- ENIC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Enel Chile (ENIC) 6-KCurrent report (foreign)

Filed: 4 Dec 17, 12:00am

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of December, 2017

Commission File Number: 001-37723

Enel Chile S.A.

(Translation of Registrant’s Name into English)

Santa Rosa 76

Santiago, Chile

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [X]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [X]

Indicate by check mark whether by furnishing the information

ontained in this Form, the Registrant is also thereby furnishing the

information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes [ ] No [X]

If °;Yes” is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b): N/A

ENEL CHILE S.A.

Santa Rosa 76 Santiago, Chile

EXTRAORDINARY SHAREHOLDERS’ MEETING

To be held on December 20, 2017

To the Holders of American Depositary Shares of EnelChile S.A. (“ADS Holders”):

AnExtraordinary Shareholders’ Meeting, including any adjournments or postponements thereof(the “Meeting”), ofEnel Chile S.A., a publicly held stock corporation (sociedad anónima abierta) organized under the laws of the Republic of Chile(the “Company” or “Enel Chile”), will be held onDecember 20, 2017 at 10:00 A.M., local time, at Enel Chile Stadium, located at Carlos Medina No. 858, Independencia, Santiago, Chile. The purpose of the Meeting is to address the matters set forth in the accompanying Notice of Meeting.

The agenda items do not prevent the Meeting from exercising its full capacity to adopt, reject, or modify any of the foregoing or agree to something different as long as it relates to the matters included in the agenda.

ADS Holders may obtain a copy of relevant documentation that explains and supports the Reorganizationat the Company’s headquarters, located in Santa Rosa 76, 15th Floor, Santiago, Chile,commencing fifteen days prior to the Meeting. The information are also made available on the Company’swebsite: www.enelchile.cl.

Citibank N.A., as depositary (the “Depositary”), has fixed the close of business on November 20,2017 as the record date for determination of ADS Holders entitled to notice of and to instruct the Depositary how to vote at the Meeting. Accordingly, only ADS Holders of the American Depositary Receipts evidencing ADSs representing shares of Enel Chile common stock of record at the close of business on that date will be entitled to notice of and to instruct the Depositary how to vote at the Meeting.

The deadline for returning your Voting Instructions to the Depositary is 10:00 A.M. E.S.T. on December 15, 2017.

Your vote is important. Please sign, date and return your Voting Instructions as soon as possible to make sure that your shares are represented at the Meeting.

November 29, 2017

INFORMATION FOR EXTRAORDINARY SHAREHOLDERS’ MEETING

TO BE HELD ON DECEMBER 20, 2017

(this “InformationStatement”)

This Information Statement and the accompanying Notice and Voting Instructions are furnished inconnection with the solicitation by the Board of Directors of Enel Chile S.A. (the “Company” or “Enel Chile”) of instructions for the voting of shares of common stock underlyingAmerican Depositary Shares(“ADSs”) of the Company at the Extraordinary Shareholders’ Meeting (the “Meeting”) to be held onDecember 20, 2017, at 10:00 A.M., local time, at Enel Chile Stadium, located at Carlos Medina No. 858, Independencia, Santiago, Chile, and at any adjournment or postponement thereof.

This Information Statement and the accompanying Notice and Voting Instructions are first beingmailed or delivered to holders of American Depositary Receipts (“ADRs”) evidencing ADSs (“ADS Holders”) on or about November 29, 2017.

No Offer or Solicitation

THIS STATEMENT AND SOLICITATION OF VOTING INSTRUCTIONS SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES, NOR SHALL THERE BE ANY SALE OF THE SECURITIES DESCRIBED HEREIN, IN ANY JURISDICTION, INCLUDING THE UNITED STATES, IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE SECURITIES LAWS OF SUCH JURISDICTION. NO OFFERING OF SECURITIES SHALL BE MADE EXCEPT BY MEANS OF A PROSPECTUS MEETING THE REQUIREMENTS OF SECTION 10 OF THE U.S. SECURITIES ACT OF 1933, AS AMENDED.

Important Information For Investors and Security Holders

The tender offer described herein has not yet commenced. If the tender offer is commenced, tender offer materials will be made available and filed with the U.S. Securities and Exchange Commission (the

“SEC”) in accordance with applicable U.S. federal securities laws and SEC rules.In connection with the proposed tender offer, Enel Chile has filed with the SEC a registration statement on Form F-4 (Registration No. 333-221156) containing a preliminary prospectus of Enel Chile regarding the proposed tender offer. The information contained in the preliminary prospectus is not complete and may be changed and the registration statement has not been declared effective by the SEC. Each of Enel Chile and Enel Generación may file with the SEC other documents in connection with the proposed tender offer.

This communication is not a substitute for the definitive prospectus that Enel Chile will file with the SEC, which will contain important information, including detailed risk factors. The definitive prospectus (when available) and related tender offer materials (when available) will be sent to shareholders and ADS Holders of Enel Generación.

INVESTORS AND SECURITY HOLDERS OF ENEL GENERACIÓN ARE URGED TOREAD THE DEFINITIVE PROSPECTUS AND OTHER TENDER OFFER MATERIALS THAT ARE FILED OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION, INCLUDING THE FULL DETAILS OF THE TENDER OFFER.

Investors and security holders will be able to obtain free copies of the tender offer materials and other documents filed with the SEC by Enel Chile and Enel Generación on the SEC’s website atwww.sec.gov. Copies of the tender offer materials and the other documents filed with the SEC by Enel Chile will also be available free of charge on the Enel Chile Investor Relations website at www.enelchile.cl or by contacting Enel Chile at Santa Rosa 76, Piso 15, Santiago, Chile, Attention: Investor Relations or by phone at +56 2 2353 4400 or by E-mail at ir.enelchile@enel.com. Copies of the tender offer materials and the other documents filed with the SEC by Enel Generación will be available free of charge on the Enel Generación Investor Relations website at www.enelgeneracion.cl or by contacting Enel Generación S.A. at Santa Rosa 76, Piso 15, Santiago, Chile, Attention: Investor Relations or by phone at +56 2 2630 9000 or by E-mail at ir.enelgeneracionchile@enel.com.

ii

SOLICITATION OF VOTING INSTRUCTIONS

Voting Instructions that are properly completed, signed and received by Citibank N.A., asdepositary (the “Depositary”), prior to 10:00 A.M. E.S.T. on December 15,2017(the “Voting Instructions Deadline”), will be voted in accordance with the instructions of the persons executing the same. The Board encourages you to instruct the Depositary as more fully described in the Voting Instructions. Your voting instructions may be revoked at any time before they are exercised, by submitting to the Depositary written notice of revocation, submitting properly executed Voting Instructions dated as of a later date or by withdrawing the shares underlying the ADSs and attending the Meeting and voting in person.

If the Voting Instructions are properly executed and returned but no specific directions are made, the Depositary will vote the shares or other securities represented by the ADSs in favor all of the items proposed by the Board of Directors for approval by shareholders.

If no voting instructions are received by the Depositary from an ADS Holder on or before the Voting Instructions Deadline, such ADS Holder shall be deemed, and the Depositary shall deem such ADS Holder, to have instructed the Depositary to give a discretionary proxy with full power of substitution, to the Chairman of the Board of the Company or to a person designated by him, to vote the shares underlying the ADSs on any matters at the Meeting, and the Depositary will give such a discretionary proxy, except that no such instruction shall be deemed and no such discretionary proxy shall be given with respect to any matter as to which (i) the Chairman of the Board directs the Depositary that he does not wish such proxy to be given, (ii) substantial opposition exists by the ADS Holders or (iii) such matter materially and adversely affects the rights of ADS Holders.

The Depositary has fixed the close of business on November 20, 2017 as the record date for determination of ADS Holders entitled to notice of and to instruct the Depositary how to vote at theMeeting (the “ADS Record Date”). Accordingly, only ADS Holders of record, at the close of business onthe ADS Record Date, of our ADRs evidencing ADSs representing shares of common stock will be entitled to notice of and to instruct the Depositary how to vote at the Meeting.

As of the ADS Record Date for the Meeting, there were 49,092,772,762 shares of common stock of Enel Chile outstanding and entitled to vote at the Meeting. Each share of common stock is entitled to one vote. As of November 24, 2017, the most recent date for which information is reasonably available, there were 3,600,356,050 shares of common stock represented by ADSs. Each ADS represents 50 shares of common stock of the Company.

As of October 31, 2017: (i) Enel, S.p.A., a company organized under the laws of Italy, beneficially owned 60.6% of the common stock of the Company; (ii) Chilean private pension funds (Administradoras de Fondos de Pensionesor “AFPs”), in the aggregate, owned 10.7% of the Company’s common stock;(iii) Chilean stockbrokers, mutual funds, insurance companies, foreign equity funds, and other Chilean institutional investors collectively owned 19.0% of the Company’s common stock; (iv) ADS Holdersowned 7.3%of the Company’s common stock; and (v) the remaining2.3%of the Company’s commonstock was owned by 6,333 minority shareholders.

