Exhibit 10.1

AGREEMENT OF LEASE

By and Between

Six Thirty-Four Second Street, LLC

a Delaware limited liability company

(“Landlord”)

and

OKTA, Inc.,

a Delaware corporation

(“Tenant”)

SUMMARY OF BASIC LEASE INFORMATION

The undersigned hereby agree to the following terms of this Summary of Basic Lease Information (the “Summary”). This Summary is hereby incorporated into and made a part of the attached Office Lease (this Summary and the Office Lease to be known collectively as the “Lease”) which pertains to the office building (the “Building”) which is located at 634 Second Street, San Francisco, California. Each reference in the Office Lease to any term of this Summary shall have the meaning as set forth in this Summary for such term. In the event of a conflict between the terms of this Summary and the Office Lease, the terms of the Office Lease shall prevail. Any capitalized terms used herein and not otherwise defined herein shall have the meaning as “set forth in the Office Lease.

|

| | | | | | | |

| TERMS OF LEASE | | | | DESCRIPTION |

| a) | | Effective Date: | | | | December 11, 2014 |

| b) | | Landlord: | | | | Six Thirty-Four Second Street, LLC, a Delaware limited liability company |

| c) | | Address of Landlord: | | c/o Manchester Capital Management 3657 Main Street Manchester Village, Vermont 05254 |

| d) | | Tenant: | | OKTA, Inc., a Delaware corporation |

| e) | | Address of Tenant (Paragraph 9): | | |

| Subsequent to occupancy | | | | 634 Second Street, San Francisco, California 94107 Attn: Bill Losch |

| Prior to occupancy | | | | 301 Brannan Street, Third Floor San Francisco, CA 94107 Attn: Bill Losch

with, at all times, a copy to:

Shartsis Friese LLP One Maritime Plaza, 18th Floor San Francisco, CA94111 Attn: Jonathan Kennedy/Kathleen Bryski |

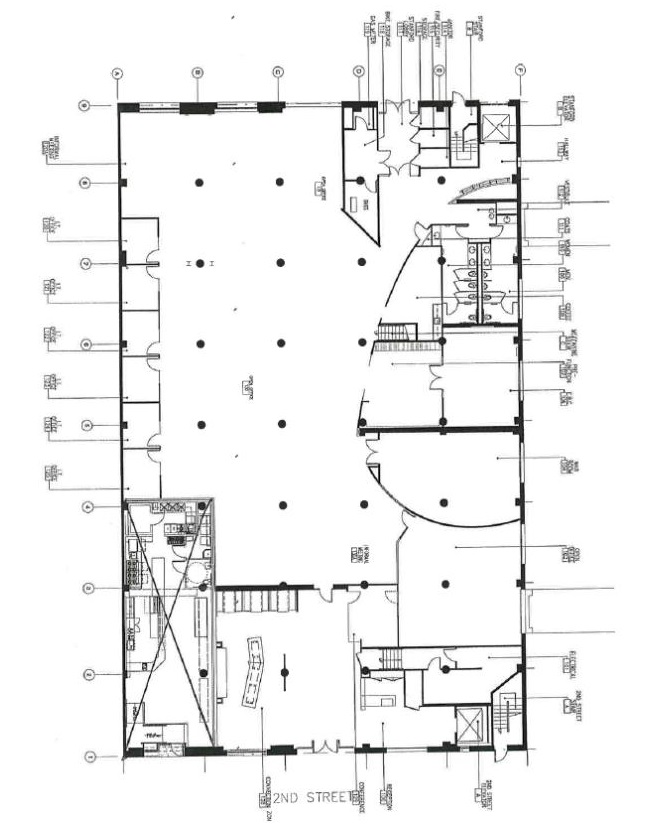

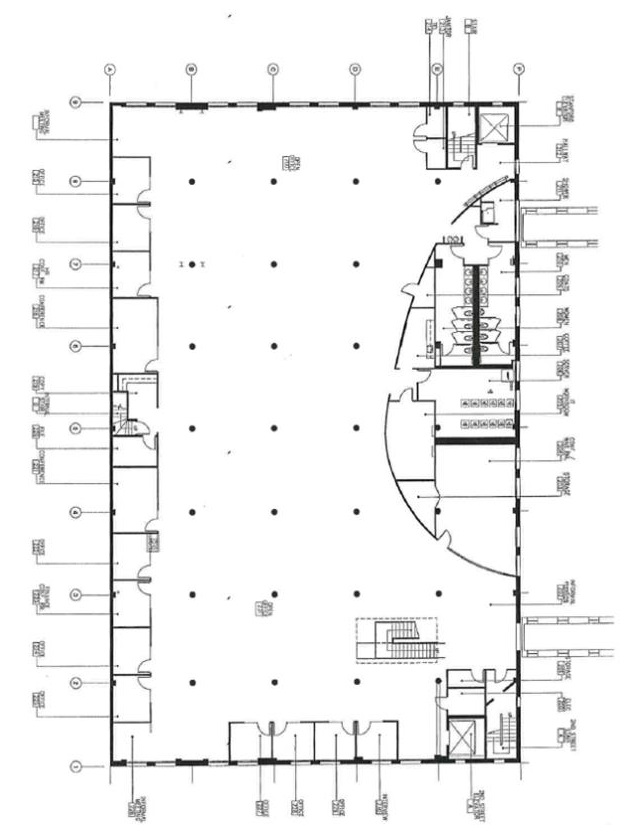

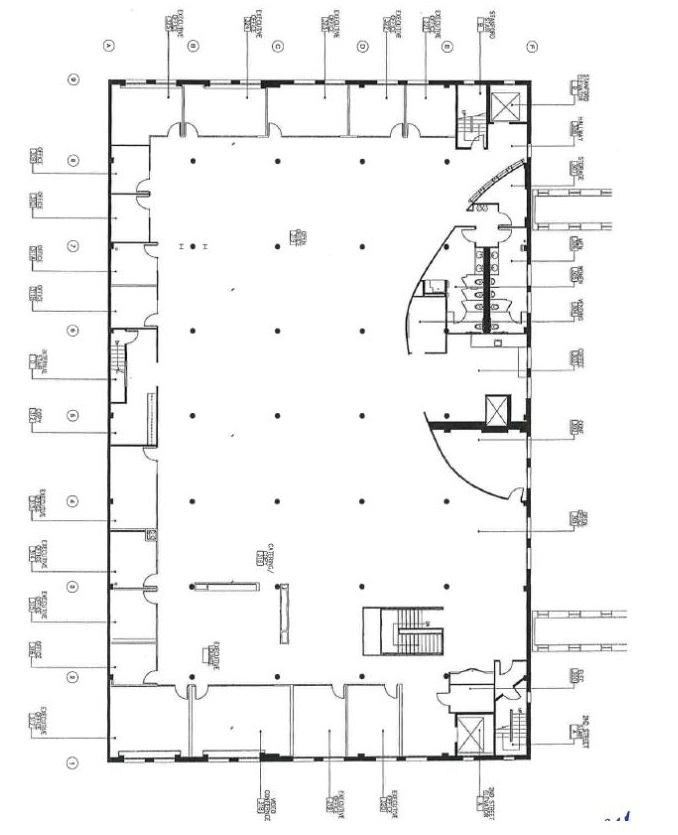

| f) | | Premises (Paragraph 1): | | 45,032 rentable square feet of space comprising all rentable space on all of the floors (ground, mezzanine, second and third floors) of the Building, excepting only 1,720 rentable square feet of retail space located on the ground and mezzanine floors (“Retail Space”), all as more particulary set forth in the attached Exhibit A. |

| g) | | Building (Paragraph 1): | | 634 Second Street, San Francisco, California. Total square footage of rentable space of the Building: approximately 46,752 rentable square feet. |

| h) | | Term (Paragraph 2): | | |

| | | (i) | Early Access Date: | | | | Prior to the Lease Commencement Date Landlord shall make the Premises available to Tenant so as to allow Tenant to commence construction of the Tenant Improvements pursuant to the Work Letter. The date upon which Landlord provide such access is referred to herein as the “Early Access Date”. It is anticipated that the Early Access Date shall occur on or about June 1, 2015. |

| | | (ii) | Lease Commencement Date: | | | | The date ninety (90) days following the Early Access Date. |

| | | (ii) | Lease Expiration Date: | | | | The day immediately preceding the ninth (9th) anniversary of the Lease Commencement Date. |

| i) | | Extension Option (Paragraph 2.2): | | One additional five (5) year term. |

