Lonestar Resources US, Inc. Year Ended 2018 Conference Call March 8, 2019

Forward‐Looking Statements Safe Harbor & Disclaimer Lonestar Resources US, Inc. cautions that this presentation (including oral commentary that accompanies this presentation) contains forward-looking statements, including, but not limited to, statements about performance expectations related to our assets and technical improvements made thereto; drilling and completion of wells; and other statements regarding our business strategy and operations. These statements involve substantial known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward- looking statements. These risks and uncertainties include, but are not limited to, the following: volatility of oil, natural gas and NGL prices, and potential write-down of the carrying values of crude oil and natural gas properties; inability to successfully replace proved producing reserves; substantial capital expenditures required for exploration, development and exploitation projects; potential liabilities resulting from operating hazards, natural disasters or other interruptions; risks related using the latest available horizontal drilling and completion techniques; uncertainties tied to lengthy period of development of identified drilling locations; unexpected delays and cost overrun related to the development of estimated proved undeveloped reserves; concentration risk related to properties, which are located primarily in the Eagle Ford Shale of South Texas; loss of lease on undeveloped leasehold acreage that may result from lack of development or commercialization; inaccuracies in assumptions made in estimating proved reserves; our limited control over activities in properties Lonestar does not operate; potential inconsistency between the present value of future net revenues from our proved reserves and the current market value of our estimated oil and natural gas reserves; risks related to derivative activities; losses resulting from title deficiencies; risks related to health, safety and environmental laws and regulations; additional regulation of hydraulic fracturing; reduced demand for crude oil, natural gas and NGLs resulting from conservation measures and technological advances; inability to acquire adequate supplies of water for our drilling operations or to dispose of or recycle the used water economically and in an environmentally safe manner; climate change laws and regulations restricting emissions of “greenhouse gases” that may increase operating costs and reduce demand for the crude oil and natural gas; fluctuations in the differential between benchmark prices of crude oil and natural gas and the reference or regional index price used to price actual crude oil and natural gas sales; and the other important factors discussed under the caption “Risk Factors” in our Amended Annual Report on Form 10-K/A filed with the Securities and Exchange Commission, or the SEC, on November, 2, 2018, our Quarterly Reports on Form 10-Q/A filed with the SEC, as well as other documents that we have filed and may file from time to time with the SEC. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward- looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates and other statistical data made by independent parties and by us relating to well performance, finding and development costs, recycle ratio and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. 2

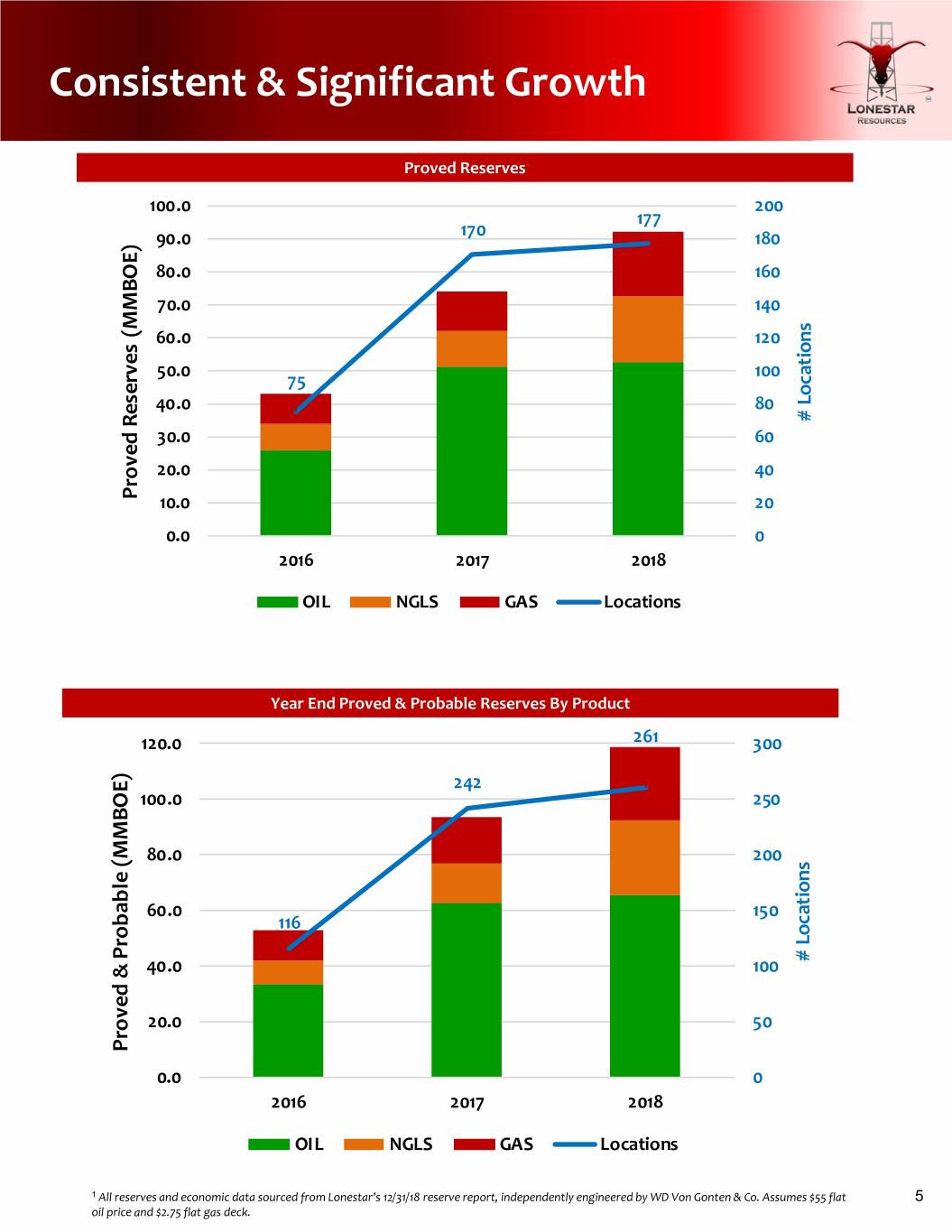

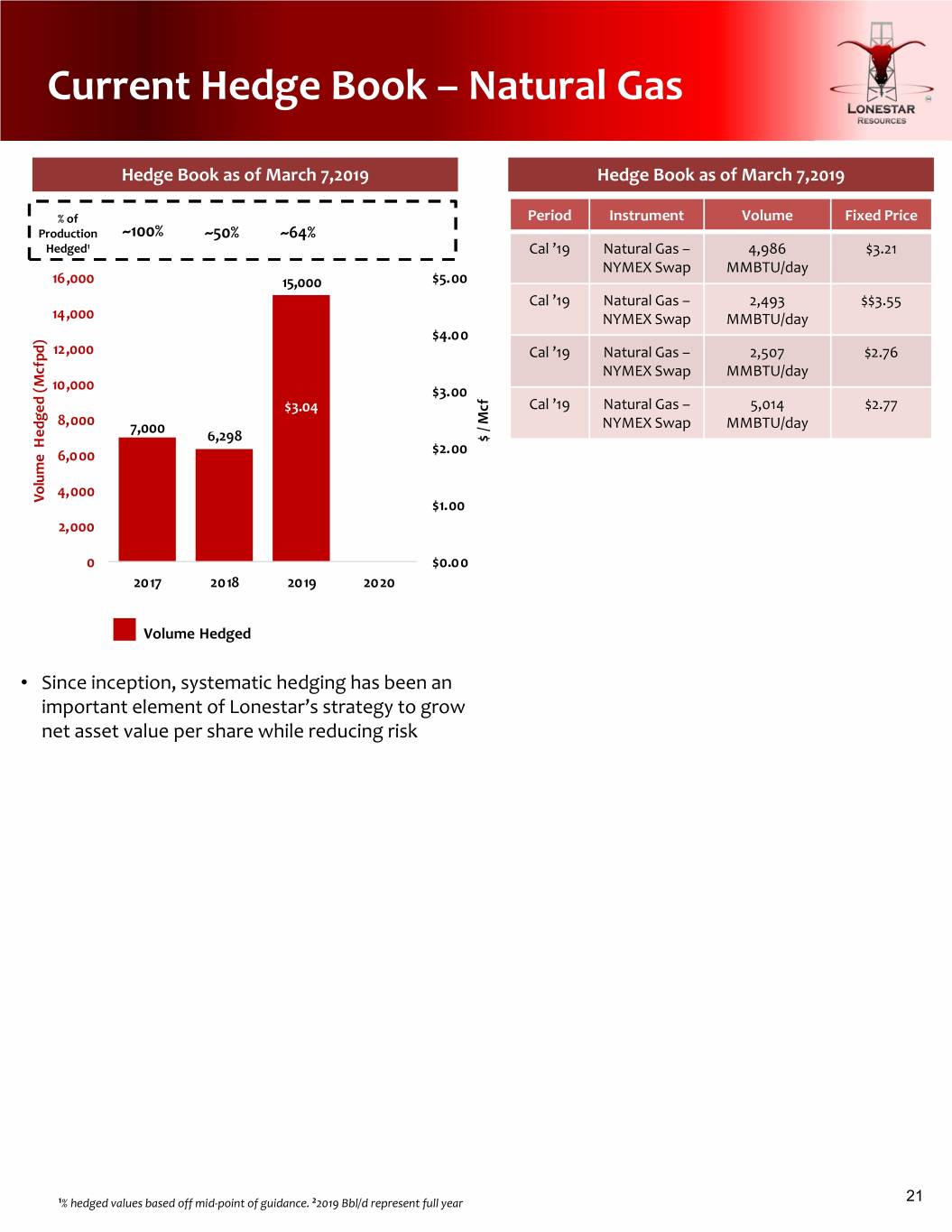

Key Messages 4Q18 Production by Product Product Volume Crude Oil 7,883 bbl/d NGL’s 2,675 bbl/d NGL's 20% Oil 60% Natural Gas 15,561 Mcf/d Gas 20% Total 13,152 Boe/d 2018 Accomplishments . Increased production by 72% to 11,155 Boe/d . Increased Adjusted EBITDAX by 101% to $130.3 MM . Reduced Debt / EBITDAX from 3.6x to 2.6x . Proved reserves 1 increased 23% to 93.4 MMBOE at F&D costs of $9.07/Boe . Proved PV‐10 1 increased 73% to $1.1 Billion . Executed accretive “Sooner” acquisition Fourth Quarter 2018 Highlights . Production increased 81%, year‐over‐year to 13,152 Boe/d . Adjusted EBITDAX increased 98%, year‐over‐year to $40.7 million Financial Transformation Complete, Enter 2019 with ~$100 MM Liquidity… . Increased borrowing base 45% to $275 MM . At December 31, 2018, Lonestar had $92 MM undrawn Borrowing Base, $5 MM cash . Agreed to sell Pirate assets for $12.3 MM, expected to close late March 2019 …Secured Energy Services to Deliver Timely Well Results . 2019 Drilling & Completion Capital Budget‐ $107‐$130 MM for 17 to 20 wells . Rigs Under Contract to Drill 2019 Capital Program, with optionality to expand . Executed Agreement for Dedication of Frac Spread for 2019 Robust Hedge Book Reduces Risk . 2019‐ ~85% Crude Oil hedged at $54.14/bbl (WTI) . 2019‐ ~64% Natural Gas hedged at $3.04/MMBTU (HH) . 2020‐ ~53% Crude Oil hedged at $57.34/bbl (WTI) Two‐Year Plan to Achieve High Returns, Excellent Growth, Self‐Funded in 2H19 . 2019 Guidance‐ 13,700‐14,700 Boe/d & $140‐$150 MM EBITDAX . 2020 Guidance‐ 17,000‐18,300 Boe/d & $170‐$190 MM EBITDAX 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co on YE18 Sec Pricing. 3

Key Financial Highlights Financial Commentary Daily Production 4Q18 Volumes Up 81% to 13,152 Boe/d Product 4Q17 Mix 4Q18 Mix . Materially Contributing Completions . Asherton #1HN, #3HN (Dimmit County) Crude Oil 5,217 72% 7,883 60% . Onstream September, 2018 NGL's 1,062 15% 2,675 20% . 2.0 gross / 2.0 net wells . Hawkeye #24H, #25H (Gonzales County) Natural Gas 5,957 14% 15,561 20% . Onstream September, 2018 Total 7,272 100% 13,152 100% . 2.0 gross / 1.3 net wells . Materially Contributing Acquisitions . Sooner Acquisition (De Witt County) Product Pricing / Revenues . Effective November 15, 2018 . 20.0 gross / 19.4 net wells $MM $ / Unit Product Pricing Improved 2%... Product 4Q17 4Q18 Chg. 4Q17 4Q18 Chg. • Oil & Gas Prices Improved While NGLs Prices Declined • Basis Differentials for All Three Products Crude Oil $27.8 $47.0 +69% $57.85 $64.86 +12% . Oil price differentials were +$6.05/bbl vs. WTI NGL’s $2.3 $5.5 +144% $23.19 $22.48 (3%) . Realizations increased $7.01 vs. 4Q17 . Better LLS pricing Nat. Gas $1.4 $5.3 +279% $2.56 $3.72 +45% . NGL price differentials were 38% of WTI Total $31.4 $57.9 +84% $46.99 $47.84 +2% . Realizations down 3% , or $0.71/bbl vs. 4Q17 . 4Q18 was 38% of WTI vs. 42% of WTI in 4Q17 . Gas price differentials were ‐$0.08/Mcf vs. HH Cash Expenses1 . Realizations increased 45% vs. 4Q17 $MM $ / Unit Per‐Unit Cash Expenses Are Declining… . LOE‐ $6.01 per Boe 17% Y‐0‐Y Expense 4Q17 4Q18 Chg. 4Q17 4Q18 Chg. . G,P&T‐ $0.80 per Boe 18% Y‐o‐Y 2 . Taxes‐ $2.38 per Boe 15% Y‐o‐Y LOE $4.9 $7.3 +50% $7.26 $6.01 (17%) . G&A‐ $3.62 per Boe 16%, Y‐o‐Y G,P&T3 $0.5 $1.0 +113% $0.68 $0.80 +18% . Int. Exp.‐ $7.89 per Boe 1% Y‐o‐Y . Total.‐ $20.70 per Boe 10% Y‐o‐Y Taxes $1.9 $2.9 +54% $2.79 $2.38 (15%) G&A4 $2.9 $4.4 +52% $4.32 $3.62 (16%) …Increasing Cash Margins in 4Q18 Int. Exp.5 $5.3 $9.5 +79% $7.95 $7.89 (1%) . Revenues‐ $47.84 per Boe, 2% Y‐o‐Y . Expenses‐ $20.70 per Boe, 10 Y‐o‐Y Total $15.4 $25.1 +63% $23.01 $20.70 (10%) . Total.‐ $27.14 per Boe, 13% Y‐o‐Y Cash $16.0 $32.8 +105% $23.98 $27.14 +13% Margin 1 Cash Operating Costs are controllable expenses incurred by the Company 4Excludes stock based compensation 2 LOE – Excludes $0.2 million of nonrecurring legal expenses 5 Excludes amortization of debt issuance cost, premiums & discounts 3 G,P&T – Gathering, processing and transportation expense 4

