0001657853us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________________________________________

FORM 10-K

| | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2021 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Commission File Number | | Exact Name of Registrant as Specified in its Charter,

Principal Executive Office Address and Telephone Number | | State of Incorporation | | I.R.S. Employer Identification No. |

| 001-37665 | | HERTZ GLOBAL HOLDINGS, INC | | Delaware | | 61-1770902 |

| | 8501 Williams Road, | Estero, | Florida | 33928 | | | | |

| | (239) | 301-7000 | | | | | | |

| | | | | | | | | | |

| 001-07541 | | THE HERTZ CORPORATION | | Delaware | | 13-1938568 |

| | 8501 Williams Road, | Estero, | Florida | 33928 | | | | |

| | (239) | 301-7000 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| | Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Hertz Global Holdings, Inc. | | Common stock | Par value $0.01 per share | | HTZ | | Nasdaq Global Select* | |

| Hertz Global Holdings, Inc. | | Warrants to purchase common stock | Each exercisable for one share of Hertz Global Holdings, Inc. common stock at an exercise price of $13.80 per share, subject to adjustment | | HTZWW | | Nasdaq Global Select* | |

| The Hertz Corporation | | None | | None | | None | |

| |

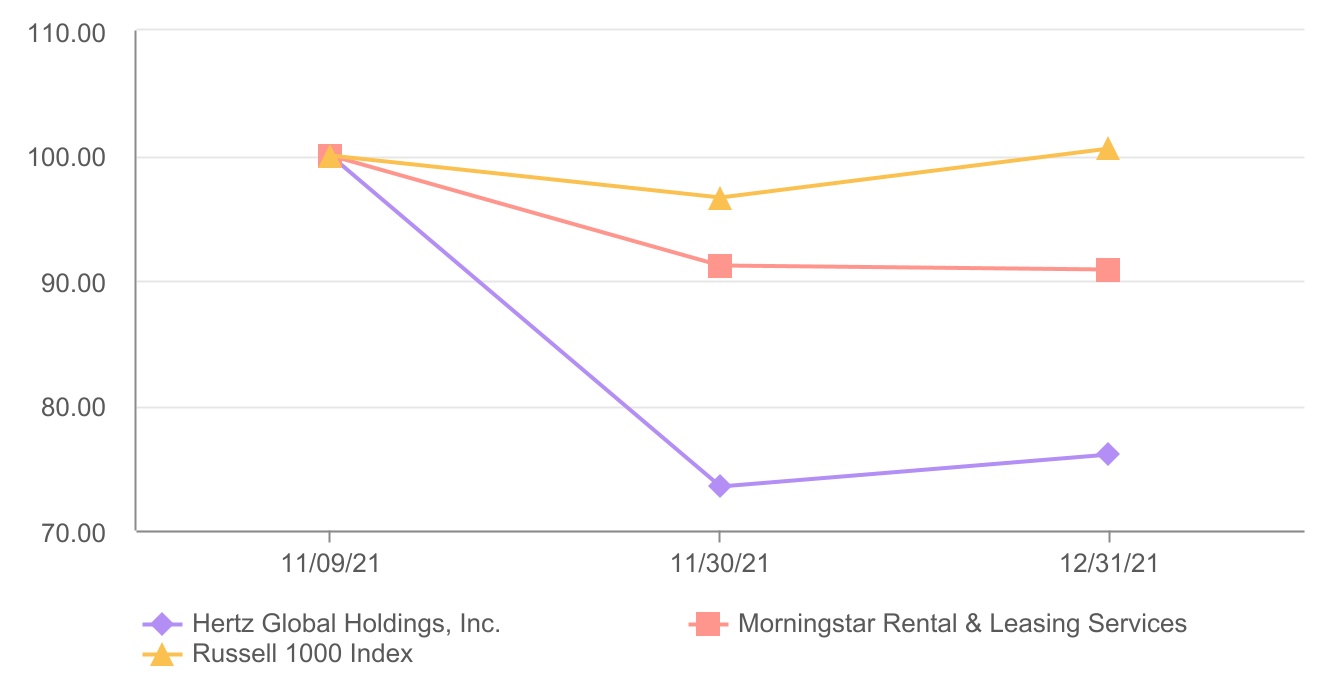

| * Hertz Global Holdings, Inc.'s common stock and Public Warrants began trading exclusively on the Nasdaq Global Select Market on November 9, 2021 under the trading symbols "HTZ" and "HTZWW," respectively. | |

|

| Securities registered pursuant to Section 12(g) of the Act: | |

| Hertz Global Holdings, Inc. | | None | | | | | | |

| The Hertz Corporation | | None | | | | | | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Hertz Global Holdings, Inc. Yes o No x

The Hertz Corporation Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Hertz Global Holdings, Inc. Yes o No x

The Hertz Corporation1 Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Hertz Global Holdings, Inc. Yes x No o

The Hertz Corporation Yes o No x

1(Note: As a voluntary filer, The Hertz Corporation is not subject to the filing requirements of Section 13 or 15(d) of the Exchange Act. The Hertz Corporation has filed all reports pursuant to Section 13 or 15(d) of the Exchange Act during the preceding 12 months as if it was subject to such filing requirements.)

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Hertz Global Holdings, Inc. Yes x No o

The Hertz Corporation Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Hertz Global Holdings, Inc. | Large accelerated filer | x | Accelerated filer | o | Non-accelerated filer

| o |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

| If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o | | |

| The Hertz Corporation | Large accelerated filer | o | Accelerated filer | o | Non-accelerated filer | x |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

| If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o | | |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262(b)) by the registered public accounting firm that prepared or issued its audits report.

Hertz Global Holdings, Inc. x

The Hertz Corporation x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Hertz Global Holdings, Inc. Yes ☐ No x

The Hertz Corporation Yes ☐ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of Hertz Global Holdings, Inc. as of June 30, 2021, was $2.7 billion based on the price at which the stock was sold on such date pursuant to Hertz Global Holdings, Inc.'s emergence from bankruptcy proceedings. There is no market for The Hertz Corporation stock.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes x No ☐

Indicate the number of shares outstanding of each of the registrants' classes of common stock, as of the latest practicable date.

| | | | | | | | | | | | | | | | | | | | |

| | | Class | | Shares Outstanding as of | February 17, 2022 |

| Hertz Global Holdings, Inc. | | Common Stock, par value $0.01 per share | | 429,294,302 |

| The Hertz Corporation | (1) | | Common Stock, par value $0.01 per share | | 100 |

| | | | | (1)(100% owned by Rental Car Intermediate Holdings, LLC) |

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| Hertz Global Holdings, Inc. | | Information required by Items 10, 11, 12 and 13 of Part III of this Form 10-K is incorporated by reference to Hertz Global Holdings, Inc.'s definitive proxy statement for its 2022 Annual Meeting of Stockholders. Hertz Global Holdings, Inc. intends to file such proxy statement with the Securities and Exchange Commission no later than 120 days after its fiscal year ended December 31, 2021. |

| The Hertz Corporation | | None |

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

GLOSSARY OF TERMS

Unless the context otherwise requires in this Annual Report on Form 10-K for the year ended December 31, 2021, we use the following defined terms:

(i)"2021 Annual Report" or "Combined Form 10-K" means this Annual Report on Form 10-K for the year ended December 31, 2021, which combines the annual reports for Hertz Global Holdings, Inc. and The Hertz Corporation into a single filing;

(ii)"2021 Rights Offering" means the Company's rights offering providing for the issuance of common stock in reorganized Hertz Global by Hertz Global's former equity holders, holders of the Company Senior Notes and lenders under the Alternative Letter of Credit Facility and certain equity commitment parties pursuant to their obligations under the Equity Purchase and Commitment Agreement (the "EPCA") as further described in Note 16, "Equity and Mezzanine Equity – Hertz Global," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data" included in this 2021 Annual Report;

(iii)"All other operations" means our former All Other Operations reportable segment which was no longer deemed a reportable segment in the second quarter of 2021 resulting from the sale of our Donlen subsidiary on March 30, 2021;

(iv)"Alternative Letter of Credit Facility" means the standalone $250 million letter of credit facility that Hertz entered into in 2019 as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(v)"Americas RAC" means our rental car reportable segment established in the second quarter of 2021 consisting of the countries and regions of the U.S., Canada, Latin America and Caribbean;

(vi)"Apollo" means Apollo Capital Management L.P. and its affiliates;

(vii)"Bankruptcy Code" means Title 11 of the United States Code, 11 U.S.C. §§ 101-1532;

(viii)"Bankruptcy Court" means the U.S. Bankruptcy Court for the District of Delaware;

(ix)"Board" means the Company's board of directors;

(x)"Certares" means Certares Opportunities LLC and its affiliates;

(xi)"Chapter 11" means chapter 11 of the Bankruptcy Code;

