PROSPECTUS SUPPLEMENT

To Prospectus dated May 30, 2018

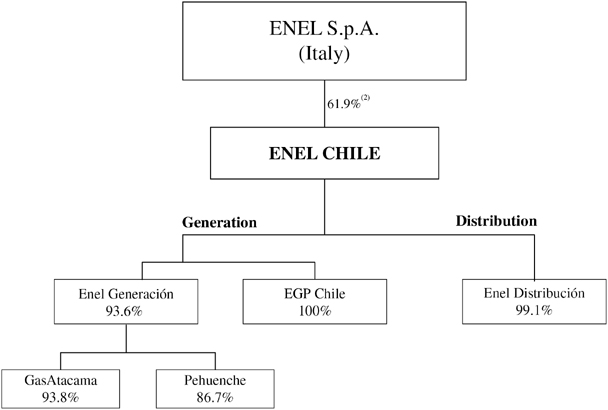

Enel Chile S.A.

US$1,000,000,000 4.875% Notes due 2028

We are offering US$1,000,000,000 4.875% Notes due 2028 (the “notes”). We will pay interest on the notes semi-annually in arrears on June 12 and December 12 of each year, commencing December 12, 2018. The notes will bear interest at a rate of 4.875% per year and will mature on June 12, 2028. We will pay principal and interest on the notes in United States dollars.

We may redeem the notes, in whole or in part, at any time and from time to time, at our option, at a redemption price equal to the greater of the outstanding principal amount of the notes and a “make-whole” amount, in each case plus accrued and unpaid interest, if any, on the principal amount of the notes being redeemed to the date of redemption. In addition, we may redeem the notes, in whole or in part, at any time and from time to time, beginning on the date that is three months prior to the scheduled maturity date of the notes, at our option, at a redemption price equal to 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest, if any, on the principal amount of the notes being redeemed to the date of redemption. We may also redeem the notes in whole, but not in part, at any time, if certain changes relating to Chilean tax laws occur, at 100% of the principal amount of the notes being redeemed, plus accrued and unpaid interest, if any, on the principal amount of the notes being redeemed to the date of redemption. See “Description of the Notes.”

The notes will be our unsecured and unsubordinated obligations and will rankpari passu in right of payment with all of our other existing and future unsecured and unsubordinated obligations, except for statutory priorities or obligations granted preference by operation of Chilean law. The notes will be effectively subordinated to all of our secured indebtedness with respect to the value of our assets securing that indebtedness and structurally subordinated to all of the existing and future liabilities of our subsidiaries. The notes will be issued in minimum denominations of US$1,000 and integral multiples of US$1,000 in excess thereof.

Investing in these notes involves risks that are described in the “Risk Factors” section of our Annual Report on Form20-F for the fiscal year ended December 31, 2017, as amended, and beginning on pageS-20 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

ANY OFFER OR SALE OF NOTES IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED DIRECTIVE 2003/71/EC (THE “PROSPECTUS DIRECTIVE”) MUST BE ADDRESSED TO QUALIFIED INVESTORS (AS DEFINED IN THE PROSPECTUS DIRECTIVE).

| | | | | | | | |

| | | Per Note | | | Total | |

Public offering price(1) | | | 98.824 | % | | US$ | 988,240,000 | |

Underwriting discount | | | 0.450 | % | | US$ | 4,500,000 | |

Proceeds to us (before expenses)(1) | | | 98.374 | % | | US$ | 983,740,000 | |

| (1) | Plus accrued interest, if any, from June 12, 2018, if settlement occurs after that date. |

We intend to apply to list the notes on the New York Stock Exchange (the “NYSE”). We expect trading in the notes on the NYSE to begin within 30 days after the original issue date. If such a listing is obtained, we will have no obligation to maintain such listing, and we may delist the notes at any time. There is currently no established trading market for the notes.

The notes may not be publicly offered or sold, directly or indirectly, in the Republic of Chile, or to any resident of Chile, except as permitted by applicable Chilean law. The notes will not be registered under Law No. 18,045, as amended (Ley de Mercado de Valores or the “Securities Market Law”), with the Financial Market Commission (Comisión para el Mercado Financiero or the “CMF”) and, accordingly, the notes cannot and will not be offered or sold to persons in Chile except in circumstances which have not resulted and will not result in a public offering under Chilean law, and/or in compliance with General Rule (Norma de Carácter General) No. 336, dated June 27, 2012, issued by the CMF (“CMF Rule 336”). Pursuant to CMF Rule 336, the notes may be privately offered in Chile to certain “qualified investors,” identified as such therein (which in turn are further described in General Rule No. 216, dated June 12, 2008, issued by the CMF). See “Underwriting Selling—Restrictions—Chile.”

Delivery of the notes is expected to be made to purchasers in book-entry form only through the facilities of The Depository Trust Company, for the benefit of its participants, including Euroclear Bank SA/NV and Clearstream Banking, société anonyme, Luxembourg on or about June 12, 2018.

Joint Book-Running Managers

| | | | | | | | | | | | |

| BBVA | | Citigroup | | J.P. Morgan | | Morgan Stanley | | Santander | | | Scotiabank | |

The date of this prospectus supplement is June 7, 2018.