UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23117

JPMorgan Trust IV

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: Last day of February

Date of reporting period: March 1, 2020 through August 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Semi-Annual Report

J.P. Morgan Money Market Funds

August 31, 2020 (Unaudited)

JPMorgan Prime Money Market Fund

JPMorgan Institutional Tax Free Money Market Fund

JPMorgan Securities Lending Money Market Fund

JPMorgan Liquid Assets Money Market Fund

JPMorgan U.S. Government Money Market Fund

JPMorgan U.S. Treasury Plus Money Market Fund

JPMorgan Federal Money Market Fund

JPMorgan 100% U.S. Treasury Securities Money Market Fund

JPMorgan Tax Free Money Market Fund

JPMorgan Municipal Money Market Fund

JPMorgan California Municipal Money Market Fund

JPMorgan New York Municipal Money Market Fund

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website www.jpmorganfunds.com and you will be notified by mail each time a report is posted and provided with a website to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action.

You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker dealer, bank, or retirement plan) or, if you are a direct investor, by going to www.jpmorganfunds.com/edelivery.

You may elect to receive paper copies of all future reports free of charge. Contact your financial intermediary or, if you invest directly with the Funds, email us at funds.website.support@jpmorganfunds.com or call 1-800-480-4111. Your election to receive paper reports will apply to all funds held within your account(s).

CONTENTS

The following disclosure applies to the JPMorgan Liquid Assets Money Market Fund, JPMorgan Tax Free Money Market Fund, JPMorgan Municipal Money Market Fund, JPMorgan California Municipal Money Market Fund and JPMorgan New York Municipal Money Market Fund.

You could lose money by investing in a Fund. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. A Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time.

The following disclosure applies to the JPMorgan Prime Money Market Fund, JPMorgan Institutional Tax Free Money Market Fund and JPMorgan Securities Lending Money Market Fund.

You could lose money by investing in a Fund. Because the share price of each Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. A Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time.

Any gain resulting from the sale or exchange of Fund shares will be taxable as long-term or short-term gain, depending upon how long you have held your shares.

The following disclosure applies to the JPMorgan U.S. Government Money Market Fund, JPMorgan U.S. Treasury Plus Money Market Fund, JPMorgan Federal Money Market Fund and the JPMorgan 100% U.S. Treasury Securities Money Market Fund.

You could lose money by investing in a Fund. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in a Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectuses for a discussion of the Funds’ investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors) for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

LETTER TO SHAREHOLDERS

OCTOBER 23, 2020 (Unaudited)

Dear Shareholders,

Even as the U.S. economy has endured a severe contraction since the start of the pandemic, financial markets have generally rebounded from lows seen in March 2020 amid unprecedented support from the Federal Reserve (the “Fed”) and investor optimism about efforts to contain the spread of COVID-19.

| | |

| | “Throughout this tumultuous year, J.P. Morgan Asset Management has responded to unprecedented conditions by continuing to seek to provide our clients with effective investment solutions and dependable service.” — Andrea L. Lisher |

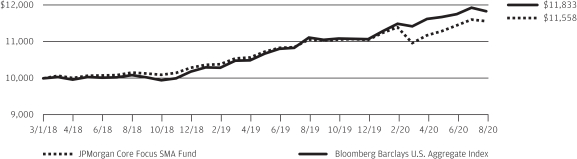

In response to an acute sell-off in financial markets in February and March 2020, the Fed unveiled an array of lending and asset purchasing programs designed to head off a liquidity crisis in credit markets and maintain the flow of credit to the public and private sectors. The Fed also slashed interest rates in March 2020, as jobless claims spiked to record highs, which helped to bolster equity markets. In the following months, financial market volatility subsided and asset prices generally began to rebound, though global oil prices remained at historically low levels amid a steep drop off in demand and slower economic

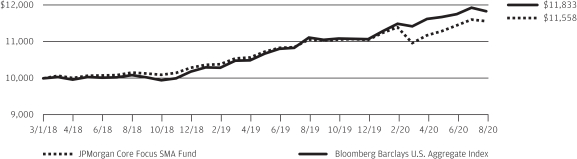

activity. For the six months ended August 31, 2020, the S&P 500 Index returned 19.6% and the Bloomberg Barclays U.S. Aggregate Index returned 2.9%.

Our long-term view remains one of cautious optimism, but we recognize the near-term risks stemming from uncertainty surrounding additional fiscal support and efforts to contain COVID-19. The pace of economic activity looks set to slow into the end of the year as services remain under pressure, and additional stimulus may be required to keep the economy on track in 2021. That said, volatility in financial markets could begin to recede as the results of the November 3rd election provide clarity on the contours of the political landscape going forward. Throughout this tumultuous year, J.P. Morgan Asset Management has responded to unprecedented conditions by continuing to seek to provide our clients with effective investment solutions and dependable service.

On behalf of J.P. Morgan Asset Management, thank you for entrusting us to manage your investment. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

Andrea L. Lisher

Head of Americas, Client

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 1 | |

FUNDS COMMENTARY

October 27, 2020

Dear Shareholders,

The emergence of COVID-19 caused the deepest downturn in economic activity since World War II. The rapid spread of the COVID-19 virus led to a collapse in the economy that fed back into financial markets. Money market flows were shaped by investors’ need to preserve and build liquidity buffers. At the height of financial market uncertainty in early March, demand for liquidity strained short-term credit markets and spread into broader financial markets.

| | |

| | “Throughout this turbulent year, JPMorgan Global Liquidity has responded to unprecedented conditions by drawing on JPMorgan’s global resources and expertise to seek to deliver effective short-term fixed income strategies.”

— John T. Donohue |

U.S. government money market funds served as the liquidity vehicle of choice for our Funds’ investors. Industry wide, hundreds of billions of dollars were allocated into these funds as investors of all types were seeking liquidity and government money market funds’ assets under management increased by $834 billion in March 2020. Conversely, prime money market funds experienced $139 billion in outflows during the month. If one were to assume that all prime money market outflows were inflows into government money market funds, an additional $695 billion had also flowed into government money market funds from other sources.

