Corporate Presentation February 2019 Exhibit 99.1

Unless the context indicates otherwise, the terms “Organogenesis,” “Company,” “we,” “us” and “our” refer to Organogenesis Holdings Inc. (formerly known as Avista Healthcare Public Acquisition Corp.), a Delaware corporation. References in this prospectus to the “Business Combination” refer to the consummation of the transactions contemplated by that certain Agreement and Plan of Merger, dated as of August 17, 2018, which transactions were consummated on December 10, 2018. This Presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include: (i) the Company’s expected revenue for fiscal 2018 and fiscal 2019 and the breakdown of such revenues in both its Advanced Wound Care and Surgical & Sports Medicine categories as well as the estimated revenue contribution of its PuraPly products (ii) changes in the markets for the Company’s products and (iii) expansion plans and opportunities. Forward looking statements with respect to the continued existence and operations of the Company, strategies, prospects and other aspects of the business of the Company are based on current expectations that are subject to known and unknown risks and uncertainties, which could cause actual results or outcomes to differ materially from expectations expressed or implied by such forward looking statements. These factors include, but are not limited to: (1) the Company has incurred significant losses since inception and anticipates that it will incur substantial losses for the foreseeable future; (2) the Company faces significant and continuing competition, which could adversely affect its business, results of operations and financial condition; (3) rapid technological change could cause the Company’s products to become obsolete and if the Company does not enhance its product offerings through its research and development efforts, it may be unable to effectively compete; (4) to be commercially successful, the Company must convince physicians that its products are safe and effective alternatives to existing treatments and that its products should be used in their procedures; (5) the Company’s ability to raise funds to expand its business; (6) the impact of any changes to the reimbursement levels for the Company’s products and the impact to the Company of the loss of preferred “pass through” status for PuraPly AM and PuraPly on October 1, 2020; (7) the Company’s ability to successfully appeal Nasdaq’s determination to delist its securities and otherwise maintain compliance with applicable Nasdaq listing standards; (8) changes in applicable laws or regulations; (9) the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; and (10) other risks and uncertainties described in other documents filed or to be filed with the Securities and Exchange Commission (“SEC”) by the Company. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements in this Presentation speak as of the date first written above. Although the Company may from time to time voluntarily update its prior forward-looking statements, it disclaims any commitment to do so whether as a result of new information, future events, changes in assumptions or otherwise except as required by securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. Forward-Looking Statements / Industry and Market Data

This Company has presented the following measures that are not measures of performance under accounting principles generally accepted in the United States (“GAAP”): EBITDA, Pro Forma Adjusted EBITDA, Adjusted Revenue and the related pro forma information. EBITDA, Pro Forma Adjusted EBITDA and Adjusted Revenue are not measurements of our financial performance under GAAP and these measures should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity. The non-GAAP financial measures included in this presentation relate to annual and interim periods prior to the Business Combination and reflect the results of Organogenesis Inc., which became a direct wholly owned subsidiary of the Company following the Business Combination. EBITDA as used herein is defined as net income (loss) attributable to Organogenesis Inc. before depreciation and amortization, interest expense and income taxes and Adjusted EBITDA is defined as EBITDA, further adjusted for the impact of certain items that the Company does not consider indicative of its core operating performance. These items include non-cash equity compensation, mark to market adjustments on warrant liabilities, interest rate swaps and contingent asset and liabilities and a gain on settlement of litigation in 2015. Adjusted EBITDA is included in this personation because it is a key measure used by the Company’s management and its board of directors to understand and evaluate the Company's operating performance, generate future operating plans and make strategic decisions regarding the allocation of capital. In particular, the Company’s management believes that the exclusion of certain items in calculating Adjusted EBITDA can produce a useful measure for period-to-period comparisons of the Company’s business and that Adjusted EBITDA can help identify underlying business trends that could otherwise be masked by the effect of the items that are excluded from Adjusted EBITDA. The Company’s management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. Other companies may calculate EBITDA, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin and other non-GAAP measures differently, and therefore The Company’s EBITDA, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin and other non-GAAP measures may not be directly comparable to similarly titled measures of other companies. A reconciliation of Non-GAAP measures used in this presentation to the most closely comparable GAAP measure is set forth in the Appendix. In this presentation, we discuss non-GAAP adjusted EBITDA and pro forma adjusted EBITDA as forward-looking non-GAAP measures as defined by Regulation G, with respect to our 2017 year end and 2018 performance. Not all of the information necessary for a quantitative reconciliation of these non-GAAP financial measure to the most directly comparable GAAP financial measure is available without unreasonable efforts at this time. The probable significance of providing these measure is that the GAAP measure could be materially different. Use of Non-GAAP Financial Measures

Key Company Highlights Notes: Includes studies yet to publish data and retrospective projects. Number of facilities that have ordered products in 1H 2018. 2016 revenue pro forma for the acquisition of NuTech. 2019 based on mid-point of 2019E guidance Experienced Leadership with Track Record of Execution Differentiated and Comprehensive Suite of Products ~200 Direct Sales Representatives 400,000+ Square feet across 3 dedicated facilities 200+ Publications reviewing Organogenesis products 14 Ongoing studies(1) 2,500+ Healthcare facilities served in 1H 2018(2) ~110 Independent Agencies 1 2 3 4 5 6 Attractive End Markets Rapidly Scaling Business with Multiple Levers for Growth Established and Scalable Infrastructure Robust Clinical Data Supporting Products Proven R&D Engine with Deep Pipeline $4.7Bn+ Surgical & Sports Medicine Market (S&SM) $7Bn+ Advanced Wound Care Market (AWC) Pipeline products expected to be launched in next 2 years 5 ~16% PF Revenue Growth CAGR 2016PF – 2019E(3)

Experienced Management Team Name/Title Background Information Howard Walthall EVP, Strategy and Market Development Gary Gillheeney, Sr President & Chief Executive Officer Tim Cunningham Chief Financial Officer Patrick Bilbo Chief Operating Officer Brian Grow Chief Commercial Officer 6 years as President and CEO of NuTech Medical Previously served as partner at Burr & Forman, specializing in technology law and litigation 25+ years in senior leadership positions in both public and private organizations Served as President and CEO of Organogenesis since 2014 16 years at Organogenesis; also served as COO and CFO Recognized as one of Ernst & Young’s 2009 “Entrepreneur of the Year“ Earlier career in public accounting with Big 4 accounting firms followed by 20+ years leading Finance in private equity and venture backed companies to an IPO or a sale Certified Public Accountant 2 years at Organogenesis 24 years with Organogenesis Previously held management and research positions at Hologic, Stryker, and Harvard Medical School 14 years with Organogenesis Previously spent 3 years at Novartis / Innovex and 1 year at Bristol-Myers Squibb Innovative Clinical Solutions Lori Freedman VP and General Counsel 15+ years as general counsel and business development executive – 14 years for public companies Most recently VP Corporate Affairs, General Counsel & Secretary of pSivida Corp. with earlier career at McDermott, Will & Emery Antonio Montecalvo VP, Health Policy and Contracting 15 years with Organogenesis 6 years experience of Provider contracting with UnitedHealth and 7 years public accounting experience with large local public accounting firms

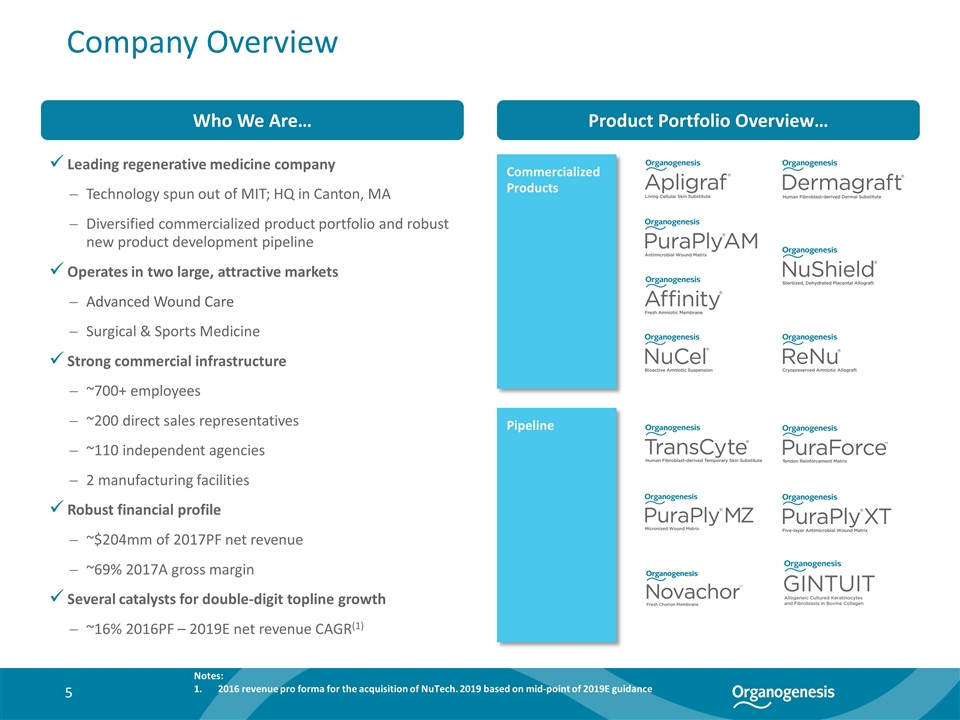

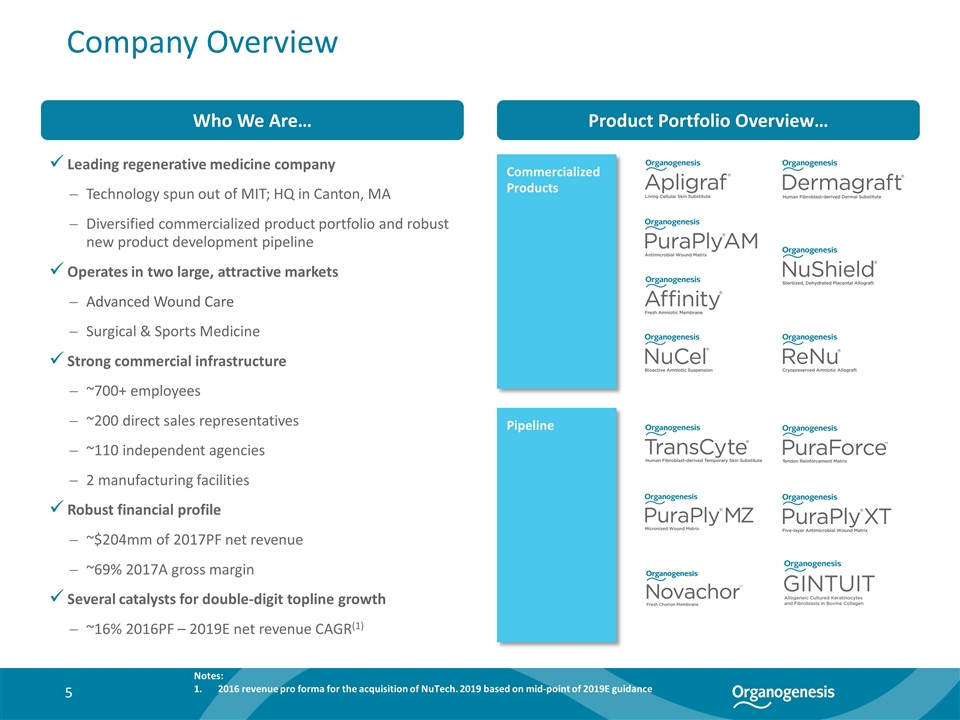

Who We Are… Leading regenerative medicine company Technology spun out of MIT; HQ in Canton, MA Diversified commercialized product portfolio and robust new product development pipeline Operates in two large, attractive markets Advanced Wound Care Surgical & Sports Medicine Strong commercial infrastructure ~700+ employees ~200 direct sales representatives ~110 independent agencies 2 manufacturing facilities Robust financial profile ~$204mm of 2017PF net revenue ~69% 2017A gross margin Several catalysts for double-digit topline growth ~16% 2016PF – 2019E net revenue CAGR(1) Product Portfolio Overview… Company Overview Commercialized Products Pipeline Notes: 2016 revenue pro forma for the acquisition of NuTech. 2019 based on mid-point of 2019E guidance

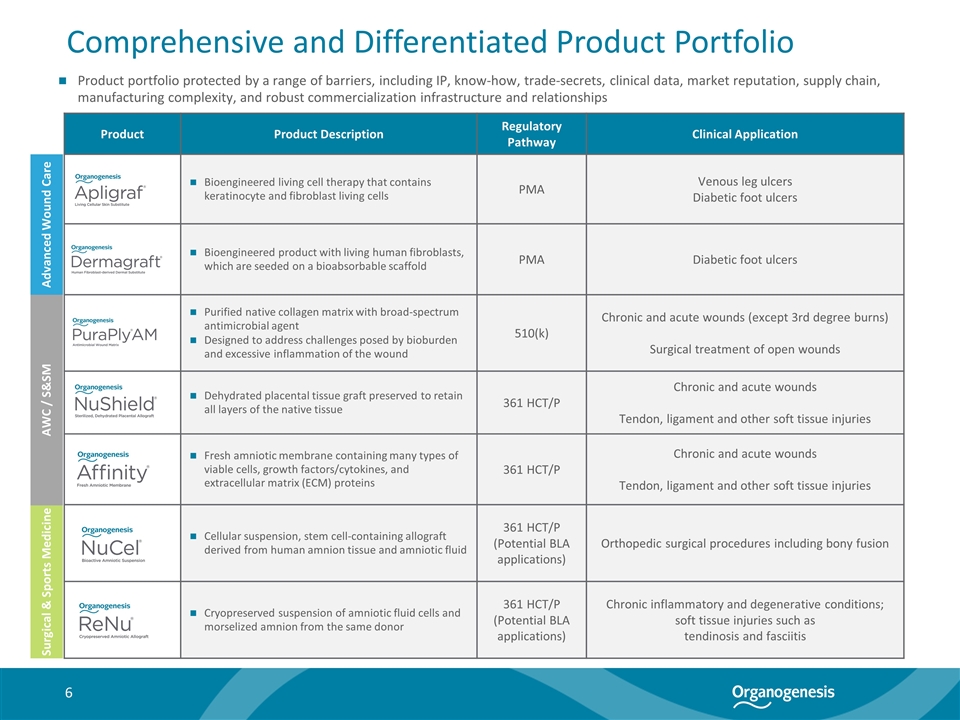

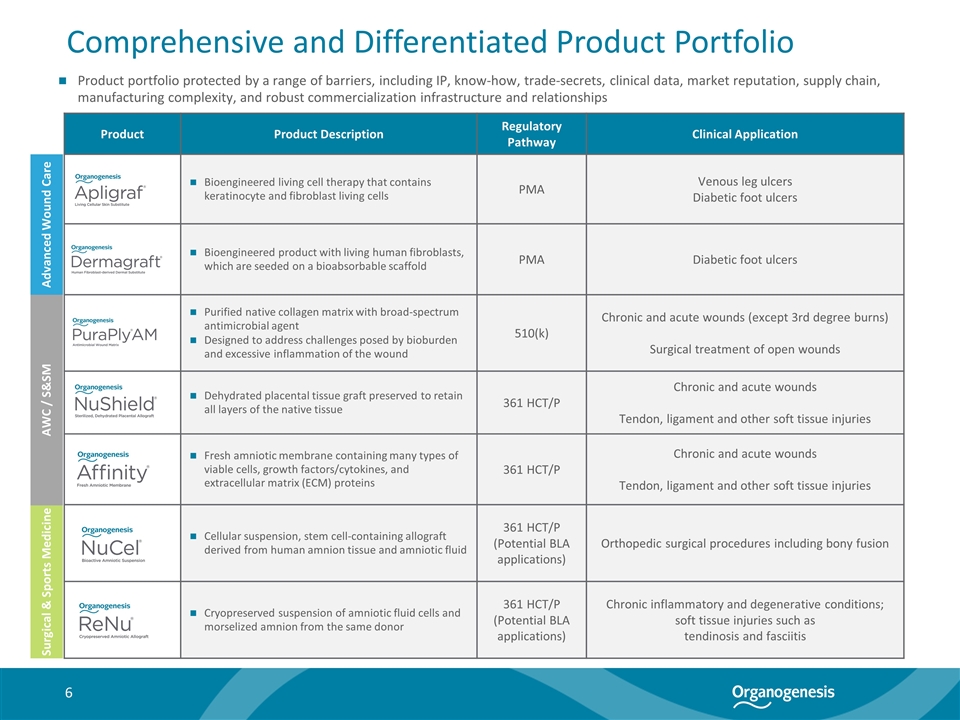

Comprehensive and Differentiated Product Portfolio Product Product Description Regulatory Pathway Clinical Application Bioengineered living cell therapy that contains keratinocyte and fibroblast living cells PMA Venous leg ulcers Diabetic foot ulcers Bioengineered product with living human fibroblasts, which are seeded on a bioabsorbable scaffold PMA Diabetic foot ulcers Purified native collagen matrix with broad-spectrum antimicrobial agent Designed to address challenges posed by bioburden and excessive inflammation of the wound 510(k) Chronic and acute wounds (except 3rd degree burns) Surgical treatment of open wounds Dehydrated placental tissue graft preserved to retain all layers of the native tissue 361 HCT/P Chronic and acute wounds Tendon, ligament and other soft tissue injuries Fresh amniotic membrane containing many types of viable cells, growth factors/cytokines, and extracellular matrix (ECM) proteins 361 HCT/P Chronic and acute wounds Tendon, ligament and other soft tissue injuries Cellular suspension, stem cell-containing allograft derived from human amnion tissue and amniotic fluid 361 HCT/P (Potential BLA applications) Orthopedic surgical procedures including bony fusion Cryopreserved suspension of amniotic fluid cells and morselized amnion from the same donor 361 HCT/P (Potential BLA applications) Chronic inflammatory and degenerative conditions; soft tissue injuries such as tendinosis and fasciitis Advanced Wound Care Surgical & Sports Medicine AWC / S&SM Product portfolio protected by a range of barriers, including IP, know-how, trade-secrets, clinical data, market reputation, supply chain, manufacturing complexity, and robust commercialization infrastructure and relationships

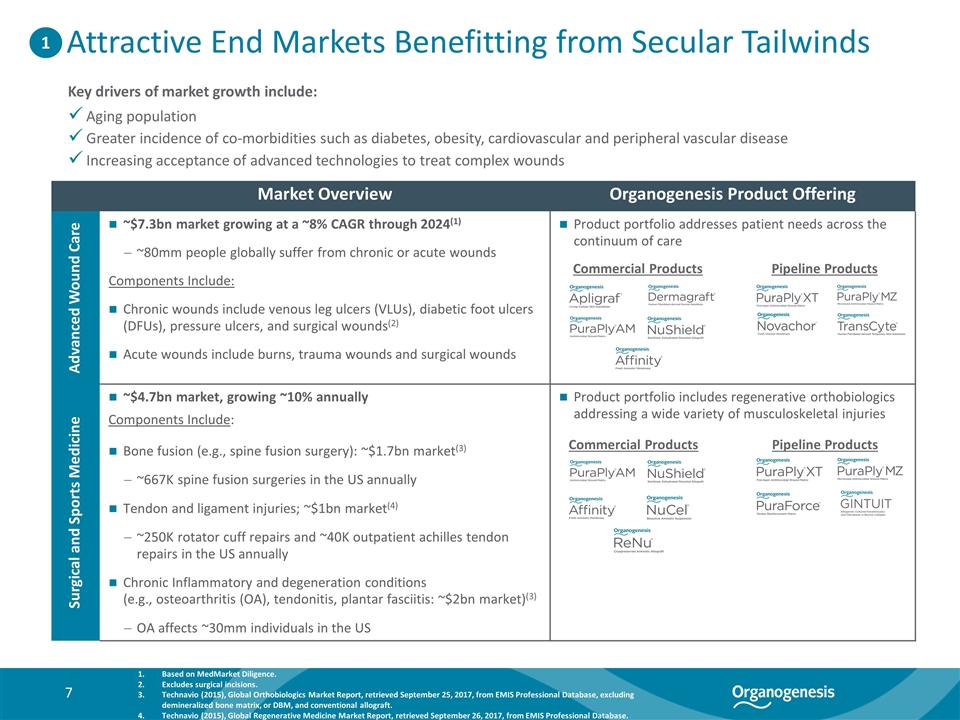

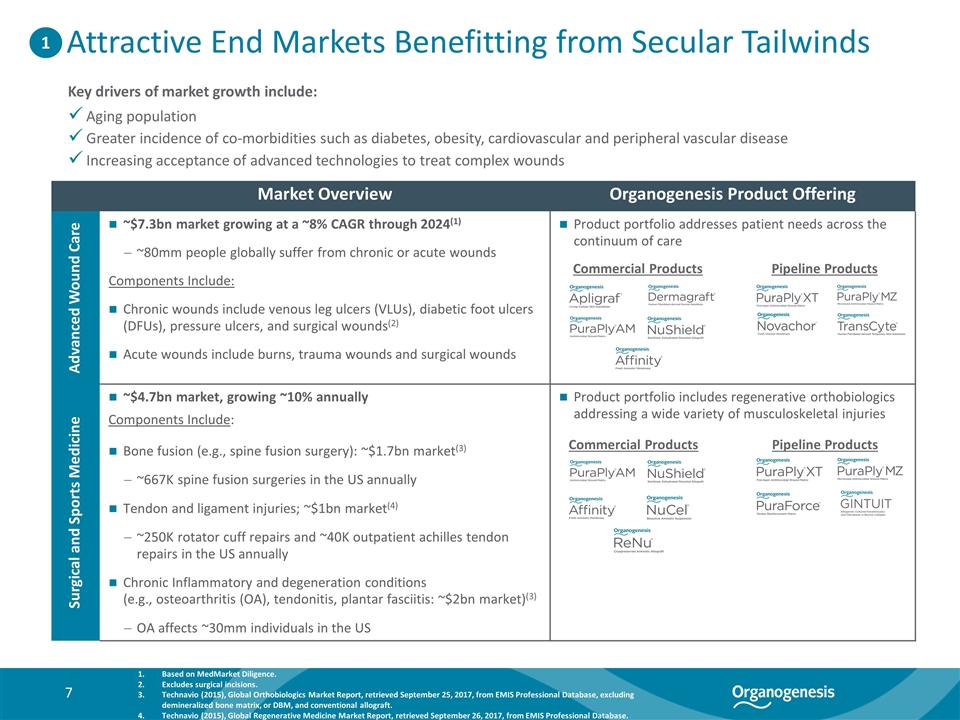

Attractive End Markets Benefitting from Secular Tailwinds Market Overview Organogenesis Product Offering Advanced Wound Care ~$7.3bn market growing at a ~8% CAGR through 2024(1) ~80mm people globally suffer from chronic or acute wounds Components Include: Chronic wounds include venous leg ulcers (VLUs), diabetic foot ulcers (DFUs), pressure ulcers, and surgical wounds(2) Acute wounds include burns, trauma wounds and surgical wounds Product portfolio addresses patient needs across the continuum of care Surgical and Sports Medicine ~$4.7bn market, growing ~10% annually Components Include: Bone fusion (e.g., spine fusion surgery): ~$1.7bn market(3) ~667K spine fusion surgeries in the US annually Tendon and ligament injuries; ~$1bn market(4) ~250K rotator cuff repairs and ~40K outpatient achilles tendon repairs in the US annually Chronic Inflammatory and degeneration conditions (e.g., osteoarthritis (OA), tendonitis, plantar fasciitis: ~$2bn market)(3) OA affects ~30mm individuals in the US Product portfolio includes regenerative orthobiologics addressing a wide variety of musculoskeletal injuries Key drivers of market growth include: Aging population Greater incidence of co-morbidities such as diabetes, obesity, cardiovascular and peripheral vascular disease Increasing acceptance of advanced technologies to treat complex wounds Based on MedMarket Diligence. Excludes surgical incisions. Technavio (2015), Global Orthobiologics Market Report, retrieved September 25, 2017, from EMIS Professional Database, excluding demineralized bone matrix, or DBM, and conventional allograft. Technavio (2015), Global Regenerative Medicine Market Report, retrieved September 26, 2017, from EMIS Professional Database. 1 Commercial Products Pipeline Products Commercial Products Pipeline Products

