UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

|

| |

| Filed by the Registrant |

| |

| Filed by a Party other than the Registrant |

| |

| Check the appropriate box: |

| | |

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

| | |

| ☒ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material under §240.14a‑12 |

|

| | |

| Triton International Limited |

| (Name of Registrant as Specified In Its Charter) |

| None |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| | Fee paid previously with preliminary materials. |

| | |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | |

| | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

TRITON INTERNATIONAL LIMITED

22 VICTORIA STREET

HAMILTON HM12, BERMUDA

April 10, 2017

Dear Shareholders,

You are cordially invited to join us for our Annual General Meeting of Shareholders (the “Annual Meeting”) to be held this year on May 10, 2017, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601 USA.

The Notice of Annual General Meeting of Shareholders and the Proxy Statement that follow describe the business to be conducted at the meeting. You will be asked to: (i) elect nine directors to the Board of Directors; (ii) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; (iii) approve on an advisory basis the compensation of our named executive officers; (iv) indicate the preferred frequency (every year, every two years or every three years) of the advisory vote on the compensation of our named executive officers; and (v) act on any other matters as may properly come before the shareholders at the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary.

Whether or not you intend to be present at the Annual Meeting, it is important that your shares be represented. Voting instructions are provided in the accompanying proxy card and Proxy Statement. Please vote via the Internet, by telephone, or by completing, signing, dating and returning your proxy card.

|

| |

| | Sincerely, |

| | |

| | Brian M. Sondey |

| | Chairman and Chief Executive Officer |

TRITON INTERNATIONAL LIMITED

22 Victoria Street

Hamilton HM12, Bermuda

______________________

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on May 10, 2017

______________________

To Our Shareholders:

The Board of Directors of Triton International Limited hereby gives notice that the Annual General Meeting of Shareholders (the “Annual Meeting”) of Triton International Limited will be held on May 10, 2017, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601 USA. The purpose of the Annual Meeting is to:

| |

| 1. | elect nine directors identified in the accompanying Proxy Statement to the Board of Directors to serve until the 2018 Annual General Meeting of Shareholders or until their respective successors are elected and qualified; |

| |

| 2. | ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; |

3.hold an advisory vote on the compensation of our named executive officers;

| |

| 4. | hold an advisory vote on the frequency of holding the advisory vote on the compensation of our named executive officers; and |

| |

| 5. | act on any other matters as may properly come before the shareholders at the Annual Meeting, including any motion to adjourn to a later date to permit further solicitation of proxies, if necessary. |

We will also present before the Annual Meeting our audited financial statements for the fiscal year ended December 31, 2016 pursuant to the provisions of the Companies Act 1981 of Bermuda, as amended (the “Companies Act”), and the Bye-Laws of Triton International Limited. These audited financial statements may be found in our Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Annual Report”). There is no requirement under Bermuda law that these financial statements be approved by shareholders, and no such approval will be sought at the Annual Meeting.

The Board of Directors has fixed the close of business on March 31, 2017 as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

You are cordially invited to attend the Annual Meeting in person. If you attend the Annual Meeting, you may vote in person if you wish, even though you may have previously voted your proxy. Triton International Limited’s Proxy Statement accompanies this notice.

April 10, 2017

|

| |

| | By Order of the Board of Directors, |

| | Marc Pearlin |

| | Secretary |

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, PLEASE PROMPTLY VOTE VIA THE INTERNET, BY TELEPHONE, OR COMPLETE, DATE, AND SIGN THE ENCLOSED PROXY CARD FOR THE ANNUAL MEETING AND RETURN IT AS INSTRUCTED ON THE PROXY CARD. THIS WILL ENSURE REPRESENTATION OF YOUR SHARES AT THE MEETING.

Internet Availability of Proxy Materials

The Proxy Statement and the 2016 Annual Report are available on www.proxyvote.com.

TRITON INTERNATIONAL LIMITED

22 Victoria Street

Hamilton HM12, Bermuda

______________________

PROXY STATEMENT

FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS

to be held on May 10, 2017

______________________

INFORMATION ABOUT VOTING

General

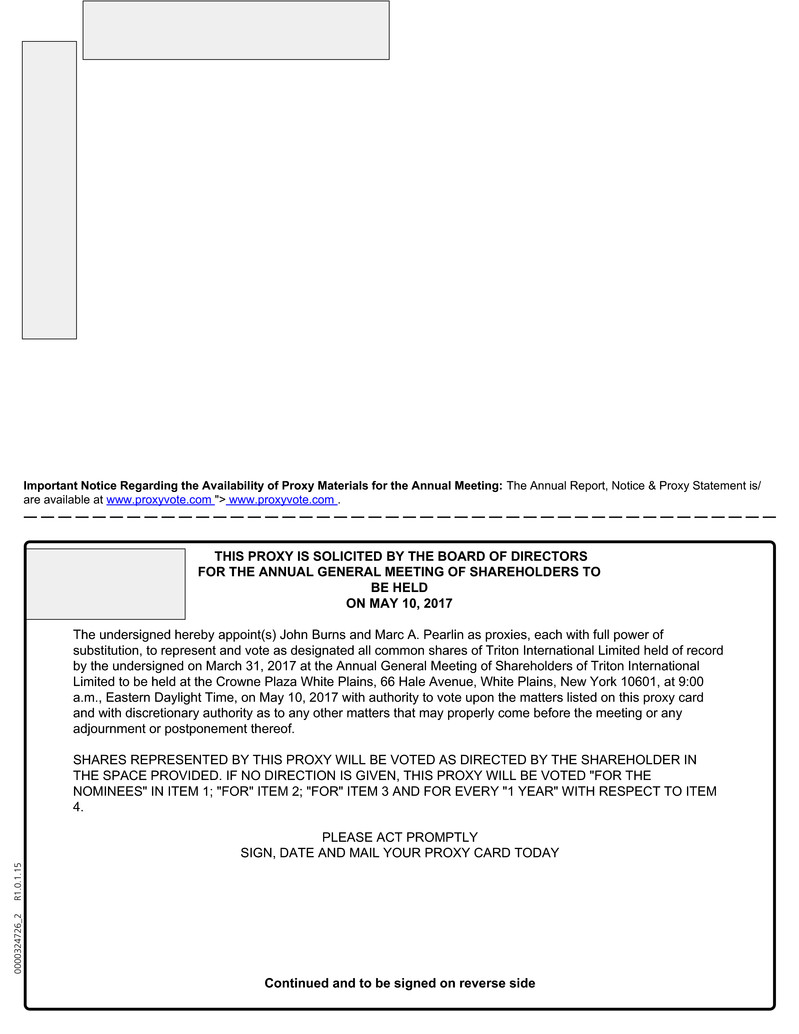

This Proxy Statement and the accompanying Notice of Annual General Meeting of Shareholders are being furnished in connection with the solicitation by the Board of Directors of Triton International Limited (“Triton,” the “Company,” “us,” “our” or “we”) of proxies for use at the Annual General Meeting of Shareholders (the “Annual Meeting”) to be held on May 10, 2017, at 9:00 a.m., Eastern Daylight Time, at the Crowne Plaza White Plains, 66 Hale Avenue, White Plains, New York 10601, and at any adjournment or postponement thereof, for the purposes set forth in the preceding Notice of Annual General Meeting of Shareholders. This Proxy Statement and the proxy card for the Annual Meeting are first being made available or distributed to shareholders of record on or about April 10, 2017.

The cost of soliciting proxies will be borne by Triton, and will consist primarily of preparing and distributing this Proxy Statement and the proxy card. Copies of the proxy materials may be furnished to brokers, custodians, nominees and other fiduciaries for forwarding to beneficial owners of Triton’s common shares, par value $0.01 per share (the “Common Shares”).

Who can vote?

Only holders of record as of the close of business March 31, 2017 (the “Record Date”) of the Common Shares are entitled to vote at the Annual Meeting. On the Record Date, there were 74,497,727 Common Shares outstanding.

