Lonestar Resources US, Inc. Presentation to Investors February 2019

Disclaimer and Forward Looking Statements Forward Looking Statements The information in this presentation includes “forward‐looking statements” that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact included in this presentation, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management are forward‐looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward‐looking statements, although not all forward‐looking statements contain such identifying words. These forward‐ looking statements are based on Lonestar Resources US Inc.’s (“LONE” or the “Company”) current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward‐looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development, production, gathering and sale of oil and natural gas. These risks include, but are not limited to, variations in the market demand for, and prices of, crude oil, NGLs and natural gas, lack of proved reserves, estimates of crude oil, NGLs and natural gas data, the adequacy of our capital resources and liquidity including, but not limited to, access to additional borrowing, borrowing capacity under our credit facilities, general economic and business conditions, failure to realize expected value creation from property acquisitions, uncertainties about our ability to replace reserves and economically develop our reserves, risks related to the concentration of our operations, drilling results, potentialfinanciallossesorearningsreductionsfromourcommoditypricerisk management programs, potential adoption of new governmental regulations, our ability to satisfy future cash obligationsandenvironmentalcostsandtheriskfactorsdiscussedinorreferencedinourfilingswiththeUnitedStatesSecuritiesandExchangeCommission (“SEC”), including our Annual Report on Form 10‐K, our Quarterly Reports on Form 10‐Q and our Current Reports on Form 8‐K in each case as amended. You are cautioned not to place undue reliance on any forward‐looking statements, which speak only as of the date of this presentation. Except as otherwise required by applicable law, we disclaim any duty to update any forward‐looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Our production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or cost increases. Reconciliation of Non‐GAAP Financial Measure EBITDAX is a financial measure that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Reconciliations of this non‐ GAAP financial measure can be found in this presentation. Industry and Market Data This presentation has been prepared by LONE and includes market data and other statistical information from third‐party sources, including independent industry publications, government publications or other published independent sources. Although LONE believes these third‐party sources are reliable as of their respective dates, LONE has not independently verified the accuracy or completeness of this information. Some data are also based on the LONE’s good faith estimates, which are derived from its review of internal sources as well as the third‐party sources described above. This document and any related presentation do not constitute an offer or invitation to subscribe for or purchase any securities, and it should not be construed as an offering document. Any decision to purchase securities in the context of a proposed offering, if any, should be made on the basis of information contained in the offering document related to such an offering. This presentation does not constitute a recommendation regarding any securities of Lonestar Resources America, Inc. or Lonestar Resources US Inc. 2

