- PR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Permian Resources (PR) DEF 14ADefinitive proxy

Filed: 18 Mar 21, 4:11pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

CENTENNIAL RESOURCE DEVELOPMENT, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. |

☐Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) | Title of each class of securities to which transaction applies: | |||

|

|

|

|

|

(2) | Aggregate number of securities to which transaction applies: | |||

|

|

|

|

|

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

|

|

|

|

(4) | Proposed maximum aggregate value of transaction: | |||

|

|

|

|

|

(5) | Total fee paid: | |||

|

|

|

|

|

|

|

|

|

|

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: | |||

|

|

|

|

|

(2) | Form, Schedule or Registration Statement No.: | |||

|

|

|

|

|

(3) | Filing Party: | |||

|

|

|

|

|

(4) | Date Filed: | |||

|

|

|

|

|

March 18, 2021

Dear Fellow Shareholders,

On behalf of the Board of Directors of Centennial Resource Development, Inc., we are pleased to invite you to our 2021 Annual Meeting of Shareholders, which will take place on April 28, 2021 at 10:00 a.m., Central Time. As we collectively continue to face the challenges associated with the COVID-19 pandemic, we wish you and your families well. For the health and safety of our employees and our shareholders, we will be conducting the Annual Meeting as a virtual meeting of shareholders. The following pages of this Proxy Statement explain how you can attend the virtual meeting on the internet.

During 2020, the world was suddenly and unexpectedly impacted by COVID-19 and the ensuing global health pandemic creating unprecedented challenges for the global economy, our industry and our company. We took early action implementing protocols to protect the health and safety of our employees and their families, which allowed us to keep our workforce safe without experiencing any operational disruptions or reported COVID-19 workplace transmissions. As the crisis caused by COVID-19 resulted in extremely depressed commodity prices, we acted to preserve the financial health of our company by halting our drilling and completions activity for much of the second and third quarters of 2020.

During this period, we focused on reducing our cost structure and implemented numerous initiatives that enhanced our leverage profile, cash flow and capital efficiency. As oil prices strengthened later in the year, we resumed modest operational activity. Despite the significant challenges posed by the pandemic, we achieved many accomplishments in 2020 and early 2021. A few highlights are noted below. We believe we are well positioned for 2021 and beyond.

| ▪ | Completed our succession plan in April 2020 with the appointment of Sean Smith as Chief Executive Officer and Steve Shapiro as independent Chairman of the Board. |

| ▪ | Transitioned to a free cash flow positive company, generating $40 million of free cash flow(1) in the second half of 2020, with proceeds used to repay borrowings under our credit facility. |

| ▪ | Executed a debt exchange in May 2020 that reduced the principal amount of our senior notes by $127 million. |

| ▪ | Reduced our cost structure, including substantial improvements in lease operating expenses and well costs from 2019 levels. |

| ▪ | Released our inaugural Corporate Sustainability Report in early 2021, which details our commitment to sustainable business practices as well as some 2020 achievements, including a 60% increase in recycled water usage and a 38% reduction in the percentage of natural gas flared from 2019 levels. |

Your vote is important, and we encourage you to review this Proxy Statement and to vote promptly so that your shares will be represented at the Annual Meeting. We also cordially invite you to attend the Annual Meeting. On behalf of the Board of Directors and management, we express our appreciation for your continued support of our company.

Sincerely,

|

|

Steven J. Shapiro | Sean R. Smith |

Chairman of the Board | Chief Executive Officer |

(1) | Free cash flow is a non-GAAP financial measure. See Appendix A of this Proxy Statement for a reconciliation to net cash provided by operating activities, our most directly comparable financial measure calculated in accordance with GAAP. |

1

To our Shareholders:

The 2021 Annual Meeting of Shareholders of Centennial Resource Development, Inc. will be a virtual meeting of shareholders conducted online at www.virtualshareholdermeeting.com/CDEV2021 on April 28, 2021 at 10:00 a.m. Central Time.

At the Annual Meeting, shareholders will be asked to:

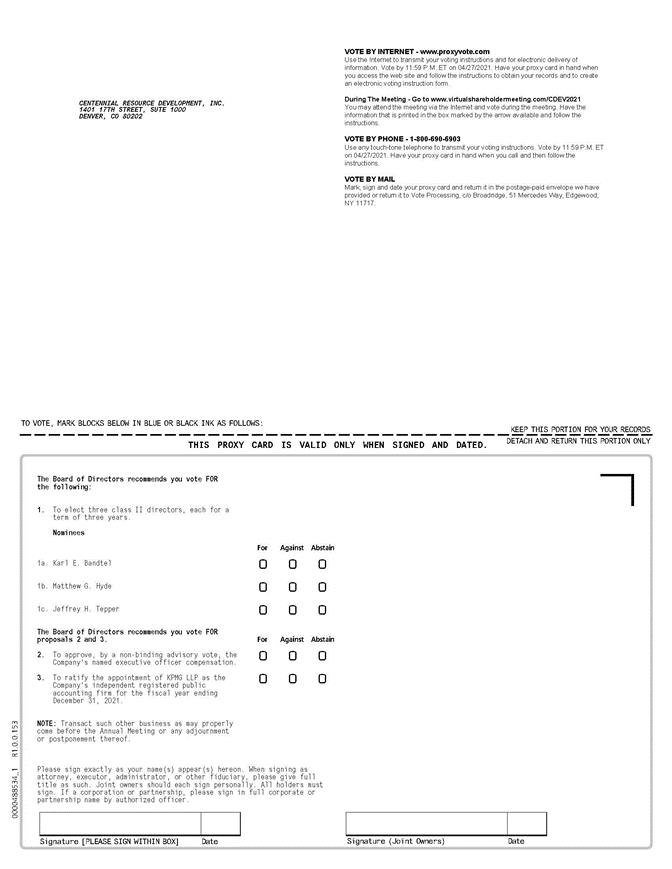

| 1. | Elect three Class II directors to our Board of Directors, each for a term of three years; |

| 2. | Approve, by a non-binding advisory vote, our named executive officer compensation; |

| 3. | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and |

| 4. | Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

All shareholders of record at the close of business on March 08, 2021, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting.

Instead of mailing a printed copy of the proxy materials, including our 2020 Annual Report, to each shareholder of record, we are providing access to these materials via the internet. This reduces the amount of paper necessary to produce these materials, as well as the costs associated with mailing these materials to all shareholders. Accordingly, on or about March 18, 2021, a Notice Regarding the Internet Availability of Proxy Materials (the Notice) was mailed to our shareholders of record as of the record date. The Notice contains instructions on how to electronically access the proxy materials on the internet and how to vote your shares. Instructions for requesting a paper copy of the proxy materials are also contained in the Notice.

Your vote is important. Whether or not you expect to attend the Annual Meeting, please vote as promptly as possible by using the internet or telephone voting procedures described in the Notice and in this Proxy Statement or by requesting a printed copy of the proxy materials (including the proxy card) and completing, signing and returning the enclosed proxy card by mail. We thank you for your continued support and cordially invite you to attend the Annual Meeting.

| By Order of the Board of Directors, |

|

|

|

|

| Davis O. O’Connor |

| Vice President, General Counsel and Secretary |

|

|

Denver, Colorado |

|

March 18, 2021 |

|

2

1 | |

|

|

2 | |

|

|

4 | |

4 | |

5 | |

5 | |

6 | |

6 | |

|

|

8 | |

8 | |

8 | |

9 | |

9 | |

11 | |

11 | |

|

|

14 | |

14 | |

14 | |

15 | |

15 | |

15 | |

16 | |

16 | |

16 | |

17 | |

19 | |

19 | |

19 | |

19 | |

20 | |

20 | |

20 | |

21 | |

|

|

22 | |

|

|

23 | |

23 | |

26 | |

31 | |

33 | |

34 |

|

|

36 | |

|

|

37 | |

37 | |

38 | |

39 | |

40 | |

40 | |

41 | |

41 | |

41 | |

|

|

43 | |

|

|

44 | |

44 | |

45 | |

|

|

Security Ownership of Certain Beneficial Owners and Management | 46 |

48 | |

|

|

Proposal 2: Approval of an Advisory Basis of our Named Executive Officer Compensation | 49 |

49 | |

|

|

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm | 50 |

50 | |

50 | |

50 | |

|

|

51 | |

|

|

51 | |

|

|

51 | |

|

|

52 | |

|

|

53 | |

|

|

57 | |

|

|

|

|

|

|

|

|

3

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider before voting. Please read the entire Proxy Statement before voting. For more complete information regarding our 2020 operational and financial performance and definitions of industry terms, please review our Annual Report on Form 10-K for the year ended December 31, 2020, which accompanies this Proxy Statement.

