UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Preferred and Income Securities Fund

Class A Shares/Ticker: JPDAX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Preferred and Income Securities Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Preferred and Income Securities Fund

(Class A Shares) | $91 | 0.85% |

How did the Fund Perform?

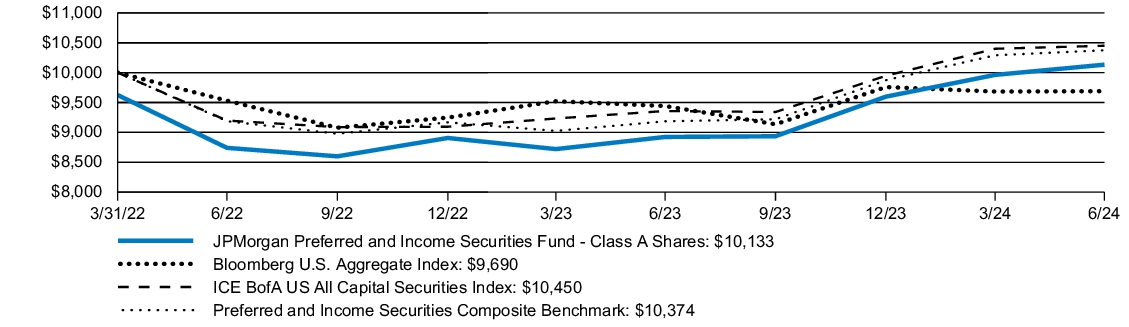

The JPMorgan Preferred and Income Securities Fund’s Class A Shares, without a sales charge, returned 13.55% for the year ended June 30, 2024. The 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Mkt. USD Contingent Capital Index (the “Index”) returned 12.94%, the Bloomberg U.S. Aggregate Index returned 2.63% and the ICE BofA US All Capital Securities Index returned 11.68% for the year ended June 30, 2024.

The Fund’s underweight allocation to duration (expressed through an underweight allocation to longer-duration, fixed-for-life retail securities) positively contributed to performance relative to the Index as interest rates rose.

The Fund’s overweight allocation to Canadian bank capital securities detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Preferred and Income Securities Fund (Class A Shares) | March 31, 2022 | 9.32 | % | 0.59 | % |

| JPMorgan Preferred and Income Securities Fund (Class A Shares) - excluding sales charge | | 13.55 | | 2.31 | |

| Bloomberg U.S. Aggregate Index | | 2.63 | | (1.39 | ) |

| ICE BofA US All Capital Securities Index | | 11.68 | | 1.98 | |

| Preferred and Income Securities Composite Benchmark | | 12.94 | | 1.65 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of JPMorgan Preferred and Income Securities Fund and the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index from March 31, 2022 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index do not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Bloomberg U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable and dollar denominated. The Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The ICE BofA US All Capital Securities Index is a subset of the ICE BofA Merrill Lynch U.S. Corporate Index including all fixed-to-floating rate, perpetual callable and capital securities. The ICE BofA Merrill Lynch Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index is a customized blend of unmanaged indices that includes 75% ICE BofA US All Capital Securities Index and 25% Bloomberg Developed Market USD Contingent Capital Index. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall have any liability or responsibility for injury or damages arising in connection therewith.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $988,655 | |

| Total number of portfolio holdings | $132 | |

| Portfolio turnover rate | $36 | % |

| Total advisory fees paid (000's) | $3,436 | |

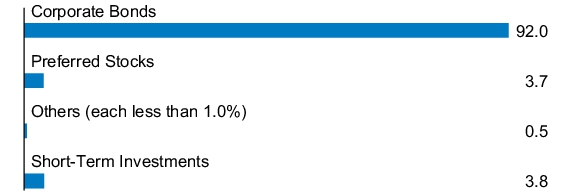

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Preferred and Income Securities Fund

Class C Shares/Ticker: JPDCX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Preferred and Income Securities Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Preferred and Income Securities Fund

(Class C Shares) | $144 | 1.35% |

How did the Fund Perform?

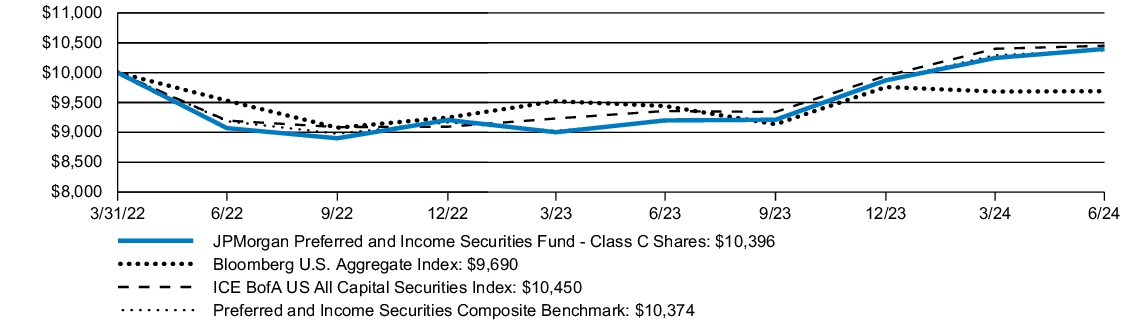

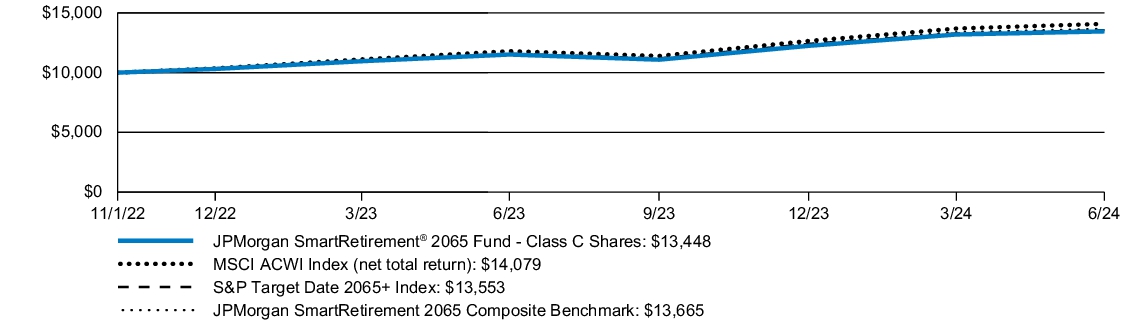

The JPMorgan Preferred and Income Securities Fund’s Class C Shares, without a sales charge, returned 13.00% for the year ended June 30, 2024. The 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Mkt. USD Contingent Capital Index (the “Index”) returned 12.94%, the Bloomberg U.S. Aggregate Index returned 2.63% and the ICE BofA US All Capital Securities Index returned 11.68% for the year ended June 30, 2024.

The Fund’s underweight allocation to duration (expressed through an underweight allocation to longer-duration, fixed-for-life retail securities) positively contributed to performance relative to the Index as interest rates rose.

The Fund’s overweight allocation to Canadian bank capital securities detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Preferred and Income Securities Fund (Class C Shares) | August 1, 2022 | 12.00 | % | 1.74 | % |

| JPMorgan Preferred and Income Securities Fund (Class C Shares) - excluding sales charge | | 13.00 | | 1.74 | |

| Bloomberg U.S. Aggregate Index | | 2.63 | | (1.39 | ) |

| ICE BofA US All Capital Securities Index | | 11.68 | | 1.98 | |

| Preferred and Income Securities Composite Benchmark | | 12.94 | | 1.65 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

Returns for Class C Shares prior to their inception date are based on the performance of Class A Shares. The actual returns for Class C Shares would have been different than those shown because Class C Shares have different expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class C Shares of JPMorgan Preferred and Income Securities Fund and the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index from March 31, 2022 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index do not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Bloomberg U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable and dollar denominated. The Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The ICE BofA US All Capital Securities Index is a subset of the ICE BofA Merrill Lynch U.S. Corporate Index including all fixed-to-floating rate, perpetual callable and capital securities. The ICE BofA Merrill Lynch Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index is a customized blend of unmanaged indices that includes 75% ICE BofA US All Capital Securities Index and 25% Bloomberg Developed Market USD Contingent Capital Index. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall have any liability or responsibility for injury or damages arising in connection therewith.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $988,655 | |

| Total number of portfolio holdings | $132 | |

| Portfolio turnover rate | $36 | % |

| Total advisory fees paid (000's) | $3,436 | |

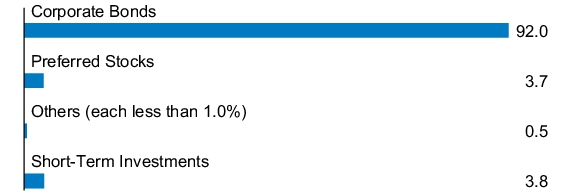

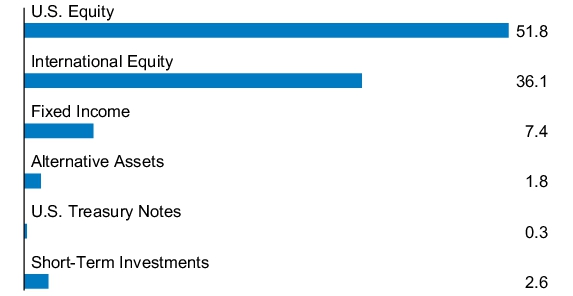

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Preferred and Income Securities Fund

Class I Shares/Ticker: JPDIX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Preferred and Income Securities Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Preferred and Income Securities Fund

(Class I Shares) | $64 | 0.60% |

How did the Fund Perform?

