UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

For the fiscal year ended September 30, 2016

FIG PUBLISHING, INC.

(Exact name of registrant as specified in its charter)

Commission File Number:24R-00037

| Delaware | | 32-0467957 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

599 Third St., Suite 211 San Francisco, CA | | 94107 |

| (Address of principal executive offices) | | (Zip Code) |

| | (415) 689-5789 | |

| | Registrant’s telephone number, including area code | |

| Fig Game Shares – PSY2, a series of non-voting preferred stock, par value $0.0001 per share |

| (Title of each class of securities issued pursuant to Regulation A) |

PART II

INFORMATION TO BE INCLUDED IN REPORT

Overview

Fig is a community powered publisher of video games. Fig’s business is to identify, license, contribute funds to the development of, market, arrange distribution for, and earn receipts from sales of video games developed by third-party video game developers with whom we enter into license agreements to publish those games. We search for new games and game ideas with the potential to generate significant earnings with the help of our publishing model.

We are evolving the video game publishing model in a number of key ways:

| | ● | Crowdfunding Campaigns. As part of our greenlighting process (through which we decide which games to publish and which not to publish), we host crowdfunding campaigns on our Parent’s website,Fig.co. These crowdfunding campaigns allow third-party developers to raise funds through the pre-sale of games, digital items, merchandise and experiences. They also allow us to gauge interest in an offering of Fig Game Shares that would reflect our economic returns as a publisher of the game. A crowdfunding campaign must be successful, in our view, before we will greenlight our publishing of a game. This allows us to predicate our greenlighting of a game on whether its crowdfunding campaign was, in our view, sufficiently successful, and allows us to calibrate the amount of funding we contribute to the development of the game. In this manner, the voice of the community is heard in our publishing. |

| | ● | Focused Curation. We conduct crowdfunding campaigns for only a small number of games each month. We believe this focus helps the gaming community concentrate their attention on each game, which we believe provides better game marketing. In our view, existing rewards-only crowdfunding platforms on which self-publishing developers depend often allow individual game campaigns to become lost in a crowd of concurrent campaigns. |

| | ● | Fig Game Shares. We offer the opportunity for gamers and fans to connect with games in a new way, by investing in our Company and receiving in exchange securities that reflect our economic returns as a publisher of the game. |

| | ● | Preservation of Developers’ Intellectual Property Ownership. We do not require developers to license or transfer away their core intellectual property rights, or rights to derivative works including prequels, sequels or spinoffs, in order to get their game published by us. We believe this approach to intellectual property ownership will provide us with a competitive advantage over traditional video game publishers in attracting talented developers with exciting game ideas. |

We believe that involving the community of gamers and fans in our game publishing will result in games that are more aligned with consumer demand, more creatively innovative and more commercially successful.

Games Licensed

As of the date of this annual report, Fig has the following seven principal games licensed for publication, all of which are already under development:Psychonauts 2,Jay and Silent Bob: Chronic Blunt Punch,Consortium: The Tower,Make Sail, Wasteland 3, Trackless andKingdoms and Castles. An eighth game,Outer Wilds, which was the first game to be promoted onFig.co, was licensed to a separate subsidiary of our Parent. The crowdfunding campaigns forPsychonauts 2,Jay and Silent Bob: Chronic Blunt Punch,Consortium: The Tower,Make Sail, Wasteland 3andTracklesshave already been completed. In addition to these eight games, in three instances crowdfunding campaigns for particular games failed to meet their goals and we will not be publishing those games. We have near-term prospects for entering into additional game publishing license agreements that we believe represent substantial commercial opportunities.

Set forth below is a table of all of games licensed for publication, identifying for each game its developer, crowdfunding campaign completion date, associated Fig Game Shares (or other securities) and associated Game Shares Asset. In the event of a liquidation or dissolution of Fig, holders of a particular series of Fig Game Shares would have preferential rights in respect of the associated Game Shares Asset, and in the event of a disposition of a Game Shares Asset, holders of the associated Fig Game Shares may receive some or all of the proceeds and have their securities redeemed. For purposes of the foregoing, “Game Shares Asset” means, in general, all assets and liabilities of the Company to the extent attributed to the publishing rights held under the associated license agreement, and the proceeds of any disposition thereof. For a more precise definition of “Game Shares Asset”, see “Other Information – Description of Company Securities – Preferred Stock”. In keeping with Fig’s game publishing model, Game Shares Assets do not include intellectual property rights in the associated game.

| Game Title | | Developer | | Crowdfunding

Campaign

Completion Date | | Associated Fig

Game Shares or

Other Securities | | Associated Game

Shares Asset |

| | | | | | | | | |

| Psychonauts 2 | | Double Fine Productions, Inc. | | January 12, 2016 | | Fig Game Shares – PSY2 | | License agreement with Double Fine Productions, Inc. forPsychonauts 2, and assets and liabilities attributed to the rights thereunder |

| | | | | | | | | |

| Jay and Silent Bob: Chronic Blunt Punch | | Interabang Entertainment | | March 31, 2016 | | Fig Game Shares – JASB | | License agreement with Interabang Entertainment forJay and Silent Bob: Chronic Blunt Punch, and assets and liabilities attributed to the rights thereunder |

| | | | | | | | | |

| Consortium: The Tower | | Interdimensional Games Incorporated | | May 11, 2016 | | Fig Game Shares – CTT | | License agreement with Interdimensional Games Incorporated forConsortium: The Tower, and assets and liabilities attributed to the rights thereunder |

| | | | | | | | | |

| Make Sail | | Popcannibal LLC | | November 2, 2016 | | Series Make Sail Units(1) | | License agreement with Popcannibal LLC forMake Sail and assets and liabilities attributed to the rights thereunder |

| | | | | | | | | |

| Wasteland 3 | | inXile Entertainment, Inc. | | November 3, 2016 | | Fig Game Shares – Wasteland 3 and Fig WL3 Units(2) | | License agreement with inXile Entertainment, Inc. forWasteland3 and assets and liabilities attributed to the rights thereunder(3) |

| | | | | | | | | |

| Trackless | | 12 East Games Entertainment, Inc. | | November 17, 2016 | | Series Trackless Units(1) | | License agreement with 12 East Games Entertainment, Inc. forTrackless and assets and liabilities attributed to the rights thereunder |

| | | | | | | | | |

| Kingdoms and Castles | | Lion Shield LLC | | January 5, 2017 | | Series Kingdoms and Castles Units(1) | | License agreement with Lion Shield LLC forKingdoms and Castlesand assets and liabilities attributed to the rights thereunder |

| (1) | These games are being published by Fig, but the securities associated with each game are being issued privately in separate series by Fig Small Batch, LLC, which is an affiliate of Fig. |

| (2) | There are two separate issuances of securities associated with this game: the Fig Game Shares – Wasteland 3 being offered in by Fig under Regulation A under the Securities Act, and the Fig WL3 Units being offered privately by Fig WL3 LLC, which is an affiliate of Fig. |

| | |

| (3) | Part of the 100% beneficial interest in this license agreement will be allotted to Fig Game Shares – Wasteland 3 and the remaining part to Fig WL3 Units. These allotments will be made in the same proportion that the proceeds from the two separate offerings of these securities bear to the total funds to be provided from Fig’s general account in support of the development of Wasteland 3. The size of the allotments will not be finally determined until both offerings are closed and we know the amount of the proceeds from each offering. However, as part of the crowdfunding campaign for Wasteland 3 conducted onFig.coin September and October 2016, we received investment reservations of $1,144,000 in such offering and investment commitments of $1,046,000 in the Rule 506(c) offering. The affiliate of Fig that is issuing the Units is currently in the process of closing the Rule 506(c) offering. Assuming that, when both offerings are closed, the public offering generates $1,000,000 of proceeds and the Rule 506(c) offering generates $1,046,000 of proceeds, Fig would allot 48.88% of the beneficial interest in this license agreement to Fig Game Shares – Wasteland 3 and 51.12% of beneficial interest in this license agreement to Fig WL3 Units. The final allotments will depend on the final amounts closed upon in the two offerings. |

Fig has near-term prospects for entering into additional game publishing license agreements that it believes represent substantial commercial opportunities.

