Exhibit 99.1

Immuron Commences US Non-Deal Institutional Investor Roadshow

Melbourne, Australia, August 15th, 2017: Australian microbiome biopharmaceutical company Immuron Limited (ASX: IMC; NASDQ: IMRN) is pleased to release to shareholders and investors its latest Company Update presentation ahead of a comprehensive roadshow to investment institutions, analysts and shareholders in the United States, where interim-CEO Dr. Jerry Kanellos will be updating on recent trials progress and upcoming milestones.

Dr. Kanellos will be meeting with key US fund managers to highlight the current position and strength of Immuron’s patent portfolio, the Company’s multiple clinical trials which are underway in the areas of NASH, ASH, C Clostridium Difficile Infection, and the increasing traction Immuron’s Travelan product, for the prevention of travellers’ diarrhea, is gaining in both the Australian and US market.

Immuron’s newly appointed Interim-CEO Dr. Jerry Kanellos highlighted;

“We have some very exciting times ahead at Immuron as many of our projects approach critical milestones and targets. Following the initial share price fluctuations after our NASDAQ listing, it’s important than we now firm up our investor base and showcase Immuron’s amazing technology platform to those who are yet to see and understand the Immuron story.

I’m truly honored to be able to present Immuron to the market and explain the Company value proposition to US institutional investors as we move into the next phase of our lifecycle.”

- - - END - - -

| COMPANY CONTACT: | | US INVESTORS RELATIONS: |

| Dr. Jerry Kanellos | | Jon Cunningham |

| Interim-Chief Executive Officer | | RedChip Companies, Inc. |

| AUS Ph: +61 (0)3 9824 5254 | | US Ph: +1 (407) 644 4256, (ext. 107) |

| jerrykanellos@immuron.com | | jon@redchip.com |

| | | |

| AUSTRALIA INVESTORS RELATIONS: | | US PUBLIC RELATIONS: |

| Peter Taylor | | Eric Fischgrund |

| NWR Communications | | FischTank - Marketing and PR |

| AUS Ph: +61 (0)4 1203 6231 | | US Ph: +1 (646) 699 1148 |

| peter@nwrcommunications.com.au | | eric@fischtankpr.com |

| Level 3, 62 Lygon Street | www.immuron.com | Phone: + 61 (0)3 9824 5254 |

| Carlton South, Victoria | | Facsimile: + 61 (0)3 9822 7735 |

| AUSTRALIA 3053 | ABN: 80 063 114 045 | |

ABOUT IMMURON:

Immuron Ltd (ASX: IMC) is a biopharmaceutical company focused on developing and commercialising oral immunotherapeutics for the treatment of many gut mediated diseases. Immuron has a unique and safe technology platform that enables a shorter development therapeutic cycle. The Company currently markets and sells Travelan® for the prevention of travellers’ diarrhea whilst its lead product candidate IMM-124E is in Phase 2 clinical trials for NASH and ASH. These products together with the Company’s other preclinical immunotherapy pipeline products targeting immune-related diseases currently under development, will meet a large unmet need in the market. For more information visit:http://www.immuron.com

FORWARD-LOOKING STATEMENTS:

Certain statements made in this release are forward-looking statements and are based on Immuron’s current expectations, estimates and projections. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “guidance” and similar expressions are intended to identify forward-looking statements. Although Immuron believes the forward-looking statements are based on reasonable assumptions, they are subject to certain risks and uncertainties, some of which are beyond Immuron’s control, including those risks or uncertainties inherent in the process of both developing and commercialising technology. As a result, actual results could materially differ from those expressed or forecasted in the forward-looking statements. The forward-looking statements made in this release relate only to events as of the date on which the statements are made. Immuron will not undertake any obligation to release publicly any revisions or updates to these forward-looking statements to reflect events, circumstances or unanticipated events occurring after the date of this release except as required by law or by any appropriate regulatory authority.

Immuron Limited August 2017 Changing the Paradigms of Care www.immuron.com ASX:IMC NASDAQ:IMRN

Forward Looking Statement Certain statements made in this presentation are forward - looking statements and are based on Immuron’s current expectations, estimates and projections . Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “guidance” and similar expressions are intended to identify forward - looking statements . Although Immuron believes the forward - looking statements are based on reasonable assumptions, they are subject to certain risks and uncertainties, some of which are beyond Immuron’s control, including those risks or uncertainties inherent in the process of both developing and commercializing technology . As a result, actual results could materially differ from those expressed or forecasted in the forward - looking statements . The forward - looking statements made in this presentation relate only to events as of the date on which the statements are made . Immuron will not undertake any obligation to release publicly any revisions or updates to these forward - looking statements to reflect events, circumstances or unanticipated events occurring after the date of this presentation except as required by law or by any appropriate regulatory authority .

Company Highlights 3 • Clinical stage biopharmaceutical company targeting inflammatory - mediated and infectious diseases with oral immunotherapies • Validated technology platform – with one registered asset generating revenue • 2 Lead clinical assets in Phase 2 development for the treatment of multiple high value indications, Fat Liver Disease and CDI . • Excellent safety profile, GRAS by FDA, expedited regulatory review and approval process • Well positioned to address high unmet medical need in multiple blockbuster markets • High - value peer licensing deals and M&A underscore potential upside • Company listed on NASDAQ in 2Q 2017 • Experienced Management Team and strong support from leading KOLs and institutions (NIH, DoD)

Experienced Management Team 4 Jerry Kanellos, PhD Chief Executive Officer Dr. Kanellos has over 20 years of experience in the pharmaceutical and biotech industries including CMC, operations and BD. He has held senior roles at CSL and was CEO of Avipep Pty Ltd a privately owned oncology biotech company. . Dan Peres, MD Chief Medical Officer Dr. Peres, a surgeon by training, has deep experience in liver diseases and clinical development including NASH, having worked for leading Medical Devices and Pharma companies since 2008. Travis Robins US Sales Director Mr. Robins is an accomplished, motivated leader with progressive years of proven success in dramatically increasing revenues and expanding market shares, while building key relationships. Reza Moussakhani Manufacturing Quality Director Mr. Moussakhani has extensive experience in implementation of project/quality and process improvements, including with Hospira and Sigma Pharmaceuticals.

Advisory Board Dr. Arun Sanyal (MD) University of Virginia Former President of the AASLD. Current Chair of the Liver Study Section at the NIH. IMM - 124E lead PI. Dr. Stephen Harrison (MD) San Antonio Military Medical Center Brooke US Army Medical Center Internationally renowned expert in NASH. Lead PI of Galectin’s GR - MD - 02’s Phase II trial. Dr. Manal Abdelmalek (MD) Duke University Medical Center Dr. Abdelmalek is a leading investigator in the field of NASH. Dr. Gerhard Rogler (MD, PhD) Zurich University Professor Rogler is a leader in the field of Colitis and has authored more than 200 original peer - reviewed articles. Dr. Miriam Vos (MD) Emory University Dr. Vos specializes in the treatment of gastrointestinal disease in children as well as fatty liver disease and obesity. Dr. Dena Lyras (PhD) Monash University Dr. Lyras is one of the world’s leading experts in C. difficile . 5 Organizations Prominent Scientific Advisory Board and Leading Research Partners

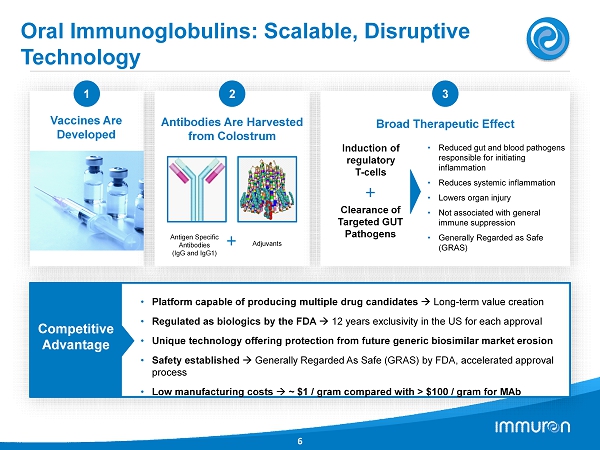

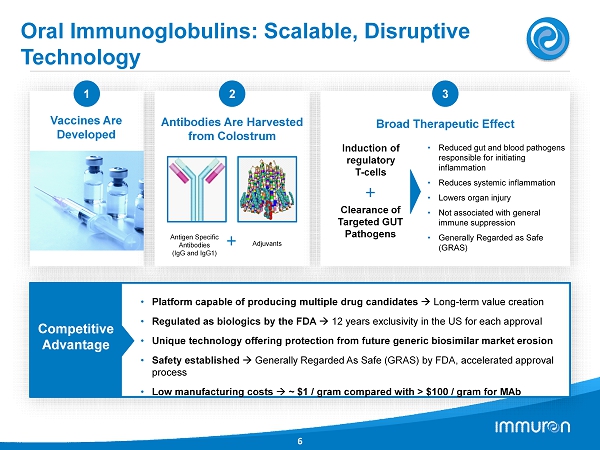

Oral Immunoglobulins: Scalable, Disruptive Technology 6 1 Vaccines Are Developed 2 Antibodies Are Harvested from Colostrum Antigen Specific Antibodies (IgG and IgG1) Adjuvants + 3 Broad Therapeutic Effect + • Reduced gut and blood pathogens responsible for initiating inflammation • Reduces systemic inflammation • Lowers organ injury • Not associated with general immune suppression • Generally Regarded as Safe (GRAS) Induction of regulatory T - cells Clearance of Targeted GUT Pathogens Competitive Advantage • Platform capable of producing multiple drug candidates Long - term value creation • Regulated as biologics by the FDA 12 years exclusivity in the US for each approval • Unique technology offering protection from future generic biosimilar market erosion • Safety established Generally Regarded As Safe (GRAS) by FDA, accelerated approval process • Low manufacturing costs ~ $1 / gram compared with > $100 / gram for MAb

