- ENIC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Enel Chile (ENIC) 6-KCurrent report (foreign)

Filed: 18 Oct 17, 12:00am

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2017

Commission File Number: 001-37723

Enel Chile S.A.

(Translation of Registrant’s Name into English)

Santa Rosa 76

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [X]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [X]

Indicate by check mark whether by furnishing the information

ontained in this Form, the Registrant is also thereby furnishing the

information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes [ ] No [X]

If °;Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

SIGNIFICANT EVENT

Enel Chile S.A.

Securities Registration Record N° 1139

Santiago October 13, 2017

Ger. Gen. N° 027/2017

Mr. Carlos Pavez T.

Superintendent of Securities and Insurance

Superintendence of Securities and Insurance

Av. Libertador General Bernardo O’Higgins N° 1449

Santiago, Chile

Ref.: SIGNIFICAN EVENT

Dear Sir,

In accordance with articles 9 and 10, paragraph 2, under the Securities Market Law N° 18,045, and as established under General Norm N°30 of the Superintendence, duly authorized on behalf of Enel Chile S.A (“Enel Chile” or the “Company”), I hereby inform you that the Company has become aware of the response issued by the Superintendence the through Official Letter No. 27,562 dated October 13, 2017, to the reserved consultation filed by the Company on that same date.

The Board of Directors of Enel Chile will analyze the response received at a forthcoming session and will duly inform to the Superintendence and the market in general, through significant event, the impacts of it in the design of the operation whose scheme was informed by a significant event dated August 25, 2017.

Attached is a copy of the consultation and the Official Letter abovementioned.

Sincerely yours,

Nicola Cotugno

Chief Executive Officer

Enel Chile S.A.

c.c.: Banco Central de Chile (Central Bank of Chile)

Bolsa de Comercio de Santiago (Santiago Stock Exchange)

Bolsa Electrónica de Chile (Chile Electronic Stock Exchange)

Bolsa de Corredores de Valparaíso (Valparaíso Stock Exchange)

Banco Santander - Representantes Tenedores de Bonos (Bondholders Representative)

Depósito Central de Valores (Central Securities Depositary)

Comisión Clasificadora de Riesgos (Risk Classification Commission)

OFORD.: Nº27562

Background: Your confidential presentation

Subject: Reports

SGD.: Nº2017100179544

Santiago, October 13, 2017

From : Superintendence of Securities and Insurance

To : Chief Executive Officer

ENEL CHILE S.A.

We have received your inquiry regarding the corporate reorganization, that was disclosed through the significant event dated August 25, 2017, involving the merger by incorporation of Enel Green Power Latin America Limitada into Enel Chile S.A. (the “Merger”) and the public tender offer (“TO”) by Enel Chile S.A. (“Enel Chile”) to purchase up to 100% of the shares issued by Enel Generación Chile S.A. (“Enel Generación”) held by minority shareholders.

Your presentation states that the operation is subject to certain conditions precedent including the following: (i) regarding the Merger, the TO to purchase shares of Enel Generación must be declared successful (requiring that Enel Chile owns at least 75% of Enel Generación shares) and (ii) regarding the TO of Enel Generación, (a) Enel Chile must reach a controlling ownership share of over 75% of Enel Generación; (b) the shareholders of Enel Generación must have approved amending the bylaws so as to eliminate the shareholding concentration limit established by Title XII of D.L. 3,500 (c) the Merger must have been approved and enabled to be carried out without restrictions (other than those related to the TO of Enel Chile) and (d) Enel Chile must have sufficient shares to be delivered to the shareholders of Enel Generación that participate in the TO.

Before going into the detail of your presentation, it is worth mentioning that since the facts of this case are of public knowledge and also taking into account public trust and the interests of the investors involved, it is reasonable to lift the confidentiality of the presentation, as stated by D.L. No 3,538/1980, article 23, paragraph 2.

You request that this Superintendence confirm that, according to the provisions of Title XXV of Law 18,045 and the General Norm N°104, Enel Chile is not precluded from including within the terms and conditions of the TO a condition to the success of the transaction, specifically that all shareholders who accept to tender their shares in the TO must assign a portion of the price per share to purchase the first issued shares of Enel Chile and allowing Enel Chile to withhold such portion of the price.