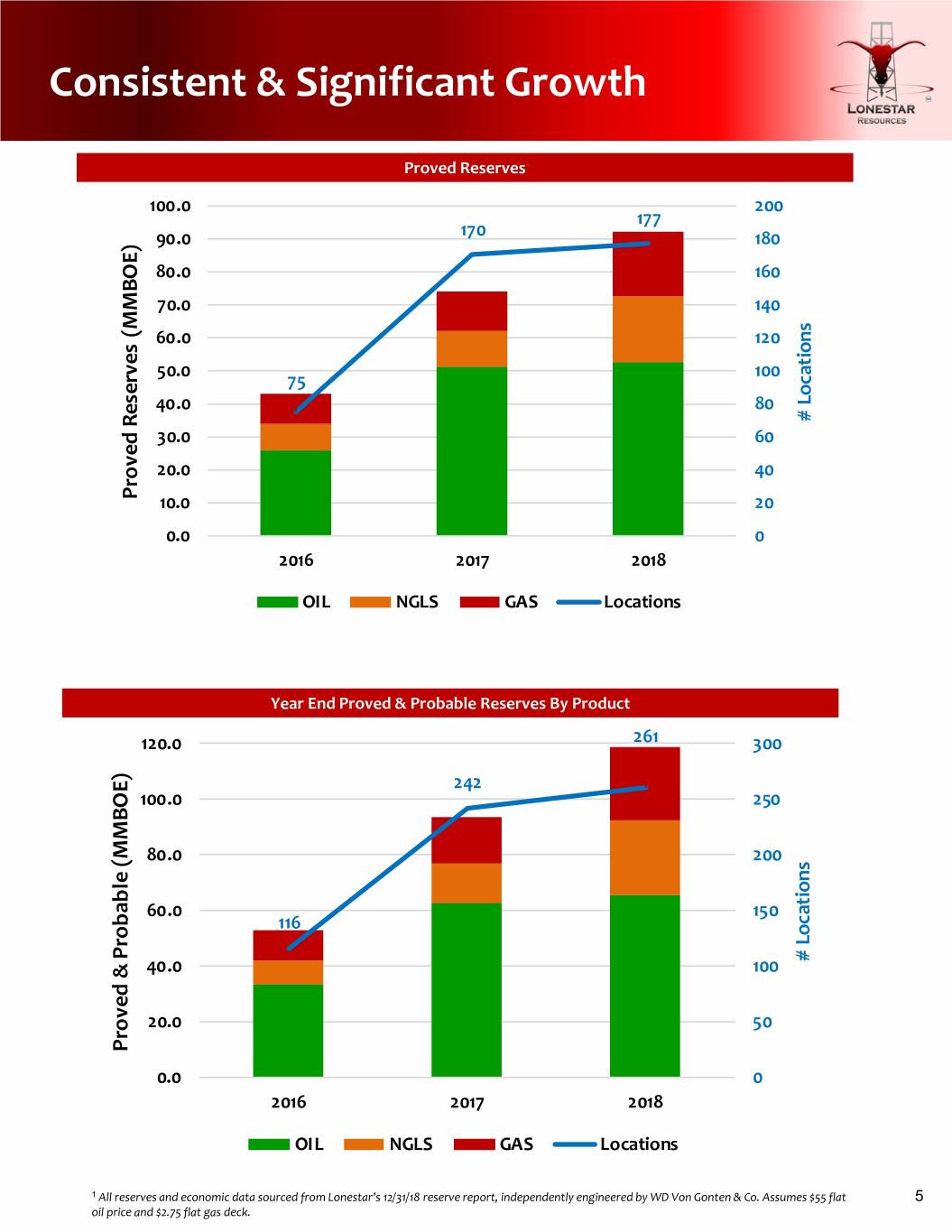

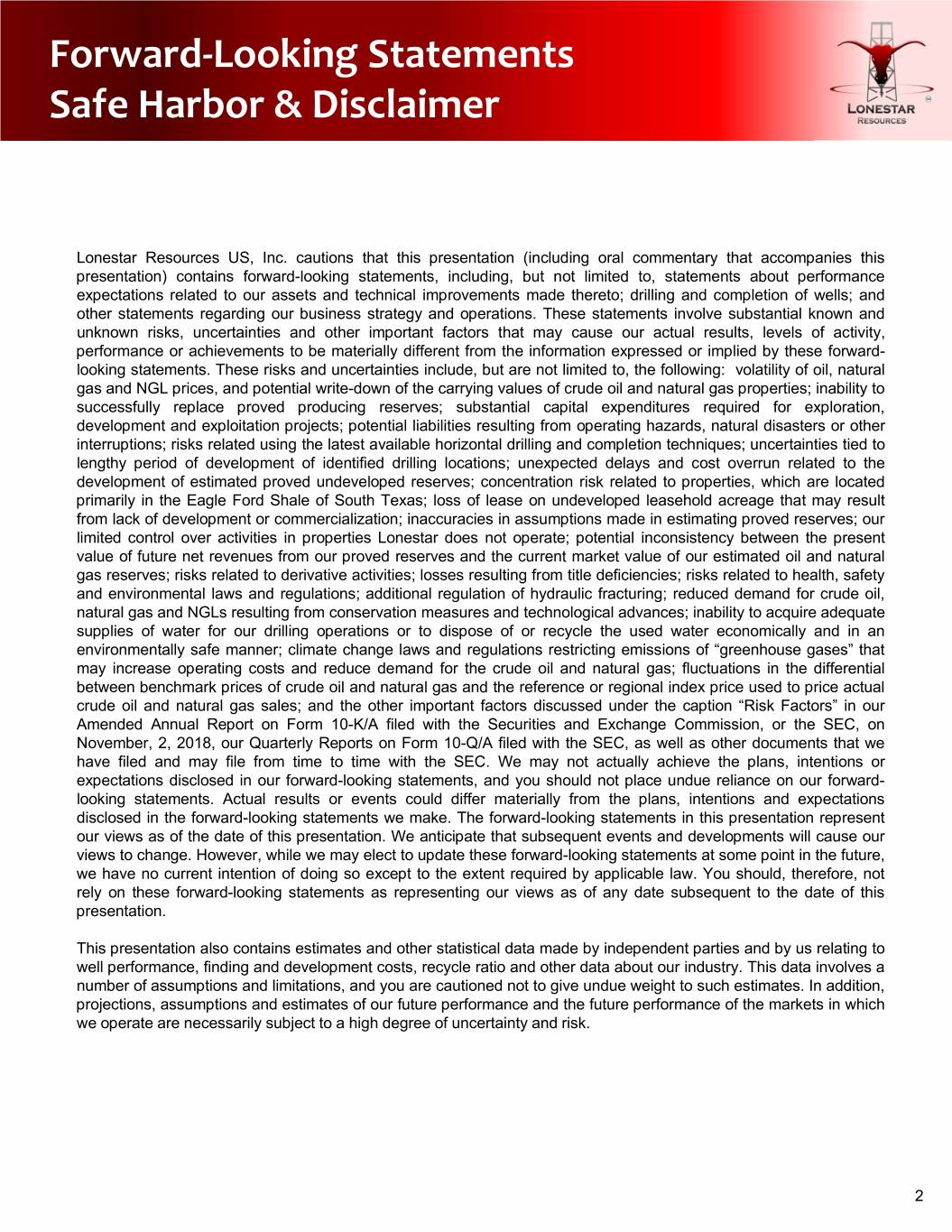

Consistent & Significant Growth Proved Reserves 100.0 200 177 90.0 170 180 80.0 160 70.0 140 (MMBOE) 60.0 120 50.0 100 75 Locations 40.0 80 # Reserves 30.0 60 20.0 40 Proved 10.0 20 0.0 0 2016 2017 2018 OIL NGLS GAS Locations Year End Proved & Probable Reserves By Product 120.0 261 300 242 100.0 250 80.0 200 (MMBOE) 60.0 150 116 Locations Probable # 40.0 100 & 20.0 50 Proved 0.0 0 2016 2017 2018 OIL NGLS GAS Locations 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat 5 oil price and $2.75 flat gas deck.

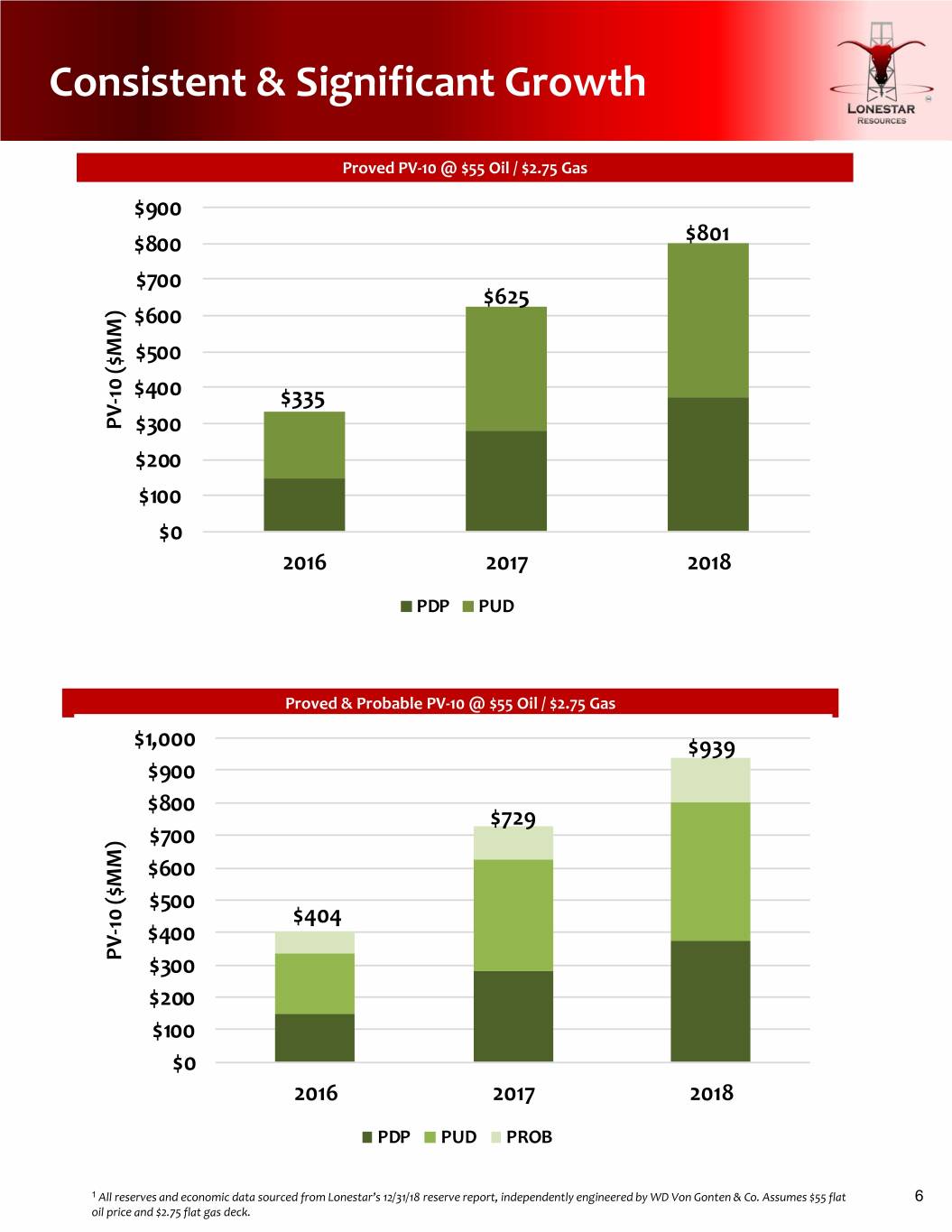

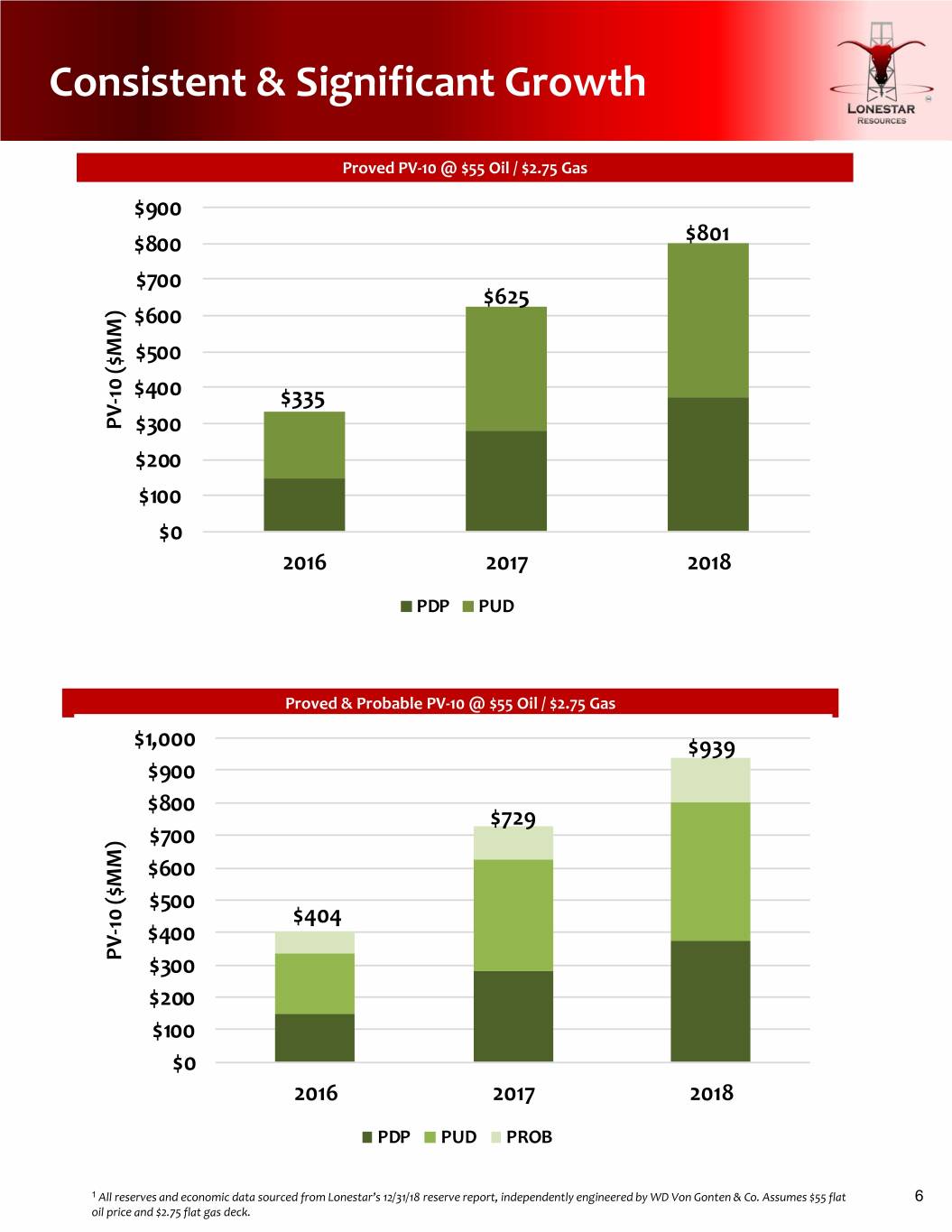

Consistent & Significant Growth Proved PV‐10 @ $55 Oil / $2.75 Gas $900 $800 $801 $700 $625 $600 $500 ($MM) 10 $400 ‐ $335 PV $300 $200 $100 $0 2016 2017 2018 PDP PUD Proved & Probable PV‐10 @ $55 Oil / $2.75 Gas $1,000 $939 $900 $800 $729 $700 $600 ($MM) $500 10 $404 ‐ $400 PV $300 $200 $100 $0 2016 2017 2018 PDP PUD PROB 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat 6 oil price and $2.75 flat gas deck.