Items 1, 2, 3 and 5, which constitute proposals to approve the Reorganization as a related party transaction under Chilean law, the Merger, the Capital Increase, and the proposed amendments of the bylaws (estatutos) of Enel Chile, respectively, presented by the Board of Directors for the consideration and vote of shareholders at the Meeting, require the affirmative vote of at least two-thirds of the

iii

outstanding common stock of the Company. Approval of Items 4 and 6 presented by the Board of Directors for the consideration and vote of shareholders at the Meeting require the affirmative vote of at least a majority of the outstanding common stock of the Company. Item 7 will be presented by the Board of Directors of the Company to the shareholders of the Company for informational purposes only. See“The Meeting—Votes Required.”

In order to constitute a quorum, shares of stock representing a majority of the aggregate voting power of such shares must be present in person or represented by proxy at the Meeting.

If you have any questions regarding the matters to be voted on at the Meeting after reading this Information Statement, please contact the Investor Relations team for the Company, at +56 2 2353-4400, e-mail ir.enelchile@enel.com, or the Information Agent, Georgeson S.A., at 1-866-216-0459 (Stockholders from the U.S. and Canada Call Toll-Free), and at 1-781-575-2137 (Stockholders from Other Countries).

iv

| TABLE OF CONTENTS | |

| WHERE YOU CAN FIND MORE INFORMATION | 1 |

| SUMMARY | 3 |

| The Companies | 3 |

| Enel Chile S.A. | 3 |

| Enel Generación Chile S.A. | 3 |

| Enel Green Power Latin América S.A. | 4 |

| The Reorganization | 4 |

| Summary Historical Financial Information | 6 |

| Enel Chile | 6 |

| Enel Generación | 8 |

| EGPL | 10 |

| Summary Pro Forma Consolidated Financial Information | 11 |

| Tentative Transaction Timetable | 12 |

| THE MEETING | 14 |

| The Matters to be Voted Upon | 14 |

| Quorum | 15 |

| Votes Required | 15 |

| How to Vote | 15 |

| ITEM 1–APPROVAL OF THE REORGANIZATION AS A RELATED PARTY TRANSACTION | 16 |

| The Merger | 16 |

| The Capital Increase | 16 |

| The Tender Offer | 17 |

| Conditions of the Reorganization | 18 |

| Conditions of the Merger | 18 |

| Conditions of the Capital Increase | 18 |

| Conditions of the Tender Offer | 19 |

| Conditions of the Amendments to the Bylaws of Enel Generación | 20 |

| Risk Factors | 20 |

| ITEM 2–THE MERGER | 22 |

| Terms of the Merger; No Merger Agreement | 22 |

| Conditions of the Merger | 23 |

| Regulatory Approvals | 23 |

| Statutory Merger Dissenters’ Withdrawal Rights | 23 |

| ITEM 3–THE CAPITAL INCREASE | 25 |

| ITEM 4–AUTHORIZATION TO VOTE IN FAVOR OF THE AMENDMENTS TO THE ENEL | |

| GENERACIÓN BYLAWS (ESTATUTOS) | 26 |

| ITEM 5–AMENDMENT OF THE BYLAWS (ESTATUTOS) OF ENEL CHILE | 27 |

| ITEM 6–GENERAL AUTHORIZATION WITH RESPECT TO THE REORGANIZATION | 28 |

| ADDITIONAL INFORMATION | 29 |

| Opinions and Reports of Independent Evaluators and Independent Appraisers | 30 |

| Opinion of Independent Evaluator of Enel Chile (LarrainVial) | 30 |

| Opinion of Additional Independent Evaluator of Enel Chile (Econsult) | 31 |

| Opinion of Independent Evaluator of Enel Generación (Banchile) | 31 |

| Opinion of Additional Independent Evaluator of Enel Generación (ASSET Chile) | 32 |

| Report of Independent Appraiser of Enel Chile (Oscar Molina) | 33 |

| Report of Independent Appraiser of EGPL (Felipe Schmidt) | 33 |

| Documents of the Board of Directors, Directors’ Committees and Individual Directors | 34 |

| General Terms of the Reorganization | 34 |

| Pronouncement of the Board of Directors of Enel Chile | 34 |

| Report of the Directors’ Committee of Enel Chile | 34 |

| Statements of Individual Directors of Enel Chile | 35 |

| Pronouncement of the Board of Directors of Enel Generación | 35 |

| Report of the Directors’ Committee of Enel Generación | 35 |

| Statements of Individual Directors of Enel Generación | 36 |

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual, quarterly and current reports and other information with the U.S.Securities and Exchange Commission (the “SEC”). The Company’s SEC filings are available to the public from the SEC’s web site at www.sec.gov. You may also read and copy any document the Company files at the SEC’spublic reference room in Washington, D.C. located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of any document the Company files at prescribed rates by writing to the Public Reference Section of the SEC at that address. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Information about the Company,including its SEC filings, is also available on the Company’s website atwww.enelchile.cl. Except as otherwise specifically provided, information contained on and linked from the Company’s website is notincorporated by reference into this Information Statement.

The Company is “incorporating by reference” in thisInformation Statement specified documents that it files with the SEC, which means:

The Company incorporates by reference in this Information Statement the documents listed below and any future Annual Reports on Form 20-F and Reports on Form 6-K (to the extent designated in the Form 6-K as being filed and incorporated by reference into thisInformation Statement) of the Company that is filed with the SEC under the Securities ExchangeAct of 1934, as amended (the “Exchange Act”),after the date of this Information Statement:

Except as otherwise provided above, the Company is not incorporating any document or information furnished and not filed in accordance with SEC rules. Upon written or oral request, the Company will provide you with a copy of any of the incorporated documents without charge (not

including exhibits to the documents unless the exhibits are specifically incorporated by reference into the documents). You may submit such a request for this material to Enel Chile S.A., Santa Rosa 76, 15th Floor, Santiago, Chile, Attention: Investor Relations, +56 2 2353-4400, ir.enelchile@enel.com.

In accordance with Chilean laws and regulations, documents, reports and other information relating to the Reorganization have been made publicly available on the websites of Enel Chile S.A. (www.enelchile.cl), Enel Generación Chile S.A. (www.enelgeneracion.cl) and Enel Green Power SpA, an affiliate of Enel Green PowerLatin América S.A.(www.enelgreenpower.com).

2

SUMMARY

The Companies

Enel Chile S.A.

Santa Rosa 76

Santiago, Chile

Telephone: +56 2 2353-4400

www.enelchile.cl

Enel ChileS.A. (“Enel Chile”)is a publicly held stock corporation (sociedad anónima abierta) organized on March 1, 2016 under the laws of the Republic of Chile that traces its origins to Enersis S.A. (currently known as Enel Américas S.A.). Enel Chile was spun off from Enersis S.A. on April 21, 2016and currently owns and operates Enersis S.A.’s former electricity generation and distribution businesses in

Chile, including Enel Generación Chile S.A., independently from Enel Américas S.A. Enel Chile is asubsidiary of Enel S.p.A. (“Enel”), which currently holds beneficial ownership of 60.6% of Enel Chile.

Enel Chile is an electricity utility company engaged, through subsidiaries and affiliates, in the electricity generation and distribution businesses in Chile. As of December 31, 2016, Enel Chile had 6,351MW of installed capacity and 1.8 million distribution customers. Enel Chile’s installed capacity iscomprised of 28 generation facilities and a total of 111 generation units, of which 54.6% consists of hydroelectric power plants.

For additional information regarding Enel Chile, see the documents listed under “Where You Can Find More Information,” including the Enel Chile 2016 Form 20-F and the Enel Chile October 2017 Form 6-K, which are incorporated by reference into this Information Statement.

Enel Generación Chile S.A.

Santa Rosa 76

Santiago, Chile

Telephone: +56 2 2630-9000

www.enelgeneracion.cl

Enel GeneraciónChile S.A. (“Enel Generación”)is a publicly held stock corporation (sociedad anónima abierta) that was organized on December 1, 1943 under the laws of the Republic of Chile and was formerly known as Empresa Nacional de Electricidad S.A. or Endesa Chile. Empresa Nacional de Electricidad S.A. spun-off Endesa Américas S.A. on April 21, 2016, then holding its electricity generation business in Argentina, Colombia and Peru, as well as its minority interests in electricity generation, distribution and transmission operations in Brazil, and subsequently changed its name to Enel Generación Chile S.A.

Enel Generación is an electricity utility company engaged, directly and through subsidiaries and affiliates, in the electricity generation business in Chile. As of December 31, 2016, Enel Generación had 6,351 MW of installed capacity, with 28 generation facilities and a total of 111 generation units. Of Enel

Generación’s total installed capacity, 54.6% consists of hydroelectric power plants and 77% of EnelGeneración’s thermoelectric installed capacity is gas/fuel oil power plants, and the remaining 23% iscoal-fired steam power plants.

