximately $425 million in annual revenues and over $200 million in inventories and properties. Her business experience gives her vast insight into economic conditions in and around the New River Valley and her accounting expertise is a significant asset for the board and management. Ms. Gentry is a graduate of Virginia Tech and is currently serving on the Board of Directors for two non-profit organizations: New River Valley Health Foundation and Friends of Calfee Park. Ms. Gentry has previously served on the Board for Carilion New River Valley Medical Center.

R. Devereux Jarratt (81) – Mr. Jarratt has been a director of the Company since its inception in November 2015. He served as a director of Cardinal and the Bank of Floyd from 2013 to 2016. Prior to retiring on December 31, 2014, he had been the Chief Executive Officer of Physicians Care of Virginia since January 1996. Mr. Jarratt has 22 years of experience in the banking industry with various banking institutions, including First National Exchange Bank, Dominion Bankshares Corporation and First Union. Mr. Jarratt has an undergraduate degree in economics, a graduate degree in accounting and is a graduate of the Stonier Graduate School of Banking. His vast business experience, including direct banking experience, combined with his in-depth knowledge of the Cardinal legacy customers and shareholders, are significant assets to the Board.

Theresa S. Lazo (66) – Mrs. Lazo has been a director of the Company since its inception in November 2015. She served as a director of Grayson and Grayson National Bank from 2011 to 2016. Mrs. Lazo currently serves on the Board of Directors of Oak Hill Academy, and she previously served on the Board of Directors of the Chestnut Creek School of the Arts from 2007 to 2014. She also served six years on the Arts Council of the Twin Counties where she held the offices of treasurer, vice president and president at various times during her tenure. Mrs. Lazo served nine years on the Galax City School Board. Through her vast experience with local non-profit organizations and public institutions she has developed extensive personal relationships within the communities served by the Company and Skyline National Bank and offers a unique perspective on our markets.

W. David McNeill (66) – Mr. McNeill has been a director of the Company since July 2018. He was one of the Founders of Great State Bank and served on the Board of Directors from 2008 to 2018. Mr. McNeill is owner and operator of Carolina Kia of High Point, Carolina Hyundai of High Point, McNeill Nissan of Wilkesboro and McNeill Chevrolet Buick of Wilkesboro. He is also owner of Carolina Automotive Group, which is primarily a real estate company owning the properties the dealerships do business on. Mr. McNeill is a graduate of UNC -Chapel Hill.

Frank A. Stewart (61) – Mr. Stewart has been a director of the Company since July 2018. He served as director of Great State Bank from 2009 to 2018. Mr. Stewart currently serves on the Caromont Health Board of Directors located in Gaston County, NC. Mr. Stewart has also served in various capacities including Chairman of the Gardner-Webb University Board of Trustees for three years. He received an Honorary Doctorate Degree in Humanities from Gardner-Webb University in May 2016 and has served on the Gardner-Webb University President’s Advisory Board. He was appointed by the North Carolina Speaker of the House to the Rural Infrastructure Authority and the North Carolina Ports Authority. Formerly, Mr. Stewart served on the Cleveland Community College Foundation Board of Directors, Coastal Carolina National Bank Board of Directors, on the United Way of Cleveland County Board, and the State Board of the USO of North Carolina. Appointed by the Governor, Frank completed two terms on the North Carolina Advisory Commission on Military Affairs. Mr. Stewart is President of Premier Body Armor, LLC of Gastonia, NC. He is also the owner of Stewart Realty and Stewart Property Management. Previously, he was the owner and founder of Ultra Machine and Fabricating, a sub-contractor manufacturer for several major defense contractors, from 1989 to 2015. Mr. Stewart’s strong leadership and commitment to excellence is an asset to the board. Mr. Stewart was born in Barranquilla, Colombia. He moved to the United States in 1982 and received his citizenship in 1992. Mr. Stewart is a graduate of UNC Charlotte with a Bachelor’s Degree in Business Administration.

John Michael Turman (76) – Mr. Turman has been a director of the Company since July 2016. He is a long-time resident of Floyd County and has led a variety of businesses in southwest Virginia relating to land, lumber, real estate development, manufacturing, and retail sales. Mr. Turman has developed extensive personal and business relationships throughout the Bank’s market area giving him significant knowledge of both current and potential customers as well as shareholders of the Company and Skyline National Bank. He attended the University of Virginia’s College at Wise and has served on the local Industrial Development Authority.

