UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission file number: 001-37724

ENDESA AMÉRICAS S.A.

(Exact name of Registrant as specified in its charter)

ENDESA AMÉRICAS S.A.

(Translation of Registrant’s name into English)

CHILE

(Jurisdiction of incorporation or organization)

Santa Rosa 76, Santiago, Chile

(Address of principal executive offices)

Raúl Arteaga, phone: (56-2) 2630-9727, raul.arteaga@enel.com, Santa Rosa 76, Piso 15, Santiago, Chile

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class | | | | Name of Each Exchange on Which Registered |

American Depositary Shares Representing Common Stock Common Stock, no par value * | | | | New York Stock Exchange |

* Listed, not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | | | |

Shares of Common Stock: | | | 8,201,754,580 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days:

¨ Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

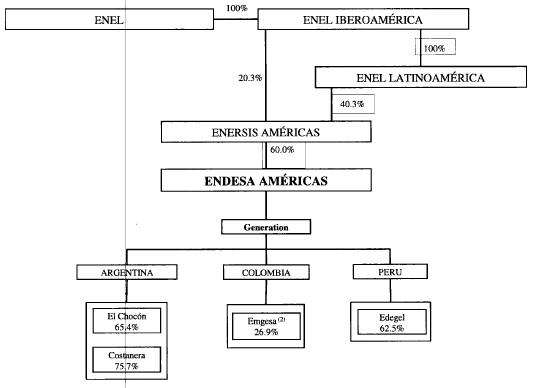

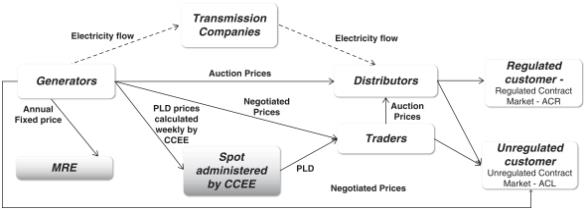

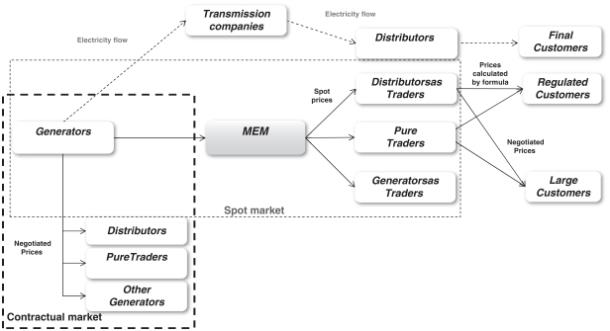

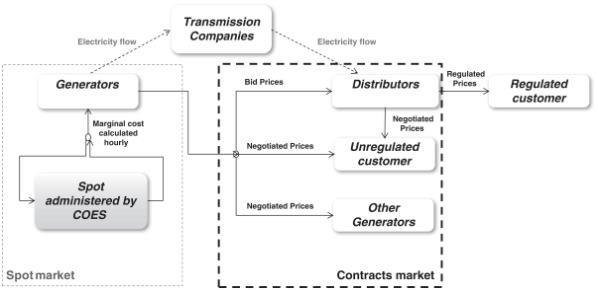

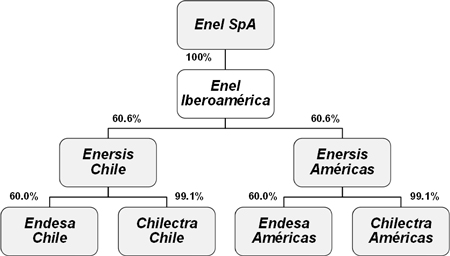

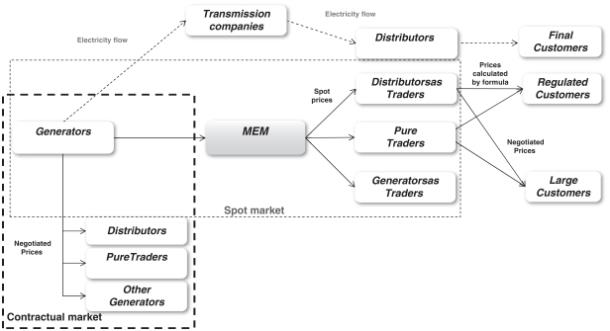

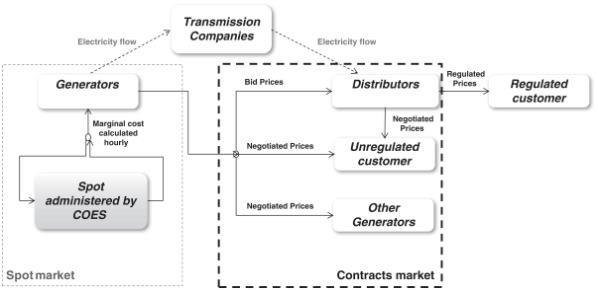

Endesa Américas’ Organizational Structure(1)

As of December 31, 2015 (assuming the spin-off of Endesa Américas had occurred as of such date)

| (1) | Only principal operating combined entities are presented here. The percentage listed for each of our combined entities represents our economic interest in such combined entity. |

| (2) | We hold 56.4% of Emgesa’s voting rights as a result of a transfer of voting rights from Enersis Américas and we are allowed to appoint the majority of the Board members pursuant to a shareholders’ agreement. We therefore control Emgesa. For more information on our control and combination of Emgesa, see “Item 5. Operating and Financial Review and Prospects – A. Operating Results – 1. Discussion of Main Factors Affecting Operating Results and Financial Condition of the Company. |

2

TABLE OF CONTENTS

3

GLOSSARY

| | | | |

| AFP | | Administradora de Fondos de Pensiones | | A legal entity that manages a Chilean pension fund. |

| | |

| Ampla | | Ampla Energia e Serviços S.A. | | A publicly held Brazilian distribution company operating in Rio de Janeiro, owned by Enel Brasil. |

| | |

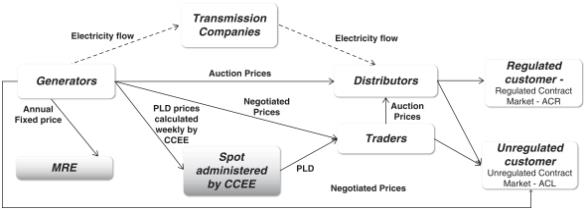

| ANEEL | | Agência Nacional de Energia Elétrica | | Brazilian governmental agency for electric energy. |

| | |

| BNDES | | Banco Nacional de Desarrollo Económico y Social | | The National Bank for Economic and Social Development (“BNDES”) is the principal agent of development in Brazil with a focus on sustainable social and environmental development. |

| | |

| Cachoeira Dourada | | Centrais Elétricas Cachoeira Dourada S.A. | | Brazilian generation company owned by Enel Brasil. |

| | |

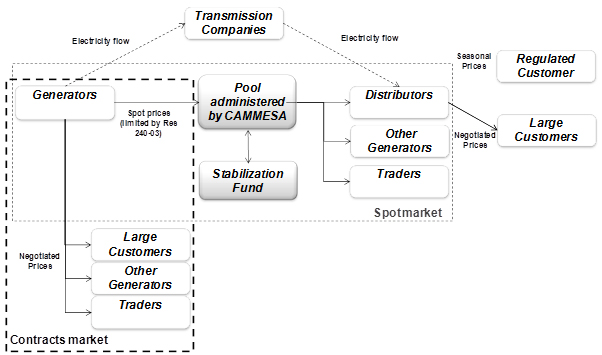

| CAMMESA | | Compañía Administradora del Mercado Mayorista Eléctrico S.A. | | Argentine autonomous entity in charge of the operation of the Mercado Eléctrico Mayorista (Wholesale Electricity Market), or MEM. CAMMESA’s stockholders are generation, transmission and distribution companies, large users and the Secretariat of Energy. |

| | |

| Chilean Stock Exchanges | | Chilean Stock Exchanges | | The three principal stock exchanges located within Chile: the Santiago Stock Exchange, the Electronic Stock Exchange and the Valparaíso Stock Exchange. |

| | |

| Chilectra Américas | | Chilectra Américas S.A. | | Electricity distribution company owned by Enersis Américas holding minority interests in electricity distribution companies in Argentina, Brazil, Colombia and Peru. |

| | |

| Chilectra Chile | | Chilectra S.A. | | Chilean electricity distribution company owned by Enersis Chile operating in the Santiago metropolitan area. |

| | |

| CIEN | | Companhia de Interconexão Energética S.A. | | Brazilian transmission company, wholly-owned by Enel Brasil. |

| | |

| Codensa | | Codensa S.A. E.S.P. | | Colombian distribution company that operates mainly in Bogotá and controlled by Enersis Américas. |