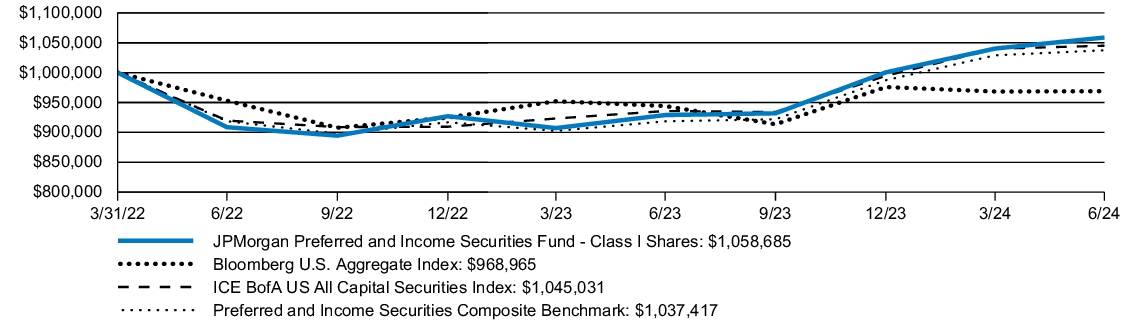

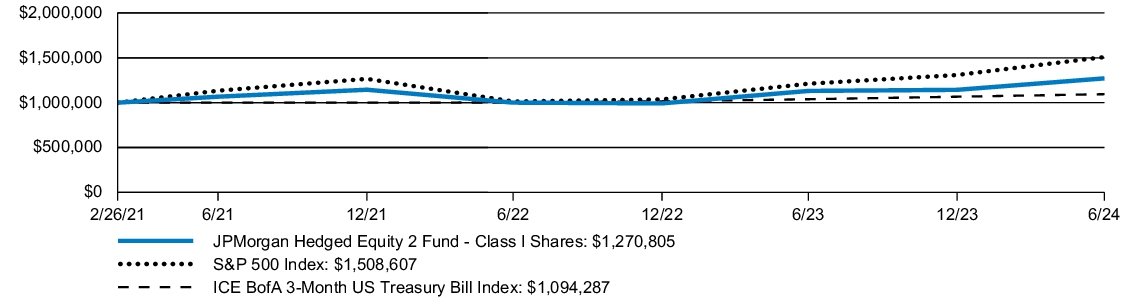

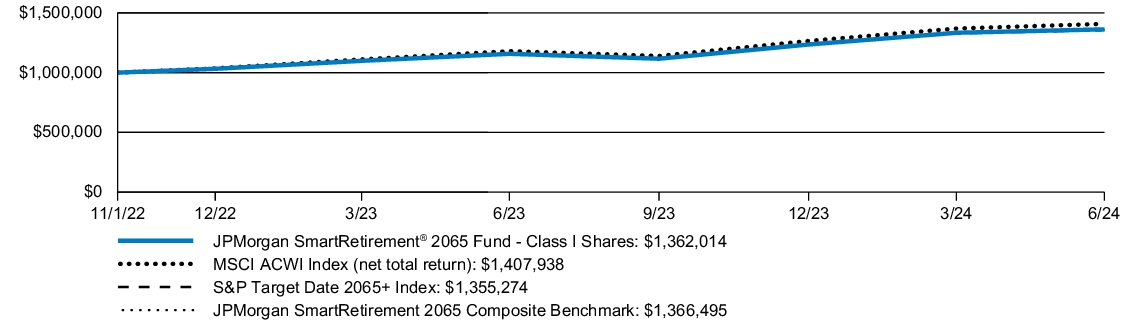

The JPMorgan Preferred and Income Securities Fund’s Class I Shares returned 13.96% for the year ended June 30, 2024. The 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Mkt. USD Contingent Capital Index (the “Index”) returned 12.94%, the Bloomberg U.S. Aggregate Index returned 2.63% and the ICE BofA US All Capital Securities Index returned 11.68% for the year ended June 30, 2024.

The Fund’s underweight allocation to duration (expressed through an underweight allocation to longer-duration, fixed-for-life retail securities) positively contributed to performance relative to the Index as interest rates rose.

The Fund’s overweight allocation to Canadian bank capital securities detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Preferred and Income Securities Fund (Class I Shares) | March 31, 2022 | 13.96 | % | 2.57 | % |

| Bloomberg U.S. Aggregate Index | | 2.63 | | (1.39 | ) |

| ICE BofA US All Capital Securities Index | | 11.68 | | 1.98 | |

| Preferred and Income Securities Composite Benchmark | | 12.94 | | 1.65 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of JPMorgan Preferred and Income Securities Fund and the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index from March 31, 2022 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index do not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Bloomberg U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable and dollar denominated. The Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The ICE BofA US All Capital Securities Index is a subset of the ICE BofA Merrill Lynch U.S. Corporate Index including all fixed-to-floating rate, perpetual callable and capital securities. The ICE BofA Merrill Lynch Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index is a customized blend of unmanaged indices that includes 75% ICE BofA US All Capital Securities Index and 25% Bloomberg Developed Market USD Contingent Capital Index. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall have any liability or responsibility for injury or damages arising in connection therewith.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $988,655 | |

| Total number of portfolio holdings | $132 | |

| Portfolio turnover rate | $36 | % |

| Total advisory fees paid (000's) | $3,436 | |

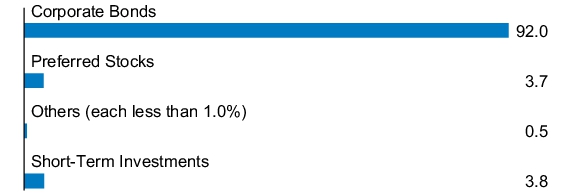

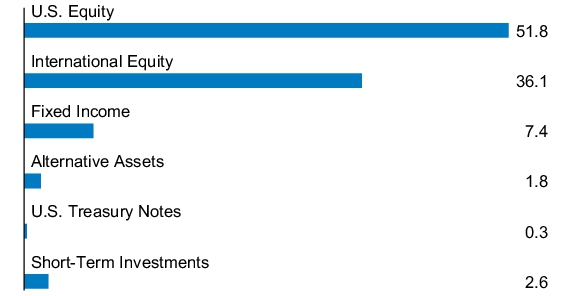

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Preferred and Income Securities Fund

Class R6 Shares/Ticker: JPDRX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Preferred and Income Securities Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Preferred and Income Securities Fund

(Class R6 Shares) | $59 | 0.55% |

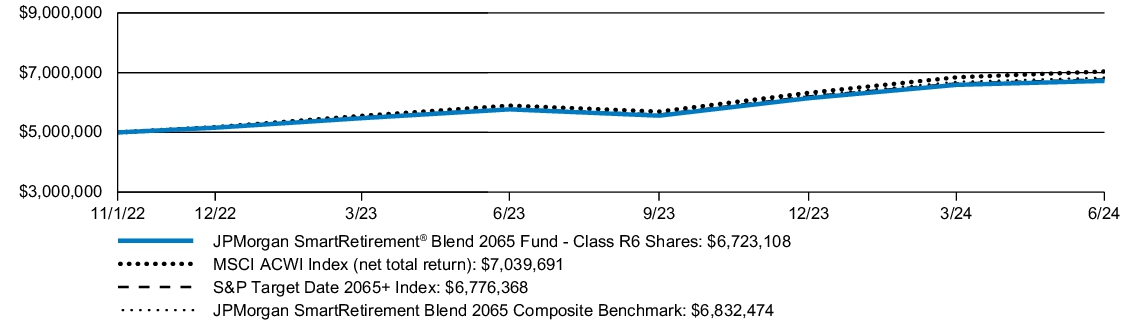

How did the Fund Perform?

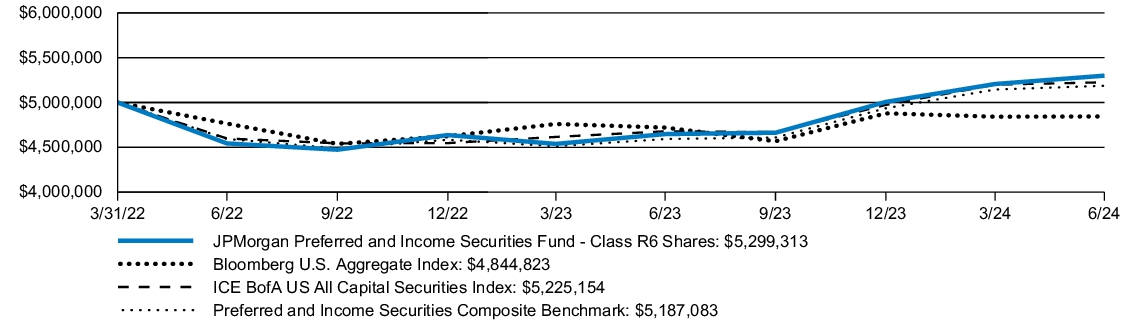

The JPMorgan Preferred and Income Securities Fund’s Class R6 Shares returned 14.01% for the year ended June 30, 2024. The 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Mkt. USD Contingent Capital Index (the “Index”) returned 12.94%, the Bloomberg U.S. Aggregate Index returned 2.63% and the ICE BofA US All Capital Securities Index returned 11.68% for the year ended June 30, 2024.

The Fund’s underweight allocation to duration (expressed through an underweight allocation to longer-duration, fixed-for-life retail securities) positively contributed to performance relative to the Index as interest rates rose.

