- CYT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Cyteir Therapeutics (CYT) DEF 14ADefinitive proxy

Filed: 27 Apr 23, 4:02pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ |

Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

CYTEIR THERAPEUTICS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Cyteir Therapeutics, Inc.

99 Hayden Ave., Building B, Suite 450

Lexington, MA 02421

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

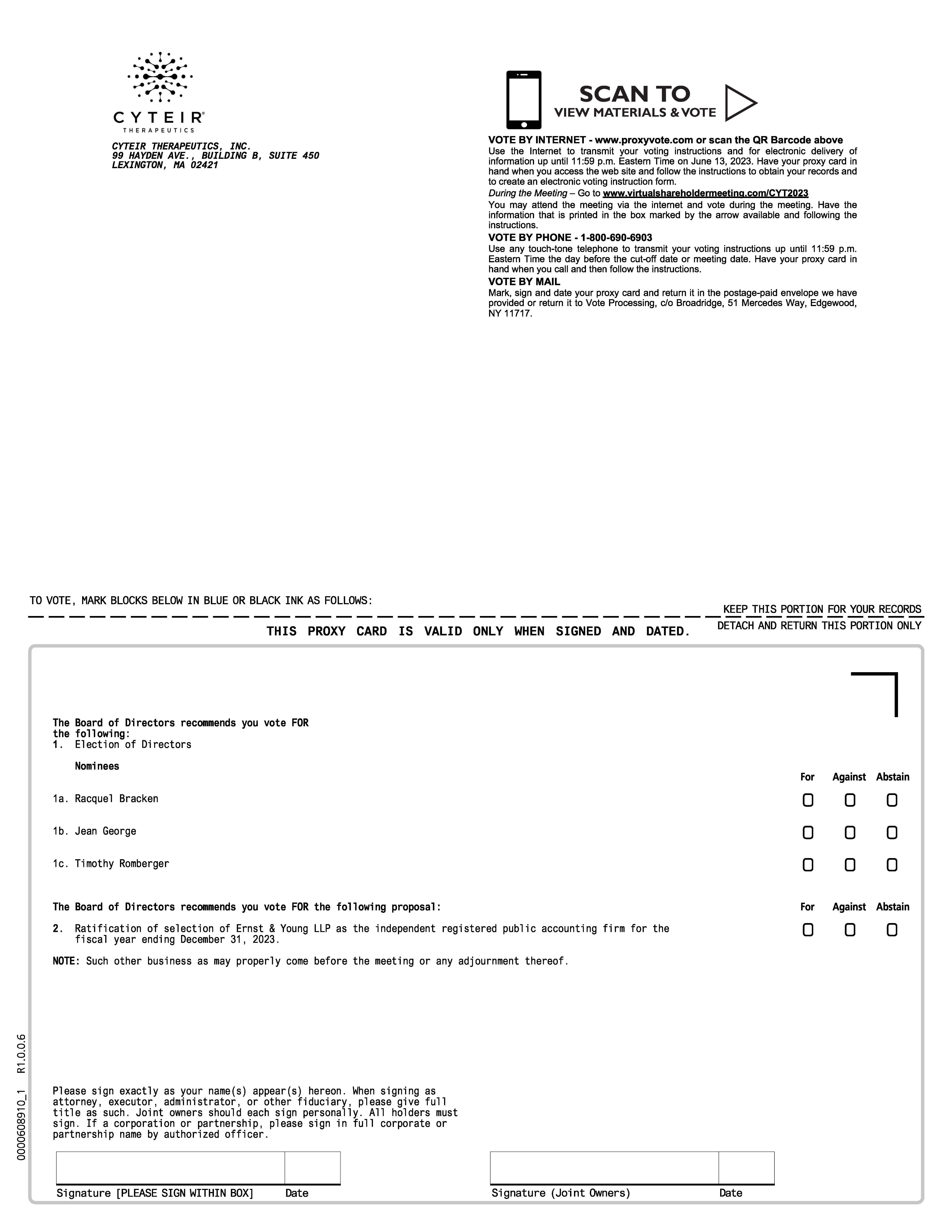

The 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of Cyteir Therapeutics, Inc. (the “Company” or “Cyteir”) will be held on June 14, 2023, at 1:00 p.m. Eastern Time. We have determined to hold a virtual-only Annual Meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost. You will be able to attend our Annual Meeting online, vote your shares, and submit your questions during the meeting by visiting at www.virtualshareholdermeeting.com/CYT2023. Details regarding how to attend the meeting online are more fully described in the Notice (as defined below) and this proxy statement. The Annual Meeting will be held for the purpose of considering and voting on the following company-sponsored proposals:

We will also consider and act upon any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

These proposals are more fully described in the proxy statement accompanying this notice. This notice, our proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”) can be accessed at www.proxyvote.com.

Our Board of Directors recommends that you vote “for” each nominee for Class II director (Proposal No. 1) and “for” ratification of the proposed independent registered public accounting firm (Proposal No. 2).

April 17, 2023 has been fixed as the record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting or any adjournments thereof.

Your vote is important. Whether or not you expect to attend the virtual-only Annual Meeting, we urge you to submit your proxy by the Internet or telephone or by signing, dating and returning the proxy card included in these materials in order to ensure that your vote is recorded. If you choose to attend the virtual-only Annual Meeting, you may still vote your shares during the Annual Meeting, even if you have previously voted or returned your proxy by any of the methods described in our proxy statement. If your shares are held in a bank or brokerage account, please refer to the materials provided by your bank or broker for voting instructions. You will need the 16-digit control number included with the Notice of Internet Availability (the “Notice”), on your proxy card, or the instructions that accompany your proxy materials to attend our 2023 annual meeting virtually via the Internet.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to make our proxy materials available to all of our stockholders over the Internet. We will be able to provide shareholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about April 27, 2023, we will commence sending to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”), containing instructions on how to access our proxy statement and Annual Report. The Notice also provides instructions on how to vote online or vote by phone and includes instructions on how to receive a paper copy of the proxy materials by mail.

All stockholders are extended a cordial invitation to attend the virtual-only Annual Meeting. Thank you for your ongoing support of and interest in Cyteir Therapeutics, Inc.

By Order of the Board of Directors

Markus Renschler, M.D.

President and Chief Executive Officer

April 27, 2023

TABLE OF CONTENTS

| Page |

2 | |

3 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 8 |

12 | |

25 | |

34 | |

36 | |

37 | |

PROPOSAL NO. 2—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 38 |

39 |

i

Cyteir Therapeutics, Inc.

99 Hayden Ave., Building B, Suite 450

Lexington, MA 02421

PROXY STATEMENT FOR 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on Wednesday, June 14, 2023 at 1:00 p.m. Eastern Time

This proxy statement, along with the accompanying Notice of 2023 Annual Meeting of Stockholders, contains information about the 2023 Annual Meeting of Stockholders of Cyteir Therapeutics, Inc., including any adjournments or postponements of the meeting, which we refer to as the “Annual Meeting.” The Annual Meeting will be conducted virtually only, via live webcast, at 1:00 p.m. Eastern Time on June 14, 2023.

In this proxy statement, we refer to Cyteir Therapeutics, Inc. as “Cyteir,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors for use at the Annual Meeting.

On or about April 27, 2023, we made available this proxy statement and the attached Notice of 2023 Annual Meeting of Stockholders to all stockholders entitled to vote at the Annual Meeting. Although not part of this proxy statement, we have also made available with this proxy statement our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, containing our financial statements for the fiscal year ended December 31, 2022.

1

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 14, 2023

This proxy statement and our Annual Report on Form 10-K are available for viewing, printing and downloading at www.proxyvote.com.

