UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

| | |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

| |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material under §240.14a-12 |

|

|

| VERSUM MATERIALS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

|

| | | | |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

LETTER TO STOCKHOLDERS

Dear Fellow Stockholder:

On behalf of your board of directors, we are pleased to invite you to attend the 2019 annual meeting of stockholders of Versum Materials, Inc. (“Versum Materials” or the “Company”). The annual meeting will be held on Tuesday, January 29, 2019, at 9:00 a.m., Mountain Standard Time, at our offices located at 8555 South River Parkway, Tempe, Arizona 85284.

Attached you will find a notice of annual meeting and proxy statement that contains additional information about the annual meeting, including the items of business and methods that you can use to vote your proxy, such as the telephone or Internet.

Your vote is important. We encourage you to sign and return your proxy card or use telephone or Internet voting prior to the annual meeting, so that your shares of common stock will be represented and voted at the annual meeting even if you cannot attend.

Sincerely,

|

| | |

| | |

| | | |

Guillermo Novo President and Chief Executive Officer | | Seifi Ghasemi Chairman of the Board of Directors |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

| | | |

Date: Tuesday, January 29, 2019

Time: 9:00 a.m., MST

Place: Versum Materials, Inc. 8555 South River Parkway Tempe, Arizona 85284

| | To our Stockholders:

As permitted under the “Notice and Access” rules adopted by the Securities and Exchange Commission, we are primarily furnishing proxy materials to our stockholders via the Internet rather than mailing paper copies of the materials to each stockholder. Therefore, most stockholders will receive a Notice of Internet Availability of Proxy Materials (the “Notice”). The Notice contains instructions about how to access the proxy materials via the Internet, how to vote your shares, and how to request a paper or electronic copy of our proxy materials, if you so desire. We believe electronic delivery should expedite the receipt of materials, significantly lower costs and help to conserve natural resources.

This proxy statement, our 2018 annual report, and any amendments to the foregoing that are required to be furnished to stockholders will be available for review online by following the instructions contained in the Notice and proxy card. You also may view the proxy materials at www.proxyvote.com.

The Board of Directors of the Company has fixed the close of business on December 6, 2018, as the record date for the determination of stockholders entitled to receive notice of, and to vote on, all matters presented at the annual meeting or any adjournments thereof. Your vote is very important. Whether or not you plan to attend the annual meeting, we ask you to please cast your vote. You can vote your shares via the Internet, telephone, mail or in person at the annual meeting.

By order of the Board of Directors,

Michael W. Valente Senior Vice President, General Counsel and Secretary

|

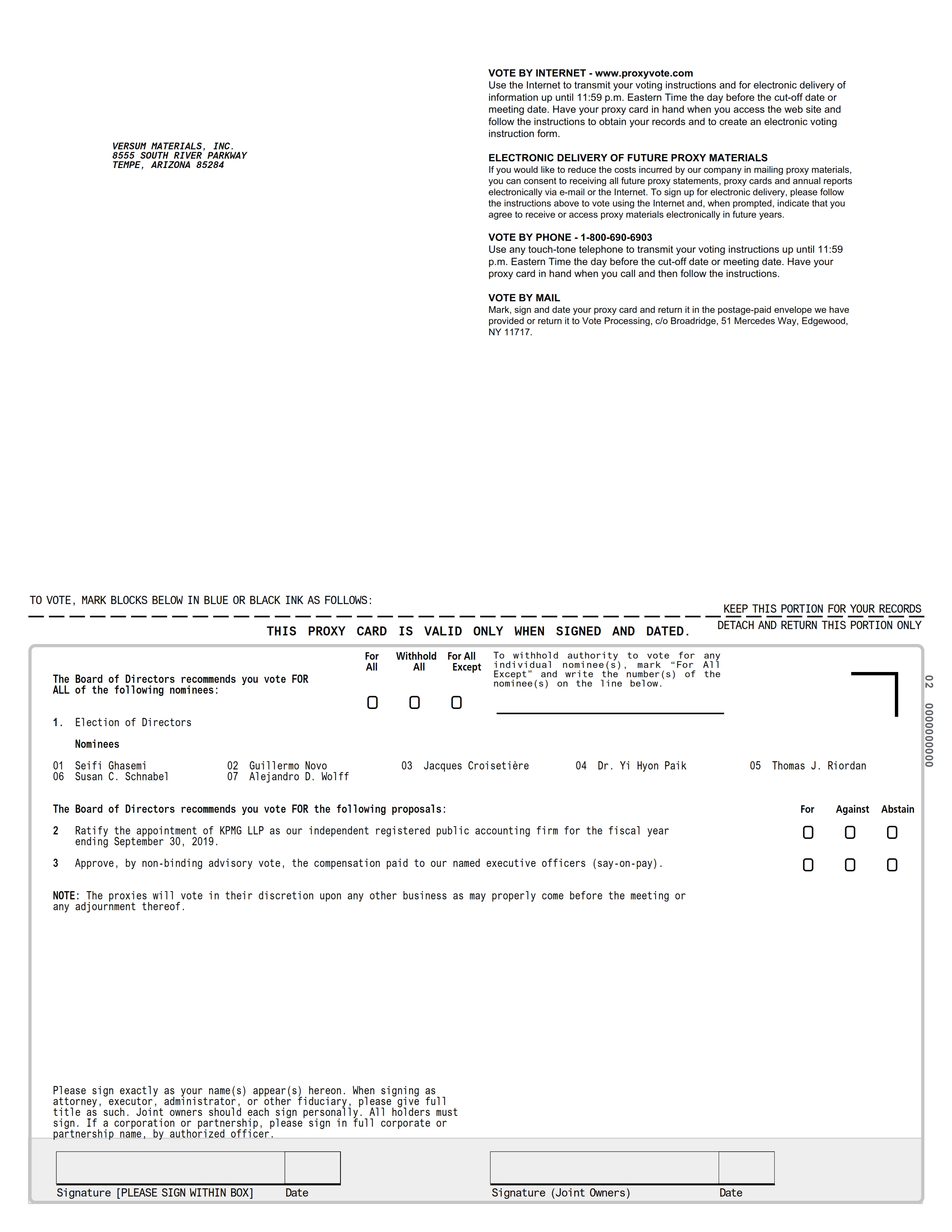

| Annual Meeting Agenda: | |

| (1) | Elect the seven nominees proposed by the Board of Directors as directors for a one year term ending in 2020; | |

| (2) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2019; | |

| (3) | Approve, by non-binding advisory vote, the compensation paid to our named executive officers (say-on-pay); and | |

| (4) | Transact any other business properly brought before the annual meeting. | |

|

|

This notice and proxy statement are first being distributed or made available, as the case may be, on or about December 20, 2018.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on January 29, 2019: This proxy statement and our Annual Report on Form 10-K for the fiscal year ended September 30, 2018, are available free of charge at the “Investors” section of our website (www.versummaterials.com). In addition, you may access our proxy statement and 2018 annual report free of charge at www.proxyvote.com. |

TABLE OF CONTENTS

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| Corporate Governance Highlights | |

| Director Skills and Attributes | |

| Director Independence | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Executive Sessions of Non-Management and Independent Directors | |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| Treatment of Long-Term Incentive Awards Outstanding at the Time of Separation | |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| | |

| |

| |

| |

PROXY STATEMENT

For the Annual Meeting of Stockholders to Be Held on

January 29, 2019

INTRODUCTION

Why You Received these Materials

We are providing this proxy statement in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Versum Materials Inc. (“Versum Materials” or the “Company”) for use at the Company’s 2019 annual meeting of stockholders (the “annual meeting”) and at any adjournment or postponement of the annual meeting. You are cordially invited to attend the annual meeting, which will be held at our offices located at 8555 South River Parkway, Tempe, Arizona 85284, on January 29, 2019 at 9:00 a.m. Mountain Standard Time. For driving directions to our offices, please call (602) 282-1000.