3

For additional information regarding Enel Generación, see the documents listed under “Where You Can Find More Information,” including the Enel Generación 2016 Form 20-F and the Enel Generación October 2017 Form 6-K, which are incorporated by reference into this Information Statement.

Enel Green Power Latin América S.A.

Avenida Presidente Riesco 5335, 15thFloor

Las Condes

Santiago, Chile

Telephone: +56 2 2899-9200

Enel Green Power Latin América S.A. (“EGPL”)is a closely held stock corporation (sociedad anónima cerrada) organized under the laws of the Republic of Chile, and is indirectly wholly owned by Enel, the parent company of the Enel group. Enel develops its renewable energy business and holds its renewable energy assets located in Chile primarily through EGPL.

EGPL is a renewable energy generation holding company engaged, through it wholly owned subsidiary Enel Green Power Chile Ltda. (“EGP Chile”), in the electricity generation business in Chile. Asof December 31, 2016, EGPL had 1,036 MW of installed capacity from 16 solar, wind, hydro andgeothermal generation facilities. Of EGPL’s installed capacity as of such date, 47.5%consisted of solar power plants, 43.6% consisted of wind power plants, and 8.9% consisted of hydro and geothermal power plants.

EGPL currently has 18 operational power plants with a total installed capacity of 1,196 MW consisting of 92 MW of hydroelectric power, 564 MW of wind power, 492 MW of solar power, and 48 MW of geothermal power. However, the 112 MW Sierra Gorda Este wind farm and the 48 MW Cerro Pabellón geothermal plant have not officially started commercial operations and are selling electricity on a test basis.

For additional information regarding EGPL, see the Enel Chile October 2017 Form 6-K (EGPL), which is incorporated by reference into this Information Statement.

The Reorganization

Enel Chile is proposing to conduct a corporation reorganization, which involves the following transactions:

4

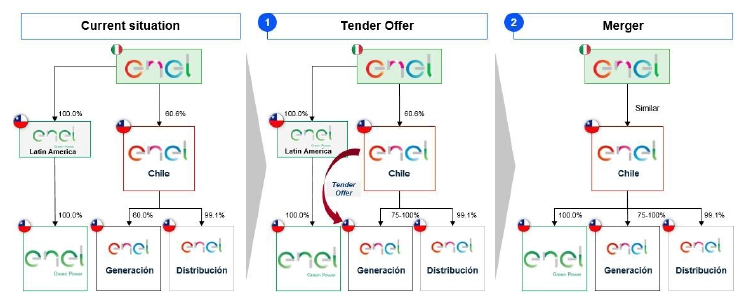

The proposed Reorganization seeks to consolidate Enel’s conventional and non-conventional renewable energy businesses in Chile under one company as shown below.

Under Chilean law, the Reorganization has been deemed a related party transaction, subject to the statutory requirements and protections of the Chilean Corporations Act.

Following the consummation of the Reorganization, Enel Chile will remain a majority owner of Enel Generación and will consolidate the Chilean electricity generation business through Enel Generación, the Chilean electricity distribution business through Enel Distribución Chile S.A.(“Enel Distribución”)and the Chilean non-conventional renewable energy business through EGPL. Enel will remain a majority owner of Enel Chile and, through its majority ownership in Enel Chile, will also remain the majority owner and ultimate parent of Enel Generación.See “Item 1–Approval of the Reorganization as a Related Party Transaction” for additional information.

5

Summary Historical Financial Information

Enel Chile

The following summary historical consolidated financial information as of December 31, 2016 and 2015 and for each year in the three-year period ended December 31, 2016 was derived from the audited consolidated financial statements of Enel Chile included in the Enel Chile 2016 Form 20-F, which is incorporated by reference into this Information Statement. The summary historical consolidated financial information as of December 31, 2014 and 2013 and for each year in the two-year period ended December 31, 2014 was derived from audited consolidated financial statements of Enel Chile not included or incorporated by reference into this Information Statement. The summary historical consolidated financial information as of June 30, 2017 and for the six months ended June 30, 2017 and 2016 have been derived from the unaudited consolidated interim financial statements of Enel Chile included in the Enel Chile October 2017 Form 6-K, which is incorporated by reference into this Information Statement. In April 2016, Enel Chile was spun-off from Enersis S.A. to hold the Chilean energy generation and distribution business of Enersis S.A. Pursuant to transitional relief granted by the SEC in respect of first time application of IFRS, summary historical consolidated financial information as of and for the year ended December 31, 2012 have been omitted. The summary historical consolidated financial informationshould be read in conjunction with Enel Chile’s Operating and Financial Review and the consolidatedfinancial statements and notes thereto incorporated by reference into this Information Statement.

The following table sets forth Enel Chile’ssummary historical consolidated financial data for the periods indicated:

| As of and for the six months ended June 30, | As of and for the year ended December 31, | ||||||||||||

| 2017(1) | 2017 | 2016 | 2016 | 2015 | 2014 | 2013 | |||||||

| (US$ millions) | (Ch$ millions) | (Ch$ millions) | |||||||||||

| Summary Consolidated Statement of | |||||||||||||

| Comprehensive Income Information | |||||||||||||

| Revenues and other operating income | 1,822 | 1,210,477 | 1,281,060 | 2,541,567 | 2,399,029 | 2,049,065 | 1,738,083 | ||||||

| Operating costs(2) | (1,480) | (983,293) | (985,639) | (1,973,778) | (1,873,540) | (1,666,315) | (1,346,460) | ||||||

| Operating income | 342 | 227,184 | 295,421 | 567,789 | 525,489 | 382,750 | 391,623 | ||||||

| Financial results(3) | (15) | (10,069) | 393 | (20,483) | (97,869) | (67,045) | (56,363) | ||||||

| Other non-operating income | 165 | 109,859 | 101 | 121,490 | 20,056 | 70,893 | 14,528 | ||||||

| Share of profit (loss) of associates and joint | |||||||||||||

| ventures accounted for using the equity | |||||||||||||

| method | (1) | (778) | 5,471 | 7,878 | 8,905 | (54,353) | 24,309 | ||||||

| Income before income taxes | 491 | 326,196 | 301,386 | 676,674 | 456,581 | 332,245 | 374,097 | ||||||

| Income tax expenses | (120) | (79,457) | (41,847) | (111,403) | (109,613) | (132,687) | (61,712) | ||||||

| Net income | 371 | 246,739 | 259,539 | 565,271 | 346,968 | 199,558 | 312,385 | ||||||

| Net income attributable to the parent | |||||||||||||

| Company | 255 | 169,660 | 176,643 | 384,160 | 251,838 | 162,459 | 229,527 | ||||||

| Net income attributable to | |||||||||||||

| non-controlling interests | 116 | 77,079 | 82,896 | 181,111 | 95,130 | 37,099 | 82,858 | ||||||

| Total basic and diluted earnings per average | |||||||||||||

| number of shares (Ch$/US$ per share) | 0.01 | 3.46 | 3.60 | 7.83 | 5.13 | 3.31 | 5.08 | ||||||

| Total basic and diluted earnings per average | |||||||||||||

| number of ADSs (Ch$/US$ per ADS) | 0.26 | 172.79 | 179.91 | 391.26 | 256.49 | 165.46 | 253.79 | ||||||

| Cash dividends per share (Ch$/US$ per | |||||||||||||

| share)(4) | 0.005 | 3.23 | 2.09 | 2.09 | — | — | — | ||||||

| Cash dividends per ADS (Ch$/US$ per | |||||||||||||

| ADS)(4) | 0.24 | 161.72 | 104.65 | 104.65 | — | — | — | ||||||

| Weighted average number of shares of | |||||||||||||

| common stock (millions) | 49,093 | 49,093 | 49,093 | 49,093 | 49,093 | 45,219 | |||||||

6

| Summary Consolidated Statement of | |||||||

| Financial Position Information | |||||||

| Total assets | 7,938 | 5,272,847 | 5,329,043 | 5,398,711 | 5,325,469 | 5,126,735 | 4,820,392 |

| Non-current liabilities | 1,754 | 1,165,434 | 1,320,963 | 1,178,471 | 1,270,006 | 1,122,585 | 826,478 |

| Equity attributable to the parent | |||||||

| Company | 4,317 | 2,868,011 | 2,636,673 | 2,763,391 | 2,592,682 | 2,472,201 | 2,438,837 |

| Equity attributable to non-controlling | |||||||

| interests | 1,105 | 733,863 | 647,821 | 699,602 | 609,219 | 611,864 | 626,947 |

| Total equity | 5,422 | 3,601,874 | 3,284,493 | 3,462,994 | 3,201,901 | 3,084,066 | 3,065,784 |

| Capital stock | 3,356 | 2,229,109 | 2,229,109 | 2,229,109 | 2,229,109 | 2,229,109 | 2,238,169 |

| Other Consolidated Financial Data | |||||||

| Capital expenditures (CAPEX)(5) | 206 | 137,052 | 70,851 | 222,386 | 309,503 | 196,932 | 128,239 |

| Depreciation, amortization and | |||||||

| impairment losses(6) | 119 | 79,328 | 83,367 | 197,587 | 150,147 | 141,623 | 127,720 |

(1) Solely for the convenience of the reader, Chilean peso amounts have been converted into U.S. dollars at the exchange rate of Ch$664.29 per US$1.00, as of June 30, 2017.

