VERSUM MATERIALS EARNINGS CONFERENCE CALL: First Quarter Fiscal 2019 February 4, 2018 – 4:30 PM Eastern Versum Materials Confidential

FORWARD-LOOKING INFORMATION This presentation contains, and management may make, certain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by references to future periods, and include statements about our expectations or predictions of future financial or business performance or conditions; statements about our anticipated growth, profitability and margins; our investments in new markets, capacity and productivity; our anticipated free cash flow; our ability to compete successfully as a leading materials supplier to the semiconductor industry and obtain next generation node opportunities; industry outlook; anticipated customer demand; and other matters. The words “believe,” “expect,” “anticipate,” “estimate,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “forecast,” “guidance,” “outlook,” “opportunity,” “positioned” and similar expressions, among others, generally identify forward-looking statements, which are based on management’s reasonable expectations and assumptions as of the date the statements were made. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially, including without limitation the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate any definitive merger agreement between us and Entegris, Inc.; the outcome of any legal proceedings that may be instituted against us or Entegris, Inc.; the ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by our and Entegris, Inc. stockholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating our business with Entegris, Inc. or fully realizing cost savings and other benefits; business disruption following the merger; our ability or the ability of Entegris, Inc. to retain and hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; uncertainty as to the long-term value of the common stock of Entegris, Inc. following the merger; legislative, regulatory and economic developments; potential business uncertainty, including changes to existing business relationships, during the pendency of the merger that could affect our or Entegris, Inc.’s financial performance; certain restrictions during the pendency of the merger that may impact our or Entegris, Inc.’s ability to pursue certain business opportunities or strategic transactions; the business, economic and political conditions in the markets in which we and Entegris, Inc. operate; events beyond our control such as acts of terrorism; product supply versus demand imbalances in the semiconductor industry or in certain geographic markets may decrease the demand for our goods and services; our concentrated customer base; the dependence of our DS&S segment upon the capital expenditure cycles of our customers; our ability to continue technological innovation and successfully introduce new products to meet the evolving needs of our customers; our ability to protect and enforce our intellectual property rights and to avoid 2 Versum Materials Confidential

FORWARD-LOOKING INFORMATION (continued) violating any third party intellectual property or technology rights; unexpected interruption of or shortages in our raw material supply; inability of sole source, limited source or qualified suppliers to deliver to us in a timely manner or at all; hazards associated with specialty chemical manufacturing, such as fires, explosions and accidents, could disrupt operations; increased competition and new product development by our competitors, changing customer needs and price increases in materials and components; operational, political and legal risks of our international operations; increased costs due to trade wars and the implementation of tariffs; the impact of changes in tax laws; the impact of changes in environmental and health and safety regulations, anticorruption enforcement, sanctions, import/export controls, tax and other legislation and regulations in the U.S. and other jurisdictions in which Versum Materials and its affiliates operate; our available cash and access to additional capital may be limited by substantial leverage and debt service obligations; possible liability for contamination, personal injury or third party impacts if hazardous materials are released into the environment; cyber security threats may compromise our data or disrupt our information technology applications or services; fluctuation of currency exchange rates; costs and outcomes of litigation or regulatory investigations; the timing, impact, and other uncertainties of future acquisitions or divestitures; and other risks, uncertainties and factors discussed in the company’s Form 10-Qs, Form 10-K and in the company’s other filings with the U.S. Securities and Exchange Commission available at www.sec.gov or in materials incorporated therein by reference. Any forward-looking statement in this press release speaks only as of the date on which it is made. The company assumes no obligation to update or revise any forward-looking statements. Non-GAAP Financial Measures This presentation contains certain “Non-GAAP financial measures.” Please refer to the Appendix for definitions of the non-GAAP financial measures used herein and for a reconciliation of those non-GAAP financial measures to their most comparable GAAP measures. 3 Versum Materials Confidential

LEGAL DISCLOSURES Important Information This communication is being made in respect of the proposed merger transaction between Versum Materials, Inc. and Entegris, Inc. In connection with the proposed merger, Entegris, Inc. will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of Versum Materials, Inc. and Entegris, Inc. and a Prospectus of Entegris, Inc., as well as other relevant documents regarding the proposed transaction. A definitive Joint Proxy Statement/Prospectus will also be sent to Versum Materials, Inc. stockholders and Entegris, Inc. stockholders. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. INVESTORS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Joint Proxy Statement/Prospectus, as well as other filings containing information about Versum Materials, Inc. and Entegris, Inc., may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Versum Materials, Inc. by accessing Versum Materials, Inc.’s website at www.versummaterials.com or from Entegris, Inc. by accessing Entegris, Inc.’s website at www.entegris.com. Copies of the Joint Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to Versum Materials, Inc. Investor Relations at Investor Relations, Versum Materials, Inc., 8555 South River Parkway, Tempe, Arizona 85284 or by calling (484) 275-5907, or to Entegris, Inc. Investor Relations at Investor Relations, Entegris, Inc., 129 Concord Road, Billerica, MA 01821 or by calling 978-436-6500. Certain Information Concerning Participants Versum Materials, Inc. and Entegris, Inc. and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Versum Materials, Inc. stockholders and Entegris, Inc. stockholders in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding Versum Materials, Inc.’s directors and executive officers is contained in Versum Materials, Inc.’s Annual Report on Form 10-K for the year ended September 30, 2018 and its Proxy Statement on Schedule 14A, dated December 20, 2018, which are filed with the SEC. Information regarding Entegris, Inc.’s directors and executive officers is contained in Entegris, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2017, its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2018, June 30, 2018 and September 29, 2018 and its Proxy Statement on Schedule 14A, dated March 28, 2018, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 4 Versum Materials Confidential

AGENDA Business and Market Review: Guillermo Novo, President & CEO Financial Overview and Guidance: George Bitto, EVP & CFO Q&A Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 5 Versum Materials Confidential

Entegris and Versum Materials Merger of Equals Creation of a Premier Specialty Materials Company January 28, 2019

BUSINESS REVIEW 7

VERSUM MATERIALS FISCAL FIRST QUARTER RESULTS (In millions, except percentages) FYQ119 FYQ118 Change Sales 339.5 330.8 +3% Gross Profit Margin 42.2% 42.2% NM Adjusted EBITDA 110.4 102.7 +7% Adjusted EBITDA Margin 32.5% 31.0% +150 bps Strong Q1 with Sales up 3% and Adj EBITDA up 7% Both segments contributed to sales and profit growth Balance sheet continues to strengthen Steady investments for future growth Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 8 Versum Materials Confidential