Additionally, you can find a copy of our Annual Report on Form 10-K on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov or in the “Investors & Media” section of our website at www.cyteir.com. You may also obtain a printed copy of our Annual Report on Form 10-K, free of charge, by sending a written request to: Cyteir Therapeutics, Inc., 99 Hayden Ave., Building B, Suite 450, Lexington, MA 02421, Attention: Secretary. Exhibits, if any, will be provided upon written request and payment of an appropriate processing fee.

EXPLANATORY NOTE

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and therefore we are permitted and intend to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include reduced disclosure obligations regarding executive compensation. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted.

We could be an emerging growth company through 2026, although circumstances could cause us to lose that status earlier, including if the market value of our common stock held by non-affiliates exceeds $700.0 million as of the last day of our most recently completed second fiscal quarter or if we have total annual gross revenue of $1.07 billion or more during any fiscal year before that time, in which cases we would no longer be an emerging growth company as of the following December 31, or if we issue more than $1.0 billion in non-convertible debt during any three-year period before that time, in2which case we would cease to be an emerging growth company immediately.

We are also a “smaller reporting company,” as that term is defined in Rule 12b-2 under the Securities and Exchange Act of 1934, as amended, or the Exchange Act. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

2

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company soliciting my proxy?

The Board of Directors of Cyteir Therapeutics, Inc. is soliciting your proxy to vote at the virtual-only 2023 Annual Meeting of Stockholders to be held at 1:00 p.m. Eastern Time on June 14, 2023, via a live webcast, including any adjournments or postponements of the meeting, which we refer to as the Annual Meeting. This proxy statement along with the accompanying Notice of 2023 Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you the Notice of 2023 Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 because you owned shares of Cyteir common stock on the record date.

When were this proxy statement and the accompanying materials sent to stockholders?

On or about April 27, 2023, we began sending the Notice of 2023 Annual Meeting of Stockholders, the proxy card and our proxy statement to all stockholders entitled to vote at the Annual Meeting.

When is the record date for the Annual Meeting?

The Company’s Board of Directors has fixed the record date for the Annual Meeting as of the close of business on April 17, 2023. Only stockholders who owned our common stock at the close of business on April 17, 2023 are entitled to vote at the Annual Meeting.

Why a virtual-only Annual Meeting?

We have determined to hold a virtual-only Annual Meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost.

To participate in the annual meeting virtually via the Internet, please visit www.virtualshareholdermeeting.com/CYT2023. You will need the 16-digit control number included on your Notice of Internet Availability, your proxy card or the instructions that accompanied your proxy materials. Instructions should also be provided on the voting instruction card provided by your bank or brokerage firm. If you do not have your 16-digit control number and attend the meeting online, you will be able to listen to the meeting only – you will not be able to vote or submit questions during the meeting.

Stockholders of record and beneficial owners as of the close of business on April 17, 2023, the record date, will have the ability to submit questions and vote electronically at the Annual Meeting via the virtual-only meeting platform.

3

How do I attend the virtual-only Annual Meeting?

The Annual Meeting will be held entirely online at www.virtualshareholdermeeting.com/CYT2023. A summary of the information you need to attend the Annual Meeting online is provided below:

Webcast replay of the annual meeting will be available until the sooner of June 14, 2024 or the date of the next annual meeting of shareholders to be held in 2024.

If your shares are held in a bank or brokerage account, instructions should also be provided on the voting instruction form provided by your bank or brokerage firm.

What if I have technical difficulties accessing the virtual meeting website?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the annual meeting login page.

How many votes can be cast by all stockholders?

A total of 35,667,429 shares of common stock of the Company were outstanding as of the close of business on April 17, 2023 and are entitled to be voted at the meeting. Each share of common stock is entitled to one vote on each matter.

4

What is the difference between being a stockholder of record and a beneficial owner?

Many of our stockholders hold their shares through stockbrokers, banks or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a stockholder of record and a beneficial owner.

Stockholder of record: If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., you are the stockholder of record, and these proxy materials are being sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals named on the proxy card and to vote at the Annual Meeting.

Beneficial owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or other nominee, who is considered to be the stockholder of record. As the beneficial owner, you have the right to tell your nominee how to vote, and you are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you obtain a legal proxy from your nominee authorizing you to do so. Your nominee has sent you instructions on how to direct the nominee’s vote. You may vote by following those instructions and the instructions on the Notice of 2023 Annual Meeting of Stockholders.

How do I vote?

If you are a stockholder of record and your shares are registered directly in your name, you may vote:

By Internet |

| If you received the Notice or a printed copy of the Proxy Materials, follow the instructions in the Notice or on the proxy card. |

By Telephone |

| If you received a printed copy of the Proxy Materials, follow the instructions on the proxy card. |

By Mail |

| If you received a printed copy of the Proxy Materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope. |

In Person (Virtual) |

| You may also vote in person virtually by attending the meeting through www.virtualshareholdermeeting.com/CYT2023. |

If your shares of common stock are held in street name through a broker, bank or other nominee, please follow the instructions you receive from them to vote your shares. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

What are the Board’s recommendations on how to vote my shares?

The Board of Directors recommends a vote:

Proposal No. 1: |

| FOR the election of Racquel Bracken, Jean George and Timothy Romberger as Class II directors. |

|

| |

Proposal No. 2: |

| FOR ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. |

5

Who pays the cost for soliciting proxies?

Cyteir will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock. Cyteir may solicit proxies by mail, personal interview, telephone or via the Internet through its directors, officers and other management employees, who will receive no additional compensation for such services.

May my broker vote for me?

If your broker holds your shares in street name, the broker may vote your shares on certain routine matters even if it does not receive instructions from you. Although the determination of whether a broker will have discretionary voting power for a particular item is typically determined only after proxy materials are filed with the Securities and Exchange Commission (“SEC”), we expect that the election of each nominee for director (Proposal 1) will be a non-routine matter and that the proposal on ratification of the appointment of our independent registered public accounting firm (Proposal 2) will be a routine matter. Accordingly, if you hold your shares through a broker and you do not timely provide your broker with specific instructions on how to vote your shares, your broker would not be authorized to cast a vote on your behalf on Proposal 1 but would be authorized to cast a vote on your behalf, in its discretion, on Proposal 2. In such cases, a “broker non-vote” may be entered with respect to your shares on Proposal 1 to reflect that your broker was present with respect to your shares at the meeting but was not exercising voting rights on your behalf with respect to those shares. Broker non-votes and abstentions will have no effect on the outcome of each proposal. Brokers generally have discretionary authority to vote on the ratification of the appointment of an independent registered public accounting firm (Proposal 2); thus, we do not expect any broker non-votes on this matter.

Can I change my vote?

You may revoke your proxy at any time before it is voted by notifying our Corporate Secretary in writing, by returning a signed proxy with a later date, by transmitting a subsequent vote over the Internet or by telephone prior to the close of the Internet voting facility or the telephone voting facility, or by attending the meeting and voting in person. If your shares are held in street name, you must contact your broker, bank or nominee for instructions as to how to change your vote.

How is a quorum reached?

The presence, in person or by proxy, of holders of at least a majority of the total number of outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes” (i.e., shares represented at the meeting held by brokers, bankers or other nominees as to which instructions have not been received from the beneficial owners or persons entitled to vote such shares and, with respect to one or more but not all proposals, such brokers or nominees do not have discretionary voting power to vote such shares), if any, will be counted for purposes of determining whether a quorum is present for the transaction of business at the meeting.

What vote is required to approve each item?