(2) Operating costs represent raw materials and supplies used, other work performed by the entity and capitalized,employee benefits expenses, depreciation and amortization expenses, impairment losses recognized in the period’sprofit or loss and other expenses.

(3) Financial results represent (+) financial income, (-) financial expenses, (+/-) foreign currency exchange differences and net gains/losses from indexed assets and liabilities.

(4) For 2016, cash dividends correspond to a payout ratio of 50% based on our 2016 annual consolidated net income as reported to the SVS, based on 10 months of results starting as of our date of formation on March 1, 2016, which therefore differs from the twelve months of net income included in the Enel Chile 2016 Form 20-F.

(5) Capital expenditures (CAPEX) figures represent cash flows used for purchases of property, plant and equipment and intangible assets for each year.

(6) For further detail, please refer to Note 28 of the Notes to the Enel Chile unaudited consolidated interim financial statements included in the Enel Chile October 2017 Form 6-K, which is incorporated by reference into this Information Statement.

7

Enel Generación

The following summary historical consolidated financial information as of December 31, 2016 and 2015 and for each year in the three-year period ended December 31, 2016 was derived from the audited consolidated financial statements of Enel Generación included in the Enel Generación 2016 Form 20-F, which is incorporated by reference into this Information Statement. The summary historical consolidated financial information as of December 31, 2014 and 2013 and for each year in the two-year period ended December 31, 2014 was derived from audited consolidated financial statements of Enel Generación not included or incorporated by reference into this Information Statement. The summary consolidated financial information as of June 30, 2017 and for the six months ended June 30, 2017 and 2016 have been derived from the unaudited consolidated interim financial statements of Enel Generación included in the Enel Generación October 2017 Form 6-K which is incorporated by reference into this Information Statement. In April 2016, Enel Generación completed the spin-off of its non-Chilean energy generation business as Endesa Américas S.A. The summary historical consolidated financial information for all periods has been restated to reflect the Endesa Américas S.A. business as discontinued operations. Pursuant to transitional relief granted by the SEC, summary historical consolidated financial information as of and for the year ended December 31, 2012 have been omitted as such information cannot be provided on a restated basis to reflect the spin-off of Endesa Américas S.A. without unreasonable effort or expense. The summary historical consolidated financial information should be read in conjunction with

Enel Generación’s Operating and Financial Review and the consolidated financial statements and notesthereto incorporated by reference into this Information Statement.

The following table sets forth Enel Generación’s summary historical consolidated financialinformation for the periods indicated:

| As of and for the six months ended June 30, | As of and for the year ended December 31, | ||||||||||||

| 2017(1) | 2017 | 2016 | 2016 | 2015 | 2014 | 2013 | |||||||

| (US$ millions) | (Ch$ millions) | (Ch$ millions) | |||||||||||

| Summary Consolidated | |||||||||||||

| Statement of Comprehensive | |||||||||||||

| Income Information | |||||||||||||

| Revenues and other operating | |||||||||||||

| income | 1,155 | 766,990 | 848,484 | 1,659,727 | 1,543,810 | 1,230,975 | 970,037 | ||||||

| Operating costs(2) | (915) | (608,117) | (614,406) | (1,228,341) | (1,141,991) | (978,713) | (700,715) | ||||||

| Operating income from | |||||||||||||

| continuing operations | 239 | 158,873 | 234,078 | 431,386 | 401,819 | 252,262 | 269,322 | ||||||

| Financial results(3) | |||||||||||||

| (25.4) | (16,882) | (6,852) | (35,679) | (114,252) | (77,345) | (73,995) | |||||||

| Other | |||||||||||||

| gains | 165 | 109,707 | 114 | 121,491 | 4,015 | 42,652 | 2,514 | ||||||

| Share of profit (loss) of associates | |||||||||||||

| and joint ventures accounted for | |||||||||||||

| using the equity | |||||||||||||

| method | (1) | (778) | 5,471 | 7,878 | 8,905 | (54,353) | 24,309 | ||||||

| Income from continuing | |||||||||||||

| operations before income | |||||||||||||

| taxes | 378 | 250,919 | 232,811 | 525,077 | 300,487 | 163,216 | 222,150 | ||||||

| Income tax expense, from | |||||||||||||

| continuing operations | (94) | (62,766) | (30,863) | (83,217) | (76,656) | (94,058) | (36,995) | ||||||

| Net income from continuing | |||||||||||||

| operations | 283 | 188,153 | 201,948 | 441,860 | 223,831 | 69,158 | 185,155 | ||||||

| Profit after tax from discontinued | |||||||||||||

| operations | — | — | 79,572 | 79,572 | 411,190 | 489,919 | 378,351 | ||||||

| Net income for the year | 283 | 188,153 | 281,520 | 521,432 | 635,021 | 559,077 | 563,506 | ||||||

| Net income attributable to the | |||||||||||||

| parent Company | 278 | 184,995 | 237,448 | 472,558 | 392,868 | 276,027 | 353,927 | ||||||

| Net income attributable to | |||||||||||||

| non-controlling | |||||||||||||

| interests | 5 | 3,158 | 44,072 | 48,874 | 242,153 | 283,050 | 209,579 | ||||||

| 8 | |||||||||||||

| As of and for the six months ended June 30, | As of and for the year ended December 31, | ||||||||||||

| 2017(1) | 2017 | 2016 | 2016 | 2015 | 2014 | 2013 | |||||||

| (US$ millions) | (Ch$ millions) | (Ch$ millions) | |||||||||||

| Basic and diluted earnings per | |||||||||||||

| share from continuing | |||||||||||||

| operations (Ch$/US$ per share). | 0.03 | 22.56 | 24.10 | 52.77 | 25.89 | 6.81 | 21.11 | ||||||

| Basic and diluted earnings per | |||||||||||||

| share from continuing | 1.02 | 676.67 | 723.10 | 1,583.10 | 776.70 | 204.30 | 633.30 | ||||||

| operations (Ch$/US$ per share). | |||||||||||||

| Total Basic and diluted earnings | |||||||||||||

| per share (Ch$/US$ per share) | 0.03 | 22.56 | 28.95 | 57.62 | 47.90 | 33.49 | 43.15 | ||||||

| Total Basic and diluted earnings | |||||||||||||

| per ADS (Ch$/US$ per ADS) | 1.02 | 676.67 | 868.53 | 1,728.50 | 1,437.00 | 1,004.70 | 1,294.50 | ||||||

| Cash dividends per share (Ch$/US$ | |||||||||||||

| per share) | 0.04 | 28.81 | 14.58 | 14.58 | 20.39 | 21.58 | 14.29 | ||||||

| Cash dividends per ADS (Ch$/US$ | |||||||||||||

| per ADS) | 1.3 | 864.3 | 437.4 | 437.4 | 611.7 | 647.4 | 428.7 | ||||||

| Number of shares of common stock | |||||||||||||

| (millions) | 8,202 | 8,202 | 8,202 | 8,202 | 8,202 | 8,202 | |||||||

| Summary Consolidated | |||||||||||||

| Statement of Financial Position | |||||||||||||

| Information | |||||||||||||

| Non-current assets and disposal | |||||||||||||

| groups held for sale or distribution | |||||||||||||

| to owners | 4,301.6 | 2,857,520 | 2,894,797 | 12,993 | 3,889,706 | 7,979 | — | ||||||

| Total assets | 4,915 | 3,265,298 | 3,432,338 | 3,399,682 | 7,278,770 | 7,237,672 | 6,762,125 | ||||||

| Non-current liabilities | 1,662.4 | 1,104,323 | 1,262,997 | 1,114,145 | 1,207,005 | 2,321,048 | 1,935,919 | ||||||

| Liabilities associated with disposal | |||||||||||||

| groups held for sale or distribution | |||||||||||||

| to owners | — | — | — | — | 1,851,784 | 5,490 | — | ||||||

| Equity attributable to the parent | |||||||||||||

| company | 2,693 | 1,788,710 | 1,572,250 | 1,700,962 | 2,648,190 | 2,700,280 | 2,651,968 | ||||||

| Equity attributable to | |||||||||||||

| non-controlling | |||||||||||||

| interests | 42 | 27,754 | 31,543 | 28,798 | 895,700 | 823,606 | 935,846 | ||||||

| Total equity | 2,734 | 1,816,464 | 1,603,793 | 1,729,760 | 3,543,890 | 3,523,886 | 3,587,814 | ||||||

