An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time an offering circular which is not designated as a Preliminary Offering Circular is delivered and the offering statement filed with the Commission becomes qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

| Preliminary Offering Circular | Dated March 9, 2016 |

Fig Publishing, Inc.

Up to 20,000 Grasslands Game Shares

$500.00 per Share

This Regulation A offering is for shares of preferred tracking stock, par value $0.0001 per share (the “Grasslands Game Shares”) of Fig Publishing, Inc., a Delaware corporation (the “Company” or “we”). We are offering a maximum of 20,000 Grasslands Game Shares at $500.00 per share, on a best efforts basis. The offering is being conducted to support the acquisition and exploitation of co-publishing rights to a new video game under development, codenamed Grasslands (“Grasslands”).

There is no trading market for our Grasslands Game Shares and we do not expect that any such market will ever develop, in part because there are provisions in the certificate of designations for the Grasslands Game Shares that impose certain restrictions on transfer of the Grassland Game Shares. As a result, investors should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation. See “The Game Shares.”

Grasslands Game Shares will be available for purchase exclusively onFig.co. The shares will be issued in book-entry electronic form only. FundAmerica Stock Transfer, LLC is the transfer agent and registrant for the Grasslands Game Shares.Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer towww.investor.gov.

These are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 9.

| | | Number of Shares | | | Price to

Public | | | Underwriting

Discounts and

Commissions (1) | | | Proceeds to

Issuer (2) | |

| Per Share | | | 1 | | | $ | 500 | | | $ | 0.00 | | | $ | 500 | |

| Total Maximum | | | 20,000 | | | $ | 10,000,000 | | | $ | 0.00 | | | $ | 10,000,000 | |

(1) The Company does not intend to use commissioned sales agents or underwriters. The securities being offered hereby will only be offered by us and persons associated with us, in reliance on the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934.

(2) Does not reflect deduction of expenses of the offering. Offering expenses will be paid in part by the issuer and in part by the issuer’s parent, Loose Tooth Industries, Inc. pursuant to the Master Services Agreement, as described herein. See “Plan of Distribution.”

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

Fig Publishing, Inc.

715 Bryant St. Suite 202

San Francisco, CA 94107

(415) 689-5789

Fig.co

Information contained onFig.co is not incorporated by reference into this offering circular, and you should not consider information contained onFig.co to be part of this offering circular.

The date of this offering circular is __________, 2016

TABLE OF CONTENTS

SUMMARY

The following summary highlights selected information contained in this offering circular. This summary does not contain all the information that may be important to you. You should read all the information contained in this offering circular, including, but not limited to, the “Risk Factors” section.

The Company

Fig Publishing, Inc., a Delaware corporation (the “Company” or “we”), is a recently formed video game publishing company that seeks to identify, license, fund, market, arrange distribution for, and earn cash receipts from sales of new video games being developed by third-party developers. We search for new games and game ideas with the potential to generate significant earnings with the help of our publishing services. Through the issuance and sale of preferred tracking stock (which we call our “Game Shares”), we raise funds for the acquisition and exploitation of publishing rights to video games on particular game-playing platforms pursuant to license agreements with the game’s third-party developers. Each separate series of our Game Shares is intended to raise funds for the acquisition and exploitation of publishing rights to a single, different video game. The Game Shares we are offering by means of this offering circular will support the acquisition and exploitation of co-publishing rights to a new video game under development, codenamed Grasslands, pursuant to a license agreement with the Grasslands game’s developer. See “—Grasslands: the Game, the Developer, the Game Shares,” below.

Game Shares are an opportunity for fans of a particular game concept to help support the development and marketing of the game and share in its potential future earnings on particular platforms. The Game Shares for a particular game track an interest in potential future sales receipts arising under the publishing license entered into between the developer of the game and a subsidiary of ours. Following the development of the game, if the game generates sales receipts, under the publishing license we will receive a substantial portion of those receipts. Pursuant to our business model, we will then pay dividends to the holders of the associated Game Shares based on those receipts. In the future, we expect to make additional offerings of different series of Game Shares, with each different series supporting the acquisition and exploitation of rights to a different game pursuant to a different license agreement.

Our Parent, Loose Tooth Industries, Inc., a Delaware corporation (“Parent”), began operations in April 2015. Our Parent is a provider of video game publishing services and the operator ofFig.co, an online technology platform created to facilitate fundraising for video games.Fig.co is designed to function as:

| | - | a rewards-based crowdfunding website, where video game developers can seek funding in the form of contributions in return for non-securities-related rewards (“Rewards Crowdfunding”); |

| | | |

| | - | an accredited investor crowdfunding website, where securities may be offered and sold only to “accredited investors,” as defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933 and pursuant to Rule 506 of Regulation D (“Accredited Crowdfunding”); and |

| | | |

| | - | a non-accredited investor crowdfunding website, where securities may be offered and sold to “qualified purchasers” as defined in Tier 2 of Regulation A of the Securities Act of 1933 (“Reg A Crowdfunding”). Fig.coalso functions as a testing-the-waters website to process indications of interest in Reg A Crowdfunding (“Reg A Testing the Waters”). |

We intend to useFig.co for our Accredited Crowdfunding, Reg A Testing the Waters and Reg A Crowdfunding campaigns, and we expect the developer of the game to useFig.co for a Rewards Crowdfunding campaign for the same game. Accredited Crowdfunding offerings will be completed and closed prior to the qualification of Reg A Crowdfunding offerings for the same series of Game Shares.

The Company’s publishing model includes the following key parts:

| | ● | Identification. Through the extensive video game industry contacts of the directors, officers, advisors and affiliates of our Company and our Parent, we establish relationships with game developers and their advisors. We evaluate the developers interested in working with us, and the games and game ideas they have, and identify particular game development efforts that we believe have significant earnings potential. |

| | | |

| | ● | Licensing. We negotiate with the developers whose game development efforts we wish to support, with the aim of entering into a license agreement that establishes the developer’s and our respective rights and obligations in the game development effort and in the marketing, distribution and sales stages that we anticipate will follow. We offer developers what we believe is a unique licensing arrangement that provides them with many of the things they complain they do not receive from conventional game publishing arrangements, such as creative control, freedom from milestone obligations and ownership of their core intellectual property and derivative works. |

| | | |

| | ● | Marketing. When a game has been successfully developed and is almost ready for the commercial market, we apply the video game marketing expertise that our principals have developed through their experience in the industry, and engage in such efforts as social media marketing, paid advertising campaigns, design of creative assets, digital public relations, influencer outreach and community marketing. |

| | | |

| | ● | Distribution. In conjunction with our marketing efforts, we identify and secure distribution for the game on any of the wide variety of platforms for which we have licensed publishing rights from the developer. Such licensed platforms will likely vary from game to game, and may include various personal computer, mobile, tablet, video game console, interactive television, virtual reality, augmented reality and other operating systems on which video games are played. (For a description of the licensed platforms for the Grasslands game, see “The Game and the Developer – The Grasslands Game”.) We identify and secure agreements with third-party distributors to distribute, deliver, transmit, stream, resale, wholesale or otherwise exploit the licensed game on the licensed platforms, and we monitor the performance of those agreements after they are entered into. For example, if Microsoft Windows has been licensed to us by the Developer, we would seek to secure agreements with distributors on that platform, such as Steam, Humble Bundle and Amazon. Distributors will be responsible for remitting cash receipts from sales of the game to the Company’s subsidiary holding the license agreement for the game. |

The Company believes that the game-by-game publishing model it has adopted will allow it to raise funds for the acquisition and exploitation of publishing rights to a variety of games, while permitting investors to choose the particular Game Shares in which they wish to invest. The return on each series of Game Shares will depend on a number of factors, including the developer’s efforts to develop a popular game and the Company’s efforts to publish the game within the terms of its license agreement.

