- ITRM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Iterum Therapeutics (ITRM) PRE 14APreliminary proxy

Filed: 17 Dec 20, 5:30pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ |

| Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Iterum Therapeutics plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

1

PRELIMINARY COPY – Subject to Completion

December [ ], 2020

Dear Iterum Therapeutics plc Shareholder,

You are cordially invited to our Extraordinary General Meeting of Shareholders to be held at Block 2, Floor 3, Harcourt Centre, Harcourt Street, Dublin 2, Ireland on January 26, 2021 at 3.00 p.m., Irish time (10.00 a.m., Eastern Time).

The purpose of the Extraordinary General Meeting is to ask shareholders to approve an increase in the authorized share capital of Iterum and related proposals to give our board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options and an updated power under Irish law to issue Iterum shares for cash without first offering those shares to existing shareholders. We are seeking an increase in the authorized share capital (and related approvals) as our current reserve of unissued and unreserved ordinary shares is very limited and the increase will provide additional flexibility with respect to share issuances required to pursue our business objectives.

The enclosed Notice of Extraordinary General Meeting of Shareholders and the accompanying proxy statement set forth more detail on the proposals that will be presented at the meeting. Our board of directors recommends that you vote "FOR" Proposals 1, 2 and 3 as set forth in the proxy statement.

We hope that you will participate in the meeting by voting through acceptable means as described in this proxy statement as promptly as possible. Your vote is important – so please exercise your right.

Sincerely,

Corey N. Fishman

President and Chief Executive Officer

The enclosed proxy statement and proxy card were first made available to shareholders on or about December [ ], 2020.

1

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Block 2 Floor 3 Harcourt Centre

Harcourt Street

Dublin 2

Ireland

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

to be held on January 26, 2021

The Extraordinary General Meeting of Shareholders (the “EGM”) of Iterum Therapeutics plc, an Irish public limited company (the “Company”), will be held on January 26, 2021, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at Block 2, Floor 3, Harcourt Centre, Harcourt Street, Dublin 2, Ireland to consider and act upon the following matters:

| 1. | To approve an increase in the authorized share capital of the Company from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares. We refer to this proposal as the authorized share capital increase proposal (Proposal No. 1). |

| 2. | If the authorized share capital increase proposal (Proposal No. 1) is approved, to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options. We refer to this proposal as the directors’ allotment authority proposal (Proposal No. 2). |

| 3. | If the directors’ allotment authority proposal (Proposal No. 2) is approved, to grant the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. We refer to this proposal as the pre-emption rights dis-application proposal (Proposal No. 3). We refer to the authorized share capital increase proposal (Proposal No. 1), the directors’ allotment authority proposal (Proposal No. 2) and the pre-emption rights dis-application proposal (Proposal No. 3) collectively as the additional share capital proposals. |

| 4. | To conduct any other business properly brought before the EGM or any adjournment or postponement thereof. |

Proposal Nos. 1 and 2 above are ordinary resolutions requiring a simple majority of the votes cast at the meeting to be approved. Proposal No. 3 above is a special resolution requiring at least 75% of the votes cast at the meeting to be approved. All proposals are more fully described in this proxy statement.

Shareholders of record at the close of business on December 16, 2020 will be entitled to notice of and to vote at the EGM or any adjournment or postponement thereof. This proxy statement is being mailed to shareholders on or about December [ ], 2020.

Special Precautions Due to COVID-19 Concerns

In light of public health concerns related to COVID-19, the Company would like to emphasize that we consider the health of our shareholders, employees and other attendees a top priority. We are monitoring guidance issued by the Irish Health Service Executive ("HSE"), the Irish government, the U.S. Center for Disease Control and Prevention and the World Health Organization and we have implemented, and will continue to implement, the measures advised by the HSE to minimize the spread of COVID-19.

Based on latest available public health guidance, we expect that the EGM will proceed under very constrained circumstances given current restrictions on public gatherings.

Shareholders’ contributions at the EGM are valued, however, shareholders are strongly encouraged to vote their shares by proxy as the preferred means of fully and safely exercising their rights. Personal attendance at the EGM may present a health risk to shareholders and others. In particular, we advise that shareholders who are experiencing any COVID-19 symptoms or anyone who has been in contact with any person experiencing any COVID-19 symptoms should not attend the EGM in person.

2

The Company may take additional procedures or limitations on meeting attendees, including limiting seating, requiring health screenings and other reasonable or required measures in order to enter the building.

In the event that a change of venue is necessitated due to public health recommendations regarding containment of COVID-19, which may include the closure of or restrictions on access to the meeting venue, we will communicate this to shareholders with as much notice as possible by an announcement, which will be published on the investor relations page of the Company’s website found at https://ir.iterumtx.com/ and which we will also file with the Securities and Exchange Commission. We advise shareholders to monitor the page regularly, as circumstances may change at short notice. We recommend that shareholders keep up-to-date with latest public health guidance regarding travel, self-isolation and health and safety precautions.

By order of the Board of Directors,

/s/ Louise Barrett

_______________________________

Louise Barrett

Secretary

Dublin, Ireland

December [ ] 2020

3

YOU MAY OBTAIN ADMISSION TO THE EGM BY IDENTIFYING YOURSELF AT THE EGM AS A SHAREHOLDER AS OF THE RECORD DATE. IF YOU ARE A RECORD OWNER, POSSESSION OF A COPY OF A PROXY CARD WILL BE ADEQUATE IDENTIFICATION. IF YOU ARE A BENEFICIAL (BUT NOT RECORD) OWNER, A COPY OF AN ACCOUNT STATEMENT FROM YOUR BANK, BROKER OR OTHER NOMINEE SHOWING SHARES HELD FOR YOUR BENEFIT ON DECEMBER 16, 2020 WILL BE ADEQUATE IDENTIFICATION. IN LIGHT OF PUBLIC HEALTH CONCERNS RELATED TO COVID-19 AND PROTOCOLS RECOMMENDED OR REQUIRED BY GOVERNMENTAL AUTHORITIES, THE COMPANY MAY IMPOSE ADDITIONAL RESTRICTIONS ON YOUR ABILITY TO ATTEND THE EGM IN PERSON, INCLUDING LIMITING SEATING, REQUIRING HEALTH SCREENINGS AND OTHER REASONABLE OR REQUIRED MEASURES IN ORDER TO ENTER THE BUILDING.

WHETHER OR NOT YOU EXPECT TO ATTEND THE EGM, PLEASE SUBMIT YOUR VOTING INSTRUCTIONS VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS SET FORTH ON THE ENCLOSED PROXY CARD OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY MATERIALS, BY COMPLETING, DATING AND SIGNING THE ENCLOSED PROXY CARD AND MAILING IT PROMPTLY IN THE PROVIDED ENVELOPE. TO HELP ENSURE REPRESENTATION OF YOUR SHARES AT THE EGM, NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

A SHAREHOLDER ENTITLED TO ATTEND AND VOTE AT THE EGM IS ENTITLED, USING THE PROXY CARD PROVIDED (OR IN THE FORM IN SECTION 184 OF THE IRISH COMPANIES ACT 2014), TO APPOINT ONE OR MORE PROXIES TO ATTEND, SPEAK AND VOTE INSTEAD OF HIM OR HER AT THE EGM. A PROXY NEED NOT BE A SHAREHOLDER OF RECORD.