Stockholders Entitled to Vote

The record date for the annual meeting is December 6, 2018. If at the close of business on December 6, 2018, you were a stockholder of record, you may vote your shares by proxy through the Internet, by telephone or by mail, or you may vote in person at the annual meeting. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. To reduce our administrative costs and help the environment by conserving natural resources, we ask that you vote through the Internet or by telephone, both of which are available 24 hours a day. You may find information on voting procedures on page 3 of this proxy statement. You may revoke your proxies at the times and in the manners described on page 3 of this proxy statement. As of December 6, 2018, the record date for the annual meeting, there were 109,111,564 shares of our common stock outstanding.

If you are a stockholder of record or hold shares through a broker, bank or other nominee and are voting by proxy, your vote must be received by 11:59 p.m. Eastern Time on January 28, 2019.

Quorum Requirements

The presence in person or by proxy of the holders of a majority of the shares of stock entitled to vote at the annual meeting is necessary to constitute a quorum for the transaction of business at the annual meeting. Each stockholder is entitled to one vote for each share of common stock held as of the record date on each matter to be voted upon. Abstentions and broker non-votes are included in determining whether a quorum is present. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that item and has not received instructions from the beneficial owner.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Delaware law and the Company’s amended and restated certificate of incorporation and amended and restated by-laws (our “by-laws”) govern the vote on the proposals to be considered at the annual meeting. The Board’s recommendation is set forth together with a description of each item in this proxy statement. In summary, the Board’s recommendations and approval requirements are:

PROPOSAL ONE

Election of Directors

The first item to be voted on is the election of the seven director nominees listed herein to serve until our annual meeting in 2020 and their successors are duly elected and qualified. The Board has nominated seven people as directors, each of whom is currently serving as a director of Versum Materials. You may find information about these nominees beginning on page 6.

BOARD RECOMMENDATIONS AND APPROVAL REQUIREMENTS

Pursuant to our by-laws, a director nominee must receive a majority of votes cast with respect to that director’s election at the annual meeting in uncontested elections at which a quorum is present. A majority of the votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that director nominee. If the number of nominees exceeds the number of directors to be elected (i.e., in contested elections), as determined by the Secretary of the Company as of the record date for an annual meeting, our directors will be elected by a plurality of votes cast.

Assuming a quorum is present, each share of common stock may be voted for as many nominees as there are directors to be elected. Stockholders may not cumulate their votes. Abstentions and broker non-votes are not counted as votes “for” or “against” a director nominee and will have no effect on the outcome of the vote on election of directors at the annual meeting.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH DIRECTOR NOMINEE.

PROPOSAL TWO

Ratification of Appointment of Independent Registered Public Accounting Firm

The second item to be voted on is the ratification of the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2019. You may find information about this proposal beginning on page 9.

You may vote in favor of the proposal, vote against the proposal or abstain from voting. Assuming a quorum is present, the proposal will pass if the number of shares voted in favor of the proposal exceeds the number of shares voted against the proposal. Abstentions will have no effect on the outcome of this proposal. As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2019.

PROPOSAL THREE

Advisory Vote on the Compensation Paid to Our Named Executive Officers

The third item to be voted on is a non-binding advisory vote on the compensation paid to our named executive officers (“say-on-pay”). You may find information about this proposal beginning on page 9.

You may vote in favor of the proposal, vote against the proposal or abstain from voting. Assuming a quorum is present, the proposal will pass if the number of shares voted in favor of the proposal exceeds the number of shares voted against the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING

As of the date of this proxy statement, the Board was not aware of any other business to be presented for a vote of the stockholders at the annual meeting. If any other matters are properly presented for a vote, the people named as proxies will have discretionary authority, to the extent permitted by law, to vote on such matters according to their best judgment.

PROXIES AND VOTING PROCEDURES

PROXIES AND VOTING PROCEDURES

Your vote is important and you are encouraged to vote your shares promptly.

How Proxies are Voted

If you are a stockholder of record, you may vote by proxy through the Internet, by telephone or by mail, or by voting in person at the annual meeting. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker or other nominee on how to submit voting instructions.

To vote by proxy if you are a stockholder of record:

|

| |

BY INTERNET | Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week. |

You will need the 16-digit number included on your proxy card to obtain your records and to create an electronic voting instruction form. |

| BY TELEPHONE | From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week. |

You will need the 16-digit number included on your proxy card in order to vote by telephone. |

BY MAIL | When you receive the proxy card, mark your selections on the proxy card. |

Date and sign your name exactly as it appears on your proxy card. |

Mail the proxy card in the enclosed postage-paid envelope provided to you. |

If you are a stockholder of record or hold shares through a broker, bank or other nominee and are voting by proxy, your vote must be received by 11:59 p.m. Eastern Time on January 28, 2019.

Each proxy will be voted as directed. However, if a proxy solicited by the Board does not specify how it is to be voted, it will be voted as the Board recommends—that is, FOR the election of each nominee for director named in this proxy statement, FOR the ratification of the appointment of KPMG as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2019 and FOR the approval of the compensation paid to our named executive officers. If any other matters are properly presented at the annual meeting for consideration, such as consideration of a motion to adjourn the annual meeting to another time or place, the persons named as proxies will have discretion, to the extent permitted by law, to vote on those matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. As of the date of this proxy statement, we do not anticipate that any other matters will be raised at the annual meeting.

How to Revoke or Change Your Proxy

Whether you have voted by Internet, telephone or mail, if you are a stockholder of record you may change your vote and revoke your proxy by:

| |

| • | voting again by Internet or telephone at a later time before the closing of the voting facilities at 11:59 p.m. Eastern Time on January 28, 2019; |

| |

| • | submitting a properly signed proxy card with a later date that is received no later than January 28, 2019; |

| |

| • | sending a written statement to that effect to our Secretary at Versum Materials, Inc., 8555 South River Parkway, Tempe, Arizona 85284, provided such statement is received no later than January 28, 2019; or |

| |

| • | attending the annual meeting, revoking your proxy and voting in person. |

You will be able to change your proxy as many times as you wish prior to its being voted at the annual meeting, and the last proxy received chronologically will supersede any prior proxies.

PROXIES AND VOTING PROCEDURES

Method and Cost of Proxy Solicitation

This proxy solicitation is being made on behalf of Versum Materials. The expense of preparing, printing and mailing this proxy statement is being paid by us. Proxies may be solicited by officers, directors and employees of Versum Materials in person, by mail, telephone, facsimile or other electronic means. We will not specifically compensate those persons for their solicitation activities. In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”), we will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expenses incurred in sending proxies and proxy materials to beneficial owners of our common stock.

Admission Procedures

You will need your proof of identification along with either your Notice of Annual Meeting of Stockholders or proof of stock ownership to enter the annual meeting. If your shares are beneficially held in the name of a bank, broker or other holder of record and you wish to be admitted to attend the annual meeting, you must present proof of your ownership of Versum Materials stock, such as a bank or brokerage account statement.

PROPOSALS YOU MAY VOTE ON

PROPOSALS YOU MAY VOTE ON

PROPOSAL ONE

Election of Directors

The first agenda item to be voted on is the election of seven directors to serve until the 2020 annual meeting of stockholders and until their successors are duly elected and qualified.

