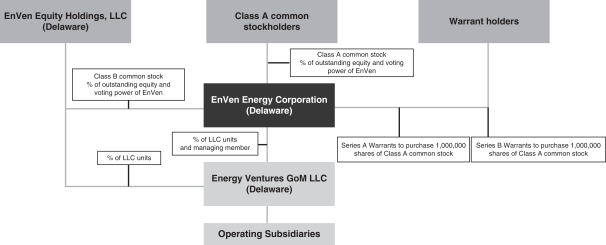

On November 4, 2015, prior to the closing of the 2015 Equity Offering, the then existing members of Energy Ventures GoM Holdings, LLC contributed 100% of their interests to a newly formed limited liability company, EnVen Equity Holdings, LLC (“Equity Holdings”) (the “Equity Holdings Contribution”). At the time of the Equity Holdings Contribution, Energy Ventures GoM Holdings, LLC owned 100% interest in GoM. As a result of the Equity Holdings Contribution, Energy Ventures GoM Holdings, LLC interests in GoM were distributed to Equity Holdings. Immediately following the Equity Holdings Contribution, Energy Ventures GoM Holdings, LLC was converted from a limited liability company to a Delaware corporation and renamed EnVen Energy Corporation (the “Conversion”).

The 2015 Equity Offering, the Equity Holdings Contribution, and the Conversion were contingent upon the First Closing of the Marathon Acquisitions, which closed on December 18, 2015 (refer toNote 2 – Significant Acquisitions of Oil and Natural Gas Properties), therefore, the organization transactions were recognized as of that date.

Class A Common Stock

As part of the 2015 Equity Offering, the Company issued 13,732,925 shares of Class A Common Stock for $10.00 per share. During the year ended December 31, 2016, the Company issued 2,128,779 additional shares of Class A Common Stock to institutional investors for $10.00 per share, the net proceeds of which were used to fund capital expenditures. During the year ended December 31, 2017, the Company only issued Class A Common Stock as part of its employee incentive award plan, discussed inNote 13 - Employee Benefit Plans.

The holders of Class A Common Stock and Class B Common Stock vote together as a single class on all matters and are entitled one vote for each share held.

Class B Common Stock

In 2015, at the time of the Conversion, the Company issued 3,333,333 shares of its Class B Common Stock to the owners of Equity Holdings, resulting in the Company’sNon-controlling Interest in GoM of approximately 19.5% held by Equity Holdings. The Company retained the majority interest ownership (approximately 80.5%) in GoM.

The holders of Class B Common Stock have the right, at their sole discretion, to redeem their interests for cash, or at option of the Company, shares of Class A Common Stock at an exchange ratio of one share of Class A Common Stock for each interest exchanged (“Redemption Rights”). During the year ended December 31, 2017, no members exercised their Redemption Rights.

Series A & Series B Warrants

As a result of the 2015 Equity Offering, the Company also has 13,732,925 Series A Warrants and 13,732,925 Series B Warrants outstanding with each warrant exercisable to purchase 0.07282 shares of Class A Common Stock. The Series A Warrants have an exercise price of $12.50 for one share of Class A Common Stock, and a maximum of 1,000,000 shares of Class A Common Stock may be issued in connection with the exercise of all Series A Warrants. The Series B Warrants have an exercise price of $15.00 for one share of Class A Common Stock, and a maximum of 1,000,000 shares of Class A Common Stock may be issued in connection with the exercise of all Series B Warrants. The warrants are exercisable at any time and expire upon the earlier of: (i) December 8, 2020 or (ii) three years following the closing date of a qualified initial public offering (“QIPO”).

Series A Preferred Stock

On December 30, 2016, the Board designated 9,867,930 shares of the Company’s authorized and unissued shares of preferred stock with a par value of $0.001 per share as Series A Preferred Stock. On the same day, the Company issued 6,159,596 shares of Series A Preferred Stock to selected institutional investors for $12.00 per

F-56