| | |

| Coelce | | Companhia Energética do Ceará S.A. | | A publicly held Brazilian distribution company operating in the state of Ceará. Coelce is controlled by Enel Brasil. |

| | |

| COES | | Comité de Operación Económica del Sistema | | Peruvian entity in charge of coordinating the efficient operation and dispatch of generation units to satisfy demand. |

| | |

| Costanera | | Central Costanera S.A. | | A publicly held Argentine generation company that is controlled by us. Formerly known as Endesa Costanera. |

| | |

| CREG | | Comisión de Regulación de Energía y Gas | | Colombian Commission for the Regulation of Energy and Gas. |

| | |

| CTM | | Compañía de Transmisión del Mercosur S.A. | | Argentine transmission company and a subsidiary of Enel Brasil. |

| | |

| DCV | | Depósito Central de Valores S.A. | | Chilean Central Securities Depositary. |

| | |

| Edegel | | Edegel S.A.A. | | A publicly held Peruvian generation company, our combined entity. |

| | |

| Edelnor | | Empresa de Distribución Eléctrica de Lima Norte S.A.A. | | A publicly held Peruvian distribution company, with a concession area in the northern part of Lima, and a subsidiary of Enersis Américas. |

| | |

| Edesur | | Empresa Distribuidora Sur S.A. | | Argentine distribution company, with a concession area in the south of the Buenos Aires greater metropolitan area, and a subsidiary of Enersis Américas. |

4

| | | | |

| | |

| El Chocón | | Hidroeléctrica El Chocón S.A. | | Argentine generation company with two hydroelectric plants, El Chocón and Arroyito, both located in the Limay River, Argentina and our combined entity. |

| | |

| Emgesa | | Emgesa S.A. E.S.P. | | Colombian generation company, our combined entity. |

| | |

| Endesa Américas | | Endesa Américas S.A. | | Our company, a publicly held limited liability stock corporation incorporated under the laws of the Republic of Chile, with electricity generation operations in Argentina, Brazil, Colombia and Peru. The Registrant of this Report. |

| | |

| Endesa Chile | | Empresa Nacional de Electricidad S.A. | | A publicly held limited liability stock corporation incorporated under the laws of the Republic of Chile, with electricity generation assets in Chile, and a combined entity of Enersis Chile |

| | |

| Enel | | Enel S.p.A. | | An Italian energy company with multinational operations in the power and gas markets. A 60.6% beneficial owner of Enersis Américas and our ultimate parent company. |

| | |

| Enel Brasil | | Enel Brasil, S.A. | | Brazilian holding company and a subsidiary of Enersis Américas. Enel Brasil was formerly known as Endesa Brasil S.A. |

| | |

| Enel Iberoamérica | | Enel Iberoamérica, S.R.L. | | A wholly-owned subsidiary of Enel and owner of 20.3% of Enersis Américas, which it acquired from Endesa Spain in October 2014. Enel Iberoamérica was formerly known as Enel Energy Europe S.R.L. |

| | |

| Enel Latinoamérica | | Enel Latinoamérica, S.A. | | A wholly-owned subsidiary of Enel Iberoamérica and owner of 40.3% of Enersis Américas. |

| | |

| Enersis Américas | | Enersis Américas S.A. | | A publicly held limited liability stock corporation incorporated under the laws of the Republic of Chile, with subsidiaries engaged primarily in the generation, transmission and distribution of electricity in Argentina, Brazil, Colombia, and Peru, and is controlled by Enel. Our parent company. |

| | |

| Enersis Chile | | Enersis Chile S.A. | | A publicly held limited liability stock corporation incorporated under the laws of the Republic of Chile, which holds combined entities engaged primarily in the generation and distribution of electricity in Chile, and is controlled by Enel. |

| | |

| ENRE | | Ente Nacional Regulador de la Electricidad | | Argentine national regulatory authority for the energy sector. |

| | |

| ESM | | Extraordinary Shareholders’ Meeting | | Extraordinary Shareholders’ Meeting. |

| | |

| FONINVEMEM | | Fondo para Inversiones Necesarias que permitan Incrementar la Oferta de Energía Eléctrica en el Mercado Eléctrico Mayorista | | Argentine fund created to increase electricity supply in the MEM. |

| | |

| Fortaleza | | Central Geradora Termelétrica Fortaleza S.A. | | Brazilian generation company that operates a combined cycle plant, located in the state of Ceará. Fortaleza is wholly-owned by Enel Brasil. |

5

| | | | |

| | |

| Gener | | AES Gener S.A. | | Chilean generation company and our competitor in Argentina and Colombia. |

| | |

| IFRS | | International Financial Reporting Standards | | International Financial Reporting Standards as issued by the International Accounting Standards Board (IASB). |

| | |

| LNG | | Liquefied Natural Gas | | Liquefied natural gas. |

| | |

| MEM | | Mercado Eléctrico Mayorista | | Wholesale Electricity Market in Argentina, Colombia and Peru. |

| | |

| MME | | Ministério de Minas e Energia | | Brazilian Ministry of Mines and Energy. |

| | |

| NCRE | | Non-Conventional Renewable Energy | | Energy sources which are continuously replenished by natural processes, such as wind, biomass, mini-hydro, geothermal, wave or tidal energy. |

| | |

| NIS | | Sistema Interconectado Nacional | | National interconnected electric system. There are such systems in Argentina, Brazil and Colombia. |

| | |

| ONS | | Operador Nacional do Sistema Elétrico | | Electric System National Operator. Brazilian non-profit private entity responsible for the planning and coordination of operations in interconnected systems. |

| | |

| Osinergmin | | Organismo Supervisor de la Inversión en Energía y Minería | | Energy and Mining Investment Supervisor Authority, the Peruvian regulatory electricity authority. |

| | |

| OSM | | Ordinary Shareholders’ Meeting | | Ordinary Shareholders’ Meeting. |

| | |

| SVS | | Superintendencia de Valores y Seguros | | Chilean Superintendence of Securities and Insurance, the authority that supervises public companies, securities and the insurance business. |

| | |

| UF | | Unidad de Fomento | | Chilean inflation-indexed, Chilean peso-denominated monetary unit. |

| | |

| UTA | | Unidad Tributaria Anual | | Chilean annual tax unit. One UTA equals 12Unidad Tributaria Mensual (“UTM”), which is a Chilean inflation-indexed monthly tax unit used to define fines, among other purposes. |

| | |

| VAD | | Valor Agregado de Distribución | | Value added from distribution of electricity. |

| | |

| XM | | Expertos de Mercado S.A. E.S.P. | | A subsidiary of Interconexión Eléctrica S.A. (“ISA”), a Colombian company that provides system management in real time services in electrical, financial and transportation sectors. |

6

INTRODUCTION

As used in this Report on Form 20-F, first person personal pronouns such as “we,” “us” or “our” refer to Endesa Américas S.A. (“Endesa Américas” or the” Company”) and our combined entities unless the context indicates otherwise. Unless otherwise noted, our interest in our principal combined entities and jointly-controlled entities and associates is expressed in terms of our economic interest as of December 31, 2015.

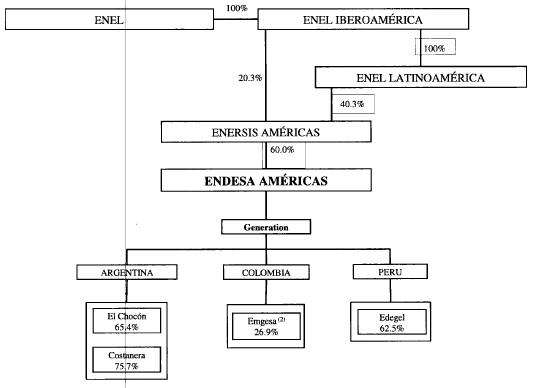

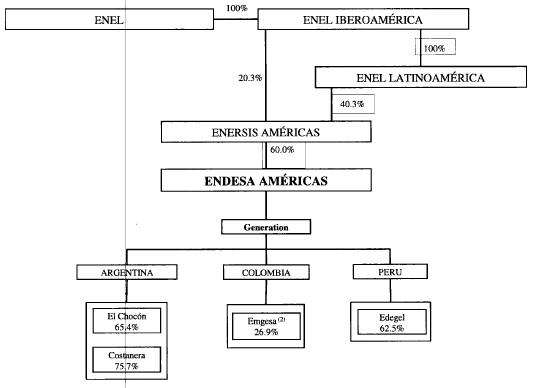

We are a Chilean company engaged directly and through our combined entities and jointly-controlled entities in the electricity generation business in Argentina, Colombia and Peru and minority interest in generation, distribution and transmission operations in Brazil. As of the date of this Report, our direct controlling entity, Enersis Américas S.A. (“Enersis Américas”), beneficially owns 60.0% of our shares. Enel S.p.A. (“Enel”), an Italian energy company with multinational operations in the power and gas markets, beneficially owns 60.6% of Enersis Américas through wholly-owned subsidiaries.

