Information regarding the Company and CRP

Set forth below is information regarding Centennial Resource Development, Inc. (the “Company” or “Centennial”) and Centennial Resource Production, LLC (“CRP”) included in the Offering Memorandum.

Reserves

The following table summarizes our estimated proved reserves and the related proved pre-tax PV10% (“Pre-Tax PV10%”) using SEC Pricing as of December 31, 2019 (the “SEC Pricing Reserves”) and Strip Pricing from April 15, 2020 (the “Strip Pricing Reserves”). The reserve estimates presented in the table below are as of December 31, 2019 and are based on reports prepared by Netherland, Sewell & Associates, Inc. (“NSAI”), our independent petroleum engineer. The SEC Pricing Reserves estimates were prepared by NSAI in accordance with current SEC rules and regulations regarding oil, natural gas and NGL reserve reporting and the Strip Pricing Reserves estimates were prepared by our management team and audited by NSAI, using closing month futures prices as reported on the NYMEX WTI for oil and NYMEX Henry Hub for natural gas on April 15, 2020.

|

| | | | | | | |

| | As of December 31, 2019 |

| | SEC Pricing(1) | | Strip Pricing(2) |

| Proved Reserves: | | | |

| Oil (MBbls) | 150,159 |

| | 139,406 |

|

| Natural gas (MMcf) | 502,430 |

| | 471,108 |

|

| NGLs (MBbls) | 67,242 |

| | 62,751 |

|

Total proved reserves (MBoe) (3) | 301,139 |

| | 280,675 |

|

| Proved Developed Reserves: | | | |

| Oil (MBbls) | 74,842 |

| | 74,476 |

|

| Natural gas (MMcf) | 237,791 |

| | 240,334 |

|

| NGLs (MBbls) | 32,743 |

| | 32,887 |

|

Total proved developed reserves (MBoe) (3) | 147,216 |

| | 147,419 |

|

| Proved Undeveloped Reserves: | | | |

| Oil (MBbls) | 75,317 |

| | 64,930 |

|

| Natural gas (MMcf) | 264,639 |

| | 230,774 |

|

| NGLs (MBbls) | 34,499 |

| | 29,864 |

|

Total proved undeveloped reserves (MBoe) (3) | 153,923 |

| | 133,256 |

|

| Reserve Values (in millions): | | | |

Proved developed Pre-Tax PV10% (4) | $ | 1,574.4 |

| | $ | 986.4 |

|

Proved undeveloped Pre-Tax PV10% (4) | 623.5 |

| | 300.2 |

|

Total proved Pre-Tax PV10% (4) | 2,197.9 |

| | 1,286.6 |

|

| Less: discounted future income tax expense | 135.5 |

| | 18.8 |

|

| Standardized measure of discounted future net cash flows | $ | 2,062.4 |

| | $ | 1,267.8 |

|

______________________

| |

(1) | Our estimated proved reserves as of December 31, 2019, and the related Pre-Tax PV10%, were calculated using the twelve-month trailing average of the first-day-of-the-month benchmark price of $52.19 per Bbl (the average West Texas Intermediate (“WTI”) posted price) and $2.58 per MMbtu (the average NYMEX Henry Hub spot price). All prices are held constant throughout the lives of the properties in accordance with SEC rules and are adjusted for transportation, quality and basis differentials as applicable. The weighted average sales prices inclusive of these adjustments as of December 31, 2019 were $52.62 per Bbl of oil, $18.99 per Bbl of NGL and $0.87 per Mcf of gas. |

