Semi-Annual Report

May 31, 2017

GoodHaven Fund

Ticker: GOODX

GoodHaven Capital Management, LLC

GoodHaven Fund

Table of Contents

| Shareholder Letter | | | 1 |

| Portfolio Management Discussion and Analysis | | | 13 |

| Sector Allocation | | | 19 |

| Schedule of Investments | | | 20 |

| Statement of Assets and Liabilities | | | 23 |

| Statement of Operations | | | 24 |

| Statements of Changes in Net Assets | | | 25 |

| Financial Highlights | | | 26 |

| Notes to Financial Statements | | | 27 |

| Expense Example | | | 36 |

| Additional Information | | | 38 |

| Privacy Notice | | | 39 |

GoodHaven Fund

PERFORMANCE as of May 31, 2017 |

| | 6 Mos | 6 Mos | 12 Mos | Calendar | 5 | Since | Since |

| | Ended | Ended | Ended | YE | Years | Incept.1 | Incept.1 |

| | 5/31/17 | 6/30/17 | 5/31/17 | 12/31/16 | Annualized | Cumulative | Annualized |

| GOODX | -3.51% | -4.00% | 4.25% | 20.13% | 3.01% | 24.87% | 3.68% |

S&P 500 Index2 | 10.80% | 9.34% | 17.46% | 11.95% | 15.40% | 107.02% | 12.56% |

| Wilshire 5000 | | | | | | | |

| Total Market Index | 8.92% | 7.70% | 15.41% | 10.67% | 12.75% | 77.38% | 9.77% |

| HFRI Fundamental | | | | | | | |

Growth Index3 | 8.35% | 9.30% | 12.61% | 4.16% | 5.49% | 12.15% | 1.87% |

| HFRI Fundamental | | | | | | | |

Value Index3 | 5.98% | 5.93% | 12.65% | 7.26% | 7.90% | 36.00% | 5.11% |

CS Hedge Fund Index3 | 4.35% | 2.85% | 6.25% | 1.25% | 4.49% | 21.92% | 3.26% |

1 | The Fund commenced operations on April 8, 2011. |

2 | with dividends reinvested |

3 | Hedge Fund Index performance figures are supplied on a month end basis and are provided for illustrative purposes as a broad equity alternative asset class only. Accordingly, “since inception” hedge fund index performance figures reflect a start date of 3/31/11 and an end date of 5/31/17. Source: Bloomberg Terminal |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling (855) OK-GOODX or (855) 654-6639. The Fund imposes a 2.00% redemption fee on shares redeemed within 60 days of purchase. Performance data for an individual shareholder will be reduced by redemption fees that apply, if any. Redemption fees are paid directly into the Fund and do not reduce overall performance of the Fund. The annualized gross expense ratio of the GoodHaven Fund is 1.10%.

Additional table data are provided for disclosure of calendar period results, which are more commonly referenced.

July 5, 2017

To Our Fellow Shareholders of the GoodHaven Fund (the “Fund”):

After gaining 20.13% in calendar 2016 compared to 11.95% for the S&P 500 over the same period, and after a modestly positive first calendar quarter of 2017, we suffered a poor second calendar quarter primarily due to a rapid and significant price decline in two large energy related holdings. Despite a number of positive business developments across most of the portfolio, these energy declines have led to modest losses in the overall portfolio year-to-date. Importantly, we think the portfolio’s intrinsic value – including our energy holdings – actually increased during this period – which should be reflected in stock price performance over time. A concentrated approach lends itself to volatility and it’s worth recalling that in 2016, we started that year down

GoodHaven Fund

roughly 5% as energy plunged in early January and ended the calendar year up just over 20%. We work hard not to be influenced by volatility, and believe that taking advantage of volatility is part of a sound long-term investment approach.

First, let’s address the issue of our energy-related holdings, which currently total a bit less than 14% of the portfolio. As Yogi Berra might have said, “it feels like déjà vu all over again.” After a big bounce off the late 2015 lows last year, oil rapidly declined over just the past several weeks from about $52 per barrel to a recent low of about $42, apparently in response to high inventory levels and bearish headlines about production. Oil equities have generally followed suit, regardless of hedges, growth profiles, business progress in growing values, or cost positioning. We estimate that our energy exposure negatively affected the portfolio by approximately 7-8% in the six calendar months ended June 30, 2017 (mostly over the last couple of months), yet our research says these companies are deeply undervalued. Insider buying in 2017 suggests that management teams agree.1

Our largest energy investments, WPX Energy and Birchcliff Energy, are predicated on several factors: research suggesting that they are undervalued today based on what we believe a competitor would pay in a negotiated transaction (based on comparable industry deals); management teams that have a track record of excellent operating expertise and skill in capital allocation; material production growth profiles over the next two or three years regardless of short-term oil and gas prices; significant above-market hedges protecting near-term cash flows; an unprecedented collapse in energy industry capital spending over the last three years; and the lowest level of new oil discoveries in nearly seventy years.

Nearly forty years ago, energy accounted for 25% of the value of the S&P 500. Today, energy appears to be less than 6% of the index and deeply undervalued relative to other sectors, despite continuing to occupy a large and critical economic role. Merger activity and insider buying has picked up in recent months as informed industry insiders see value even as energy headlines are relentlessly negative. In brief and irrespective of short-term market behavior, we believe the intrinsic values of both WPX and Birchcliff are more than double their current respective share prices (and potentially higher should a supply crunch develop) while the broader indexes seem richly valued by common historic metrics.2

__________

1 | In addition to multiple executive open-market buys at WPX Energy and Birchcliff Energy, well-known Birchliff anchor investor Seymour Schulich bought an additional five million shares of Birchcliff in recent months at prices well above recent quotes. Across the industry, there have been recent and widespread insider buying in many other energy firms. |

| | |

2 | Although we do our own research and are skeptical of much of what we read, a June 2017 research report issued by Credit Suisse suggested that the net asset value of WPX could be as high as $43 per share, based primarily on an assessment of its Permian assets. |

GoodHaven Fund

Barrick Gold remains our largest investment (with a material unrealized gain on cost as we write). After a strong 2016, Barrick was roughly flat in the first half of the year, despite two unforced errors: a need to fix leaking pipes at one of its core mines (Veladero) which had caused Argentinian regulators to temporarily halt production (now resumed) and a setback in Tanzania where the government put severe restrictions on two of the three properties in Tanzania owned by Acacia Mining (a Barrick spin-off formerly known as African Barrick.) While Barrick Gold owns approximately 64% of Acacia, it does not control that business and it receives negligible cash flow from it. Nevertheless, it remains part of the company’s guidance for forecasting production and costs, as well as reserves. Negotiating with national sovereign partners is part of any mining company’s operations and we believe Barrick and its Chairman understand this process and its importance and will be able to guide Acacia to some sort of rational solution.

On the positive side, Barrick recently closed its deal to sell half of the Veladero property to strategic partner Shandong Gold Mining of China for nearly $1 billion, most of which will be used to further reduce debt. With the highest grade and most extensive reserves in the industry, Barrick has been successfully executing on the strategy overseen by Chairman John Thornton to repair and create a strong balance sheet, allocate capital to benefit shareholders, and transform the company’s operations into the most technically advanced and efficient in the industry. At current prices, and on a steady-state basis, we believe Barrick generates close to $2 per share in pre-tax cash flow – a level suggesting significant undervaluation absent large commodity price declines. After a period of retrenchment, debt reduction, and management changes, we think the company is now positioned to play offense as well as defense.

While we recognize that operating leverage creates significant optionality in any gold miner, we note that gold supplies have barely increased in recent years compared to central bank assets, which have risen by nearly $20 trillion. Moreover, the industry as whole has poorly correlated to the S&P 500 Index, remains out of favor with most investors, and sells for a fraction of its value five years ago. Insiders have noticed: unlike the market as a whole, there has been insider buying among gold mining executives across the industry. In addition to a $4 million purchase by Chairman Thornton of Barrick at a price of $19 per share in March (well above recent market value), insiders at Kirkland Lake, Alamos Gold, Detour Gold, Goldcorp, Yamana, and Pretium Resources have all bought shares in recent months.