| j) | | Monthly Basic Rent (NNN; | | |

| | | Paragraph 4): | | |

| | | | | | | | |

| | | | Period | | Monthly Basic Rent | | Annual Rate Per RSF |

| | | | Months 1 through 12 | | $210,149.33* | | $56.00 |

| | | | Months 13 through 24 | | $216,453.81 | | $57.68 |

| | | | Months 25 through 36 | | $222,947.43 | | $59.41 |

| | | | Months 37 through 48 | | $229,635.85 | | $61.93 |

| | | | Months 49 through 60 | | $236,524.93 | | $63.03 |

| | | | Months 61 through 72 | | $243,620.67 | | $64.92 |

| | | | Months 73 through 84 | | $250,929.29 | | $66.87 |

| | | | Months 85 through 96 | | $258,457.17 | | $68.87 |

| | | | Months 96 through 108 | | $266,210.89 | | $70.94 |

| Subject to adjustment to Fair Market Rental Value at the commencement of the Extended Term. |

| * | | Subject to abatement of Monthly Basic Rent in months 1-4. |

|

| | | | | | | |

| TERMS OF LEASE | | | | DESCRIPTION |

| k) | | Security Deposit (Paragraph 7): | | $2,773,287 |

| 1) | | Direct Operating Expenses (Paragraph 5):

| | All Direct Operating Expenses of the Premises consisting in part of utility charges and certain maintenance repair costs shall be Tenant’s responsibility. |

| m) | | Common Operating Expenses (Paragraph 6.2)

| | Tenant’s Share of all Common Operating Expenses of the Building, consisting in part of property taxes, insurance premiums and deductibles, and maintenance and repair costs, shall be Tenant’s responsibility |

| n) | | Tenant’s Share: | | 96.32% (i.e., 45,032/46,752) |

| o) | | Brokers/Paragraph 10): | | Tenant’s Broker: CBRE, Inc. Landlord’s Broker: Cornish & Carey Newmark Knight Frank

|

| p) | | Work Letter: | | Attached as Exhibit B. |

| | The foregoing terms of this Summary are agreed to by Landlord and Tenant. |

|

| | | | | | |

| LANDLORD: | | TENANT: |

Six Thirty-Four Second Street LLC, a Delaware limited liability company | | OKTA, Inc. a Delaware corporation |

| | | | | | | |

| By: | | /s/ Bayard R. Kraft III | | By: | | /s/ William E. Losch |

| Name: | | Bayard R. Kraft III | | Name: | | William E. Losch |

| Its: | | Authorized Agent | | Its: | | CFO |

|

| | | |

| | | Table of Contents | Page |

| 1. | | | |

| 2. | | | |

| 3. | | | |

| 4. | | | |

| 5. | | Payment of Direct Operating Expenses | |

| 6. | | | |

| 7. | | | |

| 8. | | | |

| 9. | | | |

| 10. | | | |

| 11. | | | |

| 12. | | | |

| 13. | | | |

| 14. | | | |

| 15. | | | |

| 16. | | | |

| 17. | | | |

| 18. | | | |

| 19. | | | |

| 20. | | | |

| 21. | | | |

| 22. | | | |

| 23. | | | |

| 24. | | | |

| 25. | | | |

| 26. | | | |

| 27. | | | |

| 28. | | | |

| 29. | | | |

| 30. | | | |

| 31. | | | |

| 32. | | | |

| 33. | | | |

| 34. | | | |

| 35. | | | |

| 36. | | | |

| 37. | | | |

| 38. | | | |

| 39. | | | |

| 40. | | | |

| 41. | | | |

| 42. | | | |

| 43. | | | |

| 44. | | | |

| 45. | | | |

| 46. | | | |

| 47. | | | |

| 48. | | | |

| 49. | | | |

| 50. | | | |

| 51. | | | |

| 52. | | | |

| 53. | | | |

| 54. | | | |

| 55. | | | |

| 56. | | | |

OFFICE LEASE

THIS LEASE, dated December 11, 2014 for purposes of reference only (the “Effective Date”), is made and entered into by and between SIX THIRTY-FOUR SECOND STREET, LLC, a Delaware limited liability company (“Landlord”) and OKTA INC., a Delaware corporation (“Tenant”).

1. The Premises.

1.1 Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, the Premises designated in the Summary of Basic Lease Information (“Summary”) attached hereto, and which is more particularly described and outlined on the floor plan attached hereto and marked Exhibit A, all of which is incorporated herein by this reference. The Premises is located in the building at the address designated in the Summary (the “Building”), and located on the parcel of real property (the “Site”) under the Building. Tenant acknowledges that Landlord has made no representation or warranty regarding the condition of the Premises, Building, or Site except as specifically stated in this Lease. The parties hereto agree that said letting and hiring is upon and subject to the terms, covenants and conditions herein set forth and Tenant and Landlord covenant as a material part of the consideration for this Lease to keep and perform each and all of said terms, covenants and conditions by it to be kept and performed, and this Lease is made upon the condition of such performance.

1.2 Tenant shall have the nonexclusive right to use in common with other tenants in the Building, subject to the reasonable discretion of Landlord to determine the manner in which the public and common areas are maintained and operated, the loading and unloading areas, roadways, sidewalks, walkways, parkways, and driveways appurtenant to the Building Premises (“Common Areas”).

1.3 Landlord reserves the rights from time to time as set forth below provided that Landlord shall use commercially reasonable efforts with respect to the exercise of any and all such rights so as not to interfere with Tenant’s use of or access to the Premises:

(a) To remove, install, reinstall, use, maintain, repair and replace pipes, ducts, conduits, wires and appurtenant meters and equipment for service to other parts of the Building above the ceiling surfaces, below the floor surfaces, within the walls and in the central core areas, and to relocate any pipes, ducts, conduits, wires and appurtenant meters and equipment included in the Premises which ‘are located in the Premises or located elsewhere outside the Premises, and to expand the Building;

(b) To make changes to the Common Areas, including, without limitation, changes in the location, size, shape and number of driveways, entrances, loading and unloading areas, ingress, egress, direction of traffic and walkways;

(c) To close temporarily any of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available;

(d) To use the Common Areas at any time, including, but not limited to, while engaged in making additional improvements, repairs or alterations to the Building, or any portion thereof; and/or

(e) To do and perform such other acts and make such other changes in, to or with respect to the Site, Common Areas and Building including, without limitation, the roof and windows of the Building as Landlord may, in the exercise of Landlord’s reasonable business judgment, deem to be appropriate.

Except in the case of emergency, Landlord will use reasonable efforts to perform any work described in this Paragraph 1.3 which might be disruptive only on weekends or during periods after business hours to the extent reasonably practicable (the cost of any and all such work including, without limitation, overtime costs incurred by Landlord in connection therewith may be included in Common Operating Expenses, subject to the limitations set forth in Article 6 below). To the extent that Landlord installs, maintains, uses, repairs or replaces pipes, cables, ductwork, conduits, utility lines, and/or wires through hung ceiling space, exterior perimeter walls and column space, adjacent to and in demising partitions and columns, in or beneath the floor slab or above, below, or through the Premises, then in the course of making any such installation or repair: (x) Landlord will not reduce Tenant’s usable space, except to a de minimus extent, if the same are not installed behind existing walls or ceilings; and (y) Landlord shall box in any of the same installed adjacent to existing walls with construction materials substantially similar to those existing in the affected area(s) of the Premises.

1.4 Tenant acknowledges that certain furniture, fixtures and equipment owned by Landlord may be located within the Premises, and that the Premises currently contains certain data communication cabling within the wall and ceiling. All of such personal property and cabling owned by Landlord shall remain at the Premises and Tenant shall have the right to use all of the same during the, Term. Tenant shall have access to available space in the riser closet and shall be responsible for taking service to the floors occupied by Tenant. Tenant may install additional cabling and conduits at its sole cost and expense subject to Landlord’s reasonable prior approval as provided herein. Upon expiration or earlier termination of the Term, Tenant shall return all of the original personal property to Landlord in good condition and repair, subject to normal wear and tear and casualty. On or about the Early Access Date, Landlord and Tenant shall jointly conduct an inspection of the existing personal property

located within the Premises, so as to create an inventory of such personal property and the condition of such personal property, in order to establish “baseline” for determining the appropriate condition of such property upon return to Landlord.

1.5 The rights and obligations of the parties regarding the tenant improvements, alterations or construction of the Premises to be performed at the commencement of the Term are described in the Tenant Work Letter (“Work Letter”) attached to this Lease as Exhibit B. Any inconsistency between the provisions of the Work Letter and the provisions of the balance of this Lease shall be governed by the provisions of the Work Letter.

