1 1Q 2017 Earnings Call May 9, 2017 8:30am ET

2 Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of May 8, 2017, and Hertz Global Holdings, Inc (the “Company”). The Company undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its First Quarter 2017 results issued on May 8, 2017, and the Risk Factors and Forward- Looking Statements sections of the Company’s 2016 Form 10-K filed on March 6, 2017, and First Quarter 2017 Quarterly Report on Form 10-Q filed on May 8, 2017. Copies of these filings are available from the SEC, the Hertz website or the Company’s Investor Relations Department. 1Q

3 Non-GAAP Measures THE FOLLOWING KEY METRICS AND NON-GAAP* MEASURES WILL BE USED IN THE PRESENTATION: Adjusted corporate EBITDA Adjusted corporate EBITDA margin Adjusted pre-tax income (loss) Adjusted net income (loss) Adjusted diluted earnings (loss) per share (Adjusted diluted EPS) Total RPD Total RPU Net depreciation per unit per month Vehicle utilization Rentable Utilization 1Q *Definitions and reconciliations of these key metrics and non-GAAP measures are provided in the Company’s first quarter 2017 press release issued on May 8, 2017 and in the Company’s Form 8-K filed on May 9, 2017.

4 Agenda BUSINESS OVERVIEW Kathryn Marinello President & Chief Executive Officer Hertz Global Holdings, Inc. FINANCIAL RESULTS OVERVIEW Tom Kennedy Chief Financial Officer Hertz Global Holdings, Inc. 1Q

5 Drivers of US RAC Long-Term Growth 1Q • FLEET………………. Upgrade vehicle mix and optimize capacity • SERVICE…………… Improve processes, restructure incentives, roll out Ultimate Choice platform • MARKETING……….. Enhance digital applications • TECHNOLOGY…….. Update suite of systems for greater flexibility, productivity and capabilities Influencing Brand Preference through Product Quality and Service Excellence 2017 Earnings Impacted by Investment Strategy to Drive Long-term Growth 2018 Positioned to Benefit from Early Returns

6 1Q:17 Adjusted Corporate EBITDA Bridge 1Q Transformation Predicated on Optimizing Fleet Mix and Capacity $27 ($110) 60% of 1Q:17 year-over-year adjusted corporate EBITDA decline All Other U.S. RAC Revenue Contribution U.S. RAC Vehicle Carrying Costs Contribution Adjusted Corporate EBITDA $ in millions 1Q 2016 Actuals 1Q 2017 Actuals

7 Long-term Outperformance Opportunity: • Hertz brand strength • Industry-leading loyalty programs • Strong partnerships • Ultimate Choice offering • Mature, robust retail car-sales network • Leading-edge systems platform Execution is Key Company is Structurally Capable of Achieving Historic Margins 1Q

8 TOM KENNEDY CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc. Quarterly Overview

9 1Q:17 Consolidated Results GAAP 1Q:17 Results 1Q:16 Results YoY Change Revenue $1,916M $1,983M (3)% Income (loss) from continuing operations before income taxes $(294)M $(76)M (287)% Net Income (loss) from continuing operations $(223)M $(52)M (329)% Diluted earnings (loss) per share from continuing operations $(2.69) $(0.61) (341)% Weighted Average Shares outstanding: Diluted 83M 85M Non-GAAP* Adjusted corporate EBITDA $(110)M $27M NM Adjusted corporate EBITDA margin (6)% 1% (710 bps) Adjusted pre-tax income (loss) $(213)M $(106)M (101)% Adjusted net income (loss) $(134)M $(67)M (100)% Adjusted diluted EPS $(1.61) $(0.79) (104)% 1Q *Definitions and reconciliations of Non-GAAP measures are provided in the Company’s first quarter 2017 press release issued on May 8, 2017 and in the Company’s Form 8-K filed on May 9, 2017.