The Fund’s overweight allocation to Canadian bank capital securities detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Preferred and Income Securities Fund (Class R6 Shares) | March 31, 2022 | 14.01 | % | 2.62 | % |

| Bloomberg U.S. Aggregate Index | | 2.63 | | (1.39 | ) |

| ICE BofA US All Capital Securities Index | | 11.68 | | 1.98 | |

| Preferred and Income Securities Composite Benchmark | | 12.94 | | 1.65 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $5,000,000 invested in Class R6 Shares of JPMorgan Preferred and Income Securities Fund and the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index from March 31, 2022 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Bloomberg U.S. Aggregate Index, ICE BofA US All Capital Securities Index and 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index do not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The Bloomberg U.S. Aggregate Index is an unmanaged index that represents securities that are SEC-registered, taxable and dollar denominated. The Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The ICE BofA US All Capital Securities Index is a subset of the ICE BofA Merrill Lynch U.S. Corporate Index including all fixed-to-floating rate, perpetual callable and capital securities. The ICE BofA Merrill Lynch Corporate Index tracks the performance of U.S. dollar denominated investment grade corporate debt publicly issued in the U.S. domestic market. 75% ICE BofA US All Capital Securities Index / 25% Bloomberg Developed Market USD Contingent Capital Index is a customized blend of unmanaged indices that includes 75% ICE BofA US All Capital Securities Index and 25% Bloomberg Developed Market USD Contingent Capital Index. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material, or guarantee the accuracy or completeness of any information herein, or make any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, shall have any liability or responsibility for injury or damages arising in connection therewith.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $988,655 | |

| Total number of portfolio holdings | $132 | |

| Portfolio turnover rate | $36 | % |

| Total advisory fees paid (000's) | $3,436 | |

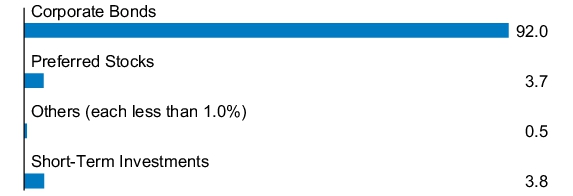

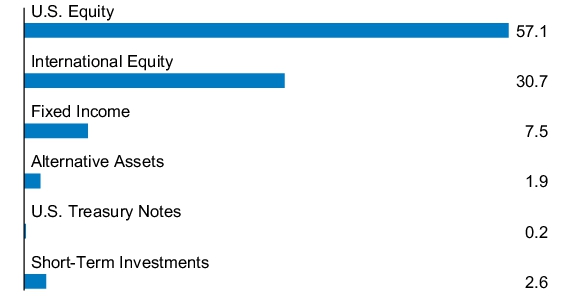

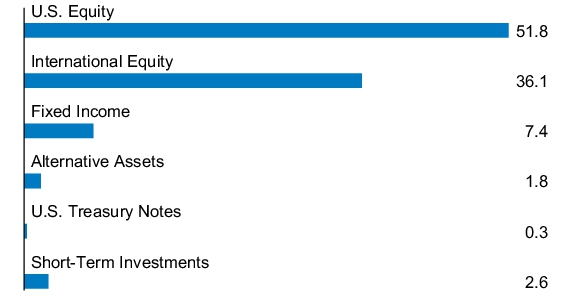

PORTFOLIO COMPOSITION - ASSET CLASS

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Equity Premium Income Fund

Class A Shares/Ticker: JEPAX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Equity Premium Income Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Premium Income Fund

(Class A Shares) | $89 | 0.85% |

How did the Fund Perform?

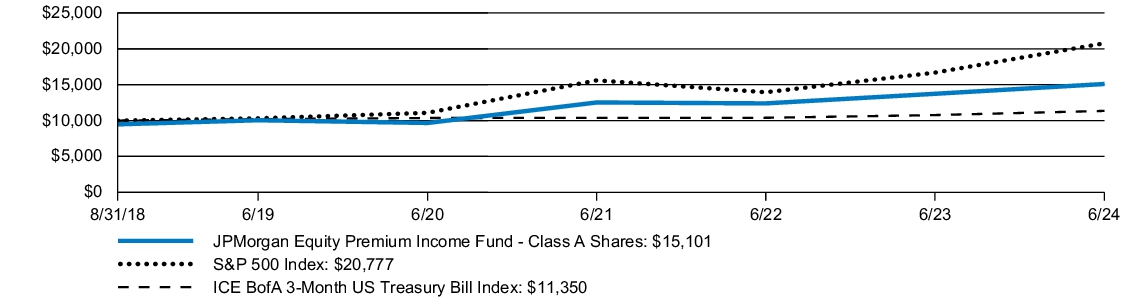

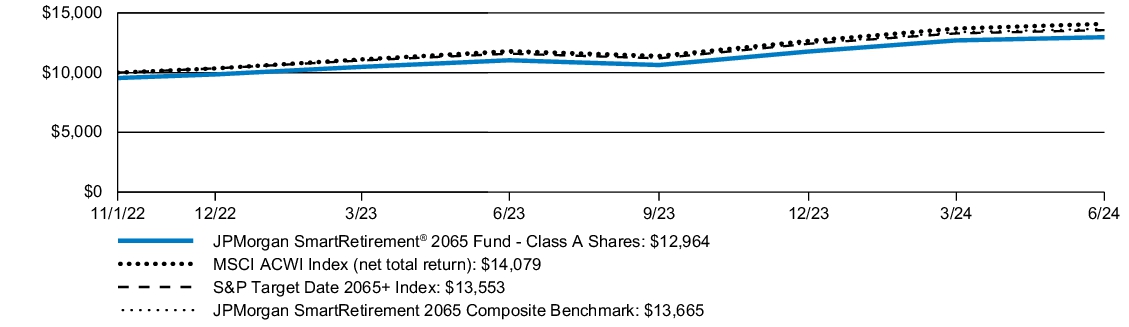

The JPMorgan Equity Premium Income Fund Class A Shares, without a sales charge, returned 9.97% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 42% of the Index’s positive return with 53% of its volatility.

The Fund’s security selection in the consumer discretionary and health care sectors contributed to performance.

An underweight position in Apple and an overweight position in Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the information technology and consumer staples sectors detracted from performance.

An underweight position in Nvidia and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | |

| JPMorgan Equity Premium Income Fund (Class A Shares) | August 31, 2018 | 4.19 | % | 7.32 | % | 7.33 | % |

| JPMorgan Equity Premium Income Fund (Class A Shares) - excluding sales charge | | 9.97 | | 8.49 | | 8.32 | |

| S&P 500 Index | | 24.56 | | 15.05 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 2.17 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of theJPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $6,226,658 | |

| Total number of portfolio holdings | $131 | |

| Portfolio turnover rate | $176 | % |

| Total advisory fees paid (000's) | $14,847 | |

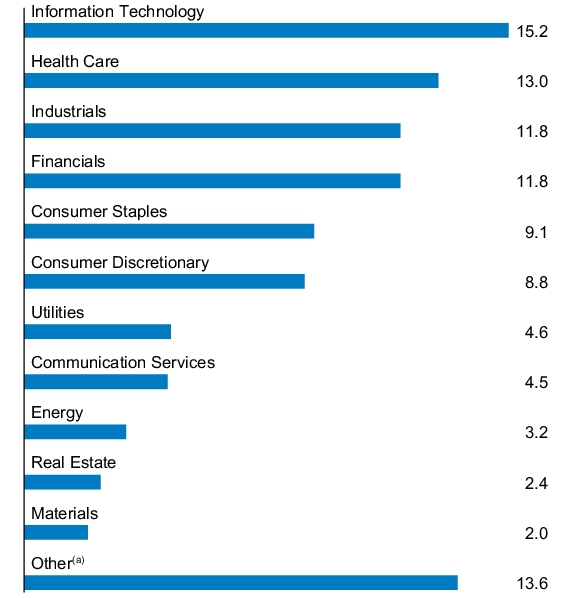

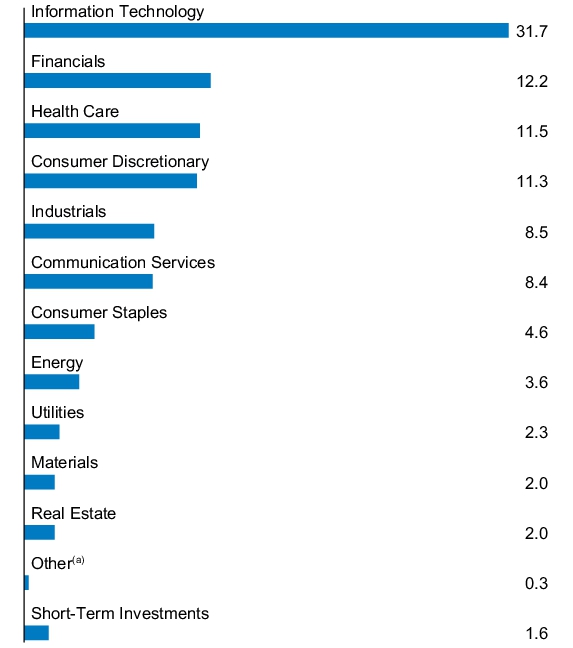

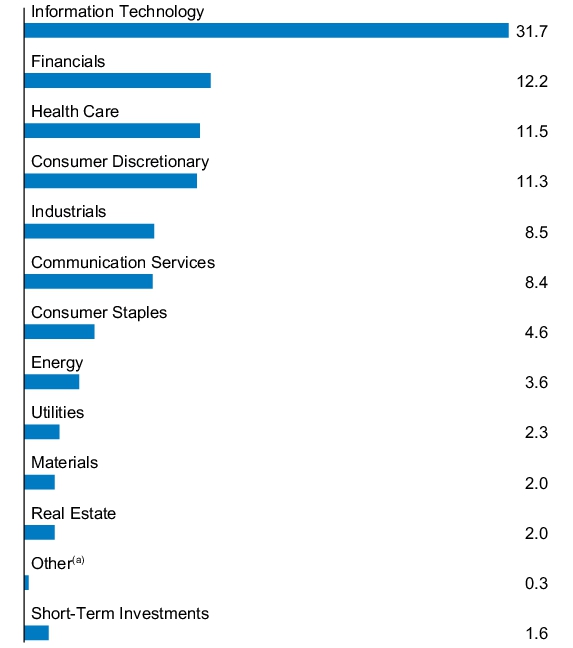

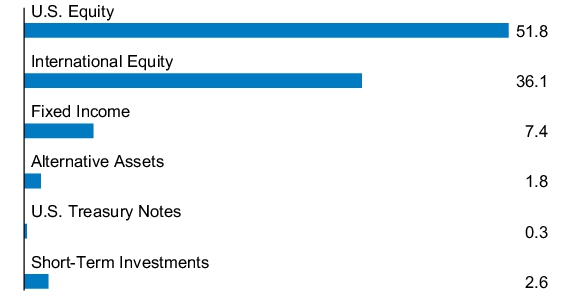

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Equity-Linked Notes that are linked to the S&P 500 Index. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Equity Premium Income Fund

Class C Shares/Ticker: JEPCX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Equity Premium Income Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Premium Income Fund

(Class C Shares) | $141 | 1.35% |

How did the Fund Perform?