1.6 References in this Lease to “rentable square feet”, “rentable square footage” and “rentable area” shall have the same meanings, and Tenant hereby acknowledges and agrees that the rentable square footage of the Premises shall be deemed, and is, 45,032 rentable square feet, and the rentable square footage of the Building shall be deemed, and is, 46,752 rentable square feet. Landlord represents that the foregoing square footage determinations were the result of a measurement made of the Building and the Premises in accordance with BOMA Standard (i.e., the American National Standard method of measuring floor area in office buildings of the Building Owners and Managers Association (ANSI Z65.1 -2010)). The parties agree that the 45,032 rentable square foot measurement of the Premises and the 46,752 rentable square foot measurement of the Building shall not be changed, and no adjustment in the Monthly Basic Rent, any monetary or other obligation of Tenant, or any other term of this Lease shall be made by reason of a change in the rentable square footage of the Premises or the Building except in connection with a physical change in the size of the Premises (and, in the event of any such physical change in the size of the Premises, any remeasurement necessitated thereby shall be carried in accordance with the BOMA Standard).

2. Term.

2.1 The term of this Lease (“Term”) shall be for the period designated in the Summary. The Term shall commence on the Lease Commencement Date and end on the Lease Expiration Date, unless the Term shall be sooner terminated or extended as hereinafter provided.

2.2 Tenant shall have one option (the “Extension Option”) to extend the Term, for an additional five (5) year period (the “Extended Term”) on all the terms and conditions contained in this Lease with the exception of the Monthly Basic Rent which shall be adjusted pursuant to the provisions of Paragraphs 4.2 and with the further exception that upon exercise of the Extension Option by Tenant, Tenant shall thereafter have no further right to extend the Term. In order to exercise the Extension Option, Tenant shall deliver written notice of its exercise of the option (“Option Notice”) to Landlord no earlier than eighteen (18) months and no later than twelve (12) months prior to the expiration of the initial Term. The Extension Option shall be subject to the following terms and conditions:

(a) The Extension Option may be exercised only by delivery of the Option Notice as provided in this Paragraph and only if, as of the date of delivery of the Option Notice and the commencement date of the Extended Term, Tenant is not in default under this Lease beyond applicable notice and cure periods (hereinafter “Default”).

(b) The rights contained in this Paragraph shall be personal to the originally named Tenant and may be exercised only by the originally named Tenant (or an entity which controls, is controlled by or is under common control with Tenant, or to any entity resulting from the merger or consolidation with Tenant or to any person or entity which acquires substantially all of the assets of Tenant as a going concern) and only if the originally named Tenant (or an entity which controls, is controlled by or is under common control with Tenant, or to any entity resulting from the merger or consolidation with Tenant or to any person or entity which acquires substantially all of the assets of Tenant as a going concern) occupies at least the entire area on two adjacent floors of the Premises as of the date it exercises the Extension Option in accordance with the terms of this Paragraph.

(c) If Tenant properly exercises the Extension Option and is not in Default, at the end of the initial Term, the Term shall be extended for the applicable Extended Term, References in this Lease to the “Term” shall include the initial Term of nine (9) years, and shall, in addition, include the Extended Term, if applicable.

3. Early Access and Possession. Landlord shall give Tenant written notice of the date on which the Premises shall be available for the purposes as described in this Paragraph 3 (“Early Access Date”). It is anticipated that the Early Access Date shall occur on or about June 1, 2015. Landlord shall allow Tenant, and Tenant’s contractors, vendors and service providers, access to the Premises and the Building at any time on or after the Early Access Date for the purpose of constructing the Tenant Improvements pursuant to the Work Letter and installing Tenant’s furniture, fixtures, equipment and other personal property, and to prepare the Premises for Tenant’s occupancy. Tenant shall provide Landlord with reasonable written evidence of liability insurance pursuant to Paragraph 21.1(a) prior to Tenant’s entry onto the Premises pursuant to the provisions of this Paragraph 3. Landlord shall have no liability or responsibility for any damage to Tenant’s property stored or kept on the Premises, whether prior or subsequent to the Lease Commencement Date except to the extent attributable to the negligence or willful misconduct of Landlord, Landlord’s employees, agents, representatives or contractors (and, in any event, subject to the provisions of Paragraph 21.6 below).

4. Monthly Basic Rent/Rent Increases.

4.1 Tenant agrees to pay to Landlord, on a monthly basis, the Monthly Basic Rent designated in the Summary commencing on the Lease Commencement Date (subject to abatement as set forth in Paragraph 4.4 below). Commencing on the first anniversary of the Lease Commencement Date and continuing on each anniversary of the Lease Commencement Date thereafter, the Monthly Basic Rent shall increase by an amount equal to three percent (3%) of the Monthly Basic Rent payable for the month immediately preceding the applicable anniversary date as more particularly provided in the Summary. Tenant shall pay the Monthly Basic Rent in advance on the first day of each and every calendar month during said Term, except that the Monthly Basic Rent due for the first month of the Term shall be paid upon the execution hereof. In the event that the Lease Commencement Date occurs other than on the first day of a calendar month, (i) Monthly Basic Rent for the initial partial calendar month of the Lease Term shall be prorated in the proportion that the number of days this Lease is in effect during such calendar month bears to the actual number of days in the first month of the Term, and the prepaid first month’s Monthly Basic Rent shall be applied to such prorated amount with the balance of the prepaid first month’s Monthly Basic Rent being applied to reduce the payment of Monthly Basic Rent to be paid on the first day of the first full calendar month of the Term of this Lease, and (ii) the Monthly Basic Rent payable for any calendar month in which the amount of Monthly Basic Rent is to increase as provided in the Summary shall be determined by prorating the applicable lesser and greater Monthly Basic Rent based on the portion of the calendar month for which each is applicable with the sum of such prorated amounts being the Monthly Basic Rent for such calendar Month. Upon the determination of the Lease Commencement Date, the parties shall promptly enter into a Lease Commencement Agreement in the form of Exhibit C attached hereto, setting forth the Lease Commencement Date and a schedule of the Monthly Basic Rent payable hereunder in accordance with the provisions of this Paragraph 4.1. The Monthly Basic Rent and all additional rent including, without limitation, Operating Rent, shall be paid to Landlord without any prior demand therefor and without any deduction or offset whatsoever, except as expressly provided herein, in lawful money of the United States of America, which shall be legal tender at the time of payment, at the address of Landlord designated in the Summary or to such other person or at such other place as Landlord may from time to time designate in writing delivered at least thirty (30) days prior to the date upon which such alternative address is to become effective. For purposes of this Lease, any amount due to Landlord from Tenant, including without limitation Monthly Basic Rent, Direct Operating Expenses and Common Operating Expenses shall be considered additional rent for purposes of this Lease and the word “rent” in this Lease shall include such additional rent as well as Monthly Basic Rent, Direct Operating Expenses and Common Operating Expenses unless the context specifically or clearly implies that only the Monthly Basic Rent, Direct Operating Expenses or Common Operating Expenses is referenced.

4.2 In the event Tenant exercises its Extension Option pursuant to the provisions of Paragraph 2.2, the Monthly Basic Rent shall be adjusted at the commencement of the Extended Term to reflect 100% of the “then-Fair Market Rental Value of the Premises” pursuant to the terms of this Paragraph. Landlord shall notify Tenant of Landlord’s good faith estimation of the Fair Market Rental Value in writing within thirty (30) days of receipt of the Option Notice (“Landlord’s Estimate”), setting forth in Landlord’s Estimate any Comparable Transactions (defined below) upon which Landlord’s Estimate is based. If Tenant does not agree with Landlord’s Estimate, Tenant shall deliver written notice of Tenant’s objection to Landlord within thirty (30) days of receipt of Landlord’s Estimate, failing which Landlord’s Estimate shall be deemed to be final. If Tenant timely objects to Landlord’s Estimate, Landlord and Tenant shall diligently attempt in good faith to agree on the Fair Market Rental Value of the Premises on or before the thirtieth (30th) day following delivery of Tenant’s written objection to Landlord’s Estimate (the “Outside Agreement Date”). If Landlord and Tenant are unable to agree on the new Monthly Basic Rent by the Outside Agreement Date, the Fair Market Rental Value of the Premises shall be determined by real estate brokers pursuant to this Paragraph. The parties shall each select a broker within thirty (30) days of the Outside Agreement Date, who together shall attempt to determine the Fair Market Rental Value of the Premises. If either party fails to appoint a broker within such time period, the broker timely appointed by the other party shall be the sole broker, whose determination shall be binding on both parties. If two brokers are timely appointed, but they are unable to agree on the Fair Market Rental Value of the Premises within sixty (60) days of the Outside Agreement Date, they shall mutually select a third broker. In the event that the two brokers are unable to mutually select a third broker, within sixty (60) days of the Outside Agreement Date, either Landlord or Tenant shall be entitled to apply to the Superior Court in and for the County of San Francisco for appointment of a third broker in accordance with the procedures as established by such court. Upon the selection of the third broker, each of Landlord’s broker and Tenant’s broker shall place their final good faith determination of the Fair Market Rental Value of the Premises in an envelope and deliver same to the third broker as well as the other broker (each, a “Final Determination”). The third broker shall, within twenty (20) days of his/her selection following the delivery of the Final Determinations, choose one of the first two brokers’ Final Determination as the applicable Fair Market Rental Value based on which of the two (2) it believes to be closest to its own determination. The third broker shall have no option but to select one or the other of the first two brokers’ Final Determinations, and shall not have the power to propose a different Fair Market Rental Value. If either broker fails to deliver a Final Determination, then the Final Determination delivered by the other broker shall be deemed to be the Fair Market Rental Value. Each party shall bear the cost of their respective brokers; if a third broker is necessary, the parties shall share equally the cost of the third broker.

