UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material under§240.14a-12 |

VERSUM MATERIALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing: |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

The following are slides presented by the chief executive officer of Merck KGaA, Darmstadt, Germany to the employees of Versum Materials on April 12, 2019

The following are slides presented by the chief executive officer of Merck KGaA, Darmstadt, Germany to the employees of Versum Materials on April 12, 2019 Nice to meet you! An Introduction to Merck KGaA, Darmstadt, Germany and our Performance Materials Business Sector Tempe, April 12, 2019 Merck KGaA Darmstadt, Germany

Science is at the heart of everything we do

51,749 Employees worldwide 66 Countries Founded 1668 14.8 Sales (€ billion) 2.2 R&D (€ billion)

our ideas are everywhere from cancer therapies and laboratory tools to semiconductor materials. Healthcare To us, it’s about discovering and developing for life in all its vibrancy, drawing our unique expertise in health care, life science and performance materials. Life Science Performance Materials

We are unique Since our founding 350 years ago, we’ve become truly global with around 52,000 employees in 66 countries working on breakthrough solutions and technologies. Merck KGaA, Darmstadt, Germany EMD serond Millipore Sigma EMD performance Materials

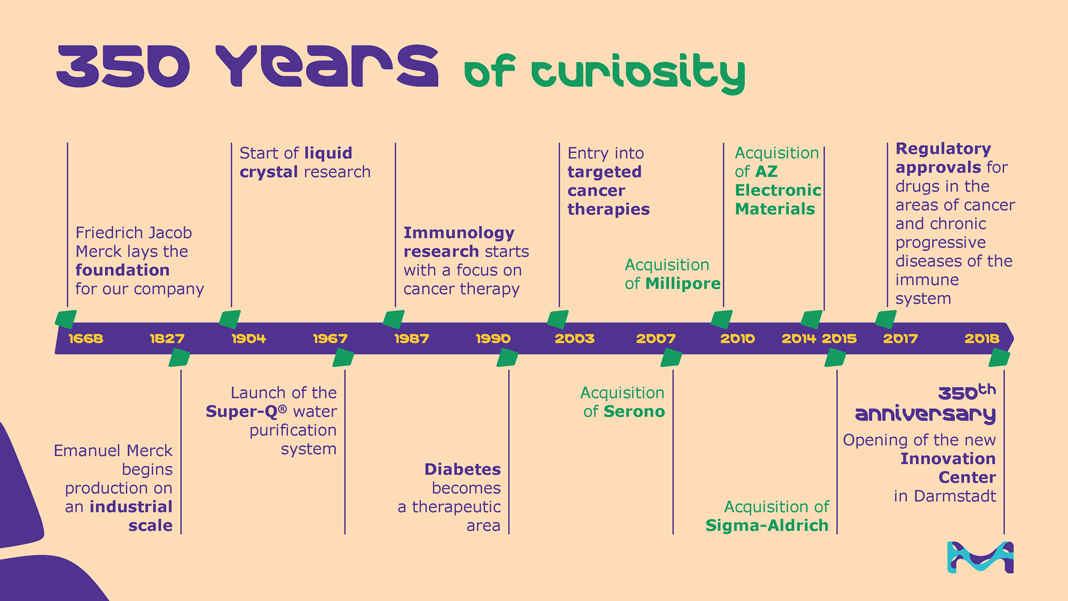

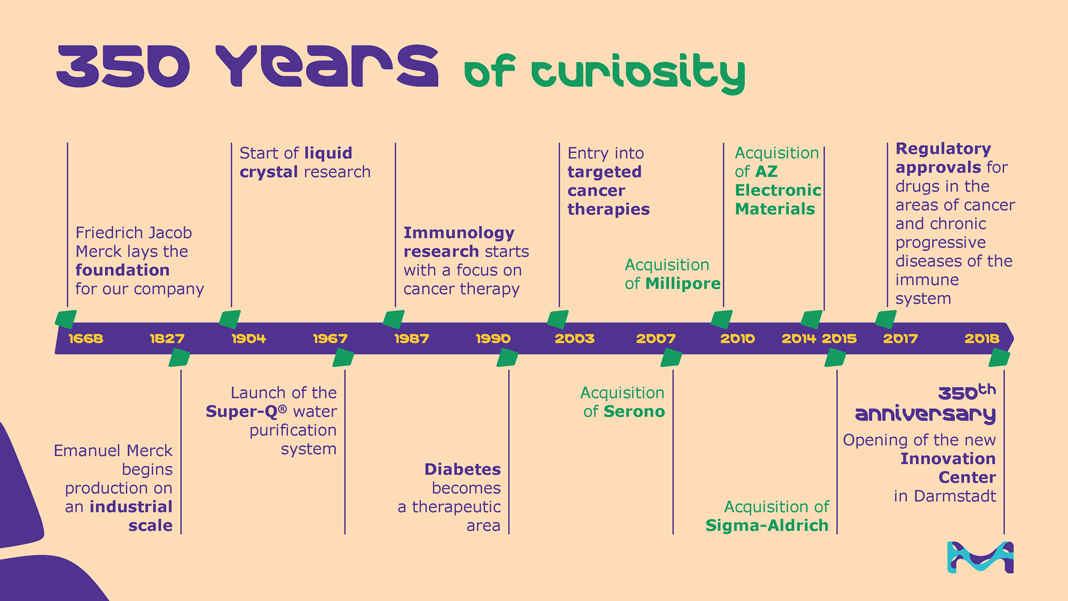

350 Years of curiosity Friedrich Jacob Merck lays the foundation for our company Start of liquid crystal research Immunology research starts with a focus on cancer therapy Entry into targeted cancer therapies Acquisition of Millipore Acquisition of AZ Electronic Materials Regulatory approvals for drugs in the areas of cancer and chronic progressive diseases of the immune system 1668 1827 1904 1967 1987 1990 2003 2007 2010 2014 2015 2017 2018 Emanuel Merck begins production on an industrial scale Launch of the Super-Q® water purification system Diabetes becomes a therapeutic area Acquisition of Serono Acquisition of Sigma-Aldrich 350th anniversary Opening of the new Innovation Center in Darmstadt

