Exhibit 99.1 Building The Future of Immune Therapeutics Company Overview January 2024

Disclaimers Important Information for Investors This confidential presentation (Presentation) is for informational purposes only and is being provided to interested parties solely in their capacity as potential investors for the purpose of evaluating a potential private offering of securities (the Purpose) by Q32 Bio Inc. (Q32) in connection with a potential business combination between Homology Medicines, Inc. (Homology) and Q32 (the Proposed Transaction). By accepting this Presentation, you acknowledge and agree that all of the information contained herein is confidential, that you will distribute, disclose, and use such information only for such Purpose and that you shall not distribute, disclose or use such information in any way detrimental to Homology or Q32. The information contained herein does not purport to be all-inclusive and none of Homology, Q32, and Leerink Partners LLC and Piper Sandler & Co. (together, the Placement Agents), nor any of their respective affiliates or respective control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. Private Placement This Presentation and any oral statements made in connection with this Presentation shall not constitute an offer to sell or the solicitation to buy any securities, nor the solicitation of a proxy, consent, or authorization in connection with the Proposed Transaction in any jurisdiction; nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any jurisdiction. ANY SECURITIES TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT), OR ANY APPLICABLE STATE OR FOREIGN SECURITIES LAW. ANY SECURITIES TO BE OFFERED IN ANY TRANSACTION CONTEMPLATED HEREBY HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES EXCHANGE COMMISSION (THE SEC), ANY STATE SECURITIES COMMISSION OR OTHER UNITED STATES OR FOREIGN REGULATORY AUTHORITY, AND WILL BE OFFERED AND SOLD SOLELY IN RELIANCE ON AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS PROVIDED BY THE SECURITIES ACT AND RULES AND REGULATIONS PROMULGATED THEREUNDER (INCLUDING REGULATION D OR REGULATION S UNDER THE SECURITIES ACT). THIS DOCUMENT DOES NOT CONSTITUTE, OR FORM A PART OF, AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY IN ANY STATE OR OTHER JURISDICTION TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH OFFER OR SOLICITATION Forward Looking Statements Certain statements contained in this Presentation may be considered forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding the Proposed Transaction, including the conditions to, and timing of, closing of the Proposed Transaction, the location and management of the combined company, the percentage ownership of the combined company, and the parties’ ability to consummate the Proposed Transaction and private placement financing, including the intended use of net proceeds from the private placement financing and the expected timing of closing and completion of the private placement financing, the composition of the Board of Directors of the combined company, the expected issuance of the contingent value right (CVR) and the contingent payments contemplated by the CVR, the combined company’s expected cash and the sufficiency of the combined company’s cash, cash equivalents and short-term investments to fund operations into mid-2026, the listing of the combined company’s shares on Nasdaq, the expectations surrounding the potential, safety, efficacy, and regulatory and clinical progress of Q32’s product candidates, including bempikibart and ADX-097, and anticipated milestones and timing, among others. Forward-looking statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: (i) the risk that the conditions to the closing of the Proposed Transaction are not satisfied, including the failure to timely or at all obtain stockholder approval for the Proposed Transaction or the failure to timely or at all obtain any required regulatory clearances; (ii) uncertainties as to the timing of the consummation of the Proposed Transaction and the ability of each of Homology and Q32 to consummate the Proposed Transaction; (iii) the ability of Homology and Q32 to integrate their businesses successfully and to achieve anticipated synergies; (iv) the possibility that other anticipated benefits of the Proposed Transaction will not be realized, including without limitation, anticipated revenues, expenses, earnings and other financial results, and growth and expansion of the combined company’s operations, and the anticipated tax treatment of the combination; (v) potential litigation relating to the Proposed Transaction that could be instituted against Homology, Q32 or their respective directors; (vi) possible disruptions from the Proposed Transaction that could harm Homology’s and/or Q32’s respective businesses; (vii) the ability of Homology and Q32 to retain, attract and hire key personnel; (viii) potential adverse reactions or changes to relationships with customers, employees, suppliers or other parties resulting from the announcement or completion of the Proposed Transaction; (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the Proposed Transaction that could affect Homology’s or Q32’s financial performance; (x) certain restrictions during the pendency of the Proposed Transaction that may impact Homology’s or Q32’s ability to pursue certain business opportunities or strategic transactions; (xi) the combined company’s need for additional funding, which may not be available; (xii) failure to identify additional product candidates and develop or commercialize marketable products; (xiii) the early stage of the combined company’s development efforts; (xiv) potential unforeseen events during clinical trials could cause delays or other adverse consequences; (xv) risks relating to the regulatory approval process; (xvi) interim, topline and preliminary data may change as more patient data become available, and are subject to audit and verification procedures that could result in material changes in the final data; (xvii) Q32’s product candidates may cause serious adverse side effects; (xviii) inability to maintain our collaborations, or the failure of these collaborations; (xix) the combined company’s reliance on third parties, including for the manufacture of materials for our research programs, preclinical and clinical studies; (xx) failure to obtain U.S. or international marketing approval; (xxi) ongoing regulatory obligations; (xxii) effects of significant competition; (xxiii) unfavorable pricing regulations, third-party reimbursement practices or healthcare reform initiatives; (xxiv) product liability lawsuits; (xxv) securities class action litigation; (xxvi) the impact of the COVID-19 pandemic and general economic conditions on our business and operations, including the combined company’s preclinical studies and clinical trials; (xxvii) the possibility of system failures or security breaches; (xxviii) risks relating to intellectual property; (xxix) significant costs incurred as a result of operating as a public company; (xxx) whether the Company will meet the Minimum Bid Price Requirement during any compliance period or otherwise in the future, whether the Company will otherwise continue to meet the Nasdaq listing standards and whether the Company would be successful in any Nasdaq appeal process and (xxxi) such other factors as are set forth in Homology’s periodic public filings with the SEC, including but not limited to those described under the heading “Risk Factors” in Homology’s Form 10-Q for the period ended September 30, 2023 and the registration statement on Form S-4 filed by Homology with the SEC. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements in this Presentation, which speak only as of the date they are made and are qualified in their entirety by reference to the cautionary statements herein. None of Homology, Q32 or the Placement Agents undertakes or accepts any duty to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or in the events, conditions or circumstances on which any such statement is based. This Presentation does not purport to summarize all of the conditions, risks and other attributes of an investment in Homology, Q32 or the combined company. 2

Disclaimers (cont.) Important Information about the Proposed Transaction and Where to Find It In connection with the Proposed Transaction, Homology filed a registration statement on Form S-4 that includes a proxy statement of Homology and that constitutes a prospectus with respect to shares of Homology's common stock to be issued in the Proposed Transaction (Proxy Statement/Prospectus). Homology may also file other documents with the SEC regarding the Proposed Transaction. This document is not a substitute for the Proxy Statement/Prospectus or any other document which Homology may file with the SEC. The registration statement has not yet become effective. After the registration statement is effective, the Proxy Statement/Prospectus will be mailed to stockholders of Homology. INVESTORS, Q32 STOCKHOLDERS AND HOMOLOGY STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE OR WILL BE FILED BY HOMOLOGY WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors, Q32 stockholders and Homology stockholders may obtain free copies of the Proxy Statement/Prospectus and other documents containing important information about Homology , Q32 and the Proposed Transaction that are or will be filed with the SEC by Homology through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Homology will also be available free of charge on Homology's website at https://investors.homologymedicines.com/financial-information/sec-filings or by contacting Homology's investor relations department by email at IR@homologymedicines.com. Participants in the Solicitation Homology, Q32 and certain of their respective directors and executive officers may be deemed under SEC rules to be participants in the solicitation of proxies of Homology stockholders in connection with the Proposed Transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Homology's stockholders in connection with the Proposed Transaction is set forth in Homology's proxy statement on Schedule 14A for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2023 and the Proxy Statement/Prospectus included in the registration statement on Form S-4 initially filed with the SEC on December 18, 2023, and any amendments thereto as filed with the SEC. Investors and security holders of Q32 and Homology are urged to read the Proxy Statement/Prospectus and other relevant documents that will be filed with the SEC by Homology carefully and in their entirety because they will contain important information about the Proposed Transaction. Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and other documents containing important information about Q32 and Homology through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Homology can be obtained free of charge by directing a written request to Homology Medicines, Inc., One Patriots Park, Bedford, MA 01730. Industry and Market Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and Q32’s own internal estimates and research. In this Presentation, Q32 relies on, and refers to, publicly available information and statistics regarding market participants in the sector in which Q32 competes and other industry data. Any comparison of Q32 to any other entity assumes the reliability of the information available to Q32. Q32 obtained these information and statistics from third-party sources, including reports by market research firms and company filings. In addition, all of the market data included in this Presentation involve a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while Q32 believes its internal research is reliable, such research has not been verified by any independent source and Q32 has not independently verified the information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but Q32 will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Confidentiality Notice This Presentation is intended exclusively for the individual or entity to which it is addressed. This Presentation and the accompanying communication may contain information that is proprietary, privileged, confidential or otherwise legally exempt from disclosure. If you are not an intended recipient, you are not authorized to read, print, retain, copy or disseminate this Presentation or any part of it. If you have received this Presentation in error, please notify the sender immediately and delete all copies of this Presentation. 3

Risk Factors Both Homology and Q32 are subject to various risks associated with their businesses and their industries. In addition, the Proposed Transaction, including the possibility that the Proposed Transaction may not be completed, poses a number of risks to each company and its respective securityholders. All references to “we,” “us” or “our” refer to the business of Q32 prior to the consummation of the Proposed Transaction. The risks described below make up a non-exhaustive list of the key risks related to Q32’s business and the factors that could cause actual results to differ from the forward-looking statements described in this Presentation. This list has been prepared solely for potential private placement investors in connection with the Proposed Transaction and not for any other purpose. You should carefully consider these risks and uncertainties, as well as factors set forth in the section entitled “Risk Factors” in Homology’s most recent quarterly report on Form 10-Q, its most recent annual report on Form 10-K and its other SEC filings. You should also carry out your own due diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this private placement transaction before making an investment decision. The list below is qualified in its entirety by disclosures contained in future documents filed or furnished in respect of the Proposed Transaction with the SEC: • Our limited operating history make it difficult to evaluate our future prospects and the risks and challenges we may encounter. We have incurred significant losses since inception, we have not generated any revenue from product sales to date and may never do so. • Our product candidates are in clinical development and we do not yet have any product candidates approved for commercial sale. • Even if the Proposed Transaction and the proposed private placement transaction are successful, we will require substantial additional capital to finance our operations in the future. If we are unable to raise such capital when needed, or on acceptable terms, we may be forced to delay, reduce or eliminate our development and pre-clinical programs, current or future clinical trials or future commercialization efforts. • Our expectations regarding our cash runway and ability to reach data inflection points are based on numerous assumptions that may prove to be untrue; we may be required to raise capital sooner than anticipated and our exposure to certain contingent liabilities and contractual obligations may be greater than anticipated. For example, our assumptions relating to the amounts of Homology’s cash available to us at the closing of the Proposed Transaction, including amounts that may be required to negotiate costs associated with the closing of the Proposed Transaction, may prove to be incorrect, and as a result any additional amounts we would be required to spend may be material and significantly impact our cash runway and ability to achieve our inflection points without significant additional capital. • We operate in an intensely competitive market that includes companies with greater financial, technical and marketing resources than us. • Failure to manage our growth effectively could cause our business to suffer and have a material adverse effect on our ability to execute our business strategy, as well as operating results and financial condition. • As our costs increase, we may experience fluctuations in our operating results, which could make our future operating results difficult to predict or cause our operating results to fall below analysts’ and investors’ expectations. • We are substantially dependent on the success of our most advanced product candidates, ADX-097 and ADX-914 and our clinical trials of such product candidates may not be successful. If we are unable to advance such product candidates through clinical development for safety or efficacy or other reasons, or commercialize our product candidates, if approved, or experience significant delays in doing so, our business will be materially harmed. • Our current or future product candidates may cause adverse or other undesirable side effects that could delay or prevent their regulatory approval, limit the commercial profile of an approved label or result in significant negative consequences following marketing approval, if any. • If we are unable to obtain and maintain patent and other intellectual property protection for our technology and product candidates or if the scope of the intellectual property protection obtained is not sufficiently broad or we are delayed in bringing product candidates to market such that those products have a shorter period of patent exclusivity than we expect, our competitors could develop and commercialize technology and product candidates similar or identical to ours, and our ability to successfully commercialize our technology and/or product candidates may be impaired. • We may be subject to intellectual property rights claims by third parties, which are costly to defend, could require us to pay significant damages and may disrupt our business and operations. • We are party to license agreements with third parties pursuant to which we obtained licenses for certain intellectual property rights utilized in the development of our product candidates; termination of these rights or the failure to comply with obligations under these agreements could materially harm our business and prevent us from developing or commercializing our product candidates. • The conditions to complete the Proposed Transaction may not be satisfied, we may not realize the expected benefits of the Proposed Transaction, or we may uncover liabilities following consummation of the Proposed Transaction that we had not anticipated. • The shares acquired in the proposed private placement transaction will be subject to registration with the SEC, and upon registration, the share price may be volatile due to a variety of factors, such as changes in the competitive environment in which we operate, the regulatory framework of the industry in which we will operate, developments in our business and operations and changes in our capital structure. 4