(xii)"Chapter 11 Cases" means the Chapter 11 cases jointly administered in the Bankruptcy Court under the caption In re The Hertz Corporation, et al., Case No. 20-11218 (MFW);

(xiii)"the Code" means the Internal Revenue Code of 1986, as amended;

(xiv)"the Company", "we", "our" and "us" mean Hertz Global and Hertz interchangeably;

(xv)"company-operated" or "company-owned" rental locations are those through which we, or an agent of ours, rent vehicles that we own or lease;

(xvi)"concessions" mean licensing or permitting agreements or arrangements granting us the right to conduct our vehicle rental business at airports;

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

(xvii)"Corporate" means corporate operations, which include general corporate assets and expenses and certain interest expense (including net interest on non-vehicle debt);

(xviii)"COVID-19" means the global pandemic resulting from the coronavirus disease 2019;

(xix)"the Debtors" means Hertz Global, Hertz and their direct and indirect subsidiaries in the U.S. and Canada that filed voluntary petitions for relief under Chapter 11 in the Bankruptcy Court on May 22, 2020;

(xx)"DIP" means debtor-in-possession;

(xxi)"DIP Credit Agreement" means the $1.65 billion superpriority secured DIP credit facility comprised of delayed-draw term loans as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xxii)"Dollar Thrifty" means Dollar Thrifty Automotive Group, Inc., a consolidated subsidiary of the Company;

(xxiii)"Effective Date" means June 30, 2021 the date in which the Plan of Reorganization became effective and the Company emerged from Chapter 11;

(xxiv)"European Vehicle Notes" means the unsecured senior notes entered into by Hertz Holdings Netherlands B.V. as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xxv)"FASB" means the Financial Accounting Standards Board;

(xxvi)"First Lien Credit Agreement" means the credit agreement reorganized Hertz entered into on the Effective Date as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xxvii)"First Lien RCF" means the senior secured revolving credit facility in an aggregate committed amount of $1.3 billion as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xxviii)"Hertz Gold Plus Rewards" means our customer loyalty program and our global expedited rental program;

(xxix)"Hertz" means The Hertz Corporation, its consolidated subsidiaries and VIEs, our primary operating company and a direct wholly-owned subsidiary of Rental Car Intermediate Holdings, LLC, which is wholly owned by Hertz Holdings;

(xxx)"Hertz Global" means Hertz Global Holdings, Inc., our top-level holding company, its consolidated subsidiaries and VIEs, including The Hertz Corporation;

(xxxi)"Hertz Ultimate Choice" is an offering at select airport locations in the U.S. that allows customers to choose their vehicle from a range of makes, models and colors available within the zone indicated on their reservation;

(xxxii)"Hertz Holdings" refers to Hertz Global Holdings, Inc. excluding its subsidiaries and VIEs;

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

(xxxiii)"HVF" refers to Hertz Vehicle Financing LLC, a non-Debtor, special purpose subsidiary of Hertz;

(xxxiv)"HVF II" refers to Hertz Vehicle Financing II LP, a non-Debtor, special purpose financing subsidiary of Hertz;

(xxxv)"HVIF" refers to Hertz Vehicle Interim Financing LLC, a non-Debtor, special purpose subsidiary of Hertz authorized by the Bankruptcy Court;

(xxxvi)"International RAC" means our international rental car reportable segment, which, effective in the second quarter of 2021, no longer includes Canada, Latin America and the Caribbean;

(xxxvii)"Knighthead" means Knighthead Capital Management, LLC and its affiliates;

(xxxviii)"Lease Rejection Orders" means the Bankruptcy Court orders entered in the Chapter 11 Cases to reject certain unexpired leases in our Americas RAC segment;

(xxxix)"Letter of Credit Facility" means the standalone $400 million letter of credit facility that Hertz entered into in 2017 as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xl)“non-program vehicles” means vehicles not purchased under repurchase or guaranteed depreciation programs for which we are exposed to residual risk;

(xli)"Old Hertz Holdings" for periods on or prior to June 30, 2016, and "Herc Holdings" for periods after June 30, 2016, refer to the former Hertz Global Holdings, Inc.;

(xlii)"Petition Date" means May 22, 2020;

(xliii)"Plan of Reorganization" means the solicitation version of the First Modified Third Amended Joint Chapter 11 Plan of Reorganization of the Debtors (as amended, supplemented or otherwise modified in accordance with its terms);

(xliv)"Plan Sponsors" means collectively Apollo, Knighthead and Certares;

(xlv)"Pre-petition" means obligations of the Debtors incurred prior to the Petition Date;

(xlvi)"Prime Clerk" means Prime Clerk, LLC, a third-party bankruptcy claims and noticing agent;

(xlvii)"program vehicles" means vehicles purchased under repurchase or guaranteed depreciation programs with vehicle manufacturers;

(xlviii)"Public Warrants" means 30-year public warrants as further described in Note 18, "Public Warrants - Hertz Global," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(xlix)"replacement renters" means renters who need vehicles while their vehicle is being repaired or is temporarily unavailable for other reasons;

(l)"SEC" means the United States Securities and Exchange Commission;

(li)"Senior Facilities" means our senior secured term facility (the "Senior Term Loan"), Senior RCF and Letter of Credit Facility, as further described in Note 6, "Debt," to the Notes to our consolidated financial

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(lii)"Senior Notes" means our unsecured senior notes as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(liii)"Senior RCF" means our senior secured revolving credit facility, as further described in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(liv)"Senior Second Priority Secured Notes" means the 7.625% Senior Second Priority Secured Notes due 2022, as further disclosed in Note 6, "Debt," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report;

(lv)“Spin-Off” means the separation of Old Hertz Holdings’ car rental business from the equipment rental business through a reverse spin-off, which was completed in June 30, 2016;

(lvi)"Tax Reform" means legislation signed into law on December 22, 2017 which amends the U.S. Internal Revenue Code to reduce tax rates and modify policies, credits and deductions for individuals and businesses, commonly known as the "Tax Cuts and Jobs Act" ("TCJA");

(lvii)"TNC" means transportation network companies that provide ride-hailing services that pair passengers with drivers via websites and mobile applications;

(lviii)"TNC Partners" means certain transportation network companies where we provide rental vehicles to their drivers under agreements that specify the relevant terms;

(lix)"U.S." means the United States of America;

(lx)"U.S. GAAP" means accounting principles generally accepted in the U.S.;

(lxi)"U.S. RAC" means our former U.S. rental car reportable segment, which is now part of our Americas RAC reportable segment;

(lxii)"VIE" means variable interest entity;

(lxiii)"Vehicle Utilization" means the portion of our vehicles that are being utilized to generate revenue; and

(lxiv)"vehicles” means cars, vans, crossovers and light trucks.

We have proprietary rights to a number of trademarks used in this 2021 Annual Report that are important to our business, including, without limitation, Hertz, Dollar, Thrifty, Hertz Gold Plus Rewards, Hertz Ultimate Choice, Hertz 24/7 and Hertz My Car. Solely for convenience, we have omitted the ® and ™ trademark designations for trademarks named in this 2021 Annual Report, but references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

EXPLANATORY NOTE

COMBINED FORM 10-K

This 2021 Annual Report combines the annual reports on Form 10-K for the year ended December 31, 2021 of Hertz Global and Hertz.

Hertz Global owns all shares of the common stock of Hertz through its wholly-owned subsidiary, Rental Car Intermediate Holdings, LLC.

Management operates Hertz Global and Hertz as one enterprise. The management of Hertz Global consists of the same members as the management of Hertz. These individuals are officers of Hertz Global and Hertz and employees of Hertz. The members of Hertz's board of directors are all executive officers of Hertz Global.

Between May 22, 2020, the Petition Date, and June 30, 2021, the Effective Date, the Debtors operated as debtors-in-possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. In general, as debtors-in-possession under the Bankruptcy Code, the Debtors were authorized to continue to operate as an ongoing business but could not engage in transactions outside the ordinary course of business without the prior approval of the Bankruptcy Court.

We believe combining the annual reports on Form 10-K of Hertz Global and Hertz into this single report results in the following benefits:

•enhancing investors' understanding of Hertz Global and Hertz by enabling investors to view the business as a whole in the same manner as management views and operates the business;

•eliminating duplicative disclosure and providing a more streamlined and readable presentation since a substantial portion of the disclosures apply to both Hertz Global and Hertz; and

•creating time and cost efficiencies through the preparation of one combined annual report instead of two separate annual reports.

Hertz generally through its subsidiaries holds all of the revenue earning vehicles, property, plant and equipment and all other assets, including the ownership interests in consolidated and unconsolidated joint ventures and VIEs. Hertz conducts the operations of the business and is structured as a corporation with no publicly traded equity. Except for net proceeds from public equity issuances by Hertz Global and cash exercises of Hertz Global Public Warrants, which may be contributed to Hertz, Hertz generates required capital through its operations or through its incurrence of indebtedness.