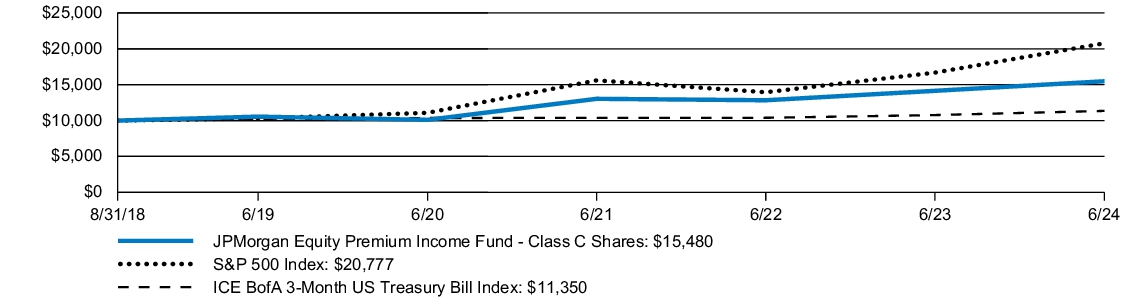

The JPMorgan Equity Premium Income Fund Class C Shares, without a sales charge, returned 9.42% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 42% of the Index’s positive return with 53% of its volatility.

The Fund’s security selection in the consumer discretionary and health care sectors contributed to performance.

An underweight position in Apple and an overweight position in Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the information technology and consumer staples sectors detracted from performance.

An underweight position in Nvidia and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | |

| JPMorgan Equity Premium Income Fund (Class C Shares) | August 31, 2018 | 8.42 | % | 7.97 | % | 7.78 | % |

| JPMorgan Equity Premium Income Fund (Class C Shares) - excluding sales charge | | 9.42 | | 7.97 | | 7.78 | |

| S&P 500 Index | | 24.56 | | 15.05 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 2.17 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class C Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C Shares reflects Class A Share's performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $6,226,658 | |

| Total number of portfolio holdings | $131 | |

| Portfolio turnover rate | $176 | % |

| Total advisory fees paid (000's) | $14,847 | |

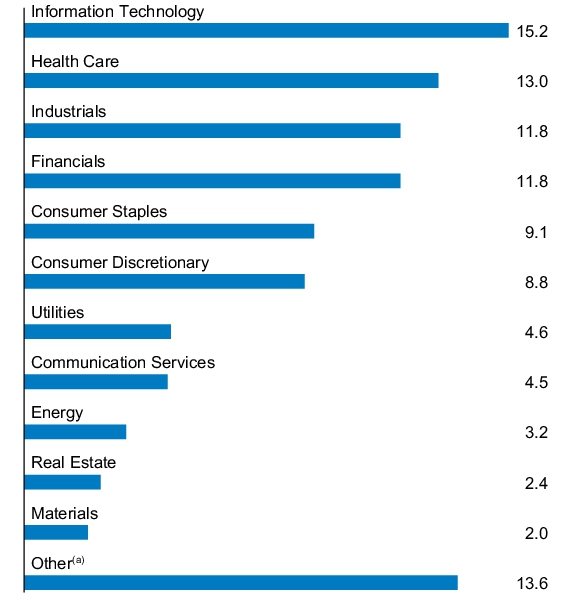

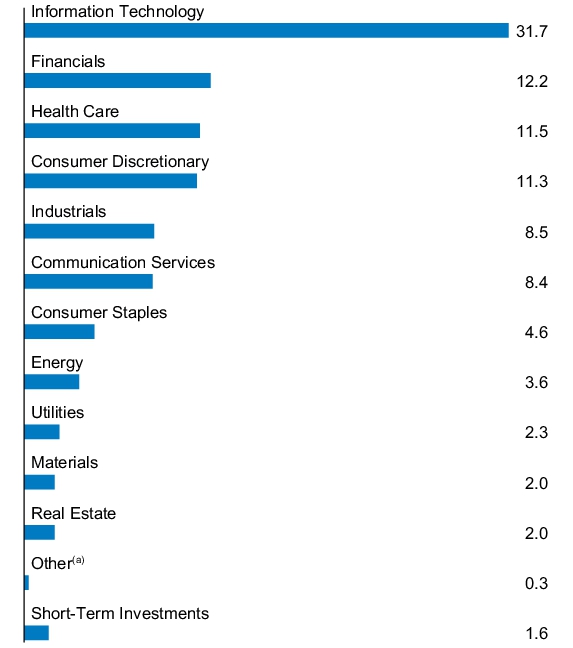

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Equity-Linked Notes that are linked to the S&P 500 Index. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Equity Premium Income Fund

Class I Shares/Ticker: JEPIX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Equity Premium Income Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Premium Income Fund

(Class I Shares) | $63 | 0.60% |

How did the Fund Perform?

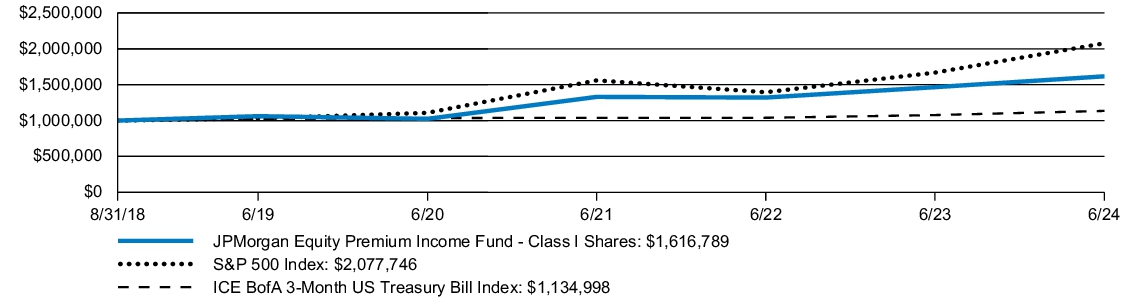

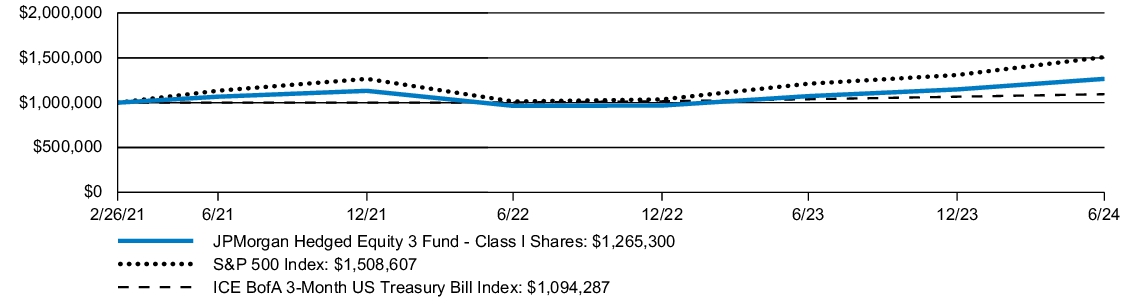

The JPMorgan Equity Premium Income Fund Class I Shares returned 10.32% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 42% of the Index’s positive return with 53% of its volatility.

The Fund’s security selection in the consumer discretionary and health care sectors contributed to performance.

An underweight position in Apple and an overweight position in Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the information technology and consumer staples sectors detracted from performance.