In response to the severe sell-off in financial markets in February and March 2020, the U.S. Federal Reserve (the “Fed”) introduced an array of facilities designed to restore liquidity and maintain the flow of credit to the public and private sectors, in addition to cutting interest rates. Primarily targeting the short-term markets, the Fed launched the Commercial

Paper Funding Facility and the Money Market Mutual Fund Liquidity Facility (MMLF). MMLF assets reached a high of $53 billion on April 8, 2020 and have since declined sharply. The Fed’s strong actions telegraphed to the financial market a willingness to take the necessary steps to ensure liquidity and the flow of credit to the financial markets.

Following the Fed’s actions, the return of investor confidence was evident as a rotation of assets from government money market funds and other sources found their way back to prime money market funds. Flows into prime money market funds were swift, with prime sector total assets under management rising above pre-pandemic levels. Additionally, as interest rates continued to drift lower, the yield spread between prime money market funds and government money market funds became a larger consideration for investors.

There remains great uncertainty regarding the path of the U.S. economy and financial markets given that efforts to contain COVID-19 have had mixed results, coupled with lack of a readily available and effective vaccine. Throughout this turbulent year, JPMorgan Global Liquidity has responded to unprecedented conditions by drawing on JPMorgan’s global resources and expertise to seek to deliver effective short-term fixed income strategies.

On behalf of JPMorgan Global Liquidity, we thank you for your continued partnership and trust in our company and our product.

Sincerely yours,

John T. Donohue

CEO Asset Management Americas & Head of Global Liquidity

J.P. Morgan Asset Management

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan Prime Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks current income while seeking to maintain liquidity and a low volatility of principal |

| Primary Investments | | High quality, short-term, U.S. dollar-denominated money market instruments |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Class C, Academy, Agency, Capital, IM, Institutional Class, Morgan, Premier and Reserve |

| Net Assets as of August 31, 2020 | | $87.5 Billion |

| Weighted Average Maturity^ | | 54 calendar days |

| Weighted Average Life^^ | | 81 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 32.6 | % |

| 2–7 calendar days | | | 5.1 | |

| 8–30 calendar days | | | 12.9 | |

| 31–60 calendar days | | | 16.5 | |

| 61–90 calendar days | | | 13.9 | |

| 91–180 calendar days | | | 12.1 | |

| 181+ calendar days | | | 6.9 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Class C Shares | | | 0.01 | % |

| Academy Shares | | | 0.20 | |

| Agency Shares | | | 0.12 | |

| Capital Shares | | | 0.20 | |

| IM Shares | | | 0.24 | |

| Institutional Class Shares | | | 0.17 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Class C Shares, Academy Shares, Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (4.93)%, 0.18%, 0.09%, 0.19%, 0.24%, 0.14%, (0.13)%, (0.06)% and (2.57)% for Class C Shares, Academy Shares, Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Prime Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 3 | |

JPMorgan Institutional Tax Free Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Aims to provide current income, while seeking to maintain liquidity and a low volatility of principal |

| Primary Investments | | High quality short-term municipal securities, the interest on which is excluded from federal income taxes |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, Capital, IM and Institutional Class |

| Net Assets as of August 31, 2020 | | $1.8 Billion |

| Weighted Average Maturity^ | | 31 calendar days |

| Weighted Average Life^^ | | 34 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 32.8 | % |

| 2–7 calendar days | | | 0.1 | |

| 8–30 calendar days | | | 50.8 | |

| 31–60 calendar days | | | 2.3 | |

| 61–90 calendar days | | | 2.1 | |

| 91–180 calendar days | | | 6.1 | |

| 181+ calendar days | | | 5.8 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Capital Shares | | | 0.02 | |

| IM Shares | | | 0.05 | |

| Institutional Class Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Capital Shares, IM Shares and Institutional Class Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.13)%, (0.01)%, 0.05% and (0.06)% for Agency Shares, Capital Shares, IM Shares and Institutional Class Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Institutional Tax Free Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan Securities Lending Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks current income while seeking to maintain liquidity and a low volatility of principal |

| Primary Investments | | High quality, short-term, U.S. dollar-denominated money market instruments |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency SL |

| Net Assets as of August 31, 2020 | | $3.7 Billion |

| Weighted Average Maturity^ | | 40 calendar days |

| Weighted Average Life^^ | | 79 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 45.0 | % |

| 2–7 calendar days | | | 0.3 | |

| 8–30 calendar days | | | 12.5 | |

| 31–60 calendar days | | | 15.6 | |

| 61–90 calendar days | | | 14.5 | |

| 91–180 calendar days | | | 8.9 | |

| 181+ calendar days | | | 3.2 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency SL Shares | | | 0.32 | % |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yield for Agency SL Shares reflects the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yield would have been 0.24% for Agency SL Shares. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Securities Lending Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 5 | |