| |

(2) | Our Strip Pricing Reserves estimates were prepared on the same basis as our SEC Pricing Reserves, except for the use of pricing based on closing monthly future prices as reported on the NYMEX WTI for oil and NYMEX Henry Hub for natural gas on April 15, 2020 and updated capital expenditures and development timing assumptions congruent with the pricing assumptions. The average future prices for benchmark commodities used in determining our Strip Pricing Reserves were $34.61 per Bbl for oil for 2020, $35.62 for 2021, $38.10 for 2022, $40.15 for 2023, $45.28 for 2024 through 2027 and $49.43 thereafter on the NYMEX WTI, and $2.05 per Mcf for natural gas for 2020, $2.58 for 2021, $2.43 for 2022, $2.40 for 2023, $2.46 for 2024 through 2029 and $2.58 for 2030 and thereafter, on the NYMEX Henry Hub. NGL pricing used in determining our Strip Pricing Reserves were approximately 30% of future crude oil prices. We believe that the use of forward prices provides investors with additional useful information about our reserves, as the forward prices are based on the market’s forward-looking expectations of oil and natural gas prices as of a certain date. Strip Pricing futures prices are not necessarily an accurate projection of future oil and gas prices. Investors should be careful to consider forward prices in addition to, and not as a substitute for, SEC prices, when considering our oil and natural gas reserves. |

| |

(3) | Calculated by converting natural gas to oil equivalent barrels at a ratio of six Mcf of natural gas to one Boe. |

| |

(4) | Pre-Tax PV10%, which includes the value of proved developed and proved undeveloped Pre-Tax PV10%, may be considered a non-GAAP financial measure as defined by the SEC and is derived from the standardized measure of discounted future net cash flows (the “Standardized Measure”), which is the most directly comparable GAAP financial measure. Pre-Tax PV10% is computed on the same basis as the Standardized Measure but without deducting future |

income taxes. We believe Pre-Tax PV10% is a useful measure for investors when evaluating the relative monetary significance of our oil and natural gas properties. We further believe investors may utilize our Pre-Tax PV10% as a basis for comparison of the relative size and value of our proved reserves to other companies because many factors that are unique to each individual company impact the amount of future income taxes to be paid. Our management uses this measure when assessing the potential return on investment related to our oil and gas properties and acquisitions. However, Pre-Tax PV10% is not a substitute for the Standardized Measure. Our Pre-Tax PV10% and Standardized Measure do not purport to present the fair value of our proved oil, NGL and natural gas reserves.

Recent Developments

Operational and Capital Budget Update

The recent worldwide outbreak of COVID-19, the uncertainty regarding the impact of COVID-19 and various governmental actions taken to mitigate the impact of COVID-19, have resulted in an unprecedented decline in demand for oil and natural gas. At the same time, the decision by Saudi Arabia in March 2020 to drastically reduce export prices and increase oil production followed by curtailment agreements among OPEC and other countries such as Russia further increased uncertainty and volatility around global oil supply-demand dynamics. Due to the decline in crude oil prices and ongoing uncertainty regarding the oil supply-demand macro environment, we have recently suspended all drilling and completion activities in order to preserve capital. Specifically, we recently reduced our operated drilling rig program to zero rigs, which is down from the one-rig program we announced on March 19, 2020 and the four-rig program that we announced with our 2020 operational guidance on February 24, 2020. As a result, we expect that our total capital expenditure budget for 2020 will be between $240 million to $290 million, which represents an approximate 60% reduction utilizing the mid-point from our original capital expenditures budget announced on February 24, 2020. Our updated guidance range provides us with the flexibility to resume modest operational activity in the second half of 2020, depending upon commodity prices and other factors. We expect to fund the remainder of our 2020 capital expenditures with cash flows from operations and borrowings under our Credit Agreement.

In addition, given the weakness in realized oil prices, we are actively evaluating whether to voluntarily curtail or shut-in a substantial portion of our current production volumes and will continue to evaluate such a measure on a regular basis in response to market conditions and contractual obligations. As substantially all of our revenues are generated by the production and sale of hydrocarbons, the curtailment or shut-in of our production could adversely affect our business, financial condition, results of operations, liquidity, and ability to finance planned capital expenditures.