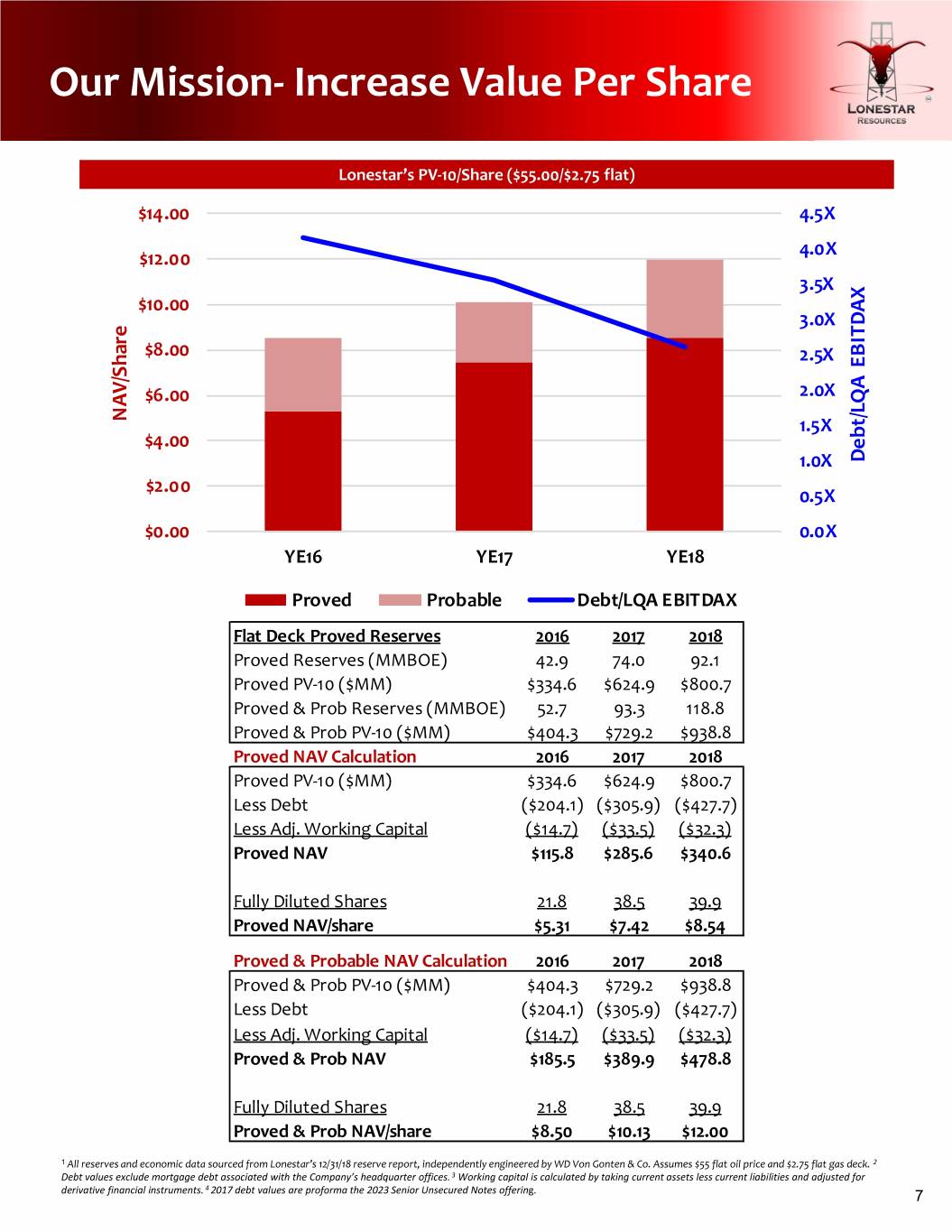

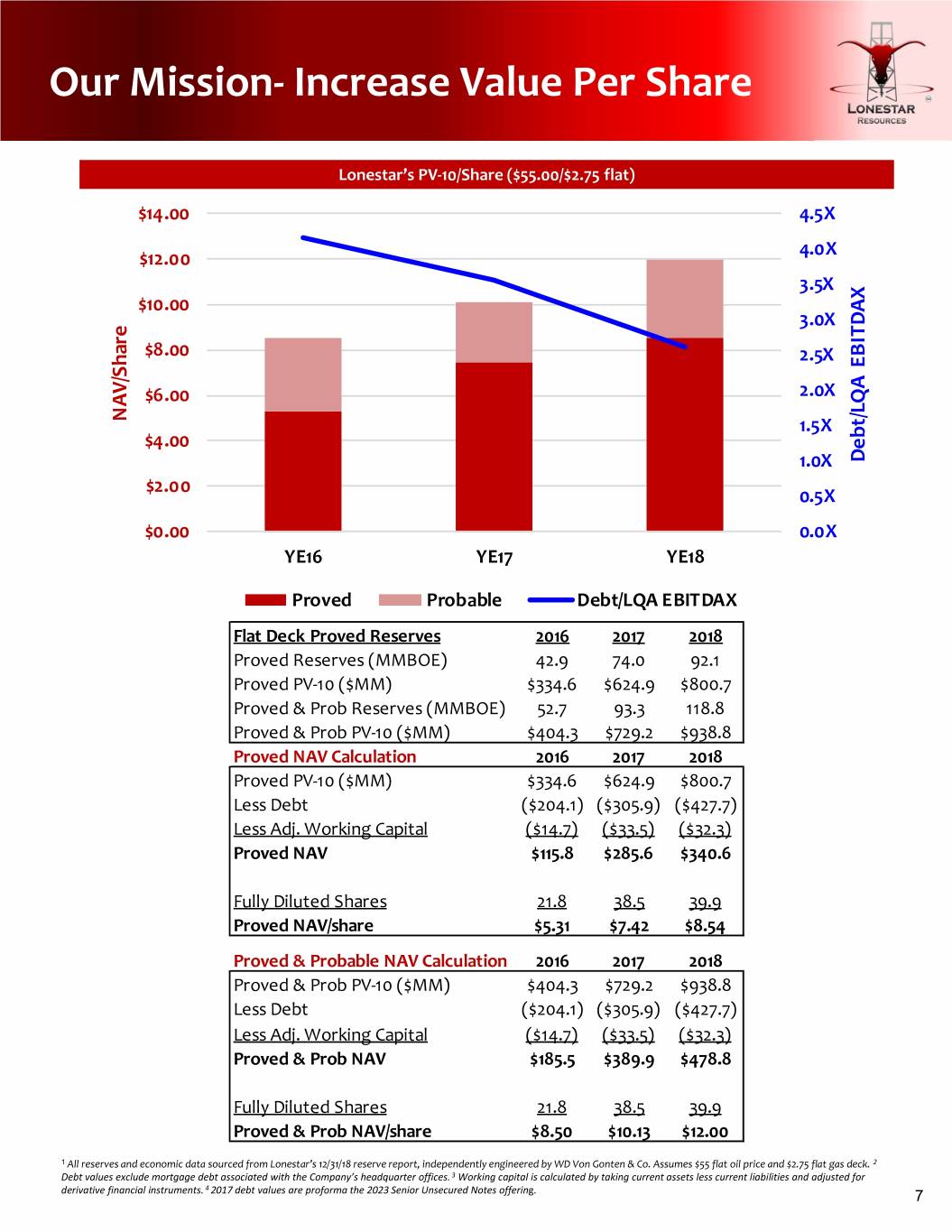

Our Mission‐ Increase Value Per Share Lonestar’s PV‐10/Share ($55.00/$2.75 flat) $14.00 4.5X 4.0X $12.00 3.5X $10.00 3.0X $8.00 2.5X EBITDAX $6.00 2.0X NAV/Share 1.5X $4.00 1.0X Debt/LQA $2.00 0.5X $0.00 0.0X YE16 YE17 YE18 Proved Probable Debt/LQA EBITDAX Flat Deck Proved Reserves 2016 2017 2018 Proved Reserves (MMBOE) 42.9 74.0 92.1 Proved PV‐10 ($MM) $334.6 $624.9 $800.7 Proved & Prob Reserves (MMBOE) 52.7 93.3 118.8 Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 Proved NAV Calculation 2016 2017 2018 Proved PV‐10 ($MM) $334.6 $624.9 $800.7 Less Debt ($204.1) ($305.9) ($427.7) Less Adj. Working Capital ($14.7) ($33.5) ($32.3) Proved NAV $115.8 $285.6 $340.6 Fully Diluted Shares 21.8 38.5 39.9 Proved NAV/share $5.31 $7.42 $8.54 Proved & Probable NAV Calculation 2016 2017 2018 Proved & Prob PV‐10 ($MM) $404.3 $729.2 $938.8 Less Debt ($204.1) ($305.9) ($427.7) Less Adj. Working Capital ($14.7) ($33.5) ($32.3) Proved & Prob NAV $185.5 $389.9 $478.8 Fully Diluted Shares 21.8 38.5 39.9 Proved & Prob NAV/share $8.50 $10.13 $12.00 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. Assumes $55 flat oil price and $2.75 flat gas deck. 2 Debt values exclude mortgage debt associated with the Company’s headquarter offices. 3 Working capital is calculated by taking current assets less current liabilities and adjusted for 4 derivative financial instruments. 2017 debt values are proforma the 2023 Senior Unsecured Notes offering. 7

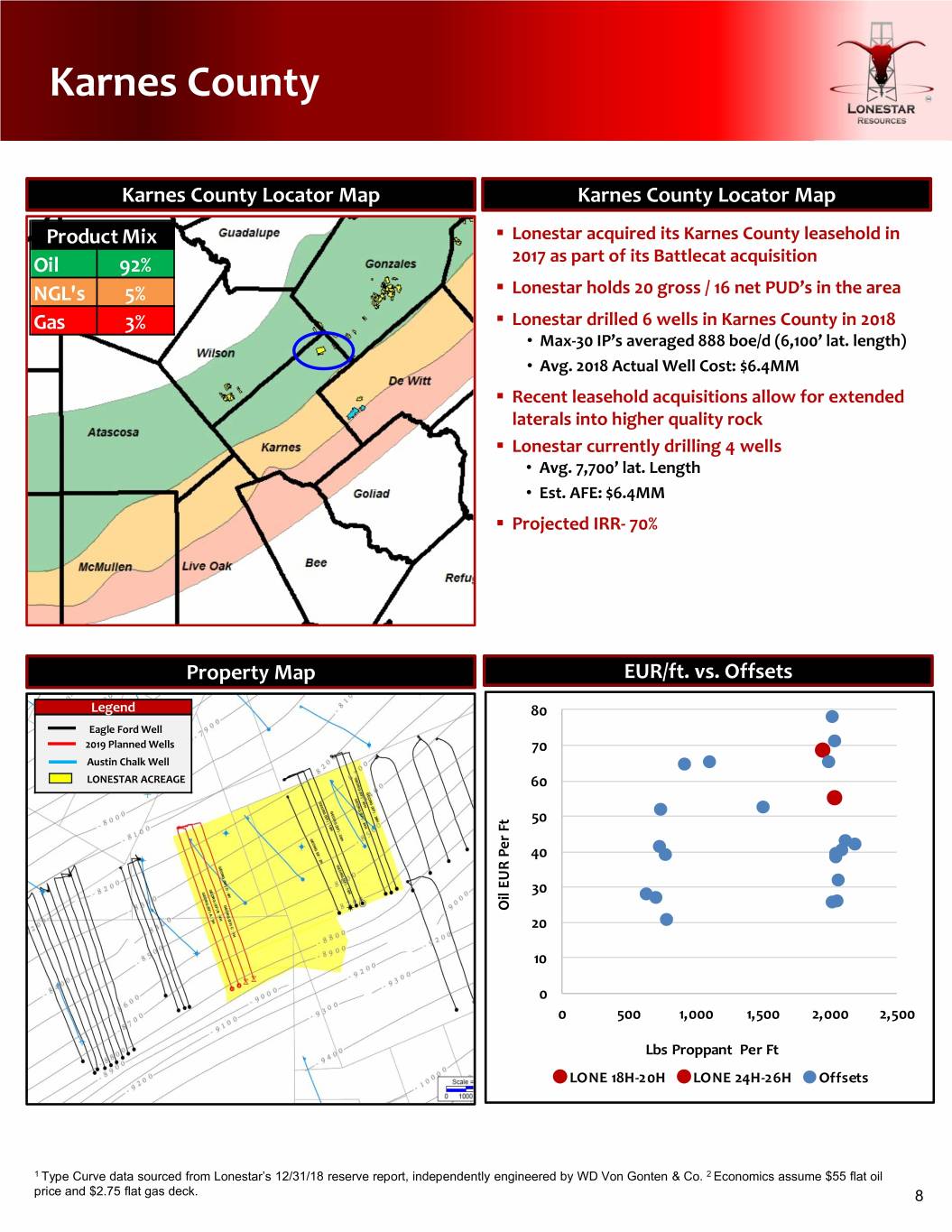

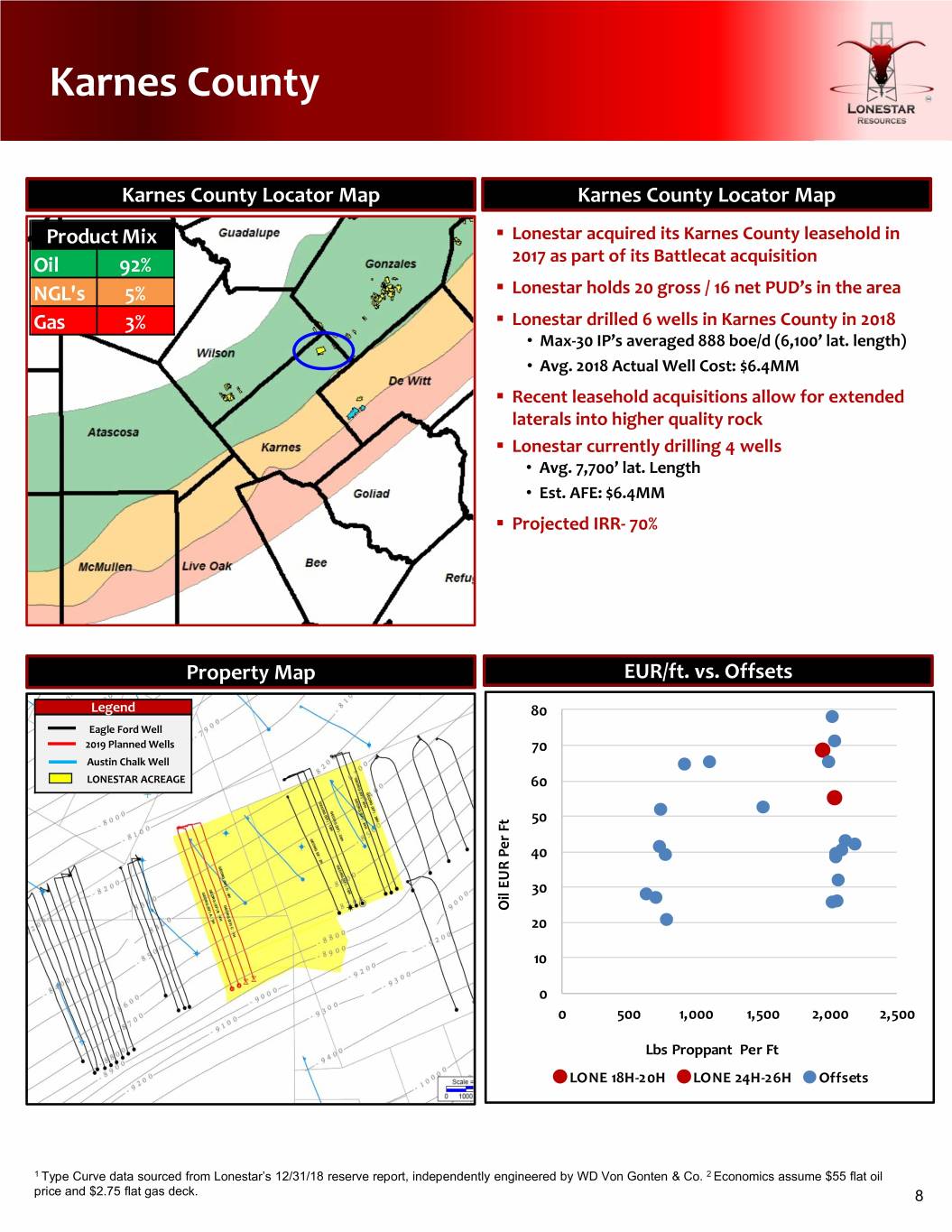

Karnes County Karnes County Locator Map Karnes County Locator Map Product Mix . Lonestar acquired its Karnes County leasehold in Oil 92% 2017 as part of its Battlecat acquisition NGL's 5% . Lonestar holds 20 gross / 16 net PUD’s in the area Gas 3% . Lonestar drilled 6 wells in Karnes County in 2018 • Max‐30 IP’s averaged 888 boe/d (6,100’ lat. length) • Avg. 2018 Actual Well Cost: $6.4MM . Recent leasehold acquisitions allow for extended laterals into higher quality rock . Lonestar currently drilling 4 wells • Avg. 7,700’ lat. Length • Est. AFE: $6.4MM . Projected IRR‐ 70% Property Map EUR/ft. vs. Offsets Legend 80 Eagle Ford Well 2019 Planned Wells 70 Austin Chalk Well LONESTAR ACREAGE 60 50 Ft Per 40 EUR 30 Oil 20 10 0 0 500 1,000 1,500 2,000 2,500 Lbs Proppant Per Ft LONE 18H‐20H LONE 24H‐26H Offsets 1 Type Curve data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $55 flat oil price and $2.75 flat gas deck. 8