2

In this regard, and only with respect to the specific inquiry you posed in your presentation, this Superintendence sees no inconvenience in including as part of the procedure of the TO of Enel Generación that the shareholders who accept selling their shares in the TO use part of the price per share they will receive to purchase first issued shares of Enel Chile, and that Enel Chile withholds this part of the price as payment for the shares, insofar they comply with the requirements and conditions established by Title XXV of the Securities Market Law and General Norm N°104 and they safeguard information transparency and the equitable treatment of all shareholders in order to avoid information asymmetry. The abovementioned is without prejudice of the board of directors’ responsibility in terms of guaranteeing the best interest of the Company and its shareholders.

Wf 769326

JAG/CSC/PTG

Cordially,

Electronic letter, may be reviewed athttp://www.svs.cl/validar_oficio/

Folio: 201727562778740kWkbrwplkIHyUlQTEuOOPusaCykodf

3

Santiago, October 13, 2017

Ger. Gen. N° 25/2017

Mr. Carlos Pavez Tolosa

Superintendent of Securities and Insurance

Av. Libertador General Bernardo O’Higgins N° 1449Santiago, Chile

Ref: Confidential inquiry related to the subject

Dear Mr. Superintendent,

Pursuant to the powers of the Superintendence of Securities and Insurance as established by Law No3,538/1980 article 4 letter a), and based on the authority referred to in letter b) of the same legal provision, we confidentially request you respond the inquiry included in this letter regarding the correct interpretation and application to the case described below.

I. Background

1. Pursuant to the information submitted to this Superintendence through the significant event dated August 25, 2017, Enel Chile S.A. (“Enel Chile”) is evaluating a corporate reorganization project consisting in the merger by incorporation of Enel Green Power Latin America Limitada (“Enel Green Power”) into Enel Chile ( the “Merger”) and a Public Tender Offer (“TO”) to be carried out by Enel Chile to acquire up to 100% of the shares issued by Enel Generación Chile S.A. owned by its minority shareholders. (“Enel Generación TO”).

2. The operation described above will allow (i) Enel Chile, through the Merger, to indirectly participate and own assets in the non-conventional renewable energy business that Enel Green Power develops and owns in Chile; and (ii) the shareholders of Enel Generación, through the TO, to own shares of Enel Chile, and therefore participate in the conventional generation business, non-conventional renewable electricity generation business and electricity distribution.

3. The operation will be subject to certain conditions precedent, which will be informed in detail later, including the following that must be considered for this Inquiry:

(i) Merger: The Enel Generación TO must be declared successful according to its particular terms and conditions.

(ii) Enel Generación TO: (a) Enel Chile must reach a controlling ownership share of Enel Generación, which will be determined by the offeror later, but, in any event, above 75% of the shares of such company; (b) theshareholders of Enel Generación must have approved amending the bylaws to eliminate the shareholding concentration limit established by Title XII of D.L. 3,500 which states that no person shall hold more than 65% of the capital with voting rights of the company, and the remaining limitations regarding shareholdings established by Title XII of D.L. 3,500 (c) the Merger must have been approved and enabled to be carried out without restrictions, and (d) Enel Chile must have sufficient shares to exchange for the shares held by the shareholders of Enel Generación that participate in the TO.

4

4. In order to avoid any distortions – even temporary ones – regarding the ownership share of Enel Chile’s shareholders, the effects of the complete operation are expected to occur in one same date. The effects of the Merger would occur on the date the declaration of a successful Enel Generación TO is published which is also the Enel Generación TO payment date.

5. In order to allow the shareholders of Enel Generación to become shareholders of Enel Chile, the Enel Generación TO will consider that such shareholders will receive a certain proportion of Enel Chile’s first issued shares (to be determined later by the offeror). In this regard, the shareholders of Enel Chile must approve a capital increase that would allow the company to have the sufficient number of shares to deliver to those shareholders of Enel Generación that decide to sell their shares as part of the Enel Generación TO.

II. Structure Implementation and Inquiries

Enel Chile is analyzing different possible structures to enable the delivery of Enel Chile shares to those shareholders of Enel Generación that accept selling their shares in the Enel Generación TO. One of such processes is described in this presentation, and the respective inquiries are included below.

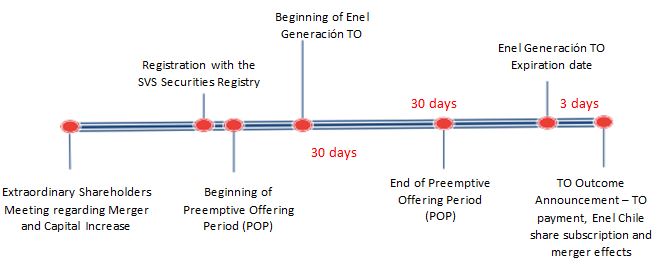

1. The process considers the main milestones identified in the diagram below, which are described later in this presentation.