Our principals have extensive experience in the business of publishing video games. Justin Bailey, our Chief Executive Officer and sole director, has been active in the video game industry for many years, having published a wide variety of free-to-play, premium and mobile games and having helped to secure many millions of dollars in game financing from publishers, investors and crowdfunding participants in recent years. Jonathan Chan, our Vice President, Business Development and Strategy , has several years of experience at the large video game publisher Electronic Arts Inc., where he focused on business development deals in the publishing and distribution of games. Nevertheless, our business is newly formed, we have not yet earned any game sales receipts, and we have no operating history, which may make it difficult for potential investors to evaluate our business and assess our future viability and prospects. A significant part of our operations are managed and administered by principals and employees of our Parent, which is compensated for the provision of such services by the Service Fee (as defined below). The Company’s fiscal year-end is September 30th.

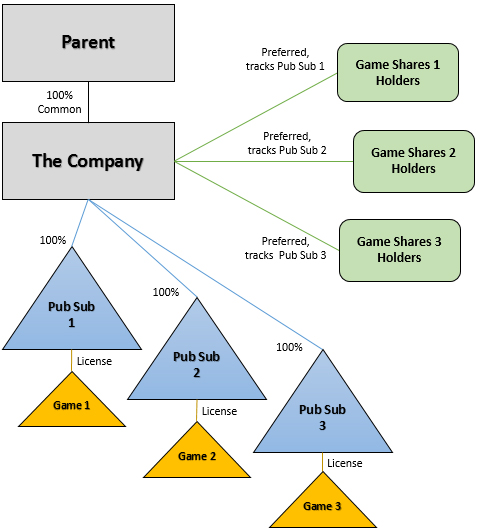

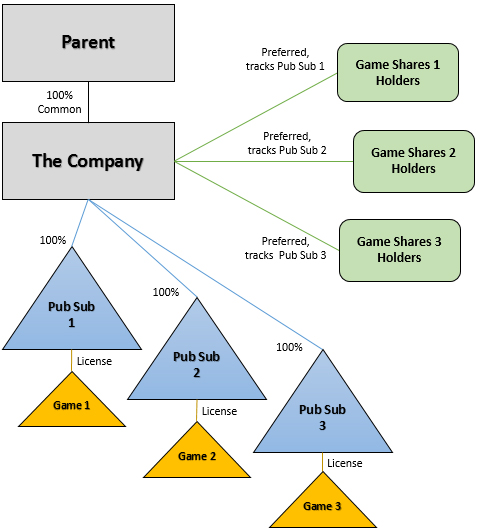

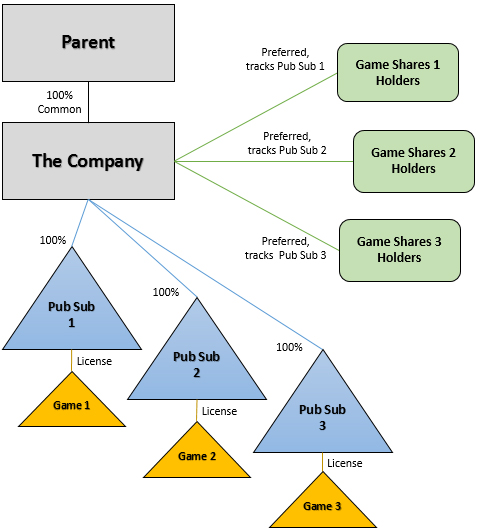

Our Game Shares will track the economic performance of a particular subsidiary of the Company (each a “Pub Sub”), which will hold the publishing license to a particular game under development, entered into between that Pub Sub and the developer of the game. The tracking will work as follows: when and if the game is developed and begins to sell, the Pub Sub will begin receiving cash from sales of the game made by distributors on the licensed platforms. After payment of the developer’s royalty and other expenses described below, the Pub Sub will then distribute the remaining receipts to the company. Pursuant to our business model, the Company will then pay out 97.5% of those receipts as dividends to holders of the associated Game Shares, subject to our dividend policy. See “Dividend Policy.”

Each Pub Sub is expected to be a Delaware limited liability company and a wholly owned subsidiary of the Company. The Pub Sub will be formed specifically to serve as the entity to which the developer licenses rights in respect of the game to be developed. The publishing license agreement between the Pub Sub and the developer will govern the funding to be provided by the Pub Sub to the developer to finish the development of the game, the Pub Sub’s rights in the exploitation of the developed game, the cash the Pub Sub will earn from such exploitation and the allocation of such cash receipts among expenses, the developer (in the form of a royalty) and the Pub Sub itself. The Game Shares will govern the rights of Game Shares holders to receive dividends, which would be paid by us from the earnings of the game that we receive from the Pub Sub, subject to our dividend policy. See “Dividend Policy.”

The general corporate, securities and licensing structure of our game investment model is illustrated below (not to scale):

Under the license agreement between a Pub Sub and a developer, the Pub Sub will have rights to publish the game on particular platforms and the right to receive cash from sales of the game made by distributors on such platforms, in exchange for:

| | Upfront funds provided to the developer to help complete the development of the game for commercial sale (the “Game Development Funding”). | + | After the game begins to sell on the licensed platforms, a certain substantial percentage (the “Developer Royalty”) of the Pub Sub’s Adjusted Gross Receipts, as defined below). |

Proceeds from the sale of the Game Shares will not only provide the Game Development Funding but also provide funds for the Company. Specifically, the Game Development Funding will be equal to a percentage of the proceeds of the sale of the related Game Shares expected to range between 95% and 97.5% (as provided in the relevant license agreement). The remaining portion of the proceeds will be retained by the Company in order to cover operating expenses, the Game Shares offering costs and the costs of any pre-release marketing of the game. Our Parent will pay for any such expenses in excess of the proceeds retained by the Company, pursuant to the Master Services Agreement. See “The Company – Master Services Agreement with Our Parent.”

The Developer Royalty will be calculated based on a formula negotiated between the Company and the developer that depends in part on the size of the Game Development Funding.

“Adjusted Gross Receipts” equals:

| | Cash received by the Pub Sub from distributors of the game on the licensed platforms, net of distributor fees and deductions (“Sales Receipts”), generally expected to be approximately 70% of the retail price of the game. | - | Certain sales expenses, such as chargebacks or disputed credit card charges and sales taxes not already covered by distributors, generally expected to be no more than 2.5% of Sales Receipts. | - | A fixed-percentage fee paid to our Parent for providing management and administrative services to us (the “Service Fee”), generally expected to vary between 0.1% and 20%. |

From Adjusted Gross Receipts, the Pub Sub will pay the Developer Royalty to the developer, and the remaining funds (“Pub Sub Cash”) will be distributed to us. Investors in Game Shares will receive 97.5% of the Pub Sub Cash, in the form of dividends on their Game Shares, subject to our dividend policy (see “Dividend Policy”), and the remaining 2.5% will be retained by the Company. The Company intends to use this remaining 2.5% of Pub Sub Cash for general corporate and working capital purposes, including payment of expenses that may be applicable to all Pub Subs generally, and to pay dividends to our Parent.

