Exhibit 99.3

Corporate Governance Statement

The Board of Directors of Immuron Limited (“the Company”) is responsible for the corporate governance of the Company and guides and monitors the business and affairs of the Company on behalf of its shareholders.

The format of the Corporate Governance Statement is based on the Australian Stock Exchange Corporate Governance Council’s (“the Council”) “Corporate Governance Principles and Recommendations”. In accordance with the Council’s recommendations, the Corporate Governance Statement must contain certain specific information and must disclose the extent to which the Company has followed the guidelines during the period.

Where a recommendation has not been followed, that fact must be disclosed, together will the reasons for the departure. Immuron’s Corporate Governance Statement is structured with reference to the Council’s principles and recommendations, which are as follows:

| Principle 1 | Lay solid foundations for management and oversight |

| Principle 2 | Structure the board to add value |

| Principle 3 | Act ethically and responsibly |

| Principle 4 | Safeguard integrity in corporate reporting |

| Principle 5 | Make timely and balanced disclosure |

| Principle 6 | Respect the rights of shareholders |

| Principle 7 | Recognise and manage risk |

| Principle 8 | Remunerate fairly and responsibly |

Commensurate with the spirit of the ASX Corporate Governance Principles and Recommendations,the Company has followed each recommendation where the Board has considered the recommendation to be an appropriate benchmark for corporate governance practices, taking into account factors such as the size of the Company and the Board, resources available and activities of the Company. Where the Company’s corporate governance practices depart from the Principles and Recommendations, the Board has offered full disclosure of the nature of, and reason for, the adoption of its own practice.

Immuron’s corporate governance practices were in place throughout the year ended 30 June 2018. For further information on the corporate governance policies adopted by Immuron Limited, please refer to its website: www.immuron.com.

Principle 1: Lay solid foundations for management and oversight.

Role of the Board.

The primary role of the Board is to provide effective governance over the Company’s affairs to ensure the interests of the shareholders are protected and the confidence of the investing market is maintained whilst having regard for the interests of all the stakeholders.

This role is exercised by the Board, as whole, and each Director exercising diligent attention to the affairs of the Company.

In particular the Board is responsible for:

| 1) | Setting the Company’s values and standards of conduct and ensuring that these are adhered to |

| 2) | Providing strategic direction and approving corporate strategic initiatives; |

| 3) | Oversight of the Company, including its control and accountability systems; |

| 4) | Appointing and removing the Chief Executive Office; |

| 5) | Reviewing and ratifying systems of risk management and internal compliance and controls, codes of conduct and legal compliance; |

| 6) | Monitoring senior management performance and ensuring appropriate resources are available; |

| Page 1 |

Corporate Governance Statement

| 7) | Approving and monitoring the progress of major capital expenditure, capital management and acquisitions and divestitures; |

| 8) | Approving and monitoring financial and other reporting to shareholders and regulatory authorities. |

To ensure that all new Board members understand what is expected of them, in addition to their obligations under the Corporation Act, the Company provides them with a document setting out the key terms and conditions relating to their appointment.

Role of Management.

Through the Chief Executive Officer, management is responsible to the Board for the:

| 1) | Development and implementation of agreed corporate strategy and performance objectives; |

| 2) | Undertaking the day to day activities of the Company; |

| 3) | Identifying all matters to be included in a risk profile of the Company and ensuring that effective risk management systems are implemented and adhered to; |

| 4) | Observing the code of conduct; |

| 5) | Ensuring that the Board is fully informed of all matters which may have a material impact on the ability of the Company to meet its obligations. |

Board Appointments

The Company undertakes comprehensive reference checks prior to appointing a director, or putting that person forward as a candidate to ensure that person is competent, experienced, and would not be impaired in any way from undertaking the duties of director. The Company provides relevant information to shareholders for their consideration about the attributes of candidates together with whether the Board supports the appointment or re-election.

The terms of the appointment of a non-executive director, executive directors and senior executives are agreed upon and set out in writing at the time of appointment.