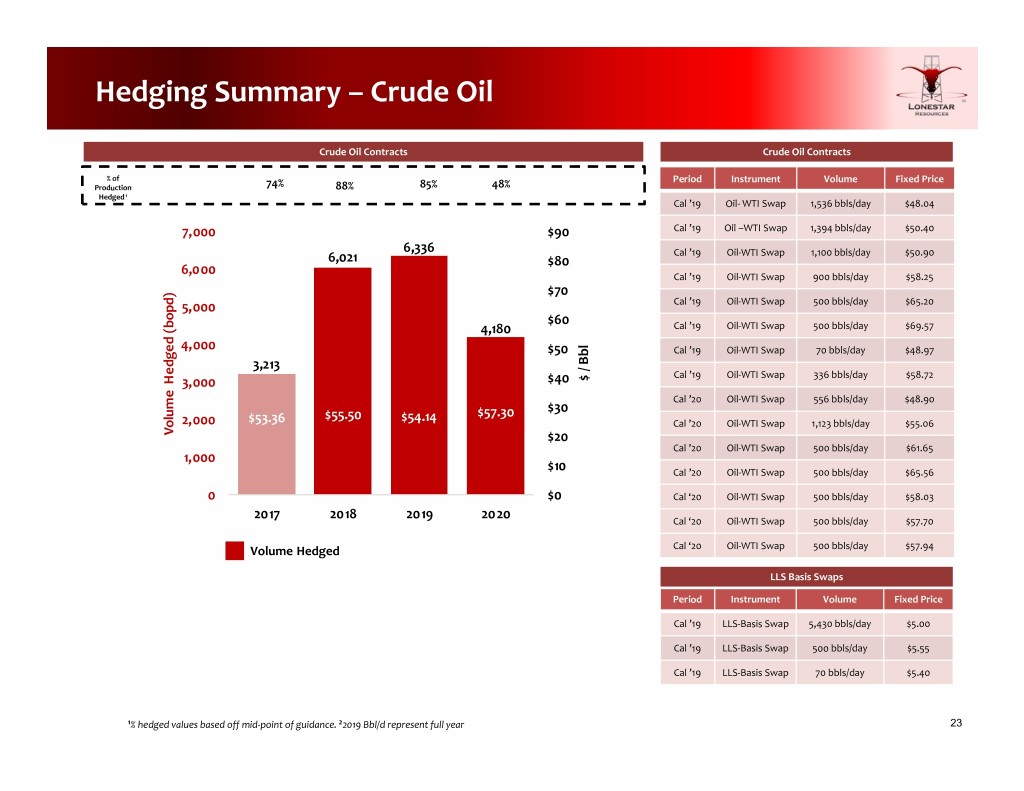

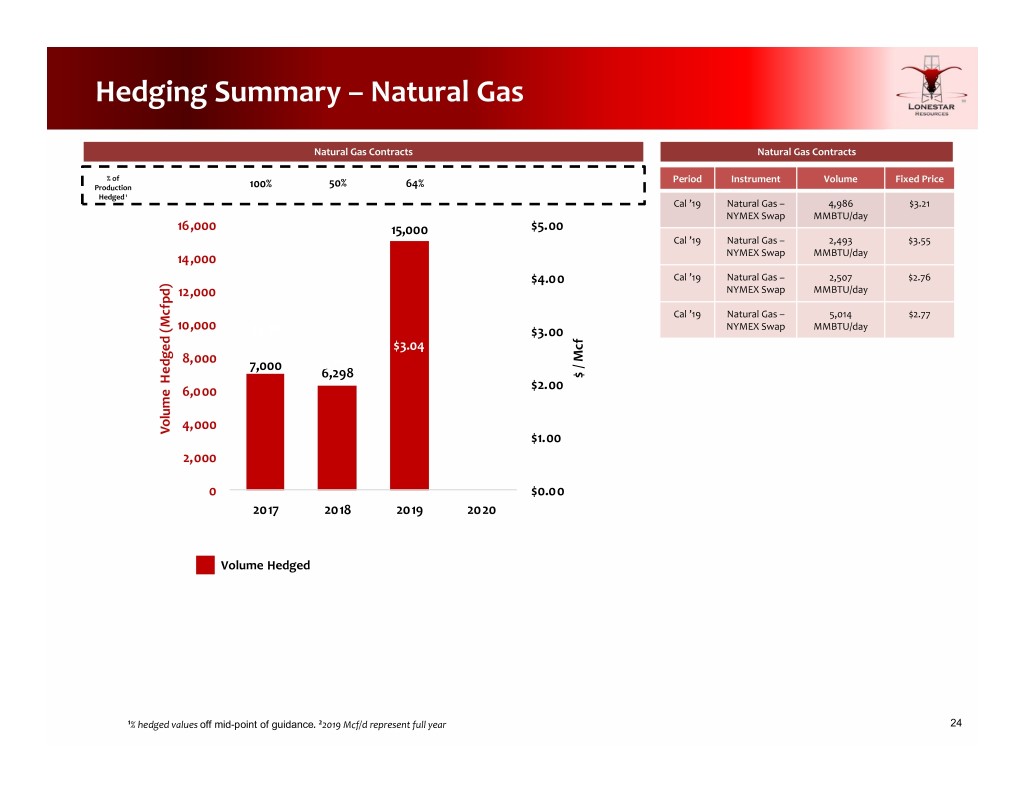

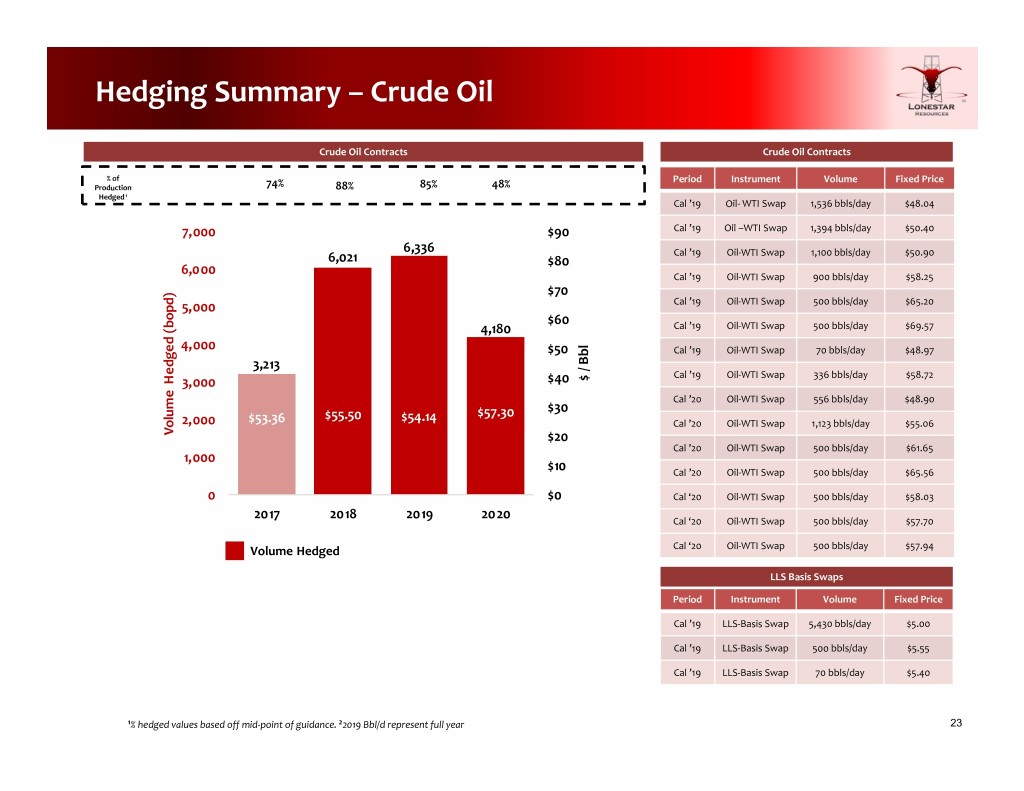

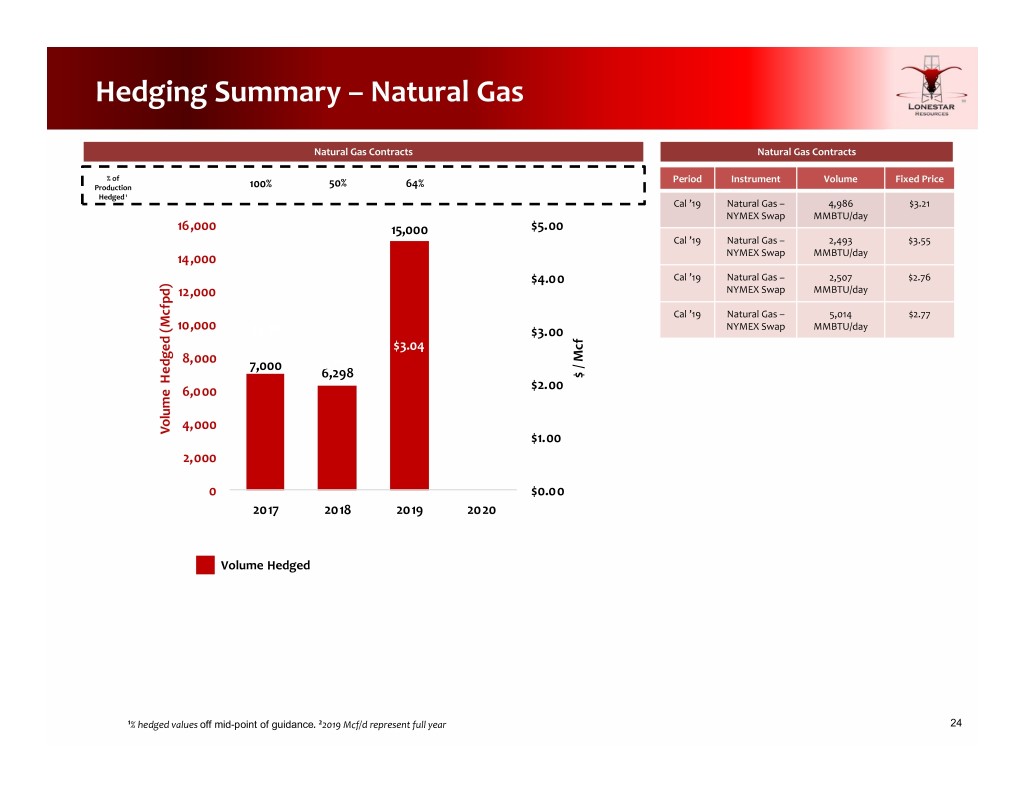

Company Profile Share Price . Pure Play Eagle Ford Operator… • +57,000 Net Acres in the Crude Oil Window of the Eagle Ford Shale $12.00 500 • Unfettered access to oil and gas transportation infrastructure $11.00 $10.00 400 • Technical leader with 100% focus in the Eagle Ford, drilling extended $9.00 reach laterals with proprietary targeting and completion techniques, $8.00 $4.94 300 $7.00 Shares) yielding differential results (US$) $6.00 ('000 Price $5.00 .…With Track Record of Rapidly Increasing Value Per Share 200 $4.00 • Share Proved reserves increased at CAGR of 52% to 93.4 MMBOE $3.00 Volume 100 • 3‐year All‐Sources Finding & Onstream Costs of $7.43 per Boe $2.00 • Proved PV‐10 increased at CAGR of 33% to $9.34/share in 2018 $1.00 $0.00 0 • Proved & Probable PV‐10 increased at CAGR of 23% to $12.81/share in 2018 . Focused Capital Program in Areas of Success Volume LONE Equity Price • 2019 & 2020 Programs largely drilled in areas where LONE registered significant success & returns in 2018 Enterprise Value • IRR’s of 55‐70% at $55/$2.75 flat Ticker (NASDAQ:NMS) LONE . Hedging Discipline Locks in Returns & Cash Flows Share Price2 $4.94 4 • 2019‐ ~85% Crude Oil Hedged at $54.14/bbl (WTI) Shares Out (Fully Diluted) 3 40.1 MM • 2019 ~64% Natural Gas Hedged at $3.04/MMBTU (HH) 4 • 2020‐ 48% Crude Oil Hedged at $57.30/bbl (WTI) 4 Market Cap $198 MM .Continued Growth in Production & EBITDAX Cash3 $4.5 MM • 2018 Production‐ 11,155 Boe/d (+72% vs. 2017) Long Term Debt3 $429 MM • 2019 Production Guidance‐ 13,700‐14,700 boe/d (+27% vs. 2018)5 Enterprise Value $623 MM • 2020 Production Target‐ 17,000 – 18,300 boe/d 1Based on YE18 Reserve Report 2February 25, 2018 3Preliminary as of December 31, 2018 4At the mid‐point of guidance 5Our production estimates are based on, among other things, our current planned capital expenditures and drilling program, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling, completion and equipping cost assumptions and certain well performance assumptions. In addition, achieving these production estimates and maintaining the required capital expenditures and drilling activity to achieve these estimates will depend on the availability of capital, regulatory approval and the existing regulatory environment, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should also recognize that the reliability of any guidance diminishes the farther in the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance. 3

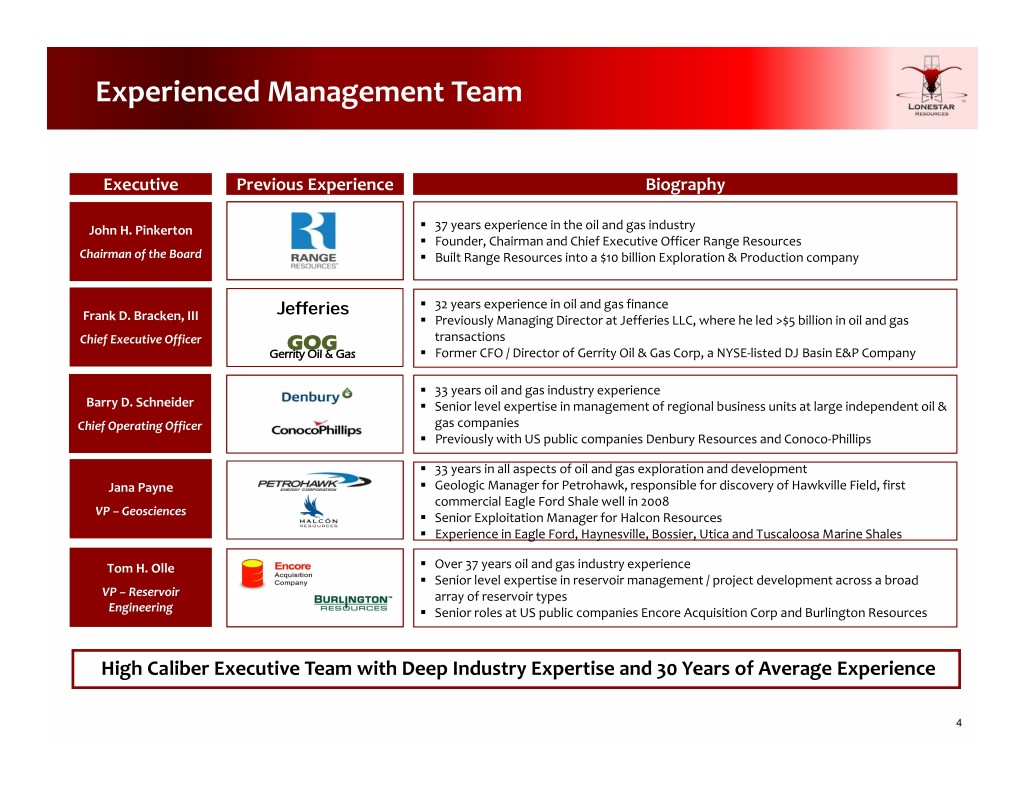

Experienced Management Team Executive Previous Experience Biography John H. Pinkerton . 37 years experience in the oil and gas industry . Founder, Chairman and Chief Executive Officer Range Resources Chairman of the Board . Built Range Resources into a $10 billion Exploration & Production company . 32 years experience in oil and gas finance Frank D. Bracken, III . Previously Managing Director at Jefferies LLC, where he led >$5 billion in oil and gas Chief Executive Officer GOG transactions Gerrity Oil & Gas . Former CFO / Director of Gerrity Oil & Gas Corp, a NYSE‐listed DJ Basin E&P Company . 33 years oil and gas industry experience Barry D. Schneider . Senior level expertise in management of regional business units at large independent oil & Chief Operating Officer gas companies . Previously with US public companies Denbury Resources and Conoco‐Phillips . 33 years in all aspects of oil and gas exploration and development Jana Payne . Geologic Manager for Petrohawk, responsible for discovery of Hawkville Field, first commercial Eagle Ford Shale well in 2008 VP – Geosciences . Senior Exploitation Manager for Halcon Resources . Experiencep in Eagleg Ford,, Haynesville,y, Bossier,, Utica and Tuscaloosa Marine Shales Tom H. Olle . Over 37 years oil and gas industry experience . Senior level expertise in reservoir management / project development across a broad VP – Reservoir array of reservoir types Engineering . Senior roles at US public companies Encore Acquisition Corp and Burlington Resources High Caliber Executive Team with Deep Industry Expertise and 30 Years of Average Experience 4