Proposal No. 1: Elect Class II Directors |

| As this is an uncontested election of directors, each director nominee must receive a greater number of shares voted FOR his or her election than shares voted AGAINST such election (also known as a “majority” of the votes cast) to be elected a director. You may vote FOR the nominee, AGAINST the |

6

|

| nominee or ABSTAIN. Abstentions and broker non-votes will have no effect on the results of this vote. |

Proposal No. 2: Ratify Selection of Our Independent Registered Public Accounting Firm |

| The affirmative vote of a majority of the votes cast on this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. We do not expect broker non-votes for this proposal. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, the Audit Committee of the Board of Directors will reconsider its selection. |

Could other matters be decided at the Annual Meeting?

Cyteir does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business come before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies. If you hold shares through a broker, bank or other nominee as described above, they will not be able to vote your shares on any other business that comes before the Annual Meeting unless they receive instructions from you with respect to such matter.

What happens if the meeting is postponed or adjourned?

Subject to the provisions of our bylaws, your proxy may be voted at the postponed or adjourned meeting. You will still be able to change your proxy until it is voted.

What does it mean if I receive more than one proxy statement, proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with a broker, bank or other nominee. Please vote in accordance with the instruction set forth in the proxy statement, proxy card or voting instruction form with respect to all of your shares.

Whom should I contact if I have any additional questions?

If you hold your shares directly, please contact ir@cyteir.com. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contact your broker, bank or nominee holder directly.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of March 31, 2023 (unless otherwise specified), with respect to the beneficial ownership of our common stock by each person who is known to own beneficially more than 5% of the outstanding shares of common stock, each person currently serving as a director, each nominee for director, each named executive officer (as set forth in the Summary Compensation Table below) and all directors and executive officers as a group. The number of shares beneficially owned by each entity or person is determined in accordance with the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares over which the individual has sole or shared voting power or investment power as well as any shares that the individual has the right to acquire within 60 days of March 31, 2023 through the exercise of any stock options, warrants or other rights. Except as otherwise indicated, and subject to applicable common property laws, the persons in the table have sole voting and investment power with respect to all shares of common stock held by that person.

Shares of common stock subject to options, warrants or other rights that are now exercisable or are exercisable within 60 days after March 31, 2023 are considered outstanding for purposes of computing the percentage ownership of the persons holding these options, warrants or other rights but are not to be considered outstanding for the purpose of computing the percentage ownership of any other person. As of March 31, 2023, there were 35,658,429 shares of common stock outstanding. Unless otherwise indicated, the address for each beneficial owner is c/o Cyteir Therapeutics, Inc., 99 Hayden Ave., Building B, Suite 450, Lexington, MA 02421.

Name and address of beneficial owner |

| Number of |

|

| Percentage |

| ||

5% or greater stockholders: |

|

|

|

|

|

| ||

Novo Holdings A/S (1) |

|

| 3,940,413 |

|

|

| 11.1 | % |

Entities affiliated with Droia Ventures (2) |

|

| 3,536,803 |

|

|

| 9.9 | % |

Entities affiliated with Venrock (3) |

|

| 3,259,022 |

|

|

| 9.1 | % |

FMR LLC and affiliates (4) |

|

| 2,908,376 |

|

|

| 8.2 | % |

BML Investment Partners, L.P. and affiliates (5) |

|

| 2,735,973 |

|

|

| 7.7 | % |

Baker Bros. Advisors LP and affiliates (6) |

|

| 2,492,118 |

|

|

| 7.0 | % |

Osage University Partners II, LP (7) |

|

| 2,459,572 |

|

|

| 6.9 | % |

Entities affiliated with Lightstone Ventures (8) |

|

| 2,444,265 |

|

|

| 6.9 | % |

Avidity Partners Management LP and affiliates (9) |

|

| 1,795,800 |

|

|

| 5.0 | % |

Directors and named executive officers: |

|

|

|

|

|

| ||

Markus Renschler, M.D. (10) |

|

| 1,420,204 |

|

|

| 3.9 | % |

Paul Secrist, Ph.D. (11) |

|

| 280,474 |

|

| * |

| |

Adam Veness (12) |

|

| 53,944 |

|

| * |

| |

Racquel Bracken (13) |

|

| 31,400 |

|

| * |

| |

Jean George (14) |

|

| 2,475,665 |

|

|

| 6.9 | % |

Jeffrey Humphrey, M.D. (15) |

|

| 11,791 |

|

| * |

| |

Susan Molineaux, Ph.D. (16) |

|

| 61,914 |

|

| * |

| |

Timothy Romberger (17) |

|

| 400,847 |

|

|

| 1.1 | % |

Stephen Sands (18) |

|

| 9,433 |

|

| * |

| |

John Thero (19) |

|

| 19,433 |

|

| * |

| |

Joseph S. Zakrzewski (20) |

|

| 447,967 |

|

|

| 1.3 | % |

All executive officers and directors as a group (12 persons) (21) |

|

| 5,301,109 |

|

|

| 14.4 | % |

8

* Represents beneficial ownership of less than one percent of our outstanding common stock.

9

10

11

MANAGEMENT AND CORPORATE GOVERNANCE

In accordance with our amended and restated certificate of incorporation, our Board of Directors is divided into three classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose terms are then expiring, to serve from the time of election and qualification until the third annual meeting following their election or until their earlier death, resignation or removal. Our directors are divided among the three classes as follows:

The Class I directors are Jeffrey Humphrey, M.D., Stephen Sands and John Thero, and their terms will expire at our 2025 annual meeting of stockholders.

The Class II directors are Racquel Bracken, Jean George and Timothy Romberger, and their terms will expire at our 2023 annual meeting of stockholders.

The Class III directors are Susan Molineaux, Ph.D., Markus Renschler, M.D. and Joseph Zakrzewski, and their terms will expire at our 2024 annual meeting of stockholders.

Our amended and restated certificate of incorporation provides that the authorized number of directors may be changed only by resolution of our Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

DIRECTOR BIOGRAPHIES

Information concerning our directors is set forth below. The biographical description of each director includes the specific experience, qualifications, attributes and skills that led to the Board of Directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director.

DIRECTOR NOMINEES (CLASS II DIRECTORS)

Racquel Bracken has served as a member of our Board of Directors since 2018. Ms. Bracken currently serves as a Partner at Venrock, where she has worked since May 2016, and focuses on pharmaceutical and biotech investments. Prior to Venrock, Ms. Bracken was a founding early employee of Clovis Oncology, a biopharmaceutical company focused on acquiring, developing and commercializing targeted small molecule therapies in combination with companion diagnostics. Earlier in her career, Ms. Bracken was on the investment team at Domain Associates, where she focused on early-stage healthcare investing. Prior to joining Domain, Ms. Bracken was a consultant at Easton Associates, a management consultancy dedicated to the medical industry. Ms. Bracken is also a co-founder and member of the board of directors of Federation Bio, where she has served since January 2019, a member of the board of directors of MBrace since November 2021, and a member of the board of directors of Confluence Therapeutics, Inc. since May 2022. Ms. Bracken received an A.B. in molecular and cellular biology from Harvard University and is a member of the Kaufman Fellows. We believe Ms. Bracken is qualified to serve on our Board of Directors due to her knowledge and experience in the venture capital and biopharmaceutical industries.