General Information

The full Board has considered and nominated the following nominees for a one-year term expiring in 2020 or until his or her successor is duly elected and qualified:

|

| | |

| Name | Age | Title |

| Seifi Ghasemi | 74 | Chairman of the Board |

| Guillermo Novo | 56 | Director, President and Chief Executive Officer |

| Jacques Croisetière | 64 | Director |

| Dr. Yi Hyon Paik | 63 | Director |

| Thomas J. Riordan | 68 | Director |

| Susan C. Schnabel | 57 | Director |

| Alejandro D. Wolff | 62 | Director |

Proxies delivered pursuant to this solicitation will be voted in favor of the election of the nominees designated above, except in cases of proxies bearing contrary instructions. The nominees have confirmed that they will serve if elected. If, for any reason, any nominee becomes unavailable for election and the Board selects a substitute nominee, the proxies will be voted for the substitute nominee selected by the Board. The Board has no reason to believe that any of the named nominees is not available or will not serve if elected.

PROPOSALS YOU MAY VOTE ON

The nominees are current directors of the Company, and a description of the background of each is set forth below.

Nominees for Election at the Annual Meeting

|

| | | |

Seifi Ghasemi Age 74 Chairman of the Board

Committees: • N/A | | Biographical Information: Mr. Ghasemi became Chairman, President and Chief Executive Officer of Air Products and Chemicals, Inc. (“Air Products”) in July 2014. Prior to this appointment, Mr. Ghasemi was an independent member of Air Products’ board of directors since September 2013. From 2001-2014, Mr. Ghasemi served as Chairman and Chief Executive Officer of Rockwood Holdings, Inc., a global leader in inorganic specialty chemicals and advanced materials that was acquired by Albemarle Corporation in January 2015. From 1997-2001, he held leadership roles at GKN, plc, a global industrial company, including positions as Director of the Main Board of GKN, plc, and Chairman and Chief Executive Officer of GKN Sinter Metals, Inc. and Hoeganes Corporation. Earlier in his career, Mr. Ghasemi spent nearly 20 years with The BOC Group, plc (the industrial gas company which is now part of Linde AG) in positions including Director of the Main Board of BOC Group, plc; President of BOC Gases Americas; and Chairman and Chief Executive Officer of BOC Process Plants, Ltd. and Cryostar. Mr. Ghasemi earned his undergraduate degree from Abadan Institute of Technology and holds an M.S. degree in mechanical engineering from Stanford University. He also was awarded an honorary Doctor of Science degree from Lafayette College in 2017 and an honorary Doctor of Engineering degree from Stevens Institute of Technology in 2018. Mr. Ghasemi is a member of The Business Council, an association of the chief executive officers of the world’s most important business enterprises. He also was the recipient of the 2017 biennial International Palladium Medal from the Société de Chimie Industrielle for his distinguished contributions to the chemical industry.

| |

| | | |

| | Qualifications: Mr. Ghasemi has deep experience in the specialty chemicals industry. His prior executive leadership of an international specialty chemicals and materials company provides the Board with broad experience in navigating many of the challenges Versum Materials faces, such as portfolio management, strategic planning, talent management and international operations. | |

| | | | |

|

| | | |

Guillermo Novo Age 56 Director, President and CEO

Committees: • N/A | | Biographical Information: Mr. Novo has been the President and CEO of Versum Materials since our separation from Air Products on October 1, 2016, and is a member of our board of directors. Previously, he was Executive Vice President, Materials Technologies of Air Products since October 2014. He joined Air Products in September 2012 as Senior Vice President Electronics, Performance Materials, Strategy and Technology. Prior to joining Air Products, Mr. Novo was employed by the Dow Chemical Company where he most recently served as group vice president, Dow Coating Materials, a large specialty chemicals business, since July 2010. He began his career in 1986 with Rohm and Haas Company (which merged with Dow in 2009) and over the next 24 years progressed through a variety of commercial, marketing, and general management positions, living in South America, the United States and Asia. In 1998, Mr. Novo was named a vice president at Rohm and Haas, and in 2006 he became a corporate officer and one of five group executives on the corporate leadership team responsible for driving the overall strategy for the company. He serves on the board of directors of Bemis Company, Inc. Mr. Novo holds a B.S. degree in industrial engineering from the University of Central Florida and an MBA from the University of Michigan. | |

| | | |

| | Qualifications: Mr. Novo has over thirty years of leadership experience in the specialty materials industry and brings to the Board detailed insight into the Company’s worldwide customers, markets, operations and strategies. | |

| | | | |

PROPOSALS YOU MAY VOTE ON

|

| | | |

Jacques Croisetière Age 64 Independent Director

Committees: • Audit (Chair) • Compensation | | Biographical Information: From August 2009 to December 2012, Mr. Croisetière was the Senior Vice President and Chief Financial Officer at Bacardi Limited. Before Bacardi Limited he worked at Rohm and Haas Company as its Executive Vice President, Chief Financial Officer and Chief Strategy Officer from April 2003 to April 2009, and before that was Vice President, European Region Director and Director Ion Exchange Resins and Inorganic Specialty Solutions from July 1999 to March 2003. Mr. Croisetière earned a degree in Industrial Management from C.E.G.E.P. Ahuntsic, and a degree in Accounting Science and a Bachelor of Science degree in Finance from University of Montreal, Hautes Etudes Commerciales. | |

| | | |

| | Qualifications: As the former chief financial officer of multinational companies, Mr. Croisetière brings extensive financial expertise and leadership experience to the Board, including experience in the global specialty materials industry. | |

| | | |

| | | |

|

| | | |

Dr. Yi Hyon Paik Age 63 Independent Director Committees: • Audit • Corp. Gov. and Nom. | | Biographical Information: From March 2014 to April 2016, Dr. Paik was the President and Chief Strategy Officer of Samsung SDI Company. Prior to Samsung SDI Company, he was the Executive Vice President and Head of Electronic Materials Business at Samsung Cheil Industries from 2010 to 2013. From 2009 to 2010 Dr. Paik worked at the Dow Chemical Company as its Business Group Vice President and Head of Electronic Materials Business. Before the Dow Chemical Company he served at the Rohm and Haas Company as Business Group Vice President and President of Electronic Materials Business and before that as Vice President and President of its Microelectronics Business. He serves on the Advisory Board of Zeptor Corporation, a private company. Dr. Paik earned a Bachelor of Arts and Master in Chemistry from Seoul National University, a Ph.D. in Chemistry at the University of Pittsburgh and a Postdoctoral Fellow at Columbia University. | |

| | | |

| | Qualifications: As the former president of a multinational company, Dr. Paik provides the Board with extensive leadership experience in the electronic materials industry including strategic planning and global business expertise with a deep technical understanding. | |

| | | |

| | | |

|

| | | |

Thomas J. Riordan Age 68 Independent Director

Committees: • Compensation (Chair) • Corp. Gov. and Nom. | | Biographical Information: Mr. Riordan served as Chief Legal and Administrative Officer and Board Secretary of Rockwood Holdings, Inc. from 2000 to 2015 while also serving as its Senior Executive Vice President from 2014 to 2015, its Senior Vice President, Chief Administrative Officer and General Counsel from 2005 to 2013 and before that as Vice President from 2000 to 2005. Before Rockwood Holdings, Inc. he worked at Laporte plc from 1989 to 2000 as the Vice President, U.S. General Counsel while also serving as Administrative Officer from 1995 to 2000. Mr. Riordan earned a Bachelor of Arts and Master in Business Administration from Loyola University and a Juris Doctor from Northern Illinois University. | |

| | | |

| | Qualifications: Mr. Riordan provides the Board with the benefit of over 40 years of senior executive experience with global companies including legal, human resources and specialty materials experience. | |

