UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THESECURITIES ACT OF 1933

For the fiscal year ended December 31, 2016

FUNDRISE EAST COAST OPPORTUNISTIC REIT, LLC

(Exact name of registrant as specified in its charter)

Commission File Number:024-10566

| Delaware | | 30-0889118 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

1601 Connecticut Ave., NW, Suite 300 Washington, DC

(Address of principal executive offices) | | 20009

(Zip Code) |

(202) 584-0550

Registrant’s telephone number, including area code

Common Shares

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

Part II.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report on Form 1-K (“Annual Report”) that are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| • | our ability to effectively deploy the proceeds raised in our initial public offering (the “Offering”); |

| • | our ability to attract and retain members to our sponsor’s online crowdfunding platform (the “Fundrise Platform”); |

| • | risks associated with breaches of our data security; |

| • | changes in economic conditions generally and the real estate and securities markets specifically; |

| • | limited ability to dispose of assets because of the relative illiquidity of real estate investments; |

| • | intense competition in the real estate market that may limit our ability to attract or retain tenants or re-lease space; |

| • | defaults on or non-renewal of leases by tenants; |

| • | increased interest rates and operating costs; |

| • | our failure to obtain necessary outside financing; |

| • | decreased rental rates or increased vacancy rates; |

| • | the risk associated with potential breach or expiration of a ground lease, if any; |

| • | difficulties in identifying properties to complete, and consummating, real estate acquisitions, developments, joint ventures and dispositions; |

| • | our failure to successfully operate acquired properties and operations; |

| • | exposure to liability relating to environmental and health and safety matters; |

| • | changes in real estate and zoning laws and increases in real property tax rates; |

| • | failure of acquisitions to yield anticipated results; |

| • | risks associated with breaches of our data security; |

| • | risks associated with derivatives or hedging activity; |

| • | our level of debt and the terms and limitations imposed on us by our debt agreements; |

| • | the need to invest additional equity in connection with debt refinancings as a result of reduced asset values; |

| • | our ability to retain our executive officers and other key personnel of our advisor, our property manager and their affiliates; |

| | | |

| • | expected rates of return provided to investors; |

| • | the ability of our sponsor and its affiliates to source, originate and service our loans and other assets, and the quality and performance of these assets; |

| • | our ability to retain and hire competent employees and appropriately staff our operations; |

| • | legislative or regulatory changes impacting our business or our assets (including changes to the laws governing the taxation of real estate investment trusts (“REITs”) and Securities and Exchange Commission (“SEC”) guidance related to Regulation A or the JOBS Act); |

| • | changes in business conditions and the market value of our assets, including changes in interest rates, prepayment risk, operator or borrower defaults or bankruptcy, and generally the increased risk of loss if our investments fail to perform as expected; |

| • | our ability to implement effective conflicts of interest policies and procedures among the various real estate investment opportunities sponsored by our sponsor; |

| • | our ability to access sources of liquidity when we have the need to fund redemptions of common shares in excess of the proceeds from the sales of our common shares in our continuous offering and the consequential risk that we may not have the resources to satisfy redemption requests; |

| • | our failure to maintain our status as a REIT; |

| • | our compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940, as amended (the “Advisers Act”), the Investment Company Act and other laws; and |

| • | changes to generally accepted accounting principles, or GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

FUNDRISE EAST COAST OPPORTUNISTIC REIT, LLC

(the "East Coast eREITTM")

The Company

Fundrise East Coast Opportunistic REIT, LLC is a Delaware limited liability company formed on November 19, 2015 to originate, invest in and manage a diversified portfolio primarily consisting of investments in multifamily rental properties and development projects located primarily in the states of Massachusetts, New York, New Jersey, North Carolina, South Carolina, Georgia and Florida, as well as the metropolitan statistical areas (“MSAs”) of Washington, DC and Philadelphia, PA, with such investments consisting of equity interests in such properties or debt, as well as commercial real estate debt securities and other select real estate-related assets, where the underlying assets primarily consist of such properties. We define development projects to include a range of activities from major renovation and lease-up of existing buildings to ground up construction. While we intend to primarily invest in multifamily rental properties and development projects located in the states of Massachusetts, New York, New Jersey, North Carolina, South Carolina, Georgia and Florida, as well as the MSAs of Washington, DC and Philadelphia, PA, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may also invest in commercial real estate-related debt securities (including commercial mortgage-backed securities, or CMBS, collateralized debt obligations, or CDOs, and REIT senior unsecured debt) and other real estate-related assets. We may make our investments through majority-owned subsidiaries, some of which may have rights to receive preferred economic returns. The use of the terms “Fundrise East Coast Opportunistic REIT”, the “Company”, “we”, “us” or “our” in this Annual Report refer to Fundrise East Coast Opportunistic REIT, LLC unless the context indicates otherwise.

We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (“the Code”), commencing with our taxable year ending December 31, 2016. As of April 1, 2017 and December 31, 2016, our portfolio was comprised of approximately $19,152,000 and $12,689,000 worth of equity in controlled subsidiaries and other real estate holding entities, respectively, that in the opinion of our Manager, meets our investment objectives. SeeItem 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments” for information concerning our investments since December 31, 2016. We will seek to create and maintain a portfolio of multifamily rental properties and development project investments that generate a low volatility income stream of attractive and consistent cash distributions. Our focus on investing in debt and equity instruments will emphasize the payment of current returns to investors and preservation of invested capital as our primary investment objectives, as well as emphasizing capital appreciation from our investments, as is typically the case with strategies focused exclusively on opportunistic or equity oriented investments.

Fundrise Advisors, LLC, our Manager, manages our day-to-day operations. Our Manager is an investment adviser registered with the SEC and a wholly-owned subsidiary of our sponsor. A team of real estate and debt finance professionals, acting through our Manager, makes all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in our operating agreement. Our Manager also provides asset management, marketing, investor relations and other administrative services on our behalf with the goal of maximizing our operating cash flow and preserving our invested capital. Rise Companies Corp., our sponsor, is able to exercise significant control over our business.

We have offered, are offering, and will continue to offer up to $50,000,000 in our common shares, which represent limited liability company interests in our company (the “Offering”). See Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview” for more information concerning the current status of the Offering.

We expect to offer common shares in our Offering until we raise the maximum amount being offered, unless terminated by our Manager at an earlier time. Until December 31, 2017, the per share purchase price for our common shares will be $10.00 per share, an amount that was arbitrarily determined by our Manager. Thereafter, the per share purchase price will be adjusted every fiscal quarter and, as of January 1st, April 1st, July 1st and October 1st of each year (or as soon as commercially reasonable and announced by us thereafter), will equal the greater of (i) $10.00 per share or (ii) the sum of our net asset value, or NAV, divided by the number of our common shares outstanding as of the end of the prior fiscal quarter (NAV per share). Although we do not intend to list our common shares for trading on a stock exchange or other trading market, we have adopted a redemption plan designed to provide our shareholders with limited liquidity on a quarterly basis for their investment in our shares.

Investment Strategy

We originate, acquire, asset manage, operate, selectively leverage, syndicate and opportunistically sell multifamily rental properties and development projects through the acquisition of equity interests in such properties or debt (including senior mortgage loans, subordinated mortgage loans (also referred to as B Notes), mezzanine loans, and participations in such loans), as well as commercial real estate debt securities and other real estate-related assets, where the underlying assets primarily consist of such properties. Our management has extensive experience investing in numerous types of properties. While we focus our investments primarily in multifamily rental properties and development projects, in the event that appropriate investment opportunities are not available, we may acquire a wide variety of commercial properties, including office, industrial, retail, recreation and leisure, single-tenant residential and other real properties. These properties may be existing, income-producing properties, newly constructed properties or properties under development or construction and may include multifamily rental properties purchased for conversion into condominiums and single-tenant properties that may be converted for multifamily use. We focus on acquiring properties with significant possibilities for capital appreciation, such as those requiring development, redevelopment or repositioning, those located in markets with high growth potential and those available from sellers who are distressed or face time-sensitive deadlines. We also may invest in real estate-related securities, including securities issued by other real estate companies, either for investment or in change of control transactions completed on a negotiated basis or otherwise, and in bridge and mezzanine loans that may lead to an opportunity to purchase a real estate interest. In addition, to the extent that our Manager and its investment committee determines that it is advantageous, we also may make or invest in commercial mortgage-backed securities, mortgage loans and Code Section 1031 tenant-in-common interests. Our portfolio of debt investments is secured primarily by U.S. based collateral, primarily multifamily rental properties and development projects, and diversified by security type.

We seek to create and maintain a portfolio of multifamily rental properties and development project investments that generate a low volatility income stream of attractive and consistent cash distributions. Our focus on investing in debt and equity instruments emphasizes the payment of current returns to investors and preservation of invested capital as our primary investment objectives, as well as emphasizing capital appreciation from our investments, as is typically the case with strategies focused exclusively on opportunistic or equity-oriented investments.

For debt investments, our Manager directly structures, underwrites and originates many of the debt products in which we invest, as doing so provides for the best opportunity to control our borrower and partner relationships and optimize the terms of our investments. Our proven underwriting process, which our management team has successfully developed over their extensive real estate careers in a variety of market conditions and implemented at our sponsor, involves comprehensive financial, structural, operational and legal due diligence of our borrowers and partners in order to optimize pricing and structuring and mitigate risk. We feel the current and future market environment for multifamily rental properties and development projects (including any existing or future government-sponsored programs) provides a wide range of opportunities to generate compelling investments with strong risk-return profiles for our shareholders.

Investment Objectives

Our primary investment objectives are:

| | · | to realize growth in the value of our investment within approximately five years of the termination of our Offering; |

| | · | to grow net cash from operations so more cash is available for distributions to investors; |

| | · | to pay attractive and consistent cash distributions; |

| | · | to enable investors to realize a return on their investment by beginning the process of liquidating and distributing cash to investors within approximately five years of the termination of our Offering, or providing liquidity through alternative means such as in-kind distributions of our own securities or other assets; and |

| | · | to preserve, protect and return shareholders’ capital contributions. |

We also seek to realize growth in the value of our investments by timing their sale to maximize value. There can be no assurance that we will be able to achieve these objectives.