Industry Trends

There are a number of key trends that our Company believes will continue to drive the growth and popularity of video games. The growth of digital distribution and gameplay is making it easier for customers to discover, buy and engage with a variety of games. At the same time, digital distribution and gameplay make it harder for developers to find audiences for their games without relying on paid marketing. The emergence of new platforms on which to play games, such as has occurred recently with mobile devices, is expanding the range of possible gameplay experiences. In particular, the ubiquity and convenience of mobile devices allow players to engage with games in new play patterns, and allow publishers and distributors to develop new monetization models. Advancements in technology, such as virtual reality, augmented reality, mixed reality and smart TVs, will continue to drive more immersive and entertaining gaming experiences. In addition, players can engage with games for longer periods of time as they purchase additional content and services that are provided to them digitally. Our Company hopes that these trends will enable each of its games to achieve increased sales and increase the size and engagement of the gamer community.

Market Opportunity

Our goal is to provide game developers and game fans a more balanced and sustainable approach to game publishing. We aspire to provide a publishing solution that retains the best, and discards the worst, of traditional publishing and self-publishing with rewards-only crowdfunding. The following are anecdotal views based on our industry experience.

Traditional Publishing Arrangements

In traditional publishing arrangements, particularly with large video game publishers, the publisher provides funding to a developer for a particular video game’s development in exchange for the intellectual property rights to the game, which include distribution rights as well as rights to sequel games and other derivative works (such as film and merchandise rights). The intellectual property rights to a game are a developer’s most important asset, and turning them over to a publisher not only relinquishes creative control over the game but also creates a relationship with the publisher that is similar to employment. The developer is paid a royalty that is typically half or less than half of the net revenue earned from the game. The formulas by which developers earn royalties can be disproportionately favorable to the publisher. Most publishing deals involve what is known as “advances against royalties”. In other words, the amounts provided by the publisher to the developer to create the game are treated as pre-paid royalties. This means that the developer must effectively “pay back” the advances at the previously negotiated royalty rate; that publishers take all the game’s revenue until they have received, typically, two to three times the amount advanced; and that only thereafter would developers receive any money from their game.

Self-Publishing with Rewards-Only Crowdfunding

Rewards-only crowdfunding has made the self-publishing of video games a more viable option for developers, but rewards-only crowdfunding alone has its limits. Developers have found it difficult to raise enough money through rewards-only crowdfunding to meet an entire game development budget and additionally finance post-development marketing and distribution efforts.

Our Alternative

As described more fully above and below, our publishing model is intended to bridge the gap between traditional publishing models and self-publishing through rewards-only crowdfunding.

Key Aspects of Our Business

Identification

We consider and evaluate games being developed for any game-playing platform and technology and in any genre. We believe we have extensive video game industry contacts though the directors, officers, advisors and affiliates of our Company and our Parent, and we seek to use these contacts to access developers and games that meet our criteria. Through our contacts, we seek to establish working relationships with promising developers and their advisors, in order to begin the process of educating them about our business, the benefits of a video game co-publishing license agreement with us and the benefits of a continuing relationship with us.

Prior to entering into a license agreement to publish a particular game, we evaluate the game and the developer to determine whether, in our opinion, the game is likely to be successfully developed and become a commercial success. We consider a great game to be a distillation of a complex set of factors. But, in our selection of games to publish, we focus in particular on the following factors:

| | ● | The experience of the developer and the talents of the developer’s team. |

| | | |

| | ● | The developer’s track record for the delivery of games on time and within budget. |

| | | |

| | ● | Historical sales performance of prior games. |

| | | |

| | ● | The degree of likelihood that the game can be developed on time and as envisioned. |

| | ● | Estimates of potential sales of the game. |

| | ● | Whether the developer will be using technologies, such as game engines, with which the developer has successfully created games in the past. |

| | | |

| | ● | The developer’s past releases on the platforms that the developer is targeting for the game. |

| | | |

| | ● | The extent of the developer’s existing social community and fan base, as well as the social community and fan base of any game franchise to which the game will belong. |

In order to help us gather the information we need and want to make a decision as to whether to seek to publish a game, we present the developer of each game we may publish with a due diligence questionnaire, a copy of which is an exhibit to this annual report. The information received in response to the questionnaire is part of what we consider in deciding whether to seek to publish the game.

Licensing

It is our intention that each video game co-publishing license agreement we enter into be based on a template license agreement that acts as a standard baseline. The material terms of our baseline license agreement are summarized below. Generally, only certain terms of the baseline license agreement will be subject to negotiation with each developer.

Fig Baseline License Agreement Material Terms

| Term | | Description |

| | | |

Conditions | | All of Fig’s obligations under the license agreement are conditioned on the success, as determined by Fig, of a crowdfunding campaign onFig.co. In addition: |

| | | ● | if Fig’s due diligence of the developer and the game has not been completed to Fig’s satisfaction prior to the execution of the license agreement, Fig’s obligations under the license agreement will be further conditioned on Fig’s satisfactory completion of that due diligence; and |

| | | | |

| | | ● | to the extent that, in Fig’s judgment, the developer’s level of experience and sophistication requires it, Fig may further condition its obligations under the license agreement upon the receipt from the developer, at appropriate times, of sufficiently detailed development timelines and budgets, as well as evidence of progress under such timelines and of performance under such budgets. |

| Fig Funds | | The amount of funds to be provided from Fig’s general account in support of the development of the game (the “Fig Funds”) will be disbursed to the developer of the game pursuant to an agreed-upon schedule that reflects the game development timeline and the relative needs of the developer and Fig. The license agreement will set forth a range within which the precise Fig Funds amount will be determined by Fig. See “– Crowdfunding Campaigns”, below. The Fig Funds will be non-recoupable (except in certain circumstances if the license agreement is terminated). |

| Developer Obligations | | Among other obligations, the developer must: |

| | | ● | provide interim versions of the game for inspection upon 30 days’ notice, |

| | | | |

| | | ● ● ● ● | not grant liens over its intellectual property in the game to third parties; maintain records of its use of the Fig Funds; meet with Fig on a quarterly basis; give Fig meaningful rights to consult on and inspect the status and progress of game development. |

| License | | Fig shall have a license to an identified version of the game in connection with co-publishing, distributing, advertising, marketing and promoting the game to consumers for use on each of the specified licensed platforms, including updates of and enhancements to the game (although such rights may or may not extend to downloadable content, or “DLCs”). The developer will retain the ability to license to co-publishers publishing rights on the same platforms licensed to Fig. Should material co-publishing arrangements exist, the license agreement will contain agreed-upon methods by which Fig will effectively be credited with some or all of the cash from sales arranged by such co-publishers (including the developer as a co-publisher), or by which Fig can pre-approve such co-publishing arrangements should certain conditions exist, or by which Fig’s right to a certain minimum level of sales receipts is otherwise protected. Fig expects that co-publishing arrangements, and the consequent agreed-upon methods by which Fig’s rights to sales receipts will be protected, may be more elaborate in respect of some types of games (for example, sequels to successful past games and games developed by larger developers with longer industry track records). |

| Security regarding Sales Receipt Payments | | The developer will deliver to Fig an agreed upon number of valid Steam game keys for the associated game on agreed licensed platforms (“Fig Keys”) no later than 14 days from the commercial launch of the game. The Fig Keys will be solely owned by Fig. In the event Fig is underpaid the amounts it is owed under the license agreement, it can then sell the Steam game keys in an amount sufficient to offset any amounts by which it has been underpaid, retaining 100% of the sales receipts from the Steam game keys sold. |

| | | |

| Licensed Game | | Fig’s license will extend to updates of and enhancements to the game that the developer may generate. The license may or may not extend to DLCs. The license will not include derivative works of the game (such as prequels, sequels or spinoffs). |