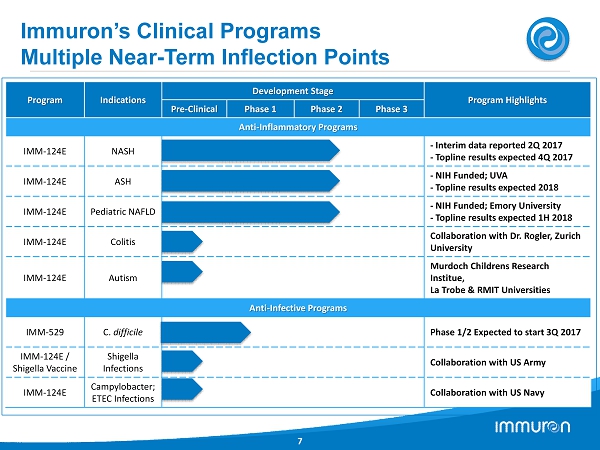

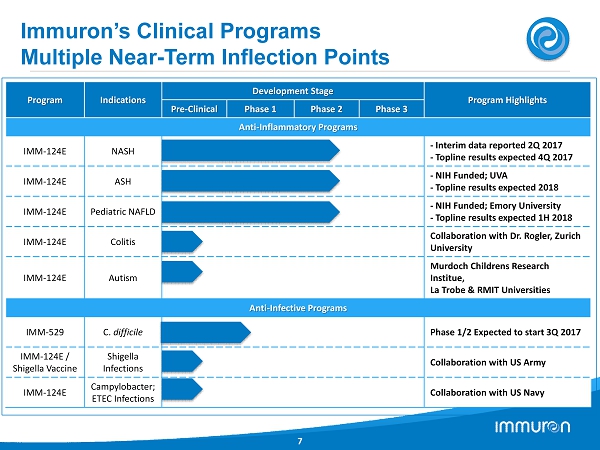

Immuron’s Clinical Programs Multiple Near - Term Inflection Points 7 Program Indications Development Stage Program Highlights Pre - Clinical Phase 1 Phase 2 Phase 3 Anti - Inflammatory Programs IMM - 124E NASH - Interim data reported 2Q 2017 - Topline results expected 4Q 2017 IMM - 124E ASH - NIH Funded; UVA - Topline results expected 2018 IMM - 124E Pediatric NAFLD - NIH Funded; Emory University - Topline results expected 1H 2018 IMM - 124E Colitis Collaboration with Dr. Rogler, Zurich University IMM - 124E Autism Murdoch Childrens Research Institue , La Trobe & RMIT Universities Anti - Infective Programs IMM - 529 C. difficile Phase 1/2 Expected to start 3Q 2017 IMM - 124E / Shigella Vaccine Shigella Infections Collaboration with US Army IMM - 124E Campylobacter; ETEC Infections Collaboration with US Navy

IMM - 124E Revolutionary Treatment for NASH

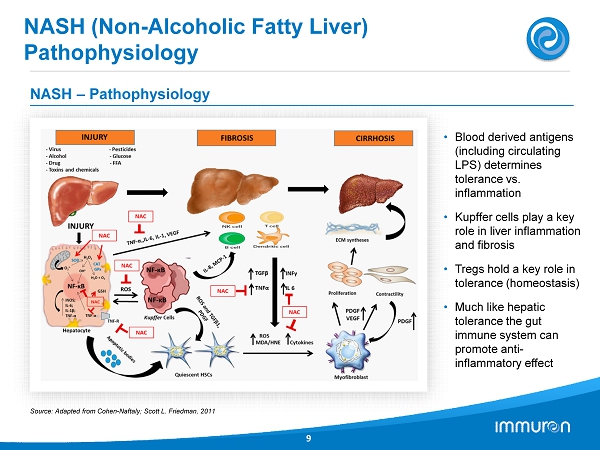

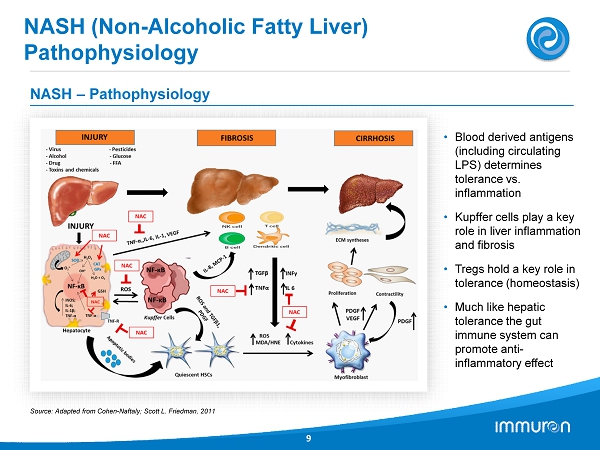

NASH (Non - Alcoholic Fatty Liver) Pathophysiology 9 NASH – Pathophysiology • Blood derived antigens (including circulating LPS) determines tolerance vs. inflammation • Kupffer cells play a key role in liver inflammation and fibrosis • Tregs hold a key role in tolerance (homeostasis) • Much like hepatic tolerance the gut immune system can promote anti - inflammatory effect Source: Adapted from Cohen - Naftaly; Scott L. Friedman, 2011

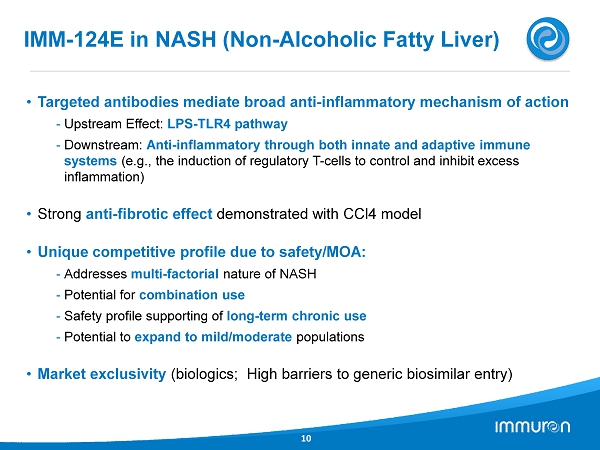

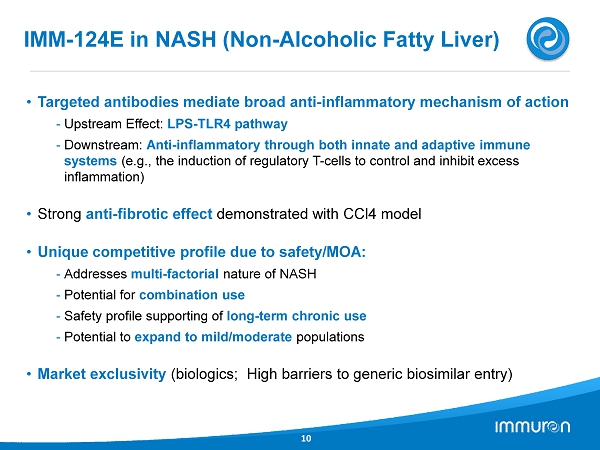

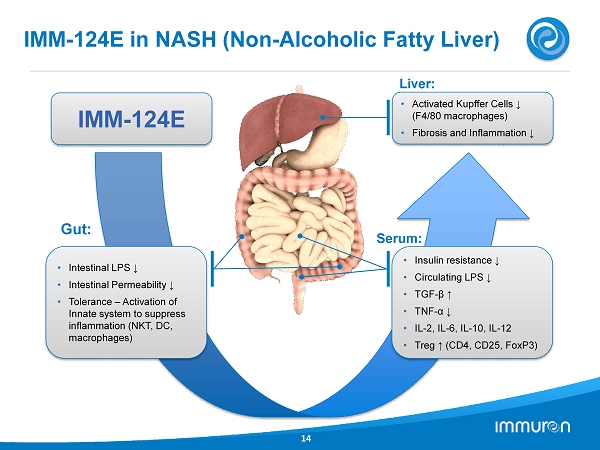

IMM - 124E in NASH (Non - Alcoholic Fatty Liver) 10 • Targeted antibodies mediate broad anti - inflammatory mechanism of action - Upstream Effect: LPS - TLR4 pathway - Downstream: Anti - inflammatory through both innate and adaptive immune systems (e.g., the induction of regulatory T - cells to control and inhibit excess inflammation) • Strong anti - fibrotic effect demonstrated with CCl4 model • Unique competitive profile due to safety/MOA: - Addresses multi - factorial nature of NASH - Potential for combination use - Safety profile supporting of long - term chronic use - Potential to expand to mild/moderate populations • Market exclusivity (biologics; High barriers to generic biosimilar entry)

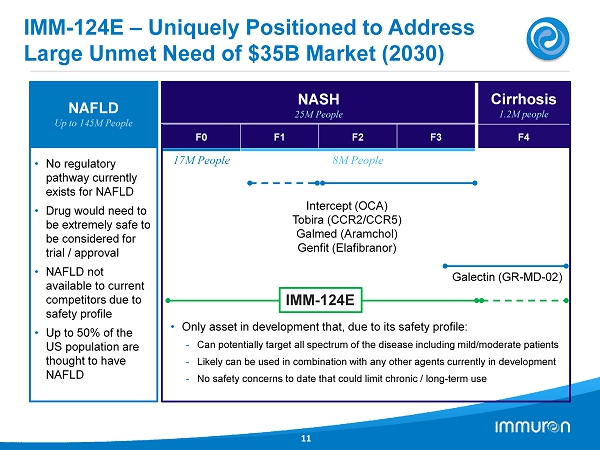

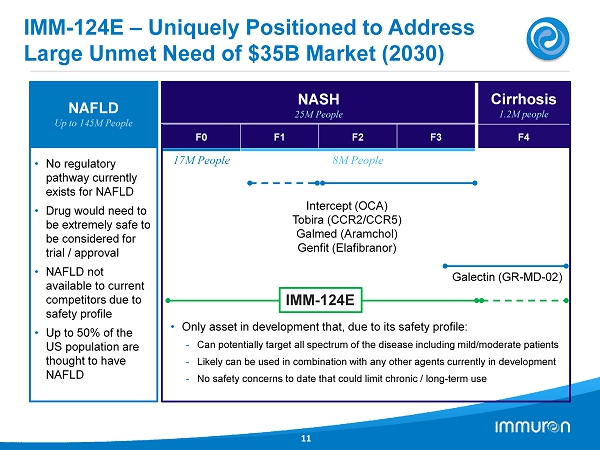

Cirrhosis 1.2 M people F4 IMM - 124E – Uniquely Positioned to Address Large Unmet Need of $35B Market (2030) 11 NAFLD Up to 145M People • No regulatory pathway currently exists for NAFLD • Drug would need to be extremely safe to be considered for trial / approval • NAFLD not available to current competitors due to safety profile • Up to 50% of the US population are thought to have NAFLD NASH 25M People F0 F 1 F2 F3 17M People 8M People Intercept (OCA) Tobira (CCR2/CCR5) Galmed ( Aramchol ) Genfit ( Elafibranor ) Galectin (GR - MD - 02) • Only asset in development that, due to its safety profile: - Can potentially target all spectrum of the disease including mild/moderate patients - Likely can be used in combination with any other agents currently in development - No safety concerns to date that could limit chronic / long - term use IMM - 124 E