Jean George, M.B.A., has served as a member of our Board of Directors since 2018. Ms. George is currently a General Partner of Lightstone Ventures, where she focuses on biopharmaceutical and medical device investments, which position she has held since April 2013. Ms. George is also a General Partner of

12

Advanced Technology Ventures, which position she has held since February 2002. Ms. George has been featured on the Forbes Midas List and was previously a member of the Scientific Advisory Board for the Massachusetts Life Sciences Center. Ms. George has been in the biopharmaceutical industry for over 20 years, including 10 years with Genzyme Corporation, where she held a variety of operational roles in marketing, product development, and business development, including Vice President of Global Sales and Marketing. Ms. George was also Vice President and Founder of Genzyme’s Tissue Repair Division. Ms. George currently serves on the board of directors of Calithera Biosciences, Inc. since 2010, Gemini Therapeutics since 2016, and a number of private companies. Ms. George previously served on the board of directors of Acceleron Pharma, Inc. from 2005 to April 2020, Zeltiq Aesthetics from October 2013 to June 2015 and Catabasis Pharmaceuticals, Inc. from 2010 to June 2019. Ms. George received a B.S. in Biology from the University of Maine and an M.B.A. from Simmons College Graduate School of Management. We believe Ms. George is qualified to serve on our Board of Directors due to her knowledge and experience in the venture capital and biopharmaceutical industries.

Timothy Romberger, our co-founder, has served as a member of our Board of Directors since 2015. Mr. Romberger served as our acting Chief Executive and Head of Business Development from 2012 to the fall of 2015. Mr. Romberger played an instrumental role in the engagement of Celgene as an early strategic partner and the closing of both the Series A and Series B investment rounds. Mr. Romberger has served as a member of the board of directors of Sur-Seal, a Heartwood Partners portfolio company, since 2021. Mr. Romberger is currently Managing Director of TRC Advisory, LLC, a business strategy consulting firm that he founded in July 2014. Before founding Cyteir and TRC, Mr. Romberger served as Managing Director at Marakon Associates, a global strategy consultancy. Mr. Romberger is an experienced business strategist and entrepreneur with more than 25 years of experience advising CEOs and their leadership teams in the areas of strategy, commercial effectiveness and organizational development. Mr. Romberger holds a degree in Economics and Corporate Finance from the University of Pennsylvania—Wharton School of Business. We believe Mr. Romberger is qualified to serve on our Board of Directors due to his expertise and experience as our co-founder and his extensive experience as a business strategist.

DIRECTORS WITH TERMS EXPIRING IN 2024 (CLASS III DIRECTORS)

Susan Molineaux, Ph.D., has served as a member of our Board of Directors since 2020. Dr. Molineaux has also served as a member of the board of directors of Geron Corporation since 2012. From 2015 to 2022, Dr. Molineaux served on the board of directors of Theravance Biopharma, Inc. Dr. Molineaux also has been Chief Executive Officer, President and a member of the board of directors of Calithera Biosciences, Inc., a biotechnology company developing oncology therapeutics, since co-founding the company in June 2010. Prior to starting Calithera, Dr. Molineaux was a co-founder of Proteolix and served as Chief Scientific Officer for two years before becoming Proteolix’s President and Chief Executive Officer. Proteolix was acquired by Onyx Pharmaceuticals in November 2009. Prior to co-founding Proteolix, Dr. Molineaux was Vice President of Biology at Rigel Pharmaceuticals from 2000 to 2003. Before that, she was Vice President of Biology at Praelux, and from 1994 to 1999, Dr. Molineaux served as Vice President of Drug Development at Praecis Pharmaceuticals. From 1989 to 1994, Dr. Molineaux was a scientist in the immunology group at Merck. Dr. Molineaux received a B.S. in Biology from Smith College and a Ph.D. in Molecular Biology from Johns Hopkins University. Dr. Molineaux completed a postdoctoral fellowship at Columbia University. We believe Dr. Molineaux is qualified to serve on our Board of Directors due to her extensive experience as an executive officer at biopharmaceutical companies, as well as her scientific background.

Markus Renschler, M.D., has served as a member of our Board of Directors since May 2016, and as President & Chief Executive Officer since January 2018. Previously, Dr. Renschler was an executive at Celgene from 2008 to 2017, serving as Senior VP and Chief Medical Officer of Celgene Cellular Therapeutics, Senior VP and Global Head of Hematology Oncology Medical Affairs, VP of Business

13

Development and VP of Clinical Research & Development. Prior to that, from 2007 to 2008, Dr. Renschler was VP of Clinical Development at Pharmion Corporation. Prior to that from 1996 to 2007, Dr. Renschler served in different clinical development roles at Pharmacyclics, last as Senior VP, Oncology Clinical Development. Dr. Renschler has over 25 years’ experience in building successful biopharmaceutical companies and in cancer research from basic laboratory research to drug approval and drug launches. Dr. Renschler had responsibility for successful global registrations and launches in breast cancer, non-small cell lung cancer and pancreatic cancer as well as the medical strategy for drug launches in hematologic malignancies and solid tumors for drugs such as REVLIMID® (lenalidomide), POMALYST® (pomalidomide), ABRAXANE® (nab-paclitaxel), and VIDAZA® (azacytidine). Dr. Renschler was a post-doctoral fellow with Dr. Ronald Levy at Stanford University. Dr. Renschler is a board-certified medical oncologist with an MD from Stanford University and BA from Princeton University. Dr. Renschler was an Adjunct Clinical Associate Professor of Medicine (Oncology) at Stanford University until 2015, where he was teaching and treating patients in the lymphoma program. Over his career, Dr. Renschler has authored or co-authored over 40 scientific papers and has been named as an inventor on numerous issued and pending patents. We believe Dr. Renschler is qualified to serve on our Board of Directors due to his extensive experience in the biotechnology industry, cancer drug discovery and development, corporate governance, business development and executive leadership.

Joseph Zakrzewski has served as a member of our Board of Directors since 2018 and chairman since 2020. Mr. Zakrzewski has also served as chairman of the board of directors of AN2 Therapeutics, Inc. since 2017. Mr. Zakrzewski previously served as a member of the board of directors of Amarin Corporation from 2010 until 2022, and as chairman of the board of directors of Onxeo S.A. from 2015 to 2019. From 2011 to 2021, Mr. Zakrzewski served as a member of the board of directors of Acceleron Pharma Inc. From 2017 to March 2022, Mr. Zakrzewski served as a member of the board of directors of Sangamo Therapeutics, Inc. From 2008 through 2017, Mr. Zakrzewski served as a member of the board of directors of Insulet Corporation. From 2010 through 2013, Mr. Zakrzewski served as Chairman and Chief Executive Officer of Amarin. From 2007 to 2010, Mr. Zakrzewski served as President and Chief Executive Officer of Xcellerex. From 2005 to 2007, Mr. Zakrzewski served as the Chief Operating Officer of Reliant Pharmaceuticals. From 1988 to 2004, Mr. Zakrzewski held various executive positions at Eli Lilly & Company in the areas of R&D, manufacturing, finance and business development. In addition, Mr. Zakrzewski served as a Venture Partner with OrbiMed in 2010 and 2011. He also currently serves and has previously served on the board of directors of a number of privately held companies. Mr. Zakrzewski received a B.S. in Chemical Engineering and an MS in Biochemical Engineering from Drexel University as well as an MBA in Finance from Indiana University. We believe that Mr. Zakrzewski’s substantial experience as an executive officer of other pharmaceutical companies, as well as Mr. Zakrzewski’s service on boards of directors of other pharmaceutical companies qualify him to serve as a member of our Board of Directors.