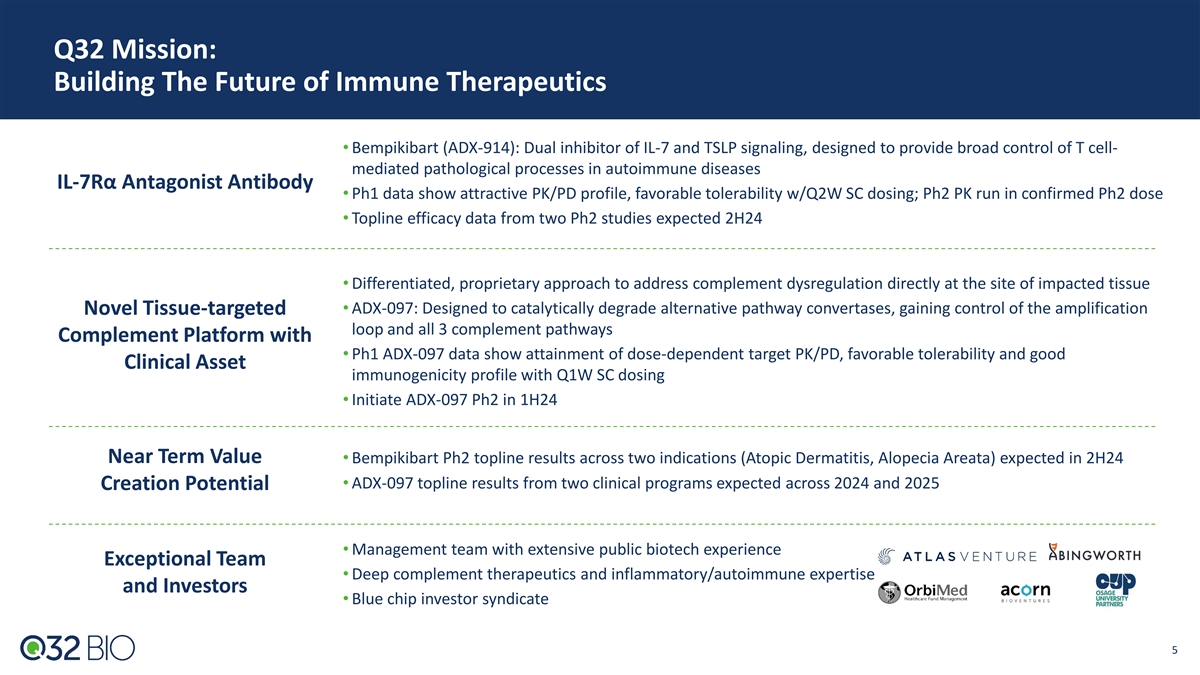

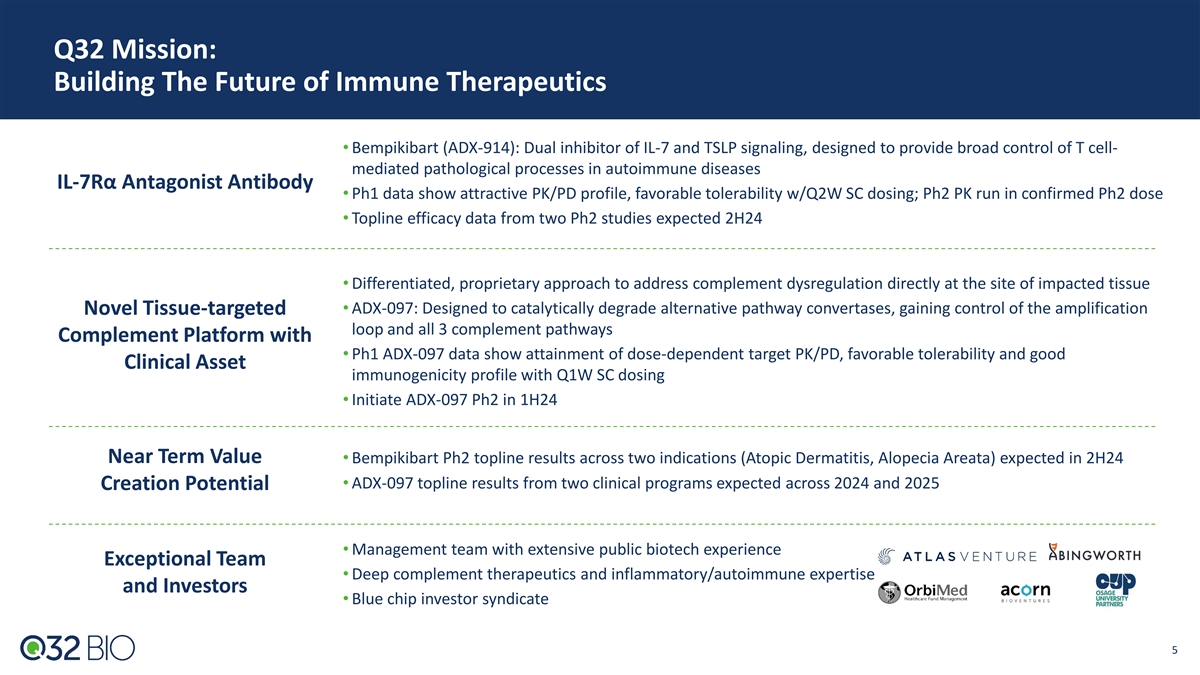

Q32 Mission: Building The Future of Immune Therapeutics • Bempikibart (ADX-914): Dual inhibitor of IL-7 and TSLP signaling, designed to provide broad control of T cell- mediated pathological processes in autoimmune diseases IL-7Rα Antagonist Antibody • Ph1 data show attractive PK/PD profile, favorable tolerability w/Q2W SC dosing; Ph2 PK run in confirmed Ph2 dose • Topline efficacy data from two Ph2 studies expected 2H24 • Differentiated, proprietary approach to address complement dysregulation directly at the site of impacted tissue • ADX-097: Designed to catalytically degrade alternative pathway convertases, gaining control of the amplification Novel Tissue-targeted loop and all 3 complement pathways Complement Platform with • Ph1 ADX-097 data show attainment of dose-dependent target PK/PD, favorable tolerability and good Clinical Asset immunogenicity profile with Q1W SC dosing • Initiate ADX-097 Ph2 in 1H24 Near Term Value • Bempikibart Ph2 topline results across two indications (Atopic Dermatitis, Alopecia Areata) expected in 2H24 • ADX-097 topline results from two clinical programs expected across 2024 and 2025 Creation Potential • Management team with extensive public biotech experience Exceptional Team • Deep complement therapeutics and inflammatory/autoimmune expertise and Investors • Blue chip investor syndicate 5

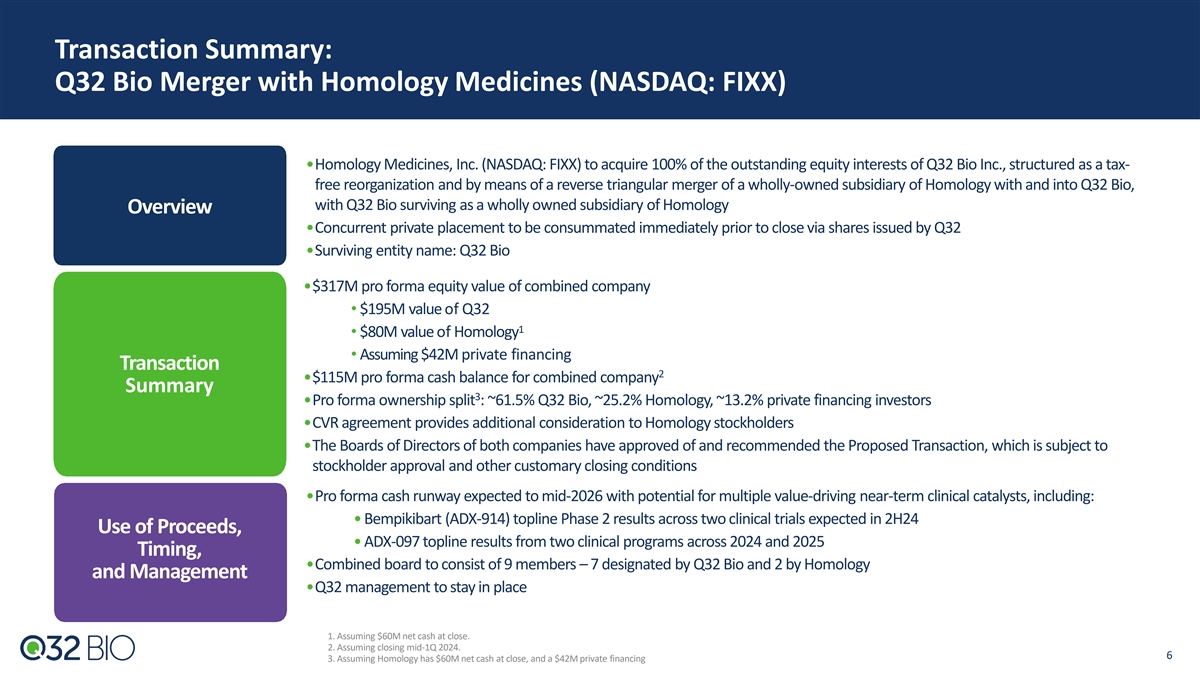

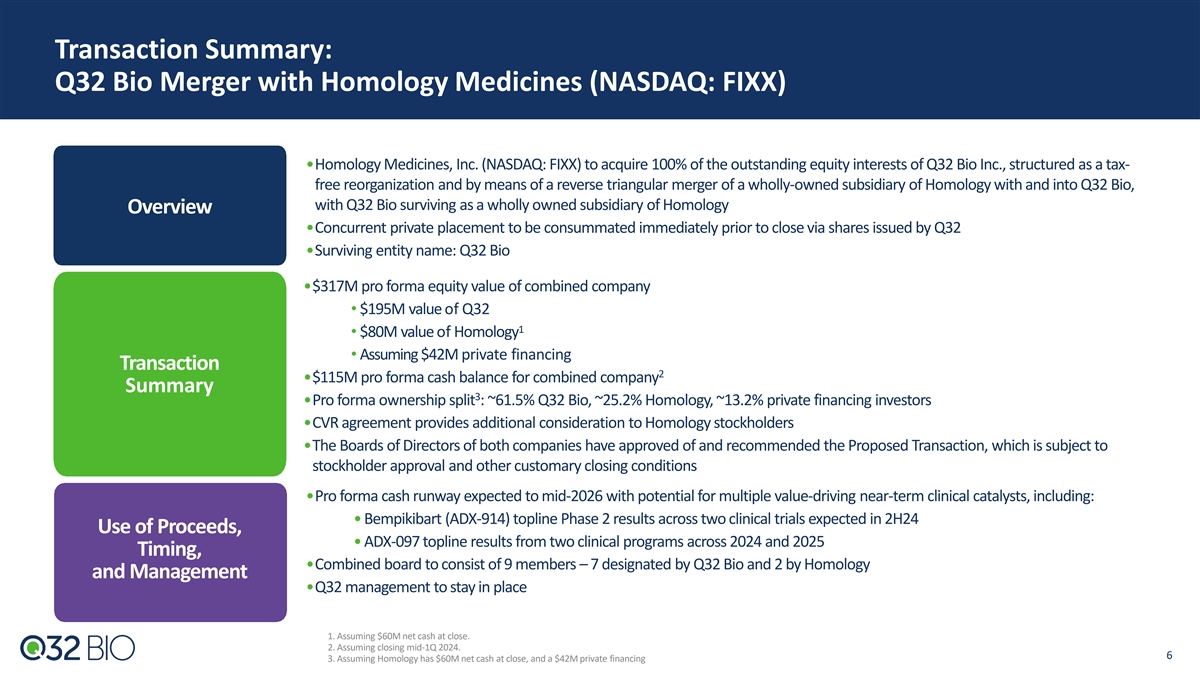

Transaction Summary: Q32 Bio Merger with Homology Medicines (NASDAQ: FIXX) •Homology Medicines, Inc. (NASDAQ: FIXX) to acquire 100% of the outstanding equity interests of Q32 Bio Inc., structured as a tax- free reorganization and by means of a reverse triangular merger of a wholly-owned subsidiary of Homology with and into Q32 Bio, with Q32 Bio surviving as a wholly owned subsidiary of Homology Overview •Concurrent private placement to be consummated immediately prior to close via shares issued by Q32 •Surviving entity name: Q32 Bio •$317M pro forma equity value of combined company • $195M value of Q32 1 • $80M value of Homology • Assuming $42M private financing Transaction 2 •$115M pro forma cash balance for combined company Summary 3 •Pro forma ownership split : ~61.5% Q32 Bio, ~25.2% Homology, ~13.2% private financing investors •CVR agreement provides additional consideration to Homology stockholders •The Boards of Directors of both companies have approved of and recommended the Proposed Transaction, which is subject to stockholder approval and other customary closing conditions •Pro forma cash runway expected to mid-2026 with potential for multiple value-driving near-term clinical catalysts, including: • Bempikibart (ADX-914) topline Phase 2 results across two clinical trials expected in 2H24 Use of Proceeds, • ADX-097 topline results from two clinical programs across 2024 and 2025 Timing, •Combined board to consist of 9 members – 7 designated by Q32 Bio and 2 by Homology and Management •Q32 management to stay in place 1. Assuming $60M net cash at close. 2. Assuming closing mid-1Q 2024. 6 3. Assuming Homology has $60M net cash at close, and a $42M private financing

Q32 Management Team: Experienced Public Company Leadership Team with Deep Drug Development Experience Executive Team Jodie Morrison Lee Kalowski, MBA Shelia Violette, PhD Jason Campagna, MD, PhD Maria Marzilli, MPH Saul Fink, PhD CEO Interim CFO CSO, President of CMO EVP, Corporate Strategy CTO Research & Founder & Program Operations Scientific Advisors Board of Directors David Grayzel, M.D. Mark Iwicki Kathy LaPorte Michael Holers, M.D. John P. Atkinson, M.D. Brian Kotzin, M.D. Atlas Venture Independent Independent Washington University Nektar Therapeutics (Chairman) University of Colorado Isaac Manke, Ph.D. Jodie Morrison Bill Lundberg, M.D. Acorn Bioventures Q32 Independent Simon Read, Ph.D. Peter Merkel, M.D. Diyong Xu Mariana Oncology University of Pennsylvania OrbiMed 7