Hertz Global does not conduct business itself, other than issuing public equity or debt obligations or receiving proceeds from cash exercises of public warrants from time to time, and incurring expenses required to operate as a public company. Hertz Global and Hertz have entered into a master loan agreement whereby Hertz Global may borrow from Hertz up to $25 million. Transactions recorded under the master loan agreement are eliminated upon consolidation at the Hertz Global level but not upon consolidation at the Hertz level. Differences between the financial statements of Hertz Global and Hertz are generally limited to the activity described above and the remaining assets, liabilities, revenues and expenses of Hertz Global and Hertz are the same on their respective financial statements.

Although Hertz is generally the entity that enters into contracts and holds assets and debt, Hertz Global consolidates Hertz for financial statement purposes, and therefore, disclosures that relate to activities of Hertz also generally apply to Hertz Global. In the sections that combine disclosures of Hertz Global and Hertz, this report refers to actions as being actions of the Company, or Hertz Global, which is appropriate because the business is one enterprise and Hertz Global operates the business through Hertz. When appropriate, Hertz Global and Hertz are named specifically for their individual disclosures and any significant differences between the operations and results of Hertz Global and Hertz are separately disclosed and explained.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

EXPLANATORY NOTE (Continued)

This report also includes separate Exhibit 31 and 32 certifications for each of Hertz Global and Hertz in order to establish that the Chief Executive Officer and the Chief Financial Officer of each entity have made the requisite certifications and that Hertz Global and Hertz are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 (the "Exchange Act") and 18 U.S.C. §1350.

This Combined Form 10-K is separately filed by Hertz Global Holdings, Inc. and The Hertz Corporation. Each registrant hereto is filing on its own behalf all of the information contained in this 2021 Annual Report that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND SUMMARY OF RISK FACTORS

Certain statements contained or incorporated by reference in this 2021 Annual Report include "forward-looking statements." Forward-looking statements are identified by words such as "believe," "expect," "project," "potential," "anticipate," "intend," "plan," "estimate," "seek," "will," "may," "would," "should," "could," "forecasts," "guidance" or similar expressions, and include information concerning our liquidity, our results of operations, our business strategies and other information about our business. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate. We believe these judgments are reasonable, but you should understand that these statements are not guarantees of future performance or results and our actual results could differ materially from those expressed in the forward-looking statements due to a variety of important factors, both positive and negative.

Important factors that could affect our actual results and cause them to differ materially from those expressed in forward-looking statements include, among other things, those that may be disclosed from time to time in subsequent reports filed with or furnished to the SEC, those described under "Risk Factors" set forth in Item 1A of this 2021 Annual Report, and the following, which also summarizes the principal risks of our business:

•the length and severity of COVID-19 and the impact on our vehicle rental business as a result of travel restrictions and business closures or disruptions, as well as the impact on our employee retention and talent management strategies;

•our ability to purchase adequate supplies of competitively priced vehicles at a reasonable cost as a result of the continuing global semiconductor microchip manufacturing shortage (the "Chip Shortage") and other raw material supply constraints;

•the impact on the value of our non-program vehicles upon disposition when the Chip Shortage and other raw material supply constraints are alleviated;

•our ability to attract and retain key employees;

•levels of travel demand, particularly business and leisure travel in the U.S. and in global markets;

•significant changes in the competitive environment and the effect of competition in our markets on rental volume and pricing;

•occurrences that disrupt rental activity during our peak periods;

•our ability to accurately estimate future levels of rental activity and adjust the number and mix of vehicles used in our rental operations accordingly;

•our ability to implement our business strategy, including our ability to implement plans to support a large scale electric vehicle fleet and to play a central role in the modern mobility ecosystem;

•our ability to adequately respond to changes in technology, customer demands and market competition;

•the mix of program and non-program vehicles in our fleet can lead to increased exposure to residual risk;

•our ability to dispose of vehicles in the used-vehicle market and use the proceeds of such sales to acquire new vehicles;

•financial instability of the manufacturers of our vehicles, which could impact their ability to fulfill obligations under repurchase or guaranteed depreciation programs;

•an increase in our vehicle costs or disruption to our rental activity due to safety recalls by the manufacturers of our vehicles;

•our access to third-party distribution channels and related prices, commission structures and transaction volumes;

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS AND SUMMARY OF RISK FACTORS (Continued)

•our ability to offer an excellent customer experience, retain and increase customer loyalty and market share;

•our ability to maintain our network of leases and vehicle rental concessions at airports in the U.S. and internationally;

•our ability to maintain favorable brand recognition and a coordinated branding and portfolio strategy;

•a major disruption in our communication or centralized information networks or a failure to maintain, upgrade and consolidate our information technology systems;

•our ability to prevent the misuse or theft of information we possess, including as a result of cyber security breaches and other security threats, as well as our ability to comply with privacy regulations;

•risks associated with operating in many different countries, including the risk of a violation or alleged violation of applicable anti-corruption or anti-bribery laws and our ability to repatriate cash from non-U.S. affiliates without adverse tax consequences;

•our ability to utilize our net operating loss carryforwards;

•risks relating to tax laws, including those that affect our ability to deduct certain business interest expenses and offset previously-deferred tax gains, as well as any adverse determinations or rulings by tax authorities;

•changes in laws, regulations, policies or other activities of governments, agencies and similar organizations, including those related to accounting principles, that affect our operations, our costs or applicable tax rates;

•the recoverability of our goodwill and indefinite-lived intangible assets when performing impairment analysis;

•costs and risks associated with potential litigation and investigations, compliance with and changes in laws and regulations and potential exposures under environmental laws and regulations; and

•the availability of additional or continued sources of financing for our revenue earning vehicles and to refinance our existing indebtedness.

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date of this 2021 Annual Report and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

PART I

ITEM 1. BUSINESS

OUR COMPANY

Hertz Holdings was incorporated in Delaware in 2015 to serve as the top-level holding company for Rental Car Intermediate Holdings, LLC, which wholly owns Hertz, Hertz Global's primary operating company. Hertz was incorporated in Delaware in 1967 and is a successor to corporations that have been engaged in the vehicle rental and leasing business since 1918.

We are engaged principally in the business of renting vehicles primarily through our Hertz, Dollar and Thrifty brands, and we operate our vehicle rental business globally from approximately 11,400 corporate and franchisee locations in North America, Europe, Latin America, Africa, Asia, Australia, the Caribbean, the Middle East and New Zealand. We remain one of the largest worldwide vehicle rental companies and our Hertz brand name is one of the most recognized globally. We have an extensive network of airport and off airport rental locations in the U.S. and in all major European markets. In addition to vehicle rental, we provided integrated vehicle leasing and fleet management solutions through our Donlen subsidiary, which sold substantially all of its assets and certain liabilities on March 30, 2021 (the "Donlen Sale"), as disclosed in Note 3, "Divestitures," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report.

COVID-19 Pandemic

In March 2020, the World Health Organization declared COVID-19 a pandemic, affecting multiple global regions. The impact of this pandemic has been extensive in many aspects of society, which has resulted in significant disruptions to the global economy, as well as businesses around the world. In an effort to halt the spread of COVID-19, many governments around the world placed significant restrictions on travel, individuals voluntarily reduced their air and other travel in attempts to avoid the outbreak, and many businesses announced closures and imposed travel restrictions. In 2021, individuals across the globe have increasingly gained access to COVID-19 vaccinations, particularly in the U.S. As a result, many of the government-imposed restrictions have been lifted or eased, and travel, particularly domestic leisure travel, has experienced a strong rebound. There remains continued uncertainty about the duration of the negative impact from COVID-19 and its variants, including the length and scope of travel restrictions and business closures that may be imposed by governments of impacted countries or voluntarily undertaken by individuals and private businesses.

Emergence from Bankruptcy

On May 22, 2020, the Debtors filed petitions under Chapter 11 of the Bankruptcy Code in the Bankruptcy Court. The Chapter 11 Cases were jointly administered by the Bankruptcy Court under the caption In re The Hertz Corporation, et al., Case No. 20-11218 (MFW).

On May 14, 2021, the Debtors filed the Plan of Reorganization, and the solicitation version of the Supplement to the Disclosure Statement which was approved by the Bankruptcy Court on May 14, 2021. On June 10, 2021, the Plan of Reorganization was confirmed by the Bankruptcy Court. On June 30, 2021, the Plan of Reorganization became effective in accordance with its terms and the Debtors emerged from Chapter 11 (the "Chapter 11 Emergence"). For additional information about our restructured debt and new equity in connection with the Plan of Reorganization, see Note 6, "Debt," and Note 16, "Equity and Mezzanine Equity – Hertz Global," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report. Additional information about the Chapter 11 Cases, including access to documents filed with the Bankruptcy Court, is available online at https://restructuring.primeclerk.com/hertz, a website administered by Prime Clerk. The information on this website is not incorporated by reference and does not constitute part of this 2021 Annual Report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Our Strategy

Our strategy is focused on excellence in execution of our rental operations, electrification of the fleet, shared mobility, connected cars and exiting vehicles from the fleet directly to consumers. Our core assets and capabilities underpin this strategy and our partnerships with Tesla, Uber and Carvana are positioning us at the center of the modern mobility ecosystem. We will continue building on our brand strength and global fleet management expertise, combining it with new investments in technology, electrification, shared mobility and a digital-first customer experience. Our key fleet management capabilities will allow us to diversify and profitably grow in new areas of the mobility sector.