What proposals will be voted on at the Annual Meeting?

Shareholders will vote on the following proposals at the Annual Meeting:

| |

| • | the election of nine directors identified in this Proxy Statement to serve on our Board of Directors (Proposal 1); |

| |

| • | the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017 (Proposal 2); |

| |

| • | an advisory vote on the compensation of our named executive officers as described in this Proxy Statement (Proposal 3); |

| |

| • | an advisory vote on the preferred frequency (every year, every two years or every three years) of the compensation of our named executive officers (Proposal 4); and |

| |

| • | such other business as may properly be brought before the 2017 Annual Meeting (including any adjournment or postponement(s) thereof). |

In addition, in accordance with Section 84 of the Companies Act and Section 39 of our Bye-Laws, our audited financial statements for the fiscal year ended December 31, 2016 will be presented at the Annual General Meeting. These audited financial statements are included in our Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Annual Report”). There is no requirement under Bermuda law that these financial statements be approved by shareholders, and no such approval will be sought at the Annual Meeting.

How does our Board of Directors recommend that I vote on the proposals?

| |

| 1. | “FOR” the election of nine directors identified in this Proxy Statement to serve on our Board of Directors until the 2018 Annual Meeting of Shareholders or until their respective successors are elected and qualified; |

| |

| 2. | “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017; |

| |

| 3. | “FOR” the approval of the compensation of our named executive officers as described in this Proxy Statement; and |

| |

| 4. | “FOR” the approval that the Company hold an advisory vote on executive compensation “EVERY YEAR”. |

If any other matters properly come before the Annual Meeting or any adjournment or postponement thereof, the persons named in the proxy card will vote the shares represented by all properly executed proxies in their discretion.

How many votes can I cast?

You will be entitled to one vote per Common Share owned by you on the Record Date.

How do I vote by proxy?

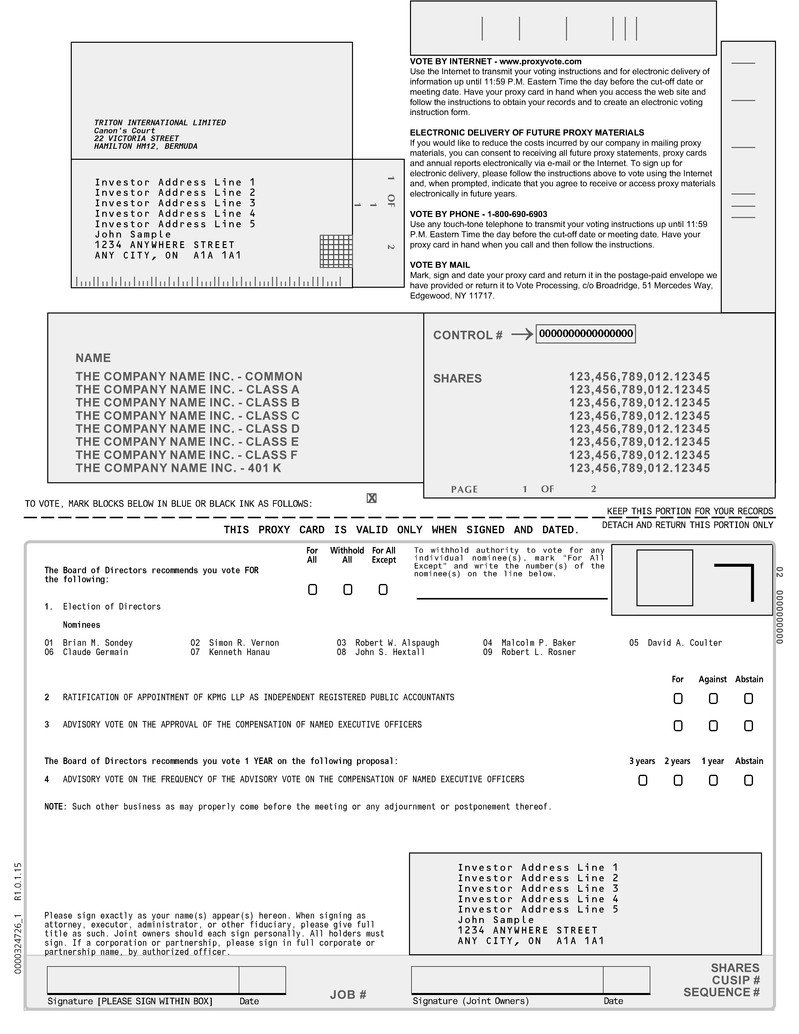

Vote by Internet

The proxy card or voting instruction card contains instructions on how to view our proxy materials on the Internet, vote your shares on the Internet, and request electronic delivery of future proxy materials. An electronic copy of this Proxy Statement and the 2016 Annual Report are available at www.proxyvote.com. You may use the Internet to transmit your voting instructions until 11:59 p.m., Eastern Time, on May 9, 2017. You should have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Shareholders may request receipt of future proxy materials by email, which will save us the cost of printing and mailing documents to those shareholders. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Vote by Telephone 1-800-690-6903

Call 1-800-690-6903 from any touch-tone telephone and follow the instructions. Have your proxy card available when you call and use the Company Number and Account Number shown on your proxy card. The submission of your proxy by telephone is available 24 hours a day. To be valid, a submission by telephone must be received by 11:59 p.m., Eastern Time, on May 9, 2017.

Vote by Mail

Follow the instructions on the enclosed proxy card for the Annual Meeting to vote on the proposals to be considered at the Annual Meeting. Sign and date the proxy card and return it as instructed on the proxy card.

The proxy holders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on the proposals, the proxy holders will vote for you on the proposals.

Unless you instruct otherwise, the proxy holders will vote “FOR” the nominees proposed by our Board of Directors, “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017, “FOR” the approval of the compensation of our named executive officers as described in this Proxy Statement, and that the Company hold an advisory vote on executive compensation “EVERY YEAR”. If any other matters properly come before the Annual Meeting or any adjournment or postponement thereof, the persons named in the proxy card will vote the Common Shares represented by all properly executed proxies in their discretion.

What if other matters come up at the Annual Meeting?

The matters described in this Proxy Statement are the only matters we know will be voted on at the Annual Meeting. If other matters are properly presented at the Annual Meeting or any adjournment or postponement thereof, the proxy holders will vote your shares as they see fit at their discretion.

What can I do if I change my mind after I vote my shares?

At any time before the vote at the Annual Meeting, you can revoke your proxy either by (i) giving our Secretary a written notice revoking your proxy, (ii) voting again on a later date on the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), (iii) signing, dating and returning to our Secretary a new proxy card bearing a later date or (iv) attending the Annual Meeting and voting in person. Your presence at the Annual Meeting will not revoke your proxy unless you vote in person. All written notices or new proxies should be sent to our Secretary, c/o Estera Services (Bermuda) Limited at 22 Victoria Street, Hamilton HM12 Bermuda.

Can I vote in person at the Annual Meeting rather than by completing the proxy card?

Although we encourage you to vote via the Internet, by telephone, or by completing and returning the proxy card to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares in person.

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

What are broker non-votes?

Broker non-votes are shares held in street name by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote those shares as to a particular matter. Under the rules of the New York Stock Exchange, your broker or nominee does not have discretion to vote your shares on non-routine matters such as Proposal 1 (election of directors), Proposal 3 (advisory vote on the compensation of named executive officers) and Proposal 4 (advisory vote on the frequency of the advisory vote on the compensation of our named executive officers). However, your broker or nominee does have discretion to vote your shares on routine matters such as Proposal 2 (ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017). Broker non-votes are not counted for purposes of determining whether a proposal has been approved.

What is a quorum?