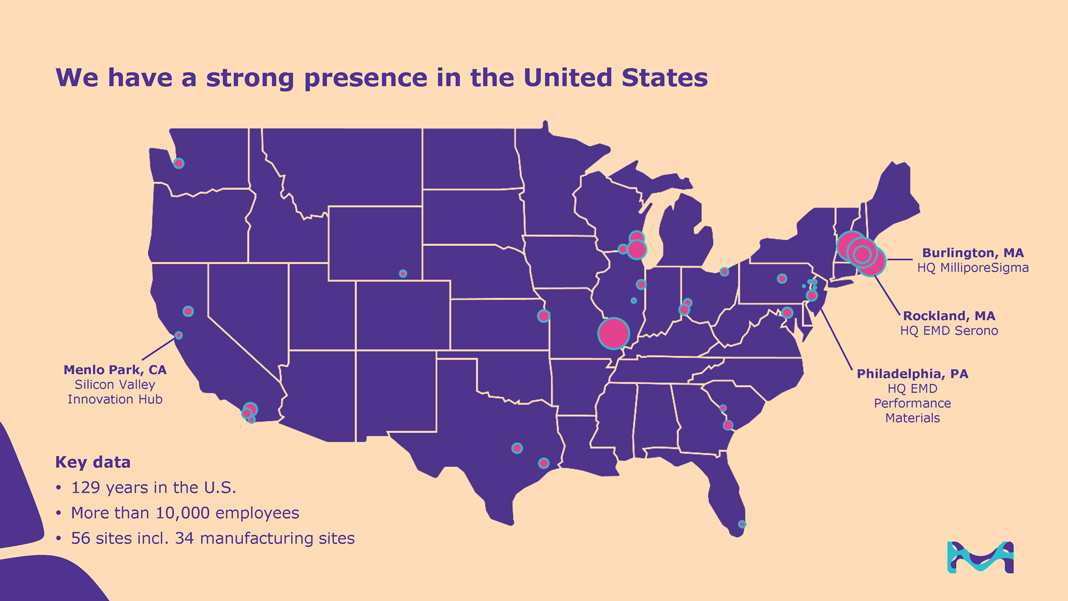

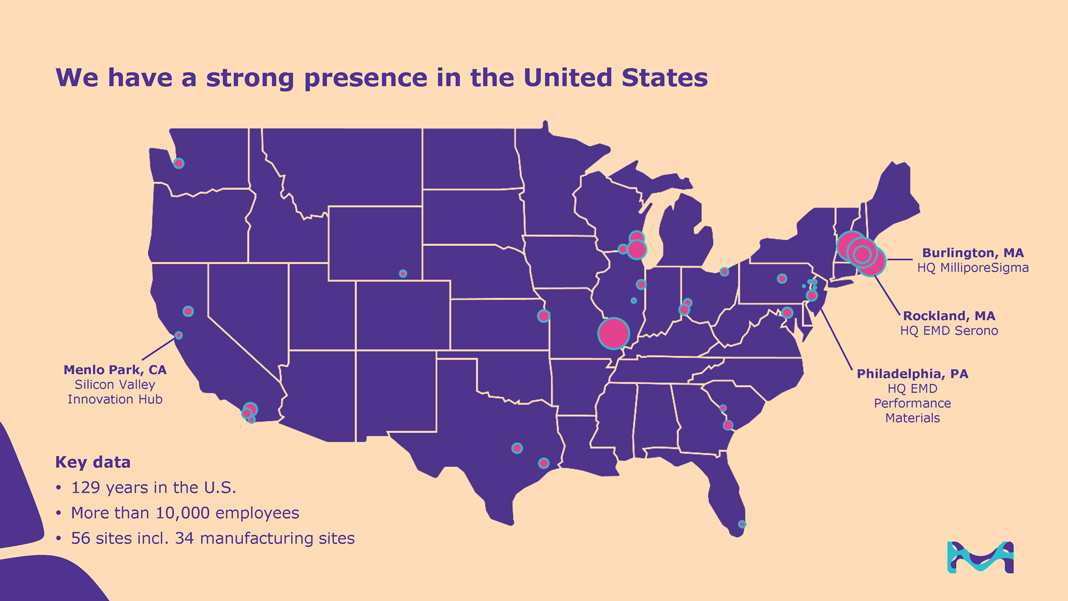

We have a strong presence in the United States Menlo Park, CA Silicon Valley Innovation Hub Burlington, MA HQ MilliporeSigma Rockland, MA HQ EMD Serono Philadelphia, PA HQ EMD Performance Materials Key data 129 years in the U.S. More than 10,000 employees 56 sites incl. 34 manufacturing sites