4

TABLE OF CONTENTS

5

PRELIMINARY COPY – Subject to Completion

ITERUM THERAPEUTICS PLC

Block 2 Floor 3 Harcourt Centre

Harcourt Street

Dublin 2

Ireland

PROXY STATEMENT FOR THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JANUARY 26, 2021 AT BLOCK 2, FLOOR 3, HARCOURT CENTRE, HARCOURT STREET, DUBLIN 2, IRELAND

Important Notice Regarding the Availability of Proxy Materials

for the Extraordinary General Meeting of Shareholders

to be held on January 26, 2021

This proxy statement is available at www.proxyvote.com

for viewing, downloading and printing.

This proxy statement as filed with the Securities and Exchange Commission (“SEC”) and a form of proxy is being mailed on or about December [ ], 2020 to holders of record as of the close of business on December 16, 2020.

6

INFORMATION ABOUT THE EXTRAORDINARY GENERAL MEETING AND VOTING

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the "board of directors" or the "board") of Iterum Therapeutics plc (the "Company," "Iterum," "we" or "us") for use at the Extraordinary General Meeting of Shareholders (the "EGM") to be held on January 26, 2021, beginning at 3.00 p.m., Irish time (10.00 a.m., Eastern Time), at our offices at Block 2, Floor 3, Harcourt Centre, Harcourt Street, Dublin 2, Ireland and at any adjournment or postponement thereof. On December 16, 2020, the record date for the determination of shareholders entitled to vote at the EGM, there were issued, outstanding and entitled to vote an aggregate of 48,731,028 of our ordinary shares, par value $0.01 per share ("ordinary shares"). Each ordinary share entitles the record holder thereof to one vote on each of the matters to be voted on at the EGM.

Your vote is important no matter how many shares you own. Please take the time to vote. Take a moment to read the instructions below. Choose the way to vote that is easiest and most convenient for you and cast your vote as soon as possible.

If you are the "record holder" of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may vote in one of four ways:

| (1) | You may vote over the Internet. You may vote your shares by following the "Online" instructions on the enclosed proxy card. If you vote over the Internet, you do not need to vote by telephone or complete and mail your proxy card. The internet voting facilities for eligible shareholders of record will close at 6:00 a.m., Irish time (1:00 a.m., Eastern Time), the day of the EGM. |

| (2) | You may vote by telephone. You may vote your shares by following the "Phone" instructions on the enclosed proxy card. If you vote by telephone, you do not need to vote over the Internet or complete and mail your proxy card. If you vote by telephone, your use of that telephone system, and specifically the entry of your pin number/other unique identifier, will be deemed to constitute your appointment, in writing and under hand, and for all purposes of the Irish Companies Act 2014, of each of David G. Kelly and Louise Barrett as your proxy to vote your shares on your behalf in accordance with your telephone instructions. The telephone voting facilities for eligible shareholders of record will close at 6:00 a.m., Irish time (1:00 a.m., Eastern Time), the day of the EGM. |

| (3) | You may vote by mail. You can vote by completing, dating and signing the proxy card provided to you and promptly mailing it in the provided postage-paid envelope. If you vote by mail, you do not need to vote over the Internet or by telephone. We must receive the completed proxy card by 5.00 p.m., Irish time (12.00 p.m., Eastern Time), on January 25, 2021. |

| (4) | You may vote in person. If you attend the EGM, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the EGM. Ballots will be available at the EGM. You may obtain directions to the location of the EGM by requesting them in writing or by telephone as follows: c/o Secretary, Iterum Therapeutics plc, Block 2 Floor 3 Harcourt Centre, Harcourt Street, Dublin 2, Ireland, Phone: +353 1 9038354. |

Please bear in mind that the Company encourages Shareholders to submit proxy materials, rather than attend the EGM in person. Please refer to the Section entitled "Special Precautions Due to COVID-19 Concerns" contained in the Notice of Extraordinary General Meeting of Shareholders section of this proxy statement for more information.

All proxies that are executed and delivered by mail or in person or are otherwise submitted over the Internet or by telephone will be voted on the matters set forth in the accompanying Notice of Extraordinary General Meeting of Shareholders in accordance with the shareholders' instructions. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the board of directors' recommendations on such proposals as set forth in this proxy statement. All proxies will be forwarded to the Company's registered office electronically.

After you have submitted a proxy, you may still change your vote and revoke your proxy prior to the EGM by doing any one of the following things:

| • | submitting a new proxy by following the "Online" or " Phone" instructions on the enclosed proxy card at a date later than your previous vote but prior to the voting deadline (which is 6:00 a.m., Irish time (1:00 a.m., Eastern Time), the day of the EGM); |

7

| • | signing another proxy card and either arranging for delivery of that proxy card by mail to the registered office of the Company prior to the start of the EGM, or by delivering that signed proxy card in person at the EGM; |

| • | giving our Secretary a written notice before or at the EGM that you want to revoke your proxy; or |

| • | voting in person at the EGM. |

Your attendance at the EGM alone will not revoke your proxy.

If the shares you own are held in "street name" by a bank, broker or other nominee record holder, which we collectively refer to in this proxy statement as "brokerage firms," your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. To vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which, if available, would be provided by your brokerage firm on the voting instruction form that it delivers to you. Because most brokerage firms are member organizations of the New York Stock Exchange (“NYSE”), the rules of the NYSE will likely govern how your brokerage firm would be permitted to vote your shares in the absence of instruction from you. Under the current rules of the NYSE, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain "discretionary" items but will not be allowed to vote your shares with respect to certain “non-discretionary” items. Proposals Nos. 1, 2 and 3 are all “non-discretionary” items, meaning that if you do not instruct your brokerage firm on how to vote with respect to these Proposals, your brokerage firm will not vote with respect to the proposals and your shares will be counted as “broker non-votes”. “Broker non-votes” are shares that are held in “street name” by a brokerage firm that indicates in its proxy that it does not have or did not exercise discretionary authority to vote on a particular matter.

If your shares are held in street name, you must bring an account statement from your brokerage firm showing that you are the beneficial owner of the shares as of the record date (December 16, 2020) to be admitted to the EGM. To be able to vote your shares held in street name at the EGM, you will need to obtain a proxy card from the holder of record.

Votes Required

The holders of a majority of our ordinary shares issued and outstanding and entitled to vote at the EGM will constitute a quorum for the transaction of business at the EGM. Ordinary shares represented in person or by proxy (including “broker non-votes” (as described above) and shares which abstain or do not vote with respect to one or more of the matters presented for shareholder approval) will be counted for purposes of determining whether a quorum is present at the EGM. The following votes are required for approval of the proposals being presented at the EGM:

Proposal No. 1: To approve an increase in the authorized share capital of the Company from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required for the approval of an increase in the authorized share capital of the Company from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares.

Proposal No. 2: If Proposal No. 1 is approved, to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options. The affirmative vote of the holders of ordinary shares representing a majority of the votes cast on the matter and voting affirmatively or negatively is required in order to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options.

Proposal No. 3: If Proposal No. 2 is approved, to grant the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. The affirmative vote of the holders of ordinary shares representing at least 75% of the votes cast on the matter and voting affirmatively or negatively is required in order to grant the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance.