JPMorgan Liquid Assets Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks current income with liquidity and stability of principal |

| Primary Investments | | High quality, short-term instruments including corporate notes, U.S. government securities, asset-backed securities, repurchase agreements, commercial paper, funding agreements, certificates of deposit, municipal obligations and bank obligations |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Class C, Agency, Capital, E*Trade^, Institutional Class, Investor, Morgan, Premier and Reserve Shares |

| Net Assets as of August 31, 2020 | | $12.5 Billion |

| Weighted Average Maturity^^ | | 54 calendar days |

| Weighted Average Life^^^ | | 85 calendar days |

| | | | |

MATURITY SCHEDULE*^^ | |

| 1 calendar day | | | 31.7 | % |

| 2–7 calendar days | | | 6.3 | |

| 8–30 calendar days | | | 11.6 | |

| 31–60 calendar days | | | 15.1 | |

| 61–90 calendar days | | | 14.2 | |

| 91–180 calendar days | | | 15.0 | |

| 181+ calendar days | | | 6.1 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Class C Shares | | | 0.01 | % |

| Agency Shares | | | 0.14 | |

| Capital Shares | | | 0.21 | |

| Institutional Class Shares | | | 0.19 | |

| Investor Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | E*Trade Shares had no assets from the close of business on October 19, 2016. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Class C Shares, Agency Shares, Capital Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares and Reserve Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.75)%, 0.11%, 0.21%, 0.16%, (0.28)%, (0.21)%, (0.05)% and (1.00)% for Class C Shares, Agency Shares, Capital Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares and Reserve Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Liquid Assets Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan U.S. Government Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks high current income with liquidity and stability of principal |

| Primary Investments | | High quality, short-term securities issued or guaranteed by the U.S. government or by U.S. government agencies or instrumentalities and repurchase agreements collateralized by such obligations |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Academy, Agency, Capital, E*Trade, IM, Institutional Class, Investor, Morgan, Premier, Reserve and Service Shares |

| Net Assets as of August 31, 2020 | | $180.9 Billion |

| Weighted Average Maturity^ | | 32 calendar days |

| Weighted Average Life^^ | | 101 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 35.0 | % |

| 2–7 calendar days | | | 6.4 | |

| 8–30 calendar days | | | 23.0 | |

| 31–60 calendar days | | | 13.2 | |

| 61–90 calendar days | | | 13.1 | |

| 91–180 calendar days | | | 7.0 | |

| 181+ calendar days | | | 2.3 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Academy Shares | | | 0.03 | % |

| Agency Shares | | | 0.01 | |

| Capital Shares | | | 0.03 | |

| E*Trade Shares | | | 0.01 | |

| IM Shares | | | 0.08 | |

| Institutional Class Shares | | | 0.01 | |

| Investor Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

| Service Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Academy Shares, Agency Shares, Capital Shares, E*Trade Shares, IM Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares, Reserve Shares and Service Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been 0.03%, (0.07)%, 0.02%, (0.82)%, 0.08%, (0.02)%, (0.27)%, (0.37)%, (0.22)%, (0.49)% and (0.81)% for Academy Shares, Agency Shares, Capital Shares, E*Trade Shares, IM Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares, Reserve Shares and Service Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan U.S. Government Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 7 | |

JPMorgan U.S. Treasury Plus Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks current income with liquidity and stability of principal |

| Primary Investments | | Direct obligations of the U.S. Treasury including Treasury bills, bonds and notes and other obligations issued or guaranteed by the U.S. Treasury and repurchase agreements collateralized by U.S. Treasury securities |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Class C, Agency, Capital, IM, Institutional Class, Investor, Morgan, Premier and Reserve Shares |

| Net Assets as of August 31, 2020 | | $37.0 Billion |

| Weighted Average Maturity^ | | 28 calendar days |

| Weighted Average Life^^ | | 58 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 45.2 | % |

| 2–7 calendar days | | | 1.3 | |

| 8–30 calendar days | | | 24.6 | |

| 31–60 calendar days | | | 5.9 | |

| 61–90 calendar days | | | 13.1 | |

| 91–180 calendar days | | | 9.0 | |

| 181+ calendar days | | | 0.9 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Class C Shares | | | 0.01 | % |

| Agency Shares | | | 0.01 | |

| Capital Shares | | | 0.06 | |

| IM Shares | | | 0.11 | |

| Institutional Class Shares | | | 0.03 | |

| Investor Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020 . |

| (1) | The yields for Class C Shares, Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares and Reserve Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.89)%, (0.04)%, 0.05%, 0.11%, 0.00%, (0.24)%, (0.34)%, (0.19)% and (0.63)% for Class C Shares, Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Investor Shares, Morgan Shares, Premier Shares and Reserve Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan U.S. Treasury Plus Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan Federal Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Aims to provide current income while still preserving capital and maintaining liquidity |

| Primary Investments | | Direct obligations of the U.S. Treasury including Treasury bills, bonds and notes as well as debt obligations issued or guaranteed by U.S. government agencies or instrumentalities |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, Institutional Class, Morgan and Premier Shares |

| Net Assets as of August 31, 2020 | | $3.2 Billion |

| Weighted Average Maturity^ | | 38 calendar days |

| Weighted Average Life^^ | | 88 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 30.1 | % |

| 8–30 calendar days | | | 22.9 | |

| 31–60 calendar days | | | 9.5 | |

| 61–90 calendar days | | | 34.4 | |

| 91–180 calendar days | | | 3.1 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Institutional Class Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Institutional Class Shares, Morgan Shares and Premier Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.08)%, (0.03)%, (0.41)% and (0.23)% for Agency Shares, Institutional Class Shares, Morgan Shares and Premier Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Federal Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 9 | |

JPMorgan 100% U.S. Treasury Securities Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Aims to provide the highest possible level of current income while still maintaining liquidity and providing maximum safety of principal |

| Primary Investments | | Direct obligations of the U.S. Treasury including Treasury bills, bonds and notes |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, Capital, IM, Institutional Class, Morgan, Premier and Reserve Shares |

| Net Assets as of August 31, 2020 | | $111.6 Billion |

| Weighted Average Maturity^ | | 54 calendar days |

| Weighted Average Life^^ | | 96 calendar days |

| | | | |

MATURITY SCHEDULE*^ | |

| 1 calendar day | | | 15.7 | % |

| 2–7 calendar days | | | 0.6 | |

| 8–30 calendar days | | | 16.1 | |

| 31–60 calendar days | | | 12.9 | |

| 61–90 calendar days | | | 38.2 | |

| 91–180 calendar days | | | 16.5 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Capital Shares | | | 0.04 | |