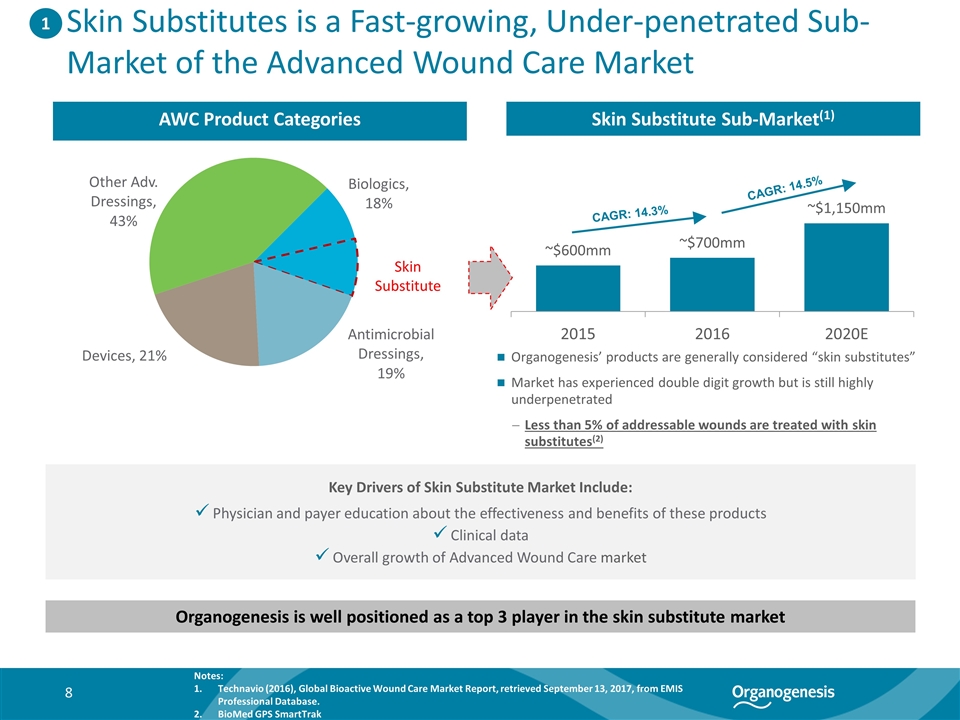

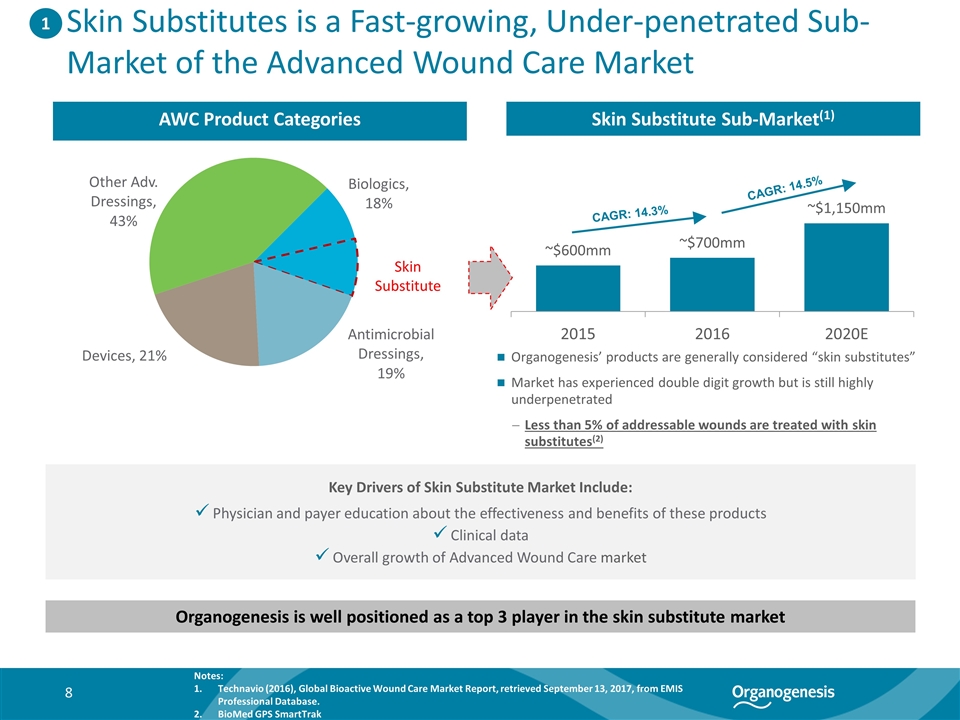

Skin Substitutes is a Fast-growing, Under-penetrated Sub-Market of the Advanced Wound Care Market AWC Product Categories Skin Substitute Sub-Market(1) Organogenesis’ products are generally considered “skin substitutes” Market has experienced double digit growth but is still highly underpenetrated Less than 5% of addressable wounds are treated with skin substitutes(2) Organogenesis is well positioned as a top 3 player in the skin substitute market Key Drivers of Skin Substitute Market Include: Physician and payer education about the effectiveness and benefits of these products Clinical data Overall growth of Advanced Wound Care market Skin Substitute Notes: Technavio (2016), Global Bioactive Wound Care Market Report, retrieved September 13, 2017, from EMIS Professional Database. BioMed GPS SmartTrak 1 CAGR: 14.3% CAGR: 14.5%

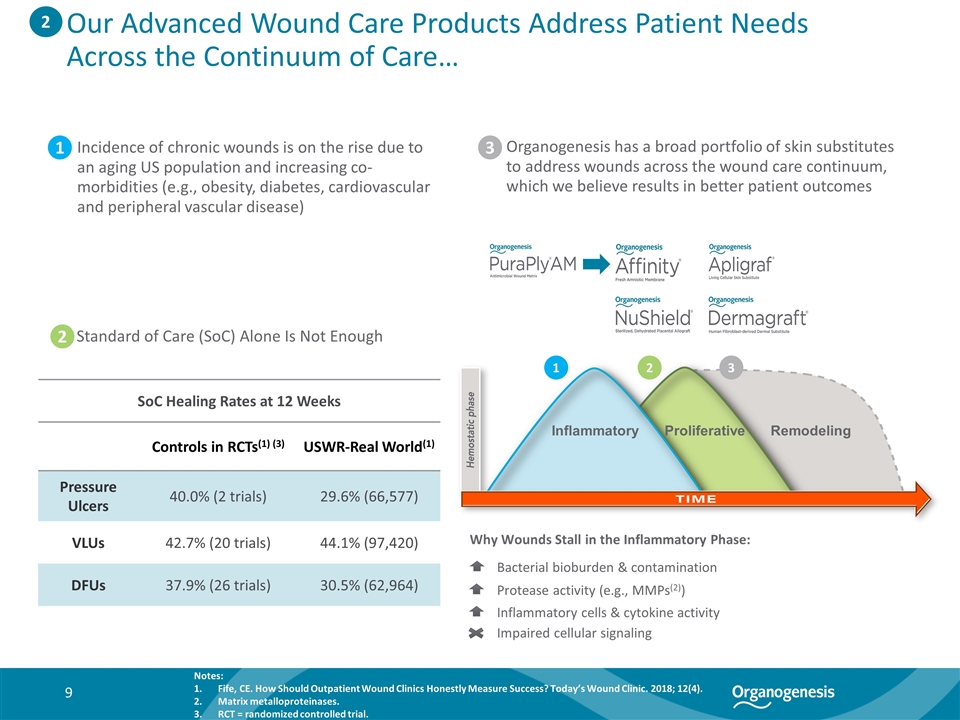

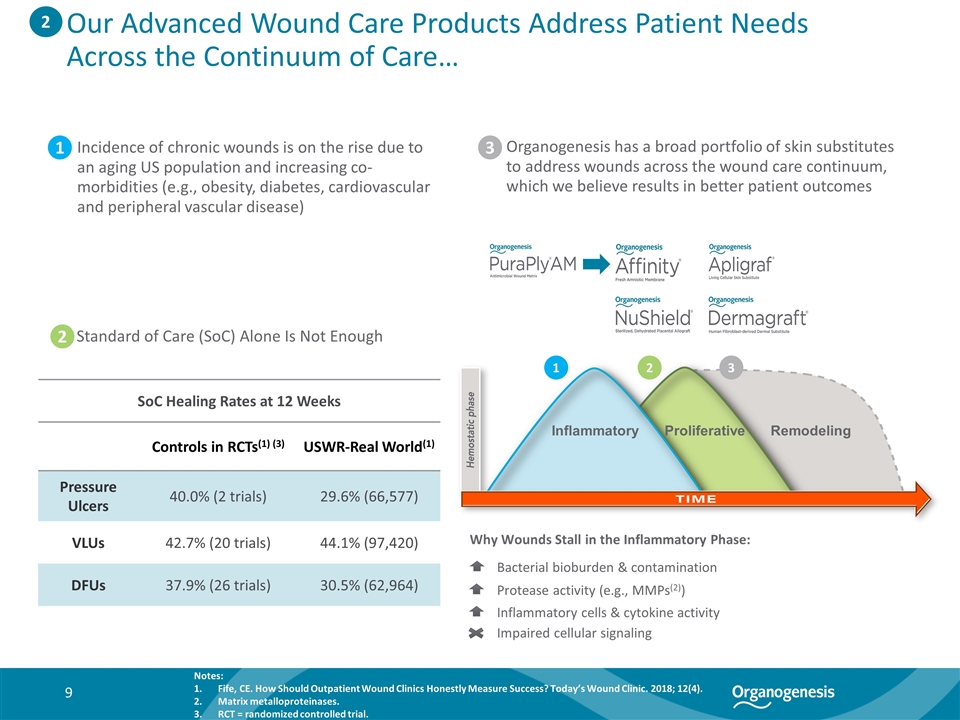

Bacterial bioburden & contamination Protease activity (e.g., MMPs(2)) Inflammatory cells & cytokine activity Impaired cellular signaling Incidence of chronic wounds is on the rise due to an aging US population and increasing co-morbidities (e.g., obesity, diabetes, cardiovascular and peripheral vascular disease) 2. Standard of Care (SoC) Alone Is Not Enough SoC Healing Rates at 12 Weeks Controls in RCTs(1) (3) USWR-Real World(1) Pressure Ulcers 40.0% (2 trials) 29.6% (66,577) VLUs 42.7% (20 trials) 44.1% (97,420) DFUs 37.9% (26 trials) 30.5% (62,964) Inflammatory Proliferative Remodeling Organogenesis has a broad portfolio of skin substitutes to address wounds across the wound care continuum, which we believe results in better patient outcomes Why Wounds Stall in the Inflammatory Phase: 2 Notes: Fife, CE. How Should Outpatient Wound Clinics Honestly Measure Success? Today’s Wound Clinic. 2018; 12(4). Matrix metalloproteinases. RCT = randomized controlled trial. 1 2 3 1 2 3 Our Advanced Wound Care Products Address Patient Needs Across the Continuum of Care…

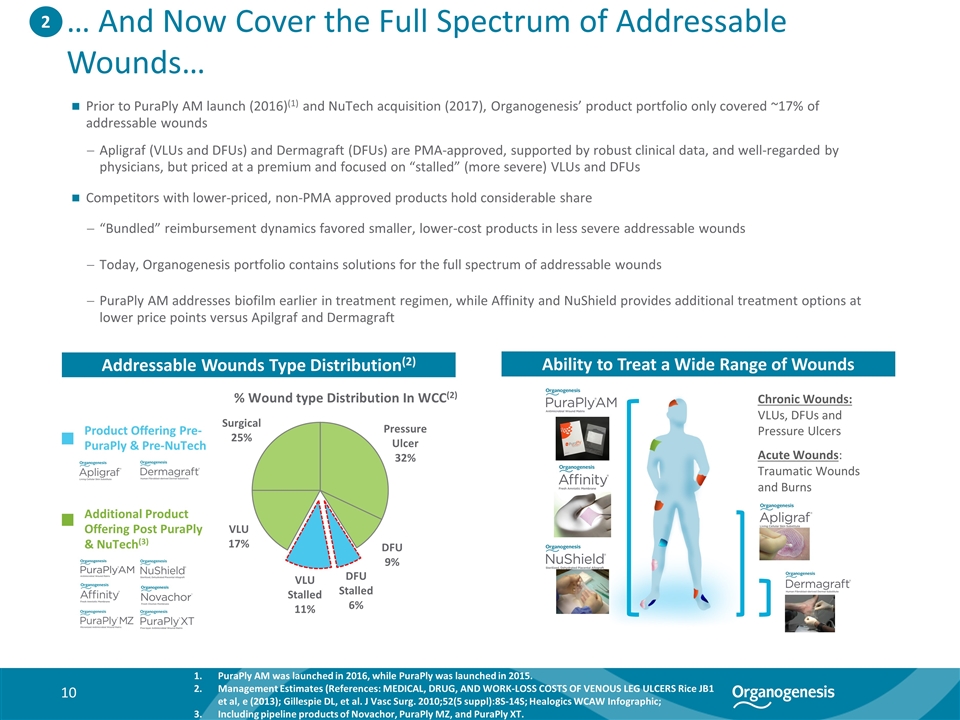

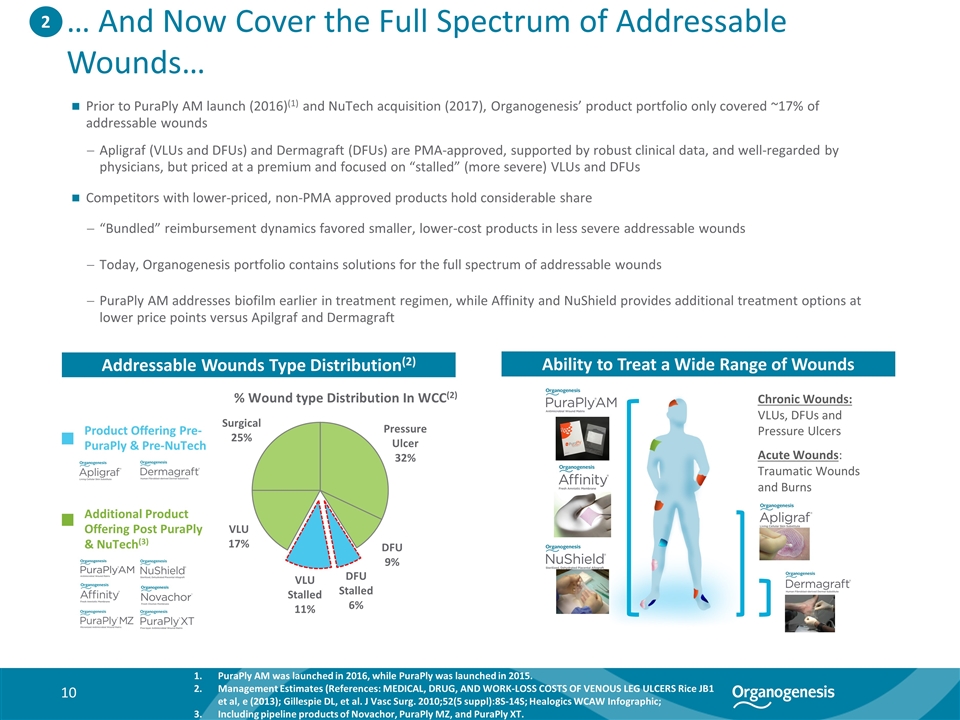

… And Now Cover the Full Spectrum of Addressable Wounds… Addressable Wounds Type Distribution(2) Ability to Treat a Wide Range of Wounds Chronic Wounds: VLUs, DFUs and Pressure Ulcers Acute Wounds: Traumatic Wounds and Burns 2 % Wound type Distribution In WCC(2) Prior to PuraPly AM launch (2016)(1) and NuTech acquisition (2017), Organogenesis’ product portfolio only covered ~17% of addressable wounds Apligraf (VLUs and DFUs) and Dermagraft (DFUs) are PMA-approved, supported by robust clinical data, and well-regarded by physicians, but priced at a premium and focused on “stalled” (more severe) VLUs and DFUs Competitors with lower-priced, non-PMA approved products hold considerable share “Bundled” reimbursement dynamics favored smaller, lower-cost products in less severe addressable wounds Today, Organogenesis portfolio contains solutions for the full spectrum of addressable wounds PuraPly AM addresses biofilm earlier in treatment regimen, while Affinity and NuShield provides additional treatment options at lower price points versus Apilgraf and Dermagraft Additional Product Offering Post PuraPly & NuTech(3) Product Offering Pre-PuraPly & Pre-NuTech PuraPly AM was launched in 2016, while PuraPly was launched in 2015. Management Estimates (References: MEDICAL, DRUG, AND WORK-LOSS COSTS OF VENOUS LEG ULCERS Rice JB1 et al, e (2013); Gillespie DL, et al. J Vasc Surg. 2010;52(5 suppl):8S-14S; Healogics WCAW Infographic; Including pipeline products of Novachor, PuraPly MZ, and PuraPly XT.

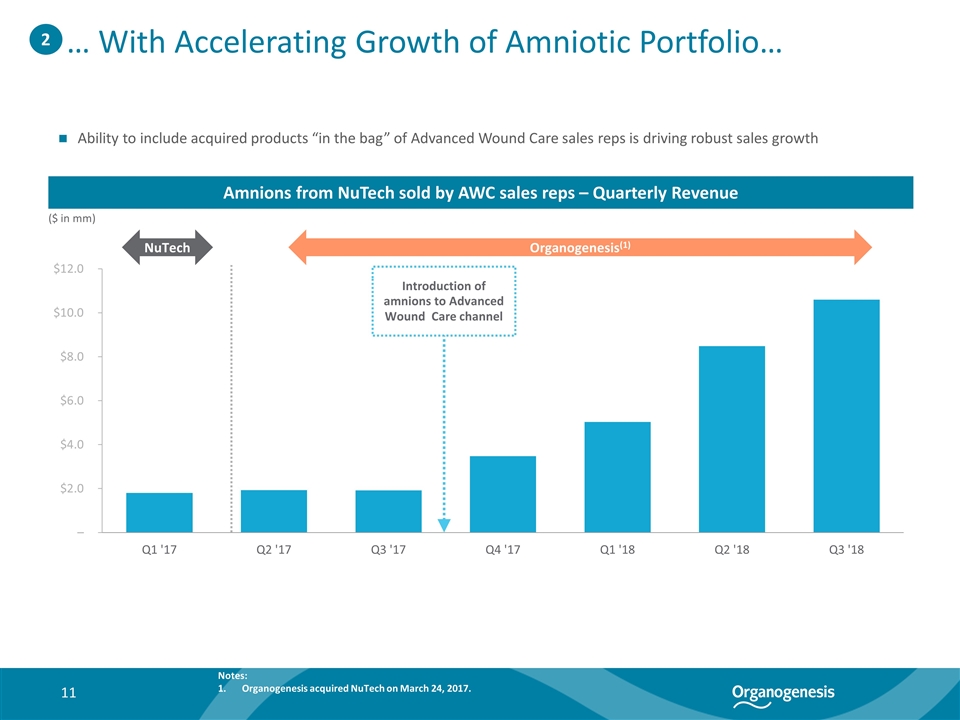

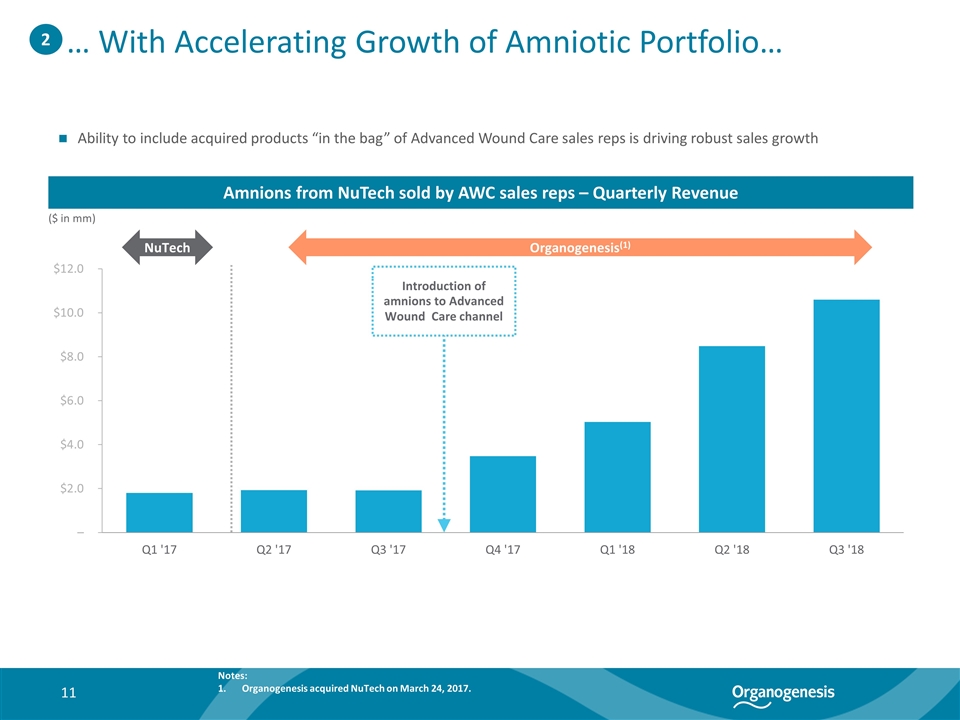

… With Accelerating Growth of Amniotic Portfolio… ($ in mm) Amnions from NuTech sold by AWC sales reps – Quarterly Revenue Ability to include acquired products “in the bag” of Advanced Wound Care sales reps is driving robust sales growth 2 (0.3%) 22% 13.2% NuTech Organogenesis(1) Introduction of amnions to Advanced Wound Care channel Notes: Organogenesis acquired NuTech on March 24, 2017.

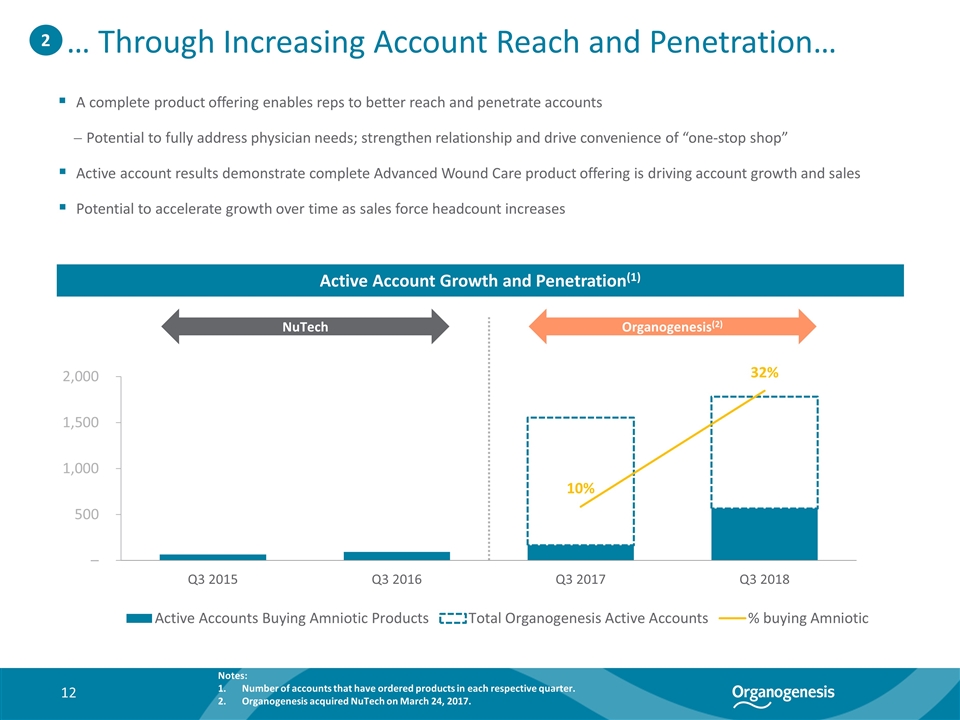

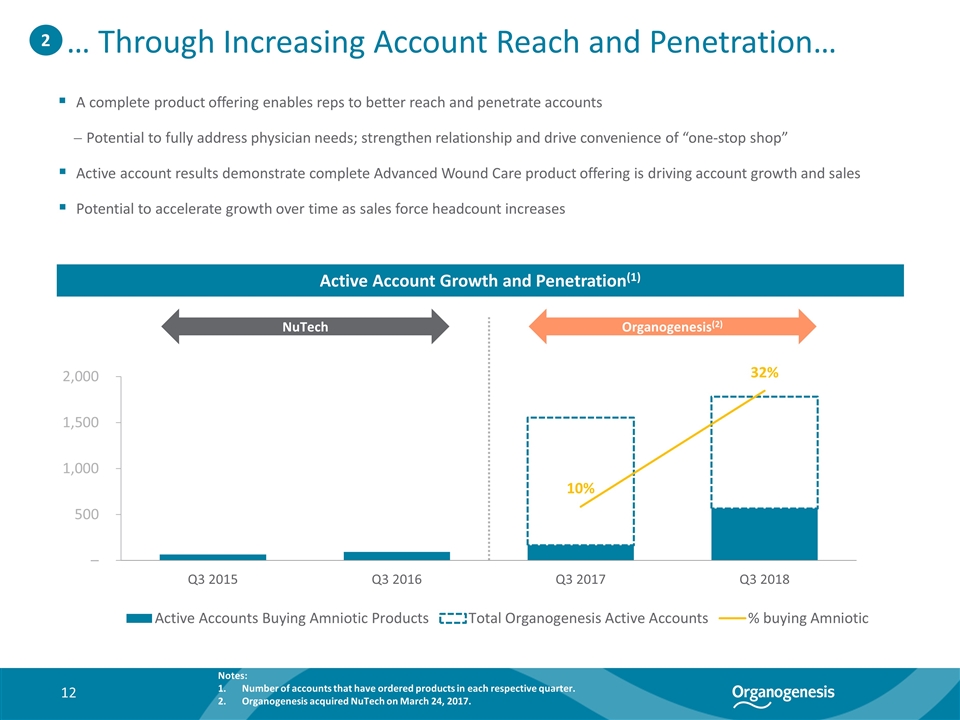

A complete product offering enables reps to better reach and penetrate accounts Potential to fully address physician needs; strengthen relationship and drive convenience of “one-stop shop” Active account results demonstrate complete Advanced Wound Care product offering is driving account growth and sales Potential to accelerate growth over time as sales force headcount increases Active Account Growth and Penetration(1) 2 … Through Increasing Account Reach and Penetration… NuTech Organogenesis(2) Notes: Number of accounts that have ordered products in each respective quarter. Organogenesis acquired NuTech on March 24, 2017.