Competition

Our net income depends, in large part, on our ability to source, acquire and manage investments with attractive risk-adjusted yields. We compete with many other entities engaged in real estate investment activities, including individuals, corporations, bank and insurance company investment accounts, other REITs, private real estate funds, and other entities engaged in real estate investment activities as well as online lending platforms that compete with the Fundrise Platform, many of which have greater financial resources and lower costs of capital available to them than we have. In addition, there are numerous REITs with asset acquisition objectives similar to ours, and others may be organized in the future, which may increase competition for the investments suitable for us. Competitive variables include market presence and visibility, amount of capital to be invested per project and underwriting standards. To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction or to employ more liberal underwriting standards when evaluating potential investments than we are, our investment volume and profit margins for our investment portfolio could be impacted. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying the assets that we have targeted for acquisition. Although we believe that we are well positioned to compete effectively in each facet of our business, there is enormous competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Risk Factors

We face risks and uncertainties that could affect us and our business as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our Offering Circular dated October 5, 2016, as supplemented, (the “Offering Circular”) which may be accessedhere, as the same may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our common shares.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

Fundrise East Coast Opportunistic REIT, LLC is a newly organized Delaware limited liability company formed to originate, invest in and manage a diversified portfolio primarily consisting of investments in multifamily rental properties and development projects located primarily in the states of Massachusetts, New York, New Jersey, North Carolina, South Carolina, Georgia and Florida, as well as the metropolitan statistical areas (“MSAs”) of Washington, DC and Philadelphia, PA, with such investments consisting of equity interests in such properties or debt, as well as commercial real estate debt securities and other select real estate-related assets, where the underlying assets primarily consist of such properties. We are externally managed by Fundrise Advisors, LLC, or our Manager, which is an investment adviser registered with the Securities and Exchange Commission, or SEC, and a wholly-owned subsidiary of our sponsor, Rise Companies Corp., the parent company of Fundrise, LLC, our affiliate. Fundrise, LLC owns and operates an online investment platform www.fundrise.com. On October 25, 2016, we commenced operations upon our satisfying the $1.0 million minimum offering requirement (not including the $100,000 received in the private placements to our sponsor and Fundrise, LP).

We have offered, are offering, and will continue to offer up to $50,000,000 in our common shares in our Offering. As of April 1, 2017 and December 31, 2016, we had raised total gross offering proceeds of approximately $11.35 million and $6.36 million, respectively, from settled subscriptions (including the $100,000 received in the private placements to our sponsor, Rise Companies Corp., and Fundrise, LP, an affiliate of our sponsor), and had settled subscriptions in our Offering and private placements for an aggregate of approximately 1,135,000 and 636,000 , respectively, of our common shares. Assuming the settlement for all subscriptions received as of April 1, 2017, approximately 3,865,000 of our common shares remained available for sale to the public under our Offering.

To mitigate the effect of our lack of assets, revenue and operating history, our Manager agreed, for a period until December 31, 2016 (the “fee waiver period”), to waive its asset management fee during the fee waiver period if the average annualized non-compounded return to investors is less than eight percent (8%). Following the conclusion of the fee waiver period, our Manager may, in its sole discretion, waive its asset management fee, in whole or in part. The Manager will forfeit any portion of the asset management fee that is waived. As of April 1, 2017, our Manager has not waived the asset management fee since the end of the fee waiver period. For more information regarding the fee waiver support of our common shares, please see “Description of Our Common Shares – Distributions” in our Offering Circular.

We have operated in a manner intended to qualify as a REIT for federal income tax purposes beginning with the year ended December 31, 2016.

Our Investments

During the year ended December 31, 2016, we entered into the following investments. See “Recent Developments”below for a description of investments we have made since December 31, 2016.

| Investment Type | Date | Description |

| | | |

| Acquisitions of Controlled Subsidiaries | 11/21/16 | Directly acquired ownership of a “majority-owned subsidiary”, CEAI Sandtown Vista, LLC (the “Sandtown Controlled Subsidiary”), in which we have the right to receive a preferred economic return for a purchase price of $5,000,000, which is the initial stated value of our equity interest in the Sandtown Controlled Subsidiary. The Sandtown Controlled Subsidiary used the proceeds to acquire a stabilized, 350-unit garden-style multi-family property, Sandtown Vista, located at 1475 Sand Bay Drive, Atlanta, GA 30331. The Sandtown Controlled Subsidiary intends to |

| | | increase the value of the Sandtown Property by completing light renovations and is anticipating redeeming the Sandtown Controlled Subsidiary Investment via refinancing or sale by July 2022. More information on the Sandtown Controlled Subsidiary acquisition can be foundhere. |

| | | |

| | 11/30/16 | Directly acquired ownership of a “majority-owned subsidiary”, Enclave at Lake Ellenor JV, LLC (the “RSE REM Controlled Subsidiary”), for an initial purchase price of $7,650,000, which is the initial stated value of our equity interest in the RSE REM Controlled Subsidiary. The RSE REM Controlled Subsidiary used the proceeds to close on the acquisition of a single stabilized garden-style multi-family property totaling 296 units located at 2100 W Oak Ridge Road in Orlando, FL. The RSE REM Investment was funded with $650,000 in proceeds from our Offering and $7 million in proceeds from that certain Promissory Grid Note by and between us and our sponsor. More information on the RSE REM Controlled Subsidiary acquisition can be foundhere. |

Distributions

While we are under no obligation to do so, we have in the past and expect in the future to declare and pay distributions quarterly in arrears; however, our Manager may declare other periodic distributions as circumstances dictate. In order that investors may generally begin receiving distributions immediately upon our acceptance of their subscription, we expect to authorize and declare distributions based on daily record dates.

On January 12, 2017, we paid out our first distribution to shareholders of record as of the close of business on each day of the period commencing on November 1, 2016 and ending on December 31, 2016. Our Manager has declared daily distributions for shareholders of record as of the close of business on each day from November 1, 2016 through June 30, 2017, as shown in the table below:

| Distribution Period | | Daily Distribution

Amount/Common

Share | | | Date of

Declaration | | Payment Date (1) | | Annualized Yield

(2) | | | |

| 11/01/16 – 11/30/16 | | | 0.0008219178 | | | 10/26/16 | | 1/12/17 | | | 3.00 | % | | |

| 12/01/16 – 12/31/16 | | | 0.0013698630 | | | 11/30/16 | | 1/12/17 | | | 5.00 | % | | |

| 01/01/17 – 03/31/17 | | | 0.0022602740 | | | 12/31/16 | | 4/21/17 | | | 8.25 | % | | |

| 04/01/17 – 06/30/17 | | | 0.0023972603 | | | 03/21/17 | | 7/21/17 | | | 8.75 | % | | |

| Weighted Average (11/01/16 through 06/30/17) | | | 0.0020194158 | (3) | | | | | | | 7.37 | % | (4) | |

| | | | | | | | | | | | | | | |

(1) Dates presented are the dates on which the distributions were, or are, scheduled to be distributed; actual distribution dates may vary.

(2) Annualized yield numbers represent the annualized yield amount of each distribution calculated on an annualized basis at the then current rate, assuming a $10.00 per share purchase price. While the Manager is under no obligation to do so, each annualized basis return assumes that the Manager would declare distributions in the future similar to the distributions for each period presented, and there can be no assurance that the Manager will declare such distributions in the future or, if declared, that such distributions would be of a similar amount.

(3) Weighted average daily distribution amount per common share is calculated as the average of the daily declared distribution amounts from November 1, 2016 through June 30, 2017.

(4) Weighted average annualized yield is calculated as the annualized yield of the average daily distribution amount for the periods presented, assuming a $10.00 per share purchase price.While the Manager is under no obligation to do so, the average annualized basis return assumes that the Manager would declare distributions in the future similar to the average distributions for the period from November 1, 2016 through June 30, 2017, and there can be no assurance that the Manager will declare such distributions in the future or, if declared, that such distributions would be of a similar amount.

Redemption Plan

We have adopted a redemption plan whereby, on a quarterly basis, a shareholder may obtain liquidity as described in detail in our Offering Circular, which may be accessedhere, Our Manager may in its sole discretion, amend, suspend, or terminate the redemption plan at any time, including to protect our operations and our non-redeemed shareholders, to prevent an undue burden on our liquidity, to preserve our status as a REIT, following any material decrease in our NAV, or for any other reason.

As of December 31, 2016, 15,100 common shares have been submitted for redemption through our redemption plan, and 100% of such redemption requests have been honored.

Sources of Operating Revenues and Cash Flows

We generate revenues from net interest income on our commercial real estate investments, as well as cash flow distributions and equity in earnings from our investments in unconsolidated joint ventures . Our income is primarily derived through the difference between revenue and the cost at which we are able to finance our investments. We may also seek to acquire investments which generate attractive returns without any leverage.

Outlook and Recent Trends

We believe that the near and intermediate-term market for investment in select East Coast commercial real estate properties, joint venture equity investments, and other real estate-related assets is compelling from a risk-return perspective, particularly with regard to multifamily rental units.

For purposes of this Annual Report, when discussing the East Coast, we are primarily referring to the states of Massachusetts, New York, New Jersey, North Carolina, South Carolina, Georgia and Florida, as well as the metropolitan statistical areas (“MSAs”) of Washington, DC and Philadelphia, PA. We favor a strategy weighted toward targeting mezzanine debt and joint venture equity with preferred economic returns that maximize current income, and equity investments with significant potential value creation but below the radar of institutional-sized investors.

We pursue a variety of tactics to search for pricing opportunistic dislocations in the East Coast multifamily market including: (i) acquiring value-add and lease-up properties; (ii) acquiring assets that require repositioning or redevelopment; (iii) investing in ground-up new development projects; and (iv) providing senior debt, mezzanine debt and recapitalization equity capital for existing transactions.

We believe that our investment strategy, combined with both our unique web-based origination platform and the experience and expertise of our Manager’s team, provides opportunities to originate investments with attractive current and accrued returns, long-term equity returns and strong structural features with local, joint venture real estate companies. This strategy expects to take advantage of changing market conditions to achieve favorable risk adjusted returns.