5

2. This structure assumes that Enel Chile shareholders approve the capital increase of the company and a sufficient number of new shares are issued to deliver to the shareholders of Enel Generación that decide to participate in the TO and sell their shares (“Enel Chile Capital Increase”). The capital increase of Enel Chile will only be payable in cash.

3. Once the new shares resulting from the capital increase are registered in the Registry of this Superintendence, in accordance with Law 18,046 regarding Corporations (the “Chilean Companies Act”), the preemptive offering period will begin. The shares of Enel Chile that are not subscribed during the preemptive offering period will be delivered to the shareholders of Enel Generación that had sold their shares in the Enel Generación TO, as described later in this presentation.

4. The subscription and payment of the new shares issued as a result of the Enel Chile Capital Increase will be subject to the following conditions precedent:

(i) That by the end of the preemptive offering period, a certain number of newly issued shares are available to be delivered in the Enel Generación TO; and

(ii) That the Enel Generación TO is declared successful according to its particular terms and conditions.

5. The Enel Generación TO will start a few days after the preemptive offering period begins. This TO will consider a price payable in cash to shareholders who accept to sell their shares. The success of the Enel Generación TO, in accordance to common law as well as articles 203 and 210 of the Securities Market Law 18,045 ( “Securities Market Law”) regarding legal instruments, will be subject to the condition thatall shareholders that accept to tender their shares in the Enel Generación TO assign a portion of the price in cash they receive (such portion will be properly informed in the Initial Enel Generación TO Announcement and Prospectus) to acquire first issued shares of Enel Chile. Therefore, in addition to transferring and delivering the shares and other documentation commonly required as proof of acceptance in a tender offer process, shareholders of Enel Generación that accept to sell their shares in the Enel Generación TO must sign a share subscription agreement for first issued shares of Enel Chile for the price and number indicated in the Initial Enel Generación TO Announcement and Prospectus. The effects of these contracts will occur on the payment date of the TO.

We also stress that the terms of the condition previously described will be applicable to all shareholders that sell their shares in the Enel Generación TO, so that, allshareholders will receive equal treatment in accordance with article 209 of the Securities Market Law.

6

6. To facilitate the subscription and payment of the Enel Chile shares by those Enel Generación’ shareholders that decide to sell their shares in the Enel Generación TO, the portion of the price of the Enel Generación TO to be assign to acquire the shares of Enel Chile will be withheld by Enel Chile and accounted for as payment for the subscription of Enel Chile shares. The remaining portion of the price will be paid in cash to the shareholders of Enel Generación on the payment date of the Enel Generación TO.

III. Inquiry

With regard to the process previously described, we respectfully request that you confidentially confirm that according to the provisions of Title XXV of the Securities Market Law 18,045 and the General Norm N°104 of this Superintendece, Enel Chile is not precluded from including within the terms and conditions of the TO a condition that must be satisfied in order to declare the transaction a success. Specifically that all shareholders who accept to sell their shares in the TO must assign a portion of the price they receive in cash (such portion will be properly informed in the Initial Enel Generación TO Announcement and Prospectus) to purchase the first issued shares of Enel Chile and allow Enel Chile to withhold such portion of the price to use as payment for its first issued shares that should be subscribed accordingly.

In this regard, it is worth mentioning that the minutes of the History of Law 19,705 include an opinion of the Superintendence of Securities and Insurance, which expresses that the law gives the offeror the liberty to ex-ante determine the conditions to be satisfied in order to complete the share acquisition transaction. Such conditions must be objective and explicit in a clear, detailed and highlighted manner in both the initial announcement and the prospectus.

The present Inquiry is confidential considering that the implementation process of the transaction described herein may change depending upon, among other considerations, the answer of this Superintendence to this Inquiry.

We are at your disposal for any further information you consider necessary to answer this inquiry. To do so, if additional information is needed, please contact the undersigned (domingo.valdes@enel.com | T + 562 2 630 9227).

Cordially,

Domingo Valdes P.

7

General Counsel

Enel Chile S.A.

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Enel Chile S.A. | |

| By: /s/ Nicola Cotugno | |

| -------------------------------------------------- | |

| Title: Chief Executive Officer |

Date: October 18, 2017