VERSUM MATERIALS WELL POSITIONED FOR FUTURE GROWTH Leadership positions in all core businesses Well positioned at all major customers Exciting innovation pipeline Unique growth opportunities to accelerate growth Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 9 Versum Materials Confidential

UPDATED 2019 PRIORITIES REMAIN FOCUSED ON EXECUTION AND ADVANCING OUR STRATEGY Maintain EHS focus Execute to deliver financial commitments Execute our strategies and core initiatives Support merger approvals and integration planning NOTES: EHS: Environment, Health and Safety 10 Versum Materials Confidential

FINANCIAL UPDATE 11

INCOME STATEMENT HIGHLIGHTS FISCAL FIRST QUARTER 2019 VERSUS 2018 (In millions, except percentages and per share data) FYQ119 FYQ118 % change Sales $339.5 $330.8 +3% Gross Profit (A),(B) 143.4 139.6 +3% Gross Profit Margin 42.2% 42.2% S&A Costs and R&D 48.4 48.0 +1% Operating Income (A),(B) 95.8 89.3 +7% Adjusted Net Income (A) 60.2 59.2 +2% Adjusted Diluted EPS 0.55 0.54 +2% Adjusted EBITDA (A),(B) 110.4 102.7 +7% Adjusted EBITDA Margin 32.5% 31.0% +150 BPS Separation and Restructuring Expenses 1.1 1.8 - 39% Adjusted Tax Rate 26.0% 23.1% (A) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s election to change its inventory valuation method of accounting for its U.S. inventories from the last-in, first-out (“LIFO”) method to the first-in, first-out (“FIFO”) method. (B) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s change in classification of the non-service components of net periodic pension cost. ➢ Continued Growth and Margin Expansion . Volume growth in both segments . EBITDA margin improvement from higher volumes and cost discipline Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 12 Versum Materials Confidential

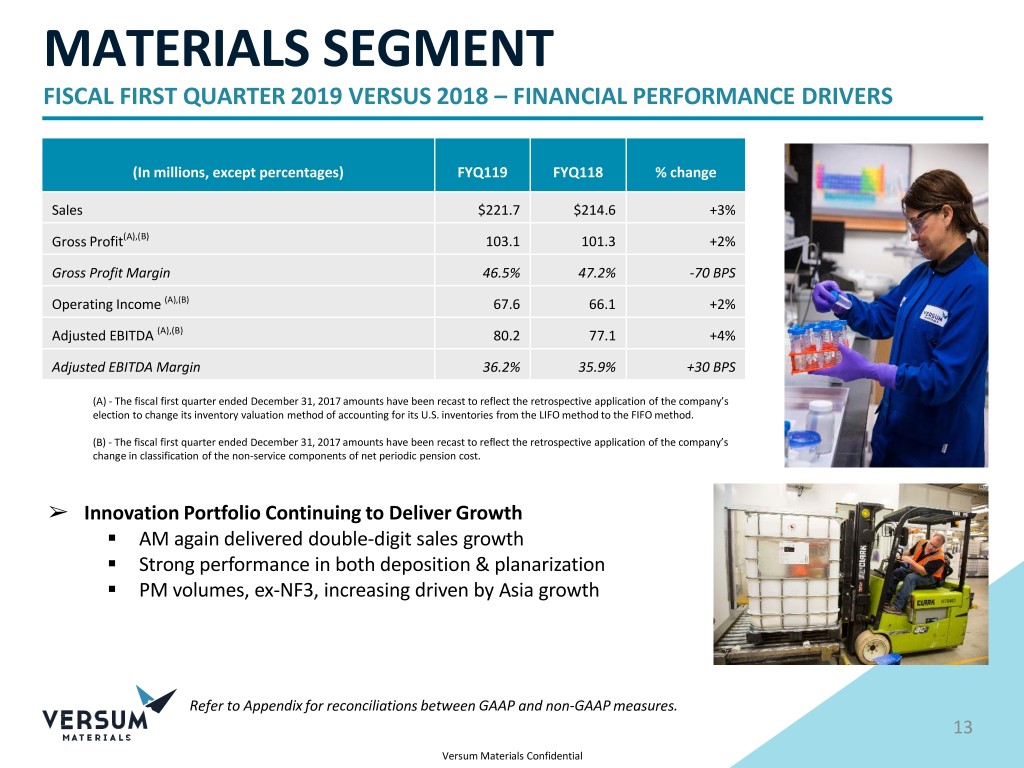

MATERIALS SEGMENT FISCAL FIRST QUARTER 2019 VERSUS 2018 – FINANCIAL PERFORMANCE DRIVERS (In millions, except percentages) FYQ119 FYQ118 % change Sales $221.7 $214.6 +3% Gross Profit(A),(B) 103.1 101.3 +2% Gross Profit Margin 46.5% 47.2% -70 BPS Operating Income (A),(B) 67.6 66.1 +2% Adjusted EBITDA (A),(B) 80.2 77.1 +4% Adjusted EBITDA Margin 36.2% 35.9% +30 BPS (A) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s election to change its inventory valuation method of accounting for its U.S. inventories from the LIFO method to the FIFO method. (B) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s change in classification of the non-service components of net periodic pension cost. ➢ Innovation Portfolio Continuing to Deliver Growth . AM again delivered double-digit sales growth . Strong performance in both deposition & planarization . PM volumes, ex-NF3, increasing driven by Asia growth Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 13 Versum Materials Confidential

