Significant Acquisitions

On March 25, 2019, we completed the acquisition (the “Phillips Acquisition”) of all of the equity interests in subsidiaries of PEP I Holdings, LLC, PEP II Holdings, LLC and PEP III Holdings, LLC (collectively, the “Phillips Sellers”). The aggregate consideration for the Phillips Acquisition consisted of 9,400,000 OpCo common units and an equal number of Class B units. The assets acquired in the Phillips Acquisition consist of approximately 866,528 gross acres and 12,210 net royalty acres.

On April 17, 2020, we completed the acquisition of all of the equity interests in Springbok Energy Partners, LLC and Springbok Energy Partners II, LLC (the “Springbok Acquisition”) from the owners of such entities (collectively, the “Springbok Sellers”). The aggregate consideration for the Springbok Acquisition consisted of (i) approximately $95.0 million in cash, (ii) the issuance of 2,224,358 common units and (iii) the issuance of 2,497,134 OpCo common units and an equal number of Class B units. At the time of the Springbok Acquisition, the acreage acquired had over 90 operators on 2,160 net royalty acres across core areas of the Delaware Basin, DJ Basin, Haynesville, STACK, Eagle Ford and other U.S. leading basins.

On December 7, 2021, we completed the acquisition of all of the equity interests in certain subsidiaries owned by Caritas Royalty Fund LLC and certain of its affiliates (the “Cornerstone Acquisition”) for an aggregate purchase price of approximately $54.6 million in cash. The Partnership funded the payment of the purchase price with borrowings under its secured revolving credit facility. The assets acquired in the Cornerstone Acquisition consisted of approximately 26,000 gross producing wells across the Permian, Mid-Continent, Haynesville and other leading U.S. basins.

Kimbell Tiger Acquisition Corporation

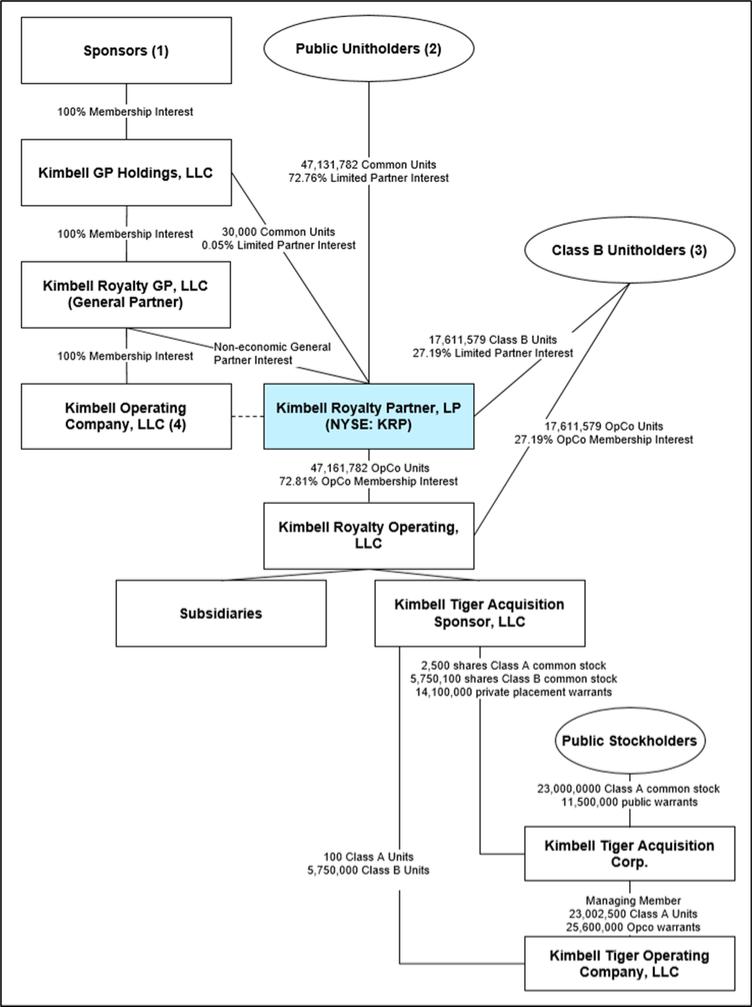

In April 2021, we formed Kimbell Tiger Acquisition Corporation (“TGR”) as a special purpose acquisition company, or SPAC, for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The sponsor of TGR is Kimbell Tiger Acquisition Sponsor, LLC (the “TGR Sponsor”), which is a wholly owned subsidiary of the Operating Company. The Sponsor owns a combination of equity securities in TGR and TGR’s operating company, Kimbell Tiger Operating Company, LLC (“TGR Opco”), that represent 20% of the total outstanding shares of common stock of TGR. TGR intends to focus its search for a target business in the energy and natural resources industry in North America.

On February 8, 2022, TGR completed its initial public offering of 23,000,000 units, including 3,000,000 units that were issued pursuant to the underwriter’s exercise in full of its over-allotment option. Each unit had an offering price of $10.00 and consists of one share of Class A common stock of the TGR, par value $0.0001 per share (the “Class A Common Stock”), and one-half of one redeemable warrant of TGR (each such whole warrant, a “Public Warrant”). Each Public Warrant entitles the holder thereof to purchase one share of Class A Common Stock at a price of $11.50 per share.

On February 8, 2022, simultaneously with the closing of TGR’s IPO and pursuant to a separate private placement warrants purchase agreement dated February 3, 2022, TGR completed the private sale of 14,100,000 warrants (the “Private Placement Warrants”) to the TGR Sponsor at a purchase price of $1.00 per Private Placement Warrant, generating gross proceeds of $14,100,000. Each Private Placement Warrant is exercisable to purchase for $11.50 one share of Class A Common Stock.

Of the net proceeds of TGR’s IPO and the sale of the Private Placement Warrants, $236,900,000, including $8,050,000 of deferred underwriting discounts and commissions, has been deposited into a U.S. based trust account at J.P. Morgan Chase Bank, N.A., with Continental Stock Transfer & Trust Company acting as trustee.

Our Oil and Gas Assets

We categorize our oil and gas assets into two groups: mineral interests and overriding royalty interests.

Mineral Interests

Mineral interests are real property interests that are typically perpetual and grant ownership to all the oil and natural gas lying below the surface of the property, as well as the right to explore, drill and produce oil and natural gas on