Licensed Platforms | | The game will be licensed for use on either (i) a specific list of platforms, (ii) all platforms or (ii) all platforms except for a specific list of platforms. |

| Committed Platforms | | The developer may not be obligated to deliver the game in executable format for all licensed platforms. The license agreement may provide that the developer is only obligated to deliver the game in executable format on a certain subset of licensed platforms, which we refer to as “Committed Platforms”. |

| Game Delivery Date | | The developer will agree to deliver the game in executable format for the licensed platforms (or in some cases, the Committed Platforms only) by a designated game delivery date. |

| | | |

| Derivative Works Holdback | | The developer may be required to wait for a period of time before releasing derivative works of the game (such as prequels, sequels or spinoffs), which requirement we refer to as the “derivative works holdback”. |

| | | |

| Developer Revenue Share | | The developer’s revenue share will be a certain percentage of the sales receipts received in respect of the game. The revenue share rate will be a fixed rate, although the fixed rate may increase after one or more game sales thresholds are reached. |

| Termination for Cause | | The developer and our Company shall each have the right to terminate the license agreement upon a material default or breach by the other party, which the breaching party is not able to remedy within thirty days. |

| | | |

Resource Schedule, Quarterly Meetings | | The Fig Funds will be disbursed to the developer of the game pursuant to an agreed-upon schedule that reflects the game development timeline and the relative needs of the developer and Fig. The developer will be required to meet with Fig on a quarterly basis to discuss the development status of the game and any other matters of concern. |

| | | |

| Indemnification | | The parties agree to mutual indemnification for claims arising out of: (i) breach of the license agreement; (ii) any claims by the indemnifying party’s creditors to the effect that the indemnified party is responsible or liable for the indemnifying party’s obligations; and (iii) the use of the licensed rights. |

In the event that a developer materially breaches the terms of its license agreement, for example by failing to deliver the game, the holders of Fig Game Shares must rely on our Company to pursue any claims against the developer. The license agreement will be between the developer and the Company, and a holder of Fig Game Shares will have no rights under the license agreement, as a third-party beneficiary or otherwise. We intend to enforce all contractual obligations under our license agreements to the extent we deem necessary and in the best interests of the Company and holders of Fig Game Shares.

All sales receipts received by Fig in respect of sales of a particular game, pursuant to the license agreement between Fig and the developer of that game, will be deposited into a separate account or sub-account under Fig’s control. From the cash available in the sub-account, Fig will pay dividends to holders of the Fig Game Shares associated with that game, pursuant to its dividend policy. See “Other Information – Our Dividend Policy”.

The foregoing description of our baseline license agreement material terms is a summary only and is qualified in its entirety by reference to the particular license agreement that has been agreed with the developer of the game to which the Fig Game Shares relate.

There can be no assurance that our assessments with respect to any developer and the potential sales of any game will be accurate, and a failure of any of our assessments could have a materially adverse impact on our business and our ability to pay dividends to holders of Fig Game Shares.

Fig Service Fee

Depending on the particular game and crowdfunding campaign, Fig may retain a percentage, generally expected to be 10%, of game sales receipts, which we refer to as the “Fig Service Fee”. The Fig Service Fee will serve as compensation toward the cost of platform and publishing services, in campaigns in which Fig imposes such a fee. Fig may apply a higher or lower Fig Service Fee depending on the degree of services and corresponding expenses that Fig predicts will be necessary to successfully publish a game, as well as other factors. In certain cases, Fig may determine that, because it is still building its business, because it desires to attract high quality developers, because the desirability of publishing the particular game is especially high, or for other reasons relating to Fig’s assessment of the business advantages that may accrue to Fig and its security holders, the Fig Service Fee maybe lower than the percentage indicated above or nominal, or there may be no such fee.

Crowdfunding Campaigns

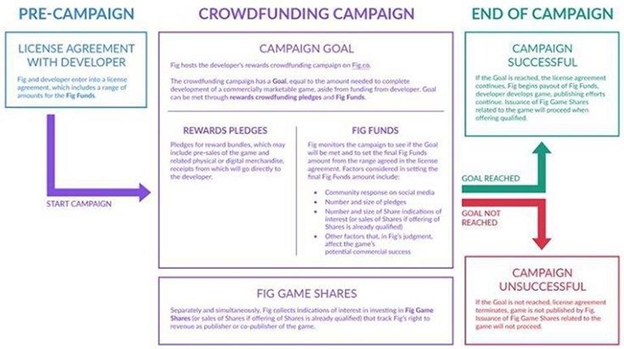

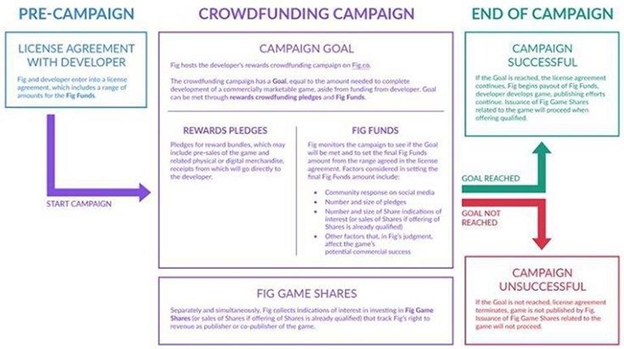

As part of our greenlighting process, we host crowdfunding campaigns on our Parent’s website,Fig.co. These crowdfunding campaigns allow the developers with whom we have entered into license agreements to raise funds through the pre-sale of games, digital items, merchandise and experiences. They also allow us to gauge interest in the game, decide not to publish the game if interest is insufficient and, if we are to publish the game, help us determine what amount to provide to the developer in support of the completion of the game.

A crowdfunding campaign must be successful, in our view, before we will greenlight our publishing of a game. If the crowdfunding campaign is not successful, the license agreement will terminate. If it is successful, the license agreement will continue, we will begin providing the developer with the Fig Funds and the developer will proceed with developing the game and delivering it pursuant to the terms of the license agreement, so that we may publish it as we have planned.

The interaction of our decision to enter into a license agreement in respect of a particular game, conduct a crowdfunding campaign for the game, and proceed thereafter based on the success or lack of success of the crowdfunding campaign, is illustrated below:

As described in the illustration above, the parties will enter into the license agreement with a range agreed for the Fig Funds amount, but without the precise Fig Funds amount having been determined by Fig. Next, a crowdfunding campaign for the game will be launched onFig.co and will last, typically, 30 to 40 days. As the outset of the crowdfunding campaign, Fig will set the goal that the campaign must reach to be successful. The goal will be posted onFig.co in the web pages relating to the crowdfunding campaign. The goal will be the dollar amount that Fig and the developer agree will be needed to complete the development of a commercially marketable version of the game, aside from funding that the developer will itself provide or arrange. The goal can be met in the crowdfunding campaign through a combination of rewards pledges and the Fig Funds. By the end of the crowdfunding campaign, Fig will determine, based on a number of factors (many of which will relate to Fig’s assessment of the success of the crowdfunding campaign), the precise amount of the Fig Funds within the range previously agreed. If the Fig Funds, as finally determined, and the rewards pledges, together add up to the goal of the crowdfunding campaign, then the license agreement will remain in effect. If they do not add up to the goal, the license agreement will terminate and Fig will not publish the game. Fig may decide to increase or decrease the Fig Funds during the course of the crowdfunding campaign and before setting the final amount of Fig Funds. If it does so, it expects to adjust the size of the Fig Funds as posted onFig.co. Note that, in any scenario in which an increase of the amount of the Fig Funds above the minimum amount set forth in the license agreement is required to be made, or maintained, in order for the crowdfunding campaign goal to be met, Fig will retain its discretion to make or maintain that increase, or not, even if as a result of Fig not making or maintaining that increase the goal is not met, the crowdfunding campaign fails and the license agreement is terminated.