| Capital stock(4) | 961 | 638,289 | 638,289 | 638,289 | 1,537,723 | 1,537,723 | 1,537,723 | ||||||

| Other Consolidated Financial | |||||||||||||

| Information | |||||||||||||

| Capital expenditures (CAPEX)(5) | |||||||||||||

| 155 | 103,086 | 75,639 | 194,880 | 537,805 | 421,314 | 292,017 | |||||||

| Depreciation, amortization and | |||||||||||||

| impairment losses(6) | |||||||||||||

| 89 | 58,869 | 66,021 | 163,386 | 115,042 | 113,766 | 92,577 | |||||||

| (1) | Solely for the convenience of the reader, Chilean peso amounts have been converted into U.S. dollars at the exchange rate of Ch$664.29 per US$1.00, as of June 30, 2017. |

| (2) | Operating costs represent raw materials and supplies used, other work performed by the entity and capitalized,employee benefits expenses, depreciation and amortization expenses, impairment loss recognized in the period’sprofit or loss and other expenses. |

| (3) | Financial results represent (+) financial income, (-) financial expenses, (+/-) foreign currency exchange differences and net gains/losses from indexed assets and liabilities. |

| (4) | Capital stock represents issued capital plus share premium. |

| (5) | Capital expenditures (CAPEX) figures represent cash flows used for purchases of property, plant and equipment and intangible assets for each year. |

| (6) | For further detail, please refer to Notes 8C and 27 of the Notes to the Enel Generación unaudited consolidated interim financial statements included in the Enel Generación October 2017 Form 6-K, which is incorporated by reference into this Information Statement. |

9

EGPL

The following summary historical consolidated financial information as of December 31, 2016 and 2015 and for each year in the two-year period ended December 31, 2016 was derived from the audited consolidated financial statements of EGPL included in the Enel Chile October 2017 Form 6-K (EGPL), which is incorporated by reference into this Information Statement. The summary consolidated financial information as of June 30, 2017 and for the six months ended June 30, 2017 and 2016 and income statements for the year ended December 31, 2014 have been derived from the unaudited consolidated interim financial statements of EGPL included in the Enel Chile October 2017 Form 6-K (EGPL), which is incorporated by reference into this Information Statement. Pursuant to Item 3.A.1 of Form 20-F, summary historical consolidated financial information as of and for the years ended December 31, 2013 and 2012 have been omitted as such information cannot be provided without unreasonable effort or expense. The summary historical consolidated financial information should be read in conjunction with

EGPL’s consolidated financial statements and notes thereto included in the Enel Chile October 2017 Form

6-K (EGPL), which is incorporated by reference into this Information Statement.

The following table sets forth EGPL’s summary historical consolidated financial information forthe periods indicated:

| For the six months ended June 30, | For the year ended December 31, | |||||||||

| 2017 | 2016 | 2016 | 2015 | 2014 | ||||||

| (US$ millions) | (US$ millions) | |||||||||

| Summary Consolidated | ||||||||||

| Statement of Comprehensive | ||||||||||

| Income Information | ||||||||||

| Revenues and other operating | ||||||||||

| income | 177,784 | 121,935 | 307,740 | 203,791 | 146,814 | |||||

| Operating costs(1) | (120,883) | (85,868) | (200,205) | (140,545) | (98,149) | |||||

| Operating income | 56,901 | 36,067 | 107,535 | 63,246 | 48,665 | |||||

| Financial results(2) | (40,422) | (26,520) | (99,536) | (42,697) | (15,972) | |||||

| Other gains | 67 | 5,687 | 8,167 | - | - | |||||

| Income before income taxes | 16,546 | 15,234 | 16,166 | 20,549 | 32,693 | |||||

| Income tax expense | 6,185 | 46,577 | 6,576 | (23,787) | (22,050) | |||||

| Net income | 22,731 | 61,811 | 22,742 | (3,238) | 10,643 | |||||

| Net income attributable to the | ||||||||||

| parent Company | 21,427 | 58,281 | 20,411 | (1,878) | 8,788 | |||||

| Net income attributable to | ||||||||||

| non-controlling interests | 1,304 | 3,530 | 2,331 | (1,360) | 1,855 | |||||

| Other Consolidated Financial | ||||||||||

| Information | ||||||||||

| Capital expenditures (CAPEX)(4) | 136,420 | 380,086 | 532,486 | 218,883 | 274,301 | |||||

| Depreciation, amortization and | ||||||||||

| impairment losses(5) | 52,858 | 32,206 | 81,993 | 50,695 | 22,861 | |||||

| (1) | Operating costs represent raw materials and supplies used, other work performed by the entity and capitalized, employee benefits | |||||||||

| expenses, depreciation and amortization expenses, impairment loss recognized in the period’s profit or loss and other expenses. | ||||||||||

| (2) | Financial results represent (+) financial income, (-) financial expenses, (+/-) foreign currency exchange differences and net | |||||||||

| gains/losses from indexed assets and liabilities. | ||||||||||

| (3) | Capital stock represents issued capital. | |||||||||

| (4) | Capital expenditures (CAPEX) figures represent cash flows used for purchases of property, plant and equipment and intangible | |||||||||

| assets for each year. | ||||||||||

| (5) | For further detail, please refer to Note 27 of the Notes to the EGPL unaudited consolidated interim financial statements included | |||||||||

| in the Enel Chile October 2017 Form 6-K (EGPL), which is incorporated by reference into this Information Statement. | ||||||||||

10

Summary Pro Forma Consolidated Financial Information

The following summary pro forma consolidated financial information give effect to the Tender Offer and the Merger and should be read in conjunction with the Unaudited Pro Forma Consolidated Financial Information and related notesmade available on Enel Chile’s website at www.enelchile.cl.For accounting purposes, the Tender Offer will be accounted for as acquisitions of minority interests and the Merger will be accounted for as a combination of entities under common control. The historical financial information set forth below has been derived from, and is qualified by reference to, the consolidated financial statements of Enel Chile, Enel Generación and EGPL, and should be read in conjunction with those financial statements and notes thereto incorporated herein by reference. The Unaudited Pro Forma Consolidated Statements of Comprehensive Income for the years ended December 31, 2016, 2015 and 2014 give effect to the Tender Offer and the Merger as if they had been consummated on January 1, 2014, and the Unaudited Pro Forma Consolidated Statement of Financial Position as of June 30, 2017 gives effect to the Tender Offer and the Merger as if they had been consummated on June 30, 2017. You should not rely on this summary unaudited pro forma consolidated information as being indicative of the results that would actually have been obtained if the Tender Offer and the Merger had been consummated for the above-mentioned periods or the future results of Enel Chile.

| For the six months | ||||

| ended | For the year ended December 31, | |||

| June 30, 2017 | 2016 | 2015 | 2014 | |

| (in thousands of Ch$, except share and per share amounts) | ||||

| Pro Forma Consolidated Statement of | ||||

| Comprehensive Income Information: | ||||

| Revenues and other operating | ||||

| income | 1,242,579,709 | 2,612,018,524 | 2,455,302,875 | 2,074,923,468 |

| OperatingIncome | 264,744,050 | 640,503,283 | 566,896,374 | 410,478,010 |

| Income before taxes from continuing | ||||

| operations | 302,662,762 | 618,695,963 | 401,124,723 | 281,964,243 |

| Income tax expense, continuing | ||||

| operations | (66,588,519) | (90,418,248) | (109,981,456) | (130,779,422) |

| Net income from continuing | ||||

| operations | 236,074,243 | 528,277,715 | 291,443,267 | 151,184,821 |

| Net income attributable to Enel | ||||

| Chile | 232,169,537 | 518,889,614 | 282,180,804 | 135,387,580 |

| Net income attributable to non-controlling | ||||

| interests | 3,904,706 | 9,388,101 | 9,262,463 | 15,797,241 |

| Basic and diluted earnings per share: | ||||

| Basic and diluted earnings per share from | ||||

| continuing operations | 3.24 | 7.25 | 3.94 | 1.89 |

| Basic and diluted earnings per | ||||

| share | 3.24 | 7.25 | 3.94 | 1.89 |

| Weighted average number of shares of common | ||||

| stock(thousands) | 69,754,349.33 | 69,754,349.33 | 69,754,349.33 | 69,754,349.33 |

| Pro Forma Consolidated Statement of Financial Position | ||||

| Information: | As of the six months ended June 30, 2017 | |||

| (in thousands of Ch$) | ||||

| TotalAssets | 6,985,088,190 | |||

| Total non-current liabilities | 3,173,273,129 | |||

| Total current liabilities | 590,588,426 | |||

| Equity attributable to parent company | 3,105,199,037 | |||

| Total equity | 3,221,226,635 | |||

11

Tentative Transaction Timetable

Below is a tentative transaction timetable for the Reorganization.There may be significant changes depending on developments and all future dates are all subject to change.