| IM Shares | | | 0.07 | |

| Institutional Class Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.07)%, 0.03%, 0.07%, (0.03)%, (0.37)%, (0.22)% and (0.47)% for Agency Shares, Capital Shares, IM Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan 100% U.S. Treasury Securities Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan Tax Free Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Aims to provide the highest possible level of current income which is excluded from gross income, while still preserving capital and maintaining liquidity* |

| Primary Investments | | High quality short-term municipal securities, the interest on which is excluded from federal income taxes |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, Institutional Class, Morgan, Premier and Reserve Shares |

| Net Assets as of August 31, 2020 | | $10.7 Billion |

| Weighted Average Maturity^ | | 41 calendar days |

| Weighted Average Life^^ | | 41 calendar days |

| | | | |

MATURITY SCHEDULE**^ | |

| 1 calendar day | | | 17.1 | % |

| 8–30 calendar days | | | 63.1 | |

| 31–60 calendar days | | | 4.0 | |

| 61–90 calendar days | | | 0.9 | |

| 91–180 calendar days | | | 5.9 | |

| 181+ calendar days | | | 9.0 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Institutional Class Shares | | | 0.02 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | A portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax (AMT), and some investors may be subject to certain state and local taxes. |

| ** | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.07)%, (0.02)%, (0.37)%, (0.22)% and (0.47)% for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Reserve Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Tax Free Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 11 | |

JPMorgan Municipal Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

| Objective† | | Seeks as high a level of current interest income exempt from federal income tax as is consistent with liquidity and stability of principal* |

| Primary Investments | | High quality short-term municipal securities, the interest on which is excluded from federal income taxes |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, E*Trade^, Institutional Class, Morgan, Premier and Service Shares |

| Net Assets as of August 31, 2020 | | $1.2 Billion |

| Weighted Average Maturity^^ | | 38 calendar days |

| Weighted Average Life^^^ | | 38 calendar days |

| | | | |

MATURITY SCHEDULE**^^ | |

| 1 calendar day | | | 21.4 | % |

| 2–7 calendar days | | | 2.8 | |

| 8–30 calendar days | | | 58.2 | |

| 31–60 calendar days | | | 2.7 | |

| 61–90 calendar days | | | 1.5 | |

| 91–180 calendar days | | | 5.5 | |

| 181+ calendar days | | | 7.9 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.05 | % |

| Institutional Class Shares | | | 0.10 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Service Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | E*Trade Shares had no assets from the close of business on September 21, 2016. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | A portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax (AMT), and some investors may be subject to certain state and local taxes. |

| ** | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Service Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been 0.01%, 0.06%, (0.29)%, (0.14)% and (0.73)% for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Service Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan Municipal Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan California Municipal Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

|

| Objective† | | Aims to provide the highest possible level of current income which is exempt from federal and California personal income taxes, while still preserving capital and maintaining liquidity* |

| Primary Investment | | California short-term municipal obligations |

| Suggested investment time frame | | Short-term |

| Share classes offered | | Agency, E*Trade^, Institutional Class, Morgan, Premier and Service |

| Net Assets as of August 31, 2020 | | $412.0 Million |

| Weighted Average Maturity^^ | | 47 calendar days |

| Weighted Average Life^^^ | | 47 calendar days |

| | | | |

MATURITY SCHEDULE**^^ | |

| 1 calendar day | | | 11.4 | % |

| 2–7 calendar days | | | 9.3 | |

| 8–30 calendar days | | | 49.7 | |

| 31–60 calendar days | | | 9.7 | |

| 61–90 calendar days | | | 4.1 | |

| 91–180 calendar days | | | 3.8 | |

| 181+ calendar days | | | 12.0 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Institutional Class Shares | | | 0.01 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Service Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | E*Trade Shares had no assets from the close of business on September 21, 2016. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | A portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax (AMT), and some investors may be subject to certain state and local taxes. |

| ** | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Service Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.12)%, (0.06)%, (0.41)%, (0.27)% and (0.86)% for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares and Service Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan California Municipal Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 13 | |

JPMorgan New York Municipal Money Market Fund

FUND FACTS

SIX MONTHS ENDED AUGUST 31, 2020 (Unaudited)

| | |

|

| Objective† | | Aims to provide the highest possible level of current income which is excluded from gross income and exempt from New York State and New York City personal income taxes, while still preserving capital and maintaining liquidity* |

| Primary Investment | | New York short-term municipal obligations |

| Suggested investment time frame. | | Short-term |

| Share classes offered | | Agency, E*Trade^, Institutional Class, Morgan, Premier, Reserve and Service |

| Net Assets as of August 31, 2020 | | $1.2 Billion |

| Weighted Average Maturity^^ | | 40 calendar days |

| Weighted Average Life^^^ | | 40 calendar days |

| | | | |

MATURITY SCHEDULE**^^ | |

| 1 calendar day | | | 12.1 | % |

| 2–7 calendar days | | | 0.1 | |

| 8–30 calendar days | | | 73.5 | |

| 31–60 calendar days | | | 2.1 | |

| 61–90 calendar days | | | 0.2 | |

| 91–180 calendar days | | | 0.4 | |

| 181+ calendar days | | | 11.6 | |

| | | | |

7-DAY SEC YIELD AS OF AUGUST 31, 2020(1) | |

| Agency Shares | | | 0.01 | % |

| Institutional Class Shares | | | 0.04 | |

| Morgan Shares | | | 0.01 | |

| Premier Shares | | | 0.01 | |

| Reserve Shares | | | 0.01 | |

| Service Shares | | | 0.01 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111 (retail investors) or 1-800-766-7722 (institutional investors).