In the case of certain games, Fig expects that the developer may have third-party sources of funds that will be used to finance the development of the game. In such cases, Fig expects that the budget agreed by the parties for the development of the game and, by extension, the goal set by Fig for the crowdfunding campaign, will reflect this additional funding. For example, if Fig and the developer agree that $500,000 will be needed to complete the development of a commercially marketable version of the game, and the developer will provide $50,000 of this and a third party known to the developer will provide another $150,000, then the goal for the crowdfunding campaign will be $300,000, which will need to be met by a combination of rewards pledges and the finally determined Fig Funds amount, if the license agreement is to continue in effect.

If the crowdfunding campaign reaches its goal, the developer will receive the proceeds of all the rewards pledges made. The developer will receive these directly from the backers who made rewards pledges, through the credit cards whose information the backers provided toFig.co when they made their pledges. Fig will not be involved in this payment process. If the crowdfunding campaign does not meet its goal, then the rewards pledges made will not be collected, and the developer will receive nothing from the rewards crowdfunding portion of the campaign.

In addition, if the crowdfunding campaign reached its goal, Fig will pay the Fig Funds to the developer as agreed in the license agreement. All of the Fig Funds will be paid by Fig from its general funds. There will be no direct payment of any proceeds from any sale of any Fig Game Shares to any developer, for any purpose. The Fig Funds will be non-recoupable (except in certain circumstances if the license agreement is terminated).

This description of the crowdfunding campaign process is a summary of how we expect the process to work typically for games under license. Below, we describe additional, key aspects of the crowdfunding campaign.

Rewards Portion of a Crowdfunding Campaign

Fig believes that the rewards portion of a crowdfunding campaign helps rally the gamer community to provide financial support for the development of a game through the pre-purchase of rewards – tiered bundles of games, digital items, physical merchandise and experiences, including t-shirts, figurines, posters or in-game content that enhance the game-playing experience. Camping trips, city tours, consulting on the design of in-game content and beer tastings are some of the experiences that have been offered on prior rewards campaigns. Backers pledge to pay the developer a certain amount of money in order to receive their rewards bundle of choice. To make a pledge, a backer must give a credit card authorization for the pledge amount, which will be processed only if the overall crowdfunding campaign meets its goal.

Investment Portion of a Crowdfunding Campaign

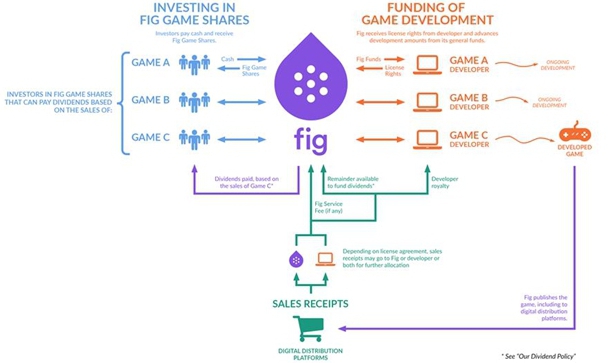

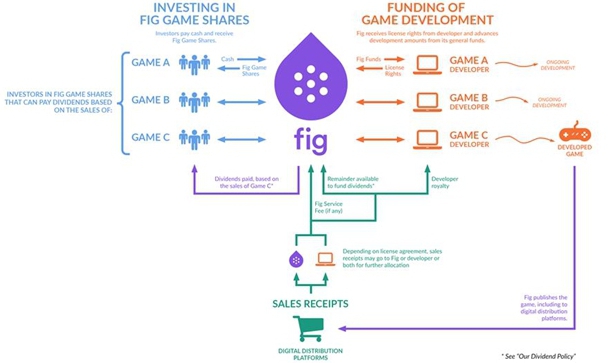

As described above, we expect all of our crowdfunding campaigns to include an offering of securities – either a particular series of Fig Game Shares issued by Fig, or other securities that are similar to Fig Game Shares that will be issued by a Fig affiliate, or both – which would pay returns based on the economic performance of the game that is the subject of the crowdfunding campaign. Provided the game is successfully developed and published, sales receipts will thereafter be received from the game and will generally be shared as follows: (i) receipts will be allocated into a revenue share for the developer and a revenue share for Fig, in the proportions specified in the license agreement for the game; (ii) depending on the particular campaign, Fig may be paid a service fee; (iii) depending on the particular campaign, Fig may allot part of its revenue share to the Fig Game Shares and another part to separate securities, issued by a Fig affiliate, that are also designed to reflect the economic performance of the same game, and to the extent Fig provides additional funds to support the development of the same game, it may keep a third allotment for itself (the size of the allotment to the Fig Game Shares being determined by the application of a percentage called the “Fig Game Shares Allotment Percentage”); (iv) Fig will pay a specified portion of the Fig Game Shares allotment to the holders of the Fig Game Shares, in the form of dividends, subject to our dividend policy; and (v) Fig’s board of directors may in its discretion from time to time pay more than the specified portion of the Fig Game Shares allotment to the holders of the Fig Game Shares, if in its view business conditions permit it. In all events, our Board may decide not to pay a dividend or to reduce the size of a dividend if it believes it would be necessary or prudent to retain such earnings in order to avoid a material adverse effect on Fig’s financial condition or results of operations (in which case the unpaid dividend amount will accrue for future payment), and dividends will not be declared or paid if prohibited under applicable law. Aggregate dividend amounts will be distributed equally among all holders of the same series of Fig Game Shares, in proportion to the number of shares held, without regard to whether the shares were bought in such offering or otherwise.

In addition to a Regulation A Offering, we expect that particular crowdfunding campaigns may from time to time also include an offering of Fig Game Shares by Fig, or other securities issued by a Fig affiliate, in each case under Rule 506 of Regulation D under the Securities Act of 1933 (each an “Accredited Investor Offering”). Such an offering would only be open to investors that are “accredited investors” within the meaning of Rule 501 under Regulation D. Accredited investors who visitFig.co in connection with a crowdfunding campaign must follow the directions posted onFig.co in order to participate in any Accredited Investor Offering being conducted.

The proceeds of all of our multiple, separate series of Fig Game Shares go into our general account, and will be used to support Fig’s operations and business activities generally.

The Fig Game Shares that investors receive will all be, regardless of the series of Fig Game Shares, capital stock of Fig without any rights to vote on any matters relating to our Company, the Fig Game Shares or otherwise. See “Other Information – Description of Company Securities”. Our different series of Fig Game Shares will differ from each other in that each series will pay holders of those securities dividends, if any, based on Fig’s revenue share from a different, particular game. Investors in Fig Game Shares should be particularly aware of the following:

| | ● | The time delay between a purchase of Fig Game Shares and the receipt of dividends (if any) could be extensive. Game development can take months or years, and dividends will become available to holders of Fig Game Shares only after development is successfully completed and the game begins to sell commercially. The cancellation or delay of a game’s release is also an important determinant as to whether dividends will become available to such holders. In addition, the period of time between a purchase of Fig Game Shares and the commercial sale of the related game could be increased if the game is not delivered at the time agreed in the related license agreement. |

| | ● | There is no trading market for Fig Game Shares and we do not expect one to develop, in part because we may have imposed certain transfer restrictions on the particular series of Fig Game Shares being offered. As a result, investors should be prepared to retain their Fig Game Shares for as long as those shares remain outstanding and should not expect to benefit from any share price appreciation. |

| | ● | Amounts will only become available for revenue sharing and payment of dividends if and when the game generates sales receipts, and the total amount available for Fig’s revenue share – and consequently for dividends – will typically depend on both the amount of Fig’s receipts from sales of the game and the amount of funds Fig provides to the developer for the development of the game, in all events as specified in the license agreement for the game. |