DIRECTORS WITH TERMS EXPIRING IN 2025 (CLASS I DIRECTORS)

Jeffrey Humphrey, M.D., has served as a member of our Board of Directors since December 2021. Dr. Humphrey served as the Chief Executive Officer of RADD Pharmaceuticals, Inc. from November 2022 to April 2023. He was previously the Chief Medical Officer of Magenta Therapeutics from 2021 to 2022, and the Chief Medical Officer of Constellation Pharmaceuticals from 2020 to 2021. Prior to Constellation Pharmaceuticals, Dr. Humphrey served in various positions at affiliates of Kyowa Kirin Co. Ltd. (“Kyowa Kirin”), a pharmaceutical and biotechnology company, from April 2012 to June 2020. At Kyowa Kirin, he served as Chief Development Officer from August 2019 to June 2020, as President and Chief Medical Officer of Kyowa Kirin Pharmaceutical Development, Inc. from April 2013 to August 2019, and as Senior Vice President, Drug Development of Kyowa Hakko Kirin Pharma, Inc. from April 2012 to March 2013. He previously served in senior management positions for early and late drug development and medical affairs at Pfizer, Bayer, and Bristol Myers Squibb. Dr. Humphrey holds a A.B.

14

from Harvard University and an M.D. from Case Western Reserve University School of Medicine and trained in internal medicine and oncology at the John Hopkins Hospital and National Cancer Institute, respectively. We believe Dr. Humphrey is qualified to serve on our Board of Directors because of his extensive experience in drug development and his leadership experience in the biotechnology industry.

Stephen Sands has served on our Board of Directors since 2022. Mr. Sands has served as Vice Chairman of Investment Banking since March 2014 and Chairman of the Healthcare Group at Lazard Group LLC since May 2016 and has held other positions at Lazard since 1994. From July 1986, Mr. Sands worked at McKinsey & Company, leaving as a Partner in the healthcare practice in October 1994. While on leave from McKinsey from December 1987 to August 1990, he co-founded two life sciences companies: Enzytech (acquired by Alkermes) and Opta Food Ingredients (spun-out of Enzytech and acquired by Stake Technology now SunOpta). He currently is a director of Cytosite Biopharma Inc., a private biotechnology company, since February 2019. Mr. Sands has previously served as director on the boards of several life sciences companies, including Cognition Therapeutics, Inc., National Imaging Associates (acquired by Magellan Health), Inc. and Isogen LLC (acquired by Monsanto). In addition to his responsibilities at Lazard, Mr. Sands is a member of the Washington University (St. Louis) School of Engineering & Applied Science National Counsel and of the board of trustees of the New York Hall of Science. Mr. Sands earned a B.A. in Biology from Oberlin College, a B.S.and M.S. in Chemical Engineering from Washington University in St. Louis, and an MBA with a concentration in Finance from New York University. We believe Mr. Sands is qualified to serve on our Board of Directors due to his knowledge and experience as an executive officer and service as a director of other biopharmaceutical companies.

John F. Thero has served on our Board of Directors since 2022. Mr. Thero has more than 30 years of senior financial and operational management experience, including supporting the growth of life science companies for over 20 years, most recently as President and Chief Executive Officer of Amarin Corporation plc from 2014 to 2021. Mr. Thero began his professional career at Arthur Andersen LLP, during which time he became a Certified Public Accountant. He currently serves as a member of the board of directors of CinCor Pharma, Inc. Mr. Thero previously served on the board of directors of Chiasma, Inc. from 2015 until the company was sold in 2021. He received a B.A. in Economics from the College of the Holy Cross. In 2019, Mr. Thero was named Ernst & Young LLP Entrepreneur of the Year for Life Sciences. We believe that Mr. Thero’s experience in management positions at life sciences companies, provide him with the appropriate qualifications and skills to serve as a member of our Board of Directors.

Director Independence

Under the rules of the Nasdaq Stock Market, independent directors must comprise a majority of our Board of Directors. In addition, the Nasdaq Stock Market rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent and that director nominees be selected or recommended for the board’s selection by independent directors constituting a majority of the independent directors or by a nominating and corporate governance committee comprised solely of independent directors. Under the Nasdaq Stock Market rules, a director will only qualify as “independent” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that such person is “independent” as defined under Nasdaq Stock Market rules and the rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an audit

15

committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board of Directors has determined that each of our directors, with the exception of Dr. Renschler, is an “independent director” as defined under applicable rules of the Nasdaq Stock Market. In addition, Mr. Romberger and Mr. Thero each satisfies the independence criteria set forth in Rule 10A-3 under the Exchange Act, and all members of our compensation committee satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act and are “non-employee directors” as defined in Section 16b-3 of the Exchange Act. In making such determination, our Board of Directors considered the relationships that each such non-employee director has with our Company and all other facts and circumstances that our Board of Directors deemed relevant in determining his or her independence, including the beneficial ownership of our capital stock by each non-employee director. Dr. Renschler is not an independent director under these rules because he is our President and Chief Executive Officer.

Board Membership Criteria

Our Nominating and Corporate Governance Committee is responsible for developing and recommending to our Board of Directors criteria for Board membership and, consistent with those criteria, recommending to the Board of Directors director candidates and nominees for the next annual meeting of stockholders. As reflected in our Corporate Governance Guidelines, it is the policy of the Board of Directors that all directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s stockholders. The Board of Directors believes that each director should possess the requisite ability, judgment and experience to oversee the Company’s business, and should contribute to the overall diversity of the Board of Directors. The Board of Directors considers the qualifications of directors and director candidates individually and in the broader context of its overall composition and the Company’s current and anticipated future needs.

16

Our Nominating and Corporate Governance Committee does not have a policy (formal or informal) with respect to diversity, but takes into consideration each candidate’s ability, judgment and experience and the overall diversity and composition of our Board of Directors when recommending director nominees. We value the many kinds of diversity reflected in our director nominees. The below table sets forth certain diversity characteristics of our Board:

Board Diversity Matrix (as of April 27, 2023) | ||||

Total Number of Directors | 9 | |||

Female | Male | Non-Binary | Did Not Disclose Gender | |

Part I: Gender Identity | ||||

Directors | 3 | 6 | - | - |

Part II: Demographic Background | ||||

African American or Black | - | - | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | 1 | - | - | - |

Hispanic or Latinx | - | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | 3 | 6 | - | - |

Two or More Races or Ethnicities | 1 | - | - | - |

LGBTQ+ | - | |||

Demographic Background Undisclosed | 1 | |||

Stockholders may also nominate persons to be elected as directors in accordance with our bylaws and applicable law, as described under “General Matters—Stockholder Proposals and Nominations.” The Nominating and Corporate Governance Committee does not have a written policy regarding stockholder nominations, but it has determined that it is the practice of the committee to consider candidates proposed by stockholders if made in accordance with our bylaws.

Board Meetings and Attendance

The Board of Directors held 5 meetings during the year ended December 31, 2022. Each of the directors attended at least seventy-five percent (75%) of the meetings of the Board of Directors and the committees of the Board of Directors on which he or she served during the year ended December 31, 2022 (in each case, which were held during the period for which he or she was a director and/or a member of the applicable committee and excluding any meetings in which a director was an interested party).

The non-employee directors met in executive session during each of the regularly scheduled Board of Directors meetings during the year ended December 31, 2022.

The Board of Directors has adopted a policy that each member of the Board of Directors is expected to attend our annual stockholder meetings. All of our directors attended our 2022 Annual Meeting of Stockholders.

17

Role of the Board in Risk Oversight

Our Board of Directors has an active role, as a whole and also at the committee level, in overseeing the management of our risks. Our Board of Directors is responsible for general oversight of risks and regular review of information regarding our risks, including liquidity risks and operational risks. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements. The Audit Committee is responsible for overseeing the management of risks relating to accounting matters and financial reporting. The Nominating and Corporate Governance Committee is responsible for overseeing the management of risks associated with the independence of our Board of Directors, potential conflicts of interest and significant issues of corporate social responsibility. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board of Directors is regularly informed through discussions from committee members about such risks. Our Board of Directors believes its administration of its risk oversight function has not negatively affected our Board of Directors’ leadership structure.