The Company Secretary

The Company Secretary is accountable directly to the Board, through the Chairman, on all matters to do with the proper functioning of the Board, including agendas, Board papers and minutes, advising the Board and its Committees (as applicable) on governance matters, monitoring that the Board and Committee policies and procedures are followed, communication with regulatory bodies and the ASX and statutory and other filings.

Diversity Policy

The Company is committed to increasing diversity amongst its employees, and not just in the area of gender diversity. Our workforce is employed based on the right person for the job regardless of their gender, age, nationality, race, religious beliefs, cultural background, sexuality or physical ability or appearance.

Executive and Board positions are filled by the best candidates available without discrimination. The Company is committed to increasing gender diversity within these positions when appropriate appointments become available. The Company is also committed to identifying suitable persons within the organisation, and where appropriate opportunities exist, advance diversity to support the promotion of talented employees into management positions.

The Company has not set any gender specific diversity objectives as it believes that multicultural diversity and other diversity factors are equally important within its organisation.

The following table demonstrates the Company’s gender diversity as at the date of this report:

| | Number of Males | Number of Females |

| Directors | 6 | — |

| Key Management Personnel | 1 | — |

| Other Company Employees/Consultants | 5 | 4 |

| Page 2 |

Corporate Governance Statement

Board Performance Review

The Board considers the ongoing development and improvement of its own performance, the performance of individual directors and Board Committees as critical to effective governance.

The Board has adopted an informal self-evaluation process to measure its own performance. The performance of the Board and individual directors is reviewed at least every year by the Board as a whole. This process includes a review in relation to the composition and skills mix of the Directors of the Company. Performance reviews involve analysis based on key performance indicators aligned with the financial and non-financial objectives of the Company. A performance review in accordance with the processes disclosed occurred during the 2018 financial year.

Performance Review of KMP

On at least an annual basis, the Board conducts a formal performance review of the Chief Executive Officer and any other key management personnel (KMP). The Board assesses the performance of KMP against qualitative and quantitative key performance indicators relevant to each KMP. A performance review of KMP occurred during the 2018 financial year in accordance with this process.

Independent Advice

The Board collectively and each Director individually may take, at the expense of the Company, such independent professional advice as is considered necessary to fulfill their relevant duties and responsibilities.

Principle 2: Structure the Board to add value.

Board composition

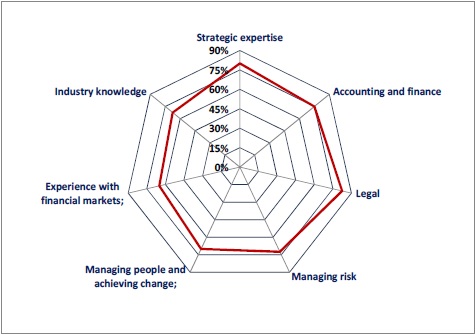

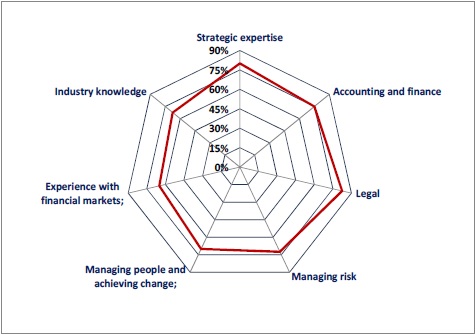

The Board is comprised of five Non-Executive Directors and one Executive Director. Four of the five Non-Executives, Dr Roger Aston, Mr Daniel Pollock, Prof. Ravi Savarirayan and Mr Richard J Berman, are Independent Directors who act independent of management and free of any business or other relationship that could materially interfere with the exercise of their unfettered and independent judgment. The Board does consist of a majority of independent directors. The Board considers the presence of four independent directors on the Board (including the Chairman) provides the Board with sufficient independence. The Board assesses whether a director is independent in accordance with the Council’s independence guidelines. The skills and expertise of the Directors as a collective group are captured in the following graph:

The skills, experience and expertise relevant to the position of each director who is in office at the date of the annual report and their term of office are detailed in the directors’ report.

