Exhibit 10.1 TRITON INTERNATIONAL LIMITED AMENDED AND RESTATED 2016 EQUITY INCENTIVE PLAN NOTICE OF RESTRICTED SHARE GRANT You ("Grantee") have been granted the following number of restricted common shares (the “Restricted Shares”) of Triton International Limited (the "Company"), par value $0.01 per share ("Shares"), pursuant to the Triton International Limited Amended and Restated 2016 Equity Incentive Plan (the "Plan"). The Restricted Shares are subject to all of the terms and conditions as set forth in the Plan, this Notice of Restricted Share Grant (the “Notice”) and the Restricted Share Award Agreement (the “Award Agreement”), including any additional terms and conditions for Grantee's country of residence set forth in the Appendix attached hereto (the “Appendix”): Name of Grantee: [ ] Overall Target Shares: [ ] Number of Time Vesting Shares Only [ ], plus Minimum Performance Shares [ ]: [ ] Additional Shares if Target Performance Vesting Met: [ ] Further Additional Shares if Maximum Performance Vesting Met: [ ] Effective Date of Grant: [ ] Vesting Date: [ ], subject to earlier vesting or forfeiture pursuant to the terms of the Plan and the attached Award Agreement, including as a result of a Termination of Service, and subject to meeting performance criteria for those Restricted Shares that are also subject to meeting the performance criteria set forth on the exhibit attached hereto. Capitalized terms that are not defined herein shall have the meanings ascribed to them in the Plan. By your signature and the signature of the Company's representative below (or by electronically accepting this award pursuant to the procedures established by the Company’s stock plan administrator), you and the Company agree that these Restricted Shares are granted under and governed by the terms and conditions of this Notice, the Plan and the Award Agreement, both of which are attached to and made a part of this document. GRANTEE: TRITON INTERNATIONAL LIMITED: By: Title:

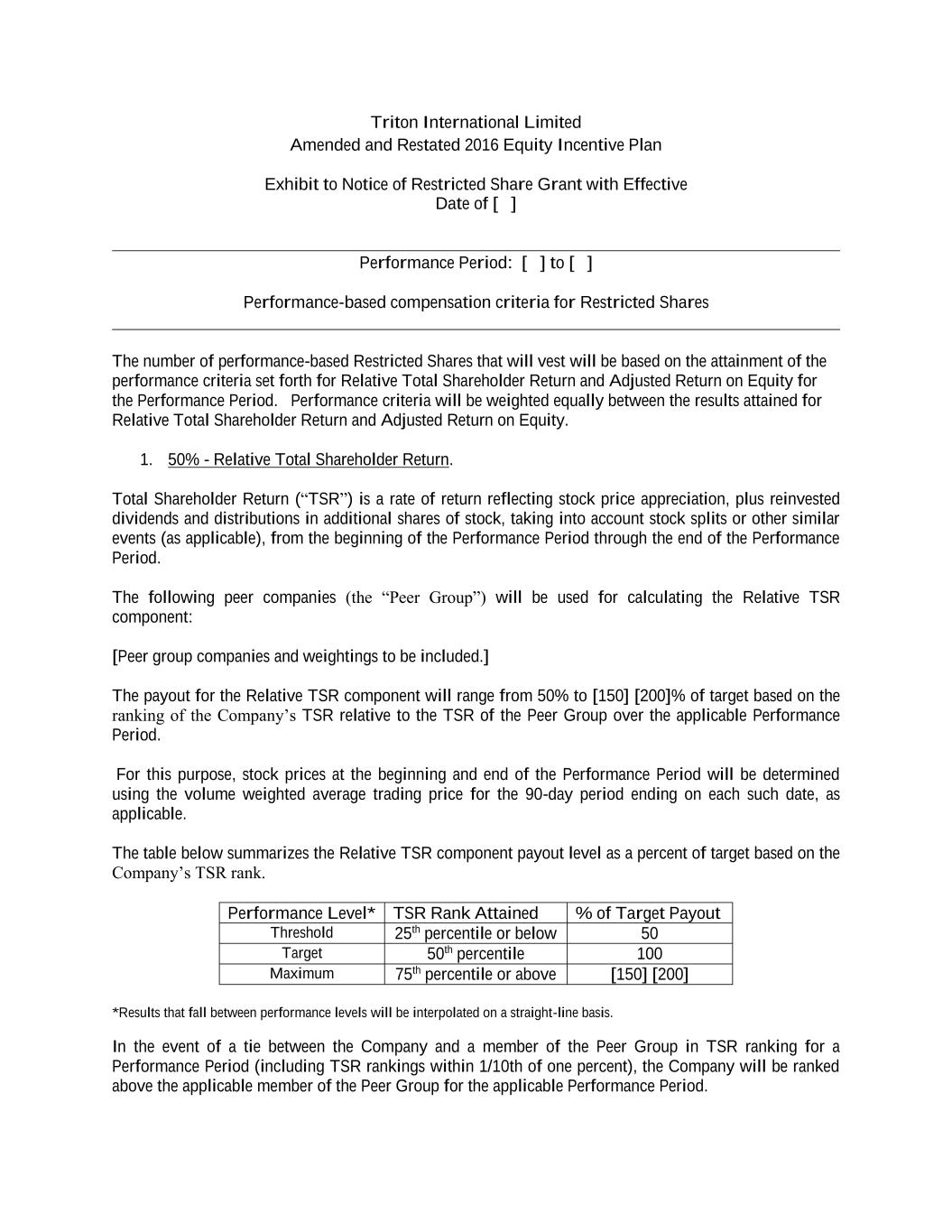

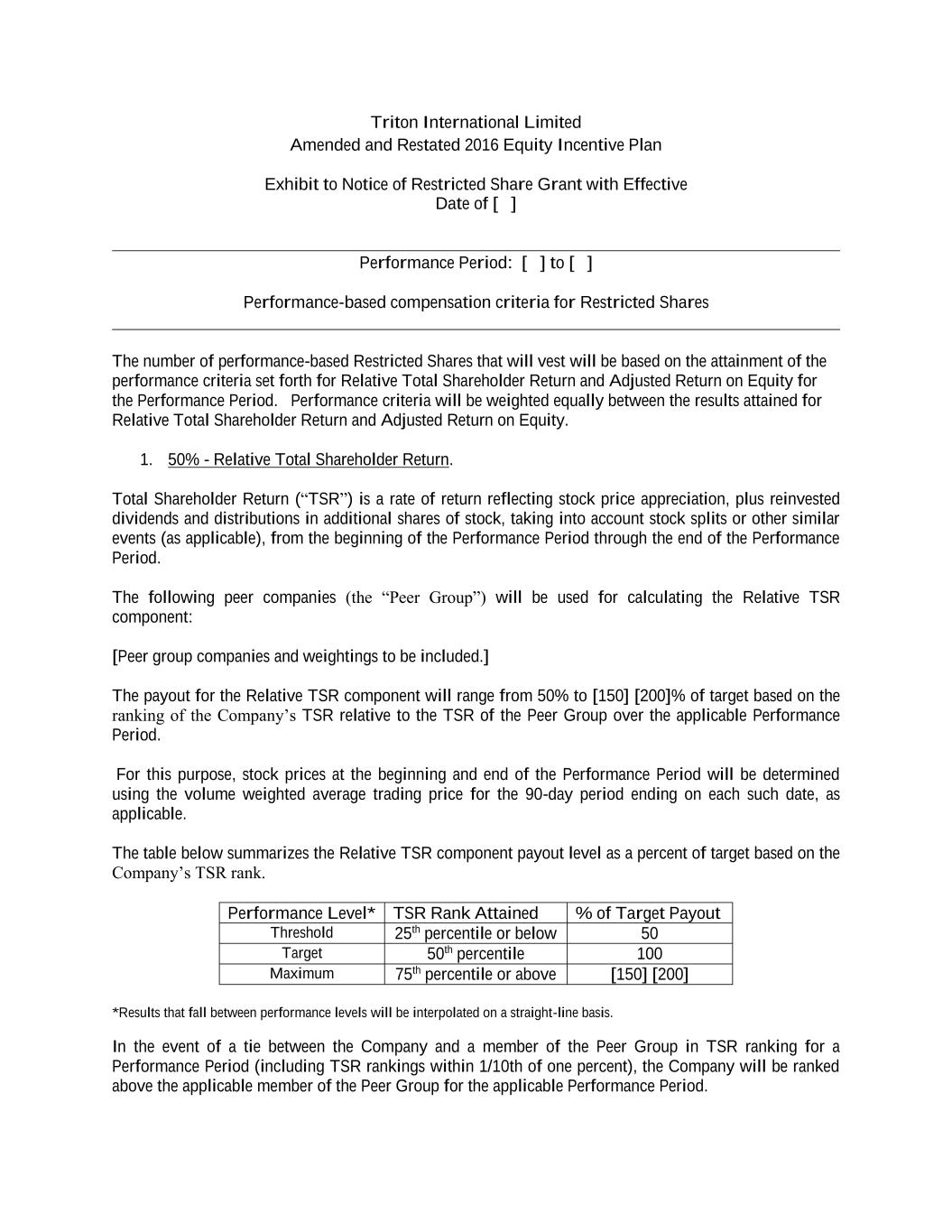

Triton International Limited Amended and Restated 2016 Equity Incentive Plan Exhibit to Notice of Restricted Share Grant with Effective Date of [ ] Performance Period: [ ] to [ ] Performance-based compensation criteria for Restricted Shares The number of performance-based Restricted Shares that will vest will be based on the attainment of the performance criteria set forth for Relative Total Shareholder Return and Adjusted Return on Equity for the Performance Period. Performance criteria will be weighted equally between the results attained for Relative Total Shareholder Return and Adjusted Return on Equity. 1. 50% - Relative Total Shareholder Return. Total Shareholder Return (“TSR”) is a rate of return reflecting stock price appreciation, plus reinvested dividends and distributions in additional shares of stock, taking into account stock splits or other similar events (as applicable), from the beginning of the Performance Period through the end of the Performance Period. The following peer companies (the “Peer Group”) will be used for calculating the Relative TSR component: [Peer group companies and weightings to be included.] The payout for the Relative TSR component will range from 50% to [150] [200]% of target based on the ranking of the Company’s TSR relative to the TSR of the Peer Group over the applicable Performance Period. For this purpose, stock prices at the beginning and end of the Performance Period will be determined using the volume weighted average trading price for the 90-day period ending on each such date, as applicable. The table below summarizes the Relative TSR component payout level as a percent of target based on the Company’s TSR rank. Performance Level* TSR Rank Attained % of Target Payout Threshold 25th percentile or below 50 Target 50th percentile 100 Maximum 75th percentile or above [150] [200] *Results that fall between performance levels will be interpolated on a straight-line basis. In the event of a tie between the Company and a member of the Peer Group in TSR ranking for a Performance Period (including TSR rankings within 1/10th of one percent), the Company will be ranked above the applicable member of the Peer Group for the applicable Performance Period.