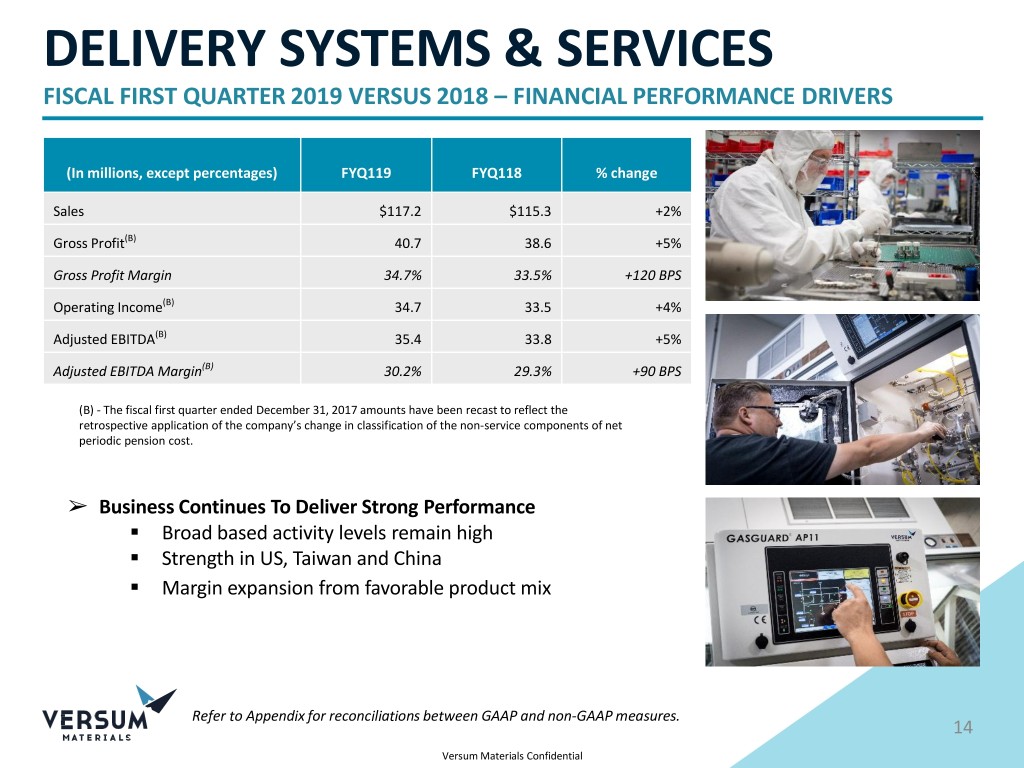

DELIVERY SYSTEMS & SERVICES FISCAL FIRST QUARTER 2019 VERSUS 2018 – FINANCIAL PERFORMANCE DRIVERS (In millions, except percentages) FYQ119 FYQ118 % change Sales $117.2 $115.3 +2% Gross Profit(B) 40.7 38.6 +5% Gross Profit Margin 34.7% 33.5% +120 BPS Operating Income(B) 34.7 33.5 +4% Adjusted EBITDA(B) 35.4 33.8 +5% Adjusted EBITDA Margin(B) 30.2% 29.3% +90 BPS (B) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s change in classification of the non-service components of net periodic pension cost. ➢ Business Continues To Deliver Strong Performance . Broad based activity levels remain high . Strength in US, Taiwan and China . Margin expansion from favorable product mix Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 14 Versum Materials Confidential

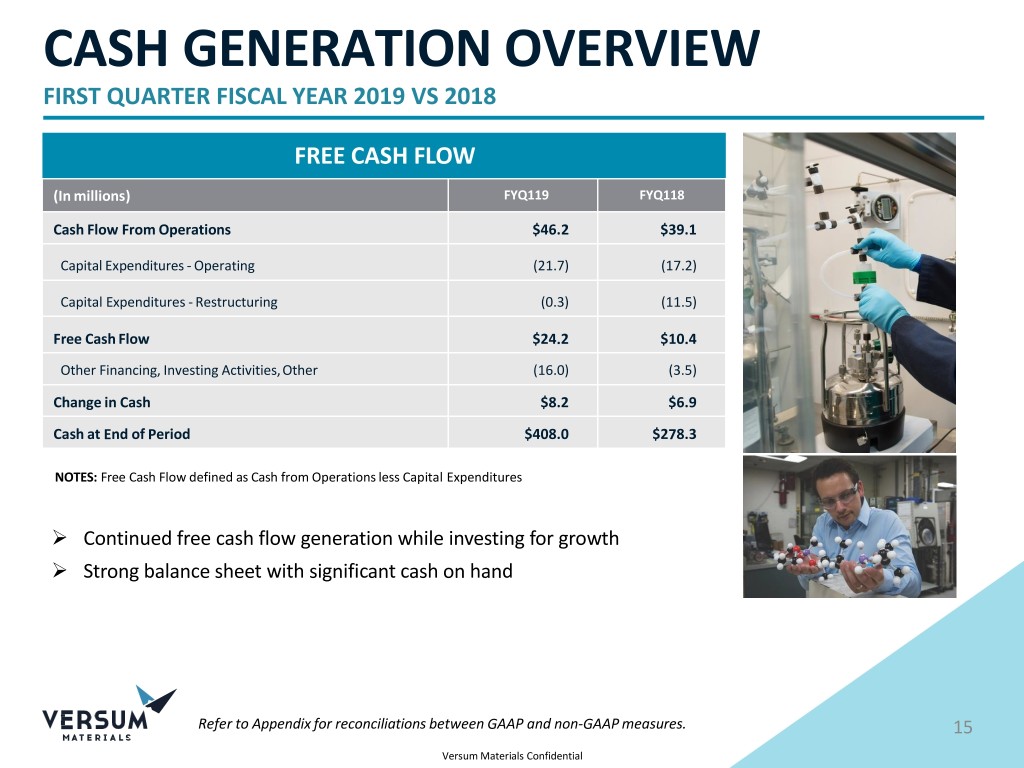

CASH GENERATION OVERVIEW FIRST QUARTER FISCAL YEAR 2019 VS 2018 FREE CASH FLOW (In millions) FYQ119 FYQ118 Cash Flow From Operations $46.2 $39.1 Capital Expenditures - Operating (21.7) (17.2) Capital Expenditures - Restructuring (0.3) (11.5) Free Cash Flow $24.2 $10.4 Other Financing, Investing Activities,Other (16.0) (3.5) Change in Cash $8.2 $6.9 Cash at End of Period $408.0 $278.3 NOTES: Free Cash Flow defined as Cash from Operations less Capital Expenditures Continued free cash flow generation while investing for growth Strong balance sheet with significant cash on hand Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 15 Versum Materials Confidential