| | | |

| | | |

PROPOSALS YOU MAY VOTE ON

|

| | | |

Susan C. Schnabel Age 57 Independent Director

Committees: • Audit • Corp. Gov. and Nom. | | Biographical Information: Ms. Schnabel is the Co-Founder and Managing Partner of aPriori Capital Partners, an independent leveraged buyout fund advisor created in connection with the spin-off of DLJ Merchant Banking Partners from Credit Suisse in 2014. Prior to forming aPriori Capital, Ms. Schnabel worked at Credit Suisse from 1998 to 2014 where she served as a Managing Director in the Asset Management Division and Co-Head of DLJ Merchant Banking. Ms. Schnabel formerly has served on the boards of numerous public companies including Neiman Marcus, STR Holdings, Rockwood Holdings, Inc. and Shoppers Drug Mart. She also serves on the Harvard Business School Alumni Advisory Board, the Cornell University Trustee Council, the California Institute of Technology - Investment Committee, the US Olympic & Paralympic Foundation Board of Directors, and the board of directors of the Los Angeles Music Center Foundation. Ms. Schnabel earned a Bachelor of Science in Chemical Engineering from Cornell University and a Masters in Business Administration from Harvard Business School. | |

| | | |

| | Qualifications: Ms. Schnabel provides the Board with her extensive financial and management expertise, experience with global transactions and significant board of directors experience. | |

| | | |

| | | |

|

| | | |

Ambassador Alejandro D. Wolff Age 62 Lead Director

Committees: • Corp. Gov. and Nom. (Chair) • Compensation | | Biographical Information: Ambassador Wolff was the U.S. Ambassador to Chile from September 2010 to July 2013. Prior to that, he served as Ambassador and Deputy Permanent U.S. Representative to the United Nations from 2005 to 2010. Ambassador Wolff retired from the Department of State in August 2013 with the rank of Career Minister following a 33-year Foreign Service career that included overseas tours in Algeria, Morocco, Chile, Cyprus, the U.S. Mission to the European Union and France. In Washington, he served as Deputy Executive Secretary of the State Department, Executive Assistant to Secretaries of State Madeleine Albright and Colin Powell and in assignments on the Policy Planning Staff, in the Office of Soviet Union Affairs, and the Office of the Under Secretary for Political Affairs. Ambassador Wolff was Managing Director of Gryphon Partners LLC, an international consulting firm, from 2014 to 2016. He has been a Director of Albemarle Corporation since January 12, 2015, and was previously a director of Rockwood Holdings, Inc. Since March 2017, he has served on the board of directors of JetSMART SpA, a private company. Ambassador Wolff graduated Magna Cum Laude from the University of California at Los Angeles. He is a NACD Board Leadership Fellow. | |

| | | |

| | Qualifications: Ambassador Wolff brings to the Board substantial experience in governmental and international affairs, strategic planning, human resources and distinguished leadership experience. | |

| | | |

| | | |

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE.

PROPOSALS YOU MAY VOTE ON

PROPOSAL TWO

Ratification of Appointment of Independent Registered Public Accounting Firm

The second agenda item to be voted on is the ratification of the appointment of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2019.

The Audit Committee of the Board (the “Audit Committee”) has appointed KPMG as the Company’s independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ending September 30, 2019. We are asking our stockholders to ratify the appointment of KPMG as our independent registered public accounting firm because we value our stockholders’ views on the Company’s independent registered public accounting firm. See “Audit and Related Fees” on page 21 and “Report of the Audit Committee” on page 15.

Even if the appointment is ratified, the Audit Committee may in its discretion select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of Versum Materials and its stockholders. If the appointment is not ratified by our stockholders, the Audit Committee will reconsider the appointment.

A representative of KPMG is expected to attend the annual meeting and be available to respond to appropriate questions. The representative will be afforded an opportunity to make a statement if he or she desires to do so.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF KPMG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2019.

PROPOSAL THREE

Advisory Vote on the Compensation Paid to Our Named Executive Officers

The third agenda item to be voted on is a non-binding advisory vote on the compensation paid to our named executive officers (“NEOs”). Our Board and the Compensation Committee of the Board (the “Compensation Committee”) are committed to excellence in corporate governance and to executive compensation programs that align the interests of our executives with those of our stockholders. As part of that commitment, and in accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and related SEC rules, our stockholders are asked to approve an advisory non-binding resolution on the compensation of our NEOs as disclosed in the “Compensation Discussion and Analysis” and the accompanying executive compensation tables and narrative on pages 26 to 53.

This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to endorse or not endorse our fiscal 2018 executive compensation program and policies for the NEOs by voting for or against the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers as discussed and disclosed pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the compensation tables and any related material disclosed in this proxy statement, is hereby approved.”

In particular, we encourage stockholders to consider the following in determining whether to vote for this proposal:

| |

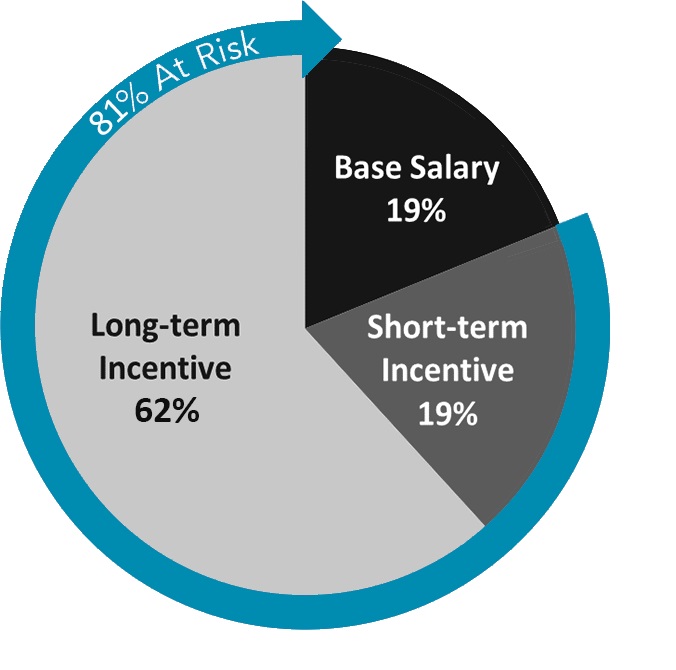

| • | The combined base salary, short-term cash incentives and long-term incentive awards, and each compensation component, for our NEOs for fiscal 2018 was positioned in the range around the median of the Versum Materials Peer Group described on pages 29 and 30. |

| |

| • | Compared to the Versum Materials Peer Group, our revenue approximated the 25th percentile, our market capitalization approximated the median and our Adjusted EBITDA margin was the highest. |

PROPOSALS YOU MAY VOTE ON

| |

| • | Our strategic and financial accomplishments include: |

| |

| ◦ | positive trend of operating improvements, with the following results for fiscal 2018 compared to fiscal 2017: |

|

| | |

| 2018 Sales | 2018 Net Income | 2018 Adjusted EBITDA |

$1,372 million | $198 million | $445 million |

é22 percent | higher than prior year Net Income of $193 million | é20 percent |

| over prior year sales of $1,127 million | over prior year Adjusted EBITDA of $372 million |

| |

| ◦ | strong operating cash flows of $278 million in fiscal 2018 with an ending cash balance of $400 million; |

| |

| ◦ | increased dividend twice, resulting in a 60% increase since inception; |

| |

| ◦ | demonstrated a strategic commitment to fuel top-line growth through capital expenditures and research and development investments; |

| |

| ◦ | exceeded our fiscal 2018 Adjusted EBITDA target of $415 million, an 11.7% increase over fiscal 2017 actual Adjusted EBITDA; and |

| |

| ◦ | successfully completed our enterprise resource planning system implementation and all activities to fully complete the administrative separation from Air Products. |

| |

| • | We believe our practices align executive officer compensation with the interests of our stockholders: |

| |

| ◦ | our performance-based compensation for our NEOs is based upon objective criteria - Adjusted EBITDA for our short-term incentives and relative and absolute total stockholder return for our long-term incentives; |

| |

| ◦ | we have stock ownership guidelines and retention requirements to more closely align the interests of our NEOs with our stockholders; |

| |

| ◦ | our equity awards require a “double trigger” in order to accelerate vesting in the event of a change in control; |

| |

| ◦ | we have an incentive compensation clawback policy and our employment agreements and equity awards to our NEOs contain clawback provisions; |

| |

| ◦ | we prohibit Board members and NEOs from pledging, short sales or hedging investments involving Company stock; and |

| |

| ◦ | we provide no excessive or unusual perquisites. |

Information regarding Adjusted EBITDA and Adjusted EBITDA margin, including reconciliations of these measures to the most directly comparable GAAP measures, is on pages 40 to 42 of our Annual Report on Form 10-K for the fiscal year ended September 30, 2018.