J. David Vaughan (55) – Mr. Vaughan has been a director of the Company since its inception in November 2015. He served on the board of Grayson and Grayson National Bank from 1999 to 2016. He is the managing partner of My Home Furnishings, LLC, a distributor specializing in youth furniture, located in Mt. Airy, North Carolina, and serves as President of Vaughan Furniture, Incorporated, a furniture distributor located in Galax, Virginia. The furniture industry has historically played a significant role in the local economy of many of the communities served by the Company and Skyline National Bank, and furniture manufacturing still provides a significant source of employment within those communities. Mr. Vaughan’s direct knowledge of this industry combined with his financial and managerial experience makes him a valuable resource to the Board. Mr. Vaughan also serves as president of the Wytheville Community College Scholarship Foundation, and as President of Vaughan Restoration Group, which is a group that works in part with the Galax Development Corporation. Mr. Vaughan also serves on the Boards of Directors for Vaughan Furniture Company, Inc., Big “V” Wholesale Company, Inc., and the Vaughan Foundation.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE NOMINEES SET FORTH ABOVE.

In addition to the specific qualifications noted above, all of our directors are active, well-respected members of the communities we serve. Their personal relationships with both current and prospective customers in those communities are an invaluable resource to the Company and the Bank.

Other Directorships

No director is or has been a director during the preceding five years of any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended.

Executive Officers Who Are Not Directors

Lori C. Vaught (49) – Mrs. Vaught, Executive Vice President and Chief Financial Officer of the Company and Skyline National Bank since January 2019, previously served as Controller of Skyline National Bank and its predecessor Grayson National Bank from August 2012 to January 2019. She also served as Grayson National Bank’s Vice President of Loan Operations from September 2002 to August 2012. Prior to those positions, she worked with two local public accounting firms with a primary focus on audit and tax services. She earned a Bachelor of Business Administration with a concentration in Accounting from Radford University. She serves as a member of the CFO Committee for the Virginia Bankers Association.

Beth R. Worrell (49) – Ms. Worrell, Executive Vice President and Chief Risk Officer of Skyline National Bank since January 2019, previously served as an independent consultant to community banks in Virginia and North Carolina, providing outsourced audit, credit review, and compliance services. Ms. Worrell also worked as a shareholder with a large regional public accounting firm where her work was also focused on community banks. She has a Bachelor of Arts degree in Mathematics and a Bachelor of Science degree in Business with a concentration in Accounting from Emory & Henry College. Ms. Worrell is a Certified Public Accountant and currently serves as Treasurer for the Chestnut Creek School of the Arts.

Rodney R. Halsey (54) – Mr. Halsey, Executive Vice President and Chief Operations Officer of Skyline National Bank, previously worked for Grayson National Bank since 1992, when he began his career as Grayson National Bank’s Loan Review Officer. From 1996 to 2001, Mr. Halsey served as Grayson National Bank’s Assistant Vice President and Loan Officer. In 2002, he was promoted to Vice President of Information Systems/Loan Officer, and in 2009, Mr. Halsey was promoted to Senior Vice President of Information Systems/Commercial Loan Officer. In 2011, Mr. Halsey was named the Chief Operating Officer of Grayson National Bank. Mr. Halsey has previously served on the Alleghany Memorial Hospital Foundation and the Mount Rogers Planning District Loan Fund Board. He currently serves on the Board of Trustees for Oak Hill Academy and the Wytheville Community College Educational Foundation. Mr. Halsey graduated from Appalachian State University with a degree in Business Administration.

C. Greg Edwards (65) – Mr. Edwards, Executive Vice President and Regional President, North Carolina for Skyline National Bank, previously served as President and Chief Executive Officer of Great State Bank from 2008 until its acquisition by Skyline National Bank in 2018. He was a member of the organizing group of Great State Bank and was elected to the board and President & CEO positions at the time the bank incorporated and began operations during July 2008. He previously served as a senior credit officer for Northwestern National Bank (formerly Wilkes National Bank) from 1994 until that bank was acquired by Integrity Financial Corp. (the parent company of Catawba Valley Bank) in 2002. Following that transaction, he joined Bank of Granite in April 2003 where he served as Senior Vice President and County Executive in Wilkes County until he joined the Great State Bank organizing group in December 2006. Mr. Edwards has 44 years of commercial banking experience and served in loan review, credit administration and lending roles prior to the positions above with Southern National Bank, First Union National Bank and Northwestern Bank.

