An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time an offering circular which is not designated as a Preliminary Offering Circular is delivered and the offering statement filed with the Commission becomes qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

| Preliminary Offering Circular | Dated December 18, 2015 |

Fig Publishing, Inc.

Up to 30,000 Grasslands Game Shares

$500.00 per Share

This Regulation A offering is for shares of preferred tracking stock, par value $0.0001 per share (the “Grasslands Game Shares”) of Fig Publishing, Inc., a Delaware corporation (the “Company” or “we”). We are offering a maximum of 30,000 Grasslands Game Shares at $500.00 per share, on a best efforts basis. The offering is being conducted in support of the development of the Grasslands video game (“Grasslands”).

If the amount indicated onFig.co in respect of the game (the “Running Campaign Total,” as further defined herein) does not reach or exceed $3,300,000 (the “Minimum Target”) within 180 days after execution of the Grasslands License Agreement (as defined below) (the “Minimum Target Date”), this offering will be cancelled and all funds raised will be returned to investors without deduction or interest earned. If the Minimum Target is reached or exceeded before the Minimum Target Date, the offering will continue until the earlier of 60 days after qualification of the offering statement to which this offering circular relates (which date may be extended in our sole discretion) and the date when all shares have been sold, at which time this offering shall close and shares shall be delivered to investors. We will notify investors of any extension of the closing date that we may choose to make by posting a notice of the extension on Fig.co. Funds raised in this offering will be deposited into an escrow account pending the closing, and if the offering is cancelled will be returned to investors without deduction or interest earned. See “The Shares – Plan of Distribution” and “Securities Being Offered.”

There is no trading market for our Grasslands Game Shares and we do not expect that any such market will ever develop, in part because there are provisions in the certificate of designations for the Grasslands Game Shares that impose certain restrictions on transfer of the Grassland Game Shares. As a result, investors should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation. See “The Shares – Securities Being Offered.”

Grasslands Game Shares will be available for purchase exclusively onFig.co. The shares will be issued in book-entry electronic form only. [ ] is the transfer agent and registrant for the Grasslands Game Shares.Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer towww.investor.gov.

These are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 11.

| | | Number of Shares | | | Price to

Public | | | Underwriting

Discounts and

Commissions (1) | | | Proceeds to

Issuer (2) | |

| Per Share | | | 1 | | | $ | 500 | | | $ | 0.00 | | | $ | 500 | |

| Total Maximum | | | 30,000 | | | $ | 15,000,000 | | | $ | 0.00 | | | $ | 15,000,000 | |

(1) The Company does not intend to use commissioned sales agents or underwriters. The securities being offered hereby will only be offered by us and persons associated with us, in reliance on the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934.

(2) Does not reflect deduction of expenses of the offering. All offering expenses will be paid by the issuer’s parent, Loose Tooth Industries, Inc. See “The Shares – Plan of Distribution.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

Fig Publishing, Inc.

715 Bryant St. Suite 202

San Francisco, CA 94107

(415) 689-5789

Fig.co

Information contained onFig.co is not incorporated by reference into this offering circular, and you should not consider information contained onFig.co to be part of this offering circular.

The date of this offering circular is __________, 2015

TABLE OF CONTENTS

SUMMARY

The following summary highlights selected information contained in this offering circular. This summary does not contain all the information that may be important to you. You should read all the information contained in this offering circular, including, but not limited to, the “Risk Factors” section.

The Company

Fig Publishing, Inc., a Delaware corporation (the “Company” or “we”) is a recently formed video game publishing company that seeks to identify, license, fund, market, distribute and earn revenues from new video games being developed by third-party developers. We search for new games and game ideas with the potential to generate significant earnings with the help of our publishing services.

Our Parent,Loose Tooth Industries, Inc., a Delaware corporation (“Parent”),began operations in April 2015. Our Parent is a provider of video game publishing services and the operator ofFig.co, an online technology platform created to facilitate fundraising for video game development.Fig.co is designed to function as:

| - | a rewards-based crowdfunding website, where video game developers can seek funding in the form of contributions in return for non-securities-related rewards (“Rewards Crowdfunding”); |

| | | |

| - | an accredited investor crowdfunding website, where securities may be offered and sold only to “accredited investors”, as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933 and pursuant to Rule 506 of Regulation D (“Accredited Crowdfunding”); and |

| | | |

| - | a non-accredited investor crowdfunding website, where securities may be offered and sold to “qualified purchasers” as defined in Tier 2 of Regulation A of the Securities Act of 1933 along with “accredited investors” (“Reg A Crowdfunding,” and together with Accredited Crowdfunding, “Investment Crowdfunding”). |

The Company expects to offer and sell securities in support of the development of particular games, pursuant to Accredited Crowdfunding, Reg A Crowdfunding or both. We intend to use Fig.co for our Investment Crowdfunding campaigns, as provided for under the Master Services Agreement with the Parent. Rewards Crowdfunding campaigns may often run concurrently in support of the development of the same games.

The Parent hosted its first campaign onFig.co to fund a video game developer in August 2015 and its second in October 2015, in each case through the use of Rewards Crowdfunding and Accredited Crowdfunding. The developers of such games conducted their Reward Crowdfunding campaigns onFig.co and the securities offered in the Accredited Crowdfunding campaigns were securities of other subsidiaries of our Parent, offered onFig.co to accredited investors. The offering of securities that we are making by means of this Offering Circular is the first of a series of Reg A Crowdfunding campaigns that we expect to undertake, typically in conjunction with Rewards Crowdfunding campaigns undertaken by the developers onFig.co and, where appropriate, with Accredited Crowdfunding offerings undertaken by us onFig.co. We expect each separate Reg A Crowdfunding campaign, and any associated Rewards Crowdfunding and Accredited Crowdfunding campaigns, to be undertaken in support of a separate game.

The Company’s co-publishing model includes the following key parts:

| | ● | Identification. Through the extensive video game industry contacts of the directors, officers, advisors and affiliates of our Company and our Parent, we establish relationships with game developers and their advisors. We evaluate the developers interested in working with us, and the games and game ideas they have, and identify particular game development efforts that we believe have significant earnings potential. |

| | | |

| | ● | Licensing. We negotiate with the developers whose game development efforts we wish to support, with the aim of entering into a license agreement that establishes the developer’s and our respective rights and obligations in the game development effort and in the marketing, distribution and sales stages that we anticipate will follow. We offer developers what we believe is a unique licensing arrangement that provides them with many of the things they complain they do not receive from conventional game publishing arrangements, such as creative control, freedom from unproductive milestone obligations and ownership of their core intellectual property and derivative works. |

| | | |

| | ● | Marketing. When a game has been successfully developed and is almost ready for the commercial market, we apply the video game marketing expertise that our principals have developed through their experience in the industry, and engage in such efforts as social media marketing, paid advertising campaigns, design of creative assets, digital public relations, influencer outreach and community marketing. |

| | | |

| | ● | Distribution.In conjunction with our marketing efforts, we identify and secure distribution channels for the game on a wide variety of game-playing “platforms,” which may include any and all personal computer, mobile, tablet, video game console, interactive television, virtual reality, augmented reality and other operating systems on which video games are played. |

Webelieve that our co-publishing model will permit us to compete successfully with traditional video game publishers for the most talented game developers and the most attractive games and game concepts, because our model treats developers better than they often are treated in conventional video game publishing arrangements, and because we believe our model demonstrates our desire to support the developer community, which desire will, we believe, be additionally attractive to developers. In addition, the Company intends to publish games in a wide variety of genres. However, the Company believes investors often wish to invest on a game-by-game basis, and to focus on game genres with which they are familiar. The Company believes that the game-by-game publishing financing model it has adopted will allow it to raise funds for the development of a variety of games, while permitting investors to choose the particular games in which they wish to invest.