| Date | Action(s) |

| August 25-28, 2017 | The Board of Directors of Enel Chile and Enel Generación authorized their |

| respective companies to analyze the proposed Reorganization. | |

| September 20, 2017 | The Board of Directors of EGPL authorized the company to analyze the |

| proposed Reorganization. | |

| October 13, 2017 | Chilean Superintendence of Securities and Insurance (Superintendencia de |

| Valores y Segurosor “SVS”) confirmed that the SVS would not object if the | |

| Tender Offer in Chile is conducted as a cash tender offer subject to the Enel | |

| Chile Share Subscription Condition. | |

| October 24, 2017 | EGPL is converted from a limited liability company (sociedad de |

| responsibilidad limitada) into a closely held stock corporation (sociedad | |

| anónima cerrada). | |

| October 24, 2017 | Chilean Superintendence of Pensions (Superintendencia de Pensiones) |

| confirmed that the Chilean Pension Funds Administrators (“AFPs”), as | |

| shareholders of Enel Generación, may agree to apply part of the | |

| consideration payable for each Enel Generación share tendered to subscribe | |

| for Enel Chile shares, subject to compliance with simultaneous delivery | |

| versus payment requirements set forth in the Compendium of Rules of the | |

| Pension System and standard share exchange procedures applicable to | |

| AFPs. | |

| November 3, 2017 | Delivery of interim Chilean financial statements of Enel Chile, Enel |

| Generación and EGPL as of and for the nine months ended September 30, | |

| 2017 (i.e., within 90 days before the date of the shareholders’ meeting to | |

| approve the Merger, as required under Chilean law). | |

| November 3, 2017 | Delivery of (i) appraisals by independent appraisers to Enel Chile and |

| EGPL, and (ii) reports by independent evaluators to Enel Chile and Enel | |

| Generación. | |

| November 9, 2017 | Delivery of the opinions of the Directors’ Committees of Enel Chile and |

| Enel Generación required under Chilean law. | |

| November 14, 2017 | Delivery of the opinions of the individual directors of Enel Chile and Enel |

| Generación with respect to the Reorganization. | |

| November 14, 2017 | Delivery of the supplementaryopinion of the Directors’ Committee of Enel |

| Generación required under Chilean law. | |

| November 14, 2017 | The Boards of Directors of Enel Chile and EGPL unanimously approved, |

| among other matters, the actions relating to the Reorganization and the | |

| summoning of extraordinary shareholders’ meetings (“ESMs”)of the | |

| respective companies to approve, among other matters, the Reorganization | |

| as a related party transaction and the Merger. |

12

| Date | Action(s) |

| November 14, 2017 | The members of the Board of Directors of Enel Generación without any |

| interest in the Reorganization unanimously approved the Reorganization as | |

| a related party transaction, and the Board of Directors of Enel Generación | |

| unanimously approved, among other matters, the summoning of the ESM to | |

| inform the shareholders about the Reorganization and to approve the | |

| amendments to the bylaws of Enel Generación. | |

| November 14, 2017 | Public notice of Enel Chile, Enel Generación and EGPL Board actions. |

| November 14, 2017 | Public notice of the agenda of the ESMs to shareholders of Enel Chile and |

| Enel Generación. | |

| November 29, 2017 | Mailing of information statements with respect to the ESMs of Enel Chile |

| and Enel Generación to the holders of Enel Chile ADSs and Enel | |

| Generación ADSs. | |

| December 15, 2017 | Voting cut-off date for Enel Chile ADSs and Enel Generación ADSs (3 |

| business days prior to the ESMs). | |

| December 20, 2017 | The ESMs of Enel Chile, Enel Generación and EGPL held. |

| December 21, 2017 | Beginning of exercise period for statutory merger dissenters’ withdrawal |

| rights in connection with the Merger for Enel Chile and EGPL shareholders. | |

| January 19, 2018 | Expiration of the exercise period for statutory merger dissenters’ withdrawal |

| rights in connection with the Merger for Enel Chile and EGPL shareholders | |

| (30 calendar days from approval of the Merger at the ESMs). | |

| Early/Mid February 2018 | Registration with the SVS and the Santiago Stock Exchange, the Valparaíso |

| Stock Exchange and the Chilean Electronic Stock Exchange (collectively, | |

| the “Chilean Stock Exchanges”)of the new Enel Chile shares to be issued in | |

| connection with the Capital Increase. | |

| Mid/Late February 2018 | Commencement of preemptive rights offering in connection with the Capital |

| Increase. | |

| Mid/Late February 2018 | Launch of the Tender Offer in Chile and the United States. |

| Mid/Late March 2018 | Expiration of the preemptive rights offering period in connection with the |

| Capital Increase (30 calendar days from launch). | |

| Mid/Late March 2018 | Expiration of the tender offer period (minimum of 30 calendar days from |

| launch of the Tender Offer) in Chile and in the United States. | |

| Mid/Late March 2018 | Publication of the notice of the results of the Tender Offer (aviso de |

| resultado) and acceptance of tendered Enel Generación shares and ADSs | |

| (three calendar days after expiration of the Tender Offer) and effectiveness | |

| of Enel Generación bylaw amendments. | |

| Early April 2018 | Reorganization effective. |

13

THE MEETING

The Extraordinary Shareholders’ Meeting of Enel Chile (the “Meeting”) will be held on December

20, 2017, at 10:00 A.M., local time, at Enel Chile Stadium, located at Carlos Medina No. 858, Independencia, Santiago, Chile.

The Matters to be Voted Upon

At the Meeting, the Board of Directors of the Company will present the following matters to the shareholders of the Company for their consideration and vote. Currently, there is no proposed wording of the resolutions to be brought before the shareholders. It is also not a requirement of Chilean law that a specific proposal or resolution be presented to shareholders before an ESM, notwithstanding that all matters to be presented to the shareholders must be described in the notice of the meeting.

| (a)the terms and conditions of the Merger, including the merger exchange ratio; | |

| (b)the statements of financial position of Enel Chile and EGPL as of September 30, 2017, duly audited under the Chilean auditing standards by the corresponding external audit firms; and | |

| (c)a capital increase by Enel Chile for purposes of authorizing shares to be issued to the shareholder of EGPL in the Merger. |

14

Item 7, which involves informing the shareholders of any related party transactions governed by Title XVI of the Chilean Corporations Act, other than the Reorganization, approved by the Board since thelast ordinary shareholders’ meeting, will be presented by the Board of Directors of the Company to the shareholders of the Company for informational purposes only.

Quorum

Under Chilean law, a quorum for a shareholders’ meeting is established by the presence, in personor by proxy, of shareholders representing at least a majority of the issued shares with voting rights of acompany. Enel, which beneficially owns 60.6% of the Company’s common stock, can establish a quorumat the Meeting without the attendance of any other shareholder. Additionally, upon the written request ofthe Company, the Depositary will represent all shares of the Company’s common stock underlying ADSs at any shareholders’ meeting for the sole purpose of establishing quorum at such meeting.

Votes Required

Approval of Items 1, 2, 3 and 5 require the affirmative vote of at least two-thirds of the outstanding common stock of the Company. Approval of Items 4 and 6 require the affirmative vote of at least a majority of the outstanding common stock of the Company. Enel currently beneficially holds 60.6% of the

Company’s outstanding common stock, and will be entitled to vote its shares of common stock on allmatters at the Meeting, and intends to vote its shares in favor of each of the items referred above that are submitted for approval.

How to Vote

Under the Deposit Agreement, dated as of April 26, 2016, among the Company, the Depositaryand all ADS Holders from time to time thereunder (the “Deposit Agreement”), ADS Holders have theright to instruct the Depositary how to vote their shares at the Meeting. For more information regarding the Deposit Agreement, see “Item 10. Additional Information” in theEnel Chile 2016 Form 20-F, which is incorporated herein by reference.

If the Voting Instructions are properly executed and returned but no specific directions are made, the Depositary will vote the shares or other securities represented by the ADSs in favor of the items proposed by the Board of Directors for approval.

The Depositary has set November 20, 2017 as the ADS Record Date. Accordingly, only ADS Holders as of the ADS Record Date are entitled to instruct the Depositary how to vote at the Meeting. Upon the timely receipt of voting instructions from an ADS Holder entitled to instruct the Depositary how to vote at the Meeting as explained in the attached Voting Instructions, the Depositary will, insofar as practicable and permitted under applicable law, the provisions of the Deposit Agreement, the by-laws of the Company and the provisions of the common stock of the Company, vote, or cause Banco Santander-Chile, as Custodian, to vote the shares underlying the ADS Holder’s ADSs in accordance withsuch voting instructions. Additionally, ADS Holders may withdraw the shares underlying the ADSs and attend and vote at the Meeting in person. If you do not attend the Meeting or do not instruct the Depositary to vote on your behalf, the Company has the contractual right under the Deposit Agreement to designate a person to vote your shares in such person’s sole discretion, unless (i) the Chairman of the Board directs the

Depositary not to give such a proxy, (ii) substantial opposition exists by the ADS Holders or (iii) the matters to be voted on materially and adversely affect the rights of ADS Holders.