OUR BUSINESS SEGMENTS

In the second quarter of 2021, in connection with our Chapter 11 Emergence and changes in how our chief operating decision maker ("CODM") regularly reviews operating results and allocates resources, we revised our reportable segments to include Canada, Latin America and the Caribbean in our Americas RAC reportable segment, which historically was our U.S. RAC reportable segment; these regions had previously been included in our International RAC reportable segment. Accordingly, all periods have been restated to conform with the revised presentation. The Company has identified two reportable segments, which are consistent with its operating segments, as follows:

•Americas RAC - Rental of vehicles as well as sales of value-added services, in the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations in this segment and we also have franchisees and partners that operate rental locations under our brands; and

•International RAC - Rental and leasing of vehicles as well as sales of value-added services in locations other than the U.S., Canada, Latin America and the Caribbean. We maintain a substantial network of company-operated rental locations, a majority of which are in Europe. Our franchisees and partners also operate rental locations in approximately 110 countries and jurisdictions, including many of the countries in which we also have company-operated rental locations.

Also, in the second quarter of 2021, as a result of the Donlen Sale, as further disclosed in Note 3, "Divestitures," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report, the All Other Operations reportable segment which was primarily comprised of the Donlen business was no longer deemed to be a reportable segment.

In addition to the above reportable segments, we have corporate operations. We assess performance and allocate resources based upon the financial information for our operating segments.

For further financial information on our segments, see (i) Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Selected Operating Data by Segment" and (ii) Note 19, "Segment Information," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Americas RAC and International RAC Segments

Brands

Our Americas RAC and International RAC vehicle rental businesses are primarily operated through three brands — Hertz, Dollar, and Thrifty. We offer multiple brands in order to provide customers a full range of rental services at different price points, levels of service, offerings and products. Each of our brands generally maintains separate airport counters, reservations, marketing and other customer contact activities. We achieve synergies across our brands by, among other things, utilizing a single fleet and fleet management team and combined vehicle maintenance, vehicle cleaning and back office functions, where applicable.

Our top tier brand, Hertz, is one of the most recognized brands in the world offering premium services that define the industry. This is consistent with numerous published best-in-class vehicle rental awards that we historically have won both in the U.S. and internationally. We go to market under the tagline of “Hertz. Let's Go!” which represents our commitment to quality, seamless travel and customer service. We have a number of innovative offerings, such as Hertz Gold Plus Rewards, Hertz Ultimate Choice and unique vehicles offered through our EV fleet and specialty collections. We continue to maintain our position as a premier provider of vehicle rental services through an intense focus on service, loyalty, quality and product innovation.

Our smart value brand, Dollar, is the choice for financially-focused travelers looking for a dependable car at a price they can afford. The Dollar brand’s main focus is serving the airport vehicle rental market, comprised of family, leisure and small business travelers. Dollar’s tagline of “We never forget whose dollar it is” indicates the brand’s mission to provide a reliable rental experience at a price that works. Dollar operates primarily through company-owned locations in the U.S. and Canada.

Our deep value brand, Thrifty, is the brand for cost-conscious travelers to find a good deal. The Thrifty brand’s main focus is serving the airport vehicle rental market, comprised of leisure travelers. Thrifty’s tagline “The Absolute Best Car for Your Money” indicates the brand’s focus on being the rental company that puts you in control of where you splurge and where you save. Thrifty operates primarily through company-owned locations in the U.S. and Canada.

In certain locations outside the U.S., we also offer our Firefly brand which is a deep value brand for price conscious leisure travelers. We have Firefly locations servicing local area airports in select non-U.S. leisure markets where other deep value brands have a significant presence.

Operations

Locations

We operate our brands at both airport and off airport locations which utilize common vehicle fleets, are supervised by common country, regional and local area management, use many common systems and rely on common vehicle maintenance and administrative centers. Additionally, our airport and off airport locations utilize common marketing activities and have many of the same customers. We regard both types of locations as aspects of a single, unitary, vehicle rental business. Off airport revenues comprised approximately 32% of our worldwide vehicle rental revenues in 2021 and approximately 46% in 2020. Our Americas RAC vehicle rental operations have company-operated locations primarily in the U.S. and Canada. Our International RAC vehicle rental operations have company-operated locations in Australia, Belgium, the Czech Republic, France, Germany, Italy, Luxembourg, the Netherlands, New Zealand, Slovakia, Spain and the United Kingdom.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

Airport

We have approximately 1,900 airport rental locations in our Americas RAC segment and approximately 1,400 airport rental locations in our International RAC segment. We believe that our extensive global network of locations contributes to the consistency of our service, cost control, Vehicle Utilization, competitive pricing and our ability to offer one-way rentals.

For our airport company-operated rental locations, we have obtained concessions or similar leasing agreements or arrangements, granting us the right to conduct a vehicle rental business at the respective airport. Our concessions were obtained from the airports' operators, which are typically governmental bodies or authorities, following either negotiation or bidding for the right to operate a vehicle rental business. The terms of an airport concession typically require us to pay the airport's operator concession fees based upon a specified percentage of the revenues we generate at the airport, subject to a minimum annual guarantee. Under most concessions, we must also pay fixed rent for terminal counters or other leased properties and facilities. Most concessions are for a fixed length of time, while others create operating rights and payment obligations that are terminable at any time. As a result of the impact from COVID-19 we received rent concessions in the form of abatement and payment deferrals of fixed and variable rent payments for certain of our airport locations. See Note 9, "Leases," to the Notes to our consolidated financial statements under the caption Item 8, "Financial Statements and Supplementary Data” included in this 2021 Annual Report for further details.

The terms of our concessions typically do not forbid us from seeking, and in a few instances actually require us to seek, reimbursement from customers for concession fees we pay; however, in certain jurisdictions the law limits or forbids our doing so. Where we are required or permitted to seek such reimbursement, it is our general practice to do so. Certain of our concession agreements may require the consent of the airport's operator in connection with material changes in our ownership. A growing number of larger airports are building consolidated airport vehicle rental facilities to alleviate congestion at the airport. These consolidated rental facilities provide a more common customer experience and may eliminate certain competitive advantages among the brands as competitors operate out of one centralized facility for both customer rental and return operations, share consolidated busing operations and maintain image standards mandated by the airports.

Off Airport

We have approximately 3,500 off airport locations in our Americas RAC segment and approximately 4,600 off airport rental locations in our International RAC segment. Our off airport rental customers include people who prefer to rent vehicles closer to their home or place of work for business or leisure purposes, as well as those needing to travel to or from airports. Our off airport customers also include people who have been referred by, or whose rental costs are being wholly or partially reimbursed by, insurance companies following accidents in which their vehicles were damaged, those expecting to lease vehicles that are not yet available from their leasing companies and replacement renters. In addition, our off airport customers include drivers for our TNC Partners, which is further described in “TNC Rentals” below.

When compared to our airport rental locations, an off airport rental location typically uses smaller rental facilities with fewer employees, conducts pick-up and delivery services and serves replacement renters using specialized systems and processes. On average, off airport locations generate fewer transactions per period than airport locations.

Our off airport locations offer us the following benefits:

•Provide customers a more convenient and geographically extensive network of rental locations, thereby creating revenue opportunities from replacement renters, non-airline travel renters and airline travelers with local rental needs;

•Provide a more balanced revenue mix by reducing our reliance on air travel and therefore reducing our exposure to external events that may disrupt airline travel trends;

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

•Contribute to higher Vehicle Utilization as a result of the longer average rental periods associated with off airport business, compared to those of airport rentals;

•Insurance replacement rental volume is less seasonal than that of other business and leisure rentals, which permits efficiencies in both vehicle and labor planning; and

•Cross-selling opportunities exist for us to promote off airport rentals among frequent airport Hertz Gold Plus Rewards program renters and, conversely, to promote airport rentals to off airport renters.

Customers and Business Mix

We conduct various sales and marketing programs to attract and retain customers. Our sales force calls on companies and other organizations whose employees and associates need to rent vehicles for business purposes or for replacement rental needs, including insurance and leasing companies, automobile repair companies and vehicle dealers. In addition, our sales force works with membership associations, tour operators, travel companies, TNC and other groups whose members, participants and customers rent vehicles for either business or leisure purposes. We advertise our vehicle rental offerings through a variety of traditional media channels, partner publications (e.g., affinity clubs and airline and hotel partners), direct mail and digital marketing. In addition to advertising, we conduct other forms of marketing and promotion, including travel industry business partnerships and press and public relations activities. As a result of cost-reduction initiatives, we have reduced the extent of our marketing and advertising activities over the last two years. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations and Selected Operating Data by Segment" for further details.