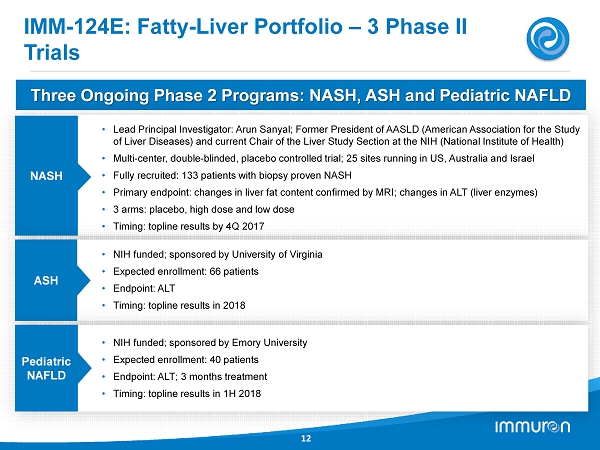

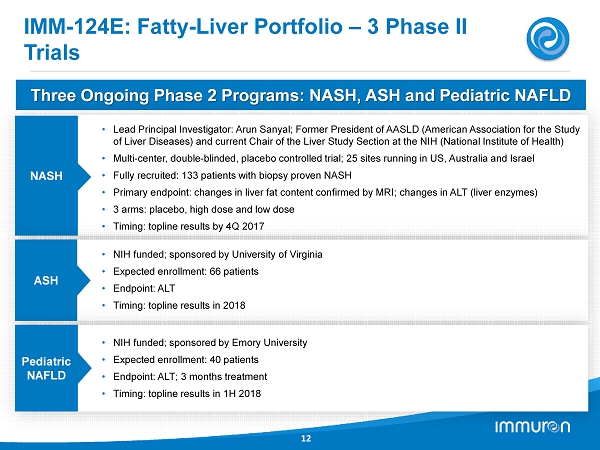

IMM - 124E: Fatty - Liver Portfolio – 3 Phase II Trials 12 Three Ongoing Phase 2 Programs: NASH, ASH and Pediatric NAFLD NASH • Lead Principal Investigator: Arun Sanyal; Former President of AASLD (American Association for the Study of Liver Diseases) and current Chair of the Liver Study Section at the NIH (National Institute of Health) • Multi - center, double - blinded, placebo controlled trial; 25 sites running in US, Australia and Israel • Fully recruited: 133 patients with biopsy proven NASH • Primary endpoint: changes in liver fat content confirmed by MRI; changes in ALT (liver enzymes) • 3 arms: placebo, high dose and low dose • Timing: topline results by 4Q 2017 ASH • NIH funded; sponsored by University of Virginia • Expected enrollment: 66 patients • Endpoint: ALT • Timing: topline results in 2018 Pediatric NAFLD • NIH funded; sponsored by Emory University • Expected enrollment: 40 patients • Endpoint: ALT; 3 months treatment • Timing: topline results in 1H 2018

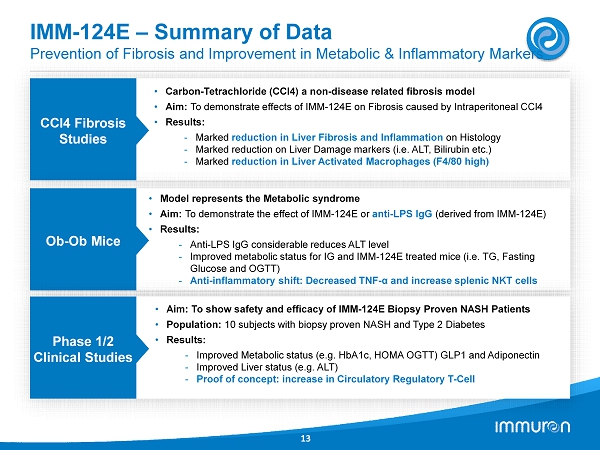

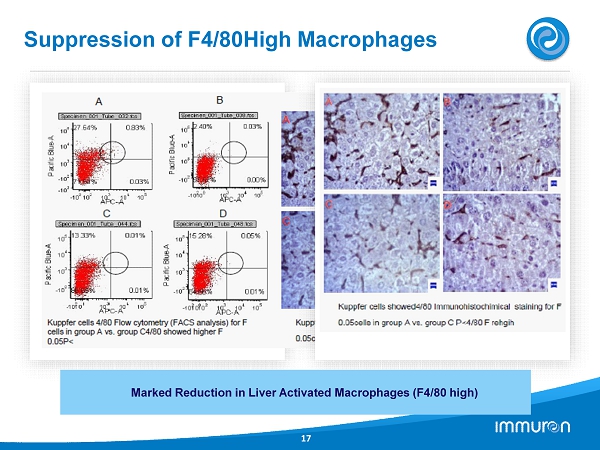

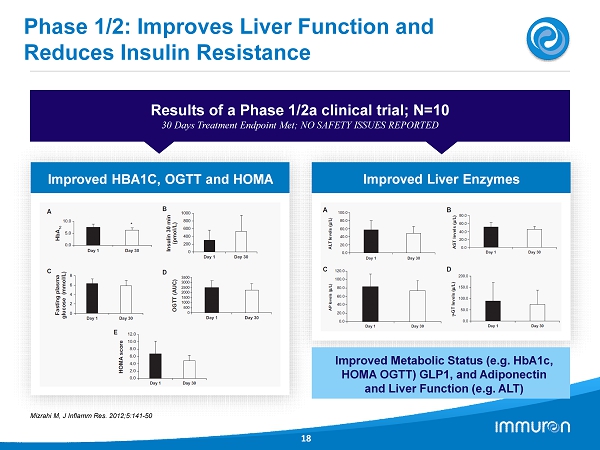

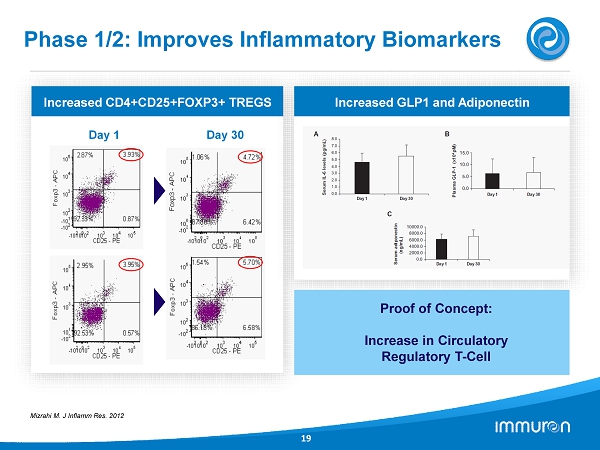

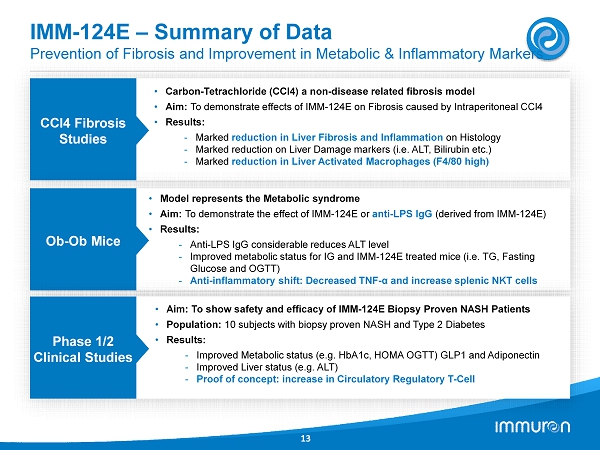

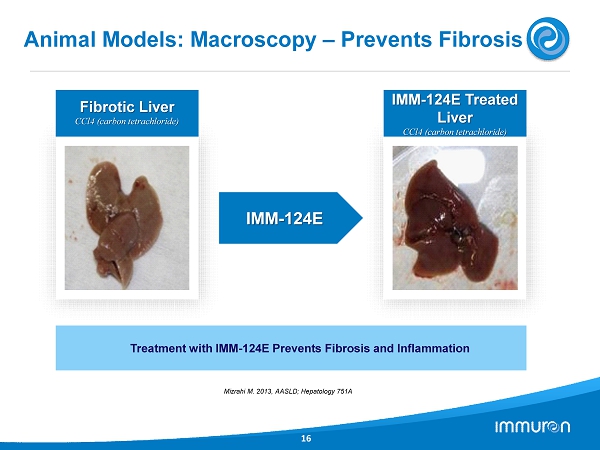

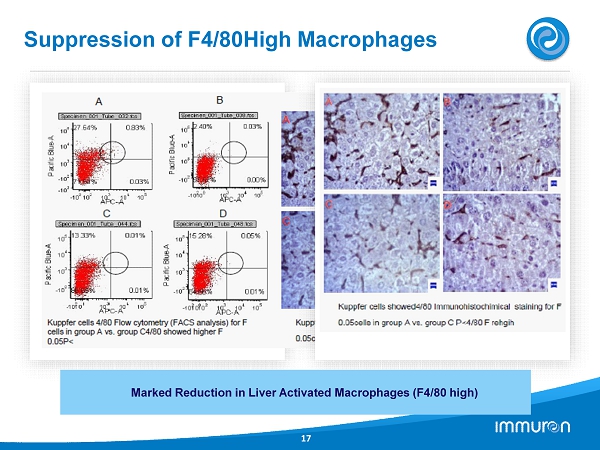

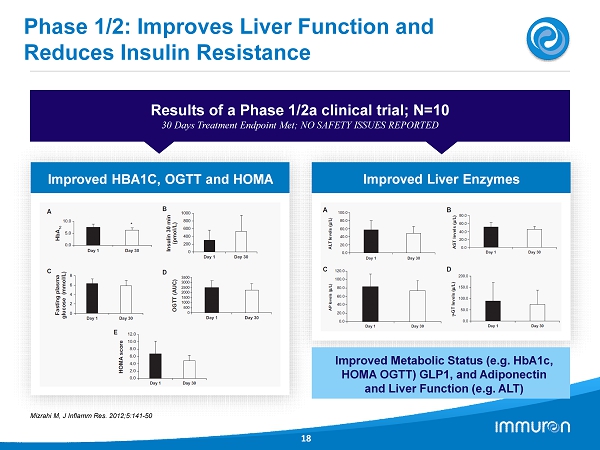

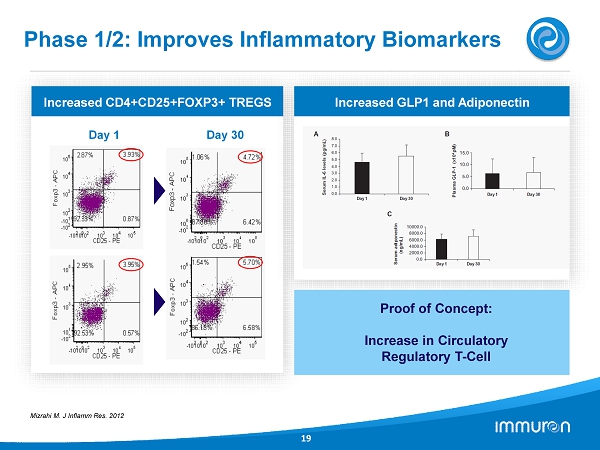

IMM - 124E – Summary of Data Prevention of Fibrosis and Improvement in Metabolic & Inflammatory Markers 13 CCl4 Fibrosis Studies • Carbon - Tetrachloride (CCl4) a non - disease related fibrosis model • Aim: To demonstrate effects of IMM - 124E on Fibrosis caused by Intraperitoneal CCl4 • Results: - Marked reduction in Liver Fibrosis and Inflammation on Histology - Marked reduction on Liver Damage markers (i.e. ALT, Bilirubin etc.) - Marked reduction in Liver Activated Macrophages (F4/80 high) Ob - Ob Mice • Model represents the Metabolic syndrome • Aim: To demonstrate the effect of IMM - 124E or anti - LPS IgG (derived from IMM - 124E) • Results: - Anti - LPS IgG considerable reduces ALT level - Improved metabolic status for IG and IMM - 124E treated mice (i.e. TG, Fasting Glucose and OGTT) - Anti - inflammatory shift: Decreased TNF - α and increase splenic NKT cells Phase 1/2 Clinical Studies • Aim: To show safety and efficacy of IMM - 124 E Biopsy Proven NASH Patients • Population: 10 subjects with biopsy proven NASH and Type 2 Diabetes • Results: - Improved Metabolic status (e.g. HbA 1 c, HOMA OGTT) GLP 1 and Adiponectin - Improved Liver status (e.g. ALT) - Proof of concept: increase in Circulatory Regulatory T - Cell