Although this advisory “say-on-pay” resolution is non-binding, the Board and the Compensation Committee value the opinions of our stockholders and will take into account the outcome of the vote when considering future executive compensation decisions. If there are a significant number of negative votes, we will seek to understand the concerns that influenced the vote, and address them in making future decisions about executive compensation programs. We currently conduct an advisory say-on-pay vote annually and intend to continue to do so.

THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS.

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the annual meeting other than the items referred to above. If any other matter is properly brought before the annual meeting for action by stockholders, proxies in the enclosed form returned to Versum Materials will be voted in accordance with the recommendation of the Board, or in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

CORPORATE GOVERNANCE AND RELATED MATTERS

CORPORATE GOVERNANCE AND RELATED MATTERS

Corporate Governance Highlights |

| |

| Director Independence | • Independent Lead Director • 5 of 7 director nominees are independent • All Board Committees are fully independent |

| Diversity | • Director nominees have diversity of gender and ethnicity • Ages of director nominees span three decades • Director nominees have diverse global business experiences and perspectives |

| Board Accountability | • Declassified Board with all directors elected annually • Simple majority voting standard for uncontested director elections |

| Board Leadership | • Annual assessment and determination of Board leadership structure • Lead Director has strong role and governance duties, including as chair of executive sessions of independent directors |

| Board Evaluation and Effectiveness | • Annual Board and Committee self-assessments |

| Director Engagement | • Governance Guidelines limit director membership on other public company boards |

| Clawback and Anti-Hedging Policies | • Permits the Company to recoup or “claw back” certain compensation if conduct leads to a restatement of financial results or for material breach of employment arrangements or violations of our code of conduct • A clawback right is generally included in employment agreements, equity award agreements and incentive plans • Directors and executive officers may not engage in pledging, short sales or hedging investments involving Company stock |

| Share Ownership Guidelines | • Non-employee directors must hold shares equivalent to at least 5x their annual cash retainer • CEO must hold shares equivalent to 6x annual base salary • All executive vice presidents and senior vice presidents must hold shares equivalent to 3x annual base salary • Until share ownership requirements are met, each executive officer is subject to holding requirements from each equity award on exercise, vesting or payment |

| Director Access | • Significant interaction with business leaders • Directors have free access to management and all other Company employees • Directors have ability to hire outside experts and consultants |

CORPORATE GOVERNANCE AND RELATED MATTERS

Director Skills and Attributes

|

| | | | | | | | |

| | | | Independent Directors | Of 7 |

| | Ghasemi | Novo | Croisetière | Paik | Riordan | Schnabel | Wolff | Directors |

Director Experience and Qualifications | | | | | | | | |

| Leadership | l | l | l | l | l | l | l | 7 |

| Financial | | | l | | | l | | 2 |

| Legal | | | | | l | | | 1 |

| Specialty Materials | l | l | l | l | l | l | | 6 |

| Human Resources | | | | | l | | l | 2 |

| Strategic Planning | l | l | l | l | l | l | l | 7 |

| Marketing | | l | | | | | | 1 |

| Global/International | l | l | l | l | l | l | l | 7 |

| Committees | | | | | | | | |

| Audit | | | CHAIR | l | | l | | 3 |

| Compensation | | | l | | CHAIR | | l | 3 |

| Corp. Gov. and Nom. | | | | l | l | l | CHAIR | 4 |

| Age Diversity | | | | | | | | |

| 50’s | | l | | | | l | | 2 |

| 60’s | | | l | l | l | | l | 4 |

| 70’s | l | | | | | | | 1 |

| Gender | | | | | | | | |

| Male | l | l | l | l | l | | l | 6 |

| Female | | | | | | l | | 1 |

Director Independence

As of the date of this proxy statement, the Board has the following three standing committees: the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee. Currently, in accordance with NYSE rules and the Company’s Corporate Governance Guidelines, each of these committees is comprised entirely of independent directors.

The Company’s Corporate Governance Guidelines define independence in accordance with the independence definition in the current NYSE corporate governance rules. When making “independence” determinations, the Board broadly considers all relevant facts and circumstances as well as any other facts and considerations specified by the NYSE, including those related to board and committee service, our by-laws or by any rule or regulation of any other regulatory body or self-regulatory body applicable to the Company. When assessing the materiality of a director’s relationship with the Company, the Board considers the issue not merely from the standpoint of the director, but also from that of persons or organizations with which the director has an affiliation. The Board has determined that Jacques Croisetière, Dr. Yi Hyon Paik, Thomas J. Riordan, Susan C. Schnabel and Alejandro D. Wolff are independent directors within the meaning of applicable NYSE listing standards and the applicable provisions of the Exchange Act.

Seifi Ghasemi, who also serves as Chairman, President and Chief Executive Officer of Air Products, is a director of Versum Materials and is our non-executive Chairman. This service to both companies may create, or may create the appearance of, a conflict of interest when the director is faced with decisions that could have different implications for Air Products and us. For example, potential conflicts of interest could arise in connection with commercial opportunities and in the resolution of any dispute that may arise between Air Products and us regarding the terms of the agreements governing the relationship of the companies entered into in connection with our separation from Air Products on October 1, 2016, when Versum Materials became an independent, publicly traded company, including with respect to the indemnification of certain matters.

Our Corporate Governance Guidelines require us to review the independence of directors annually. On an annual basis, each member of the Board is required to complete a questionnaire designed in part to provide information to assist the Board in determining whether the director is independent under NYSE rules and our Corporate Governance Guidelines. In addition, the directors or potential directors have an affirmative duty to disclose to our Corporate Governance and Nominating Committee relationships which may impair their independence. Our Corporate Governance and Nominating Committee reviews all relationships and transactions for compliance with the standards described above and makes a recommendation to the Board regarding the

CORPORATE GOVERNANCE AND RELATED MATTERS

independence of the directors of the Company. For those directors identified as independent, the Company and the Board are aware of no relationships or transactions with the Company or management.

Meetings of the Board of Directors

All directors are expected to participate in person or by telephone in all meetings of the Board, meetings of the committees of which they are members and the annual meeting of stockholders. Each of our directors attended our 2018 Annual Meeting of Stockholders, except for one director who was unable to attend. During the fiscal year ended September 30, 2018, the Board held eight meetings, the Audit Committee held eight meetings, the Compensation Committee held seven meetings and the Corporate Governance and Nominating Committee held five meetings. Excluding one self-recused absence from a Board teleconference to avoid a potential conflict of interest, Mr. Ghasemi attended at least 75% of the Board meetings during fiscal 2018, and each of the other directors attended at least 75% of the meetings of the Board and of the committees of the Board on which such director served.