All references in this Proxy Statement to “we,” “our,” “us,” “Centennial” or the “Company” refer to Centennial Resource Development, Inc. and its subsidiaries.

Annual Meeting and Voting Details

2021 Annual Meeting Details

Date & Time | Location | Record Date |

Wednesday, April 28, 2021 10:00 a.m. Central Time | Virtual meeting via live webcast at: www.virtualshareholdermeeting.com/CDEV2021 | March 08, 2021 |

Board Recommendations on Voting Matters

Voting Matter | Voting Recommendation | Page Reference |

Proposal 1: Election of Directors | FOR each Nominee | 8 |

Proposal 2: Advisory Vote on Executive Compensation | FOR | 49 |

Proposal 3: Ratification of Independent Auditors | FOR | 50 |

Voting Your Shares

Even if you plan to attend the Annual Meeting, we strongly encourage you to vote as soon as possible by using one of the methods described below. In all cases, you will need to have your Control Number in hand, which is included on the Notice Regarding the Internet Availability of Proxy Materials (the Notice) or Proxy Card you receive in the mail. The deadline to vote is 11:59 Eastern Time on April 27, 2021 (the day before the Annual Meeting) except for voting that occurs during the Annual Meeting. If mailed, your completed and signed Proxy Card must be received by April 27, 2021.

By Internet |

By Phone |

By Mobile Device |

By Mail |

www.proxyvote.com | 1-800-690-6903 |

| Complete, sign, date and return your Proxy Card in the envelope provided |

If you are the beneficial owner of shares held in street name (for example, your shares are held in your brokerage account), your method for accessing the proxy materials and voting may vary. Therefore, if you are a beneficial owner, please follow the instructions provided by your brokers or nominees to vote by internet, telephone or mail. You should contact your broker or nominee or refer to the instructions provided by your broker or nominee for further information.

You may receive more than one Notice, Proxy Card or other voting instruction form if your shares are held through more than one account (for example, through different brokers or nominees). Each Notice, Proxy Card or other voting instruction form only covers those shares held in the applicable account. If you hold shares in more than one account, you will have to provide voting instructions as to all your accounts to vote all your shares.

4

Operational and Financial Performance

As referenced in the letter from our Chairman and Chief Executive Officer (CEO), 2020 was a transformational year for us, with our capital efficiencies and cost saving initiatives driving free cash flow in the second half of 2020. Here are some highlights of what we achieved in 2020:

✓ Generated free cash flow of $40 million in Q3 – Q4, with proceeds used to repay borrowings under our credit facility ✓ Reduced cost structure, including an 18% reduction in our combined lease operating and cash general & administrative expenses for the second half of 2020 compared to the prior year period (on a per Boe basis) ✓ Decreased drilling, completions and facilities costs to approximately $850 per lateral foot for each well completed in the second half of 2020 (a 29% reduction from Q4 2019) ✓ Executed a debt exchange that reduced the principal amount of our senior notes by $127 million ✓ Reduced corporate oil decline rate to the low 30s from the low 50s at year-end 2019 |

|

|

|

Environmental, Social and Governance (ESG) Highlights

We are committed to producing oil and natural gas in a way that creates long-term value for our stakeholders, which includes the commitment to do so in an ethical, inclusive, pragmatic and environmentally and socially responsible way. That commitment extends throughout our operations and includes a dedication to superior performance with respect to environmental, social and governance (ESG) matters.

In early 2021, we published our inaugural Corporate Sustainability Report, which is available on our website at www.cdevinc.com/corporate-sustainability. The Report builds upon and substantially expands our prior ESG disclosures and covers our performance in environmental stewardship, regulatory compliance, health and safety, corporate governance, ethics, security, workforce diversity and development, wellbeing and community engagement matters. Hyperlinks to our website in this Proxy Statement are provided for convenience only, and the website content does not constitute a part of this document. The table below identifies some ESG highlights relating to 2020 performance from our Corporate Sustainability Report.

| Board Governance | ▪ Separated the roles of Chairman and CEO in 2020 with the appointment of an independent Chairman of the Board |

|

|

|

| ESG Management & Oversight | ▪ Formed an ESG working group, consisting of select officers and employees from across the organization, to manage our ESG initiatives and regularly report to the Nominating, Environmental, Social and Governance (NESG) Committee |

|

|

|

| Water Recycling | ▪ Recycled and reused 4.8 million barrels of water ▪ Increased recycled water usage by 60% from 2019 levels |

|

|

|

| Flaring | ▪ Reduced the percentage of natural gas flared by 38% from 2019 levels ▪ Flared only 0.5% of total natural gas volumes produced in Q4 2020 |

|

|

|

| Prioritizing Pipelines Over Trucks | ▪ Transported 99% of our produced water by pipeline, reducing trucking-related emissions, improving safety, minimizing the potential for spills and lessening the impact on local roads |

|

|

|

| Responsibly Powering Our Operations | ▪ Implemented the use of dual-fuel systems on drilling rigs and completion equipment to reduce diesel consumption and related emissions ▪ Connected our Reeves County, Texas wells to the electric grid, reducing the use of diesel and natural gas generators (and their related emissions) from 135 to 10 |

|

|

|

| Health & Safety | ▪ Suffered 0 recordable employee injuries in 2020 ▪ Suffered 0 reported workplace transmissions of COVID-19 |

5

There are currently nine directors on our Board, divided into three equal classes. The table below identifies the director nominees named in this Proxy Statement, each of whom is currently a director and was previously elected to the Board by our shareholders.

Director Nominees | Age | Director Since | Committee Membership | |||

Audit | Compensation | NESG | ||||

Karl E. Bandtel | 54 | 2016 |

|

|

| |

Matthew G. Hyde | 65 | 2018 |

|

|

| |

Jeffrey H. Tepper | 55 | 2016 |

|

|

| |

|

|

|

|

| ||

Corporate Governance and Compensation Highlights

We are committed to corporate governance and compensation practices that follow best practices, promote the long-term interests of our shareholders, strengthen our Board, foster management accountability and help build public trust in our company. The table below identifies some highlights.

Board & Committee Structure |

| Governance Practices |

| Compensation Practices |

✓ Roles of Chairman of the Board and CEO are separate ✓ Majority voting in uncontested director elections ✓ Board committees include only independent directors ✓ Diverse Board skills and experience |

| ✓ Board and Committee risk oversight ✓ Active shareholder engagement ✓ No employment agreements ✓ No shareholder rights (poison pill) or similar plan ✓ Non-hedging and non-pledging policies for our company securities ✓ Director education ✓ Related person transactions policy |

| ✓ Pay-for-performance philosophy ✓ Stock Ownership Guidelines ✓ Independent Compensation Consultant ✓ Annual equity grants to directors ✓ Compensation clawback policy ✓ Compensation risk assessment ✓ Double-trigger change-in-control benefits ✓ No tax gross-ups for change-in-control payments ✓ ESG performance goals included in Annual Incentive Program (AIP) |

2020 Executive Compensation

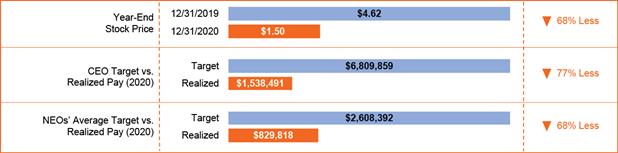

Our executive compensation program ties a significant portion of our named executive officers’ compensation to the operational, financial and stock price performance of our company. The following graphic illustrates how our executives’ realized pay in 2020 aligns with our 2020 stock price performance.