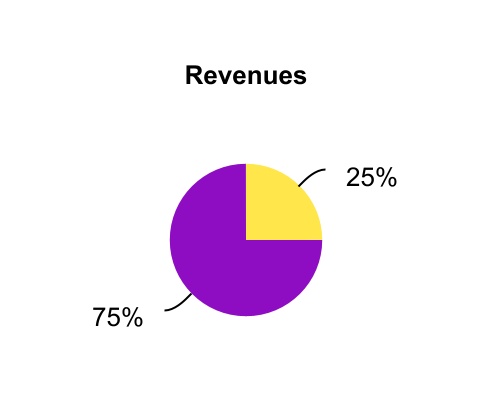

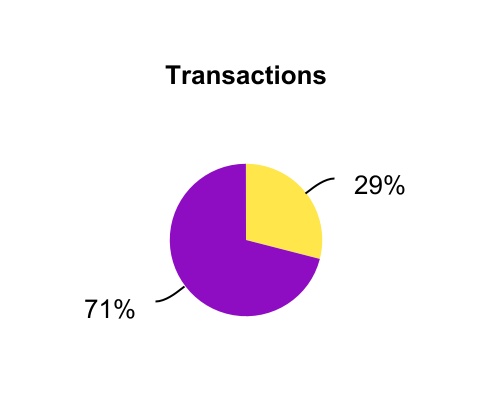

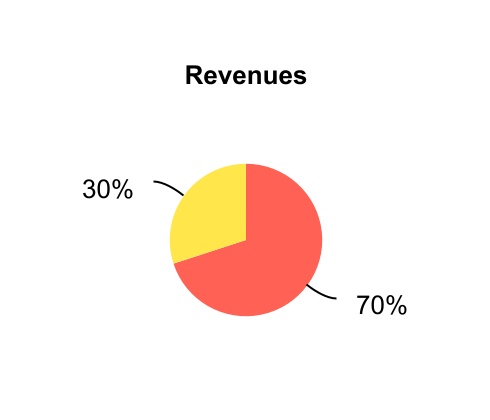

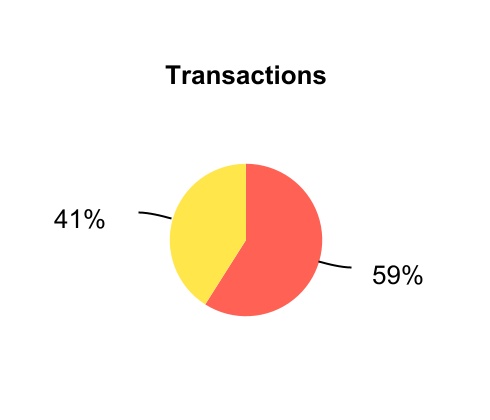

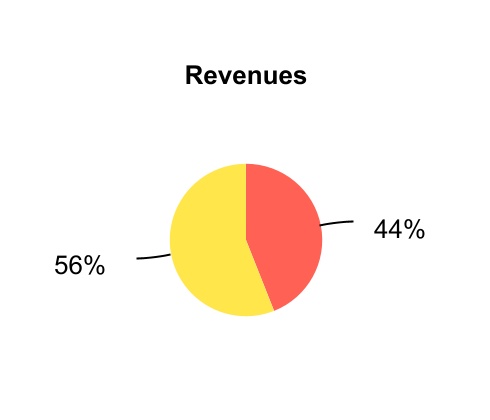

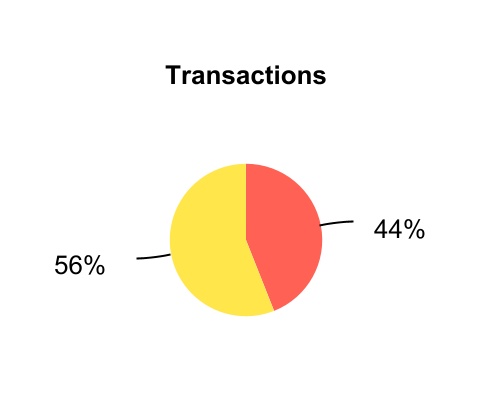

We categorize our vehicle rental business based on the purpose and type of location from which customers rent from us. The following charts set forth the percentages of rental revenues and rental transactions in our Americas RAC and International RAC segments based on these categories.

VEHICLE RENTALS BY CUSTOMER

Year Ended December 31, 2021

Americas RAC

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

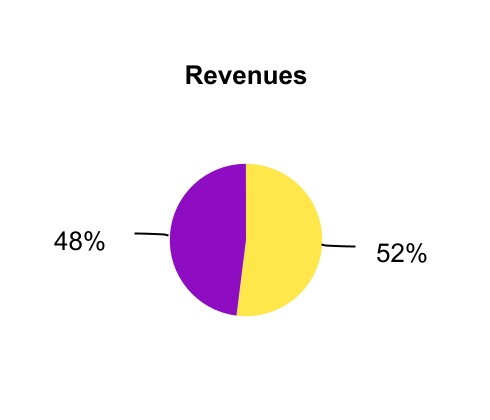

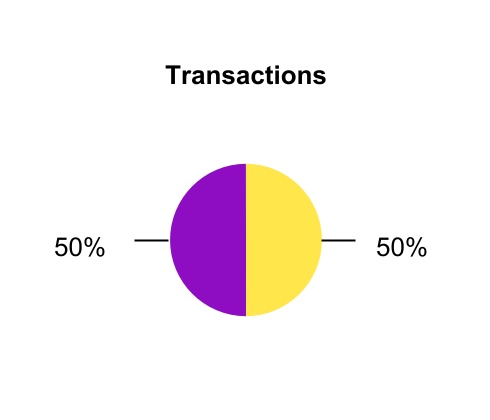

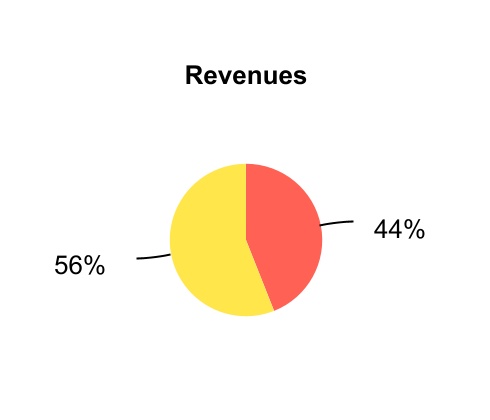

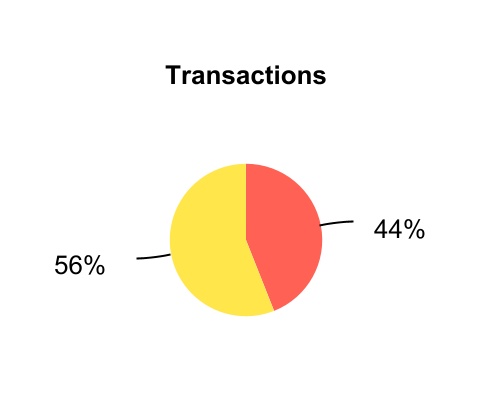

International RAC

Customers who rent from us for “business” purposes include those who require vehicles in connection with commercial activities, including drivers for our TNC Partners and delivery service providers, the activities of governments and other organizations or for temporary vehicle replacement purposes. Most business customers rent vehicles from us on terms that we have negotiated with their employers or other entities with which they are associated, and those terms can differ from the terms on which we rent vehicles to the general public. We have negotiated arrangements relating to vehicle rental with many businesses, governments and other organizations.

Customers who rent from us for “leisure” purposes include individual travelers booking vacation travel rentals with us and people renting to meet other personal needs. Leisure rentals are generally longer in duration and generate more revenue per transaction than business rentals. Leisure rentals also include rentals by customers of U.S. and international tour operators, which are usually a part of tour packages that can include air travel and hotel accommodations.

VEHICLE RENTALS BY LOCATION

Year Ended December 31, 2021

Americas RAC

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

International RAC

Demand for airport rentals is generally correlated with airline travel patterns, and transaction volumes generally follow global airline passenger traffic ("enplanement") and Gross Domestic Product ("GDP") trends. Customers often make reservations for airport rentals when they book their flight plans, which make our relationships with travel agents, associations and other partners (e.g., airlines and hotels) a key competitive strategy in generating consistent and recurring revenue streams. As discussed above, individuals across the globe have increasingly gained access to COVID-19 vaccinations resulting in many government-imposed travel restrictions being lifted or eased, and travel, particularly domestic leisure travel, has experienced a strong rebound. However, there remains continued uncertainty about the duration of the negative impact from COVID-19 and its variants, including the length and scope of travel restrictions and business closures that may be imposed by governments of impacted countries or voluntarily undertaken by individuals and private businesses.