BOARD COMMITTEES

Our Board of Directors has established three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee, each of which operates pursuant to a charter adopted by our Board of Directors. After the suspension of our internal research programs in January 2023, the Board of Directors dissolved the Science and Technology Committee. The Board of Directors may also establish other committees from time to time to assist us and the Board of Directors in their duties. The composition and functioning of all of our committees complies with all applicable requirements of the Sarbanes-Oxley Act, the Nasdaq Stock Market and the Exchange Act. The charters of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee are each available on the corporate governance section of our website at www.cyteir.com.

18

The following table describes which directors serve on each of the Board of Directors’ committees.

Name | Audit | Compensation | Nominating | |||

Racquel Bracken(1) | X(2) | |||||

Jean George, M.B.A.(1) | X | X(2) | ||||

Jeffrey Humphrey, M.D. | ||||||

Susan Molineaux, Ph.D. | X | |||||

Markus Renschler, M.D. |

|

| ||||

Timothy Romberger(1) | X | |||||

Stephen Sands | X | |||||

John Thero | X(2) | |||||

Joseph Zakrzewski |

| X | X |

Audit Committee

Our Audit Committee is composed of John Thero, Timothy Romberger and Stephen Sands, with Mr. Thero serving as Chair of the committee. The Board of Directors has determined that each of Messrs. Thero, Romberger and Sands meets the independence requirements of Rule 10A-3 under the Exchange Act and the applicable listing standards of Nasdaq. The Board of Directors has determined that each of Messrs. Thero, Romberger and Sands are “audit committee financial experts” within the meaning of the SEC regulations and applicable listing standards of Nasdaq. Our Audit Committee’s responsibilities include:

19

During the year ended December 31, 2022, the Audit Committee met five times. The report of the Audit Committee is included in this proxy statement under “Audit Committee Report.”

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of Jean George, Susan Molineaux, Ph.D. and Joseph Zakrzewski, with Ms. George serving as Chair of the committee. Our Nominating and Corporate Governance Committee’s responsibilities include:

20

During the year ended December 31, 2022, the Nominating and Corporate Governance Committee met three times.

Compensation Committee

Our Compensation Committee is composed of Racquel Bracken, Jean George and Joseph Zakrzewski, with Ms. Bracken serving as Chair of the committee. The Board of Directors has determined that each member of the Compensation Committee is “independent” as defined under the applicable listing standards of Nasdaq and meets the independence criteria set forth in Rule 10C-1 under the Exchange Act. Our Compensation Committee’s responsibilities include:

21

During the year ended December 31, 2022, the Compensation Committee met three times.

Delegation of Authority and the Role of Management

The Compensation Committee may delegate to subcommittees, consisting of one or more members of the Compensation Committee, any of the responsibilities of the full committee.

Our Chief Executive Officer makes compensation-related recommendations to the Compensation Committee with respect to annual base salary, target bonus opportunities and long-term incentive award grants for the named executive officers (other than himself). No member of the management team, including our Chief Executive Officer, has a role in determining his or her own compensation.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers and persons who beneficially own more than ten percent of our common stock to file with the SEC initial reports of beneficial ownership of our stock and reports of changes in that beneficial ownership with the SEC. Executive officers, directors and greater than ten percent beneficial owners are required by the SEC to furnish us with copies of all Section 16(a) forms they file with the SEC.

22

Based solely upon a review of the copies of such forms furnished to us and written representations from our executive officers and directors, we believe that during the year ended December 31, 2022, all Section 16(a) filing requirements applicable to our executive officers, directors and greater than ten percent beneficial owners were complied with on a timely basis.

Code of Ethics and Conduct

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A current copy of the code is posted on the investor section of our website. In addition, we intend to post on our website all disclosures that are required by law or listing rules concerning any amendments to, or waivers from, any provision of the code.

Policy Against Hedging of Stock

Our insider trading policy prohibits our directors, officers and employees from entering into hedging or monetization transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds, because such transactions may permit a director, officer or employee to continue to own securities obtained through our employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs, the individual may no longer have the same objectives as our other shareholders.

23

EXECUTIVE OFFICERS

Below is a list of the names, ages as of April 15, 2023 and positions, and a brief account of the business experience of the individuals who serve as our executive officers.

Name |

| Age |

| Position |

Markus Renschler, M.D. |

| 61 |

| President, Chief Executive Officer and Director (Class III) |

David Gaiero |

| 44 |

| Chief Financial Officer and Treasurer |

Adam M. Veness, Esq. |

| 37 |

| General Counsel and Secretary |

EXECUTIVE OFFICER BIOGRAPHIES

Biographical information for Markus Renschler, M.D., our Chief Executive Officer and President, is included herein under “Director Biographies—Directors with Terms Expiring in 2024 (Class III Directors).”

David Gaiero has served as our Chief Financial Officer since January 2023, and previously was our Vice President of Finance from December 2020 until January 2023. Prior to joining Cyteir, Mr. Gaiero served in various roles at Wave Life Sciences from 2017 to 2020, most recently serving as Interim Chief Financial Officer and prior to that, serving as Vice President and Corporate Controller. Prior to joining Wave, from 2015 to 2017, Mr. Gaiero served as Vice President and Corporate Controller of OvaScience, Inc. Prior to that, Mr. Gaiero held various positions of increasing responsibility and scope in finance and accounting at iRobot Corporation. Mr. Gaiero began his career in public accounting at PricewaterhouseCoopers LLP. Mr. Gaiero received a B.B.A. in Accounting from the University of Massachusetts, Amherst, and is a Certified Public Accountant in Massachusetts.

Adam M. Veness, Esq. has served as our General Counsel since April 2022 and has served as our General Counsel and Secretary since May 2022. Prior to joining Cyteir, Mr. Veness served as general counsel and secretary of Acceleron Pharma Inc. from 2019 until the company’s sale in 2021. Mr. Veness held various positions of increasing responsibility within the legal department of Acceleron from 2014 to 2019, and also served as Acceleron’s compliance officer from 2017 to 2019. Prior to that, Mr. Veness was a corporate and securities attorney from 2012 to 2014 at the Boston offices of the law firm Mintz Levin, and from 2010 to 2011 he was an attorney for a boutique litigation firm. Mr. Veness received a B.A. in political science and philosophy from Tulane University and a J.D. from Boston University School of Law.

24

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Introduction

This section provides an overview of the compensation awarded to, earned by or paid to our principal executive officer and our next two most highly compensated executive officers listed below in respect of their service to us for the fiscal year ended December 31, 2022. We refer to these individuals as our named executive officers. Our named executive officers are:

*In connection with the change in our research and development priorities and scope of business, Dr. Secrist's employment with the Company terminated on April 1, 2023.

The Compensation Committee of our Board of Directors is responsible for determining the compensation of our executive officers. Our executive compensation program is designed to attract, retain and reward key employees, to incentivize them based on corporate achievements, and to align their interests with the interests of our shareholders. Our Chief Executive Officer made recommendations to the Compensation Committee about the compensation of his direct reports, including Mr. Veness and Dr. Secrist, in respect of fiscal year 2022.