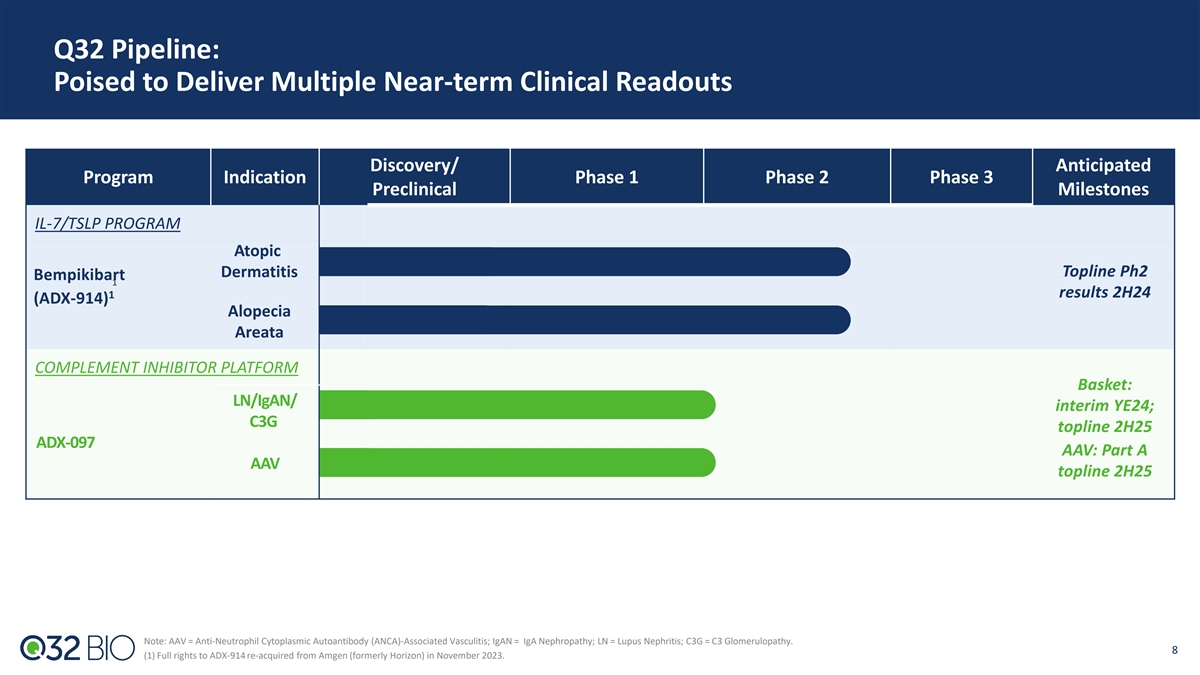

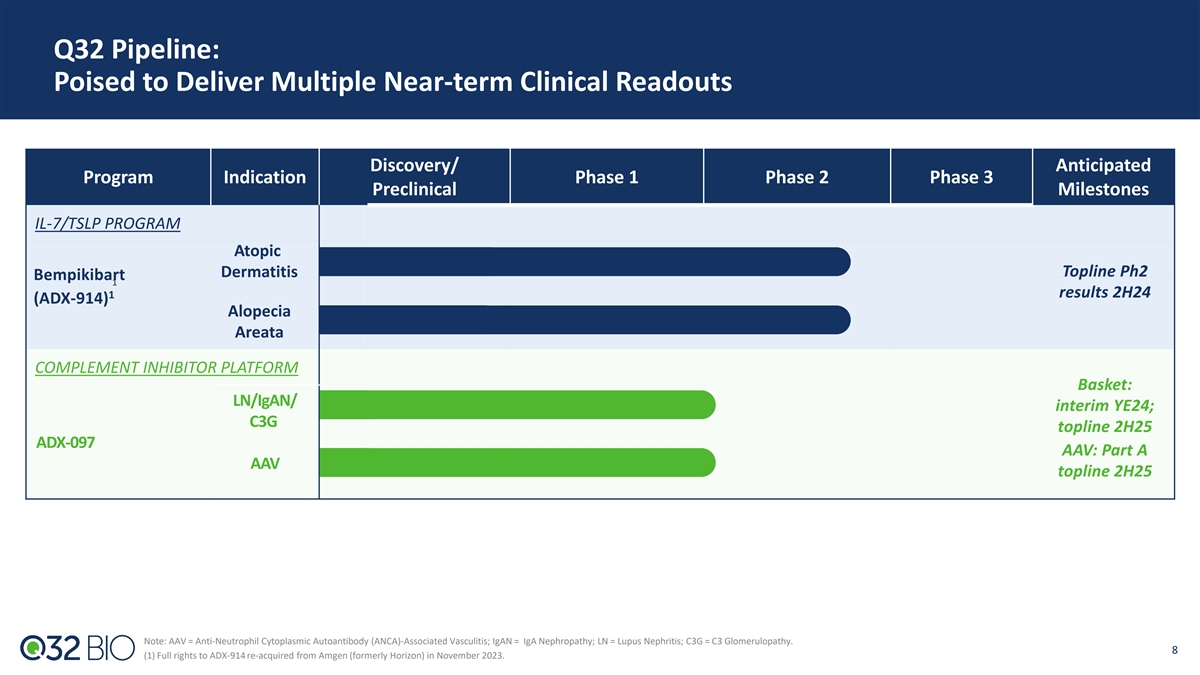

Q32 Pipeline: Poised to Deliver Multiple Near-term Clinical Readouts Discovery/ Anticipated Program Indication Phase 1 Phase 2 Phase 3 Preclinical Milestones IL-7/TSLP PROGRAM Atopic Topline Ph2 Dermatitis Bempikibart 1 results 2H24 1 (ADX-914) Alopecia Areata COMPLEMENT INHIBITOR PLATFORM Basket: LN/IgAN/ interim YE24; C3G topline 2H25 ADX-097 AAV: Part A AAV topline 2H25 Note: AAV = Anti-Neutrophil Cytoplasmic Autoantibody (ANCA)-Associated Vasculitis; IgAN = IgA Nephropathy; LN = Lupus Nephritis; C3G = C3 Glomerulopathy. 8 (1) Full rights to ADX-914 re-acquired from Amgen (formerly Horizon) in November 2023.

ADX-914 (IL-7 / TSLP Receptor Inhibitor)

Bempikibart (ADX-914): Novel Investigational Therapy for T-cell Mediated Inflammatory and Autoimmune Diseases Delivering Two Phase 2 Readouts in 2024 Bempikibart: IL-7Rα antagonist antibody blocks IL-7 and TSLP signaling IL-7 • Potent regulator of pathogenic T / T survival and proliferation eff mem • Suppresses T cells reg • Activates TfH cells to induce B-cell mediated antibody production TSLP • Central regulator of DC differentiation and TH2 cytokine production • Activates TH1, sensory neurons, mast cells, eosinophils, basophils and ILC2 Clinical Data Completed to Date • Ph1: Durable SC PK/PD and tolerability • Ph2 AD (Atopic Dermatitis) Part A: Confirmatory PK/PD; efficacy data currently blinded Topline Clinical Efficacy Data Expected 2H24 • Ph2 AD Part B • Ph2 AA (Alopecia Areata) 10 10

IL-7 and TSLP are Central Drivers of Inflammation and Autoimmunity Pathogenic Immune Response Ligand/Receptor Activation Preclinical Evidence • Induction of pathogenic T-eff/ • Elevated IL-7 and sIL-7Rα in disease • Overexpression of IL-7 or TSLP T-mem and ILC2 cells recapitulates disease pathology Increased TSLP signaling in disease • • Inhibition of T-reg function • Blocking IL-7 & TSLP pathways • Increased IL-7 and TSLP exerts protective effects in • Increased Th-helper cell mediated transcriptional signature in disease multiple models antibody production • Potential for long-term, durable • Activation of TH2 immune responses and remittive therapy response Blockade of IL-7 and TSLP has the potential to provide protection in a broad range of inflammatory and autoimmune diseases including AD, AA, UC, RA, SS, NIU, MS and others AD – atopic dermatitis, AA – alopecia areata, RA – rheumatoid arthritis, NIU – non-infectious 11 uveitis, MS – multiple sclerosis, UC – ulcerative colitis

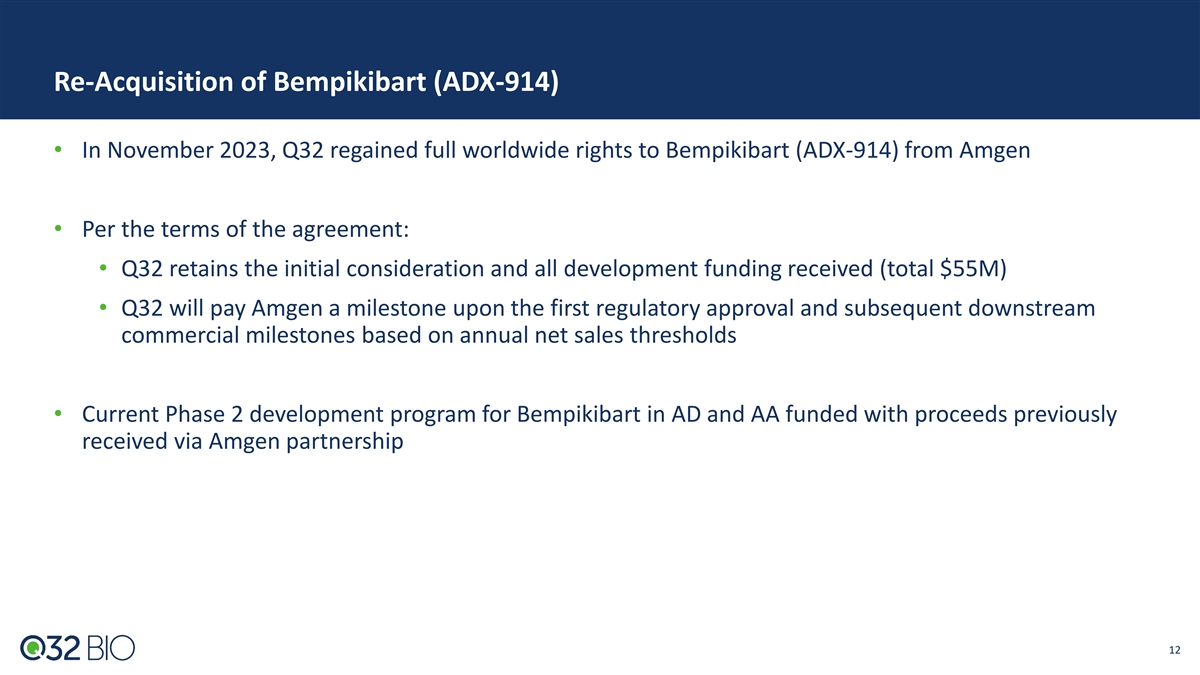

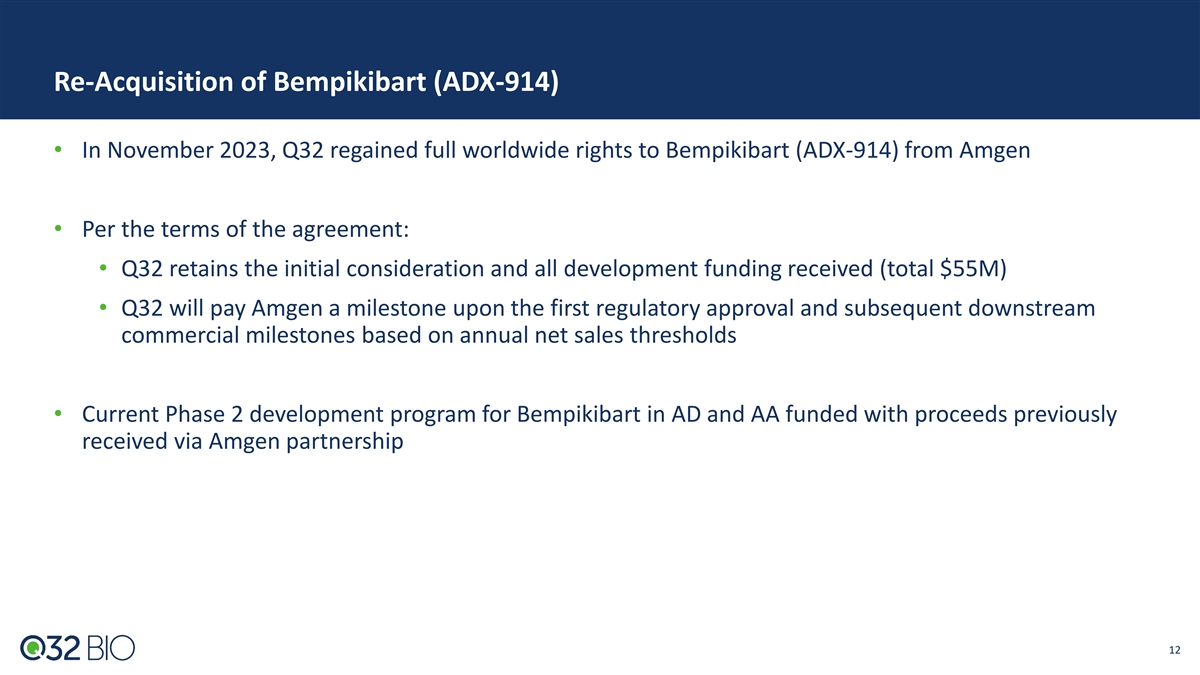

Re-Acquisition of Bempikibart (ADX-914) • In November 2023, Q32 regained full worldwide rights to Bempikibart (ADX-914) from Amgen • Per the terms of the agreement: • Q32 retains the initial consideration and all development funding received (total $55M) • Q32 will pay Amgen a milestone upon the first regulatory approval and subsequent downstream commercial milestones based on annual net sales thresholds • Current Phase 2 development program for Bempikibart in AD and AA funded with proceeds previously received via Amgen partnership 12

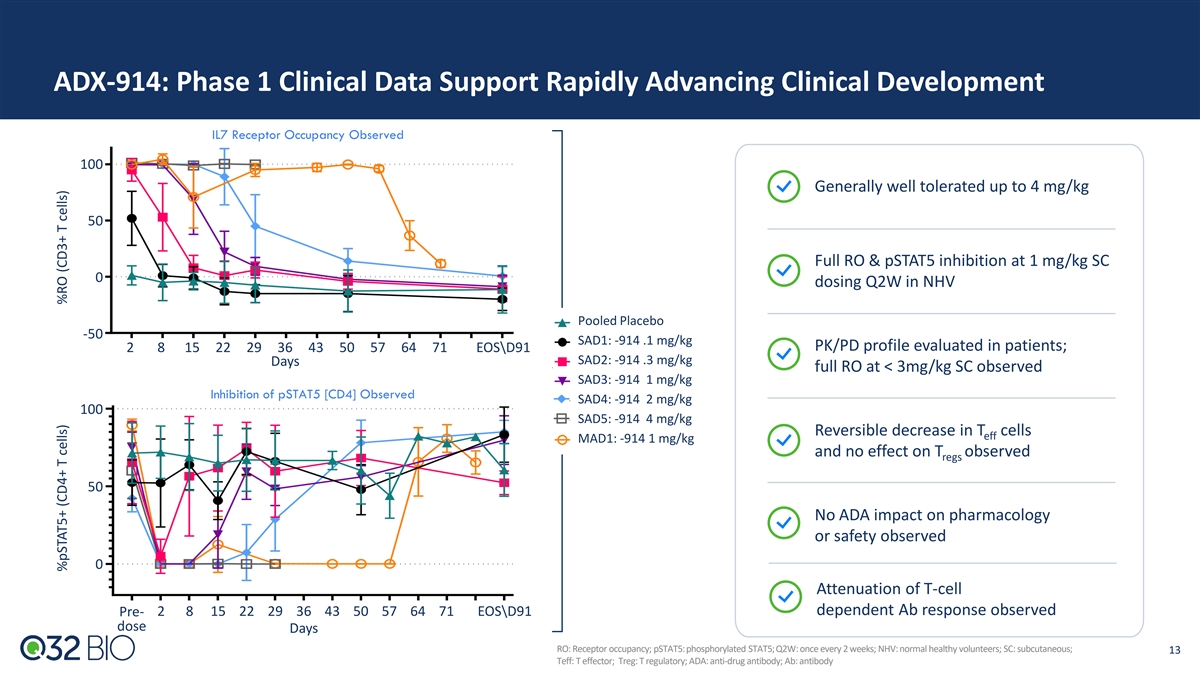

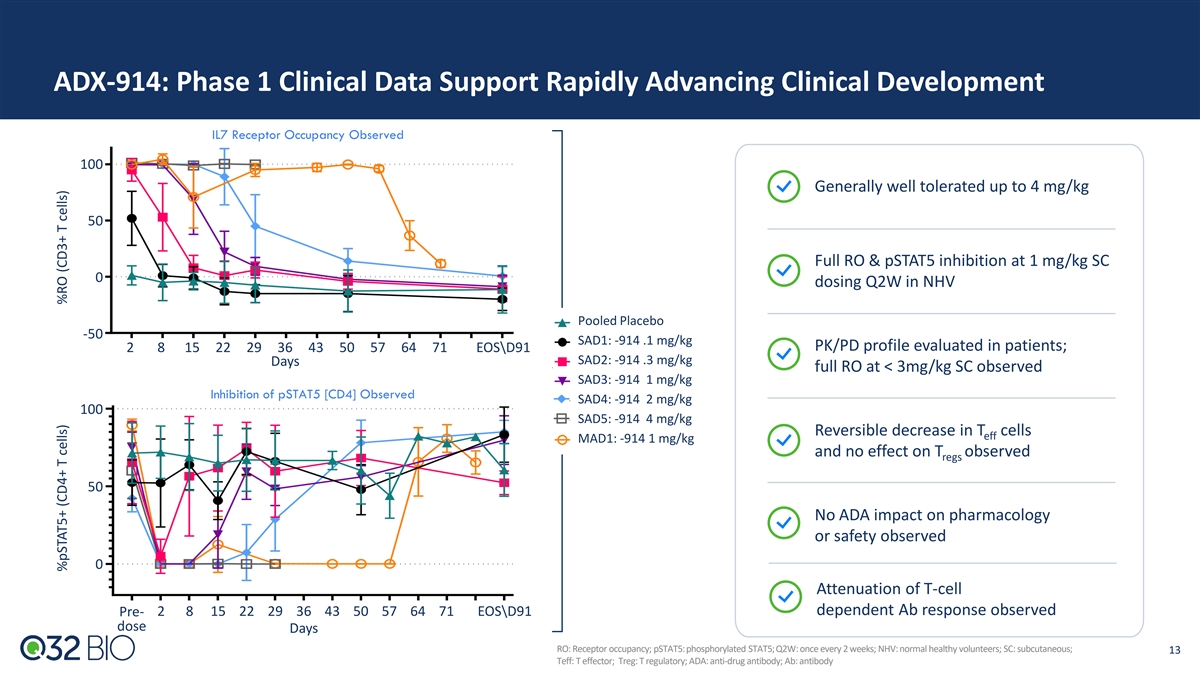

ADX-914: Phase 1 Clinical Data Support Rapidly Advancing Clinical Development IL7 Receptor Occupancy Observed 100 Generally well tolerated up to 4 mg/kg 50 Full RO & pSTAT5 inhibition at 1 mg/kg SC 0 dosing Q2W in NHV Pooled Placebo -50 SAD1: -914 .1 mg/kg PK/PD profile evaluated in patients; 2 8 15 22 29 36 43 50 57 64 71 EOS\D91 SAD2: -914 .3 mg/kg Days full RO at < 3mg/kg SC observed SAD3: -914 1 mg/kg Inhibition of pSTAT5 [CD4] Observed SAD4: -914 2 mg/kg 100 SAD5: -914 4 mg/kg Reversible decrease in T cells eff MAD1: -914 1 mg/kg and no effect on T observed regs 50 No ADA impact on pharmacology or safety observed 0 Attenuation of T-cell dependent Ab response observed Pre- 2 8 15 22 29 36 43 50 57 64 71 EOS\D91 dose Days RO: Receptor occupancy; pSTAT5: phosphorylated STAT5; Q2W: once every 2 weeks; NHV: normal healthy volunteers; SC: subcutaneous; 13 Teff: T effector; Treg: T regulatory; ADA: anti-drug antibody; Ab: antibody %pSTAT5+ (CD4+ T cells) %RO (CD3+ T cells)