8

share ownership of certain beneficial owners and management

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of [December 14/December [ ],] 2020 by:

| (a) | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our ordinary shares;

|

| (b) | each of our named executive officers;

|

| (c) | each of our directors; and

|

| (d) | all of our executive officers and directors as a group.

|

Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC”) and generally means that a person has beneficial ownership of a security if he, she, or it possesses sole or shared voting or investment power of that security, including share options that are exercisable within 60 days of [December 14/December [ ],] 2020, shares that are issuable pursuant to restricted share units vesting within 60 days of [December 14/December [ ],] 2020 and shares issuable upon exchange of our outstanding 6.500% exchangeable senior subordinated notes due 2025 (the “Exchangeable Notes”) (assuming physical settlement), which are exchangeable within 60 days of [December 14/December [ ],] 2020. Our ordinary shares issuable pursuant to share options, restricted share units, and Exchangeable Notes, not taking into account any additional ordinary shares issuable to satisfy accrued and unpaid interest due upon exchange of any Exchangeable Notes, are deemed outstanding for computing the percentage of the person holding such options, restricted share units or Exchangeable Notes and the percentage of any group of which the person is a member but are not deemed outstanding for computing the percentage of any other person. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons named in the table below have sole voting and investment power with respect to all ordinary shares shown that they beneficially own, subject to community property laws where applicable. The information does not necessarily indicate beneficial ownership for any other purpose, including for purposes of Section 13(d) and 13(g) of the Securities Act of 1933, as amended. Percentage ownership is based on [48,731,028] ordinary shares outstanding on [December 14/December [ ],] 2020. Except as otherwise set forth below, the address of the beneficial owner is c/o Iterum Therapeutics plc, Block 2 Floor 3 Harcourt Centre, Harcourt Street, Dublin 2, Ireland.

| Number of Shares Beneficially Owned |

|

| Percentage of Shares Beneficially Owned |

| ||

Principal Shareholders |

|

|

|

|

|

|

|

Entities affiliated with Advent Life Sciences(1) |

| 2,859,173 |

|

|

| 5.6 | % |

Entities affiliated with Canaan Partners(2) |

| 4,305,539 |

|

|

| 8.4 | % |

Entities affiliated with Frazier Healthcare(3) |

| 3,467,592 |

|

|

| 6.8 | % |

Entities affiliated with New Leaf Ventures(4) |

| 5,314,856 |

|

|

| 10.1 | % |

Entities affiliated with Sarissa Capital Management LP (5) |

| 19,292,766 |

|

|

| 28.4 | % |

Entities affiliated with RA Capital Management, L.P. (6) |

| 12,861,844 |

|

|

| 20.9 | % |

Directors and Named Executive Officers: |

|

|

|

|

|

|

|

Corey N. Fishman(7) |

| [452,520] |

|

| * |

| |

Michael Dunne, MD(8) |

| [384,948] |

|

| * |

| |

Judith M. Matthews(9) |

| [40,437] |

|

| * |

| |

Brenton K. Ahrens(10) |

| 25,825 |

|

| * |

| |

Mark Chin |

| 11,857 |

|

| * |

| |

Patrick J. Heron(3)(11) |

| 3,486,434 |

|

|

| 6.9 | % |

Ronald M. Hunt(4)(12) |

| 5,331,800 |

|

|

| 10.1 | % |

David G. Kelly(13) |

| 40,197 |

|

| * |

| |

Shahzad Malik, M.D.(1)(14) |

| 2,890,085 |

|

|

| 5.7 | % |

All current executive officers and directors as a group (9 persons)(15) |

| [12,664,103] |

|

|

| 22.2 | % |

|

|

|

|

|

|

|

|

* less than 1% |

|

|

|

|

|

|

|

9

10

| (6) | Consists of (a) 10,914,561 shares issuable to RA Capital Healthcare Fund, L.P., and (b) 1,947,283 shares issuable to Blackwell Partners LLC – Series A on exchange of the Exchangeable Notes held by them and exchangeable within 60 days of [December 14/December [ ],] 2020 (assuming physical settlement). RA Capital Healthcare Fund GP, LLC is the general partner of RA Capital Healthcare Fund, L.P. The general partner of RA Capital Management, L.P. is RA Capital Management GP, LLC, of which Peter Kolchinsky and Rajeev Shah are the controlling persons. RA Capital Management, L.P. serves as investment adviser for RA Capital Healthcare Fund, L.P, and Blackwell Partners LLC – Series A and may be deemed a beneficial owner, for purposes of Section 13(d) of the Securities Exchange Act of 1934 (the “Act”), of any of our securities held by RA Capital Healthcare Fund, L.P and Blackwell Partners LLC – Series A. RA Capital Healthcare Fund, L.P. has delegated to RA Capital Management L.P. the sole power to vote and the sole power to dispose of all securities held in the RA Capital Healthcare Fund, L.P.’s portfolio. Because RA Capital Healthcare Fund, L.P. has divested voting and investment power over the securities it holds and may not revoke that delegation on less than 61 days’ notice, RA Capital Healthcare Fund, L.P. disclaims beneficial ownership of the securities it holds for purposes of Section 13(d) of the Act. The principal business address of RA Capital Healthcare Fund, L.P, and Blackwell Partners LLC – Series A is c/o RA Capital Management, L.P., 200 Berkeley Street, 18th Floor, Boston, MA 02116. We obtained certain of the information regarding beneficial ownership of these shares from Schedule 13G that was filed by RA Capital Management, L.P. with the SEC on December 2, 2020.

|

| (7) | Consists of (a) 239,953 shares beneficially owned by Mr. Fishman, and (b) [212,567] shares issuable to Mr. Fishman pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020.

|

| (8) | Consists of (a) 209,498 shares beneficially owned by Dr. Dunne, (b) [129,295] shares issuable to Dr. Dunne pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020, and (c) 46,155 shares issuable to Dr. Dunne pursuant to warrants exercisable within 60 days of [December 14/December [ ],] 2020.

|

| (9) | Consists of [40,437] shares issuable to Ms. Matthews pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020.

|

| (10) | Consists of (a) 6,154 shares beneficially owned by Mr. Ahrens, and (b) 19,671 shares issuable to Mr. Ahrens pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020.

|

| (13) | Consists of (a) 37,108 shares beneficially owned by Mr. Kelly and (b) 3,089 shares issuable to Mr. Kelly pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020.

|

| (14) | Consists of (a) the shares described in note (1) above and (b) 30,912 shares issuable to Dr. Malik pursuant to share options exercisable within 60 days of [December 14/December [ ],] 2020.

|

11

MATTERS TO COME BEFORE THE EXTRAORDINARY GENERAL MEETING

BACKGROUND DISCUSSION ON PROPOSAL NOS 1 TO 3

Under Irish law, an Irish public limited company must have a maximum authorized share capital. Shareholder approval is required to increase the authorized share capital of an Irish public limited company. Under our current Constitution, pursuant to the resolutions passed at our Annual General Meeting held on June 10, 2020, our authorized share capital is $2,500,000, divided into 150,000,000 ordinary shares and 100,000,000 preferred shares, par value $0.01 per share.