Earlier in the year, we established two new investments in companies operating in less than “exuberant” industries: American Airlines and Builders FirstSource. Combined, they account for about four percent of our current portfolio and are modestly profitable thus far. Over the last decade, several large airline mergers materially reduced competition. Carriers rationalized routes and adjusted schedules, raising load factors dramatically (planes that were roughly 60% full ten years ago are roughly 80% full today). The large carriers have also established lucrative affinity

GoodHaven Fund

credit card relationships.3 While we had looked at some of these companies closely over a year ago or so, we focused more intently on these changes after Berkshire Hathaway took several large investment stakes across the airline industry.4

American is leveraged, but has good liquidity, with about $6 billion in cash. About half of the company’s $25 billion debt is recourse to the company while the other half represents non-recourse equipment and aircraft financings for one of the youngest (and most valuable) fleets in the air. The CEO, Doug Parker, is paid entirely in common shares – a strong vote of confidence that he himself has admitted would have been a terrible strategy prior to what he believes is a sea-change in industry behavior. In addition, the company has repurchased nearly 30% of the shares outstanding in recent years, with the average repurchase price near our per share cost.

While the airline business is still subject to cyclical swings, we believe the cycle lows will be well above those of the past. The industry is behaving rationally, the affinity card business reduces the volatility of earnings, and the current valuation – less than 9 times expected 2017 earnings – should cushion the risk. On the upside, share repurchases continue to accrete value when accomplished at low multiples. If we are correct, the market should begin to award a higher valuation to increasing earnings across the industry as these changes become more widely recognized.

Builders FirstSource is a company that acts as a wholesaler/distributor to commercial accounts in the homebuilding business. After a significant merger, the company is rapidly realizing efficiencies and benefitting from reduced competition. We paid about eight times our estimate of steady-state free cash flow, which assumes modest improvements in single family home construction. Near term, we expect free cash flow to be used to reduce existing leverage resulting from the merger.

The recent annual run rate of housing starts approximates 800,000 – up from less than 500,000 at the bottom of the crisis, but far below the 1,100,000 or so average that prevailed for decades before the real-estate crash of 2008 began (unadjusted for population growth). Given an increased population, additional household formation, low mortgage rates, and tight inventories of existing homes, we expect slow but continued improvement in new construction. While a rapid increase in interest rates would probably cause a slowdown, a moderate rise is unlikely to dramatically affect current levels of activity.

__________

3 | The business of selling miles to card companies is not well understood. While not broken out in detail, we believe more than 30% of American’s pre-tax earnings in the last year may have come from its credit relationships. |

| | |

4 | Berkshire Hathaway’s investment in most of the major carriers in 2016 may turn out to have a beneficial effect on competition. Over many years, one of the common refrains heard from CEOs of companies in which Berkshire has invested is a profound desire not to disappoint Berkshire by making foolish business decisions. |

GoodHaven Fund

From late March to the end of June, Systemax more than doubled in price. Although not a large position, we profited in this investment by identifying a series of investment factors that were not obvious. The company is family controlled with a strong balance sheet (significant net cash per share and virtually no debt). However, it had two businesses: one losing significant money and one profitable and growing. Unfortunately and for some time, the stock price was depressed as the money-losing business overshadowed the profitable business. The company had significant value well above market; it was just not evident in the stock quote for an extended period.

Around the end of the first calendar quarter, the company was able to sell the bulk of the money-losing business without incurring additional liability or support payments. The market quickly recognized what we had already figured out - that the remaining company was generating earnings at a run-rate of close to $40 million before taxes and usual items with over $140 million in cash and no debt and that these characteristics were worth far more than the $300 million value the market had previously assigned. Given that earnings are expected to grow, today’s market value of $700 million does not seem excessive. (We also note that a buyer of the business could probably save more than $20 million in additional expenses from large shareholder compensation, public company expenses, and other outlays.) We remain as owners, believing there are several qualitative factors suggesting that the “cleaned-up” business may become an acquisition target. Our current size allows us the flexibility to find opportunities in smaller capitalization situations in addition to larger companies. We intend to continue to try and exploit this advantage to benefit us all.

At the end of June, Staples, a roughly 2% holding with a profitable, but slowly shrinking business and a good balance sheet, received a definitive proposal to be acquired by a leveraged buyout firm. We are disappointed in the price, which we believe undervalues the $10 billion revenue core business, one of the largest on-line retailers in the United States with next day delivery to 97% of the country. In particular, the company appears to be approaching an inflection point where the decline in its retail business slows and is more than offset by modest growth in its core online/delivery business.

In many ways, the deal looks like the highly profitable going-private deal for Dell Computer a few years ago that also occurred at a time of great pessimism about an industry (then, personal computers, now retailing). If the Staples deal goes through at its current price, we will have earned a modest (but inadequate) total return over our holding period. As other large investors have also expressed disappointment, there is a small possibility that a higher bid surfaces. We may add to our position or sell out entirely, depending on developments.

This year, we have also cut back some investments that performed well in recent years and exited some others that did not – contributing to a large cash position that has affected relative results this year when compared to rapidly rising (and more

GoodHaven Fund

expensively valued) broad equity indexes (we estimate the drag to be roughly 2-3% during the calendar year to date). While we consider the current cash level to be temporarily high, our fund is not mandated to be fully invested and this characteristic should have the potential to help future returns when stress appears.5 However, cash feels especially painful when short-term, low-risk investments yield almost nothing and index prices appear to be in a permanent uptrend. Nevertheless, it makes no sense to assume outsized risks for a low incremental return. Ian Cumming, former Chairman of Leucadia National, used to call that strategy “picking up pennies in front of a steamroller – highly dangerous and not very profitable.” It makes more sense to exercise patience, wait for a higher prospective return with lower estimated risk, and employ liquidity under stress as we have in the past.

While patient with liquidity, we have also redoubled our efforts to find some one-off and non-index correlated investments where we can earn respectable returns commensurate with avoiding large risk. For example, we recently bought a short-dated and infrequently traded bond of Homefed Corporation (70% owned by Leucadia National Corporation) yielding about 6% to its maturity about a year from now, where we know the company well, the risk of default appears extremely low, and returns are far above those of cash.

We also initiated and subsequently added to a stake in New York REIT, a real-estate investment trust currently executing a plan of liquidation. After an activist got control of the company by advocating a liquidation, and prior to our investment, new management put forth its estimate of liquidating value which was sharply lower than many had assumed. The market was deeply disappointed, and the share price sold off to the point where our research suggested the price was an attractive discount to a reasonably conservative estimate of value. The company expects to fully liquidate its assets by early-to-mid 2018, offering a decent prospective return with what our research suggests is a significant “margin of safety.” We continue to look for more short-dated investments offering largely market-independent returns.

As mentioned in our prior letter, there were several positions where we noted changes might occur. In the first calendar half of the year, we reduced investments in Alphabet, Inc. and White Mountains Insurance Group and exited entirely positions in Hewlett Packard Enterprise (“HPE”), Sears Holdings, Seritage Growth Properties, and Walter Investment Management.

Although Alphabet remains our third largest investment at market value, we sold down the position as its market value climbed and the company became a larger percentage of our portfolio. Since we first bought shares in 2011, we have sold