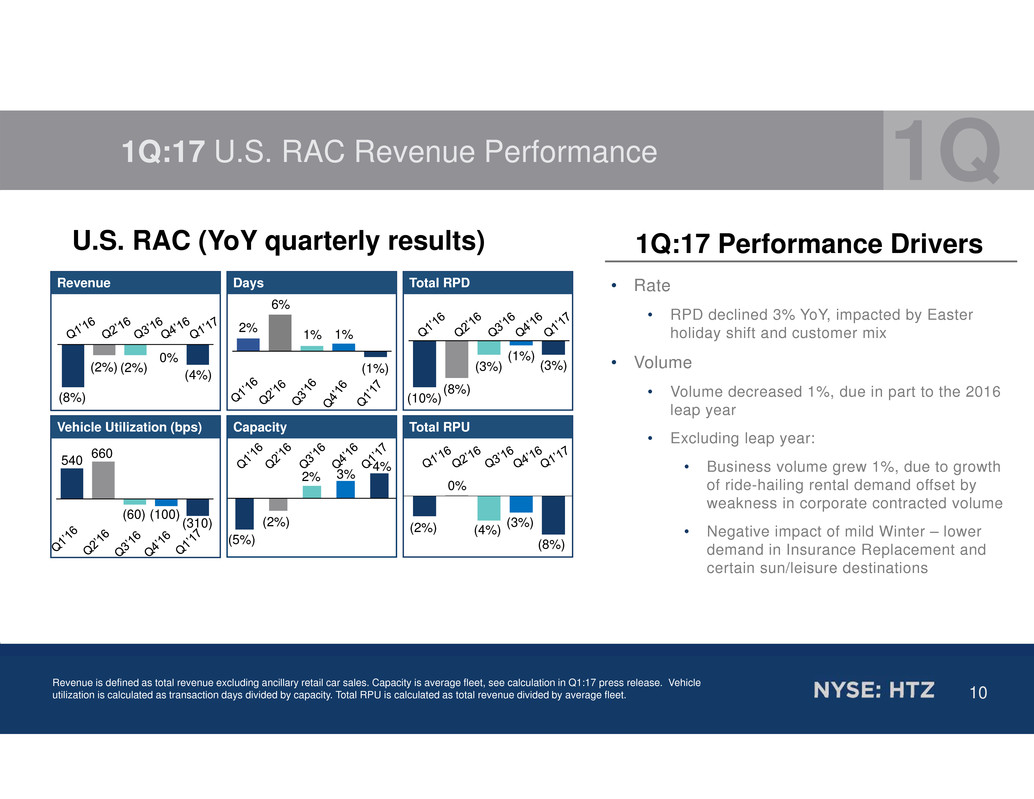

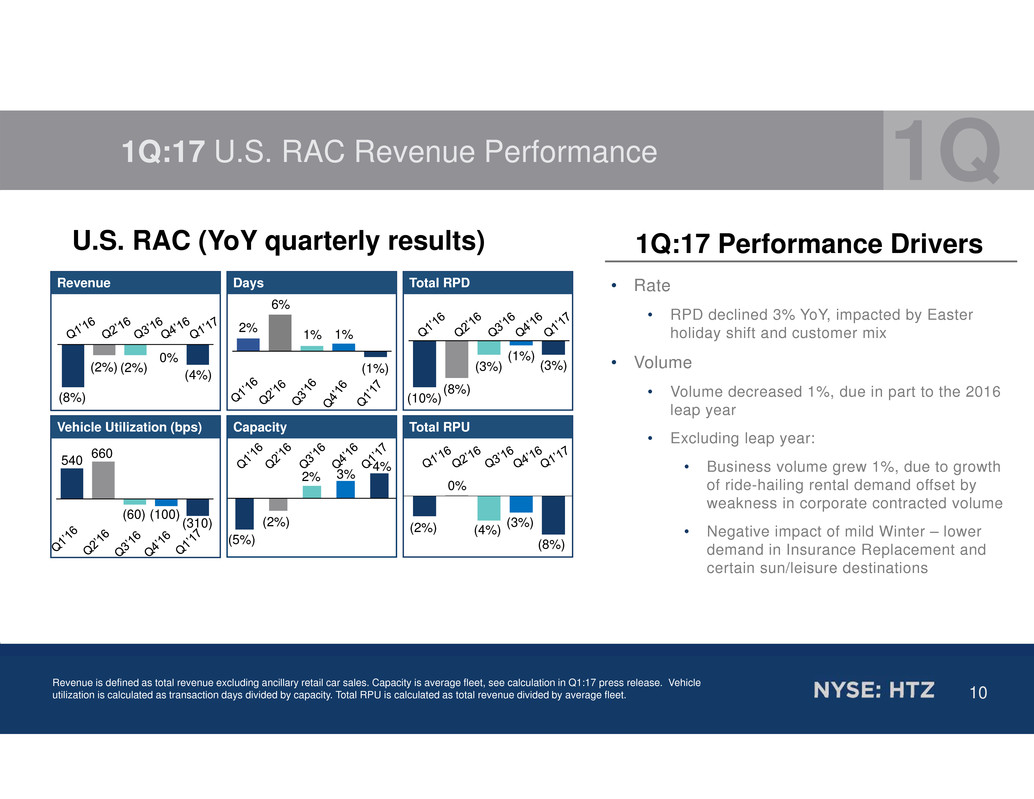

10 1Q:17 U.S. RAC Revenue Performance Revenue Days Total RPD Vehicle Utilization (bps) Capacity Total RPU (2%)(2%) (8%) 0% 6% 2% 1%1% (8%) (10%) (3%) 660540 (60) (2%) (5%) 2% 0% (2%) (4%) U.S. RAC (YoY quarterly results) Revenue is defined as total revenue excluding ancillary retail car sales. Capacity is average fleet, see calculation in Q1:17 press release. Vehicle utilization is calculated as transaction days divided by capacity. Total RPU is calculated as total revenue divided by average fleet. 1Q:17 Performance Drivers (1%) (100) 3% (3%) 1Q (4%) (1%) (3%) 4% (8%) (310) • Rate • RPD declined 3% YoY, impacted by Easter holiday shift and customer mix • Volume • Volume decreased 1%, due in part to the 2016 leap year • Excluding leap year: • Business volume grew 1%, due to growth of ride-hailing rental demand offset by weakness in corporate contracted volume • Negative impact of mild Winter – lower demand in Insurance Replacement and certain sun/leisure destinations

11 1Q:17 U.S. RAC Vehicle Utilization Vehicle Utilization YoY bps Inc/(Dec) Capacity level is timing related 1Q Q1’16 Q2’16 Q3’16 Q4’16 Q1’17 • Rentable utilization 170 basis points lower 1Q:17 vs 1Q:16, as mild weather impacted demand in