Board Role in Risk Management

The Board actively oversees risk management related to the Company and its business. The Board accomplishes this oversight with the assistance of the Audit Committee and the Compensation Committee. Our Board reviews our enterprise risk management program at least annually and considers whether risk management processes are functioning properly and are appropriately adapted to the Company’s strategy, culture, risk appetite and overall objectives. The Company’s enterprise risk management program includes reviews of cybersecurity vulnerability and the actions necessary to enhance the security of our information systems. Consideration of risk is inherent in the Board’s consideration of our long-term strategies and in the transactions and other matters presented to the Board, including capital expenditures, acquisitions and divestitures, and environmental, health and safety updates.

Our Board provides guidance to management regarding risk management as appropriate. The senior executives manage and mitigate, to the extent possible, material risks on a day-to-day basis. The roles of the Audit Committee and the Compensation Committee are as follows:

| |

| • | Audit Committee—the Audit Committee is generally responsible for oversight of guidelines and policies with respect to risk assessment and the oversight of material financial risk exposures; and |

| |

| • | Compensation Committee—the Compensation Committee is generally responsible for considering any risks arising from the Company’s compensation policies and practices. |

Each of these committees along with our senior executives are responsible for periodically reporting to the Board the material risks facing the Company and highlighting any new material risks that may have arisen since they last met.

Audit Committee

Our Audit Committee currently consists of Jacques Croisetière, Dr. Yi Hyon Paik and Susan C. Schnabel. Mr. Croisetière is the chairperson of our Audit Committee. The Board has determined that all of the members of the Audit Committee are financially literate and meet the independence requirements mandated by the applicable NYSE listing standards, Section 10A(m)(3) of the Exchange Act and our Corporate Governance Guidelines. The Board has also determined that Mr. Croisetière and Ms. Schnabel are each “audit committee financial experts” under applicable listing standards of the NYSE and applicable rules of the SEC.

Our Audit Committee is responsible for:

| |

| • | carrying out the responsibilities and duties delegated to it by the Board, including its oversight of our financial reporting policies, our internal controls and our compliance with legal and regulatory requirements applicable to financial statements and accounting and financial reporting processes; |

| |

| • | selecting our independent registered public accounting firm and reviewing and evaluating its qualifications, performance and independence; |

| |

| • | reviewing and pre-approving the audit and non-audit services and the payment of compensation to the independent registered public accounting firm; |

| |

| • | reviewing reports and material written communications between management and the independent registered public accounting firm, including with respect to major issues as to the adequacy of the Company’s internal controls; |

| |

| • | reviewing the work of our internal audit function; and |

CORPORATE GOVERNANCE AND RELATED MATTERS

| |

| • | reviewing and discussing with management and the independent registered public accounting firm our guidelines and policies with respect to risk assessment. |

Our Audit Committee has adopted a formal policy concerning the pre-approval of audit and non-audit services to be provided by our independent registered public accounting firm. The policy requires that all services to be performed by KPMG LLP and its affiliates, including audit services, audit-related services, tax services and permitted non-audit services, be pre-approved by the Audit Committee. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is subject to a budget. Specific services being provided by the independent registered public accounting firm are regularly reviewed in accordance with the pre-approval policy and the Audit Committee may pre-approve particular services on a case-by-case basis. The Audit Committee has delegated the authority to grant pre-approvals to Mr. Croisetière, the Audit Committee chairperson, when the full Audit Committee is unable to do so. At each subsequent Audit Committee meeting, the Audit Committee reviews these pre-approvals, receives updates on the services actually provided by the independent accountants, and management may present additional services for approval.

The Audit Committee has reviewed and approved the amount of fees to be paid to the independent registered public accounting firm for audit, audit-related, tax compliance and other permissible non-audit services for fiscal 2019. The Audit Committee has concluded that KPMG LLP providing such services is consistent with maintaining KPMG LLP’s independence. Audit fees represent fees for professional services provided in connection with the audit of our consolidated annual financial statements and internal controls over financial reporting and reviews of our quarterly financial statements, as well as audits of subsidiary financial statements (including statutory audits), regulatory filings, consents and other SEC-related matters.

Our Board has adopted a written charter for the Audit Committee, which is available on our website at www.versummaterials.com in the “Governance” section, and upon written request by our stockholders at no cost.

CORPORATE GOVERNANCE AND RELATED MATTERS

Report of the Audit Committee

The Audit Committee is governed by the Audit Committee Charter adopted by the Company’s Board. The Board has determined that each current member of the Audit Committee, Jacques Croisetière, Dr. Yi Hyon Paik and Susan C. Schnabel, is an “independent” director based on Rule 10A-3 of the Exchange Act, the listing standards of the NYSE and our Corporate Governance Guidelines, and that Mr. Croisetière and Ms. Schnabel are each “audit committee financial experts” under applicable listing standards of the NYSE and applicable rules of the SEC.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The independent registered public accounting firm is responsible for expressing an opinion on those audited consolidated financial statements in conformity with accounting principles generally accepted in the United States.

Consistent with SEC policies regarding auditor independence and the Audit Committee’s charter, the Audit Committee is also directly responsible for the appointment, compensation, retention, oversight and termination of the independent auditor and appointed KPMG LLP to serve in that capacity for fiscal 2018 and fiscal 2019. KPMG has been retained as the Company’s independent auditor since the Company became an independent, publicly traded company on October 1, 2016. The Audit Committee believes the appointment of KPMG LLP is in the best interests of the Company and its stockholders.

As part of that role, the Audit Committee:

| |

| • | reviewed and discussed the audited consolidated financial statements contained in the Company’s Annual Report on Form 10‑K for the fiscal year ended September 30, 2018 with the Company’s management and independent registered public accounting firm; |

| |

| • | discussed with the independent registered public accounting firm the matters required to be discussed by the applicable auditing standards adopted by the Public Company Accounting Oversight Board, including any critical audit matters; and |

| |

| • | received the written disclosures and the letter from the independent registered public accounting firm as required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committees concerning independence, and discussed with the independent registered public accounting firm the auditor’s independence from Versum Materials and its management. |

Based on the reviews and discussions referred to above, the Audit Committee approved the audited consolidated financial statements and recommended to the Board that they be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018 for filing with the SEC. The Audit Committee has also appointed KPMG LLP as the Company’s independent registered public accounting firm for fiscal 2019 and is presenting its appointment to the stockholders for ratification.

|

| |

| | AUDIT COMMITTEE |

| | |

| | Jacques Croisetière, Chairperson |

| | Dr. Yi Hyon Paik |

| | Susan C. Schnabel |

The preceding Report of the Audit Committee is provided only for the purpose of this proxy statement. This report shall not be incorporated, in whole or in part, in any other Versum Materials filing under the Securities Act of 1933, as amended, or the Exchange Act.

CORPORATE GOVERNANCE AND RELATED MATTERS

Compensation Committee

The Compensation Committee currently consists of Thomas J. Riordan, Jacques Croisetière and Ambassador Alejandro D. Wolff. Mr. Riordan is the chairperson of the Compensation Committee. The Board has determined that each member of the Compensation Committee meets the independence requirements of the SEC and NYSE applicable to compensation committee members.