Below, we present a series of different descriptions and illustrations as to how we expect to allocate game sales receipts and determine dividends based on the sale of a particular game. First, we illustrate the general flow of funds among Fig, game developers, game distributors and investors in Fig Game Shares:

Next, we set forth the formula we intend to use to determine revenue sharing and dividends for games generally. The starting amount, in the first column of the table, is the price paid for the game by a consumer in a typical sales transaction in which, pursuant to Fig’s license agreement for the game, all of that price, minus the distributor’s fee, is collected by Fig, the developer or both (depending how the terms of the license agreement dictate sales receipt collection):

| | Game sales price | – | distributor’s fee | = | gross receipts |

| | | – | developer’s revenue share | = | Fig’s revenue share |

| | | – | Fig Service Fee (if any) | = | Fig’s revenue share (adjusted) |

| | | | | x | Fig Game Shares Allotment Percentage (if applicable) |

| | | | | x | a specified dividend rate |

| | | | | = | Aggregate dividends to Fig Game Share holders (to be divided evenly among all shares outstanding) |

In regard to the table above:

| | ○ | The size of the developer’s revenue share may vary over time based on whether particular sales targets have been met for the game, as specified in the license agreement for the game. For example, the developer’s revenue share may increase after the cumulative revenue share paid to Fig reaches a certain target threshold. |

| | ○ | The Fig Service Fee is an amount that Fig will keep as compensation toward the cost of platform and publishing services, in campaigns in which Fig imposes such a fee. |

| | ○ | After the allocation of the developer’s revenue share, the remaining amount will be Fig’s revenue share (or its adjusted revenue share, if there has also been a Fig Service Fee deducted). From this amount, Fig will determine the dividends to be paid to Fig Game Share holders, by (1) multiplying Fig’s revenue share by the Fig Game Shares Allotment Percentage, if applicable, and (2) applying the specified dividend rate. |

| | ○ | The Fig Game Shares Allotment Percentage will be applied in campaigns in which the total amount of Fig Funds is greater than the proceeds of the Fig Game Shares offering. This is expected to occur if, in addition to the Fig Game Shares offering, there has been an offering of separate securities, issued by a Fig affiliate, that are also designed to reflect the economic performance of the same game, and to the extent Fig provides additional funds to support the development of the same game. The allotments will be made in the same proportions that the proceeds from these separate securities offerings and the additional funding from Fig, as applicable, bear to the total Fig Funds amount. In such circumstances, the allotment of revenue among the Fig Game Shares, the other securities and Fig, as applicable, will represent an equitable division of Fig’s revenue share among the different sources of funding that have made it possible to prudently provide the particular Fig Funds amount. |

| | ○ | The end result will be the aggregate dividends to be paid to Fig Game Shares holders, to be divided evenly among all such Fig Game Shares outstanding. In all events, Fig’s board of directors may in its discretion from time to time pay more than this end result to the holders of the Fig Game Shares, if in its view business conditions permit it. In addition, our Board may decide not to pay a dividend, or to reduce its size, if our Board believes it would be necessary or prudent to retain earnings in order to avoid a material adverse effect on Fig’s financial condition or results of operations (in which case the unpaid dividend amount will accrue for future payment), and dividends will not be declared or paid if prohibited under applicable law. |

For greater detail regarding the revenue sharing and payment of dividends described, see “Other Information – Our Dividend Policy”.

Following a defined time after the delivery of a particular developed game, our Board may, under certain circumstances, in its discretion, cancel the associated series of Fig Game Shares. We will maintain a cancellation right in respect of each series of Fig Game Shares in order to be able to withdraw the series from the market and avoid the costs of continuing to have the series outstanding after the associated game has lost most or all of its earning power. In general, we expect that our right to cancel a series of Fig Game Shares will become effective after the passage of a pre-determined amount of time (typically, a number of years) and after the game has failed to meet a pre-determined earnings floor. The purpose of our cancellation rights is to help us avoid incurring unnecessary administrative costs, and thereby benefit our Company and shareholders as a whole.

The proceeds of all of our multiple, separate series of Fig Game Shares, go into our general account, and will be used to support Fig’s operations and business activities generally. An investment in our Fig Game Shares is not an investment in any game, game developer or license agreement. Proceeds from the offering of a particular series of Fig Game Shares may be used to fund the development of games other than the game with which that series of Fig Game Shares is associated, as well as other expenditures not related to the game with which that series of Fig Game Shares is associated.

For a discussion of the game and the developer related to the Fig Game Shares offered pursuant to this annual report, see the section of this annual report entitled “The Current Game, Developer and Shares”.

Crowdfunding’s Overall Role in Our Publishing

Our crowdfunding campaigns serve critical publishing functions for us. First, the crowdfunding campaign is an event that drives marketing and awareness for the game. When we launch crowdfunding campaigns, the press can provide coverage and stories can be shared on social media channels such as Facebook and Twitter.

Our crowdfunding campaigns also present an opportunity to build or extend the fan community for a game. Our campaign page hosts a commenting forum where fans can discuss the game and the crowdfunding campaign. After a campaign is completed, we continue to message and communicate with this community through email newsletters and Fig’s social media channels. A Fig crowdfunding campaign gives the game the ability to stand apart from, for example, the 3,500+ PC games that are released each year on the Steam video game distribution website (or “storefront”) alone. It also helps achieve search engine optimization (“SEO”) for the game, by providing an early and intense occurrence of the game title in search engine search results. This also provides an advantage to Fig when it seeks to judge the marginal utility of distributing a game through channels that typically require a higher revenue share.

A crowdfunding campaign also serves as a key indicator for us of the commercial potential for a game. For example, hundreds if not thousands of backers are typically needed for the rewards portion of the crowdfunding campaign to contribute successfully to the campaign goal. We analyze the crowd’s reactions to and engagements with the campaign to decide on the precise amount of the Fig Funds and, in many cases, whether the campaign will succeed and the publishing of the game will continue, or not.

Publishing Services

If the crowdfunding campaign meets its goal, and the other conditions to the license agreement are met, we will publish the game. Our publishing services include the following.

Fig Funds and Game Development Monitoring

The Fig Funds will be disbursed to the developer of the game pursuant to an agreed-upon schedule that reflects the game development timeline and the relative needs of the developer and Fig. The Fig Funds will be non-recoupable (except in certain circumstances if the license agreement is terminated).

Community Building

Our Company believes that one of the key components to the long-term commercial success of a game is having a vibrant community of fans and followers that will purchase, virally market and promote the game. The Company provides community tools such as a forum for fan comments on the rewards portion of the game's crowdfunding campaign page, and communication tools such as an “Updates” section and email tools for the developer to use to communicate with and cultivate its fan community, not only during the crowdfunding campaign but also during the period after the campaign, leading up to the game’s commercial launch.

The community developed in respect of a particular game and developer will receive regular updates from Fig on the development and publishing of the game, in a few ways:

| | ● | Fig.cowebsite. After a crowdfunding campaign is completed, post-campaign website pages remain accessible on the Fig.co website. These pages include a section dedicated to game development updates. |

| | ● | Email updates. Email updates regarding a game’s development are sent to investors on a regular basis. We aspire to maintain an update cadence of one per month per game, on average. |

| | ● | Press statements. We anticipate releasing press statements when a game’s development is complete and the game is released for first commercialization. |

Marketing

Fig’s crowdfunding campaigns present a unique opportunity to galvanize fans and gamers to support a game, thereby spreading early awareness of the game and starting a community behind the game. We amplify the marketing and promotion of our crowdfunding campaigns through our own marketing and public relations efforts. For each of our games, we monitor our marketing spend for consumer acquisition, re-targeting and brand marketing across the Internet and social networks, relying principally on Facebook and targeted gaming sites for advertisements and social engagement. We seek to optimize our advertising spend by dynamically changing advertising copy, audience segments and channels during the period when particular ads are being shown.