The license agreement between a developer and a Pub Sub in respect of a particular game may permit the developer to license publishing rights to other parties (referred to as “co-publishers”) on some or all of the platforms licensed to the Pub Sub by the Developer. Under the terms of the between a developer and a Pub Sub, to the extent any co-publisher publishes the game on a platform that is also licensed to the Pub Sub by the Developer, the amount of cash received by the Pub Sub will not be reduced, because co-publishers will be required to provide the cash they receive to the Pub Sub for further allocation to the developer, the Pub Sub itself and (typically through the developer) the co-publishers. See “Risk Factors.”

Holders of Game Shares will be preferred stockholders of the Company. They will have no direct interest in the associated Pub Sub, license agreement, developer, core intellectual property of the game or derivative works of the game (such as sequels or spinoffs, and in some cases, downloadable content). Our rights in regard to the game and its sales receipts are limited by the specific parameters of our Pub Sub’s publishing license agreement with the developer of the game. The license agreement that relates to the Grasslands Game Shares is filed as an exhibit to the offering statement to which this offering circular relates, and is further described in the section of this offering circular entitled “The Game and the Developer”. Holders of Game Shares will also have no rights in the management of the Company, whose common shares are held 100% by our Parent.

The Company will not be able to publish the game unless and until it is developed. To the extent the game is not developed diligently or at all, the Company will not be able to publish the game diligently or at all, and therefore the game may not generate sufficient sales receipts to allow dividends to be paid at particular levels or at all. Holders of Game Shares may only look to the Company to enforce the terms of the license agreement between the relevant Pub Sub and the developer. There can be no assurance that the game developer will fully or efficiently apply the Game Development Funding, which is not secured against any assets of the developer. See “Risk Factors.”

The Company believes that the risks of the lump-sum, upfront nature of the Game Development Funding will be outweighed by the competitive advantage the Company will gain in attracting high quality developers as a result of, among other things, not demanding interests in the developer's core intellectual property and not subjecting them to milestone obligations in respect of the development of the game, as well as the benefits to the game development process resulting from the greater creative freedom afforded to the Developer. However, there can be no assurance that these risks will in fact be outweighed by the benefits we expect, and no assurance that the Company's model will not materially adversely affect the Company's business and, therefore, holders' investments in Game Shares.

In addition, because there is no trading market for Game Shares and we do not expect one to develop, holders of Game Shares should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation.

Grasslands: the Game, the Developer, the Game Shares

Our first Pub Sub, Fig Grasslands, LLC (the “Grasslands Pub Sub”), has entered into a license agreement (the “Grasslands License Agreement”) with Double Fine Productions, Inc., a California corporation (the “Grasslands Developer”), to co-publish a game that we have code-named “Grasslands” (such game, “Grasslands,”) on any and all current and future operating systems on which video games are played, excluding virtual reality platforms.

Grasslands will be a sequel to one of the Grasslands Developer’s most successful games, which has had sales of over 1,000,000 units. Tim Schafer, who is the Chief Executive Officer of the Grasslands Developer, and much of the team that developed the original game, will be working together on this sequel, which will include many of the same characters as the original game but with a new storyline. Mr. Schafer is a member of the Board of Directors of our Parent and is also a significant stockholder of our Parent. See “Risk Factors”

As payment for co-publishing rights under the Grasslands License Agreement, 97.5% of the proceeds of the sale of the Grasslands Game Shares will be paid to the Grasslands Developer. The remaining portion of the proceeds will be retained by the Company in order to cover operating expenses, the Game Shares offering costs and the costs of any pre-release marketing of the game. (Our Parent will pay for any such expenses in excess of the proceeds retained by the Company, pursuant to the Master Services Agreement. See “The Company – Master Services Agreement with Our Parent.”) We refer to this payment of proceeds as the “Grasslands Game Development Funding.” The Grasslands Developer must deliver the finished Grasslands game ready for commercial sale on the committed PC platforms, as identified in the Grasslands License Agreement, no later than July 31, 2018.

When and if Grasslands is developed and commercial sales begin, the terms of the Grasslands License Agreement relating to the sharing of cash receipts will apply. The Adjusted Gross Receipts derived from the co-publishing of Grasslands will be divided between the Grasslands Pub Sub and the Grasslands Developer on a percentage basis that varies based on (i) the size of the Game Development Funding that was made to the Grasslands Developer, and (ii) the achievement of certain Adjusted Gross Receipts targets. Specifically, until a target of $13,333,333 of Adjusted Gross Receipts is achieved, the Grasslands Developer shall receive as its Developer Royalty a percentage of Adjusted Gross Receipts equal to 100% minus (2.5 x the Grasslands Investor Share); and after the target of $13,333,333 of Adjusted Gross Receipts is achieved, the Grasslands Developer shall receive as its Developer Royalty a percentage of Adjusted Gross Receipts equal to 100% minus the Grasslands Investor Share. In each case, the “Grasslands Investor Share” means a percentage equal to the gross proceeds from the sale of Grasslands Game Shares minus $4,000 (which reflects promotional credits of $1,000 that were good for the purchase of additional Grasslands Game Shares and were granted to each of four investors in the Accredited Crowdfunding campaign who expressed an early interest in investing) divided by $33,333,333.

For a number of reasons discussed elsewhere in this offering circular, including in the section entitled “—The Company,” above, and in the section entitled “Risk Factors,” there can be no assurance that the Grasslands game will generate earnings from which dividends will be paid to holders of Grasslands Game Shares.

The Offering

| Issuer | Fig Publishing, Inc. |

| | |

Securities | A maximum of 20,000 shares of preferred tracking stock, par value $0.0001 per share (the “Grasslands Game Shares”), of the Company. The Grasslands Game Shares will track the economic performance of Fig Grasslands, LLC (the “Grasslands Pub Sub”), the licensee of the Grasslands game (“Grasslands”). When and if Grasslands is developed and begins to sell, and the Grasslands Pub Sub earns cash receipts from sales of Grasslands, holders of the Grasslands Game Shares will be paid dividends by the Company based on the Grasslands Pub Sub’s earnings received from the Grasslands game, subject to the Company’s dividend policy. See “The Game Shares” and “Dividend Policy.” |

| | |

| Price per Share | $500.00 |

| | |

| Offering Type | Regulation A offering of shares, being made by the Company on a best efforts basis. The offering is being conducted to support the acquisition and exploitation of co-publishing rights to the Grasslands video game, which is a new video game under development. |

| | |

| Minimum Target Already Achieved | Funds for the development of the Grasslands game have been and will be raised in three ways: |

| | (1) | the Grasslands Developer has conducted a Rewards Crowdfunding campaign on Fig.co; |

| | | |

| | (2) | the Company has offered and sold Grasslands Game Shares to accredited investors on Fig.co, pursuant to Rule 506(c) under the Securities Act of 1933, as amended (the “Securities Act”), and under the Grasslands License Agreement will pay proceeds to the Grasslands Developer; and |

| | | |

| | (3) | pursuant to this offering circular and Regulation A under the Securities Act, the Company will offer and sell Grasslands Game Shares to non-accredited and accredited investors who are qualified purchasers under Regulation A on Fig.co, and will pay proceeds to the Grasslands Developer under the Grasslands License Agreement. |

