Other Services Agreements

Management Services. Kimbell Operating previously had services agreements with Nail Bay Royalties and Duncan Management, LLC (collectively, the “Non-Sponsor Managers”), which are entities controlled by Benny D. Duncan, who served on the Board of Directors during the year ended December 31, 2017 and a portion of the year ended December 31, 2018. Effective as of February 8, 2022, Kimbell Operating and each of the Non-Sponsor Managers entered into agreements to terminate the services agreements of such service providers. Pursuant to these agreements, the Non-Sponsor Managers provided management, administrative and operational services to Kimbell Operating. These services included, with respect to the serviced properties: negotiating and executing leases, right of way agreements, pooling orders and similar agreements and orders; providing certain recordkeeping services; resolving title issues; collecting and disbursing payments and rendering related accounting and bookkeeping services; monitoring drilling and production activities; assisting in preparing certain federal and state tax forms; and providing certain additional accounting, title, human resources, regulatory compliance and other services.

Service Fees and Reimbursement. Under the services agreements with the Non-Sponsor Managers, Kimbell Operating paid a services fee of approximately $116,341 for the year ended December 31, 2022. Kimbell Operating paid to the Non-Sponsor Managers a monthly services fee of approximately $70,817 and $68,806 for the years ended December 31, 2021 and 2020, respectively. These amounts represented an estimated allocation of all projected costs to be incurred by such Non-Sponsor Manager in providing services to Kimbell Operating for the respective year.

Indemnification. Under the services agreements with the Non-Sponsor Managers, Kimbell Operating agreed to indemnify each Non-Sponsor Manager, its affiliates and any of their respective employees, officers, directors and agents from and against all liability, demands, claims, actions or causes of action, assessments, losses, damages, costs and expenses (including legal fees) resulting from or arising out of (i) any material breach by Kimbell Operating of the applicable services agreement or (ii) the personal injury, death, property damage or liability of any member of the Partnership Service Group, any third party or any of their respective employees, officers, directors and agents arising from, connected with or under the applicable services agreement. The Non-Sponsor Managers did not have corresponding indemnification obligations with respect to Kimbell Operating.

Limited Liability Company Agreement of Kimbell Holdings

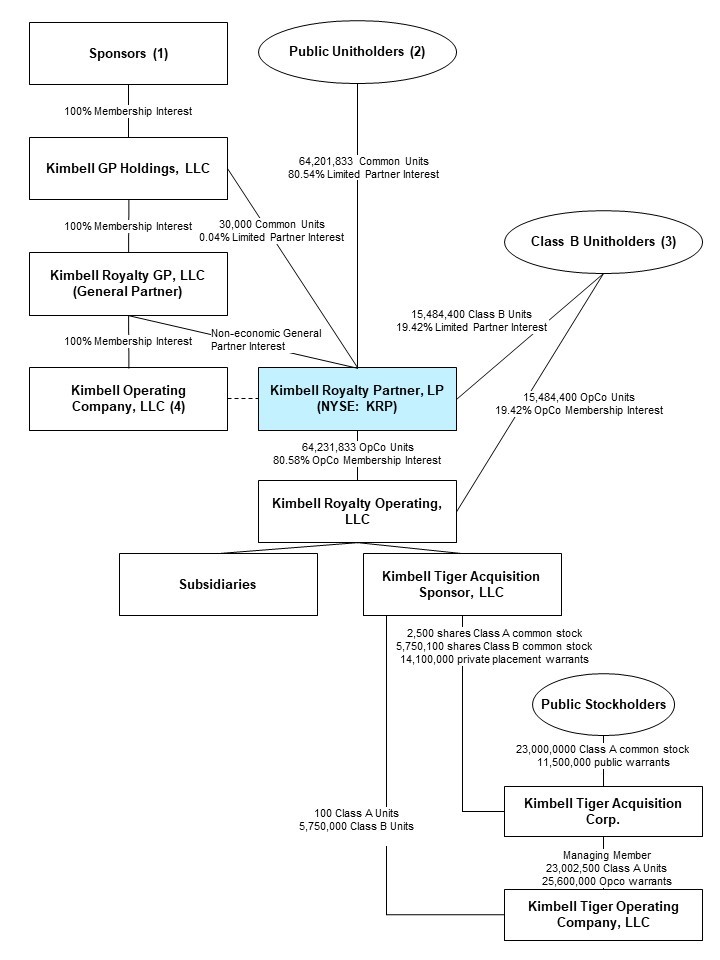

Our Sponsors have entered into the limited liability company agreement of Kimbell Holdings. Kimbell Holdings is the sole member of our General Partner. Pursuant to Kimbell Holdings’ limited liability company agreement, for so long as Messrs. Fortson, R. Ravnaas, Taylor and Wynne (or their designated successors) serve as directors of Kimbell Holdings, such persons will also serve as directors of our General Partner.

Limited Liability Company Agreement of Kimbell Tiger Acquisition Sponsor, LLC

In connection with the formation of Tiger Sponsor, our executive officers and directors, among others, purchased equity interests in Tiger Sponsor. None of the individuals have voting or investment discretion with respect to the shares of TGR or TGR Opco held by Tiger Sponsor. The amount involved in each individual’s purchase did not exceed $120,000 per person.

Other Transactions and Relationships with Related Persons

Family members of certain of our General Partner’s executive officers and directors serve as officers or employees of our General Partner and Kimbell Operating. Rand P. Ravnaas, the son of Robert D. Ravnaas and the brother of R. Davis Ravnaas, serves as Vice President—Business Development of our General Partner and Kimbell Operating, and he is a partial owner of certain of the Contributing Parties. In addition, Peter Alcorn, the son-in-law of Mitch Wynne, serves as Vice President—Land of our General Partner and Kimbell Operating, and he is a partial owner of certain of the Contributing Parties. Each of these family members will participate in the A&R LTIP and receive compensation comprising a base salary and bonuses commensurate with other similarly-situated employees.

John Wynne, the son of Mitch S. Wynne, acts as the Partnership’s agent at Higginbotham Insurance & Financial Services, which provides director and officer insurance to the Partnership. John Wynne derived a commission of approximately $24,450, $22,160 and $20,160 for the years ended December 31, 2022, 2021 and 2020, respectively, for