In addition to the direct and meaningful impact of our stock price decline on our executives’ realized pay, the following events and Compensation Committee actions impacted their 2020 realized pay:

6

| ▪ | Performance stock units granted in 2017 achieved a 0% payout in 2020 given our shareholder returns during the 2017-2020 performance period compared to our peers. |

| ▪ | Compensation Committee exercised negative discretion in determining to award 2020 AIP compensation to executives at 90% of target. |

| ▪ | Compensation Committee reduced the base salaries of our executives in May 2020, with reductions ranging from 10% to 25%, which remained in place until unreduced salaries were restored by the Committee on February 25, 2021. |

As used above, Target pay refers to the target total compensation for our executives for 2020, which equals the total of the executive’s 2020 unreduced base salary, target Annual Incentive Program (AIP) award for 2020 and grant date value of 2020 Long-Term Incentive Program (LTIP) awards. Realized pay refers to the total of the executive’s 2020 base salary, paid cash AIP awards for 2020 and the market value at vesting of previously granted stock-based awards that vested during 2020. NEOs or executives refer to our named executive officers, who are identified below on page 26 in the section called “2020 Executive Compensation Program.”

The alignment between our executives’ realized pay and stock price performance reflects our pay-for-performance philosophy where a significant portion of the executives’ compensation is performance-based. The graphic to the right reflects the mix of compensation elements for our CEO in 2020. Executive compensation is heavily weighted towards variable, or “at-risk,” pay elements that are only earned based on achievement of performance goals or through continued employment through the award’s vesting period. The ultimate realized value of these variable pay elements, if earned at all, varies based on company performance as determined by our Compensation Committee, as well as our stock price. |

| CEO Compensation Mix |

|

|

Shareholder Outreach and 2020 Say-on-Pay Vote

We believe that maintaining an open dialogue with our shareholders provides critical feedback for our Board and executive management team on a wide range of topics including our short- and long-term business strategy, ESG matters, performance, governance practices, executive compensation program and other matters of importance. As part of this commitment, and partially in response to a say-on-pay vote at our 2020 Annual Meeting of Shareholders that was lower than in previous years, our Board and management team expanded our regular shareholder engagement to better understand the views of our shareholders. Through this process, we reached out to our 30 largest shareholders, who collectively hold about 60% of our outstanding shares, as well as certain additional shareholders that were significant shareholders during 2020. The table below provides a summary of what we heard from shareholders and how we have responded.

What We Heard |

| How We Responded |

▪ Use a rate of return metric in the Annual Incentive Program (AIP) that can be calculated based on GAAP financial statements ▪ Move towards a more formulaic AIP ▪ Increase disclosure of environmental, social and governance (ESG) factors ▪ Include additional metrics in the Long-Term Incentive Program (LTIP) with an increased tie to absolute performance ▪ Some of our shareholders disfavor a classified board structure |

| ✓ Incorporated a GAAP-based rate of return metric (Cash Returned on Capital Employed) into the 2021 AIP ✓ Redesigned the AIP with formulaic scoring for 2021 program ✓ Increased disclosure of ESG factors in this Proxy Statement and issued our inaugural Corporate Sustainability Report ✓ Included quantitative and qualitative ESG goals in our 2021 AIP ✓ Compensation Committee is considering appropriate avenues to include additional metrics for 2021 LTIP awards ✓ Board annually reviews our board structure and continues to believe our current structure is appropriate and in the best interests of shareholders |

7

Election of Directors

There are currently nine directors on our Board, divided into three equal classes. The terms of office of the three Class II directors will expire at the Annual Meeting. Each nominee is currently a director, and all nominees were previously elected to the Board by our shareholders.

The following table provides a snapshot of the current members of the Board and its committees.

Director Nominees | Class | Term Expires | Director Since | Committee Membership | ||||||

Audit | Compensation | NESG | ||||||||

Karl E. Bandtel | II | 2021 | 2016 |

|

|

| ||||

Matthew G. Hyde | II | 2021 | 2018 |

|

|

| ||||

Jeffrey H. Tepper | II | 2021 | 2016 |

|

|

| ||||

Continuing Directors |

|

|

|

|

|

| ||||

Pierre F. Lapeyre, Jr. | III | 2022 | 2016 |

|

|

| ||||

David M. Leuschen | III | 2022 | 2016 |

|

|

| ||||

Sean R. Smith | III | 2022 | 2020 |

|

|

| ||||

Maire A. Baldwin | I | 2023 | 2016 |

|

|

| ||||

Steven J. Shapiro (Chairman) | I | 2023 | 2019 |

|

|

| ||||

Robert M. Tichio | I | 2023 | 2016 |

|

|

| ||||

|

|

|

|

|

| = Chair |

| = Member | ||

The Nominating, Environmental, Social and Governance (NESG) Committee of our Board identifies, evaluates and recommends director candidates to our Board with the goal of identifying individuals with a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments. In evaluating director candidates, the NESG Committee may also consider certain other criteria as set forth in our Corporate Governance Guidelines, including:

| ▪ | the candidate’s experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| ▪ | the candidate’s experience as a board member of another publicly held company and, in the case of an incumbent director, such director’s past performance on our Board; |

| ▪ | the candidate’s professional and academic experience relevant to our industry; |

| ▪ | the strength of the candidate’s leadership skills; |

| ▪ | the candidate’s experience in finance and accounting and/or executive compensation practices; |

| ▪ | the diversity of the Board in terms of gender, race, ethnicity, age, sexual orientation, professional background and otherwise; and |

| ▪ | whether the candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable. |

The NESG Committee and the Board monitor the mix of specific experience, qualifications and skills of our directors in order to ensure that the Board, as a whole, has the necessary tools to perform its oversight function effectively. The NESG Committee identifies candidates through the personal, business and organizational

8

contacts of the directors and management, as well as through executive search firms engaged by the NESG Committee to assist in the process.

We are committed to building a diverse Board comprised of individuals from different backgrounds, including differences in viewpoints, education, gender, race or ethnicity, age and other individual qualifications and attributes. While our Board is comprised of directors with diverse background, experience and gender, our Board currently lacks diversity in terms of race and ethnicity, and we are seeking opportunities to enhance this diversity. In 2020, we revised our director nomination process to better reflect our commitment to board diversity, including the clarification that any search firm retained by our NESG Committee to assist in a director search process will be directed to present a diverse pool of candidates, including women, minority and other candidates of underrepresented communities.

Our Corporate Governance Guidelines require that each nominee for director sign and deliver to our Board an irrevocable letter of resignation that becomes effective if (a) the nominee does not receive a majority of the votes cast in an uncontested election, and (b) the Board decides to accept the resignation. The Board has received such conditional letters of resignation from each of the nominees named in Proposal 1.

While the NESG Committee will consider nominees suggested by shareholders, it did not receive any shareholder nominations for the Annual Meeting prior to the deadline for such nominations.

