Mr. David Lin

Ms. Erin Purnell

Office of Financial Services

Division of Corporate Finance

United States Securities and Exchange Commission

Washington, D.C. 20549

August 28, 2018

| Re: | StartEngine Crowdfunding, Inc. |

| | | Offering Statement on Form 1-A Filed June 29, 2018 |

| | | File No. 024-10862 |

Dear Mr. Lin and Ms. Purnell:

Thank you for your comments of August 15, 2018 regarding the Offering Statement of StartEngine Crowdfunding, Inc. (the “company”). We appreciate the opportunity to respond to your comments.

Form 1-A filed June 29, 2018

Cover Page

| 1. | Please revise the cover page to disclose: |

| • | The minimum investment amounts for the Common Tokens and Preferred Tokens, as referenced on page 14; |

| • | That the maximum offering dollar amount will be raised through the sale of shares of Common Tokens or the shares of Series Token Preferred Stock or any combination thereof; |

| • | That the offering shall commence within two days of the offering statement being qualified. Refer to Rule 251(d)(3)(F) of Regulation A; |

| • | That you will accept BTC or ETH as consideration for the Tokens; and |

| • | That investors who tender BTC or ETH in exchange for Tokens may receive fewer tokens than expected as a result of any volatility between the time of receipt of such consideration and application of the conversion formula. In this regard, we note your disclosure in the penultimate risk factor on page 11. |

We have revised the cover page to disclose:

| • | The minimum investment amounts for the Common Tokens and Preferred Tokens; |

| • | That the maximum offering dollar amount will be raised through the sale of shares of Common Tokens or the shares of Series Token Preferred Stock or any combination thereof; |

| • | That the offering shall commence within two days of the offering statement being qualified; |

| • | That the company will accept BTC or ETH as consideration for the Tokens; and |

| • | That investors who tender BTC or ETH in exchange for Tokens may receive fewer tokens than expected as a result of any volatility between the time of receipt of such consideration and application of the conversion formula. |

The Offering, page 5

| 2. | With respect to the delivery of the Tokens, please disclose that an investor will be required to obtain a compatible crypto-wallet, such as MyEtherWallet, Mist, Parity or imToken to receive the Tokens, as indicated on page 15. |

We have revised the disclosure in “The Offering” accordingly.

Risk Factors

We are seeking registration as a broker-dealer..., page 7

| 3. | Your website states that you are also in discussions with tZero and other broker-dealers to offer the StartEngine token on their ATS platforms. Please revise to disclose this information, either here or elsewhere in your offering statement. |

We have revised the disclosure in the risk factor titled “There is no current market for our Common Stock or Preferred Stock or Tokens” to reflect this information.

If the company cannot raise sufficient funds it will not succeed..., page 9

| 4. | Please revise to clarify that you have no committed sources of financing, as disclosed at the bottom of page 16. |

We have revised the disclosure in this risk factor accordingly.

| 5. | We note your disclosure that "[i]f the company manages to raise only the minimum amount of funds sought, it will have to find other sources of funding . . ." (emphasis added). Please reconcile this disclosure with your statement on the cover page and elsewhere that there is no minimum offering amount. Also please clarify here or in a separate risk factor that because this is a best efforts offering with no minimum, any investment in the stock is potentially the only investment in the stock, which could leave the company without adequate capital to pursue its business plan. |

We have revised this language to clarify that there is no minimum offering amount.

We have added a new risk factor (“There is no minimum amount set as a condition to this offering”) to state that because this is a best efforts offering with no minimum, any investment in the stock is potentially the only investment in the stock, which could leave the company without adequate capital to pursue its business plan.

Holders of our Preferred Stock are entitled to potentially significant liquidation preferences..., page 10

| 6. | Please revise to include the liquidation preferences among the Series Seed Preferred Stock, the Series A Preferred Stock and the Series Token Preferred Stock. |

We have revised the disclosure with respect to liquidation preferences accordingly.