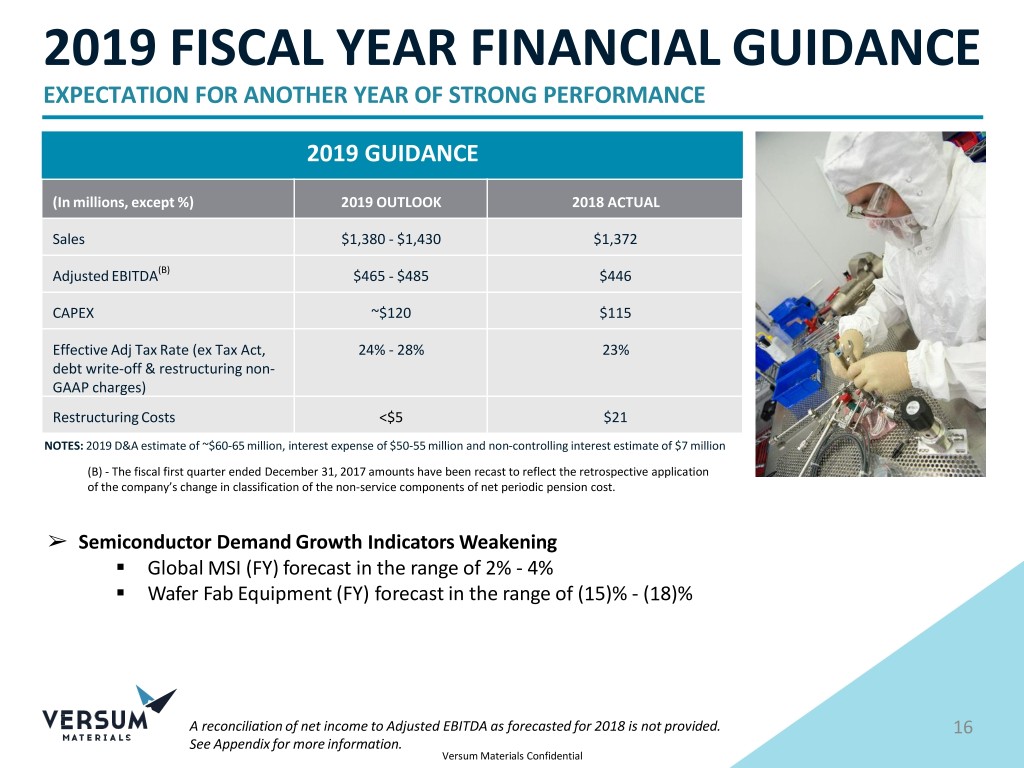

2019 FISCAL YEAR FINANCIAL GUIDANCE EXPECTATION FOR ANOTHER YEAR OF STRONG PERFORMANCE 2019 GUIDANCE (In millions, except %) 2019 OUTLOOK 2018 ACTUAL Sales $1,380 - $1,430 $1,372 Adjusted EBITDA(B) $465 - $485 $446 CAPEX ~$120 $115 Effective Adj Tax Rate (ex Tax Act, 24% - 28% 23% debt write-off & restructuring non- GAAP charges) Restructuring Costs <$5 $21 NOTES: 2019 D&A estimate of ~$60-65 million, interest expense of $50-55 million and non-controlling interest estimate of $7 million (B) - The fiscal first quarter ended December 31, 2017 amounts have been recast to reflect the retrospective application of the company’s change in classification of the non-service components of net periodic pension cost. ➢ Semiconductor Demand Growth Indicators Weakening . Global MSI (FY) forecast in the range of 2% - 4% . Wafer Fab Equipment (FY) forecast in the range of (15)% - (18)% A reconciliation of net income to Adjusted EBITDA as forecasted for 2018 is not provided. 16 See Appendix for more information. Versum Materials Confidential

SUMMARY 17

VERSUM MATERIALS BEST IN CLASS SEMICONDUCTOR MATERIALS COMPANY Solid growth High margins Low capital intensity Strong cash flow 18 Versum Materials Confidential

APPENDICES 19

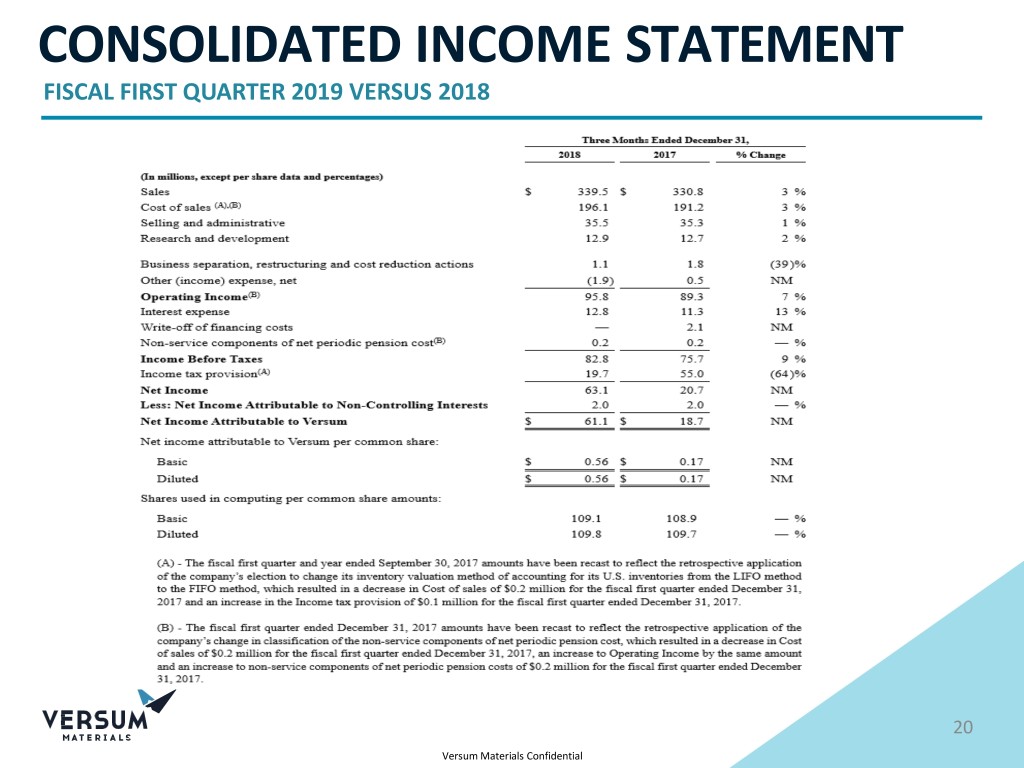

CONSOLIDATED INCOME STATEMENT FISCAL FIRST QUARTER 2019 VERSUS 2018 20 Versum Materials Confidential