Overview of the Spin-Off and Reorganization

The Spin-Off is part of a reorganization (the “Reorganization”) of certain companies ultimately controlled by Enel, which beneficially owns 60.6% of Enersis Américas. The Reorganization is intended to separate the electricity generation businesses and assets of Empresa Nacional de Electricidad S.A. (“Endesa Chile”) electricity generation businesses and assets in Chile from those in Argentina, Brazil, Colombia and Peru.

7

The Spin-Offs

Endesa Chile conducted a “división” or “demerger” under Chilean corporate law to separate Endesa Chile into two companies. The new company, Endesa Américas was established as a separate company and was assigned the equity interests, assets and associated liabilities of the Company’s businesses outside of Chile (the “Separation”) on March 1, 2016. Endesa Américas registered the shares of Endesa Américas with the Securities Registry of the SVS under Chilean law and the SEC under applicable U.S. federal securities laws, and on April 21, 2016, Endesa Chile distributed to its shareholders shares of Endesa Américas in proportion to their share ownership in Endesa Chile based on a ratio of one share of Endesa Américas for each outstanding share of the Company (the “Distribution,” and together with the Separation, the “Spin-Off”). Following the Separation and the Spin-Off, Endesa Chile continues to hold the Chilean businesses and assets formerly owned by Endesa Chile.

In addition to the Spin-Off, Chilectra S.A., a Chilean electricity distribution company and subsidiary of Enersis (“Chilectra”), conducted a “demerger” and spun-off to its shareholders pro rata the shares of a new Chilean company, Chilectra Américas S.A. (“Chilectra Américas”), that holds the non-Chilean businesses and assets, comprised exclusively of Chilectra’s ownership interests in shares of companies domiciled outside of Chile (the “Chilectra Spin-Off” and together with the Spin-Off, the “Endesa/ChilectraSpin-Offs”). Chilectra Américas registered the shares of Chilectra Américas with the Securities Registry of the SVS and Chilectra continues to hold the Chilean businesses and assets of Chilectra (“Chilectra Chile”).

Enersis Américas, as the former 60.0% owner of Endesa Chile and the 99.1% owner of Chilectra prior to the Endesa/Chilectra Spin-Offs, now owns 60.0% of Endesa Américas and 99.1% of Chilectra Américas as a result of the Endesa/Chilectra Spin-Offs and the minority shareholders of Endesa Chile and Chilectra hold their respective percentage interests in Endesa Américas and Chilectra Américas, respectively. The shares of Endesa Américas and Chilectra Américas are listed and traded on the Chilean Stock Exchanges, and the American Depositary Receipts (“ADRs”) of Endesa Américas are listed and traded on the New York Stock Exchange (“NYSE”).

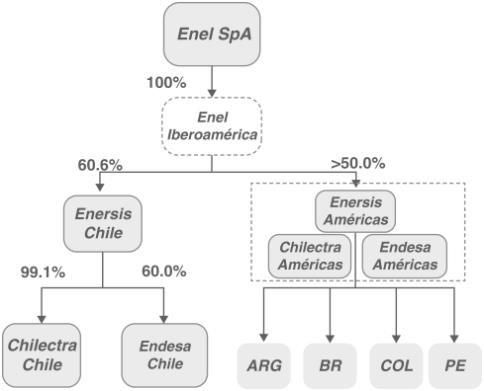

Following the Endesa/Chilectra “demergers”, Enersis S.A. conducted a “demerger” of Enersis Chile S.A. (“Enersis Chile”) and changed its name to Enersis Américas S.A. and, following the Endesa/Chilectra Spin-Offs, spun-off to its shareholders pro rata the shares of a new Chilean company, Enersis Chile, that was assigned the Chilean businesses and assets, including the equity interests in each of Endesa Chile and Chilectra Chile after giving effect to the Endesa/Chilectra “demergers” (the “Enersis Spin-Off”). Enersis Chile registered the shares of Enersis Chile with the Securities Registry of the SVS under Chilean law and the SEC under applicable U.S. federal securities laws in connection with the Enersis Spin-Off, which was completed in April 2016.

Enel beneficially owns 60.6% of Enersis Chile, and the minority shareholders of Enersis Américas own their respective percentage interest in Enersis Chile. The shares of Enersis Chile are listed and traded on the Chilean Stock Exchanges and the ADRs of Enersis Chile are listed and traded on the NYSE.

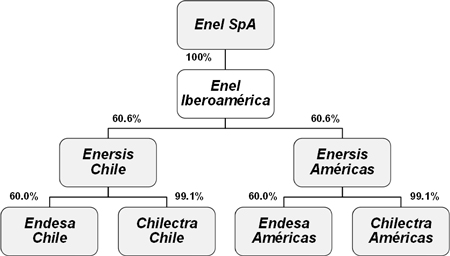

The following chart sets forth our corporate structure as of the date of this Report:

8

The Merger

Enersis Américas, our Company and Chilectra Américas, and subject to approval by shareholders holding at least two-thirds of the outstanding shares of the relevant companies, intend to merge together (the “Merger”), with Enersis Américas continuing as the surviving company under the name Enersis Américas S.A. (the “Surviving Company”). Following completion of the Merger, the Surviving Company expects to continue to have its shares publicly traded and listed in Chile on the Chilean Stock Exchanges and its ADRs traded on the NYSE. In the Merger, the shares of our Company and Chilectra Américas are expected to be converted into shares of the Surviving Company and Endesa Américas and Chilectra Américas shares will cease trading on the Chilean Stock Exchanges and Endesa Américas ADRs would cease to trade on the NYSE. Following the Merger, Enel is expected to continue to be the ultimate controlling shareholder, through its beneficial ownership, of the Surviving Company and the former minority shareholders of Enersis Américas, Endesa Américas and Chilectra Américas will own the minority interest in the Surviving Company.

A majority of the Board of Directors of Endesa Chile has determined the number of shares of Enersis Américas to be paid by Enersis Américas as consideration for each share of Endesa Américas in connection with the Merger, if approved by the respective shareholders of Enersis Américas, Endesa Américas and Chilectra Américas to be 2.8 shares of Enersis Américas for one share of Endesa Américas.

The Tender Offer

In connection with the Merger (as described below), Enersis Américas expects to conduct a public cash tender offer (oferta pública de adquisición de valores) for the shares and ADSs of Endesa Américas under Chilean law and applicable U.S. securities laws (the “Tender Offer”). The Tender Offer is expected to commence immediately prior to the date of the extraordinary shareholders’ meetings of Endesa Américas to approve the Merger.

The Tender Offer is contingent on (i) the completion of the Endesa/Chilectra Spin-Offs and the Enersis Spin-Off, (ii) the approval of the Merger by the respective shareholders of Enersis Américas, Endesa Américas and Chilectra Américas at separate extraordinary shareholders’ meetings of Enersis Américas, Endesa Américas and Chilectra Américas as described in “— The Merger,” (iii) less than 6.73% of the outstanding shares of Enersis Américas, 7.72% of the outstanding shares of Endesa Américas and 0.91% of the outstanding shares of Chilectra Américas exercising the right of withdrawal in connection with the Merger, and (iv) the absence of any significant adverse supervening events that would make the Tender Offer not in the best interest of Enersis Américas.

The Tender Offer is expected to be for all shares, including in the form of ADSs represented by ADRs of Endesa Américas (other than those held by Enersis Américas), for a price of Ch$ 285.00 per share (or the equivalent in U.S. dollars at the date of payment in the case of ADSs), and will be subject to other terms and conditions which will be provided at the appropriate time. The Tender Offer is expected to occur by the third quarter of 2016.

9

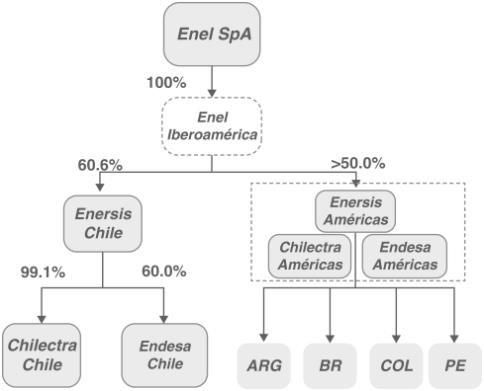

The following chart sets forth our group corporate structure following the Merger:

In connection with the Merger, each of Enersis Américas, Endesa Américas and Chilectra Américas expects to hold an extraordinary shareholders’ meeting to approve the Merger during the third quarter of 2016. Prior to such extraordinary shareholders’ meetings, Enersis Américas will register the shares of the Surviving Company to be issued in the Merger with the SEC under the Securities Act. In connection with their respective extraordinary shareholders’ meetings to approve the Merger, Enersis Américas will distribute to the shareholders of each of Enersis Américas and Endesa Américas an information statement/prospectus containing information about the Merger and the Surviving Company.