The definitive ownership of the ownership will be recorded..., page 10

| 7. | Please expand your disclosure to inform investors of StartEngine Secure’s limited experience in providing transfer agent services for digital assets. |

We have expanded the disclosure to discuss StartEngine Secure’s limited experience in providing transfer agent services for digital assets.

The further development and acceptance of digital assets..., page 11

| 8. | Please revise your disclosure in this section to specifically discuss any unfavorable regulatory actions in jurisdictions where you plan to do business. |

The company is not currently planning to do business in any jurisdictions outside the United States. However, adverse actions outside the United States may have an impact on markets in the United States. We have revised the disclosure to clarify this point and also to give examples of adverse regulatory actions in other jurisdictions.

In the event the smart contract does not work as anticipated..., page 12

| 9. | Please expand this risk factor to disclose that currently known vulnerabilities of smart contracts may cause transactions on the blockchain to be executed not pursuant to the agreed upon terms with the Token holder, and that the Token holder may have no mechanism to stop or unwind the transaction. |

We have revised the risk factor accordingly.

Plan of Distribution, page 14

| 10. | Please disclose how the company will accept BTC and ETH as payment and the custodial practices for the payments that you will receive. In this regard, it is unclear whether you intend to use a digital wallet provider or hold it internally. If you will hold the digital assets in hot wallets, describe where those wallets will be located and who will have access to them. Please also identify who will have the authority to release the proceeds from the wallet. In addition, please add a risk factor to specifically address the vulnerabilities and risks of accepting and holding BTC and ETH in such manner. |

We have amended the disclosure to explain:

| · | How the company will accept BTC and ETH as payment; |

| · | The custodial practices for the payments that the company receives; |

| · | Whether the company intends to use a digital wallet provider or hold it internally; |

| · | Whether the company will hold the digital assets in hot wallets: |

| o | where those wallets will be located; and |

| o | who will have access to them. |

| · | Who will have the authority to release the proceeds from the wallet. |

We have added a risk factor, titled “We have modified the disclosure to detail how investors can access updates on the number of Tokens, and we note that providing such updates in not required under Regulation A. In the past, we have provided updates on the campaign page for amounts committed and we intend to continue we that process" to specifically address the vulnerabilities and risks of accepting and holding BTC and ETH in such manner.

| 11. | We note your disclosure that you are initially offering your securities in all states other than Florida and Nebraska. However, this appears inconsistent with Item 5 of Part I of your Form 1-A, where you list the jurisdictions in which the securities are to be offered, including such states. Please reconcile. |

We have amended Part I to clarify that we will not initially offer our securities in Florida or Nebraska.

Process of Subscribing, page 14

| 12. | Please revise to discuss in greater detail the AML and OFAC due diligence procedures, as referenced in this section. |

We have amended the disclosure to discuss AML and OFAC procedures.

| 13. | We note your disclosure at the bottom of page 14 that StartEngine Secure will “store the shareholder records using StartEngine LDGR on the blockchain.” Please revise to describe the nature of such blockchain in greater detail (e.g., private or public blockchain, etc.). |

We have revised the discussion of the blockchain technology that StartEngine Secure will be using.

Determination of number of Tokens Issued For BTC and ETH, page 15

| 14. | Please revise to explain in greater detail the mechanics of how payments in BTC and ETH are calculated in terms of the exchange rate being used and provide illustrative examples, as appropriate. Please also describe the “recognized” currency exchanges that Prime Trust will use to determine the daily BTC and ETH exchange rates. |

We have revised the disclosure to explain in greater detail the mechanics of how payments in BTC and ETH are calculated in terms of the exchange rate being used and provided illustrative examples.

We have also identified that Prime Trust will use to determine the daily BTC and ETH exchange rates based on the rates available on Bloomberg.

| 15. | You disclose that when the company accepts BTC or ETH as payment, you anticipate holding an investor’s payment in its original form for less than a day. Please clarify the extent to which such time frame would limit an investor’s ability to receive a return of his or her investment in its original form. |

We have revised the disclosure accordingly.

