UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-K

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION A OF THESECURITIES ACT OF 1933

For the fiscal year ended December 31, 2016

FUNDRISE MIDLAND OPPORTUNISTIC REIT, LLC

(Exact name of registrant as specified in its charter)

Commission File Number: 024-10567

| Delaware | | 32-0479856 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

1601 Connecticut Ave., NW, Suite 300 Washington, DC

(Address of principal executive offices) | | 20009

(Zip Code) |

(202) 584-0550

Registrant’s telephone number, including area code

Common Shares

(Title of each class of securities issued pursuant to Regulation A)

TABLE OF CONTENTS

Part II.

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

We make statements in this Annual Report on Form 1-K (“Annual Report”) that are forward-looking statements within the meaning of the federal securities laws. The words “believe,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “seek,” “may,” and similar expressions or statements regarding future periods are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any predictions of future results, performance or achievements that we express or imply in this Annual Report or in the information incorporated by reference into this Annual Report.

The forward-looking statements included in this Annual Report are based upon our current expectations, plans, estimates, assumptions and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results and performance could differ materially from those set forth in the forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to:

| • | our ability to effectively deploy the proceeds raised in our initial public offering (the “Offering”); |

| | • | our ability to attract and retain members to our sponsor’s online crowdfunding platform (the “Fundrise Platform”); |

| | • | risks associated with breaches of our data security; |

| | • | changes in economic conditions generally and the real estate and securities markets specifically; |

| | • | limited ability to dispose of assets because of the relative illiquidity of real estate investments; |

| | • | intense competition in the real estate market that may limit our ability to attract or retain tenants or re-lease space; |

| | • | defaults on or non-renewal of leases by tenants; |

| | • | increased interest rates and operating costs; |

| | • | our failure to obtain necessary outside financing; |

| | • | decreased rental rates or increased vacancy rates; |

| | • | the risk associated with potential breach or expiration of a ground lease, if any; |

| | • | difficulties in identifying properties to complete, and consummating, real estate acquisitions, developments, joint ventures and dispositions; |

| | • | our failure to successfully operate acquired properties and operations; |

| | • | exposure to liability relating to environmental and health and safety matters; |

| | • | changes in real estate and zoning laws and increases in real property tax rates; |

| | • | our failure to maintain our status as a REIT; |

| | • | failure of acquisitions to yield anticipated results; |

| | • | risks associated with breaches of our data security; |

| | • | risks associated with derivatives or hedging activity; |

| | • | our level of debt and the terms and limitations imposed on us by our debt agreements; |

| | • | the need to invest additional equity in connection with debt refinancings as a result of reduced asset values; |

| | • | our ability to retain our executive officers and other key personnel of our advisor, our property manager and their affiliates; |

| | • | expected rates of return provided to investors; |

| | • | the ability of our sponsor and its affiliates to source, originate and service our loans and other assets, and the quality and performance of these assets; |

| | • | our ability to retain and hire competent employees and appropriately staff our operations; |

| | • | legislative or regulatory changes impacting our business or our assets (including changes to the laws governing the taxation of real estate investment trusts (“REITs”) and the Securities and Exchange Commission (“SEC”) guidance related to Regulation A or the JOBS Act); |

| | • | changes in business conditions and the market value of our assets, including changes in interest rates, prepayment risk, operator or borrower defaults or bankruptcy, and generally the increased risk of loss if our investments fail to perform as expected; |

| | • | our ability to implement effective conflicts of interest policies and procedures among the various real estate investment opportunities sponsored by our sponsor; |

| | • | our ability to access sources of liquidity when we have the need to fund redemptions of common shares in excess of the proceeds from the sales of our common shares in our continuous offering and the consequential risk that we may not have the resources to satisfy redemption requests; |

| | • | our failure to maintain our status as a REIT; |

| | • | our compliance with applicable local, state and federal laws, including the Investment Advisers Act of 1940, as amended (the “Advisers Act”), the Investment Company Act and other laws; and |

| | • | changes to generally accepted accounting principles, or GAAP. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this Annual Report. All forward-looking statements are made as of the date of this Annual Report and the risk that actual results will differ materially from the expectations expressed in this Annual Report will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this Annual Report, including, without limitation, the risks described under “Risk Factors,” the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this Annual Report will be achieved.

FUNDRISE MIDLAND OPPORTUNISTIC REIT, LLC

(the “Heartland eREITTM”)

The Company

Fundrise Midland Opportunistic REIT, LLC is a Delaware limited liability company formed on November 19, 2015 to originate, invest in and manage a diversified portfolio primarily consisting of investments in multifamily rental properties and development projects located primarily in the Houston, TX, Dallas, TX, Austin, TX, Chicago, IL, and Denver, CO metropolitan statistical areas (“MSAs”), with such investments consisting of equity interests in such properties or debt, as well as commercial real estate debt securities and other select real estate-related assets, where the underlying assets primarily consist of such properties. We define development projects to include a range of activities from major renovation and lease-up of existing buildings to ground up construction. With demand stoked by demographic trends and supply constrained by economic forces, our Manager believes that Texas, Chicago and Denver multifamily rental units have displayed strong performance and are expected to be well positioned to see continued low vacancies and healthy rent growth moving forward. While we intend to primarily invest in multifamily rental properties and development projects located in the Houston, TX, Dallas, TX, Austin, TX, Chicago, IL, and Denver, CO MSAs, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may also invest in commercial real estate-related debt securities (including commercial mortgage-backed securities, or CMBS, collateralized debt obligations, or CDOs, and REIT senior unsecured debt) and other real estate-related assets. We may make our investments through majority-owned subsidiaries, some of which may have rights to receive preferred economic returns. The use of the terms “Fundrise Midland Opportunistic REIT”, the “Company”, “we”, “us” or “our” in this Annual Report refer to Fundrise Midland Opportunistic REIT, LLC unless the context indicates otherwise.

We have elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended (“the Code”), commencing with our taxable year ending December 31, 2016. As of April 1, 2017 and December 31, 2016, our portfolio was comprised of $4,175,000 and $1,000,000 worth of controlled subsidiaries, respectively, that in the opinion of our Manager, meets our investment objectives. SeeItem 2,“Management’s Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments” for information concerning our investments since December 31, 2016. We will seek to create and maintain a portfolio of multifamily rental properties and development project investments that generate a low volatility income stream of attractive and consistent cash distributions. Our focus on investing in debt and equity instruments will emphasize the payment of current returns to investors and preservation of invested capital as our primary investment objectives, as well as emphasizing capital appreciation from our investments, as is typically the case with strategies focused exclusively on opportunistic or equity oriented investments.

Fundrise Advisors, LLC, our Manager, manages our day-to-day operations. Our Manager is an investment adviser registered with the SEC and a wholly-owned subsidiary of our sponsor. A team of real estate and debt finance professionals, acting through our Manager, makes all the decisions regarding the selection, negotiation, financing and disposition of our investments, subject to the limitations in our operating agreement. Our Manager also provides asset management, marketing, investor relations and other administrative services on our behalf with the goal of maximizing our operating cash flow and preserving our invested capital. Rise Companies Corp., our sponsor, is able to exercise significant control over our business.

We have offered, are offering, and will continue to offer up to $50,000,000 in our common shares, which represent limited liability company interests in our company (the “Offering”). SeeItem 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview” for more information concerning the current status of the Offering.

We expect to offer common shares in our Offering until we raise the maximum amount being offered, unless terminated by our Manager at an earlier time. Until December 31, 2017, the per share purchase price for our common shares will be $10.00 per share, an amount that was arbitrarily determined by our Manager. Thereafter, the per share purchase price will be adjusted every fiscal quarter and, as of January 1st, April 1st, July 1st and October 1st of each year (or as soon as commercially reasonable and announced by us thereafter), will equal the greater of (i) $10.00 per share or (ii) the sum of our net asset value, or NAV, divided by the number of our common shares outstanding as of the end of the prior fiscal quarter (NAV per share). Although we do not intend to list our common shares for trading on a stock exchange or other trading market, we have adopted a redemption plan designed to provide our shareholders with limited liquidity on a quarterly basis for their investment in our shares.

Investment Strategy

We originate, acquire, asset manage, operate, selectively leverage, syndicate and opportunistically sell multifamily rental properties and development projects through the acquisition of equity interests in such properties or debt (including senior mortgage loans, subordinated mortgage loans (also referred to as B Notes), mezzanine loans, and participations in such loans), as well as commercial real estate debt securities and other real estate-related assets, where the underlying assets primarily consist of such properties. Our management has extensive experience investing in numerous types of properties. While we focus our investments primarily in multifamily rental properties and development projects, in the event that appropriate investment opportunities are not available, we may acquire a wide variety of commercial properties, including office, industrial, retail, recreation and leisure, single-tenant residential and other real properties. These properties may be existing, income-producing properties, newly constructed properties or properties under development or construction and may include multifamily rental properties purchased for conversion into condominiums and single-tenant properties that may be converted for multifamily use. We focus on acquiring properties with significant possibilities for capital appreciation, such as those requiring development, redevelopment or repositioning, those located in markets with high growth potential and those available from sellers who are distressed or face time-sensitive deadlines. We also may invest in real estate-related securities, including securities issued by other real estate companies, either for investment or in change of control transactions completed on a negotiated basis or otherwise, and in bridge and mezzanine loans that may lead to an opportunity to purchase a real estate interest. In addition, to the extent that our Manager and its investment committee determines that it is advantageous, we also may make or invest in commercial mortgage-backed securities, mortgage loans and Code Section 1031 tenant-in-common interests. Our portfolio of debt investments is secured primarily by U.S. based collateral, primarily multifamily rental properties and development projects, and diversified by security type.

We seek to create and maintain a portfolio of multifamily rental properties and development project investments that generate a low volatility income stream of attractive and consistent cash distributions. Our focus on investing in debt and equity instruments emphasizes the payment of current returns to investors and preservation of invested capital as our primary investment objectives, as well as emphasizing capital appreciation from our investments, as is typically the case with strategies focused exclusively on opportunistic or equity-oriented investments.