__________

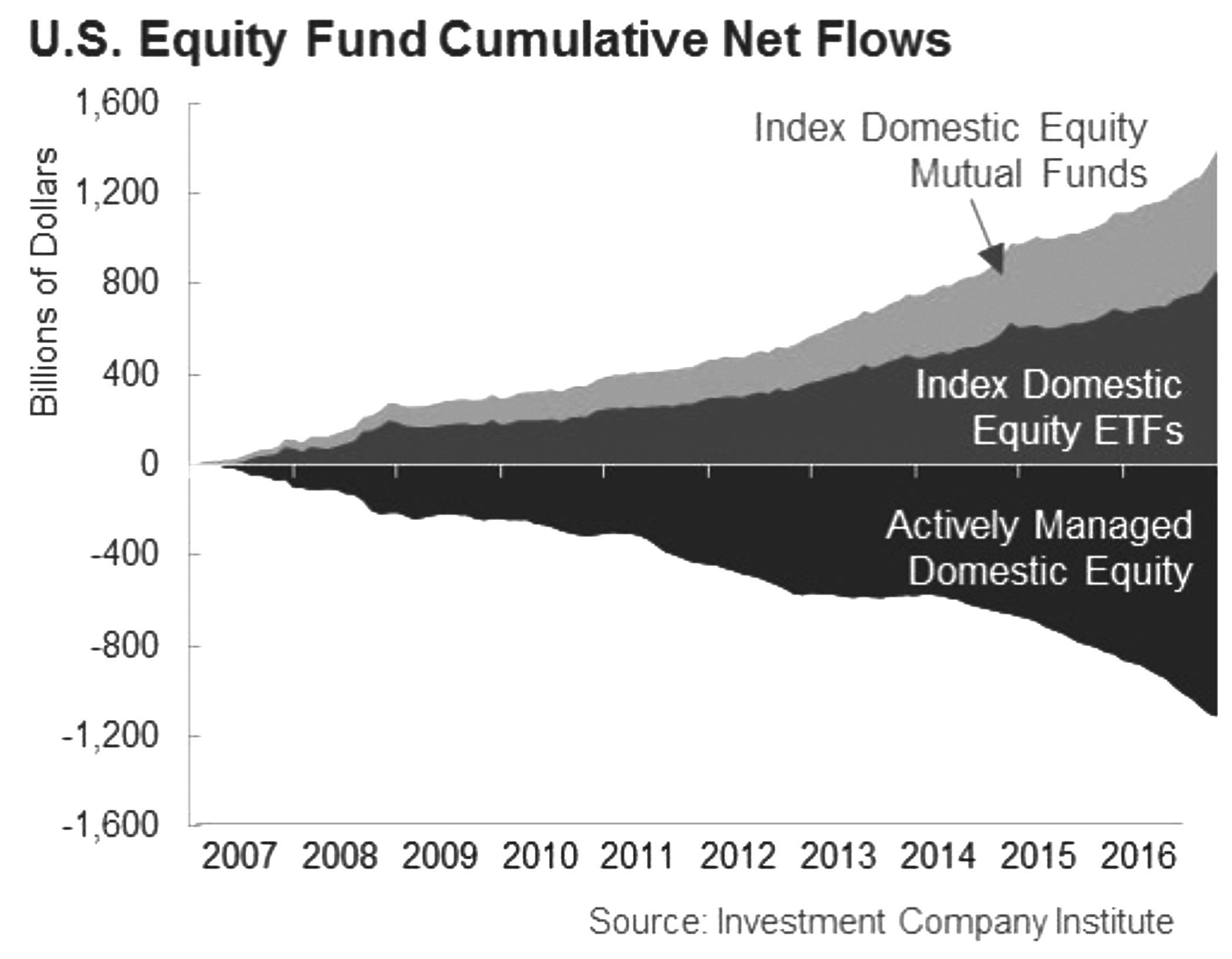

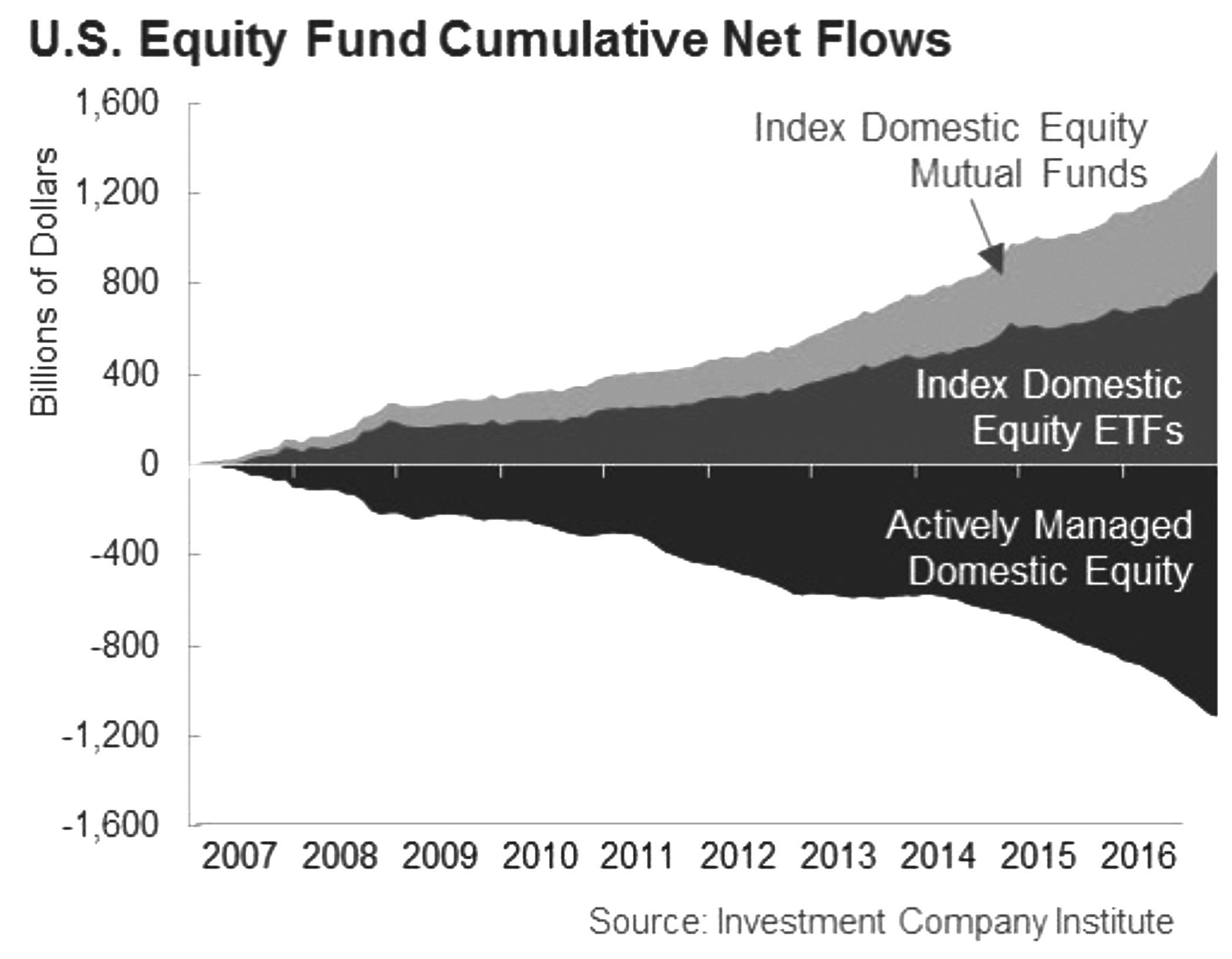

5 | Bob Rodriguez, formerly the admired (and now retired) manager of the FPA Funds, recently warned that huge money flows in recent years away from active managers, who usually have a cash cushion to meet redemptions, and into index funds and ETFs, which typically have no cash at all, may lead to an abrupt bout of rapid selling should index investors be spooked by some exigent event. |

GoodHaven Fund

enough to recoup roughly 45% of our original cost, which is now about $250 to $275 per remaining share (depending on the share class) compared to a recent quote of $950 per share or more. Although no longer dirt cheap, we continue to believe that Alphabet is one of the more reasonably valued large cap tech companies, given its balance sheet (over $100 per share in cash with little debt), significant and understated cash generation, growth profile, and optionality. It is, however, also well represented in every index fund in existence and we may reduce it further.

We also cut our White Mountains investment in half at a price of about $930, well above adjusted book value per share, following the sale or liquidation of a sizeable percentage of assets as well as a change in senior management. While we retain a roughly 2% position, much of the future value of this highly liquid business will depend on the capital allocation skills of new management. For now, we are content to patiently watch with a reduced investment in a highly liquid company with a history of shareholder friendly behavior. The company has enormous flexibility in buying back shares, paying dividends, or acquiring new businesses. White Mountains has been a successful investment that we first purchased for about $370 per share in 2011.

Our overall investment in Hewlett-Packard (which split last year into Hewlett Packard Enterprise and HP Inc.) has been rewarding, with the pieces (including those spun out and/or sold) worth about two and one half times our average purchase price. In the case of HPE, we believed the shares were approaching fair value at a time that risk was increasing, notably in the divisions selling servers and storage. For now, we retain our interest in HP Inc., a seller of personal computers and printers, which trades at a modest 12 times estimated earnings, yields about 3%, and is repurchasing shares out of cash flow rather than by increasing its leverage.

After its share price spiked higher in early 2017 (following a long period of decline), we sold our small Sears position at a loss. Never a large investment, we treated Sears as an option on the ability of the company and its management to monetize large net asset values. To date, the rapid decline in unprofitable retail operations has offset any benefit of sold real estate or distributed assets. At a modest profit, we also sold our stake in Seritage, the related real-estate investment trust, where we believed the price had moved closer to fair value despite increased risks associated with faster store closings by Sears and the need to increase its capital spending faster than expected.

Prior to the end of the second calendar quarter, we completely exited our remaining investment in Walter Investment Management. We made this decision after a weak Q1 earnings report under new management led us to conclude that a debt restructuring seemed inevitable. While the position was not large at calendar year-end, it still affected calendar 2017 year-to-date performance in a modestly negative way, and crystallized a material tax loss from cost. While no investment manager is immune from mistakes, this was a material unforced error that cost us far too much time, effort, and money.