Our principals have extensive experience in the video game industry. Justin Bailey, our Chief Executive Office and sole director, has been active in the video game industry for many years, having published a wide variety of free-to-play, premium and mobile games and having helped to secure many millions of dollars in game financing from publishers, investors and crowdfunding participants in recent years. Jonathan Chan, our Vice President, Business Development and Strategy , has several years of experience at the large video game publisher Electronic Arts Inc., where he focused on business development deals in the publishing and distribution of games.

Our business is newly formed, we have not yet earned any revenues, and we have no operating history, which may make it difficult for potential investors to evaluate our business and assess our future viability and prospects.Our operations are managed and administered by principals and employees of our Parent, which is compensated for the provision of such services by the Service Fee (as defined below).The Company’s fiscal year-end is September 30th.

The Shares

In General

We seek to combine our developer-centric approach on the game licensing and development side of our business with what we believe is a unique opportunity for investors on the financing side of our business. Our securities are designed to give investors a mechanism for investing separately in each individual game we license. We expect that many of our potential investors will be video game players and fans, and we wish to give them the opportunity to invest in particular games, one at a time – typically, we expect, within the different game genres they know and like best.

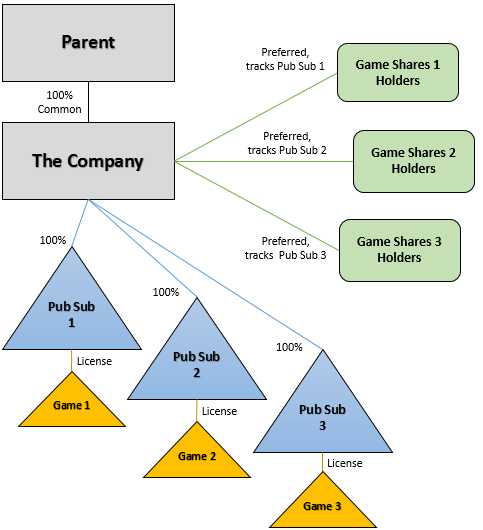

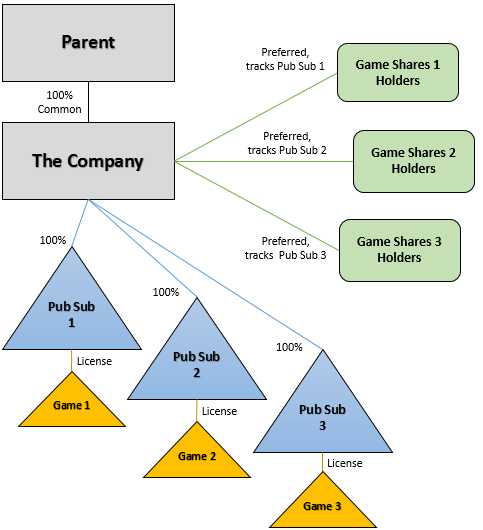

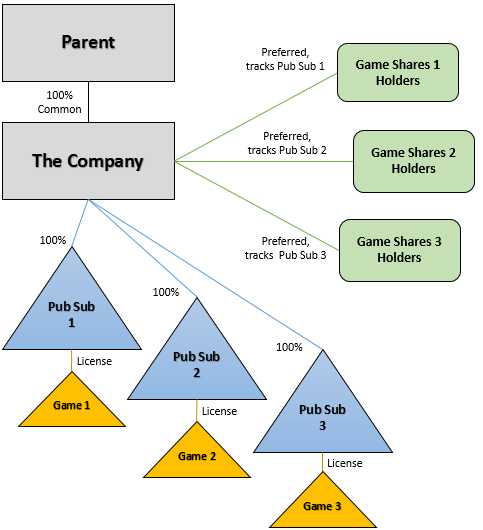

To be more specific, we intend to offer a separate series of preferred tracking stock for each of the games under development that we have been licensed. The shares of a particular series of preferred tracking stock (which we call our “Game Shares”) will track the economic performance of a particular publishing subsidiary of the Company (each a “Pub Sub”) which will hold the license to a particular game under development. The tracking will work as follows: when and if the game is developed and begins to sell, the Pub Sub will begin earning revenues from sales of the game. Those earnings will be used to cover certain expenses, and will thereafter be divided into a revenue share to be provided to the game developer and an amount to be distributed from the Pub Sub to the Company, and paid to holders of the associated Game Shares in the form of dividends on those Game Shares.

Each Pub Sub is expected to be a Delaware limited liability company and a wholly owned subsidiary of the Company. The Pub Sub will be formed specifically to serve as the entity to which the developer licenses rights in respect of the game to be developed. A license agreement between the Pub Sub and the developer will govern the support to be provided by the Pub Sub to the developer to finish the development of the game, the Pub Sub’s rights in the exploitation of the developed game, the revenues the Pub Sub will earn from such exploitation and the allocation of such revenues among expenses, the developer and the Pub Sub itself. The Game Shares will govern the rights of Game Shares holders to dividends, which would be paid by us, the Company, from the net earnings of the game that we receive from the Pub Sub, subject to the dividend policy of the Company.

The general corporate, securities and licensing structure of our individual game investment model is illustrated below (assuming investment in three games) (not to scale):

The particular manner in which a particular series of Game Shares will track the economic performance of the associated game is as follows:

A Pub Sub will enter into a license agreement with the developer of the applicable game. Under the license agreement, the Pub Sub will have rights to co-publish the game on particular platforms and the right to receive revenue from game sales on the platforms, in exchange for:

| | Upfront funds provided to the developer to help complete the game for commercial sale (the “Game Funding Payment”). | + | After the game begins to sell on the licensed platforms, a certain large percentage (the “Developer Rev Share”) of the Pub Sub’s Adjusted Gross Revenue (as defined below). |

“Adjusted Gross Revenue” equals:

| | Revenue received by the Pub Sub from the licensed platforms. | - | Certain sales expenses, such as chargebacks or disputed credit card charges and sales taxes. | - | A fee paid to our Parent for providingmanagement and administrative services (the “Service Fee”, as further described below). |

The Game Funding Payment will represent most of the proceeds of the sale of the related Game Shares; however, it will be reduced by certain accrued expenses and estimated future expenses of the Company related to the Game Shares (the “Publisher Expenses”), which estimate will be determined on a game-by-game basis. Such expenses will include:

| | - | expenses of the offering of the related Game Shares; |

| | - | taxes; and |

| | - | marketing expenses of the game prior to its sale. |

The Developer Rev Share will be based on a formula negotiated between the Company and the developer that depends in part on the size of the Game Funding Payment and will often provide for increases in the Developer Rev Share as specified revenue benchmarks are achieved. From Adjusted Gross Revenue, the Pub Sub will pay the Developer Rev Share to the developer, and the remaining funds (the “Residual Pub Sub Earnings”) will be distributed to us, the Company. Subject to our dividend policy, investors in Game Shares will receive 97.5% (the “Game Shares Percentage”) of the Residual Pub Sub Earnings, in the form of dividends on their Game Shares, and the remaining 2.5% will be retained by the Company. The Company intends to use the this remaining 2.5% of Residual Pub Sub Earnings for general corporate and working capital purposes, including payment of expenses that may be applicable to all Pub Subs generally, and to pay dividends to our Parent.