Fig intends to involve the community of Fig backers more intensely in the marketing of games, by providing easier tools for community members to share messaging and advertising about our games on their social networks. We believe that genuine grassroots involvement, driven by loyal and invested fans, represents powerful a marketing asset for our games.

Our Company’s marketing and promotional efforts are intended to maximize consumer interest in a game, promote name recognition for the game, assist sales and distribution platforms in their efforts and properly position and sell the game. Other marketing activities may include:

| | ● | Implementing public relations campaigns using online advertising (including on Facebook, Twitter, You Tube, Vimeo and/or other online social networks and websites). The Company intends to label and market each game in accordance with the applicable principles and guidelines of the Entertainment Software Rating Board (“ESRB”), an independent self-regulatory body that assigns ratings and enforces advertising guidelines for the interactive software industry. |

| | ● | Assisting in securing promotional features on various distribution sites. |

| | ● | Spending marketing and advertising dollars on customized market segments defined in part based on previous crowdfunding campaigns. |

| | ● | Engaging in early marketing and promotional activities usually associated with the later-stage commercialization of games, including the marketing and promotion of games throughFig.co’s user community and through the community of our Parent’s developer-advisers. |

| | ● | Employing various other marketing methods designed to promote consumer awareness, including through social media, co-operative advertising and product sampling through demonstration software distributed over the Internet or through digital online services. |

In addition to engaging in the marketing of its licensed games, as described above, Fig has also begun to provide marketing services on a standalone basis to game developers, separate from the Fig game publishing business. Fig will continue to take marketing-only engagements with developers that are not also publishing clients, in part in order to strengthen Fig’s overall marketing capabilities and audience network.

Distribution

Our Company will support the distribution of each game once the game is commercially released, through various digital distribution channels. We identify and secure agreements with third-party distributors to distribute, deliver, transmit, stream, resale, wholesale or otherwise exploit the licensed game on the licensed platforms, and we monitor the performance of those agreements after they are entered into. For example, if Microsoft Windows is a platform that the developer has licensed to us for distribution of its game, we would seek to secure agreements with distributors on that platform, such as Steam, Humble Bundle and Amazon. Distributors will be responsible for remitting receipts from sales of the game to us, after taking their share of sales amounts (typically 30%) as their fee. The Company has relationships with all the major digital distributors of games (also known as “storefronts”), such as Steam, Xbox One Store, PlayStation Store, Apple AppStore, Google Play Store, Gog.com, EA Origin and Humble Bundle. The Company also plans to sell games directly on the Company's affiliated website,Fig.co, which we expect will already have a strongly associated SEO due to previous crowdfunding campaigns. When a game is sold on a digital storefront, the Company will continue to market and merchandise the game on that storefront by arranging special promotions and merchandising with that storefront.

Other distribution activities may include:

| | ● | Securing promotional features on licensed platforms. |

| | ● | Conducting market research and creating and implementing marketing and sales plans. |

| | ● | Negotiating and entering into agreements to distribute the game through worldwide distributors. |

| | ● | Partnering with the developer to secure relationships and promotions through particular additional distributors. |

| | ● | Arranging for the localization of a game being distributed in a number of different markets. |

| | ● | Arranging for the porting of the game to new platforms. |

| | ● | Extending the lifetime sales of a game by reducing the wholesale price of the game to video game platforms at various times during the life cycle of the game. Price concessions may occur at any time in the game’s product life cycle, but they typically occur three to nine months after a product’s initial launch. The Company may also provide volume rebates to stimulate continued product sales. |

Distribution arrangements are typically terminable on short notice.

New gaming platforms, such as virtual reality, are expected to continue to emerge in the future. The Company intends to evaluate new platform publishing opportunities on a case-by-case basis as they emerge.

Other Services

In addition to the foregoing, Fig anticipates providing advice and consultation generally to the developers of its licensed games, including for example creative advice, advice regarding which technologies to use or platforms to focus on, advice regarding marketing approaches and hiring decisions and advice on other game and game business topics, in particular when Fig is dealing with less experienced developers.

Business Development

We support developers in business development activities to pursue commercial and strategic partnerships with other companies in the game industry, including hardware manufacturers, peripheral makers, platforms, advertisers and technology providers.

Personnel

Our principals have extensive experience in the business of publishing video games. Justin Bailey, our Chief Executive Officer and sole director, has been active in the video game industry for many years, having published a wide variety of free-to-play, premium and mobile games and having helped to secure many millions of dollars in game financing from publishers, investors and crowdfunding participants in recent years. Jonathan Chan, our Chief Operating Officer, has several years of experience at the large video game publisher Electronic Arts Inc., where he focused on business development deals in the publishing and distribution of games. See “Directors and Officers”.

Our principals are supported by employees and contractors of our Parent, including individuals dedicated to marketing, design, community relations and developer relations functions. As of November 30, 2016, five such individuals provided such support.

Our Company and our Parent

Our Company was incorporated on October 8, 2015 in Delaware as a wholly owned subsidiary of Loose Tooth Industries, Inc., a Delaware corporation (our “Parent”). The Company has only recently begun operations and has to date relied substantially on its Parent for support in the conduct of its business. The Company has been operating under a cost sharing agreement entered into between the Company and our Parent (the “Cost Sharing Agreement”), which is described in more detail below.

Our Parent was formed as a limited liability company in October 2014, was incorporated in March 2015 and began operations in April 2015. Our Parent is the operator ofFig.co, an online technology platform created to facilitate fundraising for video game development. Our Parent also took the initial steps to establish the video game publishing business that Fig now conducts. Our Parent hosted its first crowdfunding campaign onFig.co in August 2015, and as of December 31, 2016 it had hosted a total of 11 crowdfunding campaigns onFig.co. We expect to run all of our crowdfunding campaigns onFig.co.

Cost Sharing Agreement with Our Parent

We operate under a cost sharing agreement entered into between ourselves and our Parent (the “Cost Sharing Agreement”) pursuant to which we and our Parent have each agreed to share costs pursuant to an allocation policy. Pursuant to this policy and as reflected in the Cost Sharing Agreement, our Parent allocates costs in most instances pursuant to pre-determined formulas. For example, the allocation of costs associated with the payment of employee salaries is based on our estimate of each employee’s time attributed to the business activities of Fig and our Parent. Our Parent allocates (i) 50% of the salary of each of our Chief Executive Officer, Justin Bailey, and one other employee, to Fig, and the remaining 50% of each such salary to our Parent; and (ii) 100% of the salaries of our COO, Jonathan Chan, to Fig. As our Parent provides us with management and administrative services, as well as services relating to information technology provision and support, distribution rights management and other support operations, facilities, human resources, tax planning and administration, accounting, treasury and insurance, the costs of these activities are allocated 50% to our Parent and 50% to the Company.

In addition, under the Cost Sharing Agreement, our Parent may allocate to itself some or all of the expenses of Fig’s securities offerings.

The allocation policy and Cost Sharing Agreement may be adjusted in certain cases to reflect any changes to the business activities of Fig or our Parent that may arise in the future. We or our Parent may also reimburse the other party for any costs paid by such party that should have been allocated to the other party. Pursuant to the Cost Sharing Agreement, we have agreed to review our allocation policy from time to time to determine its suitability for our and our Parent’s businesses and to adjust the policy when necessary. For example, if our Parent is unable to perform any of the services we rely upon it to perform in support our business, due to financial difficulty or otherwise, we may have to perform those services or find another service-provider, and incur additional expenses, all of which would require adjustments to our allocation policy.