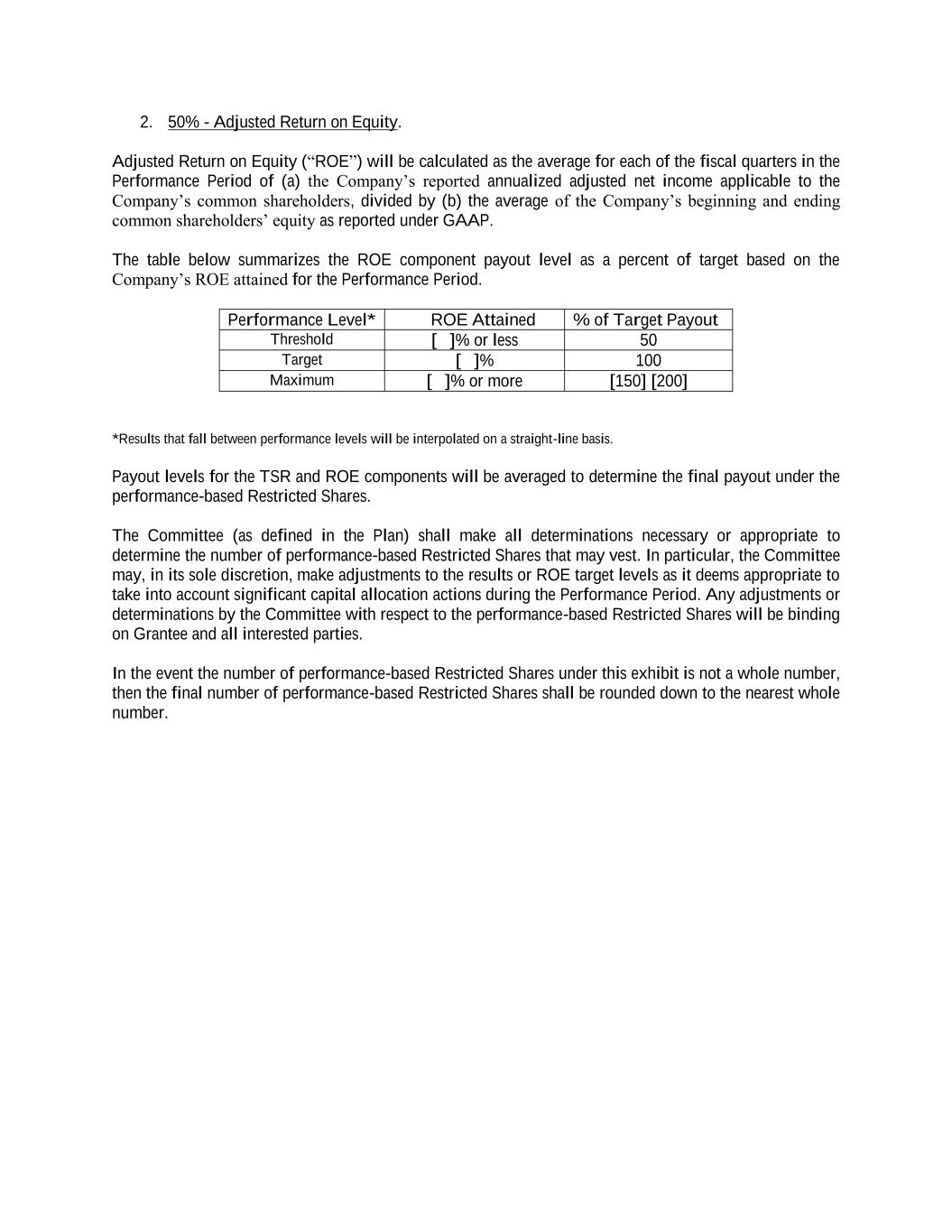

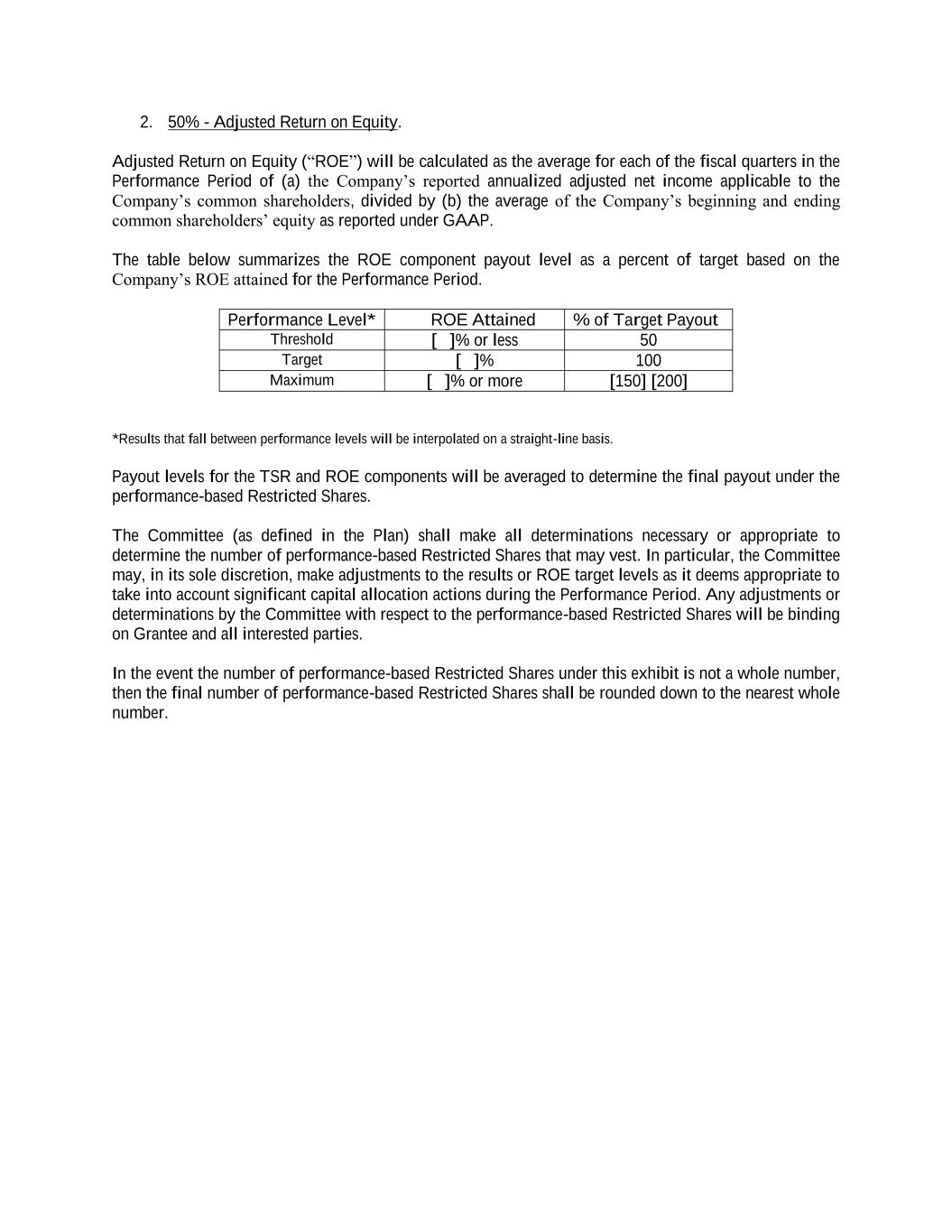

2. 50% - Adjusted Return on Equity. Adjusted Return on Equity (“ROE”) will be calculated as the average for each of the fiscal quarters in the Performance Period of (a) the Company’s reported annualized adjusted net income applicable to the Company’s common shareholders, divided by (b) the average of the Company’s beginning and ending common shareholders’ equity as reported under GAAP. The table below summarizes the ROE component payout level as a percent of target based on the Company’s ROE attained for the Performance Period. Performance Level* ROE Attained % of Target Payout Threshold [ ]% or less 50 Target [ ]% 100 Maximum [ ]% or more [150] [200] *Results that fall between performance levels will be interpolated on a straight-line basis. Payout levels for the TSR and ROE components will be averaged to determine the final payout under the performance-based Restricted Shares. The Committee (as defined in the Plan) shall make all determinations necessary or appropriate to determine the number of performance-based Restricted Shares that may vest. In particular, the Committee may, in its sole discretion, make adjustments to the results or ROE target levels as it deems appropriate to take into account significant capital allocation actions during the Performance Period. Any adjustments or determinations by the Committee with respect to the performance-based Restricted Shares will be binding on Grantee and all interested parties. In the event the number of performance-based Restricted Shares under this exhibit is not a whole number, then the final number of performance-based Restricted Shares shall be rounded down to the nearest whole number.

Page 1 of 17 TRITON INTERNATIONAL LIMITED AMENDED AND RESTATED 2016 EQUITY INCENTIVE PLAN RESTRICTED SHARE AWARD AGREEMENT SECTION 1. GRANT OF RESTRICTED SHARES. (a) RESTRICTED SHARES. On the terms and conditions set forth in the Triton International Limited Amended and Restated 2016 Equity Incentive Plan (the “Plan”), the Notice of Restricted Share Grant (the “Notice”) and this Restricted Share Award Agreement (the “Award Agreement”), including any additional terms and conditions for Grantee's country of residence set forth in the Appendix attached hereto (the “Appendix”), the Company grants to Grantee on the Effective Date of Grant the number of Shares set forth in the Notice (the “Restricted Shares”). For purposes of this Award Agreement, to the extent Grantee is not employed by the Company, the “Employer” means the member of the Group that employs Grantee. (b) PLAN AND DEFINED TERMS. The Restricted Shares are granted pursuant to the Plan, a copy of which Grantee acknowledges having received. All terms, provisions, and conditions applicable to the Restricted Shares set forth in the Plan and not set forth herein are hereby incorporated by reference herein. To the extent any provision hereof is inconsistent with a provision of the Plan, the provisions of the Plan will govern. All capitalized terms that are used in this Award Agreement and not otherwise defined herein shall have the meanings ascribed to them in the Plan. SECTION 2. RIGHT TO RESTRICTED SHARES AND DIVIDENDS OR RETURN OF CAPITAL. (a) Grantee shall not acquire a non-forfeitable right to the Restricted Shares until such Restricted Shares vest and the Committee, in its sole discretion, determines the number Restricted Shares (if any) that have vested. The Notice contains the vesting schedule (the “Vesting Schedule”). (b) All dividends/return of capital distributions on the Restricted Shares shall accrue on the books of the Company for the benefit of Grantee, but shall only become payable if and only to the extent the Restricted Shares vest, regardless of whether or not vesting is contingent upon continued employment, the achievement of performance goals, or both. Within ninety (90) days of vesting of the Restricted Shares all accrued dividends/return of capital distributions shall be paid to Grantee. (c) The Company shall issue the Restricted Shares in book entry form, registered in the name of Grantee, with legends, or notations, as applicable, referring to the terms, conditions and restrictions applicable to the Restricted Shares. Upon the lapse of restrictions relating to any Restricted Shares, the Company shall, remove the notations on any such Restricted Shares issued in book-entry form equal to the number of Restricted Shares with respect to which such restrictions have lapsed. (d) For purposes of this Award Agreement, if Grantee is employed in the United States, the “date of Termination of Service” means the effective date of Grantee's Termination of Service. If Grantee is employed outside of the United States, the “date of Termination of Service” means the earliest of (i) the date on which notice of Termination of Service is provided to Grantee, (ii) the last day of Grantee's active service with the Employer or (iii) the last day on which Grantee is an employee of the Employer, as determined in each case, without including any required advanced notice period or any period of “garden leave” or similar period mandated under

Page 2 of 17 employment laws in the jurisdiction where Grantee is employed or the terms of Grantee’s employment agreement, if any, and irrespective of the status of the termination under local labor or employment laws. The Committee shall have the exclusive discretion to determine when Grantee is no longer actively providing services for purposes of the Restricted Share grant (including whether Grantee may still be considered to be providing services while on a leave of absence). (e) As a condition of the Restricted Share grant, Grantee agrees to repatriate all payments attributable to the Restricted Shares in accordance with local foreign exchange rules and regulations in Grantee's country of residence (and country of employment, if different). In addition, Grantee agrees to take any and all actions, and consents to any and all actions taken by the Employer, the Company and any member of the Group as may be required to allow the Employer, the Company and any member of the Group to comply with local laws, rules and regulations in Grantee's country of residence (and country of employment, if different). Finally, Grantee agrees to take any and all actions that may be required to comply with Grantee's personal legal and tax obligations under local laws, rules and regulations in Grantee's country of residence (and country of employment, if different). SECTION 3. TERMINATION OF SERVICES AND CHANGE OF CONTROL. (a) TERMINATION OF SERVICE. The following provisions shall govern the treatment of the Restricted Shares upon a termination of Service of Grantee: (i) If the Termination of Service is by (x) the Company for Cause (as defined in the Plan), (y) a Consultant for any reason, or (z) an Employee without Good Reason (as defined in the Plan), all unvested Restricted Shares shall be forfeited upon the date of Termination of Service. (ii) If the Termination of Service is a result of an Employee’s death or being Disabled, all unvested Restricted Shares shall vest as of the date of the Employee's death, or date of Termination of Service if the Employee is Disabled, and shall be payable no later than sixty (60) days following death or such Termination of Service, except that for unvested Restricted Shares that are also subject to performance vesting conditions (including, for the avoidance of doubt, any Minimum Performance Shares), those unvested Restricted Shares shall continue to vest in accordance with the Vesting Schedule and payment (if any) will be based on the attainment of performance criteria as of the end of the Performance Period. (iii) If the Termination of Service is by (x) the Company without Cause or (y) Grantee with Good Reason, all unvested Restricted Shares which were not granted during the calendar year in which such Termination of Service occurs shall vest and be payable no later than sixty (60) days following such Termination of Service, except that for unvested Restricted Shares that are also subject to performance vesting conditions (including, for the avoidance of doubt, any Minimum Performance Shares), those unvested Restricted Shares shall continue to vest in accordance with the Vesting Schedule and payment (if any) will be based on the attainment of performance criteria as of the end of the Performance Period. Any Restricted Shares granted during the calendar year of Termination of Service shall be forfeited on the date of Termination of Service. (b) CHANGE OF CONTROL. Notwithstanding the Vesting Schedule and anything set forth in the Plan to the contrary, if a Change of Control (as defined in the Plan) occurs, and within twenty-