| | As calculated by the Grasslands Pub Sub pursuant to the Grasslands License Agreement, when the aggregate of (1) proceeds received in the Rewards Crowdfunding campaign, (2) purchase amounts or indications of interest received in the Accredited Crowdfunding campaign and (3) indications of interest received in the Regulation A Test the Waters campaign reached $3.3 million, which occurred on January 12, 2016, the Grasslands Developer became obligated to develop and deliver the Grasslands game under the Grasslands License Agreement. |

| | |

| | The Company believes that the Grasslands Developer will have sufficient funds to develop Grasslands in accordance with the Grasslands License Agreement, based upon the (i) the amounts the Grasslands Developer raised through rewards crowdfunding (ii) the projected Game Development Funding amount and (iii) the Company’s assessment of the financial condition of the Developer as disclosed confidentially to the Company. However, there can be no assurance that the Grasslands Developer will have sufficient funds to develop Grasslands or otherwise be able to develop the game and perform its obligations under the Grasslands License Agreement. The Grasslands Developer and the Company expect that the Grasslands Developer may choose to use more funds on the development of the Grasslands game than is necessary for minimum compliance with the Developer’s obligation to deliver an executable game pursuant to the Grasslands License Agreement, in particular because both parties are of the view that additional spending on the development of the game can result in a more commercially appealing game and thereby raise sales receipts once the game is published. However, if and to the extend the Game Developer spends more on the development of the Grasslands game, or licenses the game to additional co-publishers in order to bring in more development funding from such co-publishers, the share of receipts from game sales that will be due to the Grasslands Pub Sub, and thereby available to the Company for distribution to holders of Game Shares in the form of dividends, should not change. Under the Grasslands License Agreement, all sales receipts for the game, whether collected initially by the Pub Sub or a co-publisher (including the Grasslands Developer), will be paid to the Pub Sub for further distribution between the Grasslands Developer and the Pub Sub, so whether the final budget for the Grasslands game is low or high, the terms of the Grasslands License Agreement do not permit dilution of the Company’s share of Adjusted Gross Revenue from the game, and by extension the amounts available for distribution to Grasslands Game Shares holders in the form of dividends. |

| | |

| | See “The Game and the Developer” and “Risk Factors.” |

Where to Buy | Grasslands Game Shares will be available for purchase exclusively on Fig.co. The shares will be issued in book-entry electronic form only. FundAmerica Stock Transfer, LLC is the transfer agent and registrant for the Grasslands Game Shares. The Company does not intend to use commissioned sales agents or underwriters to help offer and sell Grassland Game Shares. The securities being offered hereby will only be offered by us and persons associated with us, in reliance on the exemption from registration contained in Rule 3a4-1 of the Securities Exchange Act of 1934. See “Plan of Distribution.” |

| Limitations on Your Investment Amount | Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A, which states: “In a Tier 2 offering of securities that are not listed on a registered national securities exchange upon qualification, unless the purchaser is either an accredited investor (as defined in Rule 501 (§230.501)) or the aggregate purchase price to be paid by the purchaser for the securities (including the actual or maximum estimated conversion, exercise, or exchange price for any underlying securities that have been qualified) is no more than ten percent (10%) of the greater of such purchaser's: (1) Annual income or net worth if a natural person (with annual income and net worth for such natural person purchasers determined as provided in Rule 501 (§230.501)); or (2) Revenue or net assets for such purchaser's most recently completed fiscal year end if a non-natural person.” For general information on investing, we encourage you to refer towww.investor.gov. |

| | |

Offering Proceeds | Up to $10,000,000, all of which will be proceeds of the Company. This amount does not reflect the deduction of offering expenses, which we estimate will be $337,500 and which will be paid (i) in part from a portion of the amount the Company retains after deduction for the Game Development Funding, and (ii) otherwise by our Parent pursuant to the Master Services Agreement. See “Plan of Distribution.” |

| | |

Use of Proceeds | We will use the proceeds from this offering to provide the Grasslands Game Development Funding, which will be paid to the Grasslands Developer pursuant to the Grasslands License Agreement, and to support the Company’s operations. The Game Development Funding will be equal to 97.5% of the proceeds of the sale of the Grasslands Game Shares. The remaining portion of the proceeds will be retained by the Company in order to cover operating expenses, the Game Shares offering costs and the costs of any pre-release marketing of the game. Our Parent will pay for any such expenses in excess of the proceeds retained by the Company, pursuant to the Master Services Agreement. See “The Company – Master Services Agreement with Our Parent.” See “Use of Proceeds,” “Risk Factors” and “The Company – Master Services Agreement with Our Parent.” |

Dividends | Investors in Grassland Game Shares will receive 97.5% of the Pub Sub Cash from the Grasslands game, in the form of dividends on their Game Shares, subject to the limitations set forth in the section entitled “Dividend Policy,” including the following: |

| | (i) | dividends are payable upon declaration by our Board; |

| | | |

| | (ii) | we expect that our Board will declare the first dividend payment on the Grasslands Game Shares promptly after the end of the first quarter in which the Grasslands Pub Sub has received Sales Receipts, and will continue to declare dividends promptly after the end of each quarter that the Grasslands Pub Sub receives such Sales Receipts; |

| | | |

| | (iii) | we expect that, in each quarter in which a dividend is declared and paid, the amount of the dividend declared and paid will be 97.5% of the Pub Sub Cash on hand as of the end of foregoing quarter; and |

| | | |

| | (iv) | in all events, our Board will retain the discretion not to pay a dividend, or to pay a dividend less than 97.5% of the Pub Sub Cash on hand as of the end of foregoing quarter, in circumstances where the Board believes that it is necessary or prudent to retain such earnings in order to avoid a material adverse effect on our financial condition or results of operations, or based on applicable legal requirements or contractual restrictions, or based on other factors that the Board deems relevant and significant to the Company. |

| | The remaining 2.5% of the Pub Sub Cash from the Grasslands game will be retained by the Company. |

| | |

| | We expect to pay dividends on or about each January 30, April 30, July 30 and October 30 after the Grasslands game has begun to generate Pub Sub Cash, and to pay them to the holders of record of Grasslands Game Shares as of the previous December 31, March 31, June 30 and September 30, respectively. |

| | |

| | The Game Shares should not be viewed as traditional preferred stock. There will be no mandated minimum periodic dividend payment, and therefore there will be no accrual for future payment of unpaid mandated minimum periodic dividends. |

| | |

| | See “The Game Shares” and “Dividend Policy.” |

| | |

Lack of Trading Market; Transfer Restrictions | There is no trading market for our Game Shares and we do not expect that any such market will ever develop, in part because there are provisions in the certificate of designations for the Grasslands Game Shares that impose certain restrictions on transfer of the Grassland Game Shares. As a result, investors should be prepared to retain their shares for so long as they remain outstanding and should not expect to benefit from share price appreciation. See “The Game Shares.” |

| | |

| No Voting Rights | Holders of Grasslands Game Shares are not entitled to vote on any matters, including, but not limited to, any matters relating to the development of Grasslands. See “The Game Shares.” |

| | |

Rights against the Company | Holders of Grasslands Game Shares shall have no rights against the Company other than to the extent of their rights to receive dividends from the Company in respect of Grasslands. For example, holders of Grasslands Game Shares shall have no right to vote on any matters relating to Company corporate governance, and shall have no rights to any assets of the Company upon liquidation or otherwise, other than to the extent of their rights to receive dividends and other distributions from the Company in respect of the Grasslands Game Shares held by such holders. See “The Game Shares.” |

| | |

| Certain U.S. Federal Income Tax Considerations | Grasslands Game Shares should be treated as stock of our Company for U.S. federal income tax purposes. There are, however, no court decisions or other authorities directly bearing on the tax effects of the issuance and classification of stock with the features of Grasslands Game Shares, so the matter is not free from doubt. In addition, the Internal Revenue Service has announced that it will not issue advance rulings on the classification of an instrument with characteristics similar to those of the Grasslands Game Shares. Accordingly, no assurance can be given that the views expressed in this paragraph, if contested, would be sustained by a court. In addition, it is possible that the Internal Revenue Service could successfully assert that the issuance of Grasslands Game Shares could be taxable to us. Please see “Risk Factors – Material U.S. Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations.” Before deciding whether to invest in Grasslands Game Shares, you should consult your tax advisor regarding possible tax consequences. |

| | |

Risk Factors | Our Grassland Game Shares are speculative securities. Investing in them involves significant risks. You should invest in them only if you can afford a complete loss of your investment. See “Risk Factors” for a discussion of factors you should carefully consider before deciding whether to invest. |