Summary of Director Qualifications

The biographies of the members of our Board have a diversity of experience and a wide variety of backgrounds, skills, qualifications and viewpoints that strengthen their ability to carry out their oversight role on behalf of our shareholders. The following matrix highlights key qualifications, skills, diversity and other attributes each director brings to the Board. More details on each director’s qualifications, skills and expertise are included in the director biographies on the following pages.

| Maire Baldwin | Karl Bandtel | Matthew Hyde | Pierre Lapeyre | David Leuschen | Steven Shapiro | Sean Smith | Jeffrey Tepper | Robert Tichio |

Age | 55 | 54 | 65 | 58 | 69 | 69 | 48 | 55 | 43 |

Tenure | 4 | 4 | 3 | 4 | 4 | 1 | 1 | 5 | 4 |

Gender Diversity |

|

|

|

|

|

|

|

|

|

Accounting / Financial Oversight |

|

|

|

|

|

|

|

|

|

Business Development / M&A |

|

|

|

|

|

|

|

|

|

ESG Oversight |

|

|

|

|

|

|

|

|

|

Executive Leadership |

|

|

|

|

|

|

|

|

|

Finance / Capital Markets |

|

|

|

|

|

|

|

|

|

Geology / Reservoir Engineering |

|

|

|

|

|

|

|

|

|

Investor Relations |

|

|

|

|

|

|

|

|

|

Marketing / Midstream |

|

|

|

|

|

|

|

|

|

Public Company Board |

|

|

|

|

|

|

|

|

|

Strategic Planning / Risk Management |

|

|

|

|

|

|

|

|

|

The three nominees for election as Class II directors are listed below. If elected, the nominees will serve on our Board for a term of three years expiring at our Annual Meeting of Shareholders in 2024 and until their respective successors are duly elected and qualified. Each of the nominees currently serves on our Board.

If prior to the Annual Meeting a nominee becomes unavailable to serve as a director, any shares represented by a proxy directing a vote will be voted for the remaining nominees and for any substitute nominee(s) designated by our Board. As of the mailing of these proxy materials, our Board has no reason to believe any director nominee would not be available to serve.

9

| |

✓Independent •Director since 2016 •Age: 54

Committees ▪NESG Committee (Chair) ▪Audit Committee

| Karl E. Bandtel has served as a director since October 2016. Mr. Bandtel was a Partner at Wellington Management Company, where he managed energy portfolios from 1997 until June 30, 2016, when he retired. He holds a Master of Business Administration and a Bachelor of Business Administration from the University of Wisconsin-Madison. We believe Mr. Bandtel is qualified to serve on our Board due to his extensive experience in evaluating and investing in energy companies, both public and private, and to his executive management skills developed as part of his career with Wellington Management Company. |

Matthew G. Hyde |

|

✓Independent •Director since 2018 •Age: 65

Committees ▪NESG Committee ▪Compensation Committee

| Matthew G. Hyde has served as a director since January 2018. Previously, Mr. Hyde was Senior Vice President of Exploration at Concho Resources Inc. from 2010 to 2016. After leaving Concho, Mr. Hyde was retired until joining our Board in January 2018. From 2008 to 2010, Mr. Hyde served as Concho’s Vice President of Exploration and Land. From 2001 to 2007, Mr. Hyde was an Asset Manager of Oxy Permian, a business unit of Occidental Petroleum Corporation (NYSE: OXY). Mr. Hyde served as President and General Manager of Occidental Petroleum Corporation’s international business unit in Oman from 1998 to 2001. Prior to that role, Mr. Hyde served in a variety of domestic and international exploration positions for Occidental Petroleum Corporation, including Regional Exploration Manager responsible for Latin American exploration activities. From 2008 to 2012, Mr. Hyde served in various leadership positions, including the Executive Committee and Chairman of the Board, for the New Mexico Oil & Gas Association (NMOGA), which promotes the safe and environmentally responsible development of oil and natural gas resources in New Mexico. Mr. Hyde has also served as a director of privately held Birch Permian Holdings, Inc. since April 2018. He is a graduate of the University of Vermont and the University of Massachusetts where he obtained Bachelor of Arts and Master of Science degrees, respectively, in Geology. Mr. Hyde also holds a Master of Business Administration from the University of California, Los Angeles. We believe Mr. Hyde is qualified to serve on our Board due to his extensive management and operational experience in the upstream oil and gas industry, including in the Permian Basin. |

Jeffrey H. Tepper |

|

✓Independent •Director since 2016 •Age: 55

Committees ▪Audit Committee (Chair) ▪Compensation Committee

| Jeffrey H. Tepper has served as a director since February 2016. Mr. Tepper is Founder of JHT Advisors LLC, an M&A advisory and investment firm. From 1990 to 2013, Mr. Tepper served in a variety of senior management and operating roles at the investment bank Gleacher & Company, Inc. and its predecessors and affiliates, where he was Head of Investment Banking and a member of the Firm’s Management Committee. As Gleacher’s former Chief Operating Officer, he also oversaw operations, compliance, technology and financial reporting. In 2001, Mr. Tepper co-founded Gleacher’s asset management activities and served as President. Gleacher managed over $1 billion of institutional capital in the mezzanine capital and hedge fund areas. Mr. Tepper served on the Investment Committees of Gleacher Mezzanine and Gleacher Fund Advisors. Between 1987 and 1990, Mr. Tepper was employed by Morgan Stanley & Co. as a financial analyst in the mergers & acquisitions and merchant banking departments. Mr. Tepper has been a director of Decarbonization Plus Acquisition Corporation (NASDAQ: DCRB) since 2020 and was previously a director of Alta Mesa Resources, Inc. from March 2017 to June 2020. Mr. Tepper received a Master of Business Administration from Columbia Business School and a Bachelor of Science in Economics from The Wharton School of the University of Pennsylvania with concentrations in finance and accounting. We believe Mr. Tepper is qualified to serve on our Board due to his significant investment and financial experience, particularly as it relates to mergers and acquisitions, corporate finance, leveraged finance and asset management. |

10

Vote Required and Board Recommendation

The election of each of our Class II director nominees requires the vote of a majority of the votes cast at the Annual Meeting, which means the number of votes cast “FOR” such nominee exceeds the number of votes cast “AGAINST” such nominee. Abstentions and broker non-votes will not be counted as votes cast and, therefore, will not have an effect on the outcome of the election of directors.

|

| Our Board unanimously recommends that you vote “FOR” the election of each of the director nominees named above. |

The terms of the six Class III and Class I directors will continue after the Annual Meeting and will expire at our 2022 (Class III) or 2023 (Class I) Annual Meeting of Shareholders. The biographies of these Continuing Directors are listed below.

Maire A. Baldwin |

|

✓Independent Director •Director since 2016 •Age: 55

Committees ▪Compensation Committee (Chair) ▪Audit Committee ▪NESG Committee

| Maire A. Baldwin has served as a director since October 2016 and was previously the Lead Independent Director from May 2018 to March 2020. Ms. Baldwin was employed as an Advisor to EOG Resources, Inc. (NYSE: EOG), an independent U.S. oil and gas company from March 2015 until April 2016. Prior to that, she served as Vice President Investor Relations at EOG from 1996 to 2014. Ms. Baldwin has served as a director of the Houston Parks Board since 2011, a non-profit dedicated to developing parks and green space in the greater Houston area where she serves on several committees. She is co-founder of Pursuit, a non-profit dedicated to raising funds and awareness of adults with intellectual and developmental disabilities. Ms. Baldwin has a Master of Business Administration and a Bachelor of Arts degree in Economics from the University of Texas at Austin. We believe Ms. Baldwin is qualified to serve on our Board due to her experience in the energy industry. From her executive experience with EOG, Ms. Baldwin has a deep understanding of the oil and gas industry generally and investor relations issues specifically, which we believe gives her an important insight into best practices relating to shareholder engagement and an understanding of the investment community’s expectations for public companies in our industry. |