Investors’ Tender of Funds, page 15

| 16. | We note your statement that tendered funds will only be returned to investors in the event that you decide to terminate the offering. Please confirm that investors will be able to request that the funds be returned to them while they are being held in escrow. |

We have revised the disclosure to clarify that investors will not be able to request that funds be returned while they are in escrow.

| 17. | We note your disclosure that for “payments in BTC or ETH, the closing will take place, if practicable, within 24 hours of the remittance of funds.” Please also disclose the time period for the closing with respect to payments other than in BTC or ETH. |

We amended the disclosure related to payments in BTC or ETH and have added disclosure with respect to the timing of closing for payments other than in BTC or ETH.

| 18. | Please file your escrow agreement as an exhibit to your Offering Statement. Please see Item 17(8) of Part III of Form 1-A. |

We have filed the escrow agreement as Exhibit 8.

| 19. | Please revise to explain how an investor will know if his/her money is being held in escrow. In addition, we note your disclosure on the cover page that you expect closings to be held at least monthly, but since you also state that you will hold closings whenever you determine to accept funds, please revise to explain how investors will know when they should expect to receive their shares. |

We have revised the disclosure to explain how an investor will know his/her money is being held in escrow.

We have also revised the disclosure to explain how an investor will know when to expect their shares.

| 20. | We note your disclosure that a closing will occur each time you determine to accept funds. Please revise to clarify whether by “funds” you mean the receipt of the BTC/ETH or the receipt of the cash upon exchange of the BTC/ETH by PrimeTrust. Please also confirm that purchases using BTC/ETH will also go through the escrow process and be subject to rolling closings. |

By “funds” we mean the receipt of cash upon the exchange of BTC/ETH by PrimeTrust. Purchases using BTC/ETH will go through the escrow process and be subject to rolling closings.

We have revised the disclosure accordingly.

Issuance of Tokens, page 15

| 21. | Please file the form of the smart contract or a written summary of such contract as an exhibit to the offering statement pursuant to Item 17 of Form 1-A. Ensure that all of the material terms of the Tokens, as embedded within the smart contract, are described in the offering statement. To the extent that you have not developed your Token, please tell us when you will do so. |

We have filed the form of smart contract as Exhibit 3.2.

The material terms of the tokens, as embedded within the smart contract, are described in “Terms of the Tokens under the Smart Contract.”

| 22. | In light of recent reports that at least two of the wallet providers that you identify on page 15 have experienced a cybersecurity breach (i.e., MyEtherWallet and EtherDelta), please add a risk factor disclosing the risks associated with the specific wallet providers that you reference. |

We have added the risk factor as requested.

Additional Perks, page 16

| 23. | We note your disclosure that investors who invest at least $1,000 will receive a “10% discount on investments on StartEngine during the first 24 hours of a Regulation CF offering.” Please revise to clarify how such discount will be calculated. Also please disclose an estimate of the value of the invitation to the annual StartEngine owners’ event. In this regard, we note the related information appearing on your website at https://www.startengine.com/own. |

We have revised the disclosure to clarify how the discount will be calculated. We have disclosed an estimate of the value of the invitation to the owners’ event.

Regulation, page 21

| 24. | If applicable, please disclose whether you intend to register as a money transmitter or money transfer service provider, and how you intend to comply with the related state and federal regulations. |

The company believes that the federal and state money transmitter registration requirements do not apply to it, and it does not intend to register. The functions performed by StartEngine Crowdfunding, Inc. and StartEngine Capital, LLC do not trigger these provisions, especially in light of the fact that no StartEngine entity ever handles fiat or crypto currency. StartEngine connects startups with investors online. The company registers investors, collects their identifying information, and helps them to find potential securities investments.