GoodHaven Fund

Even with decades of experience, it is important to dissect failures in order to improve process and results. We did not size the Walter position properly, did not correctly evaluate changes to the business model forced by new regulations, and did not dig deep enough to understand certain unfavorable capital allocation moves by prior management. Given our backgrounds, we should have reacted much sooner. We have carefully examined and noted our errors here and have amended our process to avoid any similar misjudgments.

The juggernaut of passive investing and ETFs continues to inflate indexes as investors pour into these vehicles regardless of price. After setting records for inflows in 2015 and 2016, index fund leader Vanguard has set a new record so far this year. Vanguard passive funds held a 5% ownership position in only three S&P 500 companies in 2005. That number is now four hundred and ninety-one – and Vanguard is only one of a few enormous index and ETF fund sponsors. We continue to think that the rush into passive investing is showing signs of mania. Indexes have been propelled higher by extraordinarily low rates and speculative trading in companies whose businesses have rapidly grown revenues without commensurate profit growth, but which are valued at levels that suggest the potential for significant capital loss.

Clearly, quantitative easing and central bank asset purchases have also helped to inflate both bond and stock prices. Who would have imagined that nearly a decade after a crisis, aggregate central bank balance sheets would still be expanding? The European Central Bank owns huge chunks of sovereign debt, has purchased roughly 14% of all European corporate debt, and continues to add assets. The Swiss National Bank has been a large recent buyer of equities and owns $80 billion of U.S. equities and is one of the largest shareholders of Apple Computer. At the end of May 2017, the Bank of Japan, which continues to add assets held a total of 500.8 trillion yen in assets (about US$ 4.4 trillion), of which Japanese government securities accounted for 427.2 trillion yen (about US$ 3.8 trillion). The balance appears to represent equity securities and according to estimates compiled by Bloomberg, the Japanese

GoodHaven Fund

Central Bank is a top 10 owner in about 90% of Japanese stocks through its purchases of ETFs. Taken to a logical extreme, either these activities must start to taper off, or there will be no real markets left in short order.

For those who doubt the impact of quantitative easing and indexation, look at the MSCI World Index, which in the five years ended 2016 was up 87% according to an article in Barron’s earlier this year. Of that 87%, 74 percentage points were from the expansion of P/E multiples. Dividends were up about 15%, but actual earnings declined roughly 2%, meaning that almost all of the return came from revaluation upwards of businesses that had not improved much at all. In the last four years, a similar dynamic appears in the S&P 500, where earnings have appreciated at a low single digit rate while market prices have risen five times faster. That rate is mathematically unsustainable, as anyone with a basic knowledge of compound returns easily understands.

Although we believe our recent performance can be specifically attributed primarily to weak energy securities, other “value investors” have also suffered this year – so much so that Goldman Sachs recently issued a commentary titled the “Death of Value Investing,” which recalls the famous (at least to old investors) 1974 Business Week cover proclaiming the “Death of Equities” only weeks before a major cyclical low in the stock market. The Goldman commentary reflects a sense today that value investing is in crisis, that the discipline no longer works, and that the only sensible path for investors is to stop fighting the trend and join the masses flocking

GoodHaven Fund

to index funds and ETFs.6 We suggest that such refrains tend to be loudest near significant turning points – something we saw quite obviously in 2000 as the tech bubble collapsed, although the peak was only visible with hindsight.

In today’s world, we are confident we own an aggregate portfolio trading at a sizeable discount to intrinsic value with a significant reserve of cash and equivalents as part of the portfolio compared to indexes that appear historically expensive and which have virtually no cash by design. As has happened previously, the initial shift back towards value is likely to happen unnoticed and only become obvious after the crowd has lost significant net worth. Standing apart today is emotionally difficult yet critical. Our biggest investments are in areas that are not overly popular or highly valued. We have the firepower to behave opportunistically, and the patience not to get sucked into doing something outside our circle of competence.

Rarely have we seen as large a disconnect between value and performance as we have in the last few months, as cheap seemed to get cheaper while expensive continued to rise. The positive business progress we see in the portfolio overall combined with lower aggregate market value of our holdings suggests that our portfolio is more undervalued than it’s been (a subject we intend to expand upon in our year-end letter). We have behaved accordingly, and both of us have added to our personal Fund holdings during the period. Further, we are pleased to note that our minority partner, Markel Corporation, recently made a significant investment in the Fund for its own account. We are grateful for all our fellow shareholders who see the same opportunity we do.

There is an old saying on Wall Street equating the markets with the weather on Mt. Washington in New Hampshire (the windiest place in the U.S.). If you don’t like the weather, wait fifteen minutes – and it will change dramatically. We believe we are close to an inflection point where the weather seems about to change in a beneficial way. If we are correct, a shift in investor preference could favor our approach and offer a jolt to those who have been throwing money at securities and funds with little or no attempt at analysis, and little or no concern for capital preservation.

Sincerely,

| | |

|  |

| | |

| Larry Pitkowsky | Keith Trauner |

__________

6 | Every bad idea on Wall Street typically starts as a good idea. For many, there is nothing inherently wrong with indexation, provided that the market is inexpensive or moderately valued. To paraphrase Warren Buffett, “even the best business in the world will be a poor investment at too high a price”. Index funds ignore valuation, buying when money flows in and selling when it leaves. With many index valuation measures at or close to all-time highs, investors are trying to buy what has been working but at a much higher price than what we feel is sensible. |

GoodHaven Fund

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. The Fund invests in midcap and smaller capitalization companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may invest in foreign securities which involve political, economic and currency risks, greater volatility and differences in accounting methods. These risks are enhanced in emerging markets. The Fund may invest in REITs, which are subject to additional risks associated with direct ownership of real property including decline in value, economic conditions, operating expenses, and property taxes. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower-rated, non-rated and distressed securities present a greater risk of loss to principal and interest than higher-rated securities.

The opinions expressed are those of Larry Pitkowsky and/or Keith Trauner through the end of the period for this report, are subject to change, and are not intended to be a forecast of future events, a guarantee of future results, nor investment advice. This material may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to the Fund, market or regulatory developments. The views expressed herein are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein. The views expressed herein are subject to change at any time based upon economic, market, or other conditions and GoodHaven undertakes no obligation to update the views expressed herein. While we have gathered this information from sources believed to be reliable, GoodHaven cannot guarantee the accuracy of the information provided. Any discussions of specific securities or sectors should not be considered a recommendation to buy or sell those securities. The views expressed herein (including any forward-looking statement) may not be relied upon as investment advice or as an indication of the Fund’s trading intent. Information included herein is not an indication of the Fund’s future portfolio composition.

Must be preceded or accompanied by a prospectus. It is not possible to invest directly in an index.

Cash flow is generally defined as the cash a company generates from its business operations, before capital or securities investments.

Free cash flow is generally defined as cash revenues less all normal operating expenses (including interest expense) and less an estimate of the capital spending necessary to maintain the business in its current state.

Book Value represents the accounting value remaining after a corporation’s liabilities are subtracted from its assets.

Intrinsic value is defined as the value that a rational and well-informed buyer would pay for the entire enterprise.

Tangible Book Value represents the accounting value remaining after a corporation’s liabilities are subtracted from its assets (but excluding the value of any intangible assets, such as goodwill).

Price-to-earnings ratio is a valuation ratio of a company’s current share price compared to its per-share earnings.

SNB is the Swiss National Bank.

BOE is the Bank of England.

BOJ is the Bank of Japan.

PBOC is the People’s Bank of China.

ECB is the European Central Bank.

FED is the Federal Reserve System.

GoodHaven Fund

The MSCI World Index is a broad global equity benchmark that represents large and mid-cap equity performance across 23 developed markets countries.

The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

The Wilshire 5000 Total Market Index (full-cap) measures the performance of all U.S. equity securities with readily available price data. Over 5,000 capitalization weighted security returns are used to adjust the index.

HFRI Fundamental Growth Index strategies employ analytical techniques in which the investment thesis is predicated on assessment of the valuation characteristics on the underlying companies which are expected to have prospects for earnings growth and capital appreciation exceeding those of the broader equity market. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Strategies employ investment processes designed to identify attractive opportunities in securities of companies which are experiencing or expected to experience abnormally high levels of growth compared with relevant benchmarks growth in earnings, profitability, sales or market share.

HFRI Fundamental Value Index strategies employ investment processes designed to identify attractive opportunities in securities of companies which trade a valuation metrics by which the manager determines them to be inexpensive and undervalued when compared with relevant benchmarks. Investment theses are focused on characteristics of the firm’s financial statements in both an absolute sense and relative to other similar securities and more broadly, market indicators. Relative to Fundamental Growth strategies, in which earnings growth and capital appreciation is expected as a function of expanding market share & revenue increases, Fundamental Value strategies typically focus on equities which currently generate high cash flow, but trade at discounted valuation multiples, possibly as a result of limited anticipated growth prospects or generally out of favor conditions, which may be specific to sector or specific holding.