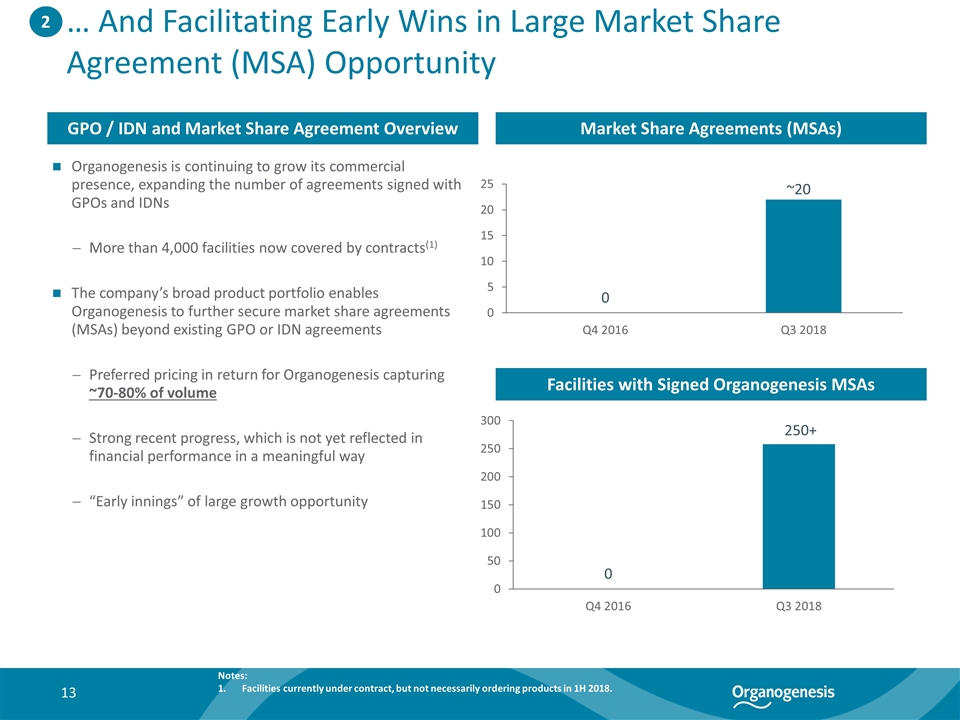

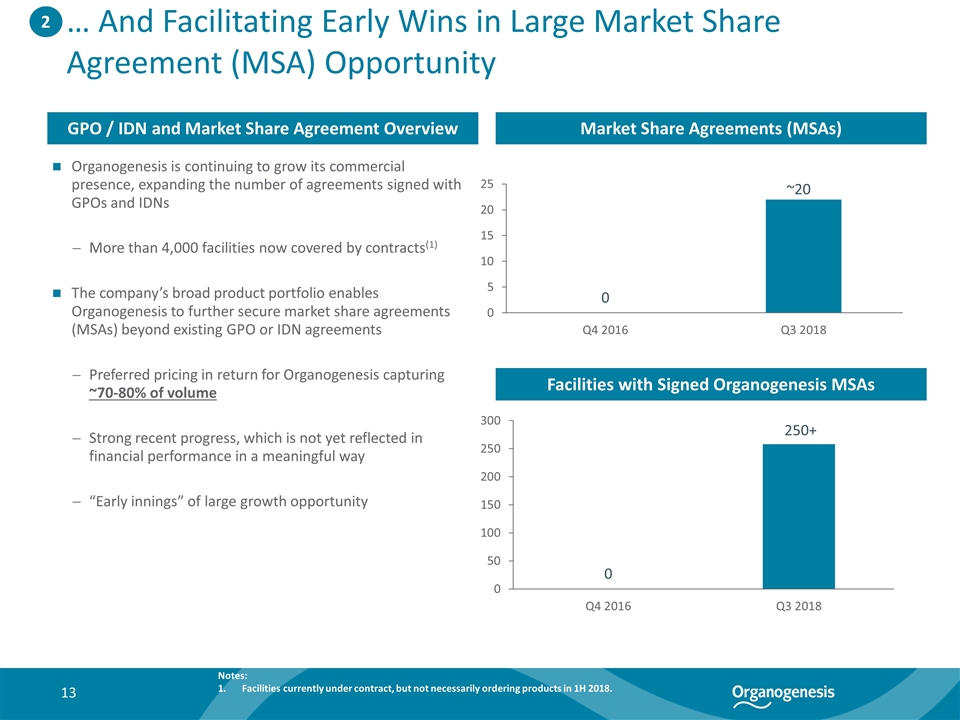

… And Facilitating Early Wins in Large Market Share Agreement (MSA) Opportunity Organogenesis is continuing to grow its commercial presence, expanding the number of agreements signed with GPOs and IDNs More than 4,000 facilities now covered by contracts(1) The company’s broad product portfolio enables Organogenesis to further secure market share agreements (MSAs) beyond existing GPO or IDN agreements Preferred pricing in return for Organogenesis capturing ~70-80% of volume Strong recent progress, which is not yet reflected in financial performance in a meaningful way “Early innings” of large growth opportunity 2 Market Share Agreements (MSAs) GPO / IDN and Market Share Agreement Overview Facilities with Signed Organogenesis MSAs ~20 Notes: Facilities currently under contract, but not necessarily ordering products in 1H 2018. 250+

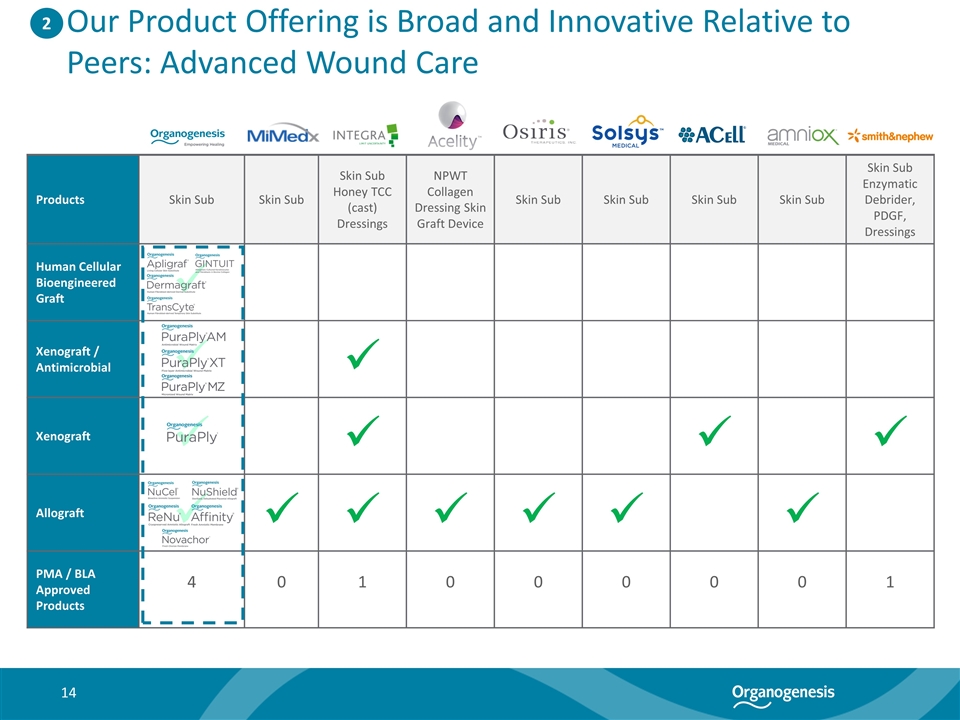

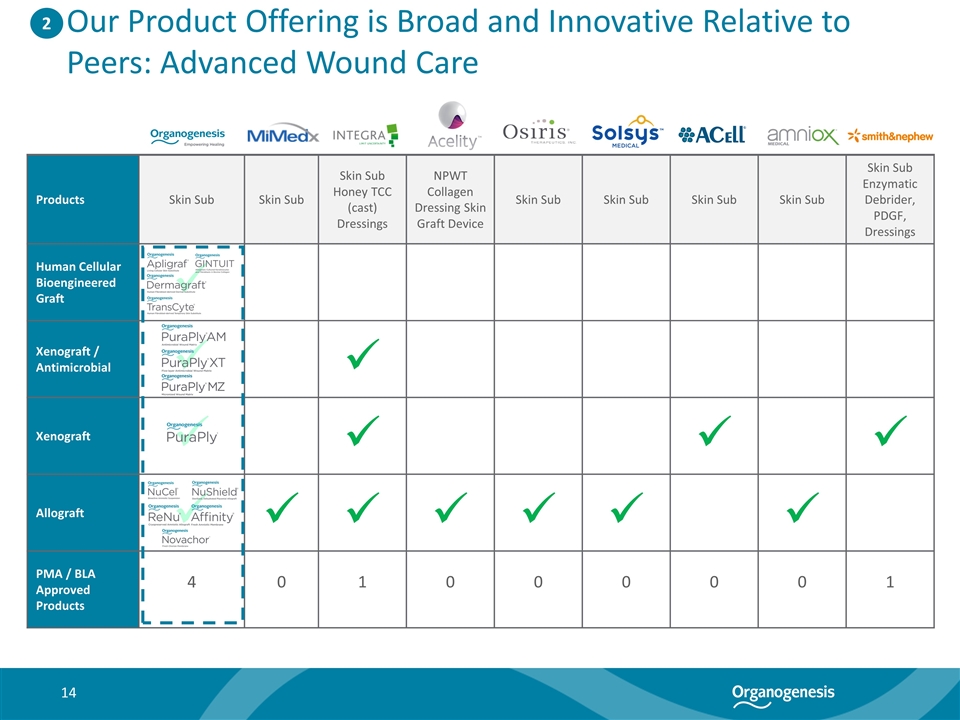

Our Product Offering is Broad and Innovative Relative to Peers: Advanced Wound Care Products Skin Sub Skin Sub Skin Sub Honey TCC (cast) Dressings NPWT Collagen Dressing Skin Graft Device Skin Sub Skin Sub Skin Sub Skin Sub Skin Sub Enzymatic Debrider, PDGF, Dressings Human Cellular Bioengineered Graft ü Xenograft / Antimicrobial ü ü Xenograft ü ü ü ü Allograft ü ü ü ü ü ü ü PMA / BLA Approved Products 4 0 1 0 0 0 0 0 1 2

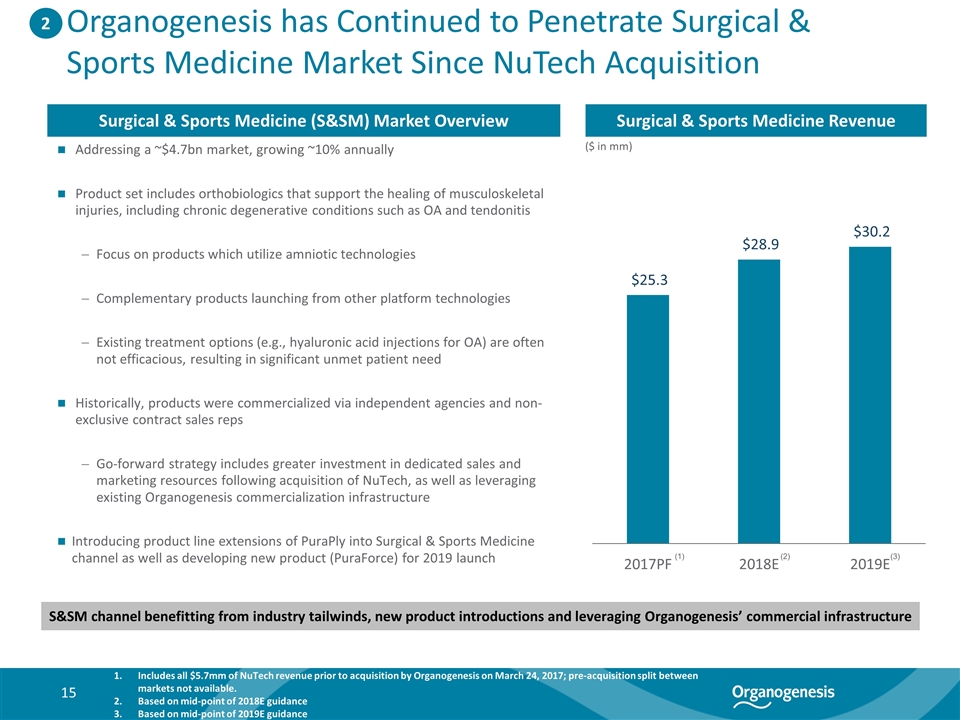

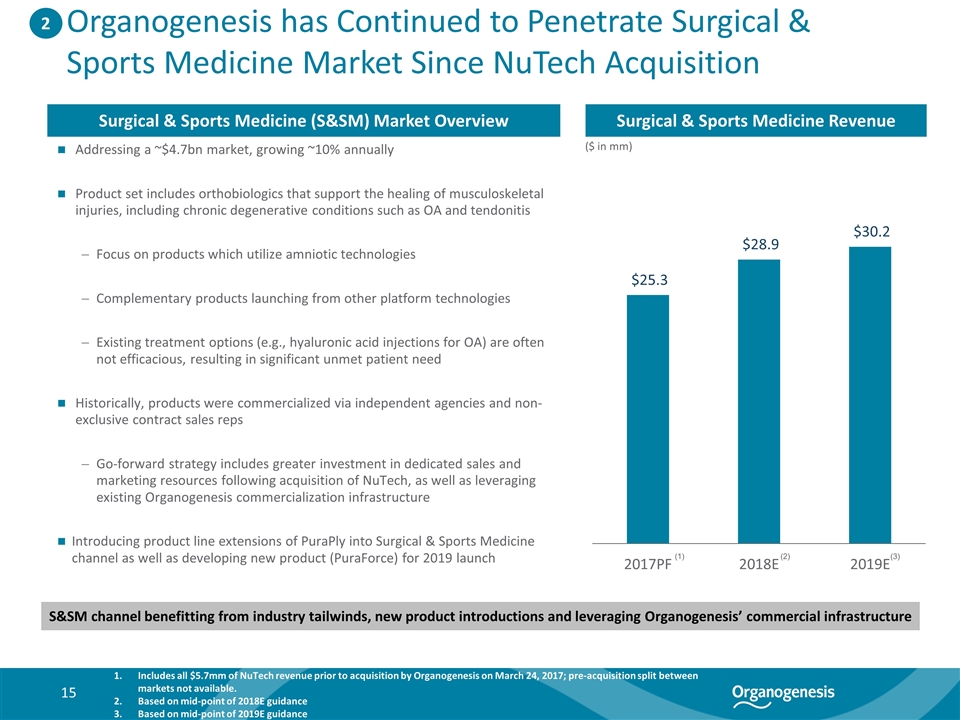

Organogenesis has Continued to Penetrate Surgical & Sports Medicine Market Since NuTech Acquisition Addressing a ~$4.7bn market, growing ~10% annually Product set includes orthobiologics that support the healing of musculoskeletal injuries, including chronic degenerative conditions such as OA and tendonitis Focus on products which utilize amniotic technologies Complementary products launching from other platform technologies Existing treatment options (e.g., hyaluronic acid injections for OA) are often not efficacious, resulting in significant unmet patient need Historically, products were commercialized via independent agencies and non-exclusive contract sales reps Go-forward strategy includes greater investment in dedicated sales and marketing resources following acquisition of NuTech, as well as leveraging existing Organogenesis commercialization infrastructure Introducing product line extensions of PuraPly into Surgical & Sports Medicine channel as well as developing new product (PuraForce) for 2019 launch Surgical & Sports Medicine Revenue 2 Surgical & Sports Medicine (S&SM) Market Overview S&SM channel benefitting from industry tailwinds, new product introductions and leveraging Organogenesis’ commercial infrastructure (1) Includes all $5.7mm of NuTech revenue prior to acquisition by Organogenesis on March 24, 2017; pre-acquisition split between markets not available. Based on mid-point of 2018E guidance Based on mid-point of 2019E guidance ($ in mm) (2) (3)

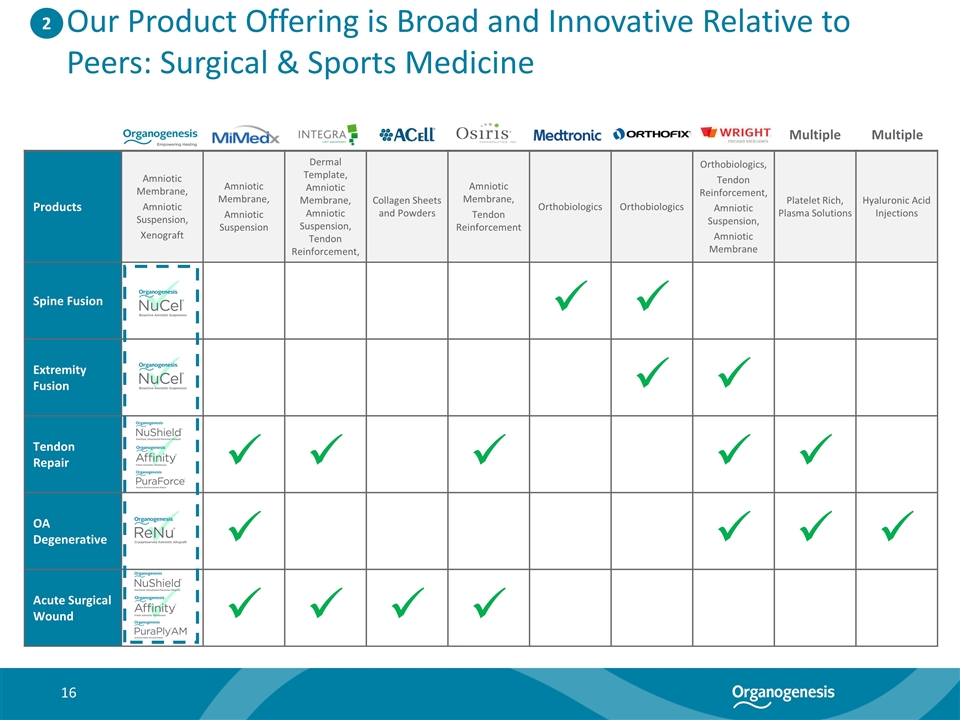

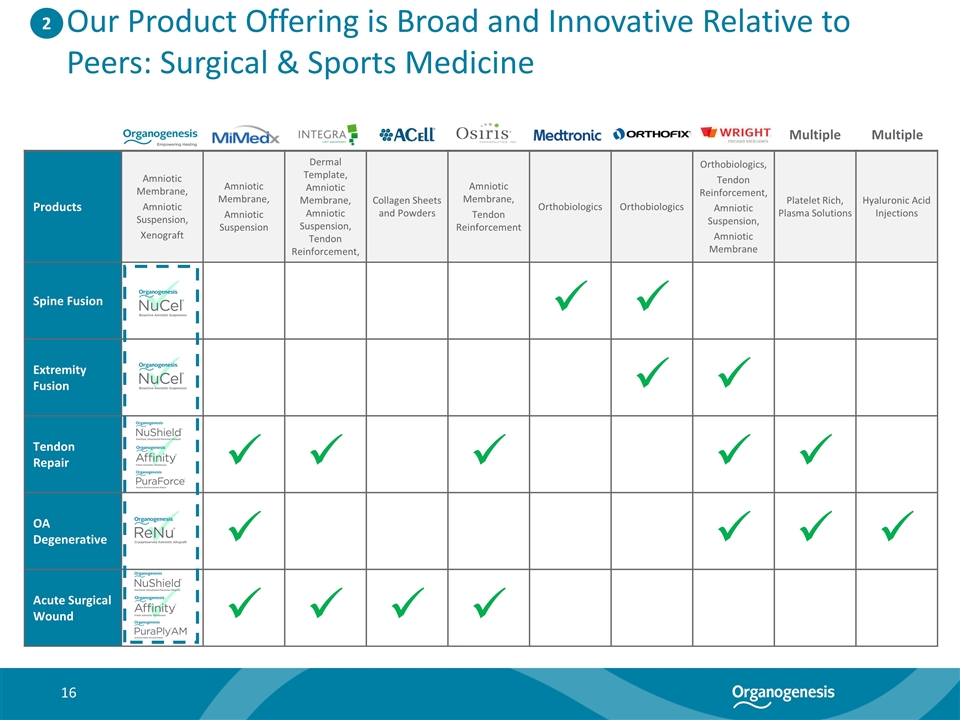

Our Product Offering is Broad and Innovative Relative to Peers: Surgical & Sports Medicine Products Amniotic Membrane, Amniotic Suspension, Xenograft Amniotic Membrane, Amniotic Suspension Dermal Template, Amniotic Membrane, Amniotic Suspension, Tendon Reinforcement, Collagen Sheets and Powders Amniotic Membrane, Tendon Reinforcement Orthobiologics Orthobiologics Orthobiologics, Tendon Reinforcement, Amniotic Suspension, Amniotic Membrane Platelet Rich, Plasma Solutions Hyaluronic Acid Injections Spine Fusion ü ü ü Extremity Fusion ü ü ü Tendon Repair ü ü ü ü ü ü OA Degenerative ü ü ü ü ü Acute Surgical Wound ü ü ü ü ü 2 Multiple Multiple

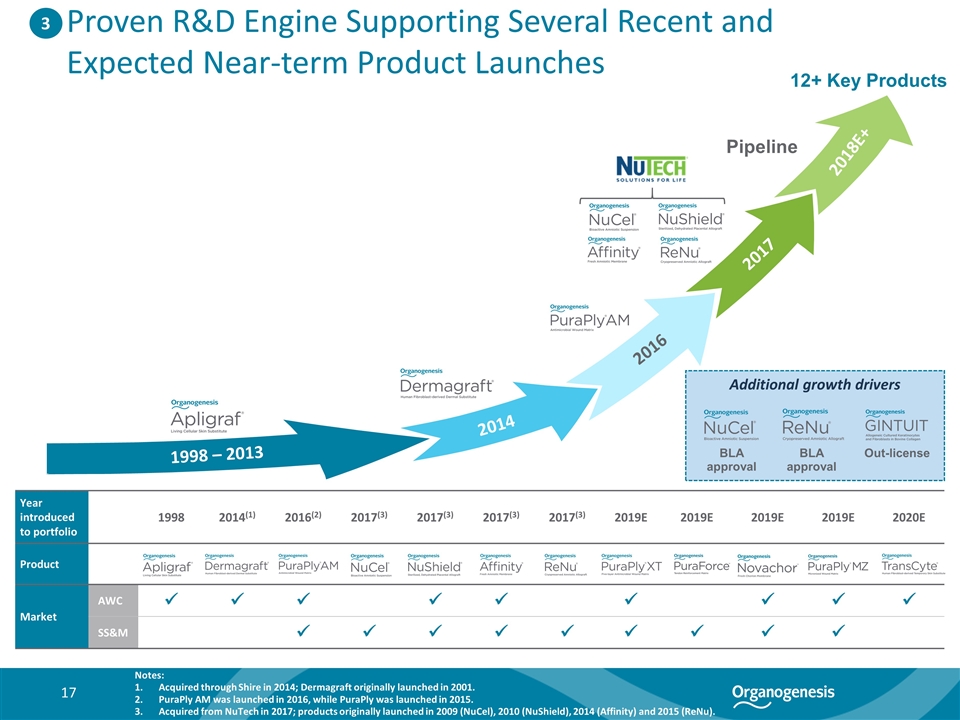

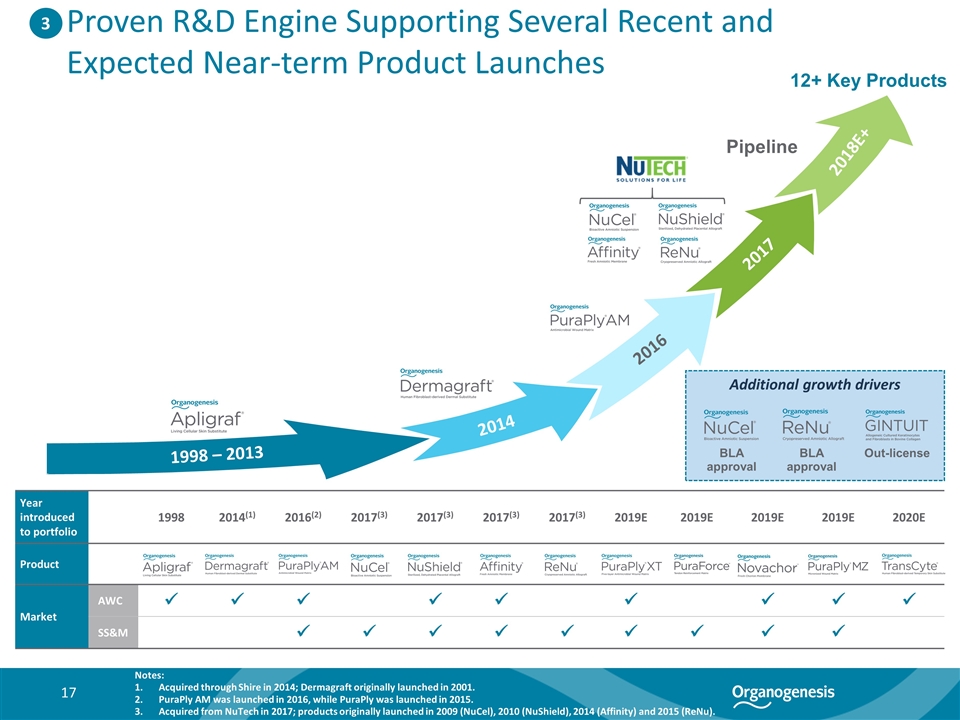

1998 – 2013 2014 2016 2017 2018E+ Proven R&D Engine Supporting Several Recent and Expected Near-term Product Launches Additional growth drivers BLA approval Out-license BLA approval Year introduced to portfolio 1998 2014(1) 2016(2) 2017(3) 2017(3) 2017(3) 2017(3) 2019E 2019E 2019E 2019E 2020E Product Market AWC ü ü ü ü ü ü ü ü ü SS&M ü ü ü ü ü ü ü ü ü Pipeline 3 Notes: Acquired through Shire in 2014; Dermagraft originally launched in 2001. PuraPly AM was launched in 2016, while PuraPly was launched in 2015. Acquired from NuTech in 2017; products originally launched in 2009 (NuCel), 2010 (NuShield), 2014 (Affinity) and 2015 (ReNu). 12+ Key Products