In addition, under Irish law, directors of an Irish public limited company must have specific authority from shareholders to allot and issue any of the company’s shares, warrants, convertible instruments and options (other than pursuant to employee equity compensation plans). Moreover, when the directors of an Irish public limited company determine that it is in the best interests of the company to issue shares for cash, the company must first offer those shares on the same or more favorable terms to existing shareholders of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right) unless the directors opt out of - i.e., "dis-apply" - the statutory pre-emption right under an authority conferred by the constitution of the company or approved by shareholders.

Pursuant to resolutions passed at our Annual General Meeting held on June 10, 2020, our board of directors is currently authorized to allot and issue shares up to a maximum of our currently existing authorized (being 150,000,000 ordinary shares and 100,000,000 preferred shares) but unissued share capital and to opt out of the statutory pre-emption right.

As of [December 14/December [ ],] 2020, [48,731,028] of our ordinary shares were issued and outstanding. In addition, as of [December 14/December [ ],] 2020, the board of directors had reserved [2,105,308] shares for issuance upon exercise of outstanding options, performance share unit awards and restricted share unit awards granted under our equity compensation plans, [2,464,604] ordinary shares that may be issued pursuant to future grants or rights under our equity compensation plans, and up to [25,144,292] ordinary shares that may be issued upon exercise of warrants outstanding as of such date. Additionally, as of [December 14/December [ ],] 2020, the board of directors had reserved 66,696,893 ordinary shares that may be issued upon full exchange of the principal amount (assuming physical settlement) of our outstanding Exchangeable Notes issued by Iterum Therapeutics Bermuda Limited in connection with our January 2020 private placement and our September 2020 rights offering of units consisting of Exchangeable Notes and limited recourse royalty-linked subordinated notes. The number of ordinary shares issuable upon full exchange of the principal amount (assuming physical settlement) of the Exchangeable Notes, and the number of ordinary shares reserved for such potential issuance, may increase depending on the exchange rate of the Exchangeable Notes from time to time, which may be adjusted pursuant to the terms of the indenture governing the Exchangeable Notes (the “EN Indenture”) in addition to the amount of accrued and unpaid interest due upon exchange from time to time. As of [December 14/December [ ],] 2020 we currently only have approximately [4,857,875] ordinary shares which are unissued, unreserved, or unallocated and therefore available for future use (i.e., not already outstanding or reserved for future issuance under our Exchangeable Notes, warrants, options, restricted share unit awards, equity plans, or otherwise allocated for other purposes).

The number of ordinary shares issued and outstanding as of [December 14/December [ ],] 2020, reflects, among other things, the ordinary shares issued in the registered direct offerings we completed on June 5, 2020 (the “June 5 2020 Offering”) and June 30, 2020 (the “June 30 2020 Offering”), in addition to the ordinary shares issued in, and the exercise of all pre-funded warrants issued in, the registered public offering we completed on October 27, 2020 (the “October 2020 Offering”). The number of ordinary shares that may be issued upon exercise of warrants that are outstanding as of [December 14/December [ ],] 2020, includes, among other things, warrants issued in the June 5 2020 Offering, the June 30 2020 Offering and the October 2020 Offering, in each case a substantial portion of which remained unexercised as of such date. In addition, the number of shares reserved for issuance upon full exchange of the principal amount (assuming physical settlement) of the Exchangeable Notes reflects a recent adjustment to the exchange rate of the Exchangeable Notes as a result of the October 2020 Offering, in which we sold an aggregate of (i) 15,511,537 ordinary shares of the Company, (ii) pre-funded warrants exercisable for an aggregate of 11,411,539 ordinary shares and (iii) warrants exercisable for an aggregate of 20,192,307 ordinary shares (the ordinary shares issued in the October 2020 Offering together with the ordinary shares issuable from time to time under the warrants and the pre-funded warrants are referred to herein as the “Additional Ordinary Shares”). As the consideration payable per Additional Ordinary Share in the October 2020 Offering was less than the then current exchange price of the Exchangeable Notes, an anti-dilution adjustment was triggered pursuant to the EN Indenture, increasing the exchange rate of the Exchangeable Notes from 1,000 shares per $1,000 of principal and accrued and unpaid interest on the Exchangeable Notes (equivalent to an initial exchange price of $1.00 per ordinary share) to 1,286.1845 shares per $1,000 of principal and accrued and unpaid interest on the Exchangeable Notes (equivalent to an exchange price of approximately $0.7775 per ordinary share) (the “Adjusted Exchange Rate”), which Adjusted Exchange Rate may be subject to future adjustments under the EN

12

Indenture. As a result of such adjustment, we reserved further ordinary shares for potential issuance upon full exchange of the principal amount (assuming physical settlement) of the Exchangeable Notes in accordance with the EN Indenture based on the Adjusted Exchange Rate.

As a result of the foregoing, we are extremely limited in our ability to issue new ordinary shares including in connection with any potential future capital raise or for other corporate uses.

In order to enable us to have sufficient authorized but unissued or unreserved share capital and authority for share issuances on a non-pre-emptive basis under Irish law to ensure future flexibility with respect to share issuances, we are seeking approval at this EGM:

| i. | To increase our authorized share capital from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares (Proposal No. 1, authorized share capital increase proposal); |

| ii. | If the authorized share capital increase proposal (Proposal No. 1) is approved, to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options for a period of five years from the date of approval (Proposal No. 2, the directors’ allotment authority proposal); and |

| iii. | If the directors’ allotment authority proposal (Proposal No. 2) is approved, to grant the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance for a period of five years from the date of approval (Proposal No. 3, the pre-emption rights dis-application proposal). We refer to the authorized share capital increase proposal (Proposal No. 1), the directors’ allotment authority proposal (Proposal No. 2) and the pre-emption rights dis-application proposal (Proposal No. 3) collectively as the additional share capital proposals. |

As a clinical stage company, we rely heavily on, and until such time as we may successfully obtain regulatory approval of our product candidates and achieve substantial positive cash flows from the commercialization of any approved drug candidates, if ever, will continue to rely heavily on, access to the capital markets in order to fund our operations. Likewise, because of the numerous risks and uncertainties associated with the development and commercialization of our product candidates, the amounts of increased capital outlays and operating expenses associated with completing the development of our product candidates are inherently uncertain, as is the time horizon for which we expect to rely principally on access to the capital markets to fund the completion of our product candidate development efforts.

Specifically, our future capital requirements will depend on numerous factors, including, without limitation, the timing and costs of our new drug application (“NDA”) for oral sulopenem for the treatment of uncomplicated urinary tract infections (“uUTI”) in patients with quinolone non-susceptible pathogens to the U.S. Food and Drug Administration (“FDA”), which NDA was submitted to the FDA at the end of November 2020; the outcome, timing and costs of seeking regulatory approvals, including with respect to our NDA for oral sulopenem for the treatment of uUTI in patients with quinolone non-susceptible pathogens; the costs of clinical manufacturing and of establishing commercial manufacturing arrangements; the costs of preparing, filing and prosecuting patent applications and maintaining, enforcing and defending intellectual property-related claims; the costs and timing of capital asset purchases; our ability to establish research collaborations, strategic collaborations, licensing or other arrangements; the costs to satisfy our obligations under current and potential future collaborations; and the timing, receipt, and amount of revenues or royalties, if any, from any approved drug candidates. Our future capital requirements are subject to numerous risks and uncertainties associated with the research, development and commercialization of pharmaceutical product candidates.