CS Hedge Fund Index is an asset-weighted hedge fund index derived from the TASS database of more than 5000 funds. The index consists of funds with a minimum of US $10 million under management and a current audited financial statement. Funds are separated into primary subcategories based on investment style. The index in all cases represents at least 85% of the assets under management in the universe. The index is rebalanced monthly, and funds are reselected on a quarterly basis. Index NAVs are updated on the 15th of each month.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) |

The Net Asset Value (“NAV”) of the GoodHaven Fund was $22.55 at May 31, 2017 based on 10,418,911 shares outstanding. This compares to the Fund’s NAV of $21.63 at May 31, 2016, an NAV of $23.37 at November 30, 2016, and an NAV of $20.00 at inception on April 8, 2011. Although the Fund did not pay a taxable distribution of capital gains or income in 2016, shareholders should be aware that the Fund has paid capital gains and income distributions in prior years that reduced NAV by the amount of a distribution on the ex-dividend date. Please note that except where otherwise indicated, discussions in this MD&A relate to the period ended May 31, 2017. For the calendar six months ended June 30, 2017, the Fund’s performance was a loss of 4.00% compared to a gain of 9.34% for the S&P 500 Index and for six-months ended May 31, 2017 was a loss of 3.51% compared to a gain of 10.80% for the S&P 500 Index. Since inception on April 8, 2011 and through May 31, 2017, the Fund’s annualized performance is a gain of 3.68% compared to an increase of 12.56% for the S&P 500 Index. The Fund gained 3.01% annualized for the five year period ending May 31, 2017 compared to 15.40% for the S&P 500 Index. Please see the portfolio manager’s letter to shareholders for additional information regarding performance and comparisons to other indexes. All comparisons assume reinvested dividends.

After a strong calendar 2016 and a modestly positive first calendar quarter in 2017, the Fund’s performance lagged materially in the second calendar quarter of 2017, primarily due to a sharp decline in energy holdings in May and June. Please refer to the discussion in the Letter to Shareholders from the Fund’s portfolio managers for more details. The external environment continues to be challenging for active managers as enormous industry reallocations away from actively managed mutual funds and into passively managed index funds (including ETFs) have continued – in the short run reinforcing the performance of the largest members of the S&P 500 (as the index is capitalization-weighted) or certain other indexes. We note that many valuation indicators for the S&P appear highly elevated and have been associated with poor forward returns in the past when viewed over a ten-year timeframe. We continue to believe the industry may be approaching an inflection point (at least in the intermediate term) where that trend will slow or perhaps reverse. As with almost all trends on Wall Street, we suspect the intense desire for index products is rearward looking, has gone too far, and may lead to significant investor losses in index funds and certain ETFs in coming years.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

The portfolio managers believe that short-term performance figures are less meaningful than a comparison of longer periods and that a long-term investment strategy should be properly judged over a period of years rather than weeks or months. Furthermore, the S&P 500 Index is an unmanaged index incurring no fees, expenses, or taxes and is shown solely for the purpose of comparing the Fund’s portfolio to an unmanaged and diversified index of large companies. Below is a table of the Fund’s top ten holdings and categories as of May 31, 2017.1

Top 10 Holdings* | | | % | | Top Categories** | | | % |

| Barrick Gold Corp. | | | 10.9 | % | | Cash and Equivalents | | | 28.9 | % |

| WPX Energy, Inc. | | | 9.3 | % | | Oil & Gas Exploration | | | | |

| Alphabet, Inc. *** | | | 6.1 | % | | & Production | | | 13.1 | % |

| Leucadia National Corp. | | | 5.0 | % | | Metals & Mining | | | 10.9 | % |

| Spectrum Brands | | | | | | Diversified Holding | | | | |

| Holdings, Inc. | | | 4.0 | % | | Companies | | | 8.3 | % |

| HP, Inc. | | | 4.0 | % | | Computers & Peripheral | | | | |

| Birchcliff Energy Ltd. | | | 3.7 | % | | Equipment | | | 6.3 | % |

| Federated Investors, Inc. – | | | | | | Computer & Internet Software | | | 6.1 | % |

| Class B | | | 3.3 | % | | Property/Casualty Insurance | | | 4.5 | % |

| Verizon Communications, Inc. | | | 3.2 | % | | Consumer Products | | | 4.0 | % |

| Berkshire Hathaway, Inc. – | | | | | | Financial Services | | | 3.3 | % |

| Class B | | | 2.8 | % | | Telecommunications | | | 3.2 | % |

| Total | | | 52.3 | % | | | | | 88.6 | % |

| * | | Top ten holdings excludes cash, money market funds and Government and Agency Obligations |

| ** | | Where applicable, includes money market funds and short-term Government and Agency Obligations |

| *** | | Issuer totals |

1 | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. |

Although the Fund experienced strong performance in 2016, asset flows continue to be negative. We believe that most of the actively managed fund industry has continued to experience significant negative outflows in early 2017, primarily benefitting passive index funds and ETFs. In order to see significant net inflows resume into the Fund, management believes that the Fund must experience an extended period of better performance or investors must decide to rethink the desirability of pouring money into passive vehicles at near record levels of historic valuation.

Nevertheless, since inception of the Fund, there have been periods where there were large new shareholder subscriptions and periods with significant net withdrawals. We believe this is primarily caused by shareholders who are attracted by the potential for better performance in a concentrated value fund but which are negatively and emotionally affected by volatility in results – resulting in short-term behavior that tends to reduce returns among mutual fund investors. It may be interesting to note that neither of the portfolio managers of the Fund, whose shareholdings total in the millions of dollars, has ever sold shares of the Fund.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

Material swings in shareholder subscriptions and redemptions can make management of the portfolio more difficult. During the most recent fiscal year, the portfolio managers were able to undertake actions to avoid creating taxable gains during 2016 without materially affecting portfolio values. As of the writing of this management discussion and while subject to change based on future portfolio decisions, we currently believe we will incur no taxable dividends in 2017. Prior to year-end, management will provide an estimate of any expected distributions as it has in prior years. The Fund’s investments are stated as of May 31, 2017, and the amounts and rankings of the Fund’s holdings today may vary significantly from the data disclosed above and the managers may have taken actions that would result in material changes to the portfolio.

The Fund’s investments having the most positive impact on portfolio performance for the annual period ended May 31, 2017 were Systemax, Alphabet, Inc., Barrick Gold Corp., Leucadia National Corp., HP Inc., and White Mountains Insurance Group. Systemax more than doubled in price as it was able to exit its money losing technology division, leaving its profitable industrial supplies business more visible. Alphabet climbed in response to strong earnings and a strong environment for technology shares, Barrick rose as gold prices strengthened through much of the period and operations continued to improve, Leucadia and HP Inc. both rose in response to stronger than expected earnings results and forward prospects, and White Mountains increased after it agreed to sell additional assets.

The Fund’s investments having the most negative impact on the portfolio for the annual period ended May 31, 2017 were WPX Energy, Walter Investment Management, Birchcliff Energy, Dundee Corporation, and Verizon Communications. Despite significant hedges and strong production growth profiles, WPX and Birchcliff both fell sharply in response to lower energy prices, Walter declined (primarily in the calendar year ended 2016) in response to weaker financial results than expected and we completely exited the position by the end of the second calendar quarter of 2017, Dundee fell in response to lower expectations for its energy and real estate investments as well as a weaker Canadian dollar and Verizon fell as competitors became promotional in the wireless phone business.

During the six-month calendar period ended June 30, 2017, the Fund initiated investments in American Airlines, Builders FirstSource, and New York REIT and disposed of its entire investments in Hewlett Packard Enterprise, Sears Holdings, Walter Investment Management, and Seritage Growth Properties. The Fund further materially reduced its investment in Alphabet and White Mountains. Some changes in other holdings may reflect adjustment relating to position sizing respective of fund flows and may not be reflective of a change in the thinking of the Fund’s portfolio managers regarding specific investments.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

The managers of the Fund do not believe that a decline in a security price necessarily means that the security is a less attractive investment. The opposite may be the case in that price declines may represent significant investment opportunities. During the first six months of the year, the largest single factors affecting performance was a significant decline in energy prices and related companies, which we believe negatively affected performance by 7-8% of average capital. We note that our two largest energy holdings both have significant above-market hedges, as well as strong production growth profiles and management teams with a history of execution. But for now, these factors are being ignored amid inventories of oil that are perceived as too high. The Fund also owns a number of businesses with exposure to economies outside the United States. Generally we do not try to hedge such exposures, but note that changes in the value of non-U.S. currencies against the U.S. dollar can impact earnings, both positively and negatively in any give reporting period. The portfolio managers generally do not try to predict macroeconomic or market swings and prefer instead to try to react to what happens.