When an investor wants to invest in a particular security, it sends money from its bank via ACH transfer or a transfer from its virtual wallet to a Nevada escrow agent, PrimeTrust, which then transmits that amount to the issuer upon the issuer’s delivery of the purchased securities. In some cases, PrimeTrust will convert a payment made in fiat currency to virtual currency, or vice versa, to match the form of payment that an issuer has requested. PrimeTrust is subject to anti-money laundering (“AML”) regulation by the Financial Crimes Enforcement Network (“FinCEN”) pursuant to the Bank Secrecy Act (“BSA”). StartEngine passes relevant customer information it collects to PrimeTrust to assist that company in satisfying its AML obligations.

The BSA requires money services businesses (“MSBs”), including money transmitters, to comply with certain AML obligations. See generally 31 CFR Part 1022 (AML rules for MSBs); 31 CFR § 1010.100(ff)(5) (defining MSBs to include money transmitters). A money transmitter is a person that engages in the business of the “acceptance of currency, funds, or other value that substitutes for currency from one person and the transmission of currency, funds, or other value that substitutes for currency to another location or person by any means.” 31 CFR § 1010.100(ff)(5) (emphasis in original).

Because StartEngine does not accept funds from customers, it does not believe it qualifies as a money transmitter under the BSA.

In addition to federal regulations under the BSA, many states regulate money transmitters, and have their own definitions of such entities. A number of states have adopted (wholly or in part) the Uniform Money Services Act (“UMSA”), a model law (available here: http://www.uniformlaws.org/shared/docs/money%20services/umsa_final04.pdf), which defines money transmission in relevant part as “receiving money or monetary value for transmission.” See UMSA Art 1, § 102(14). We do not believe that these states would treat StartEngine as engaging in money transmission, because the company does not receive money or similar value from its customers.

Separately, we note that StartEngine is in the process of registering as a broker-dealer with the Commission. The BSA has separate AML regulations that apply to registered broker-dealers. See generally 31 CFR Part 1023. Once StartEngine becomes registered as a broker-dealer, it will be subject to these rules, including requirements to identify its customers and to establish and maintain an appropriate AML program. See 31 CFR 1023.210 (AML program); 1023.220 (customer identification). A registered broker dealer cannot also be regulated as a MSB for purposes of the BSA. See 31 CFR 1010.100(ff)(8) (MSBs do not include “[a] person registered with, and functionally regulated or examined by, the SEC”).

With respect to the states, a number of states have exemptions to their money transmitter laws for persons registered with the SEC as broker-dealers. See, e.g., Cal. Fin. Code § 2010(i) (exempting broker-dealers registered under federal securities laws to the extent of their operations as broker-dealers). Thus, even if StartEngine’s activities otherwise would be deemed money transmission by a state, we beleive that state law should exempt StartEngine from its money transmitter law once it has registered with the SEC as a broker-dealer.

Regulation S, page 24

| 25. | Please discuss any steps you have taken to comply with the securities laws in foreign jurisdictions. In this regard, we note your disclosure in the second risk factor on page 8, which suggests that you have structured your offering to comply with certain foreign laws. Also please expand your disclosure to briefly describe the resale restrictions contained in Regulation S. |

We have not taken any steps to comply with the securities laws in other jurisdictions. We have revised the language in the risk factor in question to clarify that fact. We have added disclosure with respect to the Regulation S resale restrictions.

Intellectual Property, page 24

| 26. | If material, please include a risk factor addressing your ability to protect your intellectual property rights. |

We have added a risk factor regarding protection of intellectual property rights.

Securities Being Offered, page 33

| 27. | Please provide a materially complete discussion of how the Tokens will interact with the Ethereum network. As part of your response, please provide the following disclosure: |

| • | Risk factors regarding your reliance on another blockchain network. For example, disclose the risks and consequences to the company if the Ethereum network ceases to function, slows down in functionality, or forks; |

| • | A description of the content of the Ethereum-based smart contracts underlying the Tokens, and clarifying the whether the smart contract is subject to change and, if so, by whom. Considering the vulnerability of current smart contracts, please disclose what systems and processes (if any) have been developed to prevent errors and troubleshoot the functionality of the Tokens; |

| • | To the extent that there is an inherent limit in the total number of Tokens that you can create, please explain how that feature works and how it is enforced; |

| • | Disclose whether a single Token may be divided into fractions of a Token, as well as any limits on their division, or if only whole Tokens may be transferred or accepted; |

| • | Discuss the limits on the transfer of the Tokens, if any; |

| • | Explain how you intend to provide updates on the number of Tokens you have sold throughout the offering period, and the amount of proceeds raised; and |

| • | Disclose what rights, if any, the Token holders have to recoup their losses in the event that any errors occur or hidden terms, previously not disclosed to the investors, negatively impact the value of the Tokens. |