All brokers shall be licensed as such by the State of California, and shall have a minimum of ten (10) years’ experience in the leasing of similar properties in the San Francisco South of Market District (“Comparable Buildings”). Comparable Buildings shall include, without limitation, 123 Townsend Street and 139 Townsend Street, San Francisco, California. As used herein, the “South of Market District” shall mean the area bordered by the following streets: King, Folsom, 4th Street and the Embarcadero. The Fair Market Rental Value shall mean the economic terms at which tenants, as of the first day of the applicable Extended Term, are leasing for a comparable term, space comparable to the Premises, from a willing landlord, at arm’s length, which comparable space is located in Comparable Buildings with similar amenities (“Comparable Transactions”), or, if such Comparable Buildings, or comparable space within Comparable Buildings, is not available, adjustments shall be made in the determination of Fair Market Rental Value to reflect the age and quality of the Building and Premises as contrasted to other buildings used for comparison purposes, taking into consideration location, views, quality and nature of improvements, proposed term of the lease, extent of services to be provided, the time that the particular rate under consideration became or is to become effective, as well as all tenant concessions and inducements, the standard of measurement by which the rentable area of each space is measured and parking availability, which shall (i) not be subleased, and (ii) shall be leased for a term comparable to the subject Extended Term, upon terms comparable to those contained in this Lease other than Monthly Basic Rent. The intent of the parties is that Tenant will obtain the same rent and other economic benefits that landlords would otherwise give in Comparable Transactions and that Landlord will make and receive the same economic payments and concessions that landlords would otherwise make and receive in Comparable Transactions. The Monthly Basic Rent shall be adjusted to reflect the Fair Market Rental Value, as so determined. The brokers shall expressly consider in their determination of Fair Market Rental Value of the Premises the date on which the Extended Term is to commence, acknowledging that the date on which the determination is made may be several months prior to the date on which the Extended Term commences, The determination of Fair Market Rental Value shall also include the determination of annual increases in the Monthly Basic Rent throughout the Extended Term, to the extent that such increases are typically being applied in the leases of comparable properties used in determining the Fair Market Rental Value.

4.3 All payments received by Landlord from Tenant shall be applied to the oldest payment obligation owed by Tenant to Landlord. No designation by Tenant either in a separate writing or in a check or money order, shall modify this clause or have any force or effect.

4.4 Provided that Tenant is not in Default, then during the first four (4) months of the Term (the “Rent Abatement Period”), Tenant shall not be obligated to pay the Monthly Basic Rent otherwise attributable to the Premises during such Rent Abatement Period (the “Rent Abatement”). The Rent Abatement Period shall commence as of the Lease Commencement Date. Landlord and Tenant acknowledge that the aggregate amount of the Rent Abatement equals Eight Hundred Forty Thousand Five Hundred Ninety-Seven Dollars and Thirty-Two Cents ($840,597.32). Tenant acknowledges and agrees that the foregoing Rent Abatement has been granted to Tenant as additional consideration for entering into this Lease, and for agreeing to pay the rent and performing the terms and conditions otherwise required under this Lease. If at any time Tenant shall be in Default under this Lease, and if this Lease is terminated by Landlord as a consequence of such Default, then Landlord may include in its claim for termination damages, the unamortized (as of the date of the Default) amount of the Rent Abatement (assuming amortization of the Rent Abatement on a straight-line basis over the Term). Notwithstanding the above provisions of this Paragraph 4.4, Tenant shall be obligated to pay to Landlord the initial installment of Monthly Basic Rent prior to the Early Access Date, which initial installment of Monthly Basic Rent shall be applied after expiration of the Rent Abatement Period consistent with the provisions of Paragraph 4.1 above.

5. Payment of Direct Operating Expenses. Commencing as the Lease Commencement Date Tenant shall pay directly or reimburse Landlord for the costs and expenses (“Direct Operating Expenses”) set forth below in this Paragraph 5. Costs to be reimbursed to Landlord as more particularly provided in Paragraphs 5.2 and 5.3 below shall be reimbursed in accordance with the provisions of Paragraphs 6.2 and 6.3 below in a manner consistent with the reimbursement to Landlord of Tenant’s Share of Common Operating Expenses.

5.1 Tenant shall pay prior to delinquency all taxes assessed against and levied upon Tenant owned leasehold improvements, trade fixtures, furnishings, equipment and all personal property of Tenant contained in the Premises or elsewhere. When possible, Tenant shall cause its leasehold improvements other than the Tenant Improvements, trade fixtures, furnishings, equipment and all other personal property to be assessed and billed separately from the real property of Landlord.

5.2 Tenant shall reimburse Landlord for the cost of all Base Building Services and services as otherwise provided by Landlord pursuant to provisions of Paragraph 18 as more particularly provided in such Paragraph,

5.3 Tenant shall reimburse Landlord for Landlord’s costs in connection with matters benefitting the Premises but not-the Retail Space including, without limitation, maintenance and repair of the elevator and the HVAC systems serving the Premises. The exclusions set forth below in Paragraph 6.2 shall also be deemed exclusions to the expenses payable by Tenant pursuant to the provisions of this Paragraph 5.3, and the limitation on the inclusion of capital expenses set forth below in Paragraph 6 shall similarly apply to Tenant’s obligations to reimburse Landlord for capital items pursuant to the provisions of this Paragraph 5.3.

6. Payment of Taxes, Common Operating Expenses and Other Charges.

6.1 Landlord shall pay prior to delinquency all Real Property Taxes (as defined below) which accrue in connection with the Building beginning on the Commencement Date and continuing thereafter throughout the Term of this Lease, and Tenant shall reimburse Landlord for Tenant’s Share of all Real Property Taxes paid by Landlord relating to the Premises within thirty (30) days of receipt of Landlord’s invoice therefor and evidence of payment. If any installment of Real Property Taxes paid by Landlord covers any period of time prior to the Lease Commencement Date or after expiration of the Term, Tenant’s Share of the Real Property Taxes shall be equitably prorated to cover only the period of time on and after the Lease Commencement Date that this Lease is in effect, and Landlord shall reimburse Tenant for any overpayment by reason of such proration. If Landlord receives a refund of Real Property Taxes, attributable to any period during the Term, Landlord shall, either pay to Tenant, or credit against subsequent payments of Common Operating Expenses due hereunder, an amount equal to Tenant’s Share of the refund, net of any reasonable expenses incurred by Landlord in achieving such refund; provided, however, if this Lease shall have expired or is otherwise terminated, Landlord shall refund in cash any such refund or credit due to Tenant within thirty (30) days after Landlord’s receipt of such refund. Landlord’s obligation to so refund to Tenant any such refund of Real Property Taxes shall survive such expiration or termination.

As used herein, the term “Real Property Taxes” shall include any form of real estate tax, any tax levied on the collection of rent payable under this Lease (whether in the form of a business tax or rental income tax), any general, special, ordinary or extraordinary assessment, any improvement bond, levy or similar tax (or any other fee, charge, or excise which may be imposed as a substitute for any of the foregoing) imposed upon the Building by any authority having the direct or indirect power to tax, including any city, county, state or federal government, or any school, agricultural, sanitary, fire, street, drainage or other improvement district, levied against any legal or equitable interest of Landlord in the Premises. Real Property Taxes shall not include (i) any estate, inheritance, transfer, gift, state or federal income or franchise taxes, or (ii) any penalties or interest accrued in connection with the Real Property Taxes (unless the result of Tenant’s failure to comply with its obligations under this Lease) or (iii) any taxes directly payable by any occupant of the Building (including Tenant) pursuant to the provisions of such occupant’s lease or other occupancy agreement. Tenant acknowledges that Tenant shall be responsible for the payment of any increase in Real Property Taxes during the Term resulting from construction of the Tenant Improvements or any subsequent improvements constructed by Tenant during the Term. To the extent any Real Property Taxes may permit the payment in installments (such as a special assessment), Landlord shall elect to cause the same to be paid in the maximum allowable number of installments, and Tenant shall only be responsible for paying those installments to the extent accruing during the Term of the Lease.