Board Committees

The Board has established two Board committees, the Audit and Risks Committee and the Remuneration Committee, to assist the Board in discharging its responsibilities. Charters for Board Committees can be viewed on the Company’s website. Given the size of the Board and the Company, Board Committees consisting of only two members are deemed to be an appropriate size to allow the Committees to discharge their charters effectively. Both Board Committees consist of only Independent Directors and are both chaired by an Independent Director.

| Page 3 |

Corporate Governance Statement

Nomination of Directors

The responsibilities of the Remuneration Committee include considering board succession issues and reviewing Board composition to assist in ensuring the Board has the appropriate balance of skills, knowledge, experience, independence and diversity to enable it to discharge its duties and responsibilities effectively.

The Board has a skills matrix covering the competencies and experience of each member. When the need for a new director is identified, the required experience and competencies of the new director are defined in the context of this matrix and any gaps that may exist.

Induction of New Directors and Ongoing Development

New Directors are issued with a formal Letter of Appointment that sets out the key terms and conditions of their appointment, including Director’s duties, rights and responsibilities, the time commitment envisaged, and the Board’s expectations regarding involvement with any Committee work.

A new director induction program is in place and Directors are encouraged to engage in professional development activities to develop and maintain the skills and knowledge needed to perform their role as Directors effectively.

Principle 3: Act ethically and responsibly

The Company has adopted the Australian National Health and Medical Research Council guidelines on ethical research practices.

Code of Conduct

Immuron is guided in all its activities by respect for all its stakeholders including employees, shareholders, contractors, customers and suppliers.

The Board has articulated the Company’s requirements for standards of conduct, from Directors and senior management, based on the following principles;

| - | Directors are subject to re-election every three years; |

| - | The Chairman must be independent; |

| - | Conflict of interest must be avoided wherever possible. If, for any reason, a potential conflict arises, the Director/employee must declare the conflict and absent themselves from all discussions and decisions on the relevant matter; |

| - | Employees, consultants and Directors must respect the confidentiality of the Company’s assets, including intellectual property, both during and after employment; |

| - | The Company will comply with all relevant legislation and regulation; |

| - | The Company will deal fairly with all its stakeholders; |

| - | The Company will promote a culture of ethical behavior, encouraging openness amongst employees, Directors and contractors. |

Trading in Company Securities.

The Company reaffirmed its policy and procedures on securities trading in an announcement to the Australian Stock Exchange (ASX) on 17 August 2017. The Securities trading Policy can be viewed in the Company’s website.

Briefly the policy states that in respect of any designated officer, either directly or indirectly, is not to deal in the Company’s securities at any time:

| - | When a designated officer is in possession of inside information; or |

| - | Where the dealing is for short-term or speculative gain; or |

| - | Within a period of 1 week prior to the release of the Company’s quarterly activities & cashflow reports; or |

| - | Within a period of 1 week prior to the release of the Company’s half year and annual financial results. |

| Page 4 |

Corporate Governance Statement

A designated officer includes Directors, key management employees, consultants, and their associates, and is not to communicate inside information or cause that information to be communicated to another person, or deal in securities of outside companies about which they may obtain inside information by virtue of their position at Immuron.

Each Director has entered into an agreement with the Company to provide information to allow the Company to notify the ASX of any share transaction within five business days.

The Audit and Risks Committee will periodically review the compliance with this policy and report any departures to the Board.

Principle 4: Safeguard integrity in corporate reporting.

Audit and Risks Committee

The Board has established an Audit and Risks Committee, which operates under a Charter approved by the Board. It is the Board’s responsibility to ensure that an effective internal control framework exists within the Company. This includes internal controls to deal with both the effectiveness and efficiency of significant business processes, the safeguarding of assets, the maintenance of proper accounting records, and the reliability of financial information as well as non-financial considerations such as the benchmarking of operational key performance indicators. The Board has delegated responsibility for establishing and maintaining a framework of internal control and ethical standards to the Audit and Risks Committee.