10

PRESENTATION OF INFORMATION

Financial Information

In this Report, unless otherwise specified, references to “U.S. dollars,” “US$,” are to dollars of the United States of America; references to “pesos” or “Ch$” are to Chilean pesos, the legal currency of Chile; references to “Ar$” or “Argentine pesos” are to the legal currency of Argentina; references to “R$,” or “reais” are to Brazilian reais, the legal currency of Brazil; references to “soles” are to Peruvian Soles, the legal currency of Peru; references to “CPs” or “Colombian pesos” are to the legal currency of Colombia; references to “€” or “Euros” are to the legal currency of the European Union; and references to “UF” are to Development Units (Unidades de Fomento).

The UF is a Chilean inflation-indexed, peso-denominated monetary unit that is adjusted daily to reflect changes in the official Consumer Price Index (“CPI”) of the Chilean National Institute of Statistics (Instituto Nacional de Estadísticasor “INE”). The UF is adjusted in monthly cycles. Each day in the period beginning on the tenth day of the current month through the ninth day of the succeeding month, the nominal peso value of the UF is indexed in order to reflect a proportionate amount of the change in the Chilean CPI during the prior calendar month. As of December 31, 2015, one UF was equivalent to Ch$ 25,629.09. The U.S. dollar equivalent of one UF was US$ 36.09 as of December 31, 2015, using the Observed Exchange Rate reported by the Central Bank of Chile (Banco Central de Chile) as of December 31, 2015 of Ch$ 710.16 per US$ 1.00. The U.S. dollar observed exchange rate (dólar observado) (the “Observed Exchange Rate”), which is reported by the Central Bank of Chile and published daily on its webpage, is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market

The Central Bank of Chile may intervene by buying or selling foreign currency on the Formal Exchange Market to maintain the Observed Exchange Rate within a desired range.

As of March 31, 2016, one UF was equivalent to Ch$ 25,812.05. The U.S. dollar equivalent of one UF was US$ 38.54 on March 31, 2016, using the Observed Exchange Rate reported by the Central Bank of Chile as of such date of Ch$ 669.80 per US$ 1.00.

Our combined financial statements and, unless otherwise indicated, other financial information concerning us included in this Report are presented in Chilean pesos. We have prepared our combined financial statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

All of our combined entities are combined and all their assets, liabilities, income, expenses and cash flows are included in the combined financial statements after making the adjustments and eliminations related to intra-group transactions. References in this Report to combined entities refer to entities that are controlled, either directly or indirectly, by Endesa Américas. Control is achieved when Endesa Américas (i) has power over the entity, (ii) is exposed, or has rights, to variable returns from its involvement with the entity and (iii) has the ability to use its power to effect its returns. Endesa Américas has power over its combined entities when it holds the majority of the substantive voting rights or, when it has less than a majority of the voting rights, and those rights are sufficient to give it the practical ability to direct the relevant activities of the entity unilaterally.

For the convenience of the reader, this Report contains translations of certain Chilean peso amounts into U.S. dollars at specified rates. Unless otherwise indicated, the U.S. dollar equivalent for information in Chilean pesos is based on the Observed Exchange Rate for December 31, 2015, as defined in “Item 3. Key Information — A. Selected Financial Data — Exchange Rates”. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. No representation is made that the Chilean peso or U.S. dollar amounts shown in this Report could have been or could be converted into U.S. dollars or Chilean pesos, as the case may be, at such rate or at any other rate. See “Item 3. Key Information — A. Selected Financial Data — Exchange Rates”.

Technical Terms

References to “TW” are to terawatts; references to “GW” and “GWh” are to gigawatts and gigawatt hours, respectively; references to “MW” and “MWh” are to megawatts and megawatt hours, respectively; references to “kW” and “kWh” are to kilowatts and kilowatt hours, respectively; references to “kV” are to kilovolts, and references to “MVA” are to megavolt amperes. References to “BTU” and “MBTU” are to British thermal unit and million British thermal units, respectively. A “BTU” is an energy unit equal to approximately 1,055 joules. References to “Hz” are to hertz; and references to “mtpa” are to metric tons per annum. Unless otherwise indicated, statistics provided in this Report with respect to the installed capacity of electricity generation facilities are expressed in MW. One TW equals 1,000 GW, one GW equals 1,000 MW and one MW equals 1,000 kW.

11

Statistics relating to aggregate annual electricity production are expressed in GWh and based on a year of 8,760 hours, except for leap years, which are based on 8,784 hours. Statistics relating to installed capacity and production of the electricity industry do not include electricity of self-generators.

Energy losses experienced by generation companies during transmission are calculated by subtracting the number of GWh of energy sold from the number of GWh of energy generated (excluding their own energy consumption and losses on the part of the power plant), within a given period. Losses are expressed as a percentage of total energy generated.

Calculation of Economic Interest

References are made in this Report to the “economic interest” of Endesa Américas in its related companies. In circumstances where we do not directly own an interest in a related company, our economic interest in such ultimate related company is calculated by multiplying the percentage of economic interest in a directly held related company by the percentage of economic interest of any entity in the ownership chain of such related company. For example, if we own 60% of a directly held combined entity and that combined entity owns 40% of an associate, our economic interest in such associate would be 60% times 40%, or 24%.

Rounding

Certain amounts included in our combined financial statements have been rounded for ease of presentation. Percentages expressed in this Report may not have been calculated using rounded amounts, but by using amounts prior to rounding. For this reason, percentages expressed in this Report may vary from those obtained by performing the same calculations using figures in our combined financial statements. Certain other amounts that appear in the tables in this Report may not total exactly due to rounding.

12

FORWARD-LOOKING STATEMENTS

This Report contains statements that are or may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements appear throughout this Report and include statements regarding our intent, belief or current expectations, including, but not limited to, any statements concerning:

| | • | | our capital investment program; |

| | • | | trends affecting our financial condition or results from operations; |

| | • | | the future impact of competition and regulation; |

| | • | | political and economic conditions in the countries in which we or our related companies operate or may operate in the future; |

| | • | | any statements preceded by, followed by or that include the words “believes,” “expects,” “predicts,” “anticipates,” “intends,” “estimates,” “should,” “may” or similar expressions; and |

| | • | | other statements contained or incorporated by reference in this Report regarding matters that are not historical facts. |

Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to:

| | • | | changes in the regulatory framework of the electricity industry in one or more of the countries in which we operate; |

| | • | | our ability to implement proposed capital expenditures, including our ability to arrange financing where required; |

| | • | | the nature and extent of future competition in our principal markets; |

| | • | | political, economic and demographic developments in the markets in South America where we conduct our business; and |

| | • | | the factors discussed below under “Risk Factors.” |

You should not place undue reliance on such statements, which speak only as of the date that they were made. Our independent registered public accounting firm has not examined or compiled the forward-looking statements and, accordingly, does not provide any assurance with respect to such statements. You should consider these cautionary statements together with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to forward-looking statements contained in this Report to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

For all these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

13

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

| A. | Directors and Senior Management |

Not applicable.

Not applicable.

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

| A. | Selected Financial Data. |

The following selected combined financial data should be read in conjunction with our combined financial statements included in this Report. The selected combined financial data as of December 31, 2015 and 2014 and for each of the years in the three-year period ended December 31, 2015 is derived from our audited combined financial statements included in this Report. The selected combined financial data as of December 31, 2013 is derived from our combined financial statements not included in this Report. Our combined financial statements were prepared in accordance with IFRS, as issued by the IASB. Pursuant to transitional relief granted by the SEC in respect of first time application of IFRS, selected combined financial data as of December 31, 2012 and 2011 and for each of the years in the two-year period ended December 31, 2012 have been omitted.

Amounts are expressed in millions, except for ratios, operating data, and shares data. For the convenience of the reader, all data presented in U.S. dollars in the following summary, as of and for the year ended December 31, 2015, has been converted at the U.S. dollar Observed Exchange Rate (dólar observado) for that date of Ch$ 710.16 per US$ 1.00. The Observed Exchange Rate, which is reported and published daily on the Central Bank of Chile’s web page, corresponds to the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market.

For more information concerning historical exchange rates, see “ — Exchange Rates” below.