RISK FACTORS

The investment described herein is highly speculative and involves a high degree of risk of loss of all or a material portion of an investor’s entire investment. Prospective investors should give careful consideration to the following actual and potential risk factors and conflicts of interest in evaluating the merits and suitability of an investment in the Company. The risks and conflicts set forth below are not the only risks and conflicts involved in an investment in the Company. You should carefully consider the following risk factors as well as other information contained in this offering circular and the exhibits to the offering statement to which this offering circular relates before deciding to make an investment in the Company.

The sections “Risks Related to the Company” and “Risks Related to the Game Shares” contain risks that apply generally to all Game Shares we issue, now and in the future. For a description of the particular risks that additionally apply to the Game Shares we are offering by means of this offering circular, please see “Risks Related to the Game and the Developer,” below.

References to our board of directors or officers in this “Risk Factors” section currently refer to only one person, Justin Bailey, who is the sole director and officer of the Company. See “Directors, Executive Officers and Other Significant Individuals.”

Risks Related to the Company

We have no operating history, which may make it difficult for you to evaluate the potential success of our business and to assess our future viability.

We incorporated in Delaware in October 2015 as a wholly-owned subsidiary of our Parent. Our Company is currently in its early stages and has no operating history. Investment in the Company is highly speculative because it entails significant risk that we may never become commercially viable. Our operations to date have been limited to organizing the Company, business planning, identifying and negotiating with developers that meet our criteria, initiating communications with distributors, and undertaking the process of offering the Game Shares. We have not yet demonstrated the ability to successfully market or distribute a game. We will need to transition from a company focused on identifying developers, negotiating license agreements and raising funds through the sale of Game Shares to a company that is also capable of successfully publishing games. We may not be successful in such a transition. As a new business, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors.

Our independent registered public accounting firm has expressed in its report on our audited financial statements a substantial doubt about our ability to continue as a going concern.

We have not yet generated any revenues from our operations to fund our activities, and are therefore dependent upon external sources for financing our operations. To date, we are completely dependent on our Parent to fund our operations and there is a risk that we and our Parent will be unable to obtain necessary financing to continue operations on terms acceptable to us or at all. As a result, our independent registered public accounting firm has expressed in its auditors’ report on the financial statements included as part of this offering circular a substantial doubt regarding our ability to continue as a going concern. Our financial statements do not include any adjustments that might result from the outcome of the uncertainty regarding our ability to continue as a going concern. If we cannot continue as a going concern, our stockholders may lose their entire investment in the preferred stock.

We may encounter limitations on the effectiveness of our internal controls, and a failure of our internal controls to prevent error or fraud may harm the Company and its investors, including Game Shares holders.

Because we operate with minimal employees of our own, and depend on our Parent to conduct a significant portion of our administrative operations on our behalf, we may encounter limitations on the effectiveness of our internal controls over financial reporting, public disclosures and other matters. For example, as a result of our staffing, our processing of financial information may suffer from a lack of segregation of duties so that all journal entries and account reconciliations are not reviewed by someone other than the preparer. If we encounter limitations on the effectiveness of our internal controls and are unable to remediate them, we may not be able to report our financial results accurately, prevent fraud or file our periodic reports as a public company in an accurate, complete and timely manner. This could harm our business and our investors, including holders of Game Shares.

As an issuer of securities under Regulation A, we do not expect to be required to assess the effectiveness of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act. In addition, our independent registered public accounting firm has not assessed the effectiveness of our internal control over financial reporting and will not as a result of this offering be required to assess the effectiveness of our internal control over financial reporting. As a result of the foregoing, for the foreseeable future, you will not be able to depend on any attestation concerning our internal control over financial reporting from us or our independent registered public accounting firm.

A significant part of our operations have been and will continue to be provided and financed by our Parent, which is also in its early stages. Our Parent has no obligation to continue to provide and finance our operations except as required under the Master Services Agreement.

Our Parent was formed in October 2014 and began operations in April 2015. The Parent is currently in its early stages and has limited operating history. We are dependent on the continued support of our Parent under the Master Services Agreement. A significant part of our operations are supplied by the Parent, so risks regarding our operations are also subject to the risk of the Parent’s inability to perform under the Master Services Agreement. Investment in the Company is highly speculative because it entails significant risk that our Parent may never become commercially viable.

As we aggressively build our marketing, distribution, developer identification and negotiation, compliance and other administrative functions, we expect to rely heavily on our Parent to provide cash to sustain our operations, pursuant to the Master Services Agreement. Pursuant to the Master Services Agreement, the Parent provides a significant portion of our operations in exchange for the Service Fee, which fee is based on a percentage of the game sales receipts received by the Pub Subs. See “The Company — Master Services Agreement with Our Parent.” The games will not generate sales until they have been developed and available for sale, which is generally at least a year after the sale of Game Shares. See “The Game and the Developer” for the delivery date of the game relevant to this offering circular. If the Company fails to generate sufficient cash receipts from sales of the games or is unable to receive such cash on a continuing basis, our Parent may be unable to continue supplying operations for us at planned levels, due to financial difficulty or otherwise. We may be forced to significantly delay, scale back or discontinue our operations, which could materially adversely affect the value of your Game Shares.

In order to support our projected operating expenses for the next 12 months, we or our Parent may need to raise additional capital in order to continue funding our operations. Such financing may be expensive and time -consuming to obtain, and there may not be sufficient investor or commercial interest to enable us to obtain such funds on attractive terms or at all. See “Use of Proceeds.” We rely on our Parent to fund a significant part of our operations, and there can be no assurance that our Parent’s existing cash and cash equivalents will be sufficient to fund our operations until the relevant game is commercially released. If the Parent is unable to secure additional funds when needed or cannot do so on terms it finds acceptable, the Parent may be unable to continue to operate. Accordingly, the Company will be unable to continue to operate.

Our business model requires that 95% to 97.5% of the proceeds from the sale of Game Shares be used to make a substantial upfront payment to a developer in exchange for a license to publish a game and receive future cash receipts from distributors for sales of the game on the licensed platforms.

Our business model requires Pub Subs to make substantial upfront payments to developers in exchange for co-publishing rights and rights to receive future cash receipts based on sales of the games. We intend to pay 95% to 97.5% of proceeds from an offering of Game Shares to a developer to finance the acquisition of publishing rights for our Pub Subs under the license agreements with game developers. We will be at risk if for any reason our Pub Subs do not receive revenues for the games developed under the license agreements, or if they are less than we would need to sustain operations and pay dividends to holders of Game Shares. We have no history to demonstrate, and we can make no assurance, that our business model will be successful, or whether any agreements with developers or licensed platforms ultimately generate revenues from sales of the games. Consequently, it will be difficult to predict our future success, performance or viability and the viability of our business model, and any such predictions may not be accurate or reliable.