certain segments such as Insurance Replacement and certain sun destinations • Expect fleet optimization initiatives to be completed by end of 2Q:17 • Should allow for YoY utilization improvements in back half 2017 Vehicle UTE Rentable UTE 660 (310) (170) 380 540 240 (60) (60) (100) (50) * Rentable Vehicle Utilization is calculated by dividing transaction days by available car days, excluding fleet unavailable for rent e.g.: recalled, out of service, and vehicle in onboarding and remarketing channels

12 1Q:17 U.S. RAC Monthly Depreciation Per Unit 34% 24% 42% 35% 24% 41% Auction Retail Dealer Direct 1Q:17 1Q:16 Non-Program Vehicle Disposition Channel Mix Monthly Depreciation Per Unit YoY % $303 $278 $304 $321 $287 $248 $267 $269 $303 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Current Year Prior Year $348 +19% +6% +12% +14% 1Q +15% Alternative Sales Channels - Core Competency • 65% of mix 1Q:17 • Absolute sales through highest-return retail channel grew 21% in Q1:17 • 1Q:17 used car prices did not experience historical seasonal lift, prices continue to be under pressure in YoY terms • Aggressively sold Risk cars in 1Q:17 to right size capacity, despite industry residual weakness • Sold 21% more risk vehicles YoY • Outlook for FY17 residual decline adjusted to -3.5% from -3%