ADX-914 Phase 2 AD Part A Data Supports Development Program Part A Evaluated 2 mg/kg and 3 mg/kg Q2W SC for 12 weeks • PK/Dosing: Both dose groups maintained target PK threshold > 5 ug/ml (dose predicted to achieve full target engagement in tissue); 1 supports administration of 200 mg SC flat dosing (~2.7 mg/kg) in AD Part B & AA • PD: 100% of both dose groups achieved maximal RO (>90%) by day 3, maintained through entirety of dosing period (graph below) • Absolute lymphocyte counts: No CTCAE grade ≥3 lymphopenia observed • ADA: Low titer ADA, with no impact on PK observed • Safety: To date, no lymphopenia associated AEs including viral infections observed • Efficacy: Part A remains blinded. Part B blinded through topline data readout. Concentration vs Time Profiles 1. Equivalent to ~2.7 mg/kg for a 75 kg individual. 14

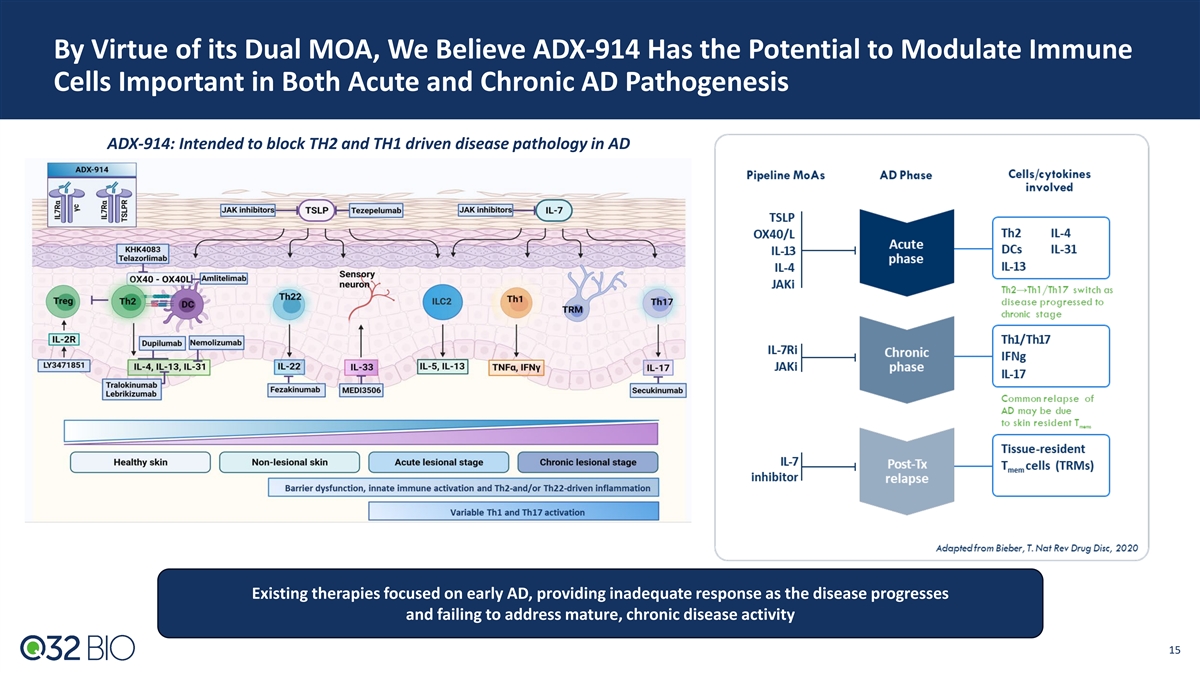

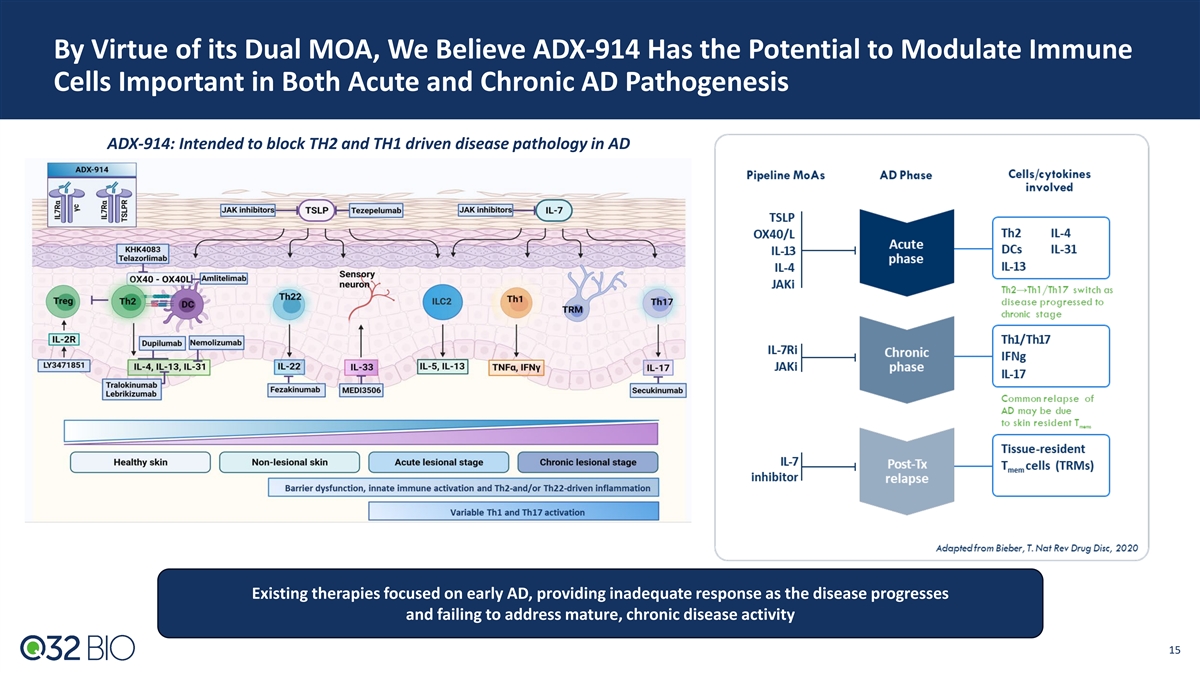

By Virtue of its Dual MOA, We Believe ADX-914 Has the Potential to Modulate Immune Cells Important in Both Acute and Chronic AD Pathogenesis ADX-914: Intended to block TH2 and TH1 driven disease pathology in AD Existing therapies focused on early AD, providing inadequate response as the disease progresses and failing to address mature, chronic disease activity 15

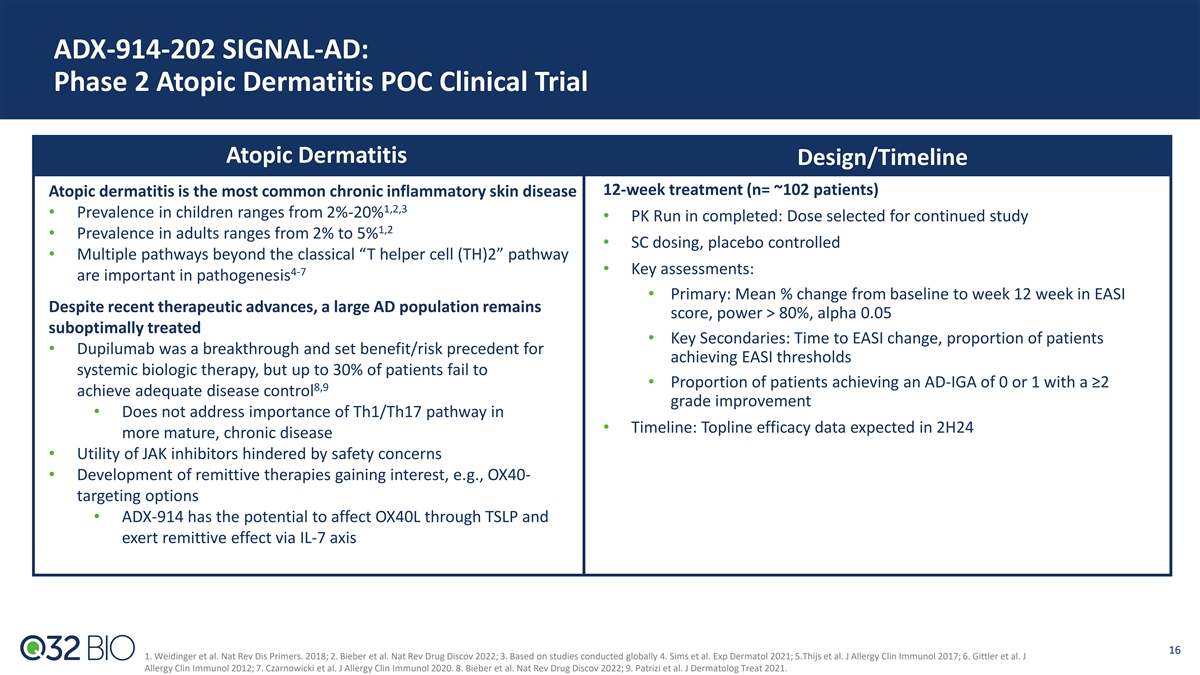

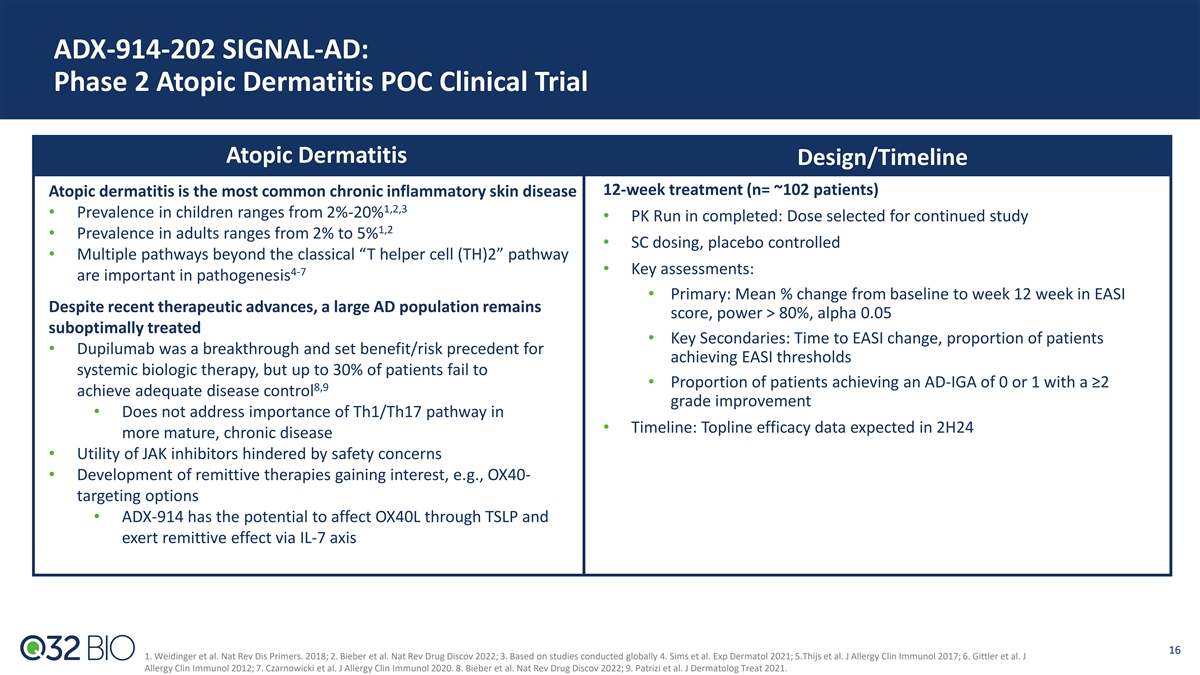

ADX-914-202 SIGNAL-AD: Phase 2 Atopic Dermatitis POC Clinical Trial Atopic Dermatitis Design/Timeline 12-week treatment (n= ~102 patients) Atopic dermatitis is the most common chronic inflammatory skin disease 1,2,3 • Prevalence in children ranges from 2%-20% • PK Run in completed: Dose selected for continued study 1,2 • Prevalence in adults ranges from 2% to 5% • SC dosing, placebo controlled • Multiple pathways beyond the classical “T helper cell (TH)2” pathway 4-7 • Key assessments: are important in pathogenesis • Primary: Mean % change from baseline to week 12 week in EASI Despite recent therapeutic advances, a large AD population remains score, power > 80%, alpha 0.05 suboptimally treated • Key Secondaries: Time to EASI change, proportion of patients • Dupilumab was a breakthrough and set benefit/risk precedent for achieving EASI thresholds systemic biologic therapy, but up to 30% of patients fail to • Proportion of patients achieving an AD-IGA of 0 or 1 with a ≥2 8,9 achieve adequate disease control grade improvement • Does not address importance of Th1/Th17 pathway in • Timeline: Topline efficacy data expected in 2H24 more mature, chronic disease • Utility of JAK inhibitors hindered by safety concerns • Development of remittive therapies gaining interest, e.g., OX40- targeting options • ADX-914 has the potential to affect OX40L through TSLP and exert remittive effect via IL-7 axis 16 1. Weidinger et al. Nat Rev Dis Primers. 2018; 2. Bieber et al. Nat Rev Drug Discov 2022; 3. Based on studies conducted globally 4. Sims et al. Exp Dermatol 2021; 5.Thijs et al. J Allergy Clin Immunol 2017; 6. Gittler et al. J Allergy Clin Immunol 2012; 7. Czarnowicki et al. J Allergy Clin Immunol 2020. 8. Bieber et al. Nat Rev Drug Discov 2022; 9. Patrizi et al. J Dermatolog Treat 2021.