The Fund’s turnover rate, a measure of how frequently assets within a fund are bought and sold by the managers, remains at reasonably low levels and is consistent with the strategies, generally long-term in nature, of GoodHaven Capital Management, the Fund’s investment advisor. Turnover rates continue to be modestly influenced by the need to meet shareholder redemptions rather than a change in the portfolio strategy of the Fund. Based on public statistics with respect to most funds, turnover remains low. Importantly, there may be times when turnover rates rise, however, we do not anticipate rapid turnover of the portfolio under normal circumstances.

The portfolio managers believe that a significant liquidity position is an important part of portfolio management. After certain security sales in the first half of 2017 that exceeded the amount of new purchases, the Fund’s liquidity position is significant. We expect to be able, as we have in the past, to invest opportunistically given the cyclical nature of the stock market. Importantly, we note that many funds, notably index funds and ETFs, typically have little or no cash, and thus no cushion to meet redemptions or to behave opportunistically with respect to new purchases. Should money flow out of funds with de minimus cash reserves, they will be forced to sell securities, even potentially into a declining market.

Since inception, the Fund has continued to have significant liquidity available both in cash holdings as well as short-term fixed income investments. In order to ensure that we have sufficient resources to behave opportunistically, the Fund has sold or reduced certain investments and may hold some modest hedges from time to time. There is no guarantee that such hedges will protect against loss and the Fund may lose money should volatility be reduced in future months. In the last year, the Fund experienced modest losses as a result of hedge transactions. Over time, we expect the Fund’s level of cash to vary significantly and could be higher or lower than shown on the most recent Schedule of Investments.

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

As of the end of the fiscal year, the Fund is operating with a significant position in cash and equivalent investments. This position reflects high average equity valuations, the opportunity set we see, and other factors. Additionally, the continued rise in general stock prices has made bargains more difficult to find and slowed reinvestment, with some measures of valuation bumping up against historic highs. Thirdly, for a variety of factors, we believe that having a cash cushion at a time of generally elevated prices and investor ebullience is a strategic advantage. Although not obvious in results, cash has allowed us to meet redemptions in an efficient manner while mostly avoiding forced liquidation of investments.

It is our intention to invest a significant portion of current liquidity in an opportunistic manner when bargains meeting our investment criteria appear. However, it is possible that the Fund may have a significant cash position for an extended period of time if, in the opinion of the portfolio managers, market conditions are unfavorable. At times when liquidity is high, the Fund may underperform a strongly rising stock market. We believe this factor impacted the Fund’s relative performance in the first half of 2017.

Over time, management believes that there has been a significant negative effect on Fund performance from the impact of very large cash inflows via new subscriptions and very large cash outflows via shareholder redemptions (withdrawals) particularly during a time of strong index performance. We note that although the Fund had significant liquidity during the period from Inception in April 2011 through May of 2014 (including a sizeable amount related to a large cash influx due to new Fund share subscriptions), performance was still reasonable by relative and absolute standards over that time frame, though we believe large inflows reduced returns during a period when indexes performed strongly, such as in 2013. In the last calendar year, the Fund significantly outperformed most equity indexes, despite having significant liquidity during a period when indexes significantly appreciated. However, we believe extraordinary cash withdrawals negatively affected performance in 2014 and 2015 (and in 2016 on a relative basis). The portfolio managers’ letter to shareholders contains additional discussion about performance.

Generally, we do not expect significant realized capital gain or loss from any particular short-term, non-U.S. investments when viewed over an extended period. However, we own or have owned a number of equity investments domiciled outside of the U.S. or with significant non-U.S. revenues. A strong dollar typically results in currency translation losses and may serve to reduce reported earnings of companies with significant non-U.S. revenues when reported in dollar terms. Such reduced earnings could negatively affect those companies’ market prices, although we would expect such negative effects to be primarily a short-term phenomenon.

To reiterate our view on liquidity, the portfolio managers believe that a certain amount of liquidity may benefit shareholders in several ways – by preventing liquidation of securities to meet modest levels of redemptions, by providing

GoodHaven Fund

PORTFOLIO MANAGEMENT DISCUSSION AND ANALYSIS (Unaudited) (Continued) |

ammunition to purchase existing or new holdings in declining markets without being forced to sell existing holdings, and by lessening the chance that shareholders will blindly seek liquidations during periods of market stress that could adversely impact the Fund. That said, if bargains meeting our criteria seem plentiful, we are likely to have significantly less liquidity under such conditions than has been the case since inception.

The Fund is subject to certain risks as disclosed in the Prospectus and Statement of Additional Information, both of which may be obtained from the Fund’s website at www.goodhavenfunds.com or by calling 1-855-654-6639. Some of these risks include, but are not limited to, adverse market conditions that negatively affect the price of securities owned by the Fund, a high level of cash, which may result in underperformance during periods of robust price appreciation, adverse movements in foreign currency relationships as a number of the Fund’s holdings have earnings resulting from operations outside the United States, and the fact that the Fund is non-diversified, meaning that its holdings are more concentrated than a diversified Fund and that adverse price movements in a particular security may affect the Fund’s Net Asset Value more negatively than would occur in a more diversified fund.

As of May 31, 2017, the members, officers, and employees of GoodHaven Capital Management, LLC, the investment advisor to the GoodHaven Fund, owned approximately 259,941 shares of the Fund. The portfolio managers added to personal holdings during the fiscal year. It is management’s intention to disclose such holdings (in the aggregate) in this section of the Fund’s Annual and Semi-Annual reports on an ongoing basis.