The Compensation Committee has engaged Pearl Meyer as its independent compensation consultant, to assist in evaluating our executive and director compensation practices, including program design, identification of an appropriate peer group for compensation comparison purposes and providing peer group and other pay benchmarking data. Prior to engaging Pearl Meyer, and annually thereafter, our Compensation Committee has assessed the independence of Pearl Meyer from management and, on the basis of that assessment and taking into consideration the independence factors that are required to be considered under applicable stock exchange rules, determined that no relationships exist that would create a conflict of interest or that would compromise Pearl Meyer’s independence.

25

Summary compensation table

The following table sets forth the compensation awarded to, earned by or paid to our named executive officers in respect of their service to us for the fiscal years ended December 31, 2022 and, if applicable, December 31, 2021:

Name and principal position |

| Year |

| Salary |

|

| Option awards |

|

| Nonequity incentive plan compensation |

|

| All other compensation ($)(3) |

|

| Total |

| |||||

Markus Renschler, M.D. |

| 2022 |

|

| 558,686 |

|

|

| 480,045 |

|

|

| 97,734 |

|

|

| 62,200 |

|

|

| 1,198,665 |

|

President and Chief Executive Officer |

| 2021 |

|

| 503,841 |

|

|

| 2,775,397 |

|

|

| 227,516 |

|

|

| — |

|

|

| 3,506,754 |

|

Adam M. Veness, Esq.(4) |

| 2022 |

|

| 290,143 |

|

|

| 318,866 |

|

|

| 56,044 |

|

|

| 11,606 |

|

|

| 667,659 |

|

Paul Secrist, Ph.D.(5) |

| 2022 |

|

| 421,200 |

|

|

| 189,849 |

|

|

| 80,870 |

|

|

| 12,200 |

|

|

| 704,119 |

|

Former Chief Scientific Officer |

| 2021 |

|

| 385,105 |

|

|

| 556,815 |

|

|

| 149,916 |

|

|

| — |

|

|

| 1,091,836 |

|

Narrative disclosure to summary compensation table

Annual base salary

The employment agreement, as amended and restated, as applicable, with each named executive officer, described below, establishes an annual base salary for the executive, which is subject to periodic review. In connection with our annual performance evaluation assessment and merit salary increases, effective as of January 1, 2022, Dr. Renschler’s base salary was increased to $558,686 and Dr. Secrist’s base salary was increased to $421,100. Mr. Veness commenced employment with us on April 25, 2022 and his base salary for 2022 was $425,000.

26

Annual bonuses

With respect to fiscal year 2022, each of Dr. Renschler, Mr. Veness and Dr. Secrist was eligible to receive an annual bonus, with the target amount of such bonus for each named executive officer set forth in his employment agreement with us, described below. For fiscal year 2022, the target bonus amount for Dr. Renschler was 50% of base salary and for each of Mr. Veness and Dr. Secrist was 40% of base salary. Annual bonuses for fiscal year 2022 for our named executive officers were based on the attainment of corporate objectives related to advancing our CYT-0851 program, advancing our preclinical pipeline and corporate financing goals, as determined by the Compensation Committee (100% of target bonus for Dr. Renschler and 80% of target bonus for Mr. Veness and Dr. Secrist), and individual performance goals (20% of target bonus for Mr. Veness and Dr. Secrist). In February 2023, the Compensation Committee determined that the 2022 corporate objectives had been achieved at 35% of target and that 2022 individual performance goals for each of Mr. Veness and Dr. Secrist had been achieved at 100%. For 2022, each of Dr. Renschler, Mr. Veness and Dr. Secrist received 35%, 48% and 48% of his target bonus, respectively, which was then prorated for Mr. Veness based on his partial year of employment.

Agreements with our named executive officers

Each of Dr. Renschler and Mr. Veness is, and prior to his termination of employment Dr. Secrist was, party to an employment agreement, as amended and restated, as applicable, with us that sets forth the terms and conditions of his respective employment. The material terms of the agreements are described below. The terms “cause,” “good reason” and “change in control” referred to below are defined in the respective named executive officer’s agreement.

Dr. Renschler. Dr. Renschler’s amended and restated employment agreement provides for a fixed base salary, subject to discretionary adjustment, and a target bonus opportunity (each of which has subsequently been increased to the amounts described above under “Annual base salary” and “Annual bonuses”). The actual amount of the bonus is payable based upon the achievement of quantitative and qualitative performance objectives established by our Board of Directors or the Compensation Committee.

Dr. Renschler’s employment agreement also provides that, for so long as Dr. Renschler serves as our President and Chief Executive Officer, we will nominate him to serve as a member of our Board of Directors at each annual meeting of stockholders at which his then-current term expires and, if so elected, he will continue to serve on our Board of Directors.

Dr. Renschler’s employment agreement contains a perpetual non-disparagement covenant. Dr. Renschler is also party to a Non-Competition Agreement pursuant to which he has agreed not to compete with us during his employment and for one year following the termination of his employment other than due to a layoff or a termination by us without cause. He is also party to a Nondisclosure, Inventions and Nonsolicitation Agreement under which he has agreed to a perpetual confidentiality covenant and an assignment of intellectual property covenant, and has agreed not to solicit our business partners and employees during his employment and for one year following the termination of his employment for any reason.

Mr. Veness. Mr. Veness' employment agreement provides for a fixed base salary, subject to discretionary adjustment, and a target bonus opportunity (prorated for 2022), as described above under “Annual bonuses.” The actual amount of the bonus is payable based on achievement of performance goals established by our Board of Directors or the Compensation Committee.

27

Under his employment agreement, Mr. Veness agreed not to compete with us during his employment and for one year following the termination of his employment other than due to a layoff or a termination by us without cause, and not to solicit our business partners, employees and independent contractors during his employment and for one year following the termination of his employment for any reason. In addition, he has agreed to a perpetual confidentiality covenant, a perpetual non-disparagement covenant and an assignment of intellectual property covenant. Mr. Veness is also party to a Nondisclosure, Inventions and Nonsolicitation Agreement under which he has agreed to a perpetual confidentiality covenant and an assignment of intellectual property covenant, and has agreed not to solicit our business partners and employees during his employment and for one year following the termination of his employment for any reason.

Dr. Secrist. Dr. Secrist served as our Chief Scientific Officer until April 1, 2023 when he separated from the Company in connection with our reduction in force. Prior to his termination of employment, Dr. Secrist’s amended and restated employment agreement provided for a fixed base salary, subject to discretionary adjustment, and a target bonus opportunity (each of which was increased to the amounts described above under “Annual base salary” and “Annual bonuses”). The actual amount of the bonus was payable based on achievement of performance goals established by our Board of Directors or the Compensation Committee. The severance payments and benefits Dr. Secrist is entitled to as a result of his termination of employment are described below under “Severance upon termination of employment; change in control.”

Under his employment agreement, Dr. Secrist agreed not to compete with us during his employment and for one year following the termination of his employment other than due to a layoff or a termination by us without cause, and not to solicit our business partners, employees and independent contractors during his employment and for one year following the termination of his employment for any reason. In addition, he agreed to a perpetual confidentiality covenant, a perpetual non-disparagement covenant and an assignment of intellectual property covenant. Dr. Secrist is also party to a Nondisclosure, Inventions and Nonsolicitation Agreement under which he agreed to a perpetual confidentiality covenant and an assignment of intellectual property covenant, and has agreed not to solicit our business partners and employees during his employment and for one year following the termination of his employment for any reason.

Severance upon termination of employment; change in control

Dr. Renschler. Under his amended and restated employment agreement, if Dr. Renschler’s employment is terminated by us without cause or by him for good reason, he will be entitled to (i) continued payment of his base salary for 12 months and (ii) subject to his timely election of COBRA coverage, payment of a monthly amount equal to the monthly health premiums paid by us on behalf of Dr. Renschler and his eligible dependents prior to such termination of employment for 12 months (or, if earlier, until he ceases to be eligible for COBRA coverage or obtains health coverage from another employer).