For debt investments, our Manager directly structures, underwrites and originates many of the debt products in which we invest, as doing so provides for the best opportunity to control our borrower and partner relationships and optimize the terms of our investments. Our proven underwriting process, which our management team has successfully developed over their extensive real estate careers in a variety of market conditions and implemented at our sponsor, involves comprehensive financial, structural, operational and legal due diligence of our borrowers and partners in order to optimize pricing and structuring and mitigate risk. We feel the current and future market environment for multifamily rental properties and development projects (including any existing or future government-sponsored programs) provides a wide range of opportunities to generate compelling investments with strong risk-return profiles for our shareholders.

Investment Objectives

Our primary investment objectives are:

| | · | to realize growth in the value of our investment within approximately five years of the termination of our Offering; |

| | · | to grow net cash from operations so that an increasing amount of cash flow is available for distributions to investors over the long term; |

| | · | to pay attractive and consistent cash distributions; |

| | · | to enable investors to realize a return on their investment by beginning the process of liquidating and distributing cash to investors within approximately five years of the termination of our Offering, or providing liquidity through alternative means such as in-kind distributions of our own securities or other assets; and |

| | · | to preserve, protect and return shareholders’ capital contributions. |

We also seek to realize growth in the value of our investments by timing their sale to maximize value. There can be no assurance that we will be able to achieve these objectives.

Competition

Our net income depends, in large part, on our ability to source, acquire and manage investments with attractive risk-adjusted yields. We compete with many other entities engaged in real estate investment activities, including individuals, corporations, bank and insurance company investment accounts, other REITs, private real estate funds, and other entities engaged in real estate investment activities as well as online lending platforms that compete with the Fundrise Platform, many of which have greater financial resources and lower costs of capital available to them than we have. In addition, there are numerous REITs with asset acquisition objectives similar to ours, and others may be organized in the future, which may increase competition for the investments suitable for us. Competitive variables include market presence and visibility, amount of capital to be invested per project and underwriting standards. To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction or to employ more liberal underwriting standards when evaluating potential investments than we are, our investment volume and profit margins for our investment portfolio could be impacted. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying the assets that we have targeted for acquisition. Although we believe that we are well positioned to compete effectively in each facet of our business, there is enormous competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Risk Factors

We face risks and uncertainties that could affect us and our business as well as the real estate industry generally. These risks are outlined under the heading “Risk Factors” contained in our Offering Circular dated September 30, 2016 and filed with the SEC on October 5, 2016, as supplemented, (the “Offering Circular”) which may be accessedhere, as the same may be updated from time to time by our future filings under Regulation A. In addition, new risks may emerge at any time and we cannot predict such risks or estimate the extent to which they may affect our financial performance. These risks could result in a decrease in the value of our common shares.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Overview

Fundrise Midland Opportunistic REIT, LLC is a newly organized Delaware limited liability company formed tooriginate, invest in and manage a diversified portfolio primarily consisting of investments in multifamily rental properties and development projects located primarily in the Houston, TX, Dallas, TX, Austin, TX, Chicago, IL, and Denver, CO metropolitan statistical areas (“MSAs”), with such investments consisting of equity interests in such properties or debt, as well as commercial real estate debt securities and other select real estate-related assets, where the underlying assets primarily consist of such properties. We are externally managed by Fundrise Advisors, LLC, or our Manager, which is an investment adviser registered with the Securities and Exchange Commission, or SEC, and a wholly-owned subsidiary of our sponsor, Rise Companies Corp., the parent company of Fundrise, LLC, our affiliate. Fundrise, LLC owns and operates an online investment platform www.fundrise.com. On October 25, 2016, we commenced operations upon our satisfying the $1 million minimum offering requirement (not including the $100,000 received in the private placements to our sponsor and Fundrise, LP).

We have offered, are offering, and will continue to offer up to $50,000,000 in our common shares in our Offering. As of April 1, 2017 and December 31, 2016, we had raised total gross offering proceeds of approximately $10.6 million and $5.5 million, respectively, from settled subscriptions (including the $100,000 received in the private placements to our sponsor, Rise Companies Corp., and Fundrise, LP, an affiliate of our sponsor), and had settled subscriptions in our Offering and private placements for an aggregate of approximately 1,057,000, and 550,000, respectively, of our common shares. Assuming the settlement for all subscriptions received as of April 1, 2017, approximately 3,943,000 of our common shares remained available for sale to the public under our Offering.

To mitigate the effect of our lack of assets, revenue and operating history, our Manager agreed, for a period until December 31, 2016 (the “fee waiver period”), to waive its asset management fee during the fee waiver period if the average annualized non-compounded return to investors is less than eight percent (8%). Following the conclusion of the fee waiver period, our Manager may, in its sole discretion, waive its asset management fee, in whole or in part. The Manager will forfeit any portion of the asset management fee that is waived. As of April 1, 2017, our Manager has not waived the asset management fee since the end of the fee waiver period. For more information regarding the fee waiver support of our common shares, please see “Description of Our Common Shares – Distributions” in our Offering Circularhere.

We have operated in a manner intended to qualify as a REIT for federal income tax purposes beginning with the year ended December 31, 2016.

Our Investments

During the year ended December 31, 2016, we entered into the following investments. SeeItem 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Recent Developments” below for a description of investments we have made since December 31, 2016.

| Investment Type | | Date | | Description |

| Acquisitions of Controlled Subsidiaries | | 11/11/16 | | Acquired ownership of a “majority-owned subsidiary”, Waypoint Austin Falcon Owner, LLC (the “Waypoint Austin Controlled Subsidiary”), in which we have the right to receive a preferred economic return, which is managed by Waypoint Residential LLC, in an assumption agreement in which no proceeds were transferred currently but with a deferred equity commitment of $3,000,000. The initial proceeds are anticipated to be used for the construction of a 324-unit, class-A multifamily project located at |

| | | | | the intersection of Intersection of Colorado Sands Rd. and E. Pflugerville Parkway in Pflugerville, TX. More information on the Waypoint Austin Controlled Subsidiary acquisition can be foundhere. |

| | | 12/6/16 | | Acquired ownership of a “majority-owned subsidiary”, VCM Aviator Apartment Homes, LP (the “Aviator Controlled Subsidiary”), in which we have the right to receive a preferred economic return for a purchase price of $1,000,000, which is the initial stated value of our equity interest in the Aviator Controlled Subsidiary. The Aviator Controlled Subsidiary used the proceeds to acquire a stabilized, 147-unit garden-style multifamily property, Aviator Apartments, located at 1670 North Murray Blvd., Colorado Springs, CO 80915. More information on the Aviator Controlled Subsidiary acquisition can be foundhere. |

| | | 12/30/16 | | Acquired ownership of a “majority-owned subsidiary”, Waypoint Antonio Westover Owner, LLC (the “RSE Waypoint San Antonio Controlled Subsidiary”), in which we have the right to receive a preferred economic return, in which no proceeds were transferred currently but with a deferred equity commitment of $7,025,000. The initial proceeds are anticipated to be used for the construction of a 278-unit, class-A multifamily property, La Escala, located at the corner of Military Drive and North Ellison Way, San Antonio, TX. More information on the RSE Waypoint San Antonio Controlled Subsidiary acquisition can be foundhere. |

Distributions

While we are under no obligation to do so, we have in the past and expect in the future to declare and pay distributions quarterly in arrears; however, our Manager may declare other periodic distributions as circumstances dictate. In order that investors may generally begin receiving distributions immediately upon our acceptance of their subscription, we expect to authorize and declare distributions based on daily record dates.

On December 31, 2016, we declared our first distribution to shareholders of record as of the close of business on each day of the period commencing on December 1, 2016 and ending on December 31, 2016. Our Manager has declared daily distributions for shareholders of record as of the close of business on each day from December 1, 2016 through June 30, 2017. The distributions are payable to shareholders of record as of the close of business on each day of the distribution period. The below chart details the distributions that we have declared since we commenced operations:

| Distribution Period | | Daily Distribution

Amount/Common

Share | | | Date of

Declaration | | | Payment Date

(1) | | | Annualized Yield

(2) | |

| 01/01/17 – 03/31/17 | | | 0.0022602740 | | | | 12/31/16 | | | | 4/21/17 | | | | 8.25 | % |

| 04/01/17 – 06/30/17 | | | 0.0021917808 | | | | 03/21/17 | | | | 7/21/17 | | | | 8.00 | % |

Weighted Average

(01/01/17 through 06/30/17) | | | 0.0022258382 | (3) | | | - | | | | - | | | | 8.12 | %(4) |

(1) Dates presented are the dates on which the distributions were, or are, scheduled to be distributed; actual distribution dates may vary.

(2) Annualized yield numbers represent the annualized yield amount of each distribution calculated on an annualized basis at the then current rate, assuming a $10.00 per share purchase price. While the Manager is under no obligation to do so, each annualized basis return assumes that the Manager would declare distributions in the future similar to

the distributions for each period presented, and there can be no assurance that the Manager will declare such distributions in the future or, if declared, that such distributions would be of a similar amount.

(3) Weighted average daily distribution amount per common share is calculated as the average of the daily declared distribution amounts from January 1, 2017 through June 30, 2017.

(4) Weighted average annualized yield is calculated as the annualized yield of the average daily distribution amount for the periods presented, assuming a $10.00 per share purchase price.While the Manager is under no obligation to do so, the average annualized basis return assumes that the Manager would declare distributions in the future similar to the average distributions for the period from January 1, 2017 through June 30, 2017, and there can be no assurance that the Manager will declare such distributions in the future or, if declared, that such distributions would be of a similar amount.