Tenant shall be entitled to contest any Real Property Taxes for which Tenant is responsible provided that Tenant shall obtain Landlord’s consent (which consent shall not be unreasonably withheld, conditioned or delayed) prior to contesting any Real Property Taxes, and in the event of such tax contest by Tenant, Tenant shall (i) fully indemnify Landlord pursuant to the provisions of this Lease, for any loss or liability incurred by Landlord as a consequence of Tenant’s contest of Real Property Taxes (provided, however, that such indemnity obligation shall not include the obligation to compensate Landlord on the basis of any claim that Tenant’s challenge or appeal of Real Property Taxes should have resulted in a reduction in Real Property Taxes that is greater than the reduction (if any) in Real Property Taxes realized as a consequence of Tenant’s challenge of Real Property Taxes and (ii) bear the full cost of any such contest including without limitation the cost of any interest and penalties which may be assessed. If a change in Real Property Taxes is obtained for any year of the Term, then Real Property Taxes for that year shall be retroactively adjusted to reflect any actual reduction realized by Landlord and Landlord shall provide Tenant with a credit, if any, based on the actual adjustment. Landlord shall notify Tenant in writing of any material change in any tax assessment or reassessment of the Building and the Site within sufficient time to allow Tenant to review (and protest or appeal, if appropriate) such assessment or reassessment. Landlord shall cooperate at no more than a nominal cost to Landlord and in good faith with Tenant in connection with any protest or contest of taxes or assessments made by Tenant.

6.2 Tenant shall pay to Landlord Tenant’s Share (as defined in the Summary) of all expenses incurred by Landlord in the operation of the Building, excluding any expenses paid directly by any tenant of the Building including, without limitation, the Direct Operating Expenses payable by Tenant (the “Common Operating Expenses”), pursuant to this Paragraph, Common Operating Expenses are intended to be inclusive of all costs of operating and maintaining the Building and the real property on which it is situated exclusive only of the Direct Operating Expenses, subject to the exclusions and limitations set forth herein. Landlord agrees to make reasonable efforts to minimize costs insofar as such efforts are not inconsistent with Landlord’s intent to operate and maintain the Building in a first class manner. At Tenant’s request, Landlord and Tenant shall meet and confer on an annual basis to review Landlord’s anticipated Common Operating Expenses (and any projects or programs included therein) over the ensuing calendar year. Common Operating Expenses may include, but shall not be limited to, the following: all costs and expenses of repairing, operating and maintaining the heating, ventilating and air conditioning (“HVAC”) system for the Building, the elevators, and all other major systems and components of the Building other than costs constituting Direct Operating Expenses, including maintenance contracts therefore; costs and expenses incurred by Landlord in providing water and sewer service to the Building, and other utilities and services not directly paid for by Tenant as a portion of the Direct

Operating Expenses or otherwise or payable by any other Building occupant; costs incurred by Landlord for accountants and other professionals reasonably necessary in making the computations required hereunder; all costs and expenses incurred by Landlord in operating, managing, maintaining and repairing the Building including without limitation, all sums expended in connection with the general maintenance and repair of the Building, window washing, maintenance and repair of stairways, Building signs, the Building Systems (defined below), planting and landscaping (if any), costs of supplies and personnel to implement such services, rental and/or depreciation of machinery and equipment used in providing maintenance and other services, fire protection services, and trash removal services and a reasonable management fee payable to Landlord (such property management fee shall not exceed four percent (4.0%) of all Gross Revenues; “Gross Revenues” shall mean the aggregate of the annual rentals and other revenue of any kind whatsoever derived from the use or occupancy of the Building, accrued or collected with respect to the Building, excluding only any management fee chargeable to Tenant in the calculation of the Common Operating Expenses (so as to prevent Landlord, Landlord’s affiliate, or the Building’s management company from earning a management fee on the management fee). Landlord may cause any or all of said services to be provided by an independent contractor or contractors, or the Building management company, provided that any salary, wage or other similar charges or expenses payable by Landlord shall not be included in the Common Operating Expenses other than (i) direct labor costs incurred by Landlord to perform maintenance and repairs and other services at the Building, and (ii) a portion of the salary of a building manager/superintendent to the extent the same is dedicated to the Building and the cost thereof is passed through to Landlord by Landlord’s building management company. Common Operating Expenses may also include all costs of (i) capital improvements, repairs, alterations or replacements made to the Building or any Building System carried out in order to conform to changes subsequent to the Effective Date in any applicable laws, ordinances, rules, regulations or orders of any governmental or quasi-governmental authority having jurisdiction over the Building or (ii) any capital improvements or replacement carried out for the purpose of improving the performance or efficiency of any Building System (referred to herein as “Permitted Capital Expenditures”). Permitted Capital Expenditures shall be amortized (including interest at a rate of eight percent (8%) per annum) over the useful life of such capital improvement, repair, alteration or replacement, as reasonably determined in accordance with generally accepted accounting principles consistently applied (“GAAP”). Costs and expenses incurred by Landlord in operating, managing and maintaining the Building which are incurred exclusively for the benefit of a specific tenant of the Building will not be included in the Common Operating Expenses.

Notwithstanding anything to the contrary contained in this Lease, the following shall not be included within Common Operating Expenses: (i) leasing commissions, attorneys’ fees, costs, disbursements, and other expenses incurred in connection with negotiations or disputes with tenants, or in connection with leasing, renovating, or improving space for tenants or other occupants or prospective tenants or other occupants of the Building; (ii) the cost of any service sold to any tenant (including Tenant) or other occupant for which Landlord is entitled to be reimbursed as an additional charge or rental over and above the basic rent and escalations payable under the lease with that tenant including, without limitation, the Direct Operating Expenses payable by Tenant pursuant to this Lease; (iii) depreciation other than depreciation on exterior window coverings provided by Landlord and carpeting in public corridors and common areas and the personal property referred to above; (iv) expenses in connection with services or other benefits of a type that are not provided to Tenant but which are provided another tenant or occupant of the Building; (v) overhead profit increments paid to Landlord’s subsidiaries or affiliates for management or other services on or to the Building or for supplies or other materials to the extent that the cost of the services, supplies, or materials exceeds the cost that would have been paid had the services, supplies, or materials been provided by unaffiliated parties on a competitive basis; (vi) all interest, loan fees, and other carrying costs related to any mortgage or deed of trust or related to any capital item, and all rental and other payable due under any ground or underlying lease, or any lease for any equipment ordinarily considered to be of a capital nature (except janitorial equipment which is not affixed to the Building); (vii) any compensation paid to clerks, attendants, or other persons in commercial concessions operated by Landlord; (viii) advertising and promotional expenditures; (ix) costs of repairs and other work occasioned by fire, windstorm, or other casualty of an insurable nature; (x) any costs, fines, or penalties incurred due to violations by Landlord of any governmental rule or authority, this Lease or any other lease in the Building, or due to Landlord’s negligence or willful misconduct; (xi) the cost of correcting any building code or other violations which were violations prior to the Lease Commencement Date; (xii) the cost of containing, removing, or otherwise remediating any contamination of the Building (including the underlying land and ground water) by any toxic or Hazardous Materials (defined in Paragraph 8.2(b)) where such contamination was not caused by Tenant; (xiii) costs for sculpture, paintings, or other objects of art (and insurance thereon or extraordinary security in connection therewith); and (xiv) wages, salaries, or other compensation paid to any executive employees above the grade of building manager; any other expense that under generally prevailing property management practices within the South of Market District would not be considered a normal maintenance or operating expense which is properly passed through to tenants. Additionally, any deductible payment under any Landlord’s policy of earthquake insurance shall be included in Common Operating Expenses and, for the purpose of such inclusion shall be treated as a Permitted Capital Expenditure with a useful life of ten (10) years

On or before the first day of each partial or full calendar year during the Term, or as soon as practicable thereafter, Landlord shall give to Tenant written notice of Landlord’s estimate of the Direct Operating Expenses and Tenant’s Share of Common Operating Expenses payable by Tenant pursuant to Paragraphs 5 and this Paragraph 6.2, respectively for such calendar year or

partial calendar year, as the case may be, which estimate shall be in form comparable to a Landlord’s Statement (defined below) and include a line-item breakdown of component costs. On or before the first day of each month during each calendar year or partial calendar year, as the case may be, Tenant shall pay to Landlord one-twelfth (l/12th) (or the applicable pro rata portion for any partial calendar year based on the number of months constituting such partial calendar year) of the estimated Direct Operating Expenses and Tenant’s Share of Common Operating Expenses; provided, however, that if Landlord’s notice is not given prior to the first day of any calendar year, Tenant shall continue to pay the Direct Operating Expenses and Common Operating Expenses on the basis of the prior year’s estimate until the month after Landlord’s notice is given. At any time and from time to time during the Term, Landlord may furnish Tenant with written notice of a re-estimation of the annual Direct Operating Expenses and/or Tenant’s Share of Common Operating Expenses to reflect more accurately, in Landlord’s reasonable opinion, the then-current Direct Operating Expenses and/or Common Operating Expenses. Commencing on the first day of the calendar month which commences at least thirty (30) days following the date of Landlord’s delivery of such notice to Tenant, and continuing on the first day of each subsequent calendar month during the applicable calendar year (until subsequently re-estimated), Tenant shall pay to Landlord one-twelfth of the Tenant’s Share of the estimated annual Common Operating Expenses, as re-estimated as well as one-twelfth (l/12th) of the estimated annual Direct Operating Expenses as re-estimated.