The Audit and Risks Committee consists of the following Independent Non-Executive Directors:

| - | Mr Daniel Pollock (Chairperson) |

Details of the Directors qualifications and attendance at audit committee meetings are set out in the Directors Report.

The main responsibilities of the Audit and Risks Committee are to:

| - | Determine the adequacy of the Company’s administrative, operating and accounting controls and policies including; |

| ○ | Systems of internal control and management of risks, including the risks associated with the Company’s production and R & D projects; |

| ○ | The Company’s process for monitoring compliance with laws and regulations and its own code of business conduct. |

| ○ | Oversee and appraise the quality of the audits conducted by the Company’s external auditors; |

| ○ | Maintain open lines of communication among the Board, management and external auditors to exchange views and information, as well as confirm their respective authority and responsibilities; |

| ○ | Serve as an objective party to review the financial information presented by management to the Board, shareholders and regulators; and |

| ○ | Report to the Board on matters relevant to the Committee’s role and responsibilities. |

| - | In fulfilling its responsibilities, the Audit and Risks Committee: |

| ○ | Receives regular reports from management; |

| ○ | Meets with the external auditors at least twice a year and reviews any significant disagreements between the auditors and management irrespective of whether they have been resolved; |

| ○ | Review of the audit plan with the external auditors and evaluates the effectiveness of the external audit; |

| ○ | Reviews the process the Chief Executive Officer and Chief Financial Officer have in place to support their certifications to the Board. |

The Audit and Risks Committee has the authority, within the scope of its responsibilities, to seek and request any information it requires from any employee or external party.

| Page 5 |

Corporate Governance Statement

Chief Financial Officer Declarations

The CFOs have provided the Board with a declaration that, in their opinion, the financial records of the entity have been properly maintained and that the financial statements comply with the appropriate accounting standards and give a true and fair view of the financial position and performance of the entity and that the opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

External Auditor

The Company’s external auditor attends each annual general meeting and is available to answer any questions with regard to the conduct of the audit and their report.

Prior approval of the Board must be gained for non-audit work to be performed by the external auditor. There are qualitative limits on this non-audit work to ensure that the independence of the auditor is maintained.

There is also a requirement that the audit partner responsible for the audit not perform in that role for more than five years.

Principle 5: Making timely and balanced disclosure.

As Immuron’s shares are traded on the ASX the Company is very conscious that it has an obligation to ensure that the market is both fully and accurately informed about material matters by timely and balanced disclosure.

The Company has a Disclosure Policy which outlines the disclosure obligations of the Company as required under the ASX Listing Rules and Corporations Act. The policy is designed to ensure that procedures are in place so that the market is properly informed of matters which may have a material impact on the price at which Company securities are traded.

The Company Secretary has been nominated as the person responsible for communicating with the Australian Securities Exchange (ASX). This role includes responsibility for ensuring compliance with the continuous disclosure requirement in the ASX Listing Rules and overseeing and co-ordinating information disclosure to the ASX, analysts, brokers, shareholders, the media and the public.

The information disclosed will be factual and presented in a clear and balanced way. The Company has prepared and issued to all senior staff a written policy document on this matter and requires strict adherence to this policy.

The Company’s Disclosure Policy can be viewed on the Company’s website.

Principle 6: Respect the rights of shareholders.

The Company is committed to providing current and relevant information to its shareholders.

The Company respects the rights of its shareholders and to facilitate the effective exercise of those rights the Company is committed to:

| ● | communicating effectively with shareholders through releases to the market via ASX, the company website, information mailed to shareholders and the general meetings of the Company; |

| ● | giving shareholders ready access to clear and understandable information about the Company; and |

| ● | making it easy for shareholders to participate in general meetings of the Company. |

The Company also makes available a telephone number and email address for shareholders to make enquiries of the Company. These contact details are available on the “contact us” page of the Company’s website.