Pierre F. Lapeyre, Jr. |

|

•Director since 2016 •Age: 58

| Pierre F. Lapeyre, Jr. has served as a director since October 2016. Mr. Lapeyre is a Founder of Riverstone Holdings, LLC, a private equity firm specializing in energy investments and has been a Partner/Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Lapeyre was a Managing Director of Goldman Sachs in its Global Energy and Power Group. Mr. Lapeyre joined Goldman Sachs in 1986 and spent his 14-year investment banking career focused on energy and power, particularly the midstream, upstream and energy service sectors. Mr. Lapeyre served as a non-executive board member of Riverstone Energy Limited (LSE: REL) from May 2013 until October 2020 and serves on the boards of directors or equivalent bodies of a number of public and private Riverstone portfolio companies and their affiliates. Mr. Lapeyre has also served as a director of Decarbonization Plus Acquisition Corporation (NASDAQ: DCRB) since August 2020, Decarbonization Plus Acquisition Corporation II (NASDAQ: DCRNU) since February 2021, and he was previously a director of Alta Mesa Resources, Inc. from February 2018 until June 2020. He has a Master of Business Administration from the University of North Carolina at Chapel Hill and a Bachelor of Science in Finance and Economics from the University of Kentucky. We believe Mr. Lapeyre is qualified to serve on our Board due to his extensive financing, mergers and acquisitions and investing experience in the energy and power industries. Furthermore, as a result of Mr. Lapeyre’s service on the boards of various energy and power companies, he is able to share best practices relating to transactions, risk oversight, shareholder engagement, corporate governance, corporate responsibility and management. |

11

| |

•Director since 2016 •Age: 69

| David M. Leuschen has served as a director since October 2016. Mr. Leuschen is a Founder of Riverstone and has been a Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Leuschen was a Partner and Managing Director at Goldman Sachs and founder and head of the Goldman Sachs Global Energy and Power Group. Mr. Leuschen joined Goldman Sachs in 1977, became head of the Global Energy and Power Group in 1985, became a Partner of that firm in 1986 and remained with Goldman Sachs until leaving to found Riverstone in 2000. Mr. Leuschen also served as Chairman of the Goldman Sachs Energy Investment Committee, where he was responsible for screening potential investments by Goldman Sachs in the energy and power industries and was responsible for establishing and managing the firm’s relationships with senior executives from leading companies in all segments of the energy and power industry. Mr. Leuschen has served as a non-executive board member of REL since May 2013 and serves on the boards of directors or equivalent bodies of a number of private Riverstone portfolio companies and their affiliates. Mr. Leuschen has also served as a director of Decarbonization Plus Acquisition Corporation (NASDAQ: DCRB) since August 2020, Decarbonization Plus Acquisition Corporation II (NASDAQ: DCRNU) since February 2021 and was previously a director of Alta Mesa Resources, Inc. from February 2018 until June 2020. Mr. Leuschen received a Master of Business Administration from Dartmouth’s Amos Tuck School of Business and a Bachelor of Arts degree from Dartmouth College. As a founder of Riverstone, Mr. Leuschen has overseen investments in, and the operations of, various companies in the energy and power industries. Mr. Leuschen also serves as a director on the boards of various other energy and power companies, which we believe further enhances his understanding of the industry and perspective on best practices relating to corporate governance. For these reasons, among others, we believe Mr. Leuschen is qualified to serve as a director. |

Steven J. Shapiro |

| |

✓Independent Chairman of the Board •Director since 2019 •Age: 69

Committees ▪Compensation Committee ▪NESG Committee

| Steven J. Shapiro has served as a director since October 2019 and became the Chairman of the Board in April 2020. Mr. Shapiro is a Senior Advisor to Outfitter Energy Capital, a private equity group focused on the energy industry, a position he has held since December 2016. From 2006 through December 2016, Mr. Shapiro was a Senior Advisor to TPH Partners, the legacy private equity business of Tudor, Pickering, Holt & Co. From 2000 to 2006, Mr. Shapiro held various leadership positions at Burlington Resources Inc., an oil and gas exploration and production company, including Executive Vice President of Finance and Corporate Development and Executive Vice President and Chief Financial Officer. While at Burlington Resources, he also served on the Board of Directors starting in 2004. From 1993 to 2000, Mr. Shapiro served as Senior Vice President, Chief Financial Officer and Director at Vastar Resources, Inc., an oil and gas exploration and production company. Previously, Mr. Shapiro spent 16 years with Atlantic Richfield Company, a global oil and gas company, beginning as a planning analyst in 1977 and later holding a variety of positions in ARCO’s coal and minerals businesses. Mr. Shapiro is also a Director of Elk Meadows Resources, LLC, a private oil and gas exploration and production company, a position he has held since 2013. Mr. Shapiro previously served from 2004 to January 2019 as a Director of Barrick Gold Corporation, a gold mining company (Nasdaq: GOLD); from 2010 to 2017 as Chairman of GeoSynFuels, LLC, a private biofuels company; from 2006 to 2012 as a Director of El Paso Corporation, an oil and gas exploration and production company; and from 2010 to 2012 as a Director of Asia Resource Minerals PLC, a coal exploration and mining company. Mr. Shapiro holds an undergraduate degree in Industrial Economics from Union College and a Master of Business Administration from Harvard University. From his executive experience with Burlington Resources, Mr. Shapiro has significant oil and gas operating experience and knowledge of the complex financial issues that public companies face. Mr. Shapiro has also served on the Board of Directors of other publicly traded companies, and we believe his knowledge and experience in this area will further strengthen our Board. | |

12

| ||

•Director since 2020 •Age: 48

| Sean R. Smith has served as our Chief Executive Officer and as a director since April 2020. Previously, Mr. Smith served as our Chief Operating Officer since October 2016. From May 2014 until October 2016, he served as Vice President, Geosciences of Centennial Resource Production, LLC, the private Centennial that was later acquired in connection with our business combination. Prior to joining Centennial, Mr. Smith worked at QEP Resources from February 2013 to May 2014, where he served in several roles, including as a General Manager, leading the geoscience, regulatory and reservoir engineering departments for the Williston, Powder River and Denver Julesburg Basins. Prior to QEP Resources, from 2005 to February 2013, Mr. Smith worked at Resolute Energy Corporation as a Manager and Geologist. He has also worked in various geotechnical roles at Kerr-McGee and Sanchez Oil & Gas. Mr. Smith earned his Bachelor of Arts degree in Geology from Lawrence University. He is licensed with the Texas Board of Professional Geoscientists. We believe that Mr. Smith’s role as the Chief Executive Officer, as well as his substantial experience with and understanding of the energy industry and public companies generally and our company and its assets specifically, qualify him to serve as a member of our Board. | |

Robert M. Tichio |

|

•Director since 2016 •Age: 43

| Robert M. Tichio has served as a director since October 2016. Mr. Tichio is a Partner of Riverstone and joined Riverstone in 2006. Prior to joining Riverstone, Mr. Tichio was in the Principal Investment Area of Goldman Sachs, which manages the firm’s private corporate equity investments. Mr. Tichio began his career at J.P. Morgan in the Mergers & Acquisitions group where he concentrated on assignments that included public company combinations, asset sales, takeover defenses and leveraged buyouts. Mr. Tichio serves on the boards of a number of Riverstone portfolio companies and their affiliates and has been a director of Talos Energy Inc. (NYSE: TALO) since April 2012. Mr. Tichio has been a director of Decarbonization Plus Acquisition Corporation (NASDAQ: DCRB) since August 2020 and currently serves as the Chairman. He has also been a director of Decarbonization Plus Acquisition Corporation II (NASDAQ: DCRNU) since December 2020. He holds a Master of Business Administration from Harvard Business School and a Bachelor of Arts degree from Dartmouth College. We believe Mr. Tichio is qualified to serve on our Board due to his capital markets and mergers and acquisitions experience. Mr. Tichio also serves as a director on the boards of other energy companies, which we believe further enhances his understanding of the industry and perspective on best practices relating to corporate governance, management and capital markets transactions. |

13

We are committed to corporate governance practices that promote the long-term interests of our shareholders, strengthen our Board, foster management accountability and help build public trust in our company. The table below sets forth some of our most important governance highlights, which are described in more detail in this Proxy Statement.