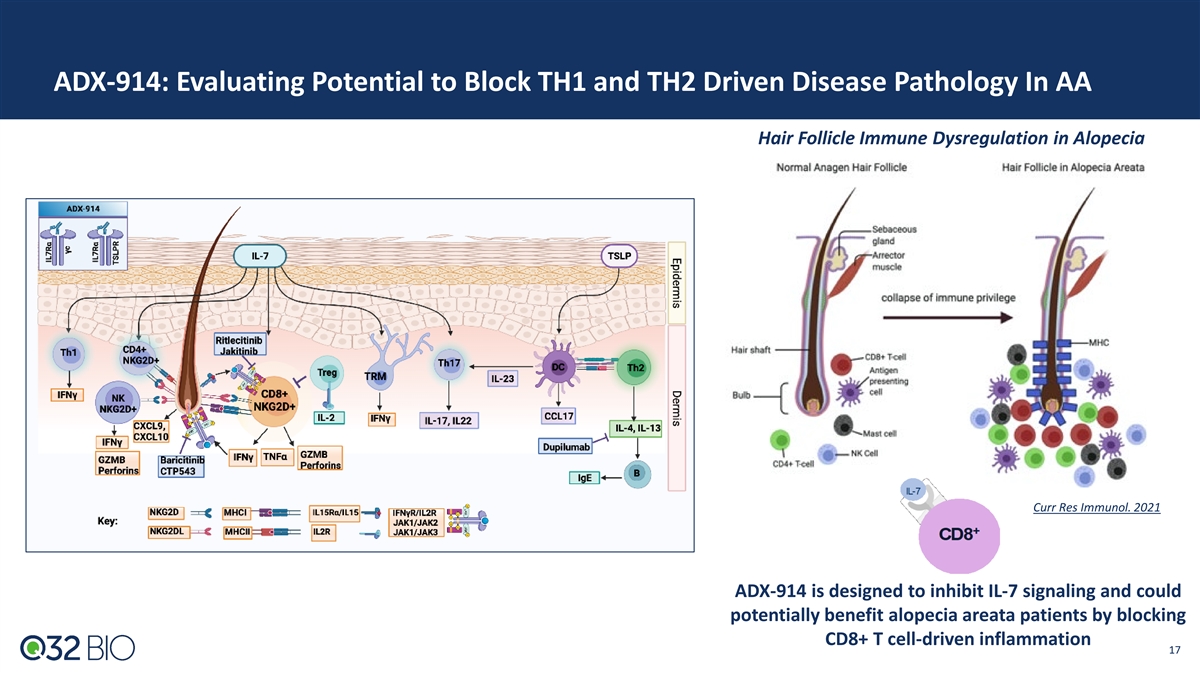

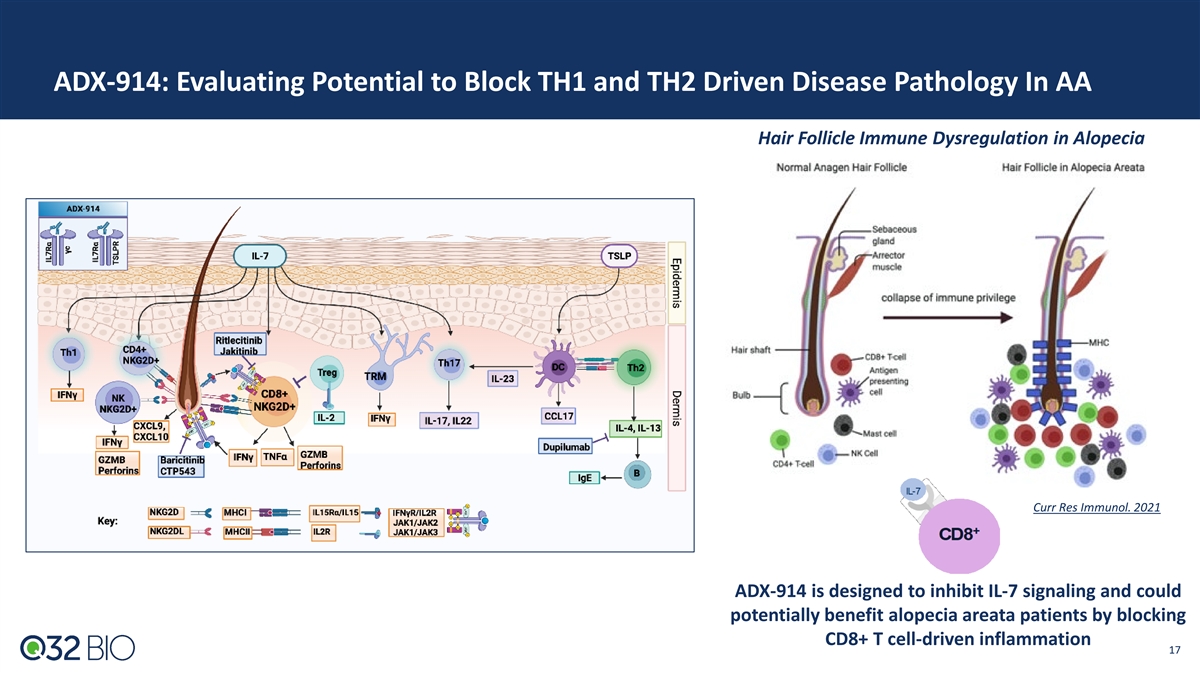

ADX-914: Evaluating Potential to Block TH1 and TH2 Driven Disease Pathology In AA Hair Follicle Immune Dysregulation in Alopecia Curr Res Immunol. 2021 ADX-914 is designed to inhibit IL-7 signaling and could potentially benefit alopecia areata patients by blocking CD8+ T cell-driven inflammation 17

ADX-914-202 SIGNAL-AA: Phase 2 Alopecia Areata POC Clinical Trial Alopecia Areata Design/Timeline 24-week treatment (n= ~40 patients) Alopecia Areata is common, and psychosocially debilitating; scalp and face commonly impacted • SC dosing, placebo controlled • Approximate prevalence of 2%, most before age 50 • Key assessments: • Up to 40% of patients develop chronic disease; 10% • Primary: Mean % change from baseline in SALT * ** progress to complete loss of scalp and/or body hair score at Week 24; power > 80%, alpha 0.05 • Key Secondaries: Time to SALT change, proportion Psychological comorbidities common and result in of patients achieving SALT thresholds major impact on patients’ lives • Proportion of patients achieving an AA-IGA of 0 or 1 with a ≥2 point improvement Despite recent first approved therapy, there remains • Change from Baseline in Clinician Reported a lack of options for inducing remission and avoiding Outcome (ClinRO) for Eyebrow and Eyelash Hair Loss life-long treatment • JAK inhibitors require chronic treatment as hair loss • Timeline: Topline efficacy data expected in 2H24 reoccurs with treatment cessation or taper; particularly challenging given class safety warnings 18 *Alopecia Totalis; **Alopecia Universalis

Tissue Targeted Platform: Building The Future of Complement Therapeutics

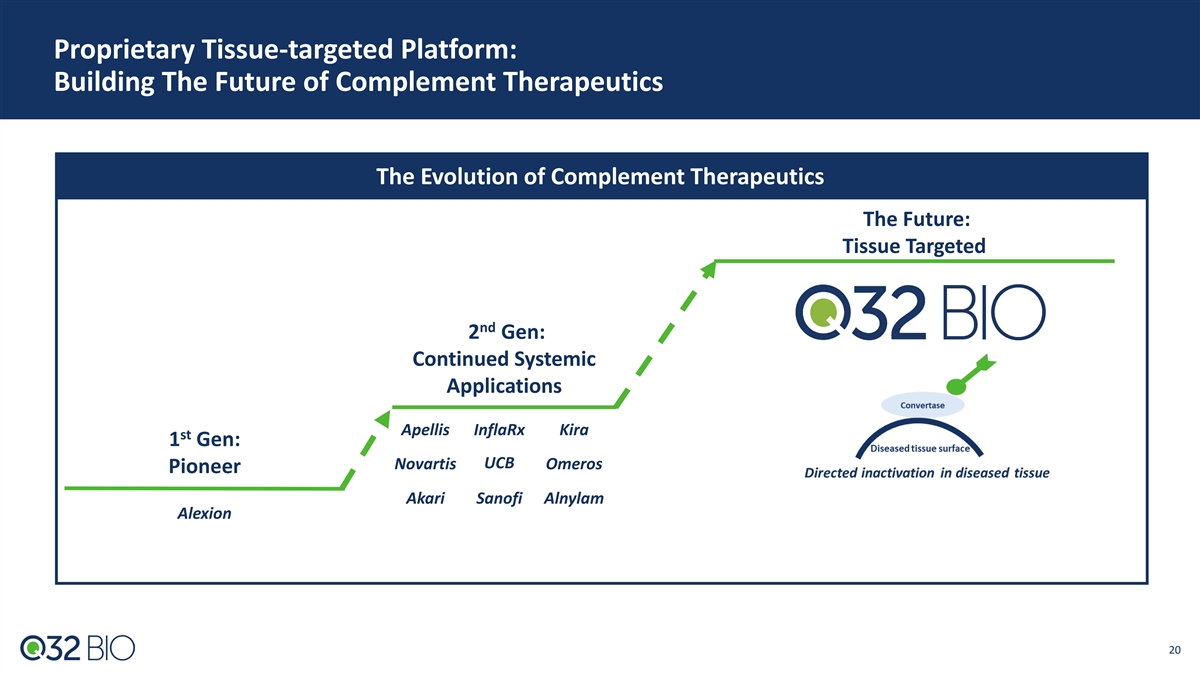

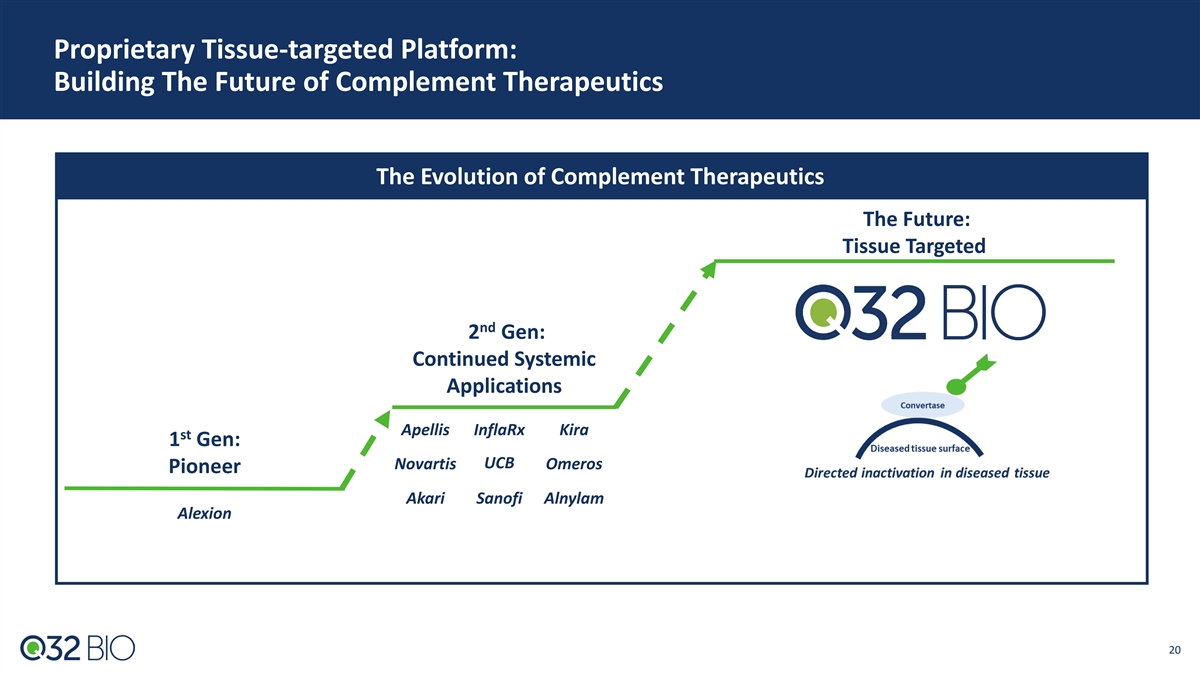

Proprietary Tissue-targeted Platform: Building The Future of Complement Therapeutics The Evolution of Complement Therapeutics The Future: Tissue Targeted nd 2 Gen: Continued Systemic Applications Apellis InflaRx Kira st 1 Gen: UCB Novartis Omeros Pioneer Akari Sanofi Alnylam Alexion 20

Q32 Tissue-targeted Platform Value Proposition: Designed to Enable Clinical Profile Superior to Systemic Complement Inhibitors The Unmet Need The Opportunity • Limited activity: • Enhanced activity through tissue targeting: Reliant on systemic blockade for impact on Differentiated approach to driving efficacy by affected organ inactivating convertases directly at site of destruction • High doses, frequent administration required: • R educ e d t re a tm e nt burden: High abundance, rapid turnover of most target SC route with QW dosing; potential for Q2W complement proteins • Infection risk: • Improved risk/benefit profile: Complement plays critical role in combating Designed to maximize therapeutic index while infection; systemic blockade increases risk maintaining intact immune surveillance; broader indication potential 21

ADX-097 (C3d targeted antibody – fH 1-5 fusion protein)

ADX-097 Lead Bivalent Fusion Protein: Designed with Unique MOA to Drive Localized, Complement Re-regulation For Enhanced Activity and Tolerability ADX-097 Design: C3d antibody – fH 1-5 Designed to be held at site of tissue complement Inactivation of alternative pathway convertases activity allowing catalytic degradation of gains control of amplification loop and all 3 alternative pathway convertases complement pathways ADX-097: Fusion protein Humanized anti-C3d mAb linked to two moieties of a negative regulatory protein (fH ) 1-5 23 23

ADX-097 Preclinical and Ph1 Data: Robust data package supports desired PK and PD with favorable tolerability and good immunogenicity profile Preclinical Data • Tissue distribution and target binding • Durable (>7 days) tissue PK/PD after SC dosing • Reduction in key proof of mechanism (POM)/proof of concept (POC) biomarkers including proteinuria and albuminuria • >40X safety margin for planned Ph2 clinical dosing Ph1 Clinical Data • Favorable tolerability and good immunogenicity profile across all SAD/MAD doses • Weekly SC dosing met desired exposures for predicted complete tissue inhibition (based on preclinical modeling) with no systemic inhibition • Proximal POM supports in-vivo ADX-097 integrity 24 24