In the event the Pub Sub materially breaches the terms of the license agreement and the developer terminates the license agreement, the Pub Sub would have limited recourse and holders of Game Shares could lose their investments.

In the event that the Pub Sub materially breaches the terms of the license agreement, the developer has the right to terminate the license agreement. If the license agreement is terminated, the Company will no longer have rights to publish the game, which means our Pub Sub will no longer have the right to receive sales receipts from game sales. The license agreement between a Pub Sub and a developer will not provide a mechanism pursuant to which the developer would be obligated to return any of the Game Development Funding in the event that the license agreement is terminated, in part because the Company wishes to encourage developers to promptly apply those funds to the successful development of the game. The developer can use the Game Development Funding to enter into contractual obligations or other commitments, such as multi-year contracts with its employees or independent contractors who are responsible for designing the game before the game delivery date. See “The Company” for a further description of the Company’s business model and philosophy regarding developer obligations.

In the event the Pub Sub materially breaches the terms of the license agreement and the developer terminates the license agreement, the holders of Game Shares would not be entitled to a refund of their investment. Furthermore, if the license agreement is terminated, the Pub Sub would no longer have rights to publish the game or receive sales receipts, and there would no longer be Pub Sub Cash from which to pay dividends to holders of Game Shares. In the event that the developer terminates the license agreement due to a material breach by the Pub Sub, the holders of the relevant Game Shares must rely on the Company to pursue any restitution of the Game Development Funding; however the Company cannot assure you that such action will be successful or that the developer would have sufficient funds to pay restitution.

In the event the developer materially breaches the terms of the license agreement, the Pub Sub will have limited recourse. The developer may not be able to develop the game as expected, on time, or at all.

Holders of Game Shares will be preferred stockholders of the Company. The license agreement will be between the developer and the relevant Pub Sub, and holders of Game Shares will have no rights under the license agreement, whether as a third-party beneficiary or otherwise. In the event that the developer materially breaches the license agreement – for example, if it fails to deliver the game on time or at all – the holders of the relevant Game Shares must rely on the Company to pursue any claims against the developer.

We intend to enforce all contractual obligations to the extent we deem necessary and in the best interests of the Company and holders of Game Shares. Any lawsuit against the developer for failure to deliver the game would likely demand the return of the Game Development Funding, however the Company cannot assure you that such lawsuit will be successful or that the developer would have sufficient funds to pay any settlements or judgments against it.

There can be no assurance that the developer can or will honor the terms of the license agreement or develop the game to be a successful game. The developer may not be able to develop the game on time or at all, and the game may not function as intended once developed. The developer may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors.

Furthermore, in the event that the developer materially defaults or breaches the terms of the license agreement and the Pub Sub elects to terminate the license agreement, the Pub Sub would no longer have rights to publish the game or receive sales receipts. Holders of Game Shares may lose their entire investment in the event the developer materially defaults or breaches the terms of the license agreement.

If the developer is no longer able to develop the game and perform its obligations under the license agreement due to bankruptcy, dissolution any other event, the Pub Sub would have limited recourse. The bankruptcy, insolvency or business failure of the developer could result in our inability to publish the game.

If the developer is no longer able to develop the game and perform its obligations under the license agreement due to bankruptcy, dissolution or any other similar event, there can be no assurance that Game Shares holders will be able to recover any or all of their investment. The insolvency or business failure of the developer could result in our inability to publish the game. In addition, if the developer were to become the subject of a proceeding under the United States Bankruptcy Code or a similar proceeding or arrangement under another state, federal or foreign law, our rights and interests to receive game sales receipts may be prejudiced or impaired, perhaps significantly so. In such circumstances, our Pub Sub may be precluded, stayed or otherwise limited in enforcing some or all of its rights under the license agreement with such developer and realizing the economic benefits contemplated therein. To the extent our Pub Sub does not receive payments to which it would otherwise be entitled, dividends might not be paid with respect to the relevant Game Shares. Even if, after a delay, the developer or a substituted party were able to resume performance under the license agreement, and the Company was able to resume payments to holders of Game Shares, because a bankruptcy or similar proceeding may take months or years to complete, the delay might effectively reduce the value of any recovery that holders of Game Shares might receive.

If the Company were to enter bankruptcy or similar proceedings, there can be no assurance that Game Shares holders will be able to recover any or all of their investments.

If the Company were to enter bankruptcy or similar proceedings, there can be no assurance that Game Shares holders will be able to recover any or all of their investments. The Company could be compelled to enter such proceedings if it became unable to pay its debts as they became due. In order to help guard against this possibility, the Company has limited its obligations under its Game Shares to the payment of amounts received under the associated publishing license agreement. Were the Company nevertheless to incur debts that it could not pay as they came due, in a bankruptcy or similar proceeding, one of a number of outcomes could ensue, including the following:

| ● | The Company could continue in business but be required to divert receipts that would otherwise be paid as dividends to Game Shares holders in order to pay the Company’s creditors; however, after a time, if the creditors were paid and the game underlying the Game Shares continued to generate sales, the Company could resume paying dividends to Game Shares holders; or |

| ● | The Company could be compelled to sell one or more of its Pub Subs in order to raise funds to pay the Company’s creditors. The Company has amended its amended and restated certificate of incorporation to require that, if a Pub Sub or all or substantially all of a Pub Sub’s assets are sold, the Pub Sub must agree to directly or indirectly assume the obligations owed under the associated Game Shares to the holders of such Game Shares and the obligations of the Pub Sub under its license agreement with the associated developer. If these requirements were enforced, the Pub Sub would continue to operate under the associated license agreement and continue to pay dividends to the Game Shares holders; however, there can be no assurance that these requirements would be enforced in a bankruptcy or similar proceeding, in particular because, in such proceedings, the court or similar authority usually has broad discretion to dispose of the assets of the bankrupt company in order to settle outstanding claims; or |

| ● | The Company’s assets, including its Pub Subs, could be disposed of under the broad discretion of the bankruptcy court or similar authority in ways that might extinguish the rights of Games Shares holders to further dividends; or divert funds intended for Game Shares holders to Company creditors or others; or divert funds intended for the holders of one series of Game Shares to pay debts assumed in respect of a different series of Game Shares or a different game, or to pay the holders of another series of Game Shares. |

In any such circumstances, Game Shares holders could lose some or all of the dividends they might otherwise have received, or some or all of their investments. In addition, even if, after a delay, the Company was able to resume payments to holders of Game Shares, because a bankruptcy or similar proceeding may take months or years to complete, the delay might effectively reduce the value of any recovery that holders of Game Shares might receive.

We have incurred significant losses since our inception, and we anticipate that such losses will continue to be incurred in the future. The Company’s operations have consumed substantial amounts of cash, and we expect they will continue to consume substantial amounts of cash.

The Company’s financial statements have been prepared on a “carve-out” basis for stand-alone reporting purposes (See Index to Financial Statements). On this carve-out basis, for the period from October 27, 2014 (inception) to September 30, 2015, we reported a net loss of approximately $389,000. We expect to continue to incur losses for the foreseeable future, and we expect these losses to increase as we continue identifying and negotiating with developers that meet our criteria, and as we develop the infrastructure necessary to support ongoing operations. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business.