We will hold the Annual Meeting if a quorum is present. A quorum will be present if the holders of a majority of the Common Shares entitled to vote on the Record Date are present in person or by proxy at the Annual Meeting. Without a quorum, we cannot hold the meeting or transact business. If you vote via the Internet, by telephone, or sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on the proposals listed on the proxy card. Abstentions and broker non-votes will also be counted as present for purposes of determining if a quorum exists.

What vote is necessary for action?

Passage of Proposal 1 (election of directors) requires, for each director, the affirmative vote of the holders of a majority of the Common Shares present in person or by proxy at the Annual Meeting and entitled to vote. You will not be able to cumulate your votes in the election of directors. Approval of Proposal 2 (ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2017) will require the affirmative vote of the holders of a majority of the Common Shares present in person or by proxy at the Annual Meeting and entitled to vote. Approval of Proposal 3 (advisory vote on the compensation of named executive officers) will require the affirmative vote of the holders of a majority of the Common Shares present in person or by proxy at the Annual Meeting and entitled to vote, although such vote will not be binding on us. With respect to Proposal 4 (advisory vote on the frequency of the advisory vote on the compensation of named executive officers), the prevailing alternative will be the one that receives the highest number of votes cast by holders of our Common Shares present in person or by proxy at the Annual Meeting and entitled to vote, although such vote will not be binding upon us. Abstentions and broker non-votes will be counted for purposes of determining whether a quorum is present; however, in tabulating the voting results for any particular proposal abstentions have the same effect as

votes against the matter, except in the case of the non-binding advisory vote on the frequency of the advisory vote on the compensation of our named executive officers, where an abstention will have no effect.

Who pays for the proxy solicitation?

We will bear the expense of soliciting proxies for the Annual Meeting, including the costs of distributing proxy materials to our shareholders. In addition to solicitation by mail, directors, officers and other employees also may solicit proxies personally, by telephone or through electronic communications, but will not receive specific compensation for doing so. We may reimburse brokerage firms and others holding shares in their names or in names of nominees for their reasonable out-of-pocket expenses in sending proxy materials to beneficial owners.

PRESENTATION OF FINANCIAL STATEMENTS

In accordance with Section 84 of the Companies Act and Section 39 of the Bye-Laws, our audited financial statements for the fiscal year ended December 31, 2016 will be presented at the Annual Meeting. These financial statements are included in our 2016 Annual Report. There is no requirement under Bermuda law that these financial statements be approved by shareholders, and no such approval will be sought at the meeting.

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, the shareholders will elect nine directors to serve until the 2018 Annual Meeting of shareholders or until their respective successors are elected and qualified. In the absence of instructions to the contrary, a properly signed and dated proxy will vote the shares represented by that proxy “FOR” the election of the nine nominees named below.

Assuming a quorum is present, each nominee will be elected as a director of Triton if such nominee receives the affirmative vote of the holders of a majority of the Common Shares present in person or by proxy at the Annual Meeting and entitled to vote. All nominees are currently incumbent directors. Shareholders are not entitled to cumulate votes in the election of directors. All nominees have consented to serve as directors, if elected. If any nominee is unable or unwilling to serve as a director at the time of the Annual Meeting, the persons who are designated as proxies intend to vote, in their discretion, for such other persons, if any, as may be designated by our Board of Directors. As of the date of this Proxy Statement, our Board of Directors has no reason to believe that any of the persons named below will be unable or unwilling to serve as a nominee or as a director if elected. The names of the nominees, their ages as of December 31, 2016, and certain other information about them are set forth below:

|

| | | | | | |

| Name | | Age | | Position | | Director Since |

| Brian M. Sondey | | 49 | | Chairman, Chief Executive Officer and Director | | July 2016 |

| Simon R. Vernon | | 58 | | President and Director | | July 2016 |

| Robert W. Alspaugh (1) | | 69 | | Director | | July 2016 |

| Malcolm P. Baker (1) | | 47 | | Director | | July 2016 |

| David A. Coulter (2)(3) | | 69 | | Director | | October 2015 |

| Claude Germain (2)(3) | | 49 | | Director | | July 2016 |

| Kenneth Hanau (1) | | 51 | | Director | | July 2016 |

| John S. Hextall (2) | | 60 | | Director | | July 2016 |

| Robert L. Rosner (3) | | 57 | | Lead Director | | October 2015 |

(1) Member of the Audit Committee

(2) Member of the Compensation Committee

(3) Member of the Nominating and Corporate Governance

Brian M. Sondey is our Chairman and Chief Executive Officer, and has served as a director of the Company since July 2016. Upon the closing of the combination of Triton Container International Limited (“TCIL”) and TAL International Group, Inc. (“TAL”) in July 2016, Mr. Sondey, who had served as the Chairman, President and Chief Executive Officer of TAL since 2004, became the Chairman and Chief Executive Officer of Triton. Mr. Sondey joined TAL’s former parent, Transamerica Corporation, in April 1996 as Director of Corporate Development. He then joined TAL International Container Corporation in November 1998 as Senior Vice President of Business Development. In September 1999, Mr. Sondey became President of TAL International Container Corporation. Prior to his work with Transamerica Corporation and TAL International Container Corporation, Mr. Sondey worked as a Management Consultant at the Boston Consulting Group and as a Mergers & Acquisitions Associate at J.P. Morgan. Mr. Sondey holds an MBA from The Stanford Graduate School of Business and a BA degree in Economics from Amherst College.

As a result of these professional and other experiences, we believe Mr. Sondey possesses particular knowledge and experience in a variety of areas including corporate finance, intermodal equipment leasing, logistics, marketing, people management and strategic planning and strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Simon R. Vernon is our President, and has served as a director of the Company since July 2016. Upon the closing of the combination of TCIL and TAL in July 2016, Mr. Vernon, who had served as the President and Chief Executive Officer of TCIL since 2003, became the President of Triton. Before being named President and Chief Executive Officer of TCIL, Mr. Vernon served as Executive Vice President of TCIL beginning in 1999, Senior Vice President beginning in 1996 and Vice President of Global Marketing beginning in 1994. Mr. Vernon also served as Director of Marketing of TCIL beginning in 1986, responsible for Southeast Asia and China and, beginning in 1991, for all of the Pacific basin. He was named Vice President, Marketing, responsible for the Pacific basin, in 1993. Prior to joining TCIL, Mr. Vernon served as chartering manager at Jardine Shipping Limited from 1984 to 1985, as a manager in the owner’s brokering department at Yamamizu Shipping Company Limited from

1982 to 1984 and as a ship broker with Matheson Charting Limited from 1980 to 1982. He holds a B.A. from Exeter University in England.

As a result of these professional and other experiences, we believe Mr. Vernon possesses particular knowledge and experience in a variety of areas including corporate finance, container leasing, logistics, marketing, people management and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Robert W. Alspaugh has served as a director of the Company since July 2016 and is the Chair of the Audit Committee. Mr. Alspaugh also has served as a director of TCIL since 2012. Mr. Alspaugh had a 36-year career with KPMG LLP, including serving as the senior partner for a diverse array of companies across a broad range of industries. Mr. Alspaugh has worked with global companies both in Europe and Japan, as well as with those headquartered in the United States. Between 2002 and 2006, when Mr. Alspaugh served as Chief Executive Officer of KPMG International, he was responsible for implementing the strategy of KPMG International, which includes member firms in nearly 150 countries with more than 100,000 employees. Prior to this position, he served as Deputy Chairman and Chief Operating Officer of KPMG’s U.S. Practice from 1998 to 2002. Mr. Alspaugh currently serves on the boards of directors of Autoliv, Inc. (where he is the Chairman of the Audit Committee and a member of the Compliance Committee), Ball Corporation (where he is the Chairman of the Audit Committee and a member of the Finance Committee) and Verifone Systems, Inc. (where he is the Chairman of the Audit Committee and a member of the Governance and Nominating Committee). Mr. Alspaugh received his B.B.A. degree in accounting from Baylor University, where he graduated summa cum laude.