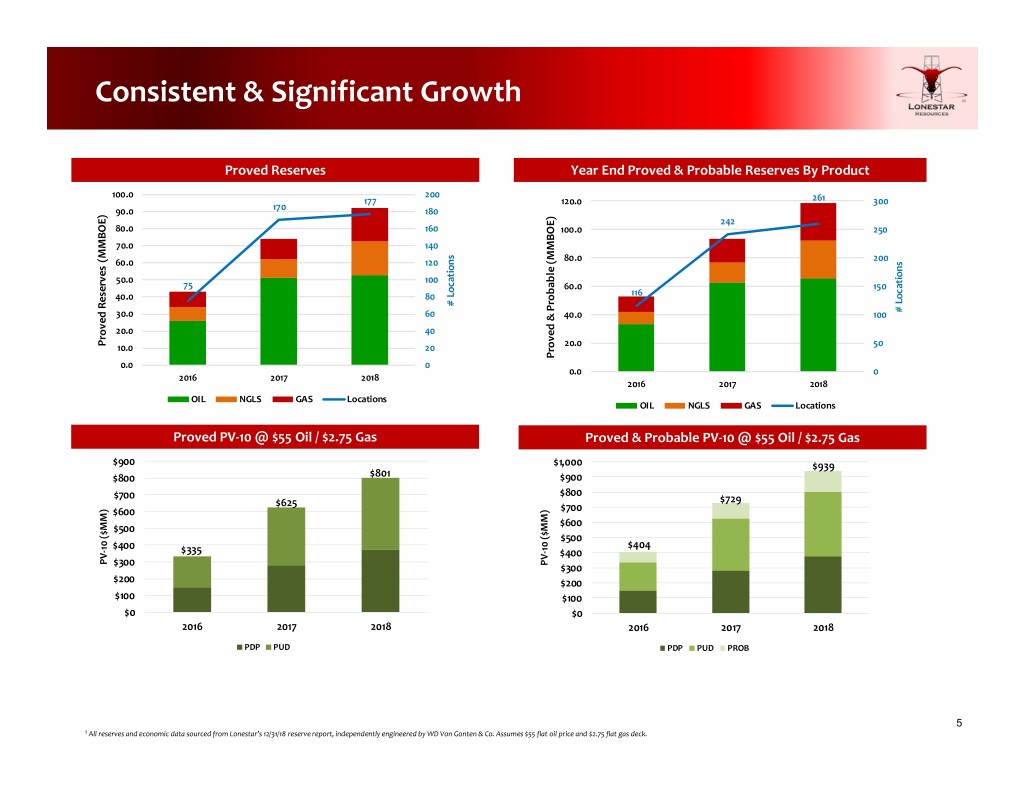

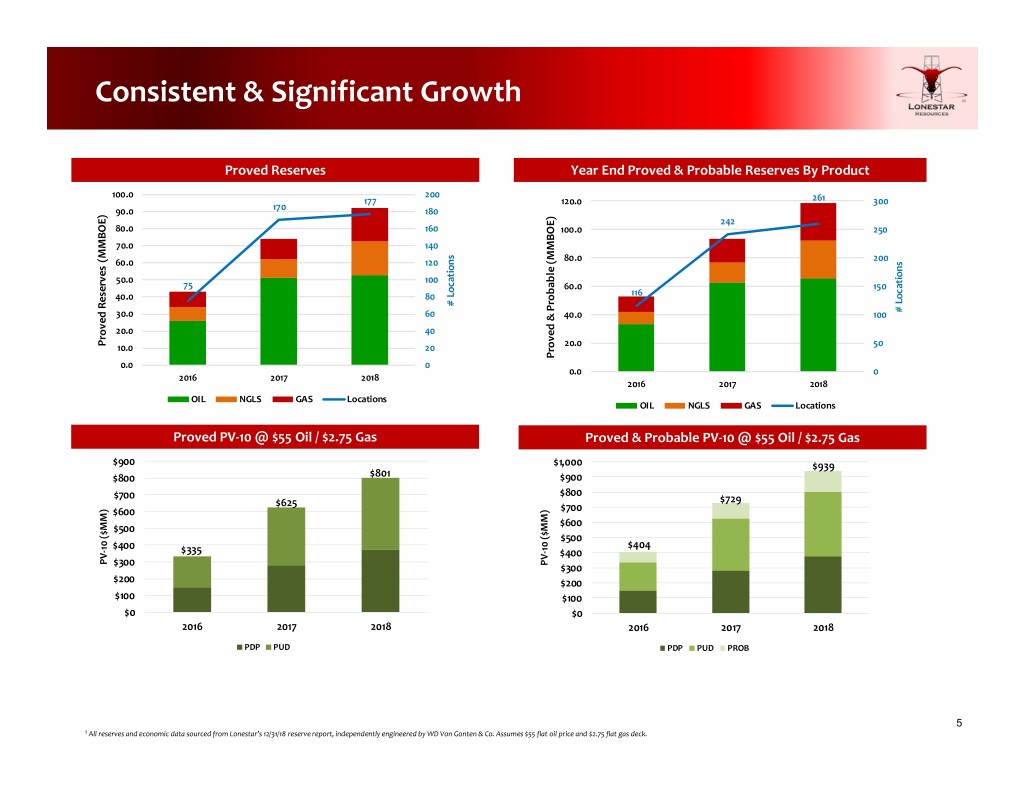

Consistent & Significant Growth Proved Reserves Year End Proved & Probable Reserves By Product 100.0 200 177 120.0 261 300 90.0 170 180 242 80.0 160 100.0 250 70.0 140 (MMBOE) 80.0 200 (MMBOE) 60.0 120 50.0 100 75 60.0 150 Locations 116 40.0 80 Locations # Reserves Probable # 30.0 60 40.0 100 & 20.0 40 Proved 10.0 20 20.0 50 Proved 0.0 0 0.0 0 2016 2017 2018 2016 2017 2018 OIL NGLS GAS Locations OIL NGLS GAS Locations Proved PV‐10 @ $55 Oil / $2.75 Gas Proved & Probable PV‐10 @ $55 Oil / $2.75 Gas $900 $1,000 $939 $800 $801 $900 $700 $800 $625 $729 $600 $700 $600 $500 ($MM) ($MM) $500 10 $400 10 $404 ‐ $335 ‐ $400 PV $300 PV $300 $200 $200 $100 $100 $0 $0 2016 2017 2018 2016 2017 2018 PDP PUD PDP PUD PROB 5 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat oil price and $2.75 flat gas deck.

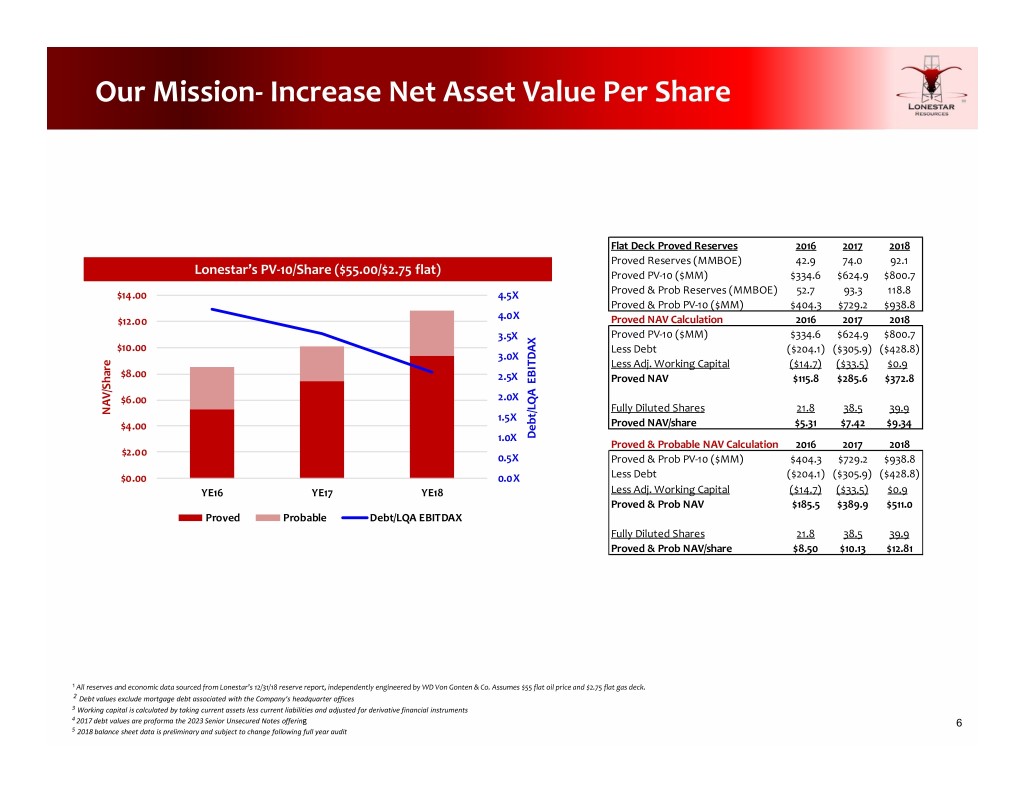

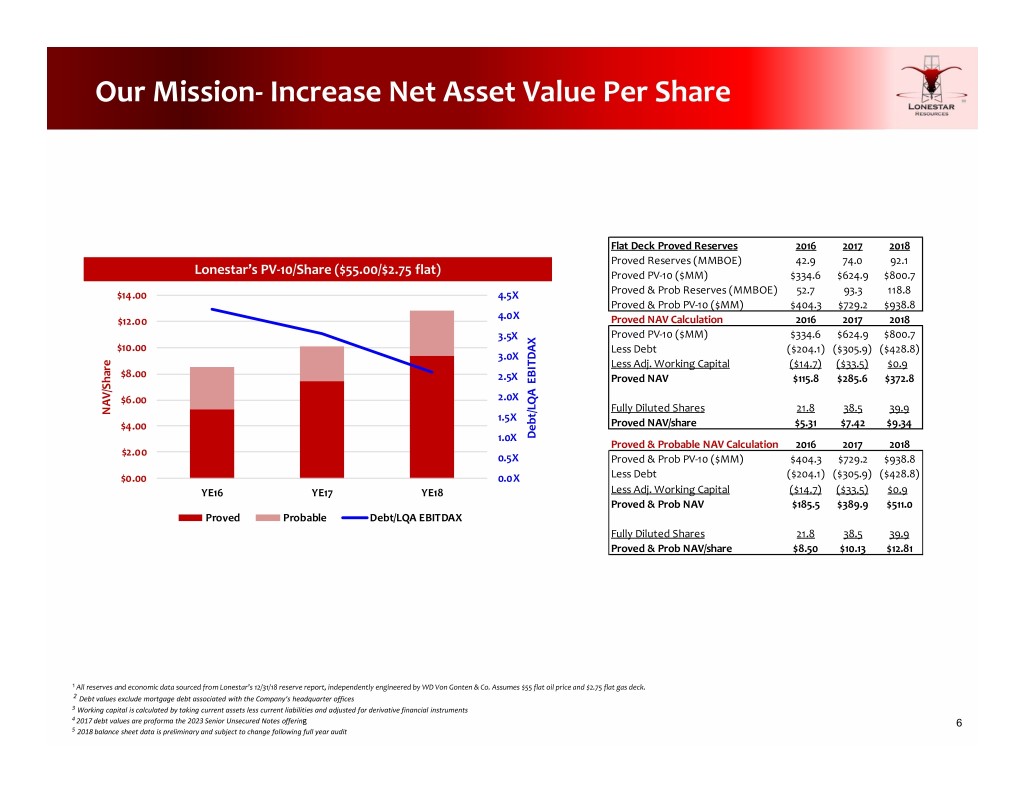

Our Mission‐ Increase Net Asset Value Per Share Flat Deck Proved Reserves 2016 2017 2018 Proved Reserves (MMBOE) 42.9 74.0 92.1 Lonestar’s PV‐10/Share ($55.00/$2.75 flat) Proved PV‐10 ($MM) $334.6 $624.9 $800.7 $14.00 4.5X Proved & Prob Reserves (MMBOE) 52.7 93.3 118.8 Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 4.0X $12.00 Proved NAV Calculation 2016 2017 2018 3.5X Proved PV‐10 ($MM) $334.6 $624.9 $800.7 $10.00 Less Debt ($204.1) ($305.9) ($428.8) 3.0X Less Adj. Working Capital ($14.7) ($33.5) $0.9 $8.00 2.5X EBITDAX Proved NAV $115.8 $285.6 $372.8 $6.00 2.0X Fully Diluted Shares 21.8 38.5 39.9 NAV/Share 1.5X $4.00 Proved NAV/share $5.31 $7.42 $9.34 1.0X Debt/LQA Proved & Probable NAV Calculation 2016 2017 2018 $2.00 0.5X Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 $0.00 0.0X Less Debt ($204.1) ($305.9) ($428.8) YE16 YE17 YE18 Less Adj. Working Capital ($14.7) ($33.5) $0.9 Proved & Prob NAV $185.5 $389.9 $511.0 Proved Probable Debt/LQA EBITDAX Fully Diluted Shares 21.8 38.5 39.9 Proved & Prob NAV/share $8.50 $10.13 $12.81 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat oil price and $2.75 flat gas deck. 2 Debt values exclude mortgage debt associated with the Company’s headquarter offices 3 Working capital is calculated by taking current assets less current liabilities and adjusted for derivative financial instruments 4 2017 debt values are proforma the 2023 Senior Unsecured Notes offering 6 5 2018 balance sheet data is preliminary and subject to change following full year audit

Consistent Delivery of Results 2018 Production Results vs. Guidance 2018 EBITDAX Results vs. Guidance 15,000 $45.0 13,000 $40.0 11,000 $MM $35.0 Boe/d $MM 9,000 $30.0 7,000 $25.0 5,000 $20.0 1Q18 2Q18 3Q18 4Q18 1Q18 2Q18 3Q18 4Q18 Low High Actual Low High Actual 7

Lonestar’s Expanded Footprint Engineered Region Net Acres Locations Avg. WI HBP Western 14,340 49 89% 95% Central 35,830 193 71% 97% Eastern Eastern 7,321 31 62% 86% Total 57,491 273 74% 86% Central Western Sooner Lonestar Acreage* Acquired Acreage 8 1 Acreage values at of 12/31/18. * Please see the reserves disclosures at the end of this presentation