Page 3 of 17 four (24) months following the occurrence of such Change of Control, Grantee experiences a Termination of Service by the Company other than for Cause or by Grantee for Good Reason, all unvested Restricted Shares shall automatically vest in full upon the date of Termination of Service (with, for the avoidance of doubt, unvested Restricted Shares that are also subject to performance vesting conditions deemed to have vested at maximum performance levels) and shall be payable no later than sixty (60) days following such Termination of Service. (c) CHANGE OF STATUS. Notwithstanding any provision in the Plan or this Award Agreement to the contrary, the Committee shall have the discretion to determine the effect upon the Restricted Shares in the case of any change in Grantee’s status from an Employee to a Consultant, or vice versa. SECTION 4. NATURE OF GRANT. In accepting the Restricted Share grant, Grantee acknowledges, understands and agrees that: (a) the Plan is established voluntarily by the Company, it is discretionary in nature and it may be modified, amended, suspended or terminated by the Company at any time, to the extent permitted by the Plan; (b) the grant of Restricted Shares is exceptional, voluntary and occasional and does not create any contractual or other right to receive future Restricted Shares, or benefits in lieu of Restricted Shares, even if Restricted Shares have been granted in the past; (c) all decisions with respect to future grants of Restricted Shares or other grants, if any, will be at the sole discretion of the Company; (d) Grantee is voluntarily participating in the Plan; (e) the Restricted Shares, and the income from and value of same, are not intended to replace any pension rights or compensation; (f) the Restricted Shares, and the income from and value of same, are not intended to replace any pension rights or compensation and are not part of normal or expected compensation for purposes of, including calculating any severance, resignation, termination, redundancy, dismissal, end-of-service payments, bonuses, holiday pay, long-service awards, pension or retirement or welfare benefits or similar payments; (g) unless otherwise agreed with the Company in writing, the Restricted Shares, and the income from and value of same, are not granted as consideration for, or in connection with, the service Grantee may provide as a director of a subsidiary of the Company; (h) the future value of the underlying Shares is unknown, indeterminable and cannot be predicted with certainty; (i) no claim or entitlement to compensation or damages shall arise from forfeiture of the Restricted Shares resulting from Grantee’s Termination of Service (for any reason, whether or not later found to be invalid or in breach of employment laws in the jurisdiction where Grantee is employed or the terms of Grantee's employment agreement, if any); (j) unless otherwise provided in the Plan or by the Company in its discretion, the Restricted

Page 4 of 17 Shares and the benefits evidenced by this Award Agreement do not create any entitlement to have the Restricted Shares or any such benefits transferred to, or assumed by, another company nor be exchanged, cashed out or substituted for, in connection with any corporate transaction affecting the Shares; (k) neither the Company nor the Employer shall be liable for any foreign exchange rate fluctuation between Grantee's local currency and the United States Dollar that may affect the value of this Award or of any amounts due to Grantee pursuant to the settlement of the Restricted Shares or the subsequent sale of any Shares acquired upon settlement; and (l) the Company is not providing any tax, legal or financial advice, nor is the Company making any recommendations regarding Grantee’s participation in the Plan or Grantee’s acquisition or sale of the Shares. Grantee should consult with Grantee’s personal tax, legal and financial advisors regarding Grantee’s participation in the Plan before taking any action related to the Plan. SECTION 5. RESTRICTIVE COVENANTS. In consideration for receiving the Restricted Share Grant, except to the extent this provision is expressly unenforceable or unlawful under applicable law, the Grantee agrees to the following restrictive covenants (“Restrictive Covenants”): (a) NON-COMPETITION. During the period the Grantee is an employee of the Company or any Related Company and during the twelve (12) months thereafter (the “Restricted Period”), the Grantee shall not, without the express approval of the Company, directly or indirectly, own, manage, operate, invest in, whether as a proprietor, partner, shareholder, member, lender, director, officer, employee, agent, representative or other participant, or otherwise engage or participate in any business or enterprise engaged in the leasing, financing, managing or sale of intermodal marine cargo containers or intermodal chassis, in the Territory (“Competitive Business”) (but a Competitive Business does not include shipping lines, terminals, or the wider container shipping industry) without regard to (A) whether the Competitive Business has its office or other business facilities within or without the Territory, (B) whether any of the activities of the Grantee referred to above occur or are performed within or without the Territory or (C) whether the Grantee resides, or reports to an office, within or without the Territory; provided, however, that (x) the Grantee may, anywhere in the Territory, directly or indirectly, in one or a series of transactions, own, invest or acquire an interest in up to five percent (5%) of the capital share of a corporation whose capital share is traded publicly, or that (y) such Grantee may accept employment with a successor company to the Company. The Grantee shall not be deemed to be engaged in a Competitive Business if Grantee is employed at a company that is not engaged in a Competitive Business but which has a sister company that is engaged in a Competitive Business if the Grantee has no involvement, direct or indirect, in the sister company whatsoever; and (b) NON-SOLICITATION. For the duration of the Restricted Period, the Grantee shall not (A) directly or indirectly, in one or a series of transactions, recruit, solicit or otherwise induce or influence any proprietor, partner, shareholder, member, lender, director, officer, employee, sales agent, lessor, customer, supplier, agent, representative or any other Person which has a business relationship with the Company or a Related Company or had a business relationship with the Company or a Related Company within the twenty-four (24) month period preceding the date of the incident in question (other than a customer or supplier who has a business relationship with the Grantee’s new employer (if any)), to discontinue, reduce or modify such employment, agency or business relationship with the Company or a Related Company, or (B) employ or seek to employ or cause any Competitive Business to employ or seek to employ any Person who is then (or was at any time within twelve (12) months prior to the date such Grantee or the Competitive Business employs or seeks to employ such Person) employed or retained by the Company or a Related Company; and

Page 5 of 17 (c) CONFIDENTIAL INFORMATION. During and after Grantee’s employment with the Company or a Related Company, the Grantee will not, directly or indirectly in one or a series of transactions disclose to any Person or use or otherwise exploit for the Grantee’s own benefit or for the benefit of anyone other than the Company or its subsidiaries any Confidential Information (as defined below) whether prepared by the Grantee or not, provided, however, that any Confidential Information may be disclosed to officers, representatives, employees and agents of the Company or its Related Companies who need to know such Confidential Information in order to perform the services or conduct the operations required or expected of them in the Business. The Grantee shall not remove any documents or materials containing Confidential Information from the premises of the Company or its Related Companies or make copies (including electronic copies) of such documents or materials, except for use in the Company’s business and in accordance with the Company’s policies regarding security of confidential information. During the term of employment, the Grantee shall use the Grantee’s commercially reasonable efforts to cause all Persons to whom Confidential Information shall be disclosed by the Grantee hereunder to observe the terms and conditions set forth herein as though each such Person or entity was bound hereby. After the term of employment, the Grantee shall not disclose Confidential Information other than to Grantee’s advisors, representatives and agents who execute a confidentiality agreement whereby they will agree to observe the confidentiality terms and conditions set forth herein. The Grantee shall have no obligation hereunder to keep confidential any Confidential Information if and to the extent disclosure of any thereof is specifically required by law; provided, however, that in the event disclosure is required by applicable law, the Grantee shall provide the Company with prompt notice of such requirement to the extent allowed by law, prior to making any disclosure, so that the Company may seek an appropriate protective order. At the request of the Company, the Grantee agrees to deliver to the Company all Confidential Information which the Grantee may possess or control. The Grantee agrees that all Confidential Information of the Company and Related Companies (whether now or hereafter existing) conceived, discovered or made by Grantee during Grantee’s employment with the Company or its Related Companies exclusively belongs to the Company and its direct and indirect subsidiaries (and not to the Grantee). The Grantee will promptly disclose such Confidential Information to the Company and its Related Companies and perform all actions reasonably requested by the Company and its Related Companies to establish and confirm such exclusive ownership. As used herein, the term “Confidential Information” means any confidential information including, without limitation, any study, data, calculations, software storage media or other compilation of information, patent, patent application, copyright, trademark, trade name, service mark, service name, trade secrets, supplier lists and contacts, customer lists and contacts, the fact of and terms of (including without limitation, pricing terms) supplier, customer or consultant contracts, pricing policies, business techniques, operational methods, marketing plans or strategies, product development techniques or plans, business acquisition plans or any portion or phase of any scientific or technical information, discoveries, designs, computer programs (including source of object codes), processes, procedures, formulas, improvements or other proprietary or intellectual property of the Company or its subsidiaries, whether or not in written or tangible form, and whether or not registered, and including all files, records, manuals, books, catalogues, memoranda, notes, summaries, plans, reports, records, documents and other evidence thereof. The term “Confidential Information” does not include, and there shall be no obligation hereunder with respect to, information that becomes generally available to the public other than as a result of a disclosure by such Grantee that is prohibited hereunder; and (d) NON-DISPARAGEMENT. During and after Grantee’s employment with the Company or a Related Company, Grantee shall not make any false, defamatory or disparaging statements about the Company or its Related Companies or the officers, employees or directors of the Company or its