13 1Q:17 International RAC • 1Q:17 revenue decreased 5%, or 4% YoY when you exclude FX - Transaction days increased 1% despite the impact of leap year, and exiting certain underperforming accounts in the UK in 2H:16 - Total RPD declined 4% due primarily to the impact of the Easter holiday falling in second quarter in 2017 versus the first quarter in 2016 • Total vehicle utilization was 75%, 30 bps higher than the prior-year period • Monthly depreciation per unit decreased 1% YoY • Direct operating and SG&A expenses per transaction day improved 5% YoY • Adjusted corporate EBITDA margin declined 180 bps YoY primarily due to the revenue decline and 80 bps of adverse claims development, partially offset by savings in operating costs 1Q

14 LIQUIDITY / BALANCE SHEET OVERVIEW TOM KENNEDY CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc.

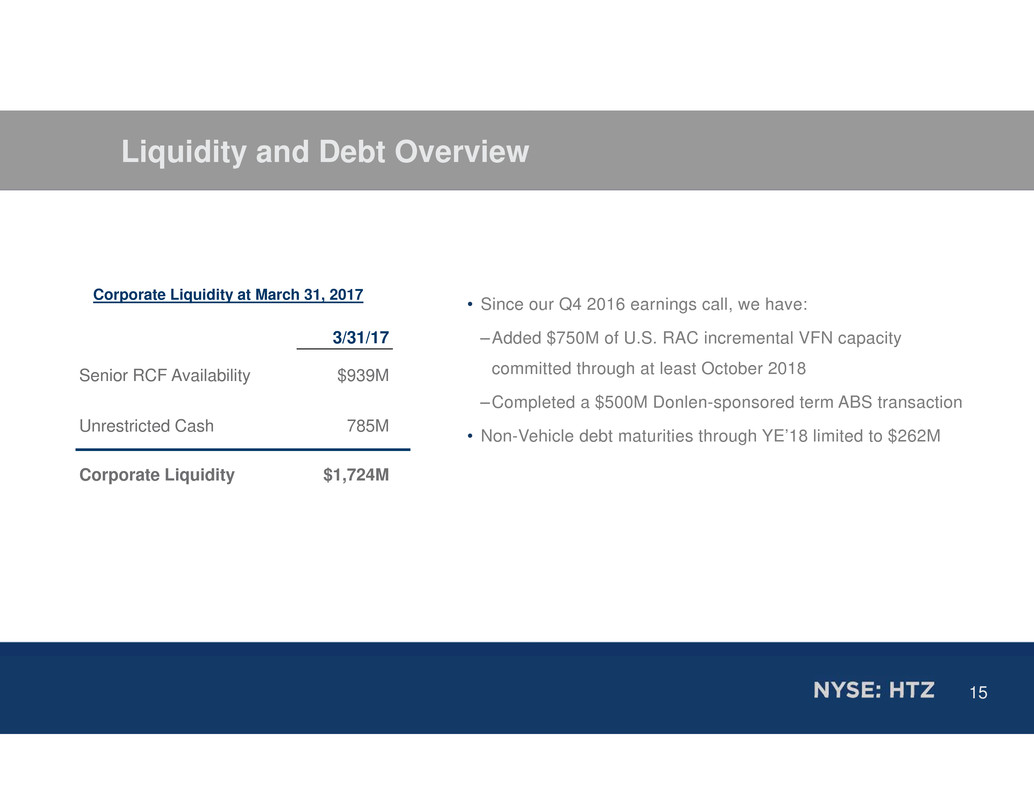

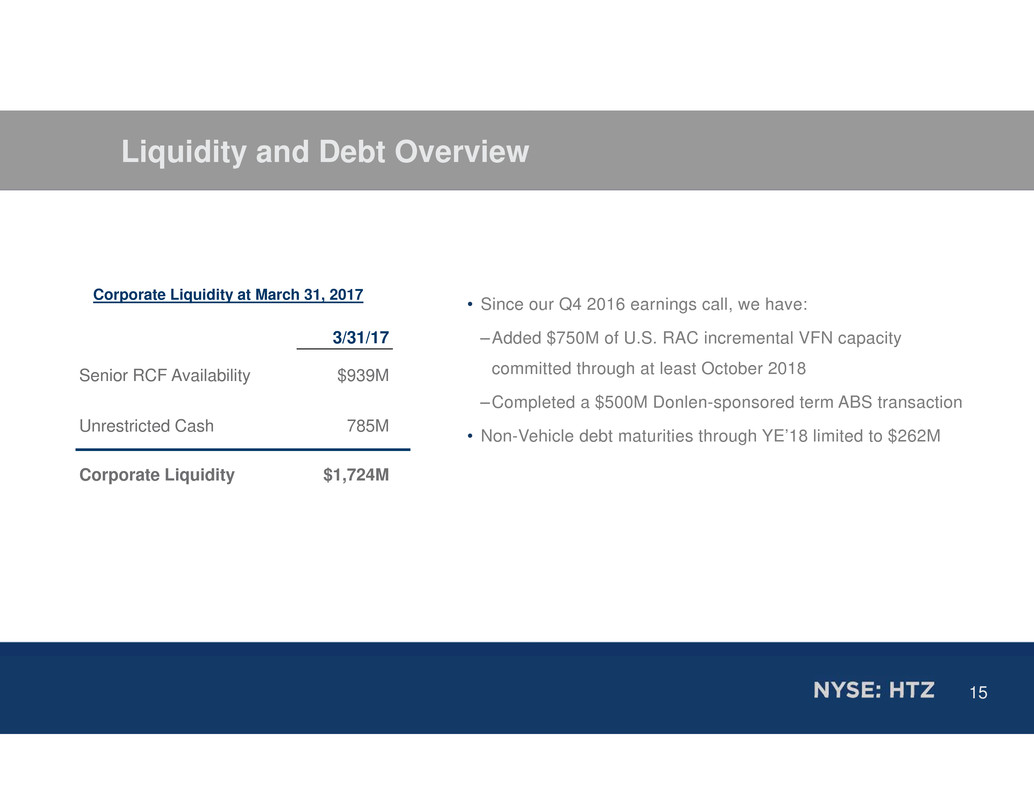

15 3/31/17 Senior RCF Availability $939M Unrestricted Cash 785M Corporate Liquidity $1,724M Liquidity and Debt Overview • Since our Q4 2016 earnings call, we have: –Added $750M of U.S. RAC incremental VFN capacity committed through at least October 2018 –Completed a $500M Donlen-sponsored term ABS transaction • Non-Vehicle debt maturities through YE’18 limited to $262M Corporate Liquidity at March 31, 2017