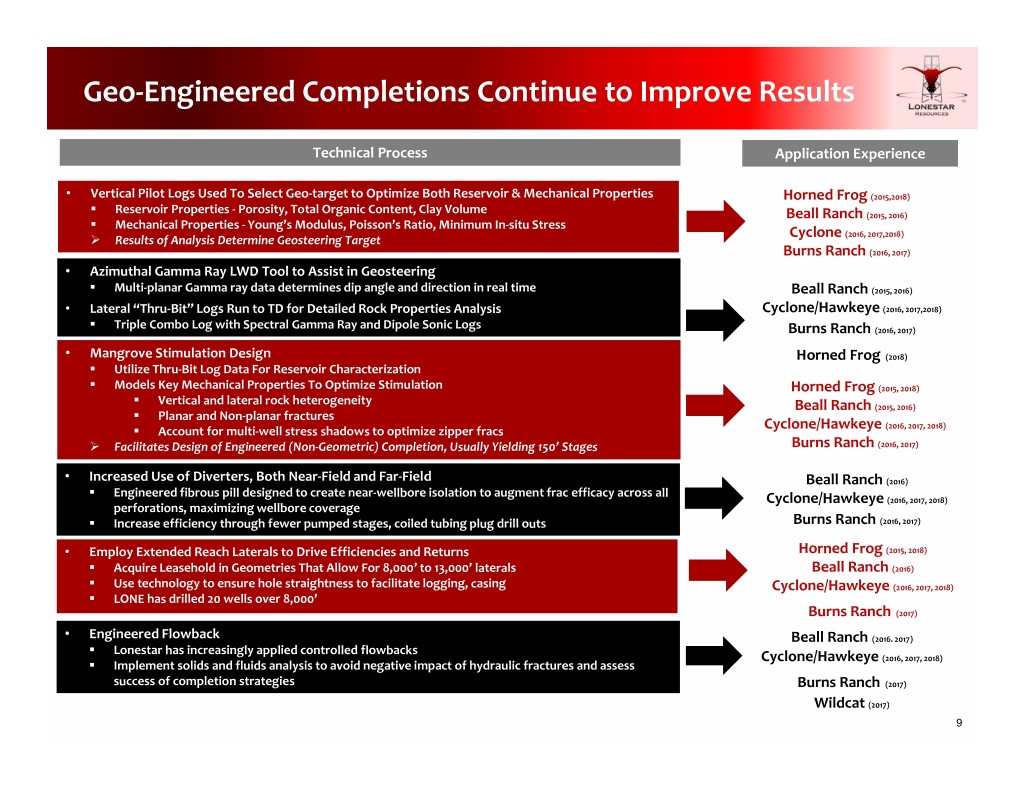

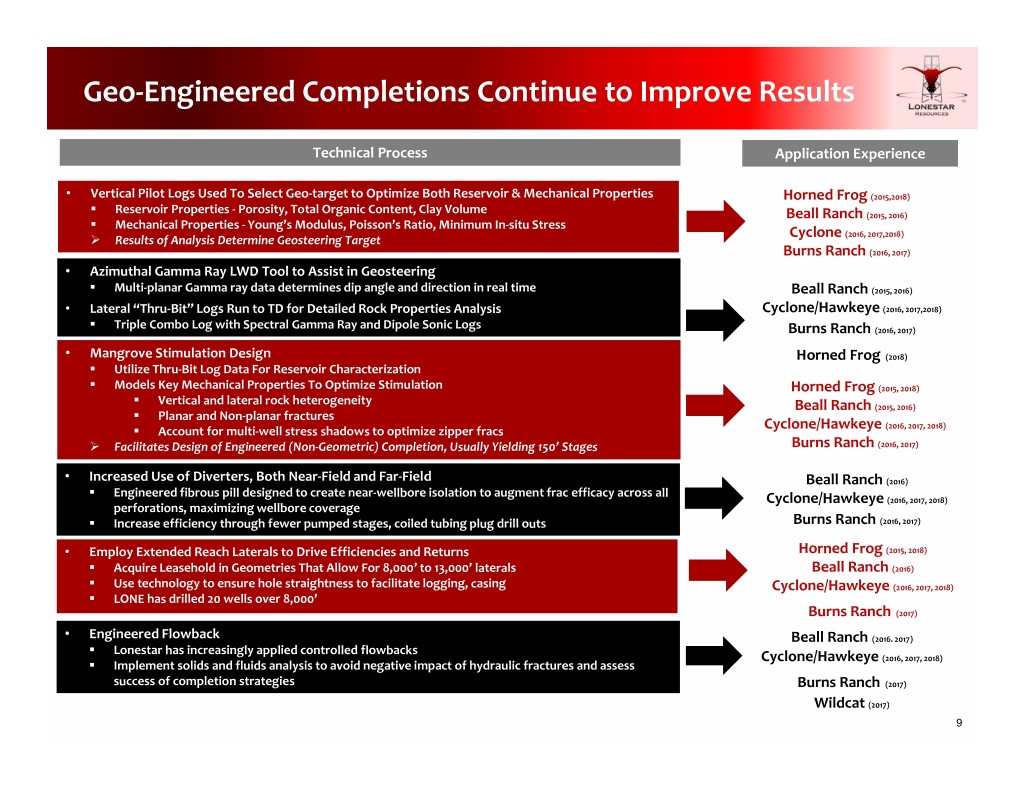

Geo‐Engineered Completions Continue to Improve Results Technical Process Application Experience • Vertical Pilot Logs Used To Select Geo‐target to Optimize Both Reservoir & Mechanical Properties Horned Frog (2015,2018) . Reservoir Properties ‐ Porosity, Total Organic Content, Clay Volume Beall Ranch (2015, 2016) . Mechanical Properties ‐ Young’s Modulus, Poisson’s Ratio, Minimum In‐situ Stress Cyclone (2016, 2017,2018) Results of Analysis Determine Geosteering Target Burns Ranch (2016, 2017) • Azimuthal Gamma Ray LWD Tool to Assist in Geosteering . Multi‐planar Gamma ray data determines dip angle and direction in real time Beall Ranch (2015, 2016) • Lateral “Thru‐Bit” Logs Run to TD for Detailed Rock Properties Analysis Cyclone/Hawkeye (2016, 2017,2018) . Triple Combo Log with Spectral Gamma Ray and Dipole Sonic Logs Burns Ranch (2016, 2017) • Mangrove Stimulation Design Horned Frog (2018) . Utilize Thru‐Bit Log Data For Reservoir Characterization . Models Key Mechanical Properties To Optimize Stimulation Horned Frog (2015, 2018) . Vertical and lateral rock heterogeneity Beall Ranch (2015, 2016) . Planar and Non‐planar fractures . Account for multi‐well stress shadows to optimize zipper fracs Cyclone/Hawkeye (2016, 2017, 2018) Facilitates Design of Engineered (Non‐Geometric) Completion, Usually Yielding 150’ Stages Burns Ranch (2016, 2017) • Increased Use of Diverters, Both Near‐Field and Far‐Field Beall Ranch (2016) . Engineered fibrous pill designed to create near‐wellbore isolation to augment frac efficacy across all Cyclone/Hawkeye (2016, 2017, 2018) perforations, maximizing wellbore coverage . Increase efficiency through fewer pumped stages, coiled tubing plug drill outs Burns Ranch (2016, 2017) • Employ Extended Reach Laterals to Drive Efficiencies and Returns Horned Frog (2015, 2018) . Acquire Leasehold in Geometries That Allow For 8,000’ to 13,000’ laterals Beall Ranch (2016) . Use technology to ensure hole straightness to facilitate logging, casing Cyclone/Hawkeye (2016, 2017, 2018) . LONE has drilled 20 wells over 8,000’ Burns Ranch (2017) • Engineered Flowback Beall Ranch (2016. 2017) . Lonestar has increasingly applied controlled flowbacks Cyclone/Hawkeye (2016, 2017, 2018) . Implement solids and fluids analysis to avoid negative impact of hydraulic fractures and assess success of completion strategies Burns Ranch (2017) Wildcat (2017) 9