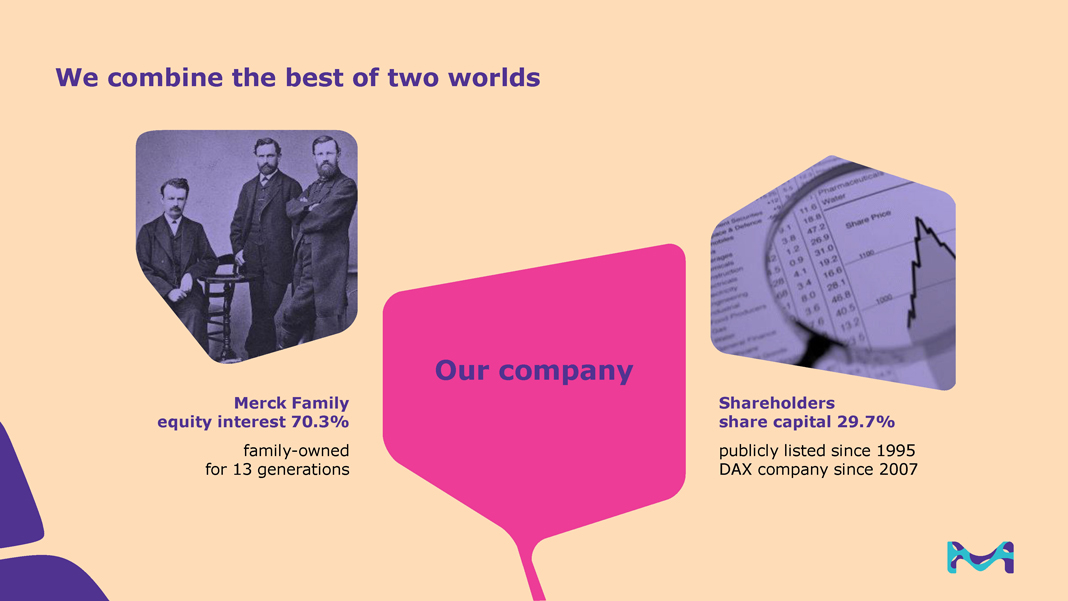

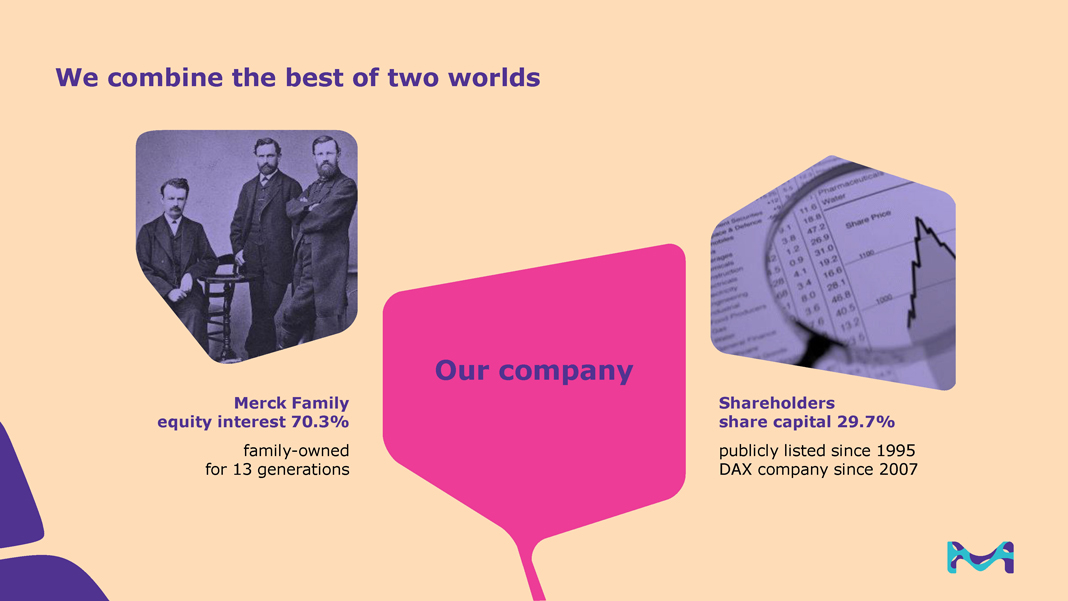

We combine the best of two worlds Merck Family equity interest 70.3% family-owned for 13 generations Our company Shareholders share capital 29.7% publicly listed since 1995 DAX company since 2007

Our values Courage Achievement Responsibility respect Integrity Transparency

Our corporate responsibility Strategy We seek to create value both for us as a company as well as for the community, focusing our strengths on those areas where we can achieve the greatest impact: Global Health, Sustainable Solutions and Broad Minds.

People – one of our top priorities

Here we are working on the next big thing

We want to create new businesses based on groundbreaking technologies Bio-Sensing & Interfaces Clean Meat Liquid Biopsy

We can create a leading electronic materials player Partner of choice Innovation Poised for growth Complementary Deep portfolio Broadened offering Creating a leading electronic materials player with focus on the semiconductor and display industries and deep customer relationships. Accelerating ability to innovate through the combination of R&D efforts. Optimally positioned to capitalize on strong long-term secular trends in the semiconductor industry. Complementary capabilities, Versum adds positions in advanced deposition, specialty gases and chemical mechanical planarization to our established presence. An attractive portfolio in high value materials, e.g. in advanced deposition materials, dielectrics, CMP slurries, and cleaning chemicals. Expanding Merck KGaA, Darmstadt, Germany’s electronic materials business and tapping new growth opportunities.