Jonathan L. Kruckow (38) – Mr. Kruckow, Executive Vice President and Regional President, Virginia for Skyline National Bank, previously worked for Grayson National Bank since 2012, when he served as Senior Vice President of Commercial Lending. Prior to joining Grayson, he worked for a large regional bank in the local market where his primary focus was providing commercial banking services for small to mid-sized businesses. He is a graduate of Virginia Tech, the Virginia Bankers Association’s School of Bank Management at the University of Virginia, and the Graduate School of Banking at Louisiana State University. Mr. Kruckow currently serves on the Virginia Bankers Association’s Lending Executives Committee, the Virginia Bankers Association’s School of Bank Management Board of Trustees and the Board of Directors for Virginia Title Center.

Milo L. Cockerham (36) – Mr. Cockerham, Executive Vice President and Chief Retail Banking Officer of Skyline National Bank, joined Skyline National Bank as a consultant in December of 2016 to help with the systems conversion of the merger of Grayson National Bank and Bank of Floyd. He now leads our network of 25 retail branch locations. Mr. Cockerham has 14 years of experience in the banking and financial services industry. Prior to joining Skyline National Bank, he served in a managerial role assisting with branch operations in a large branch network for a community bank in North Carolina. Mr. Cockerham is a graduate of Emory & Henry College with a Bachelor of Arts degree in Economics and a Bachelor of Science degree in Business Management. He is a graduate of the Graduate School of Banking at Louisiana State University. He also serves as a member of the Retail Banking Executives Committee for the Virginia Bankers Association and serves as a board member on the Galax Foundation for Excellence.

CORPORATE GOVERNANCE AND

THE BOARD OF DIRECTORS

General

The business and affairs of the Company are managed under the direction of the Board of Directors in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Bylaws. Members of the Board are kept informed of the Company’s business through discussions with the Chairman of the Board, the President and Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees.

Independence of Directors

The Board of Directors in its business judgment has determined that the following twelve of its fourteen members are independent as that term is defined by the Nasdaq Stock Market: Dr. J. Howard Conduff, Jr., Bryan L. Edwards, T. Mauyer Gallimore, A. Melissa Gentry, Thomas M. Jackson, Jr., R. Devereux Jarratt, Theresa S. Lazo, W. David McNeill, James W. Shortt, Frank A. Stewart, John Michael Turman, and J. David Vaughan. The Board considered the following transactions between us and certain of our directors or their affiliates to determine whether such director was independent under the above standards:

| | ● | Prior to the Cardinal merger, Grayson had an advisory agreement in place with Mr. Anderson under which he was paid for various consultative and advisory services related to customer, shareholder, and employee related issues. The agreement expired in September of 2014. Mr. Anderson also served as President and Chief Executive Officer of Grayson from June 2000 until his retirement in September 2013. |

Board Structure and Risk Oversight

Thomas M. Jackson, Jr. serves as the Chairman of the Board of Directors and Blake M. Edwards, Jr. serves as the President and Chief Executive Officer. While the Company’s Bylaws and corporate governance guidelines do not require that the Company’s Chairman and Chief Executive Officer positions be separate, the Board of Directors made the determination that these offices would be best served by two individuals. Separating these positions allows the Chief Executive Officer to focus on day-to-day business operations of the Company, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. The Board of Directors believes that the position of Chairman of the Board is therefore best served by a director that is independent of management.

The Company faces a number of risks, including economic risks, environmental and regulatory risks and others, such as the impact of competition. Management is responsible for the day-to-day management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. The Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

While the Board is ultimately responsible for risk oversight at the Company, the Board’s standing committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation Committee of the Board assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from compensation policies and programs. The Board of Directors also receives regular reports directly from officers responsible for oversight of particular risks within the Company. Further, the Board of Directors oversees risks through the establishment of policies and procedures that are designed to guide daily operations in a manner consistent with applicable laws, regulations and risks acceptable to the Company.

Committees of the Board

The Company has an Audit Committee and a Compensation Committee. The Company does not have a standing Nominating Committee.

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling the Board’s oversight responsibility to the shareholders relating to the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications, independence and performance of the Company’s independent auditor and the performance of the internal audit function. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the work of the independent auditor engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attestation services for the Company.

The members of the Audit Committee are Frank A. Stewart, Chairman, A. Melissa Gentry, Vice Chair, T. Mauyer Gallimore, Theresa S. Lazo, and John Michael Turman, each of whom is independent as that term is defined by the Nasdaq Stock Market.