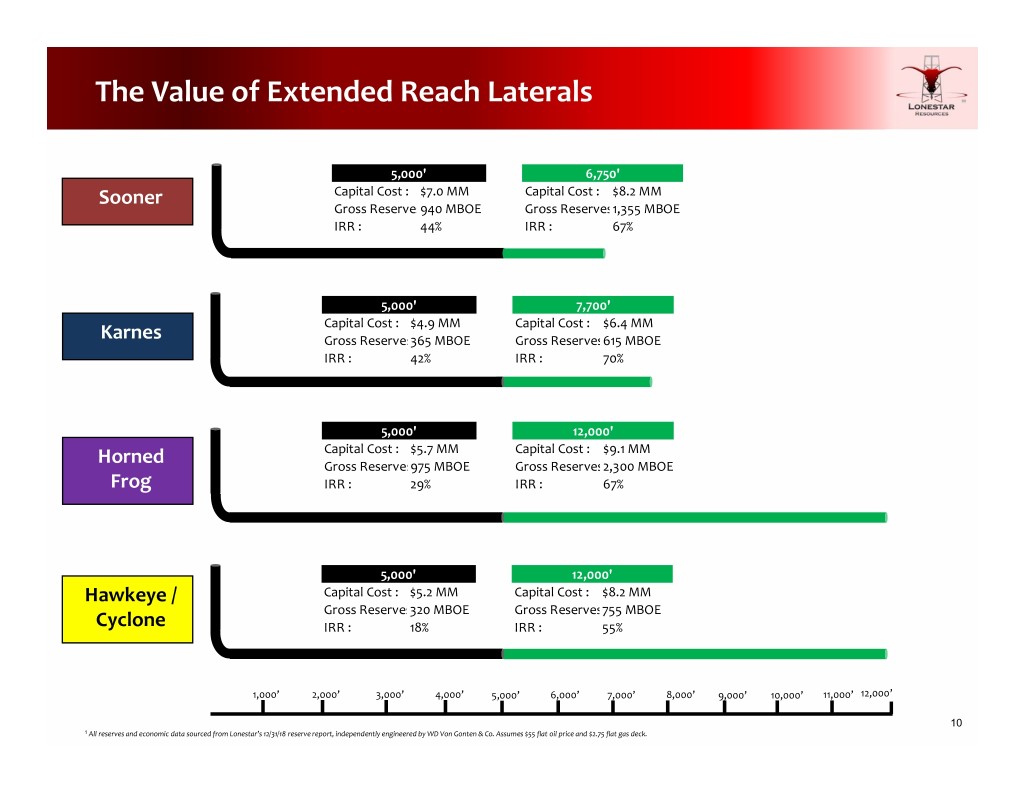

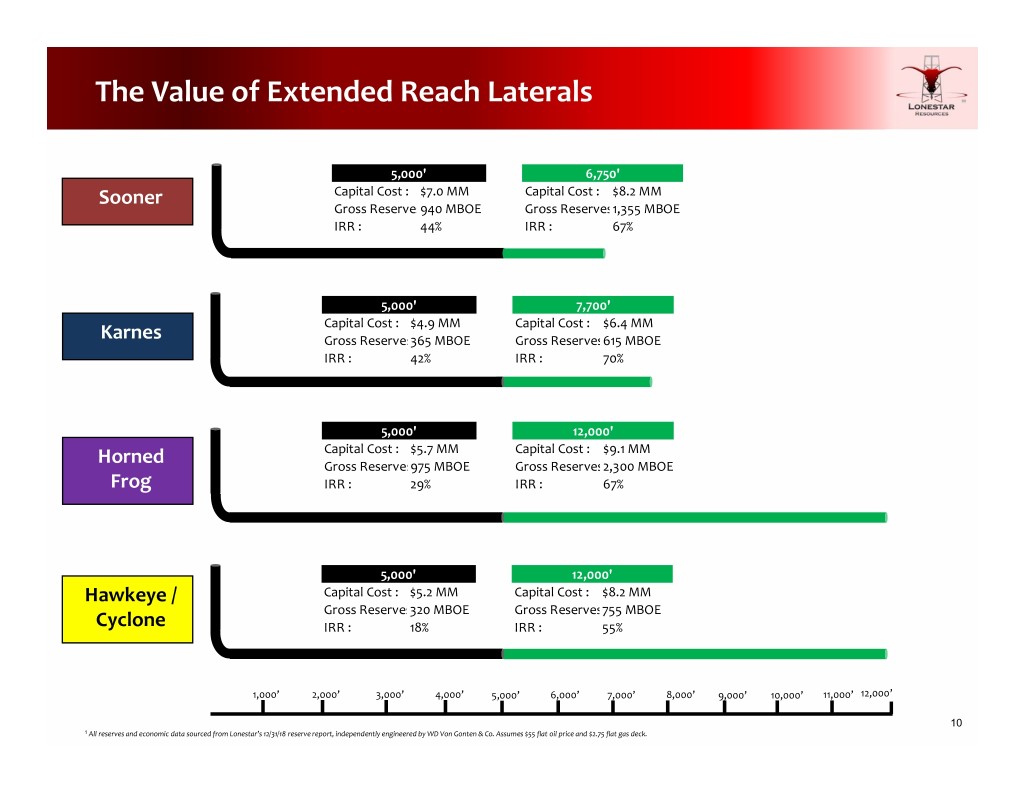

The Value of Extended Reach Laterals 5,000' 6,750' Sooner Capital Cost : $7.0 MM Capital Cost : $8.2 MM Gross Reserves940 MBOE Gross Reserves1,355 MBOE IRR : 44% IRR :67% 5,000' 7,700' Capital Cost : $4.9 MM Capital Cost : $6.4 MM Karnes Gross Reserves365 MBOE Gross Reserves615 MBOE IRR :42%IRR :70% 5,000' 12,000' Capital Cost : $5.7 MM Capital Cost : $9.1 MM Horned Gross Reserves975 MBOE Gross Reserves2,300 MBOE Frog IRR :29%IRR :67% 5,000' 12,000' Hawkeye / Capital Cost : $5.2 MM Capital Cost : $8.2 MM Gross Reserves320 MBOE Gross Reserves755 MBOE Cyclone IRR :18%IRR : 55% 1,000’ 2,000’ 3,000’ 4,000’ 5,000’ 6,000’ 7,000’ 8,000’ 9,000’ 10,000’ 11,000’ 12,000’ 10 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat oil price and $2.75 flat gas deck.

2019 Capital Program Areas of Focus

Karnes County Locator Map Property Highlights . Lonestar acquired its Karnes County leasehold in 2017 as part of its Battlecat acquisition . Lonestar holds 20 gross / 16 net PUD’s in the area . Lonestar drilled 6 wells in Karnes County in 2018 • Max‐30 IP’s averaged 888 boe/d (6,100’ lat. length) • Avg. 2018 Actual Well Cost: $6.4MM . Recent leasehold acquisitions allow for extended laterals into higher quality rock . Lonestar currently drilling 4 wells • Avg. 7,700’ lat. Length • Est. AFE: $6.4MM • Projected IRR‐ 70% Property Map EUR/ft vs. Offsets 80 Legend Eagle Ford Well 70 2019 Planned Wells 60 Austin Chalk Well LONESTAR ACREAGE 50 Ft Per 40 EUR 30 Oil 20 10 0 0 500 1,000 1,500 2,000 2,500 Lbs Proppant Per Ft LONE 18H‐20H LONE 24H‐26H Offsets 12 1 Lonestar EUR data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Offset wells engineered internally Offset wells include all pad-drilled completions at similar depths

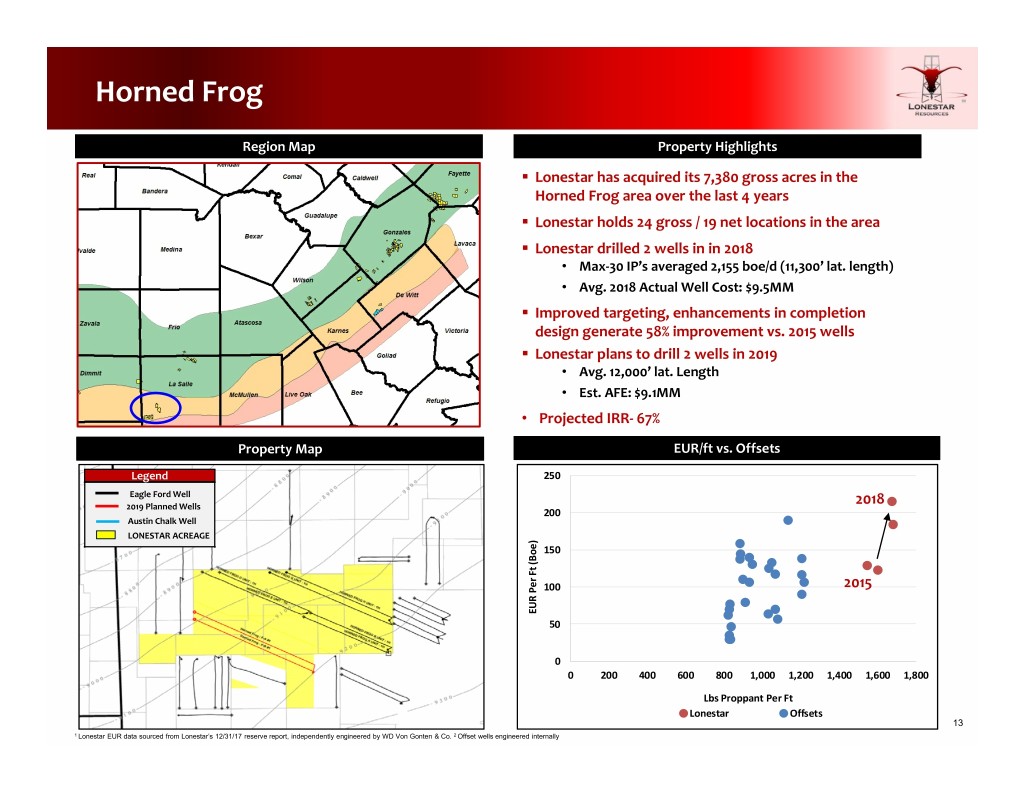

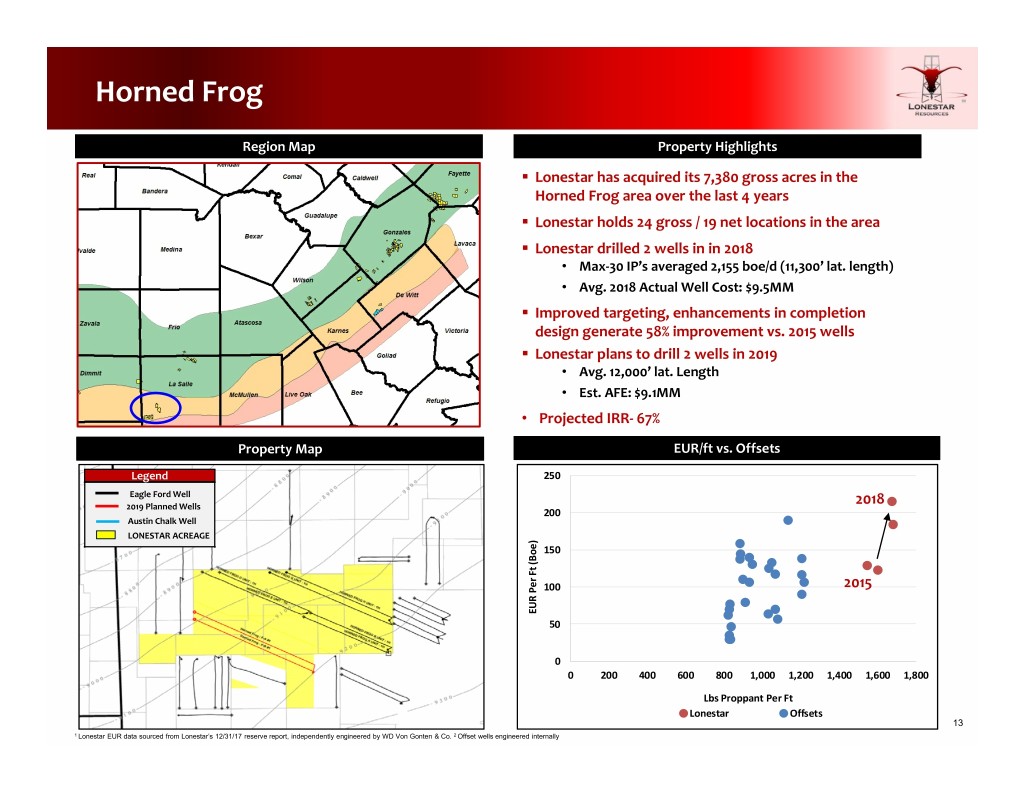

Horned Frog Region Map Property Highlights . Lonestar has acquired its 7,380 gross acres in the Horned Frog area over the last 4 years . Lonestar holds 24 gross / 19 net locations in the area . Lonestar drilled 2 wells in in 2018 • Max‐30 IP’s averaged 2,155 boe/d (11,300’ lat. length) • Avg. 2018 Actual Well Cost: $9.5MM . Improved targeting, enhancements in completion design generate 58% improvement vs. 2015 wells . Lonestar plans to drill 2 wells in 2019 • Avg. 12,000’ lat. Length • Est. AFE: $9.1MM • Projected IRR‐ 67% Property Map EUR/ft vs. Offsets Legend 250 Eagle Ford Well 2018 2019 Planned Wells 200 Austin Chalk Well LONESTAR ACREAGE 150 (Boe) Ft 100 2015 Per EUR 50 0 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Lbs Proppant Per Ft Lonestar Offsets 13 1 Lonestar EUR data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Offset wells engineered internally