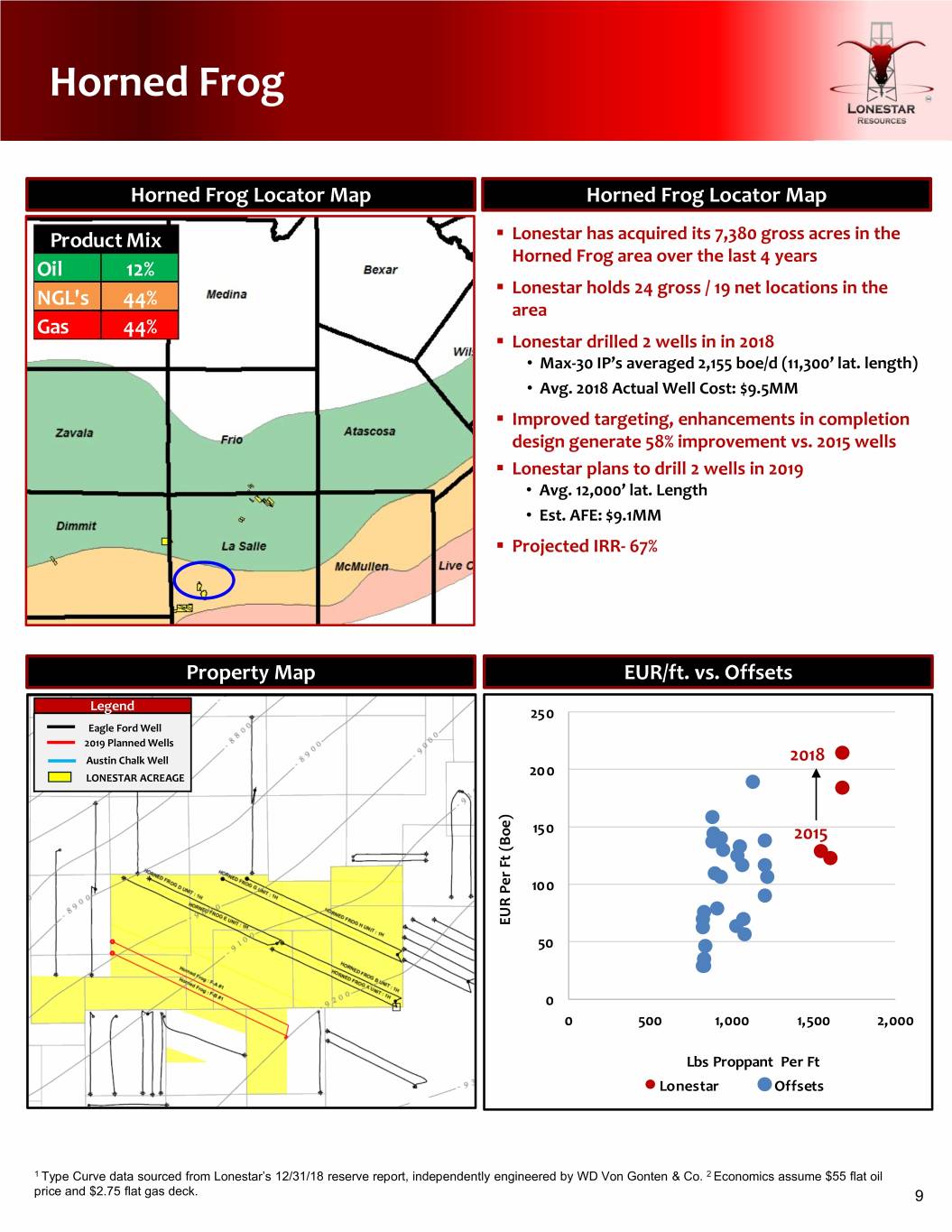

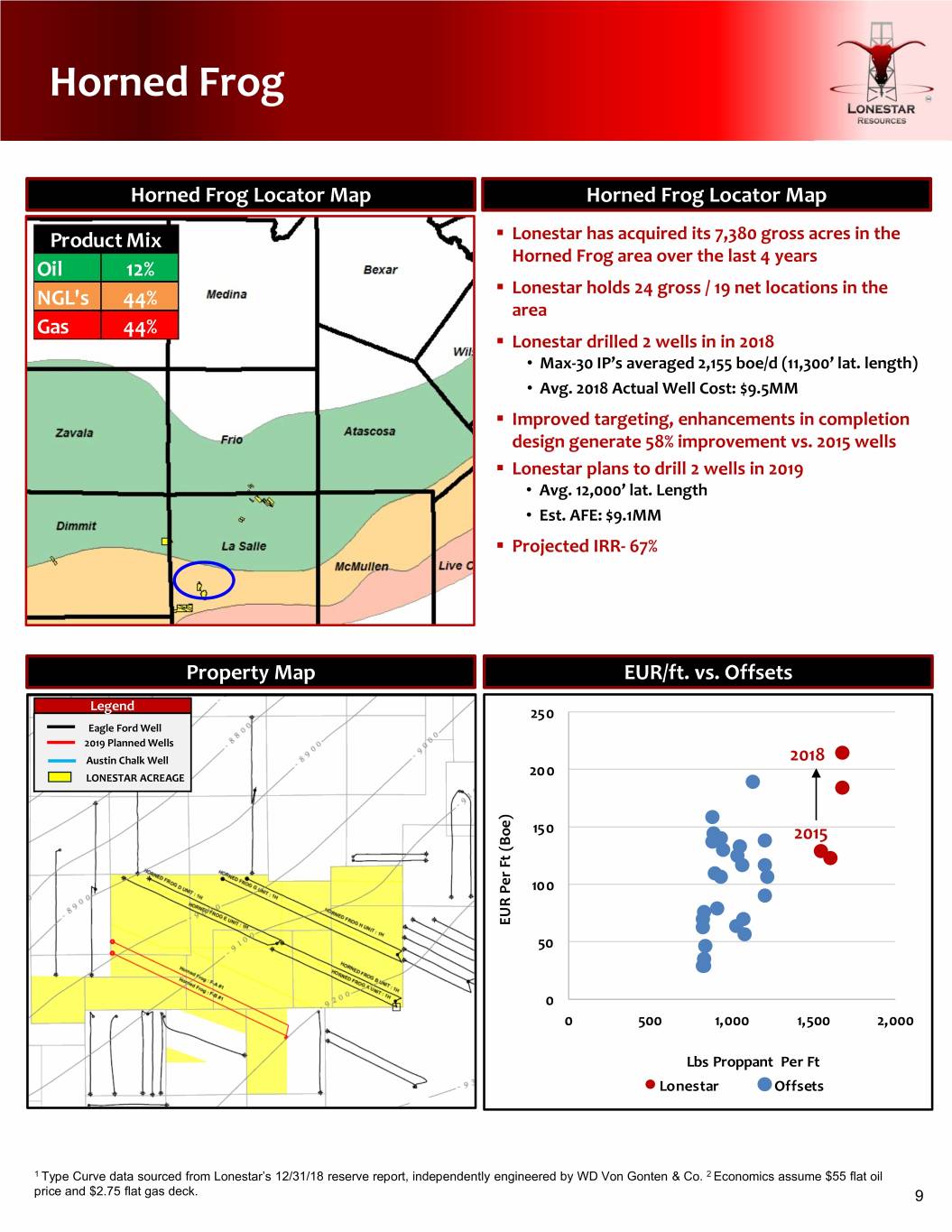

Horned Frog Horned Frog Locator Map Horned Frog Locator Map Product Mix . Lonestar has acquired its 7,380 gross acres in the Horned Frog area over the last 4 years Oil 12% . NGL's 44% Lonestar holds 24 gross / 19 net locations in the area Gas 44% . Lonestar drilled 2 wells in in 2018 • Max‐30 IP’s averaged 2,155 boe/d (11,300’ lat. length) • Avg. 2018 Actual Well Cost: $9.5MM . Improved targeting, enhancements in completion design generate 58% improvement vs. 2015 wells . Lonestar plans to drill 2 wells in 2019 • Avg. 12,000’ lat. Length • Est. AFE: $9.1MM . Projected IRR‐ 67% Property Map EUR/ft. vs. Offsets Legend 250 Eagle Ford Well 2019 Planned Wells Austin Chalk Well 2018 LONESTAR ACREAGE 200 150 2015 (Boe) Ft Per 100 EUR 50 0 0 500 1,000 1,500 2,000 Lbs Proppant Per Ft Lonestar Offsets 1 Type Curve data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $55 flat oil price and $2.75 flat gas deck. 9

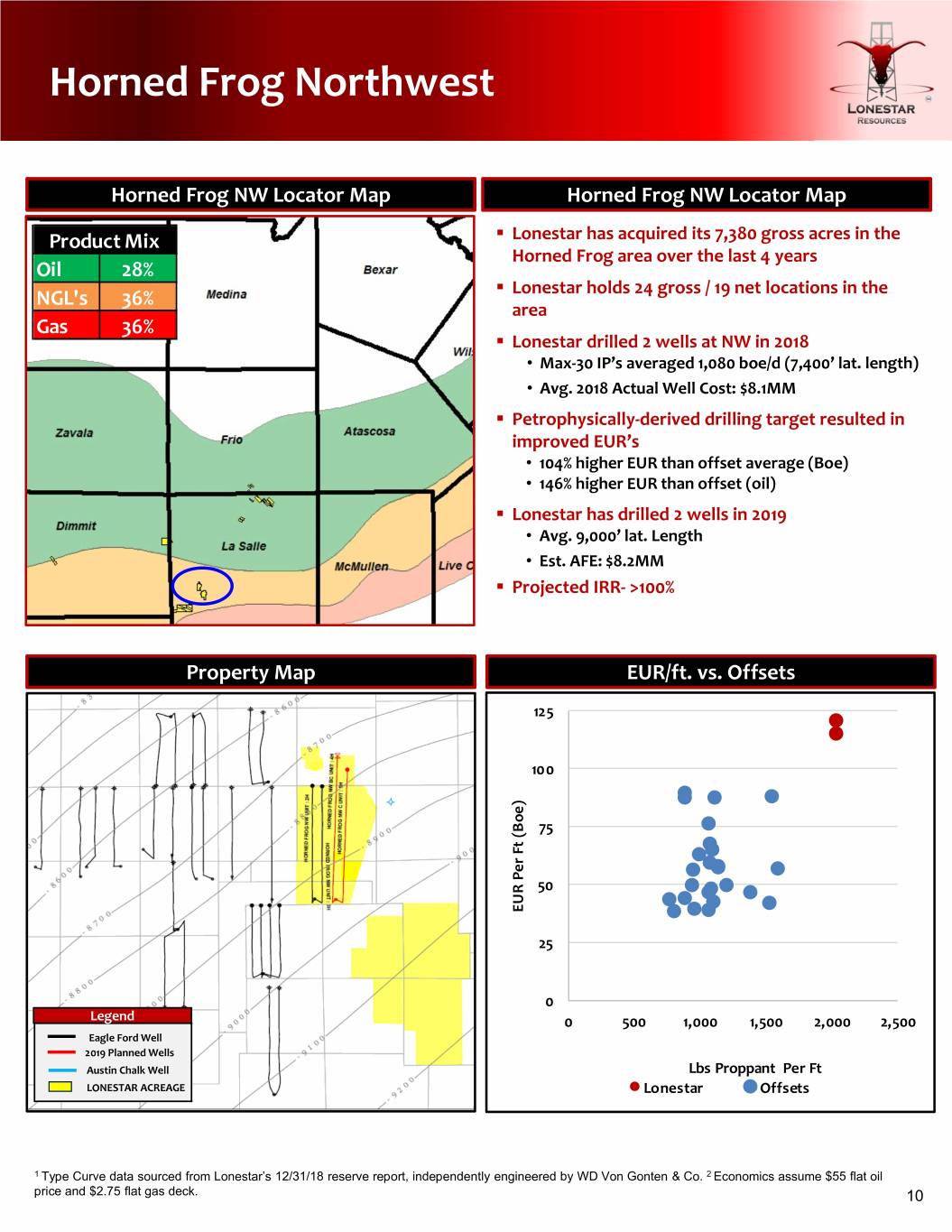

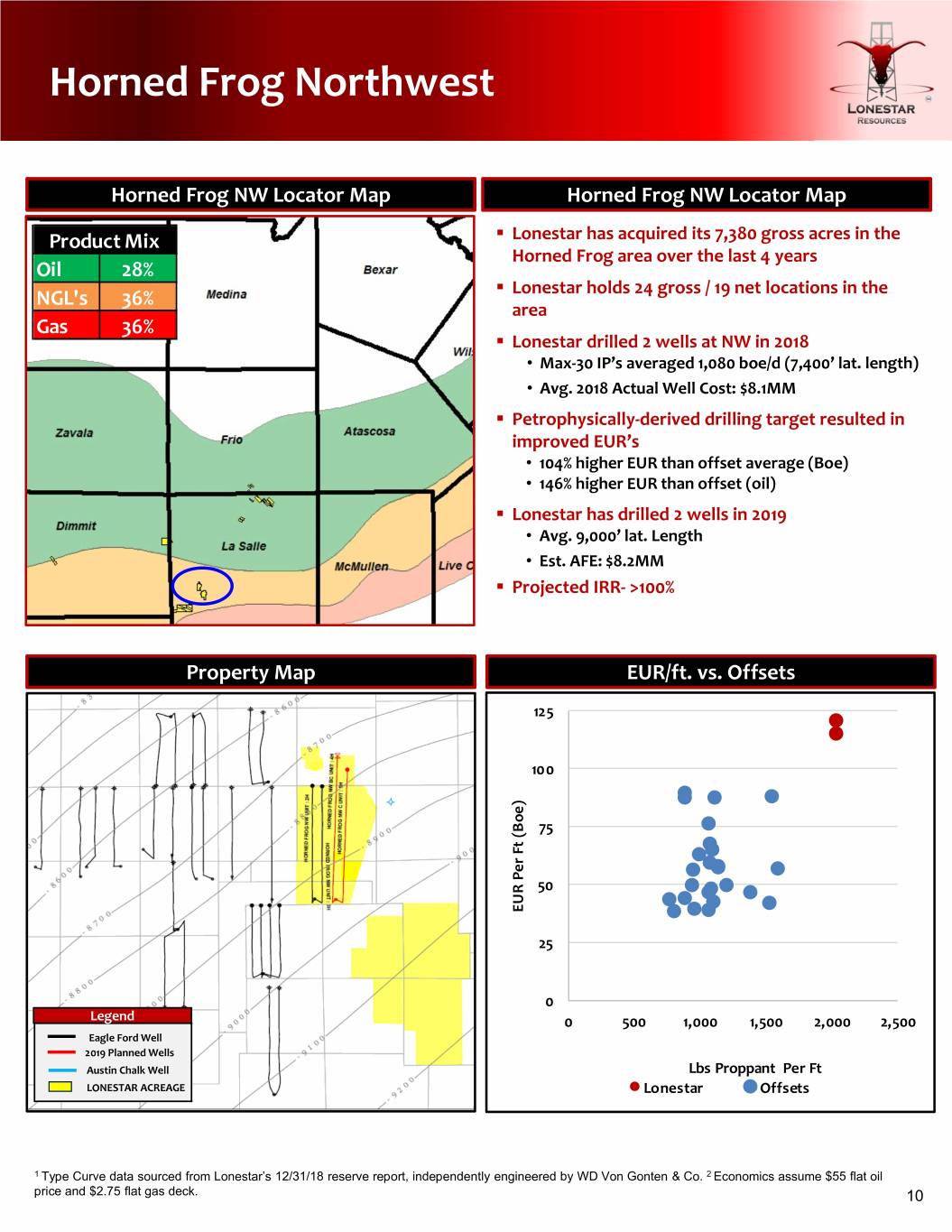

Horned Frog Northwest Horned Frog NW Locator Map Horned Frog NW Locator Map Product Mix . Lonestar has acquired its 7,380 gross acres in the Horned Frog area over the last 4 years Oil 28% . Lonestar holds 24 gross / 19 net locations in the NGL's 36% area Gas 36% . Lonestar drilled 2 wells at NW in 2018 • Max‐30 IP’s averaged 1,080 boe/d (7,400’ lat. length) • Avg. 2018 Actual Well Cost: $8.1MM . Petrophysically‐derived drilling target resulted in improved EUR’s • 104% higher EUR than offset average (Boe) • 146% higher EUR than offset (oil) . Lonestar has drilled 2 wells in 2019 • Avg. 9,000’ lat. Length • Est. AFE: $8.2MM . Projected IRR‐ >100% Property Map EUR/ft. vs. Offsets 125 100 75 (Boe) Ft Per 50 EUR 25 0 Legend 0 500 1,000 1,500 2,000 2,500 Eagle Ford Well 2019 Planned Wells Austin Chalk Well Lbs Proppant Per Ft LONESTAR ACREAGE Lonestar Offsets 1 Type Curve data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $55 flat oil price and $2.75 flat gas deck. 10

