Writer's E-Mail: cdavis@kkwc.com

Writer's Direct Dial: 212.880.9865

October 5, 2017

VIA EMAIL AND EDGAR

Perry Hindin

Special Counsel

Office of Mergers and Acquisitions

Division of Corporation Finance

U.S. Securities and Exchange Commission

100 F Street, NE

Washington D.C. 20549-3628

| Re: | Destination Maternity Corporation (the "Company") |

Preliminary Proxy Statement filed September 28, 2017

Filed by Orchestra-Prémaman S.A. and Yeled Invest S.A.

File No. 000-21196

Dear Mr. Hindin:

We acknowledge receipt of the letter of comment dated October 3, 2017 (the "Comment Letter") from the Staff of the Securities and Exchange Commission (the "Staff") with regard to the above-referenced matter. We have discussed the Comment Letter with Orchestra-Prémaman S.A. and the other participants named in the Proxy Statement (collectively, "Orchestra") as necessary and provide the following supplemental responses on their behalf. Unless otherwise indicated, the page references below are to the marked version of the attached copy of the Revised Preliminary Proxy Statement on Schedule 14A filed on the date hereof (the "Proxy Statement"). To facilitate the Staff's review, we have reproduced the text of the Staff's comments in italics below, and our responses appear immediately below each comment.

General

| 1. | Please consider including page numbers in your proxy statement. |

Orchestra acknowledges the Staff's comment and has revised the Proxy Statement to include page numbers.

| 2. | Please note that the proxy card may not confer authority to vote for the election of any person to any office for which a bona fide nominee is not named in the proxy statement. In addition, a person shall not be deemed to be a bona fide nominee and may not be named as such unless he has consented to being named in the proxy statement and to serve if elected. See Exchange Act Rule 14a-4(d). Disclosure in the Participants' proxy statement indicates that Messrs. Blitzer, Erdos and Weinstein and Ms. Payner-Gregor are not bona fide nominees. Please revise the proxy statement and proxy card to comply with Exchange Act Rule 14a-4. Also refer to Section II.I. of Exchange Act Release No. 31326 (Oct. 16, 1992). |

Orchestra acknowledges the Staff's comment and has revised the Proxy Statement and proxy card to remove the authority to vote for the election of any person to any office. Please see PDF page 34 of the Proxy Statement.

| 3. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the soliciting materials or provided to the staff on a supplemental basis with a view toward disclosure. Please provide support for the following statements: |

| · | "Given the Company's continuing track record of decreasing revenue, insufficiently clear financial reporting and prolonged stock underperformance under the oversight of the Status Quo Directors…" |

Orchestra acknowledges the Staff's comment and on a supplemental basis directs the Staff to page F-5 of the Company's Annual Report filed on Form 10-K for the fiscal year ending January 28, 2017 (the "2017 Annual Report"), reproduced below, which disclosed that the Company has experienced a steady decline in gross profits over the fiscal years ended September 30, 2014, and January 30, 2016 and 2017:

Source: 2017 Annual Report

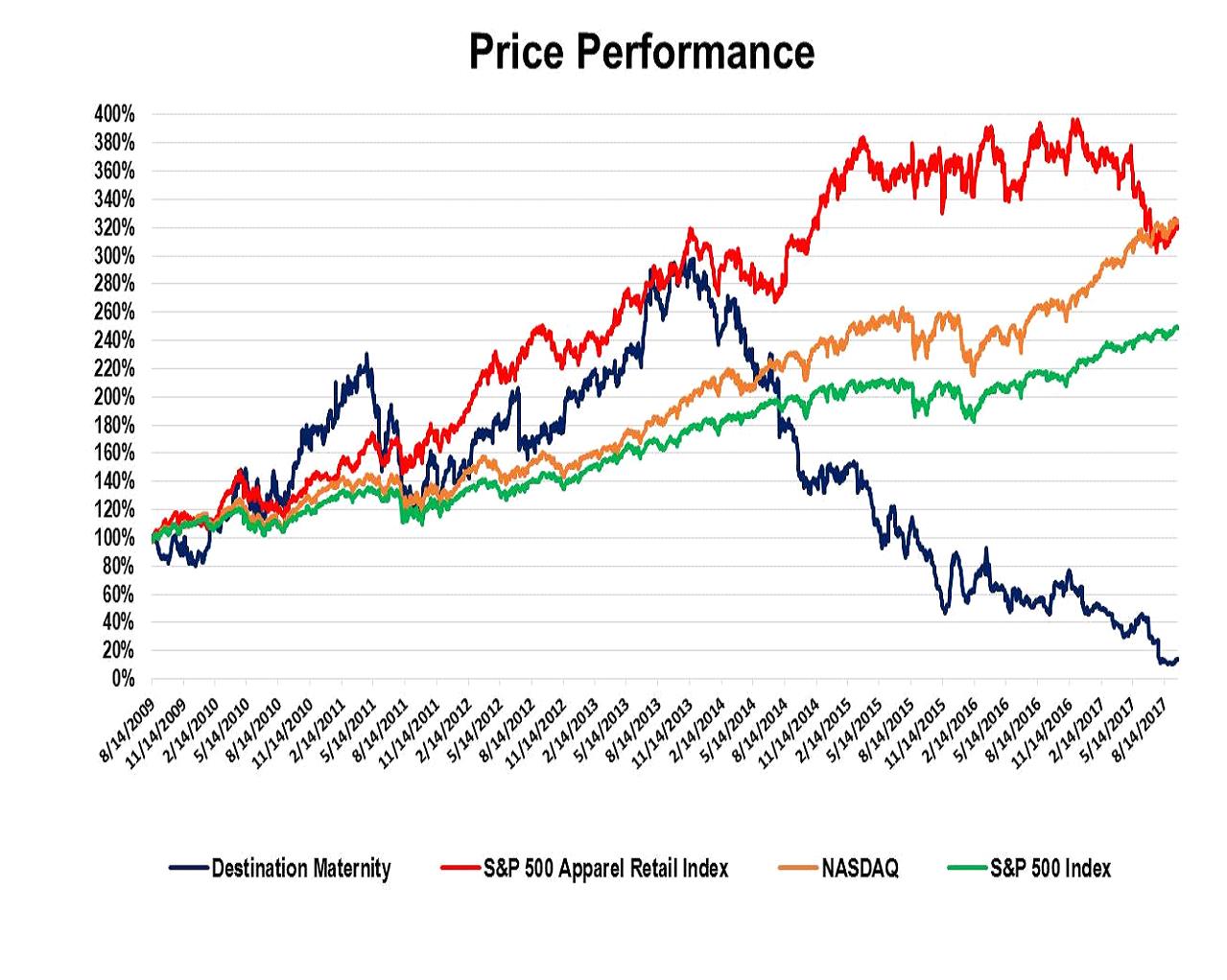

In addition, Orchestra on a supplemental basis directs the Staff to the chart included below, which illustrates the Company's historical poor stock price performance over the tenure of the Status Quo Directors—in stark contrast to the general growth of the Company's peers as indicated by the S&P 500 Apparel Retail Index, and the NASDAQ and S&P 500 Index for the same period:

Source: FactSet.

Orchestra acknowledges the Staff's comment with respect to "insufficiently clear financial reporting" and has revised the foregoing accordingly to emphasize that this is a belief. Please see page 2 of the Proxy Statement.

| · | "Under the Status Quo Directors, the company has repeatedly announced major targets, and has repeatedly missed them." |

Orchestra acknowledges the Staff's comment and on a supplemental basis directs the Staff to compare the Company's statements made in its June 11, 2015 Press Release reporting its First Quarter 2015 Financial Results – specifically, that the Company's adjusted EBITDA is "where we expected given this point in our turnaround" – with the statements contained in the Company's 2017 Annual Report – specifically, that its "slower pace" of implementing the turnaround plan has resulted "in a decline in net sales from fiscal 2015 and underperformance to 2016 expectations." Orchestra believes that every facet of the turnaround plan is pivotal to the creation of value for the Company's shareholders. We believe the Company's failure to make progress on multiple aspects of the turnaround plan represents several missed targets of the Company and provides a more than adequately supported factual basis for the assertion.