14

The following tables set forth our selected combined financial and other operating data for the years indicated:

| | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31, | |

| | | 2015(1) | | | 2015 | | | 2014 | | | 2013(2) | |

| | | (US$ millions) | | | (Ch$ millions) | |

Combined Statement of Comprehensive Income Data | | | | | | | | | | | | | | | | |

Revenues and other operating income | | | 1,835 | | | | 1,303,115 | | | | 1,215,559 | | | | 1,057,395 | |

Operating expenses(2) | | | (1,044 | ) | | | (741,548 | ) | | | (592,512 | ) | | | (543,889 | ) |

Operating income | | | 791 | | | | 561,567 | | | | 623,047 | | | | 513,506 | |

Financial income (expense), net | | | 95 | | | | 67,687 | | | | 8,564 | | | | (63,135 | ) |

Total gain (loss) on sale of non-current assets not held for sale | | | (1 | ) | | | 509 | | | | 750 | | | | 843 | |

Other non-operating income | | | 55 | | | | 38,680 | | | | 61,598 | | | | 95,038 | |

| | | | |

Income before income taxes | | | 940 | | | | 667,425 | | | | 693,959 | | | | 546,252 | |

Income tax | | | (361 | ) | | | (256,249 | ) | | | (204,051 | ) | | | (167,912 | ) |

Net income expense | | | 579 | | | | 411,176 | | | | 489,908 | | | | 378,340 | |

| | | | |

Net income attributable to shareholders of the Company | | | 254 | | | | 180,532 | | | | 220,154 | | | | 180,784 | |

| | | | | | | | | | | | | | | | |

Net income attributable to Minority interests | | | 325 | | | | 230,644 | | | | 269,754 | | | | 197,556 | |

Net income per average number of shares basic and diluted (Ch$/US$) | | | 0.03 | | | | 22.01 | | | | 26.84 | | | | 22.04 | |

Net income per average number of shares, basic and diluted (Ch$/US$ per share) | | | 0.93 | | | | 660.32 | | | | 805.25 | | | | 661.24 | |

Weighted average number of shares of common stock (millions) | | | | | | | 8,202 | | | | 8,202 | | | | 8,202 | |

| | | | |

Combined Statement of Financial Position Data | | | | | | | | | | | | | | | | |

Total assets | | | 5,477 | | | | 3,889,706 | | | | 4,002,717 | | | | 3,833,136 | |

Non-current liabilities | | | 1,657 | | | | 1,176,779 | | | | 1,260,501 | | | | 1,160,263 | |

Equity attributable to shareholders | | | 1,653 | | | | 1,173,699 | | | | 1,224,710 | | | | 1,206,187 | |

Equity attributable to Minority interests | | | 1,217 | | | | 864,219 | | | | 792,346 | | | | 908,398 | |

Total equity | | | 2,870 | | | | 2,037,918 | | | | 2,017,056 | | | | 2,114,585 | |

Allocated Capital | | | 1,267 | | | | 899,434 | | | | 899,434 | | | | 899,434 | |

Other Combined Financial Data | | | | | | | | | | | | | | | | |

Capital expenditures (CAPEX)(3) | | | 386 | | | | 273,899 | | | | 266,281 | | | | 206,848 | |

Depreciation, amortization and impairment losses(4) | | | 159 | | | | 113,219 | | | | 105,894 | | | | 103,577 | |

| (1) | Solely for the convenience of the reader, Chilean peso amounts have been converted into U.S. dollars at the exchange rate of Ch$ 710.16 per U.S. dollar, as of December 31, 2015. |

| (2) | Operating expenses include selling and administration expense. |

| (3) | CAPEX figures represent effective payments for each year. |

| (4) | For further detail please refer to Notes 8 and 26 of the Notes to our combined financial statements. |

| | | | | | | | | | | | | | | | | | | | |

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

OPERATING DATA BY COUNTRY | | | | | | | | | | | | | | | | | | | | |

Installed capacity in Argentina (MW)(1) | | | 3,632 | | | | 3,632 | | | | 3,632 | | | | 3,632 | | | | 3,632 | |

Installed capacity in Colombia (MW) (4) | | | 3,459 | | | | 3,059 | | | | 2,926 | | | | 2,914 | | | | 2,914 | |

Installed capacity in Peru (MW) (3 | | | 1,686 | | | | 1,652 | | | | 1,540 | | | | 1,657 | | | | 1,668 | |

Generation in Argentina (GWh)(4) | | | 11,405 | | | | 9,604 | | | | 10,840 | | | | 11,207 | | | | 10,713 | |

Generation in Colombia (GWh)(2)(4) | | | 13,705 | | | | 13,559 | | | | 12,748 | | | | 13,251 | | | | 12,051 | |

Generation in Peru (GWh)(3)(4) | | | 8,218 | | | | 8,609 | | | | 8,391 | | | | 8,570 | | | | 8,980 | |

| (1) | Values from 2011 to 2015 were modified and correspond to values reported to CAMMESA (Argentina TSO). |

| (2) | El Quimbo entered commercial operation during 2015, adding 400 MW of capacity. |

| (3) | In Peru, the Santa Rosa TG 7 unit was recommissioned in December 2014, and during 2015 there were capacity adjustments and upgrades to existing plants, totaling an additional 33 MW. Mainly, Huinco with 20 (MW), Santa Rosa with 6 (MW) and Callahuanca with 4 MW. |

| (4) | Beginning in 2013, we changed how we calculate our electricity generation. The impact of applying the new criteria on a cumulative basis for 2011 and 2012 is not material. We now report the energy effectively available for sales in all countries. |

Exchange Rates

Fluctuations in the exchange rate between the Chilean peso and the U.S. dollar will affect the U.S. dollar equivalent of the peso price of our shares of common stock on the Santiago Stock Exchange(Bolsa de Comercio de Santiago), the Chilean Electronic Stock Exchange (Bolsa Electrónica de Chile) and the Valparaíso Stock Exchange (Bolsa de Corredores de Valparaíso). These exchange

15

rate fluctuations affect the price of our American Depositary Shares (“ADSs”) and the conversion of cash dividends relating to the common shares represented by ADSs from Chilean pesos to U.S. dollars. In addition, to the extent that significant financial liabilities of the Company are denominated in foreign currencies, exchange rate fluctuations may have a significant impact on earnings.

In Chile, there are two currency markets, the Formal Exchange Market (Mercado Cambiario Formal) and the Informal Exchange Market (Mercado Cambiario Informal). The Formal Exchange Market is comprised of banks and other entities authorized by the Central Bank of Chile. The Informal Exchange Market is comprised of entities that are not expressly authorized to operate in the Formal Exchange Market, such as certain foreign exchange houses and travel agencies, among others. The Central Bank of Chile has the authority to require that certain purchases and sales of foreign currencies be carried out on the Formal Exchange Market. Both the Formal and Informal Exchange Markets are driven by free market forces. Current regulations require that the Central Bank of Chile be informed of certain transactions that must be carried out through the Formal Exchange Market.

The U.S. dollar Observed Exchange Rate, which is reported by the Central Bank of Chile and published daily on its web page, is the weighted average exchange rate of the previous business day’s transactions in the Formal Exchange Market. Nevertheless, the Central Bank of Chile may intervene by buying or selling foreign currency on the Formal Exchange Market to attempt to maintain the Observed Exchange Rate within a desired range.

The Informal Exchange Market reflects transactions carried out at an informal exchange rate (the “Informal Exchange Rate”). There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the Observed Exchange Rate. Foreign currency for payments and distributions with respect to the ADSs may be purchased either in the Formal or the Informal Exchange Market, but such payments and distributions must be remitted through the Formal Exchange Market.

The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos. As of December 31, 2015, the U.S. dollar Observed Exchange Rate was Ch$ 710.16 per US$ 1.00.

The following table sets forth the low, high, average and period-end Observed Exchange Rate for U.S. dollars for the periods set forth below, as reported by the Central Bank of Chile:

| | | | | | | | | | | | | | | | |

| | | Daily Observed Exchange Rate (Ch$ per US$)(1) | |

| | | Low(2) | | | High(2) | | | Average(3) | | | Period-end | |

Year ended December 31, | | | | | | | | | | | | | | | | |

2015 | | | 597.10 | | | | 715.66 | | | | 654.66 | | | | 710.16 | |

2014 | | | 527.53 | | | | 621.41 | | | | 573.70 | | | | 606.75 | |

2013 | | | 466.50 | | | | 533.95 | | | | 498.83 | | | | 524.61 | |

2012 | | | 469.65 | | | | 519.69 | | | | 486.31 | | | | 479.96 | |

2011 | | | 455.91 | | | | 533.74 | | | | 483.45 | | | | 519.20 | |

Month ended | | | | |

March 2016 | | | 669.80 | | | | 694.82 | | | | n.a. | | | | 669.80 | |

February 2016 | | | 689.18 | | | | 715.41 | | | | n.a. | | | | 694.17 | |

January 2016 | | | 710.37 | | | | 730.31 | | | | n.a. | | | | 710.37 | |

December 2015 | | | 693.72 | | | | 711.52 | | | | n.a. | | | | 710.16 | |

November 2015 | | | 688.94 | | | | 715.66 | | | | n.a. | | | | 711.20 | |

October 2015 | | | 673.91 | | | | 695.53 | | | | n.a. | | | | 690.32 | |

Source: Central Bank of Chile.

| (2) | Exchange rates are the actual low and high, on a day-by-day basis for each period. |

| (3) | The average of the exchange rates on the last day of each month during the period. |

As of April 28, 2016, the U.S. dollar Observed Exchange Rate was Ch$ 663.40 per US$ 1.00.