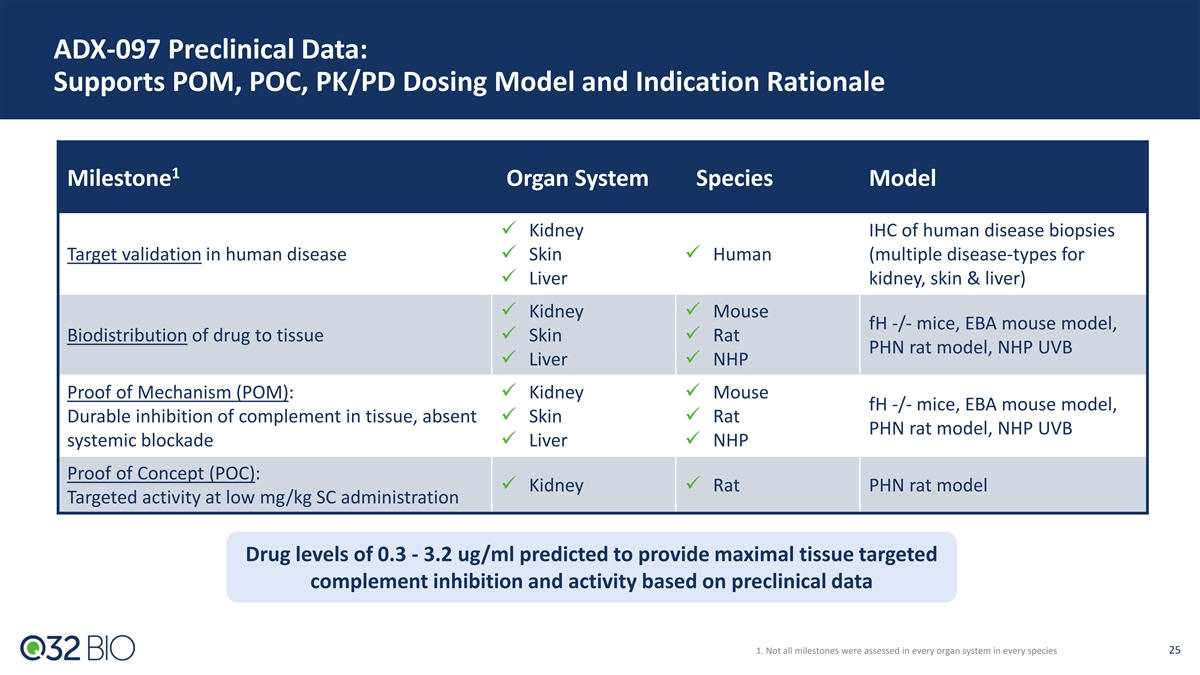

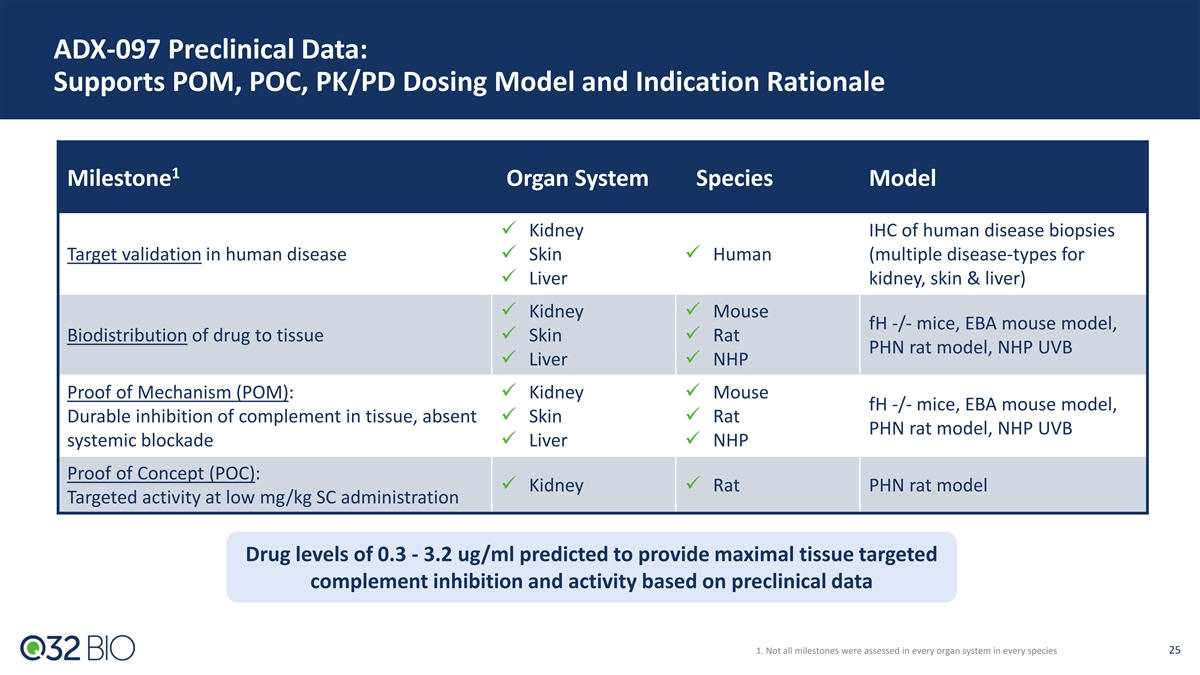

ADX-097 Preclinical Data: Supports POM, POC, PK/PD Dosing Model and Indication Rationale 1 Milestone Organ System Species Model ü Kidney IHC of human disease biopsies Target validation in human diseaseü Skinü Human (multiple disease-types for ü Liver kidney, skin & liver) ü Kidneyü Mouse fH -/- mice, EBA mouse model, Biodistribution of drug to tissueü Skinü Rat PHN rat model, NHP UVB ü Liverü NHP Proof of Mechanism (POM): ü Kidneyü Mouse fH -/- mice, EBA mouse model, Durable inhibition of complement in tissue, absent ü Skinü Rat PHN rat model, NHP UVB systemic blockadeü Liverü NHP Proof of Concept (POC): ü Kidneyü Rat PHN rat model Targeted activity at low mg/kg SC administration Drug levels of 0.3 - 3.2 ug/ml predicted to provide maximal tissue targeted complement inhibition and activity based on preclinical data 1. Not all milestones were assessed in every organ system in every species 25

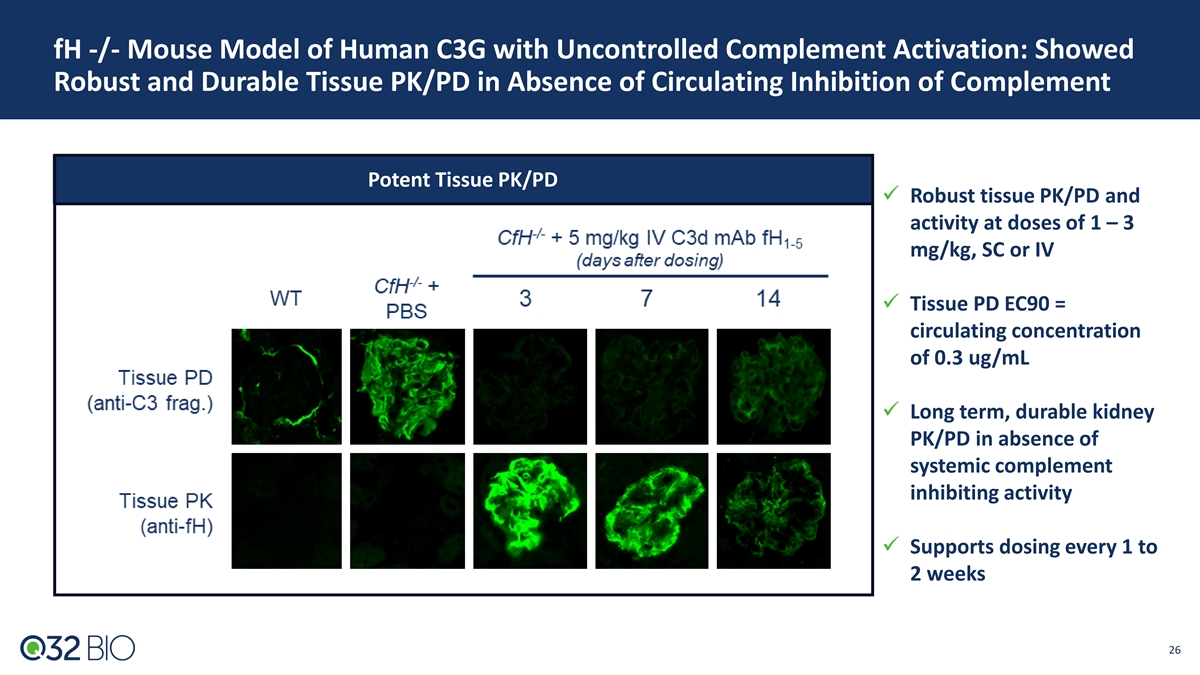

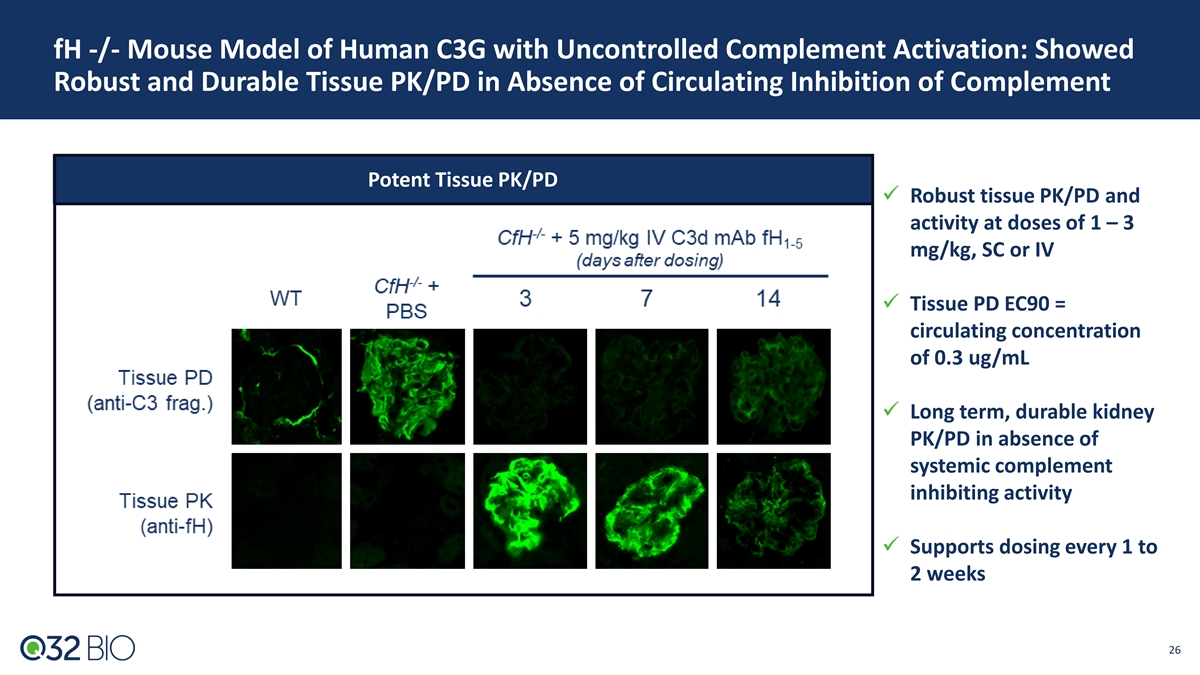

fH -/- Mouse Model of Human C3G with Uncontrolled Complement Activation: Showed Robust and Durable Tissue PK/PD in Absence of Circulating Inhibition of Complement Potent Tissue PK/PD ü Robust tissue PK/PD and activity at doses of 1 – 3 mg/kg, SC or IV ü Tissue PD EC90 = circulating concentration of 0.3 ug/mL ü Long term, durable kidney PK/PD in absence of systemic complement inhibiting activity ü Supports dosing every 1 to 2 weeks 26

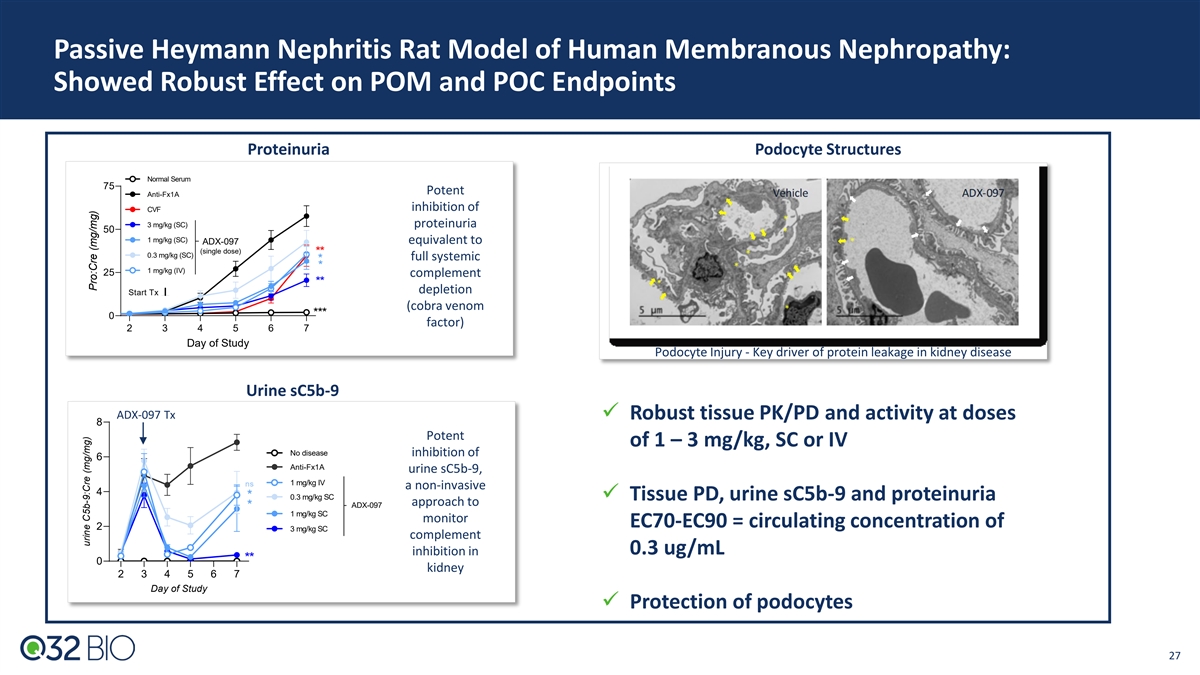

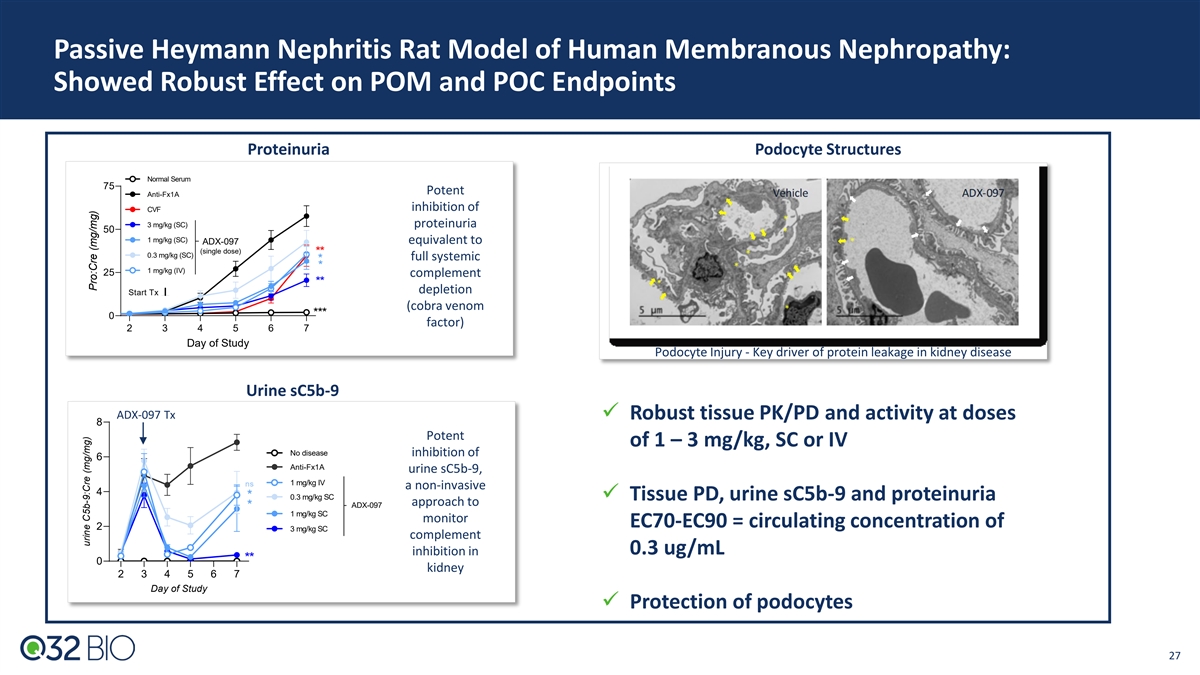

Passive Heymann Nephritis Rat Model of Human Membranous Nephropathy: Showed Robust Effect on POM and POC Endpoints Proteinuria Podocyte Structures Normal Serum 75 Potent Anti-Fx1A inhibition of CVF 3 mg/kg (SC) proteinuria 50 1 mg/kg (SC) equivalent to ADX-097 (single dose) ** 0.3 mg/kg (SC) full systemic * * 1 mg/kg (IV) 25 complement ** depletion Start Tx (cobra venom *** 0 factor) 2 3 4 5 6 7 Day of Study Podocyte Injury - Key driver of protein leakage in kidney disease Urine sC5b-9 ADX-097 Tx ü Robust tissue PK/PD and activity at doses 8 Potent of 1 – 3 mg/kg, SC or IV No disease inhibition of 6 Anti-Fx1A urine sC5b-9, 1 mg/kg IV ns a non-invasive 4 * 0.3 mg/kg SC ü Tissue PD, urine sC5b-9 and proteinuria approach to ADX-097 * 1 mg/kg SC monitor EC70-EC90 = circulating concentration of 2 3 mg/kg SC complement inhibition in 0.3 ug/mL ** 0 kidney 2 3 4 5 6 7 Day of Study ü Protection of podocytes 27 urine C5b-9:Cre (mg/mg) Pro:Cre (mg/mg)