An underweight position in Nvidia and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | |

| JPMorgan Equity Premium Income Fund (Class I Shares) | August 31, 2018 | 10.32 | % | 8.78 | % | 8.59 | % |

| S&P 500 Index | | 24.56 | | 15.05 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 2.17 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $6,226,658 | |

| Total number of portfolio holdings | $131 | |

| Portfolio turnover rate | $176 | % |

| Total advisory fees paid (000's) | $14,847 | |

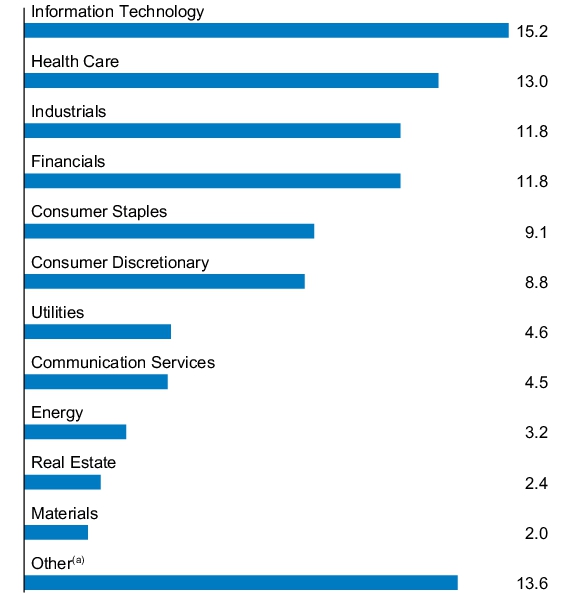

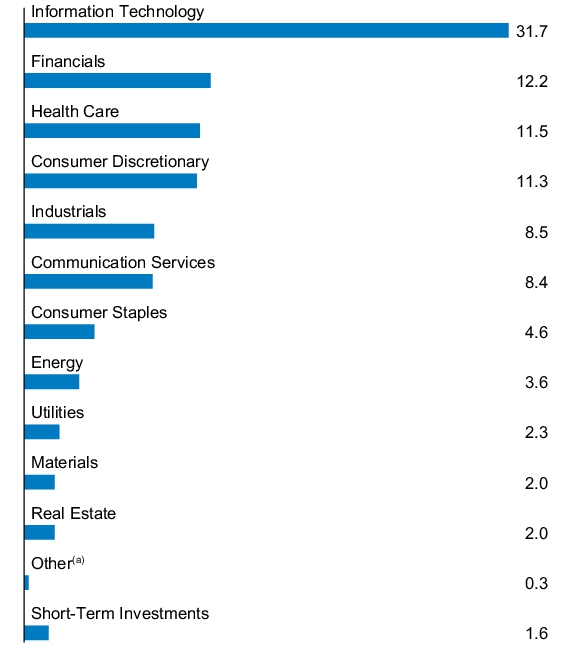

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Equity-Linked Notes that are linked to the S&P 500 Index. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Equity Premium Income Fund

Class R5 Shares/Ticker: JEPSX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Equity Premium Income Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Premium Income Fund

(Class R5 Shares) | $47 | 0.45% |

How did the Fund Perform?

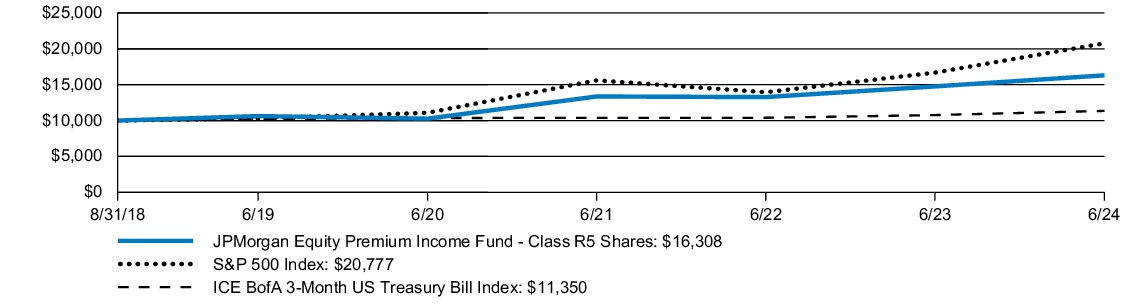

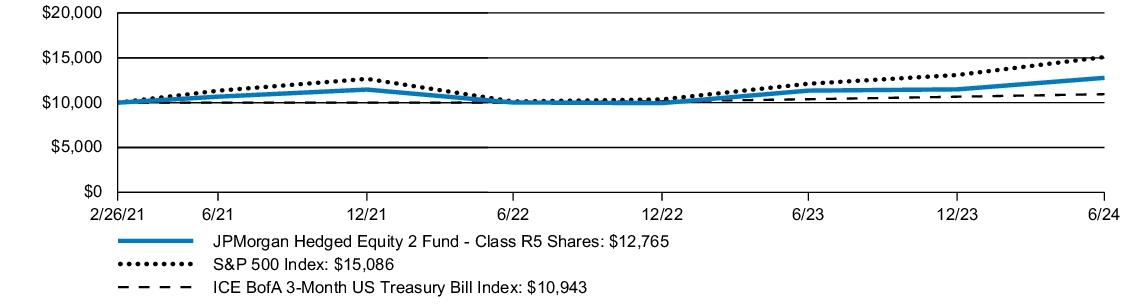

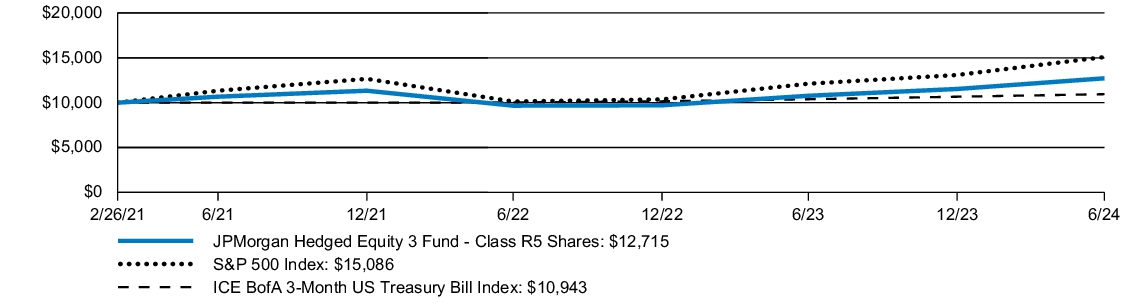

The JPMorgan Equity Premium Income Fund Class R5 Shares returned 10.48% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 42% of the Index’s positive return with 53% of its volatility.

The Fund’s security selection in the consumer discretionary and health care sectors contributed to performance.

An underweight position in Apple and an overweight position in Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the information technology and consumer staples sectors detracted from performance.

An underweight position in Nvidia and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | |

| JPMorgan Equity Premium Income Fund (Class R5 Shares) | August 31, 2018 | 10.48 | % | 8.94 | % | 8.75 | % |

| S&P 500 Index | | 24.56 | | 15.05 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 2.17 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class R5 Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $6,226,658 | |

| Total number of portfolio holdings | $131 | |

| Portfolio turnover rate | $176 | % |

| Total advisory fees paid (000's) | $14,847 | |

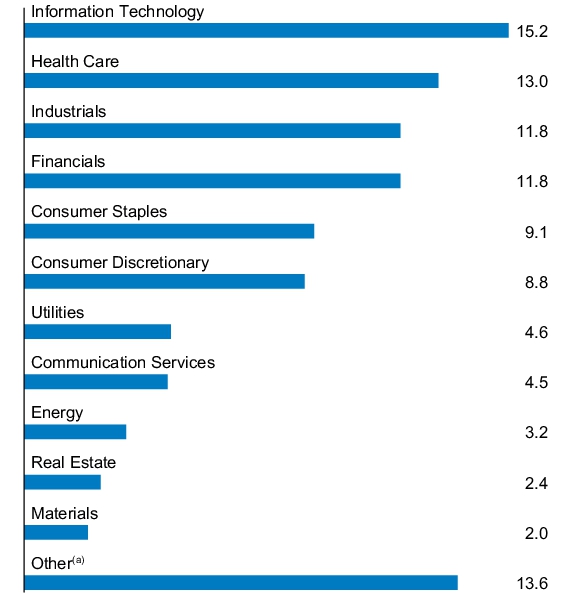

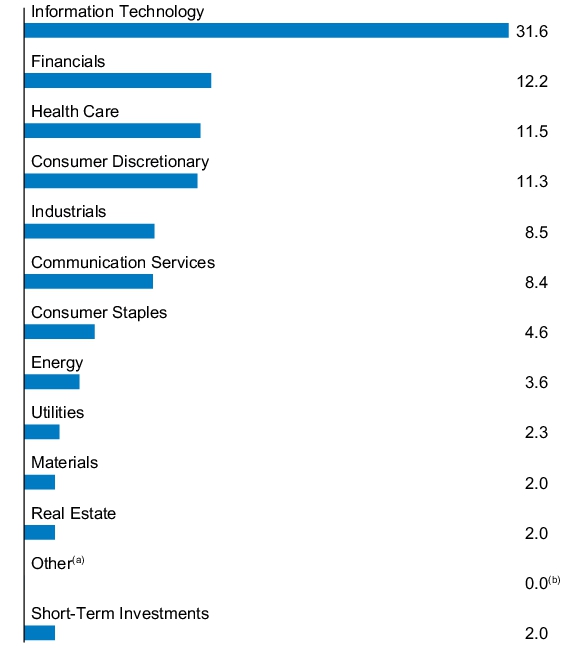

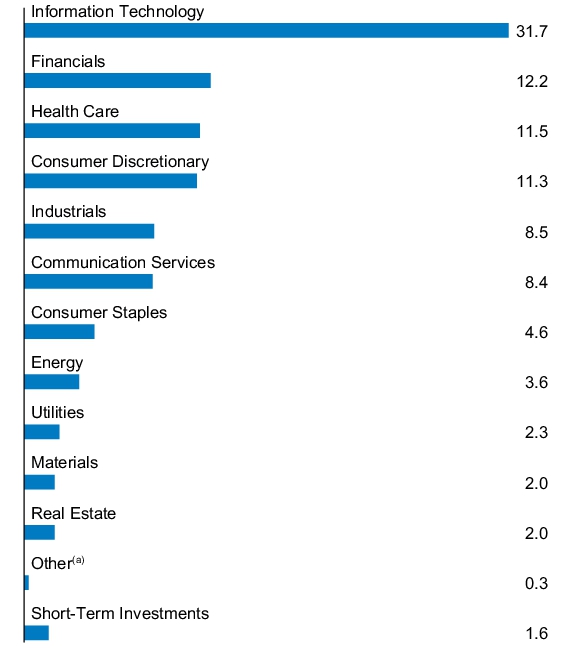

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Equity-Linked Notes that are linked to the S&P 500 Index. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Equity Premium Income Fund

Class R6 Shares/Ticker: JEPRX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Equity Premium Income Fund for the period July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Equity Premium Income Fund

(Class R6 Shares) | $36 | 0.35% |

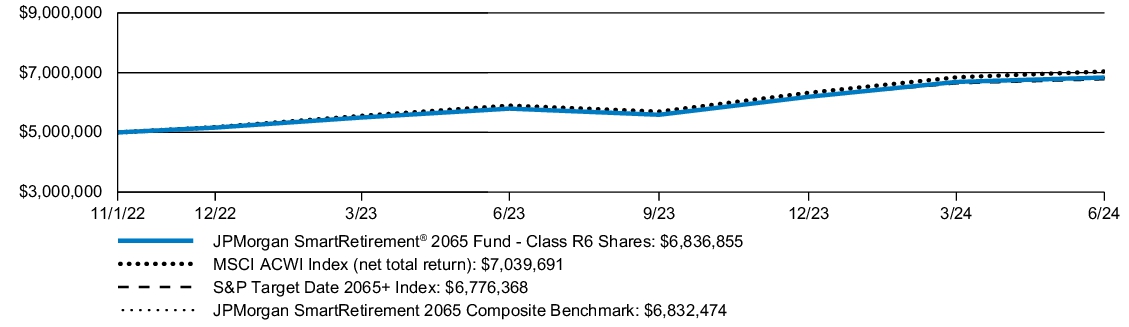

How did the Fund Perform?