Calculation of the appreciation or devaluation of the Chilean peso against the U.S. dollar in any given period is made by determining the percent change between the reciprocals of the Chilean peso equivalent of US$ 1.00 at the end of the preceding period and the end of the period for which the calculation is being made. For example, to calculate the devaluation of the year-end Chilean peso in 2015, one determines the percent change between the reciprocal of Ch$ 606.75, the value of one U.S. dollar as of December 31, 2014, or 0.001648, and the reciprocal of Ch$ 710.16, the value of one U.S. dollar as of December 31, 2015, or 0.001408. In this example, the percentage change between the two periods is negative 14.6%, which represents the 2015 year-end devaluation of the Chilean peso against the 2014 year-end U.S. dollar. A positive percentage change means that the Chilean peso appreciated against the U.S. dollar, while a negative percentage change means that the Chilean peso devaluated against the U.S. dollar.

16

The following table sets forth the period-end rates for U.S. dollars for the years ended December 31, 2011 through December 31, 2015, based on information published by the Central Bank of Chile.

| | | | |

| | | Ch$ per US$(1) |

| | | Period End | | Appreciation (Devaluation) |

| | | (in Ch$) | | (in %) |

Year ended December 31, | | | | |

2015 | | 710.16 | | (14.6) |

2014 | | 606.75 | | (13.5) |

2013 | | 524.61 | | (8.5) |

2012 | | 479.96 | | 8.2 |

2011 | | 519.20 | | (9.9) |

Source: Central Bank of Chile.

| (1) | Calculated based on the variation of period-end exchange rates. |

| B. | Capitalization and Indebtedness. |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

A financial or other crisis in any region worldwide can have a significant impact on the countries in which we have electricity investments, and consequently, may adversely affect our operations as well as our liquidity.

The four countries in which we have electricity investments are vulnerable to external shocks, including financial and political events, which could cause significant economic difficulties and affect their growth. If any of these economies experience lower than expected economic growth or a recession, it is likely that our customers will demand less electricity and that some of our customers may experience difficulties paying their electric bills, possibly increasing our uncollectible accounts. Any of these situations could adversely affect our results of operations and financial condition.

Financial and political crises in other parts of the world could also adversely affect our business. For example, instability in the Middle East or in other oil producing regions could result in higher fuel prices worldwide, which in turn could increase the cost of fuel for our thermal generation plants and adversely affect our results of operations and financial condition.

In addition, an international financial crisis and its disruptive effects on the financial industry could adversely impact our ability to obtain new bank financings on the same historical terms and conditions. A financial crisis could also diminish our ability to access the capital markets in the four countries in which we have investments, as well as the international capital markets for other sources of liquidity, or increase the interest rates available to us. Reduced liquidity could, in turn, adversely affect our capital expenditures, our long-term investments and acquisitions, our growth prospects and our dividend payout policy.

South American economic fluctuations may affect our results of operations and financial condition as well as the value of our securities.

All of our operations are located in South American countries. Accordingly, our combined revenues may be affected by the performance of South American economies as a whole. If local, regional or worldwide economic trends adversely affect the economy of any of the countries in which we have investments, our financial condition and results from operations could be adversely affected. Moreover, we have investments in volatile countries such as Argentina. Insufficient cash flows for our combined entities located in volatile countries have, in some cases, resulted in their inability to meet debt obligations and the need to seek waivers to comply with restrictive debt covenants. We also have a non-controlling participation in Enel Brasil, which consolidates all the operations in Brazil, including distribution, generation and transmission assets. As a result, we are exposed to the recent volatility of the local market in

17

that country, which have affected the financial condition of our associate. In Brazil, during 2015, some instability arose from the political sector due to corruption scandals involving several government officials, which has led to a deterioration of confidence in the Brazilian market, which in turn has led Brazil to lose its investment grade rating from Standard & Poor’s and Fitch Ratings.

Insufficient cash flows for our combined entities located in these volatile countries, have, in some cases, resulted in their inability to meet debt obligations and the need to seek waivers to comply with some debt covenants, or, to a limited extent, to require guarantees or other emergency measures from us, including extraordinary capital increases.

Future adverse developments in these economies may impair our ability to execute our strategic plans, which could adversely affect our results of operations and financial condition.

In addition, South American financial and securities markets are, to varying degrees, influenced by economic and market conditions in other countries. Colombian or Peruvian financial and securities markets may be adversely affected by events in other countries, which could adversely affect the value of our securities.

A deterioration of the economic situation in Argentina or a deeper devaluation of the Argentine peso could have an adverse effect on our debt.

The Argentine peso suffered a steep devaluation against the U.S. dollar during 2014, which has continued during 2015. Due to the decline in value of the Argentine peso relative to foreign currencies, the Argentine government has implemented policies to limit purchases of U.S. dollars. In 2014, the Argentine Central Bank raised the reference interest rate, which increased financing costs for banks and for private sector companies and it has been intervening in the market on a daily basis during 2015 in order to control further devaluation expectations. Although the pace of the devaluation of the Argentine peso against the U.S. dollar has slowed recently, the increase in interest paid on deposits has been insufficient to offset the inflation rate. The new government recently liberalized all currency restrictions imposed by the prior government, which resulted in the immediate devaluation of the Argentinean peso by more than 35% in one day. While the new government is expected to take actions to soften the impact of the one-time effect of devaluation, the devaluation of the Argentine peso may continue in 2016 and future years.

If Argentina’s economy were deemed hyperinflationary, a general price index would be used to present the amounts related to our Argentine combined entities in our combined financial statements under the provisions outlined in IAS 29, “Financial Reporting in Hyperinflationary Economies.” Amounts for the previous reporting periods would be restated by applying the general price index so that the financial statements between the periods presented would be comparative.

In 2014, the Argentine banking industry increased interest rates on loans and shortened maturities. Liquidity in the Argentine derivatives market also deteriorated, which limited access to swaps of Argentine peso denominated debt into other currencies. As a result our Argentine peso-denominated debt is exposed to further devaluation of the Argentine peso.

Argentina’s sovereign creditworthiness seriously deteriorated in 2014, based on market data and reports from credit ratings agencies and such situation has worsened during 2015. Argentina’s sovereign debt rating maintained its “selective default” rating by Standard & Poor’s and “restricted default” rating by Fitch, both ratings as a result of a default on Argentina’s sovereign bonds in July 2014. Moody’s maintained the long term foreign currency debt rating at “Caa1,” updated in November 2015 with positive outlook. Further deterioration of Argentina’s economy could adversely affect our results of operations and financial condition. For further information on our combined financial statements by geographical areas, please see Note 30 of the Notes to our combined financial statements.

Certain South American countries have been historically characterized by frequent and occasionally drastic economic interventionist measures by governmental authorities, including expropriations, which may adversely affect our business and financial results.

Governmental authorities have altered monetary, credit, tariff, tax and other policies to influence the course of the economies of Argentina, Colombia and Peru. Even though we do not have assets in Chile, we are a company established under the laws of the Republic of Chile. Therefore, taxes will be paid in Chile and we will be subject to changes in the Chilean tax laws. To a lesser extent, the Chilean government continues to exercise substantial influence over many aspects of the private sector, which may result in changes to economic or other policies. For example, in September 2014, the Chilean government approved the progressive increase of the corporate income tax and a change in the tax system, which may have an additional negative effect upon non-Chilean holders of shares or ADSs. On February 8, 2016, Law 20,899 was enacted, which made adjustments to this tax reform. For further details regarding Chilean tax considerations, please refer to “Item 10. Additional Information — E. Taxation.” Other governmental actions in these South American countries have also involved wage, price and tariff rate controls and other interventionist measures, such as expropriation or nationalization.

18

For example, Argentina froze bank accounts and imposed capital restrictions in 2001, nationalized the private sector pension funds in 2008, used its Central Bank reserves to pay down indebtedness maturing in 2010, expropriated Repsol’s 51% stake in YPF in 2012 and imposed exchange controls in 2014, which limited Argentine access to foreign currencies. In 2010, Colombia imposed an equity tax to finance reconstruction and repair efforts related to severe flooding, which resulted in an extraordinary tax expense accrual recorded in January 2011 for taxes payable in 2011 through 2014.