ADX-097-001 Phase 1 Study: Complete with Primary Goals Achieved ADX-097-001 SAD/MAD (n= 56 Healthy Volunteers) Explored Single Doses of 0.1 - 30 mg/kg IV and/or SC and 450 mg SC Multiple Dose Cohort (~6 mg/kg) Primary Goals Achieved Results • Attained expected dose-dependent PK/PD Confirm planned Ph2 • Once weekly SC dosing provided desired exposure for predicted dose/route/schedule complete tissue inhibition with no concomitant systemic inhibition Evaluate proximal POM to • PK levels aligned with predicted Wieslab alternative pathway inhibition establish in-vivo ADX-097 integrity Characterize safety profile • No serious or severe AEs or discontinuations due to AEs • No AEs related to immunogenicity Characterize immunogenicity risk • Minimal anti-drug antibodies (ADA) detected across SAD/MAD; low level titers 450 mg selected for starting Ph2 SC dose based on favorable tolerability profile and desired exposure 28

ADX-097 Phase 1 PK Data: Weekly SC Dosing Met Desired Exposures for Predicted Complete Tissue Inhibition With No Concomitant Systemic Inhibition Phase 2 Dose Identified: 450 mg SC Met Key Exposure Goals 50% systemic complement inhibition 450mg SC achieved exposures below systemic inhibition and above conservative end of predicted range for clinical activity Drug levels predicted to provide maximal tissue complement inhibition and activity based on mouse, rat and NHP preclinical data 29 Updated to include cohorts SAD 6b and SAD 8

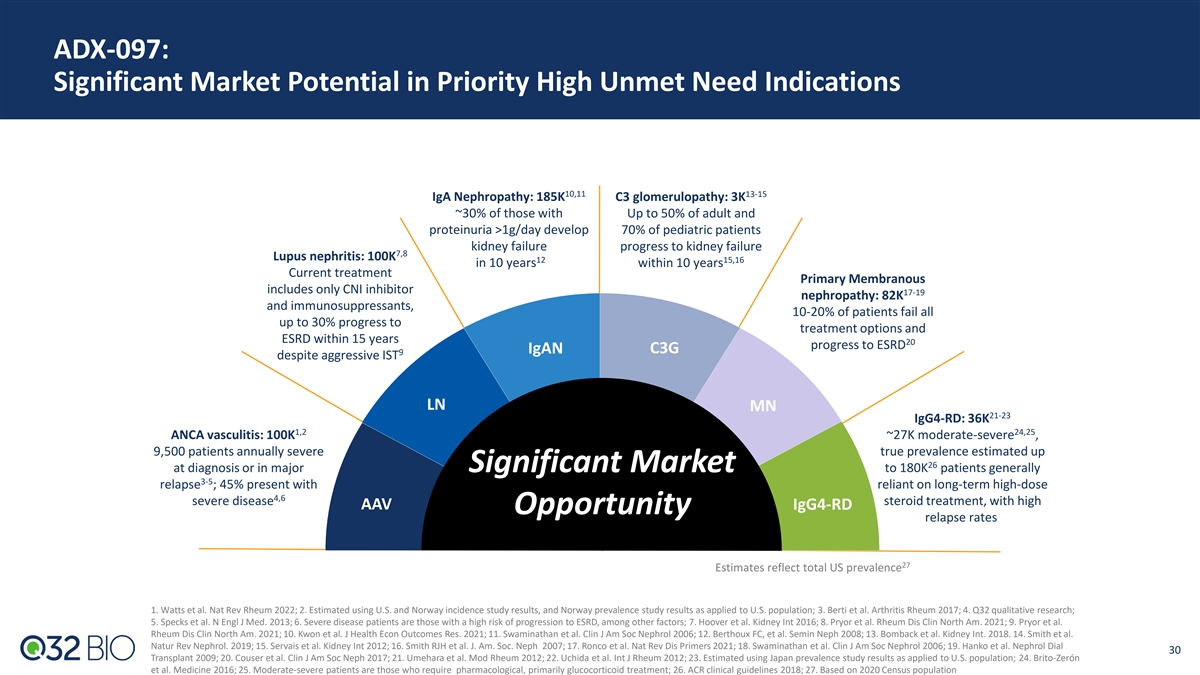

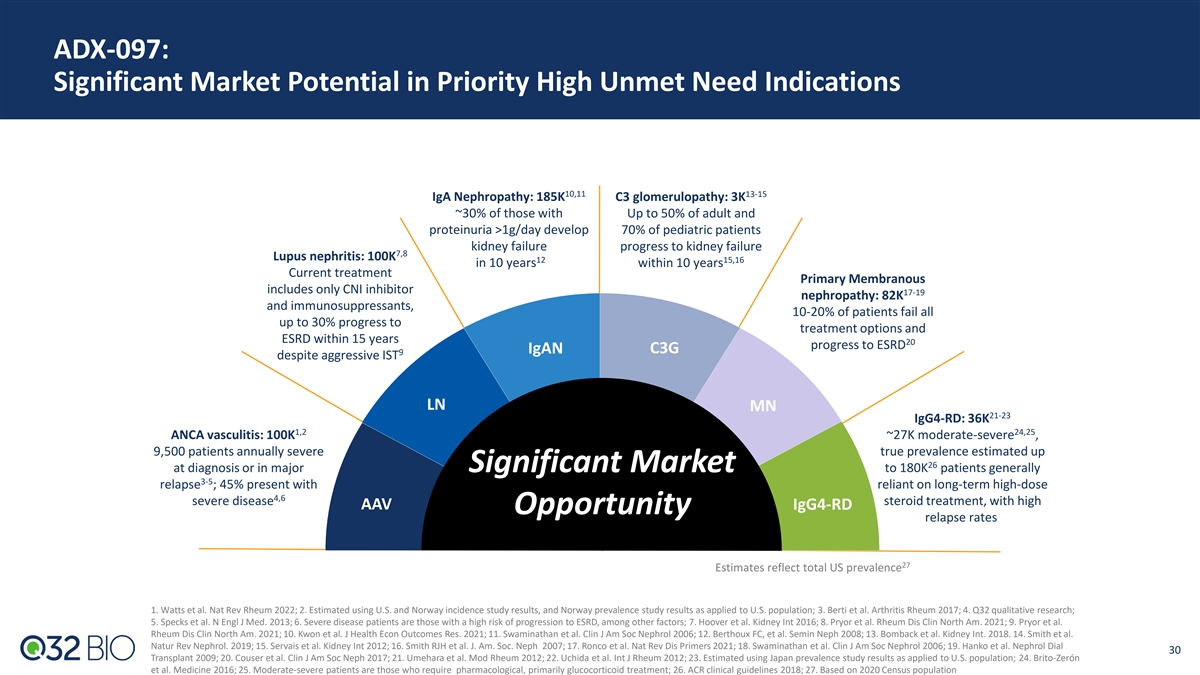

ADX-097: Significant Market Potential in Priority High Unmet Need Indications 10,11 13-15 IgA Nephropathy: 185K C3 glomerulopathy: 3K ~30% of those with Up to 50% of adult and proteinuria >1g/day develop 70% of pediatric patients kidney failure progress to kidney failure 7,8 Lupus nephritis: 100K 12 15,16 in 10 years within 10 years Current treatment Primary Membranous includes only CNI inhibitor 17-19 nephropathy: 82K and immunosuppressants, 10-20% of patients fail all up to 30% progress to treatment options and ESRD within 15 years 20 progress to ESRD IgAN C3G 9 despite aggressive IST LN MN 21-23 IgG4-RD: 36K 1,2 24,25 ANCA vasculitis: 100K ~27K moderate-severe , 9,500 patients annually severe true prevalence estimated up 26 at diagnosis or in major Significant Market to 180K patients generally 3-5 relapse ; 45% present with reliant on long-term high-dose 4,6 severe disease steroid treatment, with high AAV IgG4-RD Opportunity relapse rates 27 Estimates reflect total US prevalence 1. Watts et al. Nat Rev Rheum 2022; 2. Estimated using U.S. and Norway incidence study results, and Norway prevalence study results as applied to U.S. population; 3. Berti et al. Arthritis Rheum 2017; 4. Q32 qualitative research; 5. Specks et al. N Engl J Med. 2013; 6. Severe disease patients are those with a high risk of progression to ESRD, among other factors; 7. Hoover et al. Kidney Int 2016; 8. Pryor et al. Rheum Dis Clin North Am. 2021; 9. Pryor et al. Rheum Dis Clin North Am. 2021; 10. Kwon et al. J Health Econ Outcomes Res. 2021; 11. Swaminathan et al. Clin J Am Soc Nephrol 2006; 12. Berthoux FC, et al. Semin Neph 2008; 13. Bomback et al. Kidney Int. 2018. 14. Smith et al. Natur Rev Nephrol. 2019; 15. Servais et al. Kidney Int 2012; 16. Smith RJH et al. J. Am. Soc. Neph 2007; 17. Ronco et al. Nat Rev Dis Primers 2021; 18. Swaminathan et al. Clin J Am Soc Nephrol 2006; 19. Hanko et al. Nephrol Dial 30 Transplant 2009; 20. Couser et al. Clin J Am Soc Neph 2017; 21. Umehara et al. Mod Rheum 2012; 22. Uchida et al. Int J Rheum 2012; 23. Estimated using Japan prevalence study results as applied to U.S. population; 24. Brito-Zerón et al. Medicine 2016; 25. Moderate-severe patients are those who require pharmacological, primarily glucocorticoid treatment; 26. ACR clinical guidelines 2018; 27. Based on 2020 Census population