Off airport rentals include insurance replacements, and we have agreements with the referring insurers establishing the relevant rental terms, including the arrangements made for billing and payment. We have identified approximately 200 insurance companies, ranging from local or regional vehicle carriers to large, national companies, as our target insurance replacement market. As of December 31, 2021, we were a preferred or recognized supplier for 62% of these insurance companies and a co-primary for 19% of them.

Customer Service Offerings

At our major airport rental locations and certain smaller airport and off airport locations, customers participating in our Hertz Gold Plus Rewards program are able to rent vehicles in an expedited manner. Participants in our Hertz Gold Plus Rewards program often bypass the rental counter entirely and proceed directly to their vehicle upon arrival at our facility. Participants in our Hertz Gold Plus Rewards program are also eligible to earn Hertz Gold Plus Rewards points that may be redeemed for free rental days or converted to awards of other companies' loyalty programs. Hertz's Gold Plus Rewards program offers three elite membership tiers which provide more frequent renters the opportunity to earn additional reward points and vehicle upgrades. For the year ended December 31, 2021, rentals by Hertz Gold Plus Rewards members accounted for approximately 30% of our worldwide rental transactions. We believe the Hertz Gold Plus Rewards program provides us with a significant competitive advantage, particularly among frequent travelers, and we have targeted such travelers for participation in the program. We offer electronic rental agreements and returns for our Hertz, Dollar and Thrifty customers in the U.S. Simplifying the rental transaction saves customers time and provides greater convenience through access to digitally available rental contracts.

When Hertz Gold Plus Rewards members make a reservation for a midsize car or above, they have access to exclusive vehicles based on their membership tier via our Hertz Ultimate Choice program which allows customers to

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

choose their vehicle from a range of makes, models and colors available within the zone indicated on their reservation. Alternatively, they may upgrade at pick-up for a fee by choosing a vehicle from the Premium Upgrade zone. The Hertz Ultimate Choice program is offered at 62 U.S. and Canada airport locations as of December 31, 2021.

TNC Rentals

We have partnered with certain companies in the TNC market in North America to offer vehicle rentals to their drivers in select cities. Using vehicles for TNC rentals results in an increased supply of higher mileage, and thus more economical, used vehicles for our vehicle disposition programs discussed below. Drivers for our TNC Partners reserve vehicles online through TNC Partner websites and pick up vehicles from select locations. TNC drivers can extend the vehicle rental on a weekly basis. In October 2021, we announced an exclusive partnership with Uber to make Teslas available for their drivers to rent on the Uber network in the U.S. We believe that this arrangement will improve driver-level economics relative to internal combustion vehicles.

Hertz 24/7

We offer a car and van-sharing membership service, referred to as Hertz 24/7, which rents vehicles by the hour and/or by the day, at various locations internationally, primarily in Europe. Members reserve vehicles online, then receive the vehicles at convenient locations using keyless entry, without the need to visit a Hertz rental office. Members are charged an hourly or daily vehicle-rental fee which includes fuel, insurance, 24/7 roadside assistance and in-vehicle customer service. Hertz 24/7 specializes in Business-to-Business-to-Consumer (B2B2C) services working with retail partners to provide vans at their locations and with corporations providing pool fleets for use by their employees.

Other Customer Service Offerings

We offer a Mobile Gold Alerts service, available to participating Hertz Gold Plus Rewards customers, through which a text message and/or email with the vehicle information and location is sent approximately 30 minutes prior to arrival, providing the option to choose another vehicle. We offer Hertz e-Return, which allows customers to drop off their vehicle and go without the need to visit the rental counter. Customers can also use cashless toll lanes with our PlatePass offering where the license plate acts as a transponder. We also offer a vehicle-subscription service on a monthly or weekend basis in select locations that provides a flexible, cost-effective alternative to vehicle ownership, with no long-term commitment required, referred to as Hertz My Car and My Hertz Weekend. As a result of COVID-19, we implemented enhanced safety measures to provide customers confidence while renting our vehicles. The Hertz Gold Standard Clean seal ensures that each vehicle is sealed prior to rental following a rigorous 15-point cleaning and sanitization process that follows U.S. Centers for Disease Control and Prevention guidelines.

Rates

We rent a wide variety of makes and models of vehicles. We rent vehicles on an hourly (in select international markets), daily, weekend, weekly, monthly or multi-month basis, with rental charges computed on a limited or unlimited mileage rate, or on a time rate plus a mileage charge. Our rates vary by brand and at different locations depending on local market conditions and other competitive and cost factors. While vehicles are usually returned to the locations from which they are rented, we also allow one-way rentals from and to certain locations. We also generate revenues from reimbursements by customers of airport concession fees, unless the law limits or forbids us from doing so, and vehicle licensing costs, fueling charges, and charges for value-added services such as supplemental equipment (e.g., child seats and ski racks), loss or collision damage waiver, theft protection, liability and personal accident/effects insurance coverage, premium emergency roadside service and satellite radio.

Reservations

We price and accept reservations for our vehicles through each of our brands. Reservations are generally for a class of vehicles, such as compact, midsize or sport utility vehicle.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

We distribute pricing and content and accept reservations through multiple channels. Direct reservations are accepted at Hertz.com, Dollar.com and Thrifty.com, which have global and local versions in multiple languages. Hertz.com offers a range of products, prices and additional services as well as Hertz Gold Plus Rewards benefits, serving both company-operated and franchise locations. In addition to our websites, direct reservations are enabled via our Hertz and Dollar smartphone apps, which include additional connected products and services.

Customers may also seek reservations via travel agents or third-party travel websites. In many of those cases, the travel agent or website utilizes an Application Programming Interface connection to Hertz or a third-party operated computerized reservation system, also known as a Global Distribution System, to contact us and make the reservation.

In our major markets, including the U.S. and all other countries with company-operated locations, customers may also reserve vehicles for rental from us and our franchisees worldwide through local, national or toll-free telephone calls to our reservations center, directly through our rental locations or, in the case of insurance replacement rentals, through proprietary automated systems serving the insurance industry.

Franchisees

In certain U.S. and international markets, we have found it efficient to issue licenses under franchise arrangements to independent franchisees who are engaged in the vehicle rental business. Franchisees rent vehicles that they own or lease to customers, primarily under our Hertz, Dollar or Thrifty brand. In certain markets and under certain circumstances, franchisees may acquire franchises for multiple brands.

Franchisees generally pay an initial license fee, royalties based on a percentage of their revenues as well as other fees, and in return are provided the use of the applicable brand name, certain operational support and training, reservations through our reservation channels, and other services. Additionally, franchisees may utilize our vehicles to support one-way business intra country. Franchisee arrangements enable us to offer expanded national and international service and a broader one-way rental program. In addition to vehicle rental, certain international franchisees engage in vehicle leasing, and the rental of chauffeur-driven vehicles, camper vans and motorcycles.

The transfer of a franchisee license is limited without our consent and such licenses are generally terminable by us only for cause or after a fixed term. Many of these agreements also include a company right of first refusal should a franchisee receive a bona fide offer to sell the license. Franchisees in the U.S. typically may terminate on prior notice, generally 180 days. In Europe and certain other international jurisdictions, franchisees typically do not have early termination rights. We continue to issue new licenses and, from time to time, re-acquire franchised businesses or sell corporate locations to franchisees.

Franchise operations, including fleet acquisition, are generally financed independently by the franchisees and we do not have an investment interest in the franchisees. Fees from franchisees, including initial franchise fees, generally support the cost of our brand awareness programs, reservations system, sales and marketing efforts and certain other services and are approximately 2% of our worldwide vehicle rental revenues for the year ended December 31, 2021.