Board and Committee Structure

✓ Independent Chairman of the Board | ✓ Classified Board |

✓ 5 of 9 Independent Directors | ✓ Independent Committee Members |

✓ Diverse Board Skills and Experience | ✓ Majority Voting in Uncontested Director Elections |

Board and Committee Governance; Board’s Role in Risk Oversight

✓ Corporate Governance Guidelines | ✓ Annual Board and Committee Self-Evaluations |

✓ Code of Business Conduct and Ethics | ✓ Director Education |

✓ Board and Committee Risk Oversight | ✓ Active Shareholder Engagement |

✓ No Shareholder Rights (Poison Pill) or Similar Plan | ✓ Confidential Complaint and Reporting Procedures |

✓ Regular Review and Update of Committee Charters and other Governance Policies | ✓ Review of Related Person Transactions and other potential Conflicts of Interests |

Our website (www.cdevinc.com) includes materials that are helpful in understanding our corporate governance practices, including our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Policy for Related Person Transactions, Policy for Accounting-Related Complaints and charters for the committees of our Board.

As an oil and gas exploration and production company, we encounter a variety of risks, including, among others, commodity price volatility and supply and demand risks, risks associated with rising costs of doing business, availability of capital and financing, risks associated with our development, acquisition and production activities, environmental and other regulatory risks, weather-related risks and political instability. In 2020, many of the risks we face were exacerbated by COVID-19 and the ensuing global health pandemic. We encourage you to read our discussion of some of the risks we face in the “Risk Factors” section of our 2020 Annual Report.

Our senior management is responsible for the day-to-day management of the risks we face. We have a Risk Management Committee comprised of our Chief Financial Officer, Chief Operating Officer and General Counsel, and such other officers and employees as may be appointed from time to time by the committee. The committee meets regularly to identify, assess and manage our risk exposures and periodically reports significant risk exposures to the Audit Committee or the Board.

Our Board, directly and through its committees, oversees our management of risk exposures. Specifically, our Board is responsible for ensuring that the risk management processes designed and implemented by management are adequate to address the risks we face and function as intended. Accordingly, during the course of each year, the Board (1) reviews and approves management’s operating plans and considers any risks that could affect operating results, (2) reviews the structure and operation of our various departments and functions and (3) in connection with the review and approval of particular transactions and initiatives, reviews related risk analyses and mitigation plans.

The Board has delegated certain risk oversight responsibility to its Committees. The following table identifies the primary risk oversight of each Committee.

14

Audit Committee | Compensation Committee | NESG Committee |

▪ Financial statements and financial reporting processes ▪ Related person transactions ▪ Cybersecurity ▪ Oil and gas reserves ▪ Management’s general guidelines, policies and processes to identify and address risk exposures ▪ The adequacy and effectiveness of our internal control policies and procedures | ▪ Risks related to compensation arrangements and whether performance goals encourage excessive risk taking ▪ Retention risks ▪ Other risks relating to our human capital | ▪ Corporate governance, including board structure ▪ Succession planning ▪ ESG matters

|

NASDAQ listing rules require that a majority of the board of directors of a company listed on NASDAQ be composed of “independent directors,” which is generally defined as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which, in the opinion of the company’s board of directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board has determined that Maire Baldwin, Karl Bandtel, Matthew Hyde, Steven Shapiro and Jeffrey Tepper are independent within the meaning of the NASDAQ listing rules. Further, our Board has determined that Maire Baldwin, Karl Bandtel and Jeffrey Tepper, the current members of the Audit Committee, are independent with the meaning of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the Exchange Act).

The NESG Committee oversees and approves plans for succession planning. As it relates to CEO succession planning, the Committee identifies the qualities and characteristics necessary for an effective CEO and monitors and reviews the development and progression of potential candidates against these standards. The Committee also regularly consults with the CEO on senior management succession planning.

During 2020, the NESG Committee (known at the time as the Nominating and Corporate Governance Committee) recommended to the Board, and the Board approved, a CEO succession plan. Pursuant to the succession plan, following the retirement of Mark Papa, our former Chairman and CEO, the following governance changes and leadership transition became effective on April 1, 2020:

| ▪ | The roles of Chairman of the Board and CEO were separated; |

| ▪ | Sean Smith, our former Chief Operating Officer, became our CEO; |

| ▪ | Steven Shapiro, an independent director on the Board, became the Chairman of the Board; and |

| ▪ | Matthew Garrison, our former Vice President of Geosciences, became our Chief Operating Officer. |

We have no policy with respect to the separation of the offices of Chairman of the Board and Chief Executive Officer. As discussed above, the Board separated the Chairman and CEO roles in 2020 pursuant to a succession plan that was put in place upon the retirement of Mr. Papa. Our Board believes this leadership structure permits the CEO to focus his attention on setting the strategic direction of our company and managing our business while allowing the Chairman to function as an important liaison between our management and the Board, enhancing the ability of the Board to provide oversight of the Company’s management and affairs.

15

The Board, in consultation with the NESG Committee, has determined that a classified board structure continues to be appropriate for our company at this time and to be in the best interests of our shareholders. A classified board provides for stability, continuity and experience within our Board. In our industry in particular, long-term strategic planning is critical for the successful development of oil and natural gas resources through commodity price cycles. This structure can reduce pressure on the directors to focus on short-term results at the expense of our long-term value and success. In this regard, we believe that a three-year term for each of our directors enhances director independence from both management and shareholder special interest groups.

Majority Vote in Director Elections

Our governance documents provide for a majority voting standard in uncontested director elections. As a result, election of the director nominees named in Proposal 1 requires that each director be elected by a majority of the votes cast, meaning that the number of shares voted “FOR” a nominee must exceed the number of shares voted “AGAINST” such nominee. We believe that this majority voting standard in uncontested director elections gives our shareholders a greater voice in determining the composition of our Board than a plurality voting standard. For any director election where the number of director nominees exceeds the number of directors to be elected (in other words, a contested election), a plurality voting standard continues to apply pursuant to our governance documents.

Our Corporate Governance Guidelines include a director resignation policy to address the issue of any “holdover” director who is not re-elected but remains a director because his or her successor has not been elected or appointed. This policy requires each incumbent director that is nominated by our Board for re-election to tender an irrevocable resignation letter to the Board prior to the mailing of the proxy statement for the meeting at which such nominee is to be re-elected as director. If such incumbent director is not re-elected by a majority vote in an uncontested election, the NESG Committee will consider the tendered resignation and make a recommendation to our Board as to whether to accept or reject the resignation. The Board would then, after taking into account the recommendation of the NESG Committee, accept or reject such tendered resignation generally within 90 days following certification of the election results. Thereafter, we would publicly disclose the decision of the Board and, if applicable, the Board’s reasons for rejecting a tendered resignation. If a director’s tendered resignation is rejected, such director would continue to serve until a successor is elected, or until such director’s earlier removal or death. If a director’s tendered resignation is accepted, then the Board could fill any resulting vacancy or decrease the number of directors.

Our Board conducts its business through meetings of the Board, actions taken by written consent in lieu of meetings and by the actions of its committees. During 2020, the Board held 16 meetings, which was up significantly from the number of Board meetings held in recent years. More than half of these meetings occurred from March through May as the Board and its Committees were meeting regularly with the Company’s management to discuss risk assessments relating to COVID-19 and the resulting depressed commodity prices. During this timeframe, David Leuschen was unable to attend some of the meetings as a result of an ethics wall created at Riverstone to facilitate the discussion and negotiation of the debt exchange transaction that occurred in May 2020, in which Riverstone participated. As a result, Mr. Leuschen’s attendance for 2020 dropped to approximately 67% of the total number of Board meetings. No other incumbent director attended fewer than 75% of the total number of meetings of the Board held during 2020.

16

The Board currently has three standing committees: the Audit Committee, the Compensation Committee and the Nominating, Environmental, Social and Governance (NESG) Committee. Each of the committees reports to the Board as it deems appropriate and as the Board may request. The composition of the committees at the end of 2020, as well as the duties and responsibilities of each of the committees, are set forth below. From time to time and as necessary to address specific issues, our Board may establish other committees.