An investment in a money market fund is not insured by the FDIC or any other government agency. Although the Fund strives to preserve the value of the investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| † | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| ^ | E*Trade Shares had no assets from the close of business on September 21, 2016. |

| ^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made and may utilize the interest rate reset date for variable or floating rate securities. |

| ^^^ | The calculation takes into account the period remaining until the date on which, in accordance with the terms of the security, the principal amount must unconditionally be paid, or in the case of a security called for redemption, the date on which the redemption payment must be made. |

| * | A portion of the Fund’s income distributions may be subject to the Alternative Minimum Tax (AMT), and some investors may be subject to certain state and local taxes. |

| ** | Percentages indicated are based upon total investments as of August 31, 2020. |

| (1) | The yields for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares, Reserve Shares and Service Shares reflect the reimbursements and/or waivers of certain expenses. Without these reimbursements and/or waivers, the yields would have been (0.06)%, (0.01)%, (0.39)%, (0.21)%, (0.46)% and (0.81)% for Agency Shares, Institutional Class Shares, Morgan Shares, Premier Shares, Reserve Shares and Service Shares, respectively. |

| | An unaudited, uncertified list of prior-day portfolio holdings of the JPMorgan New York Municipal Money Market Fund is available upon request. Please contact your J.P. Morgan representative to obtain further information regarding this facility and information on holdings. |

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

JPMorgan Prime Money Market Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2020 (Unaudited)

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

Repurchase Agreements — 29.8% | |

| | |

Bank of Montreal, 0.11%, dated 8/31/2020, due 9/7/2020, repurchase price $400,009, collateralized by FHLMC, 0.46% - 6.50%, due 5/15/2025 - 10/25/2049, FNMA, 0.43% - 6.00%, due 8/25/2024 - 9/25/2049 and GNMA, 1.50% - 4.00%, due 6/16/2028 - 1/20/2070, with a value of $412,079. | | | 400,000 | | | | 400,000 | |

| | |

Barclays Capital, Inc., 0.36%, dated 8/31/2020, due 10/5/2020, repurchase price $400,138, collateralized by Collateralized Mortgage Obligations, 0.00% - 29.08%, due 10/25/2021 - 11/17/2062, FHLMC, 2.53% - 11.93%, due 10/25/2029 - 8/25/2056 and FNMA Connecticut Avenue Securities, 3.43% - 9.43%, due 10/25/2029 - 10/25/2049, with a value of $432,000. | | | 400,000 | | | | 400,000 | |

| | |

Barclays Capital, Inc., 0.41%, dated 8/31/2020, due 10/5/2020, repurchase price $180,071, collateralized by Collateralized Mortgage Obligations, 0.00% - 6.05%, due 5/15/2028 - 3/25/2061, FHLMC, 1.83% - 5.28%, due 7/25/2030 - 6/27/2050 and FNMA Connecticut Avenue Securities, 2.18% - 4.33%, due 9/25/2029 - 1/25/2040, with a value of $194,400. | | | 180,000 | | | | 180,000 | |

| | |

BMO Capital Markets Corp., 0.20%, dated 8/31/2020, due 9/1/2020, repurchase price $110,001, collateralized by Asset-Backed Securities, 0.00% - 4.34%, due 2/15/2022 - 8/15/2068, Collateralized Mortgage Obligations, 0.81% - 3.06%, due 7/25/2035 - 10/13/2048, Corporate Notes and Bonds, 0.91% - 9.38%, due 1/25/2021 - 2/1/2055, FHLMC, 2.54%, due 7/25/2026, FNMA, 6.30%, due 10/17/2038 and Sovereign Government Securities, 0.30% - 2.50%, due 10/16/2020 - 7/29/2025, with a value of $116,439. | | | 110,000 | | | | 110,000 | |

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

| | | | | | | | |

| | |

BMO Capital Markets Corp., 0.20%, dated 8/31/2020, due 9/1/2020, repurchase price $275,002, collateralized by Asset-Backed Securities, 0.00% - 6.18%, due 8/10/2022 - 1/25/2043, Collateralized Mortgage Obligations, 0.51% - 2.38%, due 7/25/2035 - 1/15/2049, Corporate Notes and Bonds, 0.44% - 9.81%, due 9/21/2020 - 12/31/2099, FHLMC, 1.50% - 5.33%, due 11/1/2030 - 8/1/2050, FNMA, 0.30% - 6.30%, due 3/1/2021 - 2/1/2048, GNMA, 2.50% - 4.50%, due 2/15/2022 - 8/20/2050 and Sovereign Government Securities, 0.30% - 0.38%, due 10/16/2020 - 7/29/2025 with a value of $289,748. | | | 275,000 | | | | 275,000 | |

| | |

BMO Capital Markets Corp., 0.23%, dated 8/31/2020, due 9/7/2020, repurchase price $105,005, collateralized by Asset-Backed Securities, 0.00% - 4.23%, due 9/15/2022 - 1/25/2043, Collateralized Mortgage Obligations, 0.93% - 1.90%, due 8/12/2042 - 4/12/2049 and Corporate Notes and Bonds, 3.35%, due 10/22/2022, with a value of $110,315. | | | 105,000 | | | | 105,000 | |

| | |

BMO Capital Markets Corp., 0.33%, dated 8/31/2020, due 9/7/2020, repurchase price $20,001, collateralized by Asset-Backed Securities, 0.00% - 3.68%, due 8/10/2022 - 2/18/2042, Collateralized Mortgage Obligations, 0.11% - 4.01%, due 6/10/2038 - 3/17/2048, Corporate Notes and Bonds, 2.20% - 6.25%, due 11/22/2020 - 3/25/2040 and FHLMC, 2.00% - 2.50%, due 8/1/2050 - 9/1/2050 with a value of $21,597. | | | 20,000 | | | | 20,000 | |

| | |

BMO Capital Markets Corp., 0.33%, dated 8/31/2020, due 9/8/2020, repurchase price $25,002, collateralized by Asset-Backed Securities, 0.00% - 8.10%, due 2/15/2022 - 1/25/2057, Collateralized Mortgage Obligations, 0.37% - 7.39%, due 11/25/2032 - 11/25/2058, Corporate Notes and Bonds, 0.91% - 6.88%, due 3/22/2022 - 1/1/2099, FHLMC, 2.00% - 2.50%, due 8/1/2040 - 9/1/2050, FNMA, 1.21% - 4.00%, due 8/1/2030 - 8/1/2050, GNMA, 2.27% - 5.50%, due 2/20/2049 - 8/20/2062 and Sovereign Government Securities, 0.38%, due 7/29/2025 with a value of $26,578. | | | 25,000 | | | | 25,000 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 15 | |