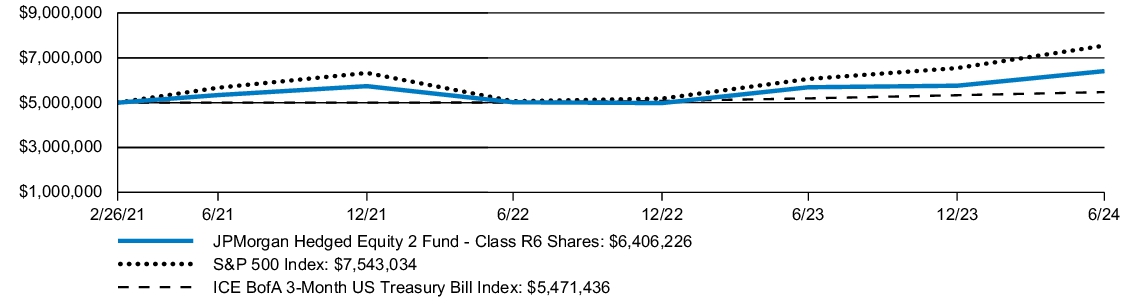

The JPMorgan Equity Premium Income Fund Class R6 Shares returned 10.51% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 42% of the Index’s positive return with 53% of its volatility.

The Fund’s security selection in the consumer discretionary and health care sectors contributed to performance.

An underweight position in Apple and an overweight position in Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the information technology and consumer staples sectors detracted from performance.

An underweight position in Nvidia and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | SINCE

INCEPTION | |

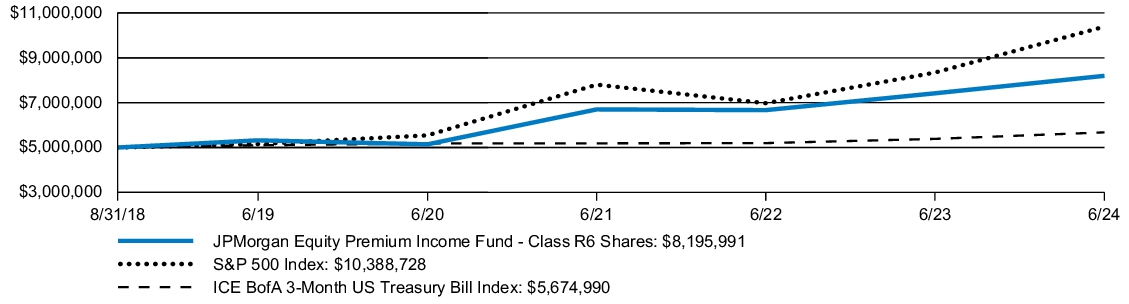

| JPMorgan Equity Premium Income Fund (Class R6 Shares) | August 31, 2018 | 10.51 | % | 9.03 | % | 8.85 | % |

| S&P 500 Index | | 24.56 | | 15.05 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 2.17 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

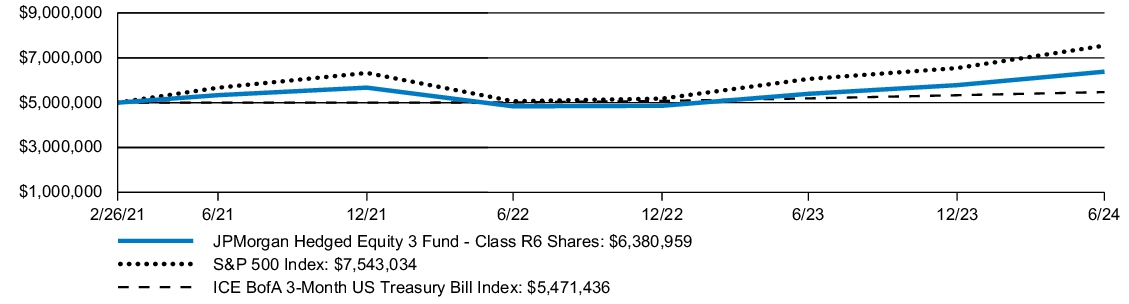

The graph illustrates comparative performance for $5,000,000 invested in Class R6 Shares of the JPMorgan Equity Premium Income Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from August 31, 2018 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $6,226,658 | |

| Total number of portfolio holdings | $131 | |

| Portfolio turnover rate | $176 | % |

| Total advisory fees paid (000's) | $14,847 | |

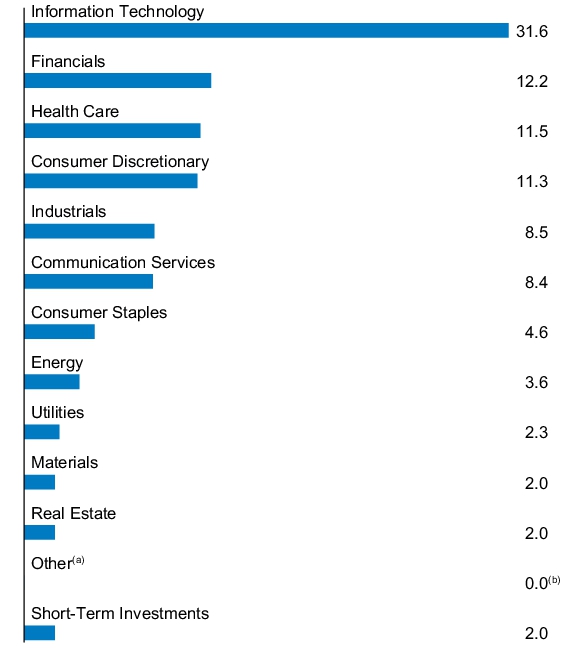

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Equity-Linked Notes that are linked to the S&P 500 Index. |

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Hedged Equity 2 Fund

Class A Shares/Ticker: JHDAX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Hedged Equity 2 Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Hedged Equity 2 Fund

(Class A Shares) | $89 | 0.84% |

How did the Fund Perform?

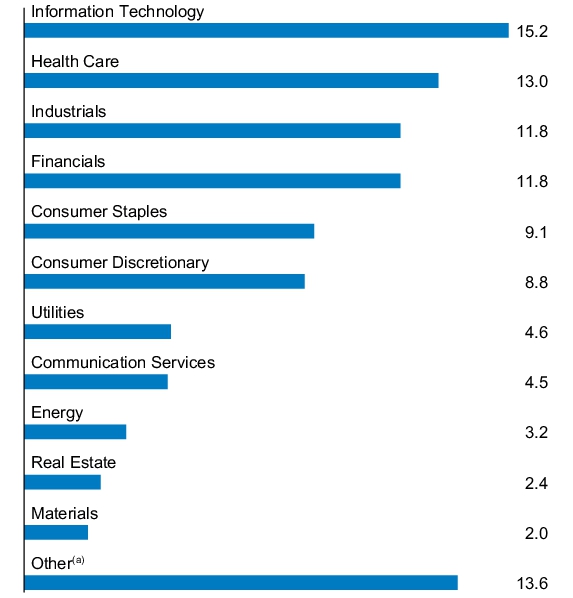

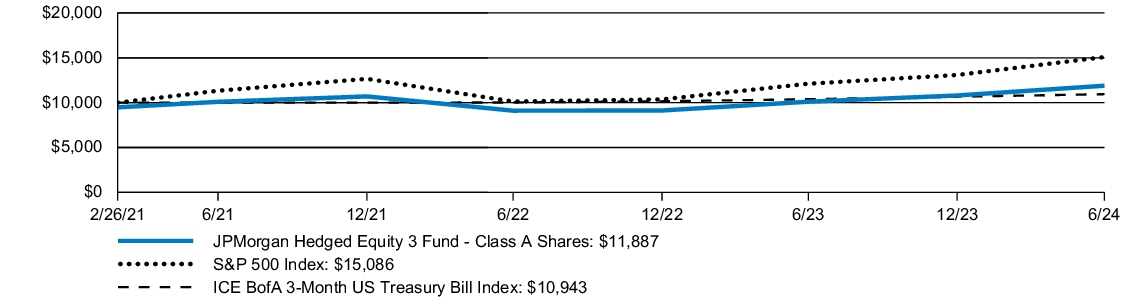

The JPMorgan Hedged Equity 2 Fund Class A Shares, without a sales charge, returned 12.12% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 50% of the Index’s positive return with 50% of its volatility.

The Fund’s security selection in the retail and media sectors contributed to performance.

Overweight positions in Nvidia and Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the telecommunications and REITs sectors detracted from performance.