Preliminary Estimate of Selected First Quarter 2020 Financial Results

We have prepared the following prospective financial information to present selected estimated results for the three months ended March 31, 2020. Management has prepared the below estimates on a basis materially consistent with the financial information presented elsewhere in this Offering Memorandum and in good faith based upon our internal reporting as of and for the three months ended March 31, 2020. These estimated ranges are preliminary and unaudited and are thus inherently uncertain and subject to change as we complete our financial results for the three months ended March 31, 2020. We are in the process of completing our customary quarterly close and review procedures as of and for the three months ended March 31, 2020, and there can be no assurance that our final results for this period will not materially differ from these estimates. Important factors that could cause actual results to differ from our preliminary estimates are set forth under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

The preliminary estimates below should not be viewed as a substitute for full interim financial statements prepared in accordance with United States generally accepted accounting principles (“GAAP”). In addition, these preliminary estimates for the three months ended March 31, 2020 are not necessarily indicative of the results to be achieved for any future period. The preliminary financial results have not been audited, reviewed or compiled by our independent registered public accounting firm. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect thereto and assumes no responsibility for, and disclaims any association with, this information.

Based on the information and data currently available, we believe our total capital expenditures for the three months ended March 31, 2020 were between $170 million and $180 million. We expect that our average daily total net equivalent production volume will be within a range of 70.0 MBoe per day (“MBoe/d”) to 73.5 MBoe/d for the three months ended March 31, 2020, as compared to 72.0 MBoe/d for the same period in 2019, and we estimate that our average daily net oil production will be within a range of 40.5 MBbls per day (“MBbls/d”) to 42.5 MBbls/d for the three months ended March 31, 2020, as compared to 40.5 MBbls/d for the same period in 2019. In addition, we estimate that our lease operating expenses will be within a range of $31.8 million to $33.5 million for the three months ended March 31, 2020, as compared to $29.9 million for the same period in 2019. Due to the recent depressed commodity prices, we also expect to record a material non-cash impairment to the carrying value of our oil and natural gas properties in the first quarter of 2020.

Borrowing Base Redetermination and Collateral Coverage

The borrowing base under our Credit Agreement is redetermined semi-annually in the spring and fall and is subject to an interim redetermination between each regularly scheduled redetermination upon the request from lenders holding two-thirds of exposure and unused commitments (the “Required Lenders”). The lenders have sole discretion in determining the amount of the borrowing base. We expect that, based on the agent bank’s current recommendation to the syndicate in connection with the Credit Agreement’s spring 2020 semi-annual borrowing base redetermination, the borrowing base will be reduced from $1.2 billion to $700 million and a minimum availability condition to borrowing of the lesser of $75 million and 25% of the aggregate principal amount of New Notes outstanding will be introduced; however, approval of such borrowing base is subject to receiving consent

from the Required Lenders and we cannot provide any assurance that the borrowing base will not be redetermined to a lesser amount.

As a result of the circumstances described above, prices for crude oil and natural gas have declined to historic lows. Utilizing the April 15, 2020 NYMEX Strip Pricing for crude oil (WTI) and natural gas (Henry Hub) discussed above, implies a Pre-Tax PV10% value of $986.4 million for our proved developed reserves and $1,286.6 million for our total proved reserves. After giving effect to the Exchange Offers (and assuming all Old Notes participate) and the borrowings outstanding under our Credit Agreement of approximately $275.0 million as of April 21, 2020, we would have aggregate outstanding secured indebtedness of $725.0 million. However, our borrowing base is expected to be redetermined to $700 million with the minimum availability condition described above. Pro forma for the Exchange Offers and assuming we are fully drawn under our Credit Agreement, we would have $1,075.0 million in aggregate outstanding secured debt. We cannot assure you that the value of our oil and gas properties, based on NYMEX prices, will provide sufficient collateral to repay our New Notes in full.

Credit Agreement Amendment

Prior to the closing of the Exchange Offers, we expect to enter into one or more amendments to the Credit Agreement (the “Credit Agreement Amendment”), which amendments will, among other things, establish the borrowing base on account of the spring 2020 scheduled redetermination (including the minimum availability condition to borrowing described above) and permit the offering of the Second Lien Notes and the Third Lien Notes and the other transactions contemplated thereby. In addition, we expect that the Credit Agreement Amendment will, among other things, provide certain covenant relief with respect to our obligation to maintain a total funded debt to EBITDAX ratio as specified in our Credit Agreement and introduce a new financial covenant testing the ratio of first lien debt to EBITDAX.