The Service Fee will be a fixed percentage of the Pub Sub’s Adjusted Gross Revenue, and is expected to vary between 5% and 20% depending on the particular game development effort and co-publishing services that are the subjects of the associated license agreement. For example, we expect the Service Fee will usually be lower for games of well-known developers, because such games will usually not require the magnitude of publishing efforts that will be required for the games of newer developers. The Parent is not obligated to apply the Service Fee toward services in respect of any particular game.

Holders of Game Shares will have no direct investment in the associated Pub Sub, developer, game or license agreement. Rather, such holders will be preferred stockholders of the Company, with the opportunity to be paid dividends by the Company based on the associated Pub Sub’s Residual Pub Sub Earnings as distributed to the Company, but without voting or other rights. In addition, because there is no trading market for Game Shares and we do not expect one to develop, holders of Game Shares should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation.

The rights of the Pub Sub to a particular game will be limited to rights to co-publish the game on particular distribution platforms, as described in the relevant license agreement. The Pub Sub will not have an interest in the developer, the game, the intellectual property of the game, any other games, or any derivative works, including any game sequels or spinoffs, and may or may not have an interest in downloadable content (DLC) associated with the game, depending on the particular license agreement. Moreover, our business model requires each Pub Sub to make a substantial upfront payment to the developer, equal to most of the proceeds of the offering of the related Game Shares minus the Publisher Expenses, in the form of the Game Funding Payment. In each case, the Game Funding Payment will not be secured by interests in the developer’s intellectual property or other assets. This arrangement presents risks to the Company, and thereby to investors in Game Shares, to the extent that the Game Funding Payment may be lost or not fully and efficiently applied to the development of the game, or the game may not be developed diligently or on time and therefore may not generate sufficient revenue to allow dividends to be paid at expected levels or at all. The Company believes that these risks will be outweighed by the competitive advantage the Company will gain in attracting high quality developers as a result of, among other things, not demanding interests in the developer’s intellectual property. However, there can be no assurance that these risks will in fact be outweighed by the benefits we expect, and no assurance that the Company’s model will not materially adversely affect the Company’s business and, therefore, holders’ investments in Game Shares. Furthermore, the developer may only be obligated to deliver the game in executable format for a subset of licensed platforms. The Pub Sub will only be entitled to revenue from sales of the game on other licensed platforms when and if the developer chooses to develop an executable format for those platforms.

The licensed platforms make their money by holding back a percentage of the retail prices at which they sell games to consumers. A platform may have substantial discretion in setting the retail price for the games it sells. As a result of platforms exercising discretion over game sales prices, and taking their percentage cuts of the game sales, the Company expects that the game revenue a Pub Sub would realize, and on which investors’ dividends would be based, may be approximately 30% of the retail price of the game on any given platform, and possibly as low as 15% or as high as 50% of such retail price.

The license agreement between a developer and a Pub Sub in respect of a particular game is expected to permit the developer to extend publishing rights not only to the Pub Sub but also to other parties (referred to as “co-publishers”), including on some or all of the platforms licensed to the Pub Sub. Under the terms of the license agreement as we expect them to be agreed in most or all such cases, to the extent any co-publisher publishes the game on a platform licensed to the Pub Sub, the amount of revenue received by the Pub Sub should not be reduced. See “Risk Factors.”

From time to time, particular developers may publicize their and our related game development efforts, including Rewards Crowdfunding and Investment Crowdfunding efforts, on their own websites or otherwise, and may collect immaterial amounts, typically through Rewards Crowdfunding, to contribute to the overall game development effort. These amounts may not end up being accounted for in developer-Pub Sub divisions of revenue pursuant to the terms of the related game license agreement or the related Game Shares.

For other terms relating to all of our preferred stock, see “The Shares – Capital Stock of the Company – Preferred Stock.”

In this Offering

The description of our Game Shares above is intended to apply generally to all Game Shares we issue, now and in the future. For a description of the particular terms and conditions that additionally apply to the Game Shares we are offering by means of this offering circular, see “The Shares – Securities Being Offered – In this Offering”.

The Game and the Developer

Our first Pub Sub, Fig Grasslands, LLC (the “Grasslands Pub Sub”), has entered into a license agreement (the “Grasslands License Agreement”) with Double Fine Productions, Inc., a California corporation (the “Grasslands Developer”), to publish a game that we have code-named “Grasslands” (such game, “Grasslands,”) on any and all current and future operating systems on which video games are played, excluding virtual reality platforms. The Grasslands License Agreement sets forth the terms and conditions under which the Grasslands Pub Sub will provide funding in support of the development of Grasslands and which governs the distribution of revenues that result from sales of Grasslands, including the distribution of a portion of such revenues as dividends to the holders of the Company’s Grasslands Game Shares preferred tracking stock.

Grasslands will be a sequel to one of the Grasslands Developer’s most successful games, which has had sales of over 1,000,000 units. Tim Schafer, who is the Chief Executive Officer of the Grasslands Developer, and much of the team that developed the original game will be working together on this sequel, which will include many of the same characters as the original game but with a brand new storyline. Mr. Schafer is a member of the Board of Directors of our Parent and is also a significant stockholder of our Parent. The game is expected to be released initially on PCs, followed by the Xbox One and PS4 consoles.

Under the Grasslands License Agreement, the Grasslands Developer will receive the proceeds of the offering by us of our preferred tracking stock, par value $0.0001 per share, tracking the economic performance of the Grasslands Pub Sub (the “Grasslands Game Shares”). We refer to this payment of proceeds as the “Grasslands Game Funding Payment.” The Grasslands Game Funding Payment will not be reduced for Publisher Expenses. Instead, our Parent will cover all the Publisher Expenses arising in relation to Grasslands, including the expenses of this offering, pursuant to a Publisher Expenses Agreement (the “Grasslands Publisher Expenses Agreement”) that we and our Parent have entered into as of December 3, 2015. Our Parent is covering these expenses in order to support our first Game Shares offering, and in contemplation of more Game Shares offerings in the future that will support additional games. The Grasslands Developer must deliver the finished Grasslands game, ready for commercial sale, no later than July 31, 2018.

When and if Grasslands is developed and commercial sales begin, the terms of the Grasslands License Agreement relating to revenue sharing will begin. The Adjusted Gross Revenue derived from the co-publishing of Grasslands will be divided between the Grasslands Pub Sub and the Grasslands Developer on a percentage basis that varies based on (i) the size of the Game Funding Payment that was made to the Grasslands Developer, and (ii) the achievement of certain Adjusted Gross Revenue targets. Specifically, until a target of $13,333,333 of Adjusted Gross Revenue is achieved, the Grasslands Developer shall receive as its Developer Rev Share a percentage of Adjusted Gross Revenue equal to 100% minus (2.5 x the Grasslands Investor Rev Share); and after the target of $13,333,333 of Adjusted Gross Revenue is achieved, the Grasslands Developer shall receive as its Developer Rev Share a percentage of Adjusted Gross Revenue equal to 100% minus the Grasslands Investor Rev Share. In each case, “Grasslands Investor Rev Share” means a percentage equal to the Game Funding Payment minus $4,000 (which reflects promotional credits of $1,000, good for the purchase of additional Grasslands Game Shares, granted to each of four investors in the Accredited Crowdfunding campaign who expressed early interest in investing) divided by $33,333,333.