An underweight position in Broadcom and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Hedged Equity 2 Fund (Class A Shares) | February 26, 2021 | 6.25 | % | 5.45 | % |

| JPMorgan Hedged Equity 2 Fund (Class A Shares) - excluding sales charge | | 12.12 | | 7.16 | |

| S&P 500 Index | | 24.56 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

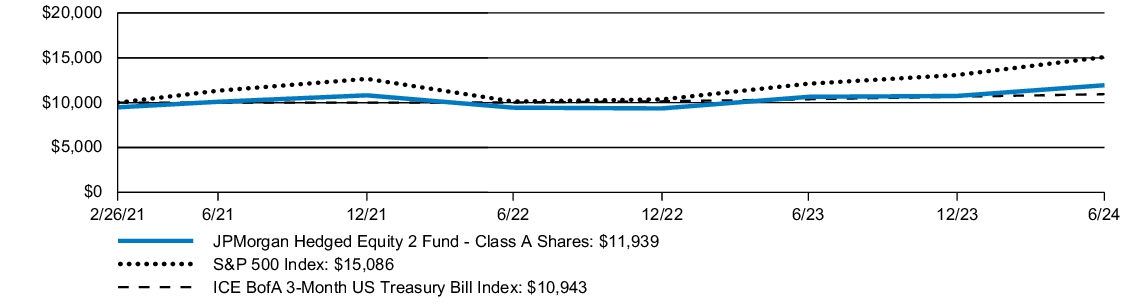

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Hedged Equity 2 Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from February 26, 2021 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and have been licensed for use by the adviser. Copyright © 2023. S&P Dow Jones Indices LLC, a subsidiary of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

Source ICE Data Indices, LLC is used with permission. ICE® is a registered trademark of ICE Data Indices, LLC or its affiliates and BofA® is a registered trademark of Bank of America Corporation licensed by Bank of America Corporation and its affiliates ("BofA"), and may not be used without BofA's prior written approval. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by J.P. Morgan Investment Management, Inc. ICE Data and its Third Party Suppliers accept no liability in connection with the use of such index data or marks. See prospectus for a full copy of the Disclaimer.

| Fund net assets (000's) | $4,752,540 | |

| Total number of portfolio holdings | $166 | |

| Portfolio turnover rate | $42 | % |

| Total advisory fees paid (000's) | $11,553 | |

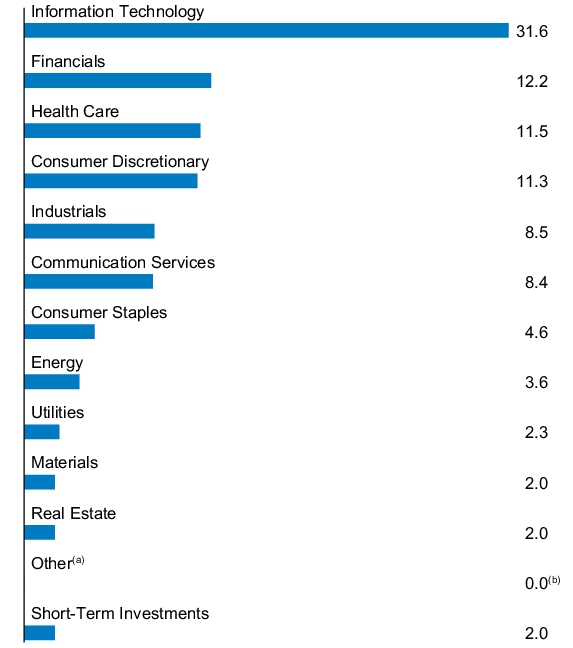

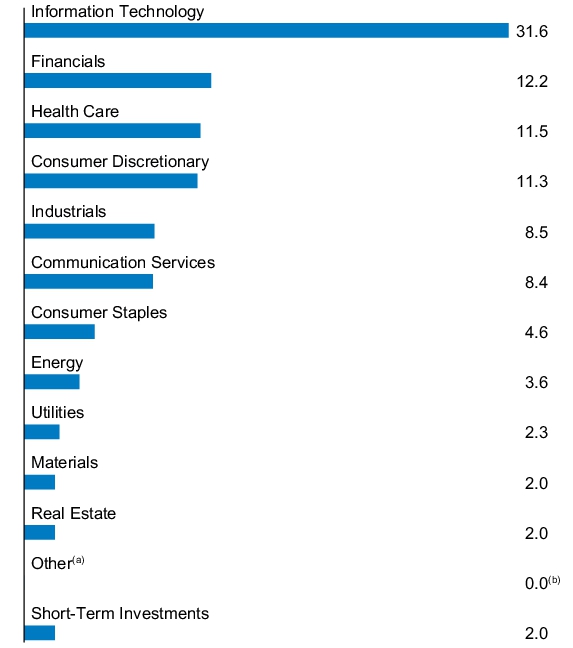

PORTFOLIO COMPOSITION - SECTOR

(% of Total Investments)

| (a) | Put Options Purchased |

| (b) | Amount rounds to less than 0.1%. |

Material changes to the Fund during the period

The Fund added “Technology Sector Risk” disclosure to its summary prospectus as of November 1, 2023. This disclosure was added in light of larger concentrations of portfolio securities in this sector.

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | June 30, 2024 (Unaudited)

JPMorgan Hedged Equity 2 Fund

Class C Shares/Ticker: JHDCX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Hedged Equity 2 Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Hedged Equity 2 Fund

(Class C Shares) | $142 | 1.34% |

How did the Fund Perform?

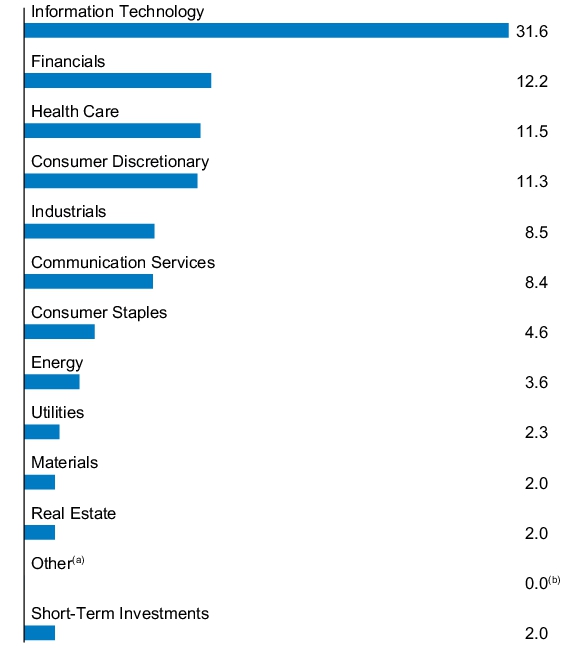

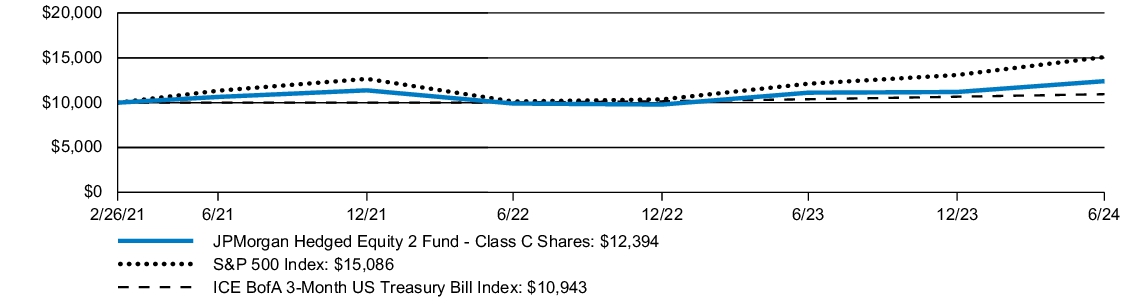

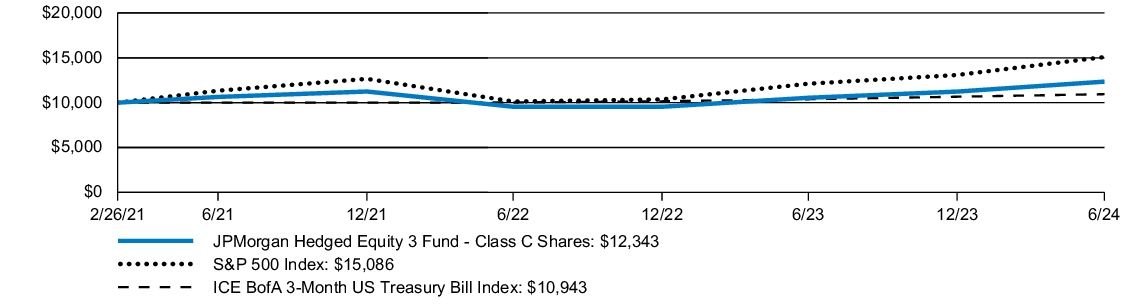

The JPMorgan Hedged Equity 2 Fund Class C Shares, without a sales charge, returned 11.55% for the year ended June 30, 2024. The S&P 500 Index (the “Index”) returned 24.56% and the ICE BofA 3-Month US Treasury Bill Index returned 5.42% for the year ended June 30, 2024.

The Fund captured 50% of the Index’s positive return with 50% of its volatility.

The Fund’s security selection in the retail and media sectors contributed to performance.

Overweight positions in Nvidia and Trane Technologies were among the top contributors to performance.

The Fund’s security selection in the telecommunications and REITs sectors detracted from performance.