As we aggressively build our marketing, distribution, developer identification and negotiation, compliance and other administrative functions, we expect to rely heavily on our Parent to provide cash to sustain our operations, pursuant to the Master Services Agreement. Any forecast of the period of time through which the Parent’s financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the factors discussed elsewhere in this “Risk Factors” section. We have based any estimates on assumptions that may prove to be wrong, and we could utilize available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to:

| | ● | the cost of the efforts to evaluate, target and access developers that meet our criteria; the cost and expense of negotiating any new license agreements; |

| | | |

| | ● | the rate at which we begin to realize income from game sales; |

| | | |

| | ● | the number and characteristics of any agreements with distributors on the licensed platforms that the Pub Subs may enter into, and the cost of negotiating such agreements; |

| | | |

| | ● | the number and characteristics of any agreements with distributors on the licensed platforms that the developer and any other co-publishers of a game may enter into; |

| | | |

| | ● | the effect of competing technological and market developments; |

| | | |

| | ● | the cost of establishing and building the publishing capabilities of the Company and the costs to market each game; and |

| | | |

| | ● | the costs of regulatory compliance and reporting. |

If a lack of available capital means that our Company is unable to expand its operations or otherwise take advantage of business opportunities, our business, financial condition and results of operations could be materially adversely affected.

Our business strategy depends on achieving economies of scale. In order to sustain operations, the Company will need to maximize cash receipts from numerous games. There can be no assurance that the Company will be able to publish enough games to sustain its business model.

Unless we achieve significant economies of scale by providing co-publishing services with respect to numerous games, maintaining successful relationships with numerous developers, and managing relationships with numerous distributors, our business model will not be successful. However, as of the date of this offering circular, there are no limited commitments to co-publish any games other than as described in this offering circular.

Our business strategy depends on maintaining productive relationships with many distributors and distribution agreements with favorable terms. Certain distributors may control a disproportionate share of the market for the delivery of video games, which may result in contracts with unfavorable terms.

We cannot predict whether and under what terms and conditions distributors on the licensed platforms will agree to enter into agreements to distribute the game, and we and the other co-publishers may not be able to attract a sufficient number of distributors to sell the games. For example, distributors may not view an agreement to sell the game as an attractive value proposition to them due to any number of factors, such as the assumptions and estimates used to determine the estimated future sales receipts of the game. As a result, we or the other co-publishers may be forced to revise terms of the distribution agreements or agree to discounted prices to attract additional distributors. There are many third-party distributors that make video games available for sale, but certain of these distributors control a disproportionate share of the market for the distribution of video game products, which could lead to unfavorable terms with such distributors. If our Pub Subs and co-publishers fail to attract distributors on the licensed platforms, or such distributors demand terms that substantially reduce the potential cash receipts of the Pub Subs, our business will be materially adversely affected and as will our ability to pay dividends to holders of Game Shares. Furthermore, under a license agreement, the developer has the ability to veto any agreements with distributors for any reason. If the Company believes that a particular distributor would be a significant source of sales receipts for a game, but the developer does not wish for its game to be distributed by that distributor, the game will not be sold by that distributor and it may achieve lower than expected receipts from sales.

There is intense competition among video games for promotional support from distributors. Promotional support could include, for example, highlighting our game on a PC distributor’s storefront landing page. To the extent that the number of products and platforms increase, competition may intensify and may require us to increase our marketing expenditures. Distributors typically devote the most and highest quality promotional support to those products expected to be best sellers. We cannot be certain that our games products will achieve or maintain “best seller” status. Due to increased competition for promotional support, distributors are in an increasingly better position to negotiate favorable terms of sale, including significant price discounts. Each game will constitute a small percentage of most distributors’ sales volume. We cannot be certain that distributors will provide the games we publish with adequate levels of promotional support on acceptable terms.

Additionally, while we are not currently aware of any reason that would prevent us or any co-publisher from obtaining any desired distribution agreements with respect to any of the licensed platforms, we cannot guarantee that we or any co-publishers will be able to conclude agreements to distribute the game on such licensed platforms. If we and our co-publishers are unable to secure agreements to distribute the game on any of the licensed platforms, we may not be able to effectively bring the game to market, which could negatively impact our business and the value of your Game Shares.

To the extent the game is distributed as a physical copy, we are subject to various additional risks.

To the extent that a distributor on a licensed platform distributes the game in physical copy, these distribution operations require the distributor to work with physical retailers, secure adequate supplies of physical copies of the game on a timely and competitive basis, and ensure that retailers maintain effective inventory and cost controls. Physical copies of games generally require working with independent manufacturers, and if those manufacturers do not provide physical copies of the game on favorable terms without delays, the distributor will be unable to deliver the game on competitive terms to retailers when they require them. Additionally, video game retailers typically have a limited amount of physical shelf space and marketing and promotional resources. Therefore, there is significant competition amongst video game publishers to deliver a high quality product that merits retail acceptance and brand recognition in a “hit”-driven market. We cannot be certain that retailers will provide the game with adequate levels of shelf space and promotional support on acceptable terms.

There is no assurance that we will enjoy successful business development as a whole, or that the Company will enjoy successful business development in respect of any particular game.

Investors must consider that our business model is based on an expectation that the Company and any co-publishers will be able to publish games successfully and that demand for such games will sustain itself or increase. There can be no assurance that our business strategies will have the desired impact on the market and lead to any significant sales receipts or that we will be able to market games effectively. Investors must consider the risks, expenses and uncertainties of a company like us, with an unproven business model, and a highly competitive and rapidly evolving market. Furthermore, neither the Company nor the Parent is obligated to apply resources to the games evenly or in any proportion. The Company and the Parent are not required to apply the Service Fee or the 2.5% of Pub Sub Cash retained by the Company for the common shares that relates to a particular game toward co-publishing services for the same game. The Company may allocate time and resources across games in its discretion.

The distributors on the licensed platforms may refuse or fail to make payments under their agreements with respect to sales of the game.

Our cash flows depend on the ability of the Pub Subs to receive payments from sales of the game by distributors on the licensed platforms. A distributor may dispute amounts to which a Pub Sub is entitled, or may be unwilling or unable to make payments to which it acknowledges the Pub Sub is entitled. In either event, we may become involved in a dispute with a distributor regarding the payment of such amounts, including possible litigation. Disputes of this nature could harm the relationship between us and the distributor, and could be costly and time-consuming to pursue. Failure by distributors to make payments to a Pub Sub for any reason could adversely affect our business and the extent of related Game Shares dividends.

The Company and your Game Shares may be harmed if the distributors or other parties with which we do business become unable to honor their obligations or seek protection under the bankruptcy laws.

While we do not intend to do business with distributors or other parties that we believe are in a poor financial condition, there is a risk that a payment default by, or the insolvency or business failure of, such parties would negatively impact our business. In addition, if the such parties were to become the subject of a proceeding under the United States Bankruptcy Code or a similar proceeding or arrangement under another state, federal or foreign law, our rights and interests to receive game income may be prejudiced or impaired, perhaps significantly so.

Co-publishers may refuse or fail to make payments under their agreements with respect to sales of the game.

The Pub Subs do not have exclusive publishing rights to the games on the licensed platforms; however the license agreements generally provide that the developer and other co-publishers must direct cash receipts of the game on the licensed platforms to the relevant Pub Sub. If the developer or other co-publishers default on this requirement, we will be limited in our ability to collect any payments for sales on the licensed platforms. Generally, we would have to pursue remedies against the developer and the co-publisher. We may become involved in a dispute with developers and co-publishers regarding the payment of such amounts, including possible litigation. Disputes of this nature could harm the relationship between us and the developer and any other co-publishers, and could be costly and time-consuming for us to pursue.