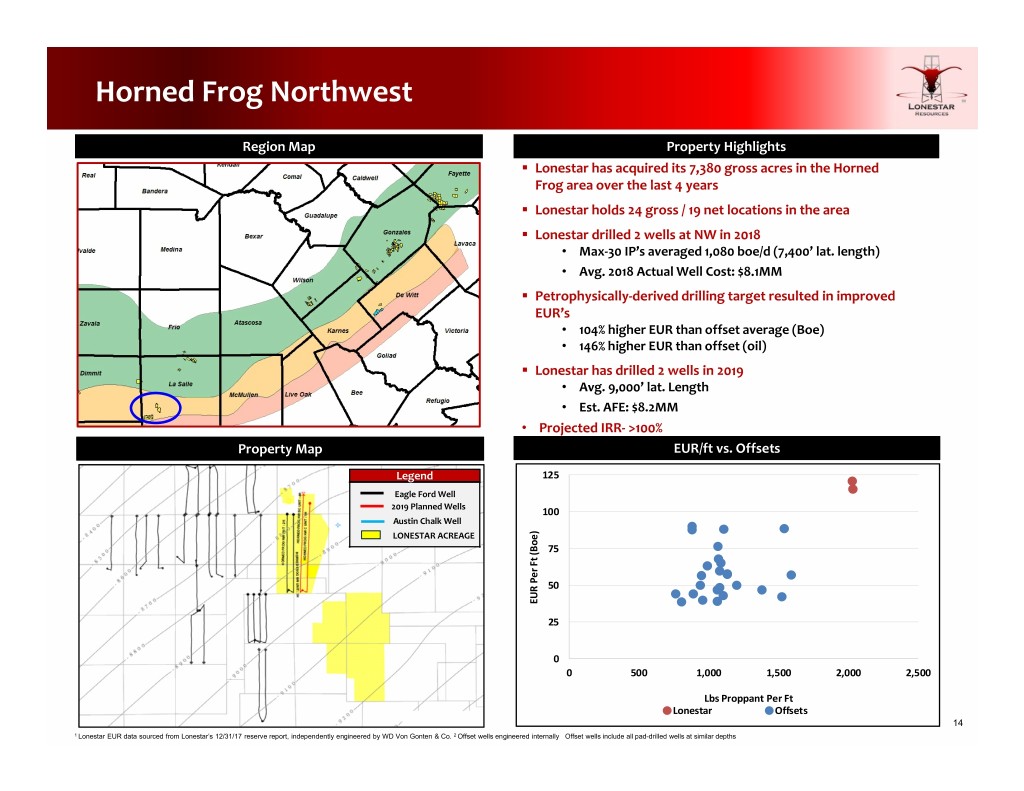

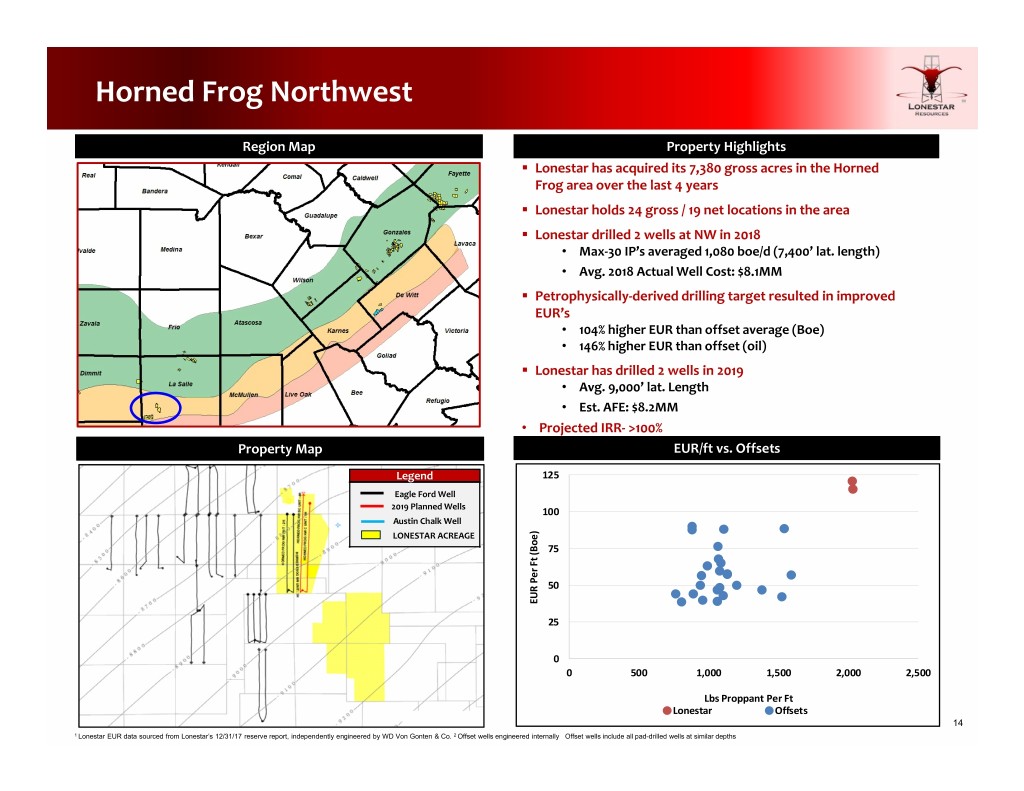

Horned Frog Northwest Region Map Property Highlights . Lonestar has acquired its 7,380 gross acres in the Horned Frog area over the last 4 years . Lonestar holds 24 gross / 19 net locations in the area . Lonestar drilled 2 wells at NW in 2018 • Max‐30 IP’s averaged 1,080 boe/d (7,400’ lat. length) • Avg. 2018 Actual Well Cost: $8.1MM . Petrophysically‐derived drilling target resulted in improved EUR’s • 104% higher EUR than offset average (Boe) • 146% higher EUR than offset (oil) . Lonestar has drilled 2 wells in 2019 • Avg. 9,000’ lat. Length • Est. AFE: $8.2MM • Projected IRR‐ >100% Property Map EUR/ft vs. Offsets Legend 125 Eagle Ford Well 2019 Planned Wells 100 Austin Chalk Well LONESTAR ACREAGE 75 (Boe) Ft Per 50 EUR 25 0 0 500 1,000 1,500 2,000 2,500 Lbs Proppant Per Ft Lonestar Offsets 14 1 Lonestar EUR data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Offset wells engineered internally Offset wells include all pad-drilled wells at similar depths

Cyclone / Hawkeye Region Map Property Highlights . Lonestar has acquired its 11,800 gross acres in the Cyclone/Hawkeye area over the last 4 years . Lonestar holds 53 gross / 29 net locations in the area . Lonestar has drilled multiple well‐pairs across its leasehold • 2016‐ Early wells generate EUR’s > 50 boe/ft • 2018‐ Hawkeye wells outpacing 3rd party EUR’s ~66 boe/ft • Avg. 2018 Actual Well Cost: $9.1MM (10,400’ lat. length) . Lonestar plans up to 3 wells in 2019 • Lat. Lengths‐ 9,000’ to 12,000’ • Est. AFE: $6.9MM to $8.3MM • Projected IRR‐ >55% Property Map EUR/ft vs. Offsets Legend 80 Eagle Ford Well 70 2019 Planned Wells Austin Chalk Well 60 LONESTAR ACREAGE 50 (Boe) Ft 40 Per 30 EUR 20 10 0 0 500 1,000 1,500 2,000 Lbs Proppant Per Ft Lonestar Offsets 15 1 Lonestar EUR data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Offset wells engineered internally Offset wells include all pad-drilled wells at similar depths

Sooner Acquisition De Witt County

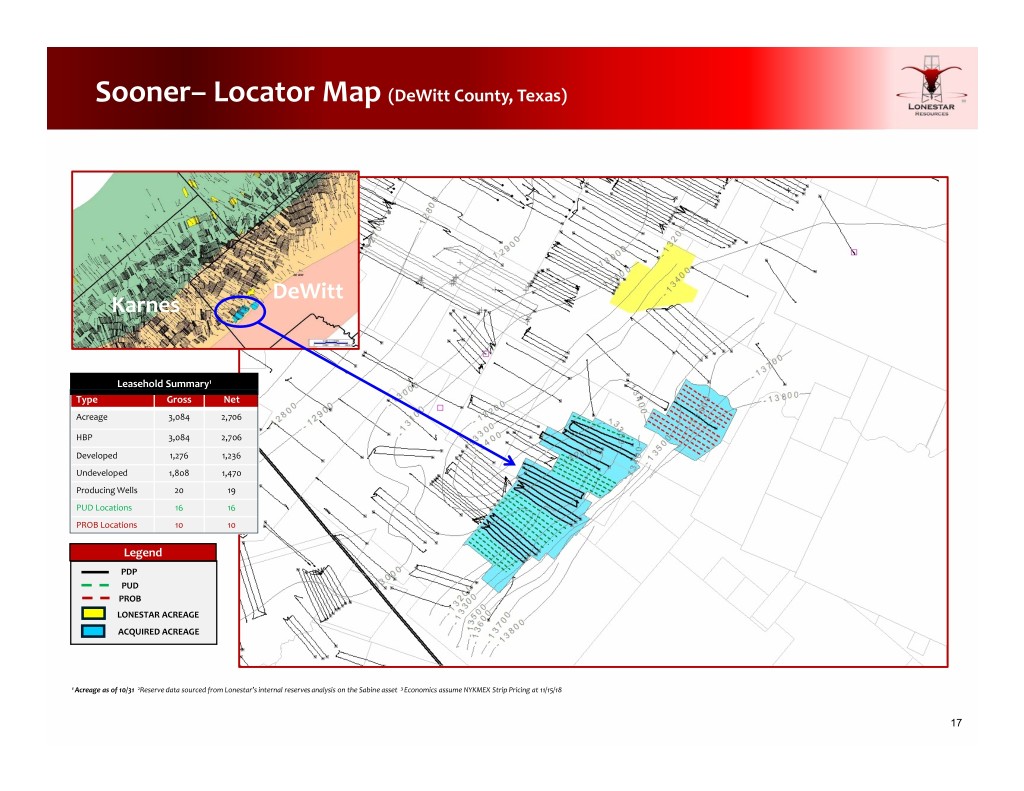

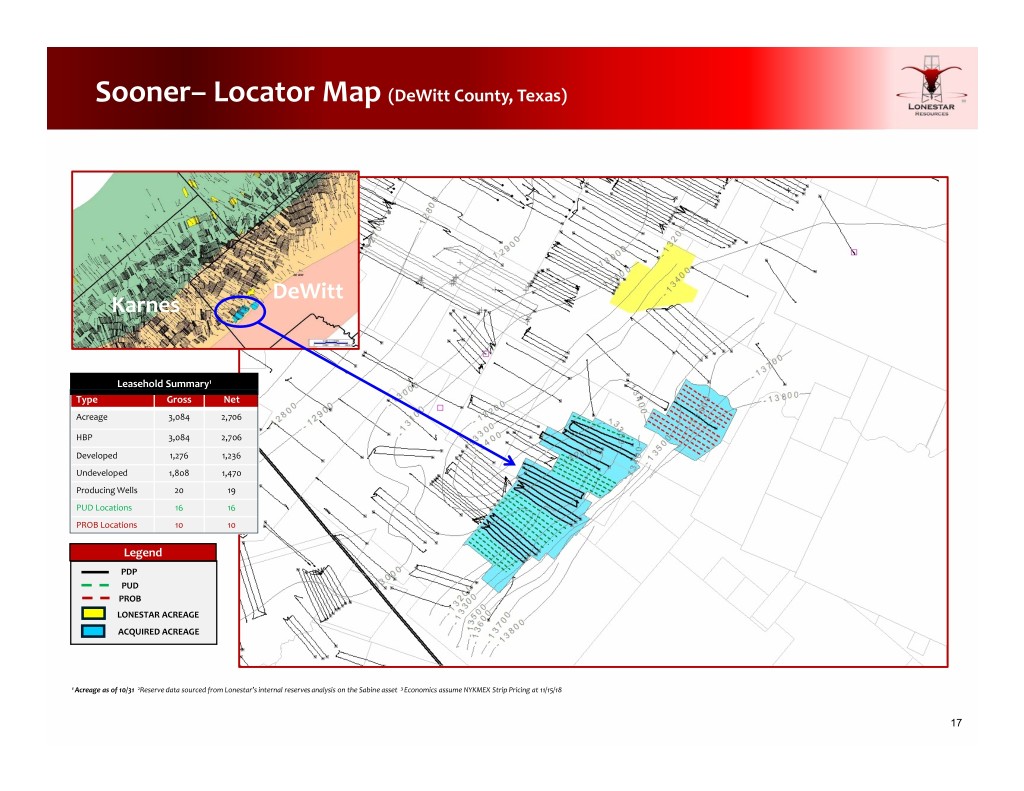

Sooner– Locator Map (DeWitt County, Texas) DeWitt Karnes Leasehold Summary1 Type Gross Net Acreage 3,084 2,706 HBP 3,084 2,706 Developed 1,276 1,236 Undeveloped 1,808 1,470 Producing Wells 20 19 PUD Locations 16 16 PROB Locations 10 10 Legend PDP PUD PROB LONESTAR ACREAGE ACQUIRED ACREAGE 1 Acreage as of 10/31 2Reserve data sourced from Lonestar’s internal reserves analysis on the Sabine asset 3 Economics assume NYKMEX Strip Pricing at 11/15/18 17