We believe that the East Coast multifamily rental market is benefitting from demographic changes, improved job growth, and strong economic dynamics.

Key statistics, as of December 2015, provided by the Bureau of Labor Statistics are set forth below:

| Key Statistics | | Massachusetts | | | New York | | | New Jersey | | | North Carolina | | | South Carolina | | | Georgia | | | Florida | | | US | |

| Population | | | 6,794,422 | | | | 19,795,791 | | | | 8,958,013 | | | | 10,042,802 | | | | 4,896,146 | | | | 10,214,860 | | | | 20,271,272 | | | | 318,900,000 | |

| Pop. Growth Since 2000 | | | 0.5 | % | | | 0.3 | % | | | 0.4 | % | | | 1.7 | % | | | 1.5 | % | | | 1.7 | % | | | 1.8 | % | | | 0.9 | % |

| Number of Employed | | | 3,413,500 | | | | 9,083,900 | | | | 3,962,200 | | | | 4,141,900 | | | | 1,948,600 | | | | 4,155,600 | | | | 7,824,500 | | | | 139,023,000 | |

| Unemployment Rate | | | 5.0 | % | | | 5.3 | % | | | 5.6 | % | | | 5.7 | % | | | 6.0 | % | | | 5.9 | % | | | 5.4 | % | | | 5.3 | % |

| Job Growth (Y-O-Y) | | | 2.2 | % | | | 1.8 | % | | | 1.3 | % | | | 2.3 | % | | | 2.7 | % | | | 2.3 | % | | | 2.9 | % | | | 2.0 | % |

Three Yr. Avg.

Employment Growth | | | 1.9 | % | | | 1.7 | % | | | 1.1 | % | | | 2.1 | % | | | 2.5 | % | | | 2.5 | % | | | 3.0 | % | | | 1.9 | % |

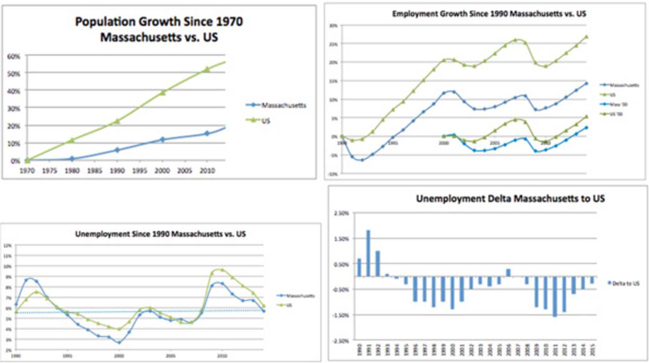

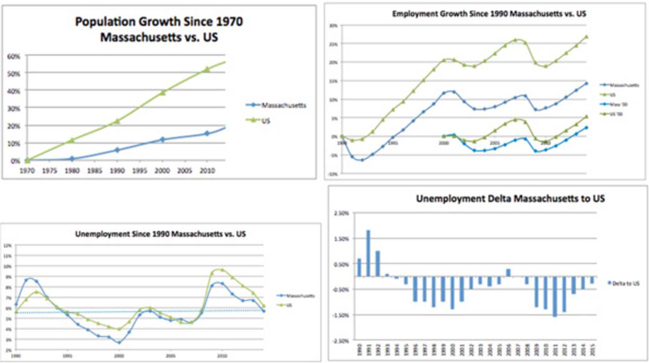

Massachusetts

Massachusetts is a slow growth, low risk, market that has low unemployment and has historically produced steady returns over the long run. As Marcus and Millichap reports in its 2016 Market Forecast, Boston-area tech and professional firms are projected to lead job growth this year, boosting apartment demand in the core and immediately surrounding areas. Tech companies expanding at Kendall Square include Google, which has grown its Cambridge Center campus. Those employed at nearby tech and bioscience firms seek residences close to work and the amenities that areas inside the Route 128 loop offer. While homeownership is an option for some residents, the cost remains out of reach for the majority of those employed in this area, generating additional need for apartments. Developers are responding to tenant demand with new luxury towers that are changing the local landscape in areas such as Cambridge, Fenway, the Seaport District and the South End. Strong demand for new rentals with the latest amenities should support further occupancy gains in core-based units. This absorption of apartments combined with a slowing construction pipeline is expected to result in lower overall vacancy in 2016 compared to 2015, allowing rents in the market to rise. Developers are projected to complete 4,500 new units in 2016, increasing local stock by 1 percent. This is a slowdown from the 7,500 rentals delivered in 2015.

| | | Nov ‘15 Nonfarm | | | % of | | | | | | US % of | | | | US 3 Yr Avg. |

| Massachusetts Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | | Increase |

| Trade, Transportation, and Utilities | | $ | 571.8 | | | | 16.2 | % | | | 0.5 | % | | | 18.9 | % | | | 1.8% |

| Professional and Business Services | | | 549.1 | | | | 15.5 | % | | | 3.3 | % | | | 14.0 | % | | | 3.3% |

| Education and Health Services | | | 772.5 | | | | 21.8 | % | | | 2.2 | % | | | 15.5 | % | | | 2.2% |

| Government | | | 475.9 | | | | 13.4 | % | | | 1.6 | % | | | 15. 3 | % | | | 0.1% |

| Leisure and Hospitality | | | 342.8 | | | | 9.7 | % | | | 2.7 | % | | | 10.8 | % | | | 3.4% |

| Financial Activities | | | 212 | | | | 6.0 | % | | | 0.8 | % | | | 5.7 | % | | | l.5% | | |

| Manufacturing | | | 249:9 | | | | 7.1 | % | | | -0 3 | % | | | 8.7 | % | | | 1.0% |

| Other Services | | | 135.9 | | | | 3.8 | % | | | 3.6 | % | | | 3.9 | % | | | 1.2% |

| Information | | | 87.4 | | | | 2.5 | % | | | 0.1 | % | | | 2.0 | % | | | 1.3% |

| Mining, Logging and Construction | | | 142.4 | | | | 4.0 | % | | | 6.0 | % | | | 5.2 | % | | | 3.4% |

| Total Nonfarm | | | 3,540 | | | | | | | | 1.9 | % | | | | | | | 1.9% |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

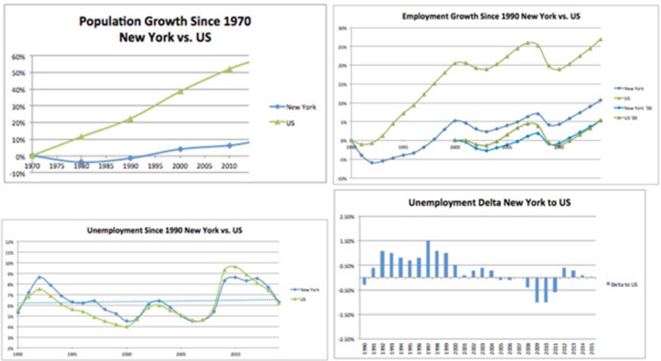

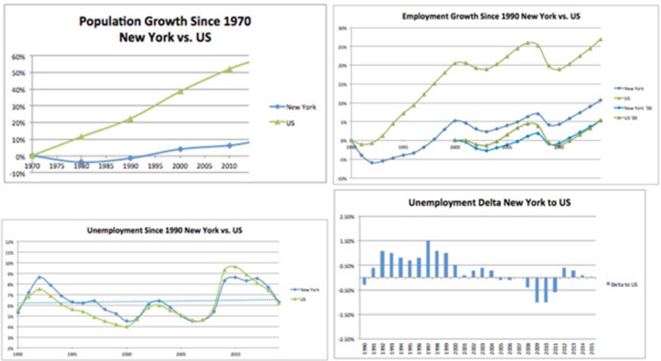

New York

With just over 9 million people, New York is a large state that is primarily driven by the 8.4 million people that live in New York City. Growth has lagged the US as a whole since 1970, but, as the below employment graph shows, employment growth has roughly matched the US as a whole since 2000. As Marcus and Millichap reports in its 2016 Market Forecast, New York City is providing investors with exciting opportunities as job creation at Google, Facebook and other large corporate employers continues to add new workers to the metro, fostering demand for rentals. The high cost of apartments, coupled with the income levels required for mortgages that are more than double the average salary, promote a vigorous multifamily market with vacancy levels near the lowest ever recorded. Developers have responded, and planned completions in 2016 are up dramatically from 2015 levels. Following the creation of 70,000 positions in 2015, New York city organizations are expected to add 80,000 staffers this year, a 1.9 percent growth rate led by professional and health services. With effective rents set to record a fifth straight year of growth, the market is expected to remain one of the brightest in the nation this year.

| | | Nov '15 Nonfarm | | | % of | | | | | | | US % of | | | US 3 Yr Avg. | |

| New York Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 1607.9 | | | | 17.1 | % | | | 1.2 | % | | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 1272.9 | | | | 13.5 | % | | | 2.4 | % | | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 1982 | | | | 21.1 | % | | | 3.0 | % | | | | 15.5 | % | | | 2.2 | % |

| Government | | | 1455.8 | | | | 15.5 | % | | | -0.6 | % | | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 880.5 | | | | 9.4 | % | | | 3.4 | % | | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 697.9 | | | | 7.4 | % | | | 0.8 | % | | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 451.3 | | | | 4.8 | % | | | -0 6 | % | | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 406.1 | | | | 4.3 | % | | | 1.9 | % | | | | 3.9 | % | | | 1.2 | % |

| Information | | | 267 | | | | 2.8 | % | | | 0.8 | % | | | | 2.0 | % | | | 1.3 | % |

| Mining, Logging and Construction | | | 384.9 | | | | 4.1 | % | | | 5.7 | % | | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 9,406 | | | | | | | | 1.7 | % | | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

New Jersey

New Jersey is the most densely populated state in the US, yet lacks a major central city. Its economy is cyclical, and although we expect to see opportunities within New Jersey, they will likely be either near New York