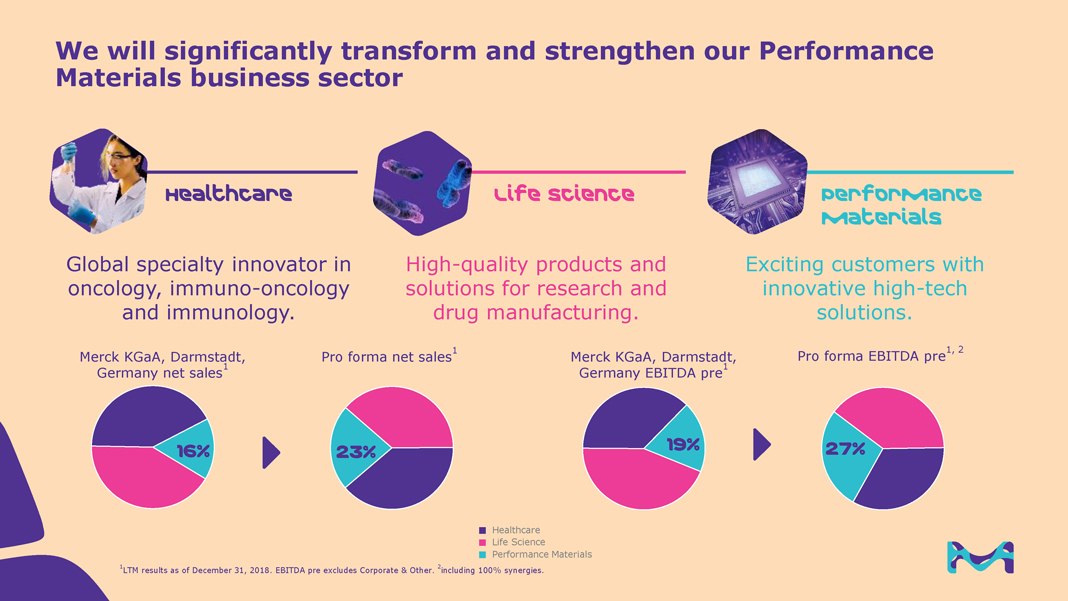

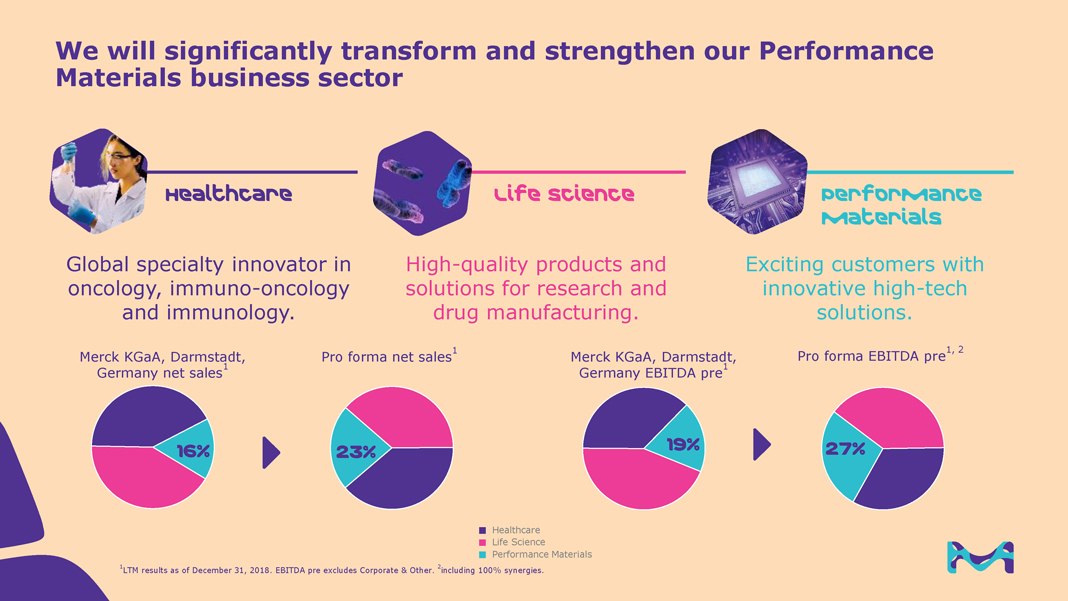

We will significantly transform and strengthen our Performance Materials business sector Healthcare Life Science Performance Materials Global specialty innovator in oncology, immuno-oncology and immunology. High-quality products and solutions for research and drug manufacturing. Exciting customers with innovative high-tech solutions. Merck KGaA, Darmstadt, Germany net sales1 Pro forma net sales1 Merck KGaA, Darmstadt, Germany EBITDA pre1 Pro forma EBITDA pre1, 2 Healthcare Life Science Performance Materials 1LTM results as of December 31, 2018. EBITDA pre excludes Corporate & Other. 2including 100% synergies.