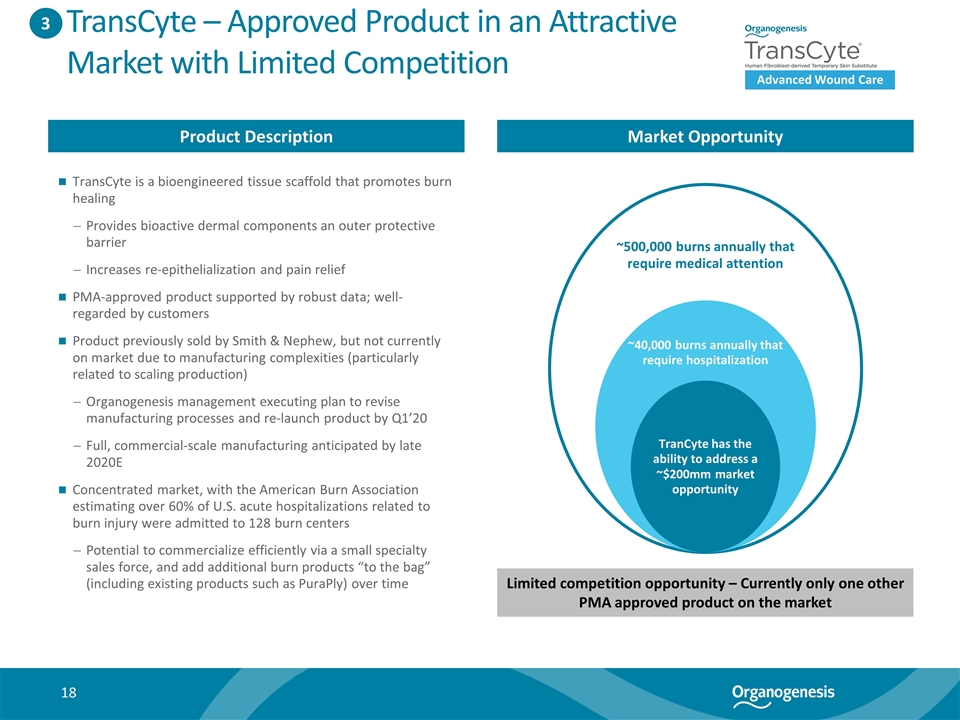

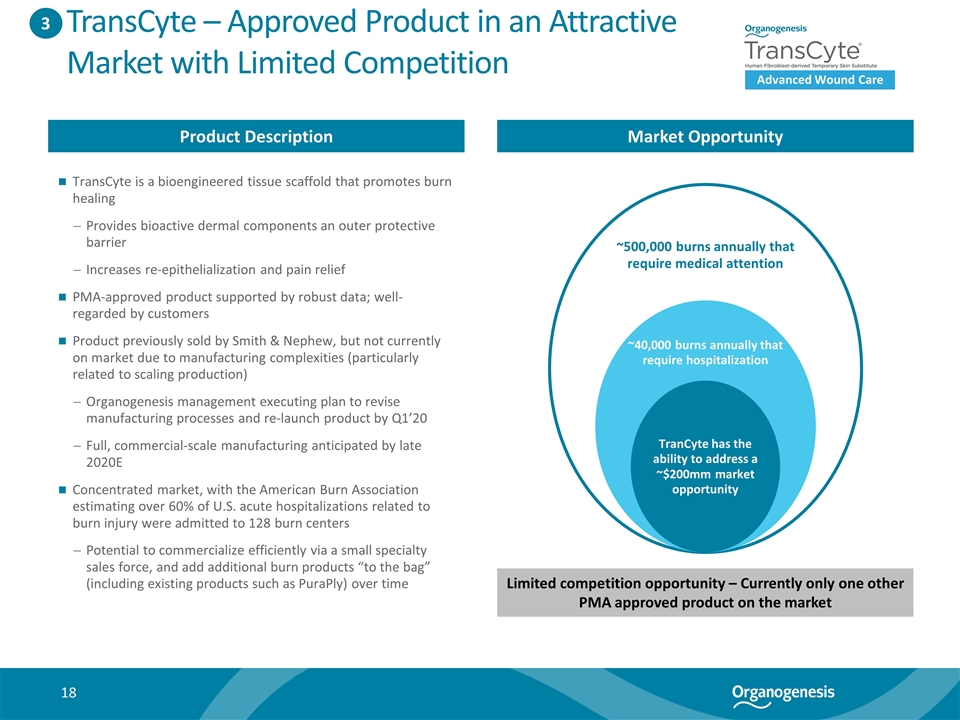

TransCyte – Approved Product in an Attractive Market with Limited Competition Product Description Market Opportunity TransCyte is a bioengineered tissue scaffold that promotes burn healing Provides bioactive dermal components an outer protective barrier Increases re-epithelialization and pain relief PMA-approved product supported by robust data; well-regarded by customers Product previously sold by Smith & Nephew, but not currently on market due to manufacturing complexities (particularly related to scaling production) Organogenesis management executing plan to revise manufacturing processes and re-launch product by Q1’20 Full, commercial-scale manufacturing anticipated by late 2020E Concentrated market, with the American Burn Association estimating over 60% of U.S. acute hospitalizations related to burn injury were admitted to 128 burn centers Potential to commercialize efficiently via a small specialty sales force, and add additional burn products “to the bag” (including existing products such as PuraPly) over time 3 To reformat into graphic ~500,000 burns annually that require medical attention ~40,000 burns annually that require hospitalization TranCyte has the ability to address a ~$200mm market opportunity Limited competition opportunity – Currently only one other PMA approved product on the market Advanced Wound Care

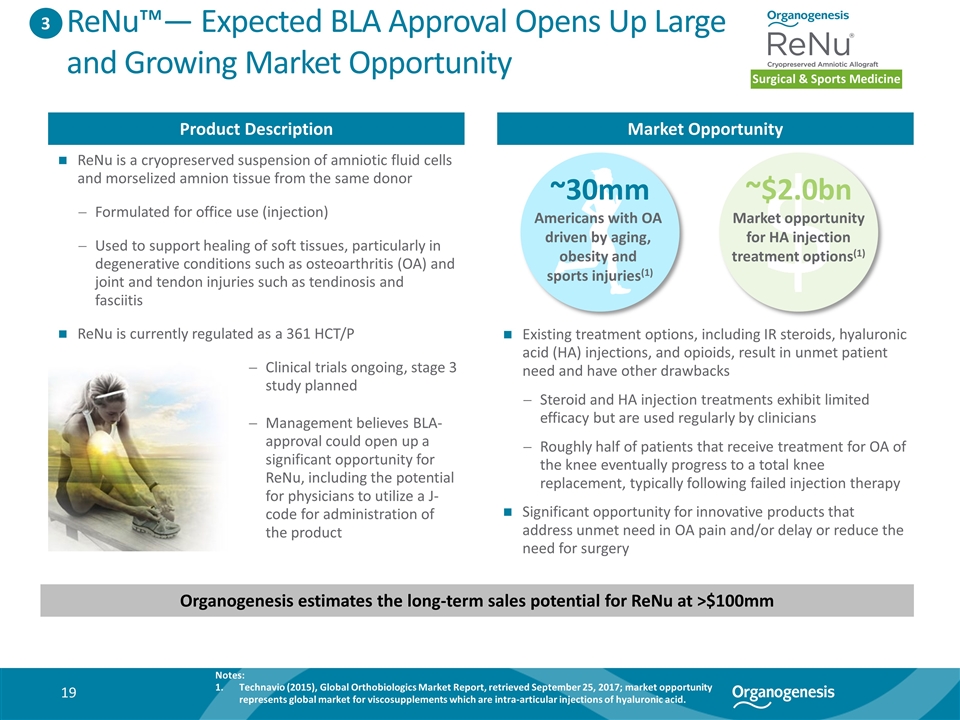

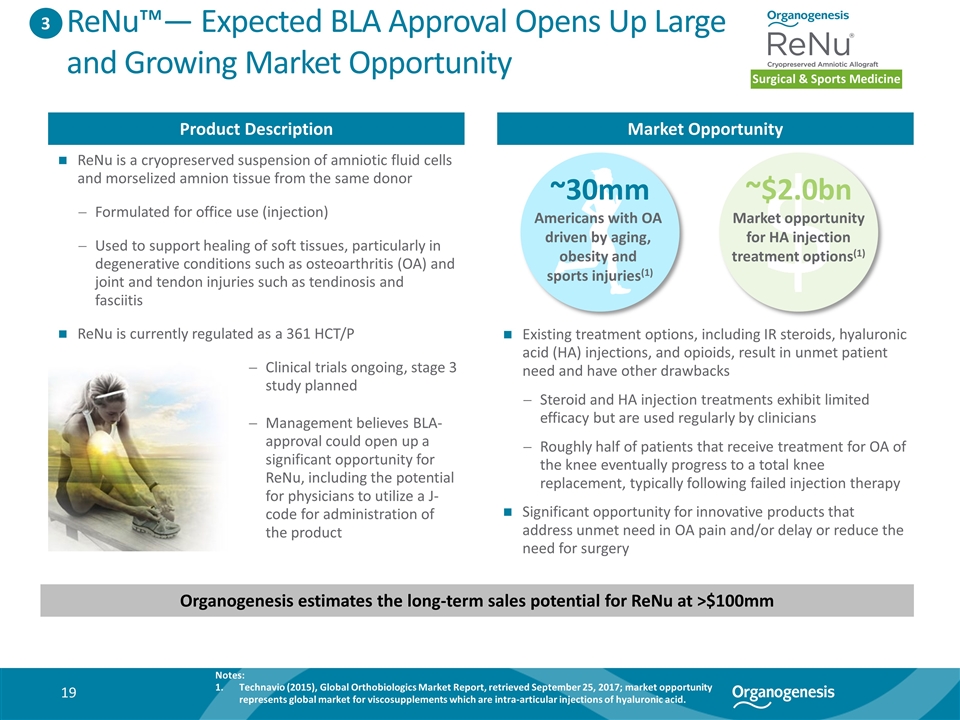

ReNu™— Expected BLA Approval Opens Up Large and Growing Market Opportunity Surgical & Sports Medicine Product Description Market Opportunity ReNu is a cryopreserved suspension of amniotic fluid cells and morselized amnion tissue from the same donor Formulated for office use (injection) Used to support healing of soft tissues, particularly in degenerative conditions such as osteoarthritis (OA) and joint and tendon injuries such as tendinosis and fasciitis ReNu is currently regulated as a 361 HCT/P Organogenesis estimates the long-term sales potential for ReNu at >$100mm 3 ~30mm Americans with OA driven by aging, obesity and sports injuries(1) ~$2.0bn Market opportunity for HA injection treatment options(1) Existing treatment options, including IR steroids, hyaluronic acid (HA) injections, and opioids, result in unmet patient need and have other drawbacks Steroid and HA injection treatments exhibit limited efficacy but are used regularly by clinicians Roughly half of patients that receive treatment for OA of the knee eventually progress to a total knee replacement, typically following failed injection therapy Significant opportunity for innovative products that address unmet need in OA pain and/or delay or reduce the need for surgery Notes: Technavio (2015), Global Orthobiologics Market Report, retrieved September 25, 2017; market opportunity represents global market for viscosupplements which are intra-articular injections of hyaluronic acid. Clinical trials ongoing, stage 3 study planned Management believes BLA-approval could open up a significant opportunity for ReNu, including the potential for physicians to utilize a J-code for administration of the product

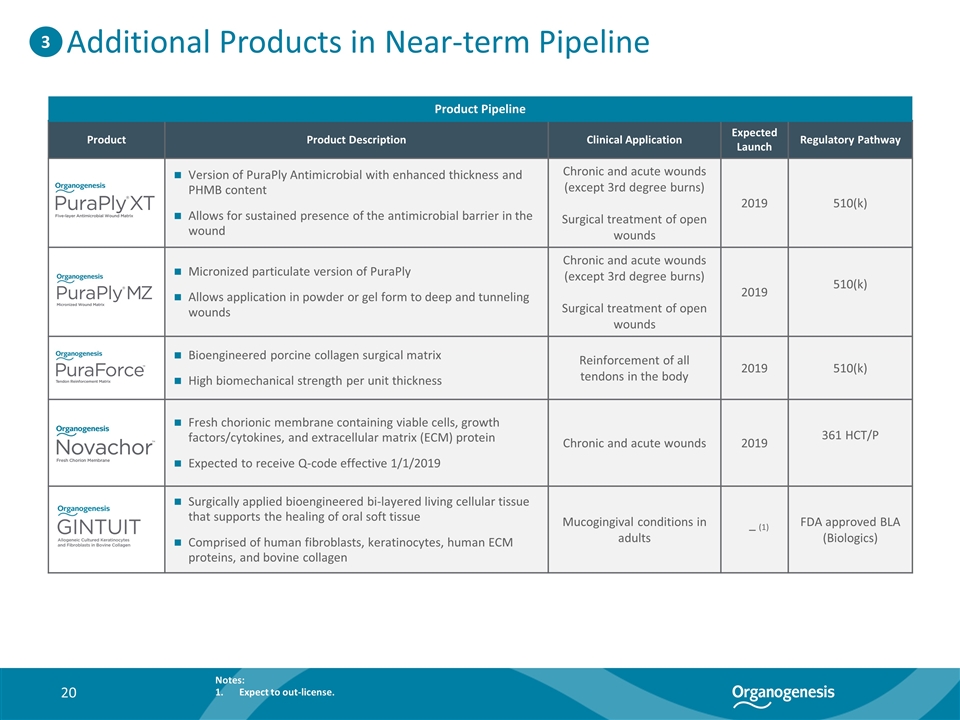

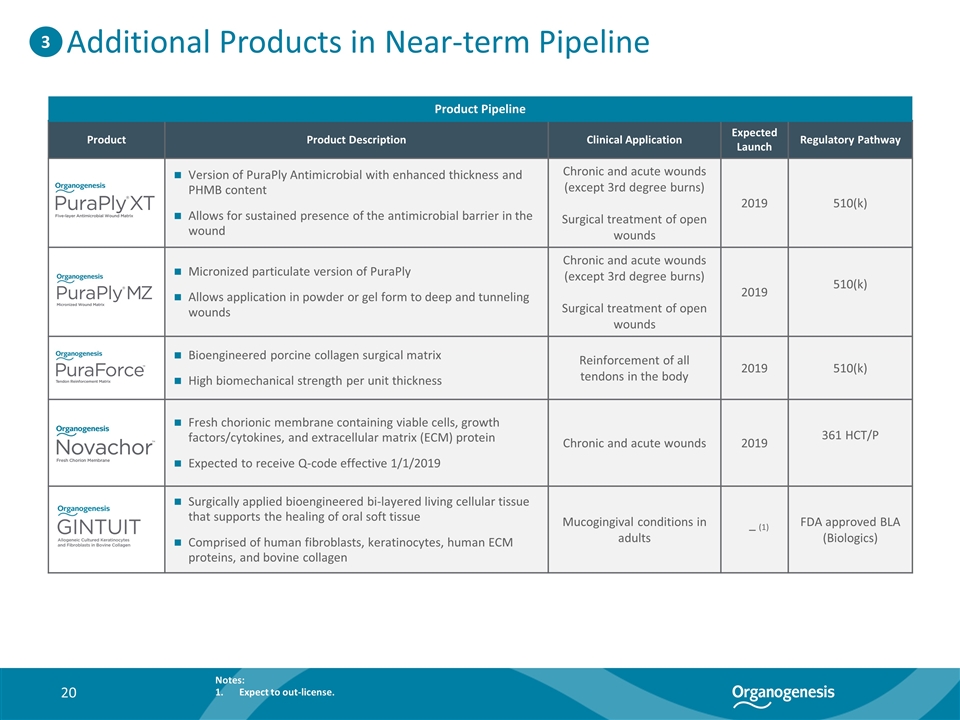

Additional Products in Near-term Pipeline Product Product Description Clinical Application Expected Launch Regulatory Pathway Version of PuraPly Antimicrobial with enhanced thickness and PHMB content Allows for sustained presence of the antimicrobial barrier in the wound Chronic and acute wounds (except 3rd degree burns) Surgical treatment of open wounds 2019 510(k) Micronized particulate version of PuraPly Allows application in powder or gel form to deep and tunneling wounds Chronic and acute wounds (except 3rd degree burns) Surgical treatment of open wounds 2019 510(k) Bioengineered porcine collagen surgical matrix High biomechanical strength per unit thickness Reinforcement of all tendons in the body 2019 510(k) Fresh chorionic membrane containing viable cells, growth factors/cytokines, and extracellular matrix (ECM) protein Expected to receive Q-code effective 1/1/2019 Chronic and acute wounds 2019 361 HCT/P Surgically applied bioengineered bi-layered living cellular tissue that supports the healing of oral soft tissue Comprised of human fibroblasts, keratinocytes, human ECM proteins, and bovine collagen Mucogingival conditions in adults – (1) FDA approved BLA (Biologics) Product Pipeline 3 Notes: Expect to out-license.

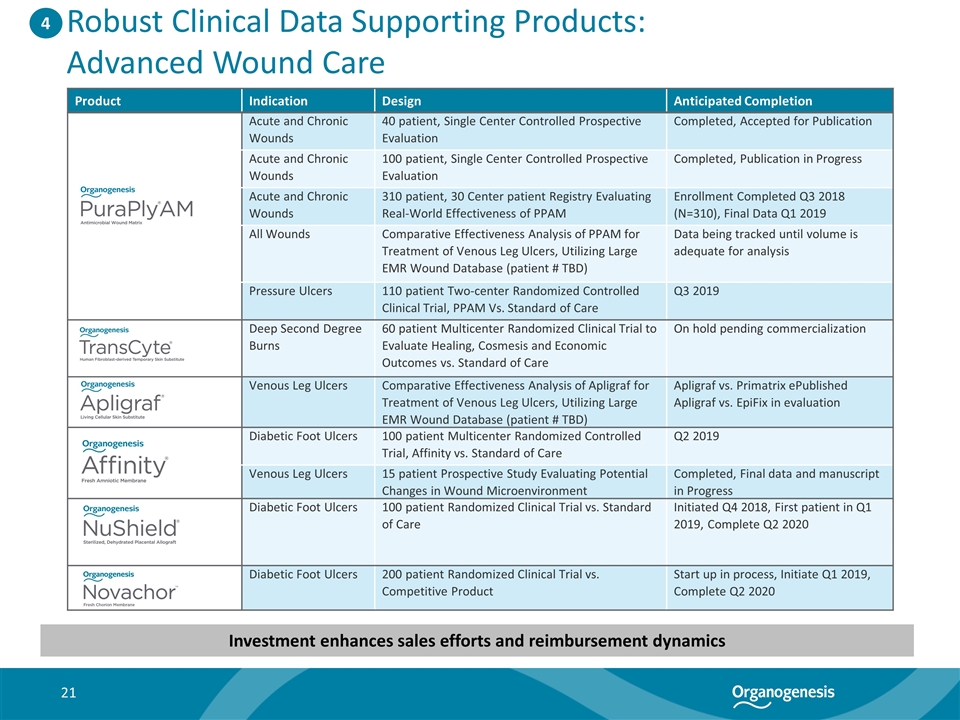

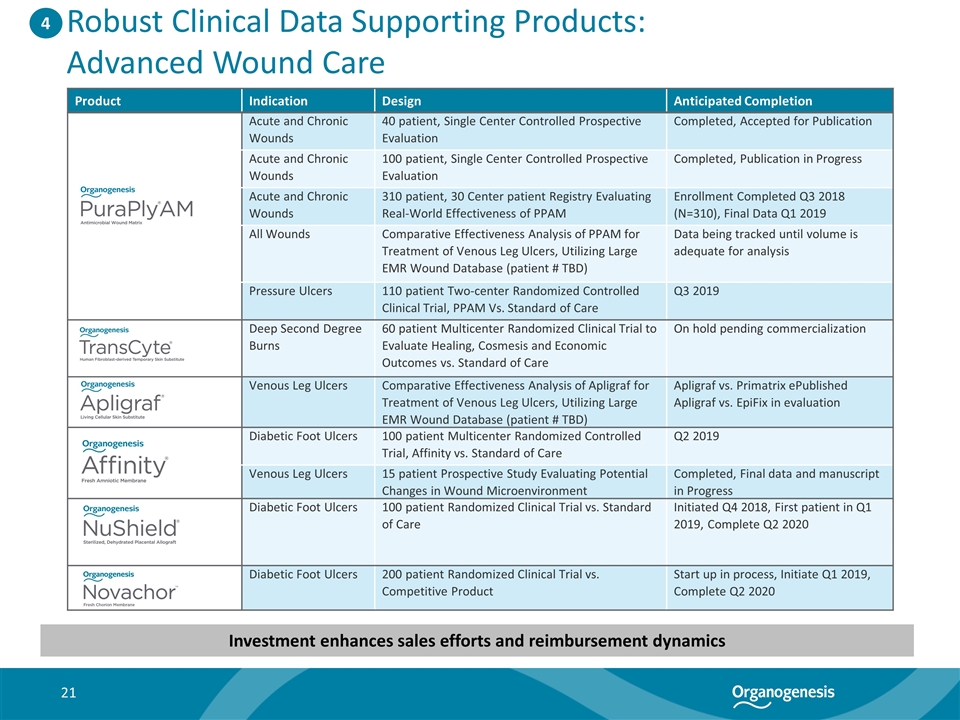

Robust Clinical Data Supporting Products: Advanced Wound Care Product Indication Design Anticipated Completion Acute and Chronic Wounds 40 patient, Single Center Controlled Prospective Evaluation Completed, Accepted for Publication Acute and Chronic Wounds 100 patient, Single Center Controlled Prospective Evaluation Completed, Publication in Progress Acute and Chronic Wounds 310 patient, 30 Center patient Registry Evaluating Real-World Effectiveness of PPAM Enrollment Completed Q3 2018 (N=310), Final Data Q1 2019 All Wounds Comparative Effectiveness Analysis of PPAM for Treatment of Venous Leg Ulcers, Utilizing Large EMR Wound Database (patient # TBD) Data being tracked until volume is adequate for analysis Pressure Ulcers 110 patient Two-center Randomized Controlled Clinical Trial, PPAM Vs. Standard of Care Q3 2019 Deep Second Degree Burns 60 patient Multicenter Randomized Clinical Trial to Evaluate Healing, Cosmesis and Economic Outcomes vs. Standard of Care On hold pending commercialization Venous Leg Ulcers Comparative Effectiveness Analysis of Apligraf for Treatment of Venous Leg Ulcers, Utilizing Large EMR Wound Database (patient # TBD) Apligraf vs. Primatrix ePublished Apligraf vs. EpiFix in evaluation Diabetic Foot Ulcers 100 patient Multicenter Randomized Controlled Trial, Affinity vs. Standard of Care Q2 2019 Venous Leg Ulcers 15 patient Prospective Study Evaluating Potential Changes in Wound Microenvironment Completed, Final data and manuscript in Progress Diabetic Foot Ulcers 100 patient Randomized Clinical Trial vs. Standard of Care Initiated Q4 2018, First patient in Q1 2019, Complete Q2 2020 Diabetic Foot Ulcers 200 patient Randomized Clinical Trial vs. Competitive Product Start up in process, Initiate Q1 2019, Complete Q2 2020 4 Investment enhances sales efforts and reimbursement dynamics