Page 6 of 17 Related Companies. Nothing in this paragraph, however, shall prevent Grantee from providing truthful testimony or information in any proceeding or in response to any request from any governmental agency, or judicial, arbitral or self-regulatory forum, or as otherwise required by applicable law. If the Grantee breaches any of the Restrictive Covenants without the Company’s written consent, all unvested Restricted Shares shall be immediately forfeited. Further, in addition to any other remedies allowed by law or contract, the Grantee acknowledges that the amount of damages that would derive from the breach of any of the Restrictive Covenants is not readily ascertainable and agrees that in the event of breach of any of the Restrictive Covenants, the Company will also have the right to seek injunctive and/or other equitable relief in any court of competent jurisdiction to enforce the Restrictive Covenants. Definitions Applicable to this Section 5: “Person” means any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust, unincorporated organization, governmental entity or any other entity. "Related Company" means all direct and indirect subsidiaries of the Company. "Territory" means the United States of America and each jurisdiction or other country in which (i) the Business was conducted by or engaged in by the Company or its subsidiaries or in which the Company sought to conduct the Business on or prior to the date hereof or (ii) the Business is conducted by or engaged in by the Company or its subsidiaries or in which the Company seeks to conduct the Business at any time during the Grantee’s employment by the Company or its subsidiaries. SECTION 6. MISCELLANEOUS PROVISIONS. (a) TAX WITHHOLDING. The Company or the Employer may make such provisions as are necessary or appropriate for the withholding of any or all federal, state, local or foreign income tax, social insurance, payroll tax, fringe benefit tax, payment on account or other tax related-items (“Tax Related- Items”) on the Shares and dividends and return of capital distributions, in accordance with Article 19 of the Plan, as applicable. Regardless of any action by the Company or the Employer, Grantee acknowledges that the ultimate liability for all Tax Related-Items associated with the Restricted Shares is and remains Grantee’s responsibility and may exceed the amount actually withheld, and the Company and the Employer (i) make no representations or undertakings regarding the treatment of any Tax Related- Items in connection with any aspect of the Restricted Shares, including the grant of the Restricted Shares, the vesting of the Restricted Shares, the subsequent sale of the Shares acquired and the receipt of any dividends and return of capital distributions; and (ii) do not commit to structure the terms of the grant or any aspect of Restricted Shares to reduce or eliminate Grantee’s liability for Tax Related-Items. Further, if Grantee is subject to tax in more than one jurisdiction, Grantee acknowledges that the Company and/or the Employer (or former employer, as applicable) may be required to withhold or account for Tax Related-Items in more than one jurisdiction. In the event the withholding requirements are not satisfied through the withholding of Shares or Grantee's regular salary and/or wages or other amounts payable to Grantee, no Shares will be issued to

Page 7 of 17 Grantee unless and until satisfactory arrangements (as determined by the Company) have been made by Grantee with respect to the payment of any Tax-Related Items which the Company determines, in its sole discretion, must be withheld or collected with respect to the Restricted Shares. If Grantee is subject to taxation in more than one jurisdiction, Grantee acknowledges that the Company and/or the Employer may be required to withhold or account for Tax-Related Items in more than one jurisdiction. By accepting the this Restricted Share grant, Grantee expressly consents to the withholding of Shares and/or the withholding of amounts from Grantee's regular salary and/or wages, or other amounts payable to Grantee, as provided for hereunder. All other Tax-Related Items related to the Restricted Shares and any Shares acquired pursuant to the vesting of the grant are Grantee's sole responsibility. (b) RIGHTS AS A SHAREHOLDER. Except for certain rights during the period of restriction as set forth in the Plan, neither Grantee nor Grantee's representative shall have any rights as a Shareholder with respect to any Shares subject to the Restricted Shares until the Restricted Shares have vested and Shares have been issued in Grantee’s name in book entry form, as the case may be. (c) DATA PRIVACY. The collection, use and transfer, in electronic or other form, of Grantee’s personal data as described in this Award Agreement and any other Restricted Share award materials will be in accordance with the Employer’s data protection notice (the “Employer Data Protection Notice”), where applicable. Such personal data may be collected, used and transferred by and among, as applicable, the Company, the Employer, any member of the Group and any third parties assisting (presently or in the future) with the implementation, administration and management of the Plan, for the exclusive purpose of implementing, administering and managing Grantee’s participation in the Plan. Where required under applicable law, personal data also may be disclosed to certain securities or other regulatory authorities where the Shares are listed or traded or regulatory filings are made, or to certain tax authorities for compliance with the Company’s, the Employer’s and/or Grantee’s tax obligations. (d) APPENDIX. If applicable, the Restricted Shares are subject to any additional terms and conditions for the country set forth in the Appendix to this Award Agreement. If Grantee relocates to another country, the terms and conditions for that country (if any) will apply to Grantee to the extent the Company determines, in its sole discretion, that applying such terms and conditions are necessary or advisable to comply with local law, rules and regulations or to facilitate the operation and administration of this Award Agreement and the Plan (or the Company may establish alternative terms and conditions as may be necessary or advisable to accommodate Grantee's transfer). The Appendix constitutes part of this Award Agreement. (e) LANGUAGE. By accepting this Award Agreement, Grantee acknowledges that Grantee is proficient in the English language, or has consulted with an advisor who is proficient in the English language, so as to enable Grantee to understand the provisions of this Award Agreement and the Plan. If Grantee has received this Award Agreement or any other document related to the Plan translated into a language other than English and if the meaning of the translated version is different than the English version, the English version will control. (f) ELECTRONIC DELIVERY AND PARTICIPATION. The Company may, in its sole discretion, decide to deliver any documents related to current or future participation in the Plan by electronic means. Grantee hereby consents to receive such documents by electronic delivery and agrees to participate in the Plan through an on-line or electronic system established and maintained by the Company or a third party designated by the Company. (g) IMPOSITION OF OTHER REQUIREMENTS. The Company reserves the right to impose other requirements on the Restricted Shares, any payment made pursuant to the Restricted Shares,