The Company has not currently designated an “audit committee financial expert.” The Company is located in a rural community where such expertise is limited; however, the Board believes that the current members of the Audit Committee have the ability to understand financial statements and generally accepted accounting principles, the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves, an understanding of internal controls and procedures for financial reporting and an understanding of audit committee functions. The Audit Committee met five times during the year ended December 31, 2022.

Compensation Committee

The Compensation Committee reviews senior management’s performance and compensation and reviews and sets guidelines for compensation of all employees. All decisions by the Compensation Committee relating to the compensation of the Company’s executive officers are reported to the full Board of Directors.

The members of the Compensation Committee are Dr. J. Howard Conduff, Jr., Chairman, Bryan L. Edwards, Vice Chair, Jacky K. Anderson, Thomas M. Jackson, Jr., and James W. Shortt. Each member, with the exception of Jacky K. Anderson, is independent as that term is defined by the Nasdaq Stock Market. The Compensation Committee met three times during the year ended December 31, 2022.

Director Nomination Process

The Board does not believe it needs a separate nominating committee because the full Board is comprised predominantly of independent directors, with the exception of Mr. Anderson and Blake M. Edwards, Jr. and has the time and resources to perform the function of selecting board nominees. When the Board performs its nominating function, the Board acts in accordance with the Company’s Articles of Incorporation and Bylaws but does not have a separate charter related to the nomination process.

In identifying potential nominees with desired levels of diversification, the Board of Directors takes into account such factors as it deems appropriate, including the current composition of the Board, the range of talents, experiences and skills that would best complement those that are already represented on the Board, the balance of management and independent directors, director representation in geographic areas where the Company operates, and the need for specialized expertise. The Board considers candidates for Board membership suggested by its members and by management, and the Board will consider candidates suggested informally by a shareholder of the Company.

Shareholders entitled to vote for the election of directors may submit candidates for formal consideration by the Company if the Company receives timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the Company. To be timely for the 2024 annual meeting, the notice must be received within the time frame set forth below in “Proposals for 2024 Annual Meeting of Shareholders”. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Section 2.5 of the Company’s Bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is Post Office Box 215, Floyd, Virginia 24019.

Communications with Directors

Any director may be contacted by writing to him or her c/o Skyline Bankshares, Inc., Post Office Box 215, Floyd, Virginia 24019. Communications to the non-management directors as a group may be sent to the same address, c/o the Secretary of the Company. The Company promptly forwards, without screening, all such correspondence to the indicated directors.

PROPOSAL TWO

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has appointed the firm of Elliott Davis, PLLC as independent registered public accountants to audit the consolidated financial statements of the Company for the fiscal year ending December 31, 2023. Elliott Davis, PLLC served as our independent registered public accounting firm for the fiscal years ended December 31, 2020, 2021 and 2022. Representatives of Elliott Davis, PLLC are expected to be present at the Annual Meeting, will have an opportunity to make a statement, if they desire to do so, and are expected to be available to respond to appropriate questions from shareholders.

Although our Bylaws do not require shareholder ratification or other approval of the retention of our independent registered public accounting firm, as a matter of good corporate governance, the Board of Directors is requesting that the shareholders ratify the appointment of Elliott Davis, PLLC as our independent registered public accounting firm for the fiscal year ending December 31, 2023. A majority of the votes cast by the holders of our common stock is required for the ratification of the appointment of Elliott Davis, PLLC as our independent registered public accounting firm.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ELLIOTT DAVIS, PLLC AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023.

PROPOSALS FOR 2024 ANNUAL MEETING OF SHAREHOLDERS

The Company’s Bylaws prescribe the procedure that a shareholder must follow to nominate directors or to bring other business before shareholders’ meetings outside of the proxy statement process. For a shareholder to nominate a candidate for director at the 2024 annual meeting of shareholders, notice of nomination must be received by the Secretary of the Company not less than 60 days and not more than 90 days prior to the one-year anniversary of the preceding year’s annual meeting. The notice must describe various matters regarding the nominee and the shareholder giving the notice. For a shareholder to bring other business before the 2024 annual meeting of shareholders, notice must be received by the Secretary of the Company not less than 60 days and not more than 90 days prior to the one-year anniversary of the preceding year’s annual meeting. The notice must include a description of the proposed business, the reasons therefor, and other specified matters. Any shareholder may obtain a copy of the Company’s Bylaws, without charge, upon written request to the Secretary of the Company. The Company must receive any notice of nomination or other business for the 2024 annual meeting of shareholders no later than March 17, 2024 and no earlier than February 16, 2024. The Company expects to hold the 2024 annual meeting of shareholders on May 21, 2024.