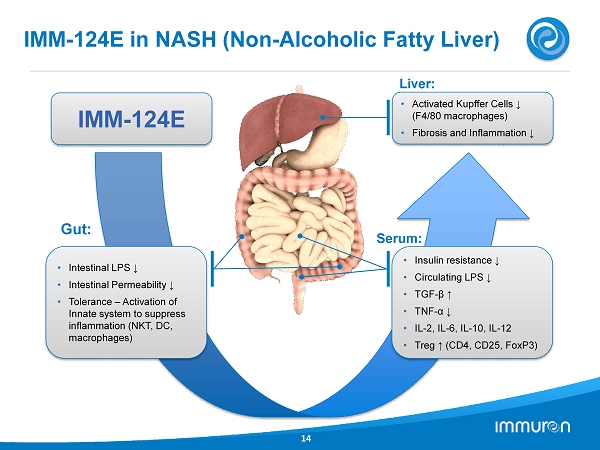

IMM - 124E in NASH (Non - Alcoholic Fatty Liver) 14 Liver: Serum: • Intestinal LPS ↓ • Intestinal Permeability ↓ • Tolerance – Activation of Innate system to suppress inflammation (NKT, DC, macrophages) Gut: • Insulin resistance ↓ • Circulating LPS ↓ • TGF - β ↑ • TNF - α ↓ • IL - 2 , IL - 6 , IL - 10 , IL - 12 • Treg ↑ (CD 4 , CD 25 , FoxP 3 ) • Activated Kupffer Cells ↓ (F 4 / 80 macrophages) • Fibrosis and Inflammation ↓ IMM - 124E

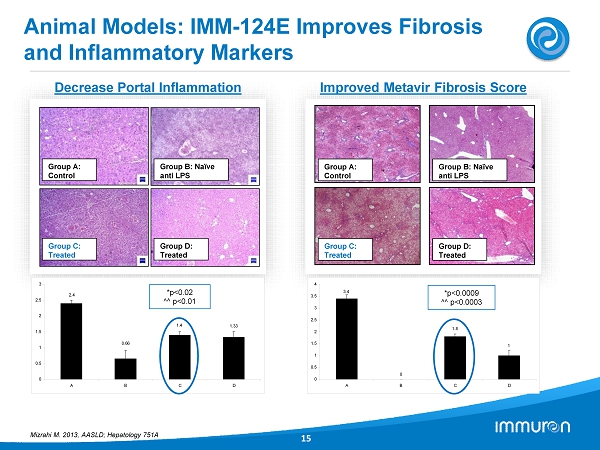

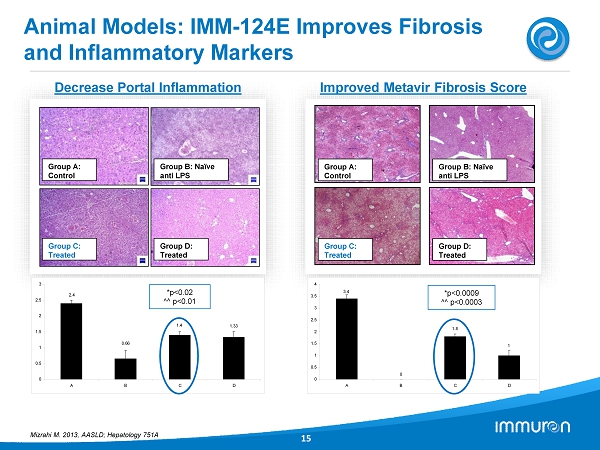

Animal Models: IMM - 124E Improves Fibrosis and Inflammatory Markers 15 Group A: Control Group D: Treated Group B: Naïve anti LPS Group C: Treated 2.4 0.66 1.4 1.33 0 0.5 1 1.5 2 2.5 3 A B C D *p< 0.02 ^^ p< 0.01 Group A: Control Group D: Treated Group B: Naïve anti LPS Group C: Treated 0 1 1.8 3.4 0 0.5 1 1.5 2 2.5 3 3.5 4 A B C D *p< 0.0009 ^^ p< 0.0003 Decrease Portal Inflammation Improved Metavir Fibrosis Score Mizrahi M. 2013 , AASLD; Hepatology 751 A

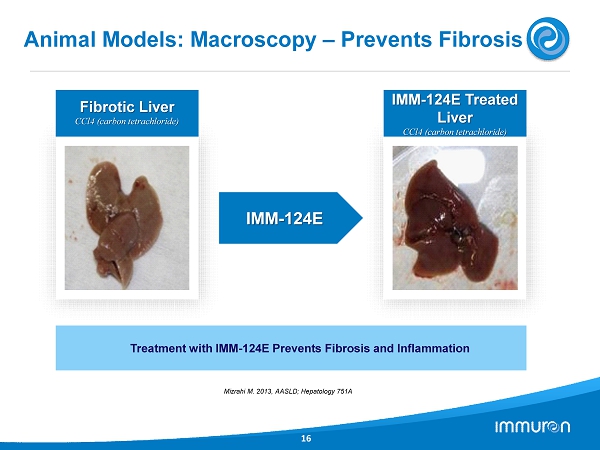

IMM - 124 E Animal Models: Macroscopy – Prevents Fibrosis 16 Fibrotic Liver CCl 4 (carbon tetrachloride) IMM - 124 E Treated Liver CCl 4 (carbon tetrachloride) Treatment with IMM - 124 E Prevents Fibrosis and Inflammation Mizrahi M. 2013 , AASLD; Hepatology 751 A

Suppression of F 4 / 80 High Macrophages 17 Marked Reduction in Liver Activated Macrophages (F 4 / 80 high)

Phase 1 / 2 : Improves Liver Function and Reduces Insulin Resistance 18 Results of a Phase 1 / 2 a clinical trial; N= 10 30 Days Treatment Endpoint Met; NO SAFETY ISSUES REPORTED Improved Liver Enzymes Improved HBA 1 C, OGTT and HOMA Mizrahi M, J Inflamm Res . 2012 ; 5 : 141 - 50 Improved Metabolic Status (e.g. HbA 1 c, HOMA OGTT) GLP 1 , and Adiponectin and Liver Function (e.g. ALT)

Phase 1 / 2 : Improves Inflammatory Biomarkers 19 Increased CD 4 +CD 25 +FOXP 3 + TREGS Day 1 Day 30 Mizrahi M. J Inflamm Res. 2012 Increased GLP 1 and Adiponectin Proof of Concept: Increase in Circulatory Regulatory T - Cell

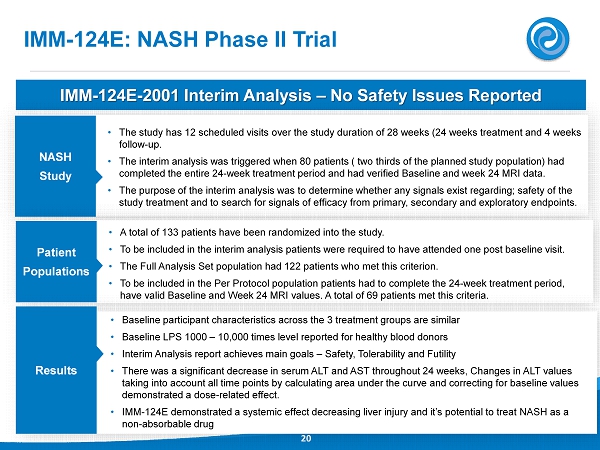

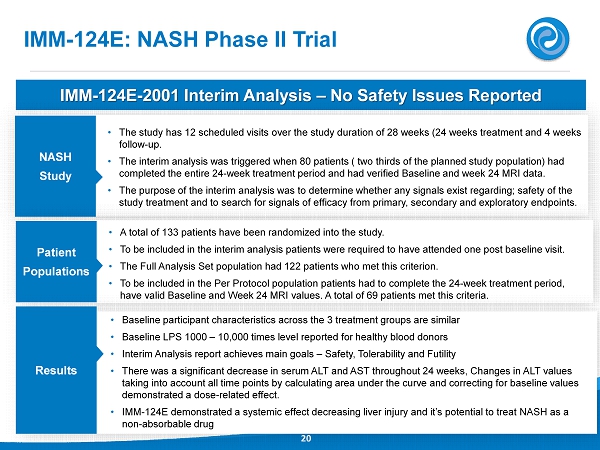

IMM - 124 E: NASH Phase II Trial 20 IMM - 124 E - 2001 Interim Analysis – No Safety Issues Reported NASH Study • The study has 12 scheduled visits over the study duration of 28 weeks ( 24 weeks treatment and 4 weeks follow - up. • The interim analysis was triggered when 80 patients ( two thirds of the planned study population) had completed the entire 24 - week treatment period and had verified Baseline and week 24 MRI data. • The purpose of the interim analysis was to determine whether any signals exist regarding; safety of the study treatment and to search for signals of efficacy from primary, secondary and exploratory endpoints. Patient Populations • A total of 133 patients have been randomized into the study. • To be included in the interim analysis patients were required to have attended one post baseline visit. • The Full Analysis Set population had 122 patients who met this criterion. • To be included in the Per Protocol population patients had to complete the 24 - week treatment period, have valid Baseline and Week 24 MRI values. A total of 69 patients met this criteria. Results • Baseline participant characteristics across the 3 treatment groups are similar • Baseline LPS 1000 – 10 , 000 times level reported for healthy blood donors • Interim Analysis report achieves main goals – Safety, Tolerability and Futility • There was a significant decrease in serum ALT and AST throughout 24 weeks, Changes in ALT values taking into account all time points by calculating area under the curve and correcting for baseline values demonstrated a dose - related effect. • IMM - 124 E demonstrated a systemic effect decreasing liver injury and it’s potential to treat NASH as a non - absorbable drug