Page 8 of 17 and Grantee's participation in the Plan, to the extent the Company determines, in its sole discretion, that such other requirements are necessary or advisable in order to comply with local law, rules and regulations or to facilitate the operation and administration of the Restricted Shares and the Plan. Such requirements may include requiring Grantee to sign any agreements or undertakings that may be necessary to accomplish the foregoing. (h) INSIDER TRADING RESTRICTIONS/MARKET ABUSE LAWS. Grantee acknowledges that, depending on Grantee’s country of residence, the broker’s country of establishment, or where the Shares are listed, Grantee may be subject to insider trading restrictions and/or market abuse laws in applicable jurisdictions, which may affect Grantee’s ability to, directly or indirectly, accept, acquire, sell, or attempt to sell or otherwise dispose of Shares, or rights linked to the value of Shares, during such times as Grantee is considered to have “inside information” regarding the Company (as defined by the laws and/or regulations in the applicable jurisdictions or Grantee's country of residence). Local insider trading laws and regulations may prohibit the cancellation or amendment of orders Grantee places before possessing the inside information. Furthermore, Grantee may be prohibited from (i) disclosing inside information to any third party, including fellow employees (other than on a “need to know” basis) and (ii) “tipping” third parties or causing them to otherwise buy or sell securities. Any restrictions under these laws or regulations are separate from and in addition to any restrictions that may be imposed under any applicable Company insider trading policy. Grantee is responsible for ensuring compliance with any applicable restrictions and should consult Grantee’s personal legal advisor on this matter. (i) EXCHANGE CONTROLS; FOREIGN ASSET/ACCOUNT REPORTING. Grantee acknowledges that Grantee's country of residence may have certain exchange controls, foreign asset and/or account reporting requirements that may affect Grantee’s ability to acquire or hold Shares under the Plan or cash received from participating in the Plan (including from any dividends received or sale proceeds arising from the sale of Shares) in a brokerage or bank account outside Grantee's country of residence. Grantee may be required to report such accounts, assets or transactions to the tax or other authorities in Grantee's country of residence. Grantee also may be required to repatriate sale proceeds or other cash received as a result of Grantee’s participation in the Plan to Grantee's country of residence through a designated bank or broker and/or within a certain time after receipt. Grantee acknowledges that it is Grantee’s responsibility to be compliant with such regulations, and Grantee should consult with Grantee’s personal legal advisor for any details. (j) NOTICE. Any notice required by the terms of this Award Agreement shall be given in writing and shall be deemed effective upon personal delivery or upon deposit with the United States Postal Service, by registered or certified mail, with postage and fees prepaid. Notice shall be addressed to the Company at its principal executive office and to Grantee at the address that Grantee most recently provided in writing to the Company. (k) CHOICE OF LAW; VENUE. This Award Agreement and the Notice shall be governed by, and construed in accordance with, the laws of the state of New York, USA, without regard to the conflict of law provisions. For purposes of litigating any dispute that arises under this grant or the Award Agreement, the parties hereby submit to and consent to the jurisdiction of the State of New York, USA, and agree that such litigation shall be conducted in the courts of New York, NY, or the federal courts of the United States for the Southern District of New York. (l) COUNTERPARTS. This Award Agreement may be executed in two or more counterparts (which may be electronic), each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Page 9 of 17 (m) MODIFICATION OR AMENDMENT. This Award Agreement may only be modified or amended by written agreement executed by the parties hereto (which may be electronic); provided, however, that the adjustments permitted pursuant to Section 4.3 of the Plan may be made without such written agreement. (n) SEVERABILITY. In the event any provision of this Award Agreement shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining provisions of this Award Agreement, and this Award Agreement shall be construed and enforced as if such illegal or invalid provision had not been included. (o) AWARD SUBJECT TO COMPANY CLAWBACK POLICY. The Restricted Shares shall be subject to clawback or recoupment pursuant to any compensation clawback or recoupment policy adopted (or that may be adopted) by the Board, as may be amended from time to time, or required by law during the term of Grantee’s employment or other service that is applicable to Grantee. (p) NO RIGHT TO CONTINUED EMPLOYMENT. Nothing in the Plan or in this Award Agreement shall confer upon Grantee any right to continue in the employ of the Company, a parent or any subsidiary or shall interfere with or restrict in any way the right of the Company, parent or any subsidiary, which is hereby expressly reserved, to remove, terminate or discharge Grantee at any time for any reason whatsoever, with or without Cause and with or without advance notice. (q) SECTION 409A COMPLIANCE. To the extent Grantee is a U.S. taxpayer, the Restricted Shares are intended to be exempt from Code Section 409A and this Award Agreement shall be interpreted, administered and operated accordingly. To the extent that any provision in this Award Agreement is ambiguous as to its compliance with Code Sections 409A or 457A, the provision shall be interpreted in a manner so that no payment due to Grantee shall be deemed subject to an “additional tax” within the meaning of Code Section 409A(a)(1)(B). The Company does not guarantee the tax treatment of any payments under this Award Agreement, including under the Code, federal, state, local or foreign tax laws and regulations. (r) COMPLIANCE WITH LAW. Notwithstanding any other provision of the Plan or this Award Agreement, unless there is an exemption from any registration, qualification or other legal requirement applicable to the Shares, the Company shall not be required to deliver any Shares issuable upon settlement of the Restricted Shares prior to the completion of any registration or qualification of the Shares under any local, state, federal or foreign securities or exchange control law or under rulings or regulations of the U.S. Securities and Exchange Commission (“SEC”) or of any other governmental regulatory body, or prior to obtaining any approval or other clearance from any local, state, federal or foreign governmental agency, which registration, qualification or approval the Company shall, in its absolute discretion, deem necessary or advisable. Grantee understands that the Company is under no obligation to register or qualify the Shares with the SEC or any state or foreign securities commission or to seek approval or clearance from any governmental authority for the issuance or sale of the Shares. Further, Grantee agrees that the Company shall have unilateral authority to amend the Award Agreement without Grantee’s consent to the extent necessary to comply with securities or other laws applicable to issuance of Shares. (s) RATIFICATION OF ACTIONS. By accepting this Restricted Share grant, Grantee and each person claiming under or through Grantee shall be conclusively deemed to have indicated Grantee's acceptance and ratification of, and consent to, any action taken under the Plan, this Award Agreement and the Noticeby the Company, the Board or the Committee.

Page 10 of 17 APPENDIX COUNTRY-SPECIFIC TERMS AND CONDITIONS FOR GRANTEES OUTSIDE THE UNITED STATES Capitalized terms used but not defined in this Appendix have the meanings set forth in the Plan, the Notice of Restricted Share Grant and the Award Agreement. Terms and Conditions This Appendix includes additional terms and conditions that govern the Restricted Shares granted under the Plan if Grantee resides and/or works in one of the countries listed below. If Grantee is a citizen or resident (or is considered as such for local law purposes) of a country other than the country in which Grantee is currently residing and/or working, or if Grantee relocates to another country after the grant of the Restricted Shares, the Company shall, in its sole discretion, determine to what extent the special terms and conditions contained herein are applicable. Notifications This Appendix may also include information regarding exchange controls and certain other issues of which Grantee should be aware with respect to participation in the Plan. The information is based on the securities, exchange control, and other laws in effect in the respective countries as of February 2023. Such laws are often complex and change frequently. As a result, the Company strongly recommends that Grantee not rely on the information in this Appendix as the only source of information relating to the consequences of Grantee’s participation in the Plan because the information may be out of date at the time the Restricted Shares vest or Grantee sells Shares acquired under the Plan. In addition, the information contained herein is general in nature and may not apply to Grantee’s particular situation, and the Company is not in a position to assure Grantee of a particular result. Accordingly, Grantee is advised to seek appropriate professional advice as to how the relevant laws in Grantee's country of residence may apply to Grantee’s situation. Finally, if Grantee is a citizen or resident (or is considered as such for local law purposes) of a country other than the country in which Grantee is currently residing and/or working, or if Grantee relocates to another country after the Restricted Shares are granted, the notifications contained herein may no longer be applicable to Grantee. European Union (“EU”) / European Economic Area (“EEA”) Data Privacy Notice for Grantees in the EU / EEA (a) General. The Company is located at Victoria Place, 5th Floor, 31 Victoria Street, Hamilton HM 10, Bermuda, and grants Restricted Shares under the Plan to certain Grantees, at its sole discretion. In conjunction with the Company's grant of the Restricted Shares under the Plan and its ongoing administration of such award, the Company is providing the following information about its data collection, processing and transfer practices, which Grantee should carefully review. (b) Purposes and Legal Bases of Processing. The Company processes Data (as defined below) for the purpose of administering and managing Grantee’s participation in the Plan and facilitating compliance with applicable tax, exchange control, securities and labor laws. The legal basis for the collection, use and other processing of Data by the Company and the third-party service