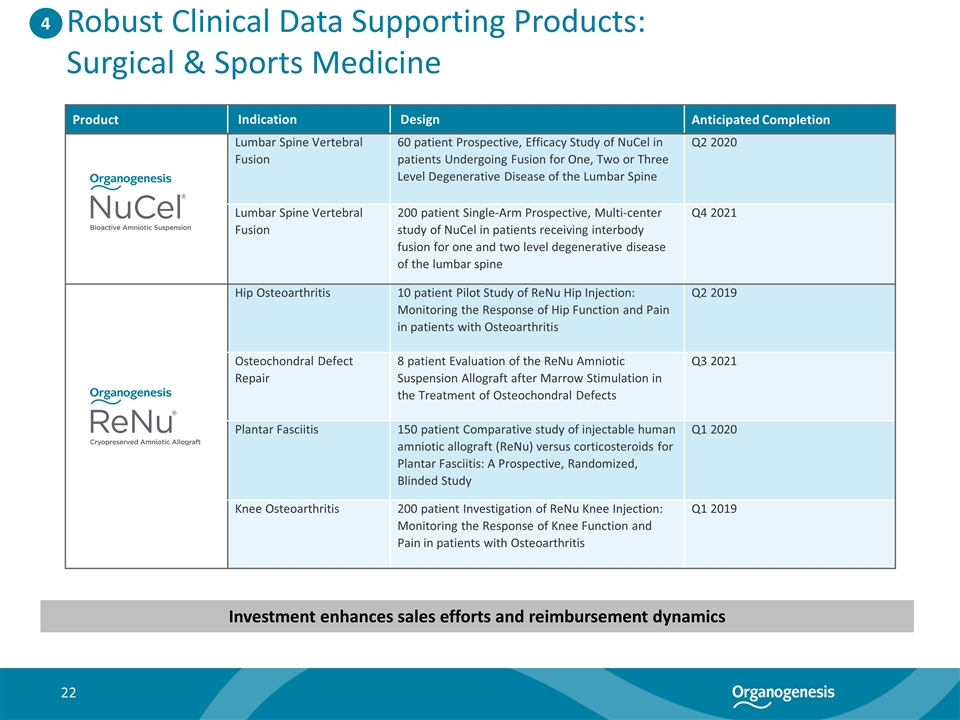

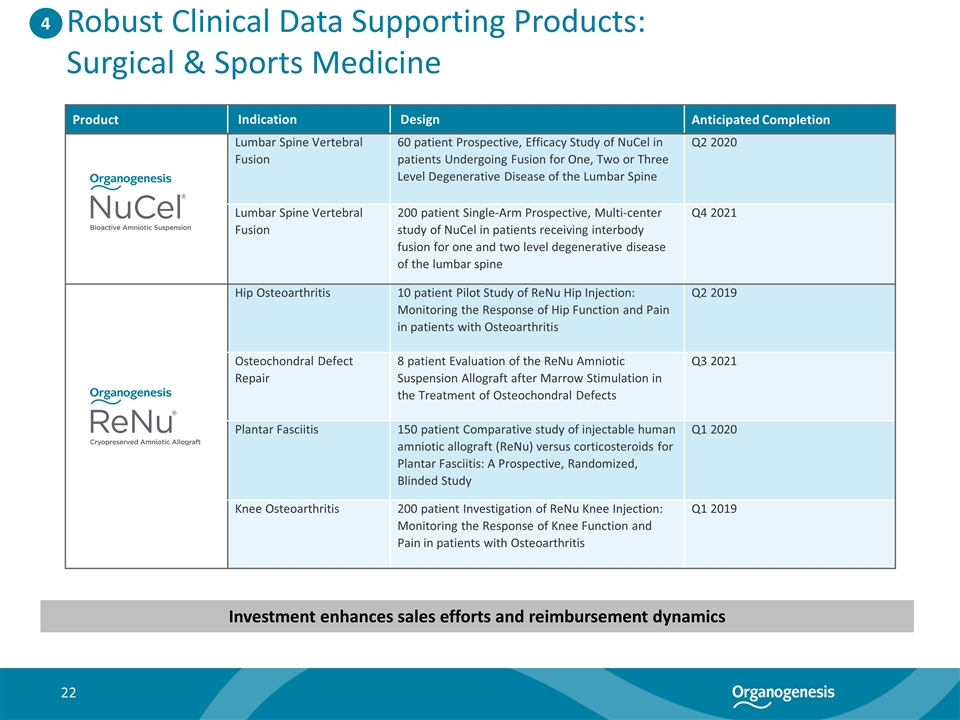

Robust Clinical Data Supporting Products: Surgical & Sports Medicine Product Indication Design Anticipated Completion Lumbar Spine Vertebral Fusion 60 patient Prospective, Efficacy Study of NuCel in patients Undergoing Fusion for One, Two or Three Level Degenerative Disease of the Lumbar Spine Q2 2020 Lumbar Spine Vertebral Fusion 200 patient Single-Arm Prospective, Multi-center study of NuCel in patients receiving interbody fusion for one and two level degenerative disease of the lumbar spine Q4 2021 Hip Osteoarthritis 10 patient Pilot Study of ReNu Hip Injection: Monitoring the Response of Hip Function and Pain in patients with Osteoarthritis Q2 2019 Osteochondral Defect Repair 8 patient Evaluation of the ReNu Amniotic Suspension Allograft after Marrow Stimulation in the Treatment of Osteochondral Defects Q3 2021 Plantar Fasciitis 150 patient Comparative study of injectable human amniotic allograft (ReNu) versus corticosteroids for Plantar Fasciitis: A Prospective, Randomized, Blinded Study Q1 2020 Knee Osteoarthritis 200 patient Investigation of ReNu Knee Injection: Monitoring the Response of Knee Function and Pain in patients with Osteoarthritis Q1 2019 4 Investment enhances sales efforts and reimbursement dynamics

Well Established Commercial Capabilities… Sales Marketing Additional Support Infrastructure Supports Customer Relationships Across Continuum of Care Hospital Outpatient Wound Care Clinic In-patient Hospital/ASC Veterans Affairs Private Office ~200 Experienced Direct Sales Reps Nationwide Opportunity to scale to ≈ 350 within a few years ~110 Established Independent Agencies Opportunity to scale similarly to direct sales force for Surgical & Sports Medicine Experienced Sales Force with Robust Training and Development Demonstrated Product Launch and Product Management Success Speaker Bureau / Clinical Experience Programs Strong Conference Presence National Account and Market Access Team Customer Service Field-Based Medical Science Liaison Team Sales Operations and Analytics Established reimbursement with CMS for Advanced Wound Care Products Expanding commercial reimbursement beyond Apilgraf, Dermagraft, and TransCyte Initialized studies to enhance sales effort and negotiations with commercial payors 2,500+ Healthcare facilities served(1) 5 Notes: Number of facilities that have ordered products in 1H 2018.

… Supported by High-Quality Manufacturing Facilities Canton, MA Birmingham, AL La Jolla, CA 65 85 150 275 Organogenesis has three facilities, including two manufacturing facilities (Canton, MA and La Jolla, CA) which produce its non-amniotic products Proven large-scale commercial cell manufacturing company Multiple levels of quality control and product safety and maintain compliance with FDA QSR and other regulations Recent successful FDA & AATB inspections in Canton, Birmingham & La Jolla Significant expansion capabilities Amniotic products are currently contract manufactured 92,000 square feet devoted to operations, R&D and manufacturing + 6,000 square feet warehouse facility R&D labs Customer Service Headquarters 4 buildings; 300,000 square feet devoted to manufacturing, shipping, operations and R&D Recent expansion of PuraPly production and logistics 25,000 square feet Facility supports QC, warehouse and distribution of amniotic products R&D at UAB Incubator facility Utilizes contract manufacturing for amniotic products 5

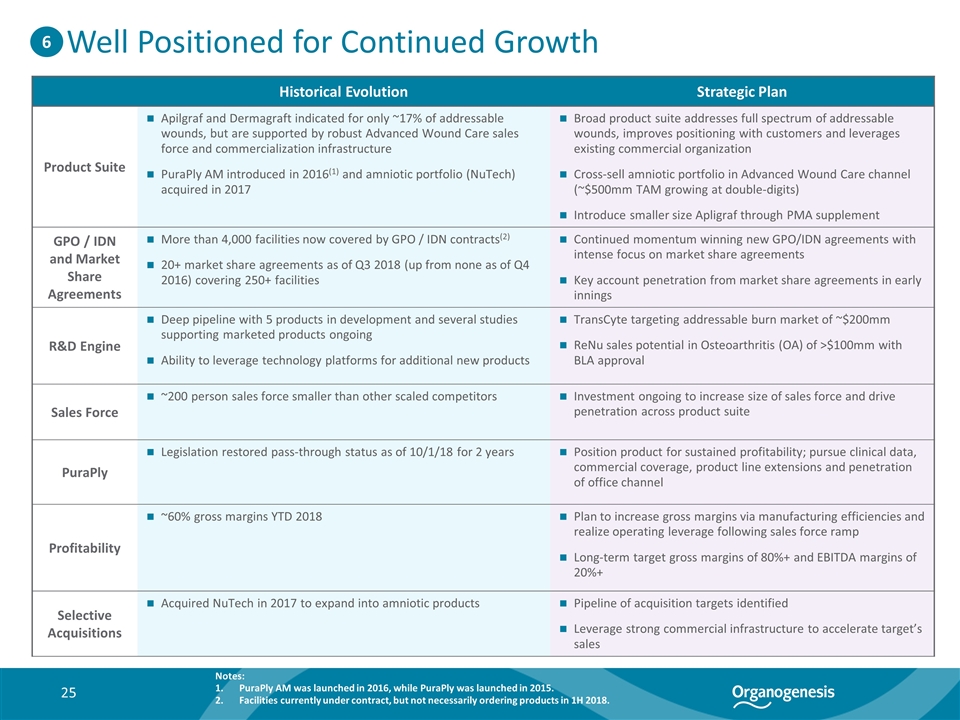

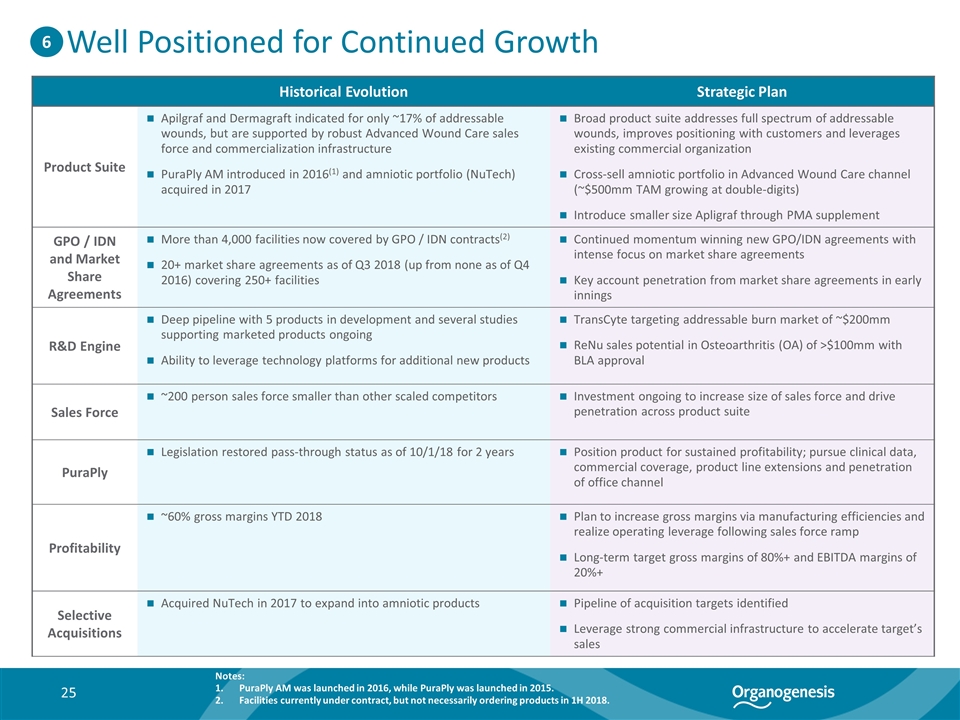

Historical Evolution Strategic Plan Product Suite Apilgraf and Dermagraft indicated for only ~17% of addressable wounds, but are supported by robust Advanced Wound Care sales force and commercialization infrastructure PuraPly AM introduced in 2016(1) and amniotic portfolio (NuTech) acquired in 2017 Broad product suite addresses full spectrum of addressable wounds, improves positioning with customers and leverages existing commercial organization Cross-sell amniotic portfolio in Advanced Wound Care channel (~$500mm TAM growing at double-digits) Introduce smaller size Apligraf through PMA supplement GPO / IDN and Market Share Agreements More than 4,000 facilities now covered by GPO / IDN contracts(2) 20+ market share agreements as of Q3 2018 (up from none as of Q4 2016) covering 250+ facilities Continued momentum winning new GPO/IDN agreements with intense focus on market share agreements Key account penetration from market share agreements in early innings R&D Engine Deep pipeline with 5 products in development and several studies supporting marketed products ongoing Ability to leverage technology platforms for additional new products TransCyte targeting addressable burn market of ~$200mm ReNu sales potential in Osteoarthritis (OA) of >$100mm with BLA approval Sales Force ~200 person sales force smaller than other scaled competitors Investment ongoing to increase size of sales force and drive penetration across product suite PuraPly Legislation restored pass-through status as of 10/1/18 for 2 years Position product for sustained profitability; pursue clinical data, commercial coverage, product line extensions and penetration of office channel Profitability ~60% gross margins YTD 2018 Plan to increase gross margins via manufacturing efficiencies and realize operating leverage following sales force ramp Long-term target gross margins of 80%+ and EBITDA margins of 20%+ Selective Acquisitions Acquired NuTech in 2017 to expand into amniotic products Pipeline of acquisition targets identified Leverage strong commercial infrastructure to accelerate target’s sales Well Positioned for Continued Growth 6 Notes: PuraPly AM was launched in 2016, while PuraPly was launched in 2015. Facilities currently under contract, but not necessarily ordering products in 1H 2018.

Financial Overview

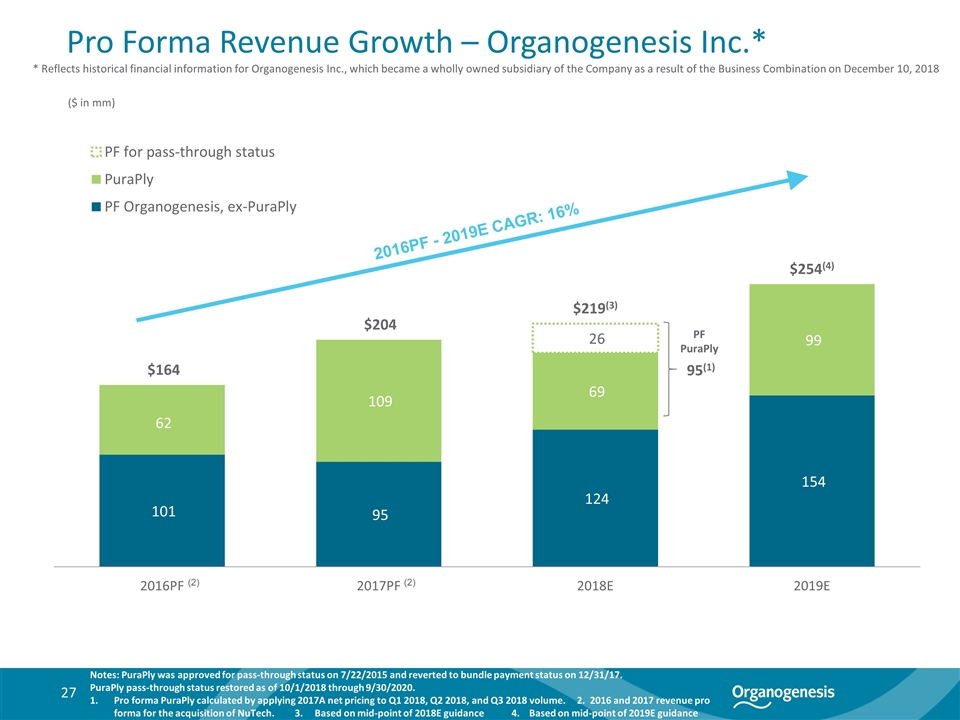

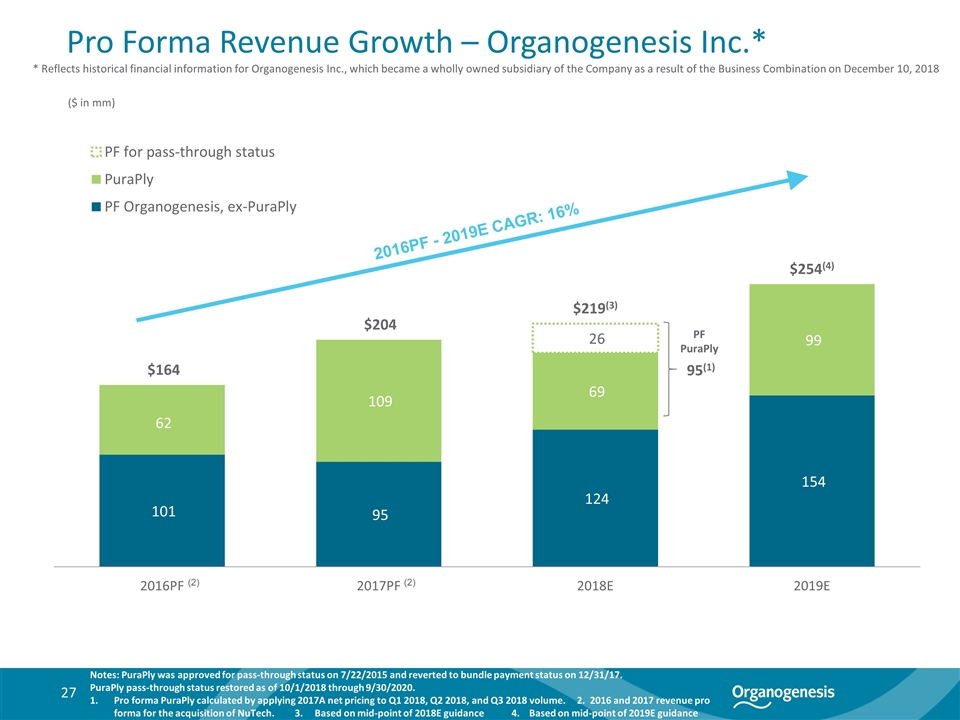

Pro Forma Revenue Growth – Organogenesis Inc.* Notes: PuraPly was approved for pass-through status on 7/22/2015 and reverted to bundle payment status on 12/31/17. PuraPly pass-through status restored as of 10/1/2018 through 9/30/2020. Pro forma PuraPly calculated by applying 2017A net pricing to Q1 2018, Q2 2018, and Q3 2018 volume. 2. 2016 and 2017 revenue pro forma for the acquisition of NuTech. 3. Based on mid-point of 2018E guidance 4. Based on mid-point of 2019E guidance 95(1) PF PuraPly ($ in mm) 2016PF - 2019E CAGR: 16% (2) (2) * Reflects historical financial information for Organogenesis Inc., which became a wholly owned subsidiary of the Company as a result of the Business Combination on December 10, 2018

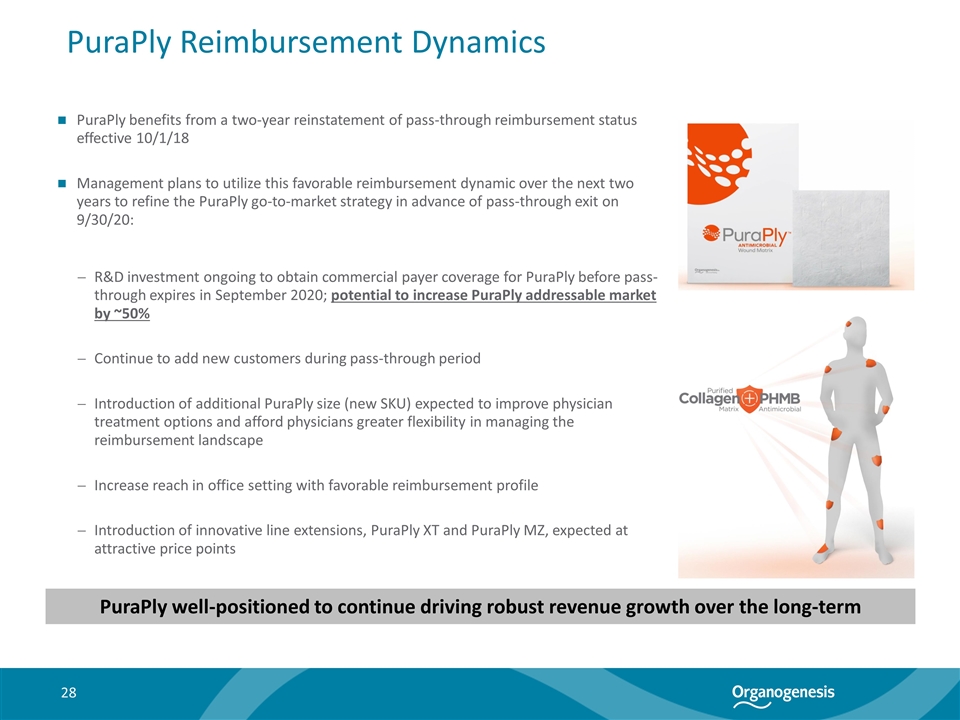

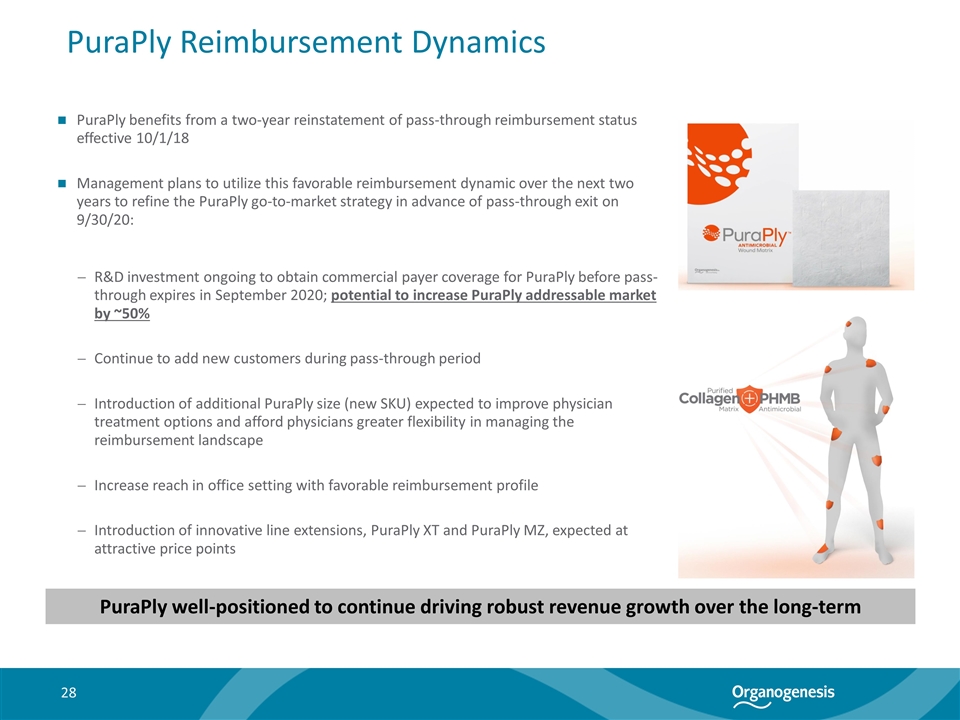

PuraPly Reimbursement Dynamics PuraPly benefits from a two-year reinstatement of pass-through reimbursement status effective 10/1/18 Management plans to utilize this favorable reimbursement dynamic over the next two years to refine the PuraPly go-to-market strategy in advance of pass-through exit on 9/30/20: R&D investment ongoing to obtain commercial payer coverage for PuraPly before pass-through expires in September 2020; potential to increase PuraPly addressable market by ~50% Continue to add new customers during pass-through period Introduction of additional PuraPly size (new SKU) expected to improve physician treatment options and afford physicians greater flexibility in managing the reimbursement landscape Increase reach in office setting with favorable reimbursement profile Introduction of innovative line extensions, PuraPly XT and PuraPly MZ, expected at attractive price points PuraPly well-positioned to continue driving robust revenue growth over the long-term

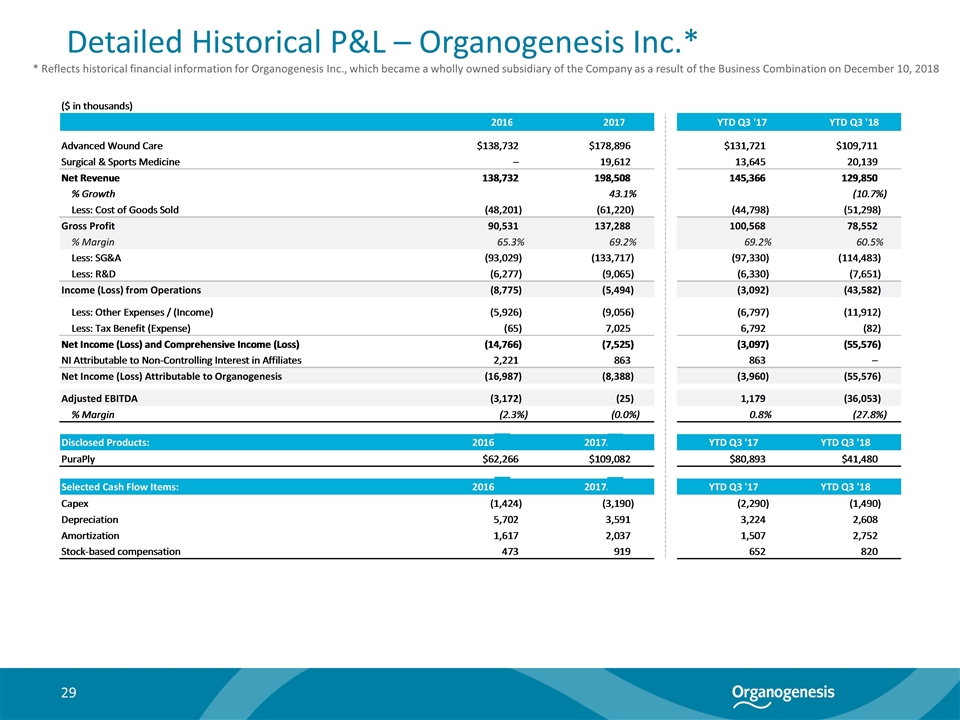

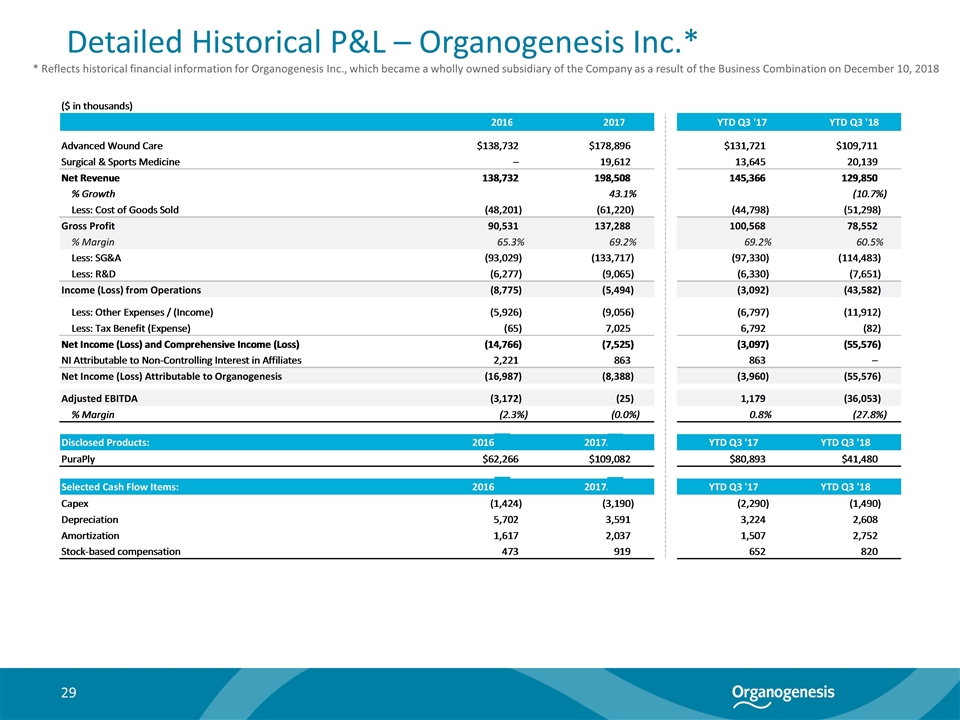

Detailed Historical P&L – Organogenesis Inc.* * Reflects historical financial information for Organogenesis Inc., which became a wholly owned subsidiary of the Company as a result of the Business Combination on December 10, 2018