| · | "Our calculations based on publicly available sources show the following: |

| o | Since Michael Blitzer joined the Board, Destination's stock price has dropped approximately [93.4%] |

| o | Since Barry Erdos joined the Board, Destination's stock price has dropped approximately [87.7%] |

| o | Since Melissa Payner-Gregor joined the Board, Destination's stock price has dropped approximately [85%] |

| o | Since B. Allen Weinstein joined the Board, Destination's stock price has dropped approximately [87.7%] |

The above figures are not characterizations. They are cold, mathematical facts."

Orchestra acknowledges the Staff's comment and on a supplemental basis directs the Staff to chart included below, which shows the Company's closing stock price as of the day each of the Status Quo Directors joined the Board, the closing stock price of the Company as of September 22, 2017 (the business day immediately prior to Orchestra releasing its Stop, Look and Listen Letter) and the percentage decrease between the two values.1 Further, Orchestra has revised the foregoing accordingly. Please see page 11 of the Proxy Statement.

Status Quo Director | Company Stock Price as of date Status Quo Director was Appointed to the Board | Company Stock Price as of Sept. 22, 2017 | Percentage Decrease | |

| Michael Blitzer | $22.98 (1/25/2013) | $ | 1.51 | | 93.43 | % |

| Barry Erdos | $10.15 (1/22/2010)2 | $ | 1.51 | | 85.12 | % |

| Melissa Payner-Gregor | $10.80 (8/14/2009) | $ | 1.51 | | 86.02 | % |

| B. Allen Weinstein | $10.15 (1/22/2010) | $ | 1.51 | | 85.12 | % |

Source: FactSet.

Reasons for the Solicitation

| 4. | We note the statement that "Orchestra has been an involved shareholder of the Company for an extended period of time and has engaged with management and the Board from time to time, including in connection with the now terminated merger." Please provide the disclosure required by Item 5(b)(1)(viii) and (xi) in connection with the merger agreement. |

Orchestra acknowledges the Staff's comment and has revised the foregoing accordingly. Please see pages 10 and 23 of the Proxy Statement.

1 The below stock price percentage decreases do not reflect dividends or other reinvestments.

2 Please note that for Status Quo Directors Messrs. Erdos and Weinstein, we have used the date of the 2010 Annual Meeting, as we are not aware of any public filings stating the exact date these Status Quo Directors were appointed to the Board.

| 5. | We note disclosure in the Schedule 13D amendment filed on September 27, 2017 indicating that the Participants "…intend to encourage the issuer to undertake a strategic review process including, without limitation, a potential sale of the Issuer or certain of its businesses or assets, in which the [Participants] may participate, as a means of enhancing shareholder value." Please revise the proxy statement to include this additional disclosure. |

Orchestra acknowledges the Staff's comment and has revised the foregoing accordingly. Please see page 9 of the Proxy Statement.

Revocation of Proxies

| 6. | Since the Participants are not soliciting with respect to their own nominees, please revise the last sentence of the first paragraph in this section. |

Orchestra acknowledges the Staff's comment and has revised the foregoing accordingly. Please see page 21 of the Proxy Statement.

Additional Participant Information

| 7. | Please revise the following statement found in this section to refer to the correct schedule: "[f]or information regarding purchases and sales of securities of the Company during the past two years by the Participants in this solicitation, see Schedule II." |

Orchestra acknowledges the Staff's comment and has revised the foregoing accordingly. Please see page 23 of the Proxy Statement.

| 8. | Since the Participants are not soliciting with respect to their own nominees, please revise the last sentence of this section to eliminate the reference to "Nominees." |

Orchestra acknowledges the Staff's comment and has revised the foregoing accordingly. Please see page 24 of the Proxy Statement.

* * *

The Staff is invited to contact the undersigned at (212) 880-9865 or with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments.

Very truly yours,

/s/ Christopher P. Davis

Christopher P. Davis

Cc: Rebecca L. Van Derlaske

Source: 2017 Annual Report

Source: 2017 Annual Report