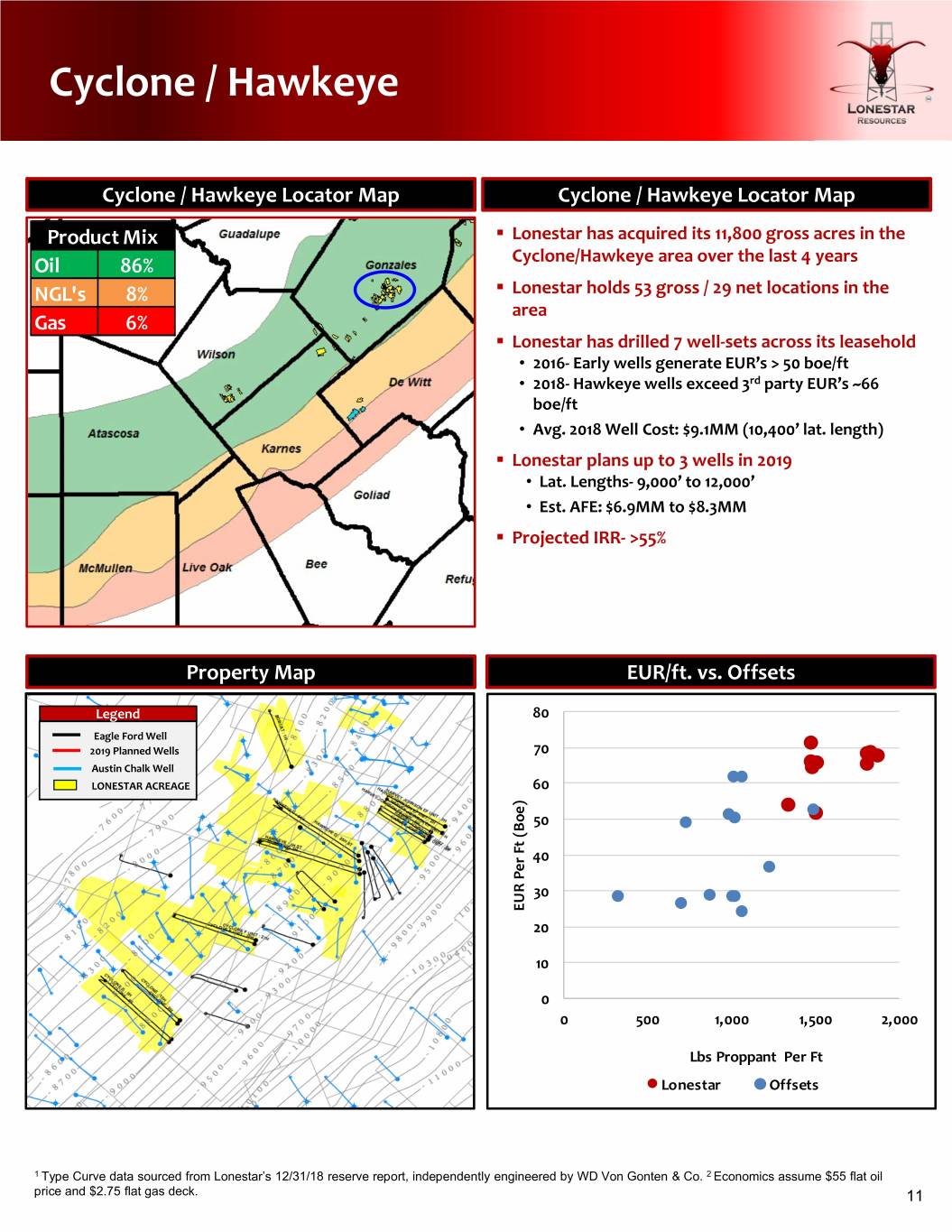

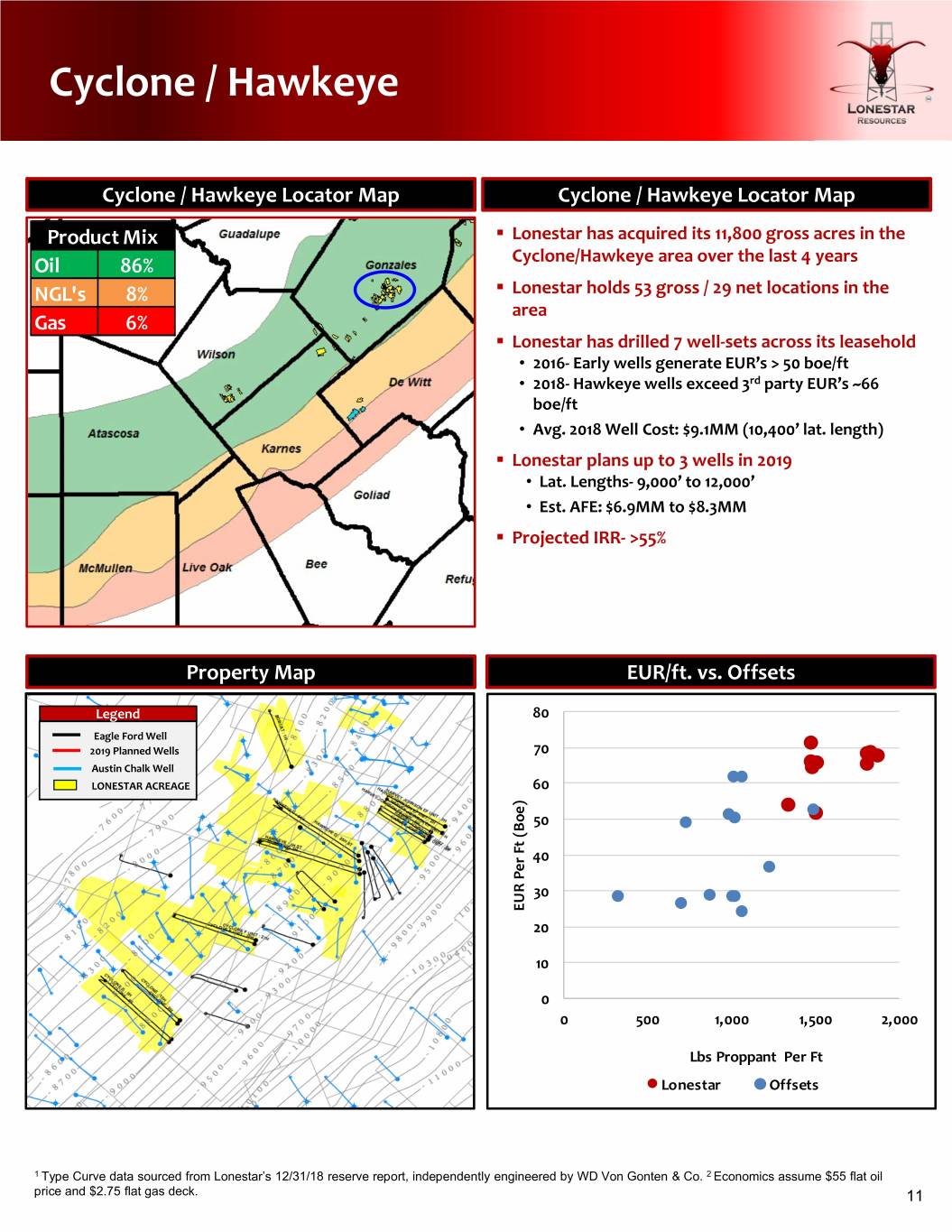

Cyclone / Hawkeye Cyclone / Hawkeye Locator Map Cyclone / Hawkeye Locator Map Product Mix . Lonestar has acquired its 11,800 gross acres in the Oil 86% Cyclone/Hawkeye area over the last 4 years NGL's 8% . Lonestar holds 53 gross / 29 net locations in the area Gas 6% . Lonestar has drilled 7 well‐sets across its leasehold • 2016‐ Early wells generate EUR’s > 50 boe/ft • 2018‐ Hawkeye wells exceed 3rd party EUR’s ~66 boe/ft • Avg. 2018 Well Cost: $9.1MM (10,400’ lat. length) . Lonestar plans up to 3 wells in 2019 • Lat. Lengths‐ 9,000’ to 12,000’ • Est. AFE: $6.9MM to $8.3MM . Projected IRR‐ >55% Property Map EUR/ft. vs. Offsets Legend 80 Eagle Ford Well 2019 Planned Wells 70 Austin Chalk Well LONESTAR ACREAGE 60 50 (Boe) Ft 40 Per 30 EUR 20 10 0 0 500 1,000 1,500 2,000 Lbs Proppant Per Ft Lonestar Offsets 1 Type Curve data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $55 flat oil price and $2.75 flat gas deck. 11

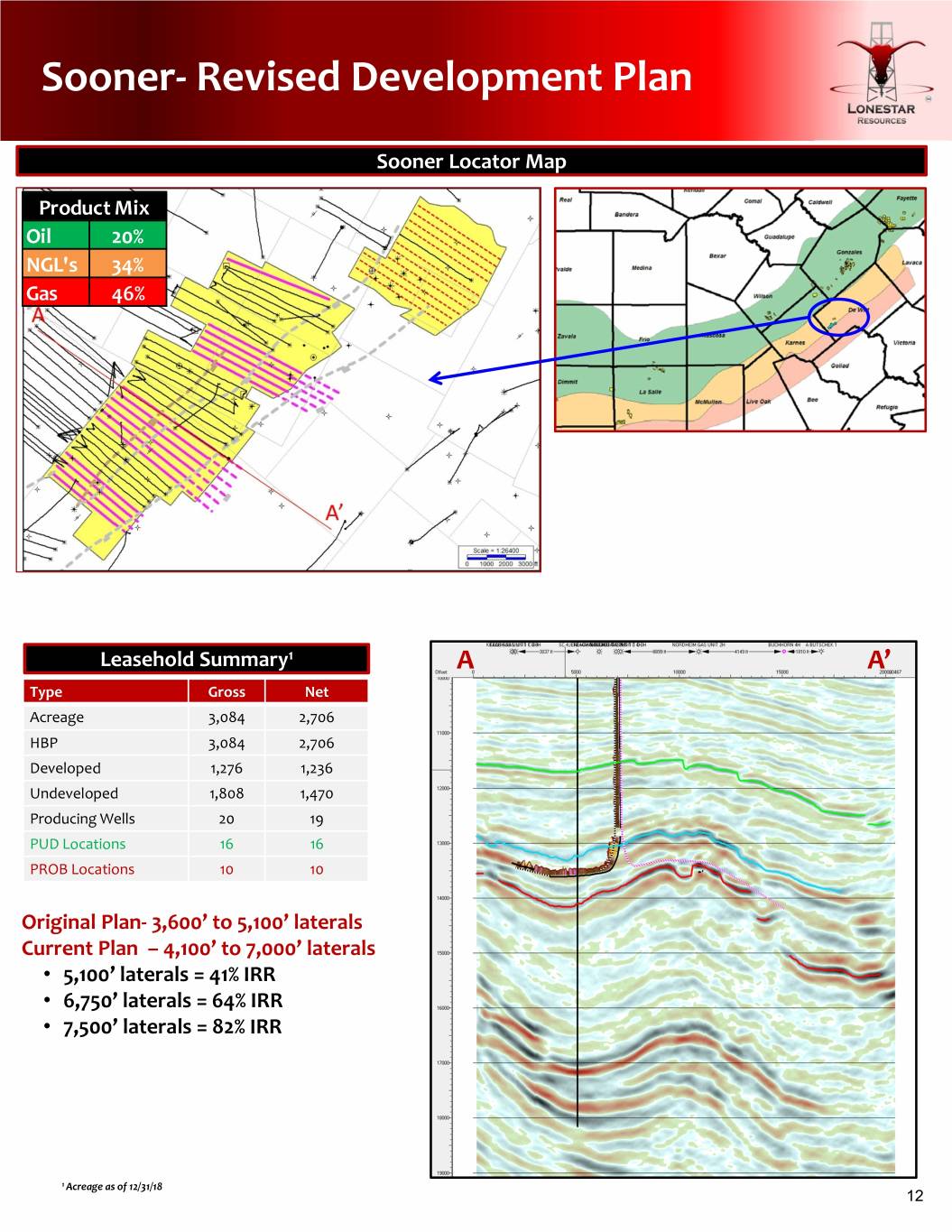

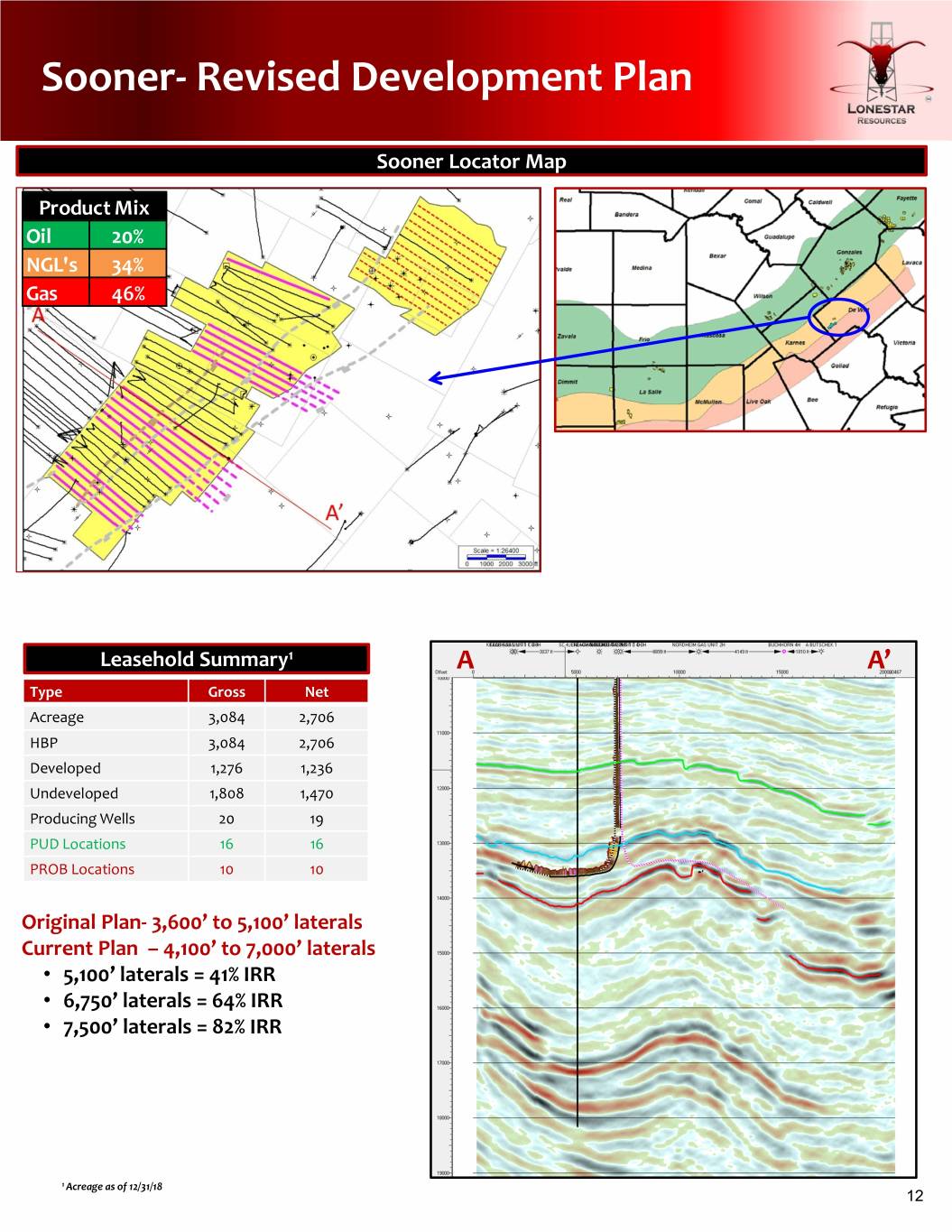

Sooner‐ Revised Development Plan Sooner Locator Map Product Mix Oil 20% NGL's 34% Gas 46% Leasehold Summary1 AA’ Type Gross Net Acreage 3,084 2,706 HBP 3,084 2,706 Developed 1,276 1,236 Undeveloped 1,808 1,470 Producing Wells 20 19 PUD Locations 16 16 PROB Locations 10 10 Original Plan‐ 3,600’ to 5,100’ laterals Current Plan – 4,100’ to 7,000’ laterals • 5,100’ laterals = 41% IRR • 6,750’ laterals = 64% IRR • 7,500’ laterals = 82% IRR 1 Acreage as of 12/31/18 12

