We have a limited operating history and no history of commercializing pharmaceutical products, which may make it difficult to evaluate the prospects for our future viability.

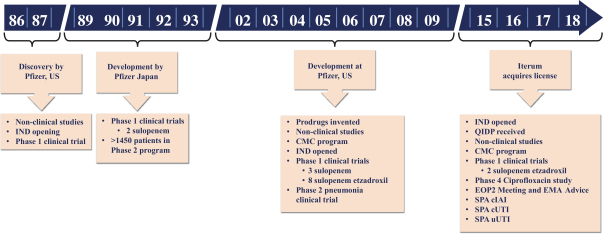

We began operations in November 2015. Since our inception, we have devoted substantially all of our financial resources and efforts to organizing and staffing our company, business planning, raising capital, planning for potential commercialization, and research and development, including preclinical and clinical development, for our sulopenem program. While the members of the development team have successfully developed and registered other antibiotics, as Iterum we have limited experience and have not yet demonstrated an ability to successfully complete a large-scale, pivotal clinical trial, obtain marketing approval, manufacture a commercial scale product (or arrange for a third party to do so on our behalf), or conduct sales and marketing activities necessary for successful product commercialization. Consequently, predictions about our future success or viability may not be as accurate as they could be if we had a longer operating history or a history of successfully developing and commercializing pharmaceutical products.

Assuming we obtain marketing approval for oral sulopenem and sulopenem, we will need to transition from a company with a research and development focus to a company capable of supporting commercial activities. We may encounter unforeseen expenses, difficulties, complications and delays, and may not be successful in such a transition.

Raising additional capital may cause dilution to our shareholders, including purchasers of ordinary shares in this offering, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Unless and until we can generate a substantial amount of revenue from our sulopenem program or future product candidates, we expect to finance our future cash needs through equity offerings, debt financings, collaboration agreements, other third-party funding, strategic alliances, licensing arrangements, marketing and distribution arrangements or government funding. In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans.

Our issuance of additional securities, whether equity or debt, or the possibility of such issuance, may cause the market price of our ordinary shares to decline, and our shareholders may not agree with our financing plans or the terms of such financings. To the extent that we raise additional capital through the sale of ordinary shares, convertible securities or other equity securities, your ownership interest may be materially diluted, and the terms of these securities could include liquidation or other preferences and anti-dilution protections that could adversely affect your rights as an ordinary shareholder. In addition, debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include restrictive covenants that limit our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends, which could adversely affect our ability to conduct our business. In addition, securing additional financing would require a substantial amount of time and attention from our management and may divert a disproportionate amount of their attention away from day-to-day activities, which may adversely affect our management’s ability to oversee the development of our product candidates.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates or grant licenses on terms that may not be favorable to us.

We may expend our limited resources to pursue a particular product candidate or indication and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success.

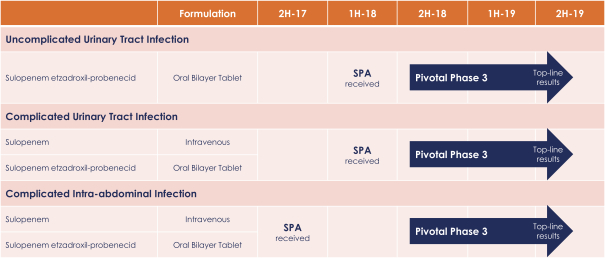

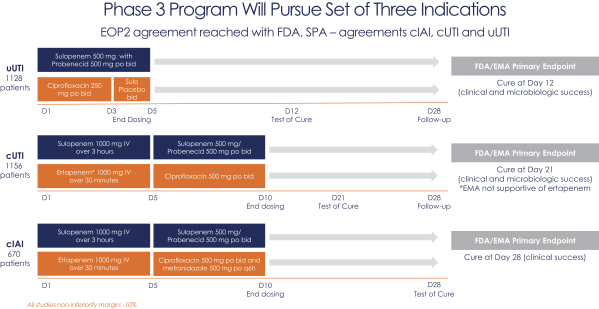

Because we have limited financial resources, we intend to focus on developing our sulopenem program for the specific indications of uUTI, cUTI and cIAI, all of which are focused on the most pressing near-term medical

13