An underweight position in Broadcom and an overweight position in Bristol Myers Squibb were among the top detractors from performance.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | SINCE

INCEPTION | |

| JPMorgan Hedged Equity 2 Fund (Class C Shares) | February 26, 2021 | 10.55 | % | 6.64 | % |

| JPMorgan Hedged Equity 2 Fund (Class C Shares) - excluding sales charge | | 11.55 | | 6.64 | |

| S&P 500 Index | | 24.56 | | 10.39 | |

| ICE BofA 3-Month US Treasury Bill Index | | 5.42 | | 4.58 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class C Shares of the JPMorgan Hedged Equity 2 Fund, the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index from February 26, 2021 to June 30, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and the ICE BofA 3-Month US Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmarks, if applicable. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of large companies in the U.S. stock market. The ICE BofA 3-Month US Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the ICE BofA 3-Month US Treasury Bill Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C Shares reflects Class A Share's performance for the period after conversion.

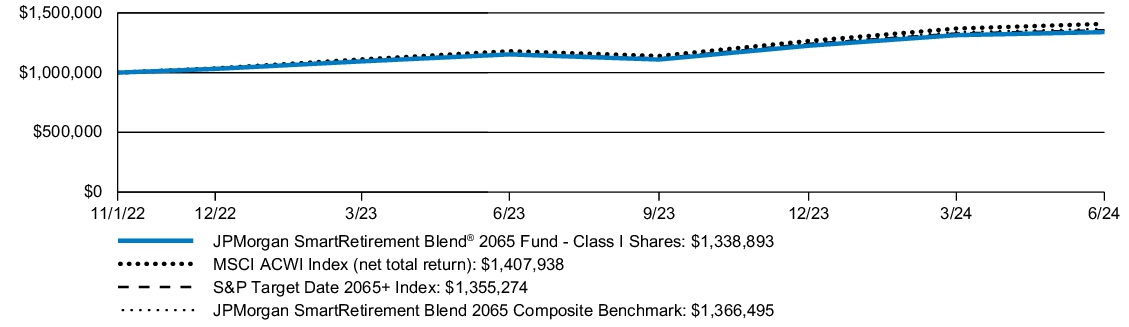

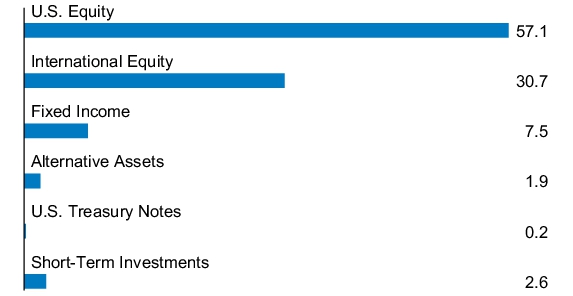

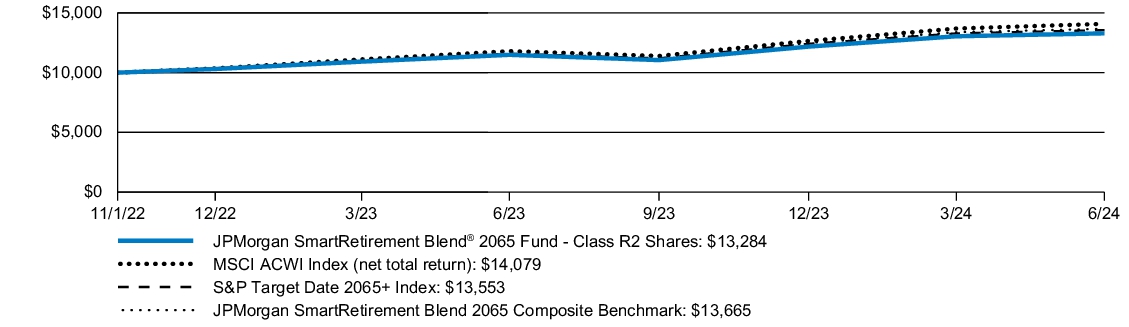

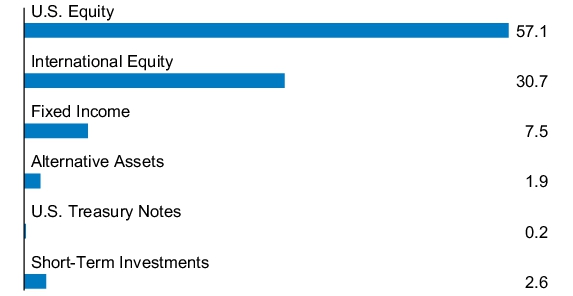

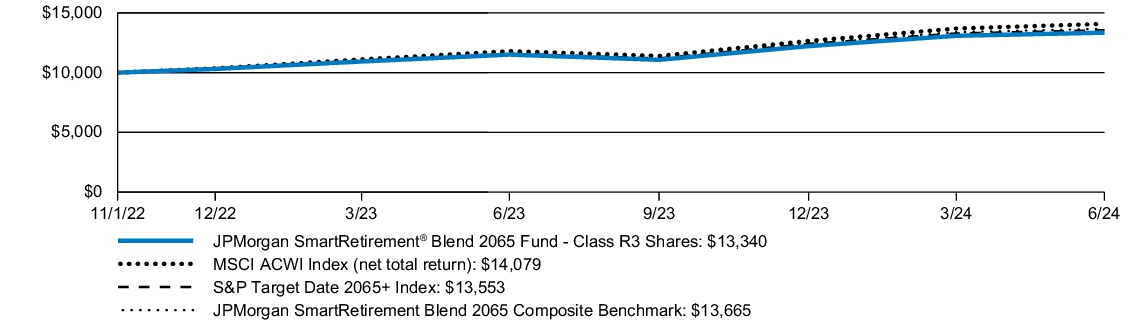

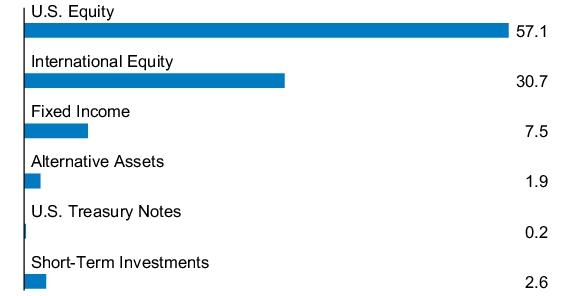

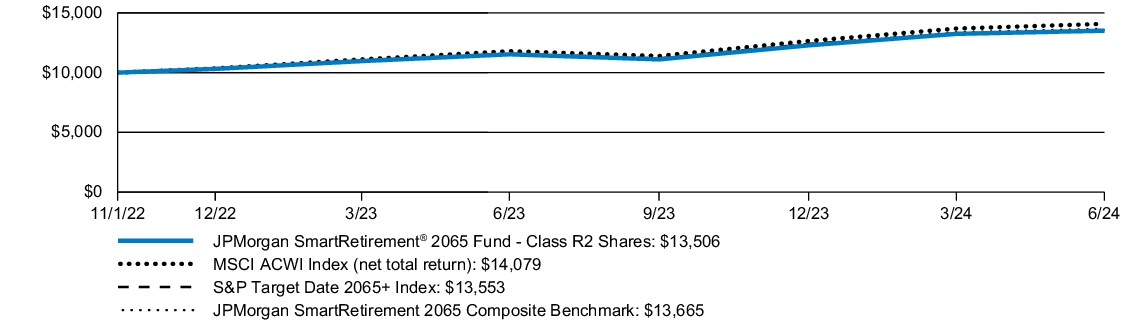

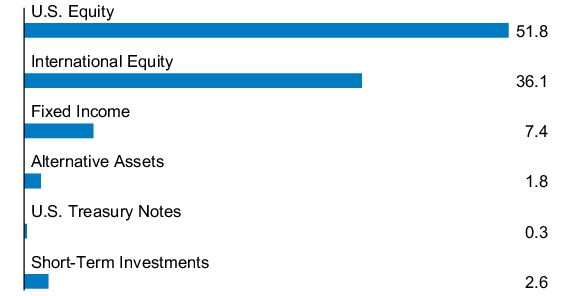

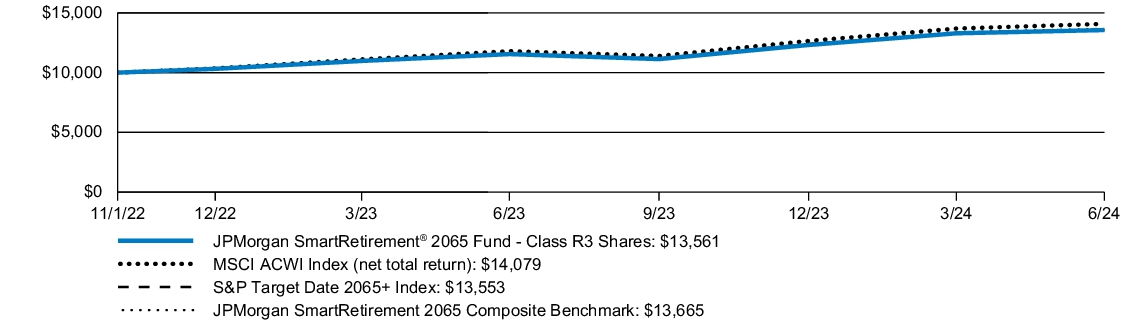

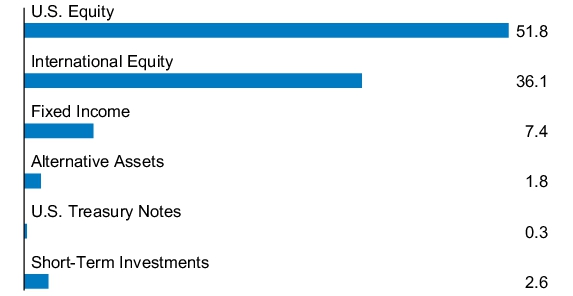

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.