The license agreement does not contain many of the restrictive provisions that are contained in traditional publisher and distributor agreements with game developers which are common in the video game industry. The Pub Sub will provide upfront funding to the developer which is not treated as an advance against royalties and is unsecured.

Many traditional publishing deals involve “advances against royalties” which means the funding provided by the publisher to the developer to create the game is treated as pre-paid royalties. This means that the developer must effectively “pay back” the advances through royalties that would otherwise be payable to the developer. The upfront funding the Pub Subs provide to developers is not treated as an advance against royalties.

Our license agreements are not secured by any collateral or guaranteed or insured by any third party, and you must rely on us to pursue remedies against the developer in the event of any default. The Game Development Funding will be an unsecured obligation of the developer to produce a saleable game on certain licensed platforms and will not be secured by any collateral, nor guaranteed or insured by any third party or governmental authority. Therefore, we will be limited in our ability to pursue remedies against the developer and recover any funding if a saleable game is not delivered. If the developer defaults under the license agreement, there can be no assurance that the developer will have adequate resources, if any, to satisfy any obligations to us under the license agreement. Moreover, holders of Game Shares will have no recourse directly against the developer.

Traditional publishers and distributors typically provide funding to developers subject to strict milestone payments. Our license agreements provide for lump-sum upfront funding and do not contain milestone provisions. Upfront lump-sum payments made to the developer by the Pub Sub pursuant to a license agreement put all of the capital raised from sales of Game Shares at risk at an earlier time than a traditional publisher funding arrangement.

If the developer is acquired or experiences a change of control during the development of the game, the impact on our business will be uncertain and your interests in the Game Shares may be adversely affected.

If the developer is acquired or experiences a change of control during its development of the game, this may cause an interruption in the development of the game. While the license agreement would remain in effect, we cannot guarantee that the new management of the developer will adequately honor the license agreement, and we may not have sufficient resources or may otherwise choose not to pursue remedies against the new management of the developer pursuant to the license agreement. Such an event may adversely impact our ability and rights to publish the game, which would negatively impact our business, the value of your Game Shares and our ability to pay dividends. Investors in Game Shares do not have an interest in the developer and would not share in the consideration provided to the developer by such acquirer.

We are dependent upon the key executives and personnel of our Company, the Parent and the developer.

Our success is dependent on the personal efforts of certain key personnel of our Company, including our CEO and sole director, Justin Bailey, and our Vice President, Business Development and Strategy, Jonathan Chan. Our success is also dependent on the personal efforts of certain key personnel of the Parent and each developer. The loss of the services of one or more key employees from our Company, our Parent, or the developer could adversely affect our business and prospects. Our success is also dependent upon our ability and the ability of our Company and Parent to hire and retain additional qualified operating, marketing, technical and financial personnel, and on each developer to retain and hire skilled and experienced game developers and other key personnel. Competition for qualified personnel in the video game industry is intense, and our Company, our Parent and the developer may each have difficulty hiring or retaining necessary personnel. If our Company, our Parent, or the developer fail to hire and retain the respective personnel necessary, our business may be significantly impaired and the value of your Game Shares may be adversely affected.

There may be conflicts of interest between our Company, the Parent and their respective directors, officers and managers which might not be resolved in your favor.

Justin Bailey, our Chief Executive Officer and sole director receives a salary, benefits and equity compensation from the Parent. See “Security Ownership of Management and Certain Securityholders” above. Mr. Bailey is the CEO and a director of our Parent. Our Parent holds all 1,000,000 outstanding shares of our common stock, and thus holds all of the voting power of our outstanding common stock and has sole control of the Company. See “Capital Stock of the Company.” Pursuant to the Master Services Agreement, our Parent provides our Company with comprehensive management and administrative services, including the services of Justin Bailey, and our Parent will be compensated for the provision of such services by the Service Fee. See “The Company — Master Services Agreement with Our Parent.” Jonathan Chan, our Vice President, Business Development and Strategy, also receives a salary, benefits and equity compensation from the Parent. See “Interest of Management and Others in Certain Transactions.”

The Company, the Parent and the developer and their respective directors, officers and managers may be involved in business activities that do not involve your particular Game Shares and may get involved in other business activities in the future. Such directors, officers or managers may have to allocate their time between supporting the success of the relevant game and the other business activities in which they are involved. Such directors, officers or managers may have conflicts of interest in allocating time, services and functions between the support of a particular game and other various existing and future enterprises.

There are actual, potential, and perceived conflicts of interest between the Company, the Parent, the Grasslands Developer and the CEO of the Grasslands Developer, and these conflicts may not be resolved in your favor.

Tim Schafer, the Chief Executive Officer and founder of the Grasslands Developer, is a board member of our Parent. Each of Mr. Schafer and the Grasslands Developer own shares of the Parent’s stock. In addition, Justin Bailey, our sole director and Chief Executive Officer, was recently the Chief Operating Officer of the Grasslands Developer, a position he held from July 2012 to March 2015. These relationships may give rise to actual or perceived conflicts of interest. For example, Mr. Schafer, as CEO and founder of the Grasslands Developer, may be motivated more by the interests of the Grasslands Developer than the interests of our Company, when participating in decisions made by the Board of the Parent that may have an effect on the Company, its relations with the Grasslands Developer, its performance under the Grasslands License Agreement or its enforcement of rights under the Grasslands License Agreement. In addition, Mr. Bailey’s history with the Grasslands Developer may cause his views and decision-making in regard to any such decisions to be less objective than it might otherwise be or insufficiently protective of the Company’s interests.

There may be actual, potential, and perceived conflicts of interest between the Company, our Parent, the Advisory Board members of the Parent who have entered into Advisory Board Agreements with our Parent, and the developers who have entered into Studio Partner Agreements with our Parent, and these conflicts may not be resolved in your favor.

Our Parent has entered into four agreements with video game developers, which we refer to as Studio Partner Agreements. Pursuant to these Studio Partner Agreements, as amended, the developers received warrants in our Parent that vest and become exercisable upon the developer launching a Rewards Crowdfunding campaign on Fig.co and engaging the Company to co-publish the game. These Studio Partner Agreements may give rise to actual or perceived conflicts of interest. For example, the recipients of warrants under the Studio Partner Agreements may launch a Rewards Crowdfunding campaign on Fig.co and engage the Company to co-publish the game with a view toward their warrants vesting rather than conducting successful campaigns that benefit the Company and the holders of the relevant Game Shares.

Our Parent has entered into agreements which the four members of our Advisory Board, we refer to as Advisory Board Agreements. Four of these Advisory Board members are executives of the four video game developers which entered into Studio Partner Agreements. Pursuant to these Advisory Board Agreements, as amended, the advisors would receive options in our Parent that vest and become exercisable upon serving on the Advisory Board of our Parent. These relationships may give rise to actual or perceived conflicts of interest. For example, the members of the Advisory Board may be motivated more by the interests of the companies (where they hold executive and possibly ownership positions) rather than the interests of our Company or holders of Game Shares, when participating in decisions made by the Advisory Board of the Parent that may have an effect on the Company, its relations with developers, its performance under the license agreement.

The developer and our Company may fail to anticipate changing consumer preferences.