Redemption Plan

We have adopted a redemption plan whereby, on a quarterly basis, a shareholder may obtain liquidity as described in detail in our Offering Circular, which may be accessedhere, Our Manager may in its sole discretion, amend, suspend, or terminate the redemption plan at any time, including to protect our operations and our non-redeemed shareholders, to prevent an undue burden on our liquidity, to preserve our status as a REIT, following any material decrease in our NAV, or for any other reason.

As of December 31, 2016, 15,250 common shares have been submitted for redemption through our redemption plan and 100% of such redemption requests have been honored.

Sources of Operating Revenues and Cash Flows

We generate revenues from net interest income on our commercial real estate debt and unconsolidated joint ventures. Our income is primarily derived through the difference between revenue and the cost at which we are able to finance our investments. We may also seek to acquire investments which generate attractive returns without any leverage.

Outlook and Recent Trends

We believe that the near and intermediate-term market for investment in select Texas, Chicago and Denver commercial real estate properties, joint venture equity investments, and other real estate-related assets is compelling from a risk-return perspective, particularly with regard to multifamily rental units. While we intend to focus on the Texas, Chicago, IL and Denver, CO real estate markets, we may also invest in other real estate markets, particularly those located outside of the east and west coasts of the United States.

For purposes of this Annual Report, when discussing Texas, we are primarily referring to the Houston, Dallas, and Austin metropolitan statistical areas (“MSAs”), and when discussing Chicago and Denver, we are primarily referring to the Chicago, IL and Denver, CO MSAs. Our investment strategy is weighted toward senior debt, mezzanine debt and preferred equity that maximize current income, and equity investments with significant potential value creation but below the radar of institutional-sized investors. This strategy is based on the area’s stable economy, filled with pockets of high growth, coupled with housing supply constraints.

We pursue a variety of tactics to identify multifamily investment opportunities including: (i) acquiring value-add and lease-up properties; (ii) acquiring assets that require repositioning or redevelopment; (iii) investing in ground-up new development projects; and (iv) providing mezzanine debt and recapitalization equity capital for existing transactions.

We believe that our investment strategy, combined with both our unique web-based origination platform and the experience and expertise of our Manager’s team, provides opportunities to originate investments with attractive current and accrued returns, long-term equity returns and strong structural features with local real estate companies. This strategy expects to take advantage of changing market conditions to achieve favorable risk adjusted returns.

Texas Market Overview and Opportunity

Texas’s multifamily rental market is benefitting from demographic changes, improved job growth, and strong economic dynamics in the State. Low cost construction and permanent financing along with a favorable cap-interest rate spread provide a modest margin of safety for asset valuations. Although employment growth was strong after the sector, particular attention should be paid to the struggling oil market.

Key statistics, as of December 2015, provided by the Bureau of Labor Statistics are set forth below:

Key Statistics | | Houston | | | Dallas | | | Austin | | | Texas | | | US | |

| Population | | | 2,239,558 | | | | 1,281,047 | | | | 912,791 | | | | 27,469,114 | | | | 318,900,000 | |

| Pop. Growth Since 2000 | | | 1.0 | % | | | 0.6 | % | | | 2.8 | % | | | 2.3 | % | | | 0.9 | % |

| Number of Employed | | | 2,925,000 | | | | 3,272,700 | | | | 914,200 | | | | 11,550,200 | | | | 139,023,000 | |

| Unemployment Rate | | | 4.5 | % | | | 4.0 | % | | | 3.3 | % | | | 4.5 | % | | | 5.3 | % |

| Job Growth (Y-O-Y) | | | 0.8 | % | | | 3.3 | % | | | 4.0 | % | | | 1.6 | % | | | 2.0 | % |

| Three Yr. Avg. Employment Growth | | | 2.6 | % | | | 3.5 | % | | | 4.0 | % | | | 2.6 | % | | | 1.9 | % |

As shown in the table above, Texas only lost 4% of its employment base in the recent recession compared to 6% in the United States, and it recovered all of its jobs by August 2011, whereas it took until March 2014 for the United States to recover all jobs lost. This started Texas on a fast recovery that has fed multifamily fundamentals. Population and employment growth has driven the Texas recovery. Employment is growing due to low corporate taxes, and affordable housing make the state an attractive place to relocate.

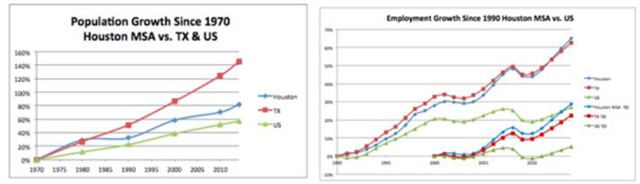

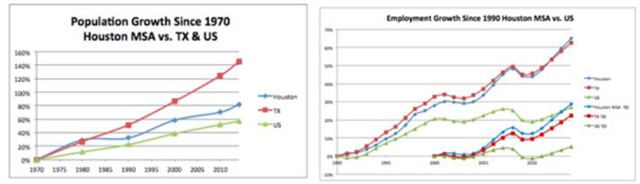

Houston

With nearly three million people, relaxed zoning restrictions and affordable construction, Houston continues to be a popular city for real estate developments. Houston saw 3.4% average employment growth from 2011-2014 when many of the multifamily projects that are now delivering were planned and began construction. Because of oil prices that are lower than they have been since 2002, the energy sector is slowing significantly, which we believe will have major effects on the Houston economy, and is believed to have already caused 2015 employment growth to slow to 0.8%.

| | | Nov ’15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| Houston MSA Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 612.6 | | | | 63.5 | % | | | 2.1 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 471.5 | | | | 48.8 | % | | | 2.4 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 375.7 | | | | 38.9 | % | | | 4.0 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 394.4 | | | | 40.9 | % | | | 2.1 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 308.8 | | | | 32.0 | % | | | 6.4 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 144.9 | | | | 15.0 | % | | | 0.2 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 240.5 | | | | 24.9 | % | | | -0.8 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 34 | | | | 3.5 | % | | | 2.9 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 321.2 | | | | 33.3 | % | | | -1.4 | % | | | 2.0 | % | | | 1.3 | % |

| Mining and Logging | | | 3007.3 | | | | 311.5 | % | | | 7.1 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 965 | | | | | | | | 2.6 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Like other Texas cities, Houston has seen employment growth above the growth experienced by United States as a whole, while having roughly equivalent population growth rates, leading to the unemployment rate being below that of the United States at the end of 2015. It is important to note that this trend is not stable, and we believe this instability may present opportunity.

Source: BLS

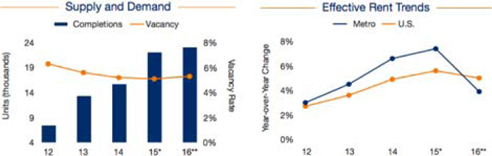

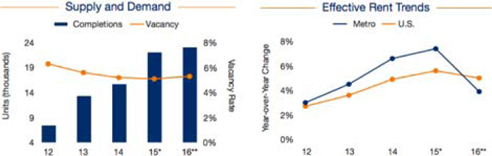

According to Marcus and Millichap’s 2016 Market Forecast, they predict relatively flat rent growth with increasing multifamily vacancy. As of November 2015 the Houston market had absorbed 13,144 units, down from 14,760 units over the same period in 2014, but still significantly higher than the historical average of 9,940 units.

We plan to focus on either Class B/C apartments that are insulated from oversupply, or select submarkets for new developments with either a growth story or an insulated position in the capital stack.

Source: Marcus & Millichap

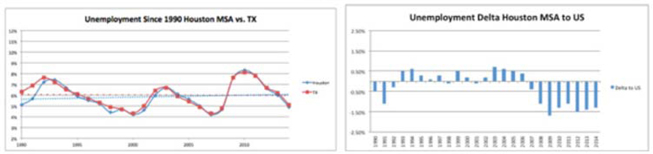

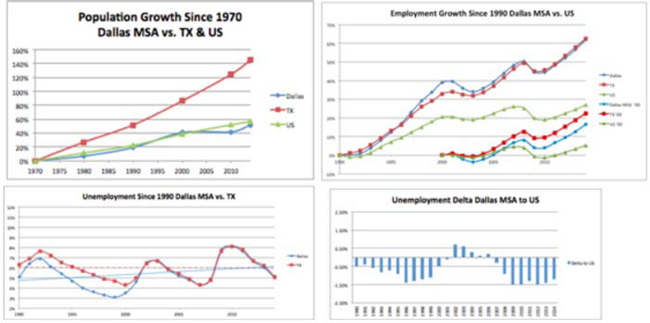

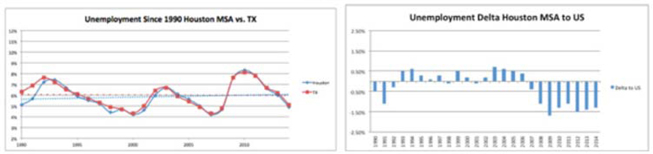

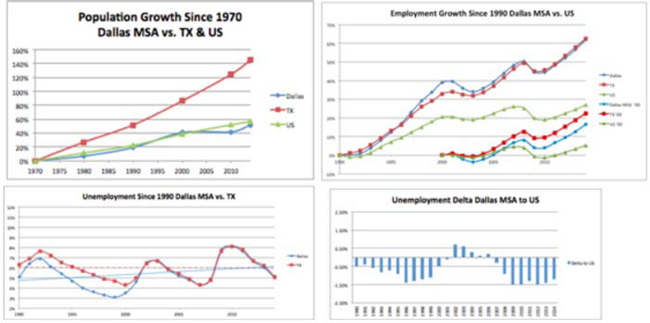

Dallas

As Marcus & Millichap points out in its 2016 Market Forecast, Dallas/Fort Worth’s vigorous job formation and economic diversity have been the dynamic force behind Dallas/Fort Worth’s growth, and they are expected to play a major role in the apartment market’s continued progression this year. Job creation in many high-paying industries is driving demand for the thousands of luxury Class A apartments coming to market. Despite the delivery of more than 20,000 rentals last year, builders should continue developing and are expected to complete an additional 23,000 units over the next four quarters in an attempt to keep pace with demand. As new Class A rentals come to market, demand is expected to be satiated and some softening will likely occur in this asset class. In contrast, demand for Class B/C housing is expected to rise as the Dallas MSA’s employment base continues to diversify amid strong hiring in retail, restaurants, hotels and the transportation industry. As a result, conditions are expected to remain tight for properties in this segment, spurring record rent growth in the months to come.