JPMorgan Prime Money Market Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2020 (Unaudited) (continued)

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

Repurchase Agreements — continued | |

| | |

BNP Paribas SA, 0.26%, dated 8/31/2020, due 9/1/2020, repurchase price $205,001, collateralized by Asset-Backed Securities, 0.56% - 5.72%, due 3/15/2027 - 6/20/2047, Collateralized Mortgage Obligations, 0.71% - 5.30%, due 11/26/2029 - 1/25/2066, Corporate Notes and Bonds, 0.00% - 7.00%, due 11/15/2022 - 4/6/2050 and U.S. Treasury Securities, 0.00% - 2.13%, due 9/1/2020 - 11/30/2024 with a value of $218,658. | | | 205,000 | | | | 205,000 | |

| | |

Bofa Securities, Inc., 0.18%, dated 8/31/2020, due 9/1/2020, repurchase price $200,001, collateralized by Common Stocks, 0.00%, due 1/1/2099 and Preferred Stocks, 0.00% - 10.88%, due 10/30/2020 - 11/1/2102, with a value of $216,000. | | | 200,000 | | | | 200,000 | |

| | |

Bofa Securities, Inc., 0.36%, dated 8/31/2020, due 10/5/2020, repurchase price $250,088, collateralized by Common Stocks, 0.00%, due 1/1/2099 and Preferred Stocks, 5.15% - 10.00%, due 8/1/2042 - 1/1/2099, with a value of $270,000. | | | 250,000 | | | | 250,000 | |

| | |

Bofa Securities, Inc., 0.49%, dated 8/31/2020, due 10/5/2020, repurchase price $200,095, collateralized by Asset-Backed Securities, 0.46% - 4.50%, due 7/20/2027 - 10/15/2048 and Collateralized Mortgage Obligations, 1.56% - 4.98%, due 7/12/2030 - 4/17/2063, with a value of $214,649. | | | 200,000 | | | | 200,000 | |

| | |

Bofa Securities, Inc., 0.49%, dated 8/31/2020, due 10/20/2020, repurchase price $342,033, collateralized by Corporate Notes and Bonds, 0.00% - 13.00%, due 1/15/2021 - 12/31/2099, with a value of $369,144. | | | 341,800 | | | | 341,800 | |

| | |

Credit Suisse Securities USA LLC, 0.29%, dated 8/31/2020, due 9/2/2020, repurchase price $60,001, collateralized by Collateralized Mortgage Obligations, 0.00%, due 4/25/2045, with a value of $64,804. | | | 60,000 | | | | 60,000 | |

| | |

Credit Suisse Securities USA LLC, 0.51%, dated 8/31/2020, due 10/5/2020, repurchase price $150,074, collateralized by Asset-Backed Securities, 0.44% - 15.00%, due 8/28/2023 - 5/29/2059 and Collateralized Mortgage Obligations, 0.00% - 45.34%, due 4/7/2033 - 1/26/2051, with a value of $162,998. | | | 150,000 | | | | 150,000 | |

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

| | | | | | | | |

| | |

Fixed Income Clearing Corp., 0.09%, dated 8/31/2020, due 9/1/2020, repurchase price $5,000,013, collateralized by U.S. Treasury Securities, 0.13% - 4.50%, due 4/15/2022 - 11/15/2049, with a value of $5,100,000. | | | 5,000,000 | | | | 5,000,000 | |

| | |

Fixed Income Clearing Corp., 0.09%, dated 8/31/2020, due 9/1/2020, repurchase price $5,000,013, collateralized by U.S. Treasury Securities, 0.50% - 3.13%, due 8/15/2027 - 8/15/2040, with a value of $5,100,000. | | | 5,000,000 | | | | 5,000,000 | |

| | |

Fixed Income Clearing Corp., 0.09%, dated 8/31/2020, due 9/1/2020, repurchase price $7,000,018, collateralized by U.S. Treasury Securities, 0.13% - 0.75%, due 7/15/2023 - 2/15/2042, with a value of $7,140,000. | | | 7,000,000 | | | | 7,000,000 | |

| | |

HSBC Securities USA, Inc., 0.19%, dated 8/31/2020, due 9/1/2020, repurchase price $20,000, collateralized by Asset-Backed Securities, 0.64%, due 6/15/2039 and Municipal Debt Securities, 0.00%, due 8/1/2031, with a value of $21,200. | | | 20,000 | | | | 20,000 | |

| | |

HSBC Securities USA, Inc., 0.19%, dated 8/31/2020, due 9/1/2020, repurchase price $75,000, collateralized by Corporate Notes and Bonds, 2.25% - 6.75%, due 1/8/2021 - 12/15/2066 and Sovereign Government Securities, 0.96% - 4.50%, due 2/27/2022 - 4/15/2070, with a value of $78,750. | | | 75,000 | | | | 75,000 | |

| | |

ING Financial Markets LLC, 0.23%, dated 8/31/2020, due 9/1/2020, repurchase price $75,000, collateralized by Sovereign Government Securities, 6.84% - 6.88%, due 8/4/2026 - 1/23/2030, with a value of $81,001. | | | 75,000 | | | | 75,000 | |

| | |

ING Financial Markets LLC, 0.23%, dated 8/31/2020, due 9/1/2020, repurchase price $400,003, collateralized by Corporate Notes and Bonds, 4.56% - 7.00%, due 3/17/2024 - 1/1/2099 and Sovereign Government Securities, 4.63% - 8.88%, due 1/22/2021 - 1/14/2041, with a value of $432,004. | | | 400,000 | | | | 400,000 | |

| | |

ING Financial Markets LLC, 0.32%, dated 8/31/2020, due 9/2/2020, repurchase price $100,002, collateralized by Corporate Notes and Bonds, 4.56% - 7.00%, due 1/27/2025 - 1/1/2099 and Sovereign Government Securities, 5.63% - 6.88%, due 8/4/2026 - 2/21/2047, with a value of $108,028. | | | 100,000 | | | | 100,000 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN MONEY MARKET FUNDS | | AUGUST 31, 2020 |