COVID-19 Outbreak

The COVID-19 outbreak and its development into a pandemic in March 2020 have required that we take precautionary measures intended to help minimize the risk to our business, employees, customers, suppliers and the communities in which we operate. Our operational employees are currently still able to work on site. However, we have taken various precautionary measures with respect to such operational employees such as requiring them to verify they have not experienced any symptoms consistent with COVID-19, or been in close contact with someone showing such symptoms, before reporting to the work site, quarantining any operational employees who have shown signs of COVID-19 (regardless of whether such employee has been confirmed to be infected) and imposing social distancing requirements on work sites, all in accordance with the guidelines released by the Center for Disease Control. In addition, most of our non-operational employees are now working remotely. We have not yet experienced any material operational disruptions (including disruptions from our suppliers and service providers) as a result of the COVID-19 outbreak, nor had any confirmed cases of COVID-19 on any of our work sites.

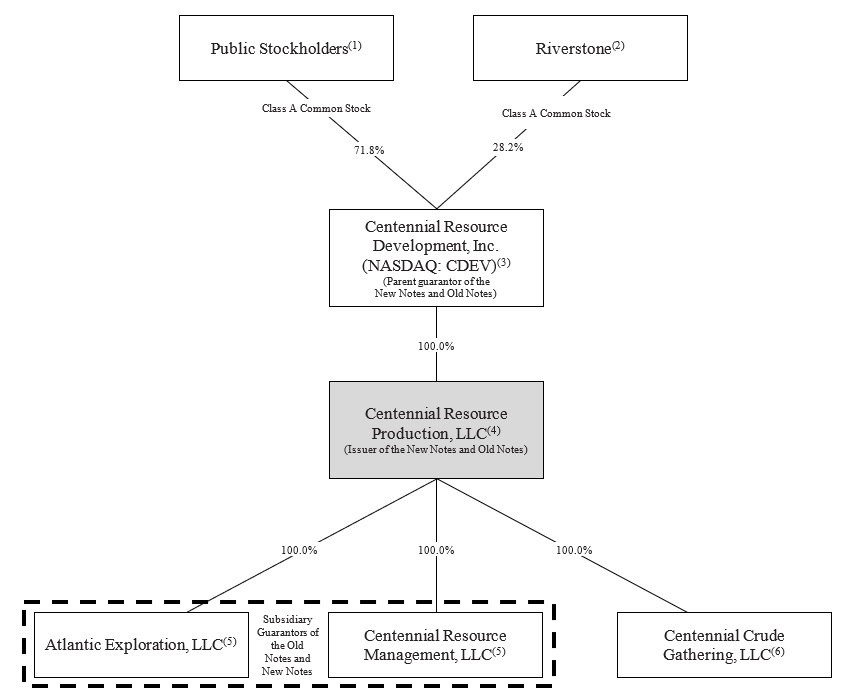

Organizational Structure

The following diagram illustrates the current ownership structure of Centennial:

_______________________________

| |

(1) | Includes NGP X US Holdings, L.P. (“NGP”), a former indirect equity owner of CRP, which also owns one share of Series A Preferred Stock of Centennial, par value $0.0001 per share (the “Series A Preferred Stock”). The Series A Preferred Stock provides NGP with the right to nominate and elect one director to Centennial’s board of directors, but the Series A Preferred Stock does not have any other voting rights or rights with respect to dividends except distributions in liquidation in the amount of $0.0001 per share. NGP has declined to exercise its right to nominate and elect a director since May 2019, when the director previously nominated and elected by NGP resigned. |

| |

(2) | As of April 20, 2020, Riverstone held approximately $51 million in aggregate principal amount of Old 2026 Notes and $107 million in aggregate principal amount of Old 2027 Notes. These Old Notes will not be deemed “outstanding” for purposes of determining whether the Requisite Consents are received in connection with the Consent Solicitations. Riverstone also owns 6,826,502 warrants as described below. |