City or Philadelphia. Over the past three years the state has seen the steadiest growth in the Construction sector, which is a less reliable driver of growth as a result of its temporary demand. As Marcus and Millichap reports in its 2016 Northern New Jersey Market Forecast, an accelerating New York City economy is spilling over the Hudson, providing more affordable residential choices in Northern New Jersey. As more firms locate into Manhattan in order to expand their footprint, newly hired workers are picking up rentals in less expensive New Jersey locales such as Jersey City and Newark, where rents can be $2,000 per month below the New York equivalent. Development reached a cycle high in 2015 as builders focused on luxury towers along the waterfronts in Hudson County. The pace of completions is expected to slow this year, mostly a result of the timing of projects rather than a lack of sufficient demand. Activity is projected to remain concentrated along major transportation routes, providing quick commutes for prospective tenants. Overall, flourishing demand is expected to allow a mid-single-digit rise in effective rents this year, more than doubling the pace of inflation. In Northern New Jersey the dip in construction is anticipated to allow demand to catch up, trimming vacancy 20 basis points to 2.5%.

| | | Nov ‘15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| New Jersey Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 869.7 | | | | 21.4 | % | | | 1.1 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 639 7 | | | | 15.7 | % | | | 0.8 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 659.1 | | | | 16.2 | % | | | 1.8 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 637.7 | | | | 15.7 | % | | | 0.1 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 354.9 | | | | 8.7 | % | | | 2.1 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 249 | | | | 6.1 | % | | | -0.5 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 247.6 | | | | 6.1 | % | | | 0.1 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 172.3 | | | | 4.2 | % | | | 1.4 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 75.3 | | | | 1.9 | % | | | -0.5 | % | | | 2.0 | % | | | 1.3 | % |

| Mining, Logging and Construction | | | 161.6 | | | | 4.0 | % | | | 5.5 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 4,067 | | | | | | | | 1.1 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

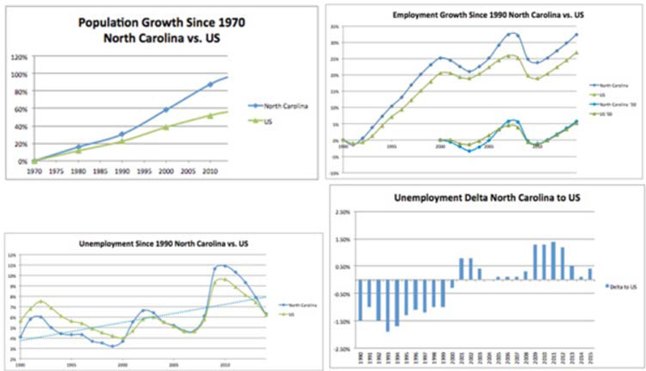

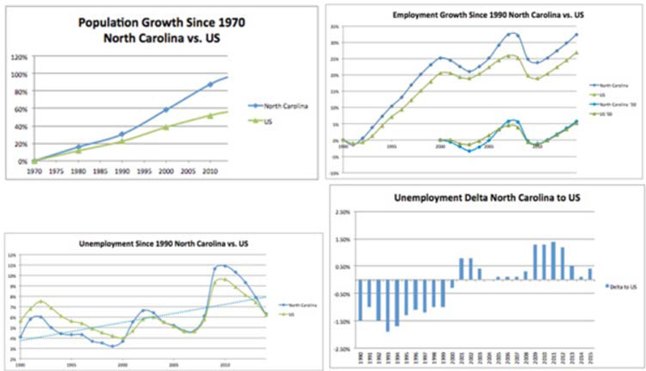

North Carolina

North Carolina is a high-growth market whose metrics look even stronger when considering only the major cities within the state. Employment growth is focused in high wage sectors, and its low cost of living has created an attractive place for people to move. As Marcus and Millichap reports in its 2016 Charlotte Market Forecast, a second consecutive year of robust job growth is expected to trigger new household formations in Charlotte and maintain a flow of residents into local apartment complexes. In response to surging demand, apartment developers continue to bring new complexes to the market. Overall, the market remains in the midst of a building boom that follows a brief respite in development in 2011 and 2012. A significant number of new units are projected to come online in the final months of 2016 and may not be sufficiently leased, however, to avert a slight uptick in the market wide vacancy rate at the end of the year. Higher yields than offered in other East Coast metros is expected to lead more apartment investors to Charlotte in 2016.

The Research Triangle, anchored by North Carolina State University, Duke University, University of North Carolina at Chapel Hill, and the cities of Raleigh and Durham, are comprised of approximately 2 million people and is expected to provide strong real estate opportunities because of demand growth, low construction costs and low cost of living.

| | | Nov’15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| North Carolina Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 810.6 | | | | 18.8 | % | | | 2.1 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 609.4 | | | | 14.1 | % | | | 3.8 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 596 | | | | 13.8 | % | | | 2.2 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 736.8 | | | | 17.0 | % | | | 0.2 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 454.6 | | | | 10.5 | % | | | 3.1 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 221.7 | | | | 5.1 | % | | | 3.2 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 463 | | | | 10.7 | % | | | 1.2 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 157.2 | | | | 3.6 | % | | | 2.7 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 75.5 | | | | 1.7 | % | | | 2.6 | % | | | 2.0 | % | | | 1.3 | % |

| Mining, Logging and Construction | | | 197.4 | | | | 4.6 | % | | | 2.5 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 4,322 | | | | | | | | 2.1 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

South Carolina

Beginning in 2013 South Carolina has seen 3 year average employment growth significantly higher than the US as a whole, which has been led by the high paying Professional and Business Services sector, which leads to positive real estate fundamentals. Although the unemployment rate has traditionally been above the US as a whole, it has fallen dramatically recently. As Colliers International reports in its Q4 2015 Multifamily Research and Forecast Report, Charleston, South Carolina’s multifamily market continues to strengthen and grow with record-high construction levels, increasing occupancy, and rising rental rates. Significant job creation and growing millennial and retiree populations are driving multifamily development. Demand for multifamily units is expected to continue through 2016 and beyond. The region’s growing tech industry and tourism industry is anticipated to attract millennials and retirees to the area. New development activity is expected to surge in the downtown, Summerville and Mount Pleasant submarkets in response to recent job announcements and projected strong future demand for rental units. Investment sales are projected to remain strong given tight market conditions, robust job creation, and low interest rates.

| | | Nov ‘15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| South Carolina Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 392.4 | | | | 19.3 | % | | | 2.7 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 276.9 | | | | 13.6 | % | | | 4.7 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 241 | | | | 11.8 | % | | | 3.4 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 368.2 | | | | 18.1 | % | | | 0.8 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 237.2 | | | | 11.7 | % | | | 3.4 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 94.5 | | | | 4.6 | % | | | 0.1 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 231.5 | | | | 11.4 | % | | | 1.3 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 73.5 | | | | 3.6 | % | | | 1.7 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 26.5 | | | | 1.3 | % | | | 0.0 | % | | | 2.0 | % | | | 1.3 | % |

| Mining, Logging and Construction | | | 92.9 | | | | 4.6 | % | | | 4.5 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 2,035 | | | | | | | | 2.5 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

Georgia

Atlanta is the financial hub of the south, and growth in the high paying Professional and Business Services sector has driven 3 year average employment growth in Georgia to levels significantly higher than the US as a whole. As Marcus and Millichap reports in its 2016 Atlanta Market Forecast, the Atlanta economy is expected to strengthen this year as corporations look to the metro as a premier market for expansion and relocation. An inflow of investor capital has supported broad-based development, with multiple billion-dollar projects currently underway. In addition to these large developments, corporate growth last year helped push the unemployment rate down to a post-recession low. Continued high-quality job opportunities are projected to put upward pressure on the pace of household formation, drawing highly skilled workers and young professionals to the metro. Developers have moved to capitalize on this strong demand and are expected to deliver a 13-year high in new units. Despite elevated levels of construction, the metro wide vacancy rate is expected to tighten to its lowest rate posted since late 2006.

| | | Nov ‘15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| Georgia Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 926.5 | | | | 21.3 | % | | | 2.5 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 659 | | | | 15.2 | % | | | 4.8 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 550.8 | | | | 12.7 | % | | | 3.0 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 702.7 | | | | 16.2 | % | | | 0.3 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 454.9 | | | | 10.5 | % | | | 4.4 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 240.6 | | | | 5.5 | % | | | 1.6 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 377.3 | | | | 8.7 | % | | | 1.8 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 155.3 | | | | 3.6 | % | | | 0.0 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 107.4 | | | | 2.5 | % | | | 1.6 | % | | | 2.0 | % | | | 1.3 | % |

| Mining, Logging and Construction | | | 173.7 | | | | 4.0 | % | | | 4.5 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 4,348 | | | | | | | | 2.5 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

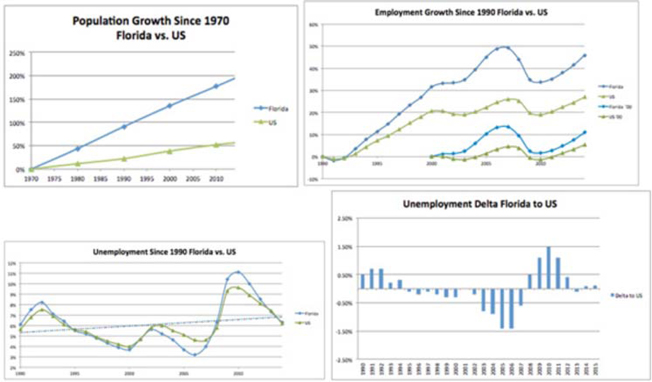

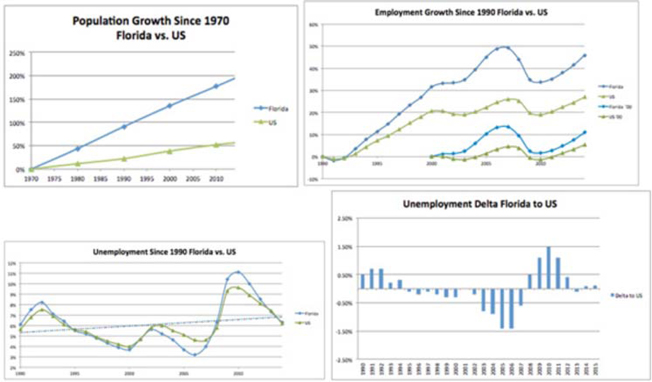

Florida

Florida has seen extremely strong fundamentals, with population and employment growth well outpacing the US as a whole. Although there is high and extremely steady population growth, largely due to retirees,

employment growth has been more cyclical in Florida than the rest of the country. Since 1970 employment growth has been higher than the US as a whole, but it has lost more jobs and recovered more than the US as a whole. As Marcus and Millichap reports in its 2016 Florida Market Forecasts, vacancy in Miami-Dade is projected to edge upward to a still-tight level in 2016 as employers maintain an elevated pace of hiring and developers wrap up projects and deliver thousands of new rentals. Continued growth in service-sector employment, the ongoing flow of new residents into Miami-Dade County and waning affordability of single-family homes in preferred neighborhoods would likely sustain a sizable renter population in the county.