16 Limited Near-Term Non-Vehicle Debt Maturities 03/31/17 Hertz Global Non-Vehicle Debt Maturity Stack (1) (2) ($ in millions) $250 $450 $700 $500 $500 $800 $5 $7 $7 $7 $7 $7 $655 $1,700 2017 2018 2019 2020 2021 2022 2023 2024 Senior Notes Term Loan Undrawn Senior RCF 1 Excludes $28 million of Promissory Notes due 2028 and $9 million of capital leases. 2 $761 million of letters of credit outstanding under the Senior RCF resulting in approximately $939 million of available borrowing capacity.

17 First Lien Financial Maintenance Covenant Consolidated First Lien Leverage Ratio as of 3/31/17 was 2.4x and was calculated as follows: – Unrestricted cash is capped at $500M; cap falls away post once Consolidated Gross Total Corporate Leverage Ratio is equal to or less than 6.0x for two consecutive quarters post 12/31/17 – Restricts ability to undertake share repurchases or pay dividends until net corporate debt leverage ratio is below 4.0x for two consecutive quarters Our Consolidated First Lien Leverage Ratio is tested each quarter and must not exceed the thresholds outlined below: Senior RCF Facility Size $1,700M Outstanding Letters of Credit - 761 Term Loan Outstanding + 695 Unrestricted Cash - 500 First Lien Secured Net Debt 1,134 TTM Adjusted Corporate EBITDA1 / 470 Consolidated First Lien Leverage Ratio 2.4X 1 TTM Adjusted Corporate EBITDA defined as $416M Reported LTM Adjusted Corporate EBIDTA + $54M Other Adjustments as permitted in calculating covenant compliance under the Senior RCF Credit Agreement YE’16 1Q’17-3Q’17 4Q’17+ 3.0X 3.25X 3.0X

18 Q&A