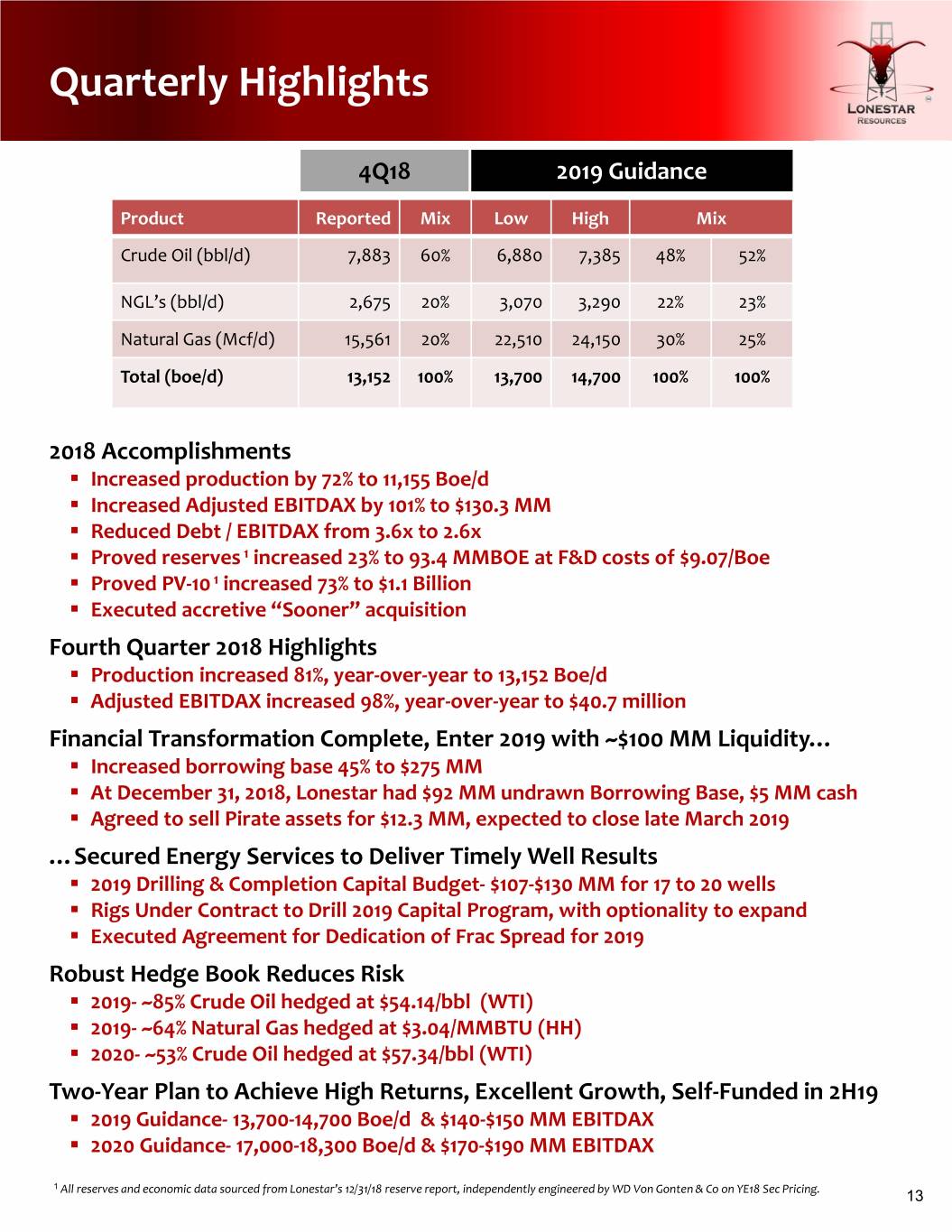

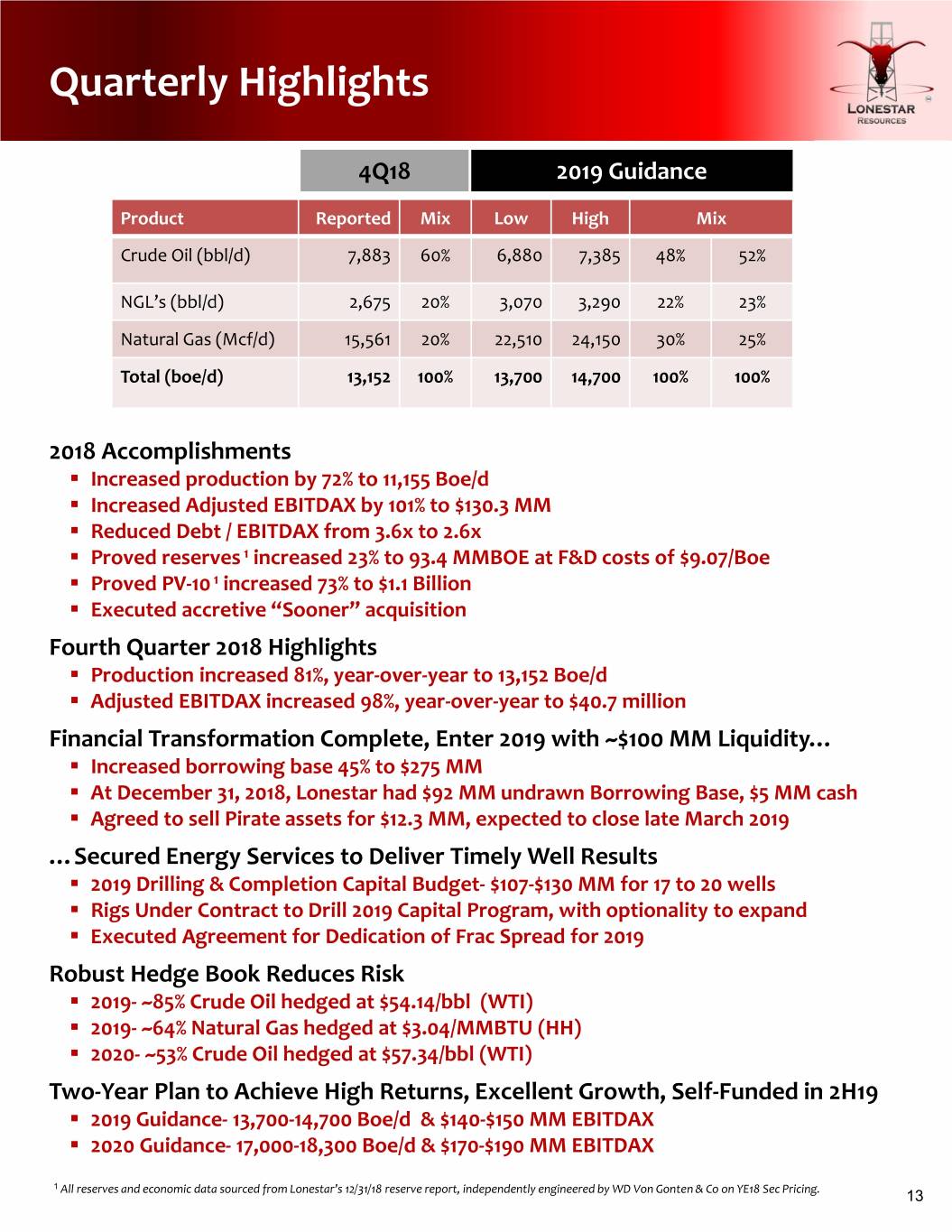

Quarterly Highlights 4Q18 2019 Guidance Product Reported Mix Low High Mix Crude Oil (bbl/d) 7,883 60% 6,880 7,385 48% 52% NGL’s (bbl/d) 2,675 20% 3,070 3,290 22% 23% Natural Gas (Mcf/d) 15,561 20% 22,510 24,150 30% 25% Total (boe/d) 13,152 100% 13,700 14,700 100% 100% 2018 Accomplishments . Increased production by 72% to 11,155 Boe/d . Increased Adjusted EBITDAX by 101% to $130.3 MM . Reduced Debt / EBITDAX from 3.6x to 2.6x . Proved reserves 1 increased 23% to 93.4 MMBOE at F&D costs of $9.07/Boe . Proved PV‐10 1 increased 73% to $1.1 Billion . Executed accretive “Sooner” acquisition Fourth Quarter 2018 Highlights . Production increased 81%, year‐over‐year to 13,152 Boe/d . Adjusted EBITDAX increased 98%, year‐over‐year to $40.7 million Financial Transformation Complete, Enter 2019 with ~$100 MM Liquidity… . Increased borrowing base 45% to $275 MM . At December 31, 2018, Lonestar had $92 MM undrawn Borrowing Base, $5 MM cash . Agreed to sell Pirate assets for $12.3 MM, expected to close late March 2019 …Secured Energy Services to Deliver Timely Well Results . 2019 Drilling & Completion Capital Budget‐ $107‐$130 MM for 17 to 20 wells . Rigs Under Contract to Drill 2019 Capital Program, with optionality to expand . Executed Agreement for Dedication of Frac Spread for 2019 Robust Hedge Book Reduces Risk . 2019‐ ~85% Crude Oil hedged at $54.14/bbl (WTI) . 2019‐ ~64% Natural Gas hedged at $3.04/MMBTU (HH) . 2020‐ ~53% Crude Oil hedged at $57.34/bbl (WTI) Two‐Year Plan to Achieve High Returns, Excellent Growth, Self‐Funded in 2H19 . 2019 Guidance‐ 13,700‐14,700 Boe/d & $140‐$150 MM EBITDAX . 2020 Guidance‐ 17,000‐18,300 Boe/d & $170‐$190 MM EBITDAX 1 All reserves and economic data sourced from Lonestar’s 12/31/18 reserve report, independently engineered by WD Von Gonten & Co on YE18 Sec Pricing. 13

Lonestar Resources US, Inc. Appendix

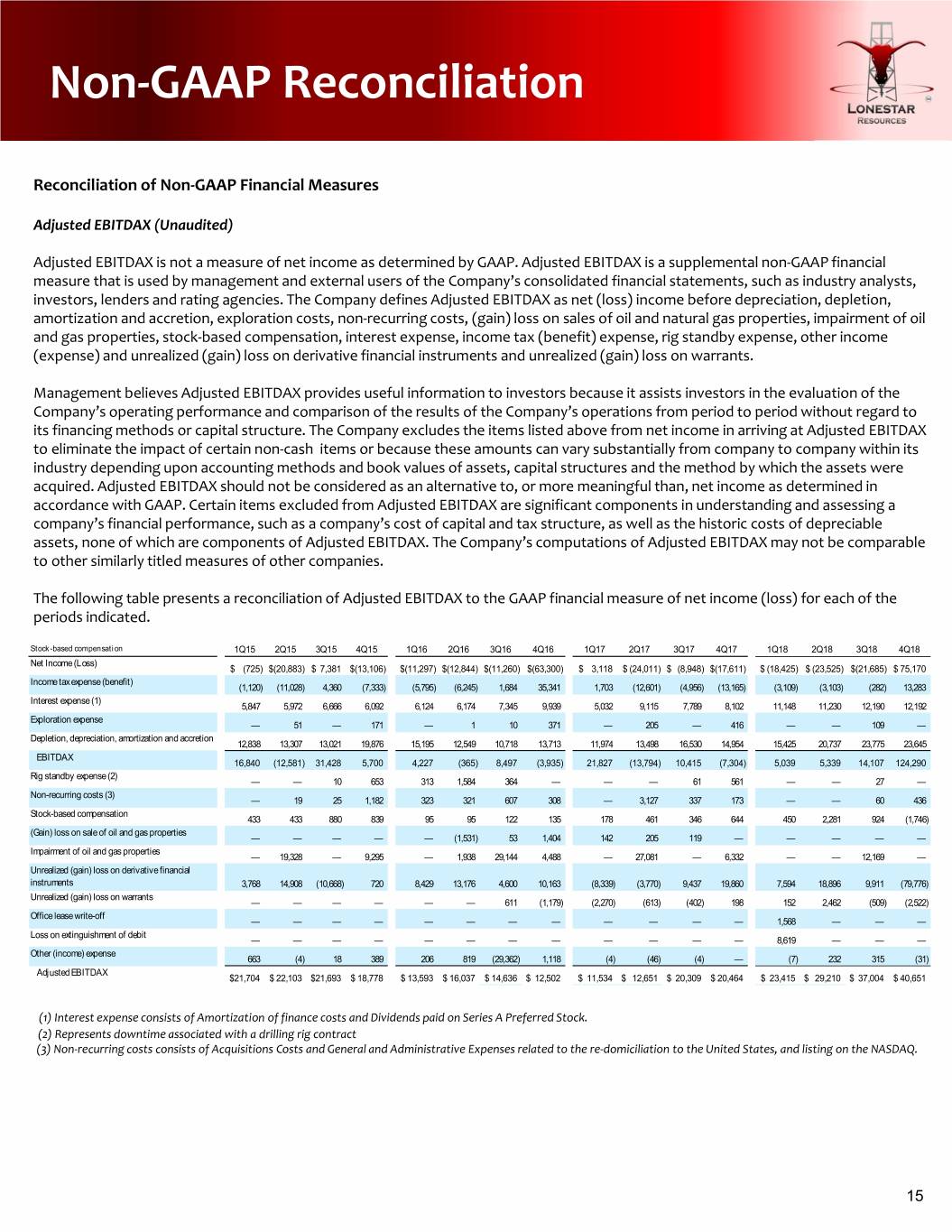

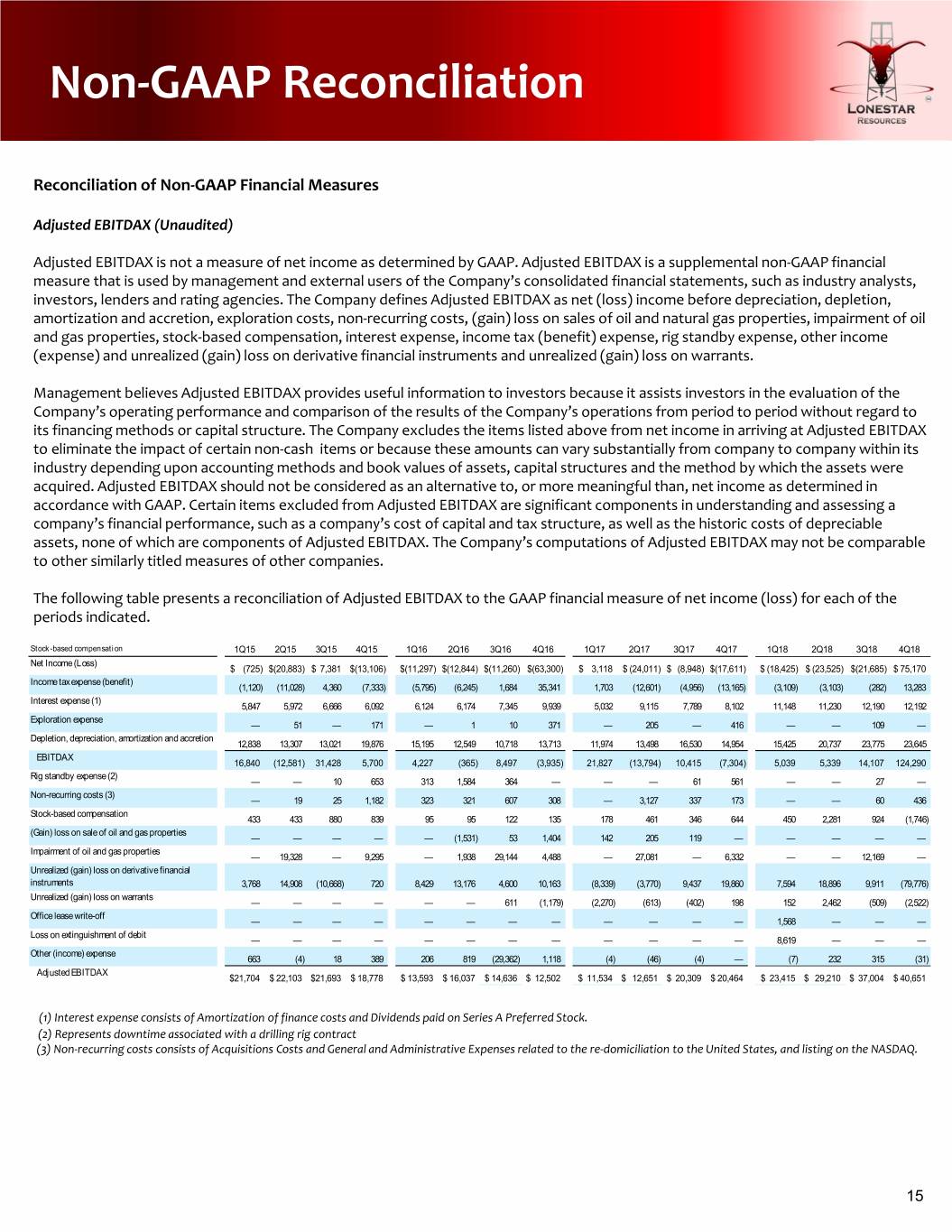

Non‐GAAP Reconciliation Reconciliation of Non‐GAAP Financial Measures Adjusted EBITDAX (Unaudited) Adjusted EBITDAX is not a measure of net income as determined by GAAP. Adjusted EBITDAX is a supplemental non‐GAAP financial measure that is used by management and external users of the Company’s consolidated financial statements, such as industry analysts, investors, lenders and rating agencies. The Company defines Adjusted EBITDAX as net (loss) income before depreciation, depletion, amortization and accretion, exploration costs, non‐recurring costs, (gain) loss on sales of oil and natural gas properties, impairment of oil and gas properties, stock‐based compensation, interest expense, income tax (benefit) expense, rig standby expense, other income (expense) and unrealized (gain) loss on derivative financial instruments and unrealized (gain) loss on warrants. Management believes Adjusted EBITDAX provides useful information to investors because it assists investors in the evaluation of the Company’s operating performance and comparison of the results of the Company’s operations from period to period without regard to its financing methods or capital structure. The Company excludes the items listed above from net income in arriving at Adjusted EBITDAX to eliminate the impact of certain non‐cash items or because these amounts can vary substantially from company to company within its industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. The Company’s computations of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies. The following table presents a reconciliation of Adjusted EBITDAX to the GAAP financial measure of net income (loss) for each of the periods indicated. Stock-based compensation 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 Net Income (Loss) $ (725) $ (20,883) $ 7,381 $ (13,106) $ (11,297) $(12,844) $(11,260) $(63,300) $ 3,118 $ (24,011) $ (8,948) $ (17,611) $ (18,425) $ (23,525) $ (21,685) $ 75,170 Income tax expense (benefit) (1,120) (11,028) 4,360 (7,333) (5,795) (6,245) 1,684 35,341 1,703 (12,601) (4,956) (13,165) (3,109) (3,103) (282) 13,283 Interest expense (1) 5,847 5,972 6,666 6,092 6,124 6,174 7,345 9,939 5,032 9,115 7,789 8,102 11,148 11,230 12,190 12,192 Exploration expense — 51 — 171 — 1 10 371 — 205 — 416 — — 109 — Depletion, depreciation, amortization and accretion 12,838 13,307 13,021 19,876 15,195 12,549 10,718 13,713 11,974 13,498 16,530 14,954 15,425 20,737 23,775 23,645 EB ITDAX 16,840 (12,581) 31,428 5,700 4,227 (365) 8,497 (3,935) 21,827 (13,794) 10,415 (7,304) 5,039 5,339 14,107 124,290 Rig standby expense (2) — — 10 653 313 1,584 364 — — — 61 561 — — 27 — Non-recurring costs (3) — 19 25 1,182 323 321 607 308 — 3,127 337 173 — — 60 436 Stock-based compensation 433 433 880 839 95 95 122 135 178 461 346 644 450 2,281 924 (1,746) (Gain) loss on sale of oil and gas properties — — — — — (1,531) 53 1,404 142 205 119 — — — — — Impairment of oil and gas properties — 19,328 — 9,295 — 1,938 29,144 4,488 — 27,081 — 6,332 — — 12,169 — Unrealized (gain) loss on derivative financial instruments 3,768 14,908 (10,668) 720 8,429 13,176 4,600 10,163 (8,339) (3,770) 9,437 19,860 7,594 18,896 9,911 (79,776) Unrealized (gain) loss on warrants — — — — — — 611 (1,179) (2,270) (613) (402) 198 152 2,462 (509) (2,522) Office lease write-off — — — — — — — — — — — — 1,568 — — — Loss on extinguishment of debit — — — — — — — — — — — — 8,619 — — — Other (income) expense 663 (4) 18 389 206 819 (29,362) 1,118 (4) (46) (4) — (7) 232 315 (31) Adjusted EBITDAX $21,704 $ 22,103 $ 21,693 $ 18,778 $ 13,593 $ 16,037 $ 14,636 $ 12,502 $ 11,534 $ 12,651 $ 20,309 $ 20,464 $ 23,415 $ 29,210 $ 37,004 $ 40,651 (1) Interest expense consists of Amortization of finance costs and Dividends paid on Series A Preferred Stock. (2) Represents downtime associated with a drilling rig contract (3) Non‐recurring costs consists of Acquisitions Costs and General and Administrative Expenses related to the re‐domiciliation to the United States, and listing on the NASDAQ. 15