As a result of these professional and other experiences, we believe Mr. Alspaugh possesses particular knowledge and experience in a variety of areas including corporate finance, strategy, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Malcolm P. Baker has served as a director of the Company since July 2016. Mr. Baker also has served as a director of TAL since 2006. Mr. Baker is the Robert G. Kirby Professor and the head of the finance unit of the Harvard University Graduate School of Business, the director of the corporate finance program at the National Bureau of Economic Research, and a consultant for Acadian Asset Management. Mr. Baker holds a BA in applied mathematics and economics from Brown University, an M.Phil. in finance from Cambridge University, and a Ph.D. in business economics from Harvard University.

As a result of these professional and other experiences, we believe Mr. Baker possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

David A. Coulter has served as a director of the Company since October 2015. Mr. Coulter served as Vice Chairman, Managing Director and Senior Advisor at Warburg Pincus, focusing on the firm’s financial services practice from 2005 - 2014. Mr. Coulter retired in September 2005 as vice chairman of J.P. Morgan & Chase Co. He previously served as Executive Chairman of its investment bank, asset and wealth management, and private equity business. Mr. Coulter was a member of the firm’s three person Office of the Chairman and also its Executive Committee. Mr. Coulter came to J.P. Morgan Chase via its July 2000 acquisition of The Beacon Group, a small merchant banking operation. Before joining The Beacon Group, Mr. Coulter was the Chairman and Chief Executive Officer of the BankAmerica Corporation and Bank of America NT & SA. His career at Bank of America was from 1976 to 1998 and covered a wide range of banking activities. He served on the board of Aeolus Re, MBIA, Webster Bank, Sterling Financial and the Strayer Corporation. He currently is on the board of Santander Asset Management and Varo Money, Inc. He also serves on the boards of Lincoln Center, Carnegie Mellon University, Asia Society of Northern California and the Foreign Policy Association. He received both his B.S. and his M.S. from Carnegie Mellon University and currently serves as a Trustee for Carnegie Mellon.

As a result of these professional and other experiences, we believe Mr. Coulter possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and economics that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Claude Germain has served as a director of the Company since July 2016 and is the Chair of the Compensation Committee. Mr. Germain also has served as a director of TAL since 2009. Since 2010, Mr. Germain has been a principal in Rouge River Capital, an investment firm focused on acquiring controlling stakes in private midmarket transportation and manufacturing companies. From 2011 to 2013, Mr. Germain was also President and CEO of SMTC Corporation (NSDQ: SMTX), a global manufacturer of electronics based in Markham, Ontario. From 2005 to 2010, Mr. Germain was Executive Vice President and Chief Operating Officer for Schenker of Canada Ltd., an affiliate of DB Schenker, where he was accountable for Schenker’s Canadian business. DB Schenker is one of the largest logistics service providers in the world. Prior

to that, Mr. Germain was the President of a Texas-based third-party logistics firm and a management consultant specializing in distribution for The Boston Consulting Group. In 2002 and 2007, Mr. Germain won Canadian Executive of the Year in Logistics. Mr. Germain holds an MBA from Harvard Business School and a Bachelor of Engineering Physics (Nuclear) from Queen’s University.

As a result of these professional and other experiences, we believe Mr. Germain possesses particular knowledge and experience in a variety of areas including logistics, transportation, distribution, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Kenneth Hanau has been a director of the Company since July 2016. He also has been a member of the Board of Directors of TAL since October 2012. Mr. Hanau is a Managing Director at Bain Capital Private Equity, a unit of Bain Capital, one of the world’s foremost private investment firms with approximately $75 billion in assets under management. He has significant experience in private equity investing, with specialized focus in the industrial and business services sectors, and currently leads Bain Capital Private Equity’s North American industrials team. Prior to joining Bain Capital in 2015, Mr. Hanau was the Managing Partner of 3i’s private equity business in North America. Mr. Hanau played an active role in investments in the industrial and business services sectors, including Mold Masters, a leading supplier of specialty components to the plastic industry, and Hilite, a global manufacturer of automotive solutions. Previously, Mr. Hanau held senior positions with Weiss, Peck & Greer and Halyard Capital. Before that, Mr. Hanau worked in investment banking at Morgan Stanley and at K&H Corrugated Case Corporation, a family-owned packaging business. Mr. Hanau is a certified public accountant and started his career with Coopers & Lybrand. Mr. Hanau received his B.A. with honors from Amherst College and his M.B.A. from Harvard Business School.

As a result of these professional and other experiences, we believe Mr. Hanau possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

John S. Hextall has been a director of the Company since July 2016. Since October 2016, Mr. Hextall has been the Chief Executive Officer of De Well Group based in Bell, California. From 2012 to 2016, Mr. Hextall served as President and CEO of the North American Region of Kuehne + Nagel, Inc., a leading global transportation and logistics provider, based in Jersey City, NJ, responsible for its subsidiaries in Canada, Mexico and the United States. He also served as CEO of Nacora Insurance Brokers Inc. Prior to his role at Kuehne + Nagel, Inc., Mr. Hextall had a wide-ranging career at UTi Worldwide Inc. ("UTi"), a non-asset-based supply chain management company with 310 offices and 230 logistics centers in 59 countries and was a member of the founding management team of UTI (formerly Union-Transport) and served as a Member of the UTi's Management Board from 2005 to 2009. Mr. Hextall held various positions at UTi over the course of 17 years, including Executive Vice President and President of Freight Forwarding from 2008 to 2010, Executive Vice President and Chief Operating Officer from 2007 to 2008 and Executive Vice President and Global Leader of Client Solutions & Delivery from 2006 to 2007. Other roles included leadership in Europe, the UK and Belgium.

Prior to his career with UTi, Mr. Hextall worked at BAX Global (formerly Burlington Air Express), where he served as a UK director. Mr. Hextall previously worked at the Booker Group and was a management graduate with Unilever. Mr. Hextall is also a director of Pacific National Corporation in Australia. Since 1980, Mr. Hextall has been a member of the Chartered Institute of Logistics and Transport, and has served as a Roundtable Member of the Council for Supply Chain Management Professionals and The Conference Board’s Global Council for Supply Chain & Logistics based in Brussels. Mr. Hextall serves as President of the Southern California, Aston University in Americas Foundation. Mr. Hextall received a Bachelor of Science, Combined Honors Degree in Transport Planning & Operations, Urban Planning and Computer Science, at the Faculty of Engineering from Aston University in Birmingham, UK.

As a result of these professional and other experiences, we believe Mr. Hextall possesses particular knowledge and experience in a variety of areas including logistics, transportation, distribution, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

Robert L. Rosner is a Founding Partner and Co-President of Vestar Capital Partners, Inc. Mr. Rosner has served as a director of the Company since July 12, 2016 and is Lead Director and the Chair of the Nominating and Corporate Governance Committee. He previously served as a member of the Triton Container International Limited Board since 2013 and as a member of its Compensation Committee. He has been with Vestar Capital Partners, Inc. since the firm’s formation in 1988. Mr. Rosner also heads Vestar Capital Partners’ Business Services and Industrial Products Groups. In 2000, Mr. Rosner moved to Paris to establish Vestar Capital Partners’ operations in Europe and served as President of Vestar Capital Partners Europe from 2000 - 2011, overseeing the firm’s affiliate offices in Paris, Milan and Munich. Mr. Rosner was previously a member of the Management Buyout Group at The First Boston Corporation. He is a director of Edward Don & Company, Institutional

Shareholder Services Inc., Mobile Technologies Inc, and 21st Century Oncology, Inc. Mr. Rosner previously served as a director of AZ Electronic Materials, Group OGF, Seves S.p.A., Sunrise Medical Inc., and Tervita Corporation. Mr. Rosner is a member of the Graduate Executive Board of The Wharton School of the University of Pennsylvania and the Board of Trustees of The Lawrenceville School. He received a B.A. in Economics from Trinity College and an M.B.A. with distinction from The Wharton School of the University of Pennsylvania.