15

ITEM 1–APPROVAL OF THE REORGANIZATION AS A RELATED PARTY TRANSACTION

The Company is seeking the approval of the Reorganization as a related party transaction in accordance with Title XVI of the Chilean Corporations Act.

On November 14, 2017, the Board of Directors of Enel Chile unanimously approved the following terms of the Reorganization:·

Merger: Merger exchange ratio of 15.80 Enel Chile shares for each EGPL share.

Tender Offer and the Capital Increase:

The following is a summary description of the Reorganization.

The Merger

The Merger involves the merger of EGPL with and into Enel Chile. The consummation of the Merger is contingent on the approval of the Merger by the shareholders of Enel Chile and EGPL and the satisfaction of conditions of the Merger described in“—Conditions of the Reorganization—Conditions ofthe Merger”below. Upon effectiveness of the Merger, EGPL will merge with and into Enel Chile. Enel Chile will be the surviving corporation under the name “Enel Chile S.A.,” and EGPL will cease to exist as a separate entity. See “—Conditions of the Reorganization—Conditions of the Merger” and “Item 2–TheMerger.”

The Capital Increase

As part of the Reorganization, Enel Chile is seeking to conduct the Capital Increase, in part, to obtain Enel Chile shares to be issued in connection with the Tender Offer to satisfy the Enel Chile U.S. Share/ADS Subscription Condition and the Enel Chile Share Subscription Condition. The Capital Increase is subject to approval by the affirmative vote of two-thirds of the outstanding voting shares of Enel Chile at the Meeting.

Under Chilean law, existing shareholders of a company have preemptive rights to subscribe for additional shares issued by means of a capital increase pro rata in proportion to their interest in thecompany (“preemptive rights”). Also under Chilean law, a preemptive rights offering is conducted fora 30-calendar day period following the publication by the company of a notice in a newspaper with national coverage of the commencement of the preemptive rights offering period with respect to the newly issued shares. In the Reorganization, the existing holders of Enel Chile shares (including Enel) will have

16

preemptive rights to subscribe for additional Enel Chile shares pro rata in connection with the newly issued shares of Enel Chile, other than the Enel Chile shares to be issued in connection with the Merger. In addition, Enel Chile shares underlying Enel Chile ADSs will have preemptive rights to subscribe for additional Enel Chile shares pro rata. Any existing holders of Enel Chile shares that have preemptive rights in connection with the Capital Increase will be able to exercise such preemptive rights only by paying cash for the newly issued Enel Chile shares.See “Item 3– The Capital Increase”and“—Conditions of the Reorganization—Conditions of the Capital Increase.”

The Tender Offer

Tender Offer is expected to be conducted as a concurrent dual tender offer in the U.S. (the “U.S. Offer”) and Chile (the “Chilean Offer”). In the U.S. Offer, Enel Chilehas announced that it intends to offer to purchase (i) all outstanding Enel Generación shares, other than Enel Generación shares currently owned by Enel Chile, held by all U.S. persons for an amount of Ch$590 in cash, without interest, payable in U.S. dollars, net of applicable withholding taxes and distribution fees for each Enel Generación share; and (ii) all outstanding Enel Generación ADSs from all holders of Enel Generación ADSs, wherever located, for an amount of Ch$17,700 in cash, without interest, payable in U.S. dollars, net of applicable withholding taxes and distribution fees for each Enel Generación ADS.

The U.S. Offer is subject to certain conditions, including the condition that any eligible holder of Enel Generación shares and/or Enel Generación ADSs validly tendering Enel Generación shares and/or Enel Generación ADSs in the U.S. Offer shall have agreed to apply Ch$236 of the consideration payable for each Enel Generación share tendered and Ch$7,080 of the consideration payable for each Enel Generación ADS tendered to subscribe for Enel Chile shares or Enel Chile ADSs, as the case may be, at a subscription price of Ch$82 per Enel Chile share (or Ch$2,460per Enel Chile ADS) (the “Enel Chile U.S. Share/ADS Subscription Condition”). Following completion of the U.S. Offer, for each Enel Generación share validly tendered in the U.S. Offer, an Enel Generación shareholder will receive Ch$354 in cash, without interest, payable in U.S. dollars net of applicable withholding taxes and distribution fees, and 2.87805 Enel Chile shares as a result of its satisfaction of the Enel Chile U.S. Share/ADS Subscription Condition. Following completion of the U.S. Offer, for each Enel Generación ADS validly tendered in the U.S. Offer, an Enel Generación ADS holder will receive Ch$10,620 in cash, without interest, payable in U.S. dollars net of applicable withholding taxes and distribution fees, and 1.72683 Enel Chile ADSs as a result of its satisfaction of the Enel Chile U.S. Share/ADS Subscription Condition

In the Chilean Offer, Enel Chile has announced that it intends to offer to purchase any and all of the outstanding Enel Generación shares, other than Enel Generación shares currently owned by Enel Chile but including Enel Generación shares held by U.S. persons, at the purchase price of Ch$590 in cash for each Enel Generación share. The Chilean Offer is subject to certain conditions, including the condition that any eligible holder of Enel Generación shares tendering in the Chilean Offer shall have agreed to apply Ch$236 of the consideration payable for each Enel Generación share tendered to subscribe for Enel Chile shares at a subscription price of Ch$82 per Enel Chile share(the “Enel Chile Share Subscription Condition”). As a result, following completion of the Chilean Offer, for each Enel Generaciónshare purchased, an Enel Generación shareholder will receive Ch$354 in cash and 2.87805 Enel Chile shares as a result of its satisfaction of the Enel Chile Share Subscription Condition.See “—Conditions of the Reorganization—Conditions of the Tender Offer.”

17

Conditions of the Reorganization

The transactions which constitute the Reorganization are interrelated and must be considered together. Therefore, the effectiveness of each of the transactions that are part of the Reorganization is subject to the conditions to the other transactions that are part of the Reorganization also being satisfied.

The conditions indicated below are not exhaustive, and additional conditions may be established by the Enel Chile, Enel Generación or EGPL or by their respective Boards of Directors.

Subject to the conditions listed below, Enel Chile, Enel Generación and EGPL intend that each of the acts that are part of the Reorganization, except for the amendments to the Bylaws of Enel Generación, shall be effective at the same date. The amendments to the Bylaws of Enel Generación shall be effective on the date on which Enel Chile publishes the results notice declaring the Tender Offer successful.

In any event, the conditions indicated below for each of the transactions that are part of the Reorganization must be satisfied on or before December 31, 2018. Therefore, the last date on which the Reorganization may become effective is December 31, 2018.

Conditions of the Merger

The consummation of the Merger will be subject to the satisfaction of the following conditions:

The absence, on the effective date of the Merger, of any legal proceeding or action seeking to: (i) prohibit or prevent the Merger between Enel Chile and EGPL; (ii) impose materiallimitations on Enel Chile’s ability to effectively exercise its property rights over the assets of EGPL to be assigned to Enel Chile as a consequence of the Merger; (iii) impose limitations on Enel Chile’s ability to continue developing and operating the projects owned by EGPL; and(iv) in general, any legal proceeding or action before any regulatory, judicial or administrative authority resulting in any of the consequences indicated in (i) to (iii) above.

Conditions of the Capital Increase

The Capital Increase will not be effective if any of the following events occur:

18

Conditions of the Tender Offer

The launch of the Tender Offer will be subject to the satisfaction of the following conditions:

The Tender Offer will be subject to the satisfaction or waiver of the following conditions on or before the expiration of the Tender Offer:

19

Enel Chile will declare the Tender Offer successful if the conditions above are satisfied or waived.

Conditions of the Amendments to the Bylaws of Enel Generación

The effectiveness of the amendments to the Bylaws of Enel Generación will be conditioned on Enel Chile declaring the Tender Offer successful.

Risk Factors

In deciding whether to vote to approve the Reorganization as a related party transaction in accordance with Title XVI of the Chilean Corporations Act, you should read this Information Statement carefully and the referred documents. You should also carefully consider the following risk factors related to the Reorganization together with the risk factors set forth in the Enel Chile 2016 Form 20-F and the Enel Generación 2016 Form 20-F.

Enel Chile may fail to realize the business growth opportunities, revenue benefits, cost savings and other benefits anticipated from, or may incur unanticipated costs associated with, the Reorganization andEnel Chile’sresults of operations, financial condition and the price of Enel Chile shares may suffer.

The Reorganization, includingEnel Chile’sacquisition of EGPL in the Merger and the Tender Offer for Enel Generación shares, may not achieve the business growth opportunities, revenue benefits, cost savings and other benefits anticipated by Enel Chile. However, these benefits may not develop and other assumptions upon which the offer consideration was determined may prove to be incorrect.