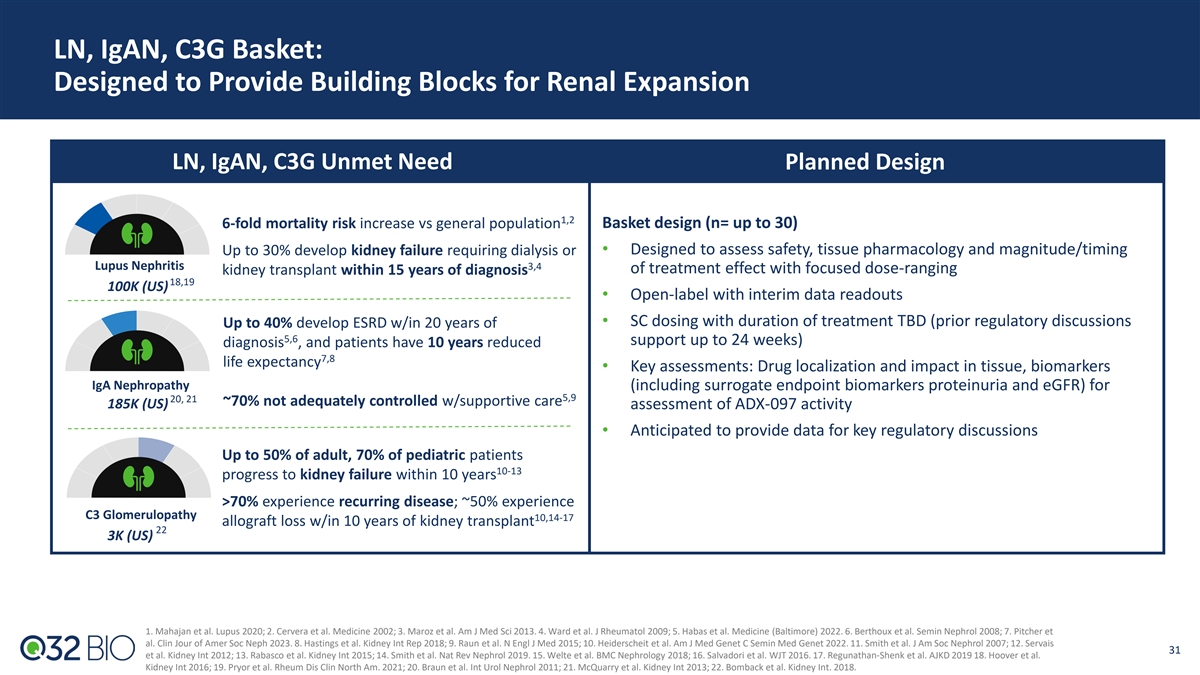

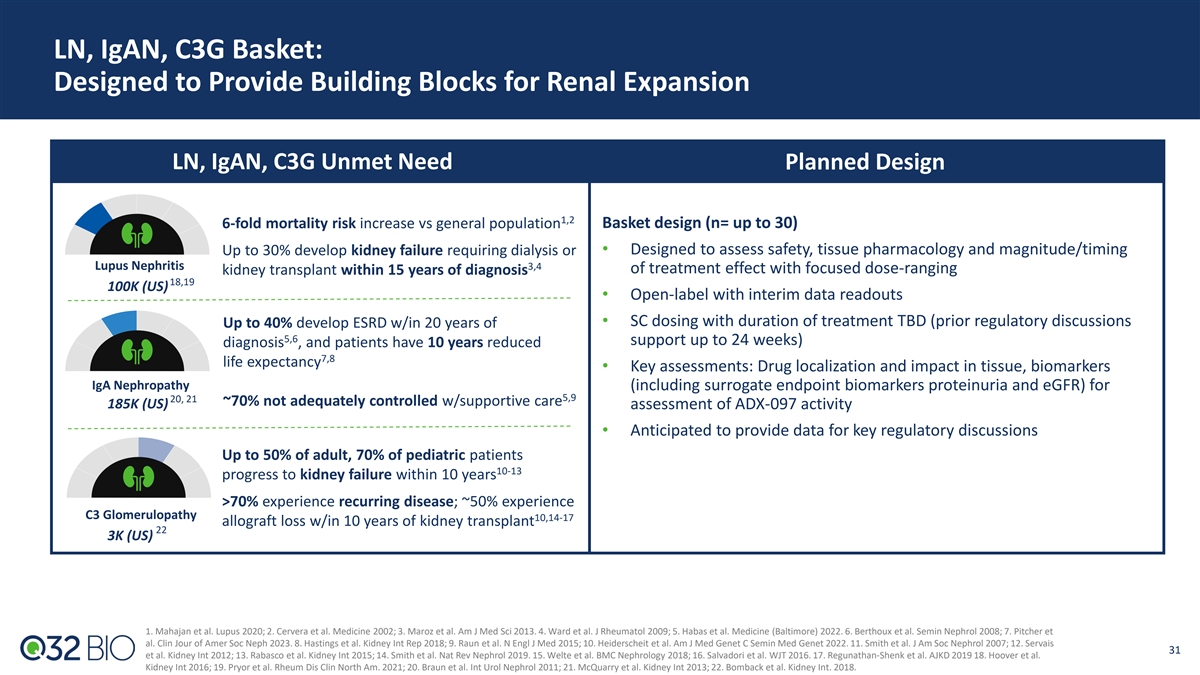

LN, IgAN, C3G Basket: Designed to Provide Building Blocks for Renal Expansion LN, IgAN, C3G Unmet Need Planned Design 1,2 6-fold mortality risk increase vs general population Basket design (n= up to 30) Up to 30% develop kidney failure requiring dialysis or • Designed to assess safety, tissue pharmacology and magnitude/timing Lupus Nephritis 3,4 of treatment effect with focused dose-ranging kidney transplant within 15 years of diagnosis 18,19 100K (US) • Open-label with interim data readouts • SC dosing with duration of treatment TBD (prior regulatory discussions Up to 40% develop ESRD w/in 20 years of 5,6 support up to 24 weeks) diagnosis , and patients have 10 years reduced 7,8 life expectancy • Key assessments: Drug localization and impact in tissue, biomarkers IgA Nephropathy (including surrogate endpoint biomarkers proteinuria and eGFR) for 5,9 20, 21 ~70% not adequately controlled w/supportive care 185K (US) assessment of ADX-097 activity • Anticipated to provide data for key regulatory discussions Up to 50% of adult, 70% of pediatric patients 10-13 progress to kidney failure within 10 years >70% experience recurring disease; ~50% experience C3 Glomerulopathy 10,14-17 allograft loss w/in 10 years of kidney transplant 22 3K (US) 1. Mahajan et al. Lupus 2020; 2. Cervera et al. Medicine 2002; 3. Maroz et al. Am J Med Sci 2013. 4. Ward et al. J Rheumatol 2009; 5. Habas et al. Medicine (Baltimore) 2022. 6. Berthoux et al. Semin Nephrol 2008; 7. Pitcher et al. Clin Jour of Amer Soc Neph 2023. 8. Hastings et al. Kidney Int Rep 2018; 9. Raun et al. N Engl J Med 2015; 10. Heiderscheit et al. Am J Med Genet C Semin Med Genet 2022. 11. Smith et al. J Am Soc Nephrol 2007; 12. Servais 31 et al. Kidney Int 2012; 13. Rabasco et al. Kidney Int 2015; 14. Smith et al. Nat Rev Nephrol 2019. 15. Welte et al. BMC Nephrology 2018; 16. Salvadori et al. WJT 2016. 17. Regunathan-Shenk et al. AJKD 2019 18. Hoover et al. Kidney Int 2016; 19. Pryor et al. Rheum Dis Clin North Am. 2021; 20. Braun et al. Int Urol Nephrol 2011; 21. McQuarry et al. Kidney Int 2013; 22. Bomback et al. Kidney Int. 2018.

AAV Two-part Phase 2: Expected to Deliver Key Biomarker Data & Evaluation of Reduction of Steroids AAV Unmet Need Planned Design Ph2 design informed by avacopan Ad Com roadmap More effective induction and maintenance 1-3 • With treatment, 5-year mortality 10-30% overall Part A (funded FPI 1Q25) : 12-week treatment (n= up to 20 patients) 1-3 • 5-year mortality with renal disease – 20-50% • Designed to evaluate safety and early treatment effect • Relapse is substantial issue: Up to 50% of patients relapse within 5 • IV loading dose followed by SC dosing as adjunct to SOC 4-8 years, often 12-18 months of IST discontinuation • Key assessments: ADX-097 localization and impact in tissue, BVAS, biomarkers for early assessment of ADX-097 activity Reduction/Elimination of Glucocorticoids (GCs) • Anticipated to provide data for key regulatory discussions • IST, particularly GC side effects, account for significant early treatment 9 related morbidity and mortality, primarily due to infection Part B (planned 2026): 24-week treatment (n= ~65 patients) • Avacopan approved in 2021, but due to limitations in development program, label states, “does not eliminate GC use” and guides to • Designed to evaluate ability to reduce GC use/exposure while 10 avoid use in active, serious infection“ maintaining same or better remission rates • Key assessments: BVAS, ADX-097 localization and impact in tissue, biomarkers for assessment of ADX-097 activity ANCA Associated Vasculitis (AAV) 8, 11-13 100K (US) 1. Tan et al. Ann Rheum Dis 2017; 2. Heil et al. RMD Open 2017; 3. Q32 internal estimates. 4. Samman et al. Int J Rheumatol 2021; 5. Tan et al. Ann Rheum Dis 2017; 6. Walsh et al N Engl J Med 2020; 7. Demiselle et al. Ann Intensive Care 2017; 8. 32 IST: immunosuppressive therapy Kitching et al. Nat Rev Dis Primers 2020; 9. Titeca-Beauport et al. BMC Nephrol 2018 10. Tavneos FDA label. 11. Berti et al. Arthritis Rheumatol 2017; 12. Watts et al. Nephrol Dial Transplant 2015. 13. Watts et al. Nat Rev Rheumatol 2022 BVAS: Birmingham Vasculitis Activity Score (planned Phase 3 endpoint)

Looking Ahead

* Merger Positions Q32 Bio to Unlock Significant Near-term Value-creation Pro forma runway through multiple value-driving Phase 2 clinical readouts Use of • To fund the continued development of pipeline candidates, other ongoing research and development activities, and for general corporate purposes Proceeds • Q32 has current cash runway into 1H24 Cash Runway • Following the merger and concurrent private financing, Q32 expects to have pro forma cash balance of 1 ~$115M , providing expected cash runway to mid 2026 Merger Supports • 2H24: Topline results from bempikibart (ADX-914) Phase 2 studies in AD and AA Potential Achievement • YE24: Interim data from planned ADX-097 Phase 2 renal basket of Numerous • 2H25: Topline results from planned ADX-097 Phase 2 Part A AAV and renal basket Anticipated Milestones 1. Assuming closing mid-1Q 2024. * Based on current management estimates 34

Q32 Mission: Building The Future of Immune Therapeutics • Bempikibart (ADX-914): Dual inhibitor of IL-7 and TSLP signaling, designed to provide broad control of T cell- mediated pathological processes in autoimmune diseases IL-7Rα Antagonist Antibody • Ph1 data show attractive PK/PD profile, favorable tolerability w/Q2W SC dosing; Ph2 PK run in confirmed Ph2 dose • Topline efficacy data from two Ph2 studies expected 2H24 • Differentiated, proprietary approach to address complement dysregulation directly at the site of impacted tissue • ADX-097: Designed to catalytically degrade alternative pathway convertases, gaining control of the amplification Novel Tissue-targeted loop and all 3 complement pathways Complement Platform with • Ph1 ADX-097 data show attainment of dose-dependent target PK/PD, favorable tolerability and good Clinical Asset immunogenicity profile with Q1W SC dosing • Initiate ADX-097 Ph2 in 1H24 Near Term Value • Bempikibart Ph2 topline results across two indications (Atopic Dermatitis, Alopecia Areata) expected in 2H24 • ADX-097 topline results from two clinical programs expected across 2024 and 2025 Creation Potential • Management team with extensive public biotech experience Exceptional Team • Deep complement therapeutics and inflammatory/autoimmune expertise and Investors • Blue chip investor syndicate 35

Thank You!

Appendix: ADX-097

Several Disease Models (Mouse, Rat and NHP) Establish Drug Levels Anticipated for Maximal Tissue PD & Activity Preclinical Disease Model Studies Establishing Dose Response and PoM/PoC 3 mg/kg SC = circ. conc of 0.3 ug/ml Several disease models demonstrate maintaining drug levels of 0.3 - 3.2 ug/ml 38 provides maximal tissue targeted complement inhibition and activity

ADX-097-101: Plasma ADX-097 Concentrations and % of Baseline Wieslab AP Activity After Single Dose IV ADX-097 IV Dosing PK % of Baseline AP Activity LLOQ Corrected • C increased dose-proportionally following 0.1 to 30 mg/kg IV dosing; Tmax achieved within 80 minutes after IV infusion max • 30 mg/kg IV ADX-097 resulted in AP activity at or below the LLOQ of the assay at end of infusion; AP activity began to recover after 7 days and returned to baseline by 14 days postdose 39

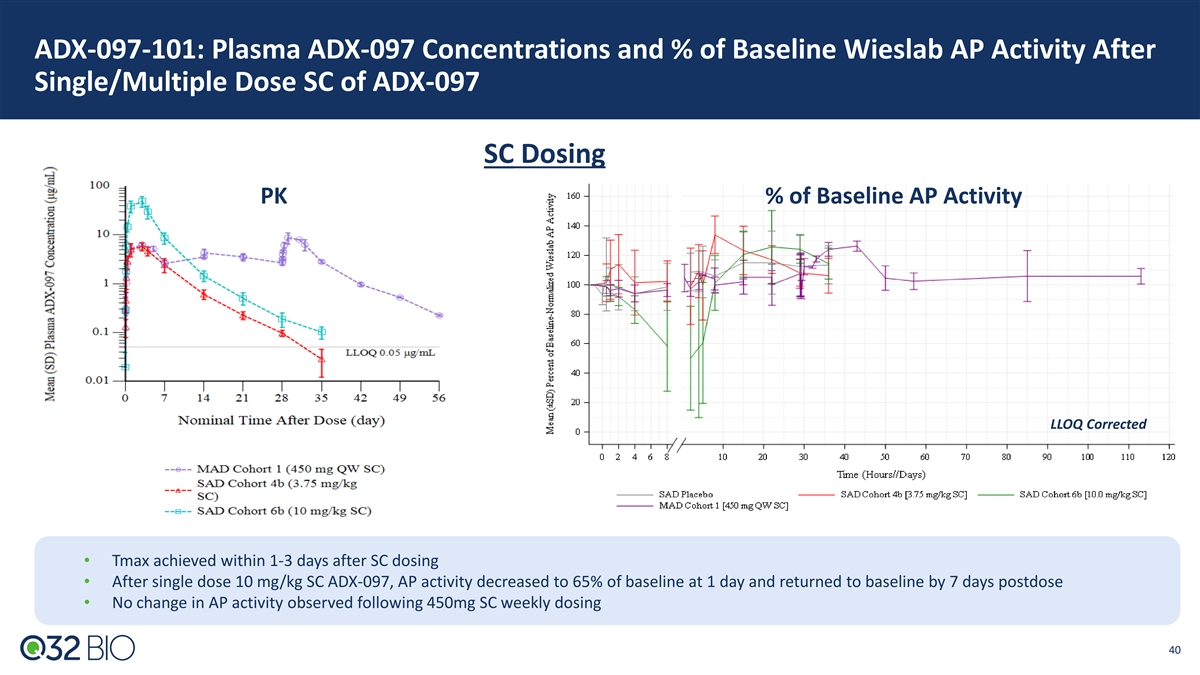

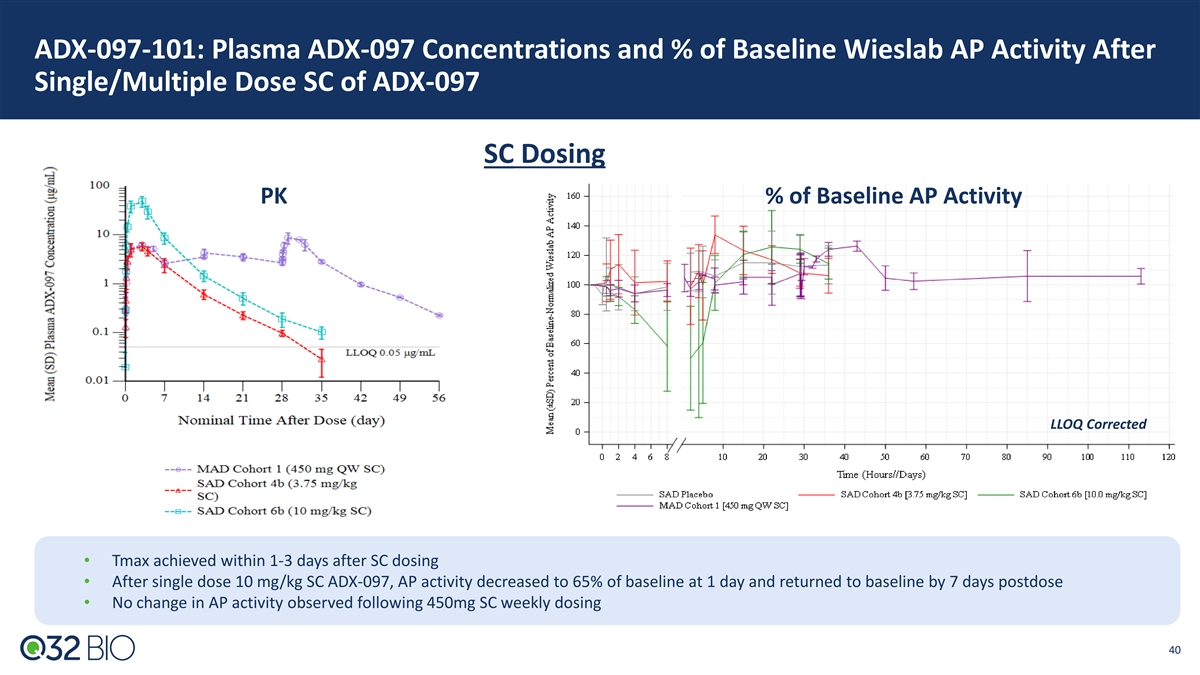

ADX-097-101: Plasma ADX-097 Concentrations and % of Baseline Wieslab AP Activity After Single/Multiple Dose SC of ADX-097 SC Dosing PK % of Baseline AP Activity LLOQ Corrected • Tmax achieved within 1-3 days after SC dosing • After single dose 10 mg/kg SC ADX-097, AP activity decreased to 65% of baseline at 1 day and returned to baseline by 7 days postdose • No change in AP activity observed following 450mg SC weekly dosing 40

ADX-097-101: Key Pharmacology Takeaways ADX-097 showed nonlinear PK with a saturable clearance mechanism • Detectable plasma ADX-097 concentrations in all PK-evaluable participants • T achieved within 80 minutes after IV infusion and within 1 to 3 days after SC injection max • C increased dose-proportionally following 0.1 to 30 mg/kg IV, whereas AUC increased dose-proportionally from 0.1 to 1 mg/kg IV max and greater than dose-proportionally at doses greater than 1mg/kg • Terminal T was dose-dependent for SC dosing 1/2 • Mild accumulation was observed after 450 mg SC QW dosing • Bioavailability of SC administered ADX-097 estimated via population PK modeling as ~50% ADX-097 showed dose dependent fluid phase AP activity inhibition, with more sustained inhibition at increasing IV and SC doses • Highest dose, 30 mg/kg IV ADX-097, resulted in AP activity at or below the LLOQ of the assay (35% of baseline Wieslab activity) at end of infusion; AP activity began to recover after 7 days and returned to baseline by 14 days postdose • After single dose 10 mg/kg SC ADX-097, AP activity decreased to 65% of baseline at 1 day and returned to baseline by 7 days postdose • No change in AP activity was observed following 450mg SC weekly dosing 41