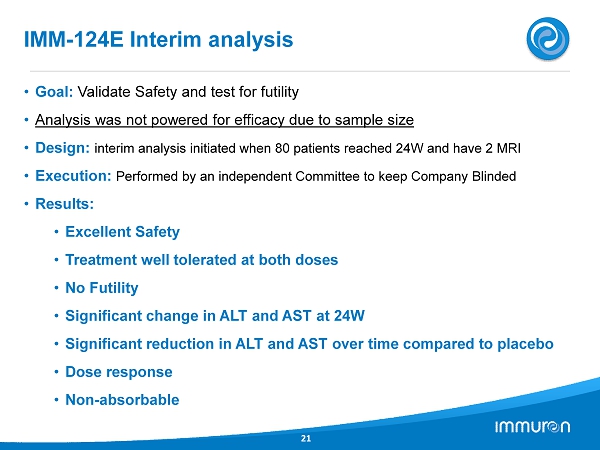

IMM - 124 E Interim analysis 21 • Goal: Validate Safety and test for futility • Analysis was not powered for efficacy due to sample size • Design: interim analysis initiated when 80 patients reached 24 W and have 2 MRI • Execution: Performed by an independent Committee to keep Company Blinded • Results: • Excellent Safety • Treatment well tolerated at both doses • No Futility • Significant change in ALT and AST at 24 W • Significant reduction in ALT and AST over time compared to placebo • Dose response • Non - absorbable

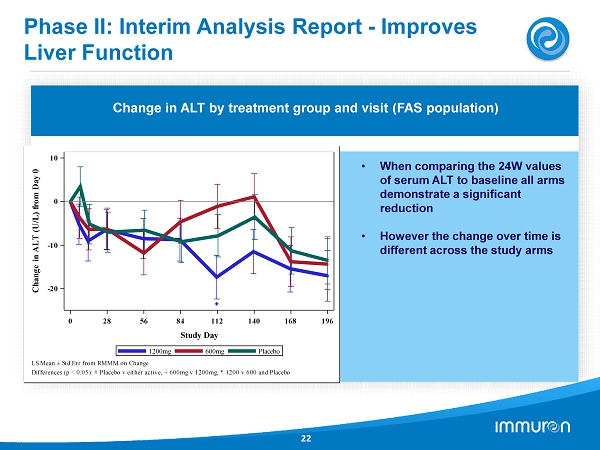

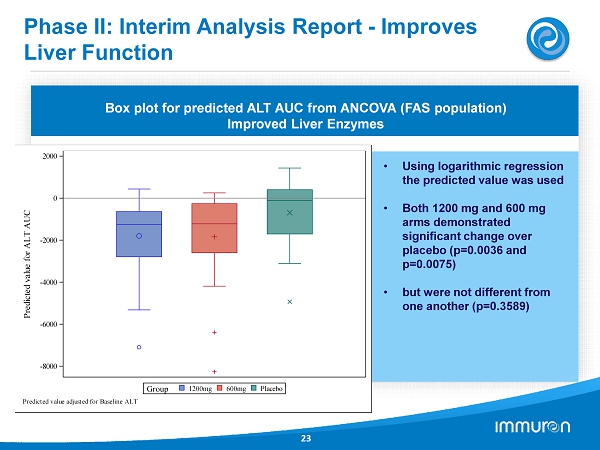

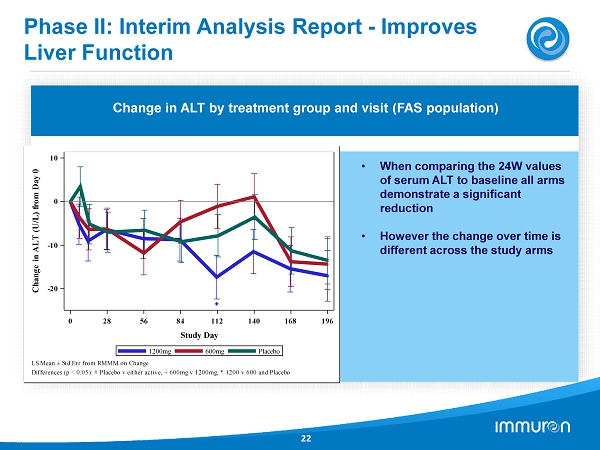

Phase II: Interim Analysis Report - Improves Liver Function 22 Results of a Phase IIa clinical trial; N= 133 24 Week Treatment; NO SAFETY ISSUES REPORTED Change in ALT by treatment group and visit (FAS population) • When comparing the 24 W values of serum ALT to baseline all arms demonstrate a significant reduction • However the change over time is different across the study arms 0 28 56 84 112 140 168 196 Study Day -20 -10 0 10 C h a n g e i n A L T ( U / L ) f r o m D a y 0 Placebo 600mg 1200mg LS Mean ± Std Err from RMMM on Change Differences (p < 0.05): # Placebo v either active, + 600mg v 1200mg, * 1200 v 600 and Placebo

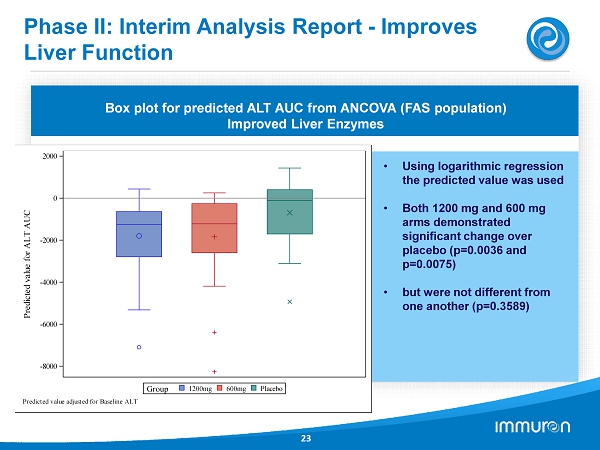

Phase II: Interim Analysis Report - Improves Liver Function 23 Results of a Phase IIa clinical trial; N= 133 24 Week Treatment; NO SAFETY ISSUES REPORTED Box plot for predicted ALT AUC from ANCOVA (FAS population) Improved Liver Enzymes • Using logarithmic regression the predicted value was used • Both 1200 mg and 600 mg arms demonstrated significant change over placebo (p= 0.0036 and p= 0.0075 ) • but were not different from one another (p= 0.3589 ) -8000 -6000 -4000 -2000 0 2000 P r e d i c t e d v a l u e f o r A L T A U C Placebo 600mg 1200mg Group Predicted value adjusted for Baseline ALT

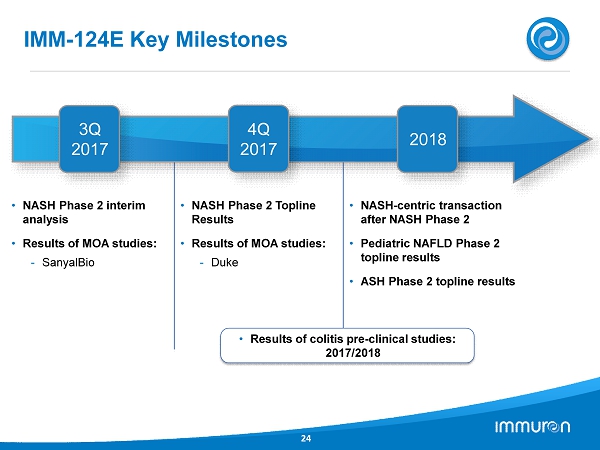

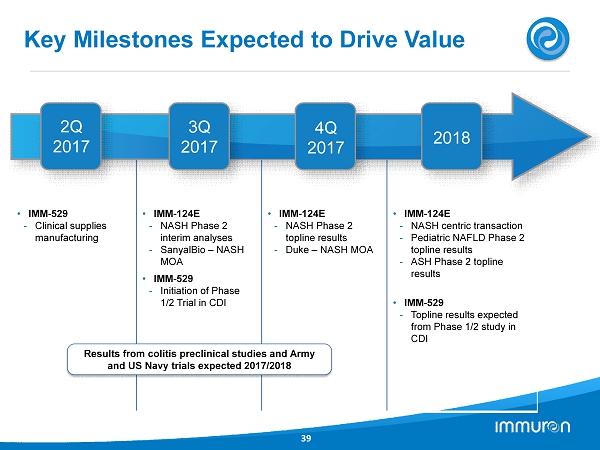

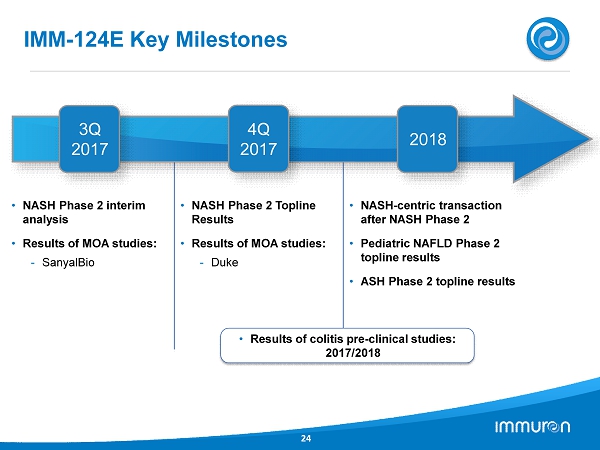

• NASH Phase 2 interim analysis • Results of MOA studies: - SanyalBio • NASH Phase 2 Topline Results • Results of MOA studies: - Duke • NASH - centric transaction after NASH Phase 2 • Pediatric NAFLD Phase 2 topline results • ASH Phase 2 topline results IMM - 124 E Key Milestones 24 3 Q 2017 4 Q 2017 • Results of colitis pre - clinical studies: 2017 / 2018 2018