| |

(3) | The above diagram excludes 8,000,000 outstanding warrants, each of which is exercisable for one share of Class A common stock of Centennial, par value $0.0001 per share (the “Class A Common Stock”), at a price of $11.50 per share. The warrants will expire on October 11, 2021 (five years after the completion of our business combination) or earlier upon redemption or liquidation. Riverstone owns 6,826,502 of the warrants, and the remainder are owned by Mark G. Papa, Centennial’s former Chief Executive Officer and Chairman. |

| |

(4) | CRP will be the issuer of the New Notes and is the issuer under the Old Notes and the borrower under the Credit Agreement. |

| |

(5) | Subsidiary guarantor of the New Notes, the Old Notes and under the Credit Agreement. |

| |

(6) | Centennial Crude Gathering, LLC (“Centennial Crude”) is not a guarantor under the Credit Agreement or the Old Notes and will not guarantee the New Notes. As of December 31, 2019, Centennial Crude had no outstanding indebtedness and no assets. |

Risk Factors

Risks Related to Our Business

In addition to the risks related to our business set forth under “Risk Factors” in our Form 10-K for the year ended December 31, 2019, our business is subject to the following risks:

The excess supply of oil and natural gas resulting from the reduced demand caused by the COVID-19 pandemic and the effects of actions by, or disputes among or between, oil and natural gas producing countries may result in transportation and storage constraints, reduced production and shut-in of our wells, any of which would adversely affect our business, financial condition, results of operations, liquidity, and ability to finance planned capital expenditures.

The recent worldwide outbreak of COVID-19, the uncertainty regarding the impact of COVID-19 and various governmental actions taken to mitigate the impact of COVID-19, have resulted in an unprecedented decline in demand for oil and natural gas. At the same time, the decision by Saudi Arabia in March 2020 to drastically reduce export prices and increase oil production followed by curtailment agreements among OPEC and other countries such as Russia further increased uncertainty and volatility around global oil supply-demand dynamics. To the extent that the outbreak of COVID-19 continues to negatively impact demand and OPEC members and other oil exporting nations fail to implement production cuts or other actions that are sufficient to support and stabilize commodity prices, we expect there to be excess supply of oil and natural gas for a sustained period. This excess supply could, in turn, result in transportation and storage capacity constraints in the United States, or even the elimination of available storage, including in the Permian Basin. If, in the future, our transportation or storage arrangements become constrained or unavailable, we may incur significant operational costs if there is an increase in price for services or we may be required to shut-in or curtail production or flare our natural gas. If we were required to shut-in wells, we might also be obligated to pay certain demand charges for gathering and processing services and firm transportation charges for pipeline capacity we have reserved. Further, any prolonged shut-in of our wells may result in materially decreased well productivity once we are able to resume operations, and any cessation of drilling and development of our acreage could result in the expiration, in whole or in part, of our leases. All of these impacts resulting from the confluence of the COVID-19 pandemic and the price war between Saudi Arabia and Russia may adversely affect our business, financial condition, results of operations, liquidity, and ability to finance planned capital expenditures.

Due to the commodity price environment, we have postponed or eliminated a portion of our developmental drilling. A sustained period of weakness in oil, natural gas and NGLs prices, and the resultant effects of such prices on our drilling economics and ability to raise capital, will require us to reevaluate and further postpone or eliminate additional drilling. Such actions would likely result in the reduction of our PUDs and related Pre-Tax PV10% and a reduction in our ability to service our debt obligations.

Additionally, as of December 31, 2019, approximately 13% of our total net acreage was not held by production and we had leases representing 3,162 and 3,750 undeveloped net acres scheduled to expire during 2020 and during 2021, respectively, in each case assuming no exercise of lease extension options where applicable. If we are required to further curtail our drilling program, we may be unable to continue to hold such leases that are scheduled to expire, which may further reduce our reserves. As a result, if oil, natural gas and/or NGL prices experience a sustained period of weakness, our future business, financial condition, results of operations, liquidity, and ability to finance planned capital expenditures may be materially and adversely affected.