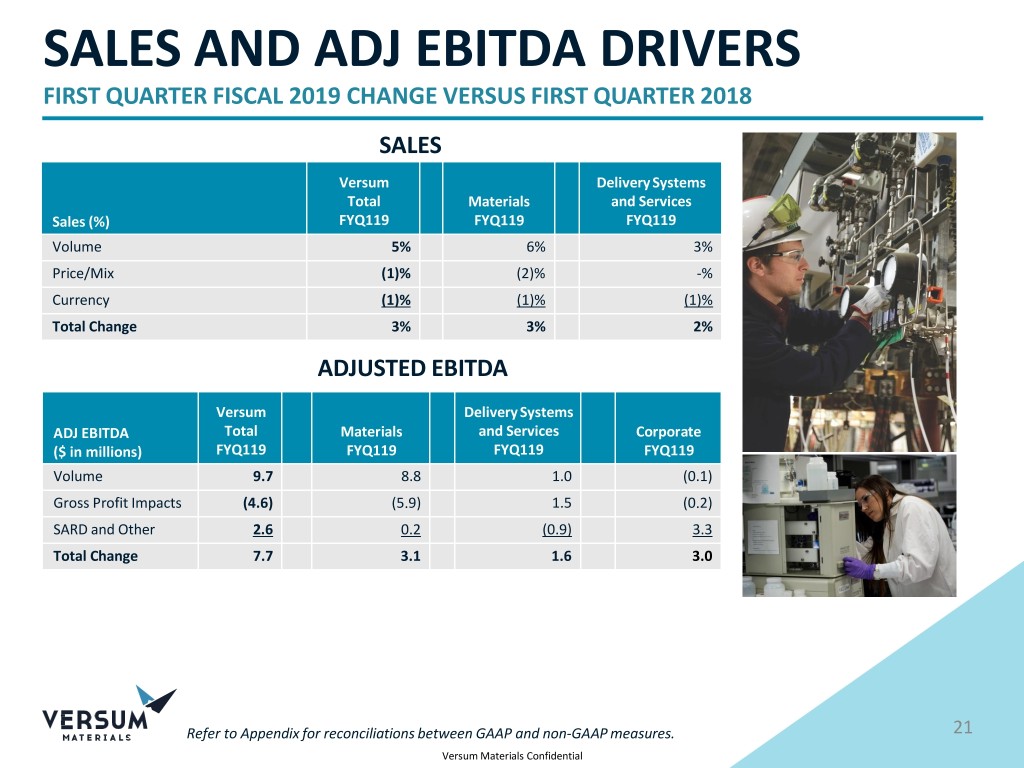

SALES AND ADJ EBITDA DRIVERS FIRST QUARTER FISCAL 2019 CHANGE VERSUS FIRST QUARTER 2018 SALES Versum Delivery Systems Total Materials and Services Sales (%) FYQ119 FYQ119 FYQ119 Volume 5% 6% 3% Price/Mix (1)% (2)% -% Currency (1)% (1)% (1)% Total Change 3% 3% 2% ADJUSTED EBITDA Versum Delivery Systems ADJ EBITDA Total Materials and Services Corporate ($ in millions) FYQ119 FYQ119 FYQ119 FYQ119 Volume 9.7 8.8 1.0 (0.1) Gross Profit Impacts (4.6) (5.9) 1.5 (0.2) SARD and Other 2.6 0.2 (0.9) 3.3 Total Change 7.7 3.1 1.6 3.0 Refer to Appendix for reconciliations between GAAP and non-GAAP measures. 21 Versum Materials Confidential