Our board of directors may at any time following the seven-year anniversary of the Game Delivery Date (as defined below) resolve to redeem some or all of the Grasslands Game Shares, if at such time the average quarterly Residual Pub Sub Earnings over the four immediately preceding, completed fiscal quarters is less than $25,000 per quarter.

We intend to enter into additional license agreements in the future to develop other games, and we are currently actively pursuing additional license agreement opportunities. For each such license agreement we enter into, we expect to create a new Pub Sub to act as the licensee, and we expect to issue a new, separate series of preferred tracking stock of the Company through which investors can participate in the development of that particular game. In this way, we hope to extend our business of providing both a developer-centric approach to the game development and game-by-game investment opportunities for investors. However, there can be no assurance provided that we will be successful in our efforts.

The Offering

Issuer | Fig Publishing, Inc. |

| | |

Securities | A maximum of 30,000 shares of preferred tracking stock, par value $0.0001 per share (the “Grasslands Game Shares”), of the Company. The Grasslands Game Shares will track the economic performance of Fig Grasslands, LLC (the “Grasslands Pub Sub”), the licensee of the Grasslands game (“Grasslands”). When and if Grasslands is developed and begins to sell, and the Grasslands Pub Sub earns sufficient revenue, holders of the Grasslands Game Shares will be paid dividends by the Company based on the Grasslands Pub Sub’s net earnings, subject to the dividend policy of the Company. See “The Shares – Securities Being Offered.” |

| | |

Price per Share | $500.00 |

| | |

| Offering Type | Regulation A offering of shares, being made by the Company on a best efforts basis. The offering is being conducted in support of the development of the Grasslands video game. |

| | |

| Minimum Target and Duration of the Offering | It is expected that funds for the development of the Grasslands game will be raised in three ways: |

| | (1) | the Grasslands Developer will conduct a Rewards Crowdfunding campaign onFig.co; |

| | | |

| | (2) | the Company will offer and sell Grasslands Game Shares to accredited investors onFig.co, pursuant to Rule 506(c) under the Securities Act of 1933, as amended (the “Securities Act”), and pay the proceeds to the Grasslands Developer under the Grasslands License Agreement; and |

| | | |

| | (3) | the Company will offer and sell Grasslands Game Shares to non-accredited and accredited investors onFig.co, pursuant to Regulation A of the Securities Act and this offering circular, and pay the proceeds to the Grasslands Developer under the Grasslands License Agreement. |

| An aggregate of the amounts raised in the Rewards Crowdfunding campaign and the amounts as to which indications of interest are received in the Investment Crowdfunding campaigns (the “Running Campaign Total”) will be calculated by the Parent and displayed onFig.co. If the Running Campaign Total does not reach or exceed $3,300,000 (the “Minimum Target”) within 180 days after execution of the Grasslands License Agreement (the “Minimum Target Date”), the License Agreement will automatically terminate, the offering of Grasslands Game Shares will be cancelled, and any and all funds that may have already been raised thereby will be returned to investors without deduction or interest earned. Investors in this offering shall not otherwise have a right to the return of their funds. |

| | If the Minimum Target is reached or exceeded before the Minimum Target Date, the offering will continue until the earlier of 60 days after qualification of the offering statement to which this offering circular relates (which date may be extended in our sole discretion) and the date when all shares have been sold, at which time this offering shall close and shares will be delivered to investors. We will notify investors of any extension of the closing date that we may choose to make by posting a notice of the extension onFig.co. Funds raised in this offering will be deposited into an escrow account pending the closing, and if the offering is cancelled will be returned to investors without deduction or interest earned. See “The Shares – Plan of Distribution.” |

Maximum Funding Amount | Under the Grasslands License Agreement, the Grasslands Developer need not accept more than a total of $15,000,000 from the aggregate amounts raised in the Accredited Crowdfunding campaign and this offering. Therefore, to the extent amounts are raised in the Accredited Crowdfunding campaign, the total amount that may be raised in this offering will be reduced. For example, if $10 million is raised in the Accredited Crowdfunding campaign (which is the intended maximum amount to be raised in that fundraising), then a maximum of $5 million may be raised in this offering. Currently, we expect the Accredited Crowdfunding campaign to be completed prior to the completion of the marketing of this offering. The Company retains the right to reject, in whole or in part, any orders for securities made in this offering, in its sole discretion. Funds raised in this offering will be deposited into an escrow account pending the closing, and if the offering is cancelled will be returned to investors without deduction or interest earned. See “The Shares – Plan of Distribution.” |

| | |

Where to Buy | Grasslands Game Shares will be available for purchase exclusively onFig.co. The shares will be issued in book-entry electronic form only. [ ] is the transfer agent and registrant for the Grasslands Game Shares. The Company does not intend to use commissioned sales agents or underwriters to help offer and sell Grassland Game Shares. The securities being offered hereby will only be offered by us and persons associated with us, in reliance on the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934. See “The Shares – Plan of Distribution.” |

| Limitations on Your Investment Amount | Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A, which states: “In a Tier 2 offering of securities that are not listed on a registered national securities exchange upon qualification, unless the purchaser is either an accredited investor (as defined in Rule 501 (§230.501)) or the aggregate purchase price to be paid by the purchaser for the securities (including the actual or maximum estimated conversion, exercise, or exchange price for any underlying securities that have been qualified) is no more than ten percent (10%) of the greater of such purchaser's: (1) Annual income or net worth if a natural person (with annual income and net worth for such natural person purchasers determined as provided in Rule 501 (§230.501)); or (2) Revenue or net assets for such purchaser's most recently completed fiscal year end if a non-natural person.” For general information on investing, we encourage you to refer towww.investor.gov. |

| | |

Offering Proceeds | Up to $15,000,000, all of which will be proceeds of the Company. This amount does not reflect the deduction of offering expenses, which we estimate will be $337,500 and which will be paid by our Parent. Under the Grasslands License Agreement, the Grasslands Developer need not accept more than a total of $15,000,000 from the aggregate amounts raised in the Accredited Crowdfunding campaign and this offering. Therefore, to the extent amounts are raised in the Accredited Crowdfunding campaign, the total amount that may be raised in this offering will be reduced. See “Use of Proceeds” and “The Shares – Plan of Distribution.” |

| | |

Use of Proceeds | We will use the proceeds from this offering to fund the Grasslands Game Funding Payment, which will be paid to the Grasslands Developer pursuant to the Grasslands License Agreement. We do not intend to use the proceeds from this offering to fund our operations; instead, our operations are being conducted by our Parent under the Master Services Agreement (as defined below), and pursuant to that agreement our Parent will be paid for conducting our operations by receiving the Service Fee once the Grasslands game begins to generate sales revenues. See “Use of Proceeds,” “Risk Factors” and “The Company – Master Services Agreement with Our Parent.” |