Page 11 of 17 providers described below is the necessity of such collection, use and processing for the Company to perform its contractual obligations under this Award Agreement and for the Company’s legitimate business interests of implementing and managing the Plan and generally administering employee equity awards. (c) Data Collection and Usage. The Company and the Employer may collect, process and use the following types of personal information about Grantee: Grantee’s name, home address, email address and telephone number, date of birth, social insurance number, passport or other identification number, salary, nationality, job title, details of all stock options or any other entitlement to Shares awarded, canceled, exercised, vested, unvested or outstanding in Grantee’s favor (“Data”). (d) Stock Plan Administration Service Providers. The Company may transfer Data to third parties which assist the Company with the implementation, administration and management of the Plan. Grantee may be asked to agree on separate terms and data processing practices with the service provider, with such agreement being a condition to Grantee’s ability to participate in the Plan. (e) International Data Transfers. Certain of the Company’s operations, including its internal stock plan administration, and its service providers are based in the United States, which means that it will be necessary for Data to be transferred to, and processed in, the United States. The legal basis for the transfer of Data to the Company and its third-party service providers is the necessity of such transfer for the Company to perform its contractual obligations under this Award Agreement and for the Company’s legitimate business interests of implementing and managing the Plan and generally administering employee equity awards. (f) Data Retention. The Company will hold and use the Data only as long as is necessary to implement, administer and manage Grantee’s participation in the Plan, or as required to comply with legal or regulatory obligations, including under tax, exchange control, securities and labor laws. This means Data may be retained after Grantee’s employment is terminated. (g) Data Subject Rights. Grantee may have a number of rights under data privacy laws in Grantee’s jurisdiction. Depending on where Grantee is based, such rights may include the right to (i) request access or copies of Data the Company processes, (ii) rectification of incorrect Data, (iii) deletion of Data, (iv) restrictions on processing of Data, (v) portability of Data, (vi) lodge complaints with competent authorities in Grantee’s jurisdiction, and/or (vii) receive a list with the names and addresses of any potential recipients of Data. To receive clarification regarding these rights or to exercise these rights, Grantee can contact Grantee’s local human resources representative. (h) Contractual Requirement. Where necessary, Grantee’s provision of Data and its processing as described above is a contractual requirement for Grantee to participate in the Plan. Grantee’s participation in the Plan and Grantee’s acceptance of the Restricted Shares is purely voluntary. Grantee can refuse to provide Data, as a result of which Grantee will not be able to participate in the Plan, but Grantee’s career and salary will not be affected in any way. Australia BREACH OF LAW. Notwithstanding anything to the contrary in the Award Agreement or the Plan, Grantee will not be entitled to, and shall not claim any benefit (including without limitation a legal right) under the Plan if the provision of such benefit would give rise to a breach of Part 2D.2 of the Corporation Act 2001 (Cth), any other provision of that Act, or any other applicable statute, rule or regulation which limits or restricts the giving of such benefits.

Page 12 of 17 SECURITIES LAW NOTIFICATION. The grant of the Restricted Shares is being made pursuant to Division 1A, Part 7.12 of the Corporations Act 2001 (Cth). If Grantee offers Shares for sale to a person or entity resident in Australia, the offer may be subject to disclosure requirements under Australian law. Grantee personally should obtain legal advice on applicable disclosure obligations prior to making any such offer. TAX NOTIFICATION. The Plan is a plan to which Subdivision 83A-C of the Income Tax Assessment Act 1997 (Cth) applies (subject to conditions in the Act). EXCHANGE CONTROL INFORMATION. Exchange control reporting is required for cash transactions exceeding AUD 10,000 and international fund transfers. The Australian bank assisting with the transaction will file the report. If there is no Australian bank involved in the transfer, Grantee personally will be required to file the report. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. Belgium FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. Belgian residents are required to report any security (e.g., Shares acquired under the Plan) or bank account established outside of Belgium on their personal annual tax return. In a separate report, Belgian residents also are required to provide a central contact point of the National Bank of Belgium with the account number of those foreign bank accounts, the name of the bank with which the accounts were opened and the country in which they were opened in a separate report. This report, as well as additional information on how to complete it, can be found on the website of the National Bank of Belgium, www.nbb.be, under the Kredietcentrales / Centrales des credits caption. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. STOCK EXCHANGE TAX INFORMATION. A stock exchange tax applies to transactions executed by Belgian residents through a non-Belgian financial intermediary, such as a U.S. broker. The stock exchange tax will apply when Shares acquired pursuant to the Award Agreement are sold. Grantee should consult with a personal tax or financial advisor for additional details on Grantee’s obligations with respect to the stock exchange tax. ANNUAL SECURITIES ACCOUNT TAX. An annual securities accounts tax may be payable if the total value of securities held in a Belgian or foreign securities account (e.g., Shares acquired under the Plan) exceeds a certain threshold on four reference dates within the relevant reporting period (i.e., December 31, March 31, June 30 and September 30). In such case, the tax will be due on the value of the qualifying securities held in such account. Grantee should consult with a personal tax or financial advisor for additional details on Grantee’s obligations with respect to the annual securities account tax. Brazil COMPLIANCE WITH LAW. By accepting the Restricted Shares, Grantee agrees to comply with applicable Brazilian laws and to report and pay applicable Tax-Related Items associated with the Restricted Shares and the subsequent sale of Shares acquired under the Plan.

Page 13 of 17 LABOR LAW ACKNOWLEDGEMENT. By accepting the Award, Grantee agrees that Grantee is (a) making an investment decision, (b) the Restrictions on the Restricted Shares will lapse only if the vesting conditions are met and (c) the value of the Restricted Shares is not fixed and may increase or decrease in value without compensation to Grantee. EXCHANGE CONTROL INFORMATION. If Grantee is resident or domiciled in Brazil, Grantee will be required to submit an annual declaration of assets and rights held outside of Brazil to the Central Bank of Brazil if the aggregate value of such assets and rights is greater than US$1,000,000 as of December 31 of each year. If the aggregate value exceeds US$100,000,000 as of the end of each quarter, a declaration must be submitted quarterly. Assets and rights that must be reported include Shares acquired under the Plan. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. If Grantee is a resident or domiciled in Brazil, Grantee may be required to submit an annual declaration of assets and rights held outside of Brazil to the Central Bank of Brazil. If the aggregate value of such assets and/or rights is US$1,000,000 or more but less than US$100,000,000, a declaration must be submitted annually. If the aggregate value exceeds US$100,000,000, a declaration must be submitted quarterly. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. TAX ON FINANCIAL TRANSACTION (IOF). Repatriation of funds (e.g., the proceeds from the sale of Shares) into Brazil and the conversion of USD into BRL associated with such fund transfers may be subject to the Tax on Financial Transactions. It is Grantee's responsibility to comply with any applicable Tax on Financial Transactions arising from Grantee’s participation in the Plan. Grantee should consult with Grantee’s personal tax advisor for additional details. Germany EXCHANGE CONTROL INFORMATION. Cross-border payments in excess of €12,500 in connection with the sale of securities (including Shares acquired under the Plan) must be reported to the German Federal Bank (Bundesbank) by the fifth day of the month following the month in which the payment is received or made. If Grantee acquires Shares with a value in excess of €12,500, the Employer will report the acquisition of such Shares to the German Federal Bank. If Grantee otherwise makes or receives a payment in excess of €12,500, Grantee personally must report the payment to Bundesbank electronically using the “General Statistics Reporting Portal” (“Allgemeines Meldeportal Statistik”) available via Bundesbank’s website (www.bundesbank.de). Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. German residents must notify their local tax office of the acquisition of Shares when they file their personal income tax returns for the relevant year if the value of the Shares acquired exceeds €150,000 or in the unlikely event that the resident holds Shares exceeding 10% of the Company’s total Shares outstanding. However, if the Shares are listed on a recognized U.S. stock exchange and you own less than 1% of the total Shares, this requirement will not apply even if Shares with a value exceeding €150,000 are acquired. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. Hong Kong