If Dr. Renschler’s employment is terminated by us without cause or by him for good reason, in either case, within 24 months after a change in control, in lieu of the severance benefits described above, he will be entitled to (i) an amount equal to 1.5 multiplied by the sum of his base salary and target bonus, payable over a period of 18 months, and (ii) subject to his timely election of COBRA coverage, payment of a monthly amount equal to the monthly health premiums paid by us on behalf of Dr. Renschler and his eligible dependents prior to such termination of employment for a period of 18 months (or, if earlier, until he ceases to be eligible for COBRA coverage or obtains health coverage from another employer).

If Dr. Renschler’s employment is terminated by us without cause or by him for good reason, in either case, at any time after a change in control, in addition to the severance benefits described above, he will

28

be entitled to (i) accelerated vesting of all outstanding stock options and other equity-based awards held by him at the time of the change in control (with any awards that are subject to performance-based vesting conditions vesting based on the greater of target or actual achievement of the applicable performance goals, as determined by our Board of Directors or the compensation committee, determined as if any applicable service-based vesting requirement had been met) and (ii) extended exercisability of outstanding stock options through the original term of the stock option.

Mr. Veness. Under his employment agreement, if Mr. Veness’ employment is terminated by us without cause or by him for good reason, he will be entitled to (i) continued payment of his base salary for nine months and (ii) subject to his timely election of COBRA coverage, payment of a monthly amount equal to the monthly health premiums paid by us on behalf of Mr. Veness and his eligible dependents prior to such termination of employment for nine months (or, if earlier, until he ceases to be eligible for COBRA coverage or obtains health coverage from another employer).

If Mr. Veness’ employment is terminated by us without cause or by him for good reason, in either case, within 12 months following a change in control, in lieu of the severance benefits described above, he will be entitled to (i) an amount equal to the sum of his base salary and target bonus, payable over a period of 12 months and (ii) subject to his timely election of COBRA coverage, payment of a monthly amount equal to the monthly health premiums paid by us on behalf of Mr. Veness and his eligible dependents prior to such termination of employment for 12 months (or, if earlier, until he ceases to be eligible for COBRA coverage or obtains health coverage from another employer).

If Mr. Veness’ employment is terminated by us without cause or by him for good reason, in either case, at any time after a change in control, in addition to the severance benefits described above, he will be entitled to accelerated vesting of all outstanding stock options and other equity-based awards held by him at the time of the change in control (with any awards that are subject to performance-based vesting conditions vesting based on the greater of target or actual achievement of the applicable performance goals, as determined by our Board of Directors or the Compensation Committee, determined as if any applicable service-based vesting requirement had been met).

Dr. Secrist. As a result of the Company’s termination of Dr. Secrist’s employment without cause on April 1, 2023, Dr. Secrist became entitled to receive the following payments and benefits pursuant to his amended and restated employment agreement: (i) continued payment of his base salary for nine months following his termination of employment and (ii) payment of a monthly amount equal to the monthly health premiums paid by us on behalf of Dr. Secrist and his eligible dependents prior to his termination of employment for nine months (or, if earlier, until he ceases to be eligible for COBRA coverage or obtains health coverage from another employer). In addition, the Compensation Committee approved the accelerated vesting, as of the date of Dr. Secrist’s termination of employment, of a portion of his stock options that would have vested by its terms on June 15, 2023.

Severance Subject to Conditions. Our obligation to provide an executive with severance payments and other benefits under the executive’s employment agreement is conditioned on the executive signing a release of claims in favor of us and complying with the restrictive covenants applicable to him.

Section 280G of the Code. Each currently employed named executive officer’s employment agreement provides for a Section 280G “better-of provision” such that payments or benefits that he receives in connection with a change in control will be reduced to the extent necessary to avoid the imposition of any excise tax under Sections 280G and 4999 of the Code if such reduction would result in greater after-tax payment amount for such named executive officer.

29

Employee and retirement benefits

We currently provide broad-based health and welfare benefits that are available to all of our employees, including our named executive officers, including health, life and AD&D, disability, vision and dental insurance. In addition, we maintain a 401(k) retirement plan for our full-time employees. The 401(k) plan also permits us to make discretionary employer contributions. Our 401(k) plan provides for a safe harbor matching contribution of 100% of up to 3% of a participant’s eligible compensation and 50% of a participant’s eligible compensation between 3% and 5%. Other than the 401(k) plan, we do not provide any qualified or non-qualified retirement or deferred compensation benefits to our employees, including our named executive officers.

Equity compensation

Each of our named executive officers received stock option grants in fiscal year 2022 under the Cyteir Therapeutics, Inc. 2021 Equity Incentive Plan, or the 2021 Plan.

On February 22, 2022, each of Drs. Renschler and Secrist was granted an option to purchase 106,200 shares of our common stock and 42,000 shares of our common stock, respectively, which vests as to 1/48 of the total underlying shares monthly following the vesting commencement date of February 22, 2022, until the option is fully vested on the fourth anniversary of the vesting commencement date, generally subject to the executive’s continued employment with us through the applicable vesting date. In connection with his commencement of employment, Mr. Veness was granted an option to purchase 177,000 shares of our common stock on May 2, 2022, which vested as to 25% of the underlying shares on April 25, 2023, and will vest as to the remaining shares in 36 equal monthly installments thereafter for three years, until the option is fully vested on the fourth anniversary of April 25, 2022, generally subject to Mr. Veness’ continued employment with us through the applicable vesting date.

Outstanding equity awards at fiscal year-end

The following table sets forth information concerning outstanding equity awards held by each of our named executive officers as of December 31, 2022:

| Option awards | |||||||||||||

Name |

| Number of |

|

| Number of |

|

| Option |

|

| Option | |||

Markus Renschler, M.D. |

|

| — |

|

|

| 32,973 |

|

|

| 1.20 |

|

| 2/24/2030(1) |

|

| 300,208 |

|

|

| 200,137 |

|

|

| 7.10 |

|

| 2/21/2031(2) | |

|

| 22,125 |

|

|

| 84,075 |

|

|

| 5.96 |

|

| 2/22/2032(3) | |

Adam Veness |

|

| — |

|

|

| 177,000 |

|

|

| 2.35 |

|

| 5/2/2032(4) |

Paul Secrist, Ph.D. |

|

| 137,878 |

|

|

| 82,727 |

|

|

| 1.20 |

|

| 3/23/2030(5) |

|

| — |

|

|

| 55,151 |

|

|

| 1.20 |

|

| 3/23/2030(6) | |

|

|

| 62,897 |

|

|

| 40,030 |

|

|

| 7.10 |

|

| 2/21/2031(7) |

|

| 8,750 |

|

|

| 33,250 |

|

|

| 5.96 |

|

| 2/22/2032(8) | |

30

31

Director compensation

The following table sets forth the compensation awarded to, earned by or paid to our non-employee directors during the fiscal year ended December 31, 2022. Dr. Renschler’s compensation for 2022 is included with that of our other named executive officers above.

Name |

| Fees earned or paid in cash |

|

| Option awards |

|

| Total |

| |||

Joseph Zakrzewski |

|

| 81,500 |

|

|

| 63,961 |

|

|

| 145,461 |

|

Racquel Bracken |

|

| 50,000 |

|

|

| 63,961 |

|

|

| 113,961 |

|

Jean George |

|

| 50,500 |

|

|

| 63,961 |

|