As a result of these professional and other experiences, we believe Mr. Rosner possesses particular knowledge and experience in a variety of areas including corporate finance, capital markets, and strategic planning that strengthens the Board of Directors’ collective knowledge, capabilities, and experience.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES LISTED ABOVE TO THE BOARD OF DIRECTORS.

Corporate Governance and Related Matters

We are required to have a majority of independent directors on our Board of Directors and to have our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee be composed entirely of independent directors. The Board of Directors has adopted a formal policy to assist it in determining whether a director is independent in accordance with the applicable rules of the New York Stock Exchange. The Director Independence Standards are available on our corporate website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Director Independence Standards” toward the end of the page. Applying these standards, our Board of Directors has determined that all directors other than Brian Sondey and Simon Vernon qualify as independent, and constitute a majority of our Board of Directors. The Board of Directors has adopted the Corporate Governance Principles and Guidelines which are available on our website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Corporate Governance Principles and Guidelines” toward the end of the page.

Board Leadership and Diversity

The Board of Directors is currently composed of seven independent directors (Messrs. Alspaugh, Baker, Coulter, Germain, Hanau, Rosner and Hextall), our Chairman and Chief Executive Officer (Mr. Sondey) and our President (Mr. Vernon). We believe that having a combined Chairman and Chief Executive Officer, a lead independent director (Mr. Rosner), and a Board of Directors in which over 75% of its members are independent and committees composed entirely of independent directors currently provides the best board leadership structure for our Company. In particular, we believe that having a single leader for the Company in a combined role is seen by certain customers and business partners as providing a strong, unified leadership that can enhance our ability to do business in certain global markets. This structure, together with our other corporate governance practices, provides effective oversight, expertise and representation of our shareholders’ interests.

Our Company does not currently have a formal policy concerning diversity for our Board of Directors; however, we believe that our Board of Directors is diverse in its members’ experience. We have Board members with corporate finance experience, accounting and reporting experience, various industry experience, as well as experience serving on boards of directors of publicly and privately held companies. Diversity is an issue that we pay attention to and as opportunities arise, we will seek to increase the diversity of our Board of Directors.

Compensation of Directors

The goal of our director compensation program is to attract, motivate and retain directors capable of making significant contributions to the long term success of our Company and our shareholders. The Compensation Committee is responsible for reviewing the compensation paid to our non-executive directors.

Mercer Consulting (“Mercer”) was engaged to assist in establishing compensation for directors for Triton. As part of this process, Mercer reviewed the compensation of companies with a market capitalization similar to Triton.

Effective from the date of the combination of TCIL and TAL, each of our non-executive directors receives an annual cash retainer for serving on the Board of Directors, an additional cash retainer for serving on one or more Committees, and an additional cash retainer if they serve as the Chair of a Committee. Mr. Rosner receives an additional cash retainer for serving as lead independent director. In addition, our non-executive directors are granted Common Shares annually. All of our directors

are reimbursed for reasonable out-of-pocket expenses incurred in connection with their attendance at Board of Directors and Committee meetings.

Prior to the date of the combination, the non-executive directors of TCIL received annual grants of common shares of TCIL for serving as directors of TCIL. In 2016, Mr. Alspaugh also received a cash bonus for serving as a director of TCIL prior to the date of the combination.

Under the terms of the Triton International Limited 2016 Equity Incentive Plan (the “2016 Equity Incentive Plan”), the maximum number of Common Shares that may be granted in any one fiscal year to any non-executive director, taken together with any cash retainer fees paid to such non-executive director during such fiscal year, may not exceed $500,000 in total value. The Nominating and Corporate Governance Committee believes that these restrictions represent meaningful limits on the total annual compensation payable to our non-executive directors.

The following table sets forth information regarding the compensation earned by our non-executive directors in 2016. For the compensation paid to Messrs. Sondey and Vernon, please see the Summary Compensation Table for 2016.

DIRECTOR COMPENSATION TABLE FOR 2016

|

| | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) (A) | | Common Shares Awards ($) (B) | | All Other Compensation ($) (C) | | Total ($) |

| Robert W. Alspaugh | | 45,000 | | 247,850 | | 43,273 | | 336,123 |

| Malcolm P. Baker | | 37,500 | | 97,849 | | — | | 135,349 |

| David A. Coulter | | 42,500 | | 222,852 | | — | | 265,352 |

| Claude Germain | | 47,500 | | 97,849 | | — | | 145,349 |

| Kenneth Hanau | | 37,500 | | 97,849 | | — | | 135,349 |

| John S. Hextall (D) | | 37,500 | | 97,849 | | — | | 135,349 |

| Robert L. Rosner (E) | | 47,500 | | 97,849 | | — | | 145,349 |

________________________________

| |

| (A) | Effective from the date of the combination of TCIL and TAL, each of our non-executive directors receive a $60,000 annual retainer, a $15,000 annual fee for serving on one Committee, an additional $10,000 annual fee for serving on a second Committee, an additional $10,000 fee for serving as the Chair of a Committee, except that the Chair of the Audit Committee receives an additional $15,000 for serving as Chair, and the lead independent director receives an additional fee of $10,000. The retainer and fees are paid quarterly, and were prorated for 2016. TAL directors received the following fees for serving as directors of TAL for the period from January 1, 2016 through July 12, 2016 prior to the combination of TCIL and TAL: Mr. Baker: $85,217; Mr. Germain: $90,543; and Mr. Hanau: $82,554. |

| |

| (B) | On September 7, 2016, Messrs. Alspaugh, Baker, Coulter, Germain, Hanau and Hextall were each granted 6,725 Common Shares. These Common Shares were granted to these independent directors at a price of $14.55 per share and were fully vested upon grant and had a grant date value of $97,849. For further discussion regarding the assumptions used in valuing these Common Share grants, please refer to Note 8 to the Company’s Form 10-K filed on March 17, 2017. On May 19, 2016, Mr. Alspaugh received a grant of 12,235 restricted common shares of TCIL with a grant date value of $150,001 which vested effective as of July 12, 2016 (the date of the closing of the combination of TCIL and TAL) and were converted at that time into 9,772 Common Shares. On May 19, 2016, Mr. Coulter received a grant of 10,196 restricted common shares of TCIL with a grant date value of $125,003, which vested effective as of July 12, 2016 (the date of the closing of the combination of TCIL and TAL) and were converted at that time into 8,143 Common Shares. |

| |

| (C) | Mr. Alspaugh received a cash bonus of $43,273 for serving as a director of TCIL. |

| |

| (D) | Fees were paid to Steers, Inc. |

| |

| (E) | Fees and share grants were paid to Vestar / Triton Investments III, LLP. |

Risk Management

As a general matter, the Board of Directors has oversight responsibility with respect to risk management for the Company and its subsidiaries. Day-to-day risk management is the responsibility of senior management. The Board of Directors focuses on and discusses with senior management key areas of risk in the Company’s business and corporate functions such as capital expenditures, capital management, corporate debt and customer credit and collection issues at its regular meetings.

Meetings and Committees of our Board of Directors

All directors were appointed to the Board of Directors on July 12, 2016, except for Messrs. Coulter and Rosner, who were appointed in October 2015. During 2016, our Board of Directors held three meetings and took action by unanimous written consent on five occasion. All of the directors attended 100% of the meetings of the Board of Directors and committees of the Board of Directors on which they served except for John Hextall, who missed one meeting of the Board of Directors and one meeting of the Compensation Committee. Mr. Hextall was not previously a director of TCIL or TAL and prior to his appointment to the Board of Directors on July 12, 2016, he had informed the Board that due to a scheduling conflict, he would not be able to attend one of the meetings of the Board of Directors and one of the meetings of the Compensation Committee. Directors are expected to make every effort to attend all meetings of the Board of Directors and the committees on which they serve, and to attend the Annual Meeting of Shareholders.