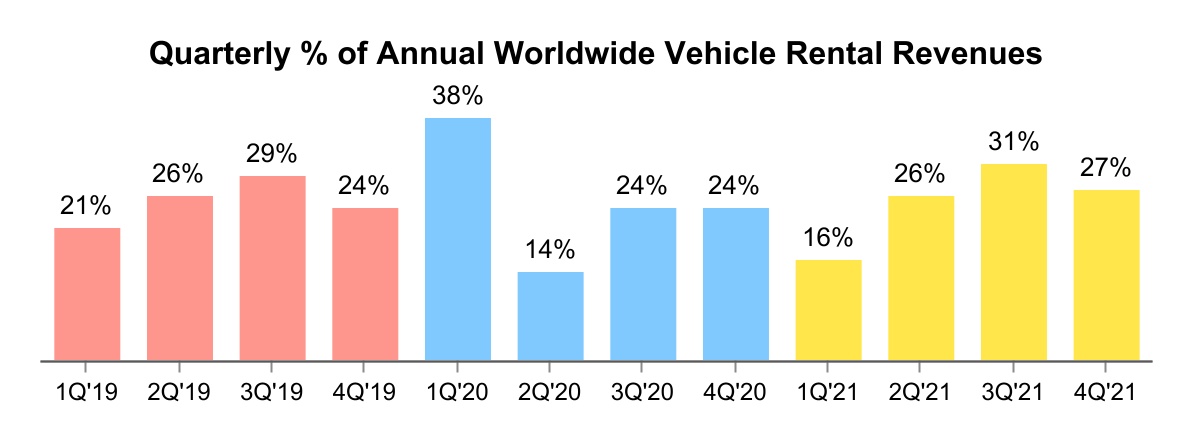

Seasonality

Our vehicle rental operations are historically a seasonal business, excluding the year ended December 31, 2020 which was impacted by the COVID-19 pandemic as discussed above, with decreased levels of business in the winter months and heightened activity during the spring and summer months ("our peak season") for the majority of countries where we generate our revenues. To accommodate increased demand, we typically increase our available fleet and staff, which is comprised of a significant number of part-time and seasonal workers, during the second and third quarters of the year. A number of our other major operating costs, including airport concession fees, commissions and vehicle liability expenses, are directly related to revenues or transaction volumes. Certain operating expenses, including real estate taxes, rent, insurance, utilities, maintenance and other facility-related

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

expenses, the costs of operating our information technology systems and minimum staffing costs, remain fixed and cannot be adjusted for seasonal demand.

The following chart sets forth this seasonal nature of our vehicle rental operations, as well as the impact of COVID-19, primarily in 2020, by presenting the proportionate contribution of each quarter to full year revenue for each of the years ended December 31, 2021, 2020 and 2019.

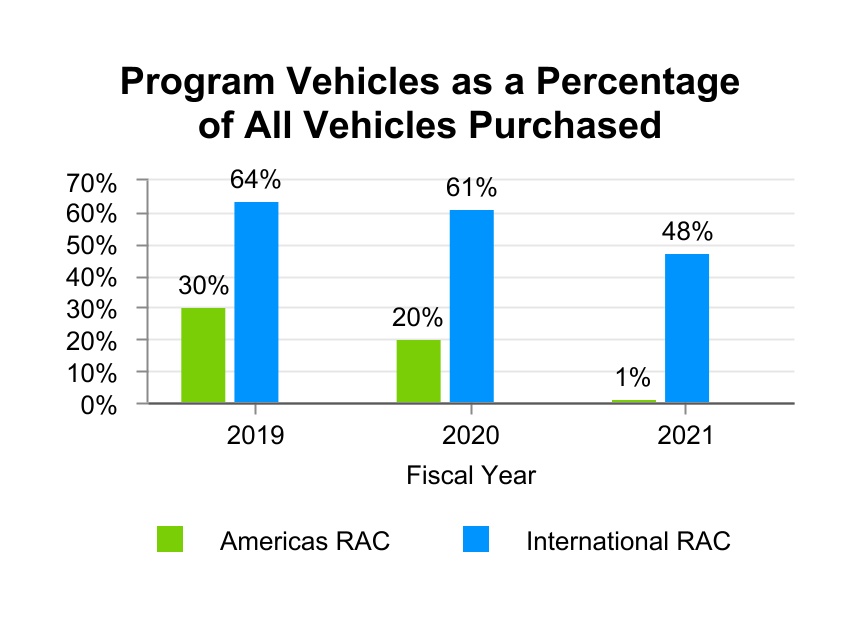

Fleet

During the year ended December 31, 2021, we operated a peak rental fleet in our Americas RAC and International RAC segments of approximately 389,300 vehicles and 78,400 vehicles, respectively. Purchases of vehicles are financed by active and ongoing global borrowing programs and through cash from operations. The vehicles purchased are either program vehicles or non-program vehicles. We periodically review the efficiencies of an optimal mix between program and non-program vehicles in our fleet and adjust the ratio of program and non-program vehicles as needed based on contract negotiations, vehicle economics and availability. During the year ended December 31, 2021, our approximate average holding period for a rental vehicle was 25 months in our Americas RAC segment and 20 months in our International RAC segment which are longer than historical holding periods as a result of supply chain constraints due to the Chip Shortage.

In October 2021, we announced our plan to significantly expand our EV rental fleet in North America, as discussed below in Corporate Responsibility—Fuel Efficient Fleet.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

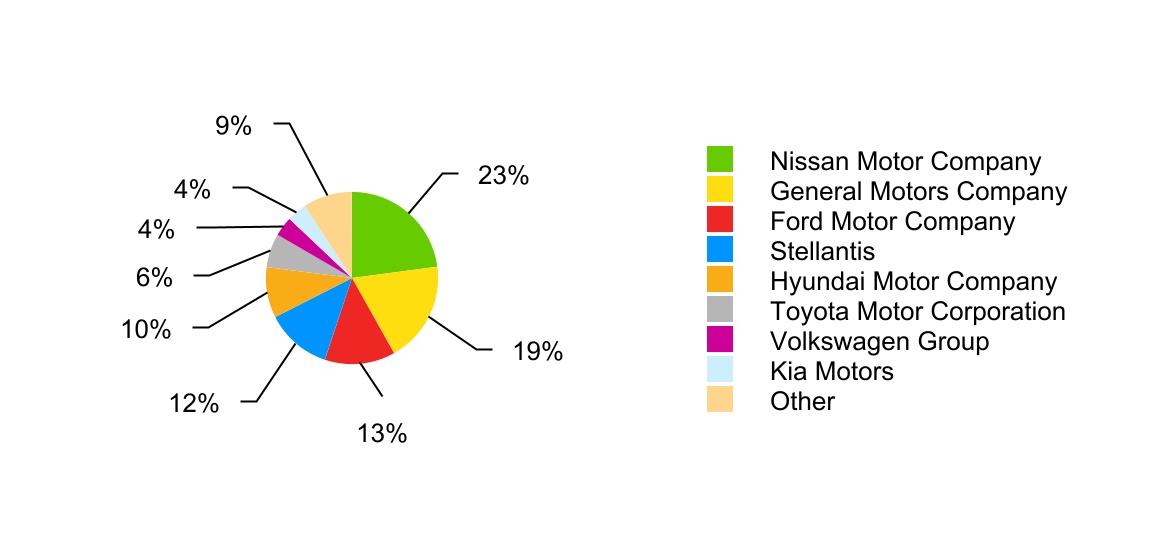

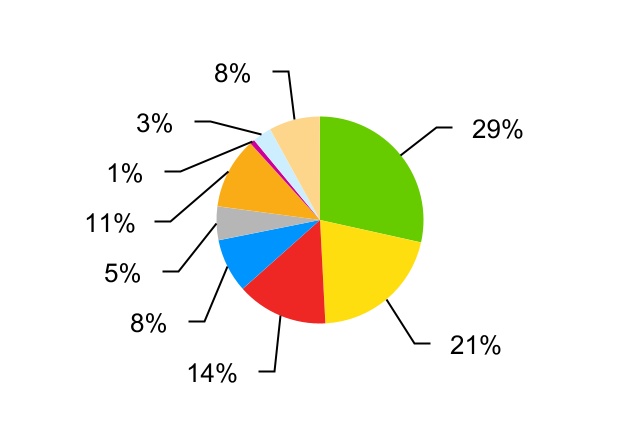

Our fleet composition is as follows:

Fleet Composition by Vehicle Manufacturer*

As of December 31, 2021

Americas RAC International RAC*

* Vehicle manufacturers Daimler AG (Mercedes Benz and Smart), Renault, Mitsubishi, Mazda, Volvo and Rover Group together comprise another 12% of the International RAC fleet and are included as "Other" in the overall and International RAC charts above.

We maintain vehicle maintenance centers which provide maintenance for our fleet, many of which include sophisticated vehicle diagnostic and repair equipment, and are accepted by automobile manufacturers, as eligible, to perform warranty work. Collision damage and major repairs are generally performed by independent contractors.

Repurchase Programs

Program vehicles are purchased under repurchase or guaranteed depreciation programs with vehicle manufacturers wherein the manufacturers agree to repurchase vehicles at a specified price or guarantee the depreciation rate on the vehicles during established repurchase periods, subject to, among other things, certain vehicle condition, mileage and holding period requirements. Repurchase prices under repurchase programs are based on the original cost less a set daily depreciation amount. These repurchase and guaranteed depreciation programs limit our residual risk with respect to vehicles purchased under the programs and allow us to reduce the variability of depreciation expense for each vehicle, however, typically the acquisition cost is higher. Program vehicles generally provide us with flexibility to increase or reduce the size of our fleet based on market demand. When we increase the percentage of program vehicles, the average age of our fleet decreases since the average

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

holding period for program vehicles is shorter than for non-program vehicles. During 2021, the number of program vehicles in our fleet decreased primarily due to the impact from the Chip Shortage on new vehicle production.