Dividends | Subject to our dividend policy, investors in Grasslands Game Shares will receive 97.5% of the Residual Pub Sub Earnings of the Grasslands Pub Sub, after they are distributed to the Company, in the form of dividends paid by the Company on their Grasslands Game Shares. For a definition of Residual Pub Sub Earnings, see “The Shares – Securities Being Offered.” Under our dividend policy, we expect to pay cash dividends, quarterly and in arrears, once the Pub Sub begins to receive a material amount of its Residual Pub Sub Earnings and distribute those earnings to us. However, our board of directors may at any time exercise its discretion not to pay dividends, including in circumstances where the board believes that the payment of a dividend may have a material adverse impact on our liquidity or capital resources. See “The Shares – Securities Being Offered.” |

| | |

Grasslands Game Shares Outstanding before Offering | 0 |

| | |

Grasslands Game Shares Outstanding after Offering | Up to 30,000 |

| | |

Lack of Trading Market; Transfer Restrictions | There is no trading market for our Game Shares and we do not expect that any such market will ever develop, in part because there are provisions in the certificate of designations for the Grasslands Game Shares that impose certain restrictions on transfer of the Grassland Game Shares. As a result, investors should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation. See “The Shares – Securities Being Offered.” |

| | |

| No Voting Rights | Holders of Grasslands Game Shares are not entitled to vote on any matters, including, but not limited to, any matters relating to the development of Grasslands. See “The Shares – Securities Being Offered.” |

| | |

Rights against the Company | Holders of Grasslands Game Shares shall have no rights against the Company other than their rights to receive dividends from the Company in respect of Grasslands. For example, holders of Grasslands Game Shares shall have no right to vote on any matters relating to Company corporate governance, and shall have no rights to any assets of the Company upon liquidation or otherwise, other than to the extent of their rights to receive dividends and other distributions from the Company in respect of each series of Grasslands Game Shares held by such holders. See “The Shares – Securities Being Offered.” |

| | |

Optional Redemption by the Company | Our board of directors may at any time following the seven-year anniversary of the Game Delivery Date resolve to redeem some or all of the Grasslands Game Shares, if at such time the average quarterly Residual Pub Sub Earnings over the four immediately preceding, completed fiscal quarters is less than $25,000 per quarter. See “The Shares – Securities Being Offered.” |

| Certain U.S. Federal Income Tax Considerations | Grasslands Game Shares should be treated as stock of our Company for U.S. federal income tax purposes. There are, however, no court decisions or other authorities directly bearing on the tax effects of the issuance and classification of stock with the features of Grasslands Game Shares, so the matter is not free from doubt. In addition, the Internal Revenue Service has announced that it will not issue advance rulings on the classification of an instrument with characteristics similar to those of the Grasslands Game Shares. Accordingly, no assurance can be given that the views expressed in this paragraph, if contested, would be sustained by a court. In addition, it is possible that the Internal Revenue Service could successfully assert that the issuance of Grasslands Game Shares could be taxable to us. Please see “Risk Factors – Material U.S. Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations.” Before deciding whether to invest in Grasslands Game Shares, you should consult your tax advisor regarding possible tax consequences. |

| | |

Risk Factors | Our Grassland Game Shares are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding whether to invest. |

RISK FACTORS

The investment described herein is highly speculative and involves a high degree of risk of loss of all or a material portion of an investor’s entire investment. Prospective investors should give careful consideration to the following actual and potential risk factors and conflicts of interest in evaluating the merits and suitability of an investment in the Company. The risks and conflicts set forth below are not the only risks and conflicts involved in an investment in the Company. You should carefully consider the following risk factors as well as other information contained in this offering circular and the exhibits to the offering statement to which this offering circular relates before deciding to make an investment in the Company.

The sections “Risks Related to the Company” and “Risks Related to the Shares” contain risks that apply generally to all Game Shares we issue, now and in the future. For a description of the particular risks that additionally apply to the Game Shares we are offering by means of this offering circular, please see “Risks Related to the Game and the Developer,” below.

References to our board of directors or officers in this “Risk Factors” section currently refer to only one person, Justin Bailey, who is the sole director and officer of the Company. See “Directors, Executive Officers and Other Significant Individuals.”

Risks Related to the Company

We have no operating history, which may make it difficult for you to evaluate the potential success of our business and to assess our future viability.

We incorporated in Delaware in October 2015 as a wholly-owned subsidiary of our Parent. Our Company is currently in its early stages and has no operating history. Investment in the Company is highly speculative because it entails significant risk that we may never become commercially viable. Our operations to date have been limited to organizing the Company, business planning, identifying and negotiating with developers that meet our criteria, initiating communications with platforms, and undertaking the process of offering the Game Shares. We have not yet demonstrated the ability to successfully market or distribute a game. We will need to transition from a company focused on identifying developers, negotiating license agreements and raising funds through the sale of Game Shares to a company that is also capable of successfully marketing and distributing games. We may not be successful in such a transition. As a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors.

We have incurred significant losses since our inception, and we anticipate that such losses will continue to be incurred in the future.

The Company’s financial statements have been prepared on a “carve-out” basis for stand-alone reporting purposes (See Index to Financial Statements). On this carve-out basis, for the period from October 27, 2014 (inception) to September 30, 2015, we reported a net loss of approximately $389,000. We expect to continue to incur losses for the foreseeable future, and we expect these losses to increase as we continue identifying and negotiating with developers that meet our criteria, and as we develop the infrastructure necessary to support ongoing operations. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses, the rate at which the developer develops the game, the rate at which we solidify relationships with developers and platforms, and the ability of games to generate revenues. Even if the games generate revenues, they may not produce payments quickly enough to sustain our operations. If the licensed platforms, the developer, or any other individuals or entities with whom our Pub Subs have or may contract in the future to sell the games, fail to make payments in amounts we expect, or at all, we may not receive enough revenue to sustain operations. Even if the games generate sales revenue in the future, such revenue may not be sustainable in subsequent periods. Our expected future losses will have an adverse effect on the Game Shares.

Our independent registered public accounting firm has expressed in its report on our audited financial statements a substantial doubt about our ability to continue as a going concern.

We have not yet generated any revenues from our operations to fund our activities, and are therefore dependent upon external sources for financing our operations. To date, we are completely dependent on our Parent to fund our operations and there is a risk that we and our Parent will be unable to obtain necessary financing to continue operations on terms acceptable to us or at all. As a result, our independent registered public accounting firm has expressed in its auditors’ report on the financial statements included as part of this offering circular a substantial doubt regarding our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of the uncertainty regarding our ability to continue as a going concern. If we cannot continue as a going concern, our stockholders may lose their entire investment in the preferred stock.

We may encounter limitations on the effectiveness of our internal controls, and a failure of our internal controls to prevent error or fraud may harm the Company and its investors, including Game Shares holders.

Because we operate with minimal employees of our own, and depend on our Parent to conduct substantially all of our administrative operations on our behalf, we may encounter limitations on the effectiveness of our internal controls over financial reporting, public disclosures and other matters. For example, as a result of our staffing, our processing of financial information may suffer from a lack of segregation of duties so that all journal entries and account reconciliations are not reviewed by someone other than the preparer. If we encounter limitations on the effectiveness of our internal controls and are unable to remediate them, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a public company in an accurate, complete and timely manner. This could harm our business and our investors, including holders of Game Shares.