Sooner Geologic Summary Lonestar Resources Gross Thickness, in ft. (Eagle Ford Shale) T Bird #1H Pilot Hole Log Upper Eagle Ford 81’ Lower Eagle Ford 246 ’ Lower Eagle Ford Shale on the acquired leasehold is among the thickest in Sugarkane Field 18

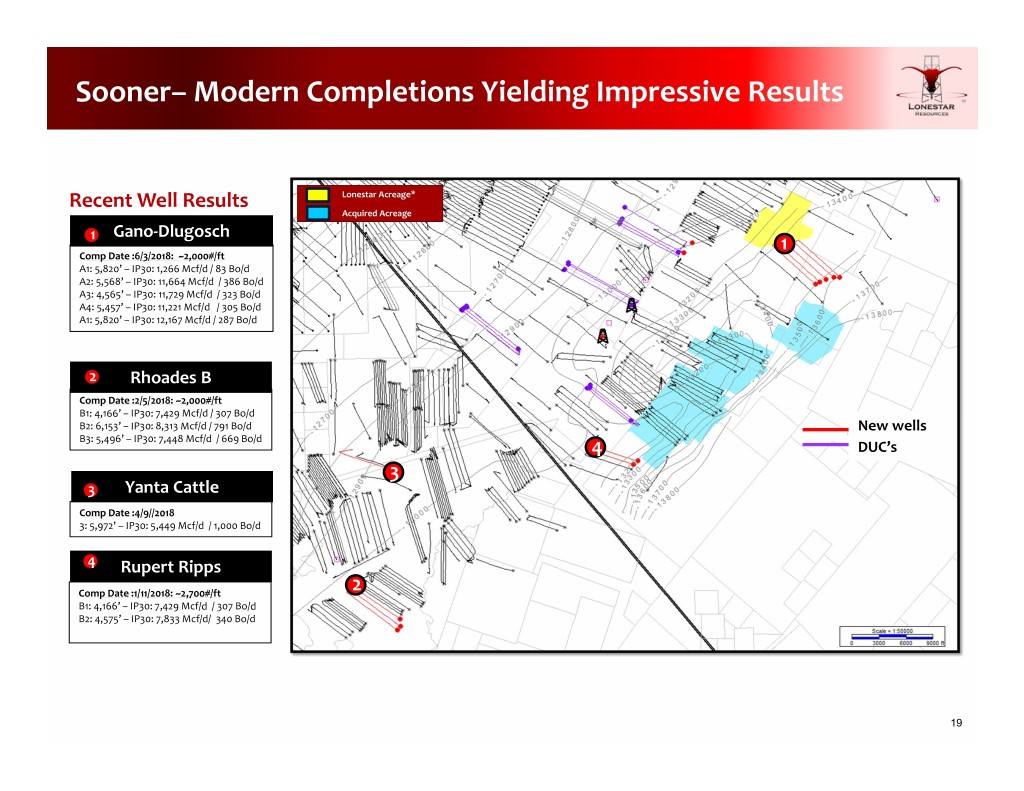

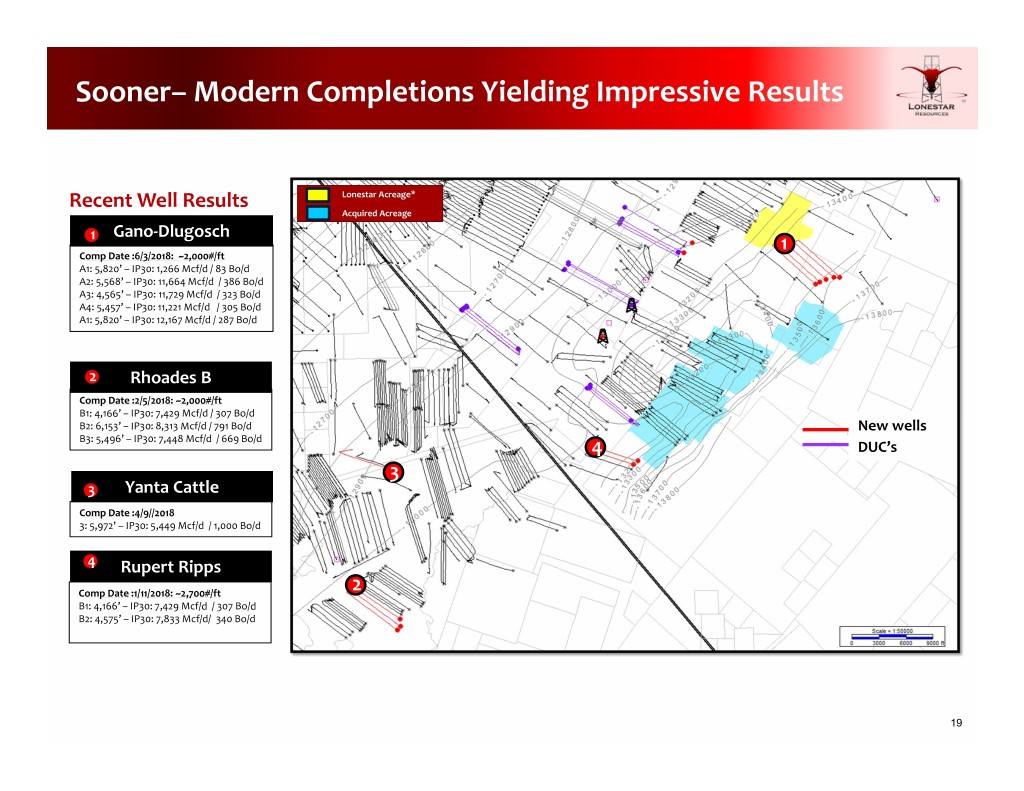

Sooner– Modern Completions Yielding Impressive Results Recent Well Results Lonestar Acreage* Acquired Acreage Gano‐Dlugosch 1 1 Comp Date :6/3/2018: ~2,000#/ft A1: 5,820’ –IP30: 1,266 Mcf/d / 83 Bo/d A2: 5,568’ –IP30: 11,664 Mcf/d / 386 Bo/d A3: 4,565’ –IP30: 11,729 Mcf/d / 323 Bo/d A4: 5,457’ –IP30: 11,221 Mcf/d / 305 Bo/d A1: 5,820’ –IP30: 12,167 Mcf/d / 287 Bo/d 2 Rhoades B Comp Date :2/5/2018: ~2,000#/ft B1: 4,166’ –IP30: 7,429 Mcf/d / 307 Bo/d B2: 6,153’ –IP30: 8,313 Mcf/d / 791 Bo/d New wells B3: 5,496’ –IP30: 7,448 Mcf/d / 669 Bo/d 4 DUC’s 3 3 Yanta Cattle Comp Date :4/9//2018 3: 5,972’ –IP30: 5,449 Mcf/d / 1,000 Bo/d 4 Rupert Ripps Comp Date :1/11/2018: ~2,700#/ft 2 B1: 4,166’ –IP30: 7,429 Mcf/d / 307 Bo/d B2: 4,575’ –IP30: 7,833 Mcf/d/ 340 Bo/d 19

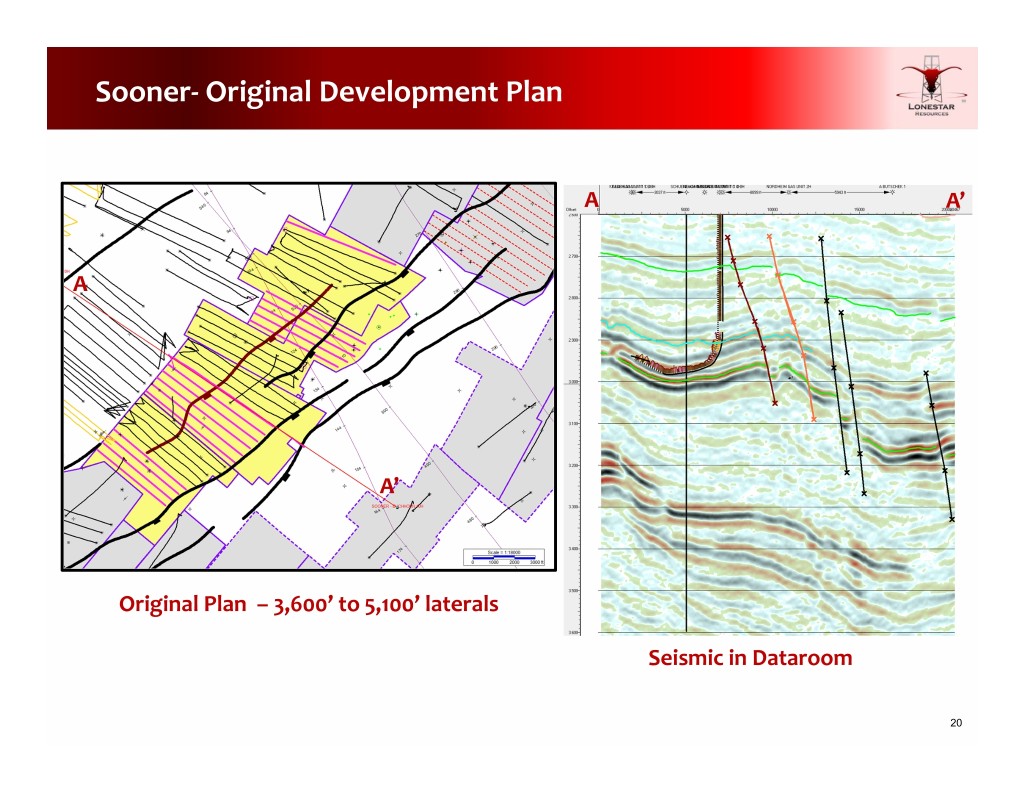

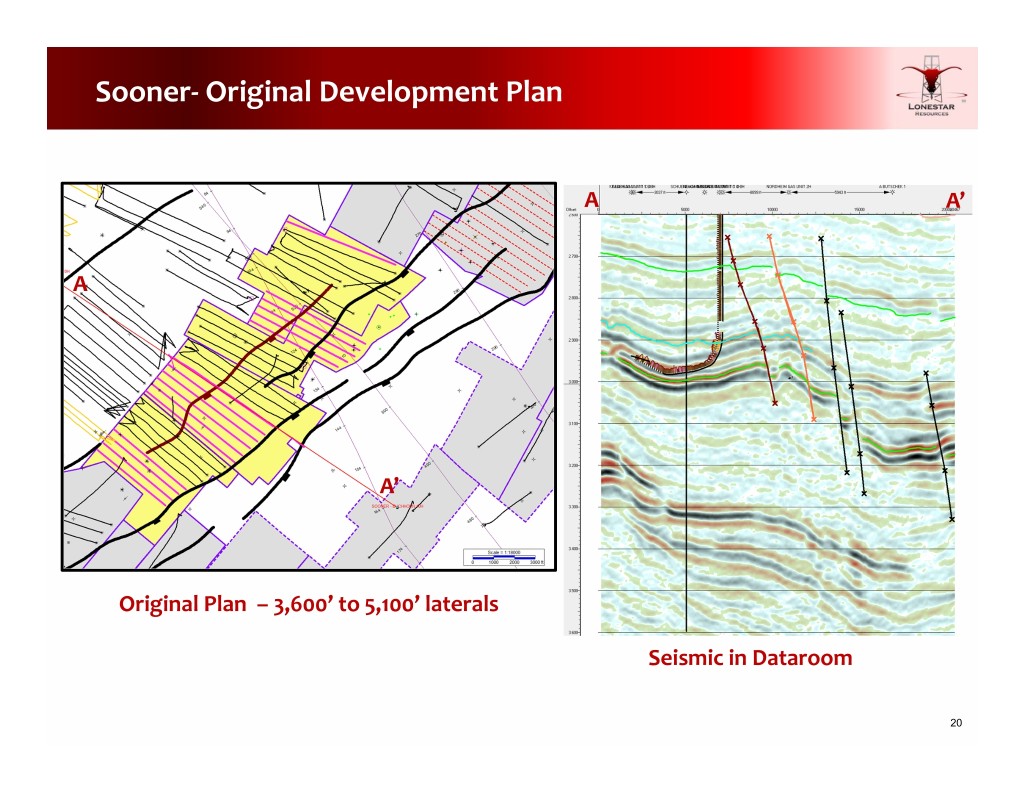

Sooner‐ Original Development Plan A A’ A A’ Original Plan – 3,600’ to 5,100’ laterals Seismic in Dataroom 20