6.3 After the expiration of each calendar year during the Term hereof Landlord shall furnish to Tenant an itemized statement, certified as correct by Landlord, setting forth the total Direct Operating Expenses and Common Operating Expenses for the preceding calendar year, the amount of Tenant’s Share of Common Operating Expenses and the payments made by Tenant with respect to such calendar year (“Landlord’s Statement”). Such annual statement shall be set forth in reasonable detail both the Direct Operating Expenses and Tenant’s Share of Common Operating Expenses.

(a) a line-item breakdown showing at least the following major categories and subcategories of costs:

(i) maintenance and repairs (cleaning; security; elevators; supplies; waste removal; heating, ventilation and air conditioning);

(ii) landscaping;

(iii) utilities (electricity; gas; and water and sewer);

(iv) insurance;

(v) salaries (engineering; and administrative); and

(vi) general and administrative (management fees; professional services; office supplies; and other).

If Tenant’s Share of the actual Common Operating Expenses and/or the actual Direct Operating Expenses for such year as set forth in Landlord’s Statement exceeds the payment so made by Tenant, Tenant shall pay Landlord the deficiency within thirty (30) days after receipt of such statement. If the payments so made by Tenant exceed Tenant’s Share of the actual Common Operating Expenses and/or the actual Direct Operating Expenses, Tenant shall be entitled to offset the excess against the next payment(s) due to Landlord because of Direct Operating Expenses and/or Common Operating Expenses, or to receive from Landlord cash in such amount, within thirty (30) days if this Lease has terminated. Until Tenant receives Landlord’s Statement pursuant to this Paragraph setting forth a new amount of Tenant’s estimated Tenant’s Share of Common Operating Expenses and the Direct Operating Expenses for the new calendar year, Tenant shall continue to pay such Tenant’s Share of the Common Operating Expenses and the Direct Operating Expenses at the rate being paid for the year just completed. Landlord shall maintain at all times during the Term, at the office of Landlord’s property manager in San Francisco, California, full, complete and accurate books of account and records prepared in accordance with generally accepted accounting principles with respect to Common Operating Expenses, Real Property Taxes and Direct Operating Expenses, and shall retain such books and records, as well as contracts, bills, vouchers, and checks, and such other documents as are reasonably necessary to properly audit Common Operating Expenses, Real Property Taxes and Direct Operating Expenses. Within one hundred twenty (120) days after receipt of Landlord’s Statement, Tenant shall have the right to audit at the offices of Landlord’s property manager located in San Francisco, at Tenant’s expense, Landlord’s accounts and records relating to Common Operating Expenses, Real Property Taxes and Direct Operating Expenses. Such audit shall be conducted by an employee of Tenant or by a certified public accountant approved by Landlord, which approval shall not be unreasonably withheld. In no event shall Tenant use an auditing service that performs operating expense audits on a “contingency” or “percentage savings” basis. If the final determination reveals that Landlord has overcharged Tenant, the amount overcharged shall be credited against Tenant’s next Common Operating Expenses and Direct Operating Expense payment obligations, or paid in cash within thirty days, if the Lease has terminated. In the event the audit reveals Tenant has underpaid its portion of Common Operating Expenses and/or Direct Operating Expenses, Tenant shall remit the shortfall to Landlord within thirty (30) days. Additionally, if Landlord is determined to have overcharged Tenant for Operating Expenses, Real Property Taxes and Direct Operating Expenses by five percent (5%) or more, Landlord shall reimburse Tenant within thirty (30) days following such determination for the reasonable cost of Tenant’s review of Landlord’s books and records (which cost may not be included as a Common Operating Expense). Notwithstanding the foregoing, Tenant shall not be responsible for any Common Operating Expenses attributable to any year which is first billed to Tenant more than two (2) calendar years after the date of expiration of the year to which such Common Operating Expense applies, provided that Tenant shall nonetheless be responsible for any such sums for any year if the same

are first levied by any governmental authority or by any public utility companies following the date that is two (2) calendar years following the expiration of such year.

6.4 Tenant acknowledges that Landlord intends to obtain a LEED-EB certification for the Building (Leadership in Energy and Environmental Design - Existing Building), and that the cost of obtaining such certification will be amortized over the useful life of such systems calculated in accordance with GAAP, and the monthly amortized cost thereof (including an annual interest rate factor of eight percent (8%)) shall be included as a part of Common Operating Expenses payable by Tenant. Tenant also agrees to reasonably cooperate with Landlord to obtain and maintain the LEED-EB certification, including without limitation complying with Landlord’s rules and regulations regarding recycling, use of “green” cleaning products and the like, as the same may be required in connection with the LEED-EB program. For purposes of this Paragraph 6.4 and the cost of obtaining LEED-EB certification, such costs included in Common Operating Expenses shall not include (i) the cost of replacement of the air handler and chiller on the roof of the Building, (ii) the cost of replacing the roof of the Building, (iii) the cost of replacing the elevator for the Building, or (iv) the cost for which Landlord is responsible pursuant to the Work Letter relating to compliance with Title 24 of the California Code of Regulations, all of which costs are anticipated to be incurred by Landlord prior to the Lease Commencement Date. Notwithstanding any provision to the countrary of this Paragraph 6.4 in no event shall the aggregate amount payable by Tenant pursuant to the provisions of this Paragraph 6.4 during the initial term of nine (9) years exceed Two Hundred Thousand Dollars ($200,000).

7. Security Deposit. As and for security for Tenant’s full and faithful performance of all the terms, covenants and conditions of this Lease to be kept and performed by Tenant, Tenant, upon execution of this Lease, shall deposit with Landlord a security deposit of Two Million Seven Hundred Seventy-Three Thousand Two Hundred Eighty Seven Dollars ($2,773,287) in cash or, at Tenant’s option, in the form of an unconditional, irrevocable letter of credit (“LOC”) in such amount in favor of Landlord in a form and from a financial institution located in San Francisco, California (or alternatively accepting presentations for draw purposes by facsimile and/or overnight courier), reasonably acceptable to Landlord. Landlord hereby approves Silicon Valley Bank as the bank issuing the LOC. At any time during the Term upon at least ten (10) business days’ prior notice to Landlord, Tenant may elect to convert the form of the Security Deposit from cash to a LOC or from a LOC to cash, so long as the provisions of this Paragraph 7 are complied with. If at any time during the Term, any item constituting rent as provided herein, or any other sum payable by Tenant to Landlord hereunder, shall be overdue and unpaid beyond any applicable notice and cure periods, then Landlord may, at the sole option of Landlord, but without any requirement to do so, and without prejudice to any other remedy which Landlord may have, access the cash deposit, or draw down or make a claim or demand for draw against the LOC, in the amount of the sum equal to the overdue and unpaid amount, together with Landlord’s actual and reasonable expenses incurred in connection with the Default, and apply such sum to payment of such overdue rent or other sum. The LOC shall provide for partial draws and further provide that any draw thereunder shall be accompanied by a certificate of an officer or manager of Landlord stating that Tenant is in Default and that Landlord or its authorized agent is entitled to draw down on the LOC the amount requested pursuant to the terms of this Lease. Further in the event of the failure of Tenant to keep and perform any nonmonetary term, covenant or condition of this Lease to be kept or performed by Tenant beyond any applicable cure periods and the receipt of any required notice, at the sole option of Landlord, and without prejudice to any other remedy which Landlord may have, Landlord may access the cash deposit or draw down the entire LOC, or so much thereof as may be necessary to compensate Landlord for any loss or damage sustained or suffered by Landlord, or which Landlord may sustain or suffer, due to such breach on the part of Tenant. In the event that all or any portion of the cash deposit is accessed or the LOC is drawn down by Landlord to pay overdue rent or other sums due and payable to Landlord by Tenant hereunder as described in this Paragraph 7, then Tenant shall, within ten (10) business days after receipt of written demand of Landlord, deliver to Landlord a sufficient amount in an additional LOC (or cash, as the case may be) to restore Landlord’s security to the original, total amount of the security deposit as provided in this Paragraph. Any failure on the part of Tenant to do so within ten (10) business days following the date on which written demand for restoration is deemed given hereunder, shall constitute a Default of this Lease pursuant to Paragraph 25.1(d) below without further written notice to Tenant. The LOC shall be maintained by Tenant during the entire Term of this Lease and for a period of thirty (30) days thereafter (the last day of such thirty (30) day period shall be referred to as the “Return Date”). If the LOC is to expire before the Return Date, Tenant shall replace the LOC by providing Landlord with a substitute LOC at least thirty (30) days prior to the expiration date of the then effective LOC being held by Landlord in the applicable amount required hereunder and the failure to do so shall constitute a Default entitling Landlord to draw the full amount of the LOC and hold the proceeds thereof as a cash security deposit hereunder. The LOC shall provide, in part, that the LOC shall be automatically renewed through and including at least the Return Date unless the issuer gives written notice to Landlord at least thirty (30) days prior to the expiration of the LOC that such issuer does not intend to renew the LOC. In such event, Landlord shall be entitled to draw the full amount of the LOC and hold the proceeds thereof as a cash security deposit hereunder unless a substitute LOC is delivered by Tenant to Landlord at least twenty (20) days prior to the expiration of the then existing LOC. Any cash deposit held by Landlord as security shall be non-interest bearing and may be commingled by Landlord with other funds of Landlord. In the event Landlord transfers the security deposit to any successor in interest of Landlord to title of the Site and Building, then, in such event, Landlord shall be discharged from any further obligation or liability with respect to the security deposit. Any LOC issued in favor of Landlord