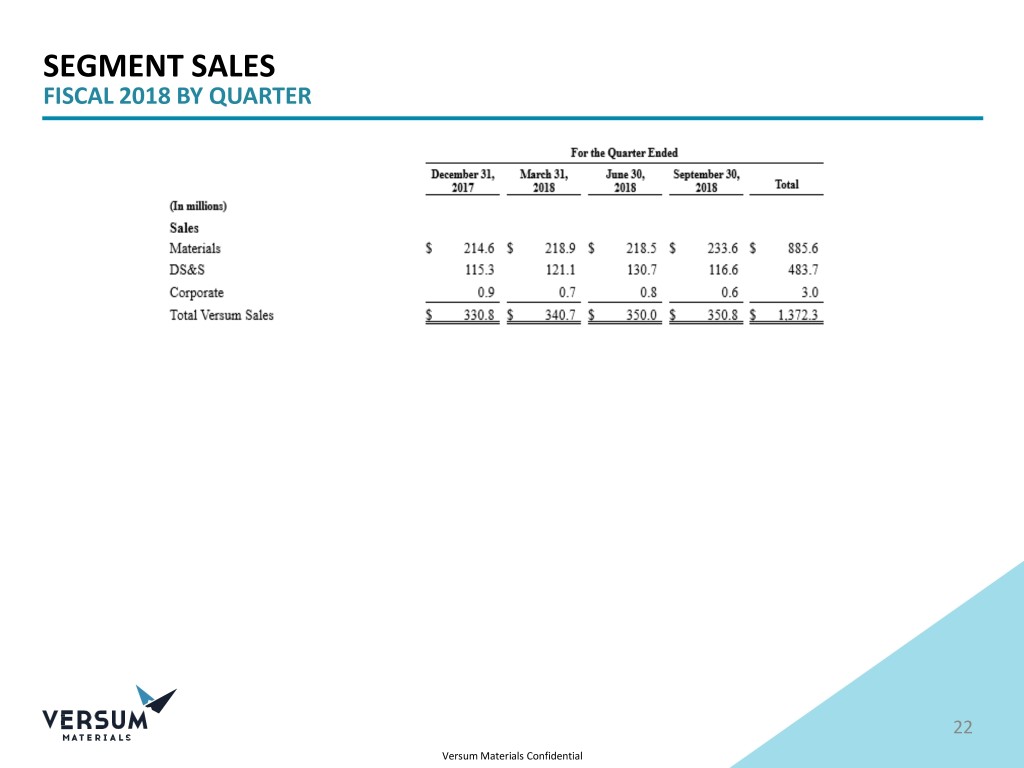

SEGMENT SALES FISCAL 2018 BY QUARTER 22 Versum Materials Confidential

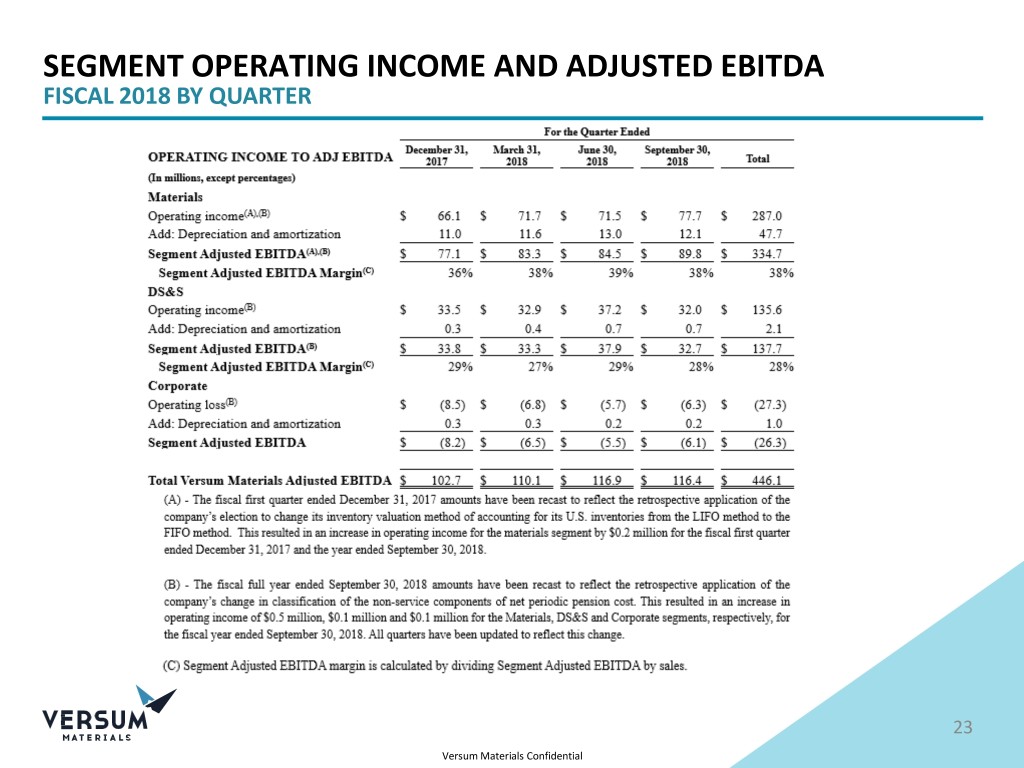

SEGMENT OPERATING INCOME AND ADJUSTED EBITDA FISCAL 2018 BY QUARTER 23 Versum Materials Confidential

Net Income Margin, Adjusted RECONCILIATIONS Non-GAAP Financial Measures This presentation and the accompanying earnings press release include “non-GAAP financial measures,” including Adjusted Net Income, Adjusted Net Income Margin, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, Segment Adjusted EBITDA, Adjusted EBITDA margin, Segment Adjusted EBITDA margin, adjusted tax rate and free cash flow. Adjusted Net Income is net income excluding certain disclosed items which we do not believe to be indicative of underlying business trends, including business separation, restructuring and cost reduction actions, net of tax, the write-off of financing costs, net of tax, and the impact of the Tax Act. Adjusted Diluted Earnings Per Share uses Adjusted Net Income but otherwise uses the same calculation used in arriving at diluted earnings per share, the most directly comparable GAAP financial measure. Adjusted EBITDA is net income excluding certain disclosed items which we do not believe to be indicative of underlying business trends, including interest expense, the write-off of financing costs, non-service components of net periodic pension cost, income tax provision, depreciation and amortization expense, non-controlling interests, and business separation, restructuring and cost reduction actions. Segment Adjusted EBITDA is segment operating income excluding segment depreciation and amortization expense. Adjusted Net Income Margin, Adjusted EBITDA margin and Segment Adjusted EBITDA margin are calculated by dividing Adjusted Net Income, Adjusted EBITDA and Segment Adjusted EBITDA, respectively, by sales. Adjusted tax rate is defined as GAAP Effective Tax Rate excluding the impacts of the write-off of financing costs, the Tax Act and expenses related to business separation, restructuring and cost reduction actions. Free cash flow is defined as cash from operations less capital expenditures. Versum Materials has provided in this Appendix reconciliations of net income to Adjusted EBITDA, net income to Adjusted Net Income, Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share and segment operating income (loss) to Segment Adjusted EBITDA, in each case the most directly comparable GAAP financial measure. Reconciliations of cash flow from operations to free cash flow are included elsewhere in this presentation. We encourage investors to read these reconciliations. A reconciliation of net income to Adjusted EBITDA as forecasted for 2019 is not provided. Versum Materials does not forecast net income as it cannot, without unreasonable effort, estimate or predict with certainty various components of net income. These components include further restructuring and other income or charges to be incurred in 2019 as well as the related tax impacts of these items. Additionally, discrete tax items could drive variability in our forecasted effective tax rate. All of these components could significantly impact net income. Further, in the future, other items with similar characteristics to those currently included in Adjusted EBITDA that have a similar impact on comparability of periods, and which are not known at this time, may exist and impact Adjusted EBITDA. 24 Versum Materials Confidential