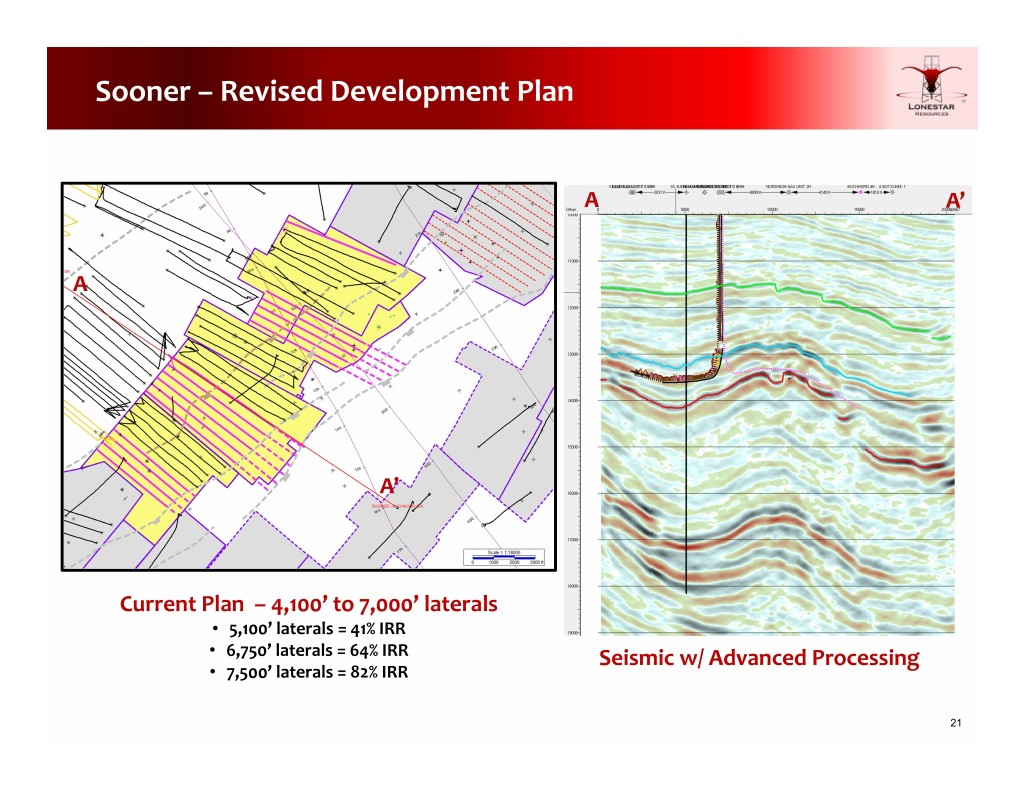

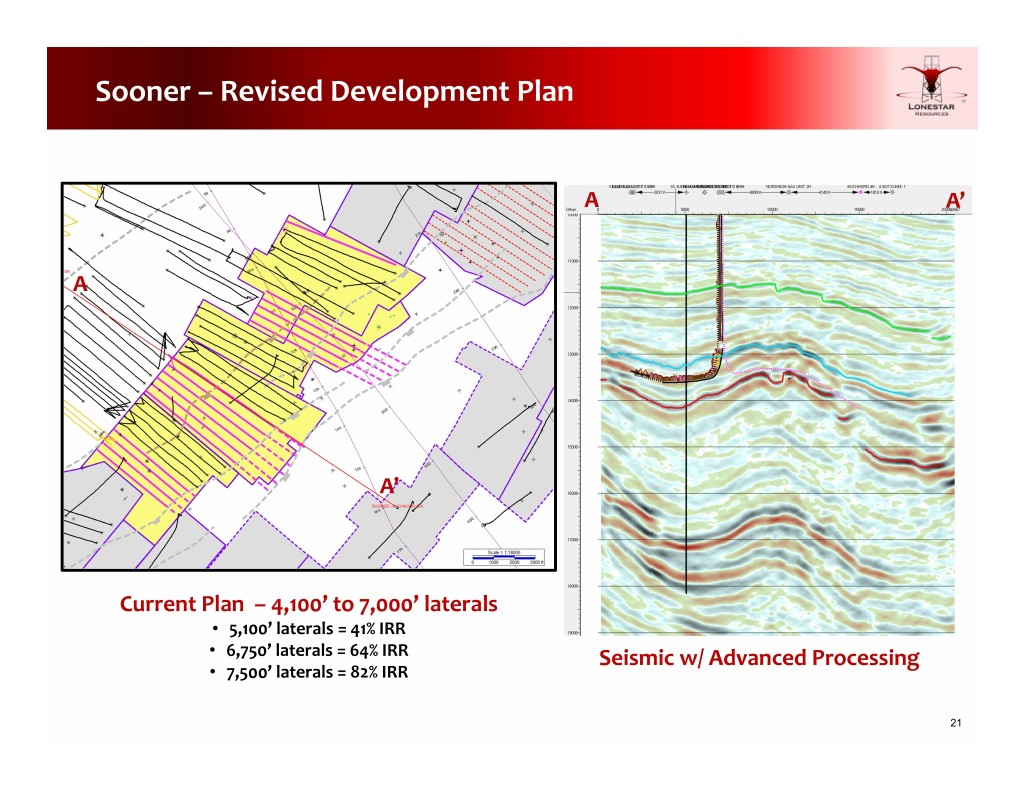

Sooner – Revised Development Plan A A’ A A’ Current Plan – 4,100’ to 7,000’ laterals • 5,100’ laterals = 41% IRR • 6,750’ laterals = 64% IRR Seismic w/ Advanced Processing • 7,500’ laterals = 82% IRR 21

Our Mission‐ Increase Net Asset Value Per Share Flat Deck Proved Reserves 2016 2017 2018 Proved Reserves (MMBOE) 42.9 74.0 92.1 Lonestar’s PV‐10/Share ($55.00/$2.75 flat) Proved PV‐10 ($MM) $334.6 $624.9 $800.7 $14.00 4.5X Proved & Prob Reserves (MMBOE) 52.7 93.3 118.8 Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 4.0X $12.00 Proved NAV Calculation 2016 2017 2018 3.5X Proved PV‐10 ($MM) $334.6 $624.9 $800.7 $10.00 Less Debt ($204.1) ($305.9) ($428.8) 3.0X Less Adj. Working Capital ($14.7) ($33.5) $0.9 $8.00 2.5X EBITDAX Proved NAV $115.8 $285.6 $372.8 $6.00 2.0X Fully Diluted Shares 21.8 38.5 39.9 NAV/Share 1.5X $4.00 Proved NAV/share $5.31 $7.42 $9.34 1.0X Debt/LQA Proved & Probable NAV Calculation 2016 2017 2018 $2.00 0.5X Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 $0.00 0.0X Less Debt ($204.1) ($305.9) ($428.8) YE16 YE17 YE18 Less Adj. Working Capital ($14.7) ($33.5) $0.9 Proved & Prob NAV $185.5 $389.9 $511.0 Proved Probable Debt/LQA EBITDAX Fully Diluted Shares 21.8 38.5 39.9 Proved & Prob NAV/share $8.50 $10.13 $12.81 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat oil price and $2.75 flat gas deck. 2 Debt values exclude mortgage debt associated with the Company’s headquarter offices 3 Working capital is calculated by taking current assets less current liabilities and adjusted for derivative financial instruments 4 2017 debt values are proforma the 2023 Senior Unsecured Notes offering 22 5 2018 balance sheet data is preliminary and subject to change following full year audit

Hedging Summary – Crude Oil Crude Oil Contracts Crude Oil Contracts % of Period Instrument Volume Fixed Price Production 74% 88% 85% 48% Hedged 1 Cal ’19 Oil‐ WTI Swap 1,536 bbls/day $48.04 7,000 $90 Cal ’19 Oil –WTI Swap 1,394 bbls/day $50.40 6,336 Cal ’19 Oil‐WTI Swap 1,100 bbls/day $50.90 6,021 $80 6,000 Cal ’19 Oil‐WTI Swap 900 bbls/day $58.25 $70 5,000 Cal ’19 Oil‐WTI Swap 500 bbls/day $65.20 $60 Cal ’19 Oil‐WTI Swap 500 bbls/day $69.57 (bopd) 4,180 4,000 $50 Cal ’19 Oil‐WTI Swap 70 bbls/day $48.97 Bbl 3,213 / Cal ’19 Oil‐WTI Swap 336 bbls/day $58.72 $ Hedged $40 3,000 Cal ’20 Oil‐WTI Swap 556 bbls/day $48.90 $30 $55.50 $57.30 2,000 $53.36 $54.14 Cal ’20 Oil‐WTI Swap 1,123 bbls/day $55.06 Volume $20 Cal ’20 Oil‐WTI Swap 500 bbls/day $61.65 1,000 $10 Cal ’20 Oil‐WTI Swap 500 bbls/day $65.56 0 $0 Cal ‘20 Oil‐WTI Swap 500 bbls/day $58.03 2017 2018 2019 2020 Cal ‘20 Oil‐WTI Swap 500 bbls/day $57.70 Volume Hedged Cal ‘20 Oil‐WTI Swap 500 bbls/day $57.94 LLS Basis Swaps Period Instrument Volume Fixed Price Cal ’19 LLS‐Basis Swap 5,430 bbls/day $5.00 Cal ’19 LLS‐Basis Swap 500 bbls/day $5.55 Cal ’19 LLS‐Basis Swap 70 bbls/day $5.40 1% hedged values based off mid‐point of guidance. 22019 Bbl/d represent full year 23

Hedging Summary – Natural Gas Natural Gas Contracts Natural Gas Contracts % of Period Instrument Volume Fixed Price Production 100% 50% 64% Hedged 1 Cal ’19 Natural Gas – 4,986 $3.21 NYMEX Swap MMBTU/day 16,000 15,000 $5.00 Cal ’19 Natural Gas – 2,493 $3.55 14,000 NYMEX Swap MMBTU/day $4.00 Cal ’19 Natural Gas – 2,507 $2.76 12,000 NYMEX Swap MMBTU/day Cal ’19 Natural Gas – 5,014 $2.77 NYMEX Swap MMBTU/day (Mcfpd) 10,000 $3.36 $3.00 $3.04 Mcf 8,000 $3.06 / 7,000 6,298 $ Hedged 6,000 $2.00 4,000 Volume $1.00 2,000 0 $0.00 2017 2018 2019 2020 Volume Hedged 1% hedged values off mid-point of guidance. 22019 Mcf/d represent full year 24