may, if required by any lender holding a mortgage or deed of trust secured by the Site and Building, be transferred to such lender provided that such lender, Landlord and Tenant enter into an agreement reasonably acceptable to all parties governing such lender’s right to draw down money on, or further transfer, the LOC. Tenant waives the provisions of California Civil Code Section 1950.7 and all other provisions of law now in force or that become in force after the date of execution of this Lease that provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damages caused by Tenant, or to clean the Premises. Landlord and Tenant agree that Landlord may, in addition, claim those sums reasonably necessary to compensate Landlord for any loss or damage caused by the act or omission by Tenant or Tenant’s officers, agents, employees, independent contractors or invitees as elsewhere provided herein. Upon the expiration or earlier termination of this Lease, Landlord shall return to Tenant within thirty (30) days of Tenant vacating the Premises so much of the security deposit as has not been applied or entitled to be held by Landlord to be applied to cure any and all defaults by Tenant and/or to compensate Landlord for any and all damages or loss suffered or which may be suffered by Landlord resulting from the default or breach by Tenant.

8. Use.

8.1 Tenant shall use the Premises for general office purposes, including administrative functions, and all purposes reasonably incident thereto and reasonably commensurate with the operation and occupancy of a technology company headquarters in the South of Market District, and shall not use or permit the Premises to be used for any other purpose without the prior written consent of Landlord, which consent may be granted or withheld in Landlord’s sole discretion. Subject to Landlord’s prior written approval of plans therefore, Tenant shall have the right to use a portion of the Premises for the operation of, and include in the Tenant Improvements (or subsequent Changes) the construction of, a kitchen/cooking facility (including a gas line of adequate capacity with gas lines stubbed to the Premises) for Tenant’s employees and guests only (in no event shall such kitchen/cooking facility be open to or serve the general public), on and subject to the following terms and conditions: Tenant shall be responsible, at its sole cost and expense (subject to the application of the Tenant Improvement Allowance), for obtaining all applicable permits, licenses and governmental approvals necessary for the use of the Premises for such kitchen/cooking facility uses (including, without limitation, any necessary approvals from the applicable health and/or fire departments, permits required in connection with any venting or other air-removal/circulation system, and any required fire-suppression systems), copies of which shall be delivered to Landlord prior to Tenant’s installation of any alterations in the Premises in connection with such kitchen/cooking facility uses. Tenant shall have access to the Premises 24 hours per day/ 365 days per year. Tenant shall not use or occupy the Premises in violation of any recorded covenants, conditions and restrictions affecting the Site or of any law, code, regulation, rule, order, or injunction or of the Certificate of Occupancy issued for the Building. Upon five (5) business days written notice from Landlord, Tenant shall discontinue any specific use of the Premises which is declared by any governmental authority having jurisdiction to be a violation of any recorded covenants, conditions and restrictions affecting the Site or of any law, code, regulation, rule, order, or injunction or of the Certificate of Occupancy. However, Tenant, at Tenant’s expense, may contest by appropriate proceedings in good faith the legality or applicability of any law affecting the Premises, provided that (i) the Building or any part thereof (including the Premises) shall not be subject to being condemned or vacated by reason of noncompliance or otherwise by reason of such contest, (ii) no unsafe or hazardous condition remains unremedied as a result of such contest, (iii) such non-compliance or contest is not prohibited under any then-applicable mortgage, (iv) such non-compliance or contest shall not prevent Landlord from obtaining any and all permits and licenses then required by applicable laws in connection with the operation of the Building, and (v) the Certificate of Occupancy for the Building (or any portion) is neither subject to being suspended by reason such of non-compliance or contest (any such proceedings instituted by Tenant being referred to herein as a “Compliance Challenge”). In the event that Tenant commences a Compliance Challenge, Tenant’s obligation to cease any use specified in Landlord’s notice and/or obligation to comply with the applicable law in question shall, unless otherwise mandated by applicable law, be suspended pending the resolution of the Compliance Challenge. Tenant shall not install any radio or television antenna, loudspeaker or other device on the roof or exterior walls of the Building without Landlord’s prior written consent. Landlord shall not unreasonably withhold, delay or condition Landlord’s consent to Tenant’s installation of antennae on the roof of the Building. Subject to Tenant’s right to commence a Compliance Challenge, Tenant shall comply with any direction of any governmental authority having jurisdiction which shall, by reason of the nature of Tenant’s specific use or alteration of the Premises, impose any duty upon Tenant or Landlord with respect to the Premises or with respect to the use or occupation thereof. Tenant shall not do or permit to be done anything which will invalidate or increase the cost of any fire, extended coverage or any other insurance policy covering the Site, the Building, the Premises, and/or property located therein and shall comply with all rules, orders, regulations and requirements of the Pacific Fire Rating Bureau or any other organization performing a similar function. Upon demand, Tenant shall promptly reimburse Landlord as additional rent for any additional premium charged for such policy by reason of Tenant’s failure to comply with the provisions of this Paragraph 8. Tenant shall not do or permit anything to be done in or about the Site, the Building, and/or the Premises which will unreasonably obstruct or interfere with the rights of other tenants or occupants of the Building, or injure them, or use or allow the Premises to be used for any unlawful purpose. Tenant shall not cause, maintain or permit any nuisance in, on or about the Site, the Building and/or the Premises, or allow any noxious odors to exist at or emanate from the Site, the Building and/or the Premises. Tenant shall not commit or suffer to be committed any waste in or

upon the Site, the Building and/or the Premises and shall keep the Premises in good repair and appearance. Tenant shall not place a load upon the Premises which exceeds the average pounds of live load per square foot of floor area specified for the Building by Landlord’s architect Huntsman Architectural Group, with the partitions to be considered a part of the live load. Landlord reserves the right to reasonably prescribe the weight and position of all safes, files and heavy equipment which Tenant desires to place in the Premises so as to distribute properly the weight thereof, based upon Landlord’s architect’s written recommendation, which Landlord will provide to Tenant. Tenant’s business machines and mechanical equipment which cause vibration or noise that may be transmitted to the Building structure or to any other space in the Building shall be so installed, maintained and used by Tenant as to eliminate such vibration or noise. Tenant shall be responsible for all structural engineering required to determine structural load. Tenant shall fasten all files, bookcases and like furnishings to walls in a manner to prevent tipping over in the event of earth movements. Landlord shall not be responsible for any damage or liability for such events.