The inability to complete our pending divestiture of our saltwater disposal wells and associated produced water infrastructure on the initial terms agreed to by the parties or in the expected time frame may adversely affect our business and financial condition.

On February 24, 2020, we entered into a purchase and sale agreement with a subsidiary of WaterBridge Resources LLC (“WaterBridge”) to divest our saltwater disposal wells and associated produced water infrastructure in Reeves County for $225 million, consisting of $150 million in cash at closing and an additional $75 million payable to us on a deferred basis upon meeting certain incentive thresholds. We believe the uncertain macro environment for the oil and gas industry and resulting changes to commodity prices and drilling and completion activity in the Delaware Basin, increase the risk that the transaction fails to close on the original timeframe and terms agreed to between us and WaterBridge. While the transaction currently remains pending, either party may terminate the transaction if closing does not occur on or before May 15, 2020. If the transaction fails to close on the initial terms agreed to between us and WaterBridge, our business and financial condition may be adversely affected. In particular, to the extent the transaction is terminated, or if we receive lower cash consideration than originally planned, then the amount of cash that we may allocate to the repayment of outstanding borrowings under our revolving credit facility or to the funding of our capital budget, and the timing of such repayment or funding, will also be affected.

Our production is not fully hedged, and we are exposed to fluctuations in oil, natural gas and NGL prices and will be affected by continuing and prolonged declines in oil, natural gas and NGL prices.

Our production is not fully hedged, and we are exposed to fluctuations in oil, natural gas and NGL prices and will be affected by continuing and prolonged declines in oil, natural gas and NGL prices. We have entered into fixed price oil swaps for April

through December of 2020 to protect against possible, additional near-term declines in oil prices. During this period, CRP has hedged approximately 19,400 barrels per day of oil at a weighted average price of $26.79 per Bbl. We intend to continue to hedge our production, but we may not be able to do so at favorable prices. Accordingly, our revenues and cash flows are subject to increased volatility and may be subject to significant reduction in prices which would have a material negative impact on our results of operations.

We cannot assure you that in connection with the spring 2020 semi-annual borrowing base redetermination, our borrowing base will not be reduced to a lesser amount than what we expect.

The borrowing base under our Credit Agreement is redetermined semi-annually in the spring and fall and is subject to an interim redetermination between each regularly scheduled redetermination upon the request from lenders holding two-thirds of exposure and unused commitments, as described in “-Recent Developments-Borrowing Base Redetermination.” The lenders have sole discretion in determining the amount of the borrowing base. We expect that, in connection with the Credit Agreement’s spring 2020 semi-annual borrowing base redetermination, the borrowing base will be reduced from $1.2 billion to $700 million and a minimum availability condition to borrowing of the lesser of $75 million and 25% of the aggregate principal amount of New Notes outstanding will be introduced; however, approval of such borrowing base is subject to receiving consent from the Required Lenders and we cannot provide any assurance as to whether the borrowing base will be redetermined at a lesser amount. If our borrowing base is redetermined to a lesser amount, we may be unable to obtain adequate funding under our revolving credit facility, which would adversely affect our development plans as currently anticipated and could have a material adverse effect on our production, revenues and results of operations.

If we fail to obtain covenant relief through the Credit Agreement Amendment or other amendment prior to such time, we could default under the Credit Agreement during the next twelve to eighteen months.

If we do not receive our requested waivers and amendments we currently do not expect to comply with the total funded debt to EBITDAX ratio covenant in the next twelve to eighteen months. The failure to obtain covenant relief through the Credit Agreement Amendment or other amendment prior to such time would result in an event of default under the Credit Agreement. Additionally, failure to comply with any of the other covenants and restrictions in the Credit Agreement would also result in an event of default.