As an issuer of securities under Regulation A, we do not expect to be required to assess the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. In addition, our independent registered public accounting firm has not assessed the effectiveness of our internal control over financial reporting and will not as a result of this offering be required to assess the effectiveness of our internal control over financial reporting. As a result of the foregoing, for the foreseeable future, you will not be able to depend on any attestation concerning our internal control over financial reporting from us or our independent registered public accounting firm.

Our operations have been and will continue to be provided and financed by our Parent, which is also in its early stages. Our Parent has no obligation to continue to provide and finance our operations except as required under the Master Services Agreement.

Our Parent was formed in October 2014 and began operations in April 2015. The Parent is currently in its early stages and has limited operating history. We are dependent on the continued support of our Parent under the Master Services Agreement. Our operations are supplied by the Parent, so risks regarding our operations are also subject to the risk of the Parent’s inability to perform under the Master Services Agreement. Investment in the Company is highly speculative because it entails significant risk that our Parent may never become commercially viable.

Pursuant to the Master Services Agreement, the Parent provides our operations in exchange for the Service Fee, which fee is based on a percentage of the game revenue received by the Pub Subs. See “The Company — Master Services Agreement with Our Parent.” The games will not generate revenue until they have been developed and available for sale, which is generally at least a year after the sale of Game Shares. If the Company fails to generate sufficient revenue from sales of the games or is unable to receive such revenue on a continuing basis, our Parent may be unable to continue supplying our operations at planned levels, due to financial difficulty or otherwise. We may be forced to significantly delay, scale back or discontinue our operations, which could materially adversely affect the value of your Game Shares.

In order to support our projected operating expenses for the next 12 months, we and our Parent may need to raise additional capital to continue funding our operations. Such financing may be expensive and time consuming to obtain, and there may not be sufficient investor interest that would enable us to obtain such funds. See “Use of Proceeds.” We rely on our Parent to fund our operations, and there can be no assurance that our Parent’s existing cash and cash equivalents will be sufficient to fund our operations until the relevant game is commercially released. If the Parent is unable to secure additional funds when needed or cannot do so on terms it finds acceptable, the Parent may be unable to continue to operate. Accordingly, the Company will be unable to continue to operate.

If the Company or our Parent were to cease performance of a Pub Sub’s obligations to a developer under a license agreement or enter bankruptcy proceedings, the status of the Game Shares would be interrupted and uncertain.

If the Company or our Parent were to cease performance of a Pub Sub’s obligations to a developer or enter bankruptcy proceedings, the developer has the right to terminate the license agreement. The developer will have no obligation to return any of the Game Funding Payment, and the holders of the related Game Shares may not have any rights to game revenue. The holders of Game Shares may lose their entire investment, unless the developer chooses to resume a substitute arrangement with another company to perform similar services with respect to the game, which arrangement would likely be on terms that are less advantageous to holders of Game Shares.

Even if the developer agreed to a substitute arrangement and the ability to make payments to holders of Game Shares could be resumed, because a bankruptcy or similar proceeding may take months or years to complete, the suspension might effectively reduce the value of any recovery that holders of Game Shares might receive by the time such recovery occurs. Any transfer to a back-up entity may be limited and subject to the approval of the bankruptcy court or other presiding authority. The bankruptcy process may delay or prevent the implementation of back-up services, which may impair the collection of game revenues to the detriment of the holders of Game Shares.

The Company’s operations have consumed substantial amounts of cash, and we expect they will continue to consume substantial amounts of cash.

As we aggressively build our marketing, distribution, developer identification and negotiation, compliance and other administrative functions, we expect to rely heavily on our Parent to provide cash to sustain our operations. Any forecast of the period of time through which the Parent’s financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the factors discussed elsewhere in this “Risk Factors” section. We have based any estimates on assumptions that may prove to be wrong, and we could utilize available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to:

| ● | the cost of the efforts to evaluate, target and access developers that meet our criteria; the cost and expense of negotiating any new license agreements; |

| ● | the rate at which we begin to realize income from game sales; |

| ● | the number and characteristics of any agreements with licensed platforms that the Pub Subs may enter into, and the cost of negotiating such agreements; |

| ● | the number and characteristics of any agreements with licensed platforms that the developer and any co-publishers of a game may enter into; |

| ● | the effect of competing technological and market developments; |

| ● | the cost of establishing and building the sales, marketing and distribution capabilities of the Company and the costs to market each game; and |

| ● | the costs of regulatory compliance and reporting. |

If a lack of available capital means that our Company unable to expand its operations or otherwise capitalize on business opportunities, our business, financial condition and results of operations could be materially adversely affected.

Our business model requires that most (or in some cases all) of the proceeds from the sale of Game Shares be used to make a substantial upfront payment to a developer in exchange for a license to publish a game and receive future revenues from sales of the game on the licensed platforms.

Our business model requires Pub Subs to make substantial upfront payments to developers in exchange for co-publishing rights and rights to receive future revenues based on sales of the games. We intend to pay proceeds (in most cases, net of any related Publisher Expenses) from the offering of Game Shares to a developer to finance the developer’s development of the game under the license agreement. We will be at risk if for any reason our Pub Subs do not receive those future revenues, or if they are less than we would need to sustain operations and pay dividends to holders of Game Shares. We have no history to demonstrate, and we can make no assurances, that our business model will be successful, or whether any agreements with developers or licensed platforms ultimately generate revenues from sales of the games. Consequently, it will be difficult to predict our future success, performance or viability and the viability of our business model, and any such predictions may not be accurate or reliable.

There can be no assurance that the developer will be able to develop the game on time or at all, or that the game will function as intended once developed.

There can be no assurance that the developer can develop the game to be a saleable or successful game. Investors must consider that the developer may not be able to create a game that we can effectively distribute or market. There can be no assurance that the developer will be able to develop the game on time or at all, or that the game will function as intended once developed. Additionally, if the developer becomes subject to bankruptcy or a similar proceeding or loses its ability to attract and retain qualified personnel, the developer may not be able to sustain operations, complete development of the game or develop a game that fails to attract consumers, and consequently our business will be materially adversely affected, as will the value of your Game Shares.

Our business strategy depends on achieving economies of scale. In order to sustain operations, the Company will need to maximize revenue from numerous games. There can be no assurance that the Company will be able to distribute enough games to sustain its business model.

Unless we achieve significant economies of scale by providing co-publishing services with respect to numerous games, maintaining successful relationships with numerous developers, and managing relationships with numerous distribution platforms, our business model will not be successful. However, as of the date of this offering circular, there are no current commitments to co-publish any games other than as described in this offering circular.

Our business strategy depends on maintaining productive relationships with many distribution platforms and distribution agreements with favorable terms.

We cannot predict whether and under what terms and conditions licensed platforms will agree to enter into distribution agreements with the Pub Subs or the co-publishers, and we may not be able to attract a sufficient number of licensed platforms to sell the games. For example, licensed platforms may not view an agreement to sell the game as an attractive value proposition to them due to any number of factors, such as the assumptions and estimates used to determine the estimated future sales revenues of the game. As a result, we or the other co-publishers may be forced to revise terms of the distribution agreements or agree to discounted prices to attract additional licensed platforms. If our Pub Subs and co-publishers fail to enter into agreements with licensed platforms, or enter into agreements with such licensed platforms on terms that substantially reduce the potential revenues of the Pub Subs, our revenues will be materially adversely affected and as will our ability to pay dividends to holders of Game Shares. Furthermore, under a license agreement, the developer may have the ability to veto any licensed platforms for any reason. If the Company believes that a particular distribution platform would be a significant source of revenue for a game, but the developer does not wish for its game to be distributed on that platform, the game will not be sold on that platform and it may achieve lower than expected revenues.