8.2 Except for the normal and proper use and storage of typical cleaning fluids and solutions, and office equipment supplies (such as copier toner), in amounts commensurate with Tenant’s permitted use and occupancy of the Premises, Tenant shall not use, introduce to the Site, the Building and/or the Premises, generate, manufacture, produce, store, release, discharge or dispose of, on, under or about the Site, the Building and/or the Premises or transport to or from the Site, the Building and/or the Premises any Hazardous Material (as defined below in this Paragraph 8.2) or allow its employees, agents, contractors, invitees or any other person or entity to do so. Tenant warrants that it shall not make any use of the Site, the Building and/or the Premises which may cause contamination of the soil, the subsoil or ground water. Tenant shall not permit the Premises to be in violation of any laws regarding Hazardous Materials brought onto the Premises by Tenant, its employees, agents or contractors; provided however that nothing in this Lease shall be construed to impose responsibility on Tenant for the remediation of Hazardous Materials that (i) were present in, on or under the Building on the Lease Commencement Date, (ii) are introduced into the Premises by Landlord’ its employees, agents or contractors, or (iii) which may migrate to the Premises through the air, water or soil through no fault of Tenant, its employees, agents or contractors. Tenant shall give immediate written notice to Landlord of (i) any action, proceeding or inquiry by any governmental authority or any third party with respect to the presence of any Hazardous Material on the Site, the Building and/or the Premises or the migration thereof from or to other property or (ii) any spill, release or discharge of Hazardous Materials that occurs with respect to the Site, the Building and/or the Premises or Tenant’s operations, of which Tenant has notice. Landlord shall give immediate written notice to Tenant of (i) any action, proceeding or inquiry by any governmental authority or any third party with respect to the presence of any Hazardous Material on the Site, the Building and/or the Premises or the migration thereof from or to other property or (ii) any spill, release or discharge of Hazardous Materials that occurs with respect to the Site, the Building and/or the Premises or Landlord’s operations, of which Landlord has notice.

(a) Tenant shall indemnify and hold harmless Landlord, its directors, officers, members, employees, managers, agents, successors and assigns (collectively “Landlord Parties”, individually a “Landlord Party”) from and against any and all claims arising from Tenant’s use, generation, manufacture, production, storage, release, discharge or disposal of Hazardous Materials on the Site, the Building and/or the Premises in violation of the terms, covenants and conditions of this Paragraph 8. The indemnity shall include all costs, fines, penalties, judgments, losses, attorney’s fees, expenses and liabilities incurred by any of the Landlord Parties for any such claim or any action or proceeding brought thereon including, without limitation,’ (a) all actual damages; and (b) the costs of any cleanup, detoxification or other ameliorative work of any kind or nature required by any governmental agency having jurisdiction thereof, including without limitation all costs of monitoring and all fees and expenses of consultants and experts retained by and of the Landlord Parties. This indemnity shall survive the expiration or termination of this Lease. In any action or proceeding brought against any of the Landlord Parties by reason of any such claim, upon notice from such Landlord Party if such Landlord Party does not elect to retain separate counsel, Tenant shall defend the same at Tenant’s expense by counsel reasonably satisfactory to such Landlord Party. Landlord shall indemnify and hold harmless Tenant, its directors, officers, members, employees, agents, successors and assigns (collectively “Tenant Parties”, individually a “Tenant Party”) from and against any and all claims arising from the use, generation, manufacture, production, storage, release, discharge or disposal of Hazardous Materials on the Site, the Building and/or the Premises occurring prior to the Lease Commencement Date or during the Lease Term as a result of Landlord’s or Landlord Parties’ use, generation, manufacture, production, storage, release, discharge or disposal of Hazardous Materials on the Site, the Building and/or the Premises.

(b) As used herein, the term “Hazardous Material” shall mean any substance or material which has been determined by any state, federal or local governmental authority to be capable of posing a risk of injury to health, safety or property, including all of those materials and substances designated as hazardous or toxic by the city or state in which the Premises are located, the U.S. Environmental Protection Agency, the Consumer Product Safety Commission, the Food and Drug Administration, the California Water Resources Control Board, the Regional Water Quality Control Board, San Francisco Bay Region, the California Air Resources Board, CAL/OSHA Standards Board, Division of Occupational Safety and Health, the California Department of Food and Agriculture, the California Department of Health Services, and any federal agencies that have overlapping jurisdiction with such California agencies, or any other governmental agency now or hereafter authorized to regulate materials and substances in the environment. Without limiting the generality of the foregoing, the term “Hazardous

Material” shall include all of those materials and substances defined as “hazardous materials” or “hazardous waste” in Sections 66680 through 66685 of Title 22 of the California Administrative Code, Division 4, Chapter 30, as the same shall be amended from time to time, petroleum, petroleum-related substances and the by-products, fractions, constituents and sub-constituents of petroleum or petroleum-related substances, asbestos, and any other materials requiring remediation now or in the future under federal, state or local statutes, ordinances, regulations or policies.

9. Payments and Notices. All rents and other sums payable by Tenant to Landlord hereunder shall be paid to Landlord by check, cashier’s check, ACH bank account transfer or wire transfer at the address designated by Landlord in the Summary or at such other places as Landlord may hereafter designate in writing at least thirty (30) days prior to the effective date upon which payments are to be made to such alternate address. Any notice required or permitted to be given hereunder must be in writing and may be given by personal delivery, certified mail, return receipt requested, or by recognized overnight courier. If notice is given by personal delivery, such notice shall be deemed to be given upon delivery (unless the date of delivery is a weekend or holiday, in which event such notice shall be deemed given upon the next succeeding business day). If notice is given by certified mail addressed to Tenant or to Landlord at the address designated in the Summary, then such notice shall be deemed given three (3) business days following deposit in the U.S. Mail, postage prepaid, addressed to Tenant or to Landlord at the addresses designated in the Summary. If notice is given by overnight courier, notice shall be deemed given the next business day following delivery to the courier for next business day delivery, charges prepaid, addressed as stated above. Either party may by written notice to the other specify a different address for notice purposes except that Landlord may in any event use the Premises as Tenant’s address for notice purposes. If more than one person or entity constitutes the “Tenant” under this Lease, the giving of any notice upon any one of said persons or entities shall be deemed as giving notice to all of said persons or entities.

10. Brokers. The parties recognize that the brokers who negotiated this Lease are the brokers whose names are stated in the Summary, and agree that Landlord shall be solely responsible for the payment of brokerage commissions to said brokers. Tenant shall have no responsibility therefor. As part of the consideration for the granting of this Lease, Tenant represents and warrants to Landlord that no other broker, agent or finder was hired by Tenant, negotiated with Tenant or, to Tenant’s knowledge, was instrumental in negotiating or consummating this Lease and to Tenant’s knowledge there is no other real estate broker, agent or finder who is, or might be, entitled to a commission or compensation in connection with this Lease. Any broker, agent or finder of Tenant whom Tenant has failed to disclose herein shall be paid by Tenant. Tenant shall hold Landlord (and/or each of the Landlord Parties) harmless from all damages and indemnify Landlord (and/or each of the Landlord Parties) for all said damages paid or incurred by Landlord (and/or each of the Landlord Parties) resulting from any claims that may be asserted against Landlord (and/or each of the Landlord Parties) by any broker, agent or finder who has, or has claimed to have, rendered services to Tenant undisclosed by Tenant herein. Landlord shall hold Tenant harmless from all damages and indemnify Tenant for all said damages paid or incurred by Tenant resulting from any claims that may be asserted against Tenant by any broker, agent or finder who has, or has claimed to have, rendered services to Landlord undisclosed by Landlord herein.

11. Holding Over. If Tenant remains in possession of the Premises after expiration or earlier termination of this Lease with Landlord’s express consent, Tenant’s occupancy shall be a month to month tenancy at a rent agreed upon by Landlord and Tenant but, in no event less than the Monthly Basic Rent payable under this Lease during the last full month before the date of expiration or earlier termination. The month to month tenancy shall be on the terms and conditions of this Lease except as provided in the preceding sentence and the Lease clauses concerning extension rights. If Tenant holds over after the expiration or earlier termination of the Term hereof without the express written consent of Landlord, Tenant shall become a tenant at sufferance only, at a rental rate equal to one hundred fifty percent (150%) of the Monthly Basic Rent which would be applicable to the Premises upon the date of expiration of the Term (prorated on a daily basis), and otherwise subject to the terms, covenants and conditions herein specified, so far as applicable including, without limitation, the obligation to pay Direct Operating Expenses and Common Operating Expenses as provided in Paragraphs 5 and 6.2. Acceptance by Landlord of rent after such expiration or earlier termination shall not constitute a consent to a holdover hereunder or result in a renewal. The foregoing provisions of this Paragraph 11 are in addition to and do not affect Landlord’s right of re-entry or any rights of Landlord hereunder or as otherwise provided by law. If Tenant fails to surrender the Premises, Tenant shall indemnify and hold Landlord harmless from all loss or liability arising out of such failure, including without limitation, any claim made by any succeeding tenant founded on or resulting from such failure to surrender. No provision of this Paragraph 11 shall be construed as implied consent by Landlord to any holding over by Tenant. Landlord expressly reserves the right to require Tenant to surrender possession of the Premises to Landlord as provided in this Lease upon expiration or other termination of this Lease. The provisions of this Paragraph 11 shall not be considered to limit or constitute a waiver of any other rights or remedies of Landlord provided in this Lease or at law; provided, however, that Landlord shall not be entitled to consequential damages except as expressly provided in this Paragraph 11.