The Jacksonville apartment market would be expected to tighten as rents rise, supported by a growing local economy that is generating new housing demand. Job creation over the past few years has pushed employment above the pre-recession peak and hiring is occurring in nearly every sector. As a result, apartment demand has grown, constricting vacancy by 600 basis points in the last five years. As companies fill new positions and bring residents to the market, apartment vacancy would be expected to retreat for the fifth consecutive year and rent growth should remain well above the previous five-year average.

Thousands of additional residents are expected to find jobs and form new rental households in Broward County (Fort Lauderdale) in 2016, keeping vacancy near 2015’s post-recession low and catapulting the average rent to a new high. Besides job growth’s principal role in expanding the pool of prospective renters, several other factors are aligned to maintain tight conditions in the apartment sector. Although some risk of overbuilding at the luxury end of the market is present, it has yet to materialize in the form of higher vacancy in new-vintage rentals.

In Orlando, completions are expected to slightly exceed tenant move-ins during 2016, pushing up the vacancy rate in Orlando from its lowest reading in 10 years. Several consecutive years of job growth, and additional hiring this year, are pumping new households into the renter pool. The spread of high-end complexes throughout the market has raised renters’ expectations, making many residents willing to pay up for modern features and enhanced curb appeal at new complexes and successfully repositioned older assets.

| | | Nov ‘15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | | | |

| Florida Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | | | |

| Trade, Transportation, and Utilities | | | 1716.4 | | | | 20.8 | % | | | 2.8 | % | | | 18.9 | % | | | 1.8 | % | | |

| Professional and Business Services | | | 1245.9 | | | | 15.1 | % | | | 4.3 | % | | | 14.0 | % | | | 3.3 | % | | |

| Education and Health Services | | | 1235.9 | | | | 15.0 | % | | | 2.9 | % | | | 15.5 | % | | | 2.2 | % | | |

| Government | | | 1094.5 | | | | 13.3 | % | | | -0.3 | % | | | 15.3 | % | | | 0.1 | % | | |

| Leisure and Hospitality | | | 1141.4 | | | | 13.8 | % | | | 4.3 | % | | | 10.8 | % | | | 3.4 | % | | |

| Financial Activities | | | 546 | | | | 6.6 | % | | | 2.4 | % | | | 5.7 | % | | | l.5 | % | | |

| Manufacturing | | | 339.7 | | | | 4.1 | % | | | 2.1 | % | | | 8.7 | % | | | 1.0 | % | | |

| Other Services | | | 342.9 | | | | 4.2 | % | | | 3.9 | % | | | 3.9 | % | | | 1.2 | % | | |

| Information | | | 135.1 | | | | 1.6 | % | | | 0.2 | % | | | 2.0 | % | | | 1.3 | % | | |

| Mining, Logging and Construction | | | 445.7 | | | | 5.4 | % | | | 7.9 | % | | | 5.2 | % | | | 3.4 | % | | |

| Total Nonfarm | | | 8,244 | | | | | | | | 3.0 | % | | | | | | | 1.9 | % | | |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Source: BLS

Washington, D.C. MSA

We define the Washington, DC MSA as the metropolitan area encompassing Washington, DC and its suburbs in Northern Virginia and Western Maryland. We believe that the Washington, DC MSA provides for a strong investment environment as a result of the following factors:

The Washington, DC MSA has been one of the most stable job markets in the country, showing consistently lower unemployment figures relative to the national average over the past 16 years.

The Washington, DC area unemployment has generally outperformed the national economy. According to the Bureau of Labor Statistics, as of June 2015, the national unemployment rate was 5.3%, while the Washington DC MSA (which is labeled “PMSA” in the chart below) had an unemployment rate was 4.8%.

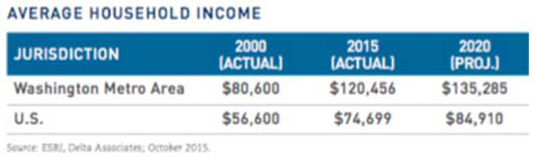

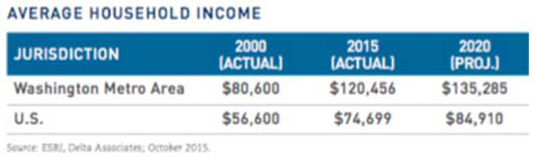

Average household income in the Washington, DC MSA is materially higher than the national median.

According to Delta Associates, a leading real estate research firm, the average income in the Washington, DC MSA is $120,456, which is 61% higher than the U.S. average.

Delta Associates concluded in their Q3 2015 retail report that “[t]he average household income in the Washington metro area grew by 49% from 2000 to 2015, compared to just 32% nationally, and it currently exceeds the national average by 61%. By 2020, the Washington metro area’s average household income is projected to rise another 12%, compared to an increase of 14% nationally. The elevated household incomes in the Washington area yield greater discretionary spending and support demand for retail goods and space.”

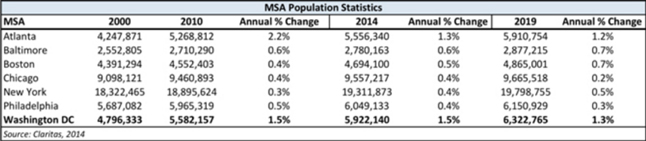

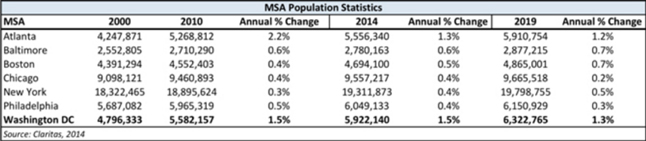

The Washington, DC Metropolitan Statistical Area (MSA) area has shown consistent demographic growth over the past decade and a half.

The Washington, DC MSA has shown steady population growth of 1.5% annually over the past 14 years with the strongest population growth occurring during the recent economic recession. According to Claritas, a demographic research firm, the population growth during this period was significantly higher than all of the competitive metropolitan areas (by relative distance and size to Washington, DC) with the exception of Atlanta. In a

period between 2009 and 2011, the population grew by 2.0% year over year, the strongest growth period over the last 10 years.

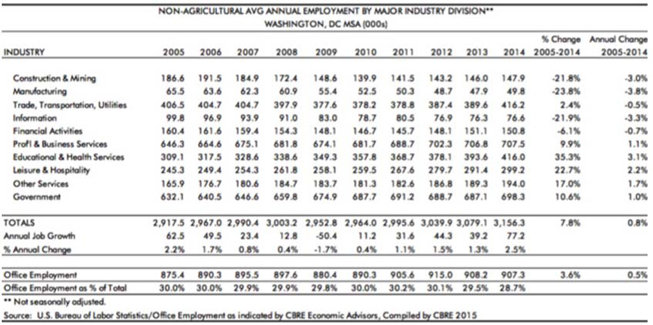

Federal, state, and local governments are major drivers of the jobs market in the Washington, DC MSA.

According to data provided by Claritas, Federal, state and local governments support a disproportionately larger share of the overall job market in the Washington, DC MSA. These sectors account for approximately 22% of local employment, above the national average of approximately 15%.

The dominant employment sectors in the Washington, DC MSA are government and services, which represent 79% of the region’s employment. Furthermore, many thousands of private sector jobs are either affiliated with, or dependent upon, the government, including government contractors to various federal agencies, law firms and lobbyists.

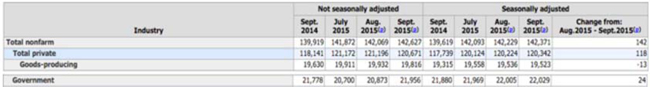

While the federal government continues to add to the region’s stable job market, small pullbacks in Federal employment between 2011 and 2013 have not measurably affected job growth in the Washington, DC MSA.

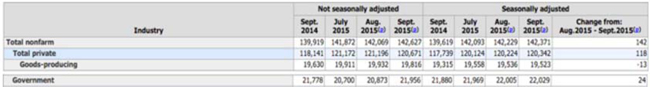

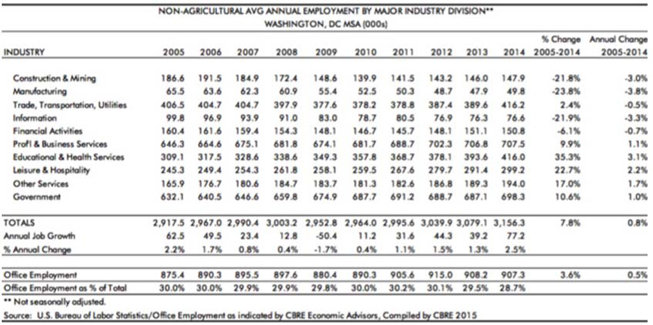

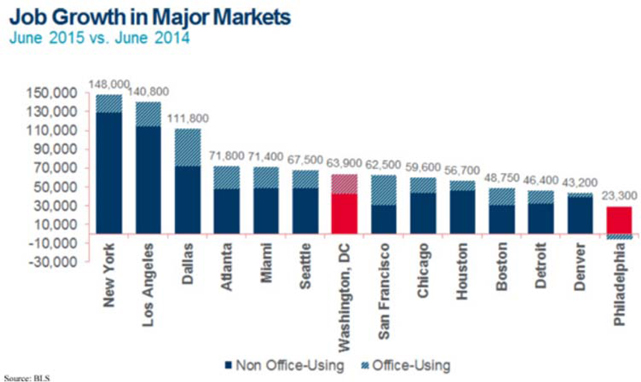

According to data provided by the U.S. Bureau of Labor Statistics/Office Employment, the Washington, DC MSA added 54,900 jobs in the 12-month period ending in June 2015 after adding 68,500 jobs in the 12-month period ending in June 2014. The June 12-month total represented the region’s highest figure since 2005.