GoodHaven Fund

SECTOR ALLOCATION at May 31, 2017 (Unaudited) |

| Sector | | % of Net Assets |

| | | | |

Cash & Equivalents1 | | | 28.9 | % |

| Oil & Gas Exploration & Production | | | 13.1 | % |

| Metals & Mining | | | 10.9 | % |

| Diversified Holding Companies | | | 8.3 | % |

| Computers & Peripheral Equipment | | | 6.3 | % |

| Computer & Internet Software | | | 6.1 | % |

| Property/Casualty Insurance | | | 4.5 | % |

| Consumer Products | | | 4.0 | % |

| Financial Services | | | 3.3 | % |

| Telecommunications | | | 3.2 | % |

| Air Transportation | | | 2.5 | % |

| Marine Services & Equipment | | | 2.3 | % |

| Guernsey Investment Fund | | | 2.2 | % |

| Retailing | | | 2.0 | % |

| General Building Materials | | | 1.2 | % |

| Real Estate Investment Trusts | | | 0.5 | % |

| Property Management | | | 0.4 | % |

| Loan Servicing | | | 0.2 | % |

| Miscellaneous | | | 0.1 | % |

| Total | | | 100.0 | % |

| | 1 | Represents cash and other assets in excess of liabilities. |

GoodHaven Fund

SCHEDULE OF INVESTMENTS at May 31, 2017 (Unaudited) |

| Shares | | COMMON STOCKS – 67.9% | | Value | |

| | | | | | |

| | | Air Transportation – 2.5% | | | |

| | 120,000 | | American Airlines Group, Inc. | | $ | 5,809,200 | |

| | | | | | | | |

| | | | Computer & Internet Software – 6.1% | | | | |

| | 3,200 | | Alphabet, Inc. – Class A1 | | | 3,158,688 | |

| | 11,500 | | Alphabet, Inc. – Class C1 | | | 11,095,890 | |

| | | | | | | 14,254,578 | |

| | | | | | | | |

| | | | Computers & Peripheral Equipment – 6.3% | | | | |

| | 498,400 | | HP, Inc. | | | 9,349,984 | |

| | 343,742 | | Systemax, Inc.2 | | | 5,475,810 | |

| | | | | | | 14,825,794 | |

| | | | Consumer Products – 4.0% | | | | |

| | 70,000 | | Spectrum Brands Holdings, Inc. | | | 9,411,500 | |

| | | | | | | | |

| | | | Diversified Holding Companies – 8.3% | | | | |

| | 39,200 | | Berkshire Hathaway, Inc. – Class B1 | | | 6,478,976 | |

| | 631,220 | | Dundee Corp.1,2 | | | 1,439,210 | |

| | 477,512 | | Leucadia National Corp. | | | 11,646,518 | |

| | | | | | | 19,564,704 | |

| | | | | | | | |

| | | | Financial Services – 3.3% | | | | |

| | 290,300 | | Federated Investors, Inc. – Class B | | | 7,710,368 | |

| | | | | | | | |

| | | | General Building Materials – 1.2% | | | | |

| | 200,000 | | Builders FirstSource, Inc.1 | | | 2,732,000 | |

| | | | | | | | |

| | | | Loan Servicing – 0.2% | | | | |

| | 510,285 | | Walter Investment Management Corp.1,3 | | | 540,902 | |

| | | | | | | | |

| | | | Marine Services & Equipment – 2.3% | | | | |

| | 376,694 | | Stolt-Nielsen Ltd.2 | | | 5,461,401 | |

| | | | | | | | |

| | | | Metals & Mining – 10.9% | | | | |

| | 1,547,150 | | Barrick Gold Corp. | | | 25,589,861 | |

| | | | | | | | |

| | | | Oil & Gas Exploration & Production – 13.1% | | | | |

| | 1,868,100 | | Birchcliff Energy Ltd. | | | 8,795,290 | |

| | 2,028,055 | | WPX Energy, Inc.1 | | | 21,943,555 | |

| | | | | | | 30,738,845 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

SCHEDULE OF INVESTMENTS at May 31, 2017 (Unaudited) (Continued) |

| Shares | | COMMON STOCKS – 67.9% (Continued) | | Value | |

| | | | | | |

| | | Property/Casualty Insurance – 4.5% | | | |

| | 8,482 | | Alleghany Corp.1 | | $ | 4,981,818 | |

| | 6,532 | | White Mountains Insurance Group | | | 5,618,042 | |

| | | | | | | 10,599,860 | |

| | | | | | | | |

| | | | Retailing – 2.0% | | | | |

| | 525,000 | | Staples, Inc. | | | 4,767,000 | |

| | | | | | | | |

| | | | Telecommunications – 3.2% | | | | |

| | 160,000 | | Verizon Communications, Inc. | | | 7,462,400 | |

| | | | TOTAL COMMON STOCKS | | | | |

| | | | (Cost $131,904,062) | | | 159,468,413 | |

| | | | | | | | |

| | | | | | | | |

| | | | GUERNSEY INVESTMENT FUND – 2.2% | | | | |

| | 711,487 | | JZ Capital Partners Limited2 | | | 5,188,585 | |

| | | | TOTAL GUERNSEY INVESTMENT FUND | | | | |

| | | | (Cost $3,886,197) | | | 5,188,585 | |

| | | | | | | | |

| | | | | | | | |

| | | | REAL ESTATE INVESTMENT TRUSTS – 0.5% | | | | |

| | 150,000 | | New York REIT, Inc.1 | | | 1,288,500 | |

| | | | TOTAL REAL ESTATE INVESTMENT TRUSTS | | | | |

| | | | (Cost $1,293,359) | | | 1,288,500 | |

| | | | | | | | |

| | | | | | | |

| Principal | | | | | | |

| Amount | | CORPORATE BONDS – 0.4% | | | | |

| | | | | | | | |

| | | | Property Management – 0.4% | | | | |

| $ | 1,050,000 | | HomeFed Corp. 6.500% due 6/30/2018 | | | 1,056,563 | |

| | | | TOTAL CORPORATE BONDS | | | | |

| | | | (Cost $1,051,969) | | | 1,056,563 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

SCHEDULE OF INVESTMENTS at May 31, 2017 (Unaudited) (Continued) |

| | MISCELLANEOUS SECURITIES – 0.1%1,4 | | Value | |

| | TOTAL MISCELLANEOUS SECURITIES | | | |

| | (Cost $705,853) | | $ | 186,750 | |

| | Total Investments | | | | |

| | (Cost $138,841,440) – 71.1% | | | 167,188,811 | |

| | Cash and Other Assets in | | | | |

| | Excess of Liabilities – 28.9% | | | 67,799,456 | |

| | TOTAL NET ASSETS – 100.0% | | $ | 234,988,267 | |

1 | Non-income producing security. |

2 | A portion of these securities are considered illiquid. As of May 31, 2017, the total value of illiquid securities was 7,723,580 or 3.3% of net assets. |

3 | Affiliated company as defined by the Investment Company Act of 1940. |

4 | Represents previously undisclosed securities which the Fund has held for less than one year. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

STATEMENT OF ASSETS AND LIABILITIES at May 31, 2017 (Unaudited) |

| ASSETS | |

| Investments in securities, at value | | | |

| (Cost $138,841,440) (Note 2) | | $ | 167,188,811 | |

| Cash | | | 72,791,559 | |

| Receivables: | | | | |

| Fund shares sold | | | 96,674 | |

| Investment securities sold | | | 299,166 | |

| Dividends and interest | | | 98,048 | |

| Total assets | | | 240,474,258 | |

| | | | | |

| LIABILITIES | |

| Payables: | | | | |

| Investment securities purchased | | | 4,083,900 | |

| Fund shares redeemed | | | 1,182,294 | |

| Management fees | | | 179,834 | |

| Support services fees | | | 39,963 | |

| Total liabilities | | | 5,485,991 | |

| | | | | |

| NET ASSETS | | $ | 234,988,267 | |

| | | | | |

| COMPONENTS OF NET ASSETS | |

| Paid-in capital | | $ | 235,051,377 | |

| Accumulated net investment loss | | | (1,316,192 | ) |

| Accumulated net realized loss on investments | | | (27,094,289 | ) |

| Net unrealized appreciation on: | | | | |

| Investments | | | 28,347,371 | |

| Net assets | | $ | 234,988,267 | |

| | | | | |

| Net Asset Value (unlimited shares authorized): | | | | |

| Net assets | | $ | 234,988,267 | |

| Shares of beneficial interest issued and outstanding | | | 10,418,911 | |

| Net asset value, offering and redemption price per share | | $ | 22.55 | |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

STATEMENT OF OPERATIONS For the Six Months Ended May 31, 2017 (Unaudited) |

| INVESTMENT INCOME | |

| Dividends from unaffiliated securities | | | |

| (net of $8,844 in foreign withholding taxes) | | $ | 1,239,246 | |

| Interest | | | 4,036 | |

| Total investment income | | | 1,243,282 | |

| | | | | |

| EXPENSES | |

| Management fees | | | 1,163,603 | |

| Support services fees | | | 258,578 | |

| Total expenses | | | 1,422,181 | |

| Net investment loss | | | (178,899 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, | |

| OPTIONS WRITTEN & FOREIGN CURRENCY | |

| Net realized gain (loss) on transactions from: | | | | |

| Unaffiliated investments & foreign currency | | | (1,184,767 | ) |

| Affiliated investments | | | (24,140,603 | ) |

| Options written | | | 114,199 | |

| Net realized loss | | | (25,211,171 | ) |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 16,407,650 | |

| Options written | | | 40,801 | |

| Net unrealized appreciation/depreciation | | | 16,448,451 | |

| Net realized and unrealized loss | | | (8,762,720 | ) |

| Net decrease in net assets resulting from operations | | $ | (8,941,619 | ) |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Six Months Ended | | | | |

| | | May 31, 2017 | | | Year Ended | |

| | | (Unaudited) | | | November 30, 2016 | |

| INCREASE (DECREASE) IN NET ASSETS FROM: | |

| | |

| OPERATIONS | |

| Net investment income (loss) | | $ | (178,899 | ) | | $ | 183,859 | |

| Net realized loss on unaffiliated | | | | | | | | |

| investments, affiliated investments, | | | | | | | | |

| options written & foreign currency | | | (25,211,171 | ) | | | (617,573 | ) |

| Change in unrealized appreciation/ | | | | | | | | |

| depreciation on investments, options | | | | | | | | |

| written & foreign currency | | | 16,448,451 | | | | 35,187,313 | |

| Net increase (decrease) in net assets | | | | | | | | |

| resulting from operations | | | (8,941,619 | ) | | | 34,753,599 | |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | |

| Net decrease in net assets derived from | | | | | | | | |

net change in outstanding shares1 | | | (27,709,776 | ) | | | (30,963,999 | ) |

| Total increase (decrease) in net assets | | | (36,651,395 | ) | | | 3,789,600 | |

| | | | | | | | | |

| NET ASSETS | |

| Beginning of period/year | | | 271,639,662 | | | | 267,850,062 | |

| End of period/year | | $ | 234,988,267 | | | $ | 271,639,662 | |

| Accumulated net investment loss | | $ | (1,316,192 | ) | | $ | (1,137,293 | ) |