An event of default, if not waived, could result in the acceleration of our outstanding indebtedness, including the New Notes. The accelerated indebtedness would become immediately due and payable. If that occurs, we may not be able to make all of the required payments or borrow sufficient funds to refinance such indebtedness. Even if new financing were available at that time, it may not be on terms that are acceptable to us.

Our ability to comply with these restrictions and covenants, including satisfying the financial ratios and tests under the Credit Agreement, may be affected by events beyond our control, including the substantial period of decline in oil, natural gas and NGLs prices. We cannot assure you that we will be able to comply with these restrictions and covenants or meet such financial ratios and tests.

If commodity prices continue to decrease or remain at current levels such that our future undiscounted cash flows from our properties are less than their carrying value, we may be required to take additional write-downs of the carrying values of our properties.

Accounting guidance requires that we periodically review the carrying value of our properties for possible impairment. Based on prevailing commodity prices and specific market factors and circumstances at the time of prospective impairment reviews, and the continuing evaluation of development plans, production data, economics and other factors, we may be required to write-down the carrying value of our properties. A write-down constitutes a non-cash charge to earnings. Due to the recent depressed commodity prices, we expect to record a material non-cash impairment to the carrying value of our oil and natural gas properties, which will have an adverse effect on our results of operations. Further impairments will be required if oil and natural gas prices remain low or decline further, our undeveloped property leases expire in whole or in part, estimated proved reserve volumes are revised downward or the net capitalized cost of proved oil and gas properties otherwise exceeds the present value of estimated future net cash flows.

The Pre-Tax PV10% of our proved reserves at December 31, 2019 may not be the same as the current market value of our estimated oil, natural gas and NGLs reserves.

You should not assume that the Pre-Tax PV10% value of our proved reserves as of December 31, 2019 as disclosed in our reserve report and elsewhere in this Offering Memorandum is the current market value of our estimated oil, natural gas and NGLs reserves. We base the discounted future net cash flows from our proved reserves on the 12-month first-day-of-the-month oil and natural gas average prices without giving effect to derivative transactions. Actual future net cash flows from our oil and natural gas properties will be affected by factors such as:

| |

| • | the actual prices we receive for oil, natural gas and NGLs; |

| |

| • | the actual development and production expenditures; |

| |

| • | the amount and timing of actual production; and |

| |

| • | changes in governmental regulations or taxation. |

The timing of both our production and our incurrence of expenses in connection with the development and production of oil and natural gas properties will affect the timing and amount of actual future net revenues from proved reserves, and thus their actual present value. In addition, the 10% discount factor we use when calculating Pre-Tax PV10% may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and natural gas industry in general. Actual future prices and costs may differ materially from those used in the present value estimates included in this Offering Memorandum, which could have a material effect on the value of our reserves. The oil and natural gas prices used in computing our Pre-Tax PV10% as of December 31, 2019 under SEC guidelines were $52.19 per Bbl and $2.58 per MMbtu, respectively, before price differentials. Using more recent prices in estimating proved reserves results in a reduction in proved reserve volumes due to economic limits, which would further reduce the Pre-Tax PV10% value of our proved reserves.

The marketability of our production is dependent upon transportation and other facilities, certain of which we do not control. If these facilities are unavailable, or if we are unable to access these facilities on commercially reasonable terms, our operations could be interrupted and our revenues reduced.

The marketability of our oil, natural gas and NGLs production depends in part upon the availability, proximity, capacity and availability of transportation and storage facilities owned by third parties. In general, we do not control these facilities, and our access to them may be limited or denied. Our oil production is generally transported from the wellhead to our tank batteries by a gathering system. Our purchasers then transport the oil by pipeline to a larger pipeline for transportation to markets. The majority of our natural gas production is generally transported by gathering lines from the wellhead to a central delivery point and is then gathered by third-party lines to a gas processing facility. We do not control these third-party transportation, gathering or processing facilities and our access to them may be limited or denied. Insufficient production from our wells to support the construction of pipeline facilities by our purchasers or a significant disruption in the availability of third-party transportation facilities or other production facilities could adversely impact our ability to deliver to market or produce our production and thereby cause a significant interruption in our operations.