Independent Director | Committee Membership | |||||||

Audit | Compensation | NESG | ||||||

Maire A. Baldwin |

|

|

| |||||

Karl E. Bandtel |

|

|

| |||||

Matthew G. Hyde |

|

|

| |||||

Steven J. Shapiro |

|

|

| |||||

Jeffrey H. Tepper |

|

|

| |||||

Number of Meetings Held in 2020 | 7 | 7 | 4 | |||||

|

|

|

| |||||

|

|

| = Chair |

| = Member | |||

Audit Committee

The principal functions of our Audit Committee are detailed in the Audit Committee charter, which is posted on the Investor Relations portion of our website at www.cdevinc.com, and include:

| ▪ | the appointment, compensation, retention, replacement and oversight of the work of the independent auditors and any other independent registered public accounting firm engaged by us; |

| ▪ | pre-approving all audit and permitted non-audit services to be provided by the independent auditors or any other registered public accounting firm engaged by us, and establishing pre-approval policies and procedures; |

| ▪ | reviewing and discussing with the independent auditors all relationships the auditors have with us in order to evaluate their continued independence; |

| ▪ | setting clear hiring policies for employees or former employees of the independent auditors; |

| ▪ | setting clear policies for audit partner rotation in compliance with applicable laws and regulations; |

| ▪ | reviewing our annual audited financial statements and quarterly financial statements with management and our independent auditors prior to their final completion and filing with the Securities and Exchange Commission (SEC); |

| ▪ | reviewing the adequacy and effectiveness of our internal control policies and procedures, including the results of management’s testing of the operating effectiveness of controls; |

| ▪ | meeting annually with our independent petroleum reservoir engineering firm and management to review the process by which our oil and gas reserves are estimated and reported; |

| ▪ | reviewing and approving any related person transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC prior to us entering into such transaction; |

| ▪ | reviewing the program, policies and systems we have in place to monitor compliance with the Code of Business Conduct and Ethics and any ethics complaints we may receive; and |

| ▪ | reviewing with management, the independent auditors and our legal advisors, as appropriate, any legal, regulatory or compliance matters, including any correspondence with regulators or government agencies and any employee complaints or published reports that raise material issues regarding our financial statements or accounting policies and any significant changes in accounting standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other regulatory authorities. |

17

Our Audit Committee consists of Jeffrey Tepper, Karl Bandtel and Maire Baldwin, with Mr. Tepper serving as the Chair. We believe that Messrs. Tepper and Bandtel and Ms. Baldwin qualify as independent directors according to the rules and regulations of the SEC with respect to audit committee membership. We also believe that Mr. Tepper qualifies as our “audit committee financial expert,” as such term is defined in Item 401(h) of Regulation S-K.

Compensation Committee

The principal functions of our Compensation Committee are detailed in the Compensation Committee charter, which is posted on the Investor Relations portion of our website at www.cdevinc.com, and include:

| ▪ | reviewing and approving on an annual basis the corporate goals and objectives relevant to our CEO’s compensation, evaluating our CEO’s performance in light of such goals and objectives and determining and approving the compensation (if any) of our CEO based on such evaluation; |

| ▪ | reviewing and approving on an annual basis the compensation of all of our other officers; |

| ▪ | reviewing on an annual basis our executive compensation policies and plans; |

| ▪ | implementing and administering our incentive compensation plans; |

| ▪ | evaluating whether our compensation arrangements encourage unnecessary or excessive risk taking; |

| ▪ | assisting management in complying with our proxy statement and annual report disclosure requirements; |

| ▪ | approving all special perquisites, special cash payments and other special compensation and benefit arrangements for our officers; |

| ▪ | producing a report on executive compensation to be included in our proxy statement; |

| ▪ | selecting and retaining independent compensation consultants; |

| ▪ | supporting management’s engagement with shareholders on executive compensation matters; |

| ▪ | considering the voting results of prior say-on-pay proposals; and |

| ▪ | reviewing, evaluating and recommending changes, if appropriate, to the compensation for directors. |

Our Compensation Committee consists of Maire Baldwin, Matthew Hyde, Steven Shapiro and Jeffrey Tepper, with Ms. Baldwin serving as the Chair. Our Board has affirmatively determined that Ms. Baldwin and Messrs. Hyde, Shapiro and Tepper meet the definition of “independent director” for purposes of serving on a compensation committee under the NASDAQ listing rules.

The Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors (independent or otherwise) to assist in carrying out its responsibilities. For information regarding the role of our CEO, other executive officers and compensation consultants in determining our executive and director compensation, please refer to the section entitled “Compensation Discussion and Analysis—Determination of Compensation.”

Nominating, Environmental, Social and Governance Committee

In October 2020, the Board adopted changes to the charter of the NESG Committee (formerly known as the Nominating and Corporate Governance Committee) to (1) change the name of the Committee to the “Nominating, Environmental, Social and Governance Committee” and (2) expressly delegate oversight authority to the Committee on environmental, social and governance (ESG) matters.

The principal functions of our NESG Committee are detailed in the charter of the NESG Committee, which is posted on the Investor Relations portion of our website at www.cdevinc.com, and include:

| ▪ | assisting the Board in identifying individuals qualified to become members of the Board, consistent with criteria approved by the Board; |

| ▪ | recommending director nominees for election or for appointment to fill vacancies; |

| ▪ | reviewing and making recommendations to the Board on corporate governance matters; |

18

| ▪ | reviewing and monitoring our policies, controls and systems relating to ESG matters, as well as broader ESG trends; |

| ▪ | monitoring the independence of directors; |

| ▪ | overseeing and approving plans for CEO succession; |

| ▪ | overseeing annual evaluations of the Board, its committees and our management; and |

| ▪ | ensuring the availability of director education programs. |

The NESG Committee also develops and recommends to the Board corporate governance and ESG principles and practices and assists in implementing them, including conducting a regular review of our corporate governance and ESG principles and practices. Pursuant to its charter, the NESG Committee will treat recommendations for directors that are received from our shareholders equally with recommendations received from any other source. The NESG Committee oversees the annual performance evaluation of the Board and the committees of the Board and makes a report to the Board on succession planning.

Our NESG Committee consists of Karl Bandtel, Maire Baldwin, Matthew Hyde and Steven Shapiro, with Mr. Bandtel serving as the Chair. Our Board has affirmatively determined that Messrs. Bandtel, Hyde and Shapiro and Ms. Baldwin meet the definition of “independent director” for purposes of serving on a nominations committee under the NASDAQ listing rules.

Our Board believes that director education is essential to the ability of our directors to fulfill their roles as directors. When a new director joins our Board, we provide a director orientation. Directors are also encouraged to attend continuing education programs designed to enhance the performance and competencies of individual directors and our Board, including through participation in National Association of Corporate Directors (NACD) events. Directors are reimbursed for any relevant director education programs they attend.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2020, no officer or employee of the Company served as a member of our Compensation Committee. None of our executive officers serve, or have served during the year ended December 31, 2020, as a member of the board of directors or compensation committee of any entity that has or had one or more executive officers serving on our Board or Compensation Committee.

Code of Business Conduct and Ethics

We have adopted a written Code of Business Conduct and Ethics (the Code of Ethics) that applies to our directors, officers and employees and that, among other purposes, is intended to assist directors, officers and employees in recognizing, avoiding and resolving ethical issues. The Code of Ethics covers various topics, including the standards of honest, ethical and fair conduct, conflicts of interest, gifts and entertainment, use of company assets, disclosure requirements, compliance, reporting and accountability, insider information and trading, issues relating to health, safety and the environment, confidentiality, anti-corruption laws and others.

The Code of Ethics is designed to comply with SEC regulations and NASDAQ listing standards related to codes of conduct and ethics and is posted on the Investor Relations portion of our website at www.cdevinc.com. A copy of our Code of Ethics is also available free of charge, upon request directed to Centennial Resource Development, Inc., 1001 17th Street, Suite 1800, Denver, Colorado, 80202, Attention: General Counsel. We intend to satisfy the disclosure requirements regarding any amendment to, or any waiver of, a provision of the Code of Ethics by posting such information on our website within four business days following the date of any such amendment or waiver.