Our Performance Materials business offers specialty chemicals and solutions that enrich people’s lives in many ways. From liquid crystals or OLEDs in the display of your TV and smartphone, the high-performance materials that make the microchips in your electronic devices possible or the effect pigments in the coating of your car, it is likely that you have come into contact with our products and solutions today.

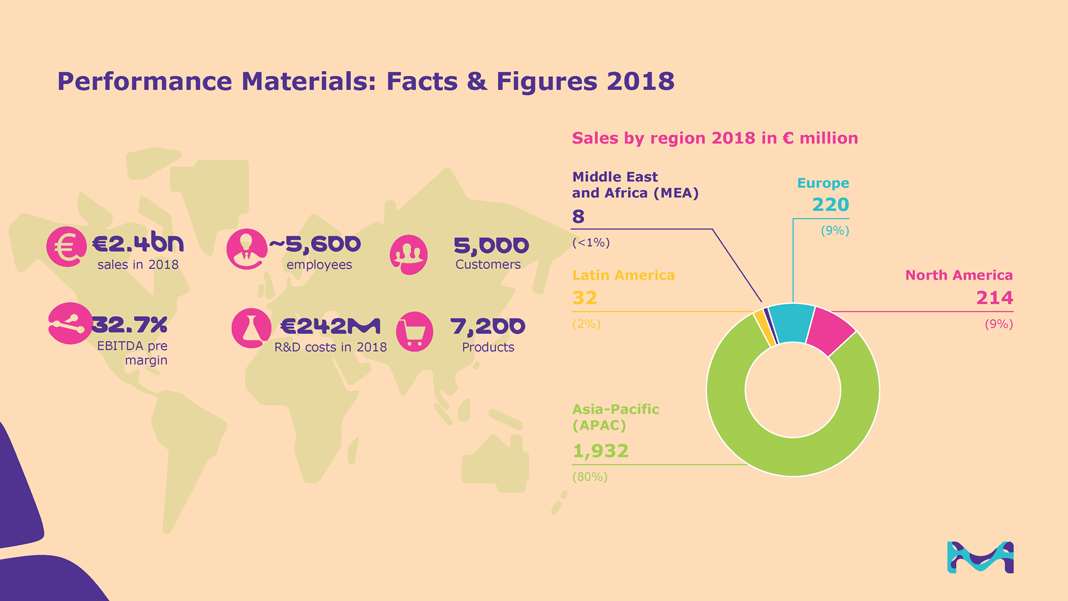

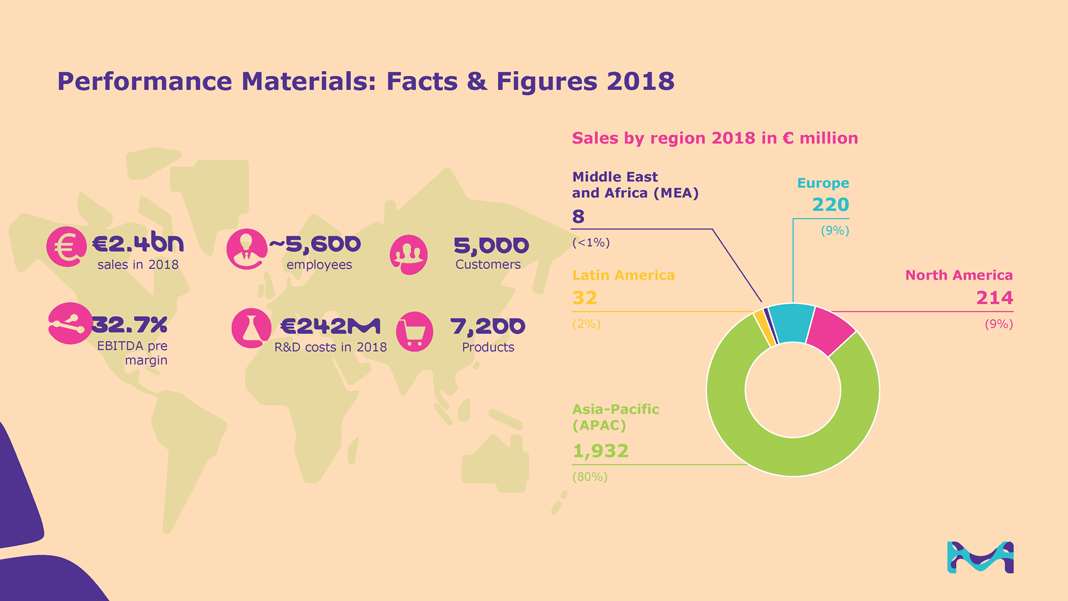

Performance Materials: Facts & Figures 2018 Sales by region 2018 in € million €2.4bn sales in 2018 ~5,600 employees 5,000 Customers 32.7% EBITDA pre margin €242M R&D costs in 2018 7,200 Products Middle East and Africa (MEA) 8 Europe 220 (<1%) Latin America 32 (2%) Asia-Pacific (APAC) 1,932 (80%) (9%) North America 214 (9%)

We are focusing on capabilities and growth, not on cost cutting 1. We want to offer a strong, complementary portfolio to the industry 2. We can build on a complementary global footprint 3. We can pursue our innovation focus 4. We are constantly strengthening our U.S. presence

We are looking forward to Learning from you.

M

Cautionary Statement Regarding Forward-Looking Statements

This communication may contain forward-looking statements based on current assumptions and forecasts made by Versum Materials, Inc. (“Versum”) management. Various known and unknown risks, uncertainties and other factors could lead to material differences between the actual future results, financial situation, development or performance of the company and the estimates given here. These factors include the following: Merck KGaA, Darmstadt, Germany’s ability to successfully complete the proposed acquisition of Versum or realize the anticipated benefits of the proposed transaction in the expected time-frames or at all; Merck KGaA, Darmstadt, Germany’s ability to successfully integrate Versum’s operations into those of Merck KGaA, Darmstadt, Germany; such integration may be more difficult, time-consuming or costly than expected; the failure to obtain Versum’s stockholders’ approval of the proposed transaction; the failure of any of the conditions to the proposed transaction to be satisfied; revenues following the proposed transaction may be lower than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the proposed transaction; the retention of certain key employees at Versum; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed transaction; the outcome of any legal proceedings related to the proposed transaction; the impact of the proposed transaction on Versum’s credit rating; the parties’ ability to meet expectations regarding the timing and completion of the