Program vehicles as a percentage of all vehicles purchased within our Americas RAC and International RAC segments during the last three fiscal years were as follows:

Hertz Car Sales, Rent2Buy and Other Vehicle Disposition Channels

During the year ended December 31, 2021, the vehicles sold in our U.S. and international vehicle rental operations that were not repurchased by manufacturers were sold through auction and dealer direct wholesale channels and retail channels.

In October 2021, we announced a nationwide agreement with Carvana with respect to our vehicle disposition process. With demand for used vehicles at an all-time high, we recognized the opportunity to streamline our vehicle disposition cycle, while at the same time filling a need in the used car market. The Carvana arrangement allows us to digitize and modernize our retail sales process while providing Carvana with a greater supply of used vehicles. This is intended to reduce our reliance on wholesale channels and allows us to renew our vehicle supply more rapidly, thereby strengthening our business.

Our retail sales channel, Hertz Car Sales, consists of a network of company-operated vehicle sales locations throughout the U.S. dedicated to the sale of vehicles from our rental fleet. Vehicles disposed of through our retail outlets provide for ancillary vehicle sales revenue, such as warranty, financing and title fees.

We also offer Rent2Buy in 26 states in the U.S., an innovative program in which customers are able to rent a vehicle from our rental fleet and if the customer purchases the vehicle, the customer is credited with a portion of their rental charges. The purchase transaction is completed through the internet and by mail in those states where permitted.

Markets and Competition

Competition among vehicle rental industry participants is intense and is primarily based on vehicle availability and quality, price, service, reliability, rental locations, product innovation and competition from online travel agents and vehicle rental brokers. We believe that the strength of the Hertz, Dollar and Thrifty brands, our extensive worldwide ownership of vehicle rental operations and our commitment to innovation, including our EV initiatives, provide us with a strong competitive advantage. Our principal vehicle rental industry competitors are Avis Budget Group, Inc.,

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

which currently operates the Avis, Budget, ZipCar and Payless brands, and Enterprise Holdings, which operates the Enterprise Rent-A-Car Company, National Car Rental and Alamo Rent A Car brands. There are also local and regional vehicle rental companies, transportation network companies which provide ride-hailing services that have some overlap in customer use cases, largely with respect to short length trips in urban areas, and peer-to-peer car sharing marketplaces.

U.S.

The U.S. represents approximately $28 billion in estimated annual industry revenues for 2021. The average number of vehicles in the U.S. vehicle rental industry in 2021 was about 2 million vehicles. U.S. industry Revenue Per Unit Per Month in 2021 was approximately $1,320.

Europe

Europe represents approximately $11 billion in estimated annual industry revenues for 2021. Europe has generally demonstrated a lower historical reliance on air travel because the European off airport vehicle rental market has been significantly more developed than it is in the U.S. Within Europe, the largest markets in which we do business are France, Germany, Italy, Spain and the United Kingdom. Throughout Europe, we do business through company-operated rental locations and through our partners or franchisees.

Asia Pacific

Asia Pacific represents approximately $14 billion in estimated annual industry revenues for 2021. Within this region, the largest markets in which we do business are Australia, China, Japan, New Zealand and South Korea. In each of these markets we do business through company-operated rental locations and through our partners or franchisees.

Middle East and Africa

The Middle East and Africa represent approximately $3 billion in estimated annual industry revenues for 2021. Within these regions, the largest markets in which we do business are Saudi Arabia, South Africa and the United Arab Emirates. In each of these markets we do business through our franchisees.

Latin America

Latin America represents approximately $3 billion in estimated annual industry revenues for 2021. Within Latin America, the largest markets in which we do business are Argentina, Brazil, Mexico and Panama. In each of these markets our Hertz, Dollar and Thrifty brands are present through our partners or franchisees.

EMPLOYEES AND HUMAN CAPITAL MANAGEMENT

As of December 31, 2021, we employed approximately 23,000 persons, consisting of approximately 17,000 persons in the U.S. and approximately 6,000 persons internationally, a decrease internationally of 14% from December 31, 2020 due primarily to a restructuring program affecting approximately 900 employees in our international operations, specifically in Europe.

Certain employees outside the U.S. are covered by a wide variety of union contracts and governmental regulations affecting, among other things, compensation, job retention rights and pensions. Labor contracts covering the terms of employment of approximately 27% of our workforce in the U.S. (including those in the U.S. territories) are presently in effect with local unions, affiliated primarily with the International Brotherhood of Teamsters and the International Association of Machinists. Labor contracts covering approximately 11% of these employees will expire during 2022. We have had no material work stoppage as a result of labor problems during the last ten years, and we believe our labor relations to be good. Nevertheless, we may be unable to negotiate new labor contracts on terms advantageous to us, or without labor interruption.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

In addition to the employees referred to above, we engage outside services, as is customary in the industry, principally for the non-revenue movement of rental vehicles between rental locations.

Human Capital Management

We continue to evolve for our customers, employees, partners, franchisees and communities. With respect to our employees, our Board and Board committees periodically review of our employee programs and initiatives, providing oversight to how we should attract, retain and develop a workforce that aligns with our values and strategies, including through competitive compensation and benefits, learning and development opportunities and cultivating an engaged and inclusive culture. In addition, we conduct anonymous surveys, seeking feedback from our broad employee base on topics including, but not limited to, effectiveness of company communication, confidence in leadership, competitiveness of our compensation and total rewards packages and career growth and development opportunities. Survey results are reviewed by our senior management and shared with employees, along with action plans, for leveraging employee insights to drive meaningful improvements in our employees' experiences.

Our people are our greatest asset and we strive to have a constant focus and attention on matters concerning our employees including retention and professional development as well as employees’ physical, emotional and financial well-being. We are committed to an inclusive workplace around the globe that champions equality, values different backgrounds and celebrates individuality. We regularly assess our benefits and program offerings to provide a compelling and comprehensive portfolio, which currently includes:

•Competitive salaries and wages;

•Retirement savings with a 401(k) Plan and an employer match, up to a certain percentage;

•Comprehensive health insurance, including medical, dental and vision plans for employees and their dependents;

•Employer provided life insurance with no cost to employees;

•No-cost employee assistance program, providing confidential counseling to help employees and their families dealing with hardships;

•Paid parental leave;

•Free health screenings and programs for tobacco cessation, weight management and wellness coaching;

•Employee referral program;

•Employee and family rental car and car sales discounts;

•Employee tuition reimbursement program;

•Employee relief fund that provides immediate, short-term financial assistance to North America employees through employee contributions and company match to assist employees dealing with natural disasters;

•Training and development opportunities; and

•Employee resource groups.

We are committed to protecting the health and safety of our employees, customers and partners. Beginning in 2020, COVID-19 caused an unprecedented crisis for the travel and tourism industry, disrupting work practices, consumer behavior and long-term strategic plans. Despite these challenges, we have maintained our priority of supporting our people and our communities. We implemented heightened safety measures for employees and customers and introduced the Hertz Gold Standard Clean process, an enhanced 15-point cleaning process. We deployed protocols, signage and employee training to ensure compliance with COVID-19 Centers for Disease Control guidelines and local regulations. We equipped our employees with personal protective equipment as well as plexiglass guards, implemented enhanced facility and vehicle cleaning practices, mandated face-coverings and established processes for assessing possible COVID-19 exposures and responding to known or suspected COVID-19 cases. In addition, we partnered with LabCorp Employer Services to provide at-home COVID-19 test kits at no charge to employees. We are committed to seeking ways to best support our employees and customers and adapting our processes in response to changing guidelines as we continue to navigate through the COVID-19

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

THE HERTZ CORPORATION AND SUBSIDIARIES

ITEM 1. BUSINESS (Continued)

pandemic. We also partnered with Rite Aid to provide educational and interactive COVID-19 vaccine webinars. In addition, we hosted multiple onsite COVID-19 vaccination clinics.

Outside of the U.S., we are committed to offering similar comprehensive programs that leverage the best of global benefits but also tailored by country to reflect local practices and culture. We evaluate our total benefits and programs annually and use feedback from employees to make thoughtful changes to ensure our programs continue to meet the needs of employees.

CORPORATE RESPONSIBILITY

We recognize our influence and are committed to do the right thing, the right way, every time – for our employees and customers, as well as our communities and our planet. Delivering on this responsibility is a never-ending journey – one that we're proud to be on. We are committed to managing our businesses ethically and responsibly as we believe doing so enables us to realize the continuous improvement, sustainable innovation and enhanced business performance that are critical to our success.

Our People and Communities

At the heart of Hertz Global is our people. Our employees help drive our progress, innovation and success. We strive to empower our employees so they can build trust with our customers and the communities we serve around the world. As discussed above in Human Capital Management, attracting and retaining top talent is more than a measure of our business success; it is a measure of who we are and what we value. In addition, we engage with our communities, and, through our global charitable giving and volunteer program, we are committed to making a positive difference in the areas where we work, live and serve.

Diversity