The Washington, DC MSA is the country’s best-educated workforce.

As of the 2014, 49 percent of the greater Washington, DC MSA’s population have a bachelor’s degree or higher, according to a research report conducted by the Brookings Institute utilizing data provided by the U.S. Census Bureau. This is the highest of all major metropolitan areas and substantially higher than the national average, which is 31.2 percent. In 2014, the region employed 3.4 times the average U.S. share of legal professionals, 2.7 times the average share of computer and math workers, 2.2 times the average share of scientists and researchers, and 2 times the average share of business and financial professionals.

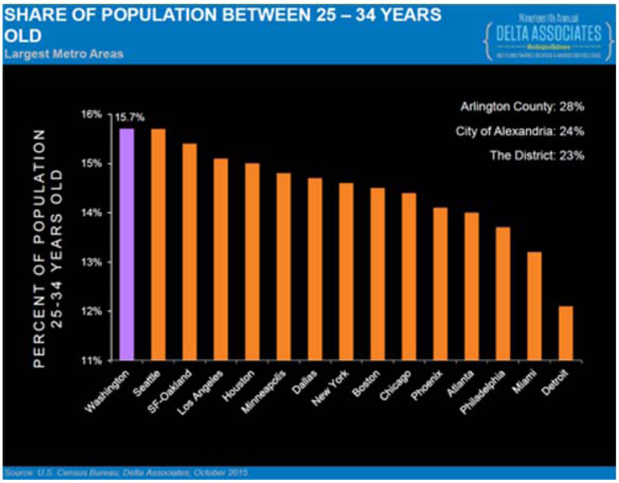

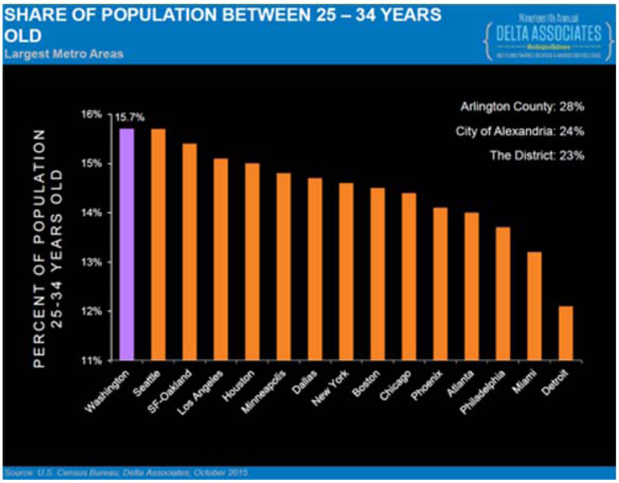

The Washington, DC MSA ranks at the top of the largest metro areas in terms of the share of its population that is between 25 and 34 years old.

According to a Washington Trendlines Market Research Report released by Delta Associates and Transwestern, “The [Washington, DC MSA] leads the nation in net in-migration of Millennials and remains the U.S. leader in the share of a region’s population with college degrees. These traits help to attract companies that are seeking to replace retiring Baby Boomers with young, well-educated additions to the work force.”

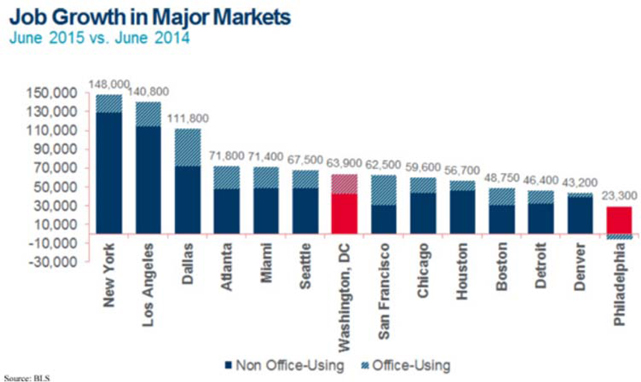

The Washington, DC MSA and Philadelphia MSA job markets have each been improving.

The Washington, DC MSA enjoys a large employment base with strong historic job growth with more than 37,000 jobs created annually over the last 19 years. The Washington, DC MSA hosts the headquarters of 15 2015 Fortune 500 companies, including Fannie Mae, Freddie Mac, Lockheed Martin, Northrop Grumman, General Dynamics, Capital One, and Booz Allen Hamilton. The nation’s 5th largest job market (3.1M payroll workers), the Washington, DC MSA enjoys a low unemployment rate of 4.3%, well below the national average of 5.4% (Delta Associates, Q2 2015). According to Delta Associates and the U.S. Census Bureau, in the twelve months ending April 2015, payroll employment in the Washington, DC MSA increased by 65,500 positions.

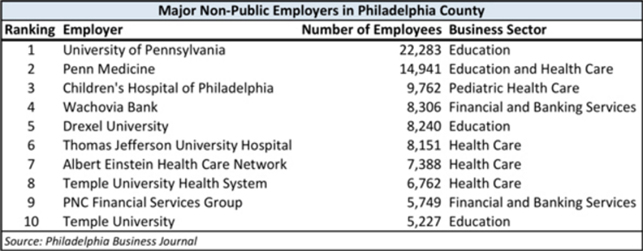

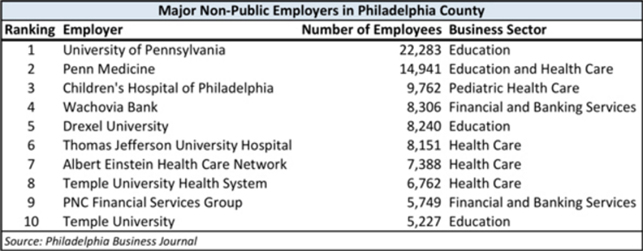

According to the federal Bureau of Labor Statistics, Philadelphia gained about 8,800 jobs in 2014, bringing total employment in the city to the highest level in more than a decade. Unemployment fell in 2014 to an annualized rate of 7.8 percent, the lowest since before the 2008 recession, and was trending even lower by the end of the year. But it remained substantially higher than the national rate of 6.2 percent. The education and medical sectors remained the bulwark of the city’s economy, accounting for more than 30 percent of all jobs. Of the 15 largest private employers in Philadelphia, 12 come from the fields of education and health care, and 11 are nonprofit organizations. The largest employers in Philadelphia are the federal and city governments, respectively. As shown in the chart below, job growth continued on a positive trajectory adding approximately 23,300 jobs by June 2015.

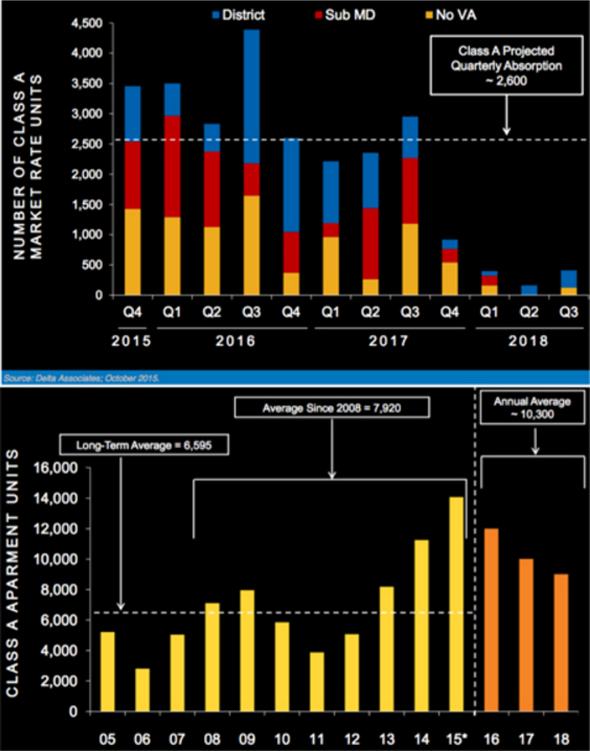

With strong job growth and record absorption, market dynamics in the Mid-Atlantic, driven by the Washington, DC MSA, reveal a favorable multifamily investment market.

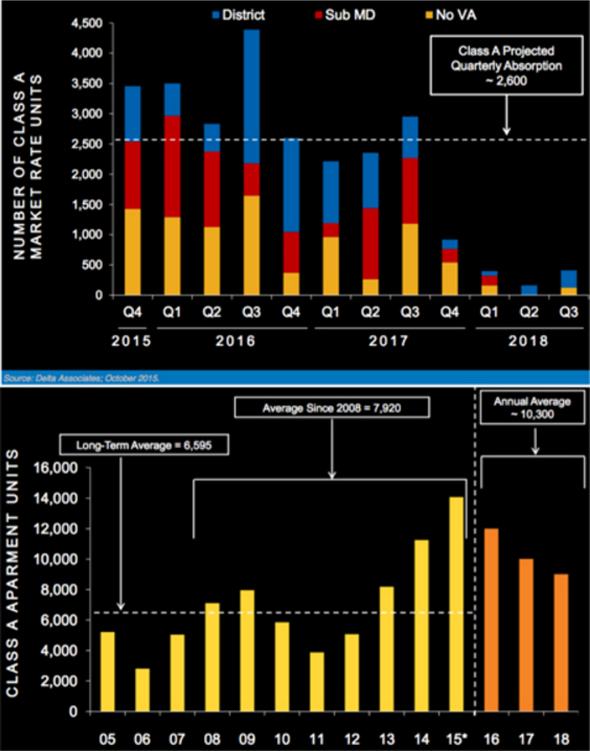

The Washington DC MSA’s Class A apartment absorption was 10,663 units for the 12-month period ending September 2014, which represented a 77% increase over the 10-year average. This record-setting absorption also helped drive the strength in the Class B market. The major contributing absorption factors are apartment supply that is no longer constrained and an increase in jobs and household formations that tend to rent rather than own.