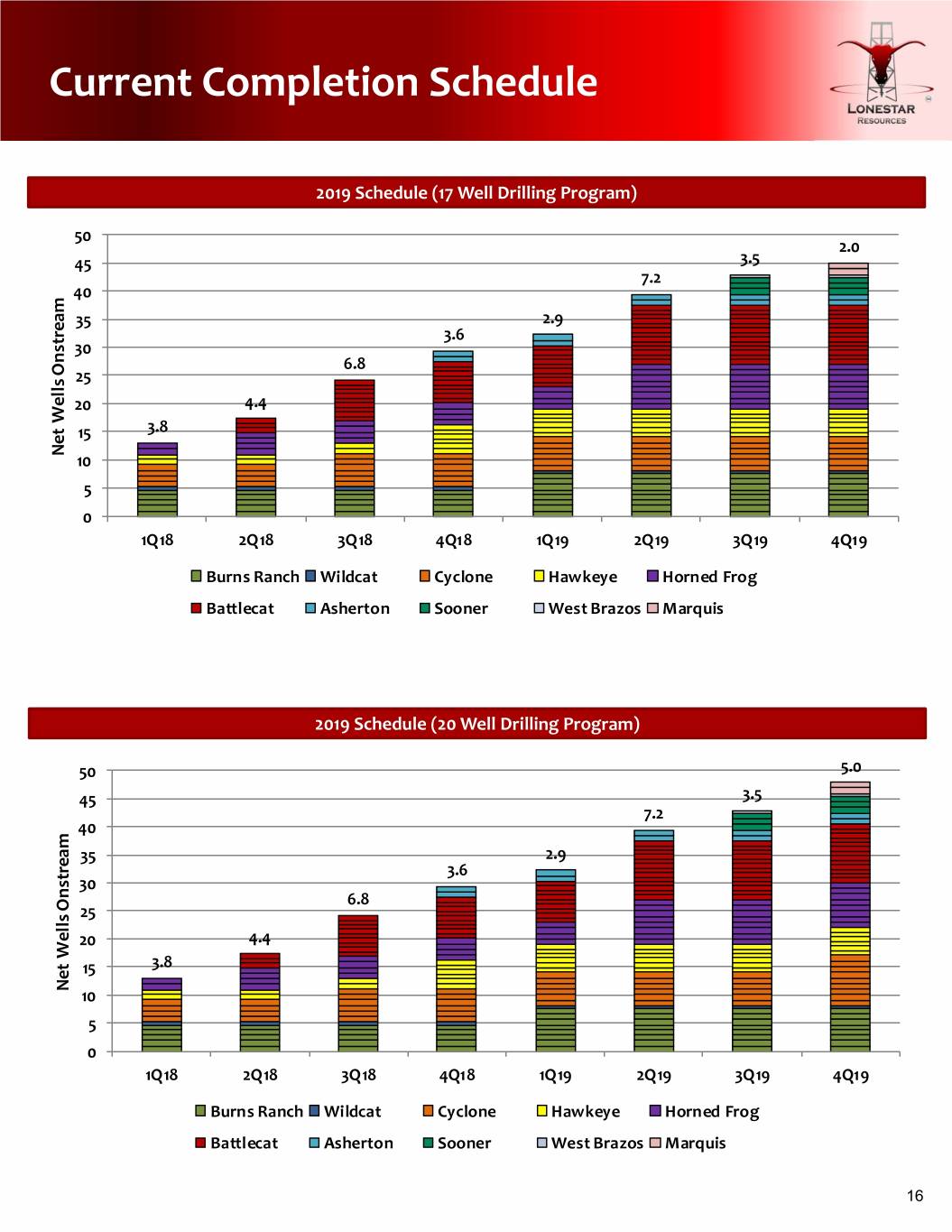

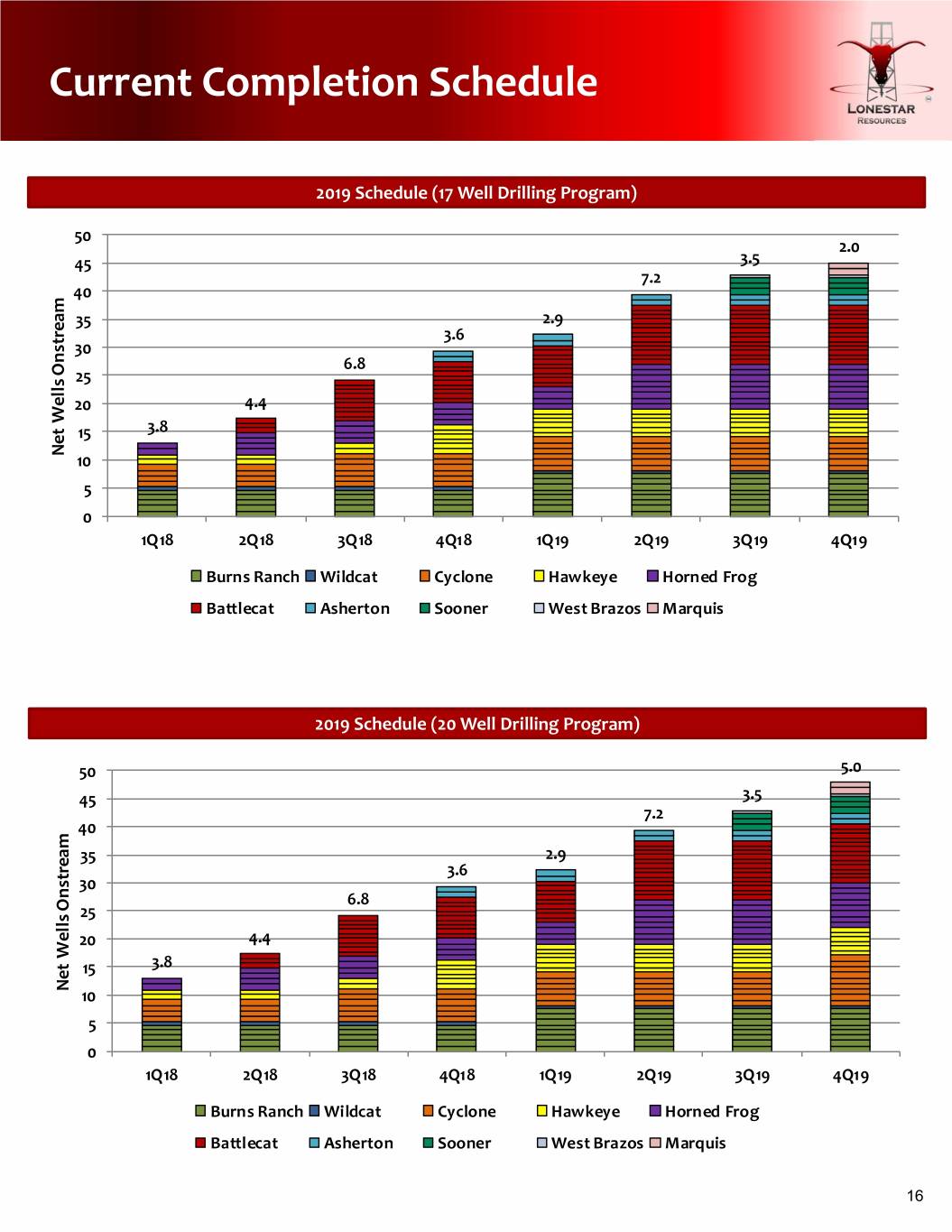

Current Completion Schedule 2019 Schedule (17 Well Drilling Program) 50 2.0 45 3.5 7.2 40 35 2.9 3.6 30 6.8 Onstream 25 20 4.4 Wells 15 3.8 Net 10 5 0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Burns Ranch Wildcat Cyclone Hawkeye Horned Frog Battlecat Asherton Sooner West Brazos Marquis 2019 Schedule (20 Well Drilling Program) 50 5.0 45 3.5 7.2 40 35 2.9 3.6 30 6.8 Onstream 25 20 4.4 Wells 15 3.8 Net 10 5 0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Burns Ranch Wildcat Cyclone Hawkeye Horned Frog Battlecat Asherton Sooner West Brazos Marquis 16

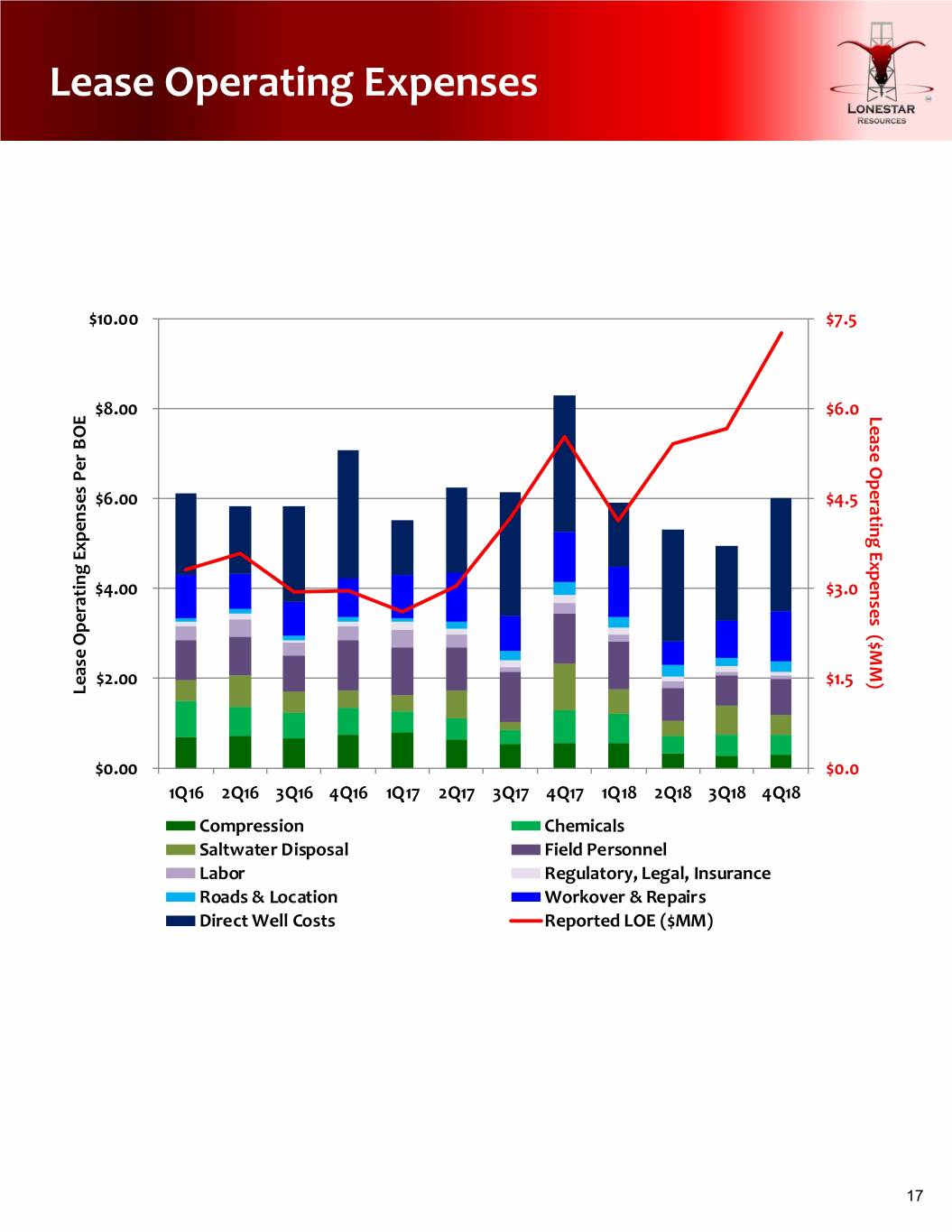

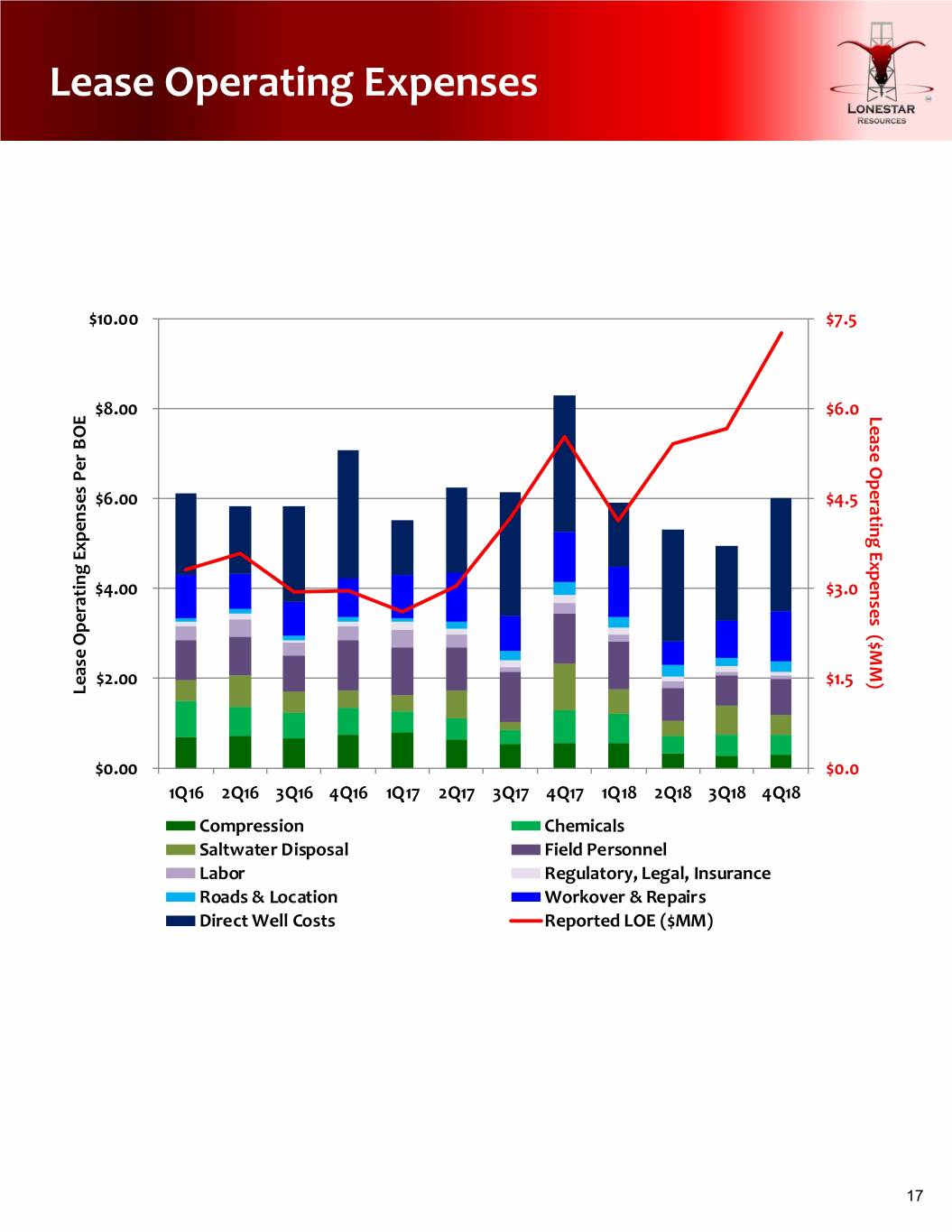

Lease Operating Expenses $10.00 $7.5 $8.00 $6.0 Lease BOE Operating Per $6.00 $4.5 Expenses Expenses $4.00 $3.0 ($MM) Operating $2.00 $1.5 Lease $0.00 $0.0 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 Compression Chemicals Saltwater Disposal Field Personnel Labor Regulatory, Legal, Insurance Roads & Location Workover & Repairs Direct Well Costs Reported LOE ($MM) 17