Shareholders may elect to, and are encouraged to, receive communications from the Company and its securities registry electronically.

The Company maintains information in relation to its corporate governance documents, Directors and senior executives, Board and committee charters, annual reports and ASX announcements on the Company’s website.

| Page 6 |

Corporate Governance Statement

Principle 7: Recognise and managing risk.

The Board is committed to the identification, assessment and management of risk throughout the Company’s business activities.

The Company’s Risk Management Policy recognises that risk management is an essential element of good corporate governance and fundamental in achieving its strategic and operational objectives. Risk management improves decision making, defines opportunities and mitigates material events that may impact security holder value.

The Board review’s the entity’s risk management framework at least annually to satisfy itself that it continues to be sound. A review of the Company’s risk management framework was conducted during the 2018 financial year.

The Company’s Risk Management Policy is periodically reviewed and updated. Management reports risks identified to the Board through regular operations reports, and via direct and timely communication to the Board where and when applicable. During the reporting period, management has reported to the Board as to the effectiveness of the Company’s management of its material business risks. The Company does not have an internal audit function.

The Company faces risks inherent to its business, including economic risks, which may materially impact the Company’s ability to create or preserve value for security holders over the short, medium or long term. The Company has in place policies and procedures, including a risk management framework (as described in the Company’s Risk Management Policy), which is developed and updated to help manage these risks. The Board does not consider that the Company currently has any material exposure to environmental or social sustainability risks.

In addition to the usual business risks, the particular risks associated with the Company’s activities are:

| - | Long lead times and high costs associated with biotech research, development and commercialisation; |

| - | The low success rate of biotech research in Australia; |

| - | Stringent health regulations which are subject to regular change; |

| - | The high level of funding required over a long period of time; |

| - | Securing and protecting the Company’s intellectual property. |

The Company also manages ongoing risk through the Audit and Risks Committee. The functions and responsibilities of that Committee are outlined earlier in this section of the report and are set out in Audit and Risks Committee Charter which is available on the Company’s website.

The Company’s Risk Management Policy can be viewed on its website.

Principle 8: Remunerate fairly and responsibly.

The Remuneration Committee is responsible for determining and reviewing compensation arrangements for the Directors and for approving parameters within which the review of the compensation arrangements for the senior executive team can be conducted by the Chief Executive Officer and/or the Board. The members of the Committee are Dr. Roger Aston (Committee Chairman) and Mr. Daniel Pollock.

Remuneration for Executive Directors and staff is determined by reference to market rates. The expected outcomes of the remuneration structure are:

| - | retention and motivation of key executives; |

| - | attraction of high quality management to the Company and consolidated entity; and |

| - | performance incentives that allow executives to share in the success of the Company. |

From time to time employees and consultants are offered shares and options under plans previously agreed by shareholders. In a Company at this stage of its development, the only meaningful performance target is the share price and the exercise price for such options, which are set above the price at which the shares are trading at the time of issue and, for Executives, usually have a vesting period of up to three years. Participants in an equity based remuneration scheme are prohibited from entering into any transaction that would have the effect of hedging or otherwise transferring the risk of any fluctuation in the value of any unvested entitlement in the Company’s securities to any other person.

| Page 7 |

Corporate Governance Statement

In setting remuneration for non-executive Directors, the Board will use the following principles;

| - | Non-Executive Directors shall be paid fees and superannuation plus supplements for committee work within the aggregate amount set by shareholders in general meeting (last set in 2005 at $350,000 for cash remuneration); |

| - | Non-Executive Directors may participate in options arrangements subject to shareholder approval. The Board does not accept that options should not be given to non-executive Directors as it believes (and shareholders have previously agreed) that in an R&D company their particular expertise is vital to the team effort and therefore options are a valid incentive; |

| - | Non-Executive Directors retirement payments are limited to compulsory employer superannuation; |

| - | Bonuses will not be paid to non-executive Directors. |

Details of remuneration paid to Directors and key management personnel are set out in the Directors Report in this Annual Report.

| Page 8 |