IMM - 529 Neutralizing Clostridium difficile , while Sparing the Microbiome

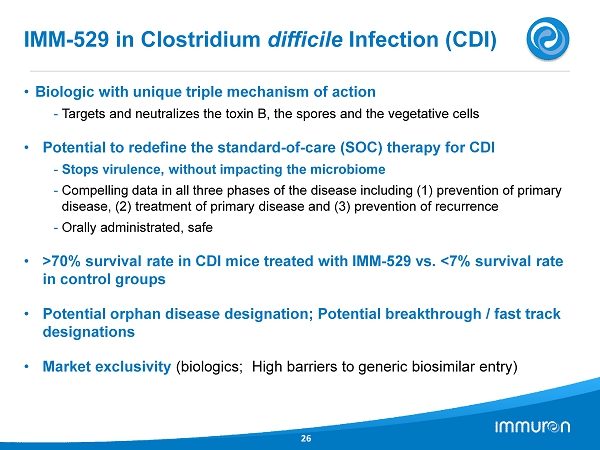

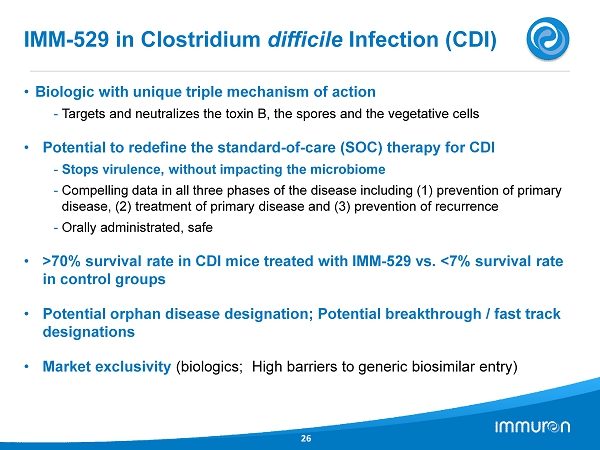

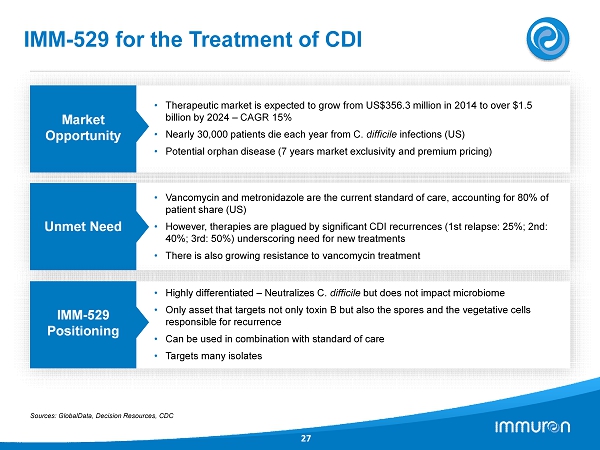

IMM - 529 in Clostridium difficile Infection (CDI) 26 • Biologic with unique triple mechanism of action - Targets and neutralizes the toxin B, the spores and the vegetative cells • Potential to redefine the standard - of - care (SOC) therapy for CDI - Stops virulence, without impacting the microbiome - Compelling data in all three phases of the disease including ( 1 ) prevention of primary disease, ( 2 ) treatment of primary disease and ( 3 ) prevention of recurrence - Orally administrated, safe • > 70 % survival rate in CDI mice treated with IMM - 529 vs. < 7 % survival rate in control groups • Potential orphan disease designation; Potential breakthrough / fast track designations • Market exclusivity (biologics; High barriers to generic biosimilar entry)

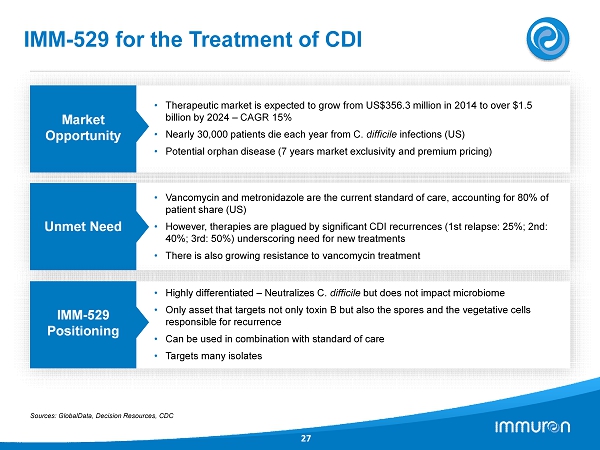

IMM - 529 for the Treatment of CDI 27 Market Opportunity • Therapeutic market is expected to grow from US$ 356.3 million in 2014 to over $ 1.5 billion by 2024 – CAGR 15 % • Nearly 30 , 000 patients die each year from C. difficile infections (US) • Potential orphan disease ( 7 years market exclusivity and premium pricing) Unmet Need • Vancomycin and metronidazole are the current standard of care, accounting for 80 % of patient share (US) • However, therapies are plagued by significant CDI recurrences ( 1 st relapse: 25 %; 2 nd: 40 %; 3 rd: 50 %) underscoring need for new treatments • There is also growing resistance to vancomycin treatment IMM - 529 Positioning • Highly differentiated – Neutralizes C. difficile but does not impact microbiome • Only asset that targets not only toxin B but also the spores and the vegetative cells responsible for recurrence • Can be used in combination with standard of care • Targets many isolates Sources: GlobalData, Decision Resources, CDC

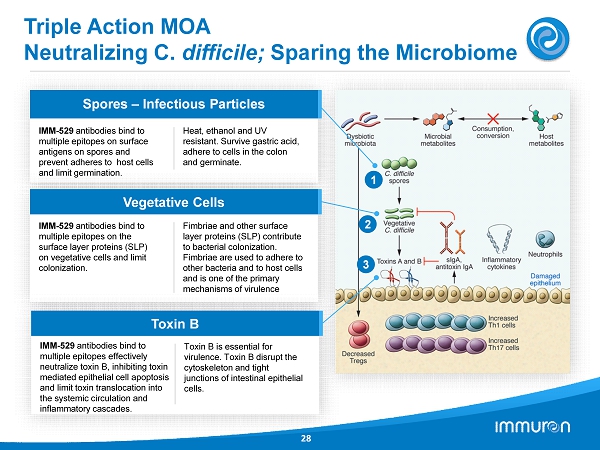

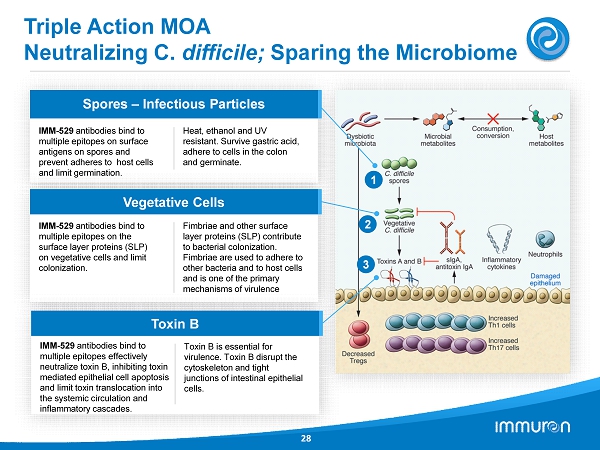

Triple Action MOA Neutralizing C. difficile; Sparing the Microbiome 28 Spores – Infectious Particles IMM - 529 antibodies bind to multiple epitopes on surface antigens on spores and prevent adheres to ho st cells and limit germination. Heat, ethanol and UV resistant. Survive gastric acid, adhere to cells in the colon and germinate. Vegetative Cells IMM - 529 antibodies bind to multiple epitopes on the surface layer proteins (SLP) on vegetative cells and limit colonization. Fimbriae and other surface layer proteins (SLP) contribute to bacterial colonization. Fimbriae are used to adhere to other bacteria and to host cells and is one of the primary mechanisms of virulence Toxin B IMM - 529 antibodies bind to multiple epitopes effectively neutralize toxin B, inhibiting toxin mediated epithelial cell apoptosis and limit toxin translocation into the systemic circulation and inflammatory cascades. Toxin B is essential for virulence. Toxin B disrupt the cytoskeleton and tight junctions of intestinal epithelial cells. 3 1 2

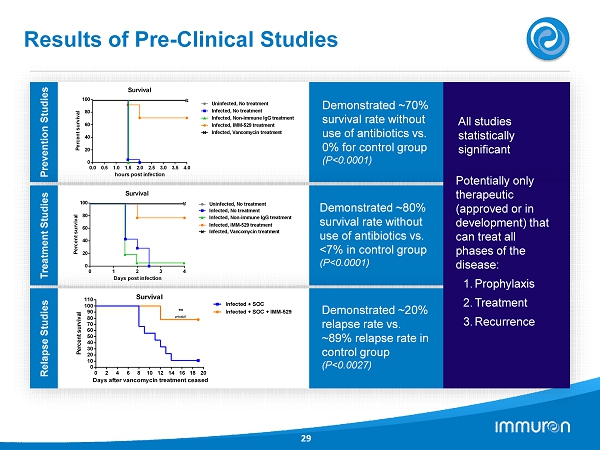

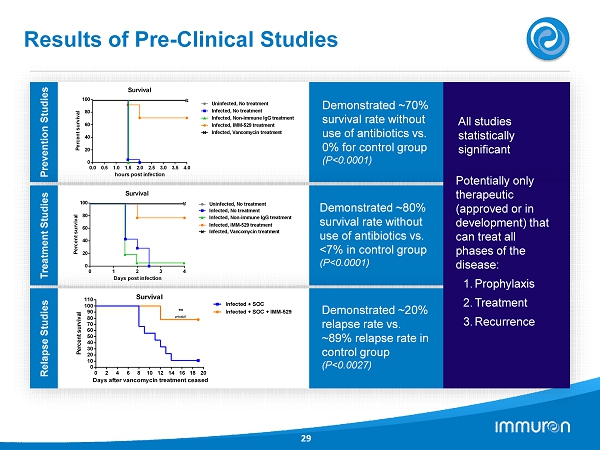

Results of Pre - Clinical Studies 29 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 0 20 40 60 80 100 Survival hours post infection P e r c e n t s u r v i v a l Uninfected, No treatment Infected, No treatment Infected, Non-immune IgG treatment Infected, IMM-529 treatment Infected, Vancomycin treatment Prevention Studies Demonstrated ~ 70 % survival rate without use of antibiotics vs. 0 % for control group (P< 0.0001 ) All studies statistically significant Treatment Studies Demonstrated ~ 80 % survival rate without use of antibiotics vs. < 7 % in control group (P< 0.0001 ) 0 1 2 3 4 0 20 40 60 80 100 Days post infection P e r c e n t s u r v i v a l Survival Infected, No treatment Infected, Non-immune IgG treatment Infected, IMM-529 treatment Infected, Vancomycin treatment Uninfected, No treatment Relapse Studies Demonstrated ~ 20 % relapse rate vs. ~ 89 % relapse rate in control group (P< 0.0027 ) Potentially only therapeutic (approved or in development) that can treat all phases of the disease: 1. Prophylaxis 2. Treatment 3. Recurrence 0 2 4 6 8 10 12 14 16 18 20 0 10 20 30 40 50 60 70 80 90 100 110 Survival Days after vancomycin treatment ceased P e r c e n t s u r v i v a l Infected + SOC Infected + SOC + IMM-529 ** p=0.0027