Our Compensation Committee is responsible for:

| |

| • | establishing and reviewing the overall compensation philosophy of the Company; |

| |

| • | reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer and other executive officers’ compensation, including annual performance objectives, if any; |

| |

| • | evaluating the performance of the Chief Executive Officer in light of these corporate goals and objectives and, either as a committee or together with the other independent directors (as directed by the Board), determining and approving the annual base salary, bonus, equity-based incentives and other benefits, direct and indirect, of the Chief Executive Officer; |

| |

| • | reviewing and approving or making recommendations to the Board on the annual base salary, bonus, equity-based incentives and other benefits, direct and indirect, of the other executive officers; |

| |

| • | considering policies and procedures pertaining to expense accounts of senior executives; |

| |

| • | reviewing and approving, or making recommendations to the Board with respect to incentive-compensation plans and equity-based plans that are subject to the approval of the Board, and overseeing the activities of the individuals responsible for administering those plans; |

| |

| • | reviewing and making recommendations to the Board, or approving, all equity-based awards, including pursuant to the Company’s equity-based plans; |

| |

| • | monitoring compliance by executives with the rules and guidelines of the Company’s equity-based plans; |

| |

| • | reviewing and monitoring all employee retirement, profit sharing and benefit plans of the Company; and |

| |

| • | reviewing and recommending to the Board the form and amount of compensation to be paid to our non-employee directors. |

Our Board has adopted a written charter for the Compensation Committee which is available on our website at www.versummaterials.com in the “Governance” section, and upon written request by our stockholders at no cost.

With respect to our reporting and disclosure matters, the responsibilities and duties of the Compensation Committee include overseeing the preparation of the Compensation Discussion and Analysis for inclusion in our annual proxy statement or Annual Report on Form 10-K in accordance with applicable rules and regulations of the SEC. The charter of the Compensation Committee permits the Compensation Committee to delegate any or all of its authority to one or more subcommittees and to delegate to one or more officers of the Company the authority to make awards to any non-Section 16 officer of the Company under the Company’s incentive-compensation or other equity-based plans, subject to compliance with the plan and the laws of the state of the Company’s jurisdiction.

Pursuant to its charter, the Compensation Committee is authorized to engage an outside advisor to assist in the design and evaluation of our executive compensation program, as well as to approve the fees paid to such advisor and other terms of the engagement. Prior to the retention of an outside advisor, the Compensation Committee assesses the prospective advisor’s independence, taking into consideration all relevant factors, including those factors specified in the NYSE listing standards.

In fiscal 2018, the Compensation Committee again engaged Frederic W. Cook & Co., Inc. (“FW Cook”) as its compensation consultant. FW Cook advised the Compensation Committee on executive officer and non-employee director compensation. The Compensation Committee did not engage any other compensation consultant in fiscal 2018. At the direction of the Compensation Committee, FW Cook provided advice on the development of incentive compensation programs, compensation trends, regulatory developments and governance issues and other matters of interest to the Compensation Committee. The Compensation Committee assessed FW Cook’s independence, taking into account a number of factors such as: (1) the provision of other services to Versum Materials by FW Cook; (2) the amount of fees received from Versum Materials; (3) FW Cook’s policies and procedures to prevent conflicts of interest; (4) any business or personal relationship between the FW Cook team members and the members of the Compensation Committee; (5) any Versum Materials stock owned by FW Cook or by the FW Cook team members; and (6) any business or personal relationship between any employee of FW Cook and any Versum Materials executive officer. FW Cook provided the Compensation Committee with appropriate assurances regarding its independence. The Compensation Committee concluded that FW Cook has been independent throughout its service to the Compensation Committee and that there are no conflicts of interest.

CORPORATE GOVERNANCE AND RELATED MATTERS

Compensation Committee Report

The Compensation Committee has reviewed and discussed the “Compensation Discussion and Analysis” with Versum Materials management. Based on its review and such discussions, the Compensation Committee recommended to the Board of Directors that the “Compensation Discussion and Analysis” be included in this proxy statement and incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018.

|

| |

| | COMPENSATION COMMITTEE |

| | |

| | Thomas J. Riordan, Chairperson |

| | Jacques Croisetière |

| | Ambassador Alejandro D. Wolff |

Compensation Committee Interlocks and Insider Participation

During fiscal 2018, no member of our Compensation Committee was an employee or officer or former officer of the Company or had any relationships requiring disclosure under Item 404 of Regulation S-K. None of our executive officers has served on the board of directors or compensation committee of any other entity that has or has had one or more executive officers who served as a member of our Board or our Compensation Committee during fiscal 2018.

Corporate Governance and Nominating Committee

Our Corporate Governance and Nominating Committee currently consists of Ambassador Alejandro D. Wolff, Dr. Yi Hyon Paik, Thomas J. Riordan and Susan C. Schnabel. Ambassador Wolff is the chairperson of our Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee is comprised solely of independent directors.

Our Corporate Governance and Nominating Committee is responsible for:

| |

| • | establishing the criteria for the selection of new directors; |

| |

| • | identifying and recommending to the Board individuals to be nominated as directors; |

| |

| • | evaluating candidates for nomination to the Board, including those recommended by stockholders; |

| |

| • | conducting all necessary and appropriate inquiries into the backgrounds and qualifications of possible candidates; |

| |

| • | considering questions of independence and possible conflicts of interest of members of the Board and executive officers; |

| |

| • | reviewing and recommending the composition and size of the Board; |

| |

| • | overseeing, at least annually, the evaluation of the Board and management; |

| |

| • | recommending members of the Board to serve on the committees of the Board and, where appropriate, recommending the removal of any member of any of the committees; and |

| |

| • | periodically reviewing the charter, composition and performance of each committee of the Board and recommending to the Board the creation or elimination of committees. |

The Corporate Governance and Nominating Committee oversees the management succession planning process. The Corporate Governance and Nominating Committee reviews and evaluates succession plans relating to the CEO and other executive officer positions and makes recommendations to the Board with respect to the selection of individuals to occupy these positions. The Corporate Governance and Nominating Committee is working with an executive search firm to assist with our CEO succession planning process. A comprehensive review of executive talent determines readiness to take on additional leadership roles and identifies developmental and coaching opportunities needed to prepare our executives for greater responsibilities.

The Corporate Governance and Nominating Committee also oversees our environmental, health and safety performance and our sustainability program. As part of that oversight, management periodically reports on key environmental, health and safety metrics and trends, certain safety incidents and learnings, program enhancements and safety culture. Management also reports to the Corporate Governance and Nominating Committee on its sustainability program, including program structure and management, key environmental, social and governance metrics and targets and future actions.

CORPORATE GOVERNANCE AND RELATED MATTERS

In nominating candidates to serve as directors, the Board’s objective, with the assistance of the Corporate Governance and Nominating Committee, is to select individuals whose particular experience, qualifications, attributes and skills can be of assistance to management in operating our business and enable the Board to satisfy its oversight responsibility effectively. When evaluating director candidates, the Corporate Governance and Nominating Committee considers, among other things, whether individual directors possess (a) minimum individual qualifications, including strength of character, mature judgment, familiarity with the Company’s business and industry, independence of thought and an ability to work collegially and (b) all other factors it considers appropriate, which may include age, gender and ethnic and racial background, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations such as antitrust issues, corporate governance background, relevant career experience, relevant technical skills, relevant business or government acumen, financial and accounting background, executive compensation background and the size, composition and combined expertise of the existing Board. The Corporate Governance and Nominating Committee evaluates candidates recommended by stockholders on a substantially similar basis as other nominees. In considering the recommendations of the Corporate Governance and Nominating Committee, the Board monitors the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. In addition, although the Board does not have a formal policy with regard to the consideration of diversity in identifying director nominees, among the many factors that the Corporate Governance and Nominating Committee carefully considers are the benefits to the Company of national origin, gender, race, as well as differences in perspective, global business experience and cultural diversity in board composition. Further, the Board does not discriminate on the basis of race, color, national origin, gender, religion, disability or sexual preference in selecting director candidates.