Changes in governmental and monetary policies regarding tariffs, exchange controls, regulations and taxation could reduce our profitability. Inflation, devaluation, social instability and other political, economic or diplomatic developments, including the response by governments in the region to these circumstances, could also reduce our profitability. Any of these scenarios could adversely affect our results of operations and financial condition.

Our electricity business is subject to risks arising from natural disasters, catastrophic accidents and acts of terrorism, which could adversely affect our operations, earnings and cash flow.

Our primary facilities include power plants and transmission assets, pipelines, liquefied natural gas (“LNG”) terminals andre-gasification plants, storage and chartered LNG tankers. Our facilities may be damaged by earthquakes, flooding, fires, and other catastrophic disasters arising from natural or accidental human causes, as well as acts of terrorism. A catastrophic event could cause disruptions in our business, significant decreases in revenues due to lower demand or significant additional costs to us not covered by our business interruption insurance. There may be lags between a major accident or catastrophic event and the final reimbursement from our insurance policies, which typically carry a deductible and are subject to per event policy maximum amounts.

As an example, on May 6, 2013, a blade of Edegel’s Santa Rosa gas turbine unit No. 7 broke and produced catastrophic damage to the unit following a fire. The turbine damage was classified as a total loss and its replacement cost exceeded US$ 60 million in property damage and lost profits. The unit was out of service for 19 months, until December 5, 2014. Such accidents may affect our operations, earnings and cash flow.

We are subject to financing risks, such as those associated with funding our new projects and capital expenditures, and risks related to refinancing our maturing debt; we are also subject to debt covenant compliance, all of which could adversely affect our liquidity.

As of December 31, 2015, our combined debt totaled Ch$ 1,117 billion.

Our debt had the following maturity profile:

| | • | | Ch$ 220 billion in 2016; |

| | • | | Ch$ 172 billion from 2017 to 2018; |

| | • | | Ch$ 158 billion from 2019 to 2020; and |

| | • | | Ch$ 567 billion thereafter. |

Set forth below is a breakdown by country for debt maturing in 2016:

| | • | | Ch$ 135 billion for Colombia; |

| | • | | Ch$ 55 billion for Peru; and |

| | • | | Ch$ 30 billion for Argentina. |

Some of our debt agreements are subject to (1) financial covenants, (2) affirmative and negative covenants, (3) events of default, (4) mandatory prepayments for contractual breaches and (5) certain change of control clauses for material mergers and divestments, among other provisions. Some of our non-Chilean debt agreements limit or prohibit transactions resulting in a change of control, as defined contractually on a case by case basis, or require the prior consent of a qualified quorum of lenders. Therefore, in some cases, we would need to obtain consents or waivers, as applicable, in order to proceed with the Spin-Off without a change of control breach of contract. A significant portion of our combined entities’ financial indebtedness is subject to cross default provisions, which have varying definitions, criteria, materiality thresholds and applicability with respect to combined entities that could give rise to such a cross default.

19

In the event that we or our combined entities breach any of these material contractual provisions, our creditors and bondholders may demand immediate repayment, and a significant portion of our indebtedness could become due and payable. For example, for the quarters ended December 31, 2014, March 31, 2015, June 30, 2015 and September 30, 2015, our Argentine combined entity El Chocón did not comply with the interest coverage ratio test (EBITDA to interest expense) pursuant to a covenant requirement under the loan agreement with Standard Bank, Deutsche Bank and Itaú that matured and was paid in February 2016. El Chocón experienced difficulties in complying with this covenant several times in the past and obtained waivers from its lenders. If the lenders had decided to declare an event of default and accelerate the loan, the principal and interest would have become immediately due and payable under this facility. Because of cross-acceleration provisions of El Chocón’s other loans, an additional debt would also have been accelerated and El Chocón would have been forced into bankruptcy.

We may be unable to refinance our indebtedness or obtain such refinancing on terms acceptable to us. In the absence of such refinancing, we could be forced to dispose of assets in order to make the payments due on our indebtedness under circumstances that might not be favorable to obtaining the best price for such assets. Furthermore, we may be unable to sell our assets quickly enough, or at sufficiently high prices, to enable us to make such payments.

We may also be unable to raise the necessary funds required to finish our projects under development or under construction. Market conditions prevailing at the moment we require these funds or other unforeseen project costs can compromise our ability to finance these projects and expenditures.

As of the date of this Report, we believe that Argentina continues to be the country in which we operate with a high refinancing risk. As of December 31, 2015, the third-party debt of our Argentine combined entities amounted to Ch$ 70 billion. As long as fundamental issues concerning the local electricity sector remain unresolved, we will roll over our outstanding Argentine debt to the extent we are able to do so. If our creditors will not continue to roll over our debt when it becomes due and we are unable to refinance such obligations, we could default on such indebtedness.

Our inability to finance new projects or capital expenditures or to refinance our existing debt could adversely affect our results of operation and financial condition.

We may be unable to enter into suitable investments, alliances and acquisitions.

On an ongoing basis, we review acquisition prospects that may increase our market coverage or supplement our existing businesses, though there can be no assurance that we will be able to identify and consummate suitable acquisition transactions in the future. The acquisition and integration of independent companies that we do not control is generally a complex, costly and time-consuming process and requires significant efforts and expenditures. If we consummate an acquisition, it could result in the incurrence of substantial debt and assumption of unknown liabilities, the potential loss of key employees, amortization expenses related to tangible assets and the diversion of management’s attention from other business concerns. In addition, any delays or difficulties encountered in connection with acquisitions and the integration of multiple operations could have a material adverse effect on our business, financial condition or results of operations.

Because our generation business depends heavily on hydrological conditions, droughts and climate change may adversely affect our operations and profitability.

Approximately 58% of our combined installed generation capacity in 2015 was hydroelectric. Accordingly, extreme hydrological conditions and climate change could adversely affect our business, results of operations and financial condition. In the last few years, regional hydrological conditions have been affected by two climate phenomena — El Niño and La Niña — that influence rainfall and resulted in droughts.

For example, El Niño phenomenon has affected Colombian hydrologic conditions since May 2015, leading to a rainfall deficit and high temperatures, and as a consequence, higher energy prices. Each El Niño event is different and, depending on its intensity and duration, the magnitude of the social and economic effects could be more pronounced. Peru has also experienced rain deficits, especially towards the end of 2015, and forecasts show an expected decrease in the natural flow of the basins in which we operate. The hydrology situation will depend on the level of reservoirs by the beginning of May 2016. Droughts also affect the operation of our thermal plants, including our facilities that use natural gas, fuel oil or coal as fuel, in the following manner:

| | • | | During drought periods, thermal plants are used more frequently. Thermal plant operating costs can be considerably higher than those of hydroelectric plants. Our operating expenses increase during these periods. In addition, depending on our commercial obligations, we may need to buy electricity at spot prices in order to comply with our contractual supply obligations and the cost of these electricity purchases may exceed our contracted electricity sale prices, thus potentially producing losses from those contracts. For further information with respect to the effect of hydrology on our business and financial results, please refer to “Item 5. Operating and Financial Review and Prospects— A. Operating Results—1. Discussion of Main Factors Affecting Operating Results and Financial Condition—a. Hydrological Conditions.” |

20

| | • | | Our thermal plants require water for cooling and droughts not only reduce the availability of water, but also increase the concentration of chemicals, such as sulfates in the water. The high concentration of chemicals in the water we use for cooling increases the risk of damaging the equipment at our thermal plants as well as the risk of violating environmental regulations. As a result, we may have to purchase water from agricultural areas that are also experiencing shortages of water. These water purchases may increase our operating costs and also require us to further negotiate with the local communities. |

| | • | | Thermal power plants burning natural gas generate emissions such as sulfur dioxide (SO2) and nitrogen oxide (NO) gases. When operating with diesel they also release particulate matter into the atmosphere. Coal fired plants generate emissions of SO2 and NO. Therefore, greater use of thermal plants during periods of drought increases the risk of producing a higher level of pollutants. |

In addition, according to certain weather forecast models, the drought that is affecting the regions where most of our hydroelectric plants are located may last for an extended period and may recur in the future. A prolonged drought may exacerbate the risks described above and have a further adverse effect upon our business, results of operations and financial condition.

Governmental regulations may adversely affect our business.

We are subject to extensive regulation on the tariffs we charge to our customers and on other aspects of our business and these regulations may adversely affect our profitability. For example, governments can impose electricity rationing during droughts or prolonged failures of power facilities. During rationing, if we are unable to generate enough electricity to comply with our contractual obligations, we may be forced to buy electricity at the spot price, as even a severe drought does not release us from our contractual obligations as aforce majeure event. If we are unable to buy enough electricity at the spot price to comply with our contractual obligations, we would have to compensate our regulated customers for the electricity we failed to provide at the rationed price. Rationing periods have occurred in the past and may occur in the future. Our generation combined entities may be required to pay regulatory penalties if they fail to provide adequate service under their contractual obligations. Currently, the Colombian government is analyzing the implementation of rationing policies due to the energy crisis that is currently affecting the country due to service outages at two power plants, unrelated to us, representing around 10% of the country’s installed capacity, coupled with reservoir levels that are 30% below average as a consequence of El Niño phenomenon. Material rationing policies imposed by regulatory authorities in any of the countries in which we operate could adversely affect our business, results of operations and financial condition.