RECONCILIATIONS Non-GAAP Financial Measures (continued) The presentation of these non-GAAP financial measures is intended to enhance the usefulness of financial information by providing measures which management uses internally to evaluate our operating performance. We use non-GAAP measures to assess our operating performance by excluding certain disclosed items that we believe are not representative of our underlying business. Management may use these non-GAAP measures to evaluate our performance period over period and relative to competitors in our industry, to analyze underlying trends in our business and to establish operational budgets and forecasts or for incentive compensation purposes. We use Adjusted EBITDA to calculate performance- based cash bonuses. We use Segment Adjusted EBITDA as the primary measure to evaluate the ongoing performance of our business segments. Management believes that free cash flow is meaningful to investors because it is an indication of the strength of the company and its ability to generate cash, however it does not represent the total increase or decrease in cash during the period. Free cash flow is not intended to be an alternative to cash flows from operating activities as a measure of liquidity. We believe non-GAAP financial measures provide securities analysts, investors and other interested parties with meaningful information to understand our underlying operating results and to analyze financial and business trends; enables better comparison to peer companies; and allows us to provide a long-term strategic view of the business going forward. These non-GAAP financial measures should not be viewed in isolation, are not a substitute for GAAP measures, and have limitations which include but are not limited to the following: (a) Adjusted Net Income and Adjusted EBITDA exclude expenses related to business separation, restructuring and cost reduction actions and the write-off of financing costs, each of which we do not consider to be representative of our underlying business operations, however, these disclosed items represent costs to Versum Materials; (b) Adjusted EBITDA is not intended to be a measure of cash available for management’s discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements; (c) though not business operating costs, interest expense and income tax provision represent ongoing costs of Versum Materials; (d) depreciation and amortization charges represent the wear and tear or reduction in value of the plant, equipment, and intangible assets which permit us to manufacture and market our products; and (e) other companies may define non-GAAP measures differently than we do, limiting their usefulness as comparative measures. A reader may find any one or all of these items important in evaluating our performance. Management compensates for the limitations of using non-GAAP financial measures by using them only to supplement our GAAP results to provide a more complete understanding of the factors and trends affecting our business. In evaluating these non-GAAP financial measures, the reader should be aware that we may incur expenses similar to those eliminated in this presentation in thefuture. 25 Versum Materials Confidential

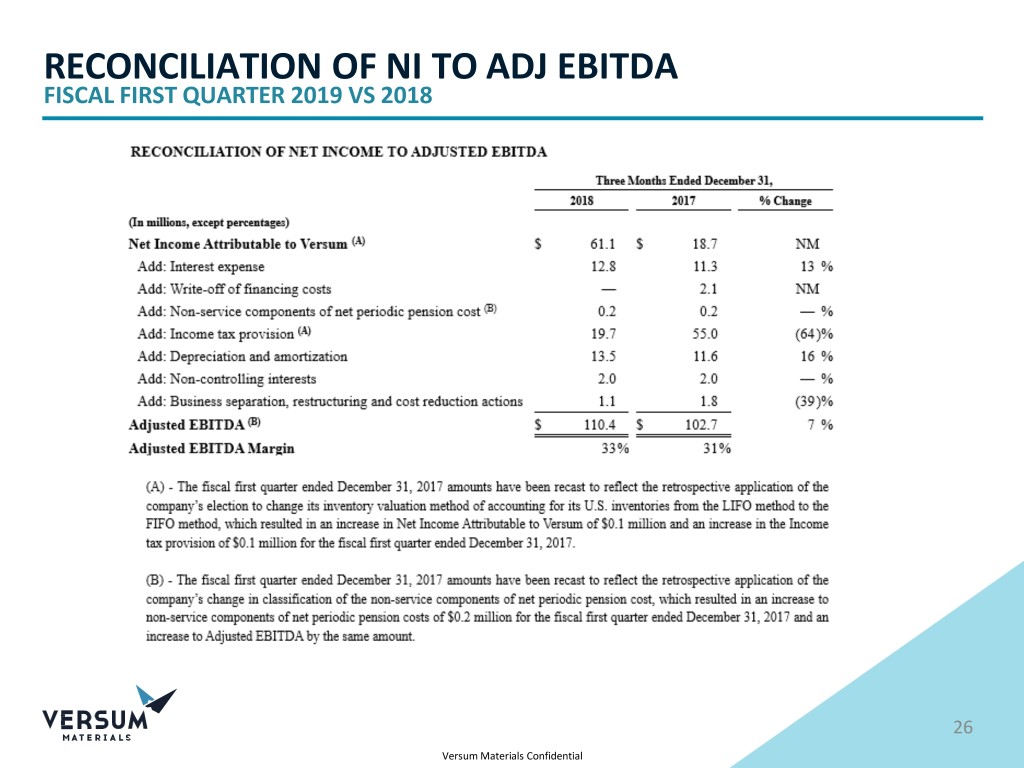

RECONCILIATION OF NI TO ADJ EBITDA FISCAL FIRST QUARTER 2019 VS 2018 26 Versum Materials Confidential

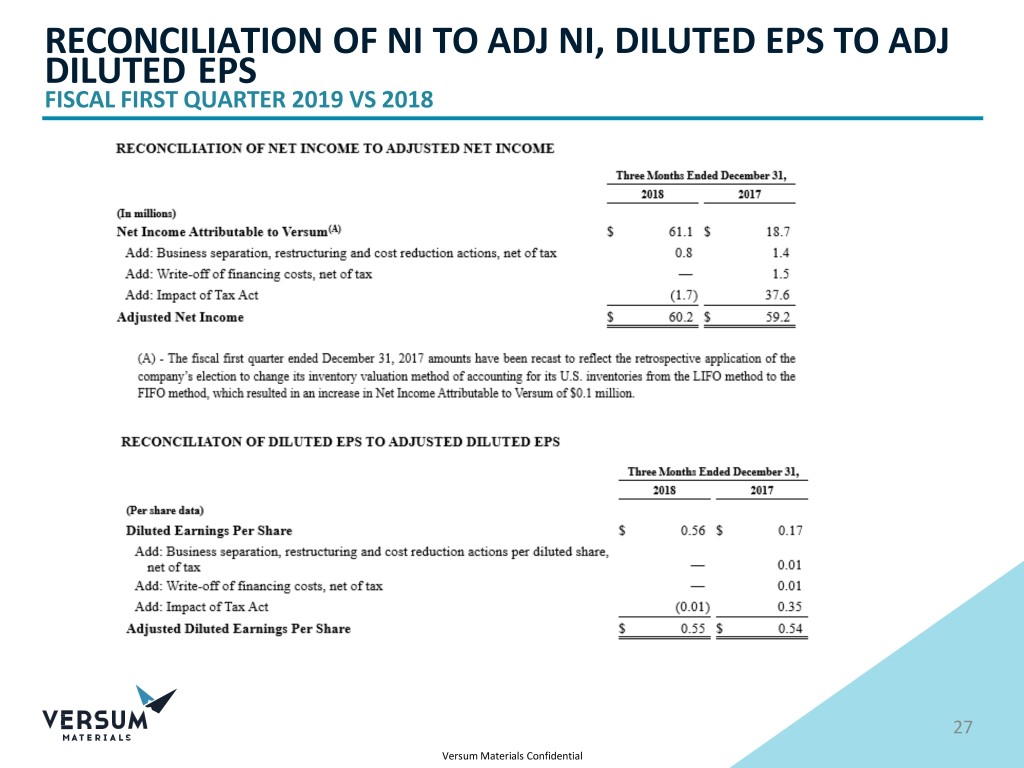

RECONCILIATION OF NI TO ADJ NI, DILUTED EPS TO ADJ DILUTED EPS FISCAL FIRST QUARTER 2019 VS 2018 27 Versum Materials Confidential