The Board of Directors has an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Audit Committee. The Audit Committee is comprised of three independent directors: Messrs. Alspaugh (Chair), Baker and Hanau, each of whom also is independent under Rule 10A-3 under the Securities Exchange Act of 1934. The Audit Committee met four times during 2016. Our Board of Directors has determined that Mr. Alspaugh qualifies as an “audit committee financial expert” as such term has been defined by the Securities and Exchange Commission regulations.

The Audit Committee is responsible for (1) selecting the independent auditor and reviewing the fees proposed by the independent auditor for the coming year and approving in advance, all audit, audit-related and tax permissible non-audit services to be performed by the independent auditors, (2) approving the overall scope of the audit, (3) discussing the annual audited financial statements, quarterly financial statements, and Forms 10-K and 10-Q, including matters required to be reviewed under applicable legal, regulatory or New York Stock Exchange requirements, with management and the independent auditor, (4) discussing earnings press releases, guidance provided to analysts and other financial information provided to the public, with management and the independent auditor, as appropriate, (5) discussing our risk assessment and risk management policies, (6) reviewing our internal system of audit, financial and disclosure controls and the results of internal audits, (7) setting hiring policies for employees or former employees of the independent auditors, (8) establishing procedures concerning the treatment of complaints and concerns regarding accounting, internal accounting controls or audit matters, (9) handling such other matters that are specifically delegated to the Audit Committee by our Board of Directors from time to time, (10) reporting regularly to the full Board of Directors and (11) performing the other related responsibilities that are set forth in its formal charter adopted by our Board of Directors.

The Audit Committee acts pursuant to a formal charter, which is available on our corporate website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Audit Committee” in the middle of the page. A written copy of the Audit Committee charter may be obtained free of charge by sending a request in writing to our Secretary, c/o Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda.

Compensation Committee. The Compensation Committee is comprised of three independent directors: Messrs. Coulter, Germain (Chair) and Hextall. The Compensation Committee met three times during 2016, and took action by unanimous consent on one occasion. The Compensation Committee is responsible for (1) reviewing and approving corporate goals and objectives relevant to the compensation of our chief executive officer and annually evaluating the chief executive officer’s performance in light of these goals, (2) reviewing and approving the compensation and incentive opportunities of our executive officers, (3) reviewing and approving employment contracts, severance arrangements, incentive arrangements and other similar arrangements between us and our executive officers, (4) receiving periodic reports on our compensation programs as they affect all employees, (5) evaluating annually the appropriate level of compensation for Board and committee service by non-employee members of the Board, (6) reviewing the Compensation Discussion and Analysis and approving it for inclusion in our Proxy Statement and (7) such other matters that are specifically delegated to the Compensation Committee by our Board of Directors from time to time.

The Compensation Committee acts pursuant to a formal charter, which is available on our corporate website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Compensation Committee” in the middle of the page. A written copy of the Compensation Committee charter may be obtained free of charge by sending a request in writing to our Secretary, c/o Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is comprised of three independent directors: Messrs. Coulter, Germain and Rosner (Chair). The Nominating and Corporate Governance Committee met once during 2016. The Nominating and Corporate Governance Committee’s purpose is to assist our Board of Directors in identifying individuals qualified to become members of our Board of Directors, assess the effectiveness of the Board of Directors and develop our corporate governance principles. The Nominating and Corporate Governance Committee is responsible for (1) identifying and recommending for election individuals who meet the criteria the Board has established for board membership, (2) recommending nominees to be presented at the Annual General Meeting of Shareholders, (3) reviewing the Board’s committee structure and recommending to the Board the composition of each committee, (4) establishing a policy for considering shareholder nominees for election to our Board, (5) developing and recommending a set of corporate governance guidelines and reviewing them on an annual basis (6) developing and recommending an annual self-evaluation process of the Board and its committees and overseeing such self-evaluations and (7) handling such other matters that are specifically delegated to the Nominating and Corporate Governance Committee by our Board of Directors from time to time.

The Nominating and Corporate Governance Committee acts pursuant to a formal charter, which is available on our corporate website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Nominating and Corporate Governance Committee” in the middle of the page. A written copy of the Nominating and Corporate Governance Committee charter may be obtained free of charge by sending a request in writing to our Secretary, c/o Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda.

Executive Sessions

To promote open discussion among the non-executive directors, our non-executive directors, who are all independent, meet occasionally in executive sessions without management participation. For purposes of such executive sessions, our “non-executive” directors are those directors who are not executive officers of Triton. The Board of Directors has designated Mr. Rosner as Lead Independent Director, who presides at such executive sessions.

Interested parties, including shareholders, may communicate directly with our non-executive directors by writing to the non-executive directors in care of Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda. Correspondence received will be forwarded to the appropriate person or persons in accordance with the procedures adopted by the non-executive directors.

Director Nomination Process

The Nominating and Corporate Governance Committee makes recommendations to our Board of Directors regarding the size and composition of our Board of Directors. The Nominating and Corporate Governance Committee reviews annually with our Board of Directors the composition of our Board of Directors as a whole and recommends, if necessary, measures to be taken so that our Board of Directors reflects the appropriate balance of knowledge, experience, skills, expertise and diversity required for our Board of Directors as a whole and contains at least the minimum number of independent directors required by the New York Stock Exchange and other applicable laws and regulations. The Nominating and Corporate Governance Committee is responsible for ensuring that the composition of our Board of Directors accurately reflects the needs of Triton’s business and, in accordance with the foregoing, proposing the addition of members and the necessary resignation of members for purposes of obtaining the appropriate members and skills. In evaluating a director candidate, the Nominating and Corporate Governance Committee considers factors that are in the best interests of Triton and its shareholders, including the knowledge, experience, integrity and judgment of each candidate; the potential contribution of each candidate to the diversity of backgrounds, experience and competencies which our Board of Directors desires to have represented; each candidate’s ability to devote sufficient time and effort to his or her duties as a director; and any other criteria established by our Board of Directors and any core competencies or technical expertise necessary to staff committees.

The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum qualifications set forth above, based on whether or not the candidate was recommended by a shareholder. Shareholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to our Board of Directors may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee, c/o Estera Services (Bermuda) Limited at 22 Victoria Street, Hamilton HM12, Bermuda not before January 10, 2018 and not later than February 9, 2018 for the 2018 Annual General Meeting and otherwise in compliance with our Bye-Laws. Submission must include the full name, age, business address and residence address of the proposed nominee, a description of the proposed nominee’s principal occupation and business experience for at least the previous five years, complete biographical information, a description of the proposed nominee’s qualifications as a director, the class and number of Triton shares that is owned beneficially or of record by the proposed nominee, the name and record address of such nominating shareholder, the class and number of Triton shares that is owned beneficially or of record by such nominating shareholder, a description of all arrangements or understandings between such nominating shareholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such shareholder, a representation that the nominating shareholder intends to appear in person or by proxy at the 2018 Annual General Meeting to nominate the person(s) named in its written notice of recommendation and such other information as required by Regulation 14A under the Exchange Act. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

Pursuant to the shareholders agreements (the “Sponsor Shareholder Agreements”) between the Company and affiliates of Warburg Pincus LLC (and a related entity)(“Warburg Pincus”) and affiliates of Vestar Capital Partners, Inc. (“Vestar)”, and collectively with Warburg Pincus, the “Sponsor Shareholders”), Warburg Pincus is entitled to designate two, and Vestar is entitled to designate one, of the directors of the Company. Warburg Pincus and Vestar also have the right to appoint certain of their directors to the Nominating and Corporate Governance Committee and the Compensation Committee of the Board of Directors. Warburg Pincus and Vestar have the right to nominate replacements for their respective designated directors, except to the extent their designation rights step-down. The nomination of any directors so designated will be subject to the approval of the Nominating and Corporate Governance Committee and of the Board of Directors. All other director replacements will be nominated by the Nominating and Corporate Governance Committee. See “Certain Relationships and Related Transactions - Sponsor Shareholders Agreements.”