Electricity regulations issued by governmental authorities in the countries in which we operate may affect the ability of our generation companies to collect revenues sufficient to offset their operating costs.

The inability of any company in our combined group to collect revenues sufficient to cover operating costs may affect the ability of that company to operate as a going concern and may otherwise have an adverse effect on our business, financial results and operations.

In addition, changes in the regulatory framework are often submitted to the legislators and administrative authorities in the countries in which we has investments and, and some of these changes could have a material adverse impact on our business, results of operations and financial condition. For example, commercial operations of Emgesa’s El Quimbo power plant have been intermittent due to legislative and judicial decisions regarding its authorization to commence commercial operations and such intermittent operations may continue in the future.

These changes could adversely affect our business, results of operations and financial condition.

Our business and profitability could be adversely affected if water rights are denied or if water concessions are granted with limited duration.

Approximately 58% of our installed capacity is hydroelectric. We own water rights for the supply of water from rivers and lakes near our production facilities, granted in Argentina by the Argentine State, in Colombia by the Ministry of Environment, Housing and Territorial Development (“MAVDT” in its Spanish acronym), and in Peru by the Water National Authority (“ANA” in its Spanish acronym). In Colombia, water rights or water concessions are granted for 50 years, renewable by equal periods; however, these concessions may be revoked, for example, due to a progressive decrease or depletion of water. In Colombia, human consumption is the first priority before any other use. A similar event may happen in Peru and we could lose our water rights, even when concessions are granted for indefinite periods, due to scarcity or decline in quality.

21

Any limitations on our current water rights, our need for additional water rights, or our current unlimited duration of water concessions could have a material adverse effect on our hydroelectric development projects and our profitability.

Regulatory authorities may impose fines on our combined entities, which could adversely affect our results of operations and financial condition.

Our electricity businesses may be subject to regulatory fines for any breach of current regulations, including energy supply failures, in the four countries in which we have investments. In Peru, fines may be imposed for a maximum of 1,400 Treasury Tax Units (Unidad Impositiva Tributaria or “UIT”), or Ch$ 1,103 million, using the UIT and foreign exchange rates as of December 31, 2015. In Colombia, fines may be imposed for a maximum of 2,000 Minimum Monthly Salaries (Salarios Mínimos Mensuales), or Ch$ 291 million using the Minimum Monthly Salary and the exchange rates as of December 31, 2015. In Argentina, there is no maximum limit for relevant fines.

Our electricity generation combined entities are supervised by their local regulatory entities and may be subject to these fines in cases where, in the opinion of the regulatory entity, operational failures affecting the regular energy supply to the system are the fault of the company such as when agents are not coordinated with the system operator. In addition, our combined entities may be required to pay fines or compensate customers if those combined entities are unable to deliver electricity, even if such failure is due to forces outside of the combined entities’ control.

For example, in April 2013, Edegel, our generation company in Peru, was fined Ch$ 73.9 million by the Osinergmin, the Peruvian regulatory electricity authority, for the unavailability in several occasions of some of its units in 2008. Edegel paid two of the four fines and appealed the other two, which are still under dispute. For further information on fines, please refer to Note 32 of the Notes to our combined financial statements.

We depend on payments from our combined entities, jointly-controlled entities and associates to meet our payment obligations.

In order to pay our obligations, we rely on cash from dividends, loans, interest payments, capital reductions and other distributions from our combined entities and equity affiliates. The ability of our combined entities and equity affiliates to pay dividends, interest payments, loans and other distributions to us is subject to legal constraints such as dividend restrictions, fiduciary duties, contractual limitations and foreign exchange controls that may be imposed in any of the four countries where they operate.

Historically, we have not been able to access at all times the cash flows of our operating combined entities due to government regulations, strategic considerations, economic conditions and credit restrictions.

Our future results from operations may continue to be subject to greater economic and political uncertainties, such as government regulations, economic conditions and credit restrictions, and therefore we may not be able to rely on cash flows from operations in those entities to repay our debt.

Dividend Limits and Other Legal Restrictions. Some of our combined entities are subject to legal reserve requirements and other restrictions on dividend payments. Other legal restrictions, such as foreign currency controls, may limit the ability of our combined entities and equity affiliates to pay dividends and make loan payments or other distributions to us. In addition, the ability of any of our combined entities that are not wholly-owned to distribute cash to us may be limited by the directors’ fiduciary duties of such combined entities to their minority shareholders. Furthermore, some of our combined entities may be forced by local authorities, in accordance with applicable regulation, to diminish or eliminate dividend payments. As a consequence of such restrictions, our combined entities could, under certain circumstances, be impeded from distributing cash to us.

Contractual Constraints. Distribution restrictions included in certain credit agreements of our combined entities Costanera and El Chocón may prevent dividends and other distributions to shareholders if they are not in compliance with certain financial ratios. Generally, our credit agreements prohibit any type of distribution if there is an ongoing default.

Operating Results of Our Combined Entities. The ability of our combined entities and equity affiliates to pay dividends or make loan payments or other distributions to us is limited by their operating results. To the extent that the cash requirements of any of our combined entities exceed their available cash, the combined entity will not be able to make cash available to us.

Any of the situations described above could adversely affect our business, results of operations and financial condition.

22

Foreign exchange risks may adversely affect our results and the U.S. dollar value of dividends payable to ADS holders.

The currencies of South American countries in which we and our combined entities operate have been subject to large devaluations and appreciations against the U.S. dollar and may be subject to significant fluctuations in the future. A portion of our combined indebtedness has been denominated in U.S. dollars. Although a substantial portion of our operating cash flows is linked to U.S. dollars, we generally have been and will continue to be materially exposed to currency fluctuations of our local currencies against the U.S. dollar because of time lags and other limitations to peg our tariffs to the U.S. dollar.

In countries where operating cash flows are denominated in the local currency, we seek to maintain debt in the same currency, but due to market conditions it may not be possible to do so.

Because of this exposure, the cash generated by our combined entities can decrease substantially when local currencies devalue against the U.S. dollar. Future volatility in the exchange rate of the currencies in which we receive revenues or incur expenditures may adversely affect our business, results of operations and financial condition.

As of December 31, 2015, the amount of our total combined debt was Ch$ 1,117 billion. Of this amount, Ch$ 160 billion, or 14%, was denominated in U.S. dollars. As of December 31, 2015, our combined foreign currency-denominated indebtedness (other than U.S. dollars) included the equivalent of:

| | • | | Ch$ 917 billion in Colombian pesos; |

| | • | | Ch$ 30 billion in Argentine pesos; and |

| | • | | Ch$ 10 billion in Peruvian soles. |

These amounts total Ch$ 957 billion in currencies other than U.S. dollars.

For the twelve-month period ended December 31, 2015, our operating cash flows were Ch$ 476 billion (before combination adjustments) of which:

| | • | | Ch$ 255 billion, or 54%, came from Colombia; |

| | • | | Ch$ 145 billion, or 30%, came from Peru; |

| | • | | Ch$ 71 billion, or 15%, came from Argentina; and |

| | • | | Ch$ 5 billion, or 1%, came from Chile. |

We are involved in litigation proceedings.

We are currently involved in various litigation proceedings, which could result in unfavorable decisions or financial penalties against us. We will continue to be subject to future litigation proceedings, which could cause material adverse consequences to our business.

For example, in 2001, the inhabitants of Sibaté (part of the Cundinamarca Department, Colombia) sued Emgesa and two other unrelated parties because of the possible contamination of El Muña Reservoir, demanding that the defendants pay for damages of CPs 3 billion (approximately Ch$ 675 billion). The plaintiffs argued that the contamination is a consequence of the pumping of polluted water from the Bogotá River. Emgesa argued that it is not responsible since the company had received the polluted water and requested the inclusion as additional defendants in the judicial proceedings, numerous public and private entities that discharged pollutants into the river or were responsible for the environmental management of the river’s basin. This request was originally accepted by the court, but in June 2015 the court decision was reversed and the new parties were subsequently excluded as defendants. Emgesa appealed such determination and the case remains pending. Our financial condition or results of operations could be adversely affected if we are unsuccessful in defending this litigation or other lawsuits and proceedings against us. For further information on litigation proceedings, please see Note 32 of the Notes to our combined financial statements.

The values of our generation business’s combined entities’ long-term energy supply contracts are subject to fluctuations in the market prices of certain commodities and other factors.