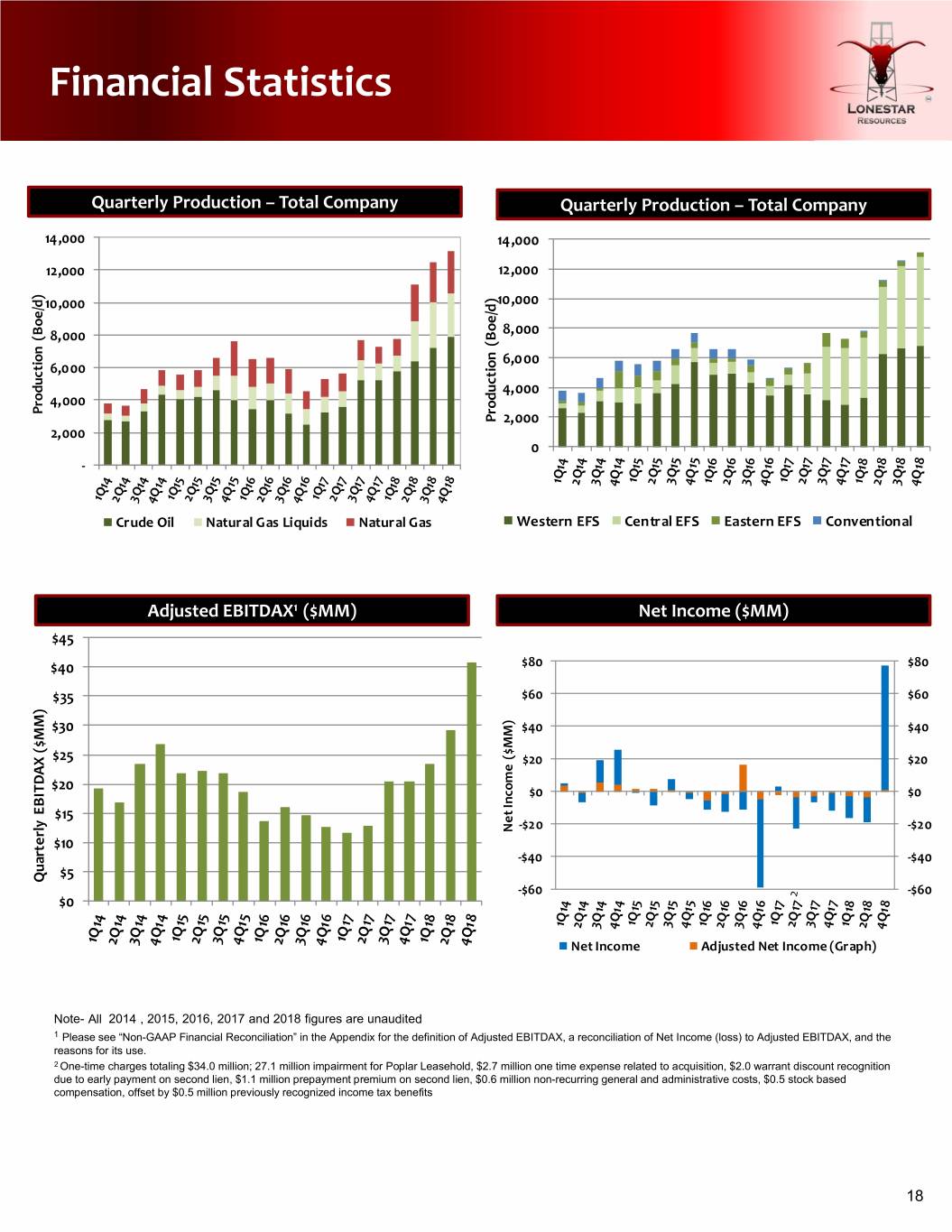

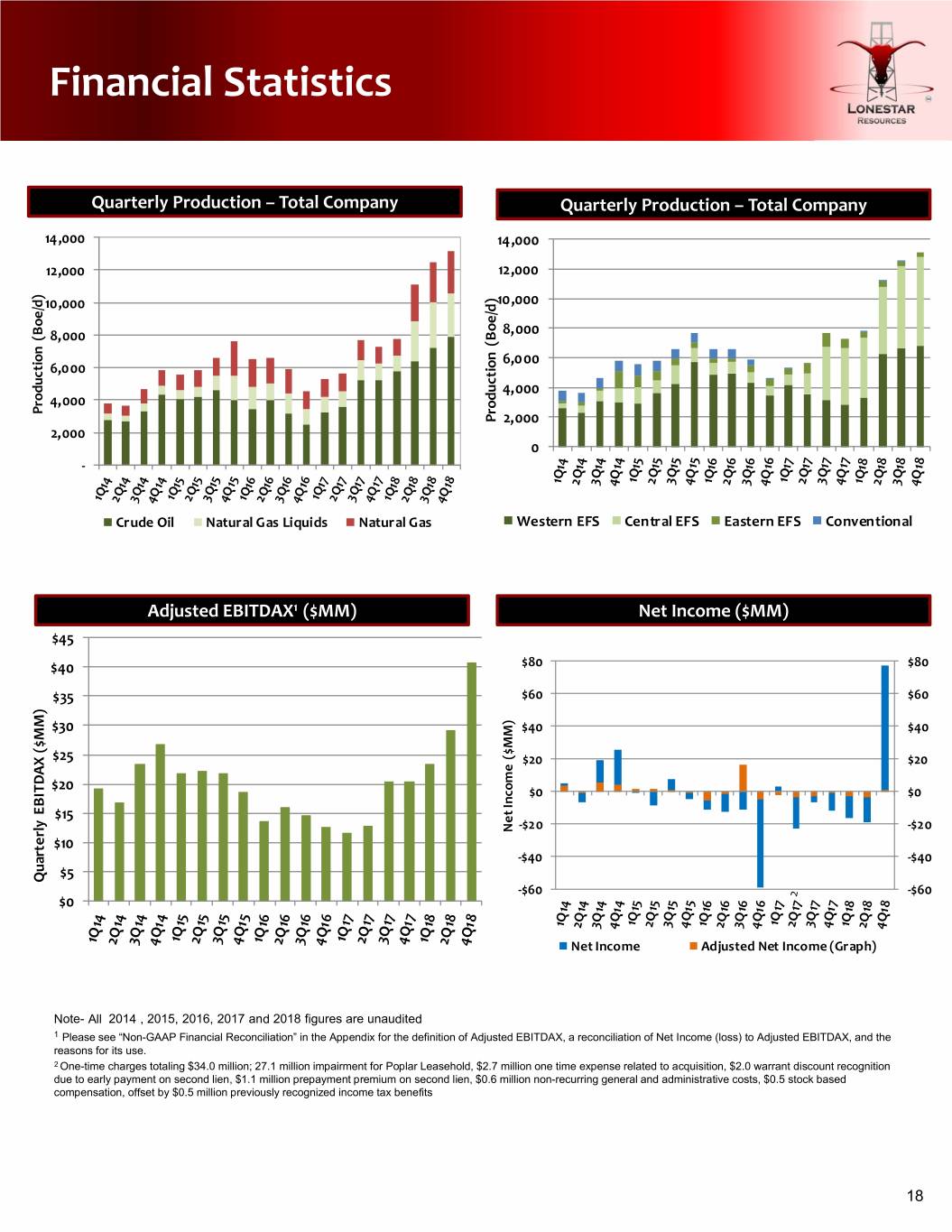

Financial Statistics Quarterly Production –Total Company Quarterly Production –Total Company 14,000 14,000 12,000 12,000 10,000 10,000 8,000 (Boe/d) 8,000 (Boe/d) 6,000 6,000 4,000 4,000 Production Production 2,000 2,000 0 ‐ Crude Oil Natural Gas Liquids Natural Gas Western EFS Central EFS Eastern EFS Conventional Adjusted EBITDAX1 ($MM) Net Income ($MM) $45 $40 $80 $80 $35 $60 $60 $30 $40 $40 ($MM) ($MM) $25 $20 $20 $20 $0 $0 Income EBITDAX $15 Net ‐$20 ‐$20 $10 ‐$40 ‐$40 $5 Quarterly ‐$60 ‐$60 $0 Net Income Adjusted Net Income (Graph) Note- All 2014 , 2015, 2016, 2017 and 2018 figures are unaudited 1 Please see “Non-GAAP Financial Reconciliation” in the Appendix for the definition of Adjusted EBITDAX, a reconciliation of Net Income (loss) to Adjusted EBITDAX, and the reasons for its use. 2 One-time charges totaling $34.0 million; 27.1 million impairment for Poplar Leasehold, $2.7 million one time expense related to acquisition, $2.0 warrant discount recognition due to early payment on second lien, $1.1 million prepayment premium on second lien, $0.6 million non-recurring general and administrative costs, $0.5 stock based compensation, offset by $0.5 million previously recognized income tax benefits 18

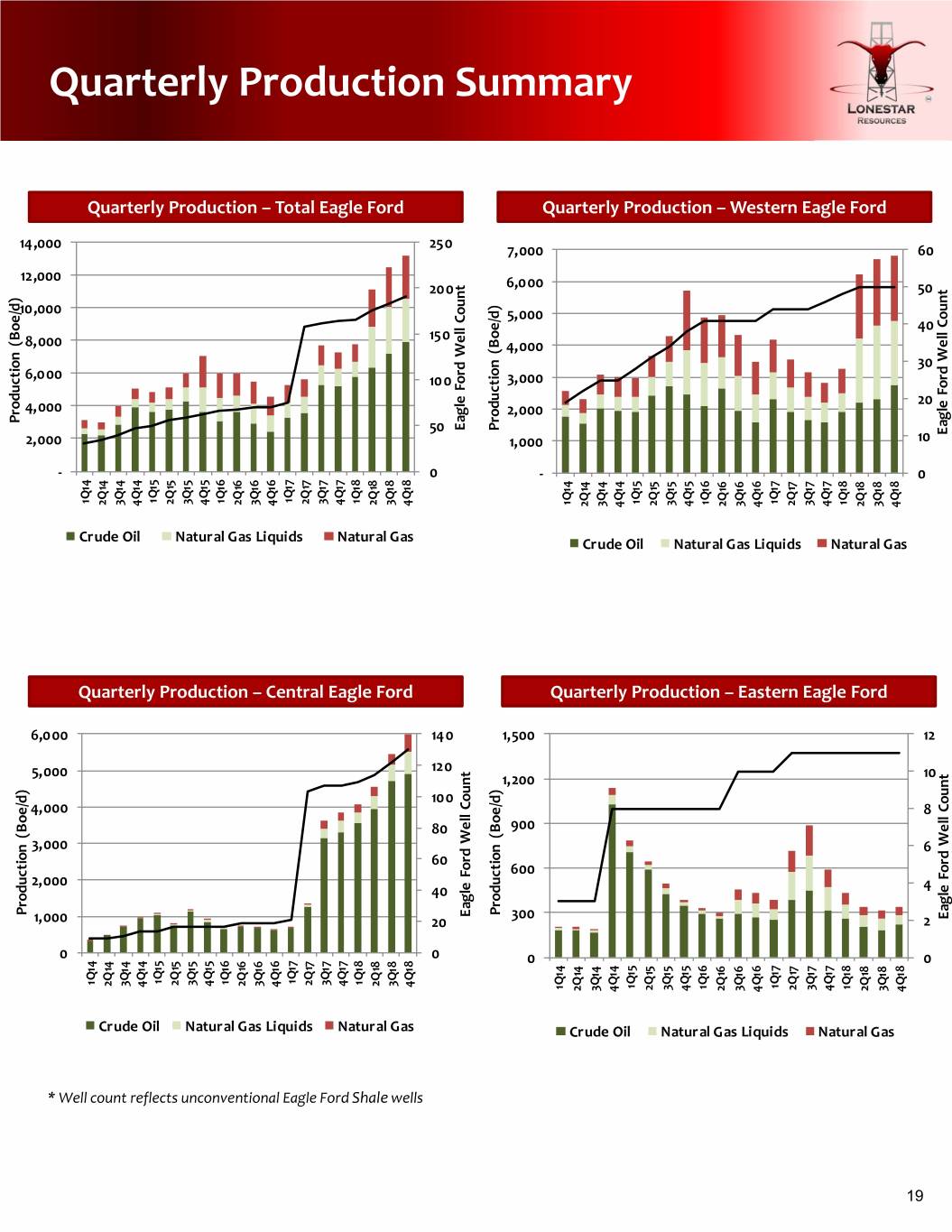

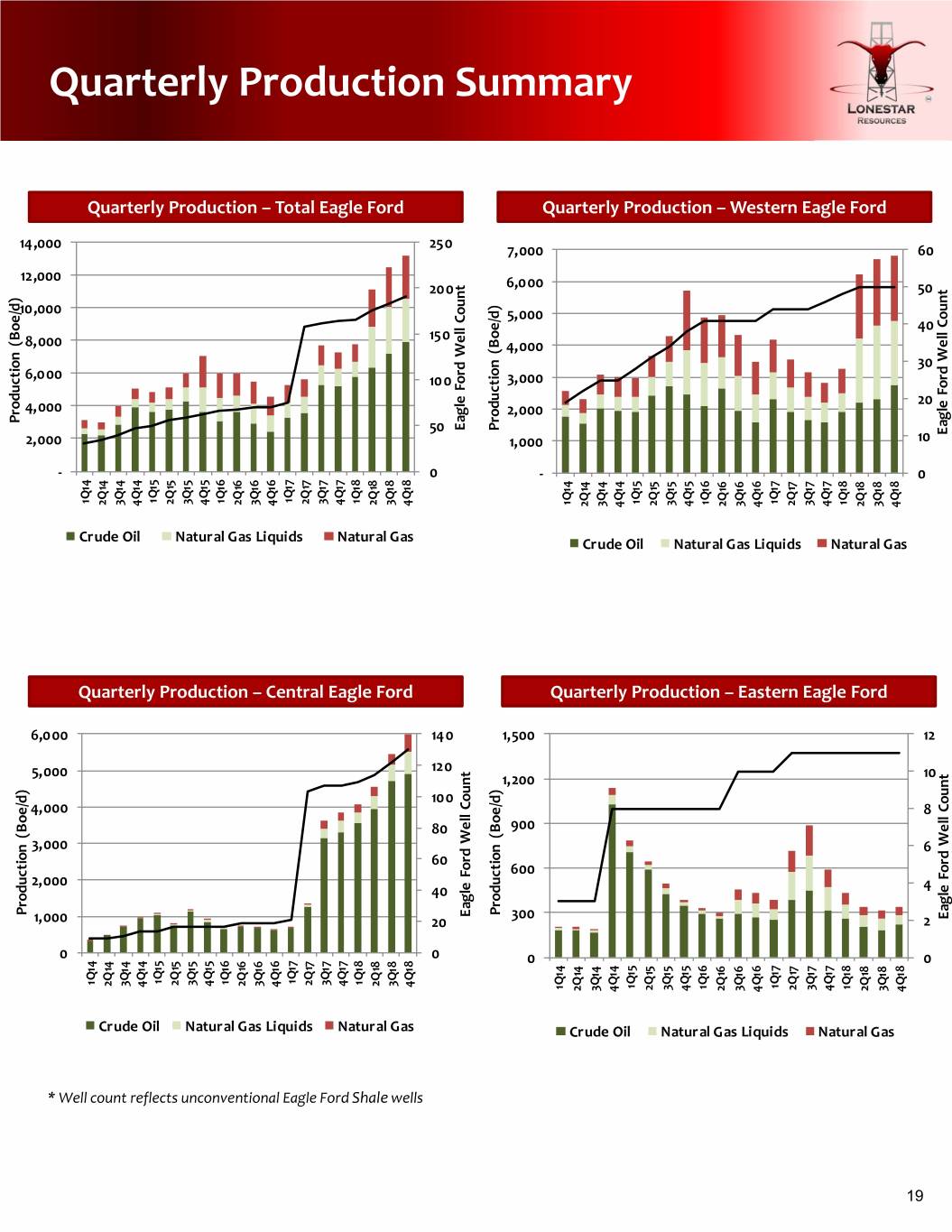

Quarterly Production Summary Quarterly Production –Total Eagle Ford Quarterly Production –Western Eagle Ford 14,000 250 7,000 60 12,000 200 6,000 50 10,000 5,000 Count Count 40 150 (Boe/d) 8,000 (Boe/d) 4,000 Well Well 30 6,000 100 3,000 Ford Ford 20 4,000 2,000 Production Eagle Production 50 Eagle 2,000 1,000 10 ‐ 0 ‐ 0 1Q17 1Q15 1Q16 1Q18 1Q14 1Q17 1Q15 3Q17 3Q15 2Q17 2Q15 1Q16 1Q14 1Q18 3Q16 4Q17 3Q18 3Q14 4Q15 2Q16 2Q18 2Q14 3Q17 3Q15 2Q17 2Q15 4Q16 4Q18 4Q14 3Q16 4Q17 3Q14 4Q15 2Q16 3Q18 2Q14 2Q18 4Q16 4Q14 4Q18 Crude Oil Natural Gas Liquids Natural Gas Crude Oil Natural Gas Liquids Natural Gas Quarterly Production – Central Eagle Ford Quarterly Production –Eastern Eagle Ford 6,000 140 1,500 12 5,000 120 1,200 10 100 Count Count 4,000 8 80 900 (Boe/d) (Boe/d) Well Well 3,000 6 60 Ford 600 Ford 2,000 40 4 Production Production Eagle 300 Eagle 1,000 20 2 0 0 0 0 1Q17 1Q15 1Q16 1Q14 1Q18 3Q17 3Q15 2Q17 2Q15 3Q16 4Q17 3Q14 3Q18 4Q15 2Q16 2Q14 2Q18 4Q16 4Q14 4Q18 1Q17 1Q15 1Q16 1Q14 1Q18 3Q17 3Q15 2Q17 2Q15 3Q16 4Q17 3Q14 3Q18 4Q15 2Q16 2Q14 2Q18 4Q16 4Q14 4Q18 Crude Oil Natural Gas Liquids Natural Gas Crude Oil Natural Gas Liquids Natural Gas * Well count reflects unconventional Eagle Ford Shale wells 19

Current Hedge Book – Crude Oil Hedge Book as of March 7,2019 Hedge Book as of March 7,2019 % of Period Instrument Volume Fixed Price Production ~74% ~88% ~85% ~53% Hedged1 Cal ’19 Oil‐ WTI Swap 1,536 bbls/day $48.04 7,000 $90 Cal ’19 Oil –WTI Swap 1,394 bbls/day $50.40 6,336 6,021 $80 Cal ’19 Oil‐WTI Swap 1,100 bbls/day $50.90 6,000 $70 Cal ’19 Oil‐WTI Swap 900 bbls/day $58.25 5,000 4,680 $60 Cal ’19 Oil‐WTI Swap 500 bbls/day $65.20 (bopd) 4,000 $50 Cal ’19 Oil‐WTI Swap 500 bbls/day $69.57 Bbl 3,213 / $ Hedged $40 3,000 Cal ’19 Oil‐WTI Swap 70 bbls/day $48.97 $57.34 $30 2,000 $53.36 $55.50 $54.14 Cal ’19 Oil‐WTI Swap 336 bbls/day $58.72 Volume $20 Cal ’20 Oil‐WTI Swap 556 bbls/day $48.90 1,000 $10 Cal ’20 Oil‐WTI Swap 1,123 bbls/day $55.06 0 $0 2017 2018 2019 2020 Cal ’20 Oil‐WTI Swap 500 bbls/day $61.65 Cal ’20 Oil‐WTI Swap 500 bbls/day $65.56 Volume Hedged Cal ‘20 Oil‐WTI Swap 500 bbls/day $58.03 • Since inception, systematic hedging has been an Cal ‘20 Oil‐WTI Swap 500 bbls/day $57.70 important element of Lonestar’s strategy to grow Cal ‘20 Oil‐WTI Swap 500 bbls/day $57.94 net asset value per share while reducing risk Cal ‘20 Oil‐WTI Swap 500 bbls/day $57.71 LLS Basis Swaps Period Instrument Volume Fixed Price Cal ’19 WTI – LLS 6,000 bbls/day $5.05 Swap 1% hedged values based off mid‐point of guidance. 22019 Bbl/d represent full year 20

Current Hedge Book – Natural Gas Hedge Book as of March 7,2019 Hedge Book as of March 7,2019 % of Period Instrument Volume Fixed Price Production ~100% ~50% ~64% Hedged1 Cal ’19 Natural Gas – 4,986 $3.21 NYMEX Swap MMBTU/day 16,000 15,000 $5.00 Cal ’19 Natural Gas – 2,493 $$3.55 14,000 NYMEX Swap MMBTU/day $4.00 12,000 Cal ’19 Natural Gas – 2,507 $2.76 NYMEX Swap MMBTU/day (Mcfpd) 10,000 $3.36 $3.00 $3.04 Cal ’19 Natural Gas – 5,014 $2.77 Mcf 8,000 $3.06 / NYMEX Swap MMBTU/day 7,000 6,298 $ Hedged 6,000 $2.00 4,000 Volume $1.00 2,000 0 $0.00 2017 2018 2019 2020 Volume Hedged • Since inception, systematic hedging has been an important element of Lonestar’s strategy to grow net asset value per share while reducing risk 1% hedged values based off mid‐point of guidance. 22019 Bbl/d represent full year 21

Glossary •“bbl” means barrel of oil. • bbls/d means the number of one stock tank barrel, or 42 US gallons liquid volume of oil or other liquid hydrocarbons per day. • “Boe” means barrels of oil equivalent, with 6,000 cubic feet of natural gas being equivalent to one barrel of oil. •Boe/d means barrels of oil equivalent per day. • “scf” means standard cubic feet. •“btu” means British thermal units. •“M” prefix means thousand. •“MM” prefix means million. •“B” prefix means billion. •“NGL” means Natural Gas Liquids– these products are stripped from the gas stream at 3rd party facilities remote to the field. •“TEV” means total enterprise value •“LTM” means last twelve months •“NTM” means next twelve months •“HBP” means held by production •“EPS” means earnings per share • “Mcf/d” means thousand cubic feet of natural gas per day • “IRR” means our internal rate of return, calculates the interest rate at which the net present value of all the cash flows (both positive and negative) from a project or investment equal zero • “EUR” means gross estimated ultimate recoveries for a single well Note: One Boe is equal to six Mcf of natural gas or one Bbl of oil or NGLs based on an industry‐standard approximate energy equivalency. This is a physical correlation and does not reflect a value or price relationship between the commodities. 22