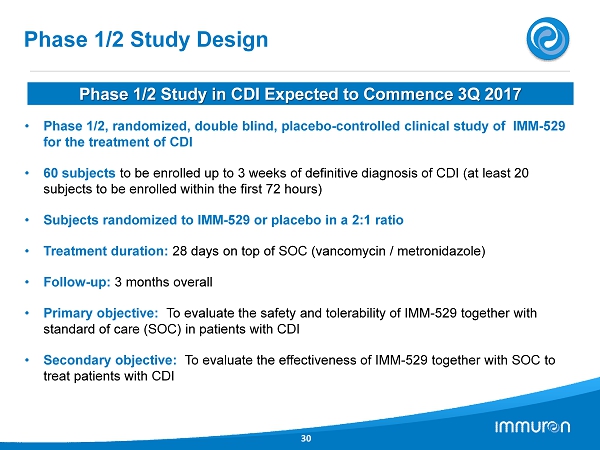

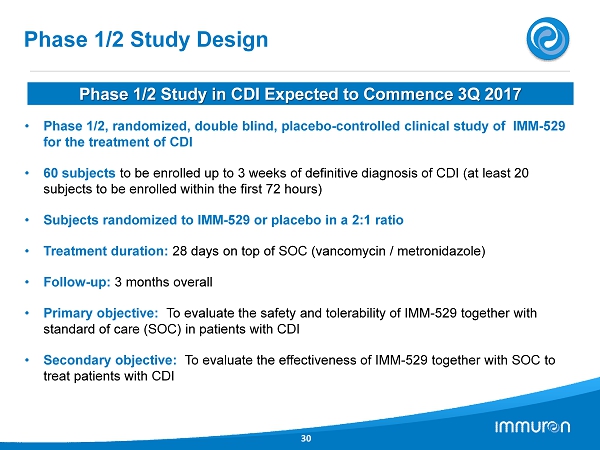

Phase 1 / 2 Study Design 30 • Phase 1 / 2 , randomized, double blind, placebo - controlled clinical study of IMM - 529 for the treatment of CDI • 60 subjects to be enrolled up to 3 weeks of definitive diagnosis of CDI (at least 20 subjects to be enrolled within the first 72 hours) • Subjects randomized to IMM - 529 or placebo in a 2 : 1 ratio • Treatment duration: 28 days on top of SOC (vancomycin / metronidazole) • Follow - up: 3 months overall • Primary objective: To evaluate the safety and tolerability of IMM - 529 together with standard of care (SOC) in patients with CDI • Secondary objective: To evaluate the effectiveness of IMM - 529 together with SOC to treat patients with CDI Phase 1 / 2 Study in CDI Expected to Commence 3 Q 2017

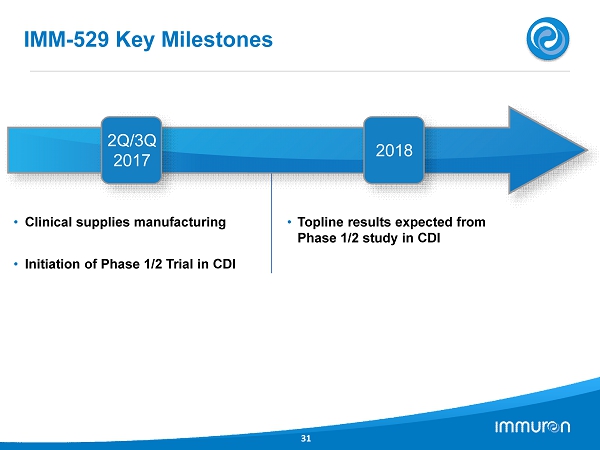

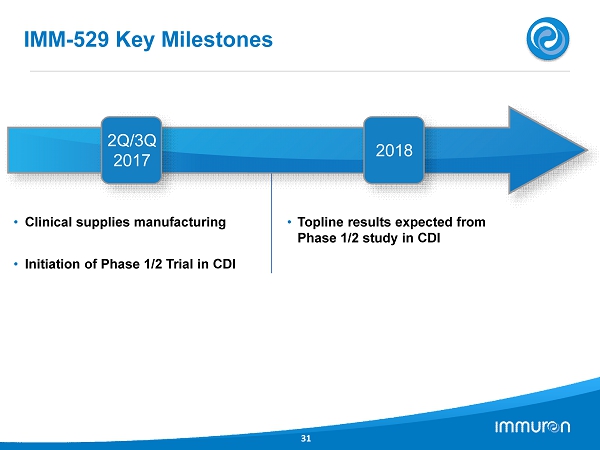

• Clinical supplies manufacturing • Initiation of Phase 1/2 Trial in CDI • Topline results expected from Phase 1/2 study in CDI IMM - 529 Key Milestones 31 2 Q/ 3 Q 2017 2018

Corporate and Financial Overview

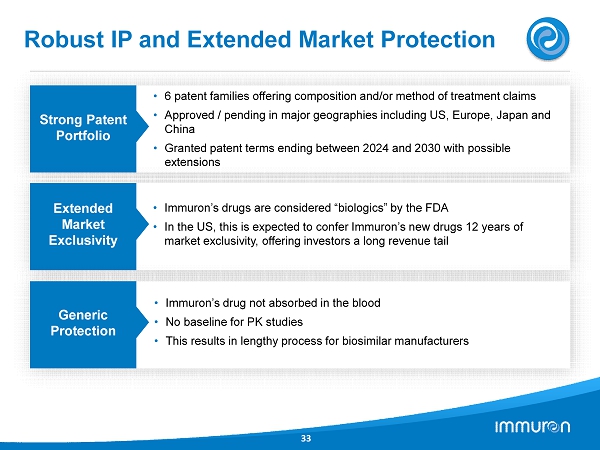

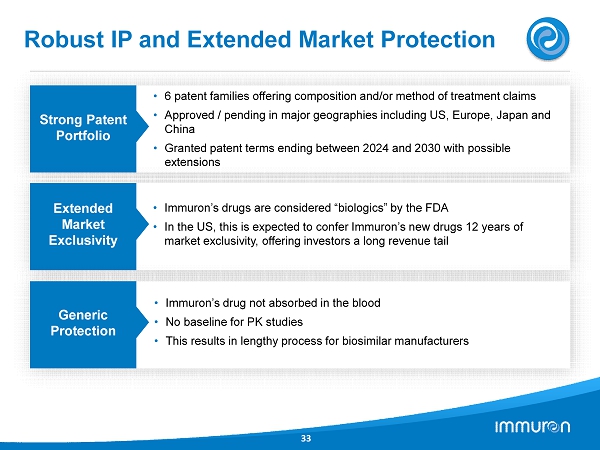

Robust IP and Extended Market Protection 33 Strong Patent Portfolio • 6 patent families offering composition and/or method of treatment claims • Approved / pending in major geographies including US, Europe, Japan and China • Granted patent terms ending between 2024 and 2030 with possible extensions Extended Market Exclusivity • Immuron’s drugs are considered “biologics” by the FDA • In the US, this is expected to confer Immuron’s new drugs 12 years of market exclusivity, offering investors a long revenue tail Generic Protection • Immuron’s drug not absorbed in the blood • No baseline for PK studies • This results in lengthy process for biosimilar manufacturers

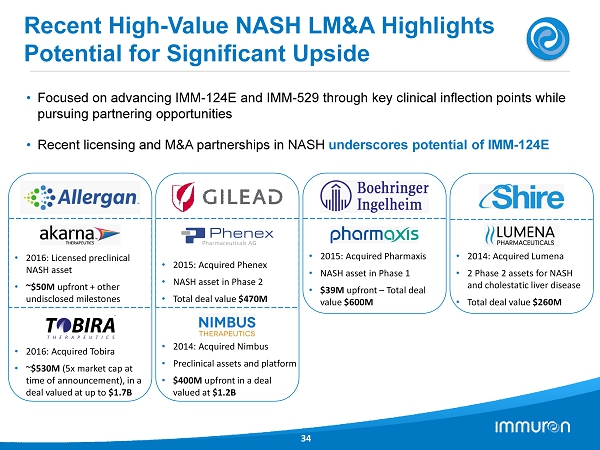

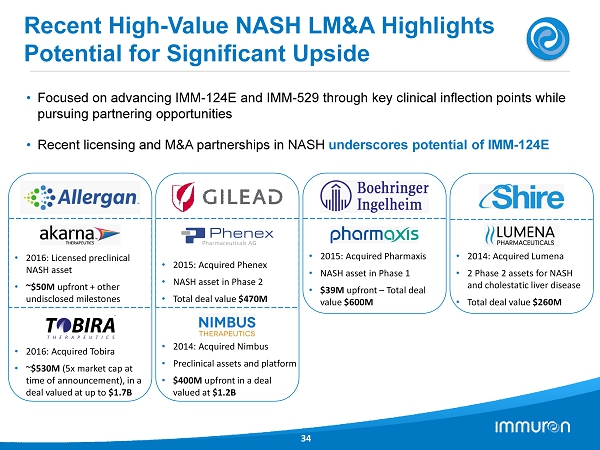

• 2016 : Licensed preclinical NASH asset • ~$ 50 M upfront + other undisclosed milestones Recent High - Value NASH LM&A Highlights Potential for Significant Upside 34 • Focused on advancing IMM - 124 E and IMM - 529 through key clinical inflection points while pursuing partnering opportunities • Recent licensing and M&A partnerships in NASH underscores potential of IMM - 124 E • 2016 : Acquired Tobira • ~ $ 530 M ( 5 x market cap at time of announcement), in a deal valued at up to $ 1.7 B • 2015 : Acquired Phenex • NASH asset in Phase 2 • Total deal value $ 470 M • 2014 : Acquired Nimbus • Preclinical assets and platform • $ 400 M upfront in a deal valued at $ 1.2 B • 2015 : Acquired Pharmaxis • NASH asset in Phase 1 • $ 39 M upfront – Total deal value $ 600 M • 2014 : Acquired Lumena • 2 Phase 2 assets for NASH and cholestatic liver disease • Total deal value $ 260 M

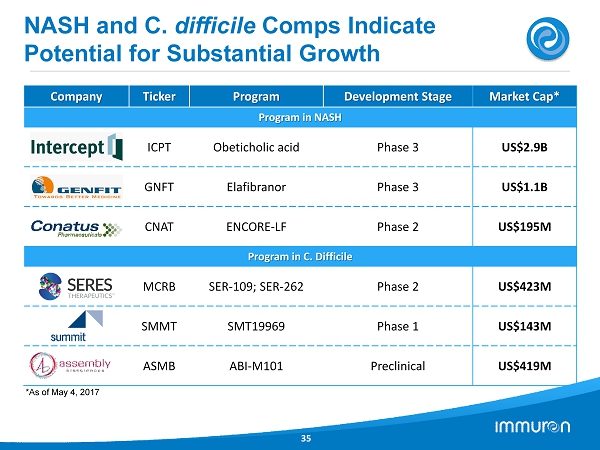

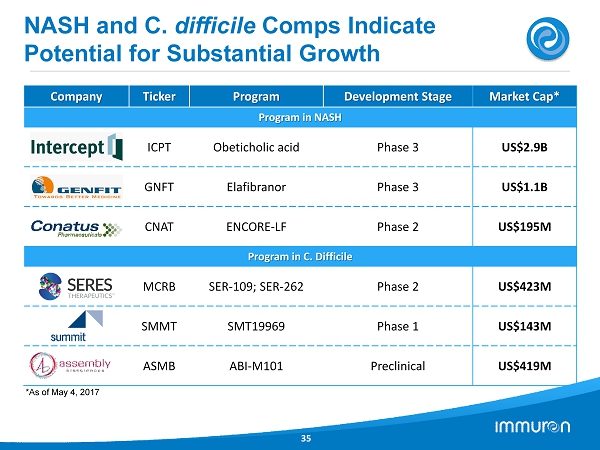

NASH and C. difficile Comps Indicate Potential for Substantial Growth 35 Company Ticker Program Development Stage Market Cap* Program in NASH ICPT Obeticholic acid Phase 3 US$2.9B GNFT Elafibranor Phase 3 US$1.1B CNAT ENCORE - LF Phase 2 US$195M Program in C. Difficile MCRB SER - 109; SER - 262 Phase 2 US$423M SMMT SMT19969 Phase 1 US$143M ASMB ABI - M101 Preclinical US$419M *As of May 4 , 2017