When considering whether the directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board focused primarily on the biographical information set forth on pages 6 through 8. In addition, the Corporate Governance and Nominating Committee considered the following characteristics about each director:

| |

| • | Seifi Ghasemi—Mr. Ghasemi has deep experience in the specialty chemicals industry. His prior executive leadership of an international specialty chemicals and materials company provides the Board with broad experience in navigating many of the challenges Versum Materials faces, such as portfolio management, strategic planning, talent management and international operations. |

| |

| • | Guillermo Novo—Mr. Novo has over thirty years of leadership experience in the specialty materials industry and brings to the Board detailed insight into the Company’s worldwide customers, markets, operations and strategies. |

| |

| • | Jacques Croisetière—As the former chief financial officer of multinational companies, Mr. Croisetière brings extensive financial expertise and leadership experience to the Board, including experience in the global specialty materials industry. |

| |

| • | Dr. Yi Hyon Paik—As the former president of a multinational company, Dr. Paik provides the Board with extensive leadership experience in the electronic materials industry including strategic planning and global business expertise with a deep technical understanding. |

| |

| • | Thomas J. Riordan—Mr. Riordan provides the Board with the benefit of over 40 years of senior executive experience with global companies including legal, human resources and specialty materials experience. |

| |

| • | Susan C. Schnabel—Ms. Schnabel provides the Board with her extensive financial and management expertise, experience with global transactions and significant board of directors experience. |

| |

| • | Alejandro D. Wolff—Ambassador Wolff brings to the Board substantial experience in governmental and international affairs, strategic planning, human resources and distinguished leadership experience. |

For a description of the procedures for stockholders to submit proposals regarding director nominations, see “Director Candidate Recommendations by Stockholders” below.

Our Board has adopted a written charter for the Corporate Governance and Nominating Committee which is available on our website at www.versummaterials.com in the “Governance” section, and upon written request by our stockholders at no cost.

Board Structure

Our Board is led by the non-executive Chairman. The Chief Executive Officer position is currently separate from the Chairman position. The Board believes that the separation of the Chairman and Chief Executive Officer positions is appropriate corporate governance for us at this time. Accordingly, Mr. Ghasemi serves as Chairman, while Mr. Novo serves as our President and Chief Executive Officer. Our Board believes that this structure best encourages the free and open dialogue of competing views and

CORPORATE GOVERNANCE AND RELATED MATTERS

provides for strong checks and balances. Additionally, Mr. Ghasemi’s attention to Board and committee matters allows Mr. Novo to focus more on overseeing the Company’s day to day operations as well as strategic opportunities and planning.

Whenever the Chairperson of the Board is also the Chief Executive Officer or is a director who does not otherwise qualify as an “independent director,” the independent directors may elect annually from among themselves a Lead Director of the Board. Service as Lead Director is generally for one year. The Lead Director helps coordinate the efforts of the independent and non-management directors in the interest of ensuring that objective judgment is brought to bear on sensitive issues involving the management of the Company and, in particular, the performance of senior management. The Lead Director’s responsibilities, which are described in the Company’s Corporate Governance Guidelines, include:

| |

| • | presiding over all meetings of the Board at which the Chairperson is not present, including any executive sessions of the independent directors or the non-management directors; |

| |

| • | assisting in scheduling Board meetings and approve meeting schedules to ensure that there is sufficient time for discussion of all agenda items; |

| |

| • | requesting the inclusion of certain materials for Board meetings; |

| |

| • | communicating to the CEO, together with the Chairperson of the Compensation Committee, the results of the Board’s evaluation of CEO performance; |

| |

| • | collaborating with the CEO on Board meeting agendas and approving such agendas; |

| |

| • | collaborating with the CEO in determining the need for special meetings of the Board; |

| |

| • | providing leadership and serving as temporary Chairperson of the Board or CEO in the event of the inability of the Chairperson of the Board or CEO to fulfill his/her role due to crisis or other event or circumstance which would make leadership by existing management inappropriate or ineffective, in which case the Lead Director shall have the authority to convene meetings of the full Board or management; |

| |

| • | being available for consultation and direct communication if requested by major stockholders; |

| |

| • | acting as the liaison between the independent or non-management directors and the Chairperson of the Board, as appropriate; |

| |

| • | calling meetings of the independent or non-management directors when necessary and appropriate; and |

| |

| • | recommending to the Board, in concert with the chairpersons of the respective Board committees, the retention of consultants and advisors who directly report to the Board, including such independent legal, financial or other advisors as he or she deems appropriate, without consulting or obtaining the advance authorization of any officer of the Company. |

Ambassador Alejandro D. Wolff has served as Lead Director since May 2017. The next election of Lead Director is currently scheduled for the date of the Company’s 2019 annual meeting of stockholders.

Executive Sessions of Non-Management and Independent Directors

Non-management directors meet in executive sessions of the Board in which management directors and other members of management do not participate. These sessions are periodically scheduled for non-management directors at meetings of the Board. In addition, generally several times a year, the independent directors of the Board meet in a private session that excludes management and non-independent directors. The Lead Director, or a director designated by the non-management or independent directors, as applicable, presides at executive sessions.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines which set forth the Board’s core principles of corporate governance and categorical standards of independence and are designed to promote its effective functioning and assist the Board in fulfilling its responsibilities. The Board will review and amend these guidelines from time to time as it deems necessary and appropriate. The Corporate Governance Guidelines are available on our website at www.versummaterials.com in the “Governance” section, and upon written request by our stockholders at no cost.

CORPORATE GOVERNANCE AND RELATED MATTERS

Code of Conduct

We are committed to conducting business in accordance with the highest ethical standards and all applicable laws, rules and regulations. We have adopted a code of conduct that applies to our employees, executive officers and directors and provide training on such code of conduct and other compliance issues. In accordance with, and to the extent required by, the rules and regulations of the SEC, we intend to post on our website at www.versummaterials.com waivers or implicit waivers (as such terms are defined in Item 5.05 of Form 8-K of the Exchange Act) and amendments to the code of conduct that apply to our directors and officers that would otherwise be required to be disclosed under the rules of the SEC or the NYSE. The code of conduct is available on our website at www.versummaterials.com in the “Governance” section, and upon written request by our stockholders at no cost.

Director Candidate Recommendations by Stockholders

In identifying prospective director candidates, the Corporate Governance and Nominating Committee may seek referrals from other members of the Board, management, stockholders and other sources. Stockholder recommendations for director candidates should include the candidate’s name and specific qualifications to serve on the Board, and the recommending stockholder should also submit evidence of such stockholder’s ownership of shares of our common stock, including the number of shares owned and the length of time of such ownership. Recommendations should be addressed to the Secretary. In addition, any stockholder who wishes to submit director nominations must satisfy the notification, timeliness, consent and information requirements set forth in our by‑laws. See “Procedures for Submitting Stockholder Proposals” on page 58.

Stockholder and Interested Party Communications with the Board of Directors

As described in the Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of the Board, including the chairperson of the Audit, Compensation, or Corporate Governance and Nominating Committees or to the non-management or independent directors as a group, so indicate in your communication and mail correspondence to the Company’s General Counsel at the following address: Versum Materials, Inc., Attn: General Counsel, 8555 South River Parkway, Tempe, Arizona 85284, who will forward such communications to the appropriate party. Such communications may be done confidentially or anonymously.

AUDIT AND RELATED FEES

The Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2019. Stockholders are being asked to ratify the appointment of KPMG LLP at the annual meeting. Representatives of KPMG LLP are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The following table summarizes aggregate fees paid or accrued by us for the fiscal years ended September 30, 2018, and September 30, 2017.

|

| | | | | | |

| | 2018 (in millions) | 2017 (in millions) |

Audit fees(1) | $ | 3.8 |

| $ | 3.2 |

|

| Audit related fees | $ | 0 |

| $ | 0 |

|

Tax fees(2) | $ | 0.1 |

| $ | 0.1 |

|

| All other fees | $ | 0 |

| $ | 0 |

|

| Total fees | $ | 3.9 |

| $ | 3.3 |

|

| |