We have added a subsection titled “Terms of the Tokens under the Smart Contract” to this section, and expanded the risk factor section to cover the following:

| • | Risk factors regarding reliance on another blockchain network; |

| • | A description of the content of the Ethereum-based smart contracts underlying the Tokens: |

| • | Clarifying whether the smart contract is subject to change and, if so, by whom. |

| • | What systems and processes (if any) have been developed to prevent errors and troubleshoot the functionality of the Tokens; |

| • | Explaining that there is no inherent limit in the total number of Tokens that you can create, as the number of Tokens will only be limited by the number of Common or Preferred Shares (which are created or increased in accordance with our Certificate of Incorporation); |

| • | Explaining that a single Token may not be divided into fractions of a Token, and only whole Tokens may be transferred or accepted; |

| • | Discussing the fact that there are no limits on the transfer of the Tokens other than those imposed by federal and state securities law; and |

| • | Disclosing what rights, if any, the Token holders have to recoup their losses in the event that any errors occur or hidden terms, previously not disclosed to the investors, negatively impact the value of the Tokens. |

In addition, we have modified the disclosure to detail how investors can access updates on the number of Tokens, and we note that providing such updates in not required under Regulation A. In the past, the company has provided updates on the campaign page for amounts committed and the company intends to continue with that process.

| 28. | Please clearly explain any differences in the rights of investors that hold your common stock in the form of electronic tokens from the rights of any other holders of common stock. |

We have added a discussion of these differences in the introductory text to this section.

| 29. | We note that your cover page defines the common stock and preferred stock offered as Common Tokens and Preferred Tokens. However, in this section and elsewhere throughout the prospectus, you refer to the securities offered as Common Stock and Preferred Stock. Please revise to be consistent in your use of defined terms. |

In certain places (including in this section), the difference in nomenclature was deliberate, in order to explain what rights are granted to holders of Common Stock and Preferred Stock pursuant to our Certificate of Incorporation and what rights are embedded in the smart contract. We have further expanded the text in the introduction to this section to make this distinction clear, and have amended defined terms throughout the offering circular.

| 30. | Please tell us whether the smart contract you intend to deploy is currently under development. In this regard, we note your disclosure on pages 18 and 35, respectively, that you are “developing a service called StartEngine LDGR” and that the “Tokens will be launched . . . with a smart contract built by LDGR.” Please note that since you are not eligible to conduct a delayed offering, all of the offering terms must be established and set forth in the offering statement prior to the time of qualification. Please revise your disclosure accordingly. |

The smart contract has been filed as Exhibit 3.2.

Preferred Stock, page 34

| 31. | Please revise to clarify whether the preferred stockholders who purchase their shares in this offering will be required to grant a proxy to the company’s CEO to vote their shares on all matters submitted to a shareholder vote, as with the purchasers of common stock in this offering. |

We have clarified that the preferred stockholders in this offering will not be required to grant a proxy to our CEO.

| 32. | On page 5, you state that up to 7,890,624 shares of preferred stock will be outstanding upon completion of the offering. According to Note 6 of the Notes to Financial Statements, the company has 7 million authorized shares of preferred stock. Please explain, if true, that you will need to amend your Certificate of Incorporation to provide for the designation and issuance of the Series Token Preferred Stock. |

We note that the company will amend its Certificate of Incorporation prior to qualification, have revised the disclosure accordingly in “Securities Being Offered – General”.