Absorption of Class A units in the Washington, DC MSA for the three-year period ended 2018 is projected by Delta Associates to be 10,300 units per year, which is significantly higher than the region’s long-term average of 6,595 units per year. This projection is predicated upon the de-nesting and un-coupling of potential renters currently living with parents or roommates, along with improved job growth and reduced uncertainty in the region over the intermediate term. As job growth continues in the Washington, DC MSA and household formation rises, this demographic is expected to enter the rental market continuing to drive demand for Class A apartments.

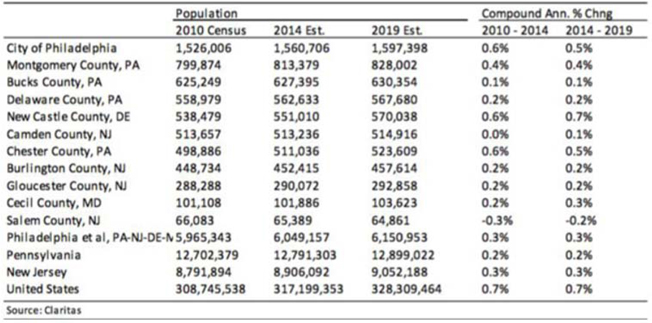

Philadelphia, in particular the City Center of Philadelphia, has seen a significant revival in population compared to the previous 60 years.

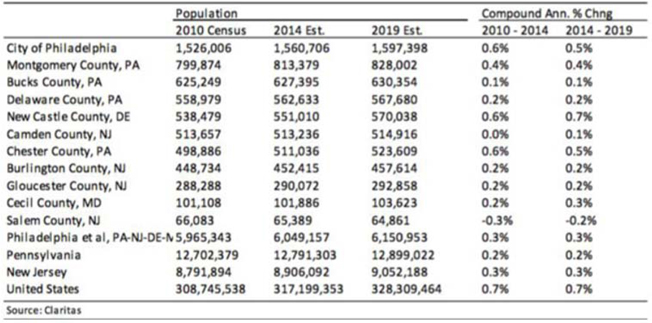

For the first time in 60 years, the 2010 Census recorded that Philadelphia’s population had grown, netting 8,456 new residents between 2000 and 2010. Since that time, downtown population growth has accelerated. According to Claritas, Philadelphia's population is projected to increase at a 0.5% annual rate from 2014 to 2019, equivalent to the addition of an average of 7,338 residents per year. Philadelphia's growth rate is expected to exceed that of Pennsylvania, which is projected to be 0.2%.

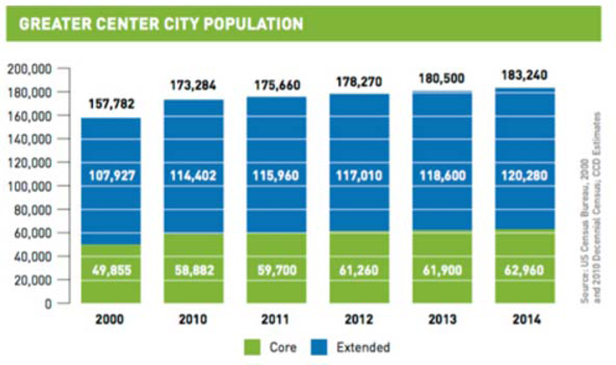

In addition to the recent growth of Philadelphia, the Center City area of Philadelphia has experienced some of the more significant population growth of any major Downtown City District.

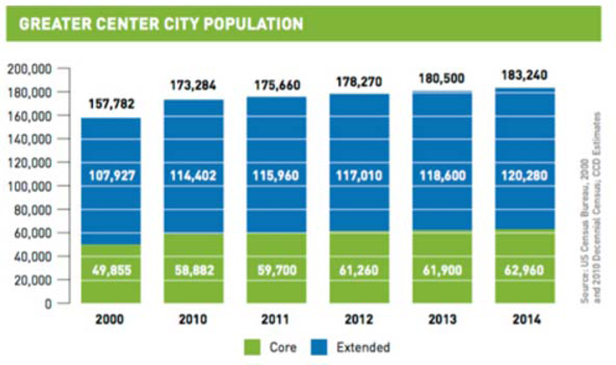

According to the U.S. Census Bureau, since 2000, the population of Center City grew by 16% to 183,240 residents. According to the Center City District and Central Philadelphia Development Corporation, “Greater Center City now ranks second only to Midtown Manhattan in size of population among U.S. downtowns.”

The Philadelphia Economy is expected to continue to be positively affected by very strong job market in Center City. Within Center City, the Education and Medical industry drives job growth. These industries are

poised for future growth, making City Center the largest concentrated center of employment in the State of Pennsylvania.

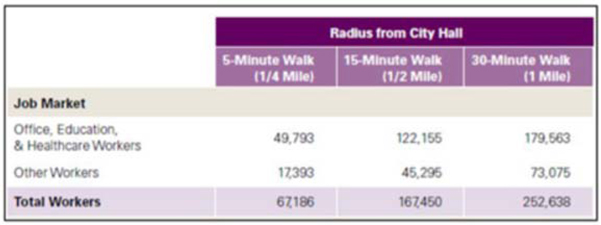

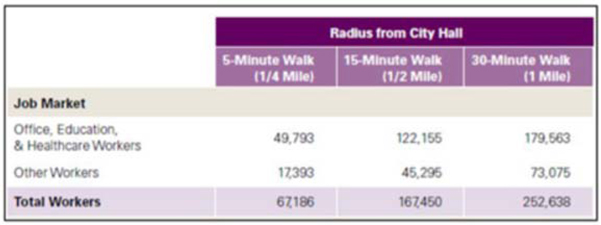

Center City Philadelphia is a major economic driver for the region. The primary employers in Center City include: finance, insurance, real estate, engineering and legal services. The following data was obtained from the Center City District and reflects a breakdown of workers within 1⁄4 mile, 1⁄2 mile and 1 mile radius from City Hall.

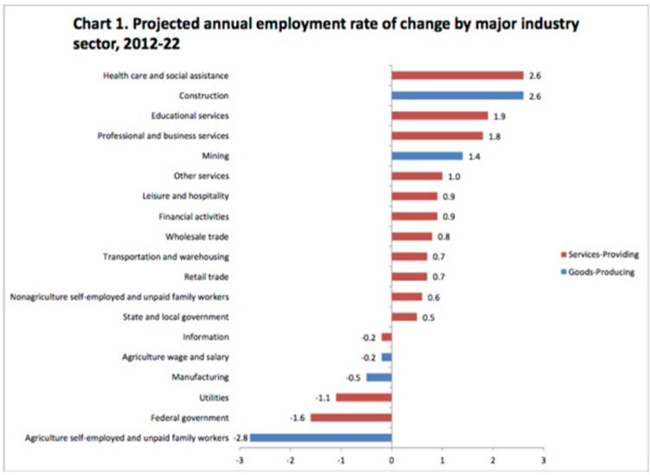

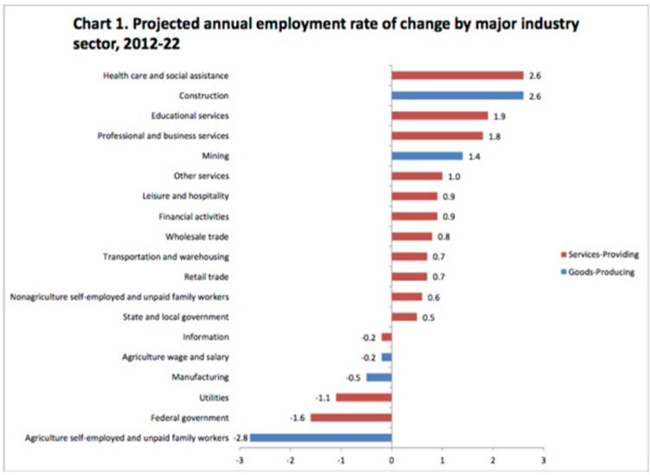

According to the chart below, using information provided by the Philadelphia Business Journal, the major non-public employers include a majority of Education, Health Care and Financial companies. These sectors are poised for future growth. According to the US Census Bureau, these sectors are within the top four categories for projected annual employment growth. See chart below, which was obtained from Census.gov:

In addition to future job growth in these sectors, the local government has enacted favorable tax treatment to retain these employment sectors. According to a 2014 employment study conducted by the Center City District & Central Philadelphia Development Corporation, favorable tax treatment cements the presence of these industries in Philadelphia:

“Healthcare and education are mature industries and stable employers, anchored by the fixed assets of tax-exempt real estate, classrooms, dormitories, medical and research equipment, and technology. Most are exempt as well from business taxes.”

Highly regarded education centers and their large student populations located within Philadelphia should continue to serve as a catalyst for future growth.

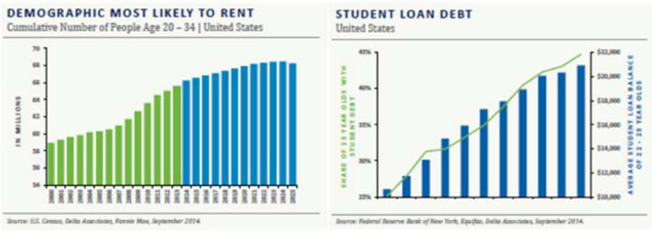

According to information provided by the Center City District, there are approximately 116,185 students in and adjacent to Center City (see chart below). According to a 2014 Campus Philly survey, 51% of non-natives who arrive in the city for higher education choose to remain in the Philadelphia region after graduation. These graduates who choose to stay in Philadelphia are expected to continue to add to future housing demand.

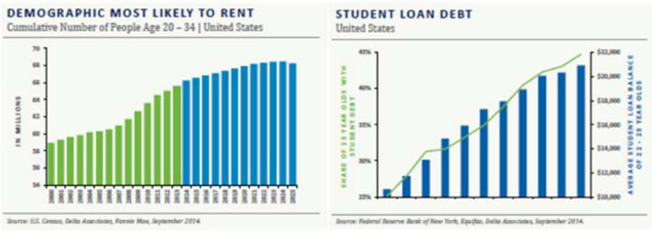

Current demographic trends are putting upward pressure on demand for multifamily units.