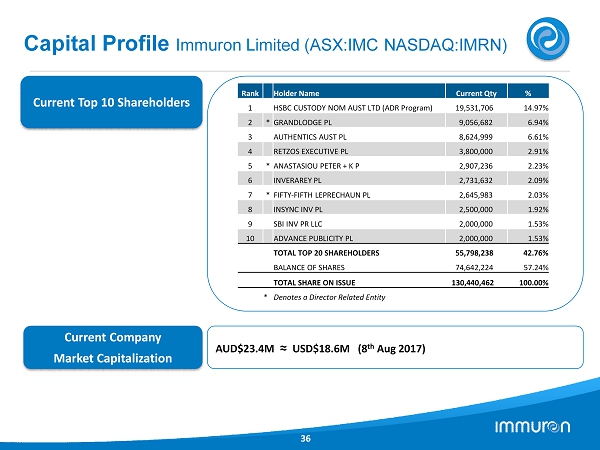

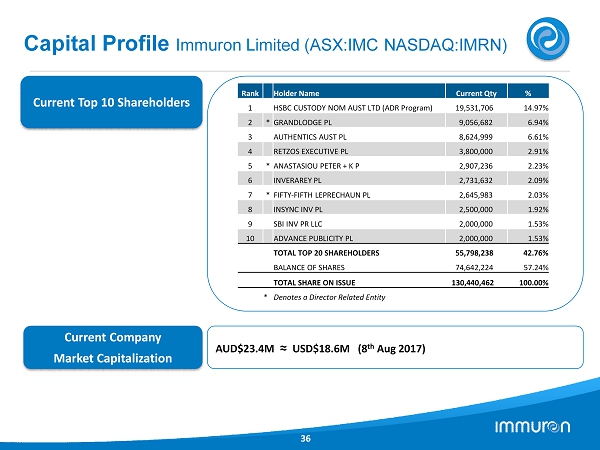

Capital Profile Immuron Limited (ASX:IMC NASDAQ:IMRN) 36 Current Top 10 Shareholders Current Company Market Capitalization AUD$ 23.4 M ≈ USD$ 18.6 M ( 8 th Aug 2017 ) Rank Holder Name Current Qty % 1 HSBC CUSTODY NOM AUST LTD (ADR Program) 19,531,706 14.97% 2 * GRANDLODGE PL 9,056,682 6.94% 3 AUTHENTICS AUST PL 8,624,999 6.61% 4 RETZOS EXECUTIVE PL 3,800,000 2.91% 5 * ANASTASIOU PETER + K P 2,907,236 2.23% 6 INVERAREY PL 2,731,632 2.09% 7 * FIFTY - FIFTH LEPRECHAUN PL 2,645,983 2.03% 8 INSYNC INV PL 2,500,000 1.92% 9 SBI INV PR LLC 2,000,000 1.53% 10 ADVANCE PUBLICITY PL 2,000,000 1.53% TOTAL TOP 20 SHAREHOLDERS 55,798,238 42.76% BALANCE OF SHARES 74,642,224 57.24% TOTAL SHARE ON ISSUE 130,440,462 100.00% * Denotes a Director Related Entity

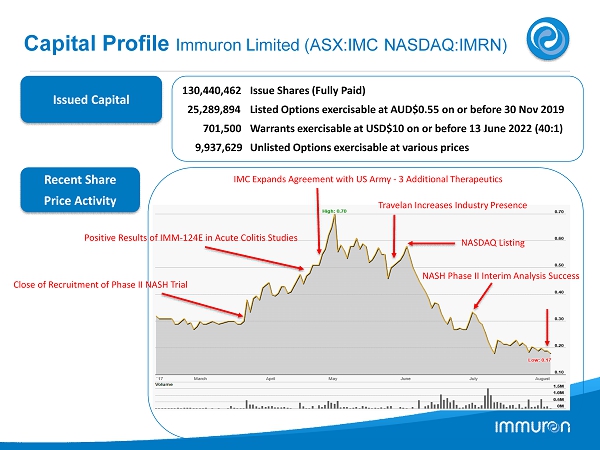

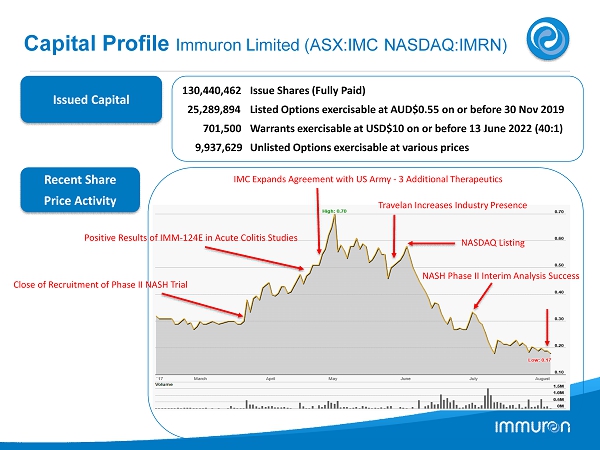

Capital Profile Immuron Limited (ASX:IMC NASDAQ:IMRN) Issued Capital Recent Share Price Activity 130 , 440 , 462 Issue Shares (Fully Paid) 25 , 289 , 894 Listed Options exercisable at AUD$ 0.55 on or before 30 Nov 2019 701 , 500 Warrants exercisable at USD$ 10 on or before 13 June 2022 ( 40 : 1 ) 9 , 937 , 629 Unlisted Options exercisable at various prices Close of Recruitment of Phase II NASH Trial Positive Results of IMM - 124 E in Acute Colitis Studies IMC Expands Agreement with US Army - 3 Additional Therapeutics Travelan Increases Industry Presence NASH Phase II Interim Analysis Success NASDAQ Listing

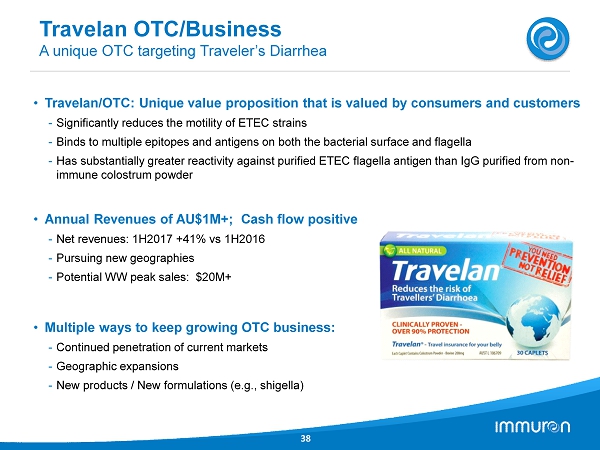

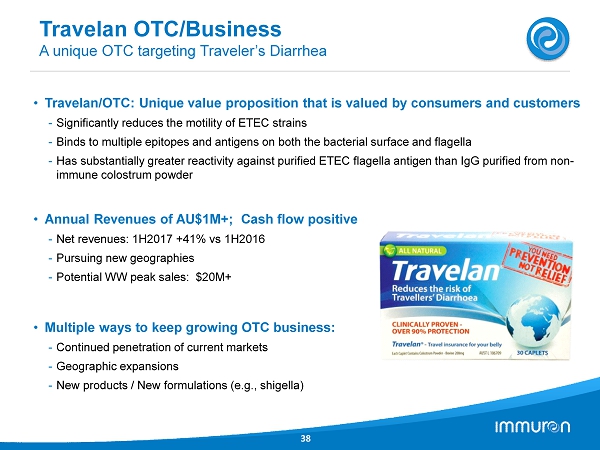

Travelan OTC/Business A unique OTC targeting Traveler’s Diarrhea • Travelan/OTC: Unique value proposition that is valued by consumers and customers - Significantly reduces the motility of ETEC strains - Binds to multiple epitopes and antigens on both the bacterial surface and flagella - Has substantially greater reactivity against purified ETEC flagella antigen than IgG purified from non - immune colostrum powder • Multiple ways to keep growing OTC business: - Continued penetration of current markets - Geographic expansions - New products / New formulations (e.g., shigella ) • Annual Revenues of AU$ 1 M+; Cash flow positive - Net revenues: 1 H 2017 + 41 % vs 1 H 2016 - Pursuing new geographies - Potential WW peak sales: $ 20 M+ 38

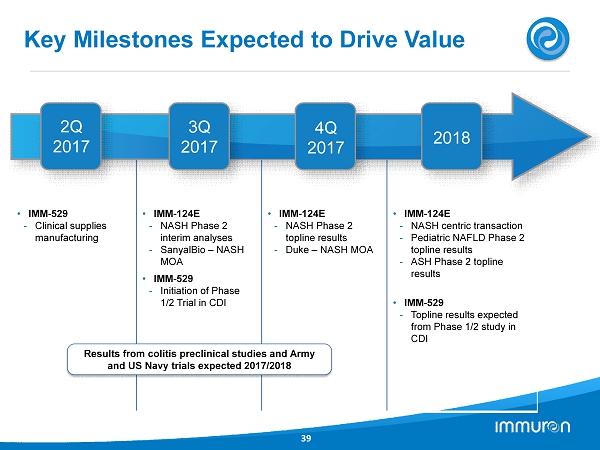

Key Milestones Expected to Drive Value 39 • IMM - 529 - Clinical supplies manufacturing • IMM - 124E - NASH Phase 2 interim analyses - SanyalBio – NASH MOA • IMM - 529 - Initiation of Phase 1/2 Trial in CDI • IMM - 124E - NASH Phase 2 topline results - Duke – NASH MOA • IMM - 124E - NASH centric transaction - Pediatric NAFLD Phase 2 topline results - ASH Phase 2 topline results • IMM - 529 - Topline results expected from Phase 1/2 study in CDI 2 Q 2017 3 Q 2017 4 Q 2017 2018 Results from colitis preclinical studies and Army and US Navy trials expected 2017 / 2018

Investment Highlights 40 x Well positioned to address high unmet medical need in multiple blockbuster markets x Two clinical assets, 4 phase 2 clinical trials on going x Robust R&D pipeline x High - value peer licensing deals and M&A underscore potential upside ( Current Market Capitalization = USD$ 18.6 M, 6 August 2017 ) x Validated technology platform – with one registered asset generating growing revenue x Listed on NASDAQ in 2 Q 2017 x Experienced Management Team with strong support from leading KOLs and institutions

Thank You