We believe that the additional share capital proposals are in the best interests of our shareholders because they provide our board the flexibility, consistent with its fiduciary duties, to allow us, subject to applicable shareholder approval and other requirements of Nasdaq and the SEC, to efficiently and cost-effectively access the capital markets without the competitive disadvantage and risks associated with seeking transaction-specific shareholder approvals. In recent years, the flexibility provided by having a sufficient number of unissued and unreserved authorized ordinary shares available for issuance has allowed us to pursue a number of financing transactions that were critical to our development. In addition, we believe that seeking the directors’ allotment authority proposal and the pre-emption rights dis-application proposal for an additional five years instead of seeking general re-approval of our share issuance authorities on a more frequent basis is in the best interests of our shareholders because seeking general re-approval of our share issuance authorities on a more frequent basis would subject us to the competitive disadvantage risk, particularly given the 75% vote threshold required to dis-apply the statutory pre-emption right. In particular, a single shareholder or small number of shareholders, including those with a short-term focus, could defeat a proposal to

13

disapply the statutory pre-emption right given the high vote threshold to approve that dis-application, even if a substantial majority of our shareholders who are supportive of our business and long-term growth strategy vote to approve the dis-application of the statutory pre-emption right.

Limitations derived from Irish capital markets practice should not apply to Iterum

While not required by Irish law, we understand that it has become market practice for companies whose share capital is listed on Euronext Dublin or the London Stock Exchange to generally limit the share allotment and issuance authority to an amount equal to 33% of their issued share capital for a period of 12 to 18 months and to generally limit the dis-application of the statutory pre-emption right to only 5% of their issued share capital for a period of 12 to 18 months. While these limitations in size and duration on share issuance authorities are part of the corporate governance framework applicable to companies whose share capital is listed on Euronext Dublin or the London Stock Exchange (regardless of whether such companies are incorporated in Ireland or elsewhere), our shares are not, and never have been, listed on the Euronext Dublin or the London Stock Exchange, and we are not subject to Euronext Dublin or the London Stock Exchange share listing rules or corporate governance standards applicable to companies whose share capital is listed on Euronext Dublin or the London Stock Exchange.

We are required to seek shareholder approval for the additional share capital proposals because we are incorporated in Ireland. However, our ordinary shares are listed solely on the Nasdaq Stock Market and as such, we believe that our shareholders expect us to, and we are committed to, follow customary U.S. capital markets practices, U.S. corporate governance standards and Nasdaq and SEC rules and regulations. We also believe that applying the standards and market practices of a market where our shares are not listed would be inappropriate and not in the best interests of our Company or our shareholders, especially in circumstances where we are committed to complying with the governance rules and practices of the actual capital market for our shares - the Nasdaq Stock Market - which imposes its own restrictions on share issuances for the protection of shareholders.

Shareholder approval of the additional share capital proposals does not mean that our board would have no limits on future share issuances. To the contrary, Iterum is considered to be a U.S. domestic reporting company under SEC rules and is subject to the same shareholder approval rules with respect to share issuances as other U.S.-incorporated companies listed on the Nasdaq. For example, Nasdaq rules generally require shareholder approval when any issuance or potential issuance will result in a “change of control” of the issuer (which may be deemed to occur if after a transaction a single investor or affiliated investor group acquires, or has the right to acquire, 20% of the ordinary shares (or securities convertible into or exercisable for ordinary shares) or voting power of an issuer and such ownership would be the largest ownership position of the issuer). Likewise, shareholder approval is required under the Nasdaq rules prior to the issuance of securities in connection with a transaction other than a public offering involving the sale, issuance or potential issuance by the company of ordinary shares (or securities convertible into or exercisable for ordinary shares) at a price that is the lower of (1) the closing price (as reflected on Nasdaq.com) immediately preceding the signing of the binding agreement or (2) the average closing price of the ordinary shares (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing of the binding agreement, which alone or together with sales by officers, directors or substantial shareholders of the company, equals 20% or more of the ordinary shares or 20% or more of the voting power outstanding before the issuance. Moreover, with limited exceptions, our board must also seek shareholder approval of equity compensation plans, including material revisions of such plans.

We understand that certain proxy advisory firms have in recent proxy seasons applied their United Kingdom and Ireland voting guidelines in formulating their voting recommendations on share issuance authorities proposals for Irish-incorporated U.S.-listed companies, meaning that they have applied or otherwise taken into account the market practice for companies whose share capital is listed on Euronext Dublin or the London Stock Exchange in formulating their voting recommendations on share issuance authorities proposals for Irish-incorporated companies, even if their shares are not listed on Euronext Dublin or the London Stock Exchange. For all of the reasons discussed above and below, we respectfully disagree with this approach.

We also understand that some Irish-incorporated companies that are listed solely on U.S. stock exchanges have followed the market practice for companies whose share capital is listed on Euronext Dublin or the London Stock Exchange with respect to their own share issuance authorities. However, those companies may have business and capital-raising needs and strategies that differ from ours or may have different approaches for creating shareholder value.

14

PROPOSAL NO. 1 – AUTHORIZED SHARE CAPITAL INCREASE

Overview

Under Irish law, an Irish public limited company must have a maximum authorized share capital. Shareholder approval is required to increase the authorized share capital of an Irish public limited company. Under our current Constitution, pursuant to the resolutions passed at our Annual General Meeting held on June 10, 2020, our authorized share capital is $2,500,000, divided into 150,000,000 ordinary shares and 100,000,000 preferred shares, par value $0.01 per share. As of [December 14/December [ ],] 2020, there are currently [4,857,875] ordinary shares unissued or unreserved and therefore available for issuance.

In order to enable the Company to have sufficient authorized, but unissued or unreserved share capital available to enable future flexibility with respect to share issuances, we are seeking approval at this EGM to increase our authorized share capital from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares.

The authorized share capital increase proposal (Proposal No. 1) is fundamental to our business and capital management because the Company needs to maintain a greater reserve of authorized but unissued ordinary shares to potentially raise capital and for general corporate purposes. We currently have no specific plans, arrangements or understandings to issue the additional ordinary shares that would be authorized if this Proposal No. 1 is approved by our shareholders, but the additional shares could be used for various purposes with or without further shareholder approval, including, for example: raising capital, including potential financing that we could determine to pursue in the near-term; the issuance of, and/or the reservation for issuance of, additional ordinary shares upon exchange of Exchangeable Notes, including the payment of accrued interest thereon, or the conversion, exchange or exercise of other securities; establishing strategic relationships with other companies; expanding our business or product pipeline through the acquisition of other businesses or products; providing equity incentives to employees, officers or directors through our equity incentive plan or in the form of inducement grants; compensation of vendors and other service providers; the issuance of ordinary shares in connection with any transaction that may result from our ongoing evaluation of corporate, organizational, strategic, financial and financing alternatives; or for other corporate purposes that have not yet been identified. Any future financing or other transaction is subject to risks and uncertainties, and we may not be able to obtain financing or complete any transaction on acceptable terms, or at all. In addition, our evaluation of corporate, organizational, strategic, financial and financing alternatives may not result in any particular action or any transaction being pursued, entered into or consummated, and there is no assurance as to the timing, sequence or outcome of any action or transaction or series of actions or transactions. Any such transactions may also require further approval of our shareholders.