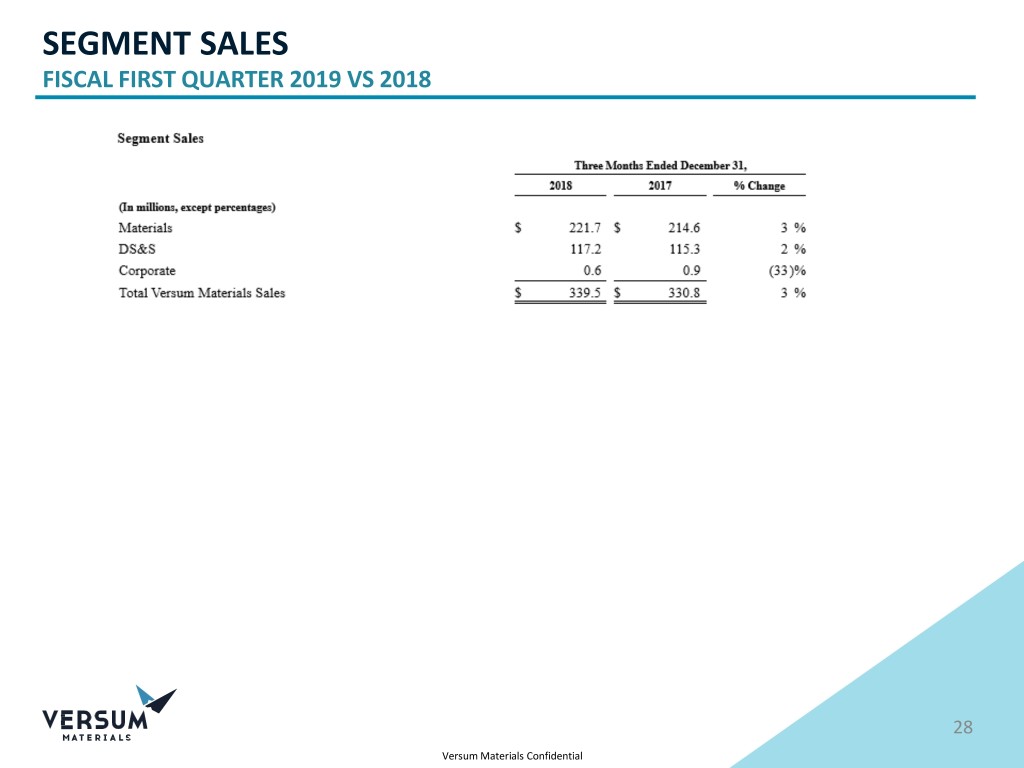

SEGMENT SALES FISCAL FIRST QUARTER 2019 VS 2018 28 Versum Materials Confidential

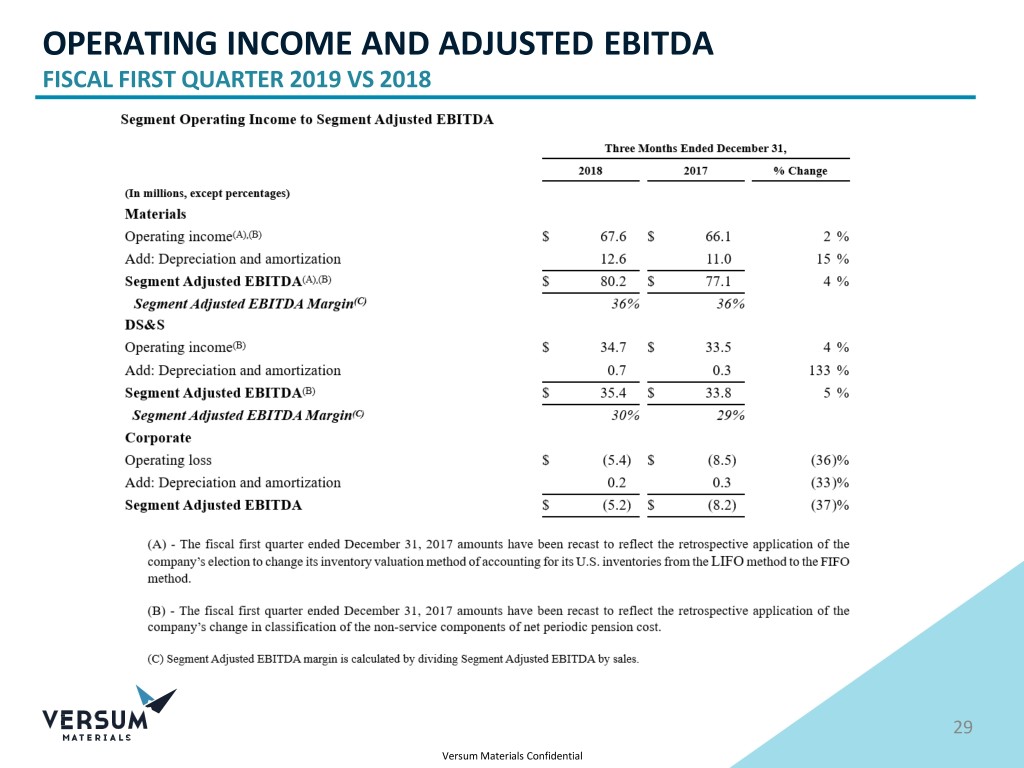

OPERATING INCOME AND ADJUSTED EBITDA FISCAL FIRST QUARTER 2019 VS 2018 29 Versum Materials Confidential