Complaint and Reporting Procedures

We have established complaint and reporting procedures that are posted on the Investor Relations portion of our website. Any person, whether or not an employee, who has a concern about our conduct or the conduct of any of our employees, may, in an anonymous manner, communicate that concern by calling one of our hotlines. Our Accounting and Compliance Whistleblower Hotline is available at 1-844-418-4481 and is intended to facilitate reporting of accounting and compliance issues. We also maintain a separate Operational Concerns Hotline, which

19

is available at 1-844-778-5868 and is intended to facilitate reporting of concerns relating to our operations, working environment, course of dealing with contractors and other operational matters. These hotlines are available 24 hours a day, seven days a week.

Annual Board and Committee Evaluation Process

The Board and each of our committees conducted self-evaluations related to their performance in 2020, including an evaluation of each director. The NESG Committee supervises the performance evaluations and uses various processes from year to year in order to solicit feedback, including Board and committee-level questionnaires prepared by each of the Board and committee members, the responses to which are used to evaluate the effectiveness of Board and committee performance and to identify areas for improvement and issues for further discussion. Following a discussion of the results of the evaluations, the Board and each committee review and discuss the evaluation results and take this information into account when assessing the qualifications of the Board and its directors, further enhancing the effectiveness of the Board and its committees over time.

Policies Relating to our Board

Shareholder Communications with the Board

All shareholders who wish to contact the Board may send written correspondence to Centennial Resource Development, Inc., 1001 17th Street, Suite 1800, Denver, Colorado, 80202, Attention: General Counsel. Communications may be addressed to an individual director, to the non-management or independent directors as a group or to the Board as a whole, marked as confidential or otherwise. Communications not submitted confidentially, which are addressed to directors that discuss business or other matters relevant to the activities of our Board, will be preliminarily reviewed by the office of the General Counsel and then distributed either in summary form or by delivering a copy of the communication. Communications marked as confidential will be distributed, without review by the office of the General Counsel, to the director or group of directors to whom they are addressed, unless there are safety or security concerns that mitigate against further transmission.

Separate Sessions of Independent Directors

Our Corporate Governance Guidelines require the Board to hold executive sessions for the independent directors, without any non-independent directors or management present, on a regularly scheduled basis but not less than twice per year. Our independent directors met in executive session on 6 occasions in 2020. Each of our independent directors attended each of the executive sessions.

Director Attendance at Annual Meeting of Shareholders

Although we do not have a formal policy regarding director attendance at our Annual Meeting of Shareholders, we encourage directors to attend. All of our directors attended the 2020 Annual Meeting of Shareholders.

We believe that maintaining an open dialogue with our shareholders provides critical feedback for our Board and executive management team on a wide range of topics including our short- and long-term business strategy, performance, ESG matters, governance practices, executive compensation program and other matters of importance. As part of this commitment, and partially in response to a say-on-pay vote at our 2020 Annual Meeting of Shareholders that was lower than in previous years, our Board and management team expanded our regular shareholder engagement to better understand the views of our shareholders. Through this process, we reached out to our 30 largest shareholders, who collectively hold about 60% of our outstanding shares, as well as certain additional shareholders that were significant shareholders during 2020.

For more information on what we heard from our shareholders and how we have responded, please read “Response to 2020 Say-on-Pay Vote and Shareholder Outreach” on page 24.

20

Environmental, Social and Governance (ESG) Initiatives

We are committed to producing oil and natural gas in a way that creates long-term value for our stakeholders, which includes the commitment to do so in an ethical, inclusive, pragmatic and environmentally and socially responsible way. That commitment extends throughout our operations and includes a dedication to superior performance with respect to ESG matters.

In early 2021, we published our inaugural Corporate Sustainability Report, which is available on our website at www.cdevinc.com/corporate-sustainability. The Report builds upon and substantially expands our prior ESG disclosures and covers our performance in environmental stewardship, regulatory compliance, health and safety, corporate governance, ethics, security, workforce diversity and development, wellbeing and community engagement matters. Below are some highlights from our Corporate Sustainability Report.

| Board Governance | ▪ Separated the roles of Chairman and CEO in 2020 with the appointment of an independent Chairman of the Board ▪ Majority voting standard in uncontested director elections |

| ESG Management & Oversight | ▪ Formed an ESG working group, consisting of select individuals from across the organization, to manage our ESG initiatives and regularly report to the NESG Committee ▪ Delegated specific authority to oversee ESG matters to the NESG Committee (re-named as a result to reflect the ESG oversight role) |

| Water Recycling | ▪ Recycled and reused 4.8 million barrels of water in 2020 ▪ Increased water recycling by 60% from 2019 levels |

| Flaring | ▪ Reduced the percentage of natural gas flared by 38% from 2019 levels ▪ Flared only 0.5% of natural gas volumes in Q4 2020 ▪ Set a 2021 flaring target of 1% of all produced natural gas |

| Prioritizing Pipelines Over Trucks | ▪ Transported 99% of our produced water by pipeline, reducing trucking-related emissions, improving safety, minimizing the potential for spills and lessening the impact on local roads |

| Responsibly Powering Our Operations | ▪ Used dual-fuel systems on drilling rigs and completion equipment to reduce diesel consumption and related emissions ▪ Connected our Reeves County, TX wells to the electric grid, reducing the use of diesel and natural gas generators (and the related emissions) from 135 to 10 |

| Emission Detection | ▪ Expanded our leak detection and repair program to identify and manage fugitive emissions, including through inspections using optical gas imaging cameras |

| Land Use | ▪ Utilized multiple wells pads and centralized production facilities, which reduce surface impact compared to single well pads and facilities ▪ Limited oil spills to 0.003% of oil produced in 2020 ▪ Limited produced water spills to 0.014% of water produced in 2020 |

| Health & Safety | ▪ Suffered 0 recordable employee injuries in 2020 ▪ Suffered 0 reported workplace transmissions of COVID-19 |

| Diversity & Inclusion | ▪ Women accounted for 38% of our employees (and 34% of our supervisors and managers) as of December 31, 2020 ▪ Minorities accounted for 24% of our employees (and 11% of our supervisors and managers) as of December 31, 2020 |

21

The Audit Committee has reviewed and discussed with management of the Company and KPMG LLP, the Company’s independent registered public accounting firm, the audited financial statements of the Company for the fiscal year ended December 31, 2020 (the Audited Financial Statements).

The Audit Committee has discussed with KPMG LLP the matters required to be discussed by the Public Company Accounting Oversight Board (PCAOB) Auditing Standard No. 1301, as in effect on the date of this Proxy Statement.

The Audit Committee has: (1) considered whether non-audit services provided by KPMG LLP are compatible with its independence; (2) received the written disclosures and the letter from KPMG LLP required by the applicable requirements of the PCAOB regarding KPMG LLP’s communications with the Audit Committee concerning independence; and (3) discussed with KPMG LLP its independence.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board that the Audited Financial Statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2020 for filing with the SEC.

Respectfully submitted,

The Audit Committee

Jeffrey H. Tepper (Chair)

Maire A. Baldwin

Karl E. Bandtel

22

Compensation Discussion and Analysis

Introductory Note

The COVID-19 pandemic created unprecedented challenges for the global economy, our industry and our company in 2020. In response to the pandemic, we took early action implementing protocols to protect the health and safety of our employees, contractors and their families. Through a series of precautionary measures, including remote working for many of our employees, we were able to keep our workforce safe without experiencing any operational disruptions or reported COVID-19 workplace transmissions.

The pandemic, taken together with related governmental actions, resulted in a significant decline in the demand for oil and natural gas. As a result, we saw extremely depressed commodity prices, including oil prices that briefly went negative in April 2020. In response, we adjusted our operational plans to preserve capital by halting all drilling and completion operations in the second and third quarters, reduced our workforce by approximately 23% to better align our headcount with operational needs and reduced the salaries and cash retainers of our officers, employees and directors.