Certain Effects of the Proposal

If Proposal No. 1 is approved, approximately [154,857,875] ordinary shares of the Company will be unissued and unreserved and therefore available for future issuances immediately following the EGM.

If Proposal No. 1 is not approved by our shareholders, we will be severely limited in our ability to raise capital in the future to support our continued operations, including, without limitation, any resources that may be required for completion of the regulatory review process with the FDA following potential acceptance of our NDA for oral sulopenem for the treatment of uUTI patients with quinolone non-susceptible pathogens, which potential acceptance is expected by the end of January 2021.

In short, if our shareholders do not approve Proposal No. 1, we may not be able to access the capital markets, complete regulatory approval processes for product candidates, complete strategic transactions, attract, retain and motivate employees, and pursue other business opportunities integral to our growth and success without further shareholder approval.

Approval of the authorized share capital increase proposal (Proposal No. 1) and the issuance of any additional ordinary shares would not in and of itself affect the rights of the holders of our currently issued ordinary shares, except for, with respect to the issuance of additional shares, effects incidental to increasing the number of ordinary shares in issue, such as dilution of the earnings per share and voting rights of current holders of ordinary shares. Furthermore, future sales of substantial amounts of our ordinary shares, or the perception that these sales might occur, could adversely affect the prevailing market price of our ordinary shares or limit our ability to raise additional capital. Shareholders should recognize that, as a result of this proposal, if the total number of authorized ordinary shares of the Company are issued, they will own a smaller percentage of outstanding ordinary shares of the Company than they presently own.

15

The issuance of additional ordinary shares could have the effect of making it more difficult for a third party to acquire, or discouraging a third party from attempting to acquire, control of the Company. We are not aware of any attempts on the part of a third party to effect a takeover of the Company, and this proposal has been proposed for the reasons stated above, and not with the intention that any increase in the authorized share capital be used as a type of anti-takeover device. In any event, under the Irish Takeover Rules, our board of directors is not permitted to take any action which might frustrate an offer for our shares (including the issue of shares, options or convertible securities) once our board of directors has received an approach which may lead to an offer or has reason to believe an offer is or may be imminent, subject to certain exceptions.

In the event Proposal No. 1 is not approved, we may solicit such shareholder approvals at a future annual or extraordinary meeting of our shareholders.

Required Vote

Under Irish law, the resolution in respect of the authorized share capital increase proposal (Proposal No. 1) is an ordinary resolution that requires the affirmative vote of a majority of the votes cast at the EGM.

The text of the resolution in respect of the authorized share capital increase proposal is as follows:

“THAT the authorized share capital of the Company be and is hereby increased from $2,500,000 divided into 150,000,000 ordinary shares of US$0.01 each and 100,000,000 preferred shares of US$0.01 each to $4,000,000 divided into 300,000,000 ordinary shares of US$0.01 each and 100,000,000 preferred shares of US$0.01 each.”

Statutory Pre-emptive Rights

Provided that the pre-emption rights dis-application proposal (Proposal No. 3) is approved, the Company's shareholders will not have statutory pre-emptive rights in connection with the shares being created pursuant to the authorized share capital increase proposal.

Dissenters’ Rights

No dissenters’ rights are available to the Company's shareholders in connection with the ordinary shares being created pursuant to the authorized share capital increase proposal (Proposal No. 1).

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY DETERMINED THAT THE AUTHORIZED SHARE CAPITAL INCREASE PROPOSAL (PROPOSAL NO. 1) IS IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS THAT YOU VOTE FOR THE AUTHORIZED SHARE CAPITAL INCREASE PROPOSAL.

16

PROPOSAL NO. 2 – DIRECTORS' ALLOTMENT AUTHORITY

This resolution proposes, subject to and conditional upon the approval by our shareholders of the authorized share capital increase proposal (Proposal No. 1), to provide the board with the requisite authority to allot and issue shares up to the authorized but unissued share capital of the Company as increased by the authorized share capital increase proposal (Proposal No. 1).

Overview

Under Irish law, directors of an Irish public limited company must have specific authority from shareholders to issue any shares, warrants, convertible instruments or options, even if such shares are part of the company’s authorized but unissued share capital. Pursuant to resolutions passed at our Annual General Meeting held on June 10, 2020, our board is currently authorized to allot and issue new shares without shareholder approval up to the amount of our currently existing authorized (being 150,000,000 ordinary shares and 100,000,000 preferred shares) but unissued share capital.

To ensure that the board continues to have full authority to issue shares, warrants, convertible instruments or options following the authorized share capital increase proposal (Proposal No. 1), we are proposing that shareholders grant our board authority to allot and issue shares up to the amount of our newly increased authorized but unissued share capital following the passing of the authorized share capital increase proposal (Proposal No. 1) for a five-year period to expire on January 26, 2026 (or such date that is five years after the date shareholders approve this Proposal No. 2).

The provision of this authority is fundamental to our business and capital management because it enables us to issue shares and potentially raise capital. Approval of the directors’ allotment authority proposal would provide the board with flexibility to issue shares up to the maximum of our authorized but unissued share capital, subject to applicable shareholder approval and other requirements of the SEC and Nasdaq. The renewed authority would apply to the issuance of shares and other securities convertible into or exercisable or exchangeable for our shares.

Approval of this authority would not exempt us from applicable Nasdaq requirements to obtain shareholder approval prior to certain share issuances or to comply with applicable SEC disclosure and other regulations.

In addition, we follow U.S. capital markets and governance standards to the extent permitted by Irish law and emphasize that this authorization is required as a matter of Irish law and is not otherwise required for other U.S. incorporated companies listed on the Nasdaq with which we compete.

Certain Effects of the Proposal

If shareholders do not approve the directors’ allotment authority proposal (Proposal No. 2), our board's currently existing authority to allot and issue shares up to the amount of our currently existing authorized (being 150,000,000 ordinary shares and 100,000,000 preferred shares) but unissued share capital will continue to apply until June 10, 2025. This would limit us to issuing [4,857,875] ordinary shares and we would have no flexibility for any future ordinary share issuances, including equity or equity-linked capital raises.

In the event Proposal No. 2 is not approved, we may solicit such shareholder approvals at a future annual or extraordinary meeting of our shareholders.

The approval of the directors’ allotment authority proposal (Proposal No. 2) will become effective only if the authorized share capital increase proposal (Proposal No. 1) is approved by our shareholders.

Required Vote

Under Irish law, the resolution in respect of the directors’ allotment authority proposal (Proposal No. 2) is an ordinary resolution that requires the affirmative vote of a majority of the votes cast at the EGM.

The text of the resolution in respect of the directors’ allotment authority proposal is as follows:

17

“THAT, subject to and conditional upon the approval by the Company's shareholders of the authorized share capital increase proposal (Proposal No. 1 as set out in the proxy statement for this Extraordinary General Meeting), the Company's directors be and they are, with effect from the passing of this resolution, hereby generally and unconditionally authorized pursuant to section 1021 of the Irish Companies Act 2014 to exercise all powers of the Company to allot and issue relevant securities (within the meaning of section 1021 of the Irish Companies Act 2014) up to the amount of the Company’s authorized but unissued share capital immediately following the passing of the authorized share capital increase proposal provided that this authority shall expire on January 26, 2026 and provided that the Company may, before such expiry, make an offer or agreement which would or might require relevant securities to be allotted or issued after such expiry and the directors may allot or issue relevant securities in pursuance of such an offer or agreement as if the authority conferred by this resolution had not expired.”