| | | Nov ’15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| Dallas MSA Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 731.3 | | | | 21.2 | % | | | 3.7 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 576.4 | | | | 16.7 | % | | | 5.3 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 431.9 | | | | 12.6 | % | | | 4.5 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 419.3 | | | | 12.2 | % | | | 2.0 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 359 | | | | 10.4 | % | | | 5.6 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 277.9 | | | | 8.1 | % | | | 3.0 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 257.8 | | | | 7.5 | % | | | -0.7 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 118.9 | | | | 3.4 | % | | | 2.3 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 82.4 | | | | 2.4 | % | | | 0.9 | % | | | 2.0 | % | | | 1.3 | % |

| Mining and Logging | | | 193.7 | | | | 5.6 | % | | | 3.8 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 3,451 | | | | | | | | 3.5 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Dallas’s employment growth, which generally has matched Texas as a whole, has been a leading driver behind its growth. Like other Texas markets, Dallas sees strong growth in high paying job sectors, specifically Professional and Business Services, Leisure and Hospitality and Education and Health Services. Although Dallas’s employment growth has exceeded that of the United States, population growth since 1970 has not, leading to an unemployment rate that is typically lower than the US.

Employment in Dallas/Fort Worth has pushed well above pre-recession levels and a consistent pace of growth appears to be emerging. Following the addition of 82,000 workers in 2015, it is expected that companies will generate 78,000 positions this year, increasing payrolls 2.3 percent.

Source: BLS

Due to the significant Class A supply that is expected to continue this year, effective rents are falling, meaning particular attention must be paid to underwriting standards and overall basis.

Source: Marcus & Millichap

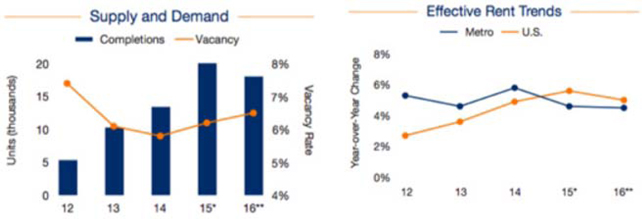

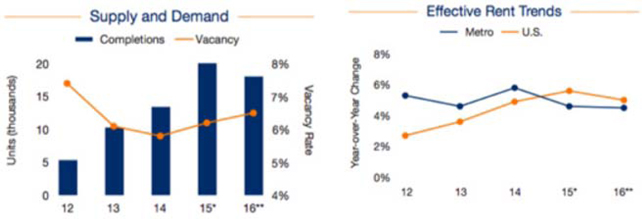

Austin

Marcus and Millichap predicts in their 2016 Forecast steadily rising home prices and a growing population base is expected to facilitate strong demand for apartments in Austin in 2016. It is expected that more than 60,000 individuals will move to the metro in 2016, supporting the creation of 23,000 households in the area. With single-family and multifamily construction expected to slow during the next 12 months, the need for affordable-housing options for these new residents will rise. The median single-family home price surpassed $250,000, making Austin the most expensive housing market in the state. Though median household income justifies housing affordability in some parts of the Austin MSA, homes in urban areas near popular employment and cultural districts are well out of range for many would-be homeowners. As a result, demand for apartments in these areas remains intense, with conditions tightening below 3 percent in select submarkets. Rent growth should remain robust this year, climbing faster than the national average for the sixth consecutive year, as vacancy constricts further.

| | | Nov ’15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| Austin MSA Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation, and Utilities | | | 167.7 | | | | 17.4 | % | | | 3.6 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 163.9 | | | | 17.0 | % | | | 7.7 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 111.1 | | | | 11.5 | % | | | 3.8 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 174.8 | | | | 18.1 | % | | | 0.8 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 115.7 | | | | 12.0 | % | | | 6.0 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 54.3 | | | | 5.6 | % | | | 4.3 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 56.8 | | | | 5.9 | % | | | 0.2 | % | | | 8.7 | % | | | 1.0 | % |

| Other Services | | | 41.2 | | | | 4.3 | % | | | 3.9 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 26.4 | | | | 2.7 | % | | | 3.6 | % | | | 2.0 | % | | | 1.3 | % |

| Mining and Lagging | | | 53.5 | | | | 5.5 | % | | | 6.9 | % | | | 5.2 | % | | | 3.4 | % |

| Total Nonfarm | | | 965 | | | | | | | | 4.0 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

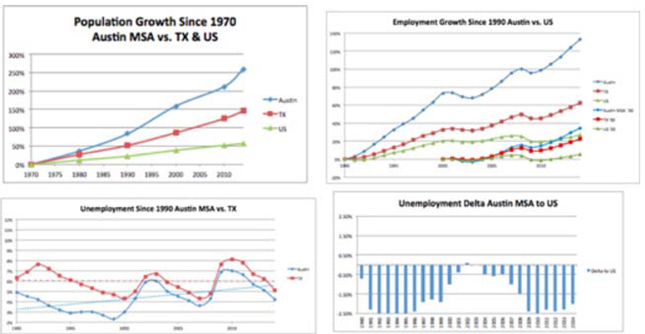

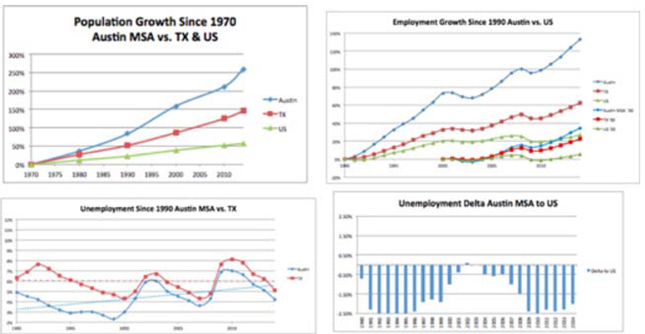

From 2012 – 2015 Austin has seen tremendous growth in high paying job sectors, supporting high population growth and a demand for new housing units. As can be seen below, employment and population growth in Austin are both well above both the United States and Texas as a whole, and area unemployment is consistently below the national level.

Source: BLS

Austin is becoming known for its culture, outdoors and technology scenes, and we believe it should continue to attract the nation’s best and brightest individuals, affording strong absorption across many real estate asset types. Our hope is to remain competitive in this market in the sub-institutional size range, as the market fundamentals should cause a high appetite for most large deals from institutional players.

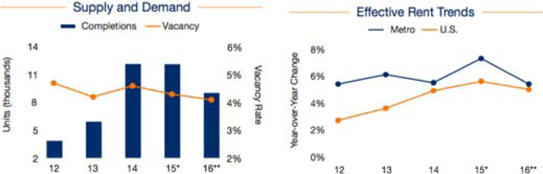

Marcus and Millichap reported in their 2016 Forecast the construction pipeline thinning. After builders delivered more than 12,000 units in each of the last two years, deliveries are expected to fall to 9,000 in 2016. Vacancy is expected to decrease slightly, while effective rent growth is predicted to slow to a more moderate 5.4% (down from 7.3% in 2015)

Source: Marcus & Millichap

Chicago and Denver Market Overview and Opportunity

Key population and employment statistics provided by the Bureau of Labor Statistics and set forth below:

| Key Statistics | | Chicago | | | Denver | | | US | |

| Population | | | 9,554,598 | | | | 2,754,258 | | | | 318,900,000 | |

| Pop. Growth Since 2000 | | | 0.4 | % | | | 2.0 | % | | | 0.9 | % |

| Number of Employed | | | 4,580,000 | | | | 1,392,200 | | | | 139,023 | |

| Unemployment Rate | | | 4.9 | % | | | 3.2 | % | | | 5.5 | % |

| Job Growth (Y-O-Y) | | | 1.0 | % | | | 2.3 | % | | | 1.9 | % |

| Three Yr. Avg. Employment Growth | | | 1.3 | % | | | 3.4 | % | | | 1.9 | % |

Chicago MSA

The Chicago, Naperville, Elgin, IL-IN-WI Metropolitan Statistical Area area includes Cook, DeKalb, DuPage, Grundy, Kane, Kendall, McHenry, Will, Jasper, Lake, Newton, Porter and Kenosha Counties (collectively, the “Chicago MSA”). We plan to evaluate individual opportunities in the Chicago MSA taking the below factors into consideration:

1. The Chicago MSA is the third largest MSA in the United States, and the economic center of the Midwest.

Chicago is a popular headquarters site for national and international companies seeking a relatively low-cost, central US location for operations. Fortune Magazine reported that Illinois housed 31 headquarters of Fortune 500 companies. According to World Business Chicago, there are over 400 major corporations headquartered in the Chicago area. Site Selection magazine awarded the Chicago MSA the distinction of being the nation’s top metropolitan area in terms of corporate investment, with 385 expansion or relocation projects recorded in 2014.

In addition to a strong corporate presence, Chicago is the nation’s second-most important financial center and the world leader in commodities trading. Chicago is the national leader in stock options trading, currency trading, currency futures, and interest rate futures. Trading of these commodities is done at three Chicago-based exchanges: the Chicago Board Options Exchange, the Chicago Stock Exchange, and the Chicago Mercantile Exchange Group. Crain’s Chicago Business reported Chicago’s tech-related jobs increased 26% from 2010 to 2013, outpacing Silicon Valley’s 21% increase and, nationwide, lagging behind only Houston.