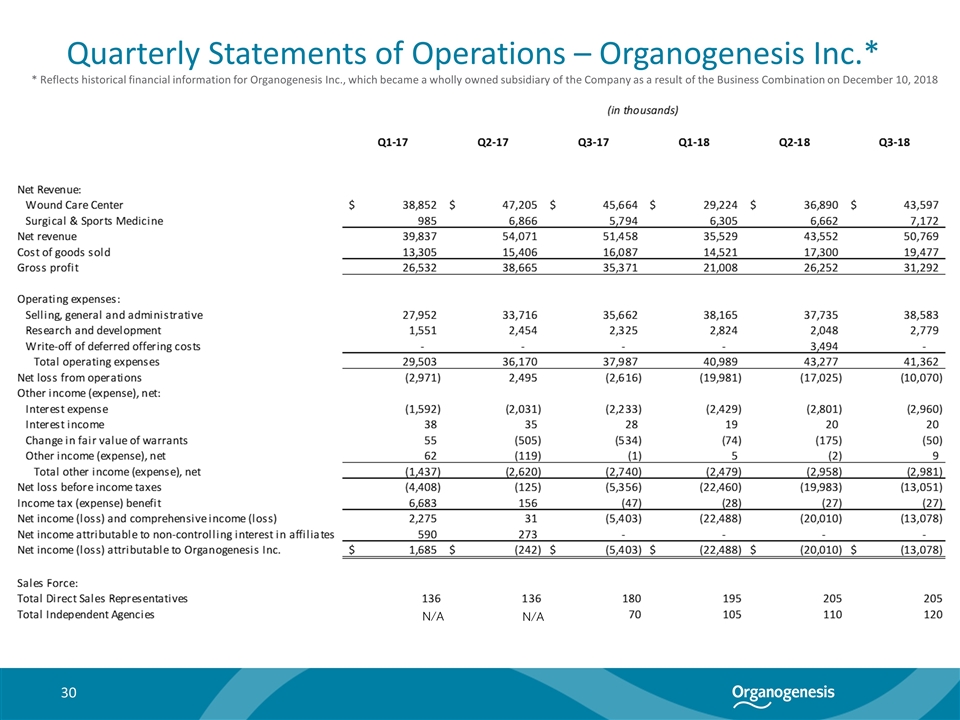

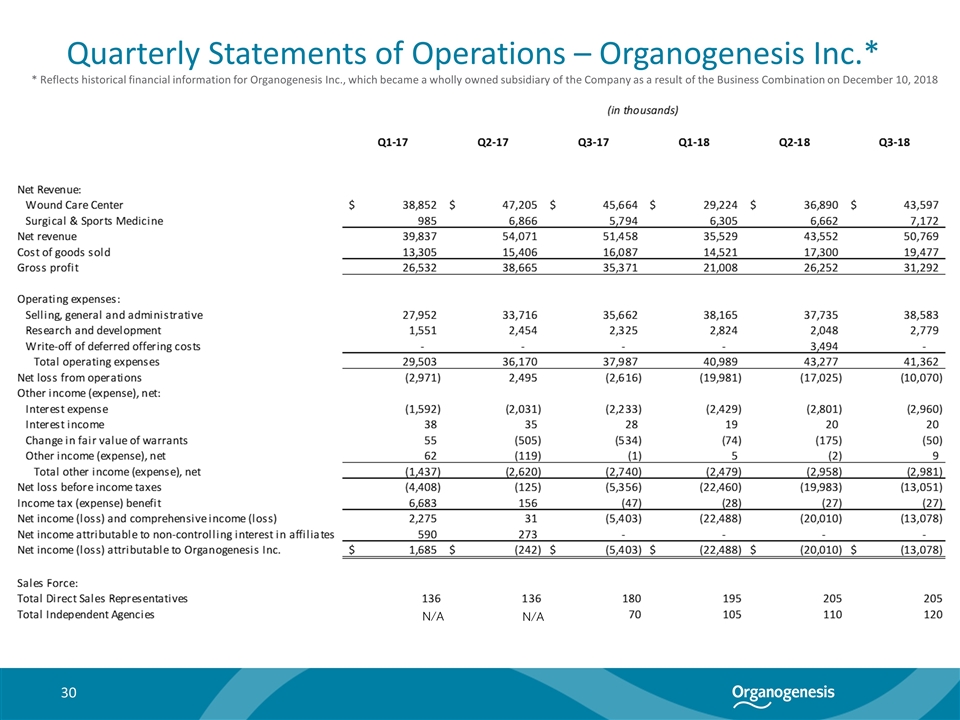

Quarterly Statements of Operations – Organogenesis Inc.* 30 * Reflects historical financial information for Organogenesis Inc., which became a wholly owned subsidiary of the Company as a result of the Business Combination on December 10, 2018 N/A N/A

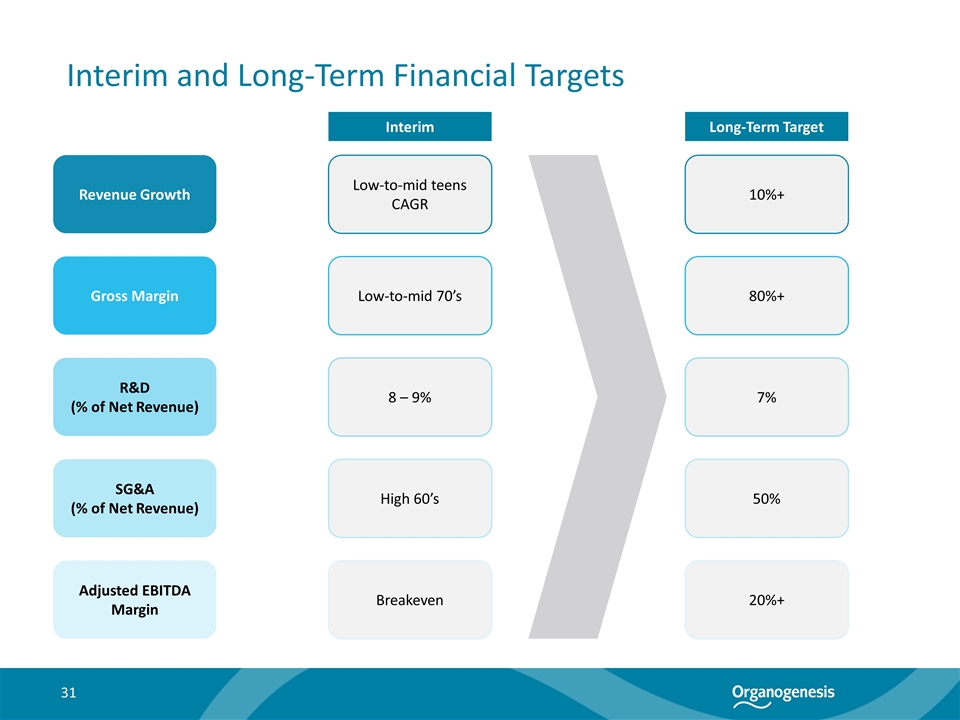

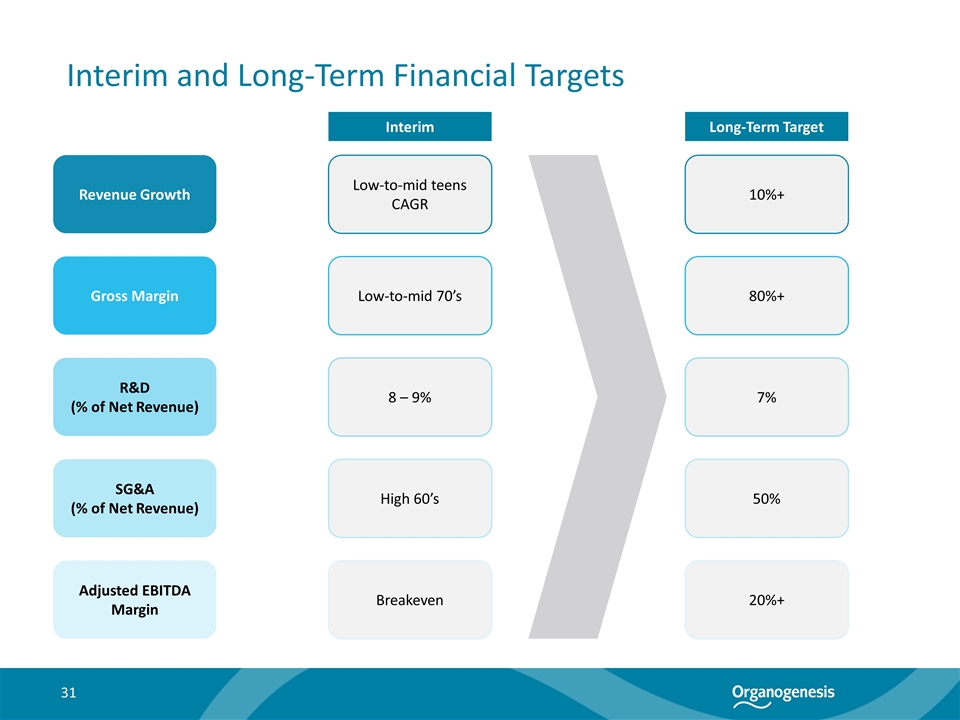

Interim and Long-Term Financial Targets Revenue Growth Gross Margin R&D (% of Net Revenue) SG&A (% of Net Revenue) Adjusted EBITDA Margin 10%+ 80%+ 7% 50% 20%+ Long-Term Target Low-to-mid teens CAGR Low-to-mid 70’s 8 – 9% High 60’s Breakeven Interim 31

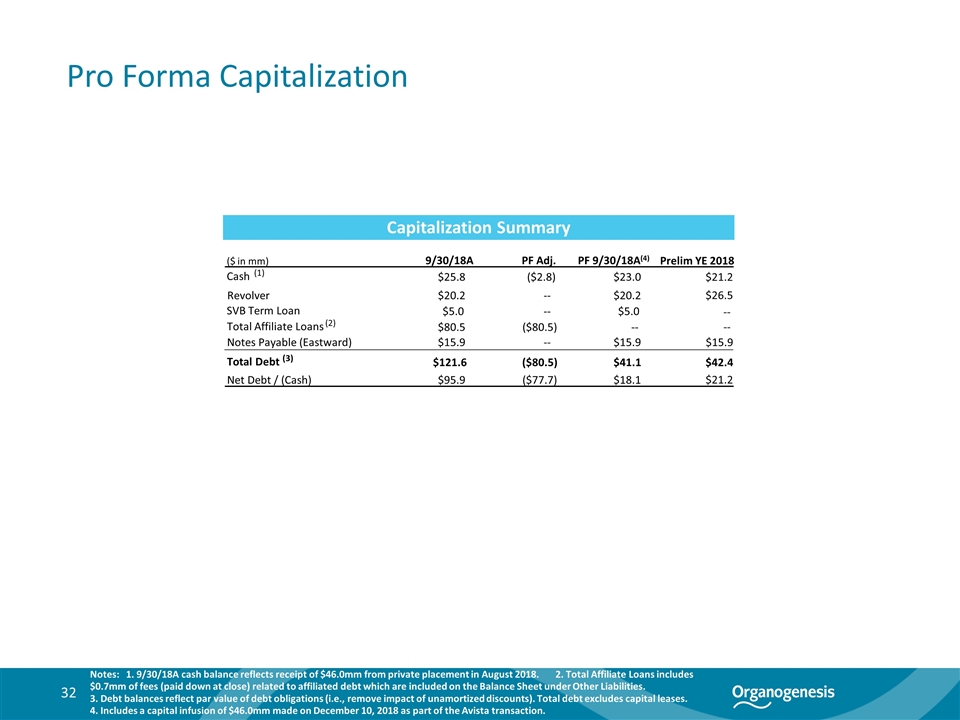

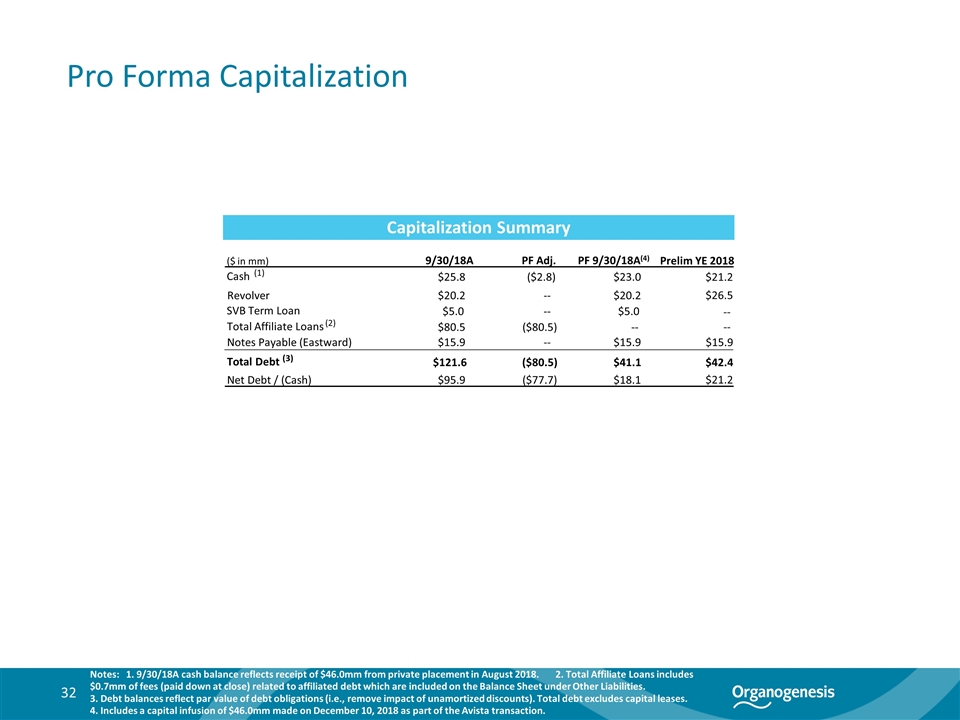

Pro Forma Capitalization 32 Notes: 1. 9/30/18A cash balance reflects receipt of $46.0mm from private placement in August 2018. 2. Total Affiliate Loans includes $0.7mm of fees (paid down at close) related to affiliated debt which are included on the Balance Sheet under Other Liabilities. 3. Debt balances reflect par value of debt obligations (i.e., remove impact of unamortized discounts). Total debt excludes capital leases. 4. Includes a capital infusion of $46.0mm made on December 10, 2018 as part of the Avista transaction. Capitalization Summary ($ in mm) 9/30/18A PF Adj. PF 9/30/18A(4) Cash (1) $25.8 ($2.8) $23.0 Revolver $20.2 -- $20.2 SVB Term Loan $5.0 -- $5.0 Total Affiliate Loans (2) $80.5 ($80.5) -- Notes Payable (Eastward) $15.9 -- $15.9 Total Debt (3) $121.6 ($80.5) $41.1 Net Debt / (Cash) $95.9 ($77.7) $18.1 Prelim YE 2018 $21.2 $26.5 -- -- $15.9 $42.4 $21.2

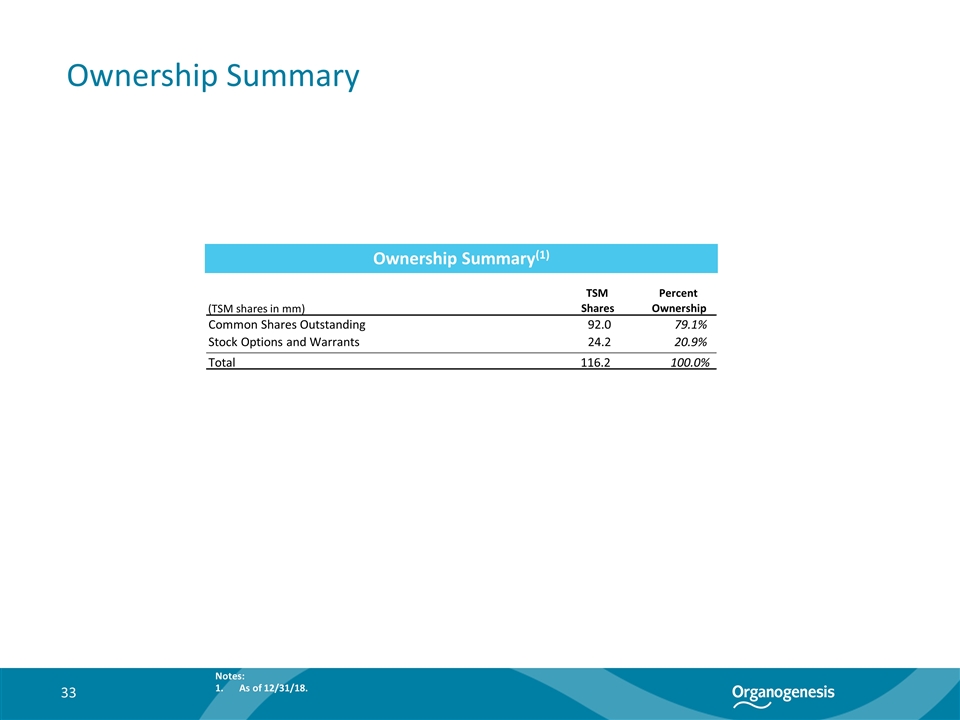

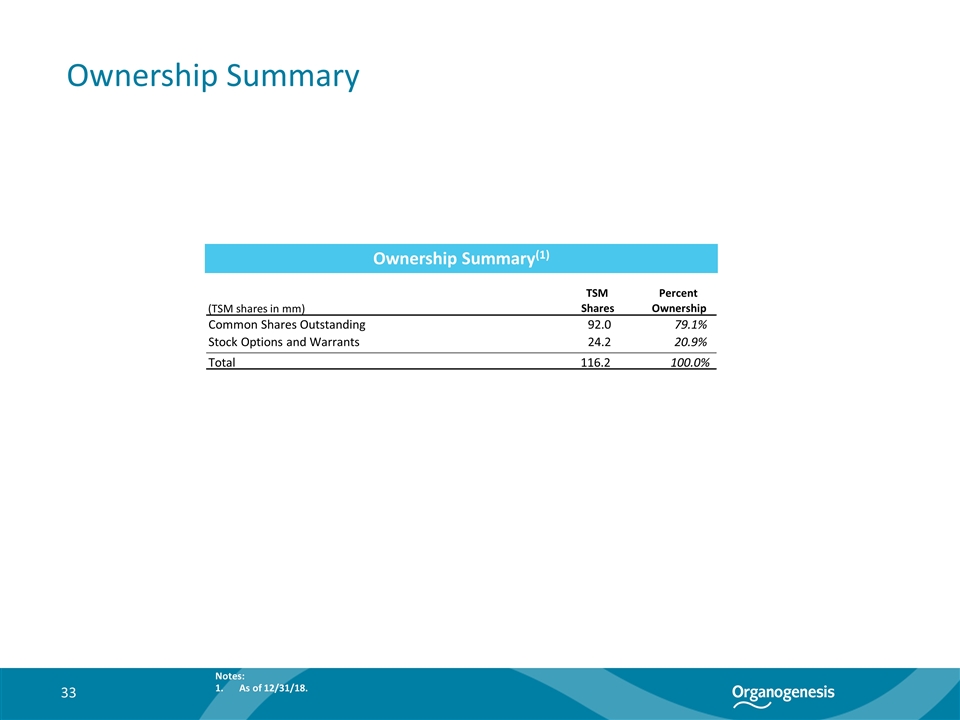

Ownership Summary Ownership Summary(1) 33 Notes: As of 12/31/18. TSM Percent (TSM shares in mm) Shares Ownership Common Shares Outstanding 92.0 79.1% Stock Options and Warrants 24.2 20.9% Total 116.2 100.0%

Appendix: Technologies, Reimbursement, & Customer Support

Experienced Management Team (Cont.) Name/Title Background Information Tom Pearl VP, Human Resources Shabnam Vaezzadeh VP, Global Medical and Clinical Affairs Zorina Pitkin SVP, Quality Systems Chris O’Reilly VP, Manufacturing Operations Over 21 years in Human Resources in progressive leadership positions 11 years with Bayer Corporation and 10 years with Siemens Healthcare supporting global organizations Most recently VP HR supporting the Laboratory Diagnostics business MD, MPA with 19 years in Medical industry Leadership position in Product Safety, Medical and Clinical Affairs for 10 years 1 year at Organogenesis 10 years with Organogenesis Previously held executive positions in Quality and Regulatory Affairs at RenaMed Biologics and Circe Biomedical (W.R. Grace), and board membership of Regulatory Affairs Professional Society 22 years with Organogenesis 3 decades of critical systems engineering and manufacturing experience in highly regulated industries: nuclear, petrochemical and biotechnology / medical device John Ferros VP, Regulatory Affairs Over 20 years in Regulatory Affairs in progressive leadership positions 15 years with CryoLife and various RA roles at Haemonetics and Johnson & Johnson Significant accomplishments in FDA and International product approvals

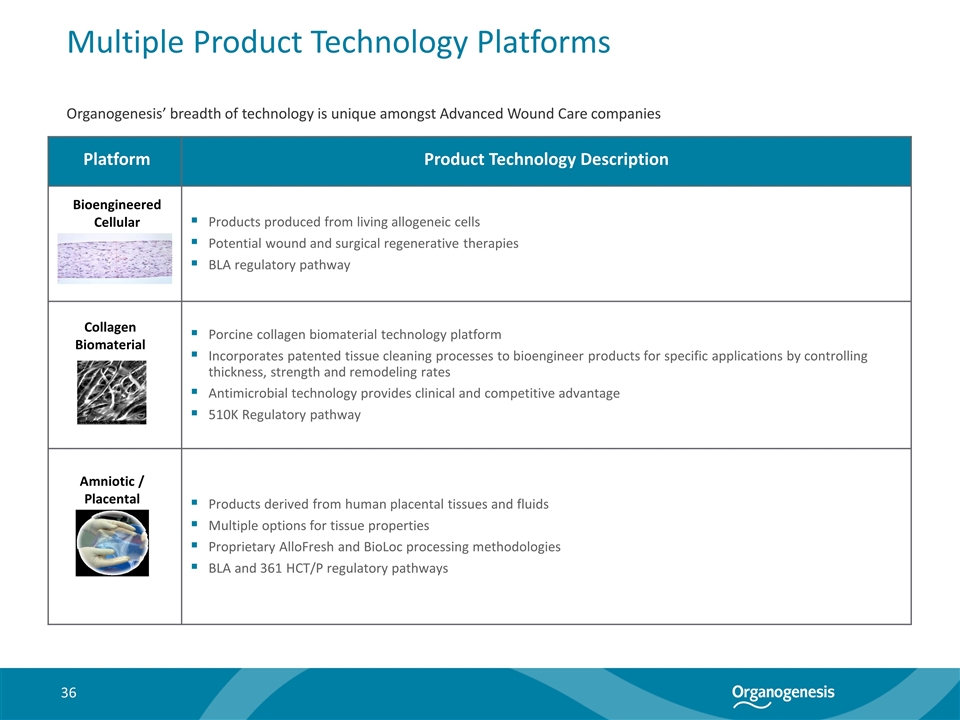

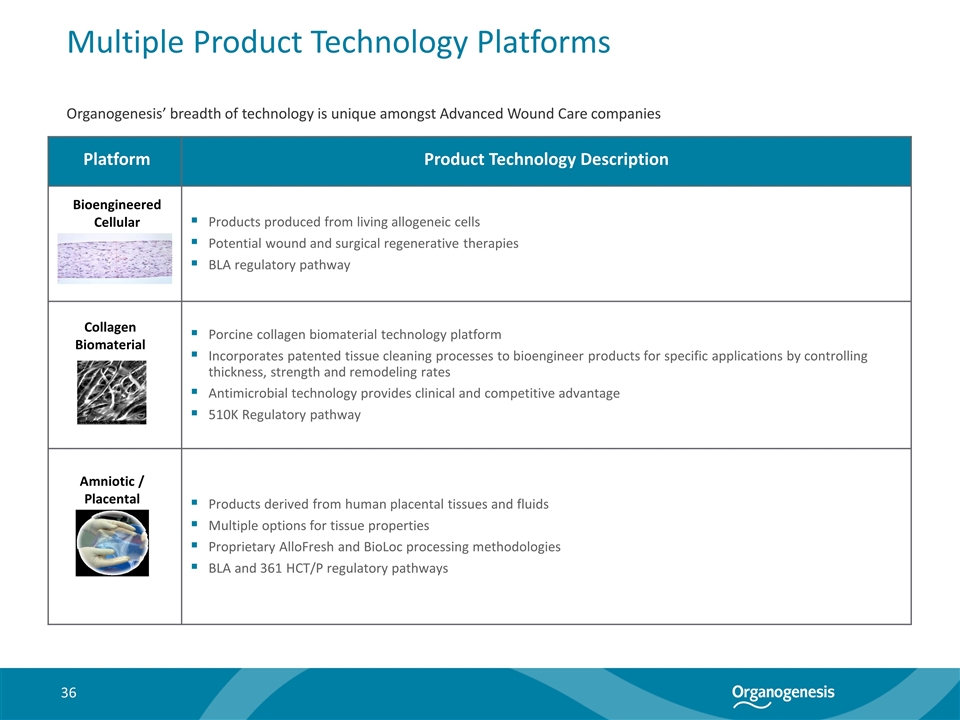

Multiple Product Technology Platforms Platform Product Technology Description Products produced from living allogeneic cells Potential wound and surgical regenerative therapies BLA regulatory pathway Porcine collagen biomaterial technology platform Incorporates patented tissue cleaning processes to bioengineer products for specific applications by controlling thickness, strength and remodeling rates Antimicrobial technology provides clinical and competitive advantage 510K Regulatory pathway Products derived from human placental tissues and fluids Multiple options for tissue properties Proprietary AlloFresh and BioLoc processing methodologies BLA and 361 HCT/P regulatory pathways Collagen Biomaterial Amniotic / Placental Bioengineered Cellular Organogenesis’ breadth of technology is unique amongst Advanced Wound Care companies