The Cost Sharing Agreement has an initial term through December 31, 2016, and will automatically renew for successive one-year terms each December 31, unless either party provides the other party with written notice of its intent not to renew at least three months prior to such date. In addition, we may terminate any specific service, or the entire agreement, without penalty, by providing 30 days’ prior written notice to our Parent, and our Parent may terminate any specific service, or the entire agreement, by providing 180 days’ prior written notice to us (provided that, in the case of termination of specific services, if we, in our sole determination, are unable to enter into a reasonable arrangement with a third party to perform such services, then our Parent will continue to perform such services for an additional period of 180 days upon receiving notice from the Company of such an event).

Competition

Our Company operates in a highly competitive industry. The Company competes with:

| | ● | Traditional game publishers. The Company faces competition for distribution licenses from traditional sources such as established video game publishers, which include some of the largest corporations in the world. These competitors may be in a stronger position to respond quickly to new technologies and may be able to undertake more extensive marketing campaigns. In addition, these competitors have longer operating histories, greater name recognition and more extensive financial resources than the Company. Traditional publishers range in size and cost structure from the very small, with limited resources, to the very large, with extensive financial, marketing, technical and other resources, such as Electronic Arts, Ubisoft, Tencent and Nexon. |

| | ● | Existing rewards-only crowdfunding platforms. Developers may choose to self-publish their games using rewards-only crowdfunding on other platforms. |

| | ● | Other games and forms of entertainment. The games we publish will compete with other online computer, console and mobile games. They will also compete with other, non-game forms of entertainment. |

Competition in the entertainment software industry is based on innovation, features, playability and product quality; name recognition; compatibility with popular platforms; access to distribution channels; price; marketing; and customer service. The industry in which the Company operates is driven by hit titles, which require increasing budgets for development and marketing. Competition for any game is influenced by the timing of competitive product releases and the similarity of such products to the relevant game.

For further discussion of the risks relating to our Company and its business, see “Other Information – Risk Factors”.

Seasonality

The business of the Company is highly seasonal, with the highest levels of consumer demand for games, and a significant percentage of sales, occurring in the holiday season in the quarter ending December 31, and seasonal lows in sales volume occurring in the quarter ending June 30. Although sales of video games generally follow these seasonal trends, there can be no assurance that this will continue. The Company’s financial results may vary based on a number of factors, including the release date of a game, cancellation or delay of a game’s release and consumer demand for a particular game and for video games generally.

Conflicts of Interest

The Company expects to do business with entities owned or controlled by affiliates. The Company may, in its discretion, conduct business with such parties. See “Interest of Management and Others in Certain Transactions”.

Properties and Company Location

We are located at 599 Third Street, Suite 211, San Francisco, California 94107, in a space that is rented and paid for by our Parent. We do not own any real property.

Government Regulation Related to Conducting Business on the Internet

The Company is subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the Internet. In addition, laws and regulations relating to user privacy, data collection and retention, content, advertising and information security have been adopted or are being considered for adoption by many countries throughout the world. Set forth below are descriptions of various U.S. laws and regulations applicable to the Company in relation to its conduct of its business on the Internet.

Electronic Signatures in Global and National Commerce Act/Uniform Electronic Transactions Act

The Federal Electronic Signatures in Global and National Commerce Act (“E-SIGN”) and similar state laws, particularly the Uniform Electronic Transactions Act (“UETA”), authorize the creation of legally binding and enforceable agreements using electronic records and signatures. E-SIGN and UETA require businesses that wish to use electronic records or signatures in consumer transactions to obtain the consumer’s consent. When a developer or potential investor registers onFig.co, the website is designed to obtain his, her or its consent to the transaction of business electronically and the maintenance of electronic records in compliance with E-SIGN and UETA requirements.

Electronic Fund Transfer Act and NACHA Rules

The federal Electronic Fund Transfer Act (“EFTA”) and Regulation E, which implements it, provide guidelines and restrictions regarding the electronic transfer of funds from consumers’ bank accounts. In addition, transfers performed by ACH electronic transfers are subject to detailed timing and notification rules and guidelines administered by NACHA. It is our policy to obtain necessary electronic authorization from developers and investors for transfers in compliance with such rules. Transfers of funds throughFig.co are intended to conform to the EFTA and its regulations and NACHA guidelines.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This Management’s Discussion and Analysis contains forward-looking statements. You should not place undue reliance on forward-looking statements, and you should consider carefully the statements made in “Other Information – Risk Factors” and elsewhere in this annual report that identify important factors that could cause actual outcomes to differ from those expressed or implied in our forward-looking statements, and that could materially and adversely affect our business, operating results and financial condition.

This Management’s Discussion and Analysis should be read together with the consolidated financial statements and notes thereto, included elsewhere in this annual report.

Overview

Our company was incorporated on October 8, 2015 in Delaware as a wholly owned subsidiary of Loose Tooth Industries, Inc., our Parent. We have only recently begun operations and have to date relied substantially on our Parent for support in the conduct of our business. We have not yet earned a significant amount of revenues and we have little operating history, which may make it difficult for potential investors to evaluate our business and assess our future viability and prospects. We have, at this time, limited assets and resources and receive substantial ongoing support from our Parent under the Cost Sharing Agreement. Pursuant to the Cost Sharing Agreement, our Parent provides us with management and administrative services, as well as services relating to information technology provision and support, distribution rights management and other support operations, facilities, human resources, tax planning and administration, accounting, treasury and insurance. The services of our executive management and other personnel are currently performed by employees and principals of our Parent, and the costs of such services are allocated between us and our Parent pursuant to the Cost Sharing Agreement.

Results of Operations

Our Parent was formed on October 27, 2014 and commenced operations in April 2015. Prior to our formation on October 8, 2015, we did not operate as a separate legal entity. Accordingly, our consolidated financial statements prior to our formation were prepared on a “carve-out” basis from our Parent’s accounts, and reflect the historical balance sheet accounts directly attributable to us together with allocations of costs incurred by our Parent. These allocations may not be reflective of the actual levels of assets, liabilities, income or costs that would have been incurred had we operated as a separate legal entity. Certain estimates, including allocations from the Parent, have been made to provide financial statements, for stand-alone reporting purposes, for the period prior to October 8, 2015. All transactions between our Parent and us prior to our formation were classified as net transfers from our Parent to us (aggregating $242,161) in our consolidated balance sheet at September 30, 2015. We believe that the assumptions underlying the carve-out financial information are reasonable; however, the resulting financial information does not necessarily reflect what our results of operations, financial position and cash flows would have been on a stand-alone basis. The cost allocation methods applied to certain common costs include the following:

| | ● | Specific identification. Where the amounts were specifically identified within our company, they were classified accordingly. |

| | | |

| | ● | Reasonable allocation. Where the amounts were not clearly or specifically identified, management determined if a reasonable allocation method could be applied. |

Upon our formation, our Parent did not contribute any assets to us and we did not assume any liabilities from it. As a result, the assets and liabilities allocated to us in our “carve-out” financial statements, other than $104,540 of deferred offering costs, which benefited us directly, were considered returned to our Parent. At the date of our inception, October 8, 2015, the assets and liabilities allocated to us, other than the deferred offering costs, constituted a net liability of $251,309, which was recognized as a contribution to us from our Parent.

Our consolidated balance sheet at September 30, 2016 and our consolidated statement of operations for the year ended September 30, 2016 are presented based on our actual results as a separate legal entity. Our consolidated balance sheet at September 30, 2015 and our consolidated statement of operations for the period from October 27, 2014 (our Parent’s inception) to September 30, 2015 are presented based on the “carve-out” basis.