Code of Ethics

We have adopted the Triton Code of Ethics which applies to all officers, directors and employees. The Code of Ethics is available on our corporate website at www.trtn.com. From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and then click on “Governance Documents” from the drop down menu. Next, click on “Code of Ethics” in the middle of the page. A written copy of the Code of Ethics may be obtained free of charge by sending a request in writing to our Secretary, c/o Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda.

Additionally, we have adopted the Triton Code of Ethics for Chief Executive and Senior Financial Officers which applies to our Chief Executive Officer, Chief Financial Officer and Controller. The Code of Ethics for Chief Executive and Senior Financial Officers is available on our corporate website at www.trtn.com and may be found on our website as follows: From our main web page, click on “Investors”, then click on “Corporate Governance” at the top of the page and click on “Governance Documents” from the drop down menu. Next, click on “Code of Ethics for Chief Executive and Senior Financial Officers” in the middle of the page. A written copy of the Code of Ethics for Chief Executive and Senior Financial Officers may be obtained free of charge by sending a request in writing to our Secretary, c/o Estera Services (Bermuda) Limited, 22 Victoria Street, Hamilton HM12, Bermuda.

If we make any substantive amendment to, or grant a waiver from, a provision of the Triton Code of Ethics or the Triton Code of Ethics for Chief Executive and Senior Financial Officers that applies to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, we will promptly disclose the nature of the amendment or waiver on our website at www.trtn.com.

Communications with Directors

Shareholders may communicate with our Board of Directors as a group, the non-executive (independent) directors as a group or an individual director directly by submitting a letter in a sealed envelope labeled accordingly. This letter should be placed in a larger envelope and mailed to Triton International Limited, 22 Victoria Street, Hamilton HM12, Bermuda, Attention: Estera Services (Bermuda) Limited.

EXECUTIVE OFFICERS

The following table sets forth certain information regarding our executive officers:

|

| | | | |

| Name | | Age | | Position |

| Brian M. Sondey | | 49 | | Chairman, Chief Executive Officer and Director |

| Simon R. Vernon | | 58 | | President and Director |

| John Burns | | 56 | | Chief Financial Officer |

| John F. O'Callaghan | | 56 | | Executive Vice President, Global Head of Field Marketing and Operations |

| Kevin Valentine | | 51 | | Senior Vice President, Triton Container Sales |

| Marc Pearlin | | 61 | | Senior Vice President, General Counsel and Secretary |

Brian M. Sondey is our Chairman and Chief Executive Officer, and has served as a director of our Company since July 2016. Upon the closing of the combination of TCIL and TAL in July 2016. Mr. Sondey, who had served as the Chairman, President and Chief Executive Officer of TAL since 2004, became the Chairman and Chief Executive Officer of Triton. Mr. Sondey joined TAL’s former parent, Transamerica Corporation, in April 1996 as Director of Corporate Development. He then joined TAL International Container Corporation in November 1998 as Senior Vice President of Business Development. In September 1999, Mr. Sondey became President of TAL International Container Corporation. Prior to his work with Transamerica Corporation and TAL International Container Corporation, Mr. Sondey worked as a Management Consultant at the Boston Consulting Group and as a Mergers & Acquisitions Associate at J.P. Morgan. Mr. Sondey holds an MBA from The Stanford Graduate School of Business and a BA degree in Economics from Amherst College.

Simon R. Vernon is our President, and has served as a director of our Company since July 2016. Upon the closing of the combination of TCIL and TAL in July 2016, Mr. Vernon, who had served as the President and Chief Executive Officer of TCIL since 2003, became the President of Triton. Before being named President and Chief Executive Officer of TCIL, Mr. Vernon served as Executive Vice President of TCIL beginning in 1999, Senior Vice President beginning in 1996 and Vice President of Global Marketing beginning in 1994. Mr. Vernon also served as Director of Marketing of TCIL beginning in 1986, responsible for Southeast Asia and China and, beginning in 1991, for all of the Pacific basin. He was named Vice President, Marketing, responsible for the Pacific basin, in 1993. Prior to joining TCIL, Mr. Vernon served as chartering manager at Jardine Shipping Limited from 1984 to 1985, as a manager in the owner’s brokering department at Yamamizu Shipping Company Limited from 1982 to 1984 and as a ship broker with Matheson Charting Limited from 1980 to 1982. He holds a B.A. from Exeter University in England.

John Burns is our Chief Financial Officer. He is responsible for overseeing our Finance and Accounting, Audit, IT, Legal, Treasury and HR departments. Upon the closing of the combination of TCIL and TAL in July 2016, Mr. Burns who had served as the Chief Financial Officer of TAL since 2009, became the Chief Financial Officer of Triton. In addition, Mr. Burns previously served as Senior Vice President of Corporate Development of TAL. Mr. Burns joined TAL’s former parent company, Transamerica Corporation, in April 1996 as Director of Internal Audit and subsequently transferred to TAL International Container Corporation in April 1998 as Controller. Prior to joining Transamerica Corporation, Mr. Burns spent 10 years with Ernst & Young LLP in their financial audit practice. Mr. Burns holds a BA in Finance from the University of St. Thomas, St. Paul, Minnesota and is a certified public accountant.

John F. O’Callaghan is our Executive Vice President, Global Head of Field Marketing and Operations, and is responsible for overseeing global marketing and operations. Upon the closing of the combination of TCIL and TAL in July 2016, Mr. O’Callaghan, who had served as the Senior Vice President, Europe, North America, South America and the Indian Sub-continent of TCIL since 2006, became the Global Head of Field Marketing and Operations of Triton. From 2002 to 2006, Mr. O'Callaghan served as Regional Vice President, Europe, South America, South Africa and the Indian Sub-continent, and prior to that as Vice President, Refrigerated Containers commencing in 1998. Mr. O’Callaghan was Director of Marketing, Refrigerated Containers from 1996 and Marketing Manager, Refrigerated Containers beginning in 1994. Prior to joining Triton, Mr. O’Callaghan worked as an architect on various construction projects including the Canary Wharf development with Koetter Kim and projects in Germany with Buro Bolles Wilson. Mr. O’Callaghan studied engineering at Trinity College Dublin and qualified with RIBA (Royal Institute of British Architects) as an architect with the Architectural Association in London.

Kevin Valentine is our Senior Vice President, Triton Container Sales. Mr. Valentine is responsible for the execution of our global container sales and trading activities. Mr. Valentine joined TAL International Container Corporation in 1994 as Marketing Manager, UK following TAL’s acquisition of his previous employer, Tiphook Container Rental. After joining TAL, Mr. Valentine held positions in TAL’s London office as General Manager UK, Area Director Europe and Vice President, Trader Container Sales & Trading, Mr. Valentine relocated to TAL’s headquarters in 2008 and prior to the combination of TCIL and

TAL was TAL’s Senior Vice President, Trader and Global Operations, responsible for overseeing TAL’s global container and chassis sales and trading activities, global fleet operations, TAL’s tank and chassis leasing product lines and its regional leasing activities in the Americas. Prior to joining TAL International Container Corporation, Mr. Valentine held positions with Tiphook Container Rental from 1990 as Marketing Manager, Indian Subcontinent and Middle East based in London and Marketing Manager, Benelux based in Antwerp, Belgium. Mr. Valentine received a BA (Hons) degree in Business from Middlesex University, London, England.

Marc Pearlin is our Senior Vice President, General Counsel and Secretary, and is responsible for overseeing all legal matters. Upon the closing of the combination of TCIL and TAL in July 2016, Mr. Pearlin who had served as the Vice President, General Counsel and Secretary of TAL since 2004, became the Senior Vice President, General Counsel and Secretary of Triton. In October 1986, Mr. Pearlin joined TAL International Container Corporation and held positions as an Associate General Counsel as well as Secretary and Assistant General Counsel of TAL. Mr. Pearlin holds a Juris Doctor degree from the University of Connecticut School of Law and a BA in Economics and Spanish from Trinity College, Hartford, Connecticut.