Like the nation, the Chicago MSA has charted a measured economic recovery over the past few quarters. However, Chicago’s recovery has not matched the employment growth of the United States as a whole. While some improvement has been observed, the regional housing market recovery remains relatively weak and employment growth remains below average. Economic forecasts call for the region to continue to improve at a modest pace over the next few quarters. Over the long term, however, economic forecasts indicate that the region should continue to grow, as the Chicago metropolitan area has made a successful transition from a manufacturing- to a service-based economy over the past two decades. However, the state's massive debts and underfunded pension programs are of particular concern as the city’s financial situation is in question.

As the epicenter of the Midwest, we expect Chicago to benefit from a continued national urbanization shift, attracting some of the nation’s best and brightest individuals. These individuals are attracted by world class universities, low cost of living and a good pace of life. Large corporations are acknowledging the urbanization shift, with the likes of Motorola and Kraft Heinz moving their headquarters in from the suburbs to the heart of the city.

2. The Chicago for-sale housing market still has room to grow, and prices are well below their pre-recession 2007 peak.

Major inland cities (including Dallas, Houston, and Chicago) all lag both the US and coastal cities in regards to home price appreciation.

Home values in the greater Chicago MSA are relatively inexpensive, compared to rents. This is partially driven by the majority of rentals being focused in the core city, while average home values pull from a wider area. Home values are still well below their 2007 peak, a trend that is likely to continue because of Chicago’s recent property tax increase, which seeks to address public employee unfunded pension liability, which is discussed in greater detail below.

The Marcus and Millichap graph below from the fourth quarter 2015 suggests an uptick in home prices.

Source: Marcus & Millichap

As reported by Curbed, a real estate publication, in November 2015, demand for new single-family homes and condos has been high in the Chicago area as inventory remains low. With the new rental market becoming increasingly saturated, more developers are looking to build new single-family homes, townhouses and condos, which could provide an opportunity for the Company to participate.

3. Chicago’s Financial Stability is in question

Large unfunded pensions caused Chicago’s ratings on outstanding municipal debt to be lowered to junk status by Moody’s in May 2015. Chicago’s multiple public employee pension systems have approximately $111 billion in unfunded liabilities. In October 2015 the Chicago City Council voted in favor of a budget that will include an unprecedented property tax hike of $589 million to help fund Chicago’s police and fire department pensions. North Chicago real estate is predicted to be hit the hardest by the increase as a result of increasing property values, with people questioning if the increase will hurt renters the most by forcing people in these hot rental neighborhoods

(including the West Loop, South Loop, Wicker Park, Logan Square, Humboldt Park and Avondale) to rent longer before being able to afford a home.

4. With multifamily supply growing in Chicago, it is unclear if absorption will be able to keep up in the face of low population and employment growth.

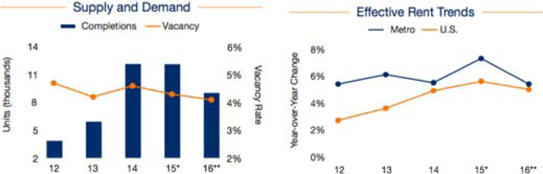

Developers are expected to remain active in Chicago with Marcus and Millichap counting 6,800 apartments under construction in Chicago, with more than 20,000 additional units proposed and in Chicago’s entitlement pipeline. During 2015, approximately 3,700 new apartments are expected to be brought into service in Chicago, a 2.2% rise in inventory, the largest delivery in 15 years. The Streeterville/River North submarket is expected to realize nearly 70% of the total. Strong tenant demand is expected to move vacancy down to 3.6% from 4.3% during 2015. During this period, many new luxury buildings are expected to push up the average effective rent 8.3% to approximately $1,672 per month. Chicago’s ability to absorb the 2015 deliveries may provide optimism for the future supply wave.

Approximately 13,000 multifamily rental units have been completed since 2012. Since the beginning of 2006, more than 48,000 new condo units were completed and almost 12,000 apartments have converted to condo units, resulting in a potential large supply of shadow rental inventory.

Chicago’s zoning committee recently approved a new measure to expand the radius where transit-oriented development can be built from 600 feet to 1,320 feet from a transit station. The constraint of providing one parking space per residential unit will be lifted allowing developers to construct denser projects in major commercial and residential corridors. With the flexibility to build, a spike in multifamily construction may occur as potential development sites are being purchased by apartment developers.

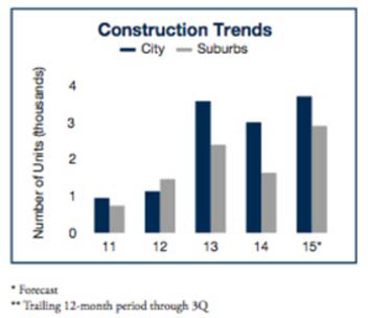

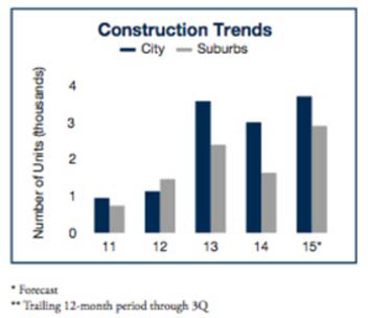

The following chart sets forth housing units completed in Chicago and its suburbs over the past five years.

Source: Marcus & Millichap

Vacancies are currently believed to be at a cyclical low. However, the new supply hitting the market may have an effect. Across the entire market, vacancies are expected to rise slightly and rent growth is expected to moderate. Despite budgetary woes, Chicago’s educational facilities and cultural amenities are expected to continue attracting the Midwest’s best and brightest. With the exception of the urban core, apartment fundamentals have shown progress indicating that the metro area should be able to accommodate the moderate amount of planned rental inventory additions to satisfy its expected near-term demand.

The chart below shows vacancy and asking rent changes over the past 10 years as reported by Fannie Mae.

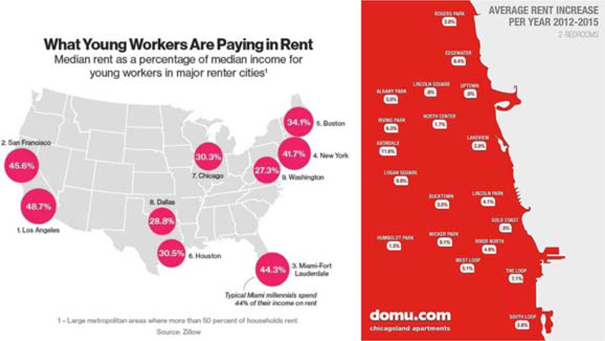

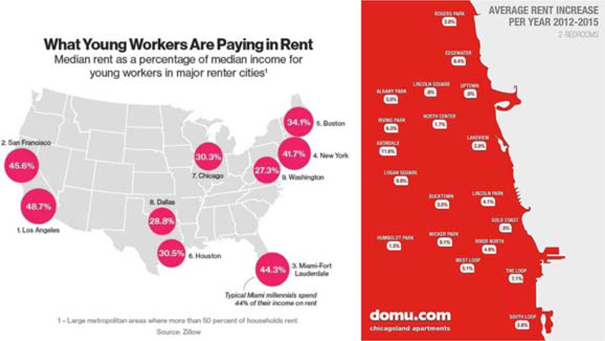

With workers paying the third lowest percent of their income on rent of the below listed 10 major cities, there may be room for renters to pay more for apartments in Chicago. Although Chicago has not seen a rent boom, it has shown steady gains in the face of large supply. However, it is unclear how long these gains will remain with continued supply and below average population and employment gains.

Strong rent growth (greater than 7% annually since 2012) has occurred in both select core and secondary Chicago in-fill locations.

After completing 3,101 units downtown in 2015—a record—developers are on track to finish about 3,500 in 2016 and another 4,500 in 2017, according to Appraisal Research, a Chicago-based consulting firm. Appraisal Research predicts absorption to be approximately 2,500 units per year, well below the 4,000 per year of supply. This should cause vacancies to increase. Downside analysis for multifamily development should either incorporate higher vacancy or lower rents than are currently present in the market, which could make it difficult to complete a high volume of transactions.

ApartmentList.com Same-Store Rental Increase July 2015

| City | | Avg Price – 1 Bed | | | YY Change – 1 Bed | | | Avg Price – 2 Bed | | | YY Change – 2 Bed | |

| San Francisco, CA | | $ | 3,350 | | | | 3.70 | % | | $ | 4,750 | | | | 4.10 | % |

| New York, NY | | $ | 2,600 | | | | 1.00 | % | | $ | 3,390 | | | | 0.80 | % |

| Miami, FL | | $ | 2,050 | | | | 4.80 | % | | $ | 2,730 | | | | 9.30 | % |

| San Jose, CA | | $ | 2,050 | | | | 9.30 | % | | $ | 2,590 | | | | 6.30 | % |

| Boston, MA | | $ | 2,050 | | | | -1.20 | % | | $ | 2,500 | | | | -1.40 | % |

| Washington, DC | | $ | 1,980 | | | | -2.40 | % | | $ | 2,880 | | | | -4.30 | % |

| Los Angeles, CA | | $ | 1,520 | | | | 6.60 | % | | $ | 2,110 | | | | 3.40 | % |

| Seattle, WA | | $ | 1,500 | | | | 6.60 | % | | $ | 2,100 | | | | 8.50 | % |

| San Diego, CA | | $ | 1,450 | | | | 6.00 | % | | $ | 1,900 | | | | 5.70 | % |

| Chicago, IL | | $ | 1,330 | | | | 2.40 | % | | $ | 1,610 | | | | 0.10 | % |

| Average | | $ | 1,988 | | | | 3.68 | % | | $ | 2,656 | | | | 3.25 | % |

Source: Appraisal Research Counselors

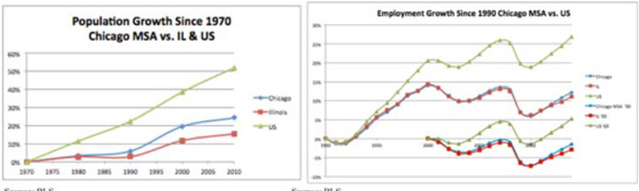

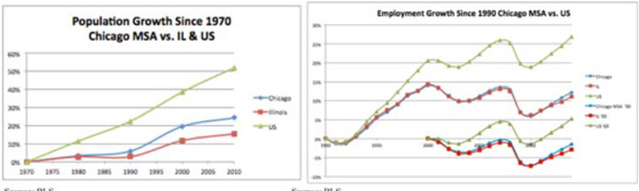

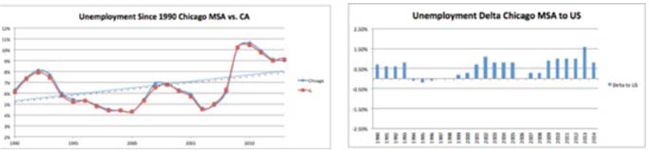

5. Chicago has seen below average population and employment growth over the past three years, causing concern for the overall health of the real estate market.