During the year ended September 30, 2016, we began providing marketing services to third parties with whom we have not entered into co-publishing license agreements, and during this period we generated approximately $8,000 in revenue from the provision of such services. Currently, we can provide no assurance as to the size of any additional revenues we may earn from providing such services. For the period from October 27, 2014 (inception) to September 30, 2015, we did not generate any revenue.

During the year ended September 30, 2016, we incurred approximately $2.2 million in expenses, comprised of approximately $622,000 in salaries and benefits, $45,000 in occupancy costs, $523,000 in professional fees, $69,000 in stock based compensation costs, $119,000 in marketing and promotion costs, $32,000 in travel expense, $675,000 in game development costs and $85,000 in other general and administrative expenses.

For the period from October 27, 2014 (inception) to September 30, 2015, we incurred approximately $389,000 in expenses, comprised of approximately $83,000 in salaries and benefits, $2,400 in occupancy costs, $216,000 in professional fees, $1,800 in stock based compensation costs, $57,000 in marketing and promotion costs, $16,000 in travel expense and $13,000 in other general and administrative expenses.

We have entered into seven principal video game co-publishing license agreements, for the gamesPsychonauts 2,Jay and Silent Bob: Chronic Blunt Punch,Consortium: The Tower, Make Sail, Wasteland 3, Trackless andKingdoms and Castles. The development of each of those seven games is underway. In addition to these games, in three instances crowdfunding campaigns for particular games failed to meet their goals and we will not be publishing those games. We have near-term prospects for entering into additional game publishing license agreements that we believe represent substantial commercial opportunities.

We expect to incur increased expenses as a result of being a public reporting company under the rules applicable to companies that have conducted Regulation A offerings (for legal, financial reporting, accounting and auditing compliance), as well as for our business operations, business development and other general corporate expenses. We expect that our legal fees per offering will decrease after our first offering or first few offerings.

Our employees are also employees of our Parent, and the allocation of expenses to pay the salaries of such employees is set forth in the Cost Sharing Agreement. We share operating space with our Parent, in San Francisco, California.

Liquidity and Capital Resources of the Company

To date, we have relied substantially on our Parent for liquidity and capital resources. As of September 30, 2016, we had approximately $787,000 in cash and approximately $81,000 of working capital, resulting mainly from our Parent’s cash contribution to us of $1 million in July 2016, approximately $389,000 in outstanding advances to our Parent and $159,480 in funds temporarily held by our Parent. Our Parent repaid the last two amounts to us in full after September 30, 2016. Net cash provided by (used in) operating activities during the year ended September 30, 2016 and during the period from October 27, 2014 (inception) to September 30, 2015 was approximately $7,300 and ($226,000), respectively. Net cash used in investing activities during the same periods was approximately $389,000 and $15,000, respectively. Net cash provided by financing activities during the same periods was approximately $1.2 million and $240,000, respectively.

As further disclosed below, on September 30, 2016, we and our Parent jointly entered into a loan and security agreement (the “Loan and Security Agreement”) with Silicon Valley Bank, under which we and our Parent, individually and collectively, can borrow up to an aggregate of $1,000,000, all or substantially all of which is intended to be used in support of our business. See a further description of the Loan and Security Agreement below. As of the date hereof, the full $1,000,000 available under the Loan and Security Agreement has been borrowed.

Loan and Security Agreement with Silicon Valley Bank

On September 30, 2016, we and our Parent jointly entered into the Loan and Security Agreement with Silicon Valley Bank (“SVB”), under which we and our Parent, individually and collectively, can, subject to the terms and conditions of the Loan and Security Agreement, borrow up to an aggregate of $1,000,000 from SVB for use as working capital and for general business purposes. It is our intention, as well as our Parent’s intention, that all or substantially all of the borrowed amounts be used in support of our business. Pursuant to the agreement, SVB made advances available by December 31, 2016 in the aggregate principal amount of $1,000,000, including one advance, in the principal amount of $250,000, upon our Parent having received a fully executed term sheet evidencing an investment commitment to purchase at least $5 million of its equity securities. Repayments are due to SVB in thirty (30) equal monthly installments commencing April 1, 2017, plus monthly payments of accrued interest at a rate of 2% above the prime rate. Outstanding advances are repayable in full on September 1, 2019. Repayment is secured by a first priority security interest in favor of SVB in substantially all of our and our Parent’s assets, excluding intellectual property. SVB will be due a fee on September 1, 2019 of 1% of the principal amount of all advances made. The agreement imposes certain restrictions on us and our Parent, including on the ability to (i) transfer, assign or dispose of business or property, (ii) permit a Change in Control (as defined in the agreement), merger or consolidation, (iii) incur any Indebtedness or Liens (as defined in the agreement), (iv) maintain any Collateral Account (as defined in the agreement), (v) issue or distribute capital stock or membership interests, make distributions or pay dividends (other than dividends paid by Fig on its preferred stock), (vi) enter into transactions with affiliates except in the ordinary course of business and upon fair and reasonable terms that are no less favorable than would be obtained in an arm-length’s basis with a non-affiliate, (vii) permit any subordinated debt or make certain amendments to any document relating to such debt and (viii) fail to comply with certain governmental regulations. Each of these restrictions is subject to certain exceptions, as specified in the Loan and Security Agreement. In connection with the Loan and Security Agreement, our Parent issued to SVB a ten-year warrant to purchase 104,529 shares of our Parent’s common stock, at $0.32 per share, subject to certain additional terms and conditions.

Going Concern

Our ability to continue as a going concern depends upon our ability to successfully accomplish the plans embodied in our business model and eventually secure other sources of financing and attain profitable operations. To date, we have depended substantially on our Parent to fund our operations and there is a risk that we and our Parent may be unable to obtain the financing, on acceptable terms or at all, necessary to continue our operations. As such, there is substantial doubt regarding our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern. These consolidated financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts, or amounts and classification of liabilities that might result from this uncertainty.

Contractual Commitments

Current agreements relating to our operations, such as rental commitments, are in the name of our Parent. We will continue to operate under the Cost Sharing Agreement, pursuant to which our Parent and us agree to share costs of the support and services provided by our Parent. See “Business – Cost Sharing Agreement with Our Parent”.

Under the video game co-publishing license agreements we have entered into, as of January 26, 2017, we have incurred the following material ongoing contractual commitments:

| Game Title | | Fig Funds Committed |

| | | |

| Psychonauts 2 | | $600,000 to $3 million (to be finally determined at or prior to the completion of closing of the offering of Fig Game Shares – PSY2) (as of the date indicated above, $589,000 closed on from private and Regulation A sales of Fig Game Shares – PSY2 and $350,000 paid to developer). |

| | | |

| Jay and Silent Bob: Chronic Blunt Punch | | Up to $400,000 ($50,000 paid to developer). |

| | | |

| Consortium: The Tower | | Up to $300,000 ($143,000 paid to developer). |

| | | |

| Wasteland 3 | | $1,200,000 to $2,500,000 (to be finally determined at or prior to the closing of the offering of Fig Game Shares – Wasteland 3) (as of the date indicated above, $965,000 closed on from private sales of Fig Game Shares – Wasteland 3 and $909,000 paid to developer). |

| | | |

| Make Sail | | $29,000 (all paid to developer). |

| | | |

| Trackless | | $12,000 (all paid to developer). |

| | | |

| Kingdoms and Castles | | $15,000 to $100,000 ($83,000 paid to developer). |

We are not otherwise committed to make any material capital expenditures, and other agreements relating to our operations, such as rental commitments, are in the name of our Parent. We will continue to operate under the Cost Sharing Agreement, pursuant to which we and our Parent have agreed to share costs of the support and services provided by our Parent. See “Business – Cost Sharing Agreement with Our Parent”.

Game-Specific Accounting

Accounting for a Particular Game’s Sales