COMPENSATION OF EXECUTIVE OFFICERS

COMPENSATION DISCUSSION AND ANALYSIS

This compensation discussion and analysis describes the material elements of our compensation program for our Chief Executive Officer, Chief Financial Officer and three other most highly compensated executive officers (the "Named Executive Officers"). Additional details are provided for each element of compensation in the tables and narratives which follow.

Impact of the Combination of TCIL and TAL

Prior to the closing of the combination of TCIL and TAL, an ad-hoc committee consisting of directors and senior executives was established to assist in the development of the compensation policies and practices to be adopted by the Company after the closing. Mercer Consulting (“Mercer”) was engaged to further assist with this process. As part of this process, the Compensation Committee, with input from the ad-hoc committee and Mercer:

| |

| • | compared the compensation policies and practices of TCIL and TAL; |

| |

| • | compared the executive compensation levels and structures of TCIL and TAL; |

| |

| • | benchmarked executive compensation structures and levels at TCIL and TAL against executive compensation structures and levels at a peer group of companies; |

| |

| • | developed a framework of executive compensation objectives, policies and practices that would be adopted by the Company after the closing of the combination; |

| |

| • | designed the short-term and long-term incentive compensation plans to be adopted by the Company for the periods after the closing of the combination; and |

| |

| • | identified new compensation packages for the senior executives expected to remain with the Company after the closing of the combination. |

New compensation packages were adopted for senior executives, including all of our Named Executive Officers, in September 2016. The Compensation Committee also established a new short-term incentive plan for all employees to cover the period from July 1, 2016, through the end of 2016. The Compensation Committee determined that all employees, including our Named Executive Officers, would have their short-term incentive payouts calculated in two parts for 2016: 50% of the payout for 2016 would be based on the employees’ pre-combination bonus plans and their original company’s performance (TCIL or TAL, whichever was applicable) prior to the closing of the combination, and 50% of the payout for 2016 would be based on the Company’s new short-term incentive plan adopted in September 2016 and the Company’s performance after the closing of the combination.

Compensation Objectives and Philosophy

We seek to provide our senior executives with compensation packages that fairly reward the executives for their contributions to the Company and allow the Company to recruit and retain high quality individuals. In addition, we seek to structure our compensation plans so that they are straightforward for our senior executives and our shareholders to understand and value, and relatively easy for the Company to administer. We link a portion of overall compensation to near-term and long-term measures of performance to motivate our senior executives and align their interests with those of our shareholders.

We believe that our compensation policies and practices do not promote excessive risk taking and therefore are not reasonably likely to have a material adverse effect on the Company. As described above under "Risk Management”, the Board of Directors has oversight responsibility with respect to risk management. The Compensation Committee oversees our compensation and employee benefit plans and practices, including our executive compensation program and equity-based grant plan and in doing so, reviews each to see that they do not encourage excessive risk taking. We also have a policy prohibiting employees from engaging in speculative transactions involving our Common Shares, including hedging or pledging transactions. For additional information on these policies, see "Anti-Hedging and Anti-Pledging Policy" below.

Compensation Programs

Our executive compensation programs include the following elements:

| |

| • | A base salary and a package of employee benefits that strives to be competitive with those offered to senior executives by our peers; |

| |

| • | Annual incentive compensation based on individual and Company performance; and |

| |

| • | Share-based, long-term incentive compensation. |

Roles and Responsibilities

The Compensation Committee is comprised of three independent directors: Claude Germain (Chairman), David Coulter and John Hextall. In accordance with its written charter, the Compensation Committee is responsible for establishing and overseeing our compensation and benefit philosophies, plans and practices, including our executive annual base compensation amounts, annual incentive compensation program and equity-based compensation plan.

Compensation for our Chief Executive Officer and all other senior executives, including our other Named Executive Officers, is established by the Compensation Committee. The Compensation Committee makes all compensation decisions with respect to our Chief Executive Officer and our President and reviews and considers our Chief Executive Officer’s and our President’s recommendations with respect to compensation decisions for our other Named Executive Officers. The Compensation Committee has the authority under its charter to retain compensation consultants to assist it in setting executive compensation.

In establishing annual executive compensation, the Compensation Committee utilizes the following:

| |

| • | executive compensation history; |

| |

| • | comparable company compensation; and |

| |

| • | executive and Company performance relative to established targets. |

Benchmarking

In connection with the combination of TCIL and TAL, Mercer was engaged to review the compensation practices and the level of executive compensation at selected peer companies. As part of this review, the ad-hoc committee and Mercer assessed the overall target and actual compensation levels and analyzed the mix of base salary, annual incentive compensation and long-term and equity-linked compensation of the named executive officers at the selected peer companies. The Compensation Committee did not specifically link the target or actual compensation levels of our Named Executive Officers to those at the selected peer companies, but rather used the peer analysis as a point of reference when determining appropriate overall compensation levels and mix of compensation for our Named Executive Officers. Mercer also provided survey information

about overall compensation and the mix of compensation at a wider range of businesses. The Compensation Committee used this survey data as an additional point of reference.

The peer group companies used by Mercer in the 2016 benchmarking survey were:

|

| | | |

| l | Aircastle Limited | l | Hub Group |

| l | Airlease | l | Matson |

| l | Forward Air | l | Mobile Mini |

| l | GATX | l | United Rentals |

| l | H&E Equipment Services | | |

The companies selected for use in the peer group are companies that operate in similar or adjacent industries.

Elements of Compensation

Our executive compensation program in 2016 consisted of the following principal elements:

| |

| • | annual cash-based incentive compensation based on the achievement of individual and Company performance goals |

| |

| • | equity‑based long-term compensation; and |

Base Salary

The Compensation Committee believes that competitive base salaries are necessary to attract and retain managerial talent. Base salaries are set at levels considered to be appropriate for the scope of the job function, the level of responsibility of the individual, the skills and qualifications of the individual, and the amount of time spent in the position. Base salaries are also established to be competitive with amounts paid to executive officers with comparable qualifications, experience and responsibilities at the peer group companies.

The Compensation Committee established new base salaries for all of our Named Executive Officers after the combination of TCIL and TAL. The new base salaries were implemented as of September 1, 2016. The new base salaries for our Named Executive Officers are expected to remain unchanged through December 31, 2017.

In future years, our Compensation Committee expects to review the performance and set the salary for our Chief Executive Officer and our President on an annual basis. As part of this process, our Chief Executive Officer and our President will make salary recommendations to the Committee concerning our other Named Executive Officers, and the Compensation Committee will review these recommendations and may approve or change the salary amounts for our other Named Executive Officers based on these recommendations. We expected that base salary amounts will be based on individual performance, peer group data, and published survey data detailing average salary increases across various industries and company sizes.

The following is a summary of our Named Executive Officers’ base salaries for 2016:

|

| | | | | | |

| Name | | Original 2016 Annual Base Salary | | New Annual Base Salary as of September 1, 2016 | | Increase |

| Brian M. Sondey (1) | | $750,000 | | $800,000 | | 6.7% |

| Simon R. Vernon (2) | | $446,086 | | $519,041 | | 16.4% |

| John Burns (1) | | $390,000 | | $425,000 | | 9.0% |

| John F. O'Callaghan (2) | | $345,721 | | $362,953 | | 5.0% |

| Kevin Valentine (1) | | $307,000 | | $330,000 | | 7.5% |

| |

| (1) | Original 2016 annual base salary for Messrs. Sondey, Burns, and Valentine is their TAL annual base salary and Triton annual base salary through September 1, 2016. |

| |

| (2) | Salaries for Messrs. Vernon and O’Callaghan were paid in GBP and the chart reflects conversions to US dollars based on the November 30, 2016 foreign exchange rate of 1 GBP to 1.25 US dollar. |

Annual Incentive Compensation