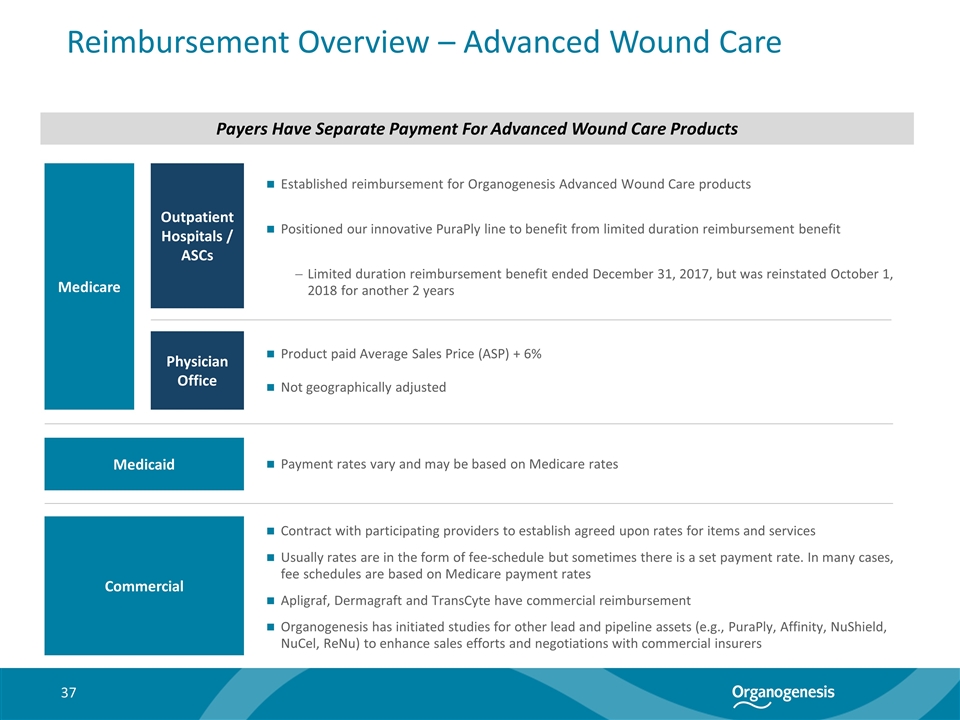

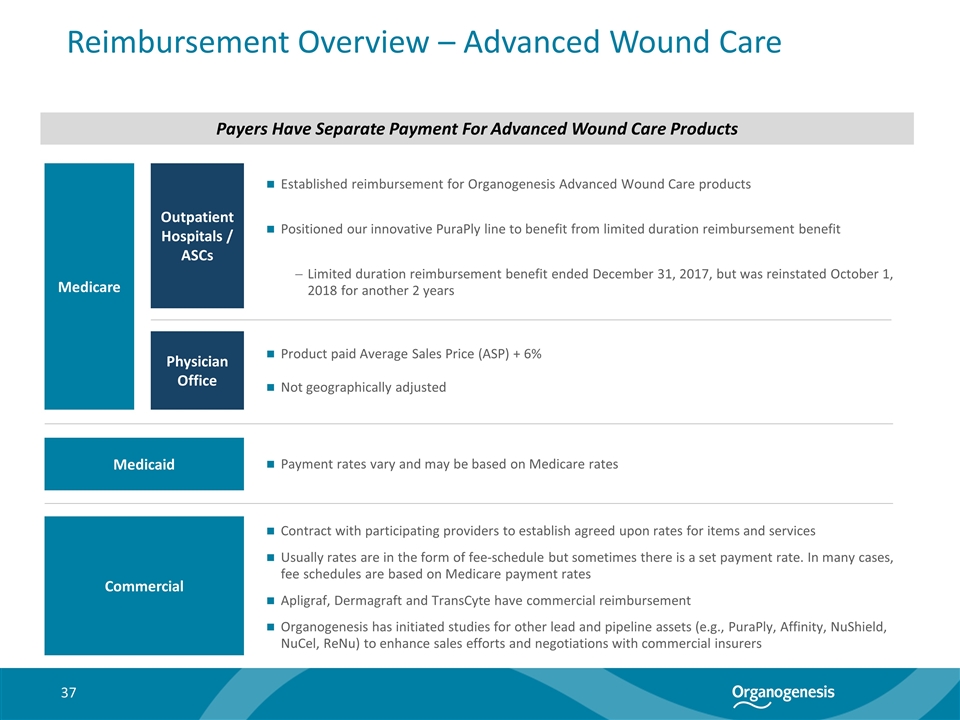

Reimbursement Overview – Advanced Wound Care Medicare Physician Office Outpatient Hospitals / ASCs Product paid Average Sales Price (ASP) + 6% Not geographically adjusted Payers Have Separate Payment For Advanced Wound Care Products Established reimbursement for Organogenesis Advanced Wound Care products Positioned our innovative PuraPly line to benefit from limited duration reimbursement benefit Limited duration reimbursement benefit ended December 31, 2017, but was reinstated October 1, 2018 for another 2 years Commercial Contract with participating providers to establish agreed upon rates for items and services Usually rates are in the form of fee-schedule but sometimes there is a set payment rate. In many cases, fee schedules are based on Medicare payment rates Apligraf, Dermagraft and TransCyte have commercial reimbursement Organogenesis has initiated studies for other lead and pipeline assets (e.g., PuraPly, Affinity, NuShield, NuCel, ReNu) to enhance sales efforts and negotiations with commercial insurers Medicaid Payment rates vary and may be based on Medicare rates

PuraPly Reimbursement Background PuraPly AM is a purified native porcine type I collagen matrix embedded with polyhexamethylene biguanide, or PHMB, a localized broadspectrum antimicrobial for the management of multiple wound types Product is differentiated in that it helps manage bioburden while also supporting the healing process across a wide variety of wound types and reducing cytotoxicity PuraPly AM was launched in 2016(1) via 510(k) clearance and quickly demonstrated robust uptake Focused sales effort supported by Organogenesis Advanced Wound Care commercialization infrastructure Product sales benefitted from “pass-through” payments in the outpatient hospital or ASC setting (granted by CMS to encourage innovative medical devices, drugs and biologics) Pass-through status refers to separate payments for the product made to providers in addition to the “bundled” payment (e.g., one set payment for the application procedure, regardless of product cost) Pass-through status ended (temporarily) on December 31, 2017; as a result, providers in these settings began only receiving bundled payments for the product. The Company saw a decline in PuraPly revenue in the first three quarters of 2018: Lower reimbursement negatively affected customer demand for overall PuraPly volumes Lower relative reimbursement for larger, higher-priced SKUs resulted in a mix shift towards smaller, lower-priced SKUs (bundled payment structure does not necessarily reimburse more for larger wounds) Reduced Organogenesis sales force focus on PuraPly relative to other products in the portfolio Consolidated Appropriations Act of 2018 signed into law in March 2018 restored pass-through status for PuraPly for two years, effective October 1, 2018 through September 30, 2020 Notes: PuraPly AM was launched in 2016, while PuraPly was launched in 2015.

Reimbursement Overview – Surgical & Sports Medicine Most Payers Do Not Reimburse Separately for Surgical Products Most payers (Medicare, Medicaid and commercial) include the payment for surgical products in the overall payment for the procedure Medicare reimburses hospital inpatient stays based on the Medicare Severity Diagnosis Related Group (MS-DRG) MS-DRG assignment is generally determined by the ICD-10 code that identifies the individual’s primary diagnosis. MS-DRG assignment may also be affected by additional diagnoses that identify complicated or complex cases and the provision of certain surgical procedures Some private payers use the MS-DRG based system to reimburse facilities for inpatient services

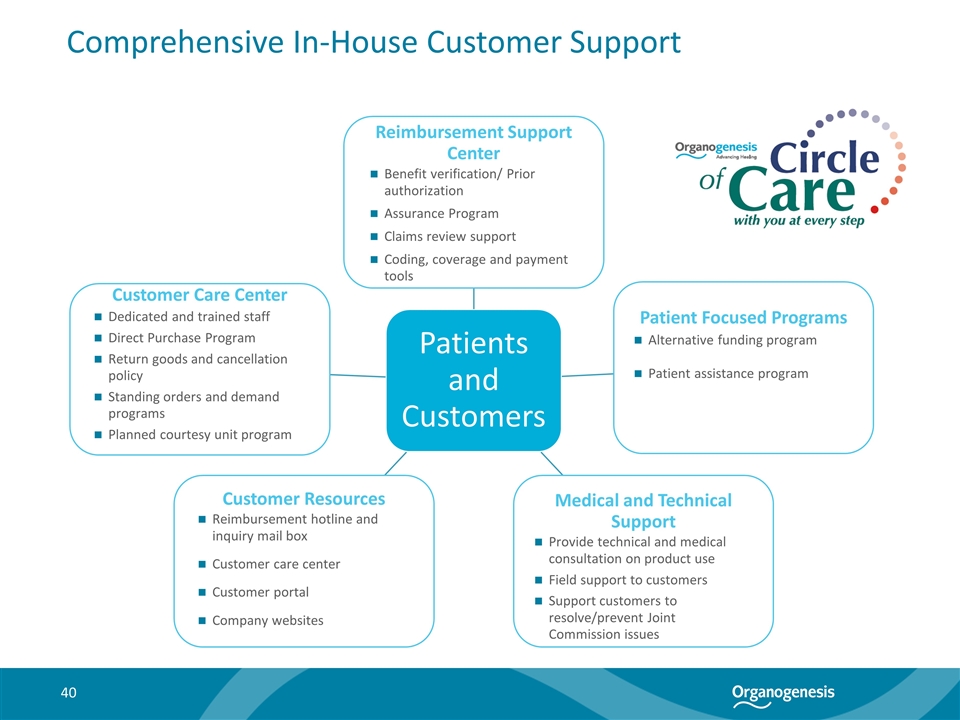

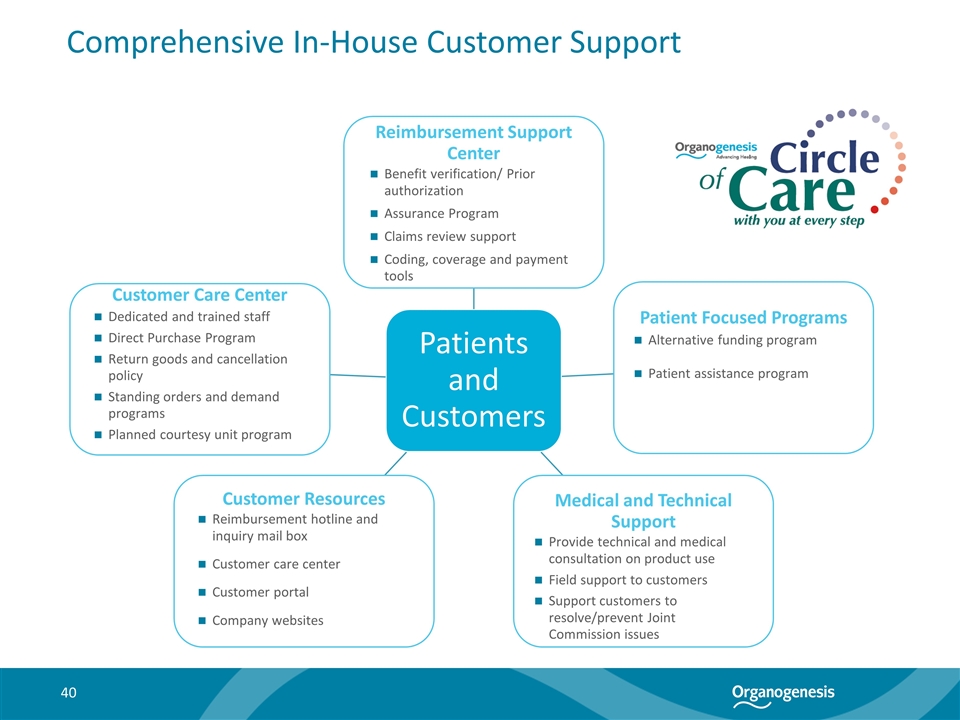

Comprehensive In-House Customer Support Benefit verification/ Prior authorization Assurance Program Claims review support Coding, coverage and payment tools Alternative funding program Patient assistance program Provide technical and medical consultation on product use Field support to customers Support customers to resolve/prevent Joint Commission issues Reimbursement hotline and inquiry mail box Customer care center Customer portal Company websites Dedicated and trained staff Direct Purchase Program Return goods and cancellation policy Standing orders and demand programs Planned courtesy unit program Patients and Customers Reimbursement Support Center Patient Focused Programs Medical and Technical Support Customer Resources Customer Care Center

Comprehensive Healthcare Compliance Program Healthcare Compliance Program To help ensure compliance with the laws and regulations governing the provision of health care goods and services, we have implemented a comprehensive compliance program based on the HHS Office of Inspector General’s Seven Elements of an Effective Compliance Program(1): Implemented written policies, procedures and standards of conduct Designated a compliance officer and compliance committee Conducted effective training and education Developed effective lines of communication Conducted internal monitoring and auditing Enforcing standards through well-publicized disciplinary guidelines Responding promptly to detected offenses and undertaking corrective action Compliance resources augmented by outside counsel Arent Fox (policy, training and enforcement) and Polaris Management (monitoring and auditing) Notes: Health & Human Services, Office of Inspector General, Compliance Program Guidance for Pharmaceutical Manufacturers, April 2003.

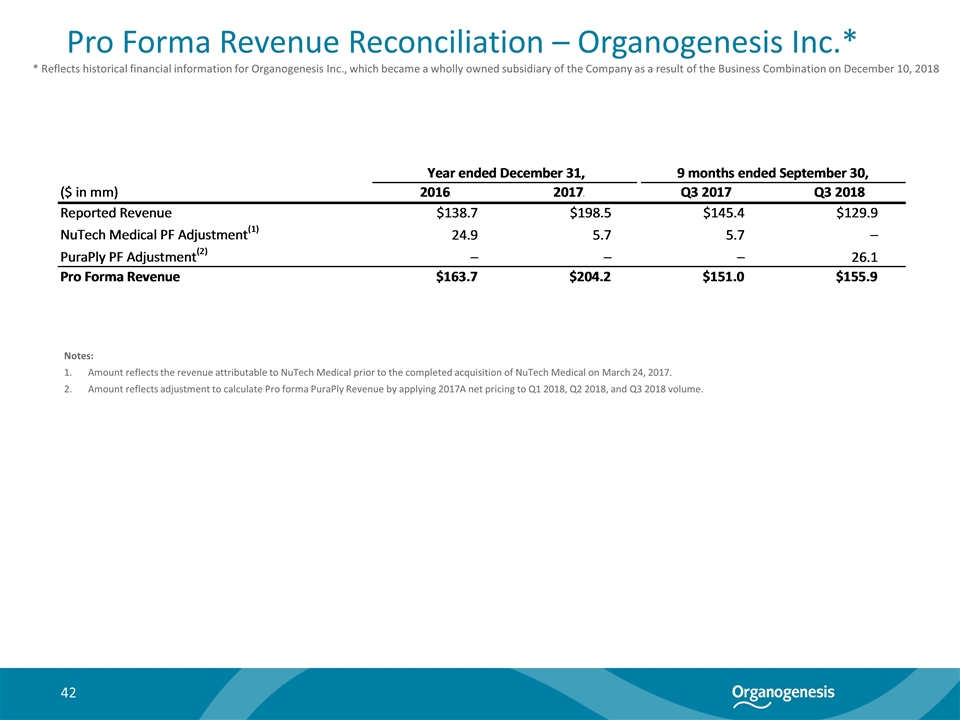

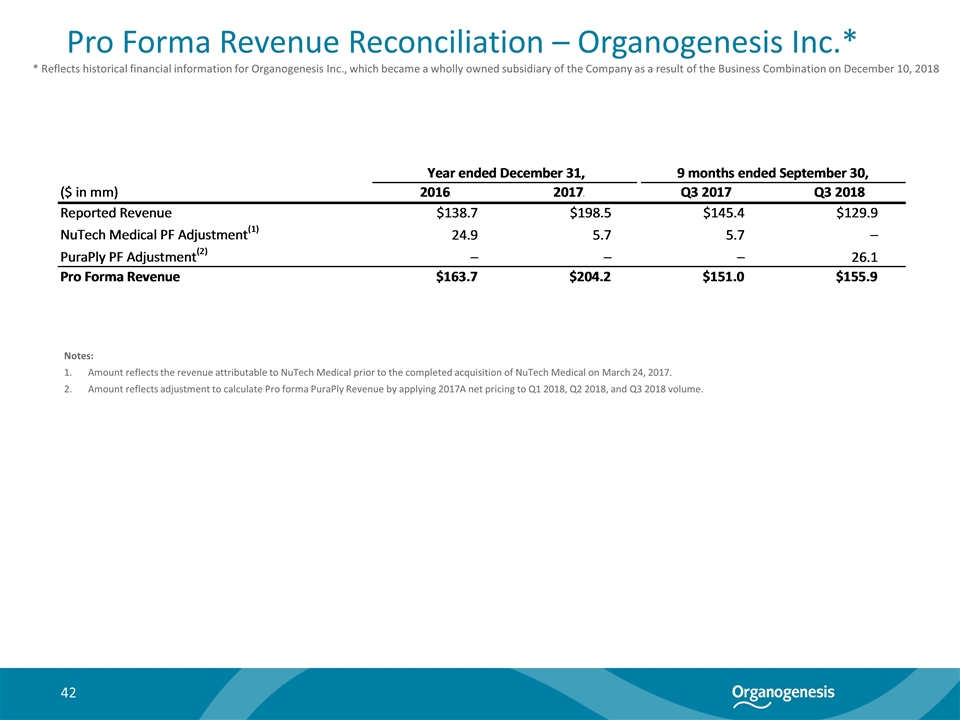

Pro Forma Revenue Reconciliation – Organogenesis Inc.* Notes: Amount reflects the revenue attributable to NuTech Medical prior to the completed acquisition of NuTech Medical on March 24, 2017. Amount reflects adjustment to calculate Pro forma PuraPly Revenue by applying 2017A net pricing to Q1 2018, Q2 2018, and Q3 2018 volume. * Reflects historical financial information for Organogenesis Inc., which became a wholly owned subsidiary of the Company as a result of the Business Combination on December 10, 2018

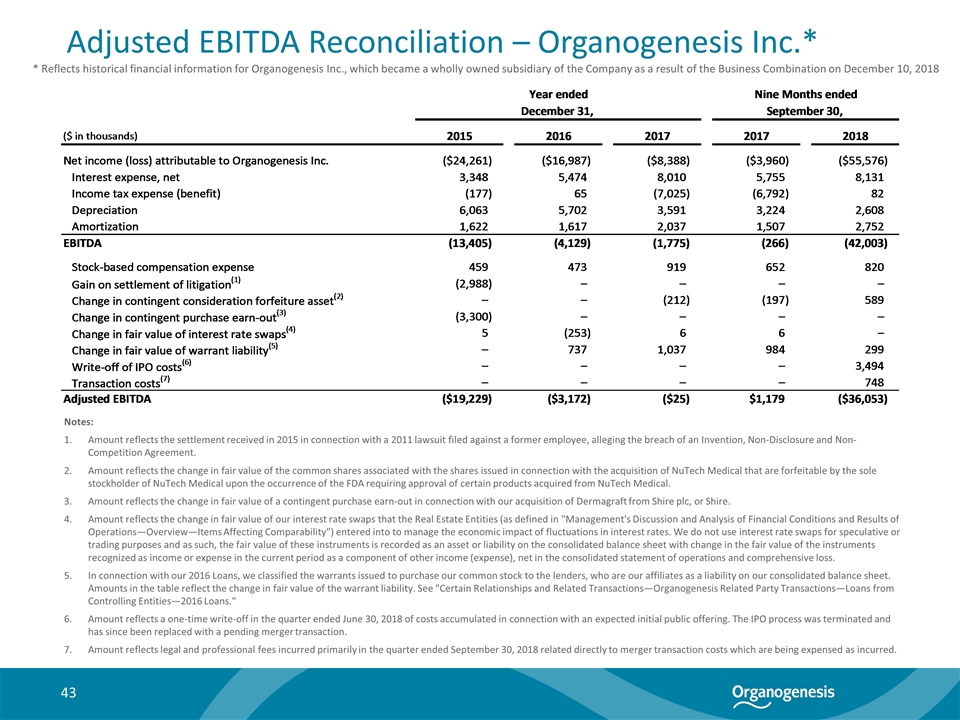

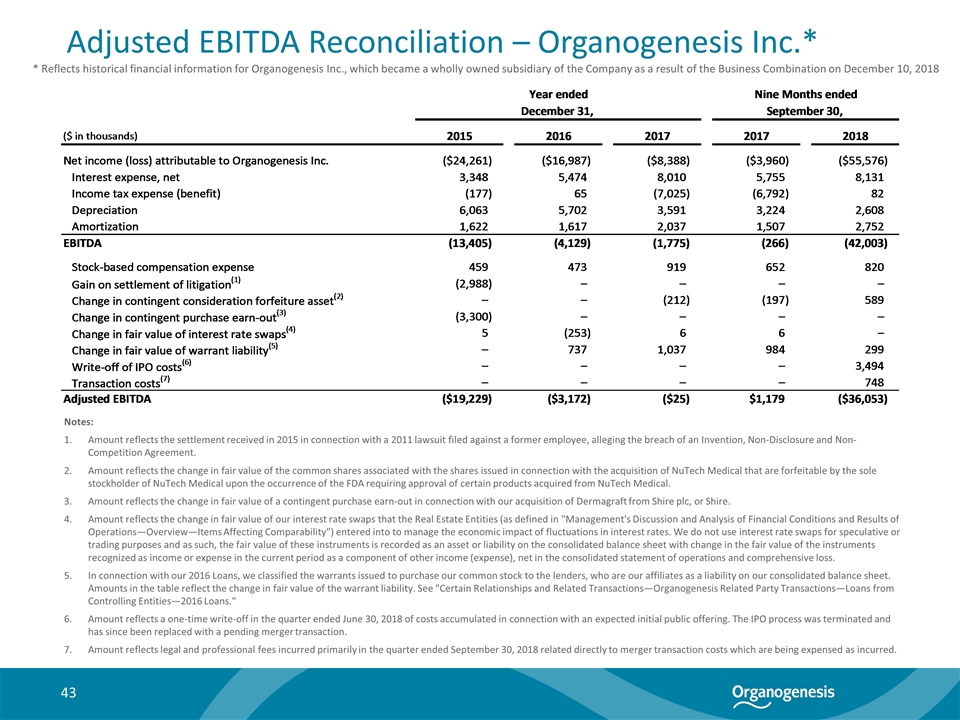

Adjusted EBITDA Reconciliation – Organogenesis Inc.* Notes: Amount reflects the settlement received in 2015 in connection with a 2011 lawsuit filed against a former employee, alleging the breach of an Invention, Non-Disclosure and Non-Competition Agreement. Amount reflects the change in fair value of the common shares associated with the shares issued in connection with the acquisition of NuTech Medical that are forfeitable by the sole stockholder of NuTech Medical upon the occurrence of the FDA requiring approval of certain products acquired from NuTech Medical. Amount reflects the change in fair value of a contingent purchase earn-out in connection with our acquisition of Dermagraft from Shire plc, or Shire. Amount reflects the change in fair value of our interest rate swaps that the Real Estate Entities (as defined in "Management's Discussion and Analysis of Financial Conditions and Results of Operations—Overview—Items Affecting Comparability") entered into to manage the economic impact of fluctuations in interest rates. We do not use interest rate swaps for speculative or trading purposes and as such, the fair value of these instruments is recorded as an asset or liability on the consolidated balance sheet with change in the fair value of the instruments recognized as income or expense in the current period as a component of other income (expense), net in the consolidated statement of operations and comprehensive loss. In connection with our 2016 Loans, we classified the warrants issued to purchase our common stock to the lenders, who are our affiliates as a liability on our consolidated balance sheet. Amounts in the table reflect the change in fair value of the warrant liability. See "Certain Relationships and Related Transactions—Organogenesis Related Party Transactions—Loans from Controlling Entities—2016 Loans." Amount reflects a one-time write-off in the quarter ended June 30, 2018 of costs accumulated in connection with an expected initial public offering. The IPO process was terminated and has since been replaced with a pending merger transaction. Amount reflects legal and professional fees incurred primarily in the quarter ended September 30, 2018 related directly to merger transaction costs which are being expensed as incurred. * Reflects historical financial information for Organogenesis Inc., which became a wholly owned subsidiary of the Company as a result of the Business Combination on December 10, 2018