Page 14 of 17 SALE OF SHARES. In the event the Restricted Shares vest within six months of the Date of Grant, Grantee agrees not to sell any Shares acquired upon vesting prior to the six-month anniversary of the Date of Grant. SECURITIES LAW NOTICE. The contents of this document have not been reviewed by any regulatory authority in Hong Kong. Grantee should exercise caution in relation to the offer. If Grantee is in doubt about any of the contents of this Award Agreement or the Plan, the Participant should obtain independent professional advice. Neither the grant nor vesting of the Restricted Shares constitutes a public offering of securities under Hong Kong law and is available only to employees of the Company and its subsidiaries. The Notice, Award Agreement, the Plan and other incidental materials (i) have not been prepared in accordance with and are not intended to constitute a “prospectus” for a public offering of securities under applicable securities legislation in Hong Kong and (ii) are intended only for the personal use of each eligible employee of the Company and its subsidiaries and may not be distributed to any other person. NATURE OF SCHEME. The Company specifically intends that the Plan will not be an occupational retirement scheme for purposes of the Occupational Retirement Schemes Ordinance (“ORSO”). India EXCHANGE CONTROL INFORMATION. Any funds realized in connection with the Plan (e.g., proceeds from the sale of Shares and cash dividends paid on the Shares) must be repatriated to India within a specified period of time after receipt as prescribed under Indian exchange control laws. Grantee is personally responsible for obtaining a foreign inward remittance certificate (“FIRC”) from the bank where Grantee deposits the foreign currency and holding the FIRC as evidence of the repatriation of funds in the event the Reserve Bank of India or the Employer requests proof of repatriation. Grantee is personally responsible for complying with exchange control laws in India, and neither the Company nor the Employer will be liable for any fines or penalties resulting from Grantee’s failure to comply with applicable laws. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. Grantee is required to declare Grantee’s foreign bank accounts and any foreign financial assets (including Shares acquired under the Plan held outside India) in Grantee’s annual tax return. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. Italy PLAN ACKNOWLEDGEMENT. By accepting the Restricted Shares, Grantee acknowledges that Grantee has received a copy of the Plan and the Award Agreement, including the Addendum in their entirety and fully understands and accepts all provisions of the Plan and the Award Agreement, including this Country Addendum. In addition, Grantee further acknowledges that Grantee has read and specifically and expressly approves without limitation the following clauses of the Award Agreement: SECTION 4 - NATURE OF GRANT SECTION 6(a) - TAX WITHHOLDING SECTION 6(c) - DATA PRIVACY SECTION 6(e) - LANGUAGE

Page 15 of 17 SECTION 6(f) - ELECTRONIC DELIVERY AND PARTICIPATION SECTION 6(g) - IMPOSITION OF OTHER REQUIREMENTS SECTION 6(h) - INSIDER TRADING RESTRICTIONS/MARKET ABUSE LAWS SECTION 6(j) - EXCHANGE CONTROLS; FOREIGN ASSET/ACCOUNT REPORTING SECTION 6(k) - CHOICE OF LAW; VENUE SECTION 6(o) - AWARD SUBJECT TO COMPANY CLAWBACK POLICY SECTION 6(p) - NO RIGHT TO CONTINUED EMPLOYMENT FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. Italian residents who, at any time during the fiscal year, hold foreign financial assets (including cash and Shares) which may generate income taxable in Italy are required to report these assets on their annual tax returns (UNICO Form, RW Schedule) for the year during which the assets are held, or on a special form if no tax return is due. These reporting obligations will also apply to Italian residents who are the beneficial owners of foreign financial assets under Italian money laundering provisions. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. FOREIGN ASSET TAX. The value of any Shares (and other financial assets) held outside Italy by individuals resident of Italy may be subject to a foreign asset tax. The taxable amount will be the fair market value of the financial assets (e.g., Shares) assessed at the end of the calendar year. The value of financial assets held abroad must be reported in Form RM of the annual return. Grantee should consult Grantee’s personal tax advisor for additional information on the foreign asset tax. Japan EXCHANGE CONTROL INFORMATION. If Grantee acquires Shares valued at more than ¥100,000,000 in a single transaction, Grantee must file a Securities Acquisition Report with the Ministry of Finance through the Bank of Japan within 20 days of the purchase of the Shares. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. Foreign Asset / Account Reporting Information. Grantee will be required to report details of any assets held outside Japan as of December 31st to the extent such assets have a total net fair market value exceeding ¥50,000,000. This report is due by March 15th each year. Grantee should consult with his or her personal tax advisor as to whether the reporting obligation applies to Grantee and whether the requirement extends to any outstanding Restricted Share awards or Shares acquired under the Plan. Netherlands No country-specific provisions. Singapore RESTRICTION ON SALE AND TRANSFERABILITY. Grantee hereby agrees that the Restricted Shares will not be offered for sale in Singapore prior to the six-month anniversary of the Date of Grant, unless such sale or offer is made pursuant to one or more exemptions under Part XIII Division 1 Subdivision (4) (other than section 280) of the Securities and Futures Act (Chap. 289, 2006 Ed.) (“SFA”) or pursuant to, and in accordance with the conditions of, any other applicable provision(s) of the SFA.

Page 16 of 17 SECURITIES LAW INFORMATION. The Restricted Share grant is being made pursuant to the “Qualifying Person” exemption under section 273(1)(f) of the SFA, on which basis it is exempt from the prospectus and registration requirements under the SFA, and is not made with a view to the Restricted Shares being subsequently offered for sale to any other party. The Plan has not and will not be lodged or registered as a prospectus with the Monetary Authority of Singapore. DIRECTOR NOTIFICATION REQUIREMENT. The directors (including alternate, substitute, associate and shadow directors) of a Singapore Subsidiary are subject to certain notification requirements under the Singapore Companies Act. The directors must notify the Singapore Subsidiary in writing of an interest (e.g., Restricted Shares, etc.) in the Company or any related company within two (2) business days of (i) its acquisition or disposal, (ii) any change in a previously disclosed interest (e.g., when the Shares are sold), or (iii) becoming a director. South Korea EXCHANGE CONTROL INFORMATION. If Grantee realizes US$500,000 or more from the sale of Shares or the receipt of any dividends with respect to any Awards granted prior to July 18, 2017, Korean exchange control laws may require Grantee to repatriate the proceeds back to Korea within three (3) years of the sale/receipt. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. FOREIGN ASSET/ACCOUNT REPORTING INFORMATION. Korean residents must declare all foreign financial accounts (e.g., non-Korean bank accounts, brokerage accounts) to the Korean tax authority and file a report with respect to such accounts in June of the following year if the monthly balance of such accounts exceeds KRW 500 million (or an equivalent amount in foreign currency) on any month-end date during a calendar year. Grantee should consult with Grantee’s personal advisor(s) regarding any personal foreign asset/foreign account tax obligations Grantee may have in connection with Grantee’s participation in the Plan. Taiwan SECURITIES LAW INFORMATION. The grant of Awards and participation in the Plan is available only for employees of the Company and its subsidiaries and affiliates. The grant of an Award and participation in the Plan is not a public offer of securities by a Taiwanese company. EXCHANGE CONTROL INFORMATION. Grantee may acquire and remit foreign currency (including proceeds from the sale of Shares acquired under the Plan) into Taiwan up to US$5,000,000 per year without justification. If the transaction amount is TWD$500,000 or more in a single transaction, Grantee must submit a Foreign Exchange Transaction Form and also provide supporting documentation to the satisfaction of the remitting bank. Grantee should consult with Grantee’s personal advisor(s) regarding any personal legal, regulatory or foreign exchange obligations Grantee may have in connection with Grantee’s participation in the Plan. United Kingdom TAX WITHHOLDING. The following provisions supplement Section 5(a) of this Award Agreement: Without limitation to Section 5(a) of this Award Agreement, Grantee agrees that he or she is liable for all Tax-Related Items and hereby covenants to pay all such Tax-Related Items as and when requested by the

Page 17 of 17 Company, the Employer or by Her Majesty’s Revenue and Customs’ (“HMRC”) (or any other tax authority or any other relevant authority). Grantee also agrees to indemnify and keep indemnified the Company and the Employer against any Tax-Related Items that they are required to pay or withhold on or have paid or will pay to HMRC (or any other tax authority or any other relevant authority) on Grantee’s behalf. Notwithstanding the foregoing, if Grantee is an executive officer or director (within the meaning of Section 13(k) of the Exchange Act), the terms of the immediately foregoing provision will not apply. In such case, if the amount of any income tax due is not collected from or paid by Grantee within ninety (90) days of the end of the U.K. tax year in which an event giving rise to the indemnification described above occurs, the amount of any uncollected income tax may constitute an additional benefit to Grantee on which additional income tax and National Insurance Contributions (“NICs”) may be payable. Grantee will be responsible for reporting and paying any income tax due on this additional benefit directly to HMRC under the self-assessment regime and for reimbursing the Company and/or the Employer for the value of any employee NICs due on this additional benefit, which the Company and/or the Employer may recover at any time thereafter by any of the means referred to in Section 5(a) of this Award Agreement. ************************************