Cook Country contains approximately 55% of the Chicago MSA’s total population. The county realized a slight population decline from 2000 to 2015 due to migration from the city into the suburbs and collar counties, but very modest population growth is projected through 2020.

Population and employment in both Chicago and Illinois has significantly lagged the United States.

| | | Percent of total

employment | | | Mean hourly wage | |

| Major occupational group | | United States | | | Chicago | | | United States | | | Chicago | | | Percent difference (1) | |

| Total, all occupations | | | 100.0 | % | | | 100.0 | % | | $ | 22.71 | | | $ | 24.48 | * | | | 8 | |

| Management | | | 5.0 | | | | 6.6 | * | | | 54.08 | | | | 53.84 | | | | 0 | |

| Business and financial operations | | | 5.1 | | | | 5.7 | * | | | | | | | 35.97 | * | | | 3 | |

| Computer and mathematical | | | 2.8 | | | | 3.3 | * | | | 40.37 | | | | 38.67 | * | | | -4 | |

| Architecture and engineering | | | 1.8 | | | | 1.4 | * | | | 39.19 | | | | 37.48 | * | | | -4 | |

| Life, physical, and social science | | | 0.8 | | | | 0.5 | * | | | 33.69 | | | | 33.77 | | | | 0 | |

| Community and social services | | | 1.4 | | | | 1.3 | * | | | 21.79 | | | | 23.63 | * | | | 8 | |

| Legal | | | 0.8 | | | | 1.0 | * | | | 48.61 | | | | 48.07 | | | | -1 | |

| Education, training, and library | | | 6.2 | | | | 6.7 | * | | | 25.10 | | | | 26.92 | * | | | 7 | |

| Arts, design, entertainment, sports, and media | | | 1.3 | | | | 1.3 | | | | 26.82 | | | | 28.10 | | | | 5 | |

| Healthcare practitioners and technical | | | 5.8 | | | | 5.4 | * | | | 36.54 | | | | 36.40 | | | | 0 | |

| Healthcare support | | | 2.9 | | | | 2.8 | | | | 13.86 | | | | 13.90 | | | | 0 | |

| Protective service | | | 2.4 | | | | 2.7 | * | | | 21.14 | | | | 23.58 | | | | 12 | |

| Food preparation and serving related | | | 9.1 | | | | 7.9 | * | | | 10.57 | | | | 10.67 | | | | 1 | |

| Building and grounds cleaning and maintenance | | | 3.2 | | | | 3.1 | | | | 12.68 | | | | 13.89 | * | | | 10 | |

| Personal care and service | | | 3.1 | | | | 2.9 | * | | | 12.01 | | | | 12.83 | * | | | 7 | |

| Sales and related | | | 10.5 | | | | 10.6 | | | | 18.59 | | | | 21.10 | * | | | 14 | |

| Office and administrative support | | | 16.0 | | | | 15.5 | * | | | 17.08 | | | | 18.16 | * | | | 6 | |

| Farming, fishing, and forestry | | | 0.3 | | | | 0.1 | * | | | 12.09 | | | | 15.01 | * | | | 24 | |

| Construction and extraction | | | 3.9 | | | | 2.8 | * | | | 22.40 | | | | 31.88 | * | | | 42 | |

| Installation, maintenance, and repair | | | 3.9 | | | | 3.0 | * | | | 21.74 | | | | 24.03 | * | | | 11 | |

| Production | | | 6.6 | | | | 7.0 | * | | | 17.06 | | | | 16.82 | | | | -1 | |

| Transportation and material moving | | | 6.8 | | | | 8.3 | * | | | 16.57 | | | | 17.26 | | | | 4 | |

Footnotes:

(1) A positive percent difference measures how much the mean wage in Chicago is above the national mean wage, while a negative difference reflects a lower

* The percent share of employment or mean hourly wage for this area is significantly different from the national average of all areas at the 90-percent confidence level.

Source: BLS

Compared to other major metros, Chicago’s 8% wage differential to the United States is relatively anemic, while cost of living in the city is the fourth highest in the nation (behind New York, San Francisco and Washington, DC). Virtually all employment sectors have lagged the United States’ growth over the past 3 years, leading to an average growth rate that is 32% less than the nation. Chicago’s Professional and Business Services sector makes up 18% of the workforce 28.5% more than its national share, and has matched the United States’ 3.3% growth. A large part of the employment growth has been driven by technology hiring in the urban core, which is helpful for the absorption of Class A multifamily developments.

During the past four quarters, the highest growth was recorded in the professional and business services and health services sectors with the creation of 14,400 and 10,300 positions, respectively. Trade, transportation and utilities followed with 9,800 jobs generated.

Similar to other Midwest MSAs, Chicago’s manufacturing base has declined. Currently, manufacturing jobs comprise 8.8 percent of the job base, just under the national average. However, Chicago has been able to diversify its job base: 18 percent of jobs are in the well-paying professional and business services sector compared to just 14 percent for the U.S. In addition, 15 percent of jobs are in the fairly stable education and healthcare sectors, which is in line with the national rate. Chicago still faces possible headwinds, however. It is expected to have only half of the national rate of population growth through 2020. In addition, unresolved state and local budget problems, which are among the nation’s most severe, may subdue growth, leaving it slightly below the national average for the U.S. Nevertheless, as a regional center, the Chicago MSA is expected to still attract young, well-educated professionals. On an absolute basis, the Chicago MSA is expected to add approximately 290,000 jobs through 2019.

| | | Sep ‘15 Nonfarm | | | % of | | | | | | US % of | | | US 3 Yr Avg. | |

| Chicago MSA Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | Increase | |

| Trade, Transportation and Utilities | | | 917.8 | | | | 20.0 | % | | | 1.2 | % | | | 18.9 | % | | | 1.8 | % |

| Professional and Business Services | | | 826.1 | | | | 18.0 | % | | | 3.3 | % | | | 14.0 | % | | | 3.3 | % |

| Education and Health Services | | | 695.4 | | | | 15.2 | % | | | 1.6 | % | | | 15.5 | % | | | 2.2 | % |

| Government | | | 552.7 | | | | 12.1 | % | | | 0.1 | % | | | 15.3 | % | | | 0.1 | % |

| Leisure and Hospitality | | | 446.4 | | | | 9.7 | % | | | 1.8 | % | | | 10.8 | % | | | 3.4 | % |

| Financial Activities | | | 288 | | | | 6.3 | % | | | 0.0 | % | | | 5.7 | % | | | 1.5 | % |

| Manufacturing | | | 406.6 | | | | 8.9 | % | | | -0.4 | % | | | 8.7 | % | | | 1.0 | % |

| Construction | | | 170.8 | | | | 3.7 | % | | | 2.6 | % | | | 4.6 | % | | | 4.1 | % |

| Other Services | | | 194.9 | | | | 4.3 | % | | | 0.9 | % | | | 3.9 | % | | | 1.2 | % |

| Information | | | 79.8 | | | | 1.7 | % | | | -0.4 | % | | | 2.0 | % | | | 1.3 | % |

| Mining and Logging | | | 1.5 | | | | 0.0 | % | | | 0.0 | % | | | 0.6 | % | | | -2.3 | % |

| Total Nonfarm | | | 4,580 | | | | | | | | 1.3 | % | | | | | | | 1.9 | % |

Numbers reported in 1,000’s

Source: BLS (not seasonally adjusted)

Denver MSA

The Denver-Aurora-Lakewood, Colorado Metropolitan Statistical area includes Adams, Arapahoe, Broomfield, Denver, Douglas and Jefferson Counties (collectively, the “Denver MSA”). We believe that the Denver MSA provides a strong investment environment as a result of the following factors:

1. High employment and population growth will continue to be the leading contributors to the tight housing market in the Denver MSA.

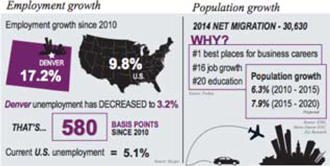

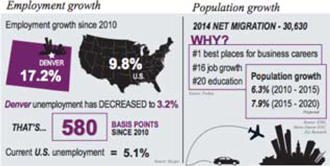

The following chart, prepared in 2015 by Lang LaSalle, shows why Denver has increased in popularity among multifamily institutional investors. Strong population and employment growth are directly correlated to the need for more housing units.

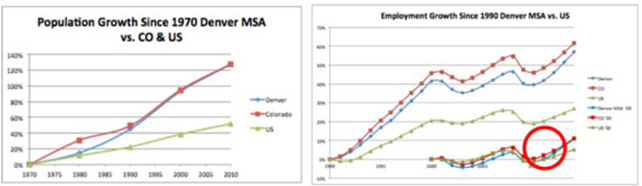

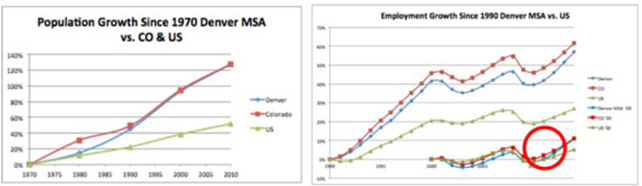

Denver, and Colorado as a whole, has experienced robust population growth, well outpacing the United States. Population growth since 2000 has averaged 2% per year, double the rate of US growth. As can be seen below in charts prepared by the Bureau of Labor Statistics, both Colorado’s and Denver’s populations are approximately 125% higher than they were in 1970.