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

Repurchase Agreements — continued | |

| | |

ING Financial Markets LLC, 0.32%, dated 8/31/2020, due 9/4/2020, repurchase price $10,000, collateralized by Corporate Notes and Bonds, 5.30% - 6.75%, due 1/27/2025 - 6/3/2050 and Sovereign Government Securities, 6.84%, due 1/23/2030, with a value of $10,803. | | | 10,000 | | | | 10,000 | |

| | |

ING Financial Markets LLC, 0.32%, dated 8/31/2020, due 9/10/2020, repurchase price $50,004, collateralized by Corporate Notes and Bonds, 4.56% - 6.75%, due 3/17/2024 - 6/3/2050 and Sovereign Government Securities, 6.84%, due 1/23/2030, with a value of $54,015. | | | 50,000 | | | | 50,000 | |

| | |

ING Financial Markets LLC, 0.28%, dated 8/31/2020, due 9/28/2020, repurchase price $50,011, collateralized by Corporate Notes and Bonds, 4.38% - 6.75%, due 5/20/2023 - 6/3/2050 and Sovereign Government Securities, 6.84%, due 1/23/2030, with a value of $54,013. | | | 50,000 | | | | 50,000 | |

| | |

Mitsubishi UFJ Trust & Banking Corp., 0.28%, dated 8/31/2020, due 9/2/2020, repurchase price $1,000,016, collateralized by Corporate Notes and Bonds, 0.00% - 4.15%, due 5/13/2022 - 5/1/2030, with a value of $1,042,997. | | | 1,000,000 | | | | 1,000,000 | |

| | |

Societe Generale SA, 0.09%, dated 8/31/2020, due 9/1/2020, repurchase price $1,000,003, collateralized by FHLMC, 0.00% - 5.55%, due 10/15/2022 - 9/1/2050, FNMA, 0.88% - 5.70%, due 5/25/2023 - 8/1/2050, GNMA, 0.41% - 3.50%, due 12/20/2026 - 8/20/2050 and U.S. Treasury Securities, 0.00% - 8.13%, due 9/17/2020 - 2/15/2050 with a value of $1,020,055. | | | 1,000,000 | | | | 1,000,000 | |

| | |

Societe Generale SA, 0.20%, dated 8/31/2020, due 9/1/2020, repurchase price $736,004, collateralized by Asset-Backed Securities, 2.70% - 8.00%, due 2/15/2027 - 11/1/2033, Corporate Notes and Bonds, 0.40% - 8.63%, due 1/19/2021 - 12/31/2099 and Sovereign Government Securities, 0.82% - 5.35%, due 9/14/2021 - 5/15/2051, with a value of $772,943. | | | 736,000 | | | | 736,000 | |

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

| | | | | | | | |

| | |

Societe Generale SA, 0.30%, dated 8/31/2020, due 9/1/2020, repurchase price $700,006, collateralized by Asset-Backed Securities, 0.28% - 8.09%, due 1/25/2030 - 2/28/2041, Collateralized Mortgage Obligations, 0.37% - 6.21%, due 1/12/2034 - 8/17/2049, Corporate Notes and Bonds, 4.63%, due 1/15/2025, FHLMC, 0.83% - 3.73%, due 8/27/2029 - 3/25/2050, FNMA Connecticut Avenue Securities, 2.18% - 3.83%, due 9/25/2029 - 1/25/2040 and Sovereign Government Securities, 2.63% - 11.88%, due 1/22/2021 - 1/23/2050, with a value of $756,006. | | | 700,000 | | | | 700,000 | |

| | |

Societe Generale SA, 0.32%, dated 8/31/2020, due 9/1/2020, repurchase price $200,002, collateralized by Asset-Backed Securities, 0.32% - 5.02%, due 7/15/2030 - 3/25/2037, Collateralized Mortgage Obligations, 0.37% - 6.00%, due 1/12/2034 - 12/16/2072, Corporate Notes and Bonds, 3.88% - 12.00%, due 6/1/2021 - 7/23/2048, FHLMC, 2.03% - 3.28%, due 2/25/2050 - 3/25/2050, FNMA Connecticut Avenue Securities, 2.18% - 3.18%, due 10/25/2029 - 1/25/2040 and Sovereign Government Securities, 4.25% - 11.88%, due 4/15/2024 - 2/17/2045, with a value of $215,409. | | | 200,000 | | | | 200,000 | |

| | |

Societe Generale SA, 0.32%, dated 8/31/2020, due 9/3/2020, repurchase price $365,010, collateralized by Asset-Backed Securities, 0.32% - 8.09%, due 3/17/2025 - 10/25/2046, Collateralized Mortgage Obligations, 0.37% - 6.21%, due 11/15/2032 - 12/16/2072, Corporate Notes and Bonds, 4.25% - 12.00%, due 11/15/2022 - 2/1/2031, FHLMC, 2.03% - 3.28%, due 12/26/2029 - 3/25/2050, FNMA Connecticut Avenue Securities, 2.18% - 3.83%, due 9/25/2029 - 1/25/2040 and Sovereign Government Securities, 2.63% - 11.88%, due 1/22/2021 - 5/11/2047, with a value of $394,225. | | | 365,000 | | | | 365,000 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2020 | | J.P. MORGAN MONEY MARKET FUNDS | | | | | 17 | |