Appendix Product Details

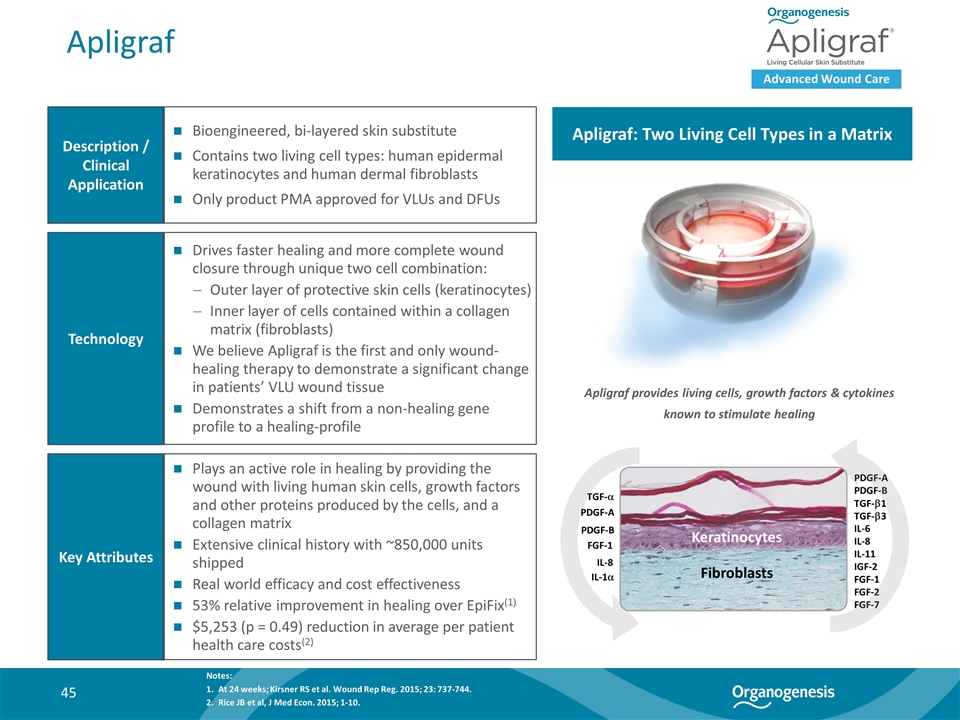

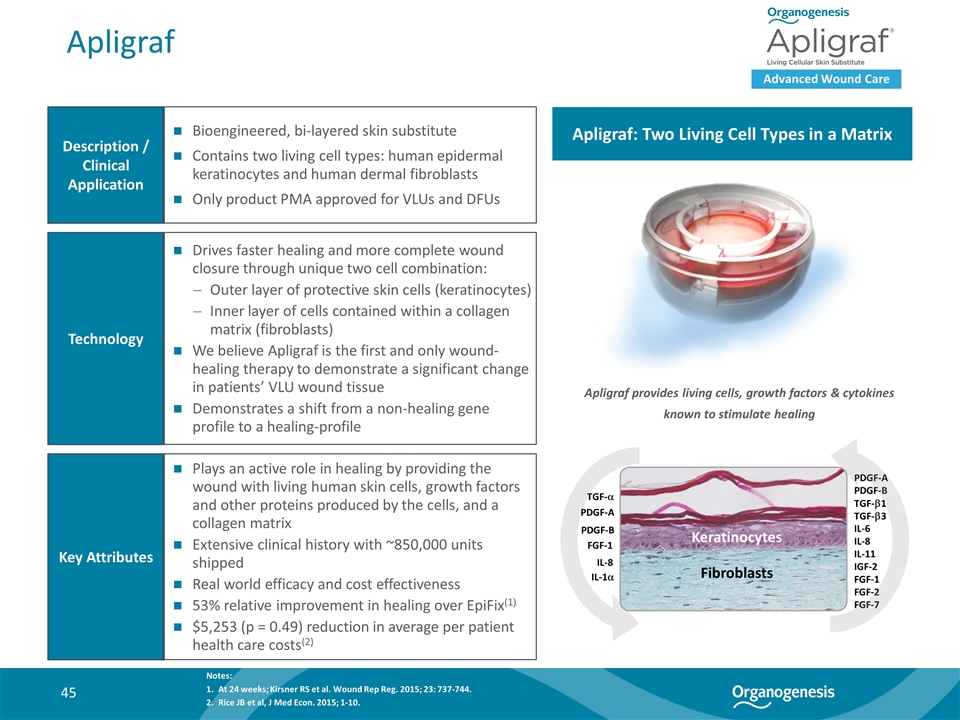

Apligraf Advanced Wound Care Description / Clinical Application Technology Key Attributes Bioengineered, bi-layered skin substitute Contains two living cell types: human epidermal keratinocytes and human dermal fibroblasts Only product PMA approved for VLUs and DFUs Drives faster healing and more complete wound closure through unique two cell combination: Outer layer of protective skin cells (keratinocytes) Inner layer of cells contained within a collagen matrix (fibroblasts) We believe Apligraf is the first and only wound-healing therapy to demonstrate a significant change in patients’ VLU wound tissue Demonstrates a shift from a non-healing gene profile to a healing-profile Plays an active role in healing by providing the wound with living human skin cells, growth factors and other proteins produced by the cells, and a collagen matrix Extensive clinical history with ~850,000 units shipped Real world efficacy and cost effectiveness 53% relative improvement in healing over EpiFix(1) $5,253 (p = 0.49) reduction in average per patient health care costs(2) Apligraf: Two Living Cell Types in a Matrix IL-6 FGF-1 FGF-7 IGF-2 FGF-2 TGF-b3 TGF-b1 PDGF-A PDGF-B IL-8 IL-11 IL-1a FGF-1 PDGF-A PDGF-B IL-8 TGF-a Apligraf provides living cells, growth factors & cytokines known to stimulate healing Keratinocytes Fibroblasts Notes: At 24 weeks; Kirsner RS et al. Wound Rep Reg. 2015; 23: 737-744. Rice JB et al, J Med Econ. 2015; 1-10.

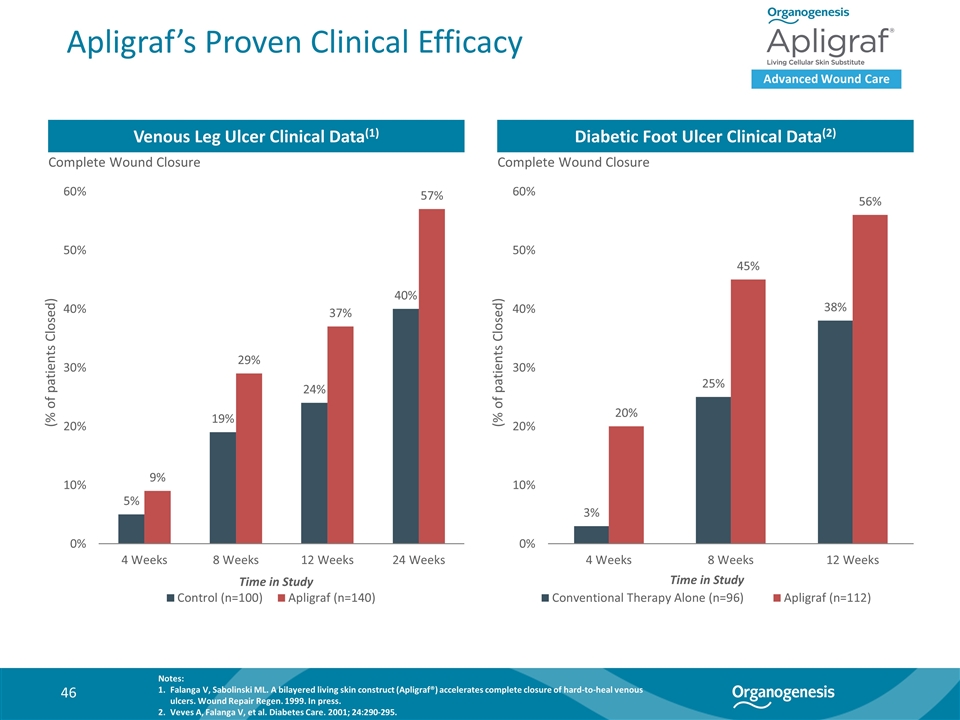

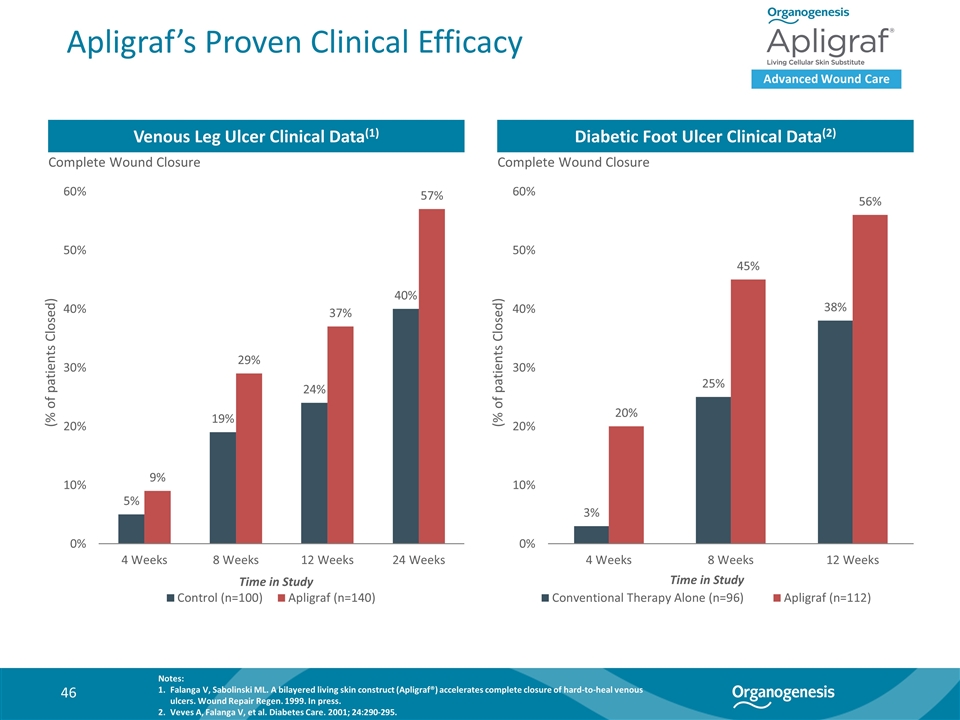

Apligraf’s Proven Clinical Efficacy Advanced Wound Care Venous Leg Ulcer Clinical Data(1) Diabetic Foot Ulcer Clinical Data(2) Complete Wound Closure Complete Wound Closure (% of patients Closed) (% of patients Closed) Time in Study Time in Study Notes: Falanga V, Sabolinski ML. A bilayered living skin construct (Apligraf®) accelerates complete closure of hard-to-heal venous ulcers. Wound Repair Regen. 1999. In press. Veves A, Falanga V, et al. Diabetes Care. 2001; 24:290-295.

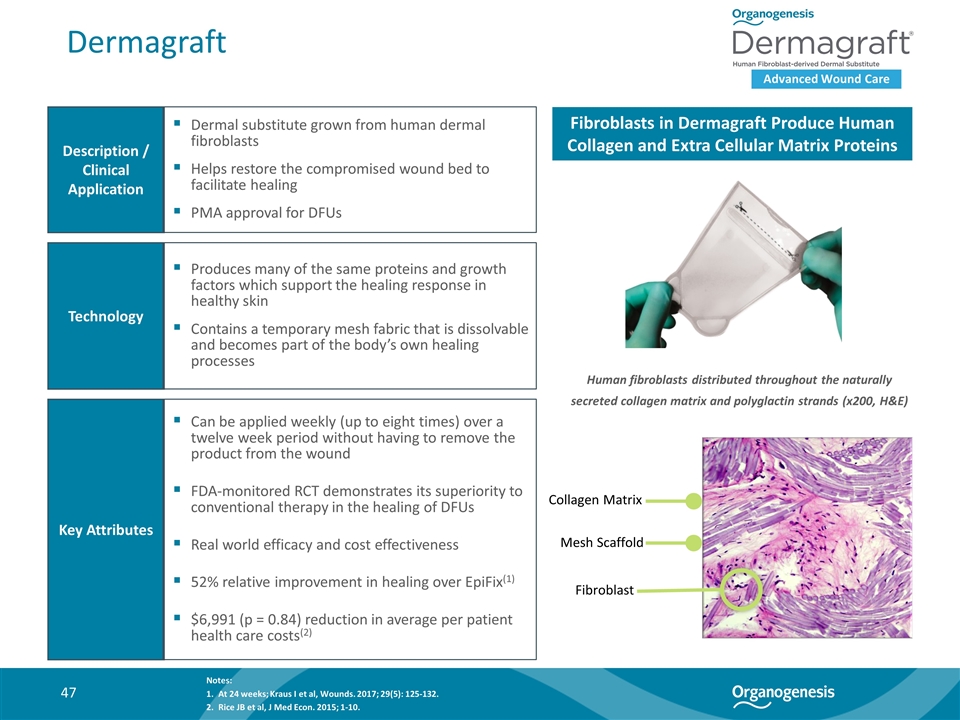

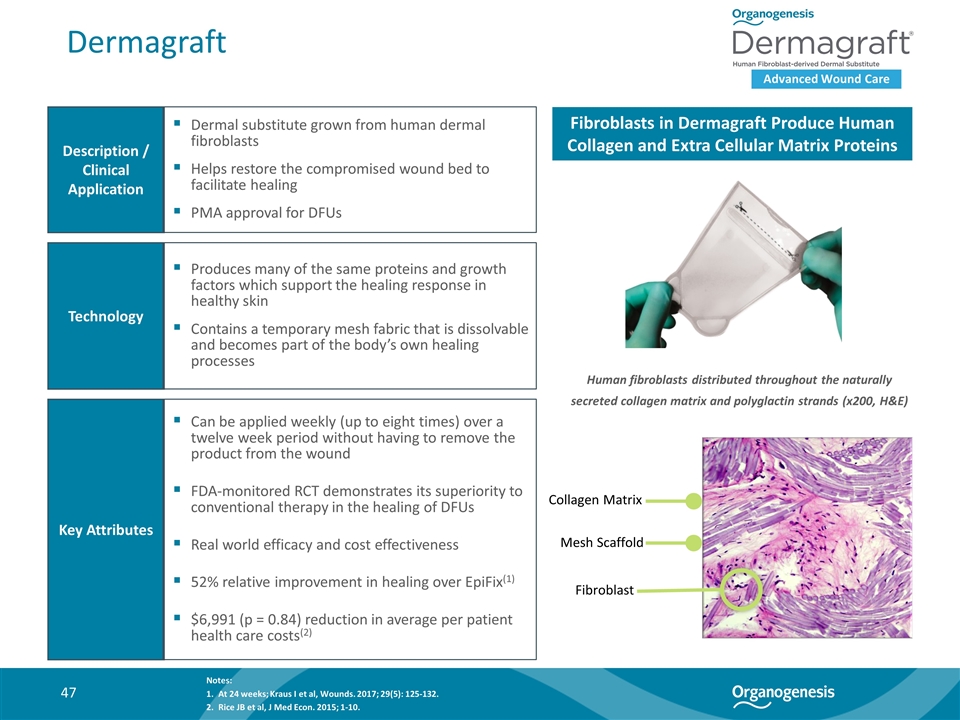

Dermagraft Advanced Wound Care Description / Clinical Application Technology Key Attributes Dermal substitute grown from human dermal fibroblasts Helps restore the compromised wound bed to facilitate healing PMA approval for DFUs Produces many of the same proteins and growth factors which support the healing response in healthy skin Contains a temporary mesh fabric that is dissolvable and becomes part of the body’s own healing processes Can be applied weekly (up to eight times) over a twelve week period without having to remove the product from the wound FDA-monitored RCT demonstrates its superiority to conventional therapy in the healing of DFUs Real world efficacy and cost effectiveness 52% relative improvement in healing over EpiFix(1) $6,991 (p = 0.84) reduction in average per patient health care costs(2) Fibroblasts in Dermagraft Produce Human Collagen and Extra Cellular Matrix Proteins Collagen Matrix Mesh Scaffold Fibroblast Human fibroblasts distributed throughout the naturally secreted collagen matrix and polyglactin strands (x200, H&E) Notes: At 24 weeks; Kraus I et al, Wounds. 2017; 29(5): 125-132. Rice JB et al, J Med Econ. 2015; 1-10.

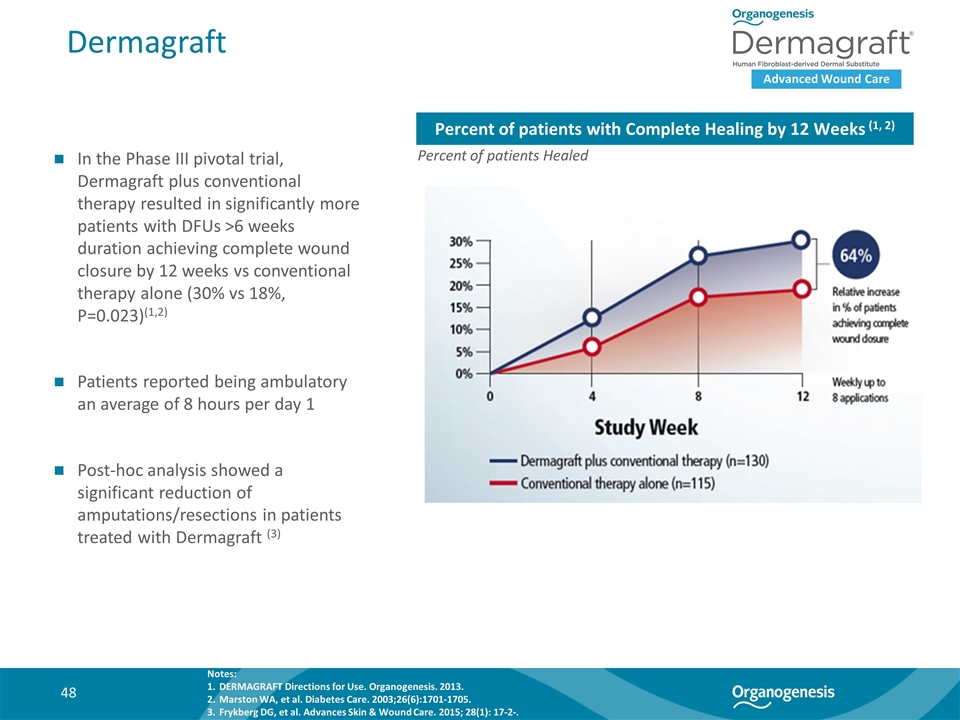

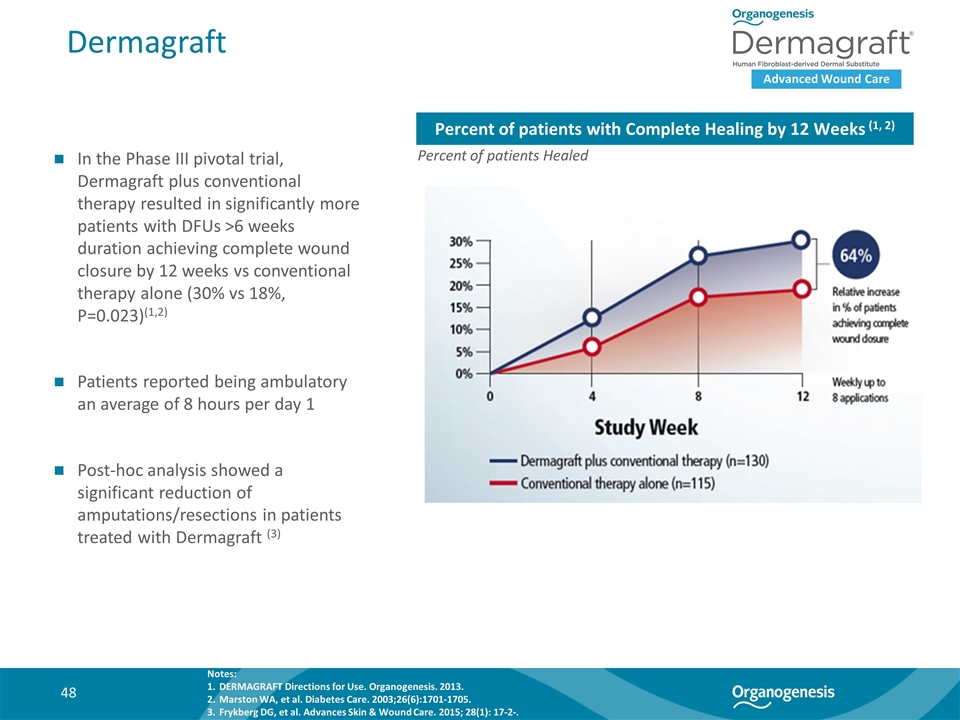

Dermagraft Advanced Wound Care In the Phase III pivotal trial, Dermagraft plus conventional therapy resulted in significantly more patients with DFUs >6 weeks duration achieving complete wound closure by 12 weeks vs conventional therapy alone (30% vs 18%, P=0.023)(1,2) Patients reported being ambulatory an average of 8 hours per day 1 Post-hoc analysis showed a significant reduction of amputations/resections in patients treated with Dermagraft (3) Percent of patients with Complete Healing by 12 Weeks (1, 2) Percent of patients Healed Notes: DERMAGRAFT Directions for Use. Organogenesis. 2013. Marston WA, et al. Diabetes Care. 2003;26(6):1701-1705. Frykberg DG, et al. Advances Skin & Wound Care. 2015; 28(1): 17-2-.

PuraPly Antimicrobial (AM) Description / Clinical Application Technology Key Attributes Clinical Update Purified native collagen matrix with broad-spectrum polyhexamethylene biguanide (PHMB) antimicrobial agent 510(k) clearances for management of multiple wound types and surgical treatment of open wounds Effective combination of PHMB with a native collagen matrix that helps manage bioburden while supporting healing across a wide variety of wound types, regardless of severity or duration Functions as a skin substitute Designed to address challenges posed by bioburden and excessive inflammation in the wound Patient enrollment and follow-up completed for: 43 patient, single center controlled prospective observational evaluation for multiple wound types 100 patient, single-center controlled prospective observational evaluation for chronic and acute wounds Patient enrollment underway for PuraPly AM RESPOND Registry AWC / S&SM

Affinity Description / Clinical Application Two clinical trials currently in process: 100 patient RCT: Affinity vs. standard of care for DFUs 20 patient prospective study: Closure time for chronic VLUs treated with Affinity Technology Key Attributes Clinical Update Fresh amniotic membrane containing many types of viable cells, growth factors/cytokines, and ECM proteins Regulated as a 361 HCT/P Treats chronic and acute wounds, as well as tendon, ligament and other soft tissue injuries Undergoes proprietary AlloFresh process that hypothermically stores the product in its fresh state Product is never dried or frozen, helping it retains its native benefits and structure We believe Affinity is one of only a few amniotic tissue products containing viable amniotic cells Native cellular properties support cell and tissue growth making it an excellent option to support wound and soft tissue healing AWC / S&SM

NuShield Description / Clinical Application Technology Key Attributes Clinical Update Dehydrated placental tissue graft Topically or surgically applied to the target tissue to support healing of acute and chronic wounds across a range of sizes Regulated as a 361 HCT/P Preserved utilizing proprietary BioLoc process Preserves native structure of the amnion and chorion membranes Available in multiple sizes and can be stored at room temperature with a five year shelf life Effective adhesion barrier Biological characteristics support healing of soft tissue defects Particularly in difficult-to-heal locations or challenging patient populations 100 patient, randomized clinical trial vs. the standard of care for the treatment of diabetic foot ulcers AWC / S&SM

NuCel Surgical & Sports Medicine Description / Clinical Application Technology Key Attributes Clinical Update Surgically implanted allograft derived from human amniotic tissue and amniotic fluid Regulated as a 361 HCT/P Used primarily in spinal and orthopedic surgical applications to support tissue healing, including bone growth and fusion Amniotic tissue harvesting process protects key biologic characteristics of the tissue Clinical efficacy demonstrated in several published clinical studies Particularly in patients with significant comorbidities such as diabetes and obesity Two retrospective lumbar spinal fusion studies of 159 patients published (one with prospective follow-up and CT) Two additional prospective lumbar studies, including multi-center, are in process Retrospective studies in long-bone non-union and in complex wounds and burns are awaiting publication Currently seeking BLA approval

ReNu™ Description / Clinical Application Technology Key Attributes Clinical Update Cryopreserved suspension of amniotic fluid cells and morselized amnion tissue from the same donor Regulated as a 361 HCT/P Used to support healing of soft tissues, particularly in degenerative conditions such as OA and joint and tendon injuries such as tendinosis and fasciitis Formulated for office use Amniotic tissue harvesting and processing protects key biologic characteristics of the tissue Completed and published pilot clinical study for knee OA in 6 patients, which we believe is indicative of its safety: Results of this study suggest potential efficacy for a period of more than a year, significantly longer than available alternatives 200 patient multi-center RCT with interim data being prepared for publication Robust pre-clinical and clinical program on-going across multiple applications Currently seeking BLA approval Surgical & Sports Medicine