To the extent the game is distributed as a physical copy, we are subject to various additional risks.

To the extent that a licensed platform distributes the game in physical copy, these distribution operations require the platform to work with physical retailers, secure adequate supplies of physical copies of the game on a timely and competitive basis, and ensure that retailers maintain effective inventory and cost controls. Physical copies of games generally require working with independent manufacturers, and if those manufacturers do not provide physical copies of the game on favorable terms without delays, the licensed platform will be unable to deliver the game on competitive terms to retailers when they require them. Additionally, video game retailers typically have a limited amount of physical shelf space and marketing and promotional resources. Therefore, there is significant competition amongst video game publishers to deliver a high quality product that merits retail acceptance and brand recognition in a “hit”-driven market. We cannot be certain that retailers will provide the game with adequate levels of shelf space and promotional support on acceptable terms.

There is no assurance that we will enjoy successful business development as a whole, or that the Company will enjoy successful business development in respect of any particular game.

Investors must consider that our business model is based on an expectation that the Company and any co-publishers will be able to market and distribute games successfully and that demand for such games will sustain itself or increase. There can be no assurance that our business strategies will have the desired impact on the market and lead to any significant revenue or that we will be able to market games effectively. Investors must consider the risks, expenses and uncertainties of a company like us, with an unproven business model, and a highly competitive and rapidly evolving market. Furthermore, neither the Company nor the Parent is obligated to apply resources to the games evenly or in any proportion. The Company and the Parent are not required to apply the Service Fee or the 2.5% of Residual Pub Sub Earnings retained by the Company for the common shares that relates to a particular game toward co-publishing services for the same game. The Company may allocate time and resources across games in its discretion.

The licensed platform, the developer, and any other co-publishers may refuse or fail to make payments under their agreements with respect to sales of the game.

Our cash flows depend on the ability of the Pub Subs to receive payments from sales of the game from licensed platforms. In some cases, the developer or another co-publisher may receive game revenue directly and provide such funds to the Pub Sub pursuant to the relevant license agreement. A developer, co-publisher, licensed platform or other third party may dispute amounts to which a Pub Sub is entitled, or may be unwilling or unable to make payments to which it is entitled. In either event, we may become involved in a dispute with a developer, co-publisher, licensed platform or other third party regarding the payment of such amounts, including possible litigation. Disputes of this nature could harm the relationship between us and the developer, co-publisher, licensed platform or other third party, and could be costly and time-consuming to pursue. Failure to make payments to a Pub Sub for any reason would adversely affect our business and in particular the value of the related Game Shares.

In addition, if the developer, co-publisher or licensed platform were to become the subject of a proceeding under the United States Bankruptcy Code or a similar proceeding or arrangement under another state, federal or foreign law, our rights and interests to receive game income may be prejudiced or impaired, perhaps significantly so. In such circumstances, our Pub Sub may be precluded, stayed or otherwise limited in enforcing some or all of its rights under the relevant agreement with such developer, co-publisher, licensed platform or other third party and realizing the economic and other benefits contemplated therein. To the extent our Pub Sub does not receive payments to which it would otherwise be entitled as a result of any such debtor relief laws, dividends may not be paid with respect to the relevant Game Shares.

The Pub Subs do not have exclusive publishing rights to the games on the licensed platforms; however the license agreements generally provide that the developer and other co-publishers must direct revenue of the game on the licensed platforms to the relevant Pub Sub. If the developer or other co-publishers defaults on this requirement, we will be limited in our ability to collect any payments for sales on the licensed platforms. Generally, we would have to pursue remedies against the developer and the co-publisher. We may become involved in a dispute with developers and co-publishers regarding the payment of such amounts, including possible litigation. Disputes of this nature could harm the relationship between us and the developer and any other co-publishers, and could be costly and time-consuming for us to pursue.

The license agreement does not contain many of the restrictive provisions that are contained in traditional publisher and distributor agreements with game developers which are common in the video game industry. The Pub Sub will provide upfront funding to the developer which is not treated as an advance against royalties and is unsecured.

Many traditional publishing deals involve “advances against royalties” which means the funding provided by the publisher to the developer to create the game is treated as pre-paid royalties. This means that the developer must effectively “pay back” the advances through royalties that would otherwise be payable to the developer. The upfront funding the Pub Subs provide to developers is not treated as an advance against royalties.

Our license agreements are not secured by any collateral or guaranteed or insured by any third party, and you must rely on us to pursue remedies against the developer in the event of any default. The development funding will be an unsecured obligation of the developer to produce a saleable game on certain licensed platforms and will not be secured by any collateral, nor guaranteed or insured by any third party or governmental authority. Therefore, we will be limited in our ability to pursue remedies against the developer and recover any funding if a saleable game is not delivered. If the developer defaults under the license agreement, there can be no assurances that the developer will have adequate resources, if any, to satisfy any obligations to us under the license agreement. Moreover, holders of Game Shares will have no recourse directly against the developer.

Traditional publishers and distributors typically provide funding to developers subject to strict milestone payments. Our license agreements provide for lump-sum upfront funding and do not contain milestone provisions. Upfront lump-sum payments made to the developer by the Pub Sub pursuant to a license agreement put all of the capital raised from sales of Game Shares at risk at an earlier time than a traditional publisher funding arrangement.

If the developer is acquired or experiences a change of control during the development of the game, the impact on our business will be uncertain and your interests in the Game Shares may be adversely affected.

If the developer is acquired or experiences a change of control during its development of the game, this may cause an interruption in the development of the game. While the license agreement would remain in effect, we cannot guarantee that the new management of the developer will adequately honor the license agreement, and we may not have sufficient resources or may otherwise choose not to pursue remedies against the new management of the developer pursuant to the license agreement. Such an event may adversely impact our ability and rights to market and distribute the game, which would negatively impact our business, the value of your Game Shares and our ability to pay dividends. Investors in Game Shares do not have an interest in the developer and would not share in the consideration provided to the developer by such acquirer.

We are dependent upon the key executives and personnel of our Company, the Parent and the developer.

Our success is dependent on the personal efforts of certain key personnel of our Company, including, but not limited to our CEO and sole director, Justin Bailey, and our Vice President, Business Development and Strategy, Jonathan Chan. Our success is also dependent on the personal efforts of certain key personnel of the Parent and each developer. The loss of the services of one or more key employees from our Company, our Parent, or the developer could adversely affect our business and prospects. Our success is also dependent upon our ability and the ability of our Company and Parent to hire and retain additional qualified operating, marketing, technical and financial personnel, and on each developer to retain and hire skilled and experienced game developers and other key personnel. Competition for qualified personnel in the video game industry is intense, and our Company, our Parent and the developer may each have difficulty hiring or retaining necessary personnel. If our Company, our Parent, or the developer fail to hire and retain the respective personnel necessary, our business may be significantly impaired and the value of your Game Shares may be adversely affected.

There may be conflicts of interest between our Company, the Parent and the developer and their respective directors, officers and managers which might not be resolved in your favor.