Strong job opportunities have attracted new residents to the Denver MSA. The total population increased by 51,200 people in 2015. This 1.7 percent increase was achieved through a natural increase (births less deaths) of 20,300 people and net migration (people moving in less people moving out) of 30,900 people. About 60 percent of the Denver MSA population growth has been due to net migration in recent years, a higher percentage than most other western US employment centers.

Source: BLS

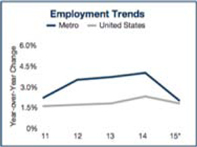

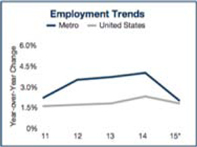

Related to Denver’s construction boom, the Mining, Logging and Construction sector of Denver’s economy has seen an average increase of 12.1% annually over the past three years. This, combined with a 5.4% average increase in Education and Health Services and a 3.6% increase in Leisure and Hospitality have been major contributors to the 3.4% three year average employment increase, which is 78% greater than the strong increase seen in the United States as a whole. Both Denver and Colorado have recovered all jobs lost in the recession considerably faster than the United States.

| | | Sep ‘15 Nonfarm | | | % of | | | | | | US % of | | | |

| Denver MSA Employment Breakdown | | Employment | | | Total | | | 3 Yr Avg. Increase | | | Total | | | US 3 Yr Avg. Increase |

| Trade, Transportation, and Utilities | | | 253.2 | | | | 18.2 | % | | | 1.9 | % | | | 18.9 | % | | 1.8% |

| Professional and Business Services | | | 246.3 | | | | 17.7 | % | | | 2.5 | % | | | 14.0 | % | | 3.3% |

| Education ana Health Services | | | 177.7 | | | | 12.8 | % | | | 5.4 | % | | | 15.5 | % | | 2.2% |

| Government | | | 195.8 | | | | 14.1 | % | | | 3.0 | % | | | 15.3 | % | | 0.1% |

| Leisure and Hospitality | | | 154.5 | | | | 11.1 | % | | | 3.6 | % | | | 10.8 | % | | 3.4% |

| Financial Activities | | | 96.6 | | | | 7.1 | % | | | 1.9 | % | | | 5.7 | % | | 1.5% |

| Manufacturing | | | 67.2 | | | | 4.8 | % | | | 2.2 | % | | | 8.7 | % | | 1.0% |

| Mining, Logging, and Construction | | | 101.5 | | | | 7.3 | % | | | 12.1 | % | | | 5.2 | % | | 3.4% |

| Other Services | | | 55.5 | | | | 4.0 | % | | | 4.2 | % | | | 3.9 | % | | 1.2% |

| Information | | | 41.9 | | | | 3.0 | % | | | -1.2 | % | | | 2.0 | % | | 1.3% |

| | | | | | | | | | | | | | | | | | | |

| Total Nonfarm | | | 1,392 | | | | | | | | 3.4 | % | | | | | | 1.9% |

Numbers reported in 1,000's

Source: BLS (not seasonally adjusted)

Table A. Occupational employment and wages by major occupational group, United States and the Denver-Aurora-Bromfield Metropolitan Statistical Area, and measures of statistical significance, May 2013

| | | Percent of total

employment | | | Mean hourly wage | |

| Major occupational group | | United States | | | Denver | | | United States | | | Denver | | | Percent

difference (1) | |

| Total, all occupations | | | 100.0 | % | | | 100.0 | % | | $ | 22.33 | | | $ | 25.05 | * | | | 12 | |

| Management | | | 4.9 | | | | 4.7 | * | | | 53.15 | | | | 59.62 | * | | | 12 | |

| Business and financial operations | | | 5.0 | | | | 8.2 | * | | | 34.14 | | | | 35.68 | * | | | 5 | |

| Computer and mathematical | | | 2.8 | | | | 4.6 | * | | | 39.43 | | | | 41.26 | * | | | 5 | |

| Architecture and engineering | | | 1.8 | | | | 2.5 | * | | | 38.51 | | | | 41.84 | * | | | 9 | |

| Life, physical, and social science | | | 0.9 | | | | 1.1 | * | | | 33.37 | | | | 34.74 | | | | 4 | |

| Community and social services | | | 1.4 | | | | 1.2 | * | | | 21.50 | | | | 22.27 | | | | 4 | |

| Legal | | | 0.8 | | | | 1.2 | * | | | 47.89 | | | | 52.65 | * | | | 10 | |

| Education, training, and library | | | 6.3 | | | | 5.3 | * | | | 24.76 | | | | 25.96 | | | | 5 | |

| Arts, design, entertainment, sports, and media | | | 1.3 | | | | 1.5 | * | | | 26.72 | | | | 25.45 | * | | | -5 | |

| Healthcare practitioner and technical | | | 5.8 | | | | 5.1 | * | | | 35.93 | | | | 37.42 | * | | | 4 | |

| Healthcare support | | | 3.0 | | | | 2.3 | * | | | 13.61 | | | | 15.56 | * | | | 14 | |

| Protective service | | | 2.5 | | | | 2.2 | * | | | 20.92 | | | | 21.60 | | | | 3 | |

| Food preparation and serving related | | | 9.0 | | | | 8.7 | | | | 10.38 | | | | 10.90 | * | | | 5 | |

| Building and grounds cleaning and maintenance | | | 3.2 | | | | 3.1 | | | | 12.51 | | | | 12.47 | | | | 0 | |

| Personal care and service | | | 3.0 | | | | 3.1 | | | | 11.88 | | | | 12.53 | * | | | 5 | |

| Sales and related | | | 10.6 | | | | 11.5 | * | | | 18.37 | | | | 21.55 | * | | | 17 | |

| Office and administrative support | | | 16.2 | | | | 16.2 | | | | 16.78 | | | | 18.24 | * | | | 9 | |

| Farming, fishing, and forestry | | | 0.3 | | | | 0.1 | * | | | 11.70 | | | | 13.55 | * | | | 16 | |

| Construction and extraction | | | 3.8 | | | | 4.2 | * | | | 21.94 | | | | 21.33 | * | | | -3 | |

| Installation, maintenance, and repair | | | 3.9 | | | | 3.6 | * | | | 21.35 | | | | 22.84 | * | | | 7 | |

| Production | | | 6.6 | | | | 3.7 | * | | | 16.79 | | | | 17.72 | * | | | 6 | |

| Transportation and material moving | | | 6.8 | | | | 5.9 | * | | | 16.28 | | | | 17.82 | * | | | 9 | |

Footnotes:

(1) A positive percent difference measures how much the mean wage in Denver is above the national mean wage, while a negative difference reflects a lower wage.

* The percent share of employment or mean hourly wage for this area is significantly different from the national average of all areas at the 90-percent confidence level.

Under current market conditions, employees on average make 12% more in Denver than in the United States as a whole, with a standout being Sales and related jobs, which make up 11.5% of the workforce, making on average 17% more than comparable jobs nationally. These are the workers that can afford to live in newly constructed multifamily and for-sale product.

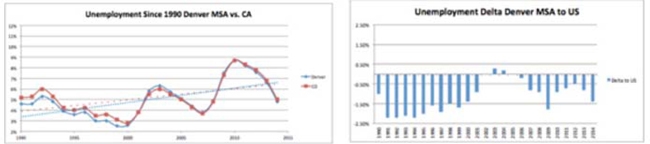

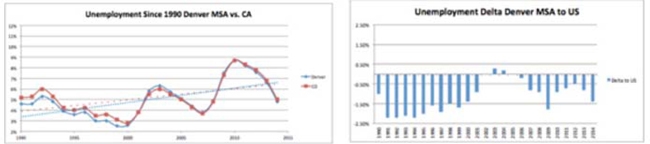

Although the recent recession caused Denver’s unemployment rate since 1990 to trend upward, it is currently at 4.2%, and the Denver MSA has more people employed than at any point in its history. Aside from 2003 and 2004, Denver’s unemployment rate has been consistently lower than the United States.

Source: BLS

Source: Marcus & Millichap

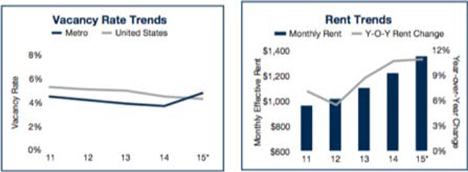

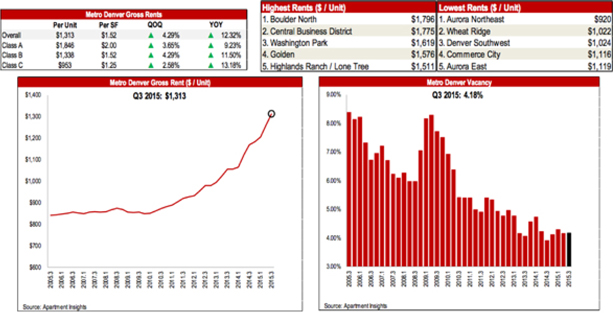

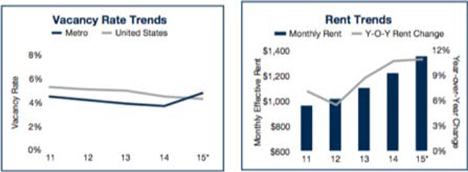

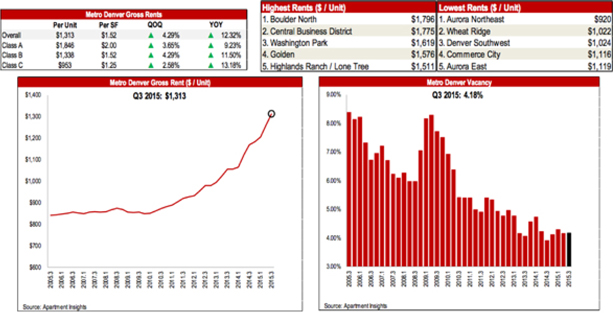

2. Denver has experienced steep rent increases in the face of heavy supply and average vacancy rates

Source: Marcus & Millichap

Marcus and Millichap reports that vacancy rates for apartments in the third quarter 2015 sat at 4%, a 50-basis-point rise from the same period a year ago. A boost in apartments coming online contributed to the rise. Vacancy rates are highest in the Denver core submarkets that experienced a large addition of new supply. The Downtown/Highlands/Lincoln Park vacancy rate was 7.0% in the third quarter, but this is due to recent supply that is available. The market is extremely tight in North Lakewood/Wheat Ridge where vacancy was only 1.1%. Apartments built in the 1970s posted the lowest vacancy at 2.9%. Marcus and Millichap predicts the supply of new rentals will outpace growth in demand through 2015 suggesting vacancy to rise to 4.8%.