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY DETERMINED THAT THE DIRECTORS' ALLOTMENT AUTHORITY PROPOSAL (PROPOSAL NO. 2) IS IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS THAT YOU VOTE FOR THE DIRECTORS' ALLOTMENT AUTHORITY PROPOSAL.

18

PROPOSAL NO. 3—PRE-EMPTION RIGHTS DIS-APPLICATION

This resolution proposes, subject to and conditional upon the approval by the Company’s shareholders of the directors’ allotment authority proposal (Proposal No. 2), to empower our board to allot the authorized but unissued share capital of the Company as increased by the authorized share capital increase proposal (Proposal No. 1) for cash otherwise than in accordance with the statutory pre-emption right under the Irish Companies Act 2014.

Overview

Under Irish law, unless otherwise authorized by shareholders, when an Irish public limited company issues shares for cash (including rights to subscribe for or otherwise acquire any shares) to new shareholders, it is required first to offer those shares on the same or more favorable terms to existing shareholders of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right). The statutory pre-emption right, if not dis-applied, affords existing shareholders the right to purchase any new shares that we propose to issue for cash in order to maintain their proportionate ownership interests in the Company following the issuance of those shares. Pursuant to resolutions passed at the Annual General Meeting of the Company held on June 10, 2020, our board is currently authorized to issue new shares for cash, up to a maximum of our currently existing authorized (being 150,000,000 ordinary shares and 100,000,000 preferred shares) but unissued share capital, without first offering them to existing shareholders, thereby opting out of the statutory pre-emption right.

The pre-emption rights dis-application proposal (Proposal No. 3) provides that for a period expiring five years from the date of the approval of the pre-emption rights dis-application proposal, our board would be empowered to issue shares for cash pursuant to the authority conferred by the directors’ allotment authority proposal (Proposal No. 2) (if approved) up to the authorized but unissued share capital of the Company as increased by the authorized share capital increase proposal (Proposal No. 1) (if approved) on the basis that statutory pre-emption rights under the Irish Companies Act 2014 will not apply to such issuances. The authority sought in this proposal is fundamental to our business and capital management initiatives because it facilitates our ability to issue shares, including, when appropriate, in connection with capital-raising activities.

The Company’s ordinary shares are not listed on Euronext Dublin nor on the London Stock Exchange. The Company follows U.S. capital markets practices (to the extent permitted by Irish law) and the governance standards of the Nasdaq. The opt-out authorization sought in this pre-emption rights dis-application proposal is required as a matter of Irish law and is not otherwise required for many companies with which we compete. Receipt of this authority would merely place us on par with other Nasdaq-listed companies, which may not be subject to a similar statutory pre-emption right.

Approval of this authority would not exempt the Company from applicable Nasdaq requirements to obtain shareholder approval prior to certain share issuances or to comply with applicable SEC disclosure and other regulations.

Certain Effects of the Proposal

If our shareholders do not approve the pre-emption rights dis-application proposal (Proposal No. 3), our board's currently existing authority to opt out of the statutory pre-emption right up to the amount of the Company's currently existing authorized (being 150,000,000 ordinary shares and 100,000,000 preferred shares) but unissued share capital will continue to apply until June 10, 2025. This would mean that, for any additional authorized but unissued shares created under the authorized share capital increase proposal (Proposal No. 1) that we may propose to issue for cash, we would generally first have to offer those shares to all of our existing shareholders on the same or more favorable terms pro-rata to the existing shareholders. As a result of this limitation, in any potential future capital raising transaction where we propose to issue shares for cash consideration, we would be required to first offer those shares that we propose to issue for cash to all of our existing shareholders in a time-consuming pro-rata rights offering, which would disadvantage us vis-à-vis many of our peers in competing for capital, would significantly encumber the capital-raising process, would significantly increase our costs, and would significantly increase the timetable for completing such a cash financing transaction, thus potentially limiting our ability to advance the development of our product candidates and otherwise achieve strategic goals that we believe are in the best interests of our shareholders.

The statutory pre-emption right applies only to share issuances for cash consideration; accordingly, it does not apply where we issue shares for non-cash consideration (such as in a share exchange transaction or in any transaction in which property other than cash is received by us in payment for shares) or where we issue shares pursuant to our employee equity compensation plans.

19

In the event Proposal No. 3 is not approved, we may solicit such shareholder approvals at a future annual or extraordinary meeting of our shareholders.

The approval of the pre-emption rights dis-application proposal (Proposal No. 3) will become effective only if the authorized share capital increase proposal (Proposal No. 1) and the directors’ allotment authority proposal (Proposal No. 2) are approved by the Company's shareholders. Therefore, unless shareholders approve Proposal No. 1 and Proposal No. 2, this Proposal No. 3 will fail and not be implemented, even if shareholders approve this Proposal No. 3.

Required Vote

Under Irish law the resolution in respect of the pre-emption rights dis-application proposal (Proposal No. 3) is a special resolution that requires the affirmative vote of not less than 75% of the votes cast in person or by proxy at the EGM (including any adjournment thereof) in order to be approved.

The text of the resolution in respect of this proposal is as follows:

“THAT, subject to and conditional upon the approval by the Company's shareholders of the directors’ allotment authority proposal (Proposal No. 2 as set out in the proxy statement for this Extraordinary General Meeting), the Company's directors be and are, with effect from the passing of this resolution, hereby empowered pursuant to section 1023 of the Irish Companies Act 2014 to allot equity securities within the meaning of the said section 1023 for cash pursuant to the authority conferred by the directors’ allotment authority proposal up to an aggregate nominal amount equal to the authorized but unissued share capital of the Company immediately following the passing of the authorized share capital increase proposal (Proposal No. 1 as set out in the proxy statement for this Extraordinary General Meeting) as if section 1022 of the Irish Companies Act 2014 did not apply to any such allotment provided that this authority shall expire on January 26, 2026 and provided that the Company may before the expiry of such authority make an offer or agreement which would or might require equity securities to be allotted after such expiry and the Company's directors may allot equity securities in pursuance of such an offer or agreement as if the power conferred by this resolution had not expired.”

OUR BOARD OF DIRECTORS HAS UNANIMOUSLY DETERMINED THAT THE PRE-EMPTION RIGHTS DIS-APPLICATION PROPOSAL (PROPOSAL NO. 3) IS IN THE BEST INTERESTS OF THE COMPANY AND ITS SHAREHOLDERS AND RECOMMENDS THAT YOU VOTE FOR THE PRE-EMPTION RIGHTS DIS-APPLICATION PROPOSAL.

20

Our board of directors knows of no other business which will be presented to this EGM. If any other business is properly brought before the EGM, proxies will be voted in accordance with the judgment of the persons named therein.