1 | Summary of capital share transactions is as follows: |

| | | | Six Months Ended | | | Year Ended | |

| | | | May 31, 2017 (Unaudited) | | | November 30, 2016 | |

| | | | Shares | | | Value | | | Shares | | | Value | |

| | Shares sold | | | 1,127,091 | | | $ | 26,069,472 | | | | 2,248,759 | | | $ | 44,719,478 | |

| | Shares redeemed2 | | | (2,331,280 | ) | | | (53,779,248 | ) | | | (3,678,675 | ) | | | (75,683,477 | ) |

| | Net decrease | | | (1,204,189 | ) | | $ | (27,709,776 | ) | | | (1,429,916 | ) | | $ | (30,963,999 | ) |

2 | Net of redemption fees of $4,555 and $8,723, respectively. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each period/year |

| | | Six Months | | | | | | | | | | | | | | | | |

| | | Ended | | | | | | | | | | | | | | | | |

| | | May 31, | | | | | | | | | | | | | | | | |

| | | 2017 | | | Year Ended November 30, | |

| | | (Unaudited) | | | 2016 | | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| Net asset value at | | | | | | | | | | | | | | | | | | |

| beginning of period/year | | $ | 23.37 | | | $ | 20.52 | | | $ | 26.77 | | | $ | 28.26 | | | $ | 24.00 | | | $ | 20.52 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| INCOME FROM INVESTMENT OPERATIONS | |

Net investment income (loss)1 | | | (0.02 | ) | | | 0.02 | | | | 0.01 | | | | (0.03 | ) | | | 0.02 | | | | 0.21 | |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | (0.80 | ) | | | 2.83 | | | | (4.40 | ) | | | (1.16 | ) | | | 4.65 | | | | 3.29 | |

| Total from | | | | | | | | | | | | | | | | | | | | | | | | |

| investment operations | | | (0.82 | ) | | | 2.85 | | | | (4.39 | ) | | | (1.19 | ) | | | 4.67 | | | | 3.50 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| LESS DISTRIBUTIONS | |

| From net investment income | | | — | | | | — | | | | — | | | | — | | | | (0.32 | ) | | | (0.01 | ) |

| From net realized gain | | | — | | | | — | | | | (1.87 | ) | | | (0.30 | ) | | | (0.09 | ) | | | (0.01 | ) |

| Total distributions | | | — | | | | — | | | | (1.87 | ) | | | (0.30 | ) | | | (0.41 | ) | | | (0.02 | ) |

| Paid-in capital from | | | | | | | | | | | | | | | | | | | | | | | | |

| redemption fees | | $ | 0.00 | 2 | | $ | 0.00 | 2 | | $ | 0.01 | | | $ | 0.00 | 2 | | $ | 0.00 | 2 | | $ | 0.00 | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, | | | | | | | | | | | | | | | | | | | | | | | | |

| end of period/year | | $ | 22.55 | | | $ | 23.37 | | | $ | 20.52 | | | $ | 26.77 | | | $ | 28.26 | | | $ | 24.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (3.51 | )%3 | | | 13.89 | % | | | (17.49 | )% | | | (4.26 | )% | | | 19.74 | % | | | 17.08 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| RATIOS/SUPPLEMENTAL DATA | |

| Net assets at end of | | | | | | | | | | | | | | | | | | | | | | | | |

| period/year (millions) | | $ | 235.0 | | | $ | 271.6 | | | $ | 267.9 | | | $ | 443.7 | | | $ | 553.5 | | | $ | 223.7 | |

| Portfolio turnover rate | | | 7 | %3 | | | 8 | % | | | 18 | % | | | 37 | % | | | 12 | % | | | 11 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to | | | | | | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 1.10 | %4 | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Ratio of net investment | | | | | | | | | | | | | | | | | | | | | | | | |

| income (loss) to average | | | | | | | | | | | | | | | | | | | | | | | | |

| net assets | | | (0.14 | )%4 | | | 0.07 | % | | | 0.06 | % | | | (0.11 | )% | | | 0.08 | % | | | 0.92 | % |

1 | Calculated using the average shares outstanding method. |

2 | Amount does not round to $0.01 per share. |

3 | Not annualized. |

4 | Annualized. |

The accompanying notes are an integral part of these financial statements.

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS May 31, 2017 (Unaudited) |

The GoodHaven Funds Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, open-end management investment company. The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The Fund commenced operations on April 8, 2011.

The Fund’s investment objective is to seek long-term growth of capital.

| NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| | A. | Security Valuation. All equity securities, which may include Real Estate Investment Trusts (“REIT’s”), Business Development Companies (“BDC’s”) and Master Limited Partnerships (“MLP’s”), that are traded on U.S. national or foreign securities exchanges are valued at the last reported sale price on the exchange on which the security is principally traded or the exchange’s official closing price, if applicable. If, on a particular day, an exchange-traded security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities, which may include REIT’s, BDC’s and MLP’s, that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. |

| | | |

| | | Debt securities are valued by using the evaluated mean price supplied by an approved independent pricing service. The independent pricing service may use various valuation methodologies, including matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. These models generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions. In the absence of a price from a pricing service, securities are valued at their respective fair values in accordance with policies approved by the Valuation Committee of the Trust. |

| | | |

| | | Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS May 31, 2017 (Unaudited) (Continued) |

| | | marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded. |

| | | |

| | | Securities for which quotations are not readily available are valued at their respective fair values as determined in accordance with policies approved by the Valuation Committee of the Trust. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board of Trustees. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. |

| | | |

| | | As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are: |

| | | Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| | | | |

| | | Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| | | | |

| | | Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

| | | The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS May 31, 2017 (Unaudited) (Continued) |

| | | The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. |

| | | |

| | | The following is a summary of the inputs used to value the Fund’s investments as of May 31, 2017. See the Schedule of Investments for the industry breakouts. |

| | | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | Common Stocks | | $ | 159,468,413 | | | $ | — | | | $ | — | | | $ | 159,468,413 | |

| | | Guernsey | | | | | | | | | | | | | | | | |

| | | Investment Fund | | | 5,188,585 | | | | — | | | | — | | | | 5,188,585 | |

| | | Real Estate | | | | | | | | | | | | | | | | |

| | | Investment Trusts | | | 1,288,500 | | | | — | | | | — | | | | 1,288,500 | |

| | | Corporate Bonds | | | — | | | | 1,056,563 | | | | — | | | | 1,056,563 | |

| | | Miscellaneous | | | | | | | | | | | | | | | | |

| | | Securities | | | — | | | | 186,750 | | | | — | | | | 186,750 | |

| | | Total Investments | | $ | 165,945,498 | | | $ | 1,243,313 | | | $ | — | | | $ | 167,188,811 | |

| | | It is the Fund’s policy to recognize transfers between levels at the end of the Fund’s reporting period. |

| | | |

| | | There were no transfers into or out of Level 1 or 2 during the period ended May 31, 2017. |

| | | |

| | | The Fund has adopted financial reporting rules and regulations that require enhanced disclosure regarding derivatives and hedging activity intending to improve financial reporting of derivative instruments by enabling investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivative instruments affect an entity’s results of operations and financial position. |

| | | |

| | | The Fund may invest, at the time of purchase, up to 10% of the Fund’s net assets in options, which are a type of derivative and employ specialized trading techniques such as options trading to increase the Fund’s exposure to certain selected securities. The Fund may employ these techniques as hedging tools as well as speculatively to enhance returns. Other than when used for hedging, these techniques may be riskier than many investment strategies and may result in greater volatility for the Fund, particularly in periods of market declines. As a hedging tool, options may help cushion the impact of market declines, but may reduce the Fund’s participation in a market advance. |

GoodHaven Fund

NOTES TO FINANCIAL STATEMENTS May 31, 2017 (Unaudited) (Continued) |

| | | Balance Sheet |

| | | |

| | | Fair values of derivative instruments as of May 31, 2017: |

| | | | Asset Derivatives as of | | Liability Derivatives as of | |

| | | | May 31, 2017 | | May 31, 2017 | |

| | | Derivative | Balance Sheet | | Fair | | Balance Sheet | | Fair | |

| | | Instruments | Location | | Value | | Location | | Value | |

| | | Equity Contracts: | | | | | | | | |

| | | Put Options | Investments in | | | | | | | |

| | | Purchased | securities, at value | | $ | 186,750 | | None | | $ | — | |

| | | Total | | | $ | 186,750 | | | | $ | — | |

| | | Statement of Operations |

| | | |

| | | The effect of derivative instruments on the Statement of Operations for the six months ended May 31, 2017: |

| | | | | | | Change in | |

| | Location of | | Realized | | | Unrealized | |

| | Gain (Loss) | | Gain (Loss) | | | Appreciation/ | |

| | on Derivatives | | on Derivatives | | | Depreciation | |

| Derivative | Recognized | | Recognized | | | on Derivatives | |