While vacancy is increasing, rent is growing even faster, with the average monthly rent increasing 10.6% year-over-year in 2015, exceeding the 9.6% increase last year (Marcus & Millichap). Jones Lang LaSalle reported even higher rent growth, showing a 12.32% year-over-year growth at the end of the third quarter 2015.

Source: Jones Lang LaSalle

Source: Apartment Association of Metro Denver

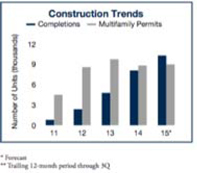

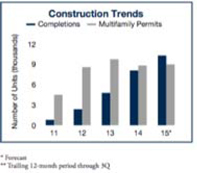

Although ticking up recently, Denver’s vacancy rate has held around the national average, while the metro area has delivered approximately 18,000 multifamily units over the past two years. Strong population growth dictates the need for additional housing units, yet the approximately 21,600 multifamily units in various stages of planning will need to be closely watched if for sale housing development increases.

Marcus and Millichap historic construction trends are set forth below along with Jones Lang Lasalles’ recent construction projections.

|  |

| | |

| Source: Marcus & Millichap | Source: Jones Lang LaSalle |

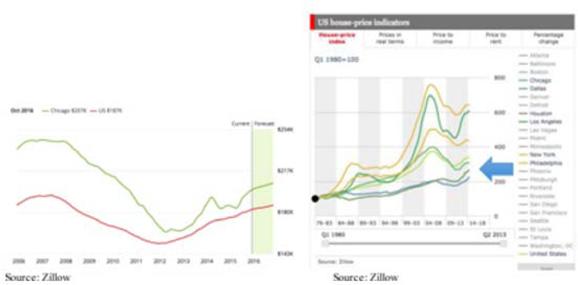

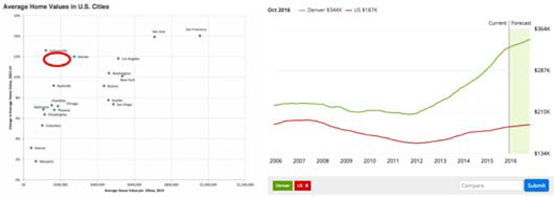

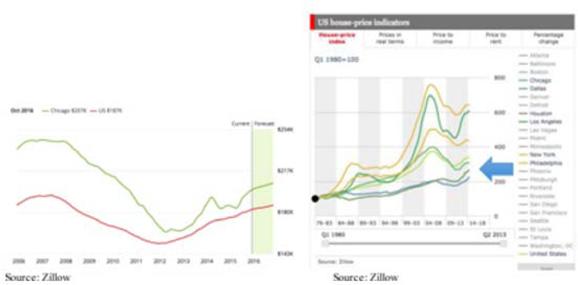

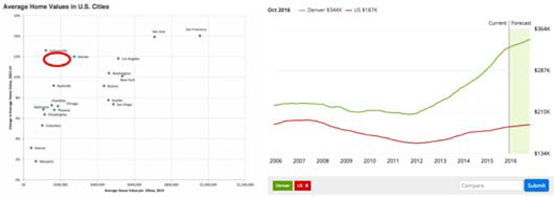

3. Denver home price inflation has well outpaced the United States largely because of demand increasing significantly faster than supply.

Denver housing inventory is low relative to current demand. As of December 2015, developers and builders of apartments had been unable to deliver new inventory quickly enough to keep up with the Denver MSA’s growing population, which has grown at double the rate of the United States, as a whole, since 2000. In a report published in August by the Downtown Denver Partnership, it was reported that 45 times as many apartments as for-sale units are in the planning pipeline. This is partially because of strict Colorado condominium defect laws that have curbed home ownership development in Denver for fear that developers would be sued by residents claiming their units were defective. In November 2015, a State legislative reform was passed severely limiting residents’ rights to sue developers assuming condominiums are built according to the then current building code. This reform should open up development opportunities for for-sale product, and potentially provide new opportunities for real estate investors.

Starbuck Realty Group reported in July 2015 that the median sale price of homes in Denver had increased an average of 12.17% per year since 2008. In May 2015, median sale prices rose 7.5% over April alone, and the median price for a detached, single-family home hit $400,000 in Denver.

Two charts from Zillow illustrate for sale housing prices in Denver currently as well as over the past several years. Zillow also forecasts continued appreciation in 2016.

Source: Zillow

Denver has experienced steep home price appreciation since 2012, well outpacing the trend for the country as a whole. Nationally construction prices have been rising, making it challenging to finance new development in many markets, but this is not the case in Denver.

Denver is a desirable place to live, and is pulling people from traditional, core, coastal cities as job opportunities for the time being are abundant and the relative cost of housing is to Denver’s advantage compared to the California coast. With strong underlying dynamics, we expect real estate investment opportunities to continue in Denver.

General Market Considerations

For general market considerations, please see “Investment Objectives and Strategy – Market Overview and Opportunity” in our Offering Circularhere.

Our Strategy

We may employ leverage to enhance total returns to our shareholders through a combination of senior financing on our real estate acquisitions, secured facilities, and capital markets financing transactions. Our target portfolio-wide leverage after we have acquired an initial substantial portfolio of diversified investments is between 50-85% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. As we acquire our initial portfolio, we employ greater leverage on individual assets (that will also result in greater leverage of the interim portfolio) in order to quickly build a diversified portfolio of multifamily rental properties and development project assets. We seek to secure conservatively structured leverage that is long-term, non-recourse, non-market-to-market financing to the extent obtainable on a cost effective basis. To the extent a higher level of leverage is employed it may come either in the form of government-sponsored programs or other long-term, non-recourse, non-market-to-market financing. Our Manager may from time to time modify our leverage policy in its discretion. However, other than during our initial period of operations, it is our policy to not borrow more than 85% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Manager’s investment committee

In executing on our business strategy, we believe that we benefit from our Manager’s affiliation with our sponsor given our sponsor’s strong track record and extensive experience and capabilities as an online real estate origination and funding platform. These competitive advantages include:

| | · | our sponsor’s experience and reputation as a leading real estate investment manager, which historically has given it access to a large investment pipeline similar to our targeted assets and the key market data we use to underwrite and portfolio manage assets; |

| | · | our sponsor’s direct and online origination capabilities, which are amplified by a proprietary crowdfunding technology platform, business process automation, and a large user base, of which a significant portion are seeking capital for real estate projects; |

| | · | our sponsor’s relationships with financial institutions and other lenders that originate and distribute commercial real estate debt and other real estate-related products and that finance the types of assets we intend to acquire and originate; |

| | · | our sponsor’s experienced portfolio management team which actively monitors each investment through an established regime of analysis, credit review and protocol; and |

| | · | our sponsor’s management team, which has a successful track record of making commercial real estate investments in a variety of market conditions. |

Critical Accounting Policies

Our accounting policies have been established to conform with U.S. Generally Accepted Accounting Principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires us to use judgment in the application of accounting policies, including making estimates and assumptions. These judgments affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Management believes that we have made these estimates and assumptions in an appropriate manner and in a way that accurately reflects our financial condition. We continually test and evaluate these estimates and assumptions using our historical knowledge of the business, as well as other factors, to ensure that they are reasonable for reporting purposes. However, actual results may differ from these estimates and assumptions. If our judgment or interpretation of the facts and circumstances relating to various transactions had been different, it is possible that different accounting policies would have been applied, thus resulting in a different presentation of the financial statements.

We believe the following critical accounting policies govern the significant judgments and estimates used in the preparation of our financial statements. Please refer toNote 2, “Summary of Significant Accounting Policies” included in the financial statements contained in this report below, for a more thorough discussion of our accounting policies and procedures. We consider our critical accounting policies to be the following:

Commercial Real Estate Debt Investments

Our commercial real estate debt investments are generally classified as held to maturity as we have both the intent and ability to hold these investments to maturity and, accordingly, are carried at cost, net of unamortized loan fees, premium, discount and unfunded commitments. We review our real estate debt investments on a quarterly basis, or more frequently when such an evaluation is warranted, to determine if an impairment exists. A real estate debt investment is impaired when, based on current information and events (including economic, industry and geographical factors), it is probable that we will be unable to collect all amounts due, both principal and interest, according to the contractual terms of the agreement. Commercial real estate debt investments that are deemed to be impaired are carried at amortized cost less a loan loss reserve, if deemed appropriate, which approximates fair value.

We have certain investments that are legally structured as equity investments with rights to receive preferred economic returns (seeItem 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Our Investments”above). We report these investments as real estate debt securities when the common equity holders have a contractual obligation to redeem our preferred equity interest at a specified date.