We believe that student debt will be a driving factor in pushing Millennials to rent rather than own. Research by Delta Associates reveals that average student loan balances for 25-year-olds has nearly doubled over the past decade. According to a study published by Delta Associates, Washington, DC, leads the nation in the net immigration of Millennials and percentage of residents with a college degree. We expect that this large and widely shared debt burden will delay saving for a down payment and likely lengthen the tenure of renters in this generation.

With demand stoked by demographic trends and supply constrained by economic forces, Mid-Atlantic multifamily rental units have displayed strong performance and are expected to be well positioned to see continued low vacancies and healthy rent growth moving forward. Additionally, the urban revival of many of the cities in the Mid-Atlantic, such as Washington, DC and Philadelphia, has created amenities and an urban lifestyle that appeal to recent college graduates.

General Market Considerations

For more information regarding general market considerations, please see “Investment Objectives and Strategy – Market Overview and Opportunity” in our Offering Circularhere.

Our Strategy

We may employ leverage to enhance total returns to our shareholders through a combination of senior financing on our real estate acquisitions, secured facilities, and capital markets financing transactions. Our target portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is between 50-85% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. As we acquire our initial portfolio, we employ greater leverage on individual assets (that will also result in greater leverage of the interim portfolio) in order to quickly build a diversified portfolio of multifamily rental properties and development project assets. We seek to secure conservatively structured leverage that is long-term, non-recourse, non-market-to-market financing to the extent obtainable on a cost effective basis. To the extent a higher level of leverage is employed it may come either in the form of government-sponsored programs or other long-term, non-recourse, non-market-to-market financing. Our Manager may from time to time modify our leverage policy in its discretion. However, other than during our initial period of operations, it is our policy to not borrow more than 85% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Manager’s investment committee.

In executing on our business strategy, we believe that we benefit from our Manager’s affiliation with our sponsor given our sponsor’s strong track record and extensive experience and capabilities as an online real estate origination and funding platform. These competitive advantages include:

| | · | our sponsor’s experience and reputation as a leading real estate investment manager, which historically has given it access to a large investment pipeline similar to our targeted assets and the key market data we use to underwrite and portfolio manage assets; |

| | · | our sponsor’s direct and online origination capabilities, which are amplified by a proprietary crowdfunding technology platform, business process automation, and a large user base, of which a significant portion are seeking capital for real estate projects; |

| | · | our sponsor’s relationships with financial institutions and other lenders that originate and distribute commercial real estate debt and other real estate-related products and that finance the types of assets we intend to acquire and originate; |

| | · | our sponsor’s experienced portfolio management team which actively monitors each investment through an established regime of analysis, credit review and protocol; and |

| | · | our sponsor’s management team, which has a successful track record of making commercial real estate investments in a variety of market conditions. |

Critical Accounting Policies

Our accounting policies have been established to conform with U.S. Generally Accepted Accounting Principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires us to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Management believes that we have made these estimates and assumptions in an appropriate manner and in a way that accurately reflects our financial condition. We continually test and evaluate these estimates and assumptions using our historical knowledge of the business, as well as other factors, to ensure that they are reasonable for reporting purposes. However, actual results may differ from these estimates and assumptions. If our judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements.

We believe the following critical accounting policies govern the significant judgments and estimates used in the preparation of our financial statements. Please refer to Note 2 —Significant Accounting Policies, included in the financial statements contained in this reportbelow, for a more thorough discussion of our accounting policies and procedures. We consider our critical accounting policies to be the following:

Commercial Real Estate Debt Investments

Our commercial real estate debt investments are generally classified as held to maturity as we have both the intent and ability to hold these investments to maturity and, accordingly, are carried at cost, net of unamortized loan fees, premium, discount and unfunded commitments. We review our real estate debt investments on a quarterly basis, or more frequently when such an evaluation is warranted, to determine if an impairment exists. A real estate debt investment is impaired when, based on current information and events (including economic, industry and geographical factors), it is probable that we will be unable to collect all amounts due, both principal and interest, according to the contractual terms of the agreement. Commercial real estate debt investments that are deemed to be impaired are carried at amortized cost less a loan loss reserve, if deemed appropriate, which approximates fair value.

We have certain investments that are legally structured as equity investments with rights to receive preferred economic returns (seeInvestments in Unconsolidated Joint Venturesdiscussed above). We report these investments as real estate debt securities when the common equity holders have a contractual obligation to redeem our preferred equity interest at a specified date.

We have invested in one real estate debt investment as of December 31, 2016. SeeNote 2, Summary of Significant Accounting Policies,Real Estate Debt Investmentsin our financial statements for further detail. The following table describes our real estate debt investment activity as of December 31, 2016 (amounts in thousands):

| Investments in Real Estate Debt: | | For the Year

Ended December 31,

2016 | | | For the Period

November 19,

2015 (Inception)

through December 31,

2015 | |

| Beginning balance | | $ | — | | | | — | |

| Investments(1) | | | 5,000 | | | | — | |

| Principal repayments | | | — | | | | — | |

| Amortization of deferred fees, costs, and discounts/premiums | | | — | | | | — | |

| Ending balance | | $ | 5,000 | | | | — | |

(1) Investments include one preferred equity investment

Principles of Consolidation

Certain of our investments are considered “majority-owned subsidiaries” within the meaning of the Investment Company Act of 1940. Our ownership interest in an investee referred to as such does not necessarily exceed 50% of the capital of the investee, and the definition under the Investment Company Act differs from the considerations provided by GAAP for whether an investee should be consolidated. We analyze our investments to determine whether they should be consolidated using the voting interest and variable interest models provided by generally accepted accounting principles. See Note 2, Summary of Significant Accounting Policies,Principles of Consolidationin our financial statements for further detail.

Certain of our investments are considered to be “majority-owned subsidiaries” within the meaning of the Investment Company Act of 1940. This definition differs from the GAAP definition of the primary beneficiary of a variable interest entity.

As of December 31, 2016 and December 31, 2015, the Company does not consolidate any separate legal entities in which we own equity interests. We generally consolidate variable interest entities (“VIE”) where the Company is the primary beneficiary of a VIE in which we have a variable interest and voting interest entities where the Company is the majority owner or otherwise controls the voting interest entity.

As of December 31, 2016 and December 31, 2015, the Company did not hold any investments in entities which are considered to be variable interest entities based on the determination that we have substantive participating rights in all of the limited partnerships or similar legal entities which may have otherwise been considered variable interest entities.

Investments in Equity Method Investees

Non-controlling, unconsolidated ownership interests in an entity may be accounted for using the equity method, at fair value or the cost method. As of December 31, 2016 we accounted for our investments in Equity Method Investees under the equity method.

Under the equity method, the investment is adjusted each period for capital contributions and distributions and its share of the entity’s net income (loss). Capital contributions, distributions and net income (loss) of such entities are recorded in accordance with the terms of the governing documents. An allocation of net income (loss) may differ from the stated ownership percentage interest in such entity as a result of preferred returns and allocation formulas, if any, as described in such governing documents. Equity method investments are recognized using a cost accumulated model in which the investment is recognized based on the cost to the investor, which includes acquisition fees. Acquisition fees incurred directly in connection with the investments in a joint venture are capitalized and amortized using the straight-line method over the estimated useful life of the underlying joint venture assets. No amortization of acquisition fees is currently reflected on the financial statements.

Fair Value Disclosures

We are required to disclose an estimate of fair value of our financial instruments for which it is practicable to estimate the value. The fair value of a financial instrument is the amount at which such financial instrument could be exchanged in a current transaction between willing parties, other than in a forced sale or liquidation. For certain of our financial instruments, fair values are not readily available since there are no active trading markets as characterized by current exchanges by willing parties.

We determine the fair value of certain investments in accordance with the fair value hierarchy that requires an entity to maximize the use of observable inputs.

As of December 31, 2016, the Company’s financial instruments consist of cash, restricted cash, one debt investment, one equity investment, and accounts payable. The carrying values of cash and cash equivalents, restricted cash, receivables, note payable to a related party and accounts payable are reasonable estimates of their fair value. The aggregate fair value of our investments is based on unobservable Level 3 inputs which management has determined to be its best estimate of current market values. The methods utilized generally included a discounted cash flow method (an income approach) and recent investment method (a market approach). Significant inputs and assumptions include the market based interest or preferred return rate, loan to value ratios, and expected repayment and prepayment dates.

As a result of this assessment, as of December 31, 2016 and December 31, 2015, management estimated the fair value of our investments to be the carrying value of each investment. SeeNote 4, Fair Value of Financial Instruments in our statements.

Recent Accounting Pronouncements

The Financial Accounting Standards Board has released several Accounting Standards Updates (“ASU”) that may have an impact on our financial statements. SeeRecent Accounting Pronouncementsin Note 2, Summary of Significant Accounting Policies in our financial statements for discussion of the relevant ASUs. We are currently evaluating the impact of the various ASUs on our financial statements and determining our plan for adoption.

Results of Operations

Revenue

On October 25, 2016, we commenced operations upon our satisfying the $1 million minimum offering requirement (not including the $100,000 received in the private placements to our sponsor and Fundrise, LP). For the year ended December 31, 2016, we had total net income of approximately $9,000 primarily attributable to interest income and equity in earnings from our investments net of interest expense incurred to acquire our investments. For the period November 19, 2015 (Inception) through December 31, 2015, we incurred net income of approximately $0 due to no operations.

The Company had no investments as of December 31, 2015. Investments were added during Q4 2016. We expect cash flows from operating activities to increase in future periods as a result of adding more investments to our portfolio, in addition to operating for a full calendar year.

Interest Income

For the year ended December 31, 2016 and for the period November 19, 2015 (Inception) through December 31, 2015, we earned interest income of approximately $70,000 and $0 from our investments, respectively.

Expenses

General and Administrative

For the year ended December 31, 2016 and for the period November 19, 2015 (Inception) through December 31, 2015, we incurred general and administrative expenses of approximately $83,000 and $0, respectively, which includes auditing and professional fees, bank fees, organizational costs and other costs associated with operating our business.

Liquidity and Capital Resources