Exhibits

| 33. | We note your disclosure on page 14 that you have agreed to pay FundAmerica LLC, a technology service provider, a license fee of $2.50 per transaction processed. Please file this agreement as an exhibit to the offering circular or tell us why it is not material. Refer to Item 17(6) of Part III to Form 1-A. |

We note that in July 2018, Prime Trust acquired the assets of FundAmerica LLC, including the technology platform and customer agreements. We have filed the agreement with FundAmerica LLC (now Prime Trust) as Exhibit 6.7.

General

| 34. | Please define each acronym or otherwise abbreviated term the first time it is used (e.g., “BTC” and “ETH”). |

We have revised the disclosure accordingly.

| 35. | Please confirm your understanding that “testing the waters” materials may be used before the qualification of the offering statement, provided that all solicitation materials are preceded or accompanied by a preliminary offering circular or contain a notice informing potential investors where and how the most current preliminary offering circular can be obtained. In this regard, please revise your website to include the information required by Securities Act Rule 255(b)(4). |

We confirm our understanding regarding testing the waters materials and have updated our website in accordance with Rule 255(b)(4).

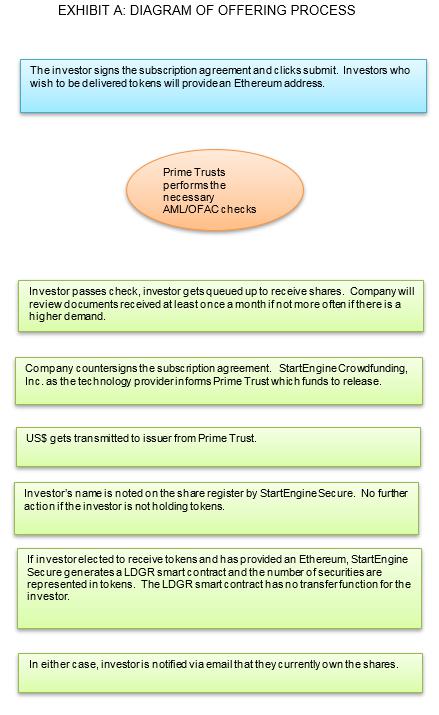

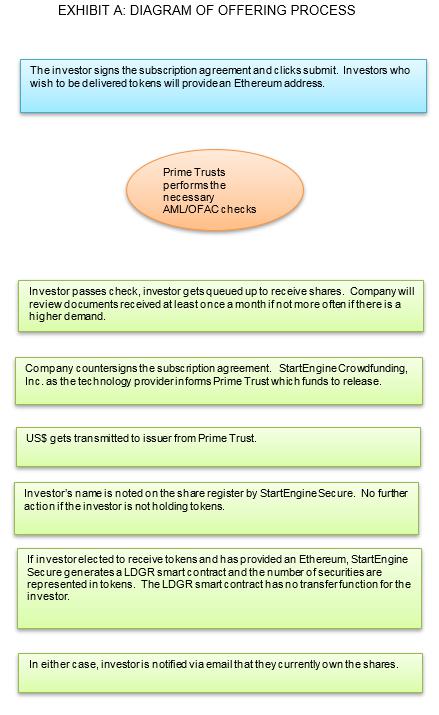

| 36. | To better understand the offering process for the Tokens pursuant to this offering statement, please provide us with a diagram or a detailed explanation of the process, starting from the initial issuance of the digital securities to the recording of each trade in the distributed ledger, as well as the clearance and settlement process. Also please describe the role of each participant in the process. |

A detailed diagram appears as Exhibit A to this response letter.

Thank you again for the opportunity to respond to your questions to the Offering Statement of StartEngine Crowdfunding, Inc. If you have additional questions or comments, please contact me at jamie@crowdchecklaw.com.

Sincerely,

/s/ Jamie Ostrow

Jamie Ostrow

CrowdCheck Law LLP (f/k/a KHLK LLP)

cc: Howard Marks

Chief Executive Officer

StartEngine Crowdfunding, Inc.

750 N San Vicente Blvd.

Suite 800 West

West Hollywood, CA 90069