Under any of these circumstances, the business growth opportunities, revenue benefits, cost savings and other benefits anticipated by us to result from the completion of the Reorganization may not be achieved as expected, or at all, or may be delayed. To the extent that Enel Chile incurs higher integration costs or achieve lower revenue benefits or fewer cost savings than expected,Enel Chile’sresults of operations and financial condition may suffer.

The potential integration of Enel Chile and EGPL may be difficult and expensive.

The Merger involves the integration of a mature business, as is the case ofEnel Chile’sconventional energy business, which Enel Chile develops through Enel Generación, withEGPL’snon-conventional renewable energy business.Enel Chile’sgoal in integrating the operations is to increase the revenues and earnings of the combined businesses through cost savings, and, as a combined company,to increase Enel Chile’s ability to satisfy the demands of its customers. In so doing,Enel Chile may encounter substantial difficulties in integrating operations, and could even incur substantial costs as a result of, among other things:

20

The diversion of management attention and any difficulties encountered from the Merger could increase costs or reduce revenues, earnings and operating results of Enel Chile following completion of the Merger. Any delays encountered in the integration process of EGPL and Enel Chile, could have an adverse effect on the revenues, level of expenses, operating results and financial condition of the Enel Chile, which may adversely affect the value of the Enel Chile securities after the completion of the Tender Offer.

Enel Chile following the Merger may not be able to retain key employees or efficiently manage the larger and broader organization, which could negatively affectEnel Chile’soperations and financial condition.

The success of Enel Chile following the Merger, will depend in part on the ability of Enel Chile to retain key employees of both Enel Chile and EGPL and successfully manage the larger and broader organization resulting from the Merger. In this context, key employees may depart because of issues relating to the uncertainty and difficulty of integration or a general desire not to remain with Enel Chile. Furthermore, Enel Chile will face challenges inherent in efficiently managing an increased number of employees. Accordingly, no assurance can be given that Enel Chile will be able to retain key employees or successfully manage the larger and more diverse combined organization, which could result in disruptionto the combined company’s business and negatively impact the combined company’s operations andfinancial condition.

The Merger will be a statutory merger and there is no merger agreement entered into between Enel Chile and EGPL or Enel, as the sole shareholder of EGPL; therefore, none of the parties involved in the Merger will have any contractual protections against each other.

The Merger will be a statutory merger under Article 99 of the Chilean Corporations Act. Under Chilean law, no merger agreement is required, provided that the shareholders of the merging corporations are presented with a document containing the terms and conditions of the merger. No merger agreement has been or will be entered into between Enel Chile and EGPL or Enel in connection with the Merger. However, the terms and conditions of the Merger are included in as part of the General Terms of the Reorganization presented to shareholders of Enel Chile and EGPL in connection with the ESMs. The General Terms of the Reorganization do not include representations and warranties or covenants regarding the merging entities. In the absence of a merger agreement providing contractual rights between the parties to the Merger, any rights of the parties to the Merger to seek indemnification or other recovery for any losses with respect to the Merger will be based solely on the protections of the Chilean Corporations Act.

21

ITEM 2–THE MERGER

The Company is seeking the approval of the Merger in accordance with rules under Title IX of the Chilean Corporations Act and Title IX of the Chilean Corporation Regulations (Reglamento de Sociedades Anónimas). The approval of the Merger will also constitute the approval of (i) the terms and conditions of the Merger, including the merger exchange ratio; (ii) the statements of financial position of Enel Chile and EGPL as of September 30, 2017, duly audited under the Chilean auditing standards by the corresponding external audit firms, provided in connection with the Merger(the “Chilean Financial Statements”); and (iii) a capital increase by Enel Chile for purposes of acquiring shares to be issued to the shareholder of EGPL in the Merger pursuant to the merger exchange ratio. The following is a summary description of the Merger.

Terms of the Merger; No Merger Agreement

On November 14, 2017, the Board of Directors of Enel Chile proposed a merger exchange ratio of 15.80 Enel Chile shares for each EGPL share. This merger exchange ratio was determined by the Board of Directors of Enel Chile based on its review of the opinions and reports of the various independent evaluators and independent appraisers involved in theReorganization. See “AdditionalInformation.”

No merger agreement has been entered into between Enel Chile and EGPL in connection with the proposed Merger. Under the Chilean Corporations Act, it is not necessary for parties to a merger to enter into a merger agreement in connection with an Article 99 statutory merger. This is because the manner in which the merged companies will be combined is prescribed by the Chilean Corporations Act. However, pursuant to Article 155(a) of the Chilean Corporate Regulations, the Boards of Directors of Enel Chile and EGPL may adopt certain terms and conditions relating to the Merger that outline certain information relating to the Merger. For purposes of the Reorganization, the Boards of Enel Chile and EGPL have approved a document entitled General Terms of the Reorganization (Bases Generales de la Reorganización) which outlines the main terms and conditions related to the Reorganization (including the Merger). The original Spanish version and an English translation of the General Terms of the Reorganization is available on the website of Enel Chile at www.enelchile.cl and is incorporated by reference into this Information Statement.

In addition, under the Chilean Corporations Act, the Boards of Directors of the companies that are parties to a merger are not required to approve the merger. Instead, the Chilean Corporations Act requires that the Board of each company that is a party to the merger must:

If two-thirds of the outstanding voting shares of each of Enel Chile and EGPL approve the Merger and all other conditions of the Merger are satisfied or waived, then the Chilean Corporations Act provides that at the effective time of the Merger:

22

Conditions of the Merger

See “—Conditions of the Reorganization—Conditions of the Merger.”

Regulatory Approvals

If the Merger is approved by two-thirds of the respective outstanding voting shares of Enel Chile and EGPL, Enel Chile and EGPL must record the minutes of their respective ESMs at which their respective shareholders approved the Merger before a Chilean notary public and publish within the 60 following days an abstract of those minutes in the Registry of Commerce (Registro de Comercio) and in the Official Gazette (Diario Oficial) in order for the Merger to be completed and the exchange of Enel Chile shares for EGPL shares to occur.

In addition, although not a precondition to the effectiveness of the Merger, before the Enel Chile shares can be issued in exchange for the shares of EGPL and such Enel Chile shares may be traded on the Chilean Stock Exchanges, Enel Chile must obtain:

There are no other regulatory approvals Enel Chile is seeking to obtain in connection with the Merger of Enel Chile and EGPL. However, in connection with the approval by the SVS of the registration of the issuance of the additional Enel Chile shares, the SVS will review the issuance to determine whether it complies with Chilean law.

In addition, in connection with the Merger and the Enel Chile ADS program, certain information must be delivered to the SVS. Enel Chile must deliver to the SVS a copy of its registration statement and any other information it submits to the SEC in the same form and at the same time its files the registration statement or such other information with the SEC. Enel Chile must report on a monthly basis the issuance and cancellation of Enel Chile ADSs, the number of Enel Chile ADSs traded, and the price and trading volumes. Enel Chile will also be required to file with the SVS on a quarterly basis a list of Enel Chile ADS holders.

Statutory Merger Dissenters’ Withdrawal Rights

Under the Chilean Corporations Act, Enel Chile shareholders and EGPL shareholders who vote against approval of the Merger, or if they did not attend the meeting, who notify the applicable company in writing within 30 days following the respective shareholders’ meetings of their opposition to the Merger,and who provide Enel Chile or EGPL, as the case may be, with the required notice of withdrawal, willhave the right to exercise statutory merger dissenters’ withdrawal rights (derecho a retiro) and to receive

23

from Enel Chile or EGPL, as the case may be, a cash payment in exchange for Enel Chile shares or EGPLshares, as applicable. A holder of Enel Chile shares exercising statutory merger dissenters’ withdrawalrights will receive a cash payment from Enel Chile that is equivalent to the weighted average of the closing prices for Enel Chile shares as reported on the Chilean Stock Exchanges during the 60-trading day period preceding the 30th trading day prior to the date on which the Merger is approved. The statutory mergerdissenters’ withdrawal rights price is Ch$74.36 per Enel Chile share. A holder of EGPL shares exercisingstatutory merger dissenters’ withdrawal rights will receive a cash payment from EGPL that is equivalentto the book value of EGPL shares, which is determined by dividing EGPL’s net worth (patrimonio) by the total number of issued and paid shares of EGPL.

Enel Chile ADS holders own beneficial interests in Enel Chile shares that are held by the custodianbank for Enel Chile’s ADS program. Enel Chile ADS holders do not hold Enel Chile shares directly andare not listed as shareholders on Enel Chile’s share registry. Therefore, any Enel Chile ADS holder that wishes to exercise statutory merger dissenters’ withdrawal rights with respect to the Merger must cancelsuch holder’s Enel Chile ADSs and become a registered shareholder of Enel Chile not later than midnight(the end of the day) on December 14, 2017 (the fifth Chilean business day prior to the Meeting) (the“Shareholder Record Date”) and then follow the procedures for exercising statutory merger dissenters’withdrawal rights as a shareholder.