JPMorgan Prime Money Market Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2020 (Unaudited) (continued)

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

Repurchase Agreements — continued | |

| | |

Societe Generale SA, 0.33%, dated 8/31/2020, due 10/1/2020, repurchase price $400,114, collateralized by Collateralized Mortgage Obligations, 2.75%, due 12/16/2072, Corporate Notes and Bonds, 4.25% - 11.75%, due 11/1/2023 - 2/1/2031, FHLMC, 2.08%, due 1/25/2050, FNMA Connecticut Avenue Securities, 2.33%, due 11/25/2039 and Sovereign Government Securities, 4.25% - 11.88%, due 3/25/2022 - 5/11/2047, with a value of $432,123. | | | 400,000 | | | | 400,000 | |

| | |

TD Securities (USA) LLC, 0.20%, dated 8/31/2020, due 9/1/2020, repurchase price $250,001, collateralized by Asset-Backed Securities, 4.80%, due 2/15/2029 and Corporate Notes and Bonds, 1.10% - 6.50%, due 2/4/2021 - 7/1/2050, with a value of $262,581. | | | 250,000 | | | | 250,000 | |

| | |

UBS Securities LLC, 0.29%, dated 8/31/2020, due 9/7/2020, repurchase price $300,017, collateralized by Asset-Backed Securities, 0.99%, due 11/9/2020, Collateralized Mortgage Obligations, 3.44%, due 9/17/2048, Commercial Paper, 0.00%, due 1/28/2021 and Corporate Notes and Bonds, 0.73% - 11.50%, due 9/15/2020 - 12/31/2099 with a value of $321,044. | | | 300,000 | | | | 300,000 | |

| | |

Wells Fargo Securities LLC, 0.23%, dated 8/31/2020, due 9/2/2020, repurchase price $52,001, collateralized by Certificates of Deposit, 0.00%, due 12/21/2020 - 10/3/2025, with a value of $54,602. | | | 52,000 | | | | 52,000 | |

| | |

Wells Fargo Securities LLC, 0.23%, dated 8/31/2020, due 9/3/2020, repurchase price $104,002, collateralized by Sovereign Government Securities, 2.38% - 10.63%, due 1/15/2021 - 9/20/2048, with a value of $109,219. | | | 104,000 | | | | 104,000 | |

| | |

Wells Fargo Securities LLC, 0.55%, dated 8/31/2020, due 9/21/2020, repurchase price $250,080, collateralized by Certificates of Deposit, 0.00% - 0.28%, due 9/15/2020 - 8/25/2021, with a value of $262,861. | | | 250,000 | | | | 250,000 | |

| | | | | | | | |

| | |

Total Repurchase Agreements

(Cost $26,058,800) | | | | | | | 26,058,800 | |

| | | | | | | | |

| | | | | | | | |

| INVESTMENTS (a) | | PRINCIPAL

AMOUNT

($000) | | | VALUE

($000) | |

U.S. Treasury Obligations — 0.7% | |

| | |

U.S. Treasury Floating Rate Notes (US Treasury 3 Month Bill Money Market Yield + 0.12%), 0.22%, 9/1/2020 (b)

(Cost $649,943) | | | 650,000 | | | | 649,943 | |

| | | | | | | | |

Corporate Notes — 0.4% | |

|

Banks — 0.4% | |

| |

Barclays Bank plc (United Kingdom) | | | | | |

| | |

(OBFR + 0.15%), 0.23%, 9/1/2020 (b) (c) | | | 125,000 | | | | 125,000 | |

| | |

(OBFR + 0.30%), 0.38%, 9/1/2020 (b) (c) | | | 200,000 | | | | 200,000 | |

| | | | | | | | |

| |

Total Corporate Notes

(Cost $325,000) | | | | 325,000 | |

| | | | | |

Municipal Bonds — 0.2% | |

|

Alaska — 0.1% | |

| | |

Alaska Housing Finance Corp., State Capital Project Series 2018A, Rev., VRDO, 0.17%, 9/8/2020 (d) | | | 65,000 | | | | 65,000 | |

| | | | | | | | |

|

New York — 0.1% | |

| | |

New York State Dormitory Authority, State Personal Income Tax, General Purpose Series 2020B, Rev., RAN, 5.00%, 3/31/2021 | | | 110,000 | | | | 113,103 | |

| | | | | | | | |

| |

Total Municipal Bonds

(Cost $177,827) | | | | 178,103 | |

| | | | | |

Short-Term Investments — 68.5% | |

|

Certificates of Deposit — 41.7% | |

| | |

ABN Amro Bank NV (Netherlands) 0.25%, 2/22/2021 (e) | | | 65,000 | | | | 64,919 | |

| | |

Agricultural Bank of China Ltd. (China) 0.65%, 10/20/2020 | | | 100,000 | | | | 100,049 | |

| | |

Banco Del Estado De Chile (Chile) | | | | | | | | |

| | |

0.35%, 9/14/2020 | | | 50,000 | | | | 50,004 | |

| | |

0.32%, 9/25/2020 | | | 24,000 | | | | 24,003 | |

| | |

0.30%, 10/6/2020 | | | 100,000 | | | | 100,014 | |

| | |

0.28%, 10/23/2020 | | | 150,000 | | | | 150,023 | |

| | |

Bank of Montreal (Canada) | | | | | | | | |

| | |

1.53%, 9/28/2020 | | | 200,000 | | | | 200,000 | |

| | |

1.40%, 10/1/2020 | | | 200,000 | | | | 200,222 | |

| | |

0.20%, 10/30/2020 | | | 100,000 | | | | 100,010 | |

| | |

(ICE LIBOR USD 3 Month + 0.03%), 0.29%, 11/27/2020 (b) | | | 100,000 | | | | 100,000 | |

| | |

0.23%, 2/12/2021 | | | 200,000 | | | | 200,014 | |

| | |