Solicitation of Proxies

This proxy is solicited on behalf of our board of directors. We will bear the expenses connected with this proxy solicitation. In addition to the solicitation of proxies by mail, we expect to pay banks, brokers and other nominees their reasonable expenses for forwarding proxy materials to principals and obtaining their voting instructions. In addition to the use of the mail, our directors, officers and employees may, without additional remuneration, solicit proxies in person or by use of other communications media.

Householding of Annual and Extraordinary Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements. This means that only one copy of our proxy statement may have been sent to multiple shareholders in the same household. We will promptly deliver a separate copy to any shareholder upon request submitted in writing to us at Iterum Therapeutics plc, Block 2 Floor 3 Harcourt Centre, Harcourt Street, Dublin 2, Ireland, Attention: Investor Relations, or by calling +353 1 9038354. Any shareholder who wants to receive separate copies of the proxy statement or who is currently receiving multiple copies and would like to receive only one copy for his or her household, should contact his or her bank, broker or other nominee record holder, or contact us at the above address and phone number.

Shareholder Proposals for 2021 Annual General Meeting of Shareholders

Proposals of shareholders intended to be presented at our 2021 annual general meeting of shareholders pursuant to Rule 14a-8 promulgated under the Exchange Act must be received by us at our offices at c/o Secretary, Iterum Therapeutics plc, Block 2 Floor 3 Harcourt Centre, Harcourt Street, Dublin 2, Ireland, no later than January 11, 2021, in order to be included in the proxy statement and proxy card relating to that meeting.

In addition, shareholders who intend to present matters for action at our 2021 annual general meeting or nominate directors for election to our board of directors (other than pursuant to Rule 14a-8) must comply with the requirements set forth in our Constitution. For such matters, under our Constitution, proper written notice must be received by our secretary at our registered office at the address noted above, no earlier than January 07, 2021 and no later than February 06, 2021; except if the date of the 2021 annual general meeting is changed by more than thirty (30) days from the first anniversary date of the 2020 Annual General Meeting, the shareholder's notice must be so received not earlier than one hundred and twenty (120) days prior to such annual general meeting and not later than the close of business on the later of (i) the 90th day prior to such annual general meeting or (ii) the 10th day following the day on which a public announcement of the date of the annual general meeting is first made.

21

PRELIMINARY COPY – SUBJECT TO COMPLETION

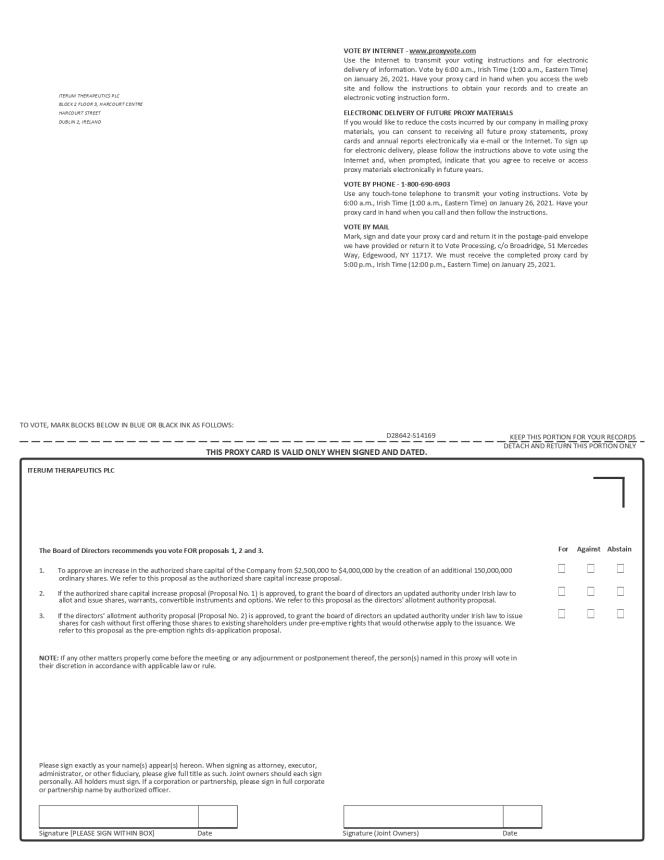

ITERUM THERAPEUTICS PLC BLOCK 2 FLOOR 3, HARCOURT CENTRE HARCOURT STREET DUBLIN 2, IRELAND VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 6:00 a.m., Irish Time (1:00 a.m., Eastern Time) on January 26, 2021. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 6:00 a.m., Irish Time (1:00 a.m., Eastern Time) on January 26, 2021. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. We must receive the completed proxy card by 5:00 p.m., Irish Time (12:00 p.m., Eastern Time) on January 25, 2021. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D28642-S14169 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY ITERUM THERAPEUTICS PLC The Board of Directors recommends you vote FOR proposals 1, 2 and 3. For Against Abstain 1. To approve an increase in the authorized share capital of the Company from $2,500,000 to $4,000,000 by the creation of an additional 150,000,000 ordinary shares. We refer to this proposal as the authorized share capital increase proposal. 2. If the authorized share capital increase proposal (Proposal No. 1) is approved, to grant the board of directors an updated authority under Irish law to allot and issue shares, warrants, convertible instruments and options. We refer to this proposal as the directors' allotment authority proposal. 3. If the directors' allotment authority proposal (Proposal No. 2) is approved, to grant the board of directors an updated authority under Irish law to issue shares for cash without first offering those shares to existing shareholders under pre-emptive rights that would otherwise apply to the issuance. We refer to this proposal as the pre-emption rights dis-application proposal. NOTE: If any other matters properly come before the meeting or any adjournment or postponement thereof, the person(s) named in this proxy will vote in their discretion in accordance with applicable law or rule. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

22

PRELIMINARY COPY - SUBJECT TO COMPLETION Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting: The Notice and Proxy Statement is available at www.proxyvote.com. D28643-S14169 ITERUM THERAPEUTICS PLC Extraordinary General Meeting of Shareholders January 26, 2021 3:00 PM Irish Time Block 2 Floor 3, Harcourt Centre Harcourt Street Dublin 2, Ireland This proxy is solicited on behalf of the Board of Directors The undersigned shareholder(s), revoking all prior proxies, hereby appoint(s) David G. Kelly and Louise Barrett, or either of them, as proxies (the “Proxies”), each with the power of substitution, and hereby authorise(s) them to represent and vote all of the ordinary shares of Iterum Therapeutics plc that the undersigned is/are entitled to vote, with all the powers which the undersigned would possess if personally present at the Extraordinary General Meeting of Shareholders of Iterum Therapeutics plc to be held on January 26, 2021, or at any postponement or adjournment thereof. You may vote at the Extraordinary General Meeting if you were a shareholder of record at the close of business on December 16, 2vote is entitled to appoint one or more proxies to attend, speak and vote instead of him or her at the Extraordinary General Meeting. A proxy need not be a shareholder of record. If you wish to nominate a proxy other than David G. Kelly or Louise Barrett, please contact our Company Secretary. Any such nominated proxy must attend the Extraordinary General Meeting in person in order for your votes to be cast. Shares represented by this proxy will be voted by the Proxies in the manner directed. If no such directions are indicated, the Proxies will have authority to vote FOR Proposal Nos 1, 2, and 3. In their discretion, the Proxies are authorised to vote upon such other business as may properly come up before the meeting and any adjournment or postponement thereof. Continued and to be signed on reverse side

23