proposed transaction; delays in obtaining any approvals required for the proposed transaction or an inability to obtain them on the terms proposed or on the anticipated schedule; the impact of indebtedness incurred by Merck KGaA, Darmstadt, Germany, in connection with the proposed transaction; the effects of the business combination of Versum and Merck KGaA, Darmstadt, Germany, including the combined company’s future financial condition, operating results, strategy and plans; and other factors discussed in Merck KGaA, Darmstadt, Germany’s public reports which are available on the Merck KGaA, Darmstadt, Germany, website at www.emdgroup.com or in Versum’s Annual Report onForm 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) for the fiscal year ended on September 30, 2018 and Versum’s other filings with the SEC, which are available at http://www.sec.gov and Versum’s website at www.versummaterials.com. Except as otherwise required by law, Versum assumes no liability whatsoever to update these forward-looking statements or to conform them to future events or developments. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Important Information and Where to Find It

This communication relates to the proposed merger transaction involving Versum and Merck KGaA, Darmstadt, Germany. In connection with the proposed merger, Versum and Merck KGaA, Darmstadt, Germany, intend to file relevant materials with the SEC, including Versum’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, and is not a substitute for the Proxy Statement or any other document that Versum or Merck KGaA, Darmstadt, Germany, may file with the SEC or send to Versum’s stockholders in connection with the proposed merger. STOCKHOLDERS OF VERSUM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s web site, http://www.sec.gov, or Versum’s website at http://investors.versummaterials.com or by phone at484-275-5907.

Participants in Solicitation

Versum, Merck KGaA, Darmstadt, Germany, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Versum common stock in respect of the proposed transaction. Information about the directors and executive officers of Versum is set forth in Versum’s Annual Report onForm 10-K for the fiscal year ended September 30, 2018, which was filed with the SEC on November 21, 2018, and the proxy statement for Versum’s 2019 annual meeting of stockholders, which was filed with the SEC on December 20, 2018. Information about the directors and executive officers of Merck KGaA, Darmstadt, Germany, is set forth on Schedule I of the Schedule 14A filed by Merck KGaA, Darmstadt, Germany, with the SEC on March 22, 2019. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.