Justin Bailey, our Chief Executive Officer and sole director receives a salary, benefits and equity compensation from the Parent. See “Security Ownership of Management and Certain Securityholders” above. Mr. Bailey is the CEO and a director of our Parent. Our Parent holds all 1,000,000 outstanding shares of our common stock, and thus holds all of the voting power of our outstanding common stock and has sole control of the Company. See “Capital Stock of the Company.” Pursuant to the Master Services Agreement, our Parent provides our Company with comprehensive management and administrative services, including the services of Justin Bailey, and our Parent will be compensated for the provision of such services by the Service Fee. See “The Company — Master Services Agreement with Our Parent.” Jonathan Chan, our Vice President, Business Development and Strategy, also receives a salary, benefits and equity compensation from the Parent. See “Interest of Management and Others in Certain Transactions.”

The Company, the Parent and the developer and their respective directors, officers and managers may be involved in business activities that do not involve your particular Game Shares and may get involved in other business activities in the future. Such directors, officers or managers may have to allocate their time between supporting the success of the relevant game and the other business activities in which they are involved. Such directors, officers or managers may have conflicts of interest in allocating time, services and functions between the support of a particular game and other various existing and future enterprises.

If marketing and advertising efforts fail to resonate with consumers, our business could be negatively impacted.

The game may be marketed through a diverse spectrum of advertising and promotional programs and strategies. Our ability and the ability of other co-publishers and licensed platforms to market and distribute the game is dependent in part upon the success of these programs and strategies. If the marketing for the game fails to resonate with consumers or advertising rates or other media placement costs increase, these factors could ultimately negatively impact our business, game revenues may fail to grow or may decline and our ability to pay dividends to holders of Game Shares may be reduced.

Owners of certain licensed platforms may control a disproportionate share of the market for the delivery of video games, which may result in contracts with unfavorable terms.

There are many platforms on which video games may be made available for sale, but certain of these platforms control a disproportionate share of the market for the distribution of video game products. If the Pub Sub or a co-publisher enters into an agreement with a licensed platform, a developer may be required to give such licensed platform significant approval rights over the game as delivered to consumers on such licensed platform. This may result in significant delays in getting the game approved, developed and distributed to customers on the licensed platform. Such agreement between the Pub Sub or co-publisher and an owner of a licensed platform may also contain unfavorable terms for the Pub Sub, such as the ability of one party to unilaterally change certain key terms and conditions. Such delays or terms could reduce the revenues received by our Company, harm our business and adversely affect our ability to pay dividends.

Additionally, while we are not currently aware of any reason that would prevent us or any co-publisher from obtaining any desired agreements with respect to any of the licensed platforms, we cannot guarantee that we or any co-publishers will be able to conclude agreements to distribute the game on such licensed platforms. If we and our co-publishers are unable to secure agreements to distribute the game on any of the licensed platforms, we may not be able to effectively bring the game to market, which could negatively impact our business and the value of your Game Shares.

The developer and our Company may fail to anticipate changing consumer preferences.

Our business is speculative and is subject to all of the risks generally associated with the video game industry, which has been cyclical in nature and has been characterized by periods of significant growth followed by rapid declines. Our future operating results and ability to pay dividends to holders of Game Shares will depend on numerous factors beyond our control, including:

| ● | the ability of our co-publishers to maintain the popularity of and monetize the game on the licensed platforms; |

| ● | the ability of the licensed platforms to generate revenue from sales of the game; |

| ● | the developer’s ability to maintain technological solutions and employee expertise to rapidly respond to continuous changes on a licensed platform; |

| ● | international, national and regional economic conditions, particularly economic conditions adversely affecting discretionary consumer spending; |

| ● | changes in consumer demographics; |

| ● | the availability of other forms of entertainment; and |

| ● | critical reviews and public tastes and preferences, all of which change rapidly and cannot be predicted. |

In order to plan for promotional activities, the developer, our Company, any other co-publishers, and the licensed platforms must each anticipate and respond to rapid changes in consumer tastes and preferences. A decline in the popularity of the video game industry could cause sales of a game to decline dramatically. The period of time necessary to develop a game or finalize agreements with licensed platforms is difficult to predict. During this period, consumer appeal of a particular video game may decrease, causing projected sales of the game to decline, which consequently would adversely affect the revenues of our Company, and the value of your Game Shares.

We may experience significant revenue fluctuations due to a variety of factors.

We may experience significant quarterly fluctuations in sales of the game due to a variety of factors, including the timing of the release of the game, the popularity of the game in prior periods, the timing of customer purchases, fluctuations in the size and rate of growth of consumer demand for the game, the timing of the introduction of new licensed platforms and the accuracy of forecasts of consumer demand. Our expectations of future game revenue are based on certain assumptions and projections, and our operating results will be disproportionately and adversely affected by a failure of the game to meet sales expectations. There can be no assurance that we can maintain consistent revenue for any game on a quarterly or annual basis, and any significant fluctuations in revenue may reduce the value of your Game Shares and our ability to make dividend payments.

Dependence on network suppliers may adversely affect the revenues of our Company.

Our success may depend in part upon the capacity, reliability, and performance of third party network infrastructures. Licensed platforms depend on certain third parties to provide uninterrupted and error-free service through their telecommunications networks in order to distribute the game or for customers to play the game, which are subject to physical, technological, security and other risks. These risks include physical damage, power loss, telecommunications failure, capacity limitation, hardware or software failures or defects and breaches of physical and cybersecurity by computer viruses, system break-ins or otherwise. Licensed platforms may exercise little control over these providers, which increases their vulnerability to problems with the services such third parties provide. In such event, players of the game may experience interruptions or delays their ability to play the game. Any failure on the part of licensed platforms or its third-party suppliers to ensure that a high data transmission capacity is achieved or maintained could significantly reduce customer demand for the game and ultimately damage the game’s reputation and result in a reduction in revenues from sales of the game.

The video game industry is subject to increasing regulation of content, consumer privacy, and distribution. Non-compliance with laws and regulations could materially adversely affect our business and our ability to pay dividends to holders of Game Shares.

The video game industry is subject to increasing regulation of content, consumer privacy, distribution and online hosting and delivery in the various countries where we intend to distribute the game. Such regulation could harm our business by limiting the size of the potential market for our products and by requiring additional differentiation between products for different countries to address varying regulations. For example, data protection laws in the United States and Europe impose various restrictions on web sites. If our Company, the developer, other co-publishers, and licensed platforms do not successfully respond to these regulations, sales of the game may decrease and our business may suffer. Generally, any failure of the Company, the developers, other co-publishers, or licensed platforms to comply with laws and regulatory requirements applicable to our business may, among other things, limit our ability to collect all or part of the revenues received by our Pub Subs from sales of the game, and, in addition, could subject us to damages, class action lawsuits, administrative enforcement actions, and civil and criminal liability.

The developer may have limited operating history, which could make it difficult to evaluate the developer’s future prospects and results of operations.

Investors should consider, among other factors, the developer’s prospects for success in light of the risks and uncertainties encountered by companies which may be in early stages of development. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing a new game. The developer may not be able to successfully address these risks and uncertainties or successfully develop its business plans or the game. If the developer fails to do so, it could materially harm our business and the value of the related Game Shares.

The information that we obtain from